Bridge Report:(2183)Linical fiscal year ended March 2022

Kazuhiro Hatano CEO | Linical Co., Ltd. (2183) |

|

Company Information

Market | TSE Prime Market |

Industry | Service |

CEO | Kazuhiro Hatano |

HQ Address | 10 Fl., Shin-Osaka Brick Building, 6-1 Miyahara 1-chome, Yodogawa-ku, Osaka, Japan |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥855 | 22,586,436 shares | ¥19,311million | 12.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥14.00 | 1.6% | ¥38.56 | 22.2x | ¥289.69 | 3.0x |

* Stock price as of closing on May 26, 2022. Number of shares issued at the end of the most recent quarter excluding treasury shares.

* ROE, EPS and BPS are based on FY3/22 results. DPS are based on the estimates of FY3/23.

*The Accounting Standard for Revenue Recognition (ASBJ Statement No. 29, March 31, 2020) and others have been applied from the beginning of the fiscal year ended March 2022, and the management indicators, etc. for the fiscal year ended March 2022 are the indicators, etc. after applying said accounting standard and others.

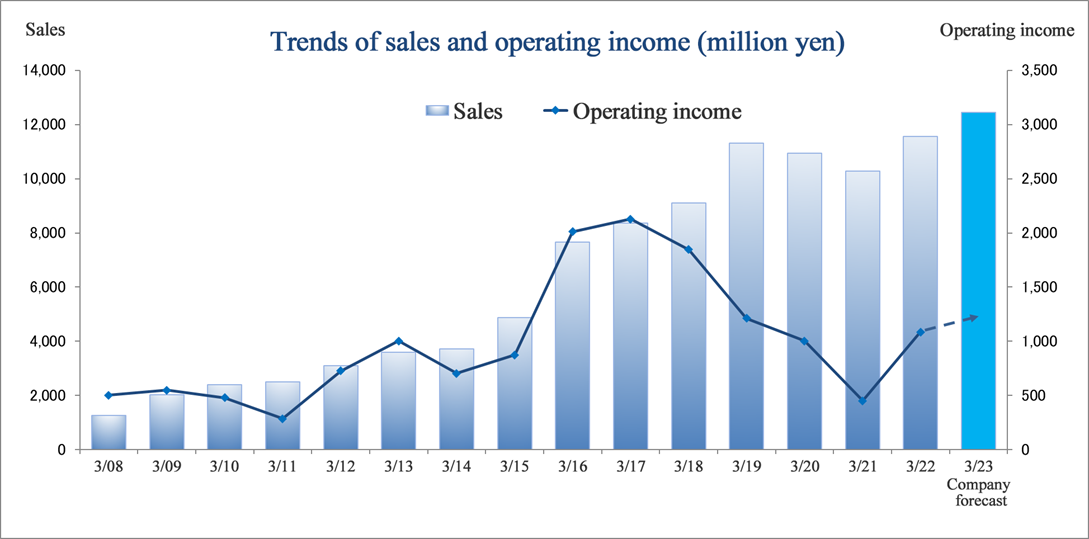

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2019 Act. | 11,313 | 1,212 | 1,253 | 568 | 25.09 | 12.00 |

March 2020 Act. | 10,935 | 1,005 | 918 | 482 | 21.38 | 14.00 |

March 2021 Act. | 10,279 | 453 | 588 | 539 | 23.91 | 14.00 |

March 2022 Act. | 11,555 | 1,085 | 1,183 | 790 | 35.00 | 14.00 |

March 2023 Est. | 12,440 | 1,224 | 1,204 | 871 | 38.56 | 14.00 |

*The Accounting Standard for Revenue Recognition (ASBJ Statement No. 29, March 31, 2020) and others have been applied from the beginning of the fiscal year ended March 2022, and revenue is recognized based on said accounting standard and others. Estimates are those of the company.

This Bridge Report reviews on the outlook of Linical Co., Ltd.’s earnings results for the fiscal year ended March 2022 and its forecast of the fiscal year ending March 2023.

Table of Contents

Key Points

1. Company Overview

2. Management Strategy

3. Fiscal Year ended March 2022 Earnings Results

4. Fiscal Year ending March 2023 Earnings Forecasts

5. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2022, sales increased 12.4% year on year and operating income rose 139.5% year on year. In addition to the recovery of the business in Japan, mainly due to the contribution of the order receiving activities to sales in the first half of the term, the businesses in Europe and the U.S., where economic activities were improving quickly, recovered to their normal growth track before the spread of COVID-19, resulting in significant year-on-year increases in sales and profit. Sales reached a record high and operating income recovered to the level in the fiscal year ended March 2020.

- The company forecasts a 7.7% year-on-year increase in sales and a 12.7% year-on-year increase in operating income in the fiscal year ending March 2023. Sales are expected to increase year on year due to the steady receipt of orders for large global projects in the U.S. and Europe. In terms of profit, the company expects a significant increase from the previous term due to strict control of the cost of sales, mainly in the business in Japan, despite investments in human resources associated with the expansion of the businesses in Europe and the U.S. and IT investments for digitization of operations, enhancement of information security, etc. The company plans to pay a common dividend of 14 yen per share, like in the previous term.

- Order backlog, which is a leading indicator of sales, is expanding rapidly. This abundant order backlog is expected to drive the company's earnings growth in the fiscal year ending March 2023 and beyond. At the same time, the business environment is expanding, especially in Europe and the U.S., as economic activity is improving. It remains to be seen whether the company will be able to undertake large-scale international joint trials and how much it will be able to increase its order backlog.

1.Company Overview

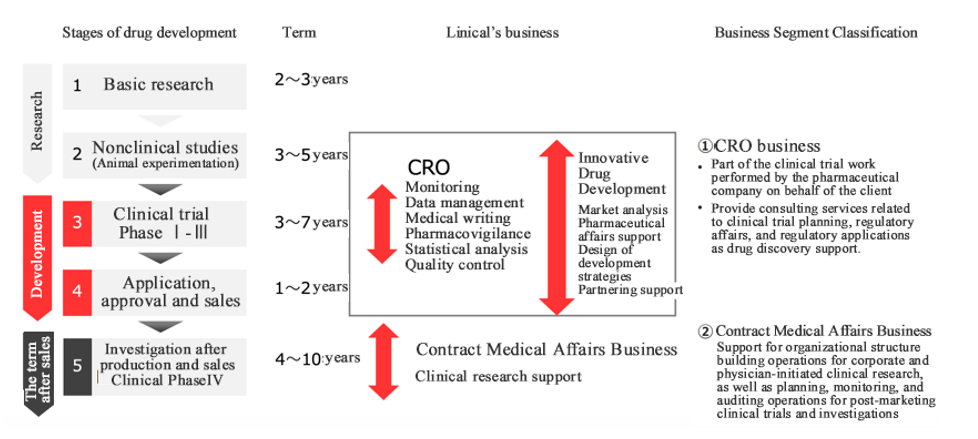

Linical Co., Ltd. provides contract research organization (CRO) services that support the drug development processes of pharmaceutical companies on an outsourced consignment basis, and sales and marketing functions for pharmaceutical products and post market launch clinical research and surveys on a consigned basis in the Contract Medical Affairs Business (CMA).

Pharmaceutical products are subject to approval of the Ministry of Health and Welfare prior to their sales, and efficacy and safety of pharmaceutical products must be confirmed through clinical trials prior to their approval. Companies providing clinical trial support services are known as contract research organization (CRO) service providers. In addition, there is a need to conduct surveys and clinical research after pharmaceutical products have been launched into the market and contract medical affairs is a service provided to support these efforts.

Linical has conducted various efforts to eradicate cancer, central nervous system and other diseases globally since its founding, and it has deployed its CRO Business in disease realms where there is strong demand for new drug development. These are highly difficult disease realms, and Linical is able to support high level clinical trials in these realms by the company’s knowledgeable and experienced experts. In addition, Linical focuses its efforts up the new drug development support and Contract Medical Affairs Business, approval application support and post approval marketing and clinical research, and post market survey support services, which exceed the traditional definition of outsourcing and is now considered to be part of a wider range of consulting services provided to customers as a "true clinical development partner". Furthermore, amidst the advance of globalization and large-scale pharmaceutical product development, the Linical Group can provide "one stop shopping" type comprehensive services for large scale global products. Consequently, Linical is able to play the role of a strategic business partner by providing total support to help raise the competitive advantage of customers in the market and to help pharmaceutical companies develop new future business opportunities.

Furthermore, Linical has a contract-based business style and is establishing a highly profitable structure. It is focusing on specific areas, specific clinical trials (i.e., Phase II and Phase III).

