Bridge Report:(2183)Linical the fiscal year March 2020

Kazuhiro Hatano CEO | Linical Co., Ltd. (2183) |

|

Company Information

Market | TSE 1st Section |

Industry | Service |

CEO | Kazuhiro Hatano |

HQ Address | 10 Fl., Shin-Osaka Brick Building, 6-1 Miyahara 1-chome, Yodogawa-ku, Osaka, Japan |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥809 | 22,586,555 shares | ¥18,273 million | 9.1% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥14.00 | 1.73% | ¥- | -x | ¥236.37 | 3.4x |

* Stock price as of closing on July 1, 2020. Number of shares issued at the end of the most recent quarter excluding treasury shares.

* ROE is based on previous term’s results. DPS are based on the estimates of FY3/21. EPS is not published.

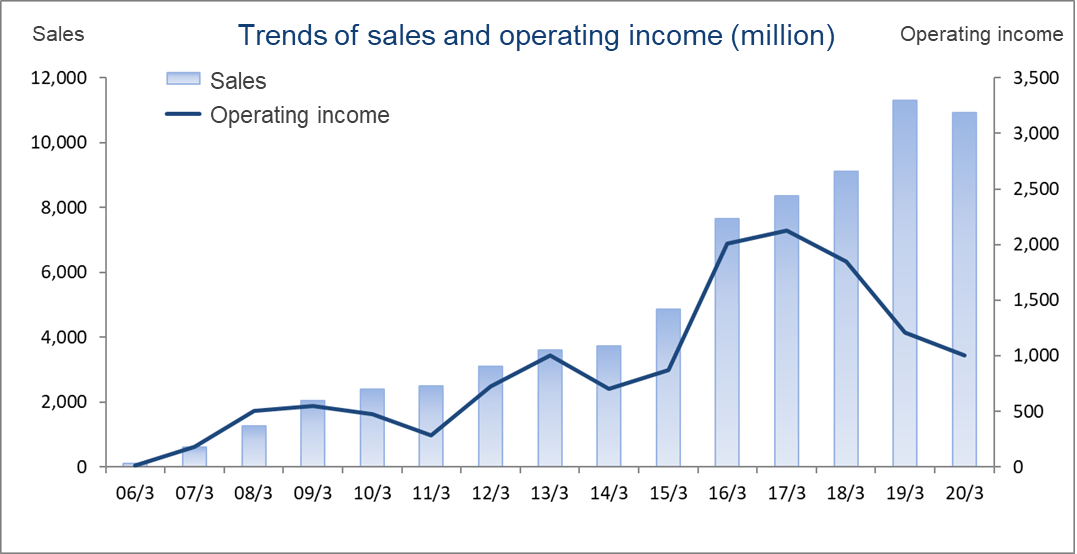

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2017 Act. | 8,355 | 2,128 | 2,076 | 1,447 | 63.59 | 10.00 |

March 2018 Act. | 9,113 | 1,846 | 1,826 | 1,295 | 57.02 | 11.00 |

March 2019 Act. | 11,313 | 1,212 | 1,253 | 568 | 25.09 | 12.00 |

March 2020 Act. | 10,935 | 1,005 | 918 | 482 | 21.38 | 14.00 |

March 2021 Est. | - | - | - | - | - | - |

* Estimates are those of the company, but are still to be determined since it is difficult to reasonably calculate the impact of the spread of COVID-19 at this point.

We present this Bridge Report about Linical Co., Ltd. and details of the fiscal year March 2020 earnings.

Table of Contents

Key Points

1. Company Overview

2. Management Strategy

3. The Fiscal Year March 2020 Earnings Results

4. Fiscal Year ending March 2021 Earnings Forecasts

5. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- In the fiscal year March 2020, sales decreased by 3.3% year on year, and ordinary income declined by 26.7% year on year. In the fourth quarter, the posting of sales was delayed as it was difficult to carry out some clinical trial operations because the worldwide spread of COVID-19 caused restrictions on visits to medical institutions, and the start of clinical trials for new projects was delayed. Also, new development projects at pharmaceutical companies were temporarily put on hold. As for profits, it was affected by the year-on-year decline in sales and the lawyers' remunerations for negotiating about the closing price of a subsidiary acquisition in the U.S. with the seller.

- The company's business plan for the fiscal year March 2021 was undecided as it was difficult to produce the earnings forecast logically at this point because the business environment surrounding the Group is expected to remain uncertain due to the impact of the global spread of COVID-19. The company intends to promptly announce the business forecast for the current term when rational calculation becomes possible. On the other hand, the ordinary dividend is to be 14 yen/share, unchanged from the previous year. A commemorative dividend of 1 yen/share was added to the ordinary dividend of 13 yen/share in the fiscal year March 2020 to commemorate the consolidated sales exceeding 10 billion yen in the fiscal year March 2019.

- It is expected that the development of vaccines and therapeutic agents for COVID-19 will be accelerated on a global scale. In March 2020, the company's South Korean subsidiary was commissioned to conduct clinical trial operations in South Korea for a COVID-19 therapeutic agent by a local pharmaceutical company. Also, in the U.S., it seems that a U.S. subsidiary has been consulted for clinical trials for vaccine and therapeutic agent development. We will pay attention to whether or not the company could receive large-scale orders for clinical trial operations for COVID-19 vaccines and therapeutic agents.

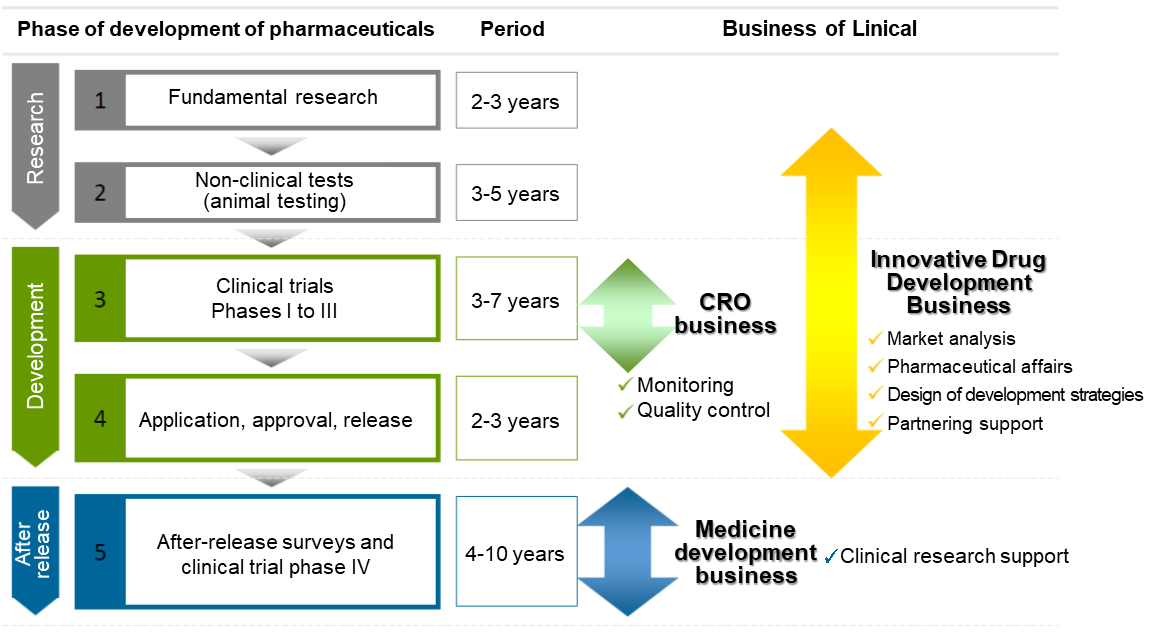

1.Company Overview

Linical Co., Ltd. provides contract research organization (CRO) services that support the drug development processes of pharmaceutical companies on an outsourced consignment basis, and sales and marketing functions for pharmaceutical products and post market launch clinical research and surveys on a consigned basis in the contract medical affairs business (CMA). Pharmaceutical products are subject to approval of the Ministry of Health and Welfare prior to their sales, and efficacy and safety of pharmaceutical products must be confirmed through clinical trials prior to their approval. Companies providing clinical trial support services are known as contract research organization (CRO) service providers. In addition, there is a need to conduct surveys and clinical research after pharmaceutical products have been launched into the market and contract medical affairs is a service provided to support these efforts.

Linical has conducted various efforts to eradicate cancer, central nervous system and other diseases globally since its founding, and it has deployed its CRO business in disease realms where there is strong demand for new drug development. These are highly difficult disease realms, and Linical is able to support clinical trials in these realms with its high levels of knowledge and bountiful expertise. In addition, Linical focuses its efforts up the new drug development support and contract medical affairs business, approval application support and post approval marketing and clinical research, and post market survey support services, which exceed the traditional definition of outsourcing and is now considered to be part of a wider range of consulting services provided to customers as a "true clinical development partner". Furthermore, amidst the advance of globalization and large-scale pharmaceutical product development, the Linical Group can provide "one stop shopping" type comprehensive services for large scale global products. Consequently, Linical is able to play the role of a strategic business partner by providing total support to help raise the competitive advantage of customers in the market and to help pharmaceutical companies develop new future business opportunities.

