Bridge Report:(1433)BESTERRA fiscal year ended January 2021

President Akitatsu Yoshino | BESTERRA CO., LTD (1433) |

|

Company Information

Market | TSE 1st Section |

Industry | Construction business |

President | Akitatsu Yoshino |

HQ Address | Kiba Park Bldg, 3-2-6 Hirano, Koto-ku, Tokyo, Japan |

Year-end | End of January |

Homepage |

Stock Information

Share Price | Share Outstanding (End of the term) | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,643 | 8,355,600 shares | ¥13,728million | 5.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥16.00 | 1.0% | ¥43.76 | 37.5x | ¥315.08 | 5.2x |

*The share price is the closing price on March 25. Each number are taken from the brief financial report of FY 1/21.

Consolidated Earnings

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Jan. 2018 (Actual) | 4,496 | 386 | 373 | 263 | 31.69 | 15.00 |

Jan. 2019 (Actual) | 4,927 | 497 | 495 | 621 | 75.25 | 15.00 |

Jan. 2020 (Actual) | 3,436 | 93 | 97 | 59 | 7.29 | 16.00 |

Jan. 2021 (Actual) | 3,682 | 124 | 212 | 142 | 17.33 | 16.00 |

Jan. 2022 (Forecast) | 5,600 | 450 | 518 | 360 | 43.76 | 16.00 |

*Forecast is from the Company’s financial report. unit: million yen, yen

This Bridge Report reviews on the outlook of BESTERRA CO., LTD’s earnings results for the fiscal year ended January 2021, its forecast of the fiscal year ending January 2022 and medium-term management plan.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended January 2021 Earnings Results

3. Fiscal Year ending January 2022 Earnings Forecasts

4. Medium-term Management Plan 2025

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended January 2021, sales were 3,682 million yen, up 7.2% year on year. Thanks to the steady progress of demolition works, the company was able to make up for the delay until the second quarter due to the coronavirus pandemic, and increased sales. Operating income rose 33.6% year on year to 124 million yen. In the second half of that term, the company made up for the delay in commencement of demolition works due to the pandemic in the first half. SG&A decreased 1.2% year on year, as personnel expenses augmented, but advertisement and R&D costs declined. The impact of the novel coronavirus was not insignificant in the first half, but their on-site business operations were not suspended, and the company made efforts to diversify clients and expand its business scope. The company considers that such efforts paid off and their results were almost in line with the forecast.

- For the term ending January 2022, sales are projected to grow 52.1% year on year to 5.6 billion yen, and operating income is forecast to rise 261.4% year on year to 450 million yen. As there is strong demand for plant dismantlement, significant increases in sales and profit are expected. The company plans to pay an interim dividend of 6 yen/share and a term-end dividend of 10 yen/share for a total of 16 yen/share per year, unchanged from the previous term. The expected payout ratio is 36.6%.

- The company announced the “mid-term management plan 2025.” Based on “Besterra ESG Management,” the company will proceed with the five strategies: “technological patent strategy,” “sales strategy,” “strengthening of the dismantlement management system,” “digital transformation (DX),” and “management strategy,” with the aim of achieving “sales of 10 billion yen, an operating income of 1 billion yen, and an ROE of 13.0%” in the term ending January 2026.

- In the term ended January 2021, sales and profit slightly grew, exceeding the forecast. While maintaining the recovery trend in the second half, the company aims to recover sales and profit considerably this term, based on the large order backlog at the end of the term. In the short term, we would like to monitor the variation in quarterly performance.

- As the Japanese government stated a global commitment: “Carbon Neutrality by 2050,” the dismantlement and renovation of power generation plants, petroleum/petrochemical plants, etc. will be accelerated further. It seems that the Japanese government expects that nuclear power plants, which do not emit greenhouse gases, will fulfill some roles, but seeing the recent news coverage, it is likely that old-fashioned nuclear power plants will be dismantled from the viewpoint of safety. While taking advantage of such demand growth, the company will strengthen its human capital and promote DX, and strive to achieve “sales of 10 billion yen and an operating income of 1 billion yen” in the term ending January 2026 and then “sales of 100 billion yen and an operating income of 10 billion yen.” We would like to keep an eye on their activities.

1. Company Overview

As a specialist in plant dismantlement, BESTERRA manages the dismantlement of plants (metal structures) for iron-making, power generation, gas, petroleum, etc. Its core competence is “the method and technology for dismantling plants,” and it has many patented methods including international patents. The company concentrates its managerial resources on engineering (proposal, design, and work planning) and management (supervision and work management), and outsources actual dismantlement work to its affiliates, and so it does not own heavy machinery or construction teams (the risk of owning assets can be avoided), and it is unnecessary to procure materials, etc. and make transactions for material production (the inventory risk can be avoided).

The Group also has two consolidated subsidiaries, Hiro Engineering, which provides human resource services for design work, etc. and 3D Visual KK, which handles 3D scan modeling and design work.

The corporate name “BESTERRA” was coined by combining the English word “Best (the superlative of ‘good’)” and the Latin word “Terra (the earth),” and、infused with the ambition to “create the best earth.” By developing an integrated system for dismantling and recycling, the company aims to actualize an advanced recycling society and contribute to the earth environment.

Corporate ethos and the code of conduct

Under the corporate ethos “We will contribute to the earth environment with our flexible way of thinking, creativity, and technologies using these concepts,” the company enacted the following code of conduct.

Long-term vision (Ideal state of the company)

・ Plant Demolition Leader in Japan

・ Proposing Plant Disassembly Technologies to the World

1-1 Characteristics of the business

The company has a single segment consisting of the plant demolition business. For others, it engages in the human resource service business and the 3D scan, modeling, and design business. In the term ended January 2021, the plant dismantling business accounted for 92.7% of total sales.

Plant dismantlement business

In the plant dismantlement business, the company works on all types of plants in the fields of ironmaking, electric power, gas, petroleum and petrochemicals, etc. The company offers services on overall engineering processes including proposals, designing, work planning, outsourcing/arrangement of equipment and materials, supervision, safety management, cost management, financial management, and handling of governmental procedures. It focuses on designing its unique demolition technologies and supervising demolition works based on demolition plans and uses specialized subcontractors for demolition works.

