Bridge Report:(1716)DAI-ICHI CUTTER KOGYO the fiscal year June 2019

President Masamitsu Takahashi | DAI-ICHI CUTTER KOGYO K.K. (1716) |

|

Company Information

Market | TSE 1st |

Industry | Construction |

President | Masamitsu Takahashi |

HQ address | 833 Hagisono, Chigasaki-shi, Kanagawa |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury shares) | Total market cap | ROE (Act.) | Trading Unit | |

1,862 yen | 5,691,668 shares | ¥10,597 million | 12.5% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥22.00 | 1.2% | ¥189.75 | 9.8 x | ¥1,853.35 | 1.0 x |

* The share price is the closing price as of November 07, 2019. The number of shares outstanding is calculated based on those at the end of the latest quarter excluding the number of treasury stock. ROE and BPS are the last quarter’s results.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Income Attributable to Owners of Parent | EPS | DPS |

June 2016 Act. | 12,857 | 1,733 | 1,780 | 1,115 | 196.01 | 12.00 |

June 2017 Act. | 12,840 | 1,412 | 1,473 | 990 | 174.01 | 15.00 |

June 2018 Act. | 16,283 | 2,187 | 2,263 | 1,487 | 261.37 | 25.00 |

June 2019 Act. | 14,871 | 1,760 | 1,843 | 1,251 | 219.80 | 20.00 |

June 2020 Est. | 15,700 | 1,730 | 1,856 | 1,080 | 189.75 | 22.00 |

* The estimated values are based on the forecasts made by the Company.

* Unit: million yen, yen

We will report on the financial results of DAI-ICHI CUTTER KOGYO for the fiscal year ended June 2019 and the outlook for the fiscal year ending June 2020 with an interview of the president Mr. Takahashi.

Table of Contents

Key Points

1. Corporate Overview

2. Fiscal Year ended June 2019 Earnings Results

3. Fiscal Year ending June 2020 Earnings Forecasts

4. Medium-Term Business Plan (from FY2019 to FY2021)

5. Interview with President Takahashi

6. Conclusions

<Reference: “Corporate Governance”>

Key Points

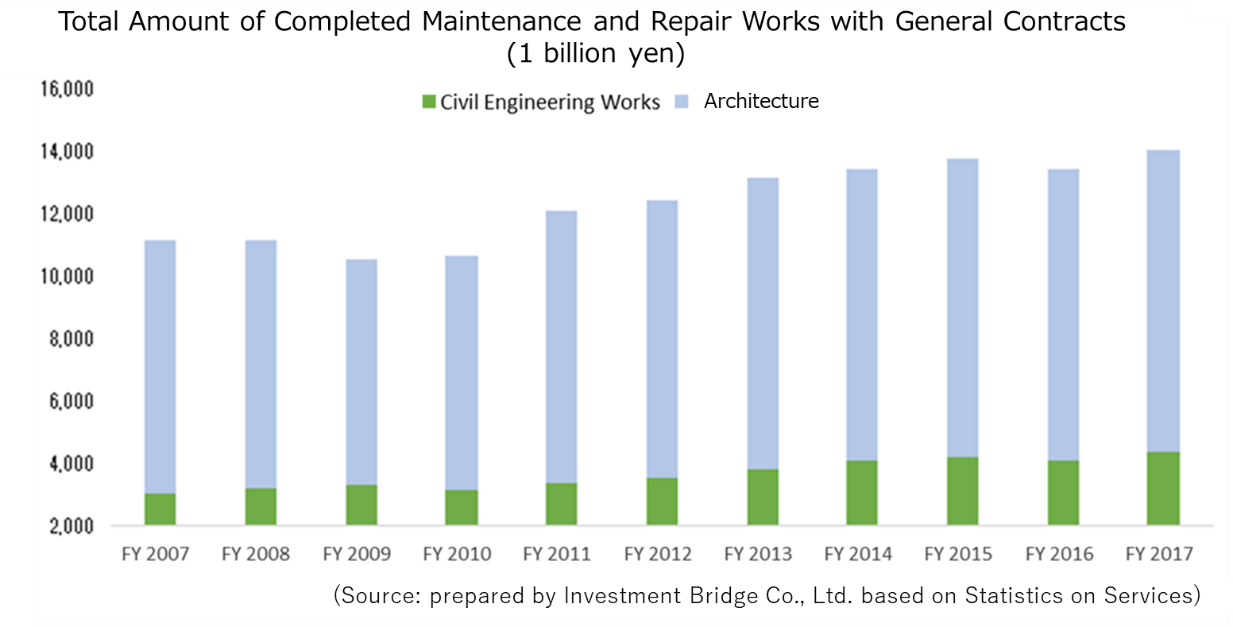

- Since its foundation in 1967, DAI-ICHI CUTTER KOGYO has been providing specialized technologies such as diamond method and water jet method with the keywords of "Cutting" "Chipping" "Cleaning" "Stripping" and "Grinding" under the basic principle of "aiming to be the best company". Against the backdrop of deteriorating social infrastructure and frequent natural disasters, the percentage of maintenance and repair work, which is the Company's strength, in domestic construction investment has been increasing year by year. In order to contribute to the society with the specialized technologies and high-quality services provided by highly skilled human resources, the Company is prioritizing the recruitment and development of human resources as its most important agenda.

- In the FY ended June 2019, the first year of the Medium-term Business Plan (up to FY ending June 2021), Net Sales decreased 8.7% year-on-year due to a decrease in the number of sawing and drilling works caused by dissipation of special factors. Operating Income fell 19.5% due to an increase in selling, general and administrative expenses stemming from the strengthening of the Company's internal structure. However, both Sales and Profits exceeded Initial Forecasts, and the objectives for the first year of the Medium-term Business Plan were achieved. The Company will pay a dividend of 20 yen. Although the Company failed to deliver its commemorative dividend of 5 yen, it maintained its ordinary dividend at the same amount as in the previous term.

- In the FY ending June 2020, DAI-ICHI CUTTER KOGYO expects to see a 5.6% increase in Revenue and a 1.7% decrease in Operating Income. Although Sales will increase as the effect of M&A, construction demand for the Olympics came to an end in the previous term, and construction in the Tokyo metropolitan area is expected to decrease during and around the Olympics. As unit prices are expected to fall due to a decrease in the number of projects, personnel expenses and administrative costs will increase due to the reinforcement of operational systems and the development of human resources. For the next FY ending June 2021, the Company expects to see a 10.8% increase in revenue and a 10.4% increase in Operating Income compared to its forecast in FY ending June 2020.

1. Corporate Overview

DAI-ICHI CUTTER KOGYO is providing maintenance and repair services for social infrastructure based on its expertise in diamond and water jet method, as well as services of building maintenance and reuse and recycling of IT equipment. The diamond method uses industrial diamonds to saw and drill roads and structures. In the conventional concrete crushing method, it was always necessary to be conscious of nuisances such as noise, vibration, dust, but in the diamond method, the operation can be executed safely, speedily, accurately and without having an adverse effect on the environment. On the other hand, the water jet method destroys concrete bonds by jetting water under extremely high pressure. With this method, a concrete structure can be repaired with pinpoint accuracy without damaging reinforcing steels.

