Bridge Report:(2183)Linical Fiscal year ended March 2021

Kazuhiro Hatano CEO | Linical Co., Ltd. (2183) |

|

Company Information

Market | TSE 1st Section |

Industry | Service |

CEO | Kazuhiro Hatano |

HQ Address | 10 Fl., Shin-Osaka Brick Building, 6-1 Miyahara 1-chome, Yodogawa-ku, Osaka, Japan |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥892 | 22,586,436 shares | ¥20,147 million | 9.8% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥14.00 | 1.6% | ¥- | -x | ¥252.92 | 3.5x |

* Stock price as of closing on July 1, 2021. Number of shares issued at the end of the most recent quarter excluding treasury shares.

* ROE is based on FY3/21 results. DPS are based on the estimates of FY3/22. EPS is not published. Number has been rounded off.

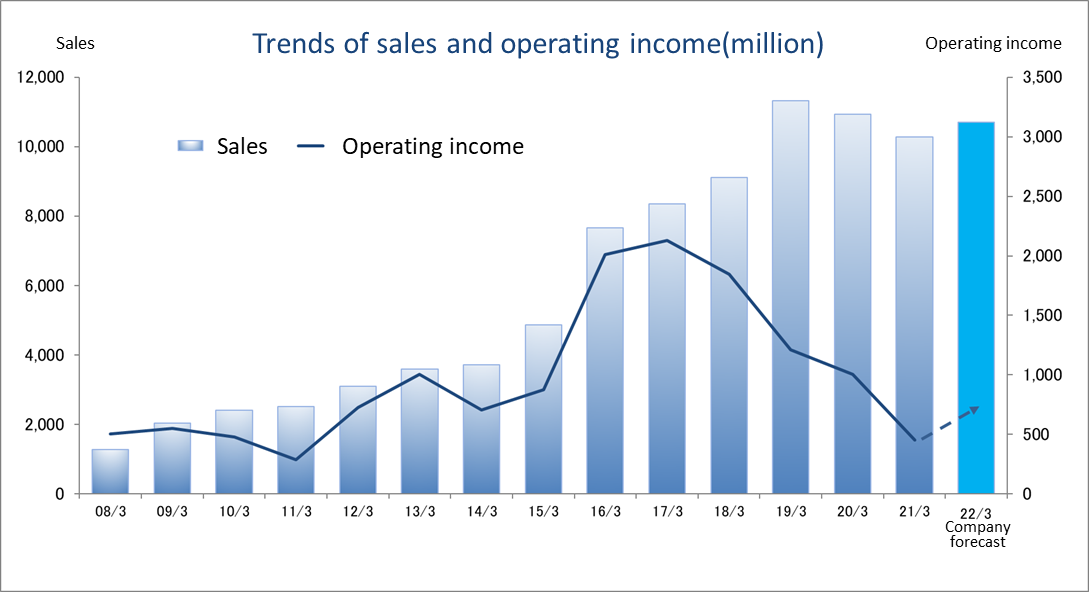

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2018 Act. | 9,113 | 1,846 | 1,826 | 1,295 | 57.02 | 11.00 |

March 2019 Act. | 11,313 | 1,212 | 1,253 | 568 | 25.09 | 12.00 |

March 2020 Act. | 10,935 | 1,005 | 918 | 482 | 21.38 | 14.00 |

March 2021 Act. | 10,279 | 453 | 588 | 539 | 23.91 | 14.00 |

March 2022 Est. | 10,700 | 683 | - | - | - | 14.00 |

* Estimates are those of the company.

* The consolidated forecast of ordinary income and parent net income is not disclosed due to many uncertain factors such as fluctuations in exchange rates.

We present this Bridge Report about Linical Co., Ltd. and details of the fiscal year ended March 2021 earnings.

Table of Contents

Key Points

1. Company Overview

2. Management Strategy

3. Fiscal Year ended March 2021 Earnings Results

4. Fiscal Year ending March 2022 Earnings Forecasts

5. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- In the fiscal year March 2021, sales and operating income decreased 6.0% and 54.9% year on year, respectively. As for clinical trial operations in the U.S., systems that enable remote clinical trials were adopted, and as the U.S. subsidiary adapted swiftly to these systems, sales increased from the previous term, and the operating income after the deduction of goodwill amortization turned positive. On the other hand, sales and profits declined in Japan and Europe because the worldwide spread of COVID-19 made it difficult to carry out some clinical trials due to restrictions on visits to medical institutions and the pandemic also led to revisions of development plans by pharmaceutical companies, such as decreasing the number of development projects.

- According to the company’s plan for the fiscal year March 2022, the company is estimated to increase sales by 4.1% and operating income by 50.6% year on year. Pharmaceutical companies, mainly in Japan and Asia, have resumed R&D investment, which had been temporarily frozen in anticipation of COVID-19 subsiding. In addition to receiving orders for global tests in Japan, the U.S., and Europe recently, inquiries for new projects are increasing. Under these circumstances and based on the epidemic and vaccination status of COVID-19 in each region, it is assumed that the earnings will be back to normal in the second quarter in the U.S., the third quarter in Europe, and the fourth quarter in Japan and Asia. The dividend is expected to be unchanged from the previous year, with a common dividend of 14 yen per share.

- For the first time in 18 years, a new drug for Alzheimer’s disease (AD) has been approved by the FDA in the U.S. This is the world’s first disease-modifying therapy drug. The company has been entrusted with multiple clinical trials for Alzheimer’s disease (AD) drugs and has already accumulated know-how in this field. In the area of Alzheimer’s disease (AD), which is expected to expand in the future, it will be interesting to see if it will be possible for the company to undertake large-scale clinical trial projects.

1.Company Overview

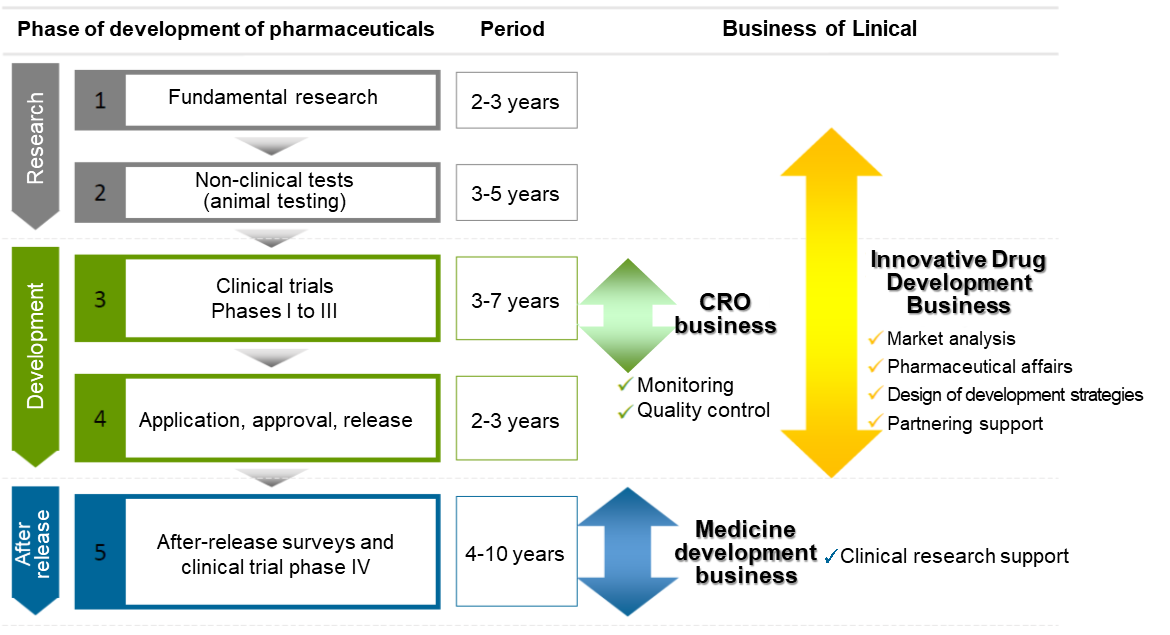

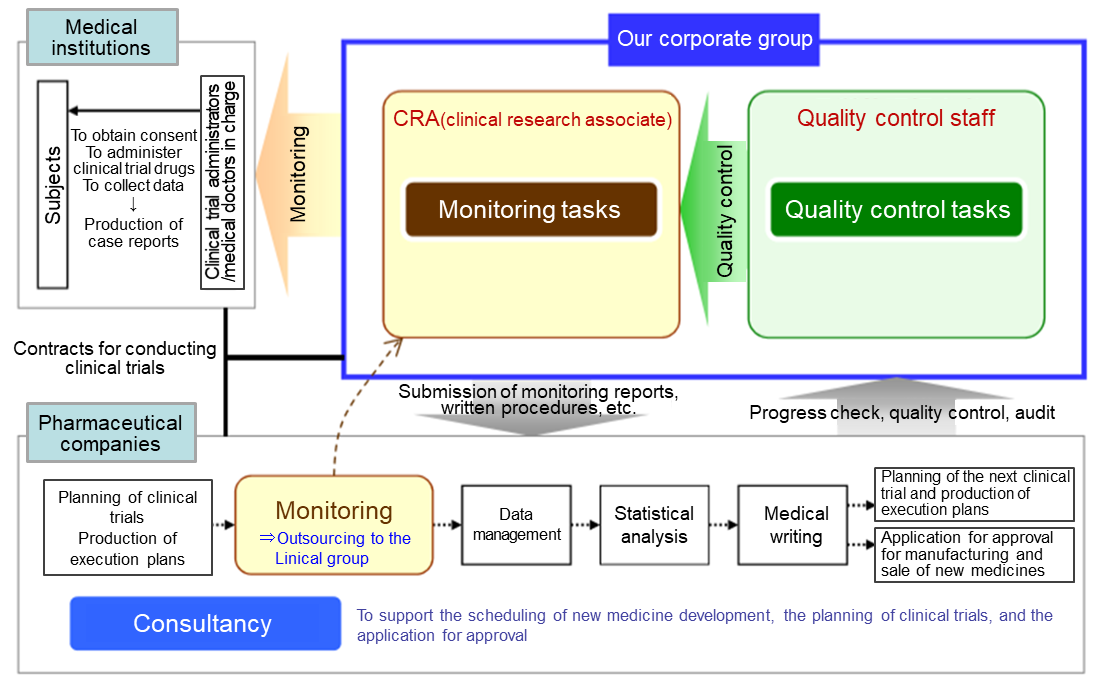

Linical Co., Ltd. provides contract research organization (CRO) services that support the drug development processes of pharmaceutical companies on an outsourced consignment basis, and sales and marketing functions for pharmaceutical products and post market launch clinical research and surveys on a consigned basis in the Contract Medical Affairs Business (CMA).