Furthermore, Linical has a contract-based business style and is establishing a highly profitable structure. It is focusing on specific businesses (i.e. monitoring, quality control, and consulting, which are the main activities of clinical trials), specific clinical trials (i.e. Phase II and Phase III) and specific customers (i.e. major pharmaceutical companies with abundant medical product development information).

【1-1 Corporate History】

Linical Co., Ltd. was established in June 2005 by nine members who worked at Fujisawa Pharmaceutical Co., Ltd. (Currently known as Astellas Pharma Inc.) on the development of immunosuppressant drugs. Established with the objective of becoming the ideal drug development outsourcing (CRO) company from Osaka, Linical focused its efforts upon the realms of central nervous system diseases (CNS) and oncology since its founding, and received one of its first orders from Otsuka Pharmaceutical Company shortly after its establishment. Thereafter, the Company fortified its staffing as part of its efforts to strengthen its order taking capabilities. In addition, Linical is benefitting from the bountiful experiences of its employees in the realm of oncology pharmaceutical product development and experiences having worked at foreign pharmaceutical companies. Consequently, Linical is successfully expanding orders in the near term.

With its advance into the site management organization (SMO, clinical trial facility support organization) business, Aurora Ltd. was turned into a subsidiary in January 2006. However, all shares held in Aurora were later sold in May 2007 in order to focus management resources upon the CRO business. In July 2008, Linical USA, Inc. was established in California, United States to provide support to Japanese pharmaceutical companies seeking to enter the United States market. Also, in October of the same year, Linical listed its shares on the Mothers Market of the Tokyo Stock Exchange, and subsequently moved its listing to the First Section of the Tokyo Stock Exchange in March 2013. In May 2013, Linical Taiwan Co., Ltd. and Linical Korea Co., Ltd. were established in Taiwan and Korea respectively. In April 2014, Linical teamed up with its Linical Korea to acquire the Korean CRO company P-pro. Korea Co., Ltd. In October 29, 2014, all of the shares of Nuvisan CDD Holding GmbH, which conducts CRO business in Europe, were acquired and it was converted to a 100% owned subsidiary effective on November 30, 2014. In order to strengthen the collaboration within the Group, the company name of Nuvisan CDD was changed to Linical Europe GmbH on December 1, 2014. In addition, Linical U.K. Ltd. was established in March 2016, and a local subsidiary called Linical Poland SP. Z.O.O. was also established in October of the same year. Moreover, LINICAL Czech Republic s.r.o was established in September 2017. In addition, Accelovance, Inc. was acquired in April 2018 and its company name was changed to Linical Accelovance America, Inc(LAA). This acquisition has contributed to a strengthening of Linical's consignment structure for global jointly conducted clinical trials.

Furthermore, Linical Hungary Kft. was established in March 2019, and Linical China Co., Ltd. was established in May 2019. As a result, the Group now has a stronger system to receive contracts for global jointly conducted clinical trials. Also, in December 2019, the European subsidiary of LAA was integrated into LINICAL Europe GmbH to strengthen the business in the European region.

【1-2 Business Description】

Linical mainly conducts contract research organization (CRO) business, post market launches clinical trial and clinical research and marketing support activities in the contract medical affairs business, and new drug development support business.

As a true partner, the company contributes to the maximization of the value of the medical drugs by helping the procedure from the non-clinical tests to clinical development and after-release surveys and clinical trial, and making it possible to shorten the time needed to start selling the drugs and prolong the life-cycle of the products. On top of that, the company supports not only pharmaceutical companies but also the bio-ventures in various ways including exit strategies.

(Source Linical)

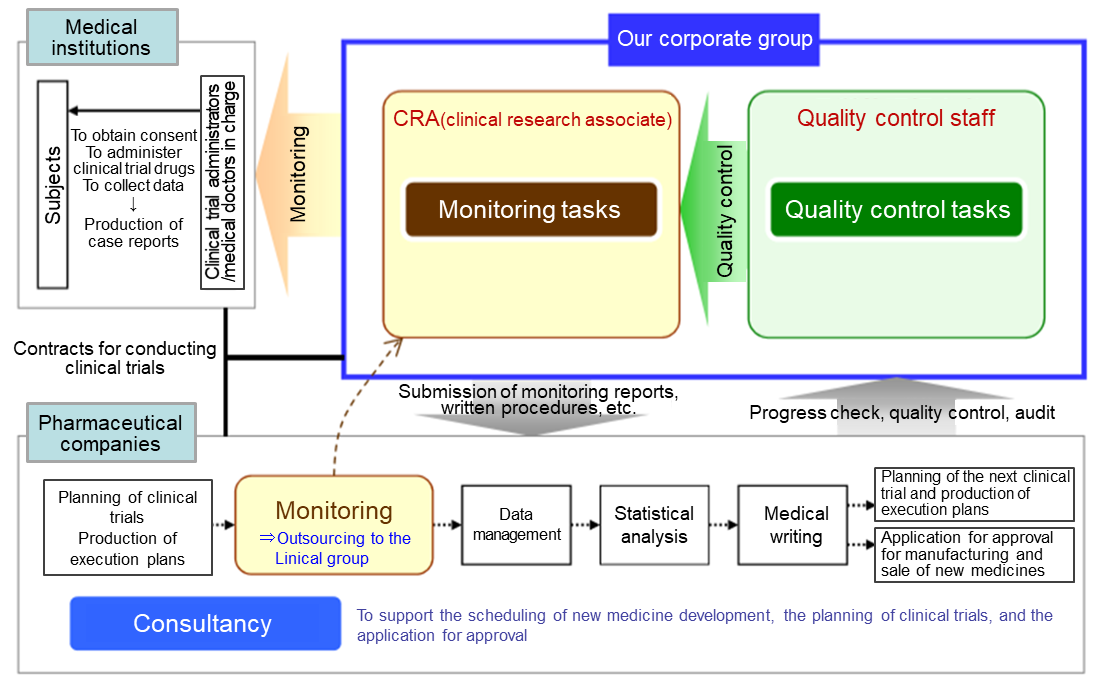

CRO Business (Contract Research Organization)

The mainstay CRO Business is characterized by business-specific CROs. In the main CRO business, Linical seeks to provide highly effective clinical trial support to allow the quick introduction of new drugs into the market by maintaining staff with high levels of technological knowledge and bountiful experiences. The company has opened facilities in Asia (Korea, Taiwan, Singapore, China), Europe and the United States to be able to respond to growing demand for global studies. Linical provides "one stop shopping" services ranging from pharmaceutical affairs to planning, implementation plan creation, monitoring, data management, statistical analysis, and pharmacovigilance. With regards to jointly conducted global jointly conducted clinical trials, Linical headquarters operates a function where personnel with in depth knowledge about various countries pharmaceutical product development work. These personnel are able to provide information necessary to establish a development environment that can enable jointly conducted global jointly conducted clinical trials to be conducted in Japanese. Among the new drug development projects spanning from 10 to 20 years, Linical is specialized in the processes of “Phase II” and “Phase III” that require 3 to 7 years targeting patients who are particularly important in clinical trials, and it provides “monitoring” services that are the core of the clinical trials in the contract-based business style in conjunction with “quality control” and “consulting.” It collects highly reliable data and supports the rapid and reliable development of new drugs. Furthermore, it focuses on major pharmaceutical companies with abundant drug development information and is specialized in the oncology and CSN disease realms with a strong demand for development from markets as well as the other challenging realms to respond to its customers’ needs (i.e. pharmaceutical companies).

In addition, the company offers high-quality services in the fields of schedule management, standard procedure documents for clinical trials, compliance with GCP, the reliability of data and case reports, etc.

* Global jointly conducted clinical trials

“Global jointly conducted clinical trials” refers to conducting clinical trials simultaneously in multiple countries or regions in order to develop new drugs on a global scale and aim for early launch.

*GCP (Good Clinical Practice)

“GCP” is the international rule the companies are supposed to obey when they conduct the clinical trial. It is enacted by Ministry of Health, Labor and Welfare as a ministerial ordinance so that they can conduct it properly in Japan.

(Source Linical)

Contract Medical Affairs Business

The Clinical Trials Act is enacted, and the environment surrounding clinical research is changing drastically. Under this circumstance, to obtain information in a timely manner and be the best partner for the medical affairs department of pharmaceutical companies, Linical provides full-service support including data management and statistical analysis with a focus on monitoring and research administration works of clinical trials. It covers clinical trials that are compliant with J-GCP, ethical guidelines, the Clinical Trails Act and/or ICH-GCP, providing services for all regulations. Furthermore, it offers services in the realms of primary and CNS from the beginning of the company’s establishment. It has also strengthened the oncology realm, and more than half of the monitors are experienced in that realm. It has a policy to respond to the latest regulations and contribute to the creation of evidence in the challenging areas based on the know-how cultivated in the past development works.