【Corporate History】

Linical Co., Ltd. was established in June 2005 by nine members who worked at Fujisawa Pharmaceutical Co., Ltd. (Currently known as Astellas Pharma Inc.) on the development of immunosuppressant drugs. Established with the objective of becoming the ideal drug development outsourcing (CRO) company from Osaka, Linical focused its efforts upon the realms of central nervous system diseases (CNS) and oncology since its founding, and received one of its first orders from Otsuka Pharmaceutical Company shortly after its establishment. Thereafter, the Company fortified its staffing as part of its efforts to strengthen its order taking capabilities. In addition, Linical is benefitting from the bountiful experiences of its employees in the realm of oncology pharmaceutical product development and experiences having worked at foreign pharmaceutical companies. Consequently, Linical is successfully expanding orders in the near term.

With its advance into the site management organization (SMO, clinical trial facility support organization) business, Aurora Ltd. was turned into a subsidiary in January 2006. However, all shares held in Aurora were later sold in May 2007 in order to focus management resources upon the CRO Business. In July 2008, Linical USA, Inc. was established in California, United States to provide support to Japanese pharmaceutical companies seeking to enter the United States market. Also, in October of the same year, Linical listed its shares on the Mothers Market of the Tokyo Stock Exchange, and subsequently moved its listing to the First Section of the Tokyo Stock Exchange in March 2013. In May 2013, Linical Taiwan Co., Ltd. and Linical Korea Co., Ltd. were established in Taiwan and Korea respectively. In April 2014, Linical teamed up with its Linical Korea to acquire the Korean CRO company P-pro. Korea Co., Ltd. On October 29, 2014, all of the shares of Nuvisan CDD Holding GmbH, which conducts CRO Business in Europe, were acquired and it was converted to a 100% owned subsidiary effective on November 30, 2014. In order to strengthen the collaboration within the Group, the company name of Nuvisan CDD was changed to Linical Europe GmbH on December 1, 2014. In addition, Linical U.K. Ltd. was established in March 2016, and a local subsidiary called Linical Poland SP. Z.O.O. was also established in October of the same year. Moreover, LINICAL Czech Republic s.r.o was established in September 2017. In addition, Accelovance, Inc. was acquired in April 2018 and its company name was changed to Linical Accelovance America, Inc. This acquisition has contributed to a strengthening of Linical's consignment structure for global jointly conducted clinical trials. In addition, Linical Hungary Kft. was established in March 2019, and Linical China Co., Ltd. was established in May 2019. Furthermore, the company further strengthened their system for undertaking global joint clinical trials, through the enhancement of their business in the European region by integrating the European subsidiary of Linical Accelovance America, Inc. (LAA) into LINICAL Europe GmbH in December 2019, and the establishment of a Shanghai branch in February 2020.

In April 2020, Linical Benelux BV and Linical Accelovance Europe BV were merged to form Linical Netherlands BV, and Linical China Co., Ltd. and Linical Accelovance China Ltd. are scheduled to be integrated in the fiscal year ending March 2023.

Despite the lingering effects of the spread of COVID-19 around the world, the company recorded record sales in the fiscal year ended March 2022 and operating income recovered to the level before the pandemic.

【Business Description】

Linical mainly conducts contract research organization (CRO) business, post market launches clinical trial and clinical research and marketing support activities in the Contract Medical Affairs Business, and new drug development support business.

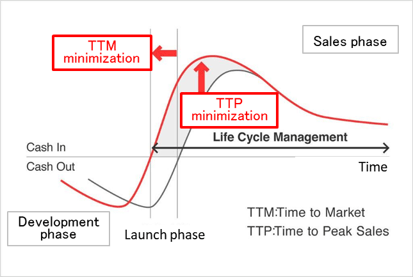

As a true partner, the company contributes to the maximization of the value of the medical drugs by helping the procedure from the non-clinical tests to clinical development and after-release surveys and clinical trial, and making it possible to shorten the time needed to start selling the drugs and prolong the life-cycle of the products. On top of that, the company supports not only pharmaceutical companies but also the bio-ventures in various ways including exit strategies.

(Source: Linical)

CRO Business (Contract Research Organization)

The CRO business undertakes part of the clinical trial operations conducted by pharmaceutical companies, including monitoring, data management, medical writing, pharmacovigilance, statistical analysis, and quality control. The company has opened facilities in Asia (Korea, Taiwan, Singapore, China), Europe and the United States to be able to respond to growing demand for global studies. Linical provides "one stop shopping" services ranging from pharmaceutical affairs to planning, implementation plan creation, monitoring, data management, statistical analysis, and pharmacovigilance. With regards to jointly conducted global jointly conducted clinical trials, Linical headquarters operates a function where personnel within depth knowledge about various countries pharmaceutical product development work. These personnel are able to provide information necessary to establish a development environment that can enable jointly conducted global jointly conducted clinical trials to be conducted in Japanese. Among the new drug development projects spanning from 10 to 20 years, Linical is specialized in the processes of “Phase II” and “Phase III” that require 3 to 7 years targeting patients who are particularly important in clinical trials, and it provides “monitoring” services that are the core of the clinical trials in the contract-based business style in conjunction with “quality control” and “consulting.” It collects highly reliable data and supports the rapid and reliable development of new drugs. Furthermore, it focuses on major pharmaceutical companies with abundant drug development information and is specialized in the oncology and CSN disease realms with a strong demand for development from markets as well as the other challenging realms to respond to its customers’ needs (i.e., pharmaceutical companies).

In addition, the company offers high-quality services in the fields of schedule management, standard procedure documents for clinical trials, compliance with GCP, the reliability of data and case reports, etc.

* Global jointly conducted clinical trials

“Global jointly conducted clinical trials” refers to conducting clinical trials simultaneously in multiple countries or regions in order to develop new drugs on a global scale and aim for early launch.

*GCP (Good Clinical Practice)

“GCP” is the international rule the companies are supposed to obey when they conduct the clinical trial. It is enacted by Ministry of Health, Labor and Welfare as a ministerial ordinance so that they can conduct it properly in Japan.

Contract Medical Affairs Business

In the contract medical affairs business, the company provides support for the organizational structure and construction of corporate and doctors-led clinical research, as well as planning for surveys, monitoring, and auditing services for post-release clinical trials and investigations. The Clinical Trials Act is enacted, and the environment surrounding clinical research is changing drastically. Under this circumstance, to obtain information in a timely manner and be the best partner for the medical affairs department of pharmaceutical companies, Linical provides full-service support including data management and statistical analysis with a focus on monitoring and research administration works of clinical trials. It covers clinical trials that are compliant with J-GCP, ethical guidelines, the Clinical Trails Act and/or ICH-GCP, providing services for all regulations. Furthermore, it offers services in the realms of primary and CNS from the beginning of the company’s establishment. It has also strengthened the oncology realm, and more than half of the monitors are experienced in that realm. It has a policy to respond to the latest regulations and contribute to the creation of evidence in the challenging areas based on the know-how cultivated in the past development works.

Innovative Drug Development Business

Following the existing CRO Business and Contract Medical Affairs Business, Linical is cultivating the third business called Innovative Drug Development Business. In the innovative drug development business, the company conducts market analysis, pharmaceutical affairs support, design of development strategies, and partnering support. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided. With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

【Five Strengths】

(1) Comprehensive "One Stop" Services on a Global Scale

Linical is Japanese global CRO services provider with the ability to provide services in the three regions of Asia, Europe, and the United States. The company contributes to new drug development as a pharmaceutical development professional. It currently operates business in 18 countries/regions and can provide services in over 20 countries/regions worldwide. Moreover, Linical boasts of highly skilled professionals with bountiful experience in a wide spectrum of comprehensive services ranging from planning, monitoring, data management, statistical analysis, medical writing, pharmaceutical affairs, pharmacology vigilance, and other various services who can respond to customers' needs, including the need for not only local but also multi-national clinical trials. Therefore, Linical is trial a comprehensive "one stop" service provider operating on a global scale.