Pharmaceutical products are subject to approval of the Ministry of Health and Welfare prior to their sales, and efficacy and safety of pharmaceutical products must be confirmed through clinical trials prior to their approval. Companies providing clinical trial support services are known as contract research organization (CRO) service providers. In addition, there is a need to conduct surveys and clinical research after pharmaceutical products have been launched into the market and contract medical affairs is a service provided to support these efforts.

Linical has conducted various efforts to eradicate cancer, central nervous system and other diseases globally since its founding, and it has deployed its CRO Business in disease realms where there is strong demand for new drug development. These are highly difficult disease realms, and Linical is able to support high level clinical trials in these realms by the company’s knowledgeable and experienced experts. In addition, Linical focuses its efforts up the new drug development support and Contract Medical Affairs Business, approval application support and post approval marketing and clinical research, and post market survey support services, which exceed the traditional definition of outsourcing and is now considered to be part of a wider range of consulting services provided to customers as a "true clinical development partner". Furthermore, amidst the advance of globalization and large-scale pharmaceutical product development, the Linical Group can provide "one stop shopping" type comprehensive services for large scale global products. Consequently, Linical is able to play the role of a strategic business partner by providing total support to help raise the competitive advantage of customers in the market and to help pharmaceutical companies develop new future business opportunities.

Furthermore, Linical has a contract-based business style and is establishing a highly profitable structure. It is focusing on specific businesses (i.e., monitoring, quality control, and consulting, which are the main activities of clinical trials), specific clinical trials (i.e., Phase II and Phase III) and specific customers (i.e., major pharmaceutical companies with abundant medical product development information).

【Corporate History】

Linical Co., Ltd. was established in June 2005 by nine members who worked at Fujisawa Pharmaceutical Co., Ltd. (Currently known as Astellas Pharma Inc.) on the development of immunosuppressant drugs. Established with the objective of becoming the ideal drug development outsourcing (CRO) company from Osaka, Linical focused its efforts upon the realms of central nervous system diseases (CNS) and oncology since its founding, and received one of its first orders from Otsuka Pharmaceutical Company shortly after its establishment. Thereafter, the Company fortified its staffing as part of its efforts to strengthen its order taking capabilities. In addition, Linical is benefitting from the bountiful experiences of its employees in the realm of oncology pharmaceutical product development and experiences having worked at foreign pharmaceutical companies. Consequently, Linical is successfully expanding orders in the near term.

With its advance into the site management organization (SMO, clinical trial facility support organization) business, Aurora Ltd. was turned into a subsidiary in January 2006. However, all shares held in Aurora were later sold in May 2007 in order to focus management resources upon the CRO Business. In July 2008, Linical USA, Inc. was established in California, United States to provide support to Japanese pharmaceutical companies seeking to enter the United States market. Also, in October of the same year, Linical listed its shares on the Mothers Market of the Tokyo Stock Exchange, and subsequently moved its listing to the First Section of the Tokyo Stock Exchange in March 2013. In May 2013, Linical Taiwan Co., Ltd. and Linical Korea Co., Ltd. were established in Taiwan and Korea respectively. In April 2014, Linical teamed up with its Linical Korea to acquire the Korean CRO company P-pro. Korea Co., Ltd. In October 29, 2014, all of the shares of Nuvisan CDD Holding GmbH, which conducts CRO Business in Europe, were acquired and it was converted to a 100% owned subsidiary effective on November 30, 2014. In order to strengthen the collaboration within the Group, the company name of Nuvisan CDD was changed to Linical Europe GmbH on December 1, 2014. In addition, Linical U.K. Ltd. was established in March 2016, and a local subsidiary called Linical Poland SP. Z.O.O. was also established in October of the same year. Moreover, LINICAL Czech Republic s.r.o was established in September 2017. In addition, Accelovance, Inc. was acquired in April 2018 and its company name was changed to Linical Accelovance America, Inc. This acquisition has contributed to a strengthening of Linical's consignment structure for global jointly conducted clinical trials. In addition, Linical Hungary Kft. was established in March 2019, and Linical China Co., Ltd. was established in May 2019. Furthermore, the company further strengthened their system for undertaking global joint clinical trials, through the enhancement of their business in the European region by integrating the European subsidiary of Linical Accelovance America, Inc. (LAA) into LINICAL Europe GmbH in December 2019, and the establishment of a Shanghai branch in February 2020.

In April 2020, Linical Benelux BV and Linical Accelovance Europe BV were merged to form Linical Netherlands BV, and Linical China Co., Ltd. and Linical Accelovance China Ltd. are scheduled to be integrated in 2021.

【Business Description】

Linical mainly conducts contract research organization (CRO) business, post market launches clinical trial and clinical research and marketing support activities in the Contract Medical Affairs Business, and new drug development support business.

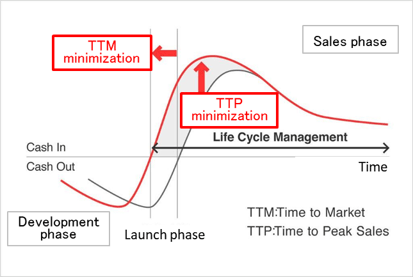

As a true partner, the company contributes to the maximization of the value of the medical drugs by helping the procedure from the non-clinical tests to clinical development and after-release surveys and clinical trial, and making it possible to shorten the time needed to start selling the drugs and prolong the life-cycle of the products. On top of that, the company supports not only pharmaceutical companies but also the bio-ventures in various ways including exit strategies.

(Source: Linical)

CRO Business (Contract Research Organization)

The mainstay CRO Business is characterized by business-specific CROs. In the main CRO Business, Linical seeks to provide highly effective clinical trial support to allow the quick introduction of new drugs into the market by maintaining staff with high levels of technological knowledge and bountiful experiences. The company has opened facilities in Asia (Korea, Taiwan, Singapore, China), Europe and the United States to be able to respond to growing demand for global studies. Linical provides "one stop shopping" services ranging from pharmaceutical affairs to planning, implementation plan creation, monitoring, data management, statistical analysis, and pharmacovigilance. With regards to jointly conducted global jointly conducted clinical trials, Linical headquarters operates a function where personnel with in depth knowledge about various countries pharmaceutical product development work. These personnel are able to provide information necessary to establish a development environment that can enable jointly conducted global jointly conducted clinical trials to be conducted in Japanese. Among the new drug development projects spanning from 10 to 20 years, Linical is specialized in the processes of “Phase II” and “Phase III” that require 3 to 7 years targeting patients who are particularly important in clinical trials, and it provides “monitoring” services that are the core of the clinical trials in the contract-based business style in conjunction with “quality control” and “consulting.” It collects highly reliable data and supports the rapid and reliable development of new drugs. Furthermore, it focuses on major pharmaceutical companies with abundant drug development information and is specialized in the oncology and CSN disease realms with a strong demand for development from markets as well as the other challenging realms to respond to its customers’ needs (i.e., pharmaceutical companies).

In addition, the company offers high-quality services in the fields of schedule management, standard procedure documents for clinical trials, compliance with GCP, the reliability of data and case reports, etc.

* Global jointly conducted clinical trials

“Global jointly conducted clinical trials” refers to conducting clinical trials simultaneously in multiple countries or regions in order to develop new drugs on a global scale and aim for early launch.

*GCP (Good Clinical Practice)

“GCP” is the international rule the companies are supposed to obey when they conduct the clinical trial. It is enacted by Ministry of Health, Labor and Welfare as a ministerial ordinance so that they can conduct it properly in Japan.

