Bridge Report:(2183)Linical Second quarter of the Fiscal Year ending March 2024

Kazuhiro Hatano CEO | Linical Co., Ltd. (2183) |

|

Company Information

Market | TSE Standard Market |

Industry | Service |

CEO | Kazuhiro Hatano |

HQ Address | Shin-Osaka Brick Building, 6-1 Miyahara 1-chome, Yodogawa-ku, Osaka, Japan |

Year-end | End of March |

HP |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥521 | 22,586,436shares | ¥11,767million | 14.2% | 100shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥15.00 | 2.9% | ¥44.63 | 11.7x | ¥353.02 | 1.48x |

* Stock price as of closing on December 7, 2023. Number of shares issued at the end of the most recent quarter excluding treasury shares.

* ROE are based on FY3/23 results. BPS are from the second quarter financial report for the fiscal year ending March 2024. EPS and DPS are based on the estimates of FY3/24.

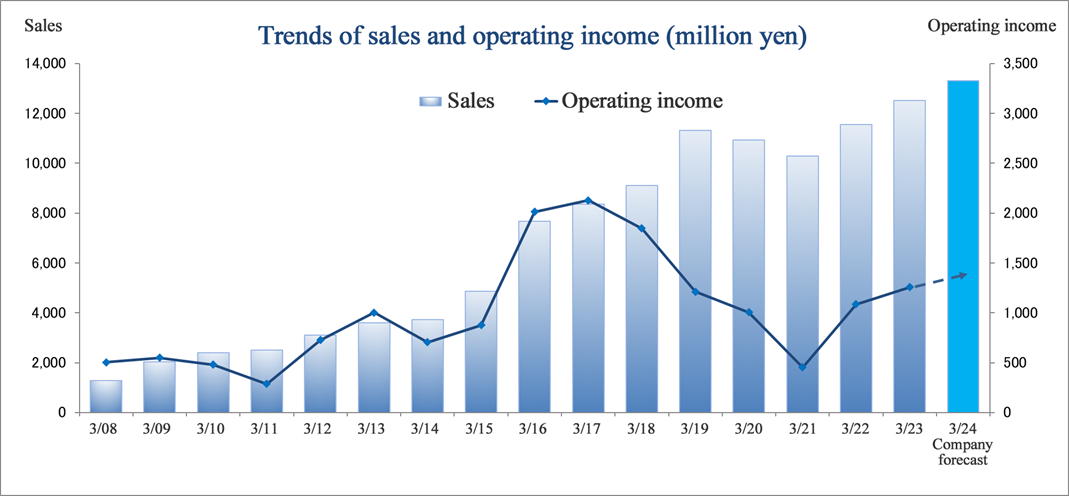

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2020 Act. | 10,935 | 1,005 | 918 | 482 | 21.38 | 14.00 |

March 2021 Act. | 10,279 | 453 | 588 | 539 | 23.91 | 14.00 |

March 2022 Act. | 11,555 | 1,085 | 1,183 | 790 | 35.00 | 14.00 |

March 2023 Act. | 12,516 | 1,256 | 1,283 | 1,004 | 44.47 | 14.00 |

March 2024 Est. | 13,300 | 1,400 | 1,400 | 1,008 | 44.63 | 15.00 |

*Unit: Million yen, yen.

*Estimates are those of the company.

This Bridge Report reviews on the outlook of Linical Co., Ltd.’s earnings results for the second quarter of the fiscal year ending March 2024 and its forecast of the fiscal year ending March 2024.

Table of Contents

Key Points

1. Company Overview

2. Management Strategy

3. Second quarter of the Fiscal Year ending March 2024 Earnings Results

4. Fiscal Year ending March 2024 Earnings Forecasts

5. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- Sales increased 2.4% year on year, and operating income also increased 12.8% year on year in the cumulative second quarter of the fiscal year ending March 2024. In terms of sales, while sales in Europe, etc. declined year on year, the significant increase in sales in the U.S. and the weaker yen contributed to sales growth. In terms of profit, Europe posted an operating loss for the consecutive second quarter, but increases in the U.S. and Japan contributed to the rise in operating income.

- At the end of the second quarter, the earnings forecast for the fiscal year ending March 2024 remains unchanged from its initial forecast calling for a 6.3% year on year growth of sales and a 11.4% year on year increase in operating income. Although the company is struggling in Europe, especially in Eastern Europe, due to the impact of the Ukraine crisis, this is expected to be offset by strong sales in the U.S., where demand for new drug development is robust.The company maintained its dividend forecast of 15 yen/share, up 1 yen/share from the previous fiscal year.

- The company aims to win large-scale global jointly conducted clinical trials contracts solely through the group by strengthening cooperation among its global sites. This would mean a significant increase in average revenue per order and is likely to be a driving force for accelerating the company's growth. We will focus on the company's acquisition of orders for large-scale global jointly conducted clinical trials.

1. Company Overview

The company is a global contract research organization (CRO) based in Japan, which provides a comprehensive range of services ranging from the initial phase of clinical trials to post-marketing studies as a professional in development of pharmaceutical products. Linical Co., Ltd. provides contract research organization (CRO) services that support the drug development processes of pharmaceutical companies on an outsourced consignment basis, and sales and marketing functions for pharmaceutical products and post market launch clinical research and surveys on a consigned basis in the Contract Medical Affairs Business (CMA).

Pharmaceutical products are subject to approval of the Ministry of Health and Welfare prior to their sales, and efficacy and safety of pharmaceutical products must be confirmed through clinical trials prior to their approval. Companies providing clinical trial support services are known as contract research organization (CRO) service providers. In addition, there is a need to conduct surveys and clinical research after pharmaceutical products have been launched into the market and contract medical affairs is a service provided to support these efforts.

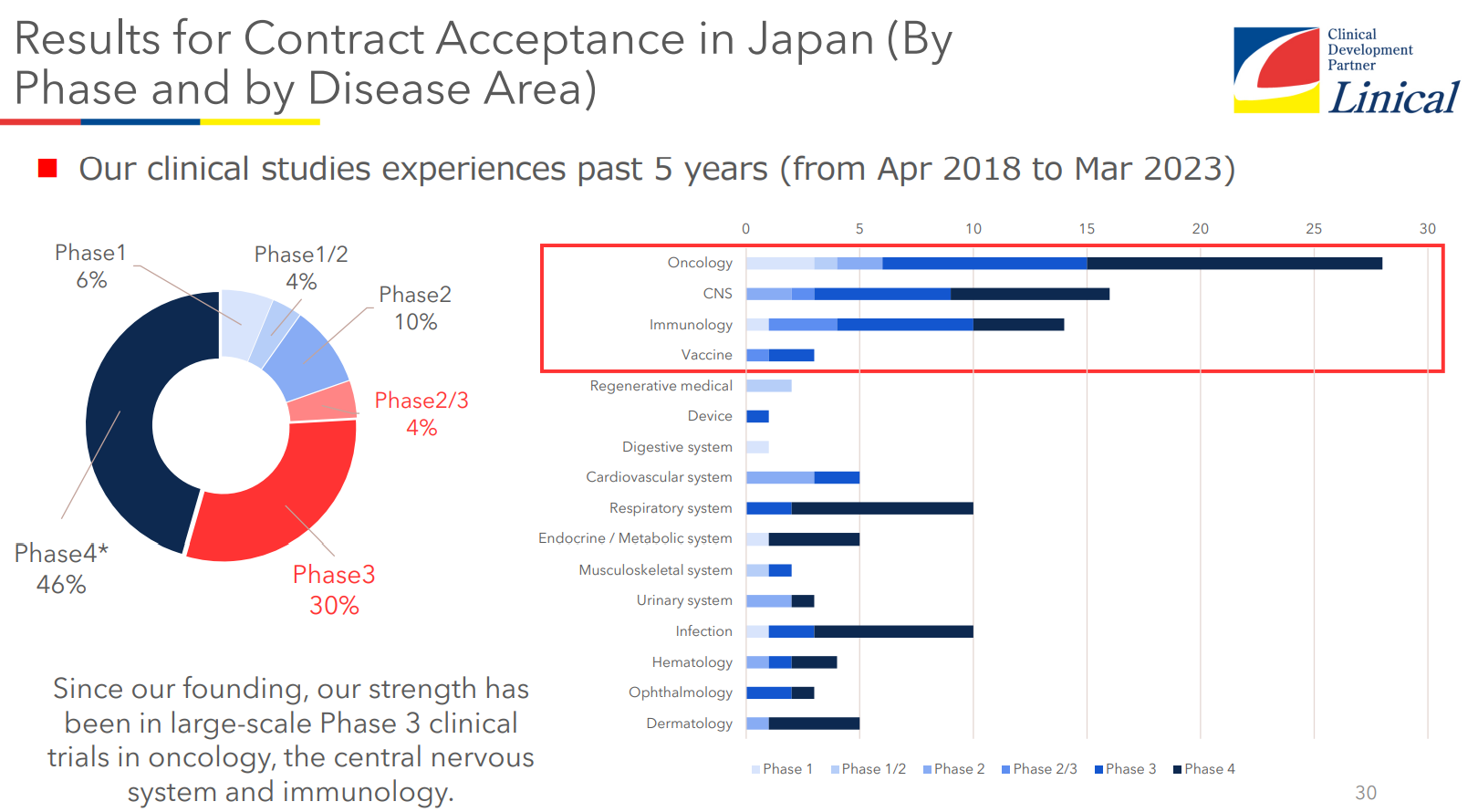

Linical has conducted various efforts to eradicate oncology, central nervous system and other diseases globally since its founding, and it has deployed its CRO Business in therapeutic areas where there is strong demand for new drug development. These are highly difficult areas, and Linical is able to support high level clinical trials in these areas by the company’s knowledgeable and experienced experts. In addition, Linical focuses its efforts up the new drug development support and Contract Medical Affairs Business, approval application support and post approval marketing and clinical research, and post market survey support services, which exceed the traditional definition of outsourcing and is now considered to be part of a wider range of consulting services provided to customers as a "true clinical development partner". Furthermore, amidst the advance of globalization and large-scale pharmaceutical product development, the Linical Group can provide "one stop shopping" type comprehensive services for large scale global products. Consequently, Linical is able to play the role of a strategic business partner by providing total support to help raise the competitive advantage of customers in the market and to help pharmaceutical companies develop new future business opportunities.

Furthermore, Linical has a contract-based business style and is establishing a highly profitable structure. It is focusing on specific areas, specific clinical trials (i.e., Phase II and Phase III).