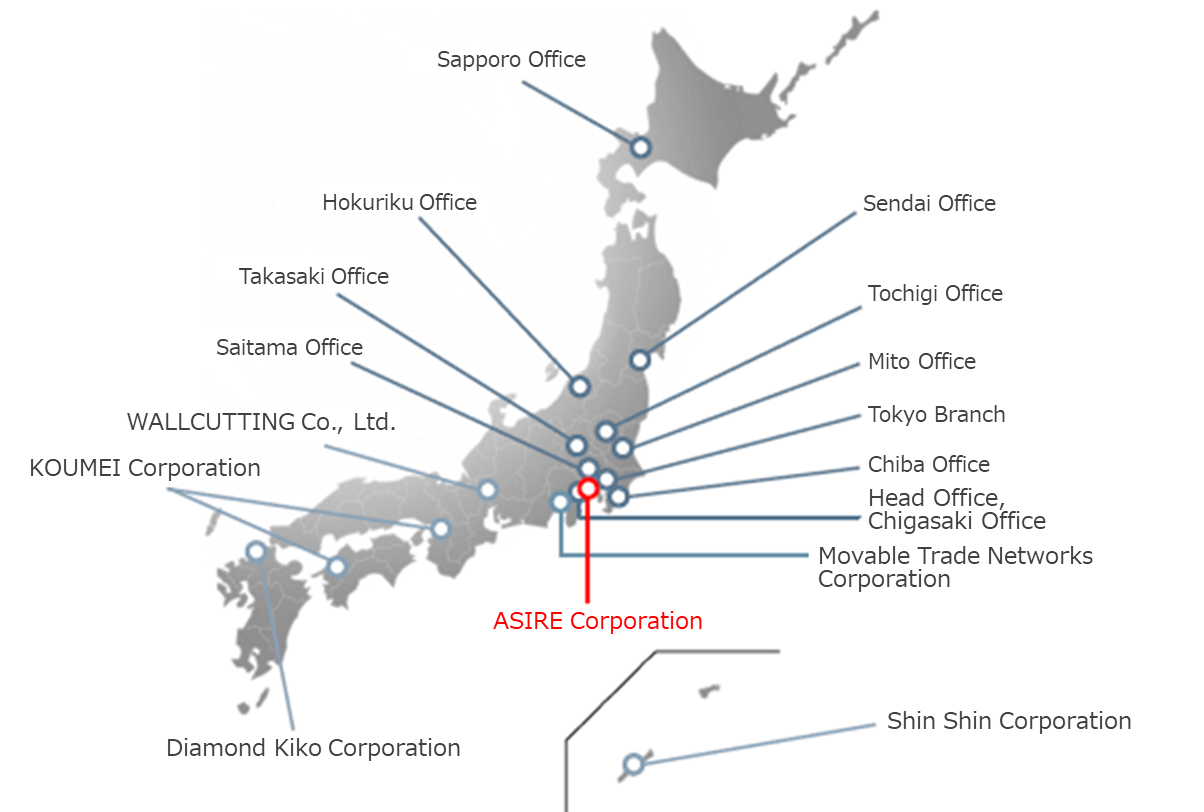

The Group includes 5 consolidated subsidiaries, WALLCUTTING Co., Ltd which engages in wire saw and core boring works; KOUMEI Corporation which is strong in offshore engineering (underwater sawing and drilling works); Shin Shin Corporation which is based in Okinawa Prefecture; ASIRE Corporation which is strong in architecture-related water jet method; Movable Trade Networks Corporation which engages in reuse and recycling business; and equity method affiliates Diamond Kiko Corporation.

[Management Philosophy: Aiming to be the best group by contributing to the society with the specialized technologies and high-quality services]

With "aiming to be the best group by contributing to the society with specialized technologies and high-quality services" as its management philosophy, the Group provides specialized technologies at various construction sites with the keywords of "Sawing" "Chipping" "Cleaning" "Stripping" and "Grinding".

Business Policy: We intend to pursue aggressive sales strategies by utilizing our organizational capacity and business development capability.

Construction Policy: We improve our quality construction power.

Safety Policy: We promote the health and safety of our employees.

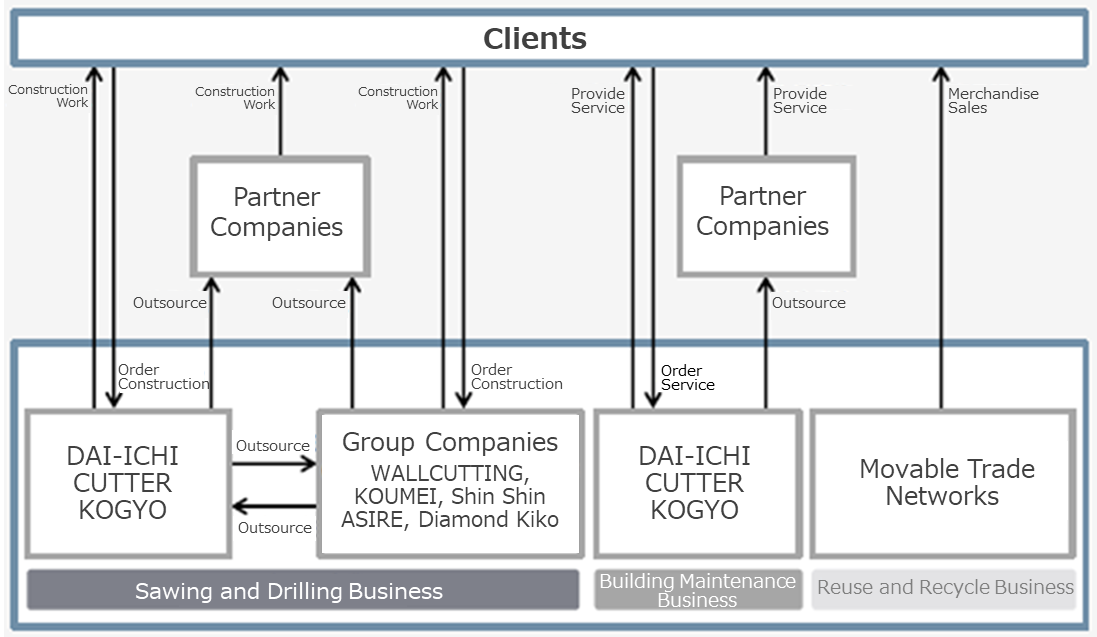

The business is divided into several categories, Sawing and Drilling Business, Building Maintenance Business, and Reuse and Recycling Business. The Sawing and Drilling Business is handled by DAI-ICHI CUTTER KOGYO, WALLCUTTING, KOUMEI Corporation, Shin Shin Corporation, ASIRE Corporation and Diamond Kiko. The Building Maintenance Business is handled by DAI-ICHI CUTTER KOGYO and the Reuse and Recycling Business is handled by Movable Trade Networks respectively.

Sales Distribution Ratio in FY ended June 2019 was 85.1%, 2.3%, and 12.6%.

(Source: the reference material of the Company)

Sawing and Drilling Business

“Sawing and drilling” refers to the sawing and drilling work necessary for various types of road pavement and the demolition and removal of concrete structures. The company’s Sawing and Drilling Business mainly focuses on the diamond method using industrial diamond (Diamond Method is a registered trademark of DAI-ICHI CUTTER KOGYO) and the water jet method using water pressure. Wastewater generated from sawing and drilling work is collected and neutralized at a large intermediate treatment facility to be reused as cutting water. Waste generated from sawing concrete is dehydrated and recycled into raw materials for concrete.

The Group operates nationwide. DAI-ICHI CUTTER KOGYO’s sales operation covers all eastern Japan. ASIRE has sales based in Kanagawa and Osaka. WALLCUTTING has sales based mainly in the Tokai region. KOUMEI has sales based in Osaka and the Chugoku and Shikoku regions. Shin Shin has sales based in Okinawa prefecture. Diamond Kiko has sales based in the Kyushu region.

As a contractor, the Group plays a major role in the work and maintenance of infrastructure, and its main clients are general contractors, road contractors, and facility providers. When they receive an order , they order sawing and drilling work of concrete to the Group. Since its clients mainly engage in public works, most of the works carried out by the Group are public works (except ASIRE whose clients are from the private sector). On the other hand, works other than public ones include maintenance of chemical plants, oil refineries, electric power plants as well as cleaning by water jet method. Works are classified into civil engineering works, architecture-related works, urban civil engineering works, road and airport works, and plant maintenance.

Main Clients

TAISEI CORPORATION, OBAYASHI CORPORATION, KAJIMA CORPORATION, SHO-BOND CORPORATION, TEKKEN CORPORATION, TOTETSU KOGYO CO., LTD., JFE Engineering Corporation, IHI Infrastructure Systems Co., Ltd., Nomura Real Estate Partners Co., Ltd., Taisei Rotec Corporation, KAJIMA ROAD CO., LTD., Sankyu Inc., Mitsubishi Jisho Community Co., Ltd., Mitsui Fudosan Residential Service Co., Ltd., NIPPO CORPORATION, THE NIPPON ROAD Co., Ltd., SHIMIZU CORPORATION, Sumitomo Mitsui Construction Co., Ltd. (in random order).

Civil Engineering Work DAI-ICHI CUTTER KOGYO undertakes repair and removal services for large structures, such as bridge, port and dam, as well as sawing and drilling services under special environments such as underwater operation. In those specific cases, services are carried out by the company’s exclusive engineers.

| |

Bridge Port Dam | Sawing and removal of viaducts, measures to prevent flaking of concrete, removal of deteriorated concrete bridge piers, surface treatment for deteriorated concrete bridge piers, and others. Sawing and removal for the reconstruction of revetments and piers. Sand control dam permeable slitting operation, construction of spillway for fishway, and others. |

Architecture-Related Work Various kinds of services for demolition and renewal works are carried out, such as demolition work of a building, base isolation work, seismic retrofit, repair work, and new construction. In addition, the Company can carry out service which is difficult by conventional methods, using alternative methods suitable for reducing the environmental load on the surrounding facilities.

| |

Building Demolition Work Base Isolation and Seismic Retrofit Repair work New Construction | Demolition and removal of blocks, static fracture of building foundations, and others. Sawing piles for installation of base isolation devices, construction of seismic slits, and others.

