Bridge Report:(2183)Linical Fiscal Year March 2019

Kazuhiro Hatano CEO | Linical Co., Ltd. (2183) |

|

Company Information

Market | TSE 1st Section |

Industry | Service |

CEO | Kazuhiro Hatano |

HQ Address | 10 Fl., Shin-Osaka Brick Building, 6-1 Miyahara 1-chome, Yodogawa-ku, Osaka, Japan |

Year-end | March |

HP |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

1,039 | 22,586,555 shares | 23,467 million | 10.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

14.00 | 1.35% | 43.02 | 24.2 x | 232.48 | 4.5 x |

* Stock price as of closing on July 10, 2019. Number of shares issued at the end of the most recent quarter excluding treasury shares.* ROE and BPS are based on previous term’s results. EPS and DPS are based on the estimates of FY3/20.

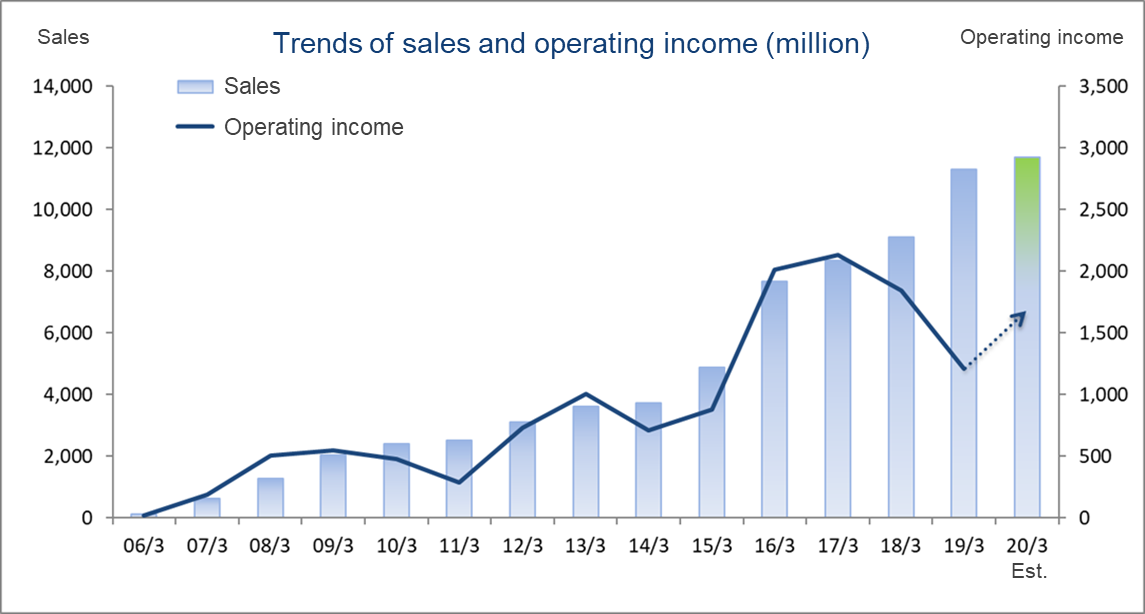

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2016 Act. | 7,666 | 2,012 | 1,985 | 1,330 | 58.40 | 10.00 |

March 2017 Act. | 8,355 | 2,128 | 2,076 | 1,447 | 63.59 | 10.00 |

March 2018 Act. | 9,113 | 1,846 | 1,826 | 1,295 | 57.02 | 11.00 |

March 2019 Act. | 11,313 | 1,212 | 1,253 | 568 | 25.09 | 12.00 |

March 2020 Est. | 11,700 | 1,560 | 1,538 | 971 | 43.02 | 14.00 |

* Estimates are those of the Company. ¥1 per share was paid during FY3/16 to commemorate the 10th anniversary of its establishment.

*A 2 for 1 stock split was performed on January 1, 2016. Dividend payment after the stock split is ¥10 per share (Including a ¥1 commemorative dividend), the actual dividend payment would have been ¥20 per share if the stock split is not considered.

We present this Bridge Report about Linical Co., Ltd. and details of the fiscal year March 2019 earnings.

Table of Contents

Key Points

1.Company Overview

2.Management Strategy

3.Fiscal Year March 2019 Earnings Results

4.Fiscal Year ending March 2020 Earnings Forecasts

5.Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- Sales rose by 24.1% year-on-year while ordinary income declined by 31.4% year-on-year during fiscal year March 2019. With regard to sales, growth in contracted projects and acquisition of Linical Accelovance America, Inc. (LAA) contributed to the increase. With regard to profits, they declined as sales fell below initial expectations despite an increase from the previous fiscal year, and they could not absorb factors such as growth in personnel expenses associated with upfront investments in human resources, an increase in the cost of sales and SG&A expenses for LAA, costs related to the acquisition of LAA, and increases in the amortization of goodwill.

- Linical’s fiscal year March 2020 earnings estimates call for sales and ordinary income to rise by 3.4% and 22.8% year-on-year, respectively. With regard to sales, through repeat orders from existing customers and cultivation of orders from new customers, it aims to accept new projects including global jointly conducted clinical trials, focusing on the oncology and central nervous system (CNS) disease realms at which the Group excels. With regard to profits, although goodwill amortization associated with M&A of European and American subsidiaries will increase, Linical will strive to increase global jointly conducted clinical trials by strengthening the management base of overseas subsidiaries and expanding the scale of the North American business in order to improve profitability. Dividend is expected to be ¥14 per share, up ¥2 per share from the previous fiscal year (a regular dividend of ¥13 per share, an increase of ¥1 per share from the previous fiscal year, in addition to the commemorative dividend of ¥1 per share to commemorate the consolidated net sales exceeding 10 billion yen in the fiscal year March 2019).

- Orders are steadily increasing. The acquisition of LAA seems to have strengthened the company’s global contract system in Asia including Japan and China, the U.S., and Europe, and it is receiving many inquiries concerning new projects such as global jointly conducted clinical trials in those areas. Thus, the expectation to acquire more large-scale orders is high. We would like to focus on the future increase in orders, which is a leading indicator of its business expansion.

1.Company Overview

Linical Co., Ltd. provides contract research organization (CRO) services that support the drug development processes of pharmaceutical companies on an outsourced consignment basis, and sales and marketing functions for pharmaceutical products and post market launch clinical research and surveys on a consigned basis in the contract medical affairs business (CMA). Pharmaceutical products are subject to approval of the Ministry of Health and Welfare prior to their sales, and efficacy and safety of pharmaceutical products must be confirmed through clinical trials prior to their approval. Companies providing clinical trial support services are known as contract research organization (CRO) service providers. In addition, there is a need to conduct surveys and clinical research after pharmaceutical products have been launched into the market and contract medical affairs is a service provided to support these efforts.

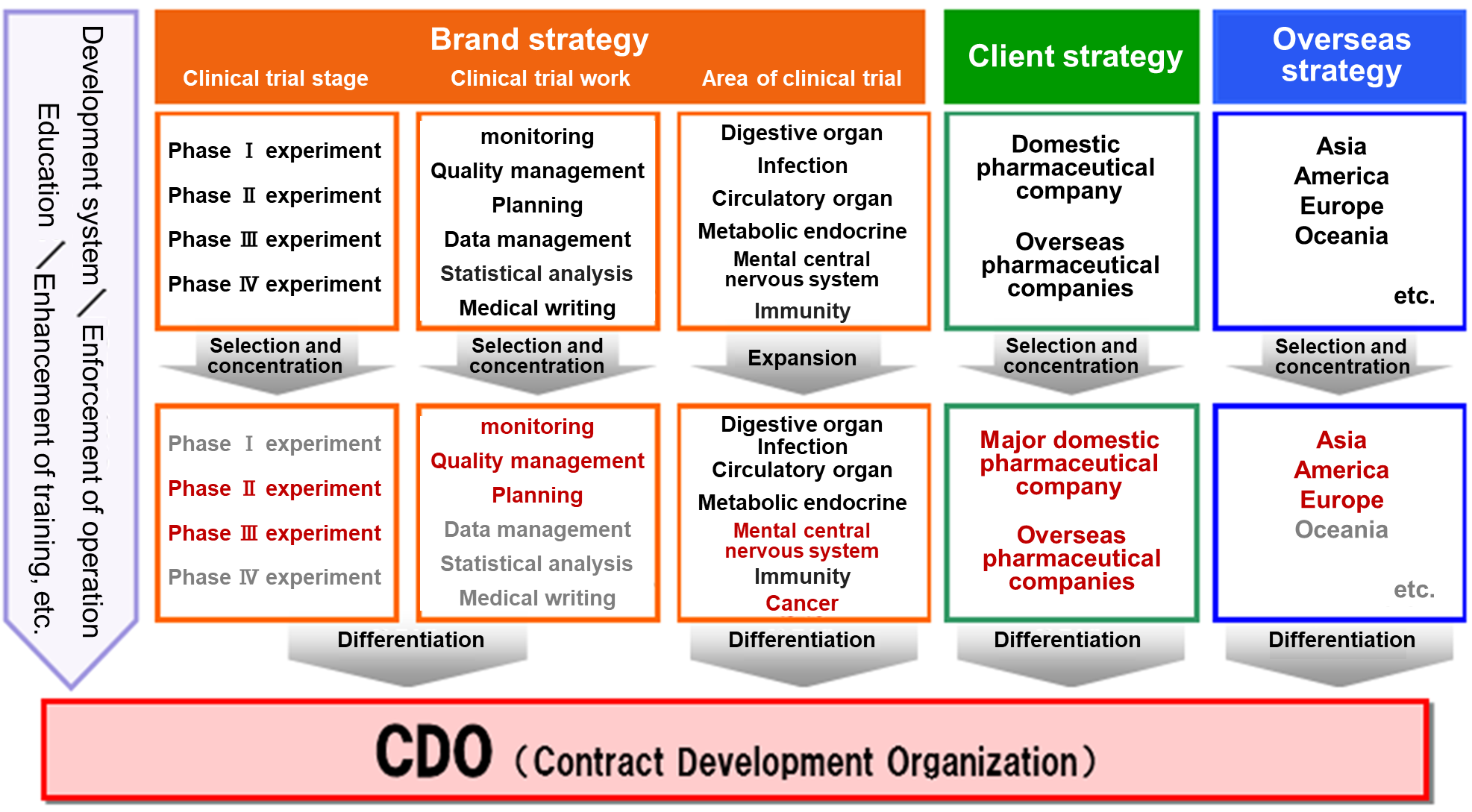

Since its founding, Linical has deployed its CRO business in disease realms where there is strong demand for new drug development and people wish for the eradication of cancer, central nervous system and other diseases globally . These are highly difficult disease realms, and Linical is able to support clinical trials in these realms with its high levels of knowledge and bountiful expertise. In addition, Linical focuses its efforts up the new drug development support and contract medical affairs business, approval application support and post approval marketing and clinical research, and post market survey support services, which exceed the traditional definition of outsourcing and is now considered to be part of a wider range of consulting services provided to customers as a "true clinical development partner". Furthermore, amidst the advance of globalization and large scale pharmaceutical product development, the Linical Group can provide "one stop shopping" type comprehensive services for large scale global products. Consequently, Linical is able to play the role of a strategic business partner by providing total support to help raise the competitive advantage of customers in the market and to help pharmaceutical companies develop new future business opportunities.