LINICAL Global Base “Three Main Operating Regions of “Japan and Asia, United States, Europe”

(Source: Linical)

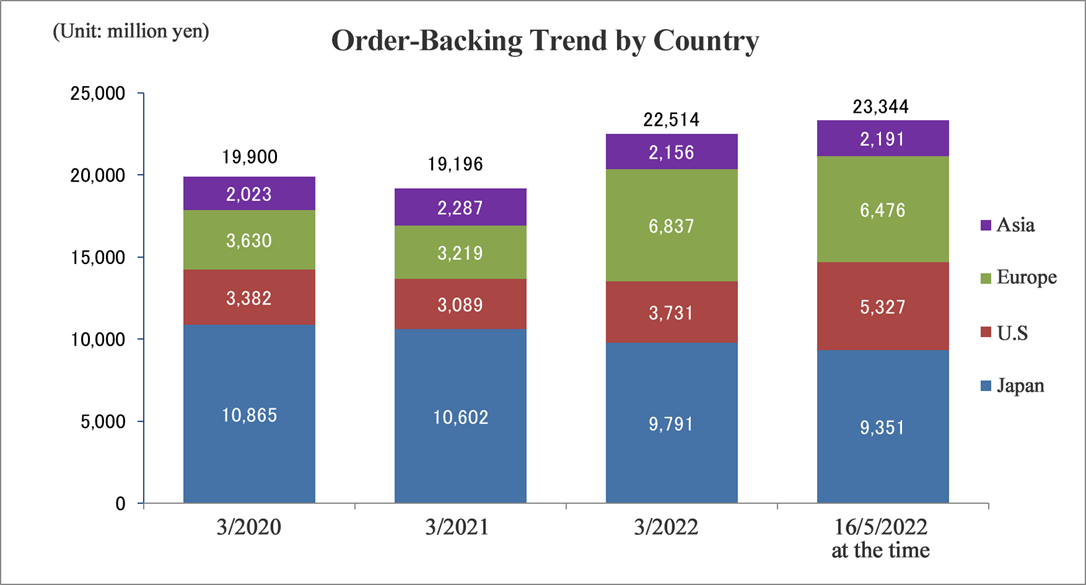

Despite the impact of the spread of COVID-19, the number of global test contracts in Europe and the U.S. has increased significantly as a result of the tri-polar structure established in Japan + Asia, the U.S. and Europe. Although the order backlog in Japan declined due to the impact of the spread of COVID-19, the order backlog in Europe and the U.S., where economic activity improvements were quick during the pandemic, increased significantly.

(2) Innovative Drug Discovery Support to Clinical Development and Research

As a corporate social responsibility (CSR), the company wants to contribute to society by playing a role in developing pharmaceutical products. Linical also enables clients to promote efficient new drug development, extend life cycle management, shorten the time required to market launch (TTM), and maximize sales at an early stage (TTP). In Japan, the company supports the creation of medicines in the Innovative Drug Development Business, conducts clinical development in the Contract Research Organization (CRO) business, and supports clinical tests and research after production or release in the Clinical Research Support Business.

(Source: Linical)

(3) Focused upon oncology, central nervous system and immune system.

Pharmaceutical product development is currently focused upon the three realms of oncology, central nervous system and immune system. Founding members of Linical boast of bountiful experience in the realm of immune system and have provided services in the highly difficult realm of immune system since the Company's founding. Thereafter, Linical has expanded its realms of expertise to include central nervous system in 2006, and oncology in 2010. Currently, Linical's business is based upon the regions of unmet medical needs in these three main business realms of oncology, central nervous system and immune system. In addition, its overseas subsidiaries are also boast of a strong track record in oncology, central nervous system, and immune system related services, which are realms where unmet medical needs are high. Furthermore, in addition to the dermatology and ophthalmology fields, which are expected to grow in the future, the company is preparing to make the regenerative medical field, which has a high degree of difficulty, as a major pillar of its future services.

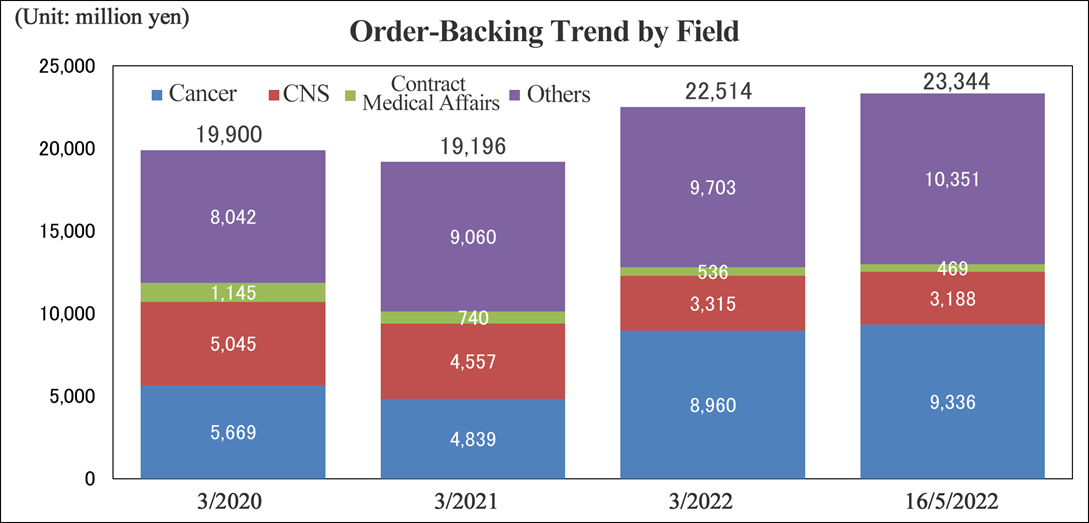

The order backlog as of May 16, 2022 is at a record high level, with particularly strong expansion in the cancer field and other areas.

(4) Global Collaboration

Linical is Japan's CRO services company that can provide clients with services on a global basis. Because of its ability to provide exceptionally high-quality services (Japan Quality), it has established its global business development center in Japan and maintains multilingual staff with the ability to communicate in Japanese, English and other languages including Korean, Chinese, German and others at its Osaka headquarters and Tokyo branch office. Overseas staff also understand Linical's advantage of having high quality services originating in Japan and provide these "Japan Quality" services throughout the Linical business globally.

The company offers proposals according to needs from clients, including a case in which a project manager and leaders from Japan, Taiwan, and South Korea are deployed in Japan and a case in which leaders are deployed at the footholds of respective countries for realizing a testing system in Asia, including Japan, Taiwan, and South Korea. In addition, the company has carried out many collaborative trials among enterprises in Japan, the U.S., EU, and other Asian countries, so it can give proposals on a global scale according to the development strategy of each client.

(5) High Quality Services

In order to provide high quality services that Linical is widely recognized for, the Company implements training of its staff in both aspects of quantity and quality of work. As a result, the Company has been able to maintain high passage rates of the GCP Support Certification Examinations administered by the Japan Society of Clinical Trials and Research (JSCTR) since the first examination and has been awarded with recognition awards for its high quality and passage rates, which in turn have contributed to promotion of clinical trials. In addition, Linical boasts of bountiful experience in GCP compatibility surveys and FDA inspection. In both instances, the Company has received high regard for its services from clients. Moreover, overseas subsidiaries have also received high regard for its bountiful experiences in dealings with the FDA, KFDA, ANVISA and other organizations. The company strongly believes that its greatest mission is to provide customers with the best service by combining high quality and speed.

2.Management Strategy

According to IQVIA Global Medicine Spending and Usage Trends "Outlook to 2025," the global pharmaceutical market is expected to grow to 176 trillion yen scale by 2025. The U.S. market is expected to account for 39.4% of the total, Europe (Germany, France, Italy, the U.K., and Spain) for 15.2%, China for 12.4%, and Japan for 5.9%. Along with the expansion of the global pharmaceutical market, the CRO market is also expected to grow in the future. Against this backdrop, it is imperative to expand business in the U.S., the world's largest market.

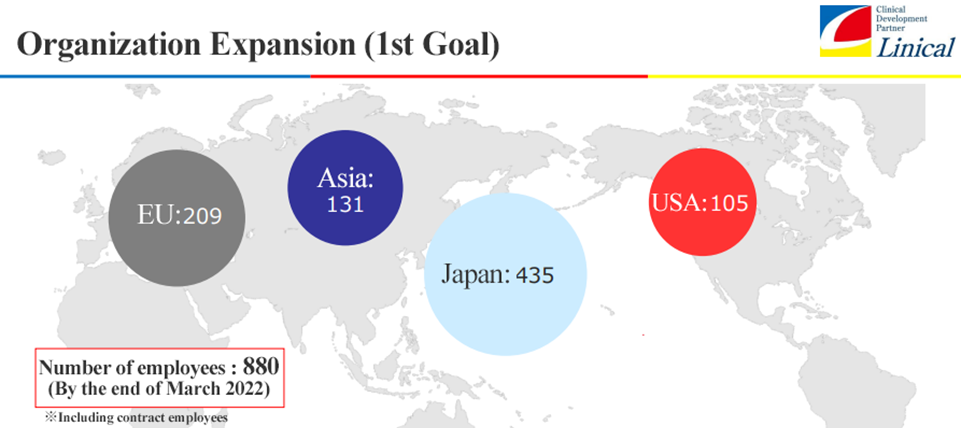

【First Goal】

(1) To establish bases in Japan and Asia, Europe, and the U.S., and build a system with 1000 employees

(2) To become profitable in all the main business regions

(3) To advance into about 20 countries around the world

(Source: Linical)