Sawing, exposing reinforcing steels by chipping, machine removal for elevator renewal, cleaning exterior walls, paint stripping, floor surface treatment, and others. Contraction joint, tiling substrate treatment, and others. |

Urban Civil Engineering Work The Company constructs civil engineering related works in urban infrastructure, such as railway operation, waste treatment facility, and waterworks facility, and is also involved in environment-related works that can be handled in total from planning to operation.

| |

Railroad Work Construction of Waste Treatment Facilities Water Supply and Sewerage Facility | Sawing and removing stairs, demolition and removing wall, and others. Cleaning inside of chimneys and removing dioxins

Removal of deteriorated concrete in pits, removal of epoxy resin coating films, and others. |

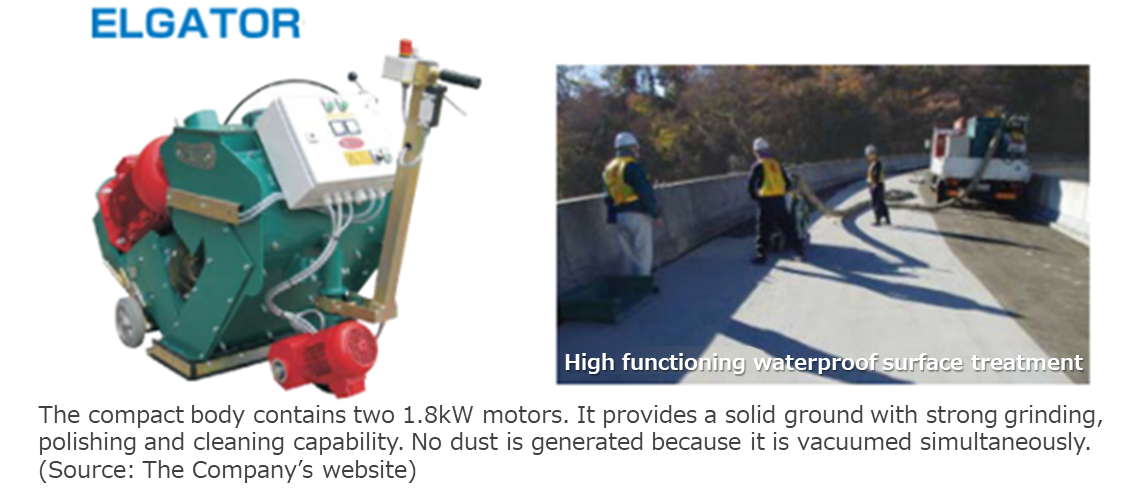

Road and Airport Construction The Company carries out various types of sawing and surface treatments for road repair, removal of deteriorated concrete, core drilling for installing lights, runway grooving at airports and others. Its strength is its ability to be able to do the operation even under specific conditions thanks to unique equipment such as grooving machines and custom-made vehicles for core drilling. | |

Maintenance of Production Facilities In the maintenance of production facilities, the Company carries out cleaning for plant maintenance, fireless sawing for remodeling work, repainting of floors, and substrate treatment. The Company ensures the quality and safety of the work by stationing certified workers for industrial cleaning. | |

Building Maintenance Business

DAI-ICHI CUTTER KOGYO is the only one in the group which handles with this business. In complex housing and office buildings, the Company carries out drain pipe cleaning, water tank cleaning, water supply facility inspection, floor cleaning, fiberscope survey, mechanical pit cleaning and so on services.

Cleaning of Wastewater Drainage Pipes | High-pressure cleaning of drainpipes such as kitchens and washstands. High-pressure water is jetted from a nozzle at the tip of the high-pressure hose to remove scale attached to piping. |

|

Cleaning of Cesspits and Wastewater Drainage Tanks | To maintain hygiene in a cesspit and wastewater drainage tanks by constantly cleaning the tank with a high-pressure washing and high-power vacuum tank. |

|

High-Pressure Hot Water Cleaning | The usage of high-temperature hot water reduces the burden on piping compared to high-pressure cleaning, which is ideal for dissolving and removing stubborn stains. (especially for oil stains). |

|

(Source: the reference material of the Company)

Reuse and Recycling Business

Reuse and Recycling Business is undertaken by Movable Trade Networks, a non-consolidated subsidiary, not subject to the equity method, and two non-equity method affiliates. In the Reuse Business, used IT-related equipment and office automation equipment, such as tablets, PCs, server, and liquid crystal displays (LCD displays), are purchased mainly from companies, and this equipment are sold mainly to corporate clients after data erasing and repairing. The Company also provides data erasing services of IT-related equipment and office installation services of office automation equipment mainly for corporate clients. Used products that are difficult to reuse are dismantled and then sold to material manufacturers. Afterwards, material dealers carry out intermediate processing and recycling. The items that the company sells to recyclers range from general materials to “rare metals” such as gold, silver, cobalt and others.

1 -2 Technology (The Company’s original method) - Diamond Method and Water Jet Method -

Diamond Method

The method is to saw and drill roads or structures by using an industrial diamond. Based on the five basic methods of flat sawing, core drilling, wall sawing, wire sawing, and grooving, the Company has developed a wide variety of diamond methods with its unique ideas.

The tools used in the diamond method are “Diamond Blade”, “Diamond Bit”, and “Diamond Wire”, each of which uses diamond segments. “Diamond Blade” is a blade whose edge is attached with segments made by hardening diamond powder with metal bond. The object is cut by rotating “Diamond Blade” at high speed (using different sizes depending on the type of material and the depth of sawing). “Diamond Bit” is a cylindrical tool with a cutting edges of diamond tips. It is rotated at a high speed to bore an object (using different bits depending on the size of a hole and the depth of the hole). “Diamond Wire” is made by attaching beads made by sintering diamond segments with metal bond to a wire at fixed intervals. “Diamond Wire” can cut any object even in a complicated shape.

Flat Sawing

Generally, flat sawing is the most suitable solution to sawing horizontal surfaces such as floors, floor slabs and pavement. The machine is mounted with a diamond blade. An operator walks from behind and operates the machine by only himself as the machine progresses. It is used for joint sawing, sawing concrete parts for replacement and removal of damaged pavement, and sawing pavement parts when laying pipes under the pavement such as electricity, telephone, gas, water, and sewer pipes. The power source of the machine is gasoline, diesel, electricity and oil pressure. Water is set to come up to the sawing edge during the sawing process in order to cool the cutting edge heated by sawing (dry flat sawing uses compressed air for cooling).

Electric Flat Sawing

(Source: The Company’s website)

Core Drilling

In this method, holes are made on objects that are drilled by a diamond bit. Core drilling is used in the field where accurate circular sawing is required. Any diameter of hole can be easily perforated, for water supply and drainage pipes, electric wiring, ducts for air-conditioning system, seismic reinforcement, and others. Core drilling can be very useful when the accuracy of the finish is especially required, such as when collecting samples for strength inspection, drilling holes for anchor bolts, and stitch drilling when removing a part of a thick wall.

(Source: The Company’s website)

Wall Sawing

In this method, a traveling guide rail is fixed to a wall, a slope, a floor or the like with anchor bolts, and an object is cut by high-speed rotation of a diamond blade and movement of a machine on the track. Wall sawing is often used to install door openings, vents, and windows, and can be cut at both right and oblique angles. As it saws along the rail, it can accurately secure an opening. It can also be operated remotely, making it safe to work in any situation. The compact and lightweight machine makes it easy to carry and provides excellent mobility even in places with limited work space such as buildings, expressways and subways.

Wall saw is making a seismic slit on the building

(Source: The Company’s website)

Wire Sawing

In this method, an object is cut by rotating the wire saw at a high speed by a hydraulic or engine type machine while maintaining a constant tension in the wire saw. The method can easily saw a thick and complicated structure regardless of the shape of the object. It can also be operated remotely or automatically, so it can be used safely and freely in all environments, including underwater, high places, and undergrounds.

Wire Sawing can cut metals as well

(Source: The Company’s website)

Grooving

In this method, multiple shallow grooves (safety groove) are carved on a road surface in a direction parallel or perpendicular to the traveling direction of vehicles. Diamond blades are attached to a cylindrical device called a drum at a predetermined pitch, which is rotated to cut a road surface (to improve quality of the road surface by improving slip resistance and drainage). And a drum is attached with a grooving machine. There are both dry method and wet method, and by carving grooves on runways, paved roads and steep slopes, slippage can be prevented. This method was first used at an airport in England in 1956, and has spread throughout the world.

(Source: The Company’s website)

Water Jet Method

In this method, high-speed water, pressurized and compressed by a high-pressure water generator and jetted from a nozzle, is used for chipping and washing. This method is attracting attention from the industry as an excellent method with consideration for the environment, because it has features such as generating less distortion, few microcracks, and less vibration.

The Company uses the system in a wide range of fields, including civil engineering, architecture, plant maintenance and the environment. In civil engineering and architecture, it is used in concrete removal, molding (opening through concrete walls, selective demolition of concrete structure), surface treatment, coating removal, cleaning, and others. In plant maintenance, it is used in cleaning work (including scale removal, and others.) of plant equipment such as tank reactors, and others. In addition, this method can be used for sawing metal (abrasive sawing), so it can be deployed in places where fire is strictly prohibited.

Less Vibration | Unlike the impact crushing by breakers, rock drills, and others, it is characterized by the mechanism to crush cement mortar bond of concrete by the energy of ultra-high-pressure water jetted from the nozzle. |

Minimal Impact on the Structure | Since deformation, strain and residual stress given to the object are small and microcracks are hardly generated, it is possible to work with the minimized impact on the structure. |

Pinpointed Removal | By setting the appropriate pressure and flow rate, only the deteriorated part of the concrete can be removed with pinpoint accuracy without damaging the reinforcing steels. |

Removing only Coating and Stains | By adjusting the pressure, only the coating or stains of the object can be removed. |

Remote Operation | Remote operation of the machine is easy because the nozzle does not contact with the object. This allows operation in curves and on curved surfaces with uniform quality. |

Removing a surface of concrete slab deteriorated by salt damage

|

(Source: The Company’s website)

1 -3 Core Competence

DAI-ICHI CUTTER KOGYO’s core competence is “human capital,” such as engineers, sales organization, and a network with partner companies. It is a source of high technology and strong sales and operation ability.