The clients for plant dismantlement are leading companies that own plants for ironmaking, electric power, gas, petroleum, etc. In most cases, the equipment installation companies of the corporate groups of clients or leading general contractors are entrusted with dismantlement, and then BESTERRA serves as the primary or second-tier subcontractor.

Also, in the plant dismantlement business, BESTERRA receives valuable materials generated through dismantlement, such as scrap, and sells them to scrap handlers. Accordingly, the company estimates the value of valuable materials while comprehensively considering material, quantity, price (market price of each material, such as iron, stainless steel, and copper), etc. and negotiates with clients about the fee for dismantlement work. In accounting, the gain from sale of valuable materials is included in revenue from dismantlement work, and posted as part of sales from completed dismantlement work. In some cases, contractors (clients) dispose of (sell) scrap, etc. by themselves.

*Two standards for posting revenue and seasonality of revenue posting of the company

The standards for posting revenue from contracts can be classified into the completed contract method, in which revenue is posted when works are completed, and the percentage-of-completion method, in which revenue is posted according to the progress of works. In the case of plant dismantlement, where valuables, such as scrap, are collected, revenue cannot be confirmed until the sale of scrap. Therefore, the company basically applies the percentage-of-completion method to large-scale projects whose contract amount exceeds 50 million yen and whose period exceeds 3 months, from the term ended January 2018 (the completed contract method is applied to the projects that are not applicable to the above criteria). The timing of posting revenue (the completion of demolition work) from works for which the completed contract method is used is often affected by the capital investment plans of clients. In the case of BESTERRA, revenue tends to be posted in the first quarter (February to April) and the fourth quarter (November to January) (the seasonality of revenue posting). However, the variation in quarterly performance may mislead investors, so the company is expanding the scope of application of the percentage-of-completion method step by step, to equalize the timings of revenue posting.

Others

In response to the chronic shortage of skilled construction workers, the company began providing human resource services in January 2013, and in March 2018, it made Hiro Engineering, which handles human resource services such as design work, a subsidiary. In January 2015, the company began offering a 3D measurement service as well. It established 3D Visual KK in December 2019, and 3D scan modeling and design business was transferred from INTER ACTION Corporation (securities code: 7725) in February 2020.

1-2 Strengths: an excellent client base, efficient dismantlement management based on plenty of experience, and intellectual property, such as patented methods

The strengths of the company are excellent client assets, efficient dismantlement management based on plenty of experience, and intellectual property, such as patented methods. Because the clients are basically engineering subsidiary companies of leading companies in ironmaking, electric, gas, coal oil fields, and major general contractors, which are easily trustable excellent clients, and it is predicted that they will receive orders continuously. The clients of the leading companies highly evaluate its company’s total management (low cost and high efficiency) of plant dismantlement that it cultivated experiences for over 40 years, and it elect a barrier to entry.

Furthermore, a variety of technologies and know-how the company possesses, which have been accumulated through environmental work, etc. is also the strength of the company, including the recycling of waste materials which is a manifest and potential intellectual property.

Patented methods, etc.

“Apple peeling demolition method” and fusing robot “Ringo☆Star”

The “apple peeling demolition method” is a method of dismantling a large spherical tank, such as gas holders and oil tanks, by cutting it in spirals from the center of the ceiling of the enclosure part. The cut part spirals down to the ground gradually under the force of the earth’s gravity (natural energy). The method enjoys superiority in a work period, cost, and safety, and has considerable competitive advantages, realizing “greater promptness, higher cost efficiency, and added safety.” Furthermore, the company offers a robot for the fusing process, “Ringo☆Star,” which automates the “apple peeling demolition method.” (The company is also working to expand the range of applications for “Ringo☆Star” by developing a new attachment).

Environment-related methods

The company has cultivated experiences and business results of a multitude of environment-related demolition works, using the “fireless methods” which do not require the use of fire. For example, although polychlorinated biphenyls (PCBs) are considered as a toxic substance and therefore totally abolished today, it had been used for many years in transformers and condensers because of its excellent thermal stability and chemical stability (electric insulation characteristics). In many cases, transformers and condensers are disposed of in conjunction with plant demolition works; however, because PCBs gasify when they are treated at the high temperature, posing a risk of inhaling the gas so generated, any firearms (such as gas cutting machines) cannot be used in demolition and withdrawal involving PCBs. The company is skillful at fireless and quasi-fireless methods using saber saws (which cut off objects with their saw blades moving in a reciprocating manner) that can cut off objects thicker than the thickness, which, in the industry, had been considered impossible to cut, through numerous devices, including measures against seizure of motors and recycling of blades. BESTERRA has applied for joint patents with Hitachi Plant Construction, Ltd. for a transformer dismantling method, a transformer dismantling jig, and a cutting device for dismantling a transformer.

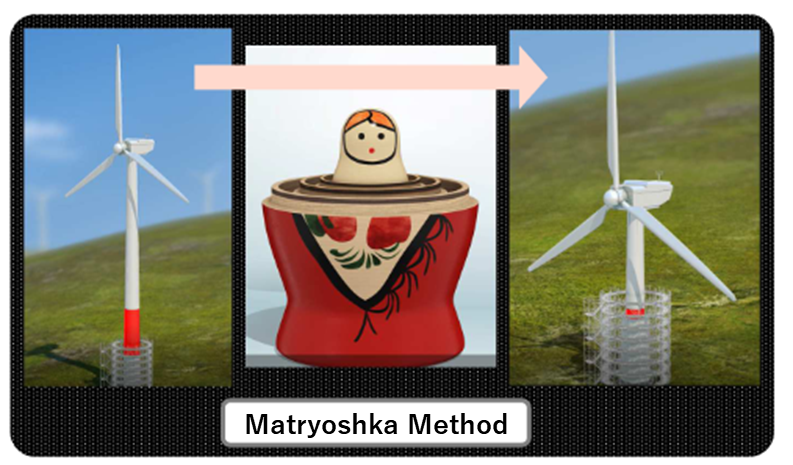

Windmill demolition works

The number of power-generating wind turbines continues to increase by about 20% annually worldwide, but the demand for dismantling is expected to increase in the future due to wear and tear and economic obsolescence. According to the material presented by the company, the wind power generation volume worldwide is 486,790 MW (by about 340,000 onshore power generation plants and about 4,000 offshore ones) with an annual growth rate of about 20%. In Japan, the number of wind power generation plants stood at 2,225 as of the end of 2017, expanding by about 90 every year. Meanwhile, as the useful life is approximately 15 to 20 years, and the windmills for power generation established in the early stage are reaching the application limit. Moreover, not a few plants need to be dismantled due to damage or fatal failure caused by thunderbolts or typhoons.