【Management philosophy】

The management philosophy is “Linical promotes the greater wellbeing of all our stakeholders—patients, clients and employees— we strive constantly to offer professional, high-quality services to support all aspects of new drug development.”

The blue color represents “Integrity&Honesty,”

the red color “Unending Enthusiasm,” and

the yellow color “Continuing Spirit of Inquiry.”

This corporate logo depicts the company’s hope of pursuing the wellbeing of patients around the world through business, and the company has the mission to “wings to new drugs.”

【Corporate History】

Linical Co., Ltd. was established in June 2005 by nine members who worked at Fujisawa Pharmaceutical Co., Ltd. (Currently known as Astellas Pharma Inc.) on the development of immunosuppressant drugs. Established with the objective of becoming the ideal drug development outsourcing (CRO) company from Osaka, Linical focused its efforts upon the realms of central nervous system diseases (CNS) and oncology since its founding, and received one of its first orders from Otsuka Pharmaceutical Company shortly after its establishment. Thereafter, the Company fortified its staffing as part of its efforts to strengthen its order taking capabilities. In addition, Linical is benefitting from the bountiful experiences of its employees in the realm of oncology pharmaceutical product development and experiences having worked at foreign pharmaceutical companies. Consequently, Linical is successfully expanding orders in the near term.

With its advance into the site management organization (SMO, clinical trial facility support organization) business, Aurora Ltd. was turned into a subsidiary in January 2006. However, all shares held in Aurora were later sold in May 2007 in order to focus management resources upon the CRO Business. In July 2008, Linical USA, Inc. was established in California, United States to provide support to Japanese pharmaceutical companies seeking to enter the United States market. Also, in October of the same year, Linical listed its shares on the Mothers Market of the Tokyo Stock Exchange, and subsequently moved its listing to the First Section of the Tokyo Stock Exchange in March 2013. In May 2013, Linical Taiwan Co., Ltd. and Linical Korea Co., Ltd. were established in Taiwan and Korea respectively. In April 2014, Linical teamed up with its Linical Korea to acquire the Korean CRO company P-pro. Korea Co., Ltd. On October 29, 2014, all of the shares of Nuvisan CDD Holding GmbH, which conducts CRO Business in Europe, were acquired and it was converted to a 100% owned subsidiary effective on November 30, 2014. In order to strengthen the collaboration within the Group, the company name of Nuvisan CDD was changed to Linical Europe GmbH on December 1, 2014. In addition, Linical U.K. Ltd. was established in March 2016, and a local subsidiary called Linical Poland SP. Z.O.O. was also established in October of the same year. Moreover, LINICAL Czech Republic s.r.o was established in September 2017. In addition, Accelovance, Inc. was acquired in April 2018 and its company name was changed to Linical Accelovance America, Inc. This acquisition has contributed to a strengthening of Linical's consignment structure for global jointly conducted clinical trials. In addition, Linical Hungary Kft. was established in March 2019, and Linical China Co., Ltd. was established in May 2019. Furthermore, the company further strengthened their system for undertaking global joint clinical trials, through the enhancement of their business in the European region by integrating the European subsidiary of Linical Accelovance America, Inc. (LAA) into LINICAL Europe GmbH in December 2019, and the establishment of a Shanghai branch in February 2020.

In April 2020, Linical Benelux BV and Linical Accelovance Europe BV were merged to form Linical Netherlands BV, and Linical China Co., Ltd. and Linical Accelovance China Ltd. are scheduled to be integrated in the fiscal year ending March 2023.

The company grew steadily through overseas mergers and acquisitions, and achieved record sales consecutively in fiscal year ended March 2022 and fiscal year ended March 2023. In addition, operating income margin recovered to a level above 10%.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

【Business Description】

As a global CRO founded in Japan, the company operates primarily in Japan, and also in Asia, Europe and the U.S, providing a comprehensive range of services ranging from the drug discovery stage to clinical development to post-marketing drug development. The company has extensive experience and achievements in the trending areas of drug development, notably in oncology, neurology , and immunology.

A CRO is an organization that receives requests from pharmaceutical companies and others to act on their behalf and provide support for clinical trials conducted during the development phase of a pharmaceutical product. It is an organization with high expertise in clinical trials and is a professional in the field of drug development. The scope of work includes monitoring activities to ensure that clinical trials are conducted in compliance with regulatory requirements and the clinical trial protocol, including data management and medical writing activities.

Linical mainly conducts contract research organization (CRO) business, post market launches clinical trial and clinical research and marketing support activities in the Contract Medical Affairs Business, and new drug development support business.

As a true partner, the company contributes to the maximization of the value of the medical drugs by helping the procedure from the non-clinical tests to clinical development and after-release surveys and clinical trial, and making it possible to shorten the time needed to start selling the drugs and prolong the life-cycle of the products. On top of that, the company supports not only pharmaceutical companies but also the bio-ventures in various ways including exit strategies.

(Source: Linical)

CRO Business (Contract Research Organization)

The CRO business undertakes part of the clinical trial operations conducted by pharmaceutical companies, including monitoring, data management, medical writing, pharmacovigilance, statistical analysis, and quality control. The company has opened facilities in Asia (Korea, Taiwan, Singapore, China), Europe and the United States to be able to respond to growing demand for global studies. Linical provides "one stop shopping" services ranging from pharmaceutical affairs to planning, implementation plan creation, monitoring, data management, statistical analysis, and pharmacovigilance. With regards to global jointly conducted clinical trials, Linical headquarters operates a function where personnel within depth knowledge about various countries pharmaceutical product development work. These personnel are able to provide information necessary to establish a development environment that can enable global jointly conducted clinical trials to be conducted in Japanese. Among the new drug development projects spanning from 10 to 20 years, Linical is specialized in the processes of “Phase II” and “Phase III” that require 3 to 7 years targeting patients who are particularly important in clinical trials, and it provides “monitoring” services that are the core of the clinical trials in the contract-based business style in conjunction with “quality control” and “consulting.” It collects highly reliable data and supports the rapid and reliable development of new drugs. Furthermore, it focuses on major pharmaceutical companies with abundant drug development information and is specialized in the oncology and CSN disease realms with a strong demand for development from markets as well as the other challenging realms to respond to its customers’ needs (i.e., pharmaceutical companies).

In addition, the company offers high-quality services in the fields of schedule management, standard procedure documents for clinical trials, compliance with GCP, the reliability of data and case reports, etc.

* Global jointly conducted clinical trials

“Global jointly conducted clinical trials” refers to conducting clinical trials simultaneously in multiple countries or regions in order to develop new drugs on a global scale and aim for early launch.

*GCP (Good Clinical Practice)

“GCP” is the international rule the companies are supposed to obey when they conduct the clinical trial. It is enacted by Ministry of Health, Labor and Welfare as a ministerial ordinance so that they can conduct it properly in Japan.

Contract Medical Affairs Business

In the contract medical affairs business, the company provides support for the organizational structure and construction of corporate and doctors-led clinical research, as well as planning for surveys, monitoring, and auditing services for post-release clinical trials and investigations. The Clinical Trials Act is enacted, and the environment surrounding clinical research is changing drastically. Under this circumstance, to obtain information in a timely manner and be the best partner for the medical affairs department of pharmaceutical companies, Linical provides full-service support including data management and statistical analysis with a focus on monitoring and research administration works of clinical trials. It covers clinical trials that are compliant with J-GCP, ethical guidelines, the Clinical Trails Act and/or ICH-GCP, providing services for all regulations. Furthermore, it offers services in the realms of primary and CNS from the beginning of the company’s establishment. It has also strengthened the oncology realm, and more than half of the monitors are experienced in that realm. It has a policy to respond to the latest regulations and contribute to the creation of evidence in the challenging areas based on the know-how cultivated in the past development works.

Innovative Drug Development Business

Following the existing CRO Business and Contract Medical Affairs Business, Linical is cultivating the third business called Innovative Drug Development Business. In the innovative drug development business, the company conducts market analysis, pharmaceutical affairs support, design of development strategies, and partnering support. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided. With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

【Services】

Strategy for drug development

Protocol Development and Study Design | The company has a track record in protocol development and study design, resulting in numerous successful clinical developments. It formulates a plan according to the project's needs and develop a roadmap for high-quality, efficient testing while mitigating risks. |

Regulatory Consulting | The company is an expert in global drug development and provides world-class consulting services in pharmaceutical affairs. It proposes the most appropriate strategies and assists in the most cost-effective and fastest response in the pharmaceutical process. |

Regulatory Affiras | The pharmaceutical affairs team at the company has extensive expertise and experience in supporting early to late-phase clinical development. Furthermore, they understand both regulatory and clinical affairs and provide comprehensive support for drug and medical device development, including regulatory application strategies, support for meetings with regulatory authorities, as well as coordination during the initiation of clinical trials. The company has extensive experience working with clients in the U.S, Europe, and Asia. |

Quality Assurance | The company places the highest emphasis on quality. It offers services worldwide, from developing SOP to QA consulting to auditing. |

Medical Writing | Medical writing is essential for clear communication and consistency in the preparation of documents related to clinical trials, as well as to ensure the safety of subjects and deal with regulatory reviews. The company aims to provide additional value through high-quality medical writing by utilizing its high level of expertise to meet the client's requirements. |

Clinical trials

Feasibility and Study Set-up | To conduct feasibility studies and select medical facilities to initiate clinical trials more swiftly. With a practical and strategic approach based on extensive field experience, the company works closely with clients to understand their objectives, propose innovative solutions, and initiate clinical trials to ensure prompt completion of incorporation. |

Project Management | The experienced project team of the company works as a partner with clients, assisting them until the completion to ensure that the trials are on schedule, within a budget, and obtain data of the expected quality. Furthermore, the company accompanies clients on projects to ensure that their needs are satisfied, responding quickly to their requests while leveraging its previous experience. |

Pharmacovigilance | The pharmacovigilance of the company is a global team of experts. They provide rapid and accurate support to clients in responding to safety information. |

Clinical Monitoring | Monitoring is essential for protecting the human rights and safety of subjects as well as ensuring regulatory compliance, data quality, and the integrity of clinical trial results. Since its establishment, the company has specifically dedicated itself to monitoring and is renowned for its quality among its clients. |

Data Management and Biostatistics | The data management and biostatistics of the company are aimed at providing both deep insights and efficiency at every stage of the process. The professionals of the company perform everything ranging from consulting to full-service data management to statistical design. |

Patient Recruitment | Finding suitable subjects for clinical trials is not easy, and the inclusion of cases is the major factor in the success or failure of a clinical trial, which can lead to significant delays in the trials and losses. It is essential for the success of a clinical trial that the recruitment plan for subjects is carefully considered. |