Furthermore, Linical has a contract-based business style and is establishing a highly profitable structure. It is focusing on specific businesses (i.e. monitoring, quality control, and consulting, which are the main activities of clinical trials), specific clinical trials (i.e. Phase II and Phase III) and specific customers (i.e. major pharmaceutical companies with abundant medical product development information).

【1-1 Corporate History】

Linical Co., Ltd. was established in June 2005 by nine members who worked at Fujisawa Pharmaceutical Co., Ltd. (Currently known as Astellas Pharma Inc.) on the development of immunosuppressant drugs. Established with the objective of becoming the ideal drug development outsourcing (CRO) company from Osaka, Linical focused its efforts upon the realms of central nervous system diseases (CNS) and oncology since its founding, and received one of its first orders from Otsuka Pharmaceutical Company shortly after its establishment. Thereafter, the Company fortified its staffing as part of its efforts to strengthen its order taking capabilities. In addition, Linical is benefitting from the bountiful experiences of its employees in the realm of oncology pharmaceutical product development and experiences having worked at foreign pharmaceutical companies. Consequently, Linical is successfully expanding orders in the near term.

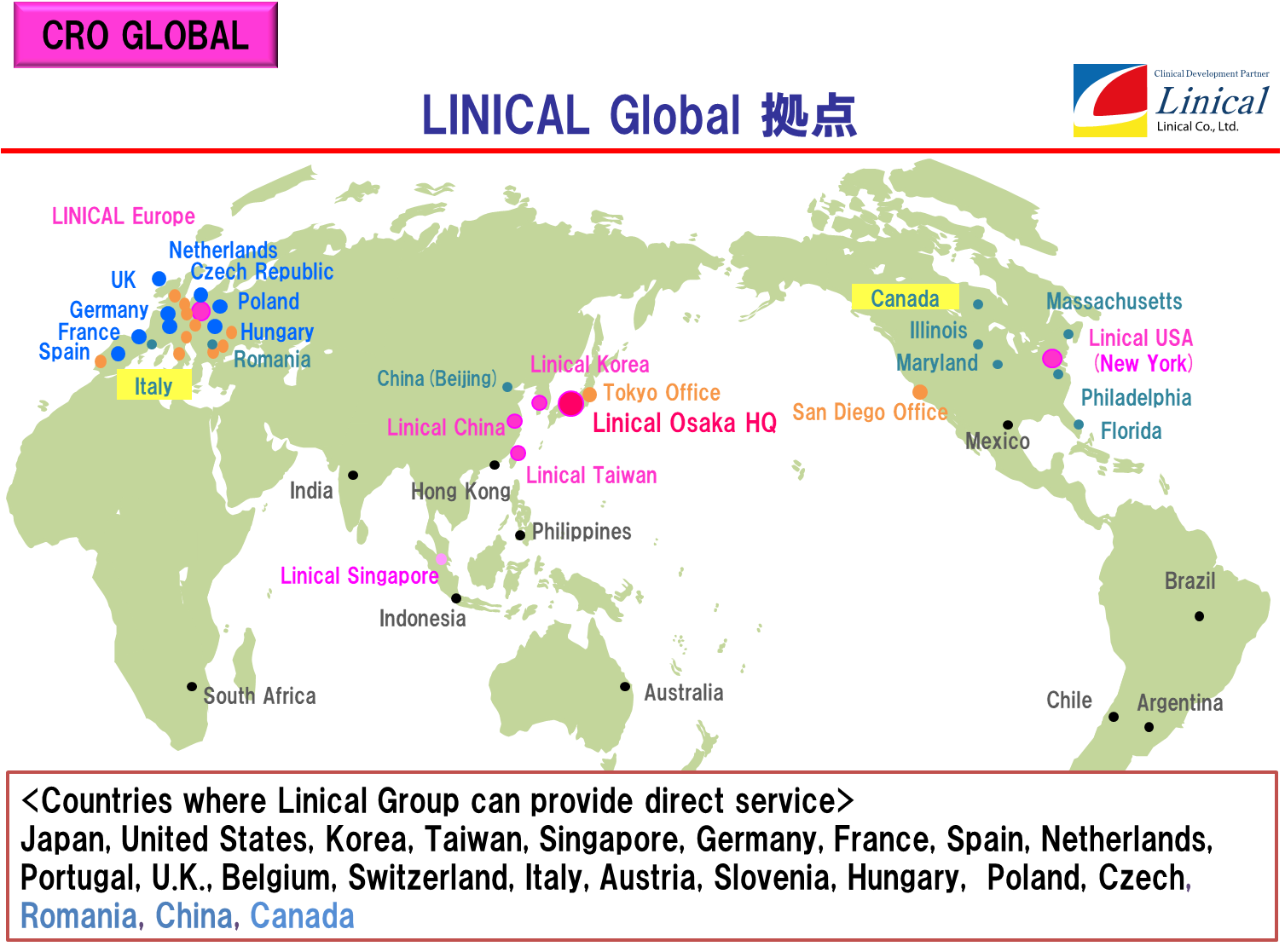

With its advance into the site management organization (SMO, clinical trial facility support organization) business, Aurora Ltd. was turned into a subsidiary in January 2006. However, all shares held in Aurora were later sold in May 2007 in order to focus management resources upon the CRO business. In July 2008, Linical USA, Inc. was established in California, United States to provide support to Japanese pharmaceutical companies seeking to enter the United States market. Also in October of the same year, Linical listed its shares on the Mothers Market of the Tokyo Stock Exchange, and subsequently moved its listing to the First Section of the Tokyo Stock Exchange in March 2013. In May 2013, Linical Taiwan Co., Ltd. and Linical Korea Co., Ltd. were established in Taiwan and Korea respectively. In April 2014, Linical teamed up with its Linical Korea to acquire the Korean CRO company P-pro. Korea Co., Ltd. In October 29, 2014, all of the shares of Nuvisan CDD Holding GmbH, which conducts CRO business in Europe, were acquired and it was converted to a 100% owned subsidiary effective on December 1, 2014. In order to strengthen the collaboration within the Group, the company name of Nuvisan CDD was changed to Linical Europe GmbH on December 1, 2014. In addition, Linical U.K. Ltd. was established in March 2016, and a local subsidiary called Linical Poland SP. Z.O.O. was also established in October of the same year. Moreover, LINICAL Czech Republic s.r.o was established in September 2017. In addition, Accelovance, Inc. was acquired in April 2018 and its company name was changed to Linical Accelovance America, Inc. This acquisition has contributed to a strengthening of Linical's consignment structure for global jointly conducted clinical trials.

Furthermore, LINICAL Hungary was established in March 2019, and LINICAL CHINA was established in May 2019. As a result, the Group now has a stronger system to receive contracts for global jointly conducted clinical trials.

【1-2 Business Description】

Linical mainly conducts contract research organization (CRO) business, post market launches clinical trial and clinical research and marketing support activities in the contract medical affairs business, and new drug development support business.

(Source: Linical)

CRO Business (Contract Research Organization)

The mainstay CRO Business is characterized by business-specific CROs. In the main CRO business, Linical seeks to provide highly effective clinical trial support to allow the quick introduction of new drugs into the market by maintaining staff with high levels of technological knowledge and bountiful experiences. The company has opened facilities in Asia (Korea, Taiwan, Singapore), Europe and the United States to be able to respond to growing demand for global studies. Linical provides "one stop shopping" services ranging from pharmaceutical affairs to planning, implementation plan creation, monitoring, data management, statistical analysis, and pharmacovigilance. With regards to jointly conducted global trials, Linical headquarters operates a function where personnel with in depth knowledge about various countries pharmaceutical product development work. These personnel are able to provide information necessary to establish a development environment that can enable jointly conducted global clinical trials to be conducted in Japanese. Among the new drug development projects spanning from 10 to 20 years, Linical is specialized in the processes of “Phase II” and “Phase III” that require 3 to 7 years targeting patients and are particularly important in clinical trials, and it provides “monitoring” services that are the core of the clinical trials in the contract-based business style in conjunction with “quality control” and “consulting.” It collects highly reliable data and supports the rapid and reliable development of new drugs. Furthermore, it focuses on major pharmaceutical companies with abundant drug development information and is specialized in the oncology and CNS disease realms with a strong demand for development from markets as well as the other challenging realms to respond to its customers’ needs (i.e. pharmaceutical companies).

* International joint examination

“International collaboration” refers to conducting clinical trials simultaneously in multiple countries or regions in order to develop new drugs on a global scale and aim for early launch.