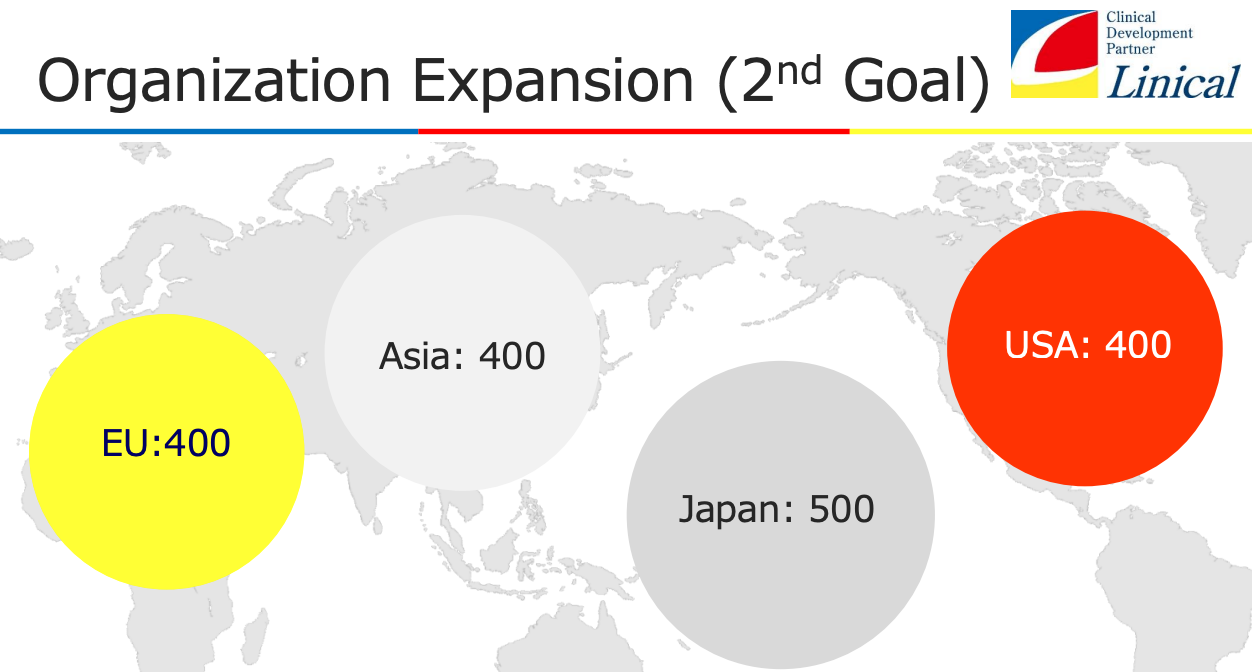

【Second Goal】

(1) To build a system with more than 1,500 employees where there will be 500 in Japan, 400 in Asia, 400 in Europe, and 400 in the U.S.

(2) To maintain and improve profitability while making growth investments (including M&A) in all main business regions

(3) The company will expand its business to about 60 countries around the world. While taking time differences into consideration, the company will consider expanding its coverage area in each Japan, the U.S., and Europe. Having a base in the southern hemisphere will enable the company to conduct clinical trials for seasonal diseases all year round.

(Source: Linical)

(1) Strategy in Japan

【CRO Business】

| Initial stage | Present |

Clients | Major domestic pharmaceutical companies | Major domestic pharmaceutical companies Major overseas pharmaceutical companies Domestic and foreign bio-ventures |

Disease areas | Oncology area CNS area Immunology area | Oncology area CNS area Immunology area Ophthalmology Dermatology area Regenerative medicine |

Services | Monitoring | Monitoring Project management Quality control and auditing Data management Medical writing Pharmacovigilance and others |

(From the reference material for the company’s financial results briefing)

Initially, the company’s clients were mainly major domestic pharmaceutical companies. However, by providing full services, the company aims to increase its market share among major overseas pharmaceutical companies and domestic and overseas bio-ventures. In addition to the domains of oncology, CNS, and immunology, the company will strengthen the domains of regenerative medicine, dermatology, and ophthalmology. Moreover, the company will evolve its business model in terms of customers, disease areas, and services, aiming to achieve medium- to long-term growth and improve profitability. Furthermore, the company plans to take a pioneering role in regenerative medicine, therapeutic applications, and other cutting-edge therapies that are expected to expand in the future.

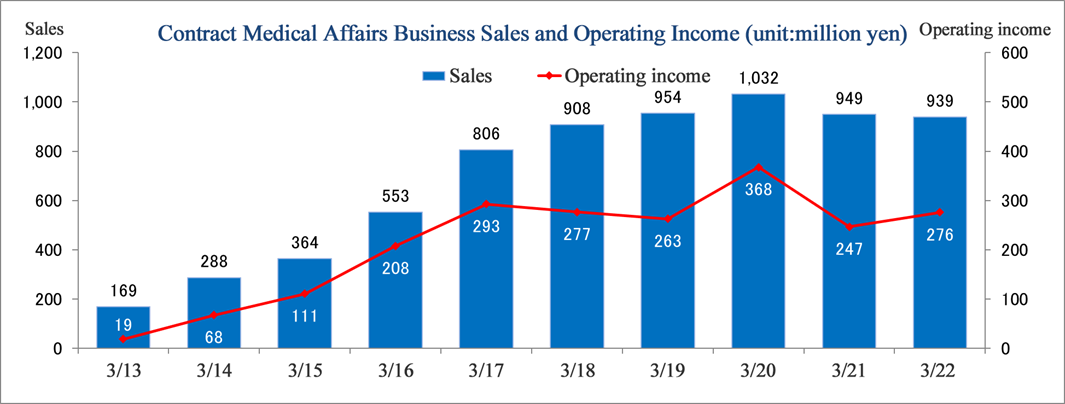

【Contract Medical Affairs Business】

The clinical research law has been enforced, and as a result, the environment surrounding clinical research is changing drastically. Thus, the company provides full-service support, including data management and statistical analysis centering on clinical research monitoring and administrative research operations to catch up on information promptly and become the best partner for the medical affairs departments of pharmaceutical companies. In addition to J-GCP, the company supports ICH-GCP-compliant clinical trials and ethical guidelines, and clinical research methods. Therefore, it can provide services under all regulations. Moreover, the company has provided services in the primary area and the central nervous system area from the beginning. Now, it is enhancing the oncology area, and more than half of the monitors are experienced in the oncology area. The number of company-initiated clinical research projects, mainly for new anti-cancer drugs, is increasing, and the number of contracts is expanding. Based on the know-how cultivated in pharmaceutical development, the company will continue to fulfill the latest regulations and contribute to creating evidence in difficult areas.

* Unit: thousand yen

(Note) From the first quarter of FY 3/16, the name of the previous segment was changed from “CSO business” to “Contract Medical Affairs Business”.

【Innovative Drug Development Business】

The company operates the third business, that is, the Innovative Drug Development Business, following the existing CRO Business and the Contract Medical Affairs Business. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided.

With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

Innovative Drug Development Business -3 types of consulting-

There are Japanese and overseas biotech venture companies and mid-sized pharmaceutical companies that want to enter the Japanese pharmaceutical market and distribute and release their products. However, they do not have sufficient knowledge of the Japanese market or pharmaceutical affairs and do not have adequate development and release functions, and need a strategic partner/licensee. Thus, the company provides these companies with the following services.

Market analysis/investigation | ・ Epidemiological survey of target diseases ・ Market value and trend forecast ・ Current treatment algorithm and guideline survey ・ Approved drugs and development pipeline survey ・ Target product performance (TPP) planning ・ Official drug price and peak sales forecast, profitability evaluation |

Pharmaceutical affairs/ Development strategies, PMDA consultation(MW) | ・ Development/pharmaceutical affairs strategy planning and proposal ・ Preparation of materials for PMDA consultation, application, attending meetings, and responding to inquiries ・ Preparation of drug study summary, protocols, consent documents, etc. ・ Clinical trial notification and responding to inquiries ・ Domestic administrator services for clinical trials ・ Registration application for orphan drugs ・ Common Technical Document (CTD) publish |

Strategic alliance/license | ・ Investigation and analysis of potential partner companies/licensees ・ Interview with potential partner companies/licensees, explanation of products/technologies ・ Participation in a conference for partnering ・ Due Diligence support ・ Contract negotiation support |

(2) Strategy in Asia

The company will achieve an operating income margin of 15% by expanding the sales of 1.2 billion yen in the fiscal year ended March 2022 to 1.5 billion yen at an early stage. In addition, the company will increase the number of employees from the end of the previous term 131to 200 at an early stage, and in the long term, the company will establish a system with 400 employees on its own. As a specific strategy, the company will promote the development of the Chinese market.