Training | The CRA training offered by the company provides more practical training, with lectures given by skilled professionals and clinical trial managers (CTMs) from clinical sites, enabling trainees to become excellent clinical development monitors with exceptional monitoring skills. |

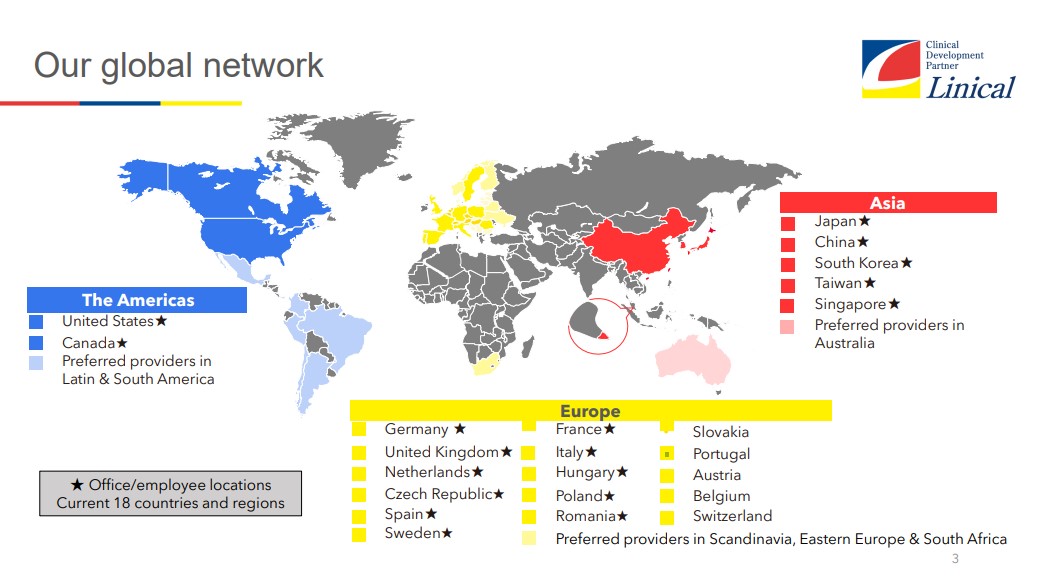

【Global expansion】

The company is a global CRO based in Japan, with a focus on Japan, it is operating its offices around the world, including Asia, Europe and the U.S. The company operates in about 20 countries/regions, and about 30 countries/regions if countries where it can provide services through partners are included. Experts in each function, who are familiar with local regulations and customs, work together globally to provide detailed services customized to each and every project.

LINICAL Global Base “Three Main Operating Regions of “Japan and Asia, United States, Europe”

(Source: Linical)

(Source: Linical)

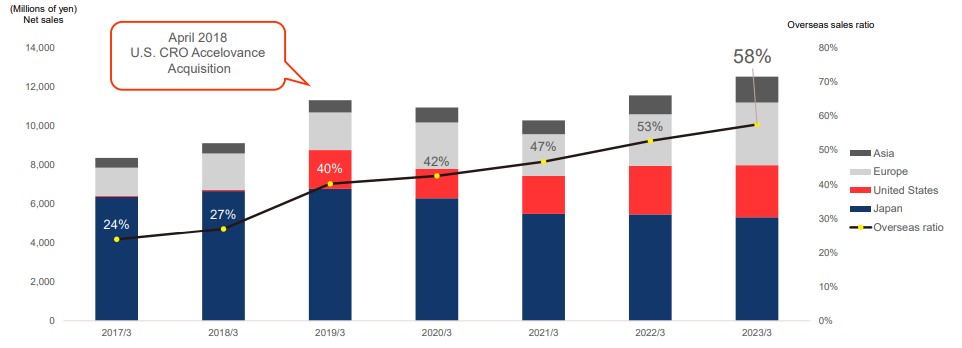

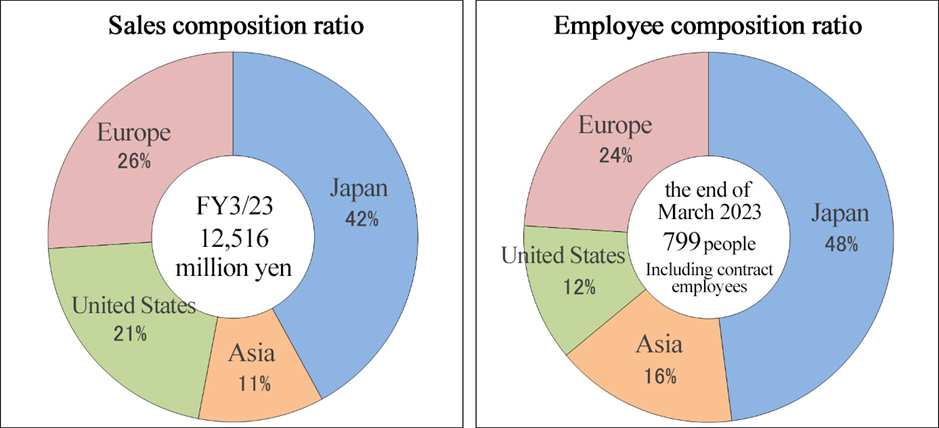

The ratio of overseas sales has gradually increased, reaching 58% in the fiscal year ended March 2023. As a global CRO, the office in each region collaborates to perform global jointly conducted clinical trials.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

Although the number of orders decreased from the end of the previous fiscal year due to the cancellation of large-scale tests in Europe, the U.S, and Japan, order backlog has remained high, with steady sales, as a result of the tripolar structure established in Japan/Asia, the U.S., and Europe.

2.Management Strategy

According to “The Global Use of Medicines 2022 OUTLOOK TO 2026” of IQVIA, the scale of the global pharmaceutical market is expected to grow from 1,423 billion US dollars in 2021 to 1,750 billion-1,780 billion US dollars in 2026 with an annual growth rate of 3-6% on average. It is projected that the U.S. market will account for 40.2% of the global market, the European market (UK, Germany, France, Italy, and Spain) 15.4%, the Chinese market 12.4%, and the Japanese market 5.2%. While the global pharmaceutical market will grow, the CRO market is expected to expand as well. Under these circumstances, only Japan is forecast to see negative growth among developed countries, so it is indispensable to expand business around the world, including the U.S., which has the largest market.

【Sales and the number of employees in each region (as of the end of March 2023)】

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

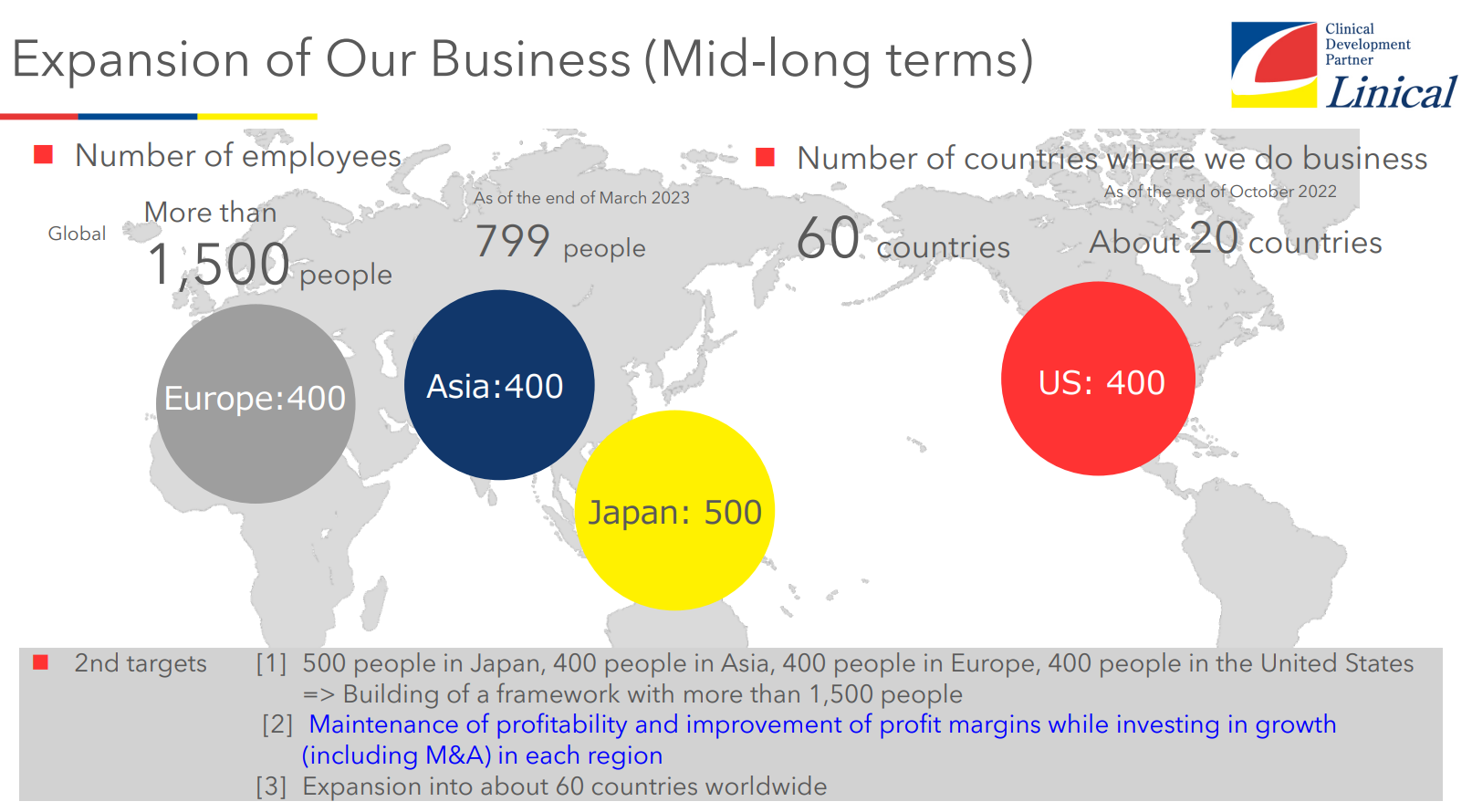

【Medium and Long term Goal】

(1) To build a system with more than 1,500 employees where there will be 500 in Japan, 400 in Asia, 400 in Europe, and 400 in the U.S.

(2) To maintain and improve profitability while making growth investments (including M&A) in all main business regions

(3) The company will expand its business to about 60 countries around the world. While taking time differences into consideration, the company will consider expanding its coverage area in each Japan, the U.S., and Europe. Having a base in the southern hemisphere will enable the company to conduct clinical trials for seasonal diseases all year round.