(Source: Linical)

Contract Medical Affairs Business

The Clinical Trials Act is enacted, and the environment surrounding clinical research is changing drastically. Under this circumstance, to obtain information in a timely manner and be the best partner for the medical affairs department of pharmaceutical companies, Linical provides full-service support including data management and statistical analysis with a focus on monitoring and research administration works of clinical trials. It covers clinical trials that are compliant with J-GCP, ethical guidelines, the Clinical Trails Act and/or ICH-GCP, providing services for all regulations. Furthermore, it offers services in the realms of primary and CNS from the beginning of the company’s establishment. It has also strengthened the oncology realm, and more than half of the monitors are experienced in that realm. It has a policy to respond to the latest regulations and contribute to the creation of evidence in the challenging areas based on the know-how cultivated in the past development works.

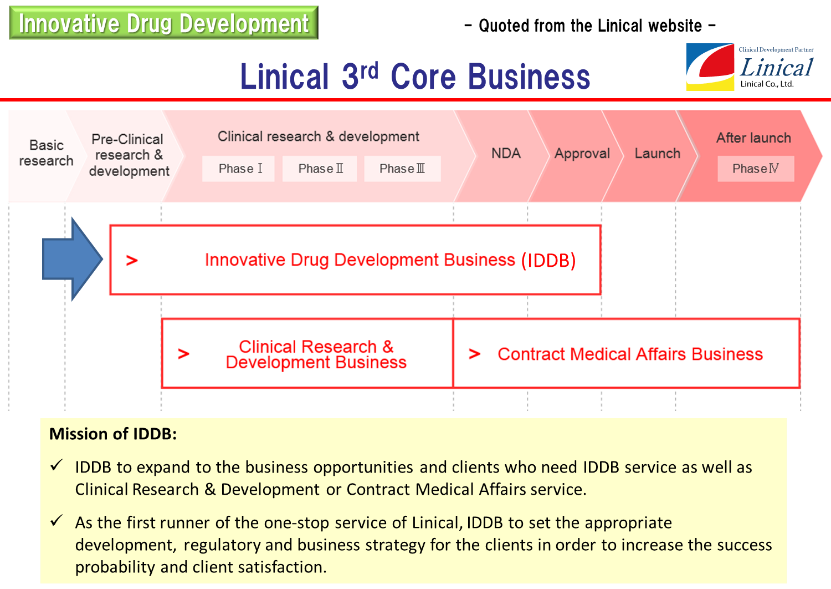

Innovative Drug Development Business

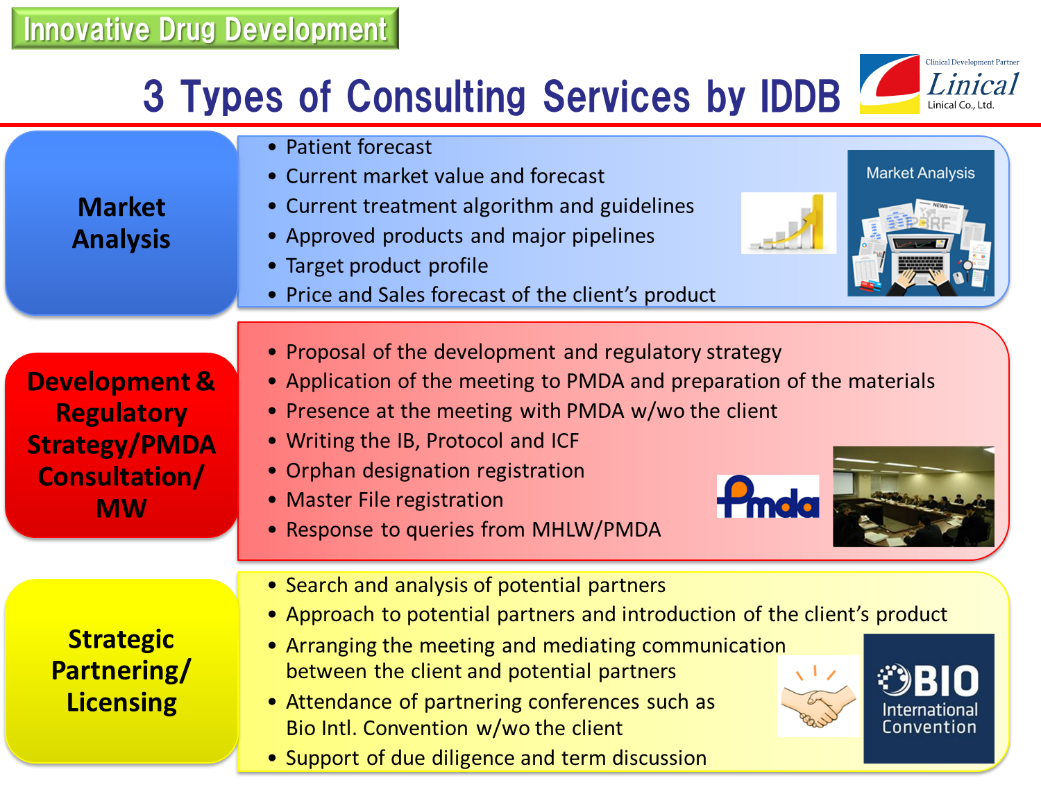

Following the existing CRO Business and Contract Medical Affairs Business, Linical is cultivating the third business called Innovative Drug Development Business. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided. With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

【1-3 Five Strengths】

(1) Comprehensive "One Stop" Services on a Global Scale

Linical is Japan's only global CRO services provider with the ability to provide services in the three regions of Asia, Europe, and the United States. In addition, the Company boasts of partners in 20 different countries, with the ability to provide services in about 30 different countries. Moreover, Linical boasts of highly skilled professionals with bountiful experience in a wide spectrum of comprehensive services ranging from planning, monitoring, data management, statistical analysis, medical writing, pharmaceutical affairs, pharmacology vigilance, and other various services who can respond to customers' needs, including the need for not only local but also multi-national clinical trials. Therefore, Linical is trial a comprehensive "one stop" service provider operating on a global scale.

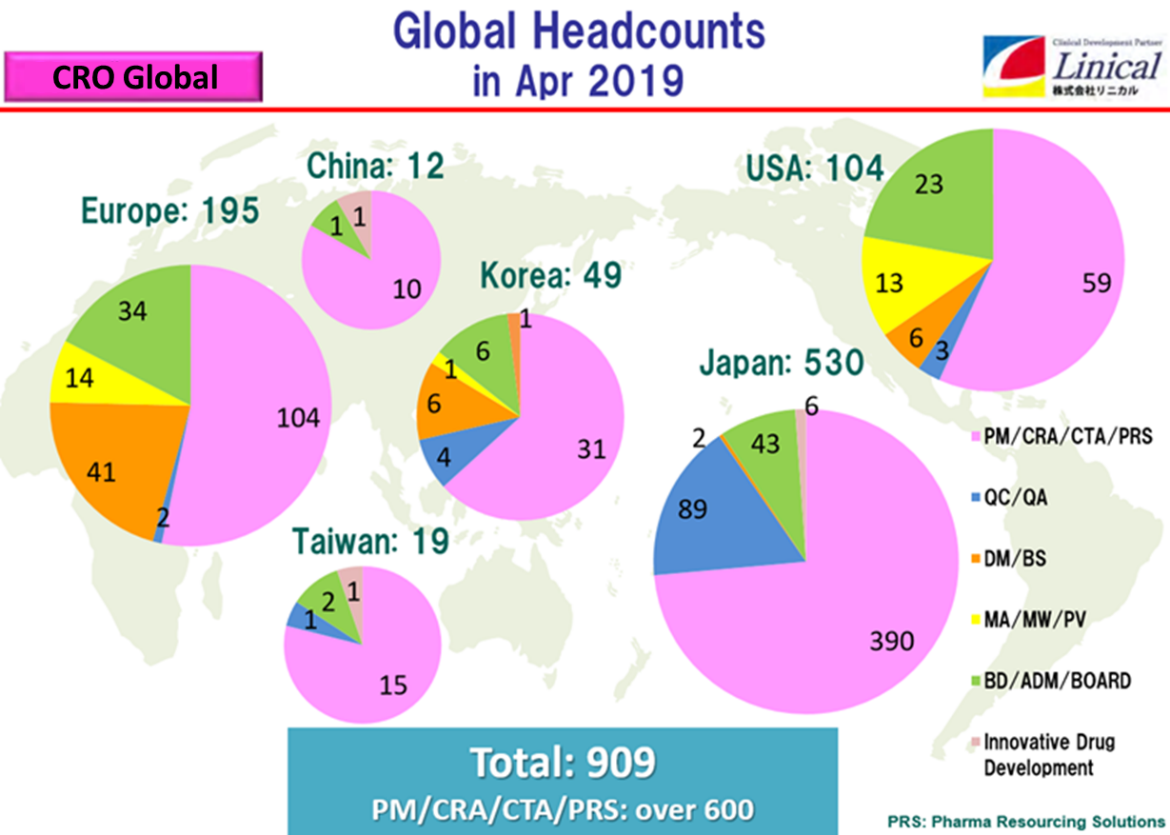

LINICAL Global Base Three Main Operating Regions of ”Japan and Asia, United States, Europe”

(Source: Linical)

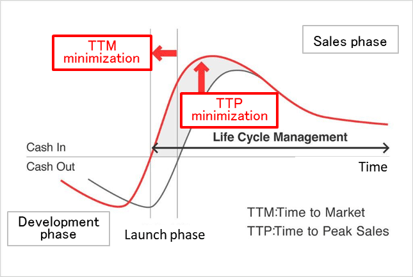

(2) Innovative Drug Discovery Support to Clinical Development and Research

Linical is a true partner that contributes to the maximization of value of drugs by offering responses required in various stages of the drug development process including new drug discovery, clinical development and post market launch manufacturing. Linical also enables clients to promote efficient new drug development, extend life cycle management, shorten the time required to market launch (TTM), and maximize sales at an early stage (TTP).