(3) Strategy in Europe

The company will achieve an operating income margin of 15% by expanding sales from 3.13 billion yen in the fiscal year ended March 2022 to 30 million euros at an early stage. In addition, it will increase the number of employees from the end of the previous term209 to 300 at an early stage. In the long term, it will establish a system with 400 employees by relying on the company’s capabilities and implementing M&A. Specific strategies include the expansion in the U.K. and the establishment of a base in Italy.

(4) Strategy in the U.S.

The company will achieve an operating income margin of 15% by expanding sales from 2.37 billion yen in the fiscal year ended March 2022 to 30 million US dollars at an early stage. In addition, it will increase the number of employees from the end of the previous term 105 to 150 at an early stage, and in the long term, it will establish a system with 400 employees through M&A. As a specific strategy, the company will set its sights on promising biotech companies with strong future growth potential.

3. Fiscal Year ended March 2022 Earnings Results

(1) Consolidated results

| FY 3/ 21 | Ratio to sales | FY 3/ 22 | Ratio to sales | YoY |

Sales | 10,279 | 100.0% | 11,555 | 100.0% | +12.4% |

Gross profit | 2,767 | 26.9% | 3,611 | 31.3% | +30.5% |

SG&A | 2,314 | 22.5% | 2,525 | 21.9% | +9.1% |

Operating Income | 453 | 4.4% | 1,085 | 9.4% | +139.5% |

Ordinary Income | 588 | 5.7% | 1,183 | 10.2% | +101.1% |

Parent Quarterly Net Income | 539 | 5.3% | 790 | 6.8% | +46.4% |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd., and may differ from actual figures. (Abbreviated hereafter)

Sales and operating income increased 12.4% and 139.5%, respectively, year on year.

Sales increased 12.4% year on year to 11,555 million yen, and operating income increased 139.5% year on year to 1,085 million yen.

As a global CRO originating from Japan, the company operates business in 18 countries including Japan, Asian countries, the U.S., and European countries, and the business environment continued to vary among regions depending on the situation of COVID-19 and the progress of vaccination. At the beginning of the term, the company had assumed that, despite the lingering impact of the pandemic, business performance in Japan and Asia would return to normal from the fourth quarter, Europe from the third quarter, and the U.S. from the second quarter of the current term. In addition to the recovery of the business in Japan, the businesses in the U.S. and Europe have recovered to their pre-COVID normal growth track, with consolidated sales exceeding 1 billion yen in most of the months since October 2021. In addition to the recovery in sales, gross profit margin rose 4.4 points year on year to 31.3%, improving profitability. In addition, the ratio of SG&A expenses to sales fell 0.6 points year on year to 21.9% as the rate of increase in SG&A expenses was kept below the rate of increase in sales, and the ratio of operating income to sales rose to 9.4% (4.4% in the previous term). On the other hand, although foreign exchange gains of 100 million yen (14 million yen in the previous term) were posted in non-operating income, the absence of subsidy income of 126 million yen posted in the previous term in this term resulted in ordinary income increasing 101.1% year on year, less than the increase in operating income. Additionally, parent net income was 790 million yen (up 46.4% year on year), as the company paid attorneys' fees and a settlement payment for arbitration regarding a project undertaken by Accelovance, Inc., the predecessor of Linical Accelovance America, Inc. (hereinafter "LAA"), and costs for countermeasures against cyber-attacks, and entered into a settlement agreement with the seller of LAA regarding disputes arising from the indemnity clause in the merger agreement and received a settlement payment via an escrow.

Regarding the dispute in the U.S., the company's consolidated subsidiaries LAA, Inc. and Topical Remedy, LLC, among others, have entered into a settlement agreement and will no longer incur any costs related to this dispute in the future. In addition, on November 3, 2021, Linical USA, Inc. (hereinafter "LUI"), a consolidated subsidiary of Linical, entered into a settlement agreement with the seller of Accelovance, Inc. (now Linical Accelovance America, Inc.), which Linical acquired in April 2018, regarding a dispute arising from an indemnity clause in the merger agreement, etc., which included a provision that the seller would pay LUI $1,445,000 out of an escrow. The $1,445,000 received by LUI as a result of this settlement was posted as extraordinary income in this term.

The adoption of the revenue recognition standard increased sales by 226 million yen and operating income and ordinary income by 16 million yen each.

Sales and profit by segment

| FY 3/ 21 | Ratio to sales | FY 3/ 22 | Ratio to sales | YoY |

CRO Business | 9,329 | 90.8% | 10,615 | 91.9% | +13.8% |

Contract Medical Affairs business | 949 | 9.2% | 939 | 8.1% | -1.0% |

Consolidated sales | 10,279 | 100.0% | 11,555 | 100.0% | +12.4% |

CRO Business | 1,765 | 87.7% | 2,538 | 90.2% | +43.8% |

Contract Medical Affairs business | 247 | 12.3% | 276 | 9.8% | +11.6% |

Adjustment amount | -1,559 | - | -1,728 | - | - |

Consolidated operating income | 453 | 100.0% | 1,085 | 100.0% | 139.5% |

*Unit: million yen

In the CRO business, sales increased 13.8% year on year to 10,615 million yen and profit increased 43.8% year on year to 2,538 million yen due to the recovery in Japan and the normalization of business performance in the U.S. and Europe. The segment profit margin was 23.9%, up 5 points from the previous term.

In the contract medical affairs business, sales decreased 1.0% year on year to 939 million yen and profit increased 11.6% year on year to 276 million yen due to the curtailment of the cost of sales, although the receipt of orders that would contribute to sales in the current term was sluggish due to the impact of COVID-19 and the revision of plans by pharmaceutical companies, including a reduction in projects in the previous term. Profit margin was 29.4%, up 3.3 points year on year.

Earnings results by regions

| FY 3/21 | FY 3/22 | ||||

Sales | Operating income | Sales | Operating income | Sales | Operating income | |

Japan | 6,483 | 281 | 6,294 | -2.9% | 506 | +80.1% |

U.S | 1,970 | 305 | 2,378 | +20.7% | 399 | +30.9% |

Europe | 2,355 | 40 | 3,136 | +33.2% | 359 | +797.5% |

Korea | 472 | 48 | 723 | +53.2% | 127 | +164.6% |

Taiwan | 169 | -44 | 117 | -30.8% | -90 | - |

China | 280 | 66 | 369 | +31.7% | 41 | -38.5% |

Adjustment | -1,450 | -243 | -1,462 | - | -257 | - |

Total | 10,279 | 453 | 11,555 | +12.4% | 1,085 | +139.5% |

*Unit: million yen

*Includes the China operations of the U.S. company Accelovance (now Linical Accelovance America (LAA)), which was acquired in April 2018.

*Amortization of goodwill is recorded as an adjustment.

【Japan】

In Japan, in addition to the contribution to sales from the order receiving activities in the first half of the term, the progress of vaccination, the improvement in economic activities due to the stabilization of the Delta variant and its subsequent replacement with the Omicron variant, which has a lower rate of severe illness and mortality, and the progress in the completion of order receipt projects, as well as the control of the cost of sales. As a result, although sales fell below the previous term's level, operating income rose sharply.

【the U.S.】

In the U.S., despite the rapid spread of the Delta variant since July, economic activities continued to improve owing to progress in vaccination and replacement by the Omicron variant, which has a lower rate of severe illness and mortality, and the company steadily completed existing and new orders. Sales and operating income reached record highs, resulting in significant increases in sales and operating income over the previous term. New drug development in the U.S. market is robust, with recent orders for a large-scale U.S.-Europe study originating in the U.S. The company plans to continue to focus on cultivating the U.S. market, including strengthening its sales division, to achieve sustainable growth.

【Europe】

In Europe, countries where the company's main bases are located, such as Germany, France, and Spain, continued to show improvement in economic activity, and the company was able to steadily fulfill existing orders and contribute to sales from several new projects, resulting in significant increases in sales and operating income over the previous term, and record-high sales and operating income. In particular, in the European business, the strengthening of the sales division since the previous term has produced significant results, winning several orders, including large-scale global projects in Japan, Asia, the United States, and Europe, and significantly increasing the order backlog that will contribute to sales in the current and next terms and beyond. The business in Europe is returning to the growth and expansion track it was on before the pandemic, although there are some cost-increasing factors such as upfront human resource investment, mainly in the U.K. and other countries.

【Asia】

In South Korea, as vaccination progressed, the clinical trial environment improved, which led to the successful completion of the existing orders and the acquisition of multiple projects this term which contributed to sales. Thus, sales and operating income grew year on year, reaching a new record high. Also in China, vaccination progressed and the clinical trial environment continued to improve, resulting in a steady flow of orders and larger sales than those in the previous term, but operating income declined due to upfront personnel investment and other factors. On the other hand, the spread of COVID-19 in China has led to lockdowns in some cities, which is a cause for concern for the fiscal year ending March 2023 results. In addition, Taiwan posted smaller sales and operating loss compared to previous term, due to a lack of new projects entrusted caused by the spread of COVID-19.