(Source: Linical)

【Initiatives to strengthen profitability】

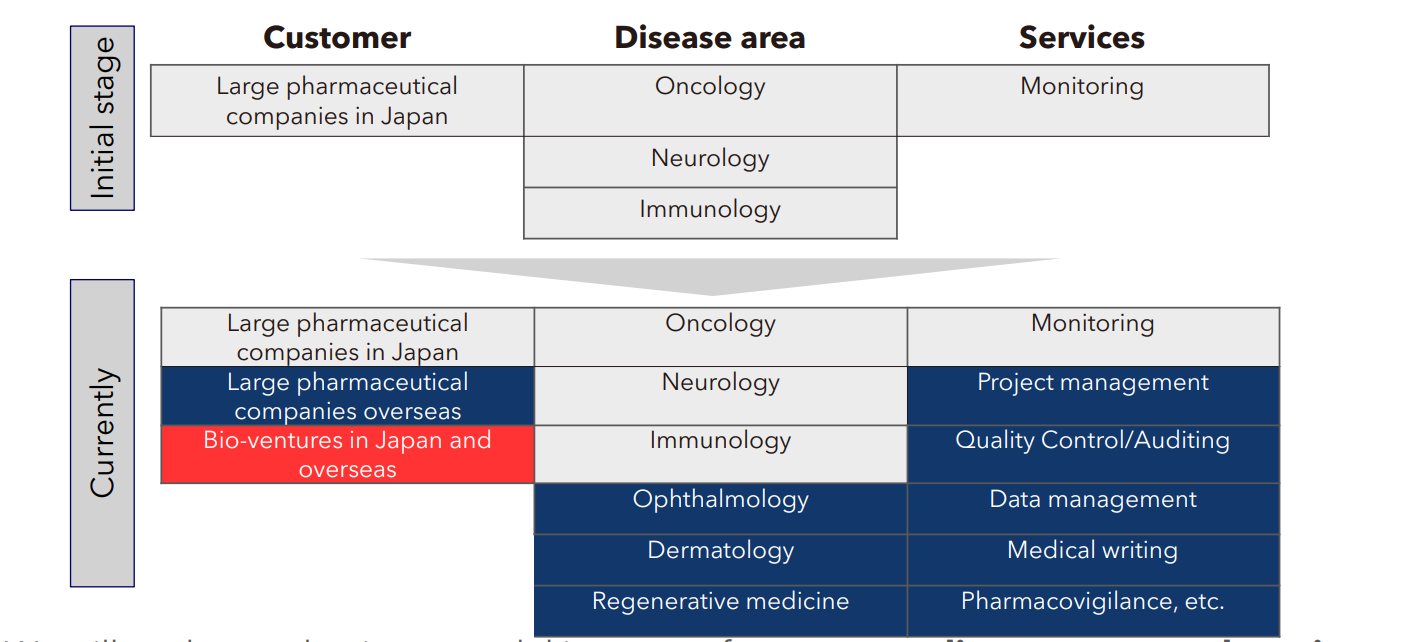

The company will evolve business models in terms of clients, disease areas, and services in light of changing market conditions and client needs.

(Source: Linical)

【Approaches and strategies for biopharma companies】

The development of new pharmaceutical products by emerging biopharma companies is increasing. In 2022, the proportion of new pharmaceutical products developed by emerging biopharma companies* accounted for 67% of the world's new pharmaceutical products. Biopharma companies play a vital role in the drug discovery process. The client base of the company, which was initially limited to major domestic pharmaceutical companies, has now expanded to include major foreign pharmaceutical companies and domestic/foreign biotech ventures.

In the U.S, following the acquisition of overseas CROs, the company has taken over the original client base, with some having grown significantly from ventures. The company plans to proactively approach biopharma companies, which continue to grow their presence in the future as well.

Emerging biopharma companies have a growing need for CROs to provide support to CROs that have extensive experience and know-how while being flexible to their own size and needs. In response to these needs, the company aims to differentiate itself from major global CROs by integrating its global one-stop CRO services with detailed solution proposals designed to meet the needs of its clients.

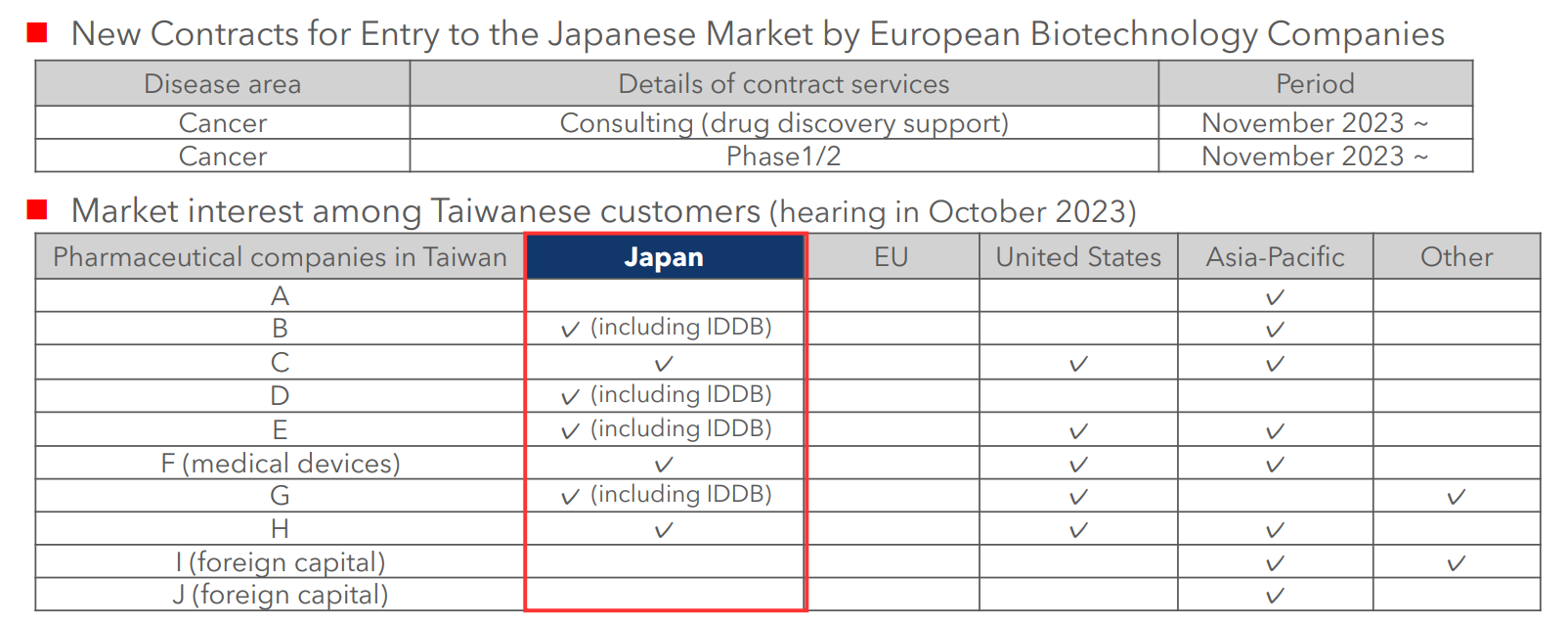

Furthermore, emerging biopharma companies wish to enter the Japanese pharmaceutical market to distribute and sell their products. However, they lack sufficient knowledge of the Japanese market/pharmaceutical regulations, adequate development/sales capabilities, and need a strategic partner/licensee. The company intends to respond to these needs by developing packages with the Innovative Drug Development Business as an entry point.

*Companies with annual sales of 500 million US dollars or less and R&D expenditure of 200 million US dollars or less, Source: IQVIA Institute.