(Source: Linical)

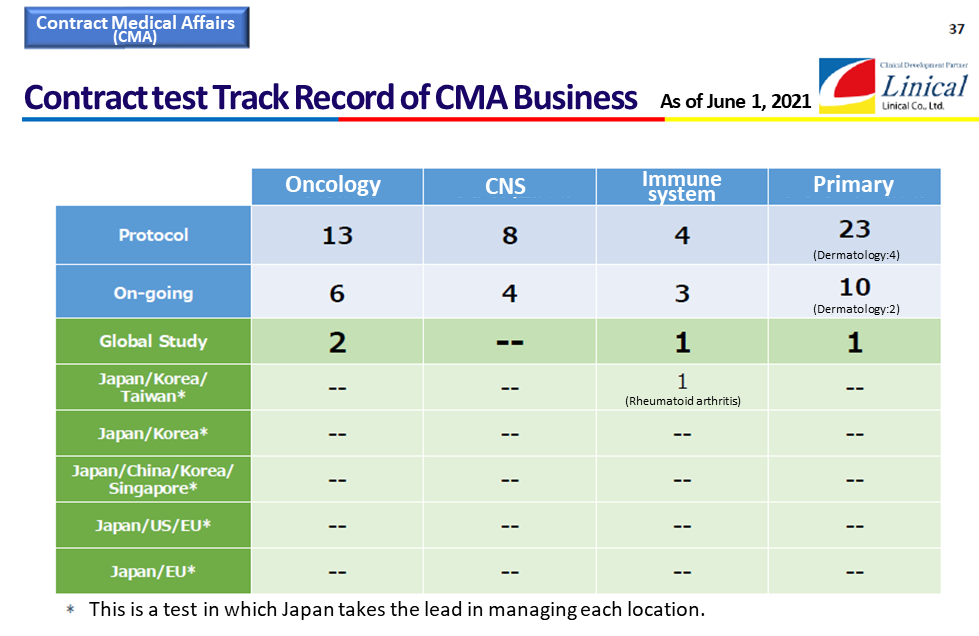

Contract Medical Affairs Business

The Clinical Trials Act is enacted, and the environment surrounding clinical research is changing drastically. Under this circumstance, to obtain information in a timely manner and be the best partner for the medical affairs department of pharmaceutical companies, Linical provides full-service support including data management and statistical analysis with a focus on monitoring and research administration works of clinical trials. It covers clinical trials that are compliant with J-GCP, ethical guidelines, the Clinical Trails Act and/or ICH-GCP, providing services for all regulations. Furthermore, it offers services in the realms of primary and CNS from the beginning of the company’s establishment. It has also strengthened the oncology realm, and more than half of the monitors are experienced in that realm. It has a policy to respond to the latest regulations and contribute to the creation of evidence in the challenging areas based on the know-how cultivated in the past development works.

Innovative Drug Development Business

Following the existing CRO Business and Contract Medical Affairs Business, Linical is cultivating the third business called Innovative Drug Development Business. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided. With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

【Five Strengths】

(1) Comprehensive "One Stop" Services on a Global Scale

Linical is Japanese global CRO services provider with the ability to provide services in the three regions of Asia, Europe, and the United States. In addition, The company is able to provide the service in about 20 countries, or about 30 if included countries where the company can provide services through partners. Moreover, Linical boasts of highly skilled professionals with bountiful experience in a wide spectrum of comprehensive services ranging from planning, monitoring, data management, statistical analysis, medical writing, pharmaceutical affairs, pharmacology vigilance, and other various services who can respond to customers' needs, including the need for not only local but also multi-national clinical trials. Therefore, Linical is trial a comprehensive "one stop" service provider operating on a global scale.

LINICAL Global Base Three Main Operating Regions of “Japan and Asia, United States, Europe”

(Source: Linical)

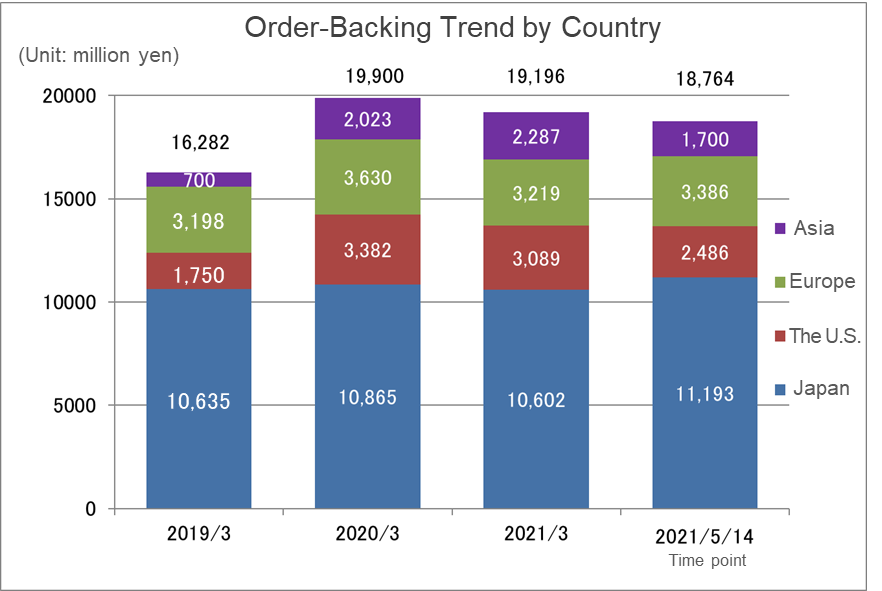

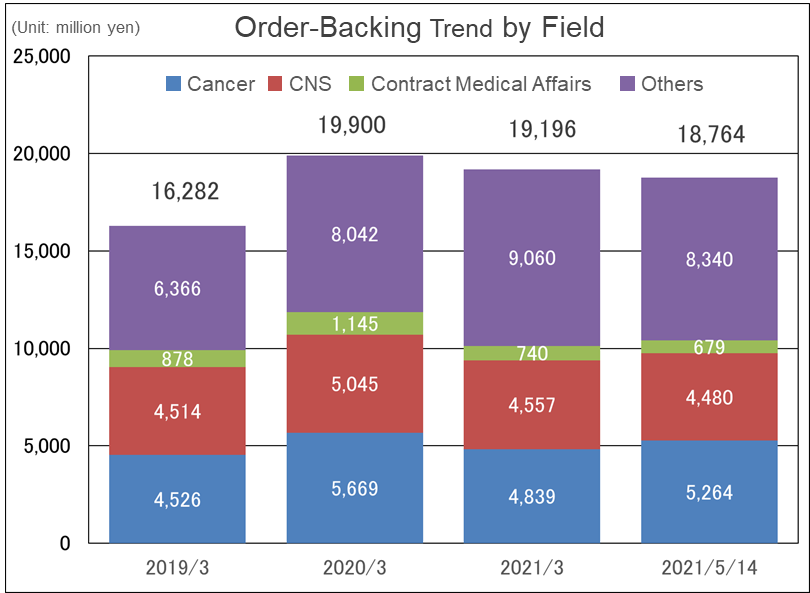

Despite the impact of the spread of COVID-19, all areas have maintained a high level of order backlog due to the improvement of the system in the three main operating regions, Japan and Asia + the U.S. + Europe. In addition, although the order backlog as of May 14, 2021 was less than the order backlog at the end of the fiscal year March 2021, the actual order backlog when adding the large-scale projects in Japan and Asia, Europe, and the U.S., which the company is in the process of concluding their contracts, would be over 20 billion yen.

(2) Innovative Drug Discovery Support to Clinical Development and Research

As a corporate social responsibility (CSR), the company wants to contribute to society by playing a role in developing pharmaceutical products. Linical also enables clients to promote efficient new drug development, extend life cycle management, shorten the time required to market launch (TTM), and maximize sales at an early stage (TTP). In Japan, the company supports the creation of medicines in the Innovative Drug Development Business, conducts clinical development in the Contract Research Organization (CRO) business, and supports clinical tests and research after production or release in the Clinical Research Support Business.

(Source: Linical)

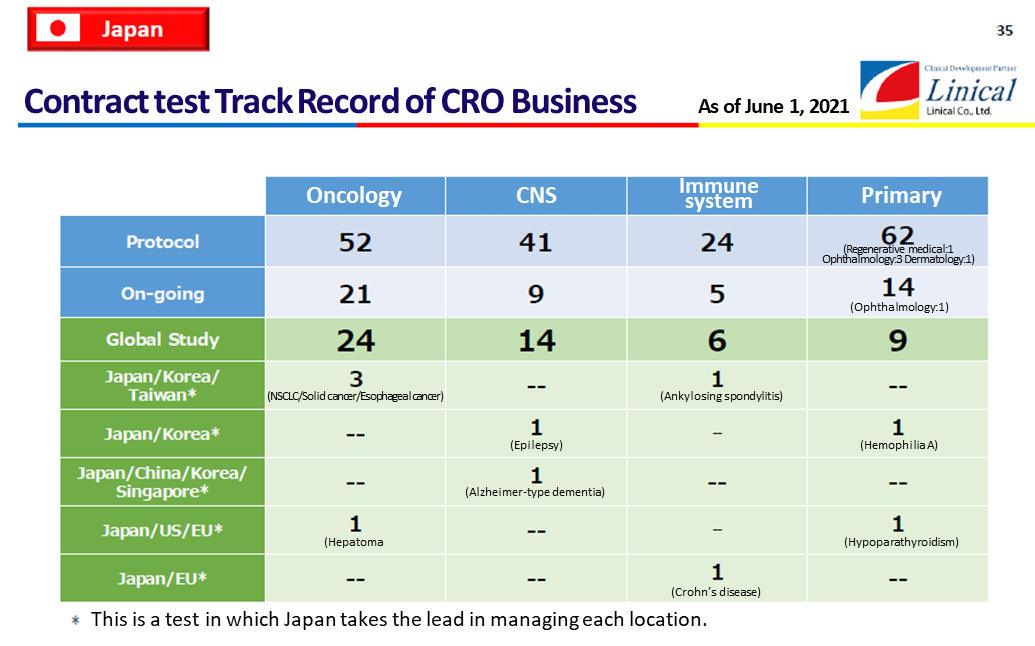

(3) Focus Upon Oncology, Central Nervous System, Immune System

Pharmaceutical product development is currently focused upon the three realms of oncology, central nervous system and immune system. Founding members of Linical boast of bountiful experience in the realm of immune system and have provided services in the highly difficult realm of immune system since the Company's founding. Thereafter, Linical has expanded its realms of expertise to include central nervous system in 2006, and oncology in 2010. Currently, Linical's business is based upon the regions of unmet medical needs in these three main business realms of oncology, central nervous system and immune system. In addition, its overseas subsidiaries are also boast of a strong track record in oncology, central nervous system, and immune system related services, which are realms where unmet medical needs are high. Furthermore, in addition to the dermatology and ophthalmology fields, which are expected to grow in the future, the company is preparing to make the regenerative medical field, which has a high degree of difficulty, as a major pillar of its future services.