Group of Engineers (human capital) | A pioneer in the diamond industry with advanced technology and an overwhelming scale |

Sales Organization (human capital) | An organized sales structure which is rare in the industry |

Network of partner companies (human capital) | A high-quality network with partner companies, as well as branches and offices nationwide. |

Nationwide Business Development | A sales activity regardless of region because of its nationwide branches and offices. |

Nationwide Business Development

(Source: the reference material of the Company)

2. Fiscal Year ended June 2019 Earnings Results

2-1 Consolidated Earnings

| FY 2018 | Ratio to Sales | FY 2019 | Ratio to Sales | Y-on-Y | Initial Forecast | Compared to Forecast |

Net Sales | 16,283 | 100.0% | 14,871 | 100.0% | -8.7% | 14,318 | + 3.9% |

Gross Profit | 4,946 | 30.4% | 4,782 | 32.2% | -3.3% | - | - |

SG&A | 2,758 | 16.9% | 3,021 | 20.3% | + 9.5% | - | - |

Operating Income | 2,187 | 13.4% | 1,760 | 11.8% | -19.5% | 1,624 | + 8.4% |

Ordinary Income | 2,263 | 13.9% | 1,843 | 12.4% | -18.5% | 1,667 | + 10.6% |

Profit attributable to owners of parent | 1,487 | 9.1% | 1,251 | 8.4% | -15.9% | 1,014 | + 23.4% |

* Unit: million yen

8.7% decrease in Sales and 19.5% decrease in Operating Income

Net Sales were 14,871 million yen, down 8.7% year-on-year. The amount of completed works in the Sawing and Drilling Business decreased 9.1% year-on-year due to the impact of higher Sales in the previous term caused by special factors. Merchandise sale in the Reuse and Recycling Business decreased 8.7% because of the effect of an insufficient supply of Intel CPUs (stagnation in PC renewal due to supply shortage of new PC products caused by CPU shortage).

Operating Income dropped 19.5% year-on-year to 1.76 billion yen. Although the cost of sales ratio improved due to an increase in the proportion of works carried out in-house, Gross Profit declined because the impact of the decline in Net Sales was not squared. On the other hand, selling, general and administrative expenses (SG&A) increased due to the strengthening of operational system.

2-2 Segment Earnings Trends

| FY 2018 | Ratio to Sales/ Profit Ratio | FY 2019 | Ratio to Sales/ Profit Ratio | Y-on-Y |

Sawing and Drilling Work | 13,927 | 85.5% | 12,654 | 85.1% | -9.1% |

Building Maintenance | 296 | 1.8% | 337 | 2.3% | + 13.8% |

Reuse and Recycling | 2,058 | 12.6% | 1,879 | 12.6% | -8.7% |

Consolidated sales | 16,283 | 100.0% | 14,871 | 100.0% | -8.7% |

Sawing and Drilling Work | 2,720 | 19.5% | 2,317 | 18.3% | -14.8% |

Building Maintenance | 14 | 4.8% | 36 | 10.9% | + 159.7% |

Reuse and Recycling | 84 | 4.1% | 1 | 0.1% | -97.8% |

Adjustments | -631 | - | -596 | - | - |

Consolidated operating income | 2,187 | 13.4% | 1,760 | 11.8% | -19.5% |

* Unit: million yen

Sawing and Drilling Business

The sales of completed works: 12,654 million yen (down 9.1% year-on-year); Segment Income: 2,317 million yen (down 14.8% year-on-year). Despite an increase in transportation infrastructure such as expressways, there was a decline in public infrastructure works whose sales in the previous term pushed by a special factor, and in industrial infrastructure works for which large-scale construction was completed then. In terms of profits, although profitability improved in each project, an increase in selling, general and administrative expenses (SG&A) due to strengthening of the sales and management systems became a burden while the amount of completed works decreased.

Building Maintenance Business

The sales of completed works: 337 million yen (up 13.8% year-on-year); Segment profit: 36 million yen (up 159.7% year-on-year). As a result of strengthening operational system while placing importance on profitability, the number of contracts for new buildings such as large and high-rise condos increased. In terms of profits, Ratio to Sales improved due to higher profitability by pursuing more profitable orders and improving the efficiency of the Company's operational system.

Reuse and Recycling Business

Sales of goods: 1,879 million yen (down 8.7% year-on-year), Segment profit: one million yen (down 97.8% year-on-year). Although sales of Apple products and home appliances for subscriptions increased, sales of notebook computers decreased due to a shortage of Intel CPUs. In terms of profits, selling, general and administrative expenses (SG&A) increased due to strengthening of the internal structure in response to the rapid expansion in recent years amid the decline in Sales, and Profits were limited.

2-3 Financial Condition and Cash Flows

Financial condition

| FY ended June 2018 | FY ended June 2019 |

| FY ended June 2018 | FY ended June 2019 |

Cash | 5,322 | 5,698 | Payables | 796 | 718 |

Receivables | 2,852 | 2,480 | Taxes Payable | 515 | 240 |

Inventories | 365 | 574 | Retirement Provisions & Liabilities | 604 | 520 |

Current Assets | 8,639 | 8,913 | Interest-Bearing Liabilities | 29 | 1 |

Tangible Assets | 3,112 | 3,326 | Lease Obligations | 13 | 26 |

Intangible Assets | 128 | 104 | Liabilities | 2,884 | 2,348 |

Investment & Others | 826 | 960 | Net Assets | 9,822 | 10,956 |

Noncurrent Assets | 4,068 | 4,391 | Total Liabilities and Net Assets | 12,707 | 13,304 |

* Unit: million yen

Total Assets at end of the term went up 597 million yen from the end of the previous term to 13,304million yen. In the Debit Side, Cash and Noncurrent Assets increased while in the Credit Side, Net Assets increased. The Company is operating essentially without borrowing and has a strong financial structure with high liquidity and financial stability. Current Rati 493.3% (382.3% at the end of the previous term), Equity Rati 79.3% (74.3% at the end of the previous term).

Cash Flows (CF)

| FY 2018 | FY 2019 | Y-on-Y | |

Operating Cash Flow (A) | 2,224 | 1,231 | -993 | -44.7% |

Investing Cash Flow (B) | -622 | -649 | -26 | - |

Free Cash Flows (A + B) | 1,602 | 581 | -1,020 | -63.7% |

Financing Cash Flow | -140 | -179 | -38 | - |

Term End Cash and Equivalents | 5,295 | 5,698 | + 402 | + 7.6% |

* Unit: million yen

Operating CF of 1,231 million yen was secured with Pre-Tax Profit of 1,847 million yen ( 2,269 million yen in the previous term), depreciation of 407 million yen (387 million yen in the previous term), Tax Expense of -850 million yen (-372 million yen in the previous term) to cover the expenditure for Investment CF for the acquisition of tangible fixed assets, securities and others. Financing CF consists of payment of dividends and repayment of interest-bearing debt.

| FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

ROE | 14.5% | 16.9% | 13.1% | 17.0% | 12.5% |

Net Income Margin | 6.94% | 8.68% | 7.71% | 9.14% | 8.41% |

Total Assets Turnover | 1.50 times | 1.40 times | 1.26 times | 1.40 times | 1.14 times |

Leverage | 1.38 x | 1.38 x | 1.34 x | 1.33 x | 1.30 x |

*ROE = Net income margin x total assets turnover x leverage. Total assets and shareholders' equity are classified as average balance during period.

3. Fiscal Year ending June 2020 Earnings Forecasts

3-1 Consolidated Earnings

| FY 2019 Act. | Ratio to Sales | FY 2020 Est. | Ratio to Sales | Y-on-Y |

Net sales | 14,871 | 100.0% | 15,700 | 100.0% | + 5.6% |

Operating Income | 1,760 | 11.8% | 1,730 | 11.0% | -1.7% |

Ordinary Income | 1,843 | 12.4% | 1,856 | 11.8% | + 0.7% |

Profit Attributable to Owners of Parent | 1,251 | 8.4% | 1,080 | 6.9% | -13.7% |

*Unit: million yen

Net Sales increased 5.6% year-on-year, Operating Income fell 1.7% year-on-year

Net sales were 15.7 billion yen, up 5.6% year-on-year. Sales are expected to increase due to the acquisition of ASIRE as a subsidiary. However, construction demand for the Olympic Games demolished in the previous term, and the number of sawing and drilling works in the Tokyo metropolitan area is expected to decrease during and around the Olympics.

In the Sawing and Drilling Business, the Company will strengthen its business development in such fields as expressway and bridge repair work, and electricity-related work. In the Building Maintenance Business, it will continue to strengthen its business focusing on high-rise apartment buildings. In the Reuse and Recycling Business, it will focus on acquiring new large clients.