(Source: Linical)

(3) Focus Upon Oncology, Central Nervous System, Immune System

Pharmaceutical product development is currently focused upon the three realms of oncology, central nervous system and immune system. Founding members of Linical boast of bountiful experience in the realm of immune system and have provided services in the highly difficult realm of immune system since the Company's founding. Thereafter, Linical has expanded its realms of expertise to include central nervous system in 2006, and oncology in 2010. Currently, Linical's business is based upon the regions of unmet medical needs in these three main business realms of oncology, central nervous system and immune system. In addition, its overseas subsidiaries are also boast of a strong track record in oncology, central nervous system, and immune system related services, which are realms where unmet medical needs are high. Furthermore, it is in the process of growing the regenerative medicine realm, which is extremely challenging, to a major pillar of future services.

(Source: Linical)

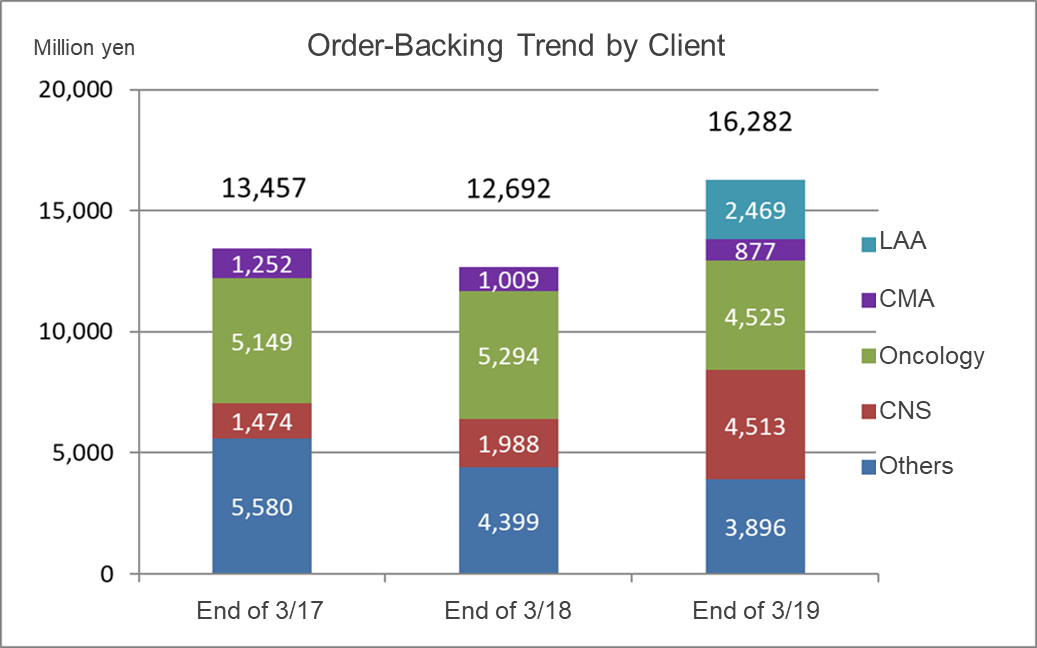

The order backlog is increasing mainly in the CNS disease realm and oncology realm. New orders are acquired while order backlog is constantly completed. During this fiscal year, the consolidation of LAA also contributed.

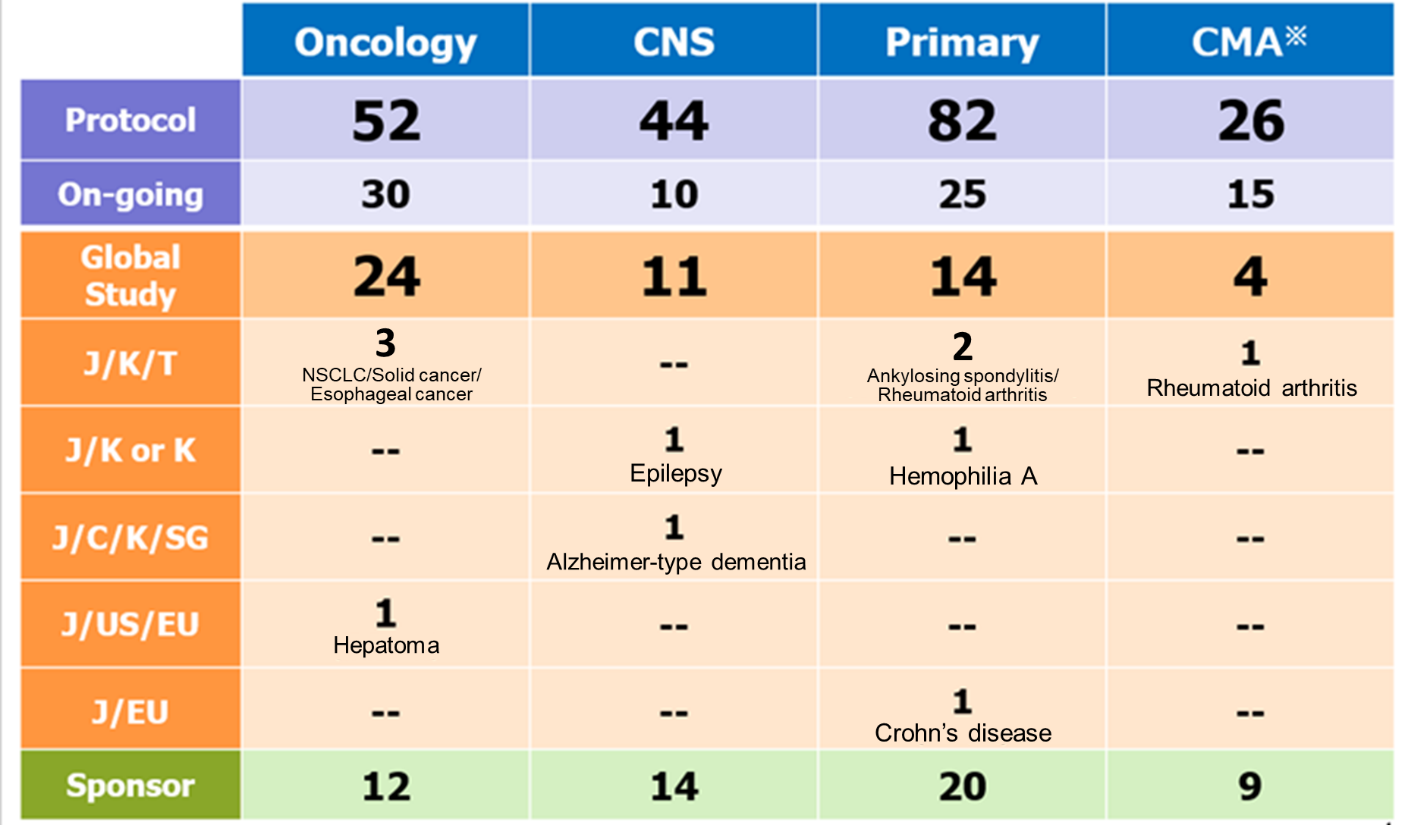

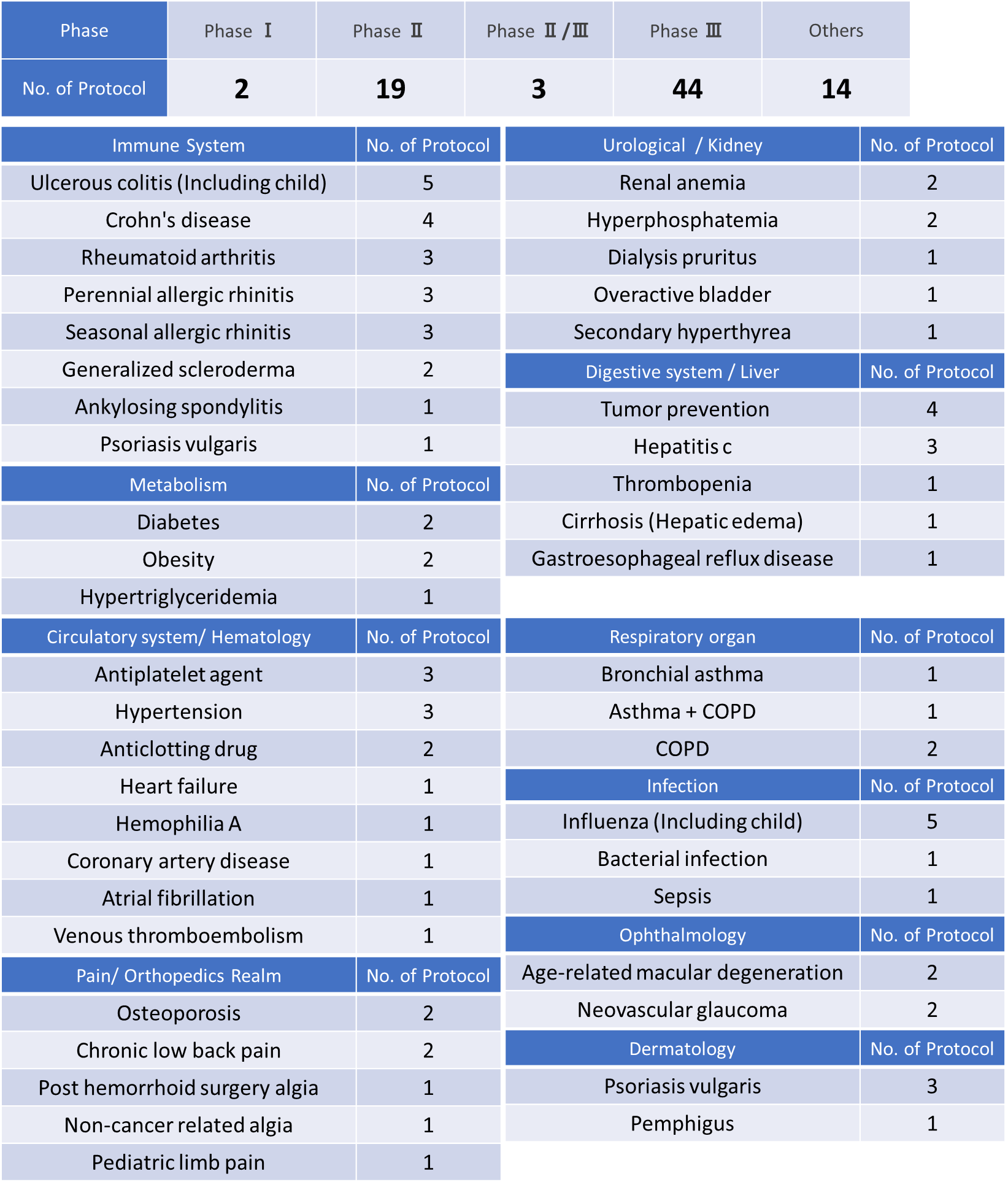

Contract test Track Record(As of May 1, 2019,)

*CMA Act. Shows Act. Extracted CMA projects from Oncology, CNS, Primary.