(Source: Linical)

Despite the impact of COVID-19, the company has been steadily completing orders and acquiring new ones, and the order backlog remains at a high level, mainly in the CNS area (central nervous system) and oncology fields.

Contract test Track Record(As of June 1, 2021)

(Source: Linical)

(Source: Linical)

(4) Global Collaboration

Linical is Japan's CRO services company that can provide clients with services on a global basis. Because of its ability to provide exceptionally high-quality services (Japan Quality), it has established its global business development center in Japan and maintains multilingual staff with the ability to communicate in Japanese, English and other languages including Korean, Chinese, German and others at its Osaka headquarters and Tokyo branch office. Overseas staff also understand Linical's advantage of having high quality services originating in Japan and provide these "Japan Quality" services throughout the Linical business globally.

The company offers proposals according to needs from clients, including a case in which a project manager and leaders from Japan, Taiwan, and South Korea are deployed in Japan and a case in which leaders are deployed at the footholds of respective countries for realizing a testing system in Asia, including Japan, Taiwan, and South Korea. In addition, the company has carried out many collaborative trials among enterprises in Japan, the U.S., EU, and other Asian countries, so it can give proposals on a global scale according to the development strategy of each client.

(5) High Quality Services

In order to provide high quality services that Linical is widely recognized for, the Company implements training of its staff in both aspects of quantity and quality of work. As a result, the Company has been able to maintain high passage rates of the GCP Support Certification Examinations administered by the Japan Society of Clinical Trials and Research (JSCTR) since the first examination and has been awarded with recognition awards for its high quality and passage rates, which in turn have contributed to promotion of clinical trials. In addition, Linical boasts of bountiful experience in GCP compatibility surveys and FDA inspection. In both instances, the Company has received high regard for its services from clients. Moreover, overseas subsidiaries have also received high regard for its bountiful experiences in dealings with the FDA, KFDA, ANVISA and other organizations. The company strongly believes that its greatest mission is to provide customers with the best service by combining high quality and speed.

2.Management Strategy

[First Goal]

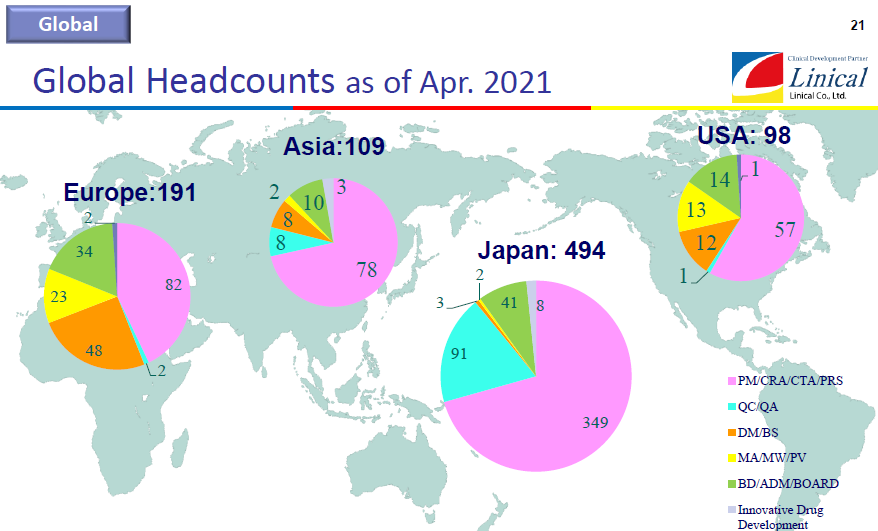

(1) To establish bases in Japan and Asia, Europe, and the U.S., and build a system with 1000 employees

(2) To become profitable in all the main business regions

(3) To advance into about 20 countries around the world

(Source: Linical)

[Second Goal]

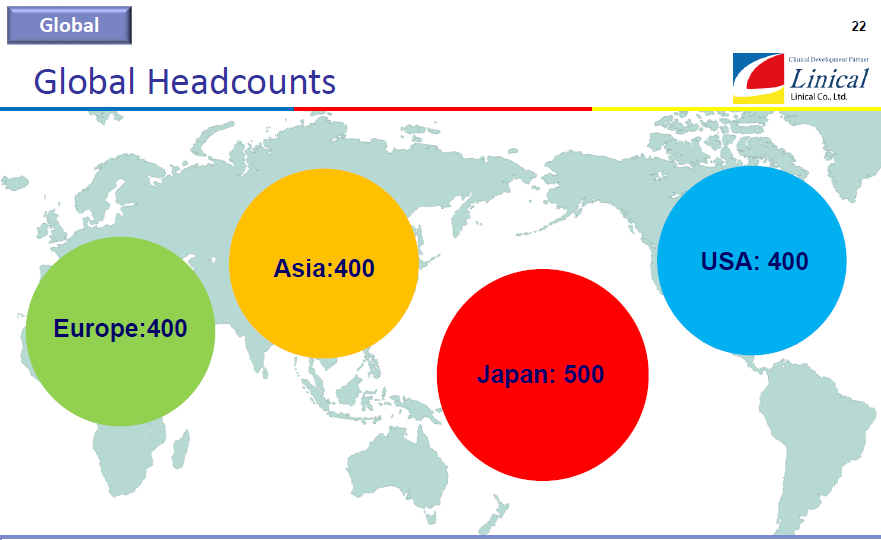

(1) To build a system with more than 1500 employees where there will be 500 in Japan, 400 in Asia, 400 in Europe, and 400 in the U.S.

(2) To maintain and improve profitability while making growth investments (including M&A) in all main business regions

(3) To advance into about 60 countries around the world

(Source: Linical)

(1) Strategy in Japan

[CRO Business]

| Initial stage | Present |

Clients | Major domestic pharmaceutical companies | Major domestic pharmaceutical companies Major overseas pharmaceutical companies Domestic and foreign bio-ventures

|

Disease areas | Oncology area CNS area Immunology area | Oncology area CNS area Immunology area Ophthalmology Dermatology area Regenerative medicine

|

Services | Monitoring | Monitoring Project management Quality control and auditing Data management Medical writing Pharmacovigilance and others |

(From the reference material for the company’s financial results briefing)

Initially, the company’s clients were mainly major domestic pharmaceutical companies. However, by providing full services, the company aims to increase its market share among major overseas pharmaceutical companies and domestic and overseas bio-ventures. In addition to the oncology, CNS, and immunology areas, the company will make a full-scale entry into the areas of regenerative medicine, dermatology, and ophthalmology.

[Contract Medical Affairs Business]

The clinical research law has been enforced, and as a result, the environment surrounding clinical research is changing drastically. Thus, the company provides full-service support, including data management and statistical analysis centering on clinical research monitoring and administrative research operations to catch up on information promptly and become the best partner for the medical affairs departments of pharmaceutical companies. In addition to J-GCP, the company supports ICH-GCP-compliant clinical trials and ethical guidelines, and clinical research methods. Therefore, it can provide services under all regulations. Moreover, the company has provided services in the primary area and the central nervous system area from the beginning. Now, it is enhancing the oncology area, and more than half of the monitors are experienced in the oncology area. Based on the know-how cultivated in pharmaceutical development, the company will continue to fulfill the latest regulations and contribute to creating evidence in difficult areas.

Earnings Trend of Contract Medical Affairs Business

| FY 3/12 | FY 3/13 | FY 3/14 | FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 |

Sales | 138,400 | 169,226 | 288,205 | 364,918 | 553,399 | 806,764 | 908,810 | 954,438 | 1,032,353 | 949,335 |

Operating Income | -21,016 | 19,504 | 68,010 | 111,006 | 208,284 | 293,028 | 277,848 | 263,702 | 368,393 | 247,600 |

* Unit: thousand yen

(Note) From the first quarter of FY 3/16, the name of the previous segment was changed from “CSO business” to “Contract Medical Affairs Business”.

[Innovative Drug Development Business]

The company operates the third business, that is, the Innovative Drug Development Business, following the existing CRO Business and the Contract Medical Affairs Business. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided.

With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

Innovative Drug Development Business -3 types of consulting-

Market analysis/investigation | ・ Epidemiological survey of target diseases ・ Market value and trend forecast ・ Current treatment algorithm and guideline survey ・ Approved drugs and development pipeline survey ・ Target product performance (TPP) planning ・ Official drug price and peak sales forecast, profitability evaluation |

Pharmaceutical affairs/ Development strategies, PMDA consultation (MW) | ・ Development/pharmaceutical affairs strategy planning and proposal ・ Preparation of materials for PMDA consultation, application, attending meetings, and responding to inquiries ・ Preparation of drug study summary, protocols, consent documents, etc. ・ Clinical trial notification and responding to inquiries ・ Domestic administrator services for clinical trials ・ Registration application for orphan drugs ・ Common Technical Document (CTD) publish |

Strategic alliance/ license | ・ Investigation and analysis of potential partner companies/licensees ・ Interview with potential partner companies/licensees, explanation of products/technologies ・ Participation in a conference for partnering ・ Due Diligence support ・ Contract negotiation support |

Contract in Innovative Drug Development Business – (from January 2019 to April 2021)-

Contract year

|

Product/Skill

|

The nationality of contract company |

Disease

| The development level in the most leading country | Service contents | ||

Market analysis | Pharmaceutical/ Development Strategy, etc. | strategic cooperation/ license | |||||