【Goodwill balance and remaining amortization period (at the end of FY2022/3)】

| Amount of money | Residual depreciation period | Annual depreciation*4 |

Korea | Depreciation ends in 19/3 | ||

Europe*1,2 | 1,349 | 11-12 years | 120 |

the U.S. *1,3 | 2,056 | 12 years | 171 |

* Unit: million yen

*1 Goodwill generated from the acquisition of Linical Accelovance America, Inc. (Hereinafter, “LAA”) was allocated to the European subsidiaries.

*2 The balance of intangible assets other than goodwill recognized by Purchase Price Allocation at the end of the fiscal year ended March 2022 is 84 million yen. The residual amortization period for these assets is 5 to 9 years.

*3 The balance of intangible assets other than goodwill recognized by Purchase Price Allocation at the end of the fiscal year ended March 2022 is 46 million yen. The residual amortization period for these assets is 5 years.

*4 Figures converted at the exchange rate at the end of the fiscal year ended March 2022.

(2) Change in order balance

| End of FY 3/21 (A) | FY 3/22 | As of May 16, 2022 (B) | Difference from the end of the previous term (B-A)/(A) |

Chugai Pharmaceutical | 3,351 | 3,786 | 3,569 | +6.5% |

Eisai | 2,926 | 2,795 | 2,362 | -19.3% |

Ono Pharmaceutical | 841 | 653 | 634 | -24.6% |

Others | 12,077 | 15,279 | 16,777 | +38.9% |

Total order backlog | 19,196 | 22,514 | 23,344 | +21.6% |

* Unit: million yen

In the CRO business, the total amount of clinical trials commissioned to the company, which has an implementation period of one to three years, is determined by the difficulty of the clinical trials due to the number of cases and the target disease. A consignment contract is concluded with the client for this implementation period, and sales are generated according to the contract. Also, in the contract medical affairs business, a consignment contract is concluded with the client for the same period, and sales are generated according to the agreement.

The order backlog is the balance of the order amount of the commissioned projects for which a contract has already been concluded. This shows the sales that will be generated in the next one to five years, which is the basis for the company's future business forecasts.

As of May 16, 2022, the order backlog was 23,344 million yen, up 21.6% from the end of the fiscal year ended March 2021. In the U.S., new drug development in the U.S. market is robust, with recent orders for a large-scale U.S.-Europe study originating in the U.S. and several other new projects, and the company is steadily receiving new orders that will contribute to sales in the next term and beyond. In addition, the company has been approached by enterprises with several other new projects and is negotiating to win contracts. In Europe, the strengthening of the sales department since the previous term has produced significant results this term, and the company has received orders for several projects, including large-scale global projects to be implemented in Japan, the U.S., and Europe. In addition, the company is currently being approached for new projects, including several large ones, and is stepping up its sales activities with the aim of accumulating orders that will contribute to sales in the next term and beyond. Furthermore, in Japan and Asia, the company is receiving an increasing number of inquiries for new projects that will contribute to sales in the next term and beyond, and is stepping up its sales activities to secure orders.

(3) Financial Conditions and Cash Flow(CF)

Financial Conditions

| March 2021 | March 2022 |

| March 2021 | March 2022 |

Cash | 5,084 | 5,985 | ST Interest-Bearing Liabilities | 1,150 | 1,139 |

Receivables and contract assets | 2,982 | 2,917 | Payables, Accrued Expenses | 1,120 | 936 |

Advance payment | 1,183 | 987 | Advances received | 1,909 | 2,147 |

Current Assets | 9,722 | 10,321 | LT Interest-Bearing Liabilities | 3,541 | 2,964 |

Tangible Assets | 701 | 664 | Liabilities | 9,568 | 9,173 |

Intangible Assets | 3,651 | 3,565 | Net Assets | 5,712 | 6,543 |

Investments and Others | 1,204 | 1,165 | Total Liabilities and Net Assets | 15,280 | 15,716 |

Noncurrent Assets | 5,557 | 5,395 | Total Interest-Bearing Liabilities | 4,692 | 4,103 |

* Unit: million yen

* Interest-bearing liabilities=Borrowings + Lease Obligations

Total assets at the end of March 2022 were 15,716 million yen, up 435 million yen from the end of the previous term. On the asset side, cash and investment securities were the main contributors to the increase, while receivables, advance payment, goodwill, and guarantee deposits were the main contributors to the decrease. On the liabilities and net assets side, the main factors in the increase were advances received, deposits received, and parent net income, while the main factors in decrease were accounts payables, accrued expense and long-term loans payable. Goodwill at the end of March 2022 was 3,406 million yen, down 56 million yen from the end of the previous term. The equity ratio at the end of March 2022 was 41.6%, up 4.2 points from the end of the previous term.

Cash Flow

|

|

|

| |

| FY 3/ 21 | FY 3/ 22 | YoY | |

Operating cash flow(A) | 23 | 1,631 | 1,608 | +6811.5% |

Investing cash flow(B) | 169 | 20 | -148 | -87.7% |

Free cash flow(A+B) | 192 | 1,652 | 1,459 | +758.0% |

Financing cash flow | -329 | -951 | -621 | - |

Cash and Equivalents at the end of quarter | 5,084 | 5,985 | 901 | +17.7% |

* Unit: million yen

On the CF side, the cash inflow from operating activities increased due to an increase in net income before income taxes and a decrease in receivables and advance payment. As a result, positive free CF expanded, although the cash inflow from investment activities narrowed due to a decrease in proceeds from the return of part of the purchase price of a subsidiary's shares. On the other hand, the cash outflow from financial activities widened due to a decrease in proceeds from long-term loans payable. As a result, the cash position at the end of the term increased 17.7% from the end of the previous term.

(4) Plan to Comply with the Listing Maintenance Criteria for the New Market Classification

The company has been listed on the Prime Market since April 2022. However, as of the transition reference date (June 30, 2021), the company did not meet the criteria for maintaining its listing on the market in terms of market capitalization of tradable shares, so it prepared a plan to comply with the criteria.

Specifically, the company intends to increase the market capitalization of tradable shares over the three-year period from the fiscal year March 2023 to the fiscal year March 2025 by (1) increasing profitability, (2) tightening corporate governance, and (3) improving accountability, in accordance with its medium-term management plan.

【Concrete efforts】

(1) Increasing Profitability | |

Expansion of the target customer base | Expansion of the customer base, which has been composed of mainly major Japanese pharmaceutical companies, to include major overseas pharmaceutical companies and domestic and overseas biotech companies. |

Expansion of target therapeutic areas | Expansion of services, which has been mainly in the fields of oncology, the central nervous system, and immunology, to cover ophthalmology, dermatology, rare diseases, etc. by adapting to treatment methods utilizing the latest modalities such as regenerative medicine, cellular medicine, nucleic acid medicine, and therapeutic applications. |

Expansion of service areas | To differentiate from competitors by strengthening consulting services that match client needs, such as market analysis, development strategy formulation, and regulatory compliance, for clients in Japan and overseas. |

Expansion of overseas business | To strengthen sales and marketing in the U.S. and Europe, which are large pharmaceutical markets, as key strategic areas, and promote the strengthening and expansion of our overseas business base with a view to expand M&A in the future. |

Strengthen financial base | In preparation for further M&A and other large-scale growth investments in the U.S. and Europe, they will reduce interest-bearing liabilities and improve equity ratio, while considering sale of treasury shares to strengthen the financial base and secure funds for growth investments. |

(2) Tightening Corporate Governance | |

Improve transparency and soundness of management | To further improve the transparency and soundness of management, the company is actively considering increasing the ratio of independent outside directors in its Board of Directors and transitioning to a company with an audit committee. |

Strategic diversification of human resources | To ensure diversity among employees, including women, mid-career hires, and non-Japanese, and develop core human resources that will contribute to the company's sustainable growth, while continuing to improve the personnel evaluation system and other personnel-related systems that will lead to fairer and more productive workforces. |

(3) Improving Accountability | |

Enhancement of information disclosure | To continue to enhance information disclosure to improve corporate value over the medium to long term, and promote the translation of notices of convocation and other disclosure documents into English. |

Promote dialogue with investors | In addition to existing financial results briefings for institutional investors, analysts, and individual investors, they will promote more opportunities for dialogue, such as individual meetings with domestic and overseas institutional investors. |

【Mid-term goal】

| March 2021 Act. | March 2022 Act. | March 2023 Est. | March 2024 Est. | March 2025 Est. |

Sales | 10,279 | 11,555 | 11,420 | 12,086 | 12,814 |

Operating income | 453 | 1,085 | 658 | 880 | 1,001 |

* Unit: million yen

The company achieved its mid-range targets for sales in the fiscal year ending March 2023 and operating income in the fiscal year ending March 2025, which were indicated in the plan for compliance with the criteria for maintaining listing, ahead of schedule in the fiscal year ended March 2022. The company intends to revise the mid-range targets and aim to increase its corporate value over the medium to long term through sustained growth and improved profitability.