(Source: Linical)

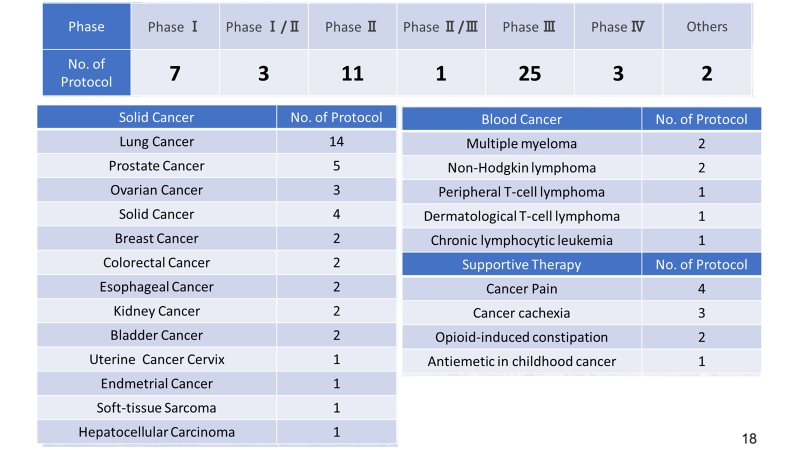

Oncology Realm ( Including CMA), Consigned Project Track Record (As of May 1, 2019)

(Source: Linical)

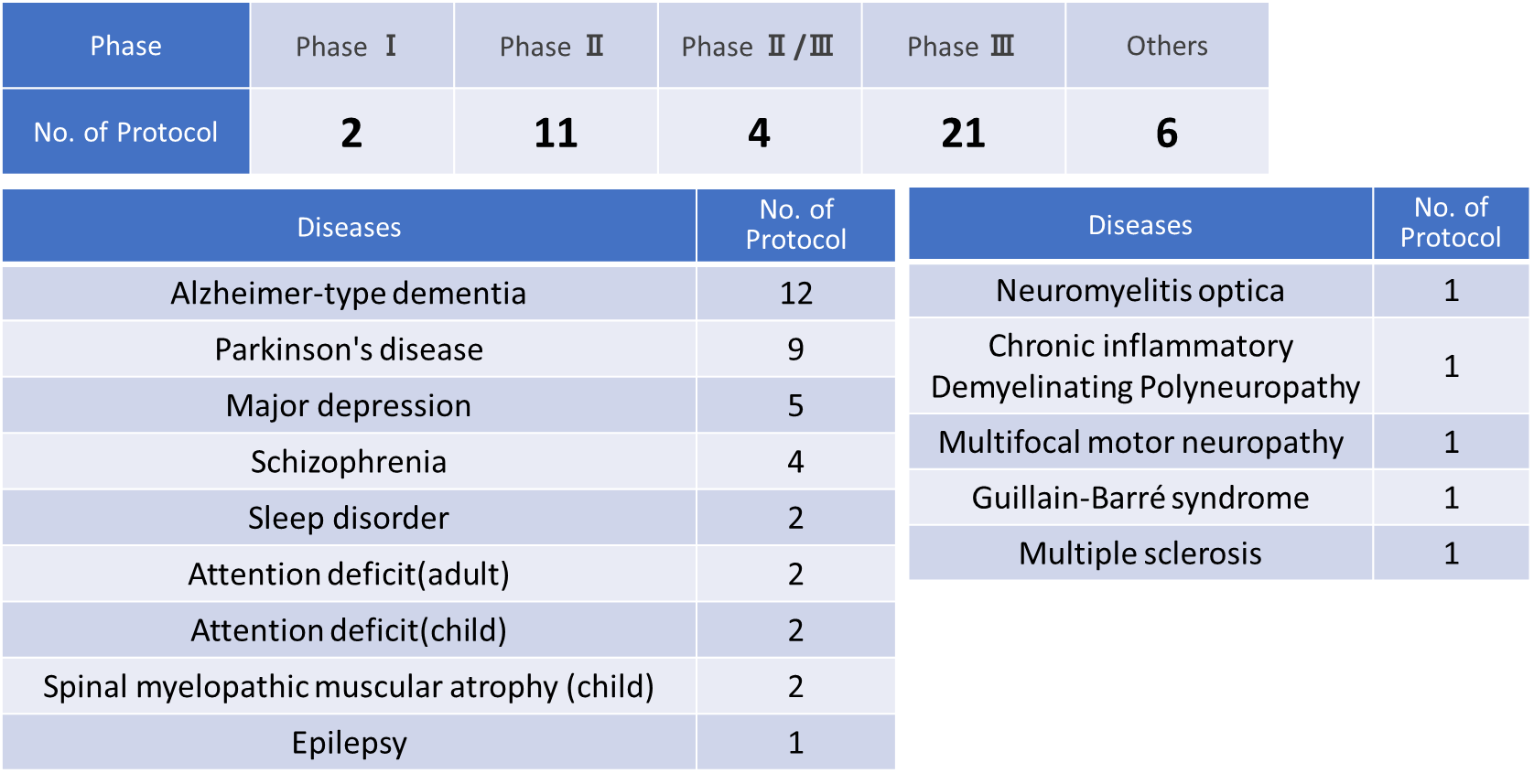

Central Nervous System ( Including CMA), Consigned Project Track Record (As of May 1, 2019)

(Source: Linical)

Primary Realms ( Including CMA), Consigned Project Track Record (As of May 1, 2019)

(Source: Linical)

(4) Global Collaboration

Linical is Japan's only CRO services company that can provide clients with services on a global basis. Because of its ability to provide exceptionally high quality services (Japan Quality), it has established its global business development center in Japan and maintains multilingual staff with the ability to communicate in Japanese, English and other languages including Korean, Taiwanese, German and others at its Osaka headquarters and Tokyo branch office. Overseas staff also understand Linical's advantage of having high quality services originating in Japan and provide these "Japan Quality" services throughout the Linical business globally.

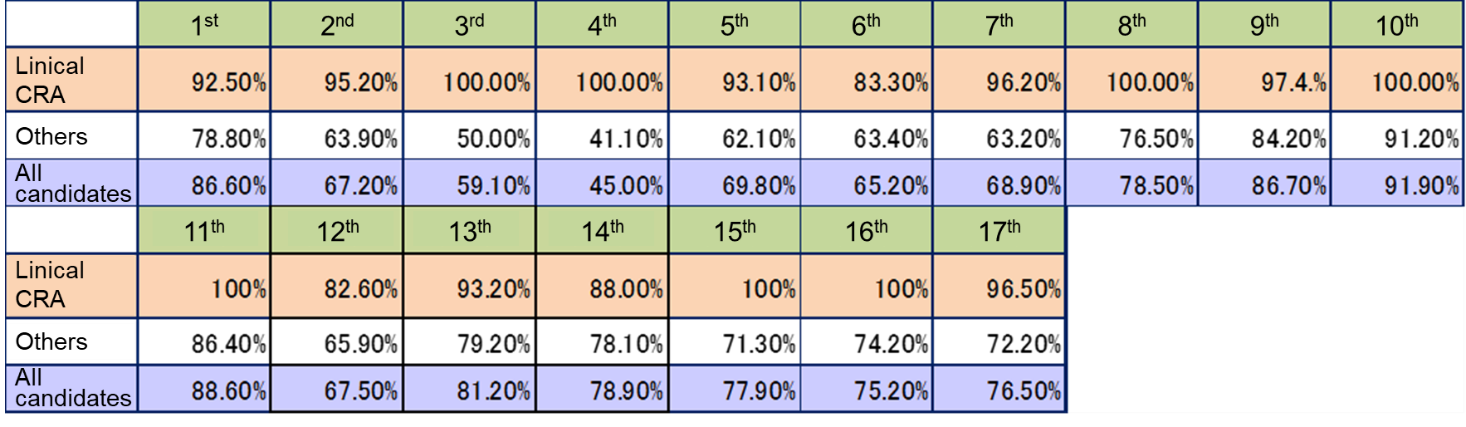

(5) High Quality Services

In order to provide high quality services that Linical is widely recognized for, the Company implements training of its staff in both aspects of quantity and quality of work. As a result, the Company has been able to maintain high passage rates of the GCP Support Certification Examinations administered by the Japan Society of Clinical Trials and Research (JSCTR) since the first examination and has been awarded with recognition awards for its high quality and passage rates, which in turn have contributed to promotion of clinical trials. In addition, Linical boasts of bountiful experience in GCP compatibility surveys and FDA inspection. In both instances, the Company has received high regard for its services from clients. Moreover, overseas subsidiaries have also received high regard for its bountiful experiences in dealings with the FDA, KFDA, ANVISA and other organizations. In addition, about 67% of trials have completed registration before the end of the predetermined registration periods. The company strongly believes that its greatest mission is to provide customers with the best service by combining high quality and speed.