2019 | Low-molecular compounds | Country A | Skin diseases | Application being prepared |

| ● |

|

Nucleic acids | Country A | Inflammation/infection/Eye diseases | Non-clinical |

| ● |

| |

Low-molecular compounds | Country A | Nerve pain | Phase I |

| ● |

| |

Monoclonal antibodies | Country A | inflammatory disease | Application being prepared |

| ● |

| |

Low-molecular compounds | Country B | Gastrointestinal diseases | Phase II/III |

| ●(ICCC) |

| |

Low-molecular compounds | Country C | Neurodegenerative diseases | Phase I/II | ● | ● |

| |

2020 | Low-molecular compounds | Country D | neurology | Phase I | ● | ● |

|

Regenerative medicine products, etc. | Country E | Eye diseases | Application being prepared | ● | ●(CTD) |

| |

Regenerative medicine products, etc. | Country A | Heart diseases | Phase I/II |

| ● |

| |

Monoclonal antibodies | Country A | Malignant tumors | Phase I/II |

| ● |

| |

2021 | Low-molecular compounds | Country F | Eye diseases | Non-clinical | ● |

|

|

●:Service being offered ●:Service provision ended

ICCC: In-Country Clinical Caretaker (Administrator of domestic clinical trials)

CTD: Common Technical Document (International standardized documents for pharmaceutical approval applications)

(Source: Linical)

(2) Strategy in Asia

The company will achieve an operating income margin of 15% by expanding the sales of 920 million yen in the fiscal year March 2021 to 1.5 billion yen at an early stage. In addition, the company will increase the number of employees from the current 109 to 200 at an early stage, and in the long term, the company will establish a system with 400 employees on its own. As a concrete strategy, the company proposes the inclusion of the Asia region in global jointly conducted clinical trials by pharmaceutical companies in Japan, Europe, and the U.S. Furthermore, the company will work to meet the development demand in Japan, Europe, and the U.S. through biotech companies in Asia. Moreover, it will promote the cultivation of the Chinese market.

(3) Strategy in Europe

The company will achieve an operating income margin of 15% by expanding sales from 19 million euros in the fiscal year March 2021 to 30 million euros at an early stage. In addition, it will increase the number of employees from the current 191 to 300 at an early stage. In the long term, it will establish a system with 400 employees by relying on the company’s capabilities and implementing M&A. As a concrete strategy, in addition to cancer and immunology diseases, the company will enhance the CNS area. The company will also expand transactions with Sanofi, Bayer, and Roche, as well as cultivate and expand transactions with promising biotech companies. Furthermore, the company aims to expand both CRO service and FSP model service.

(4) Strategy in the U.S.

The company will achieve an operating income margin of 15% by expanding sales from 20.1 million US dollars in the fiscal year March 2021 to 30 million US dollars at an early stage. In addition, it will increase the number of employees from the current 98 to 150 at an early stage, and in the long term, it will establish a system with 400 employees through M&A. As a concrete strategy, the company will expand its business areas from cancer and vaccines to CNS and immunology as well. In addition, it will focus on developing transactions with biotech companies that will become the next Gilead in order to achieve growth through working closely with customers. Currently, the company has established good relationships with two promising biotech companies and plans to foster relationships with about ten companies in the future. It will also consider expanding to Canada and Latin American regions such as Mexico.

3.Fiscal Year ended March 2021 Earnings Results

(1) Consolidated results

| FY 3/ 20 | Ratio to sales | FY 3/ 21 | Ratio to sales | YoY |

Sales | 10,935 | 100.0% | 10,279 | 100.0% | -6.0% |

Gross profit | 3,530 | 32.3% | 2,767 | 26.9% | -21.6% |

SG&A | 2,525 | 23.1% | 2,314 | 22.5% | -8.4% |

Operating Income | 1,005 | 9.2% | 453 | 4.4% | -54.9% |

Ordinary Income | 918 | 8.4% | 588 | 5.7% | -35.9% |

Parent Net Income | 482 | 4.4% | 539 | 5.3% | +11.8% |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd., and may differ from actual figures. (Abbreviated hereafter)

Sales and operating income decreased 6.0% and 54.9% year on year, respectively

Sales decreased 6.0% year on year to 10,279 million yen, and operating income declined 54.9% to 453 million yen.

The company operates business in 18 countries in Japan, Asia, the U.S., and Europe (including Italy, Canada, and South Africa). The results for the fiscal year March 2021 varied among regions due to differences in the status of and response to COVID-19. In the U.S., as for clinical trial operations, systems were established to enable remote clinical trials, and the U.S. subsidiary responded promptly to them. As a result, the company steadily completed the orders received, which have been increasing due to the improvements of the sales system that started in the previous term. Both this and the effect of improving the efficiency of the organization and business system led to the company being stably profitable since August 2020. As a result, for the full year, the company made up for the delay in business performance due to the impact of COVID-19 in the first half and achieved a large surplus in operating income after deducting goodwill amortization. In Europe, the company was affected significantly by the spread of COVID-19 due to the multiple lockdowns in Germany, France, Spain, etc., which are the company’s major base countries, and restrictions on visits to medical institutions. Therefore, the company was not able to achieve progress in the orders received or fulfill them. Nonetheless, there were signs of recovery in business results in the fourth quarter, and it finally secured an operating profit. In Japan and Asia, due to the impact of COVID-19 and pharmaceutical companies’ revision to their development plans, such as decreasing the number of development projects, the company could not make progress with securing orders that would have contributed to sales in the fiscal year March 2021. On the other hand, currently, inquiries for new projects are increasing as R&D investment at pharmaceutical companies that had been temporarily frozen is resuming in anticipation of COVID-19 subsiding. The improvement in the acquisition of new orders will contribute to future sales growth.

Gross profit margin was 26.9%, down 5.4 points from the previous term. However, SG&A declined 8.4% year on year due to a decrease in commissions paid and amortization of goodwill. Thus, the ratio of SG&A to sales was 22.5%, down 0.6 points year on year. Ordinary income declined 35.9% year on year to 588 million yen, which was lower than the rate of decrease in operating income. This was attributable to the foreign exchange loss of 48 million yen in the previous term turning into a foreign exchange gain of 14 million yen in the current term and the recording of 126 million yen as subsidy income. Moreover, despite expenses such as arbitration on projects entrusted by the U.S. subsidiary prior to its acquisition and attorneys’ fees related to negotiations with the seller of Accelovance, Inc., as well as payment of settlement money to customers, parent net income increased by 11.8% from the previous term. This was because of recording corporate tax adjustment of 200 million yen due to the recording of deferred tax assets as a result of the tax refund of 285 million yen at the U.S. subsidiary and the prospect of future taxable income due to improved business performance.

Sales and profit by segment

| FY 3/ 20 | Ratio to sales | FY 3/ 21 | Ratio to sales | YoY |

CRO Business | 9,902 | 90.6% | 9,329 | 90.8% | -5.8% |

Contract Medical Affairs business | 1,032 | 9.4% | 949 | 9.2% | -8.0% |

Consolidated sales | 10,935 | 100.0% | 10,279 | 100.0% | -6.0% |

CRO Business | 2,247 | 85.9% | 1,765 | 87.7% | -21.4% |

Contract Medical Affairs business | 368 | 14.1% | 247 | 12.3% | -32.8% |

Adjustment amount | -1,610 | - | -1,559 | - | - |

Consolidated operating income | 1,005 | - | 453 | - | -54.9% |

*Unit: million yen

In the CRO Business, both sales and profit declined because the worldwide spread of the novel coronavirus resulted in restrictions on visits to medical institutions, making it difficult to carry out some clinical trial operations and leading to a delay in the start of clinical trials for new projects, which resulted in a decrease in sales and profit. Sales dropped 5.8% year on year. Segment profit, too, went down 21.4% year on year due to decreased sales. The segment profit margin was 18.9%, down 3.8 points year on year.

Like the CRO Business, the Contract Medical Affairs Business was affected by the spread of COVID-19, resulting in a decline in sales and profit. Sales decreased 8.0% from the previous term. In addition, segment profit decreased 32.8% year on year due to a decline in sales. Profit margin was 26.1%, down 9.6 points year on year.

Non-consolidated performance trends in each country

【Japan】

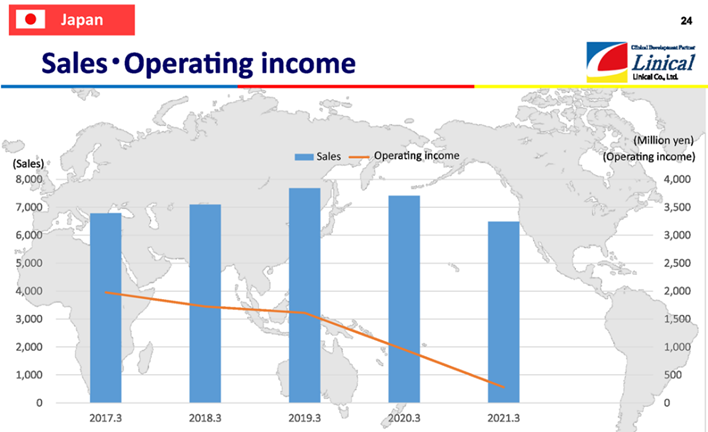

(Source: Linical)

In the fiscal year March 2020 and the fiscal year March 2021, sales and profits declined year on year. This resulted from orders not being fulfilled because of restrictions on visits to medical institutions and the effects of revisions to the development plans of pharmaceutical companies, such as decreasing the number of development projects due to the spread of COVID-19.