Operating Income was1.73 billion yen down 1.7% year-on-year. As downward pressure on unit prices is expected to increase due to changes in market conditions, increases in personnel expenses and administrative costs are expected as a result of efforts to strengthen operational systems and investment in human capital development.

3-2 Shareholder Return

The Company plans to pay an annual dividend of 22 yen per share, which is an increase of 2 yen (projected dividend payout ratio of 11.6%). For the time being, it plans to actively invest in "Human Capital" "Productivity" "Research and Development" and "Expanding the Scope of Business", trying to raise the level of the dividend payout ratio over the medium term.

4. Medium-Term Business Plan (from FY 2019 to FY 2021)

As the social infrastructure built during the period of high economic growth has become obsolete, its maintenance, including repair and renewal, has become a major issue. The Group will use technologies of "Cutting", "Cleaning", "Chipping", "Stripping" and "Grinding" to support for prolonging a lifetime of the social infrastructure and its renewal. The Group is also aware of its social responsibility to protect people's lives and economic activities from natural disasters such as earthquakes, tsunamis, typhoons and torrential rains, and to support the recovery and restoration of disaster-stricken areas in the event of a disaster and intends to contribute to the realization of a safe and secure society. However, the construction industry to which the Company belongs is facing a shortage of labor forces and engineers due to the decreasing working population caused by the declining birthrate, the aging society and the negative impression on the industry.

For this reason, under the theme of "Human Capital", the Medium-term Business Plan identified securing and nurturing future leaders, work style reforms, and improving productivity as priority measures, and incorporated many new initiatives that were ahead of the industry, such as creating a comfortable working environment for women and disabled people, and employing foreign workers with a view to expanding overseas in the future. In addition, as a leading company in the industry, the Company will actively promote technological development, such as research, discovery and development of new technologies through industry-academia collaboration and alliances with startups with cutting-edge technologies, in order to meet the needs of clients and the time.

Through these initiatives, the Company will build a solid management foundation for the continued growth and development of the Group and establish a system to protect people's lives and contribute to the society.

Proportion of social capital that is over 50 years old after construction

| 2018 | Five years later | 15 years later |

Road Bridges (approx. 726,000 bridges) | 25% | 39% | 63% |

Port Facilities (approx. 44,000 facilities) | 18% | 28% | 52% |

Sewage (Total length: approx.470,000 m) | 4% | 8% | 21% |

River Management Facilities (44,641 facilities) | 13% | 22% | 48% |

Road Tunnels (11,153 tunnels) | 20% | 27% | 42% |

4 -1 Basic Strategy

Basic Strategy 1: Strengthening and expanding human resource recruitment and development

Basic Strategy 2: Strengthening business development

Basic Strategy 3: Strengthening the network of partner companies

Basic Strategy 4: Research and development

Basic Strategy 1: Strengthening and expanding human capital recruitment and development

Various activities will be carried out for the recruitment and discovery of human resources, including company introduction sessions and networking events attended by the management, and the discovery of unique human resources who will be able to contribute to the Company’s specialized service through the employees’ referral system and external recruitment agencies.

In addition to implementing measures to retain human resources, such as branding strategies through collaborations with universities, acquisition of naming rights, and disseminating the information about the attractiveness of work both inside and outside the workplace (public relations activities), the Company will also support its employees to enhance their skills and motivation through training seminars and a skill based grading system.

Measures for human capital development

・Enhancement of training systems such as periodical trainings of the 3rd, 6th and 15th anniversaries of the employees as well as senior trainings

・Support for acquisition of official qualifications for the development of the employees’ career and skills

・Operation of the Company’s own certification systems such as the Master system and an evaluation system to assess their required skills for subdivided processes of work

・Networking and training among companies in the Group

In addition to the strategies mentioned above, the Company will improve work-life balance and promote the employment of foreign workers. In order to do so, the Company will enhance working environment through various initiatives such as introducing attendance management using tablets, setting the maximum limit of extra working hours to be below the guideline according to the Company's internal standards, and increasing the number of employees to achieve a complete five-day workweek system. It will also improve employees’ quality of life through such measures like promoting diverse work styles by allowing them to choose to work nationally or locally, setting working hours according to their work style, and improving the workplace environment to accommodate female workers, and enhance the support system for their families including recreational events for the employees, their families and business partners and various subsidy programs for the families. The Company will also increase its production by introducing a core business system customized for its business flow, sophisticating and improving the efficiency of its dispatch system, improving its productivity through research and development, and promoting the machine development by the research and development subcommittees and industry-academia collaborations.

Regarding the recruitment of foreign workers, the Company doesn’t consider it as a supplement for decreasing labor force caused by the declining birthrate but as means to develop prospective human capital to build overseas network in anticipation of future overseas business expansion and to establish overseas subsidiaries.

4 -2 Target Management Indicators

| FY 2019 Plan | FY 2019 Act. | FY 2020 Plan | FY 2021 Plan |

Net Sales | 14,318 | 14,871 | 15,700 | 17,400 |

Operating Income | 1,624 | 1,760 | 1,730 | 1,910 |

Operating Profit Margin | 11.3% | 11.8% | 11.0% | 11.0% |

Profit Attributable to Owners of Parent | 1,014 | 1,251 | 1,080 | 1,190 |

EPS | 178.24 | 219.80 | 189.75 | 209.08 |

|

|

|

|

|

Number of Employees (consolidated) | 500 | 501 | 525 | 550 |

* Unit: million yen

4 -3 Growth Investment and Initiatives in FY ended June 2019 and FY ending June 2020

DAI-ICHI CUTTER KOGYO will build a business structure to achieve sustainable growth, and promote the “establishment of a solid foundation of human resources" which will be the cornerstone of its future expansion into overseas businesses and new business fields. The Company will invest 2.52 billion yen over 3 years in human capital development, productivity improvement, expansion of business fields, and research and development.

| Detail | FY 2019 Act. | FY 2020 Target | FY 2021 Target | Total |

Human Resources Development | Recruitment and training | 170 million yen | 100 million yen | 100 million yen | 370 million yen |

Productivity Improvement | Improving the workplace environment and promoting work style reforms | 400 million yen | 300 million yen | 300 million yen | 1 billion yen |

Expansion of Business Fields | Establish new sales offices, M&A | 120 million yen | 700 million yen | 200 million yen | 1.02 billion yen |

Research and Development | Investment in R&D and new technologies | 30 million yen | 50 million yen | 50 million yen | 130 million yen |

Total | 720 million yen | 1.15 billion yen | 650 million yen | 2.52 billion yen | |

In FY ended June 2019, the first year of the Medium-term Business Plan, DAI-ICHI CUTTER KOGYO invested 720 million yen in human resources (engineers), its core competence. Due to the acquisition of ASIRE which will be consolidated from FY ending June 2020, the cumulative investment forecast for 3 years has been increased to 2.52 billion yen from the original 2 billion yen.

Human Capital Development

In FY ended June 2019, 50 members joined the Company, but the retention rate declined. The efficiency of recruitment is expected to decline in FY ending June 2020 due to further deterioration of the recruitment environment.

Productivity Improvement

In FY ended June 2019, both the monthly volume index and productivity per unit time exceeded their targets. Specifically, the monthly sales per worker was 2.29 million yen, exceeding the target of 1.7 million yen, and the sales per worker per hour was 18,524 yen, exceeding the target of 17,000 yen. In FY ending June 2020, efforts will be made to realize an optimized deployment of the employees in anticipation of future reduction of working hours.

Research and Development

In FY ended June 2019, the three-year plan started for the development of automation elemental technology through an industry-university collaboration. In addition, the Hydro-JetRD method, a new method for shortening the operation period for bridge floor slab replacement won “Technology Award” of Kansai Branch of the Japan Society of Civil Engineers, “Infrastructure Technology Development Award” of Japan Institute of Country-ology and Engineering, and “President's Award” of Hanshin Expressway Company Limited. This method is expected to be used in future highway renewal works.

In FY ending June 2020, the Company will work on automation technology, assist technology, and the visualization of intangible technologies with an eye to technology transfer.

Expansion of Business Fields

In FY ended June 2019, the Company started preparation for the launch of laser business as a new business. In FY ending June 2020, the Company will begin in earnest to prepare for overseas business expansion. It will also actively look for opportunities for merger and acquisition in carefully selected business fields.

4 -4 CSR Initiatives

A disaster recovery volunteer system was newly established as a part of CSR. A new company regulation was established to enable the employees to participate in rescue activities as volunteers and to send vehicles in the event of a disaster in various places, based on the recognition that physical support is more important for disaster recovery than financial contributions such as monetary donations. The Company will cover the financial burden of the employees as and provide them with special leaves.In FY ended June 2019, the Company concluded the “Agreement about cooperation of emergency restoration measures at the time of disaster” with Chigasaki City. As a social contribution that only the Group could make, the Company proposed to Chigasaki City to provide special-purpose vehicles and special machines owned by the Group, its staff engineers who are one of the best talents in Japan (who are regarded as its valuable asset), for flexible recovery measures taken by the city in the event of a disaster.