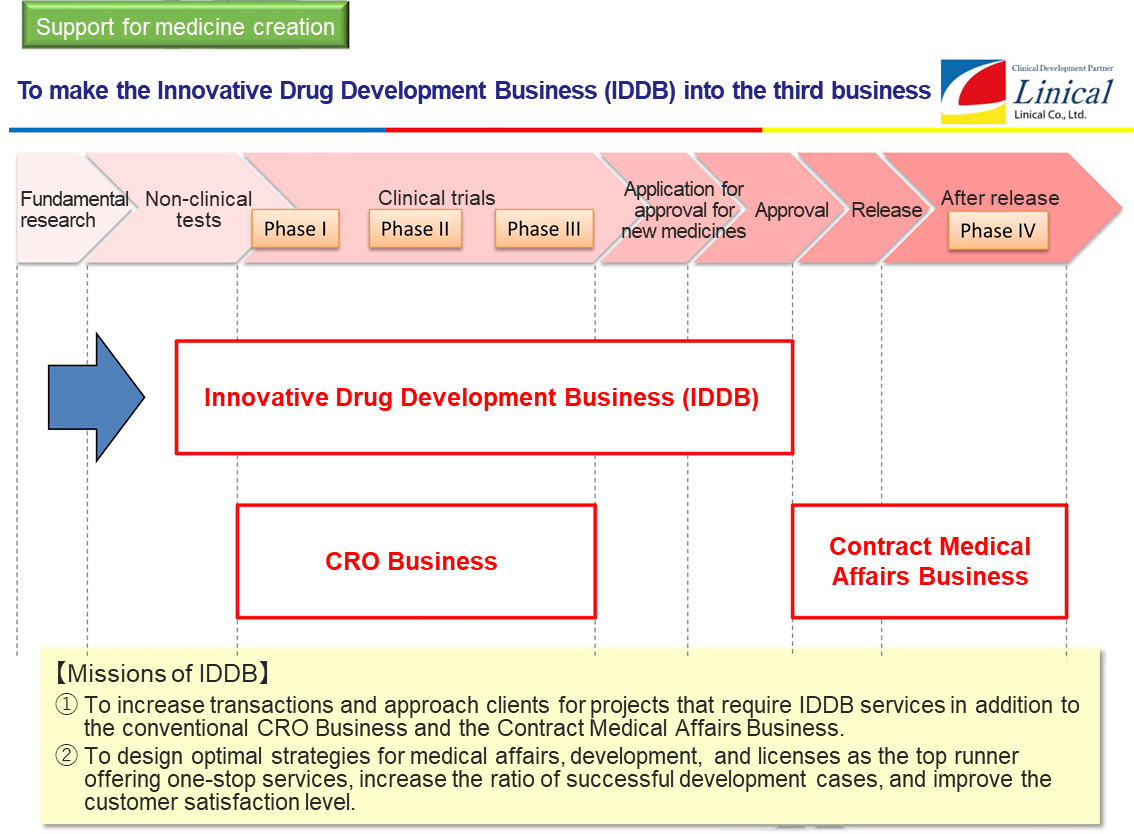

Innovative Drug Development Business

Following the existing CRO Business and Contract Medical Affairs Business, Linical is cultivating the third business called Innovative Drug Development Business. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided. With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

【1-3 Five Strengths】

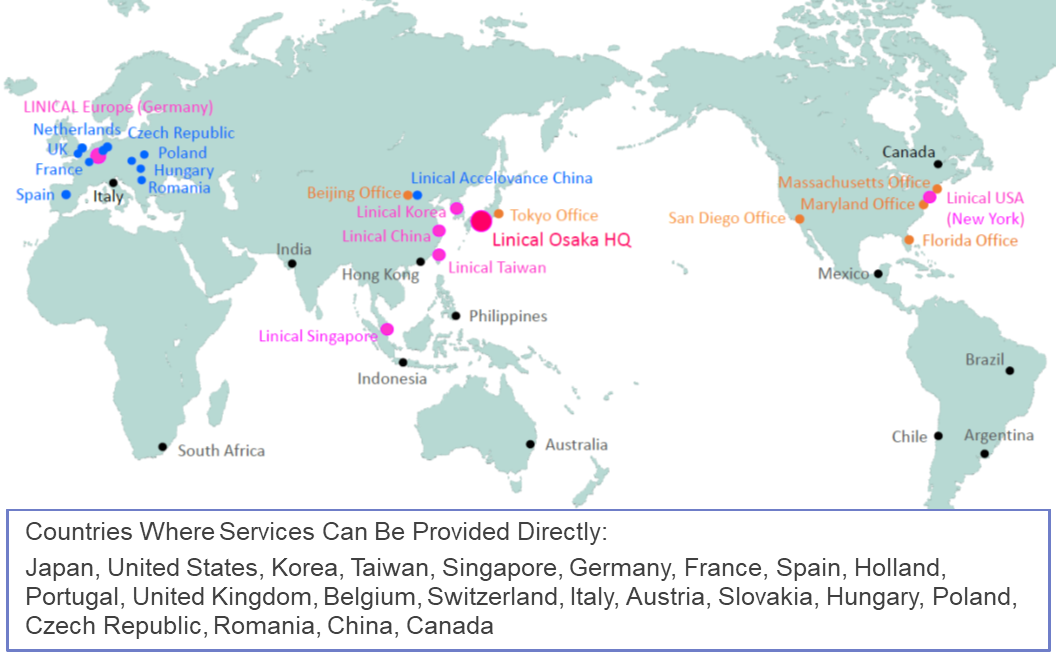

(1) Comprehensive "One Stop" Services on a Global Scale

Linical is Japan's only global CRO services provider with the ability to provide services in the three regions of Asia, Europe, and the United States. In addition, the Company boasts of partners in 20 different countries, with the ability to provide services in about 30 different countries. Moreover, Linical boasts of highly skilled professionals with bountiful experience in a wide spectrum of comprehensive services ranging from planning, monitoring, data management, statistical analysis, medical writing, pharmaceutical affairs, pharmacology vigilance, and other various services who can respond to customers' needs, including the need for not only local but also multi-national clinical trials. Therefore, Linical is trial a comprehensive "one stop" service provider operating on a global scale.

LINICAL Global Base Three Main Operating Regions of ”Japan and Asia, United States, Europe

(Source Linical)

(Source Linical)

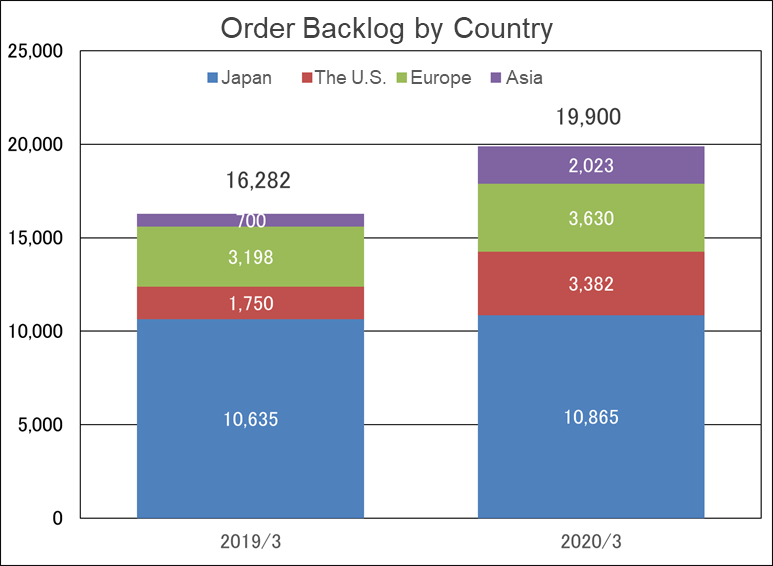

As a result of the development of the tripolar system of Japan/Asia, U.S., and Europe, the order backlog is expanding in all regions. Among the three regions, the growth of business in the U.S. is remarkable.

(2) Innovative Drug Discovery Support to Clinical Development and Research

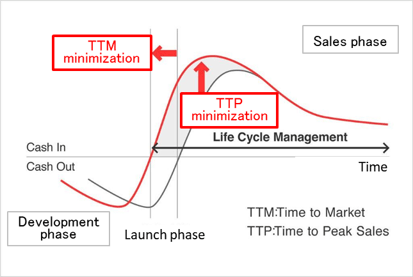

As a corporate social responsibility (CSR), the company wants to contribute to society by playing a role in developing pharmaceutical products. Linical also enables clients to promote efficient new drug development, extend life cycle management, shorten the time required to market launch (TTM), and maximize sales at an early stage (TTP). In Japan, the company supports the creation of medicines in the Innovative Drug Development Business, conducts clinical development in the Contract Research Organization (CRO) business, and supports clinical tests and research after production or release in the Clinical Research Support Business.