【Asia】

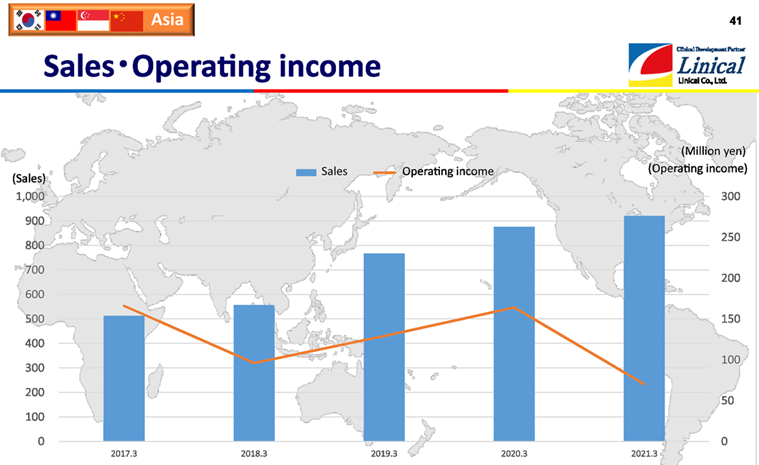

(Source: Linical)

The above graph includes the Chinese business of the American company, Accelovance (currently Linical Accelovance America (LAA)), which was acquired in April 2018 in the fiscal year March 2019. In the fiscal year March 2021, profits declined year on year due to the impact of COVID-19, as it halted the progress and fulfillment of orders received because of restrictions on visits to medical institutions. The operating income from the fiscal year March 2017 to the fiscal year in March 2019 is the amount before deducting the amortization of goodwill borne by the Korean business. The goodwill generated by the acquisition of the Korean subsidiary was amortized in the fiscal year March 2019.

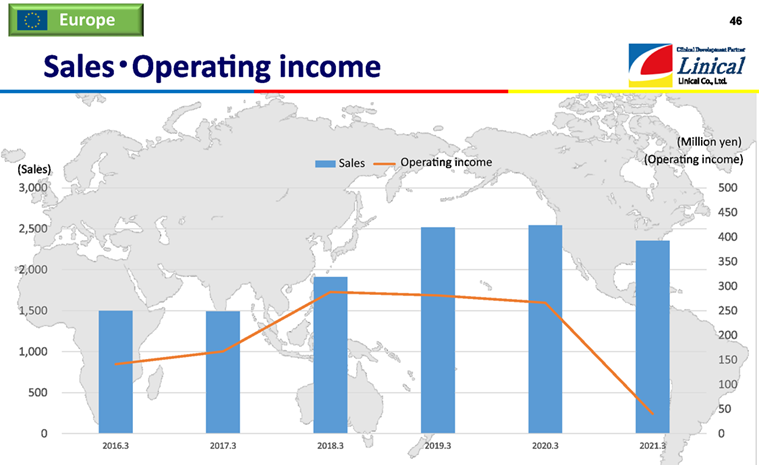

【Europe】

(Source: Linical)

The above graph includes the European business of the American company, Accelovance (currently Linical Accelovance America (LAA)), which was acquired in April 2018 in the fiscal year March 2019. In the fiscal year March 2021, as a result of lockdowns implemented multiple times in major base countries such as Germany, France, and Spain and restrictions on visits to medical institutions, the company did not achieve progress in the orders received or fulfill them, demonstrating the significant impact of the spread of COVID-19. Still, there were signs of a recovery in business performance in the fourth quarter, and although the company finally secured an operating profit, sales and profit declined year on year. The operating income in the above graph is the amount before deducting the amortization of goodwill and intangible assets associated with PPA borne by the European business.

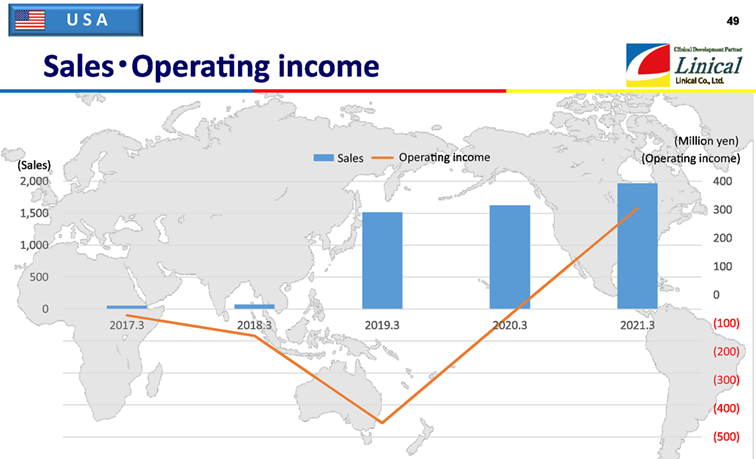

【USA】

(Source: Linical)

The American company, Accelovance (currently Linical Accelovance America (LAA)) was acquired in April 2018, and its effects were included from the fiscal year March 2019. In the fiscal year March 2019, in addition to the acquisition cost of LAA, LAA also canceled the trials of several existing projects, resulting in a large operating deficit. On the other hand, in the fiscal year March 2021, despite the impact of the spread of COVID-19, responding to the systems that enable remote clinical trials, steadily fulfilling the large number of orders acquired through the improvement in the sales system that the company has been promoting since the previous term, and enhancing the efficiency of the organization and business system led to a stable operating profit since August 2020. This made up for the delay in business results in the first half of the term, and the operating income after deducting goodwill amortization achieved a significant surplus. The operating income in the graph above is the amount before deducting the amortization of goodwill and intangible assets associated with PPA borne by the U.S. business.

Balance of goodwill and the remaining amortization period (as of the end of fiscal year March 2021)

| Amount | Period | The amount of amortization per year*4 |

Korea | Amortization finished in FY3/19 | ||

Europe *1,2 | 1,378 | 12-13years | 107 |

USA *1,3 | 2,084 | 13years | 152 |

*1 Goodwill arising from the acquisition of LAA is allocated proportionally to the European subsidiaries.

* 2 Aside from goodwill, the balance of intangible assets recognized by Purchase Price Allocation at the end of the fiscal year March 2021 was 91 million yen. The remaining amortization period for them is 6 to 10 years.

* 3 Aside from goodwill, the balance of intangible assets recognized by Purchase Price Allocation at the end of the fiscal year March 2021 was 50 million yen. The remaining amortization period for them is 6 years.

* 4 Values converted at 105 yen/dollar and 125 yen/euro.

(2) Change in order balance

| End of FY 3/20 (A) | End of FY 3/21 | As of May 14, 2021 (B) | Difference from the end of the previous term (B-A)/(A) |

Chugai Pharmaceutical | 3,227 | 3,351 | 3,266 | +1.2% |

Eisai | 3,802 | 2,926 | 3,026 | -20.4% |

Ono Pharmaceutical | 1,328 | 841 | 789 | -40.5% |

Others | 11,541 | 12,077 | 11,681 | +1.2% |

Total order backlog | 19,900 | 19,196 | 18,764 | -5.7% |

* Unit: million yen

In the business entrusted to the company, the total amount of a contract is determined based on the number of cases and the difficulty of trials based on the target disease during the trial period of about one to three years. A contract is signed with a client for this trial period, and sales are booked on a monthly basis in line with consignment contracts. Also, in the Innovative Drug Development Business, a contract is signed with a client for almost the same period, and sales are booked on a monthly basis in line with consignment contracts. Consequently, the total order backlog reflects the residual value of consignment contracts already concluded. Therefore, the order backlog reflects sales that will be booked during the course of the next one to five years and are used as an assumption for estimates of future earnings.

The order backlog as of May 14, 2021 was down 5.7% from the end of the previous fiscal year (March 2020). This was due to the spread of COVID-19 as it resulted in pushing ahead the end of the clinical trial period for existing projects in Europe to be earlier than scheduled, leading to a decrease in the order backlog due to the completion of the contract changes. The spread of COVID-19 also led to the review of the priority of development projects by customers in the U.S., causing some order cancellations. However, the company has received requests for proposals of alternative development projects with its U.S. customers that have canceled their contracts, and they are in discussions toward reaching an agreement. On the other hand, inquiries about new projects are increasing significantly, as pharmaceutical companies are restarting R&D investments that had been temporarily frozen in anticipation of COVID-19 subsiding due to the start of vaccination. This increased the number of new orders contributing to future sales, such as winning a contract for clinical trials to be conducted in Japan, Asia, and Europe from Europe. Furthermore, recently, the company has been proceeding with contract conclusion work in response to orders for large-scale projects in Japan and Asia, the U.S., and Europe. Thus, the actual order backlog is estimated to be over 20 billion yen.

(3) Financial Conditions and Cash Flow(CF)

Financial Conditions

| March 2020 | March 2021 |

| March 2020 | March 2021 |

Cash | 5,210 | 5,084 | ST Interest-Bearing Liabilities | 1,469 | 1,150 |

Receivables | 2,057 | 2,982 | Payables, Accrued Expenses | 1,060 | 1,120 |

Advance payment | 821 | 1,183 | Advances received | 1,534 | 1,909 |

Current Assets | 8,517 | 9,722 | LT Interest-Bearing Liabilities | 3,179 | 3,541 |

Tangible Assets | 741 | 701 | Liabilities | 8,922 | 9,568 |

Intangible Assets | 4,033 | 3,651 | Net Assets | 5,338 | 5,712 |

Investments and Others | 968 | 1,204 | Total Liabilities and Net Assets | 14,260 | 15,280 |

Noncurrent Assets | 5,743 | 5,557 | Total Interest-Bearing Liabilities | 4,649 | 4,692 |

* Unit: million yen

* Interest-bearing liabilities=Borrowings + Lease Obligations

Total assets as of the end of March 2021 were 15,280 million yen, up 1,019 million yen from the end of the previous term. The major items that led to the increase are, receivables and advance payment under assets, and mainly advances received and retained earnings, etc. due to the recording of net income attributable to shareholders of the parent company under total liabilities and net assets. Goodwill as of the end of March 2021 fell 369 million yen from the end of the previous term to 3,463 million yen. In addition, the capital-to-asset ratio as of the end of March 2021 was unchanged from the end of the previous term to 37.4%.