4 -5 Future Strategy

Human Capital Development

DAI-ICHI CUTTER KOGYO will continue to implement measures for identifying, recruiting and retaining human resources. For the purpose of finding talented candidates and getting to hire them, the Company will increase opportunities for candidates to meet its management at company introduction sessions, recruitment interviews and networking events where the President attends as well as the President’ meal (dining opportunities with the President), and the Company will also use various recruitment channels such as online company introduction sessions and its direct engagement with university club activities. In addition, its PR capacity will be strengthened by delivering messages about “attractive atmosphere in the workplace” through SNS and by utilizing various media (cross media).

As a measure to enhance the retention rate, the Company will develop its branding strategy by transforming itself from a low-profile company into a high-profile company, by working on visualization of the technologies and by promoting its work style reforms. In visualization of the technologies, the Company will improve employees’ skills and motivation by visualizing their skill levels with grading and master systems and by quantifying the accuracy of their work. In the work style reform, the Company will promote a five-day work week system and enhance the strict working time management.

Productivity Improvement

By introducing an effectual system, the Company will improve the dispatching efficiency of vehicles and the productivity of its engineers and sales staff to reduce their working hours. In order to improve the dispatching efficiency of vehicles, the Company will build the dispatching system which enables the most suitable allocations of vehicles by optimizing 300 staff engineers, partner companies, regions, types of technical levels for a total number of 80,000 projects per year.

The key to improvement of the productivity of the engineers and sales staff is the use of information. The Company will improve the productivity of the engineers by using tablets (groupware and internal SNS) and enhance the work efficiency by digitizing job slips, reporting, dispatch notification, technical information, photographs and others. It will also make the information about specialized jigs, special methods, new methods and improved methods available on tablets for confirmation and learning. SFA (Sales Force Automation) will be utilized for sales. Specifically, action management, client management, project management, and reporting will be digitized to strengthen the area system by nearly 80 sales members across the country and the validity of the information about clients and projects beyond areas.

Research and Development

Visualization of technologies and development of new methods and technologies will be pursued with a view to develop human resource and to improve productivity. Regarding the visualization of technologies, in addition to the visualization of operational capability (by brushing up the grading and master systems) mentioned above, visualization of procedures (including manualizing and visualizing operating procedures) and visualization of quality standards (by introduction of sensor technology to quantify the finish) will be carried out. Development of new methods and new technologies will be moved forward for each project.

Expanding Business Fields

DAI-ICHI CUTTER KOGYO is going to prepare for overseas business expansion and the company is actively looking for the opportunities for mergers and acquisitions. As for overseas business expansion, the Company will focus on one country in Southeast Asia and build a business model that is different from the existing business models there. In terms of human resources development, the Company will cultivate local employees who are candidates for future management, by educating them in Japan for about two years. As for its M&A targets, the Company envisions specialized contractors with the 5 keywords of "Cutting", "Chipping", "Cleaning", "Stripping", and "Grinding", companies who engage in work that is the Company’s business (i.e. companies operating around the supply chain of research, designing, construction, and maintenance), and affiliated companies which have specialized technologies, systems, and clients.

5. Interview with President Takahashi

Restoration and seismic repair of concrete structures such as expressways are urgent matters, and reinforcement of electric power plant, water supply and sewerage systems are also necessary. Under these circumstances, the Company plays a major role in the maintenance and repair of social infrastructure by using specialized technologies such as diamond method and water jet method. As a specialized contractor in a specific field, however, the Company is not in the public spotlight, so few people know about the Company, its growth potential and its importance of existence. We visited the head office in Chigasaki City, Kanagawa Prefecture, and interviewed President Takahashi.

President Masamitsu Takahashi | President Takahashi joined DAI-ICHI CUTTER KOGYO in April 1995. After gaining practical experiences on construction sites, he led the frontline as a head of Chiba sales office, and then served as head of the Water Jet Business Department (now, Plant Business Department) and general manager of Sales Department. He also served as a director of ShinShin, a director of KOUMEI, a director of WALLCUTTING, a director of Movable Trade Networks. After serving as an executive managing director and a senior managing director, he became president of DAI-ICHI CUTTER KOGYO in October 2017. |

5-1 Corporate Profile

Pioneer of Sawing and Drilling Work. The only things we cannot cut are love and fate.

Bridge Report (BR): The Company was started by an individual in 1966 and incorporated the following year. First, I would like to ask you about how the Company was established.

President Takahashi: KONGO CONSTRUCTION, Ltd. (Chuo-ku, Tokyo) in Tokyo was the first company in Japan to introduce road sawing machines. It was imported from the United Sates. The founder of our Company was working there. He then thought "this job is interesting", so he started this business with his high school classmates. The home of the founder was in Chigasaki City, where the head office is now located. The Ministry of Construction (now Ministry of Land, Infrastructure, Transport and Tourism) issued a notice to use flat saws when installing water pipes and sewerage pipes under the ground. The notice served as a tailwind for us

(BR): KONGO CONSTRUCTION was the first company in Japan to start sawing business, but it was not that there was a lot of this kind of work, but that they were using cutters just as a part of the work. So, your Company was one of the first companies to start as a pure-play company focused on cutters in Japan. The founder was lucky because he started a business by taking advantage of his experience at KONGO and expanded his business with the notification from the Ministry of Construction as a tailwind

President Takahashi: As a result of this notification, the number of constructions using cutters increased. At that time, industrial diamond blades were not in good quality, and the engines of machines were weak, so the thicker the pavement was, more work were needed to be outsourced to specialized contractors. I think it was largely a result of the notification from the Ministry of Construction. and the founder’s determination to specialize in cutters in the early days of cutters. In addition, I think it would have been difficult for a specialized contractor to be established unless it was in the Tokyo metropolitan area which had a large number of constructions. In that sense, the establishment of the Company in Chigasaki had a geographical advantage. I think the founder was lucky as you mentioned.

After that, we expanded business areas. In anticipation of infrastructure development throughout the country, we expanded into other business areas at an early stage. In particular, Sales offices were established in each prefecture in the Kanto region such as Kanagawa, Chiba, Saitama, Tokyo, Ibaraki, Takasaki, Tochigi. Sales office for recruitment purpose was established in Sapporo, Hokkaido in an early stage.

Improve productivity by managing the operation of vehicles and machinery in each area

(BR): The Company expanded quickly to other prefectures, didn’t it? Your Company was founded in 1966 and incorporated the following year in 1967. Sapporo Sales office was established in 1969, Chiba Sales office was established in 1970, Tochigi Sales office was established in 1973, and others. I thought that there were no construction works near the head office although the head office was located in Chigasaki. But it was for securing human capital and in anticipation of future business expansion. I feel terribly sorry about asking this question.

President Takahashi: In our construction business, I don’t think that we can have construction works in Tohoku just because we have construction works in Tokyo It is necessary to make good use of labor force and machines in each location. Like a taxi company, you cannot do business with only one or two taxies if you don’t know "where and who will take the taxi" and "where they would like to go"., Efficiency can be enhanced, only when 10 or 20 vehicles are gathered, so we have to think how to increase utilization rate. There are many orders in one day, we have to decide whether we finish it in 30 minutes and do the next one or not. So, we have to schedule those orders in each area

At the time of the Company’s establishment, if there was a construction work in Chiba prefecture or Saitama prefecture, the machine was transported from Chigasaki. Since there was no contractor who could do the work, the Company often received a call from companies in other prefectures who found us on the telephone directory or some advertisements.

(BR): By the way, Chigasaki is also in the Tokyo metropolitan area, but it might have been better to set up the head office in Tokyo, which is located in the center of Tokyo and three prefectures, if you also work in Chiba and Saitama prefectures.

President Takahashi: It would be easier for people to gather if we set up our head office in Tokyo, but we needed a large place to put vehicles, machines, and for employees to gather. It's the place where the Company was established and it needs a large place. As we grew up in Chigasaki, it may be better for the community if we pay taxes here.

Regardless of where the head office is located, we started to expand business areas from an early stage because of our business characteristic. While every effort is made to ensure that everything is completed within regional business units, the machines and teams that are used for water jet and renovating the surface treatment of building floors (substrate treatment by blasting) are located in Chigasaki and dispatched to construction sites around the country as needed. The machine is expensive and much time is required for maintenance. Also, it has been only 15 years since we started using these machines in operations, so price management is also necessary. If you manage it from one place, you can control the price of water jet and surface treatment work by blasting more effectively. You don't need to worry about sawing concrete or asphalt because each office has already accumulated experiences in such fields.

Expansion into repair work after completion of infrastructure development

(BR): In order to enjoy the advantages of each location, it is important to improve the efficiency of operations in each area. The Company has not only expanded business areas, but also developed new types of operation service. For new types of operation service, you need to accumulate data at the head office in order to improve the accuracy of estimation across the Company.

President Takahashi: Yes. When the sewerage coverage increases throughout the country, work of sawing roads will be stopped. When installing sewers, it is necessary to remove water pipes that are obstructing the installation. Electricity, telephones, and gas are also the same. Those are now put under the ground. When the coverage ratio of sewers in urban areas reaches about 80%, there will be no relocation of such things, so the work of sawing roads has come to an end. Consequently, we increased the number of services we could handle. We not only saw roads, but also drill concrete and saw large structures of concrete. In terms of types of services, there are wire saw, wall saw and airport grooving. Grooving is an anti-slip groove and we make grooves on runways. It was around that time, around 2004, that water jet was introduced. We increased the number of works related to repairing concrete by water jet.