(Source Linical)

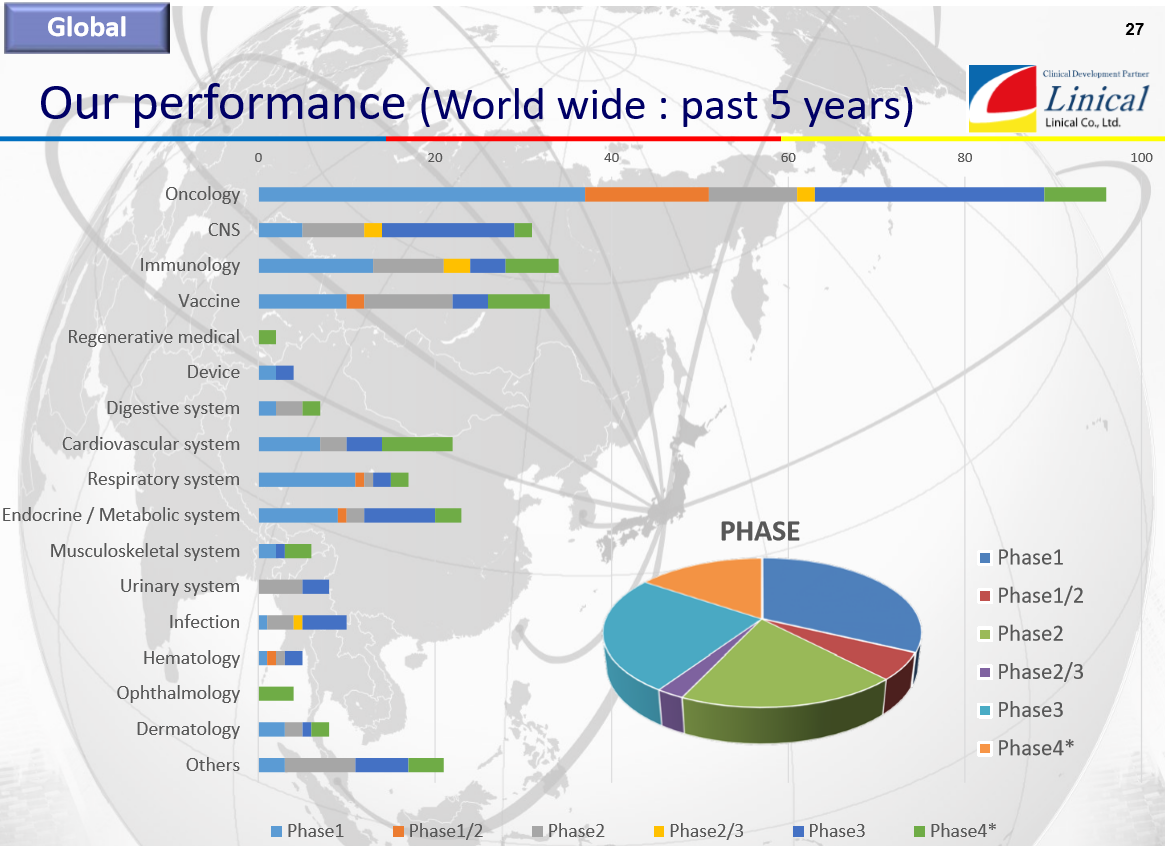

(3) Focus Upon Oncology, Central Nervous System, Immune System

Pharmaceutical product development is currently focused upon the three realms of oncology, central nervous system and immune system. Founding members of Linical boast of bountiful experience in the realm of immune system and have provided services in the highly difficult realm of immune system since the Company's founding. Thereafter, Linical has expanded its realms of expertise to include central nervous system in 2006, and oncology in 2010. Currently, Linical's business is based upon the regions of unmet medical needs in these three main business realms of oncology, central nervous system and immune system. In addition, its overseas subsidiaries are also boast of a strong track record in oncology, central nervous system, and immune system related services, which are realms where unmet medical needs are high. Furthermore, it is in the process of growing the regenerative medicine realm, which is extremely challenging, to a major pillar of future services.

Furthermore, in addition to the dermatology and ophthalmology fields, which are expected to grow in the future, the company is preparing to make the regenerative medical field, which has a high degree of difficulty, as a major pillar of its future services.

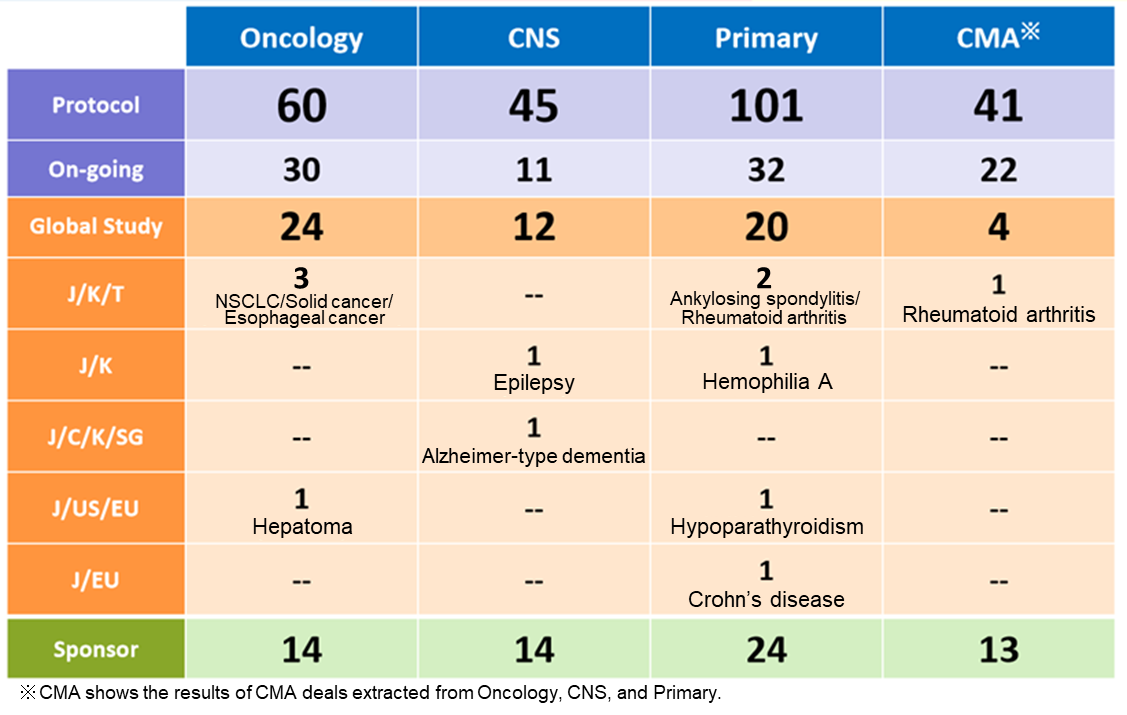

(Source Linical)

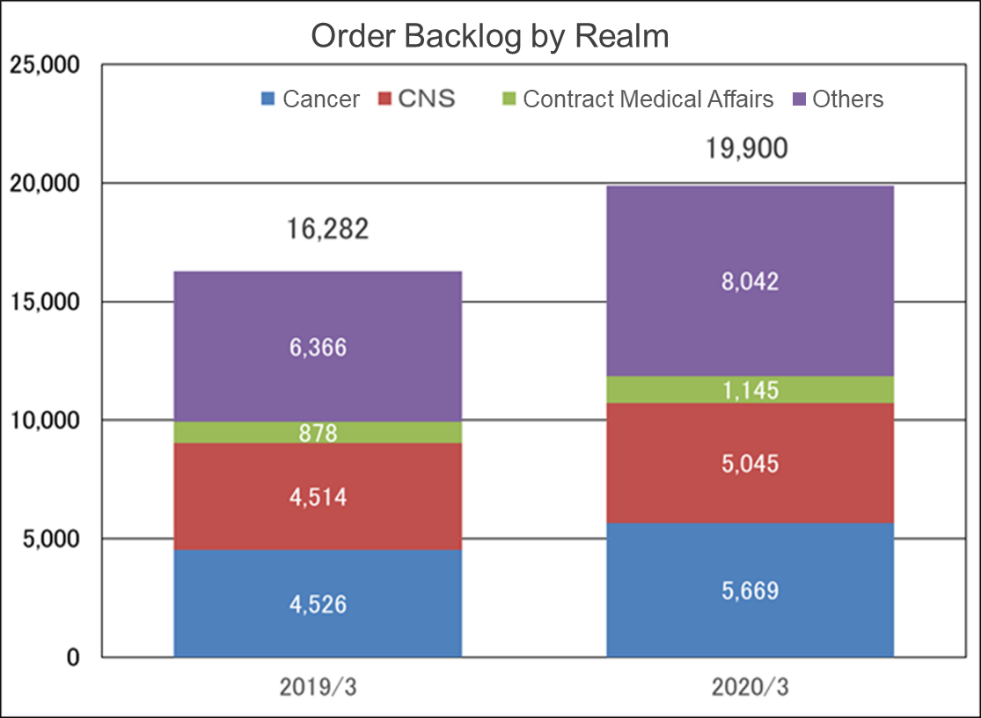

The order backlog is increasing mainly in the CNS disease realm and oncology realm. New orders are acquired while order backlog is constantly completed. Since fiscal year March 2019, the inclusion of Linical Accelovance America (LAA) in the scope of consolidation has been contributing.

Contract test Track Record(As of May1, 2020)

(Source Linical)

(4) Global Collaboration

Linical is Japan's CRO services company that can provide clients with services on a global basis. Because of its ability to provide exceptionally high-quality services (Japan Quality), it has established its global business development center in Japan and maintains multilingual staff with the ability to communicate in Japanese, English and other languages including Korean, Chinese, German and others at its Osaka headquarters and Tokyo branch office. Overseas staff also understand Linical's advantage of having high quality services originating in Japan and provide these "Japan Quality" services throughout the Linical business globally.