How to knock down a power-generating wind turbine (international patent application)

As some windmills have been built in mountain districts and on the sea, demolition of them is highly difficult. The company has devised a method for dismantling wind turbines that does not require scaffolds and has already acquired a domestic patent for “Method of knocking down a power-generating wind turbine.” International patents are pending for “Method of knocking down towering structures using their bases” and “Method for dismantling tower-shaped equipment for wind power generation.” Safety of workers can be improved dramatically, and the work period can be shortened by using these patent-based methods.

Pursuit of the value of the 3D business

Using services such as layout simulation, strain/bending/torsion measurement, comparison of structures before and after improvement, and video walkthroughs, the company converts physical data taken when plants were established (more than 30 years ago) into the latest 3D data and uses that to provide detailed information about the dismantling process. They also provide unique 3D measurement services for dismantling work using the latest measuring technology and simulation systems that are capable of drawing data as 2D diagrams, handling BIM/CIM modeling, Perfect 3D, and 3D printing, etc.

“Visualize” the dismantling process

Layout simulation | The equipment models produced with 3D CAD are placed in 3D data, and the replacement of equipment can be simulated. By moving the equipment models, it is possible to check how they interfere and collide with one another. |

Strain, bending, and torsion measurements | It is possible to measure changes in shapes. This is useful for diagnosing frameworks tentatively, to check whether a building got distorted due to an earthquake, deterioration, etc. |

Comparison of structures before and after installation

| The shapes of equipment that changes due to heat and vibration, such as pipes, conveyors, and furnaces, at the time of installation and after operation are compared. With 3D data, it is possible to grasp overall changes intuitively. |

Video walkthroughs

| Walk-through videos are produced by using synthesized point cloud data. These videos can be utilized for presentations and publicity videos regarding dismantlement plans and real estate information. |

Unique 3D measurement service

Draws a two-dimensional diagram | The 3D CAD models based on point cloud data are converted into drawings. It is also possible to produce drawings directly from point cloud data in a simple manner. |

Handles BIM/CIM modeling | Modeling is conducted with 3D CAD based on point cloud data. It is possible to produce models of the parts that require construction or renovation as BIM (building information modeling) data. |

Perfect 3D | This is a large-scale 3D data measurement service combining automobile-based MMS (mobile mapping system), airborne laser measurement, water area measurement, etc. |

3D printing | After modeling with point cloud data, data are processed and deformed so that they can be shaped with a 3D printer. It can produce fine structures with a lamination pitch of 15 μm. |

1-3 ROE analysis

| FY 18/1 | FY 19/1 | FY 20/1 | FY 21/1 |

ROE (%) | 11.7 | 23.8 | 2.3 | 5.6 |

Net Income to Sales Ratio (%) | 5.87 | 12.62 | 1.75 | 3.87 |

Asset Turnover Ratio(Times) | 1.11 | 1.08 | 0.72 | 0.67 |

Leverage(Times) | 1.80 | 1.75 | 1.85 | 2.14 |

ROE was low in the previous term and the term before that, but the company aims to achieve “an ROE of 13% in the term ending January 2026” in its “mid-term management plan 2025” (which will be described later).

2. Fiscal Year ended January 2021 Earnings Results

2-1 Consolidated results

| FY 1/20 | Ratio to sales | FY 1/21 | Ratio to sales | YoY | Compared to forecasts |

Sales | 3,436 | 100.0% | 3,682 | 100.0% | +7.2% | -3.1% |

Gross profit | 708 | 20.6% | 732 | 19.9% | +3.4% | - |

SG&A expenses | 615 | 17.9% | 608 | 16.5% | -1.2% | - |

Operating income | 93 | 2.7% | 124 | 3.4% | +33.6% | +3.8% |

Ordinary income | 97 | 2.8% | 212 | 5.8% | +118.9% | +6.4% |

Net Income | 59 | 1.7% | 142 | 3.9% | +137.8% | +9.7% |

*unit: million yen

Sales and operating income increased, and profit exceeded the forecast.

Sales were 3,682 million yen, up 7.2% year on year. Thanks to the steady progress of demolition works, the company was able to make up for the delay until the second quarter due to the coronavirus pandemic, and increased sales. Operating income rose 33.6% year on year to 124 million yen. In the second half of that term, the company made up for the delay in commencement of demolition works due to the pandemic in the first half. SG&A decreased 1.2% year on year, as personnel expenses augmented, but advertisement and R&D costs declined. The impact of the novel coronavirus was not insignificant in the first half, but their on-site business operations were not suspended, and the company made efforts to diversify clients and expand its business scope. The company considers that such efforts paid off and their results were almost in line with the forecast.The large order backlog at the end of the term, too, will contribute to the performance this term.

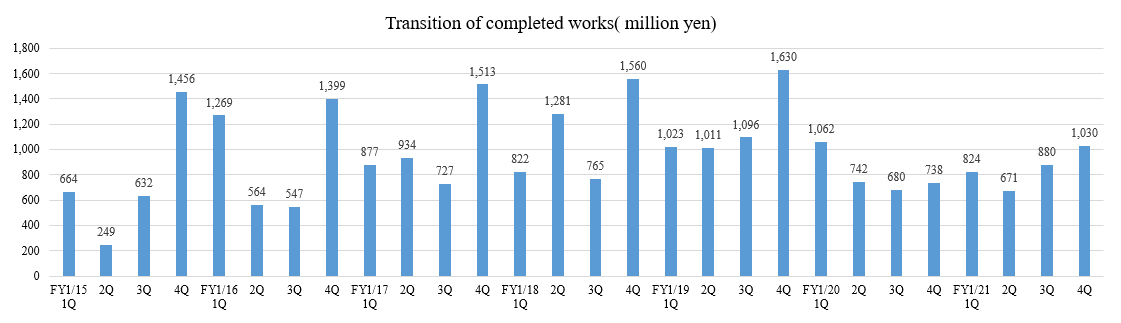

The number of completed works (rough estimates)

| FY 1/20 | Ratio to sales | FY 1/21 | Ratio to sales | YoY |

Electric power | 419 | 13% | 615 | 18% | +47% |

Steelmaking | 1,838 | 57% | 1,263 | 37% | -31% |

Petroleum/petrochemical | 548 | 17% | 1,161 | 34% | +112% |

Gas | 290 | 9% | 68 | 2% | -76% |

3D | - | - | 102 | 3% | - |

Other | 129 | 4% | 205 | 6% | +59% |

Total | 3,224 | 100% | 3,414 | 100% | +6% |

*unit: million yen

The composition is well-balanced, as the company received many orders as a main contractor in the chemical field.