Cash Flow

| FY 3/ 20 | FY 3/ 21 | YoY | |

Operating cash flow(A) | 1,192 | 23 | -1,168 | -98.0% |

Investing cash flow(B) | -144 | 169 | 313 | - |

Free cash flow(A+B) | 1,048 | 192 | -855 | -81.6% |

Financing cash flow | -903 | -329 | 573 | - |

Cash and Equivalents at the end of quarter | 5,210 | 5,084 | -126 | -2.4% |

* Unit: million yen

As for CF, the surplus of operating CF shrank due to a decrease in net income before the adjustment of taxes and a decline in the number of advances received. Investing CF turned positive due to the recording of income from the return of part of the compensation attributable to the adjustment of the compensation for acquiring the shares of the subsidiary, but the surplus of free CF has declined. Moreover, the deficit of financing CF decreased due to income from long-term borrowings. As a result, the cash position at the end of the period declined 2.4% from the end of the previous term.

(4) Recent topics

【Undertook the clinical trial of a COVID-19 therapeutic agent】

On September 9, 2020, the company signed a clinical trial outsourcing agreement with The Kitasato Institute for doctor-initiated clinical trials for the additional indication of ivermectin(*) for the treatment of new coronavirus infections. The company intends to contribute to the healthy lives of patients by introducing the Risk Based Monitoring approach to clinical trial operations, collecting highly reliable data, and contributing to the realization of rapid and reliable development.

*Ivermectin is a macrolide antibiotic discovered by Satoshi Omura, Distinguished Professor of Kitasato University, who was awarded the Nobel Prize in Physiology/Medicine in 2015. In addition to being used as a veterinary drug for parasite extermination, it is also used as a drug for parasitic infections such as onchocerciasis (river blindness) and lymphatic filariasis, and is taken by approximately 400 million people in 2019, mainly in Africa and Central and South America.

[Refund of Corporate Tax at Overseas Subsidiaries]

Following the enactment of the new Coronavirus Aid, Relief, and Economic Security Act (CARES Act) on March 27, 2020, in the U.S., LAA received a refund of 285 million yen for corporate taxes since the application for a carry-back refund was approved for the loss carried forward that occurred in the consolidated fiscal years starting on January 1, 2018 and later.

[Payment from the Seller due to Confirmation of Acquisition Price of Accelovance, Inc.]

The company’s consolidated subsidiary Linical USA, Inc. ( “LUI”) and the seller of Accelovance, Inc. (currently Linical Accelovance America, Inc. ( “LAA”)), which LUI acquired in April 2018, have finally agreed on an acquisition price and LUI received a payment of 2,509,000 US dollars. LUI continued their negotiations with the current LAA seller, which it acquired in April 2018, to adjust the acquisition price. The two companies finally agreed on an acquisition price of 30,447,000 US dollars, and the company received a payment from an escrow for 2,509,000 US dollars, the difference from the acquisition price before the price adjustment. As a result, the carrying value of LUI’s investment in LAA decreased by 2,509,000 US dollars. In addition, since the amount of goodwill generated by the acquisition of LAA decreased by the same amount, the amount of goodwill in the fiscal year March 2021 and the excess amount of past goodwill amortization were adjusted.

4.Fiscal Year ending March 2022 Earnings Forecasts

(1) Consolidated results

| FY 3/21 Act. | Ratio to sales | FY 3/22 Est. | Ratio to sales | YoY |

Sales | 10,279 | 100.0% | 10,700 | 100.0% | +4.1% |

Operating Income | 453 | 4.4% | 683 | 6.4% | +50.6% |

Ordinary Income | 588 | 5.7% | - | - | - |

Parent Net Income | 539 | 5.3% | - | - | - |

*Unit: million yen

* The consolidated forecast of ordinary income and parent net income is not disclosed due to many uncertain factors such as fluctuations in exchange rates.

Sales and operating income are estimated to increase 4.1% and 50.6% year on year, respectively.

The company’s forecasts for the fiscal year March 2022 are that sales will increase 4.1% year on year to 10.7 billion yen and operating income will rise 50.6% year on year to 683 million yen.

In the U.S., the company responded to the systems that enable conducting clinical trials remotely and receiving orders for clinical trial operations. Thus, it is in an environment where it can carry out clinical trials and record sales. Inquiries for new projects are increasing significantly at the moment due to factors such as the restart of R&D investment that had been temporarily frozen at pharmaceutical companies in anticipation of the COVID-19 pandemic subsiding. Therefore, the number of new orders is expected to rise in the future. Given this situation, the company expects to perform steadily in the U.S. from the second quarter of the fiscal year March 2022 without considering the effects of COVID-19. In Europe as well, inquiries for new projects are currently increasing, as pharmaceutical companies have restarted R&D investment that had been temporarily frozen in anticipation of the COVID-19 pandemic subsiding. Thus, the number of new orders acquired is increasing, such as winning a contract for trials from Europe to be conducted in Japan, Asia, and Europe. However, in the first half of the term, there is a high possibility that some clinical trials will face restrictions because of the COVID-19 pandemic. Hence, the company anticipates that business results will go back to normal from the third quarter onward when vaccination is expected to progress and economic activity is predicted to recover. Moreover, in Japan and Asia, the impact of the sluggish order environment due to the spread of COVID-19 will linger during the first half of the term. Pharmaceutical companies have restarted R&D investment, which had been temporarily frozen in anticipation of COVID-19 subsiding, and recently the company received orders for global trials in Japan, Asia, the U.S., and Europe. Also, inquiries related to new projects are increasing. Nonetheless, the company expects a recovery in business results from the fourth quarter.

Operating income margin is expected to rise 2 points year on year to 6.4%. The consolidated earnings forecasts for ordinary income and parent net income have not been announced due to many uncertain factors such as fluctuations in exchange rates.

The dividend is expected to be unchanged from the previous term, with a common dividend of 14 yen per share.

(2) Future Management in Each Country

[Management During the COVID-19 Pandemic]

(Profit securing strategy)

Japan | (1) To control the hiring of new graduates and stabilize employment |

Asia | (1) To secure profits by curbing recruitment of new graduates (2) To cultivate local biotech development demand |

The U.S. | (1) To enhance the organization, while recruiting new PMs, to reflect the strength of the U.S.’s CRO market |

Europe | (1) To secure profits by curbing recruitment of new graduates (2) To pursue synergies through the integration of Linical Europe and Linical Accelovance Europe |

(Investment strategy)

Asia | (1) To discuss the integration between Linical China and Linical Accelovance China |

The U.S. | (1) To continue investment by positioning it as the center of the next growth strategy (2) To keep strengthening the organization, while recruiting PMs, to reflect the strength of the U.S.’s CRO market (3) To improve the CNS and immunology areas as well as cancer and vaccine areas (4) To discuss the establishment of Linical CANADA and expanding into Latin America such as Mexico |

Europe | (1) To improve the CNS area as well as cancer and immunology areas |

[Management After the Pandemic Subsides]

(Profit securing strategy)

Japan | (1) To expand services to the fields of regenerative medicine, dermatology, and ophthalmology as well as oncology, CNS, and immunology. (2) To meet company-led clinical research-related operational needs due to the enforcement of the Clinical Trials Act (3) To expand the Innovative Drug Development Business and enhance synergies with CRO Business (4) To strengthen sales of global trials by establishing a global system |

Asia | (1) To expand the business in China to contribute to profits in the Asin region following South Korea and Taiwan. |

Europe | (1) To aim to improve profitability by improving competitiveness (2) To accelerate synergies through the integration of Linical Europe and Linical Accelovance Europe |

(Investment strategy)

Japan | (1) To discuss the establishment of Linical Australia |

Asia | (1) To consider expanding the business scale by integrating Linical China and Linical Accelovance China (2) To stabilize Singapore business (3) To consider expanding into Asian regions with high populations such as the Philippines and Indonesia |

The U.S. | (1) To continue investment by positioning it as the center of the next growth strategy, aiming for a system with 400 employees, and consider the next M&A (2) To continue organizational strengthening, including PM recruitment to reflect the strength of the U.S.’s CRO market (3) To strengthen the CNS area (4) To discuss the establishment of Linical CANADA and expanding into Latin America such as Mexico |

Europe | (1) To strengthen the CNS area (2) To build a system with 400 employees eventually through the company’s capabilities or M&A (3) To discuss the establishment of Linical Italy and Linical South Africa |

(3) To Undertake More Clinical Trials for Anti-Alzheimer’s Disease (AD) Drugs

Alzheimer’s disease (AD) patients account for 60 to 70% of all dementia patients, and the number of AD patients is estimated to be about 49 million worldwide and 5.6 million in Japan, with the lowest treatment satisfaction and drug contribution. In addition, it is a disease for which no cure has been found, and there is a tremendous medical need for new drug development. There are 126 development compounds and 152 clinical trials targeting AD (as of January 5, 2021), 80% of which are Disease-Modifying Therapeutics (DMTs). DMTs act on the essential processes of the pathophysiology of Alzheimer’s disease and suppress its progression. Aducanumab (Biogen Eisai), the world’s first DMT, was approved by the FDA on June 7, 2021 (local time), and it is the first time in 18 years that a new drug for AD has been approved in the U.S. Aducanumab targets patients with mild cognitive impairment (MCI) to early AD. However, the therapeutic approach of prophylactically applying DMTs to patients with very early AD (preclinical AD) to delay the onset of the disease has already begun.

To date, the company has been entrusted with multiple clinical trials of anti-Alzheimer’s disease (AD) drugs. With such a track record as an advantage, the company aims to undertake large-scale clinical trials of anti-AD drugs in the future.