The company offers proposals according to needs from clients, including a case in which a project manager and leaders from Japan, Taiwan, and South Korea are deployed in Japan and a case in which leaders are deployed at the footholds of respective countries for realizing a testing system in Asia, including Japan, Taiwan, and South Korea. In addition, the company has carried out many collaborative trials among enterprises in Japan, the U.S., EU, and other Asian countries, so it can give proposals on a global scale according to the development strategy of each client.

(5) High Quality Services

In order to provide high quality services that Linical is widely recognized for, the Company implements training of its staff in both aspects of quantity and quality of work. As a result, the Company has been able to maintain high passage rates of the GCP Support Certification Examinations administered by the Japan Society of Clinical Trials and Research (JSCTR) since the first examination and has been awarded with recognition awards for its high quality and passage rates, which in turn have contributed to promotion of clinical trials. In addition, Linical boasts of bountiful experience in GCP compatibility surveys and FDA inspection. In both instances, the Company has received high regard for its services from clients. Moreover, overseas subsidiaries have also received high regard for its bountiful experiences in dealings with the FDA, KFDA, ANVISA and other organizations. In addition, about 67% of trials have completed registration before the end of the predetermined registration periods. The company strongly believes that its greatest mission is to provide customers with the best service by combining high quality and speed.

2.Management Strategy

(1) Contract Research Organization (CRO) Business

Main Strategies for the CRO Business

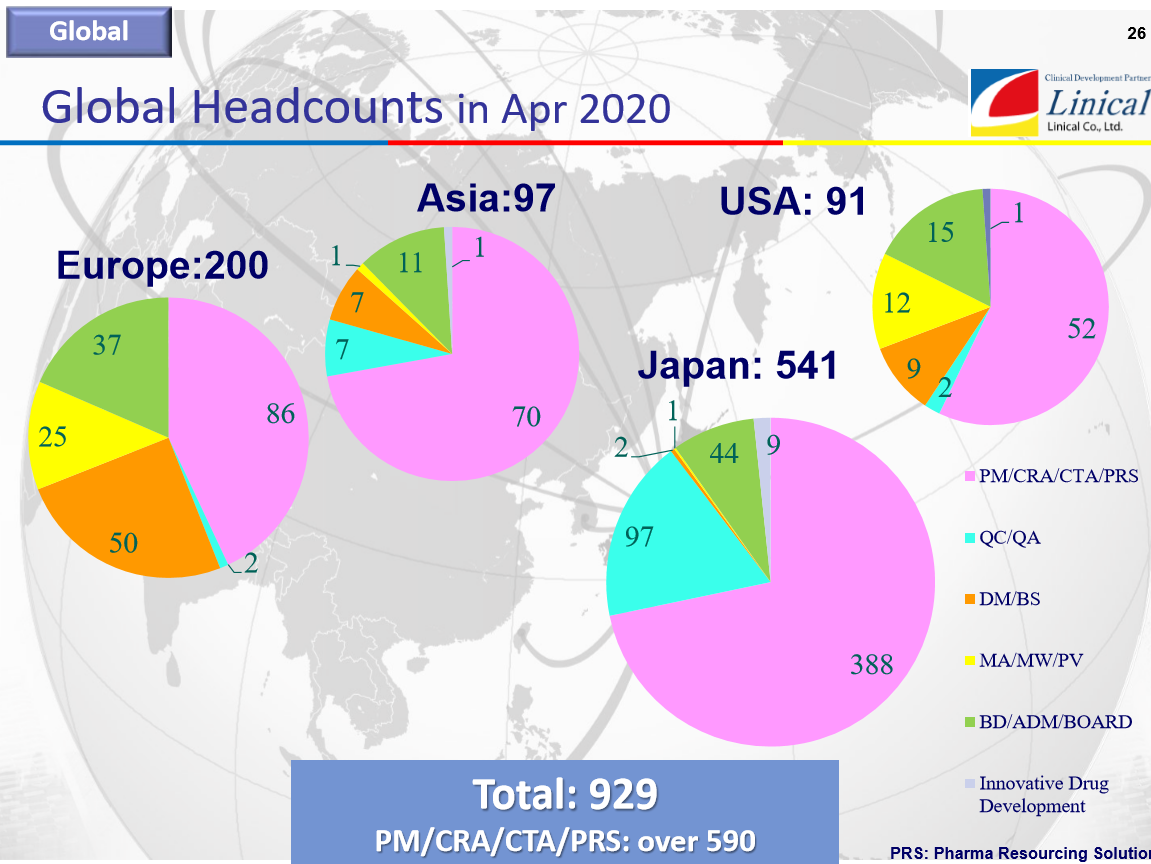

・Establish the global structure of 1,000 members

・Promote acquisition of orders based upon comprehensive capabilities for global jointly conducted clinical trials by establishing a global structure

(Source: Linical)

(Source: Linical)

As LAA became a subsidiary of the company through acquisition, the tripolar structure that is centered in Japan and is striding across Asia, Europe, and the U.S. was fortified. In addition, a global structure composed of 1,000 staff members became feasible, and the company promoted the enhancement of marketing skills and the improvement in quality.

Global Development

【Japan】

Efforts will be focused on regenerative medicine in addition to the realms of oncology, CNS disease, and immunology as well as the expansion of the businesses in the realms of skin and eyes.

Furthermore, Linical will explore the possibilities of establishing Linical Australia and Linical South Africa to be led by Japan.

It will also expand the business in China (establishment of a subsidiary in Shanghai is completed) and dispatch employees from Japan.

【The United States】

Linical will position the base in the United States as the center of its business and nurture it. Furthermore, it will explore the possibilities of establishing Linical CANADA and expanding the businesses in Latin America.

【Europe】

It aims to improve profitability by strengthening competitiveness.

【Korea】

Steps are being taken to expand the number of staff to 100 at an early stage and to establish a highly profitable earning structure based on net incomes surplus in four consecutive terms.

【Taiwan】

In addition to acquiring new projects including subsidiaries in Singapore, it will consider expanding the businesses in Hong Kong and the Philippines.

(2) Contract Medical Affairs Business

The key strategy for contract medical affairs business is to respond to the growing need for outsourcing of company-led clinical research-related work.

Linical differentiates itself from its competitors, which primarily offer only MR dispatch services, by focusing upon the consigned service type drug development business. Specifically, the Company seeks to differentiate itself by leveraging its bountiful knowhow established in the CRO business to take on highly specialized tasks. Currently, Linical provides the two main services of clinical research support and product marketing (liaison). With regards to the provision of consigned support services for clinical research, the securing of quality levels of clinical research is a critical issue for evidence creation. Linical creates procedure manuals for structure facilitation support, monitoring and surveillance implementation. Cultivation of new medical institutions and physicians as clients in the process for market launch of new products in new realms, and execution of product differentiation strategies are conducted and proposed in the product marketing (liaison) service. In addition, the ability to receive work for clinical research was responsible for the turn to profits of this business segment during fiscal year March 2013, and new orders for clinical research and development in fiscal year March 2014 allowed sales and profits to rise from the previous term.

Linical plans to continue to carry out active recruitment activities to respond to vigorous inquiries from potential clients, taking advantage of the implementation of the Clinical Trials Act.

Earnings Trend of contract medical affairs business

| FY 3/11 | FY 3/12 | FY 3/13 | FY 3/14 | FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 |

Sales | 97,827 | 138,400 | 169,226 | 288,205 | 364,918 | 553,399 | 806,764 | 908,810 | 954,438 | 1,032,353 |

Operating Income | -15,834 | -21,016 | 19,504 | 68,010 | 111,006 | 208,284 | 293,028 | 288,121 | 313,911 | 427,600 |

* Unit: thousand yen

(Note) From the first quarter of FY 3/16, the name of the previous segment was changed from “CSO business” to “Contract Medical Affairs Business”.

(3) Innovative Drug Development Business (New Business Development)

Innovative drug development business provides a wide range of services that respond to development plan establishment and drug authority correspondence.

Administrative authorities in Japan have needs of putting innovative medicines and medical equipment from Japan into practice earlier than any other countries in the world. In addition, administrative authorities in Korea and Taiwan have needs of creating new medicine that would enhance their international competitiveness. Furthermore, pharmaceutical companies and biotech venture companies that are Linical’s customers are interested in entering the Japanese pharmaceutical market to distribute and sell their products, but they are faced with challenges such as unfamiliarity with the Japanese market and pharmaceutical affairs, insufficient development capabilities, and lack of strategic partners/licensees. In response to these recent needs, Linical is strengthening its Innovative Drug Development Business to make it a third business. Linical can provide not only clinically developed products but also support services by professionals who have a long experience of providing support services at the earlier phase and, “research,” “development” and “licensing” at major pharmaceutical companies, including the partnership with both domestic and foreign biotech venture companies. Linical also finances new drug development funds.