4.Fiscal Year ending March 2023 Earnings Forecasts

(1) Consolidated results

| FY 3/22 Act. | Ratio to sales | FY 3/23 Est. | Ratio to sales | YoY |

Sales | 11,555 | 100.0% | 12,440 | 100.0% | +7.7% |

Operating Income | 1,085 | 9.4% | 1,224 | 9.8% | +12.7% |

Ordinary Income | 1,183 | 10.2% | 1,204 | 9.7% | +1.7% |

Parent Net Income | 790 | 6.8% | 871 | 7.0% | +10.2% |

*Unit: million yen

Sales up 7.7% year on year, operating income up 12.7% year on year

The company forecasts a 7.7% year-on-year increase in sales to 12,440 million yen and a 12.7% year-on-year increase in operating income to 1,224 million yen for the fiscal year ending March 2023. Sales will increase year on year due to the steady receipt of orders for large-scale global projects in the U.S. and Europe. Operating income is also expected to increase year on year due to strict control of the cost of sales, mainly in the business in Japan, despite investments in human resources associated with business expansion in Europe and the U.S. and IT investments for digitization of operations and information security, etc.

The ratio of operating income to sales is expected to rise 0.4 points from the previous term to 9.8%. Ordinary income is expected to increase 1.7% year on year without the expected foreign exchange gains, which is less than the increase in operating income.

The company plans to pay a common dividend of 14 yen per share, unchanged from the previous term. The company intends to use retained earnings as a resource for growth, hiring employees and establishing overseas bases, to increase corporate value over the medium to long term, and plans to provide stable profit returns for the time being.

Outlook for Each Country

U.S. | New drug development in the U.S. market is robust, with the company having recently received an order for a large-scale U.S.-Europe trial originating in the U.S. Inquiries for new projects have also increased significantly, and the company has steadily received new orders that will contribute to sales in the next term. In addition, the company will continue to focus on cultivating the U.S. market, strengthening its sales division, and intends to achieve further sustainable growth based on the record-high performance of the previous term. In this environment, the company expects steady growth in the U.S. market in the next term as well. |

Europe | The strengthening of the sales division has produced significant results, and the company has received orders for several projects, including large-scale global projects to be implemented in Japan, Asia, the United States, and Europe, and the order backlog, which will contribute to sales in the next term and beyond, is increasing significantly. In addition, inquiries for new projects have been increasing, and demand for new drug development is strong in the European market as well. In addition, some of the large-scale U.S.-Europe trials entrusted in the U.S. are now being conducted in Europe, and global synergies in sales are increasing within the Group. Under these circumstances, the company expects that its European operations will continue to perform well in the next term. |

Japan | Due to differences in the response to COVID-19, demand for new drug development has not recovered to the same degree as in the U.S. and European markets, and steady sales activities continue to be required to uncover new projects. On the other hand, there are signs of a turnaround in the environment for new orders, as the company has been receiving inquiries for large-scale new projects. |

China | Lockdowns have been implemented in Shanghai and other cities, and although the impact on overall performance is small, the situation needs to be monitored closely. |

(2) Medium-term Management Vision

The company advocates being the strongest CRO, not the largest. To be the strongest CRO, the company must be knowledge-intensive rather than labor-intensive and achieve the highest profitability in the industry. To achieve this, each member of the team aims to outperform the competition in terms of revenue per capita.

In addition, the company's mid-term management vision is "to become a strategic partner for clients as a global CRO from Japan," and the company will concentrate on the following strategies:

Business Focus | ◆To provide a global, one-stop-shop for services related to clinical trials. ◆Covering all phases of clinical trials. ◆To provide high-quality and speedy services with a focus on diseases with high development difficulty such as oncology and central nervous system diseases. |

Client Focus | ◆To build long-term and strategic partnerships with a wide range of clients from major pharmaceutical companies to promising biotech companies in Europe and the U.S. ◆Commitment to quality, provision of speedy and flexible services, and pursuit of client satisfaction. |

Global Coverage | ◆Coverage of a wide range of countries and regions, with a focus on major markets (Japan, the U.S., and Europe) ◆To strategically expand service areas, including the southern hemisphere, and enhance global presence by establishing a system that enables prompt collection of data on all diseases. |

5.Conclusions

Order backlog, a leading indicator of sales, is expanding rapidly. As of May 16, 2022, the company's order backlog had increased 21.6% from the end of the fiscal year ended March 2021, reaching a level of over 23.3 billion yen. This was due to a large increase in orders for global testing in Europe and the U.S. and is approximately 1.9 times the level of the company's sales plan for the fiscal year ending March 2023. There is no doubt that such an abundant order backlog will drive the company's earnings growth in the fiscal year ending March 2023 and beyond. In Japan, where order backlog has unfortunately been declining, there are signs of a turnaround in the order environment, as the company has recently received inquiries for large-scale new projects. New drug development, which had been postponed due to the spread of COVID-19, is expected to see a stronger recovery trend as economic activity improves. In this environment, the company's efforts over the past several years to strengthen its global contracting system in Japan, China and other Asian countries, the U.S., and Europe are now bearing full fruit. The company's ability to undertake large-scale international joint trials on its own means a significant increase in the average spending per order, and is expected to be a driving force in accelerating the company's growth. It remains to be seen whether the company will be able to receive more orders for large-scale international joint trials and how much it will be able to increase its order backlog.

In the business in the U.S., the company steadily completed both existing and new orders, resulting in significant increases in sales and profit over the previous term, and record-high sales and operating income. The company is planning further aggressive business expansion in the U.S., which has the world's largest pharmaceutical market and is expected to expand its CRO market in the future. As the business foundation of the U.S. subsidiary is strengthened, the cash held by the company is also increasing. Although it will not be easy to find an ideal M&A target, we will be keeping an eye on their new M&As to accelerate its growth in the U.S. in the future.

Furthermore, the company has already achieved its mid-range targets for sales in the fiscal year ending March 2023 and operating income in the fiscal year ending March 2025 in the fiscal year ended March 2022 ahead of schedule, as stated in the company's plan to meet the criteria for maintaining its listing. The company plans to revise its mid-range targets in the future. It will be interesting to see what kind of performance targets will be presented, along with new growth strategies for the future.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎Corporate Governance Report

Last updated on December. 28, 2021

The company submitted its latest corporate governance report on December 28, 2021, after applying the corporate governance code

<Basic Policy>

We contribute to the development of medical care as a partner of domestic and overseas bio-ventures and major pharmaceutical companies and medical institutions by playing a role in creating and developing new drugs with our knowledge and technology in the drug development industry. By doing so, we will continue to meet the expectations of patients and society as a whole.

Since our business activities impact people's lives, our executives and employees are required to have high ethical standards as well as expertise. Thus, we thoroughly comply with the Corporate Code of Conduct, including strict compliance with laws. In addition, we strive to improve corporate value and business development by enhancing internal control and ensuring the soundness and transparency of management.

<Regarding the implementation of the principles of the corporate governance code>Major principles for not implementing and the reasons

Principles | Reasons for not implementing the principles |

[Supplementary Principle 1-2④ Exercise of rights at a general meeting of shareholders] | Our company recognize that it is necessary to develop an environment where shareholders can exercise voting rights easily. As for the development of an environment where voting rights can be exercised electronically (such as the use of an electronic voting rights execution platform) and the translation of convocation notices into English, we will discuss them while considering the ratios of institutional investors and overseas investors, etc. |

[Principle 1-3 Basic policy for capital measures] | In order to enhance shareholder value in the medium/long term and actualize sustainable growth, our company will conduct strategic investment for securing financial soundness and sustainable growth. In detail, the basic policy for securing financial soundness is to maintain the level of shareholders’ equity that can tolerate growth investment and risk. As for the strategic investment for sustainable growth, we will allocate internal reserves to the investment for establishing systems for international joint clinical trials, which are indispensable for business development, the enrichment of footholds through M&A, etc. to improve the capital efficiency. As for dividends, which mean the return of profits to shareholders, the basic policy is to optimize the balance between the improvement in our corporate value through mid/long-term growth and return to shareholders, and we aim to return profits in a stable manner. Regarding the above basic policies for capital measures, we will consider providing explanations via our website, etc. |

[Supplementary Principle 2-4 (1) Ensuring diversity in the appointment of core human resources] | We have not set voluntary and measurable targets for ensuring diversity at this time. However, as stated in Supplementary Principle 2-4 (1) of [Disclosure Based on the Principles of the Corporate Governance Code], the group assume that ensuring diversity by employing women and mid-career hires has progressed to a certain extent. Going forward, we will continue to promote the active participation of diverse human resources to create an environment where each employee can maximize their abilities and characteristics and develop these human resources. |