Comparison of GCP passport certification exam pass rates

2.Management Strategy

(1) Contract Research Organization (CRO) Business

Main Strategies for the CRO Business

・Establish the global structure of 1,000 members

・Promote acquisition of orders based upon comprehensive capabilities for global jointly conducted clinical trials by establishing a global structure

Global Development

【Japan】

Efforts will be focused on regenerative medicine in addition to the realms of oncology, CNS disease, and immunology as well as the expansion of the businesses in the realms of skin and eyes.

Furthermore, Linical will explore the possibilities of establishing Linical Australia and Linical South Africa to be led by Japan.

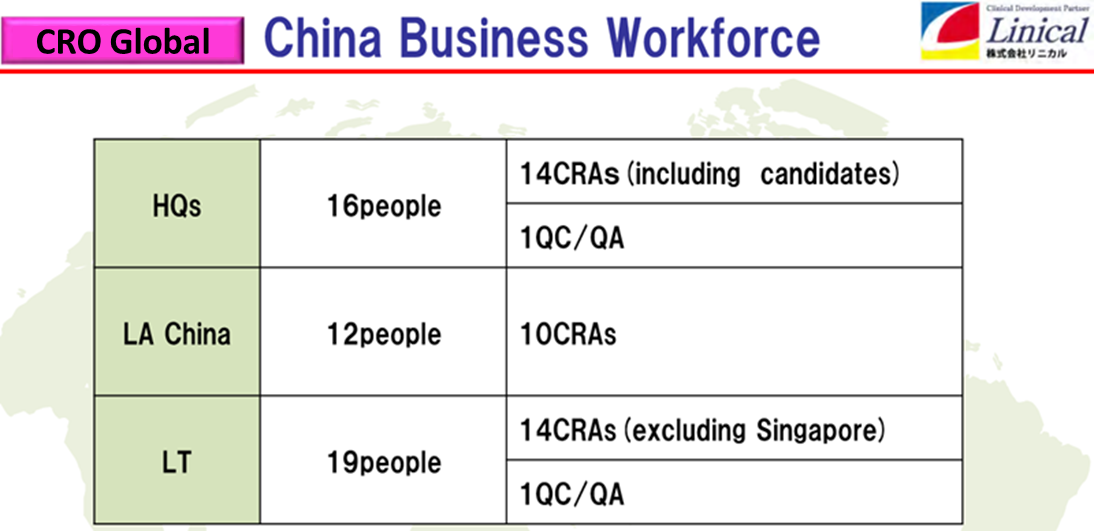

It will also expand the business in China (establishment of a subsidiary in Shanghai is completed) and dispatch employees from Japan.

【Korea】

Steps are being taken to expand the staffing to 100 at an early stage and to establish a highly profitable earnings structure based upon two consecutive terms of profits.

【Taiwan】

In addition to acquiring new projects including subsidiaries in Singapore, it will consider expanding the businesses in Hong Kong and the Philippines.

【Europe】

It aims to improve profitability by strengthening competitiveness. In addition, it will consider the establishment of Linical Italy, reinforcement of recruitment activities for CRA in the UK, and further increasing staff and expanding bases. Also, integration of Linical Accelovance Europe and Linical Europe will be advanced.

【The United States】

Linical will position the base in the United States as the center of its business and nurture it. Furthermore, it will explore the possibilities of establishing Linical CANADA and expanding the businesses in Latin America.

(Source: Linical)

With the acquisition of LAA as a subsidiary, it is expected that the sales force will be strengthened and the quality will be improved while the global 1,000-person system becomes realistic.

(Source: Linical)

Linical plans to accelerate the expansion of its Chinese business by having deeper cooperative relationships with LAA and LAA’s Chinese bases.

(2) Contract Medical Affairs Business

Responding to the special order needs of the growing number of corporate led clinical research related activities is the important strategy within the contract medical affairs business.

Linical differentiates itself from its competitors, which primarily offer only MR dispatch services, by focusing upon the consigned service type drug development business. While consigned support services for clinical research are provided as the main business of Linical., the securing of quality levels of clinical research is a critical issue for evidence creation. Linical creates procedure manuals for structure facilitation support, monitoring and surveillance implementation. In addition, the ability to receive work for clinical research was responsible for the turn to profits of this business segment during fiscal year March 2013, and new orders for clinical research and development in fiscal year March 2014 allowed sales and profits to rise from the previous term. Aggressive hiring is expected to be maintained to respond strong demand for this business. Linical plans to continue to carry out active recruitment activities to respond to vigorous inquiries from potential clients, taking advantage of the implementation of the Clinical Trials Act.

Earnings Trend of the pharmaceutical business

| FY 3/ 11 | FY 3/ 12 | FY 3/ 13 | FY 3/ 14 | FY 3/ 15 | FY 3/ 16 | FY 3/ 17 | FY 3/ 18 | FY 3/ 19 |

Sales | 97,827 | 138,400 | 169,226 | 288,205 | 364,918 | 553,399 | 806,764 | 908,810 | 954,438 |

Operating Income | -15,834 | -21,016 | 19,504 | 68,010 | 111,006 | 208,284 | 293,028 | 288,121 | 313,911 |

* Unit: thousand

(Note) From the first quarter of FY 3/16, the name of the previous segment was changed from “CSO business” to “Contract Medical Affairs business”.

(3) Innovative Drug Development Business (New Business Development)

Important strategies within the innovative drug development business include providing a wide range of services that respond to development plan establishment and drug authority correspondence, and leveraging new drug development funds.

Administrative authorities in Japan have needs of putting innovative medicines and medical equipment from Japan into practice earlier than any other countries in the world. In addition, administrative authorities in Korea and Taiwan have needs of creating new medicine that would enhance their international competitiveness. Furthermore, pharmaceutical companies and biotech venture companies that are Linical’s customers are interested in entering the Japanese pharmaceutical market to distribute and sell their products, but they are faced with challenges such as unfamiliarity with the Japanese market and pharmaceutical affairs, insufficient development capabilities, and lack of strategic partners/licensees. In response to these recent needs, Linical is strengthening its Innovative Drug Development Business to make it a third business. Linical can provide not only clinically developed products but also support services by professionals who have a long experience of providing support services at the earlier phase and, “research,” “development” and “licensing” at major pharmaceutical companies, including the partnership with both domestic and foreign biotech venture companies. Linical also finances new drug development funds. The increase of investment projects from new drug investment funds leads to the expansion of its subsequent CRO business, and its judging capability cultivated in the experiences so far will be made used of effectively. Furthermonre, experiences including development plan establishment and drug correspondence are expected to accumulate.

(Source: Linical)

Innovative Drug Development Business -3 types of consulting-

(Source: Linical)

3.Fiscal Year March 2019 Earnings

(1) Consolidated results

| FY 3/ 18 | Ratio to sales | FY 3/ 19 | Ratio to sales | YoY |

Sales | 9,113 | 100.0% | 11,313 | 100.0% | +24.1% |

Gross profit | 3,533 | 38.8% | 3,813 | 33.7% | +7.9% |

SG&A | 1,686 | 18.5% | 2,600 | 23.0% | +54.2% |

Operating Income | 1,846 | 20.3% | 1,212 | 10.7% | -34.3% |

Ordinary Income | 1,826 | 20.0% | 1,253 | 11.1% | -31.4% |

Parent Net Income | 1,295 | 14.2% | 568 | 5.0% | -56.1% |

*Unit: million yen

* The figures include figures calculated by Investment Bridge Co., Ltd., and may differ from actual figures (Abbreviated hereafter)

Sales increased 24.1% year-on-year and ordinary income decreased 31.4% year-on-year.

Sales increased 24.1% year-on-year to ¥11,313 million, and ordinary income decreased 31.4% year-on-year to ¥1,253 million.

The CRO industry and the CSO industry, to which the company belongs, are expanding gradually due to the outsourcing trend of drug development and sales and the increase in global jointly conducted clinical trials. Furthermore, pharmaceutical companies are expected to accelerate the transformation of business models and research and development activities to create innovative new drugs, including dealing with the issue of patents out of core products. Under these circumstances, Linical acquired 100% of the outstanding shares of LAA to make it a wholly owned subsidiary in order to strengthen its ability to respond to pharmaceutical companies’ global development needs including North America. Their performance is included in the consolidated results from fiscal year March 2019.

Sales increased significantly as a result of the increase in contract projects and consolidation of sales from LAA and its subsidiaries as a result of acquisition of LAA. However, sales of LAA were significantly lower than expected because of the postponement of orders immediately before the conclusion of the contract at the beginning of the acquisition and cancellation of development of multiple contract projects, and the acquisition of the new contracts went lower than expected.

Operating income decreased by 34.3% year-on-year to ¥1,212 million because sales were lower than expected despite an increase in sales from the previous year, labor expenses rose due to upfront investment in HR, cost of sales, selling, general and administrative expenses of LAA and its subsidiaries due to the acquisition of LAA were also added to Linical’s account, acquisition-related expenses in connection with the acquisition of LAA incurred, amortization of goodwill rose, and these expenses could not be absorbed by the sales. Although Linical undertook aggressive restructuring, such as reorganization of bases, reduction of surplus personnel, and system integration, other factors such as a delay in the timing of cost reduction effects, reorganization of the bases to accelerate the progress of restructuring, and recording of temporary expenses for business structure improvement in line with personnel reductions also weighed against profits. Gross profit margin was 33.7%, down 5.1 points from the previous year. Personnel expenses, payment fees and amortization of goodwill also increased, resulting in an increase in SG&A expenses by 54.2% year-on-year. SG&A as a percentage of sales increased by 4.5 points year-on-year to 23%. Ordinary income decreased by 31.4% to ¥1,253 million but the decline is relatively small compared to operating income, due to non-operating income with foreign exchange gain of ¥67 million (foreign exchange loss of ¥7 million in the previous fiscal year). Profit attributable to owners of parent decreased by 56.1% year-on-year to ¥568 million, as Linical recorded the temporary expenses to improve business structure associated with the reorganization of LAA’s US base and personnel reduction. It was also affected by the fact that the company could not recognize the future tax saving effect of tax loss carryforwards generated by LAA as deferred tax assets at this point.