(Source: Linical)

Innovative Drug Development Business -3 types of consulting-

Market analysis/investigation | ・ Epidemiological survey of target diseases ・ Market value and trend forecast ・ Current treatment algorithm and guideline survey ・ Approved drugs and development pipeline survey ・ Target product performance (TPP) planning ・ Official drug price and peak sales forecast, profitability evaluation |

Pharmaceutical affairs/ Development strategies, PMDA consultation (MW) | ・ Development/pharmaceutical affairs strategy planning and proposal ・ Preparation of materials for PMDA consultation, application, attending meetings, and responding to inquiries ・ Preparation of drug study summary, protocols, consent documents, etc. ・ Clinical trial notification and responding to inquiries ・ Domestic administrator services for clinical trials ・ Registration application for orphan drugs ・ Common Technical Document (CTD) publish |

Strategic alliance/ license | ・ Investigation and analysis of potential partner companies/licensees ・ Interview with potential partner companies/licensees, explanation of products/technologies ・ Participation in a conference for partnering ・ Due Diligence support ・ Contract negotiation support |

Contract in Innovative Drug Development Business – (from October 2016 to May 2020)-

Product/Skill

|

Disease

| The nationality of contract company | The development level in the most leading country | Service contents | ||

Market analysis | Pharmaceutical affair・MW | strategic cooperation/ license | ||||

Nucleic acids | Respiratory diseases | Country A | Phase I | ● |

| ● |

Mesenchymal stem cells | Immune diseases | Country B | Phase II | ● | ● | ● |

Monoclonal antibodies | Infection | Country C | Non-clinical | ● |

| ● |

Monoclonal antibodies | Malignant tumors | Country A | Non-clinical | ● | ● |

|

Imaging tracer | Neurodegenerative diseases | Country C | Phase I |

| ● |

|

Low-molecular compounds | Eye diseases | Country A | Phase I |

| ● |

|

Digital apps for treatment | Psychosomatic medicine | Country A | Phase Ⅲ |

| ● |

|

Immunotherapy | Allergy diseases | Country D | Phase I/II |

| ● |

|

Monoclonal antibodies | Malignant tumors | Country E | Phase Ⅲ | ● | ● | ● |

Topical medicaments | Nerve pain | Country A | Non-clinical | ● | ● |

|

Topical medicaments | Skin diseases | Country A | Application being prepared |

| ● |

|

Nucleic acids | Inflammation/infection/ ophthalmology | Country A | Non-clinical |

| ● |

|

Low-molecular compounds | Nerve pain | Country A | Phase I |

| ● |

|

Genetically engineered biological products | Inflammatory neurological diseases | Country A | Application being prepared |

| ● |

|

Low-molecular compounds | Gastrointestinal diseases | Country F | Phase II/Ⅲ |

| ●(ICCC) |

|

Low-molecular compounds | Neurodegenerative diseases | Country G | Phase I/II |

| ● |

|

Low-molecular compounds | Neurology | Country H | Phase I | ● | ● |

|

Cornea endothelial cells | Eye diseases | Country E | Phase II/Ⅲ | ● | ● |

|

●:Service being offered ●:Service provision ended

ICCC: In-Country Clinical Caretaker (Administrator of domestic clinical trials)

(Source: Linical)

3.The Fiscal Year March 2020 Earnings Results

(1) Consolidated results

| FY 3/ 19 | Ratio to sales | FY 3/ 20 | Ratio to sales | YoY |

Sales | 11,313 | 100.0% | 10,935 | 100.0% | -3.3% |

Gross profit | 3,813 | 33.7% | 3,530 | 32.3% | -7.4% |

SG&A | 2,600 | 23.0% | 2,525 | 23.1% | -2.9% |

Operating Income | 1,212 | 10.7% | 1,005 | 9.2% | -17.1% |

Ordinary Income | 1,253 | 11.1% | 918 | 8.4% | -26.7% |

Parent Net Income | 568 | 5.0% | 482 | 4.4% | -15.0% |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd., and may differ from actual figures (Abbreviated hereafter)

Sales decreased by 3.3% year on year, and ordinary income declined by 26.7% year on year

Sales fell 3.3% year on year to 10,935 million yen, and ordinary income declined by 26.7% year on year to 918 million yen.

The scales of the CRO and CSO markets, where the company operates its business, are slowly expanding, as the development and sale of pharmaceuticals are increasingly outsourced and international collaborative clinical trials are increasing. Also, pharmaceutical companies are estimated to outsource the development and sale of pharmaceuticals more frequently to create innovative new medications and improve their productivity and efficiency. Under these circumstances, the company offers its services in Europe, the U.S., and Asia, mainly Japan, and was able to acquire multiple international joint clinical trial projects and implemented them in each country. However, in the fourth quarter, the posting of sales was delayed as it was difficult to carry out some clinical trial operations due to restrictions on visits to medical institutions caused by the worldwide spread of COVID-19 and the start of clinical trials for new projects was delayed. Also, new development projects at pharmaceutical companies were temporarily put on hold. In the third quarter, a large strike in France caused a delay in conducting clinical trial operations, and due to the trend of yen appreciation beyond the company’s expectation, sales of overseas subsidiaries have decreased when converted to Japanese yen. Thus, sales were below initial expectations.

Operating income was affected by the year-on-year decline in sales and the lawyers' remunerations for negotiating about the closing price of a U.S. subsidiary acquisition with the seller. Gross profit margin was 32.3%, down by 1.4 points year on year, and the ratio of SGA to sales increased 0.1 points to 23.1%. As a result, operating income margin was 9.2%, down by 1.5 points. As for ordinary income, in the previous fiscal year, the yen's depreciation resulted in a foreign exchange gain of 67 million yen on foreign currency deposits. However, this year, ordinary income dropped by 26.7% year on year due to a foreign exchange loss of 48 million yen on foreign currency deposits as a result of the yen appreciation. Also, profit attributable to owners of parent declined by 15.0% year on year due to the extraordinary loss of 70 million yen in lawyers’ remunerations for arbitration in the U.S., and expenses related to reorganization within the Group to integrate LAA's European subsidiary into LINICAL Europe Holding GmbH to enhance the effectiveness of group management and to speed up decision making.

Sales and profit by segment

| FY 3/ 19 | Ratio to sales | FY 3/ 20 | Ratio to sales | YoY |

CRO business | 10,359 | 91.6% | 9,902 | 90.6% | -4.4% |

Contract Medical Affairs business | 954 | 8.4% | 1,032 | 9.4% | +8.2% |

Consolidated sales | 11,313 | 100.0% | 10,935 | 100.0% | -3.3% |

CRO business | 2,540 | 89.0% | 2,188 | 83.7% | -13.9% |

Contract Medical Affairs business | 313 | 11.0% | 427 | 16.3% | +36.2% |

Adjustment amount | -1,641 | - | -1,610 | - | - |

Consolidated operating income | 1,212 | 100.0% | 1,005 | 100.0% | -17.1% |

*Unit: million yen

In the CRO business, due to the spread of COVID-19, it was difficult to carry out some clinical trial operations because of restrictions on visits to medical institutions, and there was a delay in the start of clinical trials for new projects. As a result, sales decreased by 4.4% year on year. In addition, operating income declined by 13.9% year on year due to a decrease in sales year on year. The segment profit margin was 22.1%, down 2.4 points year on year.

In the Contract Medical Affairs business, sales and profits rose as a result of an increase in the occupancy rate of personnel due to orders received for projects centering on clinical research after the launch of a new medication. Sales improved by 8.2% year on year, and operating income increased by 36.2%. The segment profit margin was 41.4%, significant rise of 8.5 points year on year.

Non-consolidated performance trends in each country

| FY 3/19 | FY 3/20 | ||||

Sales | Ordinary profit | Sales | YoY | Ordinary profit | YoY | |

Japan | 7,686 | 1,708 | 7,406 | -3.6% | 923 | -46.0% |

Consolidated performance in the U.S. | 1,512 | -502 | 1,622 | +7.3% | -133 | - |

Consolidated performance in Europe | 2,516 | 277 | 2,543 | +1.0% | 270 | -2.5% |

South Korea | 420 | 44 | 526 | +25.2% | 147 | +234.1% |

Taiwan | 244 | 56 | 222 | -9.0% | 25 | -55.4% |

China | - | - | 35 | - | -2 | - |

Adjustment | -1,065 | -330 | -1,419 | - | -313 | - |

Total | 11,313 | 1,253 | 10,935 | -3.3% | 918 | -26.7% |

*Unit: million yen

*Amortization of goodwill is included in the consolidation adjustment.

In the U.S., the results of cost reduction through strengthening management and sales systems and restructuring have steadily appeared, and operating income excluding amortization of goodwill and lawyers' remunerations has returned to the black. Also, the order backlog, which contributes to sales from the next term, increased significantly from the end of the previous term. In Europe, LAA's European subsidiary was integrated into LINICAL Europe Holding GmbH to restructure the Group. Although this led to restructuring expenses, the effectiveness of group management, and the speed of decision making greatly improved. In South Korea, sales and profits exceeded initial expectations due to favorable acquisitions of new international joint clinical trials from Japan and orders from local pharmaceutical companies, as well as the completion of goodwill amortization in the last term. The company's ability to win orders improved substantially. For example, in March 2020, a Korean subsidiary contracted with ImmuneMed Inc. (Gangwon Province, South Korea) for clinical trial operations of a COVID-19 therapeutic agent in South Korea. In China, at the end of May 2019, the company completed the establishment of a subsidiary in Shanghai and started operations, and in February 2020, it opened its Beijing branch. At the beginning of establishing the subsidiary, expenses such as start-up costs exceeded revenues, but recently it has achieved a monthly profit.