The amount of completed demolition works is recovering.

Breakdown of SG&A

| FY 1/20 | Ratio to sales | FY 1/21 | Ratio to sales | Increase/ Decrease | Major change factors |

Personnel Cost | 327 | 9.5% | 333 | 9.0% | +1.7% | Increase in headcount of main employee |

R&D Cost | 16 | 0.5% | 9 | 0.2% | -45.9% | Decreased development of robots |

Commissions and Remunerations Paid | 53 | 1.5% | 64 | 1.7% | +20.2% | Factory introduction fee |

Recruitment Cost | 16 | 0.5% | 13 | 0.4% | -19.2% | Advertising media, referral fee |

Advertisement | 10 | 0.3% | 4 | 0.1% | -56.7% | Decrease of exhibition |

Other | 190 | 5.5% | 183 | 5.0% | -3.7% | - |

Total SG&A expenses | 615 | 17.9% | 608 | 16.5% | -1.2% | - |

*unit: million yen

Overall SG&A was unchanged from the previous year, although the SG&A expenses in respective categories fluctuated, as the company reconsidered costs in the fiscal year amid the coronavirus pandemic.

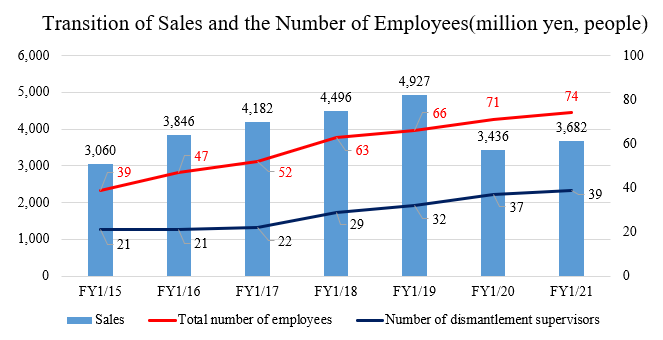

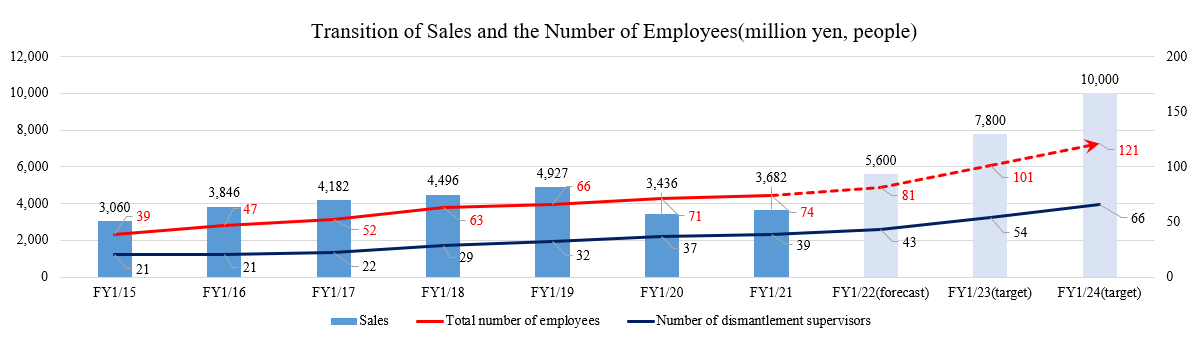

For sustainable growth, the company needs to focus on receiving orders as a main contractor, and it is indispensable to increase demolition supervisors. Accordingly, the company continuously engages in recruitment activities. The number of demolition supervisors increased by 2 from the beginning of the term to 39.

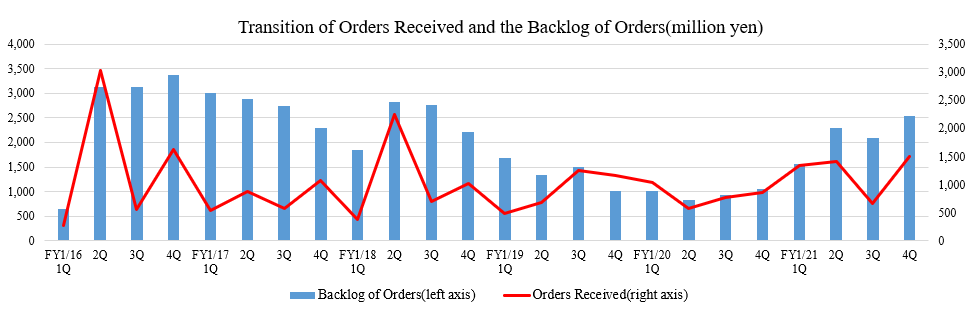

2-2 Orders received and the backlog of orders

| FY 1/20 | FY 1/21 | YoY |

The backlog of orders at the beginning of the term | 1,021 | 1,046 | 2.5% |

The amount of works received | 3,249 | 4,912 | 51.2% |

The amount of completed works | 3,224 | 3,414 | 5.9% |

The backlog of orders at the end of the term | 1,046 | 2,545 | 143.1% |

*unit: million yen

Order backlog was large, as the company received large-scale orders thanks to the improvement in the order-receipt environment caused by the increase of excess facilities. Also, in the term ending January 2022, they are reportedly receiving a sufficient number of business inquiries.

Orders received by sector (Amounts are approximate.)

| FY 1/20 | Ratio | FY 1/21 | Ratio | YoY |

Electric power | 73 | 7% | 814 | 32% | +1,012% |

Steelmaking | 565 | 54% | 382 | 15% | -32% |

Petroleum/petrochemical | 397 | 38% | 1,145 | 45% | +188% |

Gas | - | - | 76 | 3% | - |

Other | 10 | 1% | 127 | 5% | +1,117% |

Total Orders Received | 1,046 | 100% | 2,545 | 100% | +143% |

*unit: million yen

Through active marketing as a main contractor, the company received orders for large-scale dismantlement projects in the electric power and chemical fields. The market share in the iron-making field dropped, but it is expected to recover, as there will emerge demand for removal or renovation of facilities due to business reorganization, deterioration of equipment, etc.