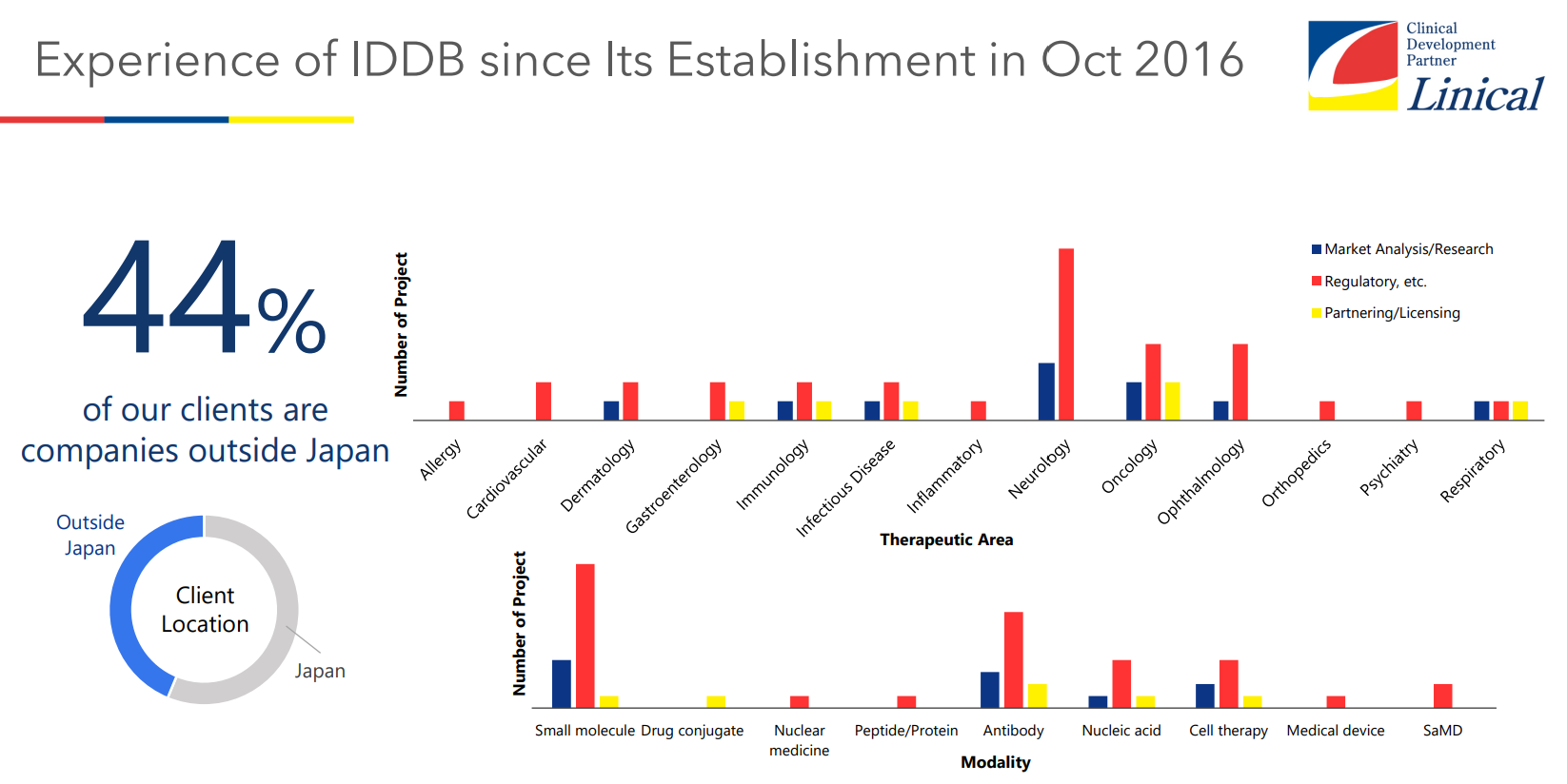

【Strategies with Innovative Drug Development Business as an entry point】

The Innovative Drug Development Business of the company has the following two features. The first is the ability to provide three services: (1) Market Analysis and Research, (2) Development&Regulatory Strategies and PMDA Consulting, and (3) Strategic Partnering/Licensing to meet various client needs. The second is having a highly experienced group of professionals. The company has employed professionals with extensive years of experience in a wide range of drug development tasks in major pharmaceutical companies and academia. Furthermore, in line with business expansion, the company has expanded its workforce both internally and externally in fiscal year 2023. Since the commencement of the Innovative Drug Development Business in October 2016, approximately 44% of its clients have been overseas companies, and the company is steadily expanding its track record in a wide range of disease areas and modalities. The company plans to continue expanding its clinical trial contracting services through the Innovative Drug Development Business as an entry point.

(Source: Linical)

【Responding to growing interest of overseas clients in the Japanese market】

In the post-pandemic period, there is a growing need for global jointly conducted clinical trials, including those in Japan, among overseas and domestic companies. On the other hand, approximately 70% of pharmaceutical products containing new active ingredients approved in Europe and the U.S in the last five years have not yet been approved in Japan. This is partly due to the fact that an additional Phase 1 trial with Japanese is required when conducting global jointly conducted clinical trials in Japan. Against this background, on September 13, 2023, the Ministry of Health, Labour and Welfare (MHLW) stated that, in principle, it is not mandatory to conduct an additional Phase I trial with Japanese prior to global jointly conducted clinical trials. Although there were concerns about delays in the development of Phase III trials (drug lag) and non-participation in Japanese development (drug loss) due to the certain amount of time and expense required to conduct additional Phase I trials with Japanese subjects, the possibility of lowering the hurdle to the participation of Japan in global jointly conducted clinical trials has increased. The company aims to expand its contracting services for global jointly conducted clinical trials, including those in Japan, using its tripolar structure of "Japan/Asia, USA, and Europe."

(Source: Linical)

(Source: Linical)

3.Second quarter of the Fiscal Year ending March 2024 Earnings Results

(1) Consolidated results

| FY3/23 2Q Cumulative | Ratio to sales | FY3/24 2Q Cumulative | Ratio to sales | YoY | |

Sales | 5,920 | 100.0% | 6,064 | 100.0% | +2.4% | |

Gross profit | 1,840 | 31.1% | 1,984 | 32.7% | +7.8% | |

SG&A | 1,467 | 24.8% | 1,563 | 25.8% | +6.6% | |

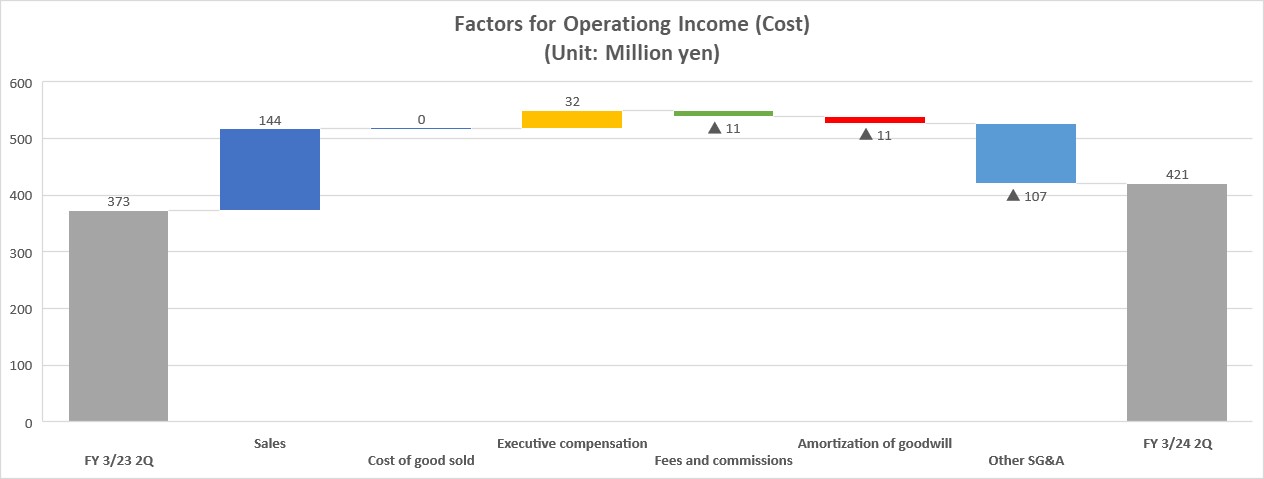

Operating Income | 373 | 6.3% | 421 | 6.9% | +12.8% | |

Ordinary Income | 614 | 10.4% | 483 | 8.0% | -21.3% | |

Parent Quarterly Net Income | 468 | 7.9% | 178 | 3.0% | -61.8% | |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd., and may differ from actual figures. (Abbreviated hereafter)

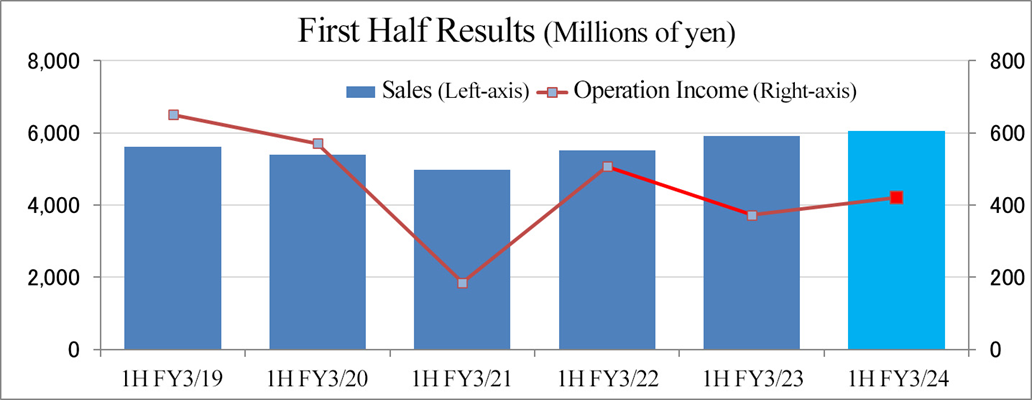

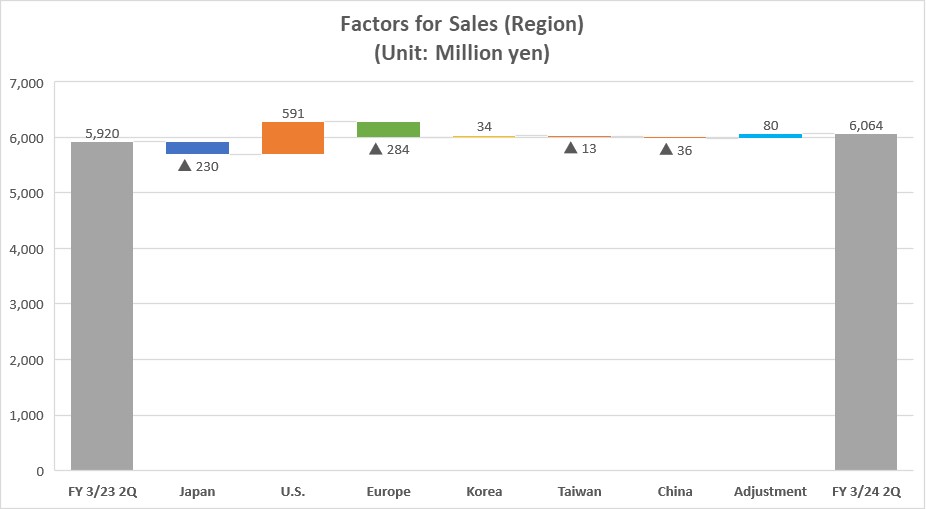

Sales grew 2.4% year on year, while operating income grew 12.8% year on year.

Sales increased 2.4% year on year to 6,064 million yen, and operating income also increased 12.8% year on year to 421 million yen.

In terms of sales, while sales in Europe, etc. declined year on year, but overall sales increased due to robust sales in the U.S. as well as the weaker yen.

In terms of profit, operating income grew year on year due to increases in the U.S. and Japan, despite an operating loss posted in Europe like in the first quarter. Gross profit margin increased 1.6 percentage points year on year to 32.7%. SG&A expenses increased 6.6% year on year due to higher travel expenses, commissions paid, and amortization of goodwill. As a result, the ratio of operating income to sales increased 0.6 percentage point year on year to 6.9%. On the other hand, ordinary income declined 21.3% year on year to 483 million yen, mainly due to a 196 million yen year on year decrease in foreign exchange gains on foreign currency deposits in non-operating income. Net income attributable to owners of parent decreased 61.8% year on year to 178 million yen, mainly due to the absence of insurance income of 50 million yen posted as extraordinary income in the same period of the previous year and business restructuring expenses of 147 million yen posted as extraordinary losses in the current fiscal year in connection with the integration of business management systems of subsidiaries in Europe and the U.S.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

Sales and profit by segment

In the CRO Business, sales grew 3.9% year on year to 5,682 million yen and operating income increased 36.3% year on year to 1,382 million yen. In the Contract Medical Affairs Business, sales decreased 15.5% to 381 million yen, and operating income dropped 33.4% to 109 million yen.