Goodwill balance and remaining amortization period (end of FY 3/2020)

| Amount | Remaining amortization period | Annual amortization amount |

South Korea | Amortization finished in FY 3/19 | ||

Europe ※1,4 | 1,310 | 13-14 years | 102 |

The U.S. ※1,2,3,4 | 2,471 | 14 years | 176 |

*1 Regarding the goodwill generated by the acquisition of LAA, the amount for its European subsidiaries is apportioned to Europe.

*2 In addition to goodwill, the balance of intangible fixed assets recognized by Purchase Price Allocation at the end of FY 3/2020 was 92 million yen. Their remaining amortization period is 1 to 11 years.

*3 In addition to goodwill, the balance of intangible fixed assets recognized by Purchase Price Allocation at the end of FY 3/2020 is 64 million yen. Their remaining amortization period is 1 to 7 years.

*4 The price adjustment after the acquisition of LAA has not been completed, and the amount of goodwill at this time is provisionally calculated.

(2) Change in order balance

| End of FY 3/19 (A) | End of FY 3/20 | As of May 25, 2020 (B) | Difference from the end of the previous term (B-A)/(A) |

Eisai | 3,350 | 3,802 | 3,660 | +9.3% |

Chugai Pharmaceutical | 3,579 | 3,227 | 3,114 | -13.0% |

Ono Pharmaceutical | 2,476 | 1,328 | 1,254 | -49.3% |

Other | 6,876 | 11,541 | 11,504 | +67.3% |

Total backlog of orders | 16,282 | 19,900 | 19,534 | +20.0% |

*Unit: million yen

In the CRO Business, the total amount of a contract is determined based on the number of cases and the difficulty of trials based on the target disease during the trial period of about one to three years. A contract is signed with a client for this trial period, and sales are booked on a monthly basis in line with consignment contracts. Also, in the Innovative Drug Development Business, a contract is signed with a client for almost the same period, and sales are booked on a monthly basis in line with consignment contracts. Consequently, the total order backlog reflects the residual value of consignment contracts already concluded. Therefore, the order backlog reflects sales that will be booked during the course of the next one to five years and are used as an assumption for estimates of future earnings.

Order backlogs as of May 25, 2020, were 20.0% higher than those at the end of the previous fiscal year (March 2019). This is because although existing contracted contracts were steadily completed and the order balance was recorded as sales, there were new contracts for contracted projects that exceeded them.

In detail, the company received a new order from an overseas bio-venture firm for large-scale clinical trials for which the company will serve as a clinical trial administrator in Japan, and several new projects for clinical trials in Japan from leading overseas pharmaceutical companies. Moreover, the impact of the strengthening of the sales system of the U.S. subsidiary materialized, and many orders were received from the U.S. bio-venture. In anticipation of the economic restart phase of each country from COVID-19, the company is promoting new orders in each country, including new vaccines and therapeutic agents for COVID-19 through remote sales activities using the Internet through which it received several consultations. Thus, the company plans to use its strengths in sales through the development of the global outsourcing system in Japan/Asia, U.S., and Europe to acquire orders.

(3) Financial Conditions and Cash Flow(CF)

Financial Conditions

| March 2019 | March 2020 |

| March 2019 | March 2020 |

Cash | 5,055 | 5,210 | ST Interest-Bearing Liabilities | 1,619 | 1,469 |

Receivables | 1,602 | 2,057 | Payables | 963 | 1,060 |

Advance payment | 663 | 821 | Taxes Payable | 488 | 141 |

Current Assets | 7,723 | 8,517 | LT Interest-Bearing Liabilities | 3,105 | 3,179 |

Tangible Assets | 134 | 741 | Liabilities | 8,008 | 8,922 |

Intangible Assets | 4,461 | 4,033 | Net Assets | 5,250 | 5,338 |

Investments and Others | 939 | 968 | Total Liabilities and Net Assets | 13,259 | 14,260 |

Noncurrent Assets | 5,535 | 5,743 | Total Interest-Bearing Liabilities | 4,725 | 4,649 |

* Unit: million yen

* Interest-bearing liabilities=Borrowings + Lease Obligations

The total assets as of the end of March 2020 were 14,260 million yen, up 101 million yen from the end of the previous term. On the side of assets, receivable, advance payment, tangible assets, etc. are major factors in increase, while on the side of liabilities and net assets, advances received, deposits, and lease obligations, etc. are major factors in increase. The goodwill as of the end of March 2020 was 3,832 million yen, down 402 million yen from the end of the previous term. The capital-to-asset ratio as of the end of March 2020 was 37.4%, down 2.2 points from the end of the previous term.

Cash Flow

|

|

|

| |

| FY 3/ 19 | FY 3/ 20 | YoY | |

Operating cash flow(A) | -796 | 1,192 | 1,989 | - |

Investing cash flow(B) | -2,617 | -144 | 2,473 | - |

Free cash flow(A+B) | -3,414 | 1,048 | 4,462 | - |

Financing cash flow | 3,282 | -903 | -4,185 | - |

Cash and Equivalents at the end of term | 5,055 | 5,210 | 155 | +3.1% |

* Unit: million yen

As for cash flows, operating CF turned positive due to an increase in advances and deposits received. In addition, the deficit of investment CF shrank as there was no longer the purchase of shares of subsidiaries resulting in a change in the scope of consolidation that occurred in the previous term, and the free CF also turned positive. On the other hand, the financing CF turned negative due to a decrease in short-term and long-term loans.

(4) Recent topics

【A consolidated subsidiary undertook the clinical trial of a COVID-19 therapeutic agent】

On March 31, 2020, LINICAL Korea, a consolidated subsidiary, and ImmuneMed, Inc. (Gangwon Province, South Korea) concluded a consignment contract for clinical trial operations in South Korea on a new antibody pharmaceutical (hzVSF-v13) based on a virus suppressing factor (VSF). ImmuneMed is an R&D-based biotechnology company specializing in the development of antiviral treatments and diagnostics for infectious diseases. The new antibody pharmaceutical (hzVSF-v13) developed by ImmuneMed has been approved by the Ministry of Food and Drug Safety, a national administrative body of South Korea, as the only agent with therapeutic purposes for COVID-19 in South Korea.

【Donations to Osaka Prefecture's "COVID-19 Cooperation Fund"】

Since the company’s foundation in Osaka in June 2005, it has been developing its business under the following management philosophy: "We pursue the happiness of our pharmaceutical companies, medical institutions, patients, shareholders, and employees by constantly providing professional quality in every aspect of pharmaceutical development." As the company supports the goals of the "COVID-19 Cooperation Fund" established by Osaka Prefecture to support the activities of the medical staff involved in medical treatment and care related to COVID-19 infections, it decided to donate ten million yen to the fund.

4.Fiscal Year ending March 2021 Earnings Forecasts

(1) Consolidated results

| FY 3/20 Act. | Ratio to sales | FY 3/21 Est. | Ratio to sales | YoY |

Sales | 10,935 | 100.0% | - | -% | -% |

Operating Income | 1,005 | 9.2% | - | -% | -% |

Ordinary Income | 918 | 8.4% | - | -% | -% |

Parent Net Income | 482 | 4.4% | - | -% | -% |

* Unit: million yen

The company's forecast for the fiscal year March 2021 is still to be determined.

The company's business plan for the fiscal year March 2021 was undecided as it was difficult to calculate the earnings forecast logically at this point because the business environment surrounding the Group is expected to remain uncertain due to the impact of the global spread of COVID-19. The company intends to promptly announce the business forecast for the current term when rational calculation becomes possible.

On the other hand, the ordinary dividend is to be 14 yen/share, unchanged from the previous year. A commemorative dividend of 1 yen/share was added to the ordinary dividend of 13 yen/share in the fiscal year March 2020 to commemorate the consolidated sales exceeding 10 billion yen in the fiscal year March 2019.

(2) Impact of the spread of COVID-19

【Current impacts】

The travel restrictions such as curfew have been expanded in many countries, and some of the clinical trial operations cannot be carried out due to the suspension of visits to medical institutions, which affects the business. Under these circumstances, the company group took the following actions.

Japan | As a general rule, work from home, and some employees have flexible working hours or work every other day |

Europe | In principle, the entire company works from home |

U.S. | In principle, work from home |

South Korea | Reducing working hours or working from home |

Taiwan | Rotating shifts between work from home and in-office work |

China | Work from home in both LC and LAC |

【Short-term impacts】Mainly in Europe and the U.S. where the damage of COVID-19 is significant,1. Some clinical trial operations cannot be performed due to restrictions on visits to medical institutions2. Delay in the clinical trial start date of newly acquired projects3. New development projects at pharmaceutical companies were temporarily put on holdDue to such effects, there are concerns regarding the impact in particular on the first half of the fiscal year March 2021.Under such circumstances, the company intends to respond to the guidelines of regulatory authorities and CRO associations in each country and seek to reduce the impact by changing contracts.