2-3 Financial condition and cash flow(CF)

Financial condition

| January 2020 | January 2021 |

| January 2020 | January 2021 |

Cash | 938 | 1,367 | Payables | 347 | 558 |

Notes receivable, accounts receivable from completed construction contracts and other | 708 | 1,392 | Borrowings and Bonds | 1,747 | 2,519 |

Current Assets | 1,965 | 2,948 | Liabilities | 2,400 | 3,435 |

Investments, Others | 2,680 | 2,765 | Net Assets | 2,540 | 2,595 |

Noncurrent Assets | 2,975 | 3,082 | Total Liabilities, Net Assets | 4,941 | 6,030 |

*unit: million yen

Total assets grew 1,089 million yen from the end of the previous term to 6,030 million yen, due to the increases in cash & deposits and accounts receivable.

Total liabilities augmented 1,035 million yen to 3,435 million yen, because debts rose 772 million yen from the end of the previous term.

Nets assets were nearly unchanged.

Capital-to-asset ratio dropped 8.4 points from the end of the previous term to 43.0%.

Cash Flow(CF)

| FY 1/20 | FY 1/21 | YoY |

Operating Cash Flow(A) | -153 | -108 | +45 |

Investing Cash Flow(B) | -2,543 | -101 | +2,442 |

Free Cash Flows (A + B) | -2,697 | -209 | +2,487 |

Financing Cash Flow | 1,604 | 638 | -966 |

Cash and Equivalents at Term End | 938 | 1,367 | +428 |

*unit: million yen

The deficit of free CF shrank, as purchase of securities or investment securities decreased from the previous term.

The cash position improved.

2-4 Topics

(1) Fund procurement for completing the mid-term management plan

In January 2021, the company announced that it would procure funds by issuing share acquisition rights to third parties for achieving the mid-term management plan.

(Outline of the fund procurement scheme)

*To allocate share acquisition rights to the investment trust operated by the Hayate Group, which is an institutional investor that creates and operates investment trusts.

*The investment trust to which share acquisition rights will be allocated is Japan’s first investment trust that was introduced as the one for directly offering funds to enterprises (true direct financing) when it was established. Besterra would become the first enterprise to receive funds through this trust.

*When share acquisition rights are exercised, 1.36 million new shares will be issued, diluting the shares by about 16%, but the company will procure funds according to the rise in share price by adopting “The issue program targeted at Kikan-Toshika

institutional investors (K-TIP)” developed by the Hayate Group.

*Compared with capital increase through a public offering, it is possible to procure funds swiftly and efficiently. Compared with simple moving strike warrants, it is possible to curtail dilution and maximize the procurement amount.

*Through the 9th and 10th issuances of share acquisition rights, the company is estimated to procure a total of about 2.6 billion yen.

(Purposes of fund procurement)

The purposes are to secure funds for growth and strengthen the financial foundation for completing “the mid-term management plan 2025 (which will be described later)” announced on March 12.

1. To secure funds for growth “Investment in M&A in the 4 fields where high synergetic effects with the plant dismantling technology can be expected” | (1) Field related to the removal of equipment for decarbonization (2) Field related to the dismantlement of wind power generation facilities (3) Digital field for pursuing 3D business value (4) Specialized dismantlement field for sophisticating the dismantling technology

The company will also allocate funds for the increase of marketing and recruiting staff, the improvement of business bases, etc. in parallel with the expansion of their business scale. |

2. To strengthen the financial foundation | In order to cope with the drop in financial flexibility through the decline in liquidity on hand, the augmentation of borrowings, etc., the company will increase shareholders’ equity and fortify its financial foundation for successful business. |

As Besterra carries out original ESG management for realizing an advanced recycling-oriented society and attaining SDGs, it recognizes “(1) the field related to the removal of equipment for decarbonization” as a priority investment target.

Through the removal of facilities for decarbonization, it is expected that technological innovation will be triggered in various sectors, including transportation, industry, commercial/residential, and electric power, and business opportunities will increase. However, the removal of facilities for decarbonization is only one example. Through M&A, the company will invest in (2) wind power generation, (3) 3D business, and (4) sophistication of the dismantling technology.

3. Fiscal Year ending January 2022 Earnings Forecasts

3-1 Consolidated Earnings

| FY 1/21 | Ratio to sales | FY 1/22(forecast) | Ratio to sales | YoY |

Sales | 3,682 | 100.0% | 5,600 | 100.0% | +52.1% |

Operating income | 124 | 3.4% | 450 | 8.0% | +261.4% |

Ordinary income | 212 | 5.8% | 518 | 9.3% | +143.4% |

Net income | 142 | 3.9% | 360 | 6.4% | +152.5% |

*unit: million yen

A significant recovery is expected. Sales are expected to reach a record high.

Sales are projected to grow 52.1% year on year to 5.6 billion yen, and operating income is forecast to rise 261.4% year on year to 450 million yen. As there is strong demand for plant dismantlement, significant increases in sales and profit are expected. The company plans to pay an interim dividend of 6 yen/share and a term-end dividend of 10 yen/share for a total of 16 yen/share per year, unchanged from the previous term. The expected payout ratio is 36.6%.

4. Mid-term management plan 2025

In March 2021, the company announced the 5-year “mid-term management plan 2025 (FY 1/22 to FY 1/26),” which starts this term.

(1) External environment

①Expansion of the dismantlement market

In Japan, the ratio of facilities that are over 50 years old will increase at an accelerating pace in the coming 30 years.

It is forecast that more plants will be dismantled or renovated, due to the rapid deterioration of facilities constructed in or after the rapid growth period in the 1960s, economic obsolescence, corporate reorganization, international relocation, etc. The Japanese dismantlement market is expected to keep growing at an accelerating pace.

The company estimates that the scale of the dismantlement market is about 1 trillion yen.

The Cabinet decided to adopt the “removal of facilities for decarbonization” based on the declaration of carbon neutrality by 2050 and the “fifth basic plan for energy,” which is focused on the reduction of greenhouse gas emissions. Like this, the government, too, is promoting the restructuring and reestablishment of the plant industry for improving efficiency, so it can be expected that there will be more governmental measures for renovating or dismantling various facilities, including power plants.