【The company's track record in clinical trials for anti-AD drugs (2012-present)】

Phase | Development compounds | Trials | Remarks |

Ⅳ(CMA) | Not applicable | 4 | From the creation of a new AD scale to verification and demonstration |

Ⅲ | 2 | 6 | Every trial is in the process of continuous testing |

Ⅱ | 3 | 3 | Every trial has completed |

Ⅰ | 1 | 2 | Every trial has completed |

Total | 6 | 15 |

|

(Source: Linical)

5.Conclusions

The order backlog is currently sluggish due to the impact of the spread of COVID-19. However, the actual order backlog exceeds 20 billion yen when adding the large-scale clinical trial projects in Japan, Asia, the U.S., and Europe, which the company is in the process of concluding their contracts. It is presumed that pharmaceutical companies are gradually resuming R&D investment, which had been temporarily frozen, in anticipation of COVID-19 subsiding due to vaccination progress. Research and development of new drugs in the oncology and central nervous system areas, which the company specializes in, cannot be restricted forever, and it is expected that clinical trials on a global scale will begin in earnest in the future. Large-scale international joint trial contracts entrusted to the company group alone will lead to a significant increase in the average spending per order, accelerating the company’s growth. Thus, it will be interesting to see if the company can receive orders for large-scale international joint trials in the future. Moreover, the U.S. subsidiary made up for the delay in the business results in the first half due to the impact of COVID-19 and generated a significant increase in operating income after deducting goodwill amortization. This resulted from the strengthening of the sales system that the company has promoted in recent years and improving the efficiency of the organization and business system. Since the profit environment has become stable, it has become possible to implement aggressive expansion strategies in the future. There are many promising biotech companies in the U.S., so, we will keep an eye on whether the company will deepen its business relationship with the rapidly growing biotech companies in the future.

Also, it cannot be ignored that the FDA has approved a new drug for Alzheimer’s disease (AD) in the U.S. for the first time in 18 years. This is the world’s first disease-modifying therapy drug, but competition for developing new drugs for AD, a disease for which no cure has yet been found, is expected to intensify in the future. The company has been entrusted with multiple clinical trials of AD drugs and already has a track record in this field. Thus, we would like to pay attention to whether the company can acquire contracts for large-scale clinical trials in the AD field, which is expected to expand in the future.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎Corporate Governance Report

Last updated on July. 1, 2021

The company submitted its latest corporate governance report on July 1, 2020, after applying the corporate governance code

<Basic Policy>

The company will contribute to the development of pharmaceutical products as a partner of leading pharmaceutical companies in Japan with its technology for developing pharmaceutical products and live up to the expectations of the entire society from the pharmaceutical field. In addition, in order to improve corporate value, it is necessary to establish a system for making decisions swiftly while securing soundness and transparency.Therefore, the company plans to reinforce its internal control, including thoroughgoing compliance with laws, which is the most important issue to be solved. Based on this idea, we are strengthening the internal control, including thorough compliance, which is the most important issue.

<Regarding the implementation of the principles of the corporate governance code>Major principles for not implementing and the reasons

Principles | Reasons for not implementing the principles |

[Supplementary Principle 1-2④ Exercise of rights at a general meeting of shareholders] | Our company recognize that it is necessary to develop an environment where shareholders can exercise voting rights easily. As for the development of an environment where voting rights can be exercised electronically (such as the use of an electronic voting rights execution platform) and the translation of convocation notices into English, we will discuss them while considering the ratios of institutional investors and overseas investors, etc. |

[Principle 1-3 Basic policy for capital measures] | In order to enhance shareholder value in the medium/long term and actualize sustainable growth, our company will conduct strategic investment for securing financial soundness and sustainable growth. In detail, the basic policy for securing financial soundness is to maintain the level of shareholders’ equity that can tolerate growth investment and risk. As for the strategic investment for sustainable growth, we will allocate internal reserves to the investment for establishing systems for international joint clinical trials, which are indispensable for business development, the enrichment of footholds through M&A, etc. to improve the capital efficiency. As for dividends, which mean the return of profits to shareholders, the basic policy is to optimize the balance between the improvement in our corporate value through mid/long-term growth and return to shareholders, and we aim to return profits in a stable manner. Regarding the above basic policies for capital measures, we will consider providing explanations via our website, etc. |

[Supplementary Principle 4-1② Roles and duties of the board of directors (1)] | Our company discuss mid-term plans at managerial meetings, checks and analyzes the progress of each plan, and revises mid-term goals and policies if necessary, through meetings. The board of directors makes a resolution about mid-term plans produced at managerial meetings, receives reports on the progress and analysis of each plan, monitors and supervises activities. As of now, our company do not announce mid-term plans, but we explain our long-term management strategies and visions at a results briefing session (twice a year) and a presentation meeting for individual investors (twice a year) while disclosing the material for briefing sessions, etc. so as to share information with shareholders and investors. From now on, we will consider to announce mid-term plans. |

[Principle 4-9 Criteria for judging the independence of independent outside directors and their qualifications] | Our company will carefully consider the disclosure of the objective criteria for judging independence that will not cause a conflict of interest with general shareholders. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

<Principle 1-4 Strategically held shares> | In order to avoid the risk of share price fluctuations and also improve capital efficiency, the company will not hold any listed shares, unless it is necessary to hold shares for cooperation and alliance. |

[Supplementary Principle 4-11① Prerequisites for securing the effectiveness of the board of directors and the board of auditors] | The primary business of our company is to develop pharmaceutical products. Accordingly, the board of directors is composed of mainly those who are versed in the businesses in the pharmaceutical field, including the development of new medications, and possess profound knowledge and experience, so that it can make a swift, accurate decision and oversee business execution. In addition, we developed a structure in which those who have technical knowledge of finance and accounting, those who have the experience of global business operation, and others can proactively express their opinions about the enrichment of corporate governance and growth strategies and have active discussions. Currently, the Board of Directors consists of nine members, including two outside directors, and one female member. |

[Supplementary Principle 4-11② Prerequisites for securing the effectiveness of the board of directors and the board of auditors]

| At present, neither directors nor auditors of our company serve as any executives of other listed companies, except independent outside directors, so as to appropriately fulfill their roles and duties. Considering transactions that would cause a conflict of interest, a resolution of the board of directors is required when an executive of our company serves also as an executive of another company, and even if said executive does so, his/her work shall be within a reasonable range. The main posts of our directors and auditors in other companies have been appropriately disclosed through annual business reports. |

Supplementary principle 4-11③ Prerequisites for ensuring effectiveness of the Board of Directors and Board of Auditors | The Company’s Board of Directors evaluated its effectiveness through a questionnaire to the ten directors (because a director resigned during the term), and three corporate auditors and discussions based on the questionnaire results. The evaluation was as follows. 1. The composition of the Board of Directors There were many positive answers regarding the number of members, the ratio of internal and external directors, knowledge, experience, specialties, gender, etc. Thus, the composition of the board was evaluated as appropriate. Moreover, enhancing expertise and accumulating experience related to globalization and DX (digital transformation) are desired to achieve medium-to-long-term growth. 2. Management of the Board of Directors There were many positive answers regarding points such as the frequency of holding meetings, the preparation of the agenda, the efficiency of material preparation, and early distribution of the material. Thus, it was evaluated as appropriate. 3. Discussion vitality and content There were many positive answers regarding the deliberation time and content, the number of remarks, the quick and flexible decision-making, operation supervision (monitoring), etc. Thus, it was evaluated as appropriate. However, some respondents requested further improvements regarding the prior explanations to outside directors to spend more time on strategically important proposals and improve the quality of discussions. To ensure the appropriateness and adequateness of decision-making at the Board of Directors, internal directors and executive officers communicate closely and regularly to deliberate vital matters at management meetings prior to the Board of Directors meetings. As for outside directors, we provide them with material before the regular monthly held Board of Directors meetings, and the CFO and the Corporate Planning Office explain the material and conduct Q&A sessions. Based on the above, we have concluded that the Board of Directors is effective. Going forward, we will continue to enhance the deliberations on strategic issues and continue the monitoring and discussions to enhance the board’s effectiveness. |

<Principle 5-1 Policy for constructive dialogue with shareholders> | The company has continuous, constructive, transparent, fair dialogue regarding business performance, managerial strategies, capital policies, risks, corporate governance systems, etc. with the following method, in order to foster trusting relationships with the aim of achieving the sustainable growth of corporate value, which is a shared goal of the company and shareholders (including potential institutional and individual investors). Dialogue with shareholders is led by the Managing Director CFO. Considering the purpose and effect of the interview, and the attributes of shareholders, the dialogue method is examined thoroughly by the senior management such as CEO and the Managing Director CFO. As for IR, mainly the financial affairs department and the management planning division gather necessary information from relevant sections of the company, prepare reference material and give explanations in an understandable manner, to enrich the dialogue with shareholders.The company has opportunities to dialogue with shareholders through the annual general meetings of shareholders, results briefing sessions (twice a year), briefing sessions for individual investors (twice a year), meetings with institutional investors and analysts inside and outside Japan at the time of disclosure of quarterly results, the disclosure of IR information via websites, the response to inquiries from individual investors by telephone, email, or the like. Then, the company reflects questions, requests, information on participants in briefing sessions, questionnaire results, etc. in IR activities. Shareholders’ interests and concerns grasped through the dialogue with them are reported to the senior managing director CFO and the information is utilized for analyzing business administration, discussing how to disclose information, etc.Concerning IR activities and the dialogue with shareholders, the company manages insider information appropriately in accordance with in-company rules. The quiet period, in which the company refrains from having dialogue about financial results, is from the day after the closing date of each quarter to the date of brief reporting. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Linical Co., Ltd. (2183) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/