(2) Performance trend in each region

Earnings results by regions

| FY3/23 2Q Cumulative | FY3/24 2Q Cumulative | ||||

Sales | Operating income | Sales | YoY | Ordinary income | YoY | |

Japan | 2,912 | 341 | 2,682 | -7.9% | 370 | +8.6% |

U.S. | 1,407 | 42 | 1,998 | +42.0% | 304 | +613.2% |

Europe | 1,862 | 120 | 1,578 | -15.3% | -118 | - |

Korea | 408 | 36 | 442 | +8.3% | 14 | -60.2% |

Taiwan | 63 | -15 | 50 | -20.1% | -16 | - |

China | 201 | 21 | 165 | -17.9% | 1 | -95.3% |

Adjustment | -933 | -172 | -853 | - | -134 | - |

Total | 5,920 | 373 | 6,064 | +2.4% | 421 | +12.8% |

*Unit: million yen

*Amortization of goodwill is recorded as an adjustment. “Sales” means the value before exclusion of internal transactions.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

【Japan】

In Japan, although the clinical trial environment has improved as the COVID-19 infection was reclassified into Class 5, and the company has steadily completed orders and recorded sales, sales declined year on year due to the significant impact of the cancellation of an existing project in the first quarter. Operating income, on the other hand, increased year on year due to cost reduction and other factors. The company will continue its efforts to curtail expenses and receive orders for new projects.

【Korea】

In South Korea, sales increased year on year due to the steady progress of existing projects and the start of several new projects, as well as the impact of the depreciation of the yen. On the other hand, operating income declined year on year due to upfront human resource investment.

【China】

In China, both sales and profit declined year on year due to a decrease in sales following the settlement of existing projects.

【Taiwan】

In Taiwan, sales declined year on year, and an operating loss was recorded due to the cancellation of an existing project and the postponement of the start of a new project.

In Asia, the company is focusing on increasing orders from local pharmaceutical companies by strengthening sales ties with Japan and the U.S., and it has been approached by several new clients.

【United States】

While there were delays in the start of large-scale global jointly conducted clinical trials in the U.S. and Europe in the same period of the previous year, the progress of existing projects exceeded expectations in the current fiscal year, and the depreciation of the yen led to a significant increase in sales and profit from the same period of the previous year. The company is receiving many inquiries from biotech companies in the U.S. and will continue to focus on deepening the U.S. CRO market to achieve sustainable growth.

【Europe】

In Europe, sales decreased year on year, and the company recorded an operating loss due to the cancellation of existing trials, postponement of the start of new projects, lower-than-expected progress in existing trials, and lower-than-expected new projects due to the challenging environment for bio ventures, in which it is difficult to raise funds. The European economy continues to experience high energy prices and high inflation due to heightened geopolitical risks such as the Russia-Ukraine conflict, and the high-interest rate policy to cope with these risks is negatively impacting the economic situation in Germany and other European countries. In order to cope with such deteriorating business confidence in Europe, the company will further promote collaboration with its U.S. operations and further strengthen global synergies in terms of sales to win new orders from U.S. companies, including those in Europe.

【Goodwill balance and remaining amortization period (at the end of FY2023/3)】

| Goodwill | Related intangible assets other than goodwill *2 | ||||

Balance at end of term | Remaining Amortization Period (year) | Annual Amortization *3 | Balance at end of term | Remaining Amortization Period (year) | Annual Amortization *3 | |

Korea | Termination of depreciation in FY 3/19 | Termination of depreciation in FY 3/19 | ||||

Europe*1 | 1,326 | 10-11 | 129 | 10.8 68.7 | 4 7.75 | 2.7 8.9 |

United states*1 | 2,058 | 11 | 187 | 40 | 4 | 10 |

Total | 3,384 | - | 316 | 119.5 | - | 21.6 |

*Unit: million yen

*1 Goodwill generated by the acquisition of Linical Accelovance America, Inc., has been apportioned pro rata to its European subsidiary.

*2 Intangible assets other than goodwill recognized by purchase price allocation.

*3 Figures have been converted at the exchange rate as of the end of the fiscal year ended March 2023.

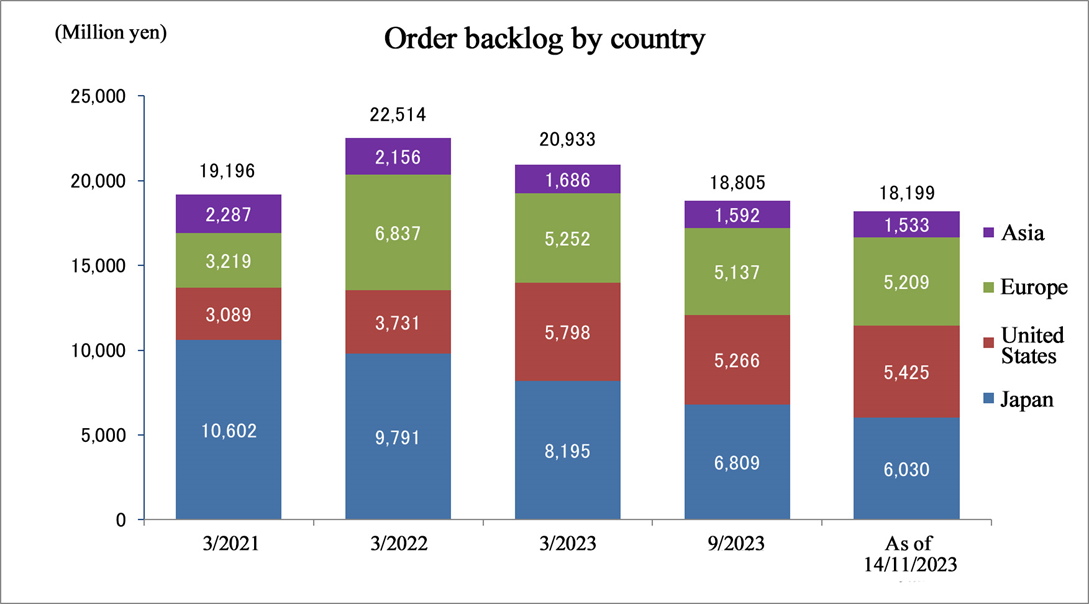

(3) Change in order backlog

| End of FY 3/23 (A) | End of FY 3/24 2Q | As of November 14, 2023 (B) | Difference from the end of the previous term (B-A)/(A) |

Japan | 8,195 | 6,809 | 6,030 | -26.4% |

United States | 5,798 | 5,266 | 5,425 | -6.4% |

Europe | 5,252 | 5,137 | 5,209 | -0.8% |

Asia | 1,686 | 1,592 | 1,533 | -9.1% |

Total | 20,933 | 18,805 | 18,199 | -13.1% |

*Unit: million yen

In the CRO business, the total amount of clinical trials commissioned to the company, which has an implementation period of one to three years, is determined by the difficulty of the clinical trials due to the number of cases and the target disease. A consignment contract is concluded with the client for this implementation period, and sales are generated according to the contract.

In the Contract Medical Affairs Business, the company enters into a consignment contract with a client for a similar period of time, and sales are generated in accordance with the contract.

The order backlog is the balance of orders received for contracted services for which contracts have already been concluded. This is an indicator of sales that will occur over the next one to five years, and is the basis for the company's future earnings forecasts.

As of November 14, 2023, order backlog was 18,199 million yen, down 13.1% from the end of the fiscal year ended March 2023.

In Japan and Asia, despite the receipt of new orders and contract changes that increased labor hours, orders were steadily completed, and their sales were recorded as the COVID-19 infection was reclassified into Class 5, and the clinical trial environment in Japan improved. In addition, there were contract changes that led to the early termination of trials. All these factors resulted in a backlog decrease. On the other hand, there are new projects that are not included in the order backlog as the company is in the process of concluding their contracts after receiving informal orders, and the company has been approached about several new projects and is continuing sales activities to build up order backlog.

In the U.S., order backlog has decreased since the end of the fiscal year ended March 2023 as a result of the steady progress of contract work, which led to the fulfillment of orders and the recording of their sales, despite the conclusion of contracts for several new projects and contract modifications that increased the labor hours involved. On the other hand, there are new projects that are not included in order backlog as the company is in the process of concluding their contracts after receiving informal orders. The company continues to receive many inquiries from biotech firms with a strong appetite for development, and has been approached with multiple projects, including global projects, and is continuing sales activities to build up order backlog.

In the European region, order backlog has decreased since the end of the fiscal year ended March 2023 as a result of the fulfillment of existing orders and the recording of their sales, despite the receipt of new orders and contract modifications that increased the labor hours involved. On the other hand, there are new projects that are not included in the above order backlog, as the company is in the process of concluding their contracts after receiving informal orders. Although there is a sense of slowdown in the European economy and uncertainty about the future environment for orders, the company is continuing its sales activities to increase orders. In addition, by further promoting collaboration with the U.S. business and further strengthening global synergies in terms of sales, the company aims to increase orders for new projects from U.S. companies, including those in Europe.

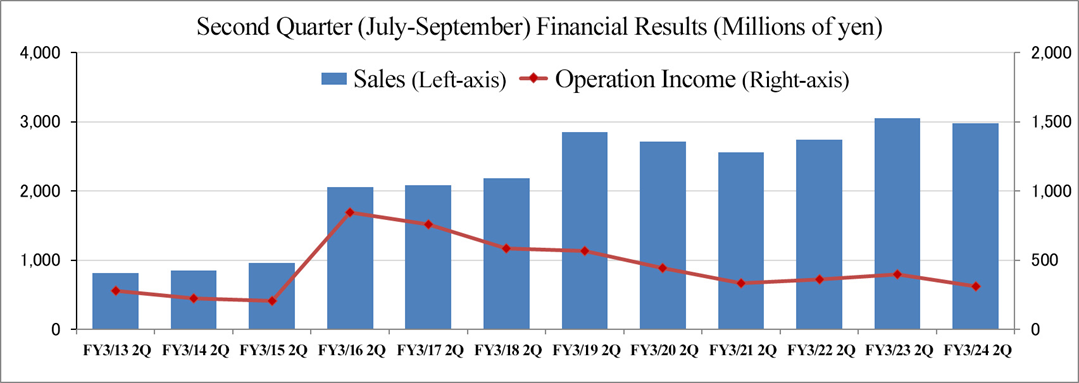

(4) Variation in performance in the second quarter (July to September)

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

In the second quarter (July-September) of the fiscal year ending March 2024, both sales and profit declined year on year. On the other hand, compared to the previous quarter (April-June), sales declined slightly, but profit rose sharply. Compared to the second quarter (July-September) of the previous fiscal year, sales were at a high level.