②Trend of the plant industry

The company considers the trend of each industry and the market scale as follows.

Industry | Market scale | Trend, etc. |

Electric power | About 13 trillion yen | As coal-fired power plants are decreasing and 24 nuclear power plants are to be decommissioned, it is necessary to comprehensively reconsider the system for actualizing the appropriate combination of energy. |

Iron-making | About 2 trillion yen | Due to business reorganization and deterioration, it is necessary to remove or renovate redundant facilities. |

Petroleum/petrochemical | About 8 trillion yen | Most of industrial complexes were constructed during the rapid economic growth period, so the sophistication, restructuring, etc. of equipment are progressing for boosting international competitiveness. |

Other manufacturing | About 20 trillion yen + α | Manufacturing industries are expected to see the renewal and dismantlement of equipment due to the streamlining of business operations through the technological evolution called the fourth industrial revolution and the changes in demand and supply in Japan. |

(2) Mid-term management plan 2025

① Ideal state and long-term vision

Besterra aims to flourish in the global market as the “plant demolition leader in Japan” and the “enterprise that proposes the plant dismantling technology to the world” based on its technologies and know-how.

To attain this goal, the company pursues “Besterra ESG management.” In detail, it will implement the five strategies: the “technological patent strategy,” “sales strategy,” “strengthening of the dismantlement management system,” “digital transformation (DX),” and “management strategy.”

② Besterra ESG management and SDGs

◎ Besterra ESG management

Under the corporate ethos: “to contribute to the earth environment with flexible thinking and creativity and technological capacity based on them,” the company aims to contribute to social sustainability and achieve beneficial growth. This is “Besterra ESG management,” and its unique business model for gaining competitive advantages.

The company will concentrate on the following five items, with the measures or policies of “SDGs of Besterra,” “enhancement of non-financial strategies and initiatives,” and “establishment of a growth model from the long-term viewpoint.”

Personnel | Pursuit of worthwhile jobs and individual growth |

Safety | Creation of a safety culture with its unique technologies |

R&D | Development of innovative demolition methods friendly to the earth |

Recycling | Realization of advanced environmental cycling through the strengthening of the venous industry |

Governance | Thorough transparency and risk control |

SDGs of Besterra

For contributing to the earth environment, the company set a total of 17 goals related to SDGs, and aims to attain them.

1 | To contribute to the earth environment by offering innovative dismantling technologies | ① To offer innovative dismantling technologies for deteriorated infrastructure ② To offer reliable, safe dismantling technologies for a low-carbon society and contribute to the earth environment ③ To offer advanced dismantling technologies as a professional in dismantlement by utilizing 3D technologies |

|

2 | To develop a working environment in which employees can feel that their jobs are worthwhile | ① To become a company in which every employee can feel that their job is worthwhile and be proud of the future ② To respect diversity and enrich the fair environment ③ To develop a fair educational environment where it is possible to exert abilities to the maximum |

|

3-1 | To realize an advanced recycling-oriented society and contribute to the establishment of a sustainable society | ① To dispose harmful materials and pollutants appropriately and offer technologies for making them harmless ② To develop a recycling business with high added value and improve productivity ③ To coexist with local communities and contribute to the improvement of local environments |

|

3-2 | To foster partnership for establishing a sustainable (advanced recycling) society | ① To foster future-oriented partnership with lofty goals beyond all kinds of boundaries ② To promote fair and equitable partnership between enterprises ③To offer new technologies, knowledge, and findings to the advanced recycling society, to attain goals |

|

③ Strategies

The outline of the five strategies: “technological patent strategy,” “sales strategy,” “strengthening of the dismantlement management system,” “digital transformation (DX),” and “management strategy” is as follows.

③-1 Technological patent strategy

The company has obtained a lot of patents regarding tanks, boilers, chimneys, etc., and will keep acquiring competitive patents for dismantlement methods in the fields of windmills, wind power generation, etc., where demand is expected to grow, and propose original demolition methods and put them into practice.

While the global demand for windmills for power generation is growing at an annual growth rate of about 20%, the demand for dismantlement is projected to rise, due to the expiration for use and economic obsolescence.

In order to meet the growing demand for dismantlement of wind power generation equipment, the company has applied for a patent for the dismantlement method “Matryoshka Method” ahead of competitors.

In addition to the 1 already obtained patent and 5 pending patents, the company is considering new multiple methods. The technological development division is in charge of development of dismantlement methods for obtaining patents and has a system for developing methods based on ideas collected from on-site staff.

(Source: The company)

Since harmful substances are used at each plant equipment, soil pollution is an issue. Through the amendment into the Soil Contamination Countermeasures Act, it became necessary to conduct a soil survey when developing land with an area of 900 m2 or larger (before the amendment: 3,000 m2 or larger) in April 2019.

They will respond to the growth of such needs.

③-2 Sales strategy

In detail, the company will work on the “increase of orders received as a main contractor,” “enhancement of corporate brand development,” “cementing of cooperation,” and “upgrade of business bases.”

◎ Increase of orders received as a main contractor

The company aims to boost earnings ratio by increasing direct orders and the ratio of directly commissioned works and public works.

Since Besterra proposes plans based on each client’s plan, it possesses the knowledge of how directly commissioned works are carried out, but in order to fortify the system, it will adopt the system for obtaining qualifications, including those for supervising engineers, increase marketing support staff, and reform the personnel system.

◎ Enhancement of corporate brand development

In order to effectively enhance its brand power, the company will enrich advertising tools and distribute unified messages to stakeholders via the media, etc.

◎ Cementing of cooperation

The company will cement corporation in various ways.

* Cementing of cooperation with group companies

The company offers human resources services and 3D measurement services via subsidiaries. It will pursue business synergy by cementing cooperation among group companies and offering services through group marketing.

* Cementing of cooperation with alliance partners

The company will cement cooperation for decommissioning nuclear power plants.

Besterra will serve as a platform, and alliance partners, such as Hitachi Plant Construction, Ltd. (business alliance formed in July 2018), Daiichi Cutter Kogyo K.K. (business alliance formed in September 2018), and Rever Holdings Corporation (business alliance formed in September 2019), will conduct cooperative activities while utilizing each other’s strengths, to establish a system for decommissioning business.