The year-end dividend is planned to be ¥12 per share as expected at the beginning of the fiscal year (an increase of ¥1 per share from the previous fiscal year).

Sales and profit by segment

| FY 3/ 18 | Ratio to sales | FY 3/ 19 | Ratio to sales | YoY |

CRO business | 8,204 | 90.0% | 10,359 | 91.6% | +26.3% |

CMA business | 908 | 10.0% | 954 | 8.4% | +5.0% |

Consolidated Sales | 9,113 | 100.0% | 11,313 | 100.0% | +24.1% |

CRO business | 2,721 | 90.4% | 2,540 | 89.0% | -6.6% |

CMA business | 288 | 9.6% | 313 | 11.0% | +9.0% |

Adjustment amount | -1,162 | - | -1,641 | - | - |

Consolidated Operating Income | 1,846 | - | 1,212 | - | -34.3% |

*Unit: million yen

In the CRO Business, sales increased by 26.3% year-on-year due to an increase in contract projects centered on global jointly conducted clinical trials as a result of continuing strong efforts to build a global contract system in Japan, Asia, the United States, and Europe, and acquisition of LAA as a subsidiary. Meanwhile, operating income decreased by 6.6% year-on-year due to an increase in personnel costs associated with human resource investment, an increase in costs associated with the acquisition of LAA, and an increase in the amortization of goodwill generated from the acquisition of LAA.

In the Contract Medical Affairs Business, sales increased by 5.0% year-on-year and operating income increased by 9.0% year-on-year due to an increase in the personnel utilization rate as orders for clinical trials after the launch of new drugs increased.

Also, due to an increase in corporate expenses, which are general administrative expenses that do not belong to each reportable segment, the negative adjustment amount rose significantly from ¥1,162 million in the previous fiscal year to ¥1,641 million.

Non-consolidated performance trends in each country

| FY 3/ 18 | FY 3/ 19 | ||||

Sales | Ordinary Income | Sales | Change | Ordinary Income | Change | |

Japan | 7,099 | 1,718 | 7,686 | +8.3% | 1,708 | -0.5% |

U.S.A. | 73 | -136 | 170 | +132.8% | -209 | - |

LAA | - | - | 1,906 | - | -323 | - |

Europe | 1,909 | 268 | 2,033 | +6.5% | 288 | +7.6% |

Korea | 366 | 51 | 420 | +14.7% | 44 | -13.1% |

Taiwan | 190 | 18 | 244 | +28.4% | 56 | +201.2% |

Consolidation adjustment | -526 | -93 | -1,148 | - | --311 | - |

Total | 9,113 | 1,826 | 11,313 | +24.1% | 1,253 | -31.4% |

*Unit: million yen

Within Japan, Linical saw an increase in sales resulting from higher new orders, but labor expenses included in cost of sales rose due to hiring new graduates and promotion and raising salaries of the existing staff. Within the United States, the start of new projects contributed to an increase in sales, but the recording of upfront expenses such as the cost of hiring more staff caused ordinary loss to expand. LAA, which was newly consolidated, also saw ordinary loss despite business structural reforms. In Europe and Taiwan, larger sales and profits were derived from an expansion in orders. In South Korea, sales rose on the back of an increase in orders, but amortization of goodwill expenses contributed to a decline in profits.

Goodwill balance and remaining amortization period (20FY 3/19 end)

| Amount of money | Remaining depreciation period | Annual depreciation |

Korea | Depreciation end | ||

Europe ※1 | 921 | 14 years | 69 |

U.S.A. ※2、3 | 3,313 | 15 years | 221 |

*Unit: million yen

*1 Intangible assets recognized by Purchase Price Allocation, other than goodwill, have a balance of ¥89 million at the end of fiscal year March 2019. Remaining amortization period is 12 years (annual depreciation of 8 million).

*2 Intangible assets recognized by Purchase Price Allocation, other than goodwill, have a balance of ¥96 million at the end of fiscal year March 2019. Among them, the remaining amortization for ¥11 million is 2 years (annual depreciation of 5 million) and the that for ¥85 million is 8 years (annual depreciation of 10 million).

*3 Amount of goodwill that has been tentatively calculated at the present time since the price adjustment of shares has not been completed after the acquisition.

(2) Change in order balance

| FY 3/ 18 (A) | FY 3/ 19 | May 15, 19 (B) | YoY change (B―A) / A |

Eisai | 1,685 | 3,350 | 4,738 | +181.2% |

Chugai Pharmaceutical | 3,674 | 3,579 | 3,456 | -5.9% |

Ono Pharmaceutical | 2,817 | 2,476 | 2,285 | -18.9% |

Other | 4,514 | 6,876 | 6,744 | +49.4% |

Total order balance | 12,692 | 16,282 | 17,225 | +35.7% |

*Unit: million yen

In the CRO Business, the total amount of a contract is determined based on the number of cases and the difficulty of trials based on the target disease during the trial period of about one to three years. A contract is signed with a client for this trial period, and sales are booked on a monthly basis in line with consignment contracts. Also, in the Contract Medical Affairs Business, a contract is signed with a client for almost the same period, and sales are booked on a monthly basis in line with consignment contracts. Consequently, the total order backlog reflects the residual value of consignment contracts already concluded. Therefore, the order backlog reflects sales that will be booked during the course of the next one to five years and are used as an assumption for estimates of future earnings.

Order backlogs as of May 15, 2019, were 35.7% higher than those at the end of the previous fiscal year (March 2018). This is because although existing contracted contracts were steadily completed and the order balance was recorded as sales, there were new contracts for contracted projects that exceeded them. Specifically, in April 2018, one of Linical’s subsidiaries in the United States acquired LAA and their order backlog was included in the account of Linical. Linical also acquired a large-scale global joint trial conducted in January 2019 in four countries: Japan, Korea, China, and Singapore (partially under contract). Due to the increase in many new projects such as global joint trial projects including the United States, Asia, and Europe, Linical is planning to strengthen the sales-related effects as it has established a certain scale of system to accept global-level contracts in Japan, Asia, the United States, and Europe through the acquisition of LAA.

(3) Financial Conditions and Cash Flow(CF)

Financial Conditions

| FY 3/ 18 | FY 3/ 19 |

| FY 3/ 18 | FY 3/ 19 |

Cash | 5,173 | 5,055 | ST Interest-Bearing Liabilities | 139 | 1,619 |

Receivables | 1,343 | 1,602 | Payables | 544 | 963 |

Advance payment | 279 | 663 | Taxes Payable | 341 | 488 |

Current Assets | 7,086 | 7,723 | LT Interest-Bearing Liabilities | 793 | 3,103 |

Tangible Assets | 106 | 134 | Liabilities | 4,042 | 8,008 |

Intangible Assets | 1,237 | 4,461 | Net Assets | 5,204 | 5,250 |

Investments and Others | 816 | 939 | Total Liabilities and Net Assets | 9,247 | 13,259 |

Noncurrent Assets | 2,160 | 5,535 | Total Interest-Bearing Liabilities | 933 | 4,723 |

※Unit: million yen

※Interest-bearing liabilities=Borrowings

As of the end of March 2019, total assets rose by ¥4,011 million from the end of the previous fiscal year to ¥13,259 million. Increase in trade receivables, advances, goodwill, on the left side and increases in short-term borrowings, long-term borrowings, etc. on the right side are the main factors of the increase. Amortization of goodwill at the end of March 2019 grew by ¥3,185 million year-on-year to ¥4,234 million. In addition, the capital adequacy ratio decreased by 16.7 points to 39.6% at the end of March 2019.

Cash Flow

| FY 3/ 18 | FY 3/ 19 | YoY | |

Operating cash flow(A) | 1,360 | -796 | -2,156 | - |

Investing cash flow (B) | -91 | -2,617 | -2,525 | - |

Free cash flow(A+B) | 1,268 | -3,414 | -4,682 | - |

Financing cash flow | -471 | 3,282 | 3,753 | - |

Cash and Equivalents at the end of term | 5,173 | 5,055 | -117 | -2.3% |

*Unit: million yen

Regarding the cash flow, operating CF turned negative due to decreases in income before income taxes, accounts payable and deposits. Furthermore, the negative range of investing CF increased due to the acquisition of a subsidiary’s stocks accompanying changes in the scope of consolidation. Free CF also turned negative. Meanwhile, financing CF turned positive due to an increase in short-term borrowings and long-term borrowings.

4.Fiscal Year ending March 2020 Earnings Forecasts

(1) Consolidated results

| FY 3/ 19 Act. | Ratio to sales | FY 3/ 20 Est. | Ratio to sales | YoY |

Sales | 11,313 | 100.0% | 11,700 | 100.0% | 3.4% |

Operating Income | 1,212 | 10.7% | 1,560 | 13.3% | 28.6% |

Ordinary Income | 1,253 | 11.1% | 1,538 | 13.1% | 22.8% |

Parent Net Income | 568 | 5.0% | 971 | 8.3% | 70.9% |

*Unit: million yen

Linical’s Earnings Estimates Call for Sales, Ordinary Income to Rise 3.4% and 22.8% Year-On-Year

Linical’s estimates for fiscal year March 2020 call for sales and ordinary income to rise by 3.4% and 22.8% year-on-year to ¥11.7 billion and ¥1,538 million, respectively.

With regard to sales, Linical will endeavor to acquire repeat orders from existing clients who have high regard for Linical’s businesses and to strengthen marketing activities to secure orders from new clients within the CRO Business. In particular, Linical intends to expand sales by acquiring new projects including global joint clinical trials in the oncology and CNS disease realms, where there is strong demand for new drug development and the Linical Group has high expertise. In the Contract Medical Affairs Business, Linical will expand its customer base by vigorously implementing marketing activities with a focus on company-driven clinical research after the launch of new drugs and strive to obtain new projects in the realms where it has expertise utilizing the know-how gained in the CRO Business.