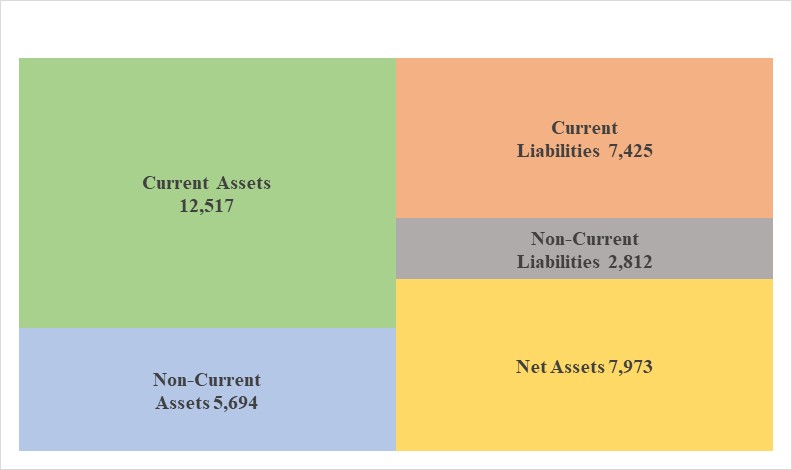

(5) Financial Conditions and Cash Flow(CF)

Financial Conditions

| March 2023 | September 2023 |

| March 2023 | September 2023 |

Cash | 7,042 | 7,316 | ST Interest-Bearing Liabilities | 1,139 | 1,139 |

Receivables and contract assets | 3,427 | 3,395 | Payables, Accrued Expenses | 955 | 917 |

Advance payment | 1,037 | 1,080 | Advances received | 2,207 | 2,447 |

Current Assets | 12,008 | 12,517 | LT Interest-Bearing Liabilities | 2,402 | 2,069 |

Tangible Assets | 625 | 545 | Liabilities | 9,883 | 10,238 |

Intangible Assets | 3,511 | 3,793 | Net Assets | 7,581 | 7,973 |

Investments and Others | 1,319 | 1,354 | Total Liabilities and Net Assets | 17,464 | 18,211 |

Noncurrent Assets | 5,455 | 5,694 | Total Interest-Bearing Liabilities | 3,542 | 3,209 |

* Unit: million yen

* Interest-bearing liabilities=Borrowings + Lease Obligations

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

Total assets at the end of September 2023 increased 747 million yen from the end of the previous period to 18,211 million yen. On the asset side, cash and deposits, goodwill and deferred tax assets increased, while tangible fixed assets and investments in securities decreased. On the liabilities and net assets side, the main factors of increase were advances received, deposits received and foreign currency translation adjustments, while accrued expenses and long-term loans payable were the main factors of decrease. The equity ratio at the end of September 2023 was 43.8%, up 0.4 percentage points from the end of the previous year.

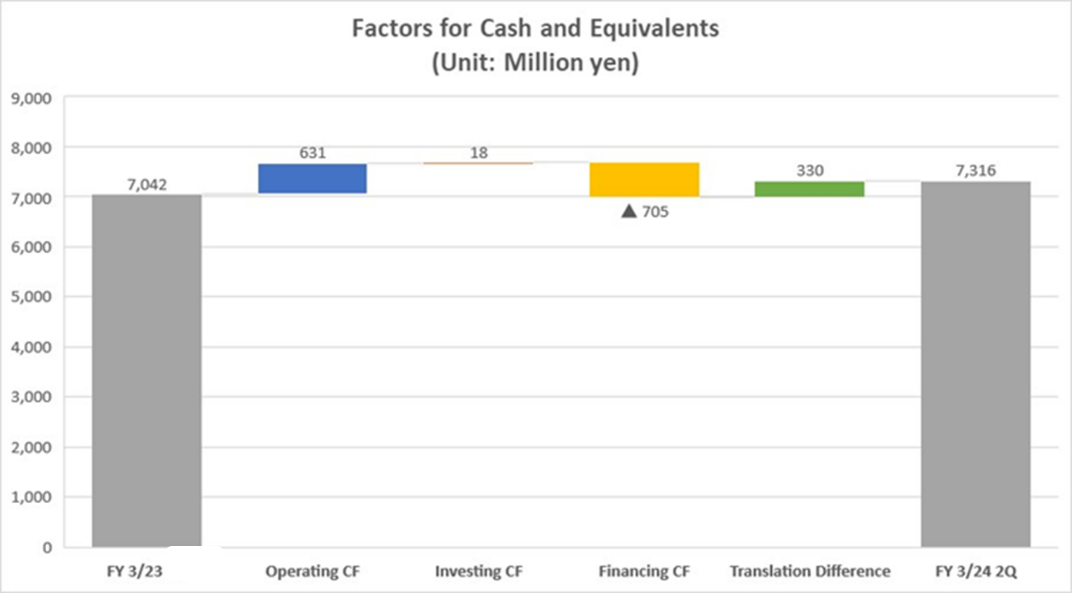

Cash Flow |

|

|

| |

| FY3/23 2Q Cumulative | FY3/24 2Q Cumulative | YoY | |

Operating cash flow(A) | 659 | 631 | -27 | -4.2% |

Investing cash flow(B) | -27 | 18 | +45 | - |

Free cash flow(A+B) | 631 | 649 | +17 | +2.8% |

Financing cash flow | -636 | -705 | -68 | - |

Cash and Equivalents at the end of quarter | 6,303 | 7,316 | +1,013 | +16.1% |

* Unit: million yen

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

In terms of cash flow, the cash inflow from operating activities shrank due to a decrease in quarterly net income before income taxes and an increase in income taxes paid. On the other hand, free cash flow recorded a surplus due to an increase in income from distributions from investment partnerships, which led to a cash inflow from investment activities. In addition, the cash outflow from financial activities increased due to an increase in the repayment of lease obligations.

(6) Status of Compliance with Listing Maintenance Standards for the Prime Market (Changed) and Application for Selection to the Standard Market

◎ Status of Implementation and Evaluation of Efforts to Conform to the Listing Maintenance Standards for the Prime Market

In the plan announced on December 27, 2021, the company set forth its basic policy, challenges, and initiatives to comply with the criteria for maintaining the Prime Market's listing (standards for market capitalization of tradable shares) by increasing market capitalization of tradable shares. The company's basic policies are (i) improving share price and (ii) increasing the number of shares in circulation to increase the market capitalization of tradable shares. In (i) improving share price, which is the core of these policies, the company has been aiming to increase the market capitalization of tradable shares by improving corporate value by (1) strengthening profitability, (2) enhancing corporate governance, and (3) improving accountability as a company.

Specifically, the Board of Directors will be composed of (1) outside directors, who make up the majority of the board members, and (2) female directors, who account for at least 30%, by appointing some of the current directors (excluding those who are members of the Audit and Supervisory Committee and outside directors) as executive officers who do not concurrently serve as directors. In addition, the scope of responsibility and authority of executive officers shall be clarified, and their personnel affairs and compensation will be subject to consultation by the Nomination Committee and the Compensation Committee to ensure objectivity, transparency, and fairness regarding personnel affairs and compensation in the same manner as that of directors. These revisions are expected to further strengthen corporate governance in terms of (1) further enhancing the governance and supervisory functions of the Board of Directors by having outside directors constitute the majority, (2) improving the speed and effectiveness of business execution by expanding the executive officer system, and (3) ensuring the appropriate scale and diversity of the Board of Directors.

◎ Standard Market Selection

While aiming to meet the requirements for remaining listed on the Prime Market, the company has been concurrently considering the selection of the Standard Market since the revision of TSE rules, effective April 1, 2023, provides an opportunity for the company to re-select the Standard Market. There are many factors necessary to comply with the Prime Market criteria for the market capitalization of tradable shares, which cannot be achieved by the company's efforts alone. Even if the company meets the criteria for maintaining its listing on the Prime Market during the period of transitional measures, there is always a risk that the company will fail to satisfy these criteria before it grows to a size that enables it to satisfy these requirements sustainably. In light of this situation, the Board of Directors has carefully discussed the issue and reached the conclusion that the most important thing is to ensure an environment in which shareholders can continue to hold and trade the company's shares. In addition, the company has decided to apply for selection as a "Standard Market" stock, based on the judgment that the company's corporate value will be enhanced by concentrating its limited management resources on improving profitability and sustainable growth over the medium to long term, rather than falling into a short-term management perspective to satisfy the criteria for maintaining the listing on the Prime Market.

◎ Compliance with the Criteria for Remaining Listed on the Standard Market

The company complies with all criteria for remaining listed on the Standard Market as of March 31, 2023.

| Number of shareholders | Number of tradable shares | Market capitalization of tradable shares (100 million yen) | Floating share ratio (%) | Monthly average trading volume | |

The company's Compliance status | As of March 31, 2023 | 3,767 | 99,553 | 69.5 | 40.2 | 5,939 |

Criteria for remaining listed on the Standard Market | 400 | 2,000 | 10 | 25 | 10 | |

Compliance status | Compliant | Compliant | Compliant | Compliant | Compliant | |

(From the company's IR news)

4. Fiscal Year ending March 2024 Earnings Forecasts

(1) Consolidated results

| FY 3/23 Act. | Ratio to sales | FY 3/24 Est. | Ratio to sales | YoY |

Sales | 12,516 | 100.0% | 13,300 | 100.0% | +6.3% |

Operating Income | 1,256 | 10.0% | 1,400 | 10.5% | +11.4% |

Ordinary Income | 1,283 | 10.3% | 1,400 | 10.5% | +9.1% |

Parent Net Income | 1,004 | 8.0% | 1,008 | 7.6% | +0.4% |

*Unit: million yen

Sales up 6.3% year on year, operating income up 11.4% year on year

With the end of the second quarter, the earnings forecast for the fiscal year ending March 2024 remains unchanged, in which the company predicts a 6.3% year on year increase in sales to 13.3 billion yen and an 11.4% year on year increase in operating income to 1.4 billion yen.

Although the company is struggling in Europe, especially in Eastern Europe, due to the impact of the Ukraine crisis, this is expected to be offset by strong sales in Japan, Asia, and the U.S., where demand for new drug development is robust.

In Japan, COVID-19 was reclassified as a class-5 infectious disease, so the clinical trial environment is expected to become normal. In the U.S., the development of new medicines is active, so the company receives an increasing number of inquiries about new projects, including large-scale ones. Although the company struggled in Europe in the first half of the fiscal year, mainly in Eastern Europe due to the impact of the Ukrainian crisis, it plans to turn the situation around thanks to growth in Japan, Asia, and the U.S., where demand for new drug development is robust. The ratio of operating income to sales is expected to rise 0.5 points from the previous term to 10.5%. Net income is projected to be unchanged from the previous term, as insurance money received and income taxes-deferred will decrease.