In Japan, there are 60 nuclear reactors at 19 locations, but 24 reactors out of them are to be decommissioned. The examination on the compliance with the new standards will progress, and the decommissioning business is expected to grow. Actually, business inquiries are reportedly increasing.

* Cementing of cooperation with Rever HD

The company will cement the cooperation with Rever Holdings Corporation, which is an equity-method affiliate.

While the core business of Besterra is the dismantlement of plants, which is positioned between the arterial industries including “electric power, iron-making, and petroleum/petrochemical ones” and the venous industries including “scraps and industrial waste,” the core business of the Rever Holdings Group is the intermediate processing in the venous industries including “scraps and industrial waste.”

While responding to the deterioration of infrastructure, whose market is expected to grow, the two companies will fulfill the role of linking the arterial and venous industries and establish an indispensable position in the advanced recycling society.

◎ Upgrade of business bases

In order to increase orders for recurring-revenue projects (such as continuous orders from clients, works that require supervisors always staying, the apple peeling dismantlement method, and PCB treatment works), the company will consider the establishment of new business bases in Kyushu, where the amount of dismantlement projects is large, industrial complexes in Kashima, etc., Sendai, etc.

③-3 Strengthening of the dismantlement management system

* Improvement of the procurement system

The company used to outsource works at each site for swift management, but seeing the expansion of the corporate scale, the newly established procurement division of the headquarters has adopted a cost control system. It aims to optimize procurement costs by outsourcing works all at once.

* Staffing plans

As the company specializes in dismantlement management, it needs to deploy a supervisor for all works. For sustainable growth, it is indispensable to increase dismantlement supervisors, so it will engage in company-wide recruitment activities.

* Development of a personnel training system

In order to cope with the chronic shortage of manpower, the company will develop “a program for producing advanced dismantlement engineers” to increase the number of employees who will drive business growth and make them useful early.

“Program for producing advanced dismantlement engineers”

The company will implement the “training program” for realizing the transfer of techniques from experienced engineers to inexperienced ones.

In addition, it will “introduce a course for specialists in dismantlement and a course for managers” and “enrich the system for promoting the acquisition of qualifications” for producing dismantlement supervisors, and formulate and operate a personnel system, which is focused on the workstyles of individuals.

* Cementing of cooperation with subcontractors

Actual dismantlement works are conducted by subcontractors, and Besterra supervises and manages on-site work. Subcontractors are groups of engineers who take central roles in dismantlement works. Accordingly, Besterra aims to improve the quality of works by cementing the cooperation with them.

Besterra makes transactions with a hundred and several tens of subcontractors per year. They are composed of a broad range of companies, including dismantling firms, companies that lease or rent heavy machinery, equipment, etc., and companies that process scraps and industrial waste. Among subcontractors around Japan, only about 30 companies possess the technology required for Besterra’s works, so Besterra entrust them even if the site is distant.

With the dismantlement plan designed by Besterra, the dismantlement process is optimized, and a high profit margin is actualized. Besterra pays to subcontractors within about 35 days after the closing date of a transaction, while clients pay within about 105 days after the closing date of a transaction. This is a merit in cash management for subcontractors undertaking the works of Besterra.

* Acquisition of essential technologies through M&A, etc.

The company will encourage enterprises that possess essential technologies for the processes such as preliminary surveys, planning, dismantlement, disposal of waste, and ground leveling to join the Besterra Group through M&A or the like and acquire advanced technologies.

③-4 Promotion of DX

By utilizing data and digital technologies, the company will upgrade products, services, and business models, and reform its business operations, organizations, processes, corporate culture, and climate, to establish a competitive advantage.

* Crane rail inspection robots and revision to inspection methods

In order to efficiently conduct regular inspection of overhead cranes, which are installed at plants and factories to convey heavy objects and parts, the company has developed a self-propelled inspection robot that runs on a crane rail in cooperation with iXs Co., Ltd.

A distortion of an overhead crane caused by deterioration due to aging would lead to a serious accident if it is not dealt with, so the regulations on safety of cranes, etc. in the Industrial Safety and Health Act stipulates that an enterprise that has installed a crane shall inspect it voluntarily once a month and once a year.

In the conventional manual inspection, workers had to go to the ceiling. Accordingly, there was a risk of an accident, visual inspection led to inconsistency, and the loss of opportunities occurred due to the suspension of factory operation.

Meanwhile, inspection robots can reduce the risk of accidents among workers, always obtain accurate, meticulous data, and complete inspection in a short period of time or in a spare time.

Besterra estimates that the market scale is about 30 billion yen.

* Reform of design and dismantlement processes

By converting paper data at the time of construction (over 30 years ago) into cutting-edge 3D data, the company will conduct dismantlement whose processes are “visualized.”

* Streamlining of on-site work based on the collaboration between people and robots

The company will use people and robots together at dismantlement sites while combining technologies for 3D measurement, dismantlement, and robot control.

③-5 Management strategy

*Environment

The company will contribute to the environment-oriented business administration of each client, by actualizing environment-oriented business administration itself and providing dismantlement technologies for revamping plant equipment that would produce high environmental burdens.

* Reform of workstyles and development of a system for working without worry

The company has adopted various systems so that employees can work with peace in mind for a long period of time. It will make efforts to increase the retention rate of employees and utilize the systems for recruitment.

(Concrete examples)

・Income insurance: The company will fully bear the insurance premiums. 50% of monthly pay will be covered until the age of retirement (60 years old). It is one of the best income insurances in Japan.

・ Retirement benefit system

・ Employee shareholding association: The company bears 15% of the reserve for members.

・ Retainable annual paid holidays: Paid holidays can be generally retained for 40 days as set forth in the Labor Standards Act, but in the company, it can be retained for up to 80 days in case an employees needs to recover from an injury or a disease.

*Governance

In order to actualize a system for achieving profitable growth and a sustainable society, the company will tighten its corporate governance.

As mentioned above, the company has procured funds by issuing share acquisition rights for the purposes of securing funds for growth and fortifying its financial foundation for completing the mid-term management plan.