With regard to profit, in the CRO Business, in addition to the amortization of goodwill associated with the M&A of European subsidiaries, the amortization of goodwill associated with the acquisition of LAA in April 2018 will be added. However, Linical will take measures to realize a highly profitable earning structure with increasing number of global jointly conducted clinical trials by strengthening management base of the overseas subsidiaries and expanding the businesses in North America. In the Contract Medical Affairs Business, an increase in sales due to acquisition of new projects is expected to contribute to an increase in profit.

Operating income is expected to grow by 28.6% year-on-year to ¥1,560 million. Despite the upfront investments including increases in staffing and consolidation of subsidiaries in Europe, taking into account the effects of the structural reforms implemented in the previous fiscal year, operating income margin is projected to rise 2.6 points to 13.3%. The company does not anticipate any significant amounts of income or losses to be booked at the non-operating and extraordinary income levels.

Linical anticipates dividends to rise by ¥2 per share from the previous term to ¥14 per share. The dividend will be a regular dividend of ¥13 per share, an increase of ¥1 per share from the previous fiscal year, plus a commemorative dividend of ¥1 per share, commemorating the consolidated sales of ¥10 billion in the fiscal year March 2019.

(2) Recent topics

Completed establishment of an overseas subsidiary (People’s Republic of China)

In China, Linical Accelovance China Ltd. (located in Beijing, hereinafter referred to as “LAC”) owned by LAA, which was acquired last year, is already operating the business. It is receiving contracted projects of global jointly conducted clinical trials including China by pharmaceutical companies in Japan and Europe and also receiving inquiries on multiple development projects. In order to meet the demands of pharmaceutical companies for global jointly conducted clinical trials in China, which is expected to increase in the future, and to further improve the speed, quality and convenience of sponsors, Linical established its subsidiary “Linical China Co., Ltd.”, which is directly managed by the Japanese head office in Shanghai, China. Linical intends to expand the size and base of the local subsidiary, explore the possibility of establishing an efficient business base in China, and respond to the diverse global development needs of pharmaceutical companies, including the Chinese market. Linical China Co., Ltd. was established as of May 28, 2019, and will be wholly owned by Linical.

Establishment of an indirectly-owned subsidiary in Hungary

LINICAL Europe Holding GmbH, a wholly owned consolidated subsidiary of Linical, has established a wholly owned subsidiary in Hungary. In Europe, it is already operating businesses in several countries, mainly in Germany, but with the aim of strengthening the system for global jointly conducted clinical trials contract in Europe, LINICAL Europe Holding GmbH converted the LINICAL Europe GmbH Hungary branch office to a company. The company was established on March 26, 2019.

5.Conclusions

Linical’s results in FY March 2019 showed a tough decrease in operating income by 34.3% year-on-year, despite an increase of 24.1% year-on-year in sales. These tough results were affected by the postponement of orders immediately before the conclusion of the contract at the beginning of the acquisition, cancellation of development of multiple contract projects, and acquisition of a smaller number of new contracts than expected at LAA. To respond to these, the company undertook structural reforms of LAA. The reforms included the reduction of surplus personnel, consolidation and decommissioning of bases, and streamlining of operations through the integration of overlapping functions with existing departments in the United States and Europe. We would like to pay attention to the future trend of LAA’s business performance as to what kind of impact proactive structural reforms implemented in the previous fiscal year will give to the current business performance. Despite such a difficult profit environment, Linical’s orders are steadily increasing. Although there was an effect of LAA’s consolidated contribution, the order backlog as of May 15, 2019, increased by 35.7% from the end of fiscal year March 2018. This was contributed by the acquisition of large-scale global jointly conducted clinical trials conducted in four countries including Japan, South Korea, China, and Singapore (partially in a contract conclusion process) in January this year. Furthermore, Linical seems to be receiving inquiries on many new projects such as global joint trial projects in the United States, Asia, and Europe. Thus, the possibility of acquiring further large orders is increasing in the future. This is a result of having strengthened the global contracting system in Asia including Japan and China, the United States and Europe through the acquisition of LAA. We would like to pay attention to the future order backlog, which is a key indicator of estimates of future earnings. In May 2019, Linical also established its subsidiary “Linical China Co., Ltd.,” which is directly managed by the Japanese head office in Shanghai, China. It is intending to expand the business at an early stage, including aggressive recruitment of personnel. We would like to pay attention to their strategies to expand the business in the Chinese market as well as their efforts and results.

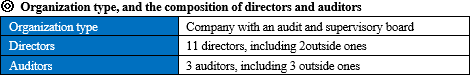

<Reference: Regarding Corporate Governance>

◎Corporate Governance Report

The company submitted its latest corporate governance report on July 2, 2019 after applying the corporate governance code

<Basic Policy>

The company will contribute to the development of pharmaceutical products as a partner of leading pharmaceutical companies in Japan with its technology for developing pharmaceutical products and live up to the expectations of the entire society from the pharmaceutical field. In addition, in order to improve corporate value, it is necessary to establish a system for making decisions swiftly while securing soundness and transparency.Therefore, the company plans to reinforce its internal control, including thoroughgoing compliance with laws, which is the most important issue to be solved. Based on this idea, we are strengthening the internal control, including thorough compliance, which is the most important issue.

<Regarding the implementation of the principles of the corporate governance code>Major principles and reasons

Principles | Reasons for not implementing the principles |

Principle 4-7 Roles and Responsibilities of Independent External Directors | To secure effective management supervision from a standpoint independent from management, etc., and enhance corporate value over the medium to long term by obtaining advice based on the extensive experiences and knowledge, we appoint two external directors who are familiar with the pharmaceutical industry and have deep knowledge and experiences. We will build a system in which they can fulfill their roles and responsibilities. |

【Supplementary Principle 4-8-2 Utilization of independent external directors】 | Our company will develop systems for communication and coordination between independent external directors and the management and for cooperation with auditors or the board of auditors. |

【Principle 4-9 Criteria for judging the independence of independent outside directors and their qualities】 | Our company will carefully discuss the disclosure of criteria for objectively judging independence, etc. that have no risk of causing a conflict of interest with general shareholders. |

【Supplementary Principle 4-10-1 Utilization of arbitrary systems】 | Our company will discuss measures for strengthening the independence and objectivity of the functions of the board of directors for appointing executives and directors, determining their remunerations, and so on, and their accountability. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

| <Principle 1-4 Strategically held shares>

| In order to avoid the risk of share price fluctuations and also improve capital efficiency, the company will not hold any listed shares, unless it is necessary to hold shares for cooperation and alliance. |

Supplementary principle 4-11-3 Prerequisites for ensuring effectiveness of the Board of Directors and Board of Auditors

| As a result of analyzing and evaluating the effectiveness of the Board of Directors by the Board of Directors, we have concluded that it is operating effectively as follows. During the previous fiscal year, the Board of Directors met 13 times in total, including regular and extraordinary meetings, and various management issues were discussed including management strategy and investment, and business execution. 1) In accordance with the rules of the Board of Directors, every important matter is selected as agenda, and the Board of Directors meets every month for deliberation in a timely and appropriate manner. 2) Prior to deliberation at the Board of Directors meetings, problems and issues, risks, and countermeasures are clarified at management meetings such as the Management Committee to increase the effectiveness of discussions. 3) The information materials for the Board of Directors meetings are distributed in advance for smooth and active discussions and for sufficient deliberation at the Board of Directors. 4) In principle, all directors, all external auditors (independent auditors), and observers including advisory lawyers, all executive officers, and general manager of the Corporate Planning Department attend the Board of Directors meeting every month to actively express their opinions to that the objectivity of the discussion is enhanced. 5) We receive reports on a regular basis concerning the management status through various conference bodies and implement appropriate risk management and business execution monitoring. 6) In order to further enhance the management supervisory function of the Board of Directors, we consider it important to have external directors with extensive management experiences. Therefore, from the previous fiscal year, we increased the number of external directors to 2, and a total of 5 independent officers, including 3 external auditors, participate in the monthly Board of the Directors meetings in principle, and actively express their opinions, thereby increasing the objectivity of the discussion. |

Supplementary principle 4-14-2 Training of Directors and Auditors

| We not only encourage the Directors and Auditors to proactively learn but provide workshops on the themes (e.g. compliance, trends at general meetings of shareholders) that are considered necessary for the performance of their duties. In addition, we offer opportunities for office visits, conference tours, and interviews for them to understand the status of business execution. Information on workshops held by third parties that are useful for the performance of their duties is also shared with the Directors and Auditors. |

<Principle 5-1 Policy for constructive dialogue with shareholders> | The company has continuous, constructive, transparent, fair dialogue regarding business performance, managerial strategies, capital policies, risks, corporate governance systems, etc. with the following method, in order to foster trusting relationships with the aim of achieving the sustainable growth of corporate value, which is a shared goal of the company and shareholders (including potential institutional and individual investors).

Dialogue with shareholders is led by the Managing Director CFO. Considering the purpose and effect of the interview, and the attributes of shareholders, the dialogue method is examined thoroughly by the senior management such as CEO and the Managing Director CFO. As for IR, mainly the financial affairs department and the management planning division gather necessary information from relevant sections of the company, prepare reference material and give explanations in an understandable manner, to enrich the dialogue with shareholders.The company has opportunities to dialogue with shareholders through the annual general meetings of shareholders, results briefing sessions (twice a year), briefing sessions for individual investors (twice a year), meetings with institutional investors and analysts inside and outside Japan at the time of disclosure of quarterly results, the disclosure of IR information via websites, the response to inquiries from individual investors by telephone, email, or the like. Then, the company reflects questions, requests, information on participants in briefing sessions, questionnaire results, etc. in IR activities.Shareholders’ interests and concerns grasped through the dialogue with them are reported to the senior managing director CFO and the information is utilized for analyzing business administration, discussing how to disclose information, etc. Concerning IR activities and the dialogue with shareholders, the company manages insider information appropriately in accordance with in-company rules. The quiet period, in which the company refrains from having dialogue about financial results, is from the day after the closing date of each quarter to the date of brief reporting. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Linical Co., Ltd. (2183) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/