【Mid- to long-term impacts】Since the development of new medications against the diseases which threaten humankind will not stop, it is expected that the development of vaccines and therapeutic agents for COVID-19 will be accelerated. In March 2020, a South Korean subsidiary has already been commissioned by a local pharmaceutical company to conduct clinical trials in South Korea for the treatment of COVID-19 and has also been consulted for clinical trials for vaccine and therapeutic agent development in the U.S.

5.Conclusions

The order backlog of the company is steadily accumulating. In the fiscal year March 2020, it received orders for large-scale clinical trials of overseas bio-ventures, as well as multiple clinical trials in Japan from major overseas pharmaceutical companies. This is said to be the result of the improvement of the three-region system of Japan/Asia + U.S. + Europe that the company strengthened in recent years. Above all, the fact that the growth of the U.S. being remarkable makes us expect the future accelerated growth. Contrary to such an abundant order backlog, due to the impact of COVID-19, all countries have expanded movement restrictions such as curfews, and some clinical trial operations cannot be carried out due to the suspension of visits to medical institutions. However, the backlog is a leading indicator of future sales, and most of them will eventually be included in sales. We will focus on when the measures such as suspension of visits to medical institutions will be lifted, and clinical trial operations will resume at full capacity to drive the company's business expansion.

In addition, it is expected that the development of vaccines and therapeutic agents for COVID-19 will be accelerated on a global scale. In March 2020, the company's South Korean subsidiary was commissioned to conduct clinical trial operations in South Korea for a COVID-19 therapeutic agent by a local pharmaceutical company. Also, in the U.S., it seems that a U.S. subsidiary has been consulted for clinical trials for vaccine and therapeutic agent development. We would like to pay attention to whether or not the company could acquire large-scale orders for clinical trial operations for COVID-19 vaccines and therapeutic agents, with hope.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 11 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎Corporate Governance Report

The company submitted its latest corporate governance report on July 1, 2020, after applying the corporate governance code

<Basic Policy>

The company will contribute to the development of pharmaceutical products as a partner of leading pharmaceutical companies in Japan with its technology for developing pharmaceutical products and live up to the expectations of the entire society from the pharmaceutical field. In addition, in order to improve corporate value, it is necessary to establish a system for making decisions swiftly while securing soundness and transparency.Therefore, the company plans to reinforce its internal control, including thoroughgoing compliance with laws, which is the most important issue to be solved. Based on this idea, we are strengthening the internal control, including thorough compliance, which is the most important issue.

<Regarding the implementation of the principles of the corporate governance code>Major principles and reasons

Principles | Reasons for not implementing the principles |

[Supplementary Principle 1-2④ Exercise of rights at a general meeting of shareholders] | Our company recognize that it is necessary to develop an environment where shareholders can exercise voting rights easily. As for the development of an environment where voting rights can be exercised electronically (such as the use of an electronic voting rights execution platform) and the translation of convocation notices into English, we will discuss them while considering the ratios of institutional investors and overseas investors, etc. |

[Principle 1-3 Basic policy for capital measures] | In order to enhance shareholder value in the medium/long term and actualize sustainable growth, our company will conduct strategic investment for securing financial soundness and sustainable growth. In detail, the basic policy for securing financial soundness is to maintain the level of shareholders’ equity that can tolerate growth investment and risk. As for the strategic investment for sustainable growth, we will allocate internal reserves to the investment for establishing systems for international joint clinical trials, which are indispensable for business development, the enrichment of footholds through M&A, etc. to improve the capital efficiency. As for dividends, which mean the return of profits to shareholders, the basic policy is to optimize the balance between the improvement in our corporate value through mid/long-term growth and return to shareholders, and we aim to return profits in a stable manner. Regarding the above basic policies for capital measures, we will consider providing explanations via our website, etc. |

[Supplementary Principle 4-1② Roles and duties of the board of directors (1)] | Our company discuss mid-term plans at managerial meetings, checks and analyzes the progress of each plan, and revises mid-term goals and policies if necessary, through meetings. The board of directors makes a resolution about mid-term plans produced at managerial meetings, receives reports on the progress and analysis of each plan, monitors and supervises activities. As of now, our company do not announce mid-term plans, but we explain our long-term management strategies and visions at a results briefing session (twice a year) and a presentation meeting for individual investors (twice a year) while disclosing the material for briefing sessions, etc. so as to share information with shareholders and investors. From now on, we will consider to announce mid-term plans. |

[Principle 4-9 Criteria for judging the independence of independent outside directors and their qualifications] | Our company will carefully consider the disclosure of the objective criteria for judging independence that will not cause a conflict of interest with general shareholders. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

<Principle 1-4 Strategically held shares> | In order to avoid the risk of share price fluctuations and also improve capital efficiency, the company will not hold any listed shares, unless it is necessary to hold shares for cooperation and alliance. |

[Supplementary Principle 4-11① Prerequisites for securing the effectiveness of the board of directors and the board of auditors] | The primary business of our company is to develop pharmaceutical products. Accordingly, the board of directors is composed of mainly those who are versed in the businesses in the pharmaceutical field, including the development of new medications, and possess profound knowledge and experience, so that it can make a swift, accurate decision and oversee business execution. In addition, we developed a structure in which those who have technical knowledge of finance and accounting, those who have the experience of global business operation, and others can proactively express their opinions about the enrichment of corporate governance and growth strategies and have active discussions. At present, the board of directors is composed of 11 members, including one female member. |

[Supplementary Principle 4-11② Prerequisites for securing the effectiveness of the board of directors and the board of auditors] | At present, neither directors nor auditors of our company serve as any executives of other listed companies, except independent outside directors, so as to appropriately fulfill their roles and duties. Considering transactions that would cause a conflict of interest, a resolution of the board of directors is required when an executive of our company serves also as an executive of another company, and even if said executive does so, his/her work shall be within a reasonable range. The main posts of our directors and auditors in other companies have been appropriately disclosed through annual business reports. |

Supplementary principle 4-11-3 Prerequisites for ensuring effectiveness of the Board of Directors and Board of Auditors

| Three outside auditors interviewed 11 directors, who constitute the board of directors of our company, and evaluated the effectiveness of the board of directors based on the interview results, as follows.1. Composition of the board of directorsThe board of directors is composed of directors who are versed in the practice of development of pharmaceutical products and the business of pharmaceutical products and a CFO who possesses technical knowledge and experience about business administration, including finance and accounting, so the composition of the board of directors is appropriate. Directors who possess international knowledge and experience about the business of pharmaceutical products and female directors were selected, to secure diversity. Each director is required to further enhance their skills and contribute to the company, to obtain the knowledge of the ICT field, AI, etc., in which technological innovation is active, manage the corporate group for global business operation, and so on. 2. System for supporting the activities of directors In-house directors attend multiple meetings, including those involving executives of overseas subsidiaries, so as to collect information and have discussions regarding the businesses outside the scope of their duties, too. On the other hand, the information offered to outside directors before meetings of the board of directors needs to be enriched further. 3. Operation of meetings of the board of directors, and invigoration of discussions Outside directors ask questions, express their opinions, etc. to a sufficient degree, to have constructive discussions. 4. Contents of agendas and discussions Items to be resolved and items to be reported are appropriately included in agendas. There was an opinion that the subjects of mid-term strategies should be discussed intensively. From the above evaluation results, it was concluded that the board of directors has secured its effectiveness. Considering the opinions and discussions in the process of continuous evaluation, we will refine the operation of the board of directors and its environment, and improve the systems for deliberating the subjects of strategies, monitoring the progress of each plan, and so on. |

<Principle 5-1 Policy for constructive dialogue with shareholders> | The company has continuous, constructive, transparent, fair dialogue regarding business performance, managerial strategies, capital policies, risks, corporate governance systems, etc. with the following method, in order to foster trusting relationships with the aim of achieving the sustainable growth of corporate value, which is a shared goal of the company and shareholders (including potential institutional and individual investors). Dialogue with shareholders is led by the Managing Director CFO. Considering the purpose and effect of the interview, and the attributes of shareholders, the dialogue method is examined thoroughly by the senior management such as CEO and the Managing Director CFO. As for IR, mainly the financial affairs department and the management planning division gather necessary information from relevant sections of the company, prepare reference material and give explanations in an understandable manner, to enrich the dialogue with shareholders.The company has opportunities to dialogue with shareholders through the annual general meetings of shareholders, results briefing sessions (twice a year), briefing sessions for individual investors (twice a year), meetings with institutional investors and analysts inside and outside Japan at the time of disclosure of quarterly results, the disclosure of IR information via websites, the response to inquiries from individual investors by telephone, email, or the like. Then, the company reflects questions, requests, information on participants in briefing sessions, questionnaire results, etc. in IR activities.Shareholders’ interests and concerns grasped through the dialogue with them are reported to the senior managing director CFO and the information is utilized for analyzing business administration, discussing how to disclose information, etc.Concerning IR activities and the dialogue with shareholders, the company manages insider information appropriately in accordance with in-company rules. The quiet period, in which the company refrains from having dialogue about financial results, is from the day after the closing date of each quarter to the date of brief reporting. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Linical Co., Ltd. (2183) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/