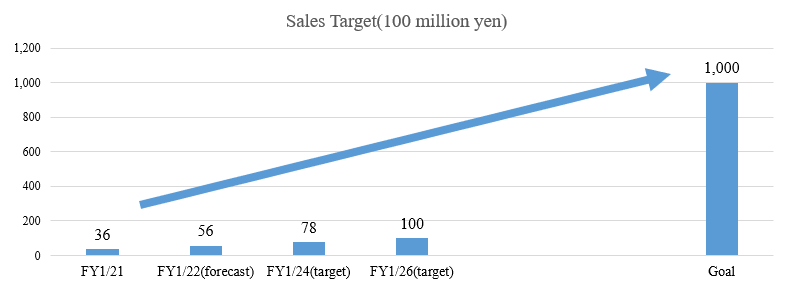

⑤ Numerical goals

The company set the following numerical goals.

| FY21/1 | 1st year FY 22/1 | 3rd year FY 24/1 | 5th year FY 26/1 | CAGR (1) | CAGR (2) |

Sales | 3,682 | 5,600 | 7,800 | 10,000 | +22.1% | +15.6% |

Operating income | 124 | 450 | 720 | 1,000 | +51.8% | +22.1% |

Ordinary income | 212 | 518 | 794 | 1,072 | +38.3% | +19.9% |

Net income | 142 | 360 | 552 | 752 | +39.6% | +20.2% |

Operating income margin | 3.4% | 7.9% | 9.2% | 10.0% | - | - |

ROE | 5.6% | 12.3% | 12.5% | 13.0% | - | - |

EPS | 17 | 43 | 67 | 91 | +39.9% | +20.6% |

*unit: million yen, yen.

*CAGR (1) is the average annual growth rate from FY01/21 to FY01/26, and CAGR (2) is the average annual growth rate from FY01/22 to FY01/26, calculated by Investment Bridge Co., Ltd.

In the long term, the company aims to achieve “sales of 100 billion yen and an operating income of 10 billion yen” and “a 10% share in the plant dismantlement market.”

⑥ Distribution of profits and return to shareholders

With regard to the distribution of net income, the company set the policies: (1) “investment for future growth,” (2) “internal reserve for strengthening the business base,” and (3) “return of profit to shareholders targeting a payout ratio of 40%.”

For growth, the company allocates funds rationally according to situations to the investment in human resources (recruitment and education), the investment in technological development (dismantlement methods and robots), the investment in systems (3D systems, BIM and CIM), and the investment in strategic business (M&A).

5. Conclusions

In the term ended January 2021, sales and profit slightly grew, exceeding the forecast. While maintaining the recovery trend in the second half, the company aims to recover sales and profit considerably this term, based on the large order backlog at the end of the term. In the short term, we would like to monitor the variation in quarterly performance.

As the Japanese government stated a global commitment: “Carbon Neutrality by 2050,” the dismantlement and renovation of power generation plants, petroleum/petrochemical plants, etc. will be accelerated further. It seems that the Japanese government expects that nuclear power plants, which do not emit greenhouse gases, will fulfill some roles, but seeing the recent news coverage, it is likely that old-fashioned nuclear power plants will be dismantled from the viewpoint of safety. While taking advantage of such demand growth, the company will strengthen its human capital and promote DX, and strive to achieve “sales of 10 billion yen and an operating income of 1 billion yen” in the term ending January 2026 and then “sales of 100 billion yen and an operating income of 10 billion yen.” We would like to keep an eye on their activities.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with a board of company auditors |

Directors | 9 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance Report Update date: April 24, 2020

Basic policy

In order to promote sound business administration and win social trust sufficiently, our company recognizes corporate governance as the most important issue, puts importance on the improvement of the soundness, transparency, and fairness of business administration, and complies with laws and regulations thoroughly, and all executives operate business while keeping in mind that “the violation of laws or regulations would lead to management responsibility.” In detail, our company disseminates and executes business pursuant to laws, regulations, and in-company rules thoroughly, by developing appropriate systems for making decisions about business administration, fulfilling duties, supervising work, conducting internal control, etc.

It is also important to reform management systems for “achieving appropriate share price” and “increasing share price sustainably” to emphasize shareholders and strengthen the function to check business administration, to establish global-level corporate governance. The results of such efforts would win the trust of society, increase corporate value, and satisfy shareholders.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary principle 4-3-3】

Our company has not established a clear procedure ensuring objectivity, timeliness and transparency for dismissal of the president or CEO, but we strive to realize a mutual assessment by involving outside directors in the process of evaluation of nomination and remuneration of the Board of Directors, in order to carry out the assessment of effectiveness of the Board of Directors appropriately.

【Principle 4-11】

The Board of Directors consists of directors and others with thorough knowledge of each of our business lines, and outside directors who are company managers. While we consider the size of the board appropriate, we cannot say the same with regard to gender and ethnic diversity. As such, we will strive to place importance on diversity when appointing directors going forward. In addition, the Board of Directors, joined by outside directors, shall periodically meet to discuss the structure and management of the board in order to improve its capabilities and effectiveness. Our Board of Auditors comprises three independent auditors, including tax accounts and persons with experience in corporate management, with expert knowledge and experience in management, finance, accounting, sales, auditing, etc.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

From the viewpoint of business expansion based on maintaining and strengthening long-term, stable partnerships with business partners, etc., we will acquire and hold the shares of business partners, etc., if we judge that this will contribute to the improvement of our mid/long-term corporate value. For equity investments premised on forming business alliances, the management meets with and receives explanations of the operating environment, business strategy, and purposes of the capital alliance from representatives of the other party. Based on this, the Board of Directors comprehensively evaluates the appropriateness of the stock valuation report and judges whether the deal should take place. For strategically held shares, the Board of Directors constantly checks whether the holding of such shares will contribute to the improvement of our corporate value and confirms the purpose and rationality of said holding based on that check. Our company will appropriately buy/sell shares and exercise voting rights in accordance with relevant regulations, based on a comprehensive evaluation from the viewpoint of improving our corporate value.

【Principle 5-1 Policy on constructive dialogue with shareholders】

Regarding requests from shareholders for dialogue (interviews), our company believes that we should express a positive attitude within a reasonable scope in order to contribute to sustainable growth and medium- and long-term improvement of the corporate value of our company. Aiming to promote constructive dialogue with shareholders, with the planning department designated as a department in charge of IR activities, our company holds financial results briefings targeted at financial institutions and investors semiannually and discloses corporate information as needed on our website and through the system of optional disclosure offered by Tokyo Stock Exchange.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2021 Investment Bridge Co., Ltd. All Rights Reserved. |