For the area development, we shifted our focus from each prefecture to broader regions. For example, Sendai sales office controls six Tohoku area prefectures, Sales office in the Hokuriku region controls Joshinetsu (Gunma, Nagano and Niigata prefectures).

(BR): Is water jet used for repair work? It is interesting that concrete gets broken by water.

President Takahashi: It can be broken by water. The good thing about water jet is that you can remove the damaged part of the concrete and leave the rest as it is. You can break the concrete without damaging reinforcing steels. NEXCO, the former Japan Highway Public Corporation instructed us to use water jet for demolition related to repairing concrete structures. Water jet was first introduced to Japan more than 30 years ago, but it has been popular only for the last 15 years. Concrete floor slab and concrete floor under the asphalt of expressway on which cars pass can be restored by grinding and chipping the damaged concrete and pouring new concrete while utilizing the existing reinforcing steels.

(Source: the reference material of the Company)

The service period ranges from 30 minutes to 4 or 5 years. 15 billion yen in annual revenue can be created by building up small services

(BR): Water jet generates less vibration and can be directed with pinpoint accuracy, so they don't damage healthy parts of the structure.

By the way, how long does a service take? Since it is a contractor, I think there are orders and backlogs, but they are not disclosed.

President Takahashi: How long is the service period for one project? This is very difficult to answer. The shortest time is 10 minutes. If the shortest time is 30 minutes, it ranges from 30 minutes to 4 or 5 years. Therefore, the amount of contract fee ranges from 10,000 yen to hundreds of millions yen. We collect them and generate revenues every year. Service that takes 30 minutes means just sawing road for a few meters long. For example, let’s say there is a work that requires sawing around a manhole. This work is sawing the circumference into a square to adjust the height of the manhole. One lap around the manhole is about 4 meters. So, it will be finished in about 30 minutes.

There are many small orders from local builders and local constructors. We have to scrape together works, and it starts with works delivered in 30 minutes for 10,000 yen. You can scrape together works through business development at local branches rather than working in Tokyo. We think that those small works are our main dishes, and the side dishes are big works occasionally requested from general contractors.

So, there is no backlog of orders. The lead time is very short. If the work can be finished in less than one hour, order and delivery are on the same day. There are long-term and large-scale projects, but even so, the amount of backlog of orders a year ago is several hundred million yen. So, the maximum will be around 1 billion yen. It is like a taxi company, “we don't know when customers get on or how far they would like to go”. However, they can expect a certain number of customers if they wait in this area at this time. The same applies to our business.

5 -2 Profile of President Takahashi

(BR): I'd like to know Mr. Takahashi's profile along with the Company profile. According to your biography, you have experienced in many sections all over the Company such as head of the Chiba Sales Office, head of the Water Jet Business Office, general manager of Sales Department, a director of major subsidiaries…

President Takahashi: Yes. I started my career at the Chiba Sales office and sawed the road myself at that time. When we entered the Company, all employees had to provide services at construction sites, even for female employees. I worked at construction sites for two years and was transferred to the Sales Department. There were few staff to work at night, so I went to construction sites even when I was working in the Sales Department. For 10 years I was doing sales and cutting works. Some of the road works are to be at night, because there are many places where you can't do it in the daytime. I was working day time, night time and day time because I was in charge of helping cutting works while I was working in Sales Department.

(BR): You worked in sales for 10 years while helping cutting works at night. You said that "We have to scrape together works." so there must have been a lot of clients.

President Takahashi: When I was working at the Chiba Sales Office, I worked with local builders, construction companies, road construction companies, and paving companies, sometimes general contractors. At that time, most of the works were sawing roads. And after that, we started Water Jet Business and the sales from the top-level salesperson was around 300 million yen. I was told that salesperson should make at least 100 million yen, and average salespeople made 150 million to 200 million yen in total. The amount of construction per project is now increasing, so our top salesperson makes about 500 million yen, but they still have to scrap together.

(BR): You have experienced as a field worker, head of the Business Department, and general manager of Sales Department. For me, it seems that "you know everything about the Company". You also have experience as a director of major subsidiaries

President Takahashi: Our subsidiaries’ work is the same, but each of them has its own characteristics. We first acquired WALLCUTTING in Nagoya. I think it was in 2007. WALLCUTTING is a company that only provides wire saws and core boring without road cutters, and works mainly in the Tokai area. Their main clients are general contractors and dismantlers. They engage in both architecture and civil engineering.

Next, we acquired KOUMEI in 2009. KOUMEI is good at offshore engineering work, they work like a professional diver in our industry. There were some works where we saw or broke concrete in the water. At that time, we had to explain about the operation to divers who set the machine and saw in the water. That's why it was inefficient. Both of us were not specialized in each other’s field. In the case of KOUMEI, divers can work on land, and their staff on land can dive into the sea, so they can communicate very well with each other. This is the characteristic of KOUMEI and their strength, the ability to operate in the water.

We then established a joint venture, Shin Shin in Okinawa in 2010. There are many U.S. military bases in Okinawa. We allocate host-nation support for U.S. forces, so we have more works than we expected. Sales doesn’t go as far as 1 billion or 2 billion, but we have enough orders on a small scale. We have sometimes big projects at U.S. military bases, and we dispatch staffs when we get a big project. With that in mind, we established a company in Okinawa. We needed to form a company in Okinawa prefecture, not just a Sales Office in Okinawa.

After that, we acquired Movable Trade Networks in 2014. This company is reusing and recycling of PCs which is different from what we do, but since we had a good match and were interested in diversification, we acquired them.

(BR): Each subsidiary has its own characteristics, and you have experienced them. I hate to interrupt you, but you acquired ASIRE, a company operating in the same industry in May.

President Takahashi: ASHIRE is a company that has strength in water jet cutting for architecture. We are rather good at civil engineering, but ASIRE is good at architecture. In the large-scale renovation of an apartment, we need to remove stain of exterior-wall coating before we repaint or recoat it. In the case of apartment which has tiled exterior-wall, we roughen the surface of the concrete in order to improve the adhesive surface of the tiles. In the specification by the Ministry of Land, Infrastructure, Transport and Tourism, you are required to roughen the surface of the concrete with water jet. This is exactly what ASHIRE does, roughing the wall with water before tiling it with glue.

Asbestos has become a problem. Asbestos is included in the paint. In the past, mixing asbestos made paints stickier. When we demolish aged building, there is asbestos in it. The government instructs us to strip the paint before demolishing buildings in order to prevent dispersal of asbestos. Stripping a paint is now done by water. This has become ASHIRE’s popular service. It is said that asbestos problem will continue to peak for about 10 years, or lasts until around 2040.

Because it is necessary to investigate whether or not asbestos is contained in the demolition work (regulatory measures based on the Air Pollution Control Act), ASIRE is providing this service at various places such as Hokkaido, Kumamoto and Kyoto and others.

5 -3 Market, Business Environment and the Company’s Strengths

(BR): I see. That's interesting. Now, I would like to know about the market and business environment. How big is the market?

President Takahashi: The size of diamond cut market is around 150 billion yen. The size of water jet market is around 30 billion yen. This market is occupied by specialized contractors. Small companies are carrying out many projects. There are reportedly 1800 companies in the diamond cut market. The smallest companies are operating with only one machine. There are many companies which have 2 or 3 machines. 90% of companies have less than 5 machines. Most of them are owned by family business entities.

(BR): The size of diamond method and water jet method is combined adds up to 180 billion yen, so that’s probably why your company’s share has not reached 10%. I think there is a lot of room to expand the market share, but is this industry going to be reorganized into major companies?

President Takahashi: Yes. I think it will be either consolidated or closed. At the management meeting this morning, I heard that one company closed the business. I want to work together with companies with which we can work together. Small companies have specific clients with whom they have close relationship and they get works from those clients. We compete with these companies when we approach local builders or construction companies in the countryside. We are competing with companies that have only one or two employees.

But these days, we are trying to be a good business partner with small companies which have specific clients. If they have a large-scale project which they can’t manage from their client, we would like to work it with them. We can get orders without unnecessary competitions. We are trying to help them understand that there are benefits. We can increase orders by considering cooperation with small companies, and we can also receive orders at an appropriate price.

(BR): In addition to the increase of aging social infrastructure, there is a lot of room to increase the market share. Industry reorganization and consolidation of companies would lead to reductions in infrastructure maintenance and repair cost. As the only listed company in the industry, your company is expected to play a leading role in the reorganization of the industry. I heard that your company’s strength in this industry is your “employees”. I would like to know about that point in a little more detail.

President Takahashi: The strength of our employees is the high ratio of engineers to employees, the abundance of talented sales personnel, mobilization capacity through business development of the Group and order entry performance.