[Supplementary Principle 3-1(2) Promotion of disclosure and provision of information in English based on the ratio of overseas investors] | From the first quarter of the fiscal year March 2022, we began disclosing information in English on the summary of (quarterly) financial statements and consolidated financial statements. In the future, we will also consider disclosing information in English, such as notices of convocation of general meetings of shareholders and material for financial results briefings. |

[Supplementary Principle 3-1 (3) Sustainability Initiatives] | We aim to work with the society toward sustainable growth based on our management philosophy of "pursuing the happiness of our stakeholders, pharmaceutical companies, medical institutions, patients, shareholders, and employees by always providing professional quality in all aspects of drug development." Specifically with the two missions of "supporting the development of innovative drugs" and "ensuring the safety of drugs" in mind, each officer and employee is conscious of their social responsibility and carries out the company activities with integrity. By doing so, we contribute to the healthy and prosperous lives of people worldwide, which would lead to our company achieving sustainable growth and improving corporate value over the medium to long term. Regarding our SDG-related development goals, we are making a substantial effort to achieve SDG 3: "Ensure Healthy Lives and Promote Well-Being for All at All Ages," by contributing to society through our business, which is drug development support. We are also striving to achieve SDG 5: "Achieve Gender Equality" and SDG 8: "Decent Work and Economic Growth" by promoting human resources development and diversity. Based on the above concepts, current situation, and business plan, we are currently considering the basic policy regarding our sustainability efforts, the framework for information disclosure, and concrete vital challenges. |

[Supplementary Principle 4-2 (2) Formulation of basic policy regarding the efforts for the company's sustainability] | As described in [Reasons for not following the principles of the Corporate Governance Code] <Supplementary Principle 3-1 (3) Sustainability Initiatives>, we are reviewing the basic policy and efforts regarding our sustainability initiatives. |

[Supplementary Principle 4-10 (1) Appropriate involvement and advice from independent outside directors by establishing an independent nominating/remuneration committee] | The company currently has two independent outside directors and has established a system for communication and coordination with all directors and management and a system for cooperation with corporate auditors. Thus, there are sufficient discussions at the board of directors regarding nominations and compensation. Therefore, we believe that we have been able to carry out highly effective deliberations and supervision in line with the purpose of the Corporate Governance Code. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

<Principle 1-4 Strategically held shares> | In order to avoid the risk of share price fluctuations and also improve capital efficiency, the company will not hold any listed shares, unless it is necessary to hold shares for cooperation and alliance. |

[Supplementary Principle 2-4 (1) Ensuring diversity in the appointment of core human resources] | 1. Concept of ensuring diversity Our corporate group promotes the active participation of diverse human resources to create an environment where each employee can maximize their abilities and characteristics and develop these human resources. 2. Situation of promotion of the diversity of core human resources (1) Women As of the end of November 2021, the ratio of female employees to all employees at the Japanese headquarters was 44.4%. The ratio of female executive officers was 16.7%, and the ratio of female managers was 19.4%. As of the end of November 2021, the ratio of female employees to all employees in the entire group was 58.6%. The ratio of female executive officers was 25.0%, and the ratio of female managers was 36.5%. (2) Foreigners As of the end of November 2021, the ratio of foreign nationals to all employees at the Japanese headquarters was 6.6%. In addition, the ratio of foreign employees in managerial positions was 1.9%. As of the end of November 2021, the ratio of foreign nationals to all employees based on the country where each company is located was 7.4%. In addition, the ratio of foreign nationals among executive officers was 8.3%, and the ratio of foreign employees of managerial positions was 3.3%. (3) Mid-career hires As of the end of November 2021, the ratio of mid-career hires to all employees at the Japanese headquarters was 40.8%. The ratio of mid-career hires for executive officers is 100%, and the ratio of mid-career hires for managers is 59.7%. As of the end of November 2021, the ratio of mid-career hires to all employees in the entire group was 63.9%. The ratio of mid-career hires for executive officers was 100%, and the ratio of mid-career hires for managers was 70.4%. 3. Human resources development policy for ensuring diversity, in-house environment improvement policy, and its status Based on the concept of ensuring diversity, we have established and implemented the following systems. - In-house systems We implement systems such as a three-day workweek system, a maternity leave system, a childcare leave system, a flextime work system, and a retired employee reinstatement registration system. - Recruitment (Age): We have been hiring a wide range of age groups, that is, people in their twenties to their sixties, in the fiscal year 2021. - Nationality: Since the fiscal year 2017, we have been working on hiring foreign nationalities with numerical targets and hiring them every year. - Training: Since the fiscal year 2019, we have been conducting company-wide training on understanding different cultures every year. |

[Supplementary Principle 4-11 (1) The concept on the board’s balance, diversity, and scale] | Our main business is drug development. For this reason, the board of directors is composed mainly of persons familiar with the operations of the pharmaceutical industry, including new drug development, and have deep knowledge and experience to make swift and accurate decisions and supervise business execution. In addition, we have established a system in which those who have expertise in finance and accounting and experience in the global expansion of the business overseas can actively express their opinions on enhancing governance and growth strategies and have fruitful discussions. The board of directors currently consists of nine members, including two independent outside directors and one female. Furthermore, the two independent outside directors have a wealth of management experience, including serving as presidents and representative directors of other companies. |

[Supplementary Principle 4-11 (3) Evaluation of the effectiveness of the board of directors] | The Company's Board of Directors evaluated its effectiveness through a questionnaire to the ten directors (because a director resigned during the term) and three corporate auditors and discussions based on the questionnaire results. The evaluation was as follows. 1. The composition of the Board of Directors There were many positive answers regarding the number of members, the ratio of internal and external directors, knowledge, experience, specialties, gender, etc. Thus, the composition of the board was evaluated as appropriate. Moreover, enhancing expertise and accumulating experience related to globalization and DX (digital transformation) are desired in order to achieve medium-to-long-term growth. 2. Management of the Board of Directors There were many positive answers regarding points such as the frequency of holding meetings, the preparation of the agenda, the efficiency of material preparation, and early distribution of the material. Thus, it was evaluated as appropriate. 3. Discussion vitality and content There were many positive answers regarding the deliberation time and content, the number of remarks, the quick and flexible decision-making, operation supervision (monitoring), etc. Thus, it was evaluated as appropriate. However, some respondents requested further improvements regarding the prior explanations to outside directors in order to spend more time on strategically important proposals and improve the quality of discussions. In order to ensure the appropriateness and adequateness of decision-making at the Board of Directors, internal directors and executive officers will communicate closely and regularly to deliberate vital matters at management meetings prior to the Board of Directors meetings. As for outside directors, we provide them with material before the Board of Directors monthly regular meetings, and the CFO and the Corporate Planning Office explain the material and conduct Q&A sessions. Based on the above, we have concluded that the Board of Directors is effective. From the fiscal year ending March 2022 onward, we will continue to enhance the deliberations on strategic issues and continue the monitoring and discussions to enhance the board's effectiveness. |

<Principle 5-1 Policy for constructive dialogue with shareholders> | The company has continuous, constructive, transparent, fair dialogue regarding business performance, managerial strategies, capital policies, risks, corporate governance systems, etc. with the following method, in order to foster trusting relationships with the aim of achieving the sustainable growth of corporate value, which is a shared goal of the company and shareholders (including potential institutional and individual investors). Dialogue with shareholders is led by the Managing Director CFO. Considering the purpose and effect of the interview, and the attributes of shareholders, the dialogue method is examined thoroughly by the senior management such as CEO and the Managing Director CFO. As for IR, mainly the financial affairs department and the management planning division gather necessary information from relevant sections of the company, prepare reference material and give explanations in an understandable manner, to enrich the dialogue with shareholders.The company has opportunities to dialogue with shareholders through the annual general meetings of shareholders, results briefing sessions (twice a year), briefing sessions for individual investors (twice a year), meetings with institutional investors and analysts inside and outside Japan at the time of disclosure of quarterly results, the disclosure of IR information via websites, the response to inquiries from individual investors by telephone, email, or the like. Then, the company reflects questions, requests, information on participants in briefing sessions, questionnaire results, etc. in IR activities. Shareholders’ interests and concerns grasped through the dialogue with them are reported to the senior managing director CFO and the information is utilized for analyzing business administration, discussing how to disclose information, etc.Concerning IR activities and the dialogue with shareholders, the company manages insider information appropriately in accordance with in-company rules. The quiet period, in which the company refrains from having dialogue about financial results, is from the day after the closing date of each quarter to the date of brief reporting. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Linical Co., Ltd. (2183) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/