60% of our full-time employees are engineers. It's an industry where mechanization is difficult. In the case of large-scale civil engineering works, it is possible to run heavy unmanned machines using GPS, but as I mentioned, our work period ranges from 30 minutes to 4 or 5 years, and situations of our work sites vary, and it is difficult to reach the point of unmanned construction. We really need manpower. As you say, there are many aging structures that need to be repaired and protected. In order to dispatch good engineers to repair works, it is necessary to properly train and increase human resources. We believe such an effort will "strengthen our employees", which will come to fruition in around 10 years.

(BR): It is an industry that is difficult to mechanize and depends on engineers, but it goes well with maintenance and repair work, and it shows its strength in measures for aging social infrastructure. Considering that successive typhoons caused serious damages in Japan, disaster prevention measures must be urgent too.

President Takahashi: Prime Minister Abe pledged to build national resilience in Abenomics (Prime Minister Abe’s economic policies), its major policy is to "protect the safety and security of the Japanese people's lives". From this point of view, distribution and transportation networks, in which our Company has a strength, need to be protected with an enough budget because expressways, trains, and airports are used for transporting goods and evacuating people in times of disaster, not to mention in times of peace.

In order to prevent disasters caused by typhoons and torrential rains, it is necessary to store a certain amount of water in dams, and it is also necessary to construct sand control dams to prevent driftwood from flowing down when rivers overflow. It is also necessary to widen rivers and heighten embankments. For example, when you widen a river, you need to lengthen the bridge to match the width of the river, so we need to add more bridges or break an old bridge and build a new bridge next to it. In other words, sawing and drilling works will be needed. Conversely, when you build new buildings, we have few works to do. When you repair something, we are needed. Even underground water pipes cannot supply drinking water in the event of an earthquake unless they are made quake-resistant. If the sewers are not earthquake-resistant, they won't be able to drain water. In recent years, the idea of disaster prevention has been incorporated into construction work.

5 -4 Medium-Term Business Plan (FY ended June 2019 to FY ending June 2021)

(BR): The expanding Maintenance and Repair Market is compatible with your company’s technologies. Now, I would like to know about the Medium-term Business Plan. In FY ended June 2019, the first year of Medium-term Business, Sales decreased due to the dissipation of special factors in the previous term. In this financial year, the second year of Medium-term Business, Sales are planned to increase by only 5.6% from the previous term, due to the impact of the Tokyo Olympics. However, in the next year, FY ending June 2021, Sales are planned to increase by 10.8% from the present term, FY ending June 2020. On the assumption that you can secure human resources in line with the plan and if there are no special factors, can you achieve a double-digit sales growth by taking in the demand for maintenance and repair of social infrastructure?

President Takahashi: Yes, I think we can. NEXCO and JR are currently working on10 or 15-year renewal plans, they started in 2016 or 2015. NEXCO has a 15-year plan. This is the third year.

(BR): So, you have large-scale and long-term renewal plans that will allow for a double-digit growth of your Company. The Medium-term Business Plan sets four basic strategies. The first is "strengthening and expanding human resource recruitment and development". In order to make the most out of the favorable business environment, it is necessary to secure human resources above all else. So, you will take the lead in recruiting activities in various occasions such as company introduction sessions.

President Takahashi: In order to build a foundation for growth, securing and developing human resources is of paramount importance. Then, adapting high-technology and IT is also important. In the construction industry, the working population will decrease by a third in 10 years due to the aging population and increasing number of retirees. The subcontractors are also facing an aging problem. We have to recruit young people. In addition, the exemption of the construction industry from the legal overtime cap will be ended and the cap will be applied. Until now, the construction industry has been exempted from the overtime cap. If we don't secure enough employees, we won't be able to carry out our works under time constraints.

(Note) " Act on the Arrangement of Related Acts to Promote Work Style Reform " (Enacted on June 29, 2018), which is scheduled to take effect on April 1, 2019, will have various effects on the construction industry, including the application of overtime cap with penalties which was not previously applicable.

However, our current recruitment activity is not only about recruiting the manpower we need now, but also about securing the manpower in anticipation of future labor shortage. In the future, when we have a more serious understaffing problem in the whole industry, a company with sufficient workers will win. We are promoting our recruitment activity with that future in mind.

Another emphasis of our human resource strategy is retention. We not only recruit, but also we make them feel that they have "satisfying work" and "meaningful work", and showing them that they are working for a good company will help employee retention. We retain, train and dispatch qualified employees to construction sites. We promote employee training, concurrently with recruitment.

The image of the construction industry is not so good, and many people do not know about the specialized contractors. Especially in the case of our Company, there are no visible deliverables. We don’t have such things as “we built this bridge or this building”. The lack of deliverables means that it is difficult to find satisfaction. I personally think it's really cool to see our employees working at construction sites. I want them to be aware that they are "cool" and want to send out the image to the world. So, I started using Instagram to send the Company’s detailed information.

(BR): It is necessary not only to recruit but also to retain, train employees and enhance corporate image. The second basic strategy is “strengthening business development”. I would like to know how you are addressing this agenda.

President Takahashi: We work with the five keywords of "Cutting", "Chipping", "Cleaning", "Stripping", and "Grinding". Our major policy is to develop our business with awareness in these categories. For example, in terms of the keyword of "Cutting", we have been using diamond tools and water to saw, but I am thinking there are possibly other cutting methods and tools. We have been cutting asphalt and concrete since our foundation, but recently we also cut iron. I think there is something else to cut other than iron. In other words, our business development is to expand our business fields.

Another approach is to explore the possibility of our business field in depth. For example, we could focus more on electric power plants among our existing business fields. We are considering targeting works related to decommissioning of nuclear power plants which will increase in future. In addition, if the renewal of expressways will continue for 15 years, I am considering making it into a project and developing business in that area. We will develop our business with the right emphasis.

(BR): I see. Expanding business fields and exploring business field in depth are your business approach. This will not be done blindly but with sharpness. I would like to know your approach to your third basic strategy, "Strengthening the network of partner companies".

President Takahashi: We don’t intend to work on all projects by ourselves, and it is necessary to have a balance in which half of the projects are handled by ourselves and the rest of the projects are handled by subcontractors. We think of subcontractors as important business partners. If a construction site stretches over a broad area, such as highway and others, the total cost of the construction work will be reduced by subcontractors’ helps. For example, rather than dispatching our operators to Aomori from here, you can save time and cost by engaging subcontractors operating around Aomori.

Our Company is listed on the stock market, and our size is big in this industry, so subcontractors are reluctant to approach us. If subcontractors work with our Company’s employees and then think that our Company’s atmosphere is good, they may come to us with new business or they may ask us to buy their own companies and ask us to take care of their employees in the future. Of course, to acquire a company is not our purpose, but we are trying to increase the number of subcontractors little by little for various purposes.

(BR): I understood developing good relationships with small contractors which have strong links to local builders is a part of this strategy.

President Takahashi: It's a part of the strategy, and it's also business development. It is about strengthening our sales activities.

(BR): I understood. Now, I would like to know about the fourth strategy, Research and Development.

President Takahashi: Although we said that automation is difficult, it does not mean that we have done nothing. Otherwise, we will be left behind. We try to create new business ideas while thinking about what we can do ourselves. One idea is to develop an equipment which enables women or elderly people to work as effectively as hardworking people in their 30s.

And, it's really a small thing, but another idea is using tablets. If the burden of daily work is reduced or the work process is made faster, productivity will also be increased. It is also an effective measure to address the labor shortage. We are consciously incorporating industry-academia collaboration as part of our business, or increasing contacts with companies other than our existent clients. Industry-academia collaboration activity is to develop automation technologies for road sawing. Now, engineers are controlling machines, but we plan to do it automatically.

5 -5 Message to Shareholders and Investors

(BR): I think it's about time. I would like to have your message to shareholders and investors. Before that, I would like to know about shareholder returns. Currently, the dividend payout ratio is about 10%. Will it be around 10% for the time being?

President Takahashi: Yes. I think we need to raise it little by little. For the time being, we plan to actively invest in such areas as "human resources" "productivity" "research and development" and "expanding business fields" and raise the dividend payout ratio in the medium term.

(BR): Your Company's financial situation is excellent. High liquidity and high stability with a Current Ratio of 493.3% and an Equity Ratio of 79.3%. I look forward to seeing how this excellent financial position will translate into business expansion. I would like to have your message to shareholders and investors.

President Takahashi: It may sound presumptuous, but I think our Company is necessary for Japan. With so many disasters and so many things to protect, I have a responsibility as a contributor to the restoration of social- infrastructure to train and deliver talented people to construction sites.

As for the environment surrounding our Company, the problem of aging of social capital is getting more serious year by year. For us, it's a tailwind, and we can expect to have a heavy workload in the future.

Our Company may be a low-profile company, but I hope that all of investors, including our shareholders, will get to know our Company and understand our Company’s characteristics and our contribution to society. We would appreciate it if you could support and cooperate with us.

(BR): I think many investors don't know about your Company. However, as a specialized contractor, your Company has technical and sales capabilities, a nationwide network, and high social value. Your Company also has a good business environment for long-term growth. I hope that investors will understand this and change their perception. I look forward to your Company’s future development.

Thank you very much for telling me an interesting story for a long time today. I wish President Takahashi and DAI-ICHI CUTTER KOGYO continued success and prosperity.

6. Conclusions