The company plans to pay an ordinary dividend of 15 yen/share, up 1 yen/share from the previous term. Payout ratio will be 33.6%.

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

(2) Outlook and strategies in each region

Japan | ◆The COVID-19 infection was reclassified into Class 5infection was reclassified into Class 5, and the clinical trial environment has normalized. ◆The progress is steady, and order backlog will be steadily fulfilled. Sales will increase steadily, but the impact will remain for the full year. ◆Sales of new drug development other than the novel coronavirus-related projects are expected to remain flat. However, the company will promote the development of new drugs as more companies from other industries are entering the market. |

The U.S. | ◆The new drug development in the U.S. market is robust, and there are many inquiries for new projects, including large-scale projects. ◆ The uncertainty in business confidence is affecting the cash flow of U.S. biotech companies. ◆The company aims to establish a system that can cover large-scale trials throughout the U.S. as soon as possible. |

Europe | ◆Deteriorating business confidence in Europe is making it difficult for bio-venture companies to raise funds. ◆The company strives to win European trials by further promoting collaboration with the U.S. business and demonstrating synergies in terms of sales and marketing. |

Asia | ◆The company will promote sales activities to build up order backlog. |

【Changes in the management systems in Europe and the U.S.】

The company revised the management systems in Europe and the U.S. while keeping the subsidiaries in Europe and the U.S. unchanged. (1) The chain-of-command systems in Europe and the U.S. will be centralized and the CEO will have authority, to make decisions swiftly. (2) The overlapping systems and operations in Europe and the U.S. will be unified to optimize the structure. (3) The business units in Europe and the U.S. will enhance their marketing structures, to offer unified services.

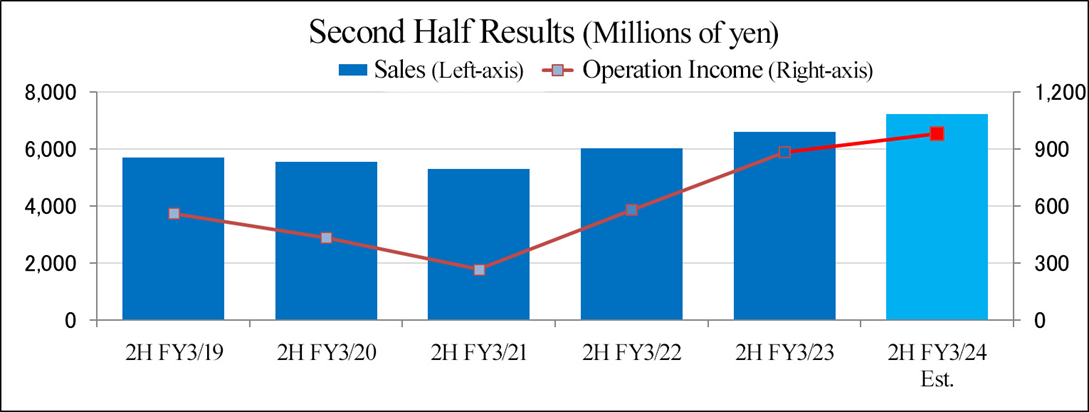

(3) Rate of progress toward full-year forecasts and second-half performance trends

| FY3/24 First half results | FY3/24 Company plan | Rate of Progress |

Sales | 6,064 | 13,300 | 45.6% |

Operating Income | 421 | 1,400 | 30.1% |

Ordinary Income | 483 | 1,400 | 34.6% |

Parent Net Income | 178 | 1,008 | 17.7% |

*Unit: million yen

Although the company struggled in Europe in the first half of the fiscal year due to the impact of the Ukraine crisis, it will seek to bounce back with growth in Japan, Asia, and the U.S., where demand for new drug development is robust. In Europe, the company will further promote collaboration with its U.S. business and further strengthen global synergies in terms of sales, thereby increasing the number of orders for new projects from U.S. companies, including those in Europe.

(4)Initiatives to Strengthen Profitability

Further Growth of Overseas Business | ◆Execute M&A in early phases to realize growth in the U.S., the most important market ◆Strengthen management and sales capabilities in Europe and the U.S., with a focus on the U.S. ◆Expansion into the Southern Hemisphere |

Customer base Expansion | ◆Receive repeat orders from major Japanese pharmaceutical companies and contracts from European and U.S. pharmaceutical companies ◆Focus on European and U.S. biotech start-ups with promising development pipelines Differentiate from major global CROs and expand the client base by providing detailed proposals that match their needs. |

Disease Area Expansion | ◆In addition to oncology, central nervous system, and autoimmune disease areas, the company will strengthen collaboration with medical institutions, external experts, and business partners in areas where needs are expanding due to new drug discovery modalities (rare diseases, ophthalmology, dermatology, etc.) to conduct high-quality clinical trials in a short period of time. |

Expansion of service areas | ◆Compared to major pharmaceutical companies, biotech companies have limited experience and resources in global development. By strengthening the training of in-house specialized human resources and strengthening the use of external resources through collaboration, the company will be able to provide high-quality proposals that match customer needs. ◆Provide services quickly and flexibly on a global one-stop basis |

5.Conclusions

The company continued to struggle in Europe, posting an operating loss in the second quarter like in the first quarter. The European economy continues to struggle with high energy prices and high inflation due to heightened geopolitical risks such as the Russia-Ukraine conflict, for which Germany and other European countries implemented a high-interest rate policy. This has harmed the economic situation in Germany and elsewhere in Europe. In this difficult environment, existing trials were canceled, the start of new projects was postponed, progress in existing trials was less than expected, and the acquisition of new projects was also less than expected as biotech ventures are struggling to raise funds. To deal with these challenges, the company aims to rebuild its European business by further promoting collaboration with its U.S. business and further strengthening global synergies in terms of sales and marketing to win orders from U.S. companies for new projects, including the U.S. companies in Europe. It remains to be seen whether these efforts will lead to an early recovery of the company's performance in Europe.

The order backlog as of November 14, 2023, was 18,199 million yen, down 13.1% from the end of fiscal year ended March 2023. This was due to the cancellation of large-scale trials in Europe, the U.S., and Japan. On the other hand, in Japan and Asia, although not included in the order backlog, several new projects have been informally accepted, and the company is in the process of concluding contracts, and there are several inquiries regarding new projects. There are also new projects in the U.S. that are not included in the order backlog as they have been informally accepted and are in the process of being finalized. The appetite for biotech development continues to be strong, and the company is receiving many inquiries regarding new projects, including global projects. The company aims to win large-scale global jointly conducted clinical trials contracts solely through the group by strengthening cooperation among its global sites. This would mean a significant increase in average revenue per order and is likely to be a driving force for accelerating the company's growth. It will be interesting to see how the company acquires orders for future large-scale global jointly conducted clinical trials.

Furthermore, the U.S. business is growing steadily. In the first half of the fiscal year ending March 2024, sales and operating income in the U.S. business grew to a level approaching that of the Japanese business. Thus, we can see that the growth potential of the world's largest market is great. The strong performance of the U.S. subsidiary has led to an increase in cash and cash equivalents and a decrease in interest-bearing debt. In order to accelerate growth in the U.S., the most important market, it is expected that the company will execute the next round of M&A as soon as possible. We have high expectations for the company's future growth strategy in the U.S. business and will keep an eye on it.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an Audit & Supervisory Committee |

Directors who are not Audit Committee Members | 9 directors, including 2 outside ones |

Directors who are Audit Committee Members | 3 directors. All of them are outside directors |

◎Corporate Governance Report

Last updated on July 3, 2023

<Basic Policy>

(1) Management Philosophy

Our management philosophy is “To promote the greater wellbeing of all our stakeholders — patients, business partners, shareholders, and employees — we strive constantly to offer professional, high-quality services to support all aspects of new drug development.” We aim to contribute to the development, evolution and diffusion of new therapeutic technologies including new pharmaceuticals, and ultimately to the healthy lives of human beings, by continuously developing and maintaining the knowledge and experience of our executives and employees, as well as the know-how and systems of our organization.

(2) Basic Approach on Corporate Governance

Based on the above management philosophy, our company will contribute to the birth and growth of new disease prevention and therapeutic technologies, including new pharmaceuticals, with our know-how and technologies in pharmaceutical development. As a partner of healthcare companies and medical institutions, including domestic and foreign bio-venture firms, pharmaceutical companies, and medical device manufacturers, our company will contribute to the development of healthcare and meet the expectations of patients and the entire society.

Since our business activities impact people's lives, our executives and employees are required to have high ethical standards as well as expertise. Thus, we thoroughly comply with the Corporate Code of Conduct, including strict compliance with laws. In addition, we strive to improve corporate value and business development by enhancing internal control and ensuring the soundness and transparency of management.

<Regarding the implementation of the principles of the corporate governance code>

Major principles for not implementing and the reasons

Principles | Reasons for not implementing the principles |

【Supplementary Principle 1-2 (2) Medium-term Management Plan】 | The Medium-term Management Plan of the company is reviewed by the Management Board, with progress checked and analyzed at each meeting, reviewing the medium-term targets and policies as necessary and appropriate. The Board of Directors approves the Medium-term Management Plan formulated by the Management Board while receiving reports on progress and analysis results, while monitoring and supervising the plan. While selecting the Prime Market, the company disclosed a “Plan for Compliance with Listing Maintenance Criteria,” where it announced a three-year Medium-term Management Plan ending in the fiscal year ending March 2025. In the future, the company will consider revising its targets and policies as required based on progress, disclosing and explaining them together with its vision and management strategies to develop a common understanding with its shareholders and investors. |

【Supplementary Principle 4-2 (1) Compensation System】 | In addition to fixed compensation, the company has adopted a performance-based compensation system, a monetary compensation linked to performance over a single fiscal year for directors responsible for executing the company's business. On the other hand, the directors responsible for business execution are founding members of the company and already possess a certain number of the company's shares. Therefore, the increase or decrease in shareholder value reflecting medium to long-term performance is linked to the increase or decrease in the value of the shares possessed, which virtually includes incentives similar to medium to long-term performance-based compensation, enabling mutual interest and value-sharing with the shareholders. In this context, no non-monetary compensation, such as share-based compensation linked to medium to long-term performance, has been established. Furthermore, the company will consider necessary revisions to its executive compensation system, including medium to long-term performance-based compensation, in line with changes in the composition of the board of directors, including the appointment of directors other than founding members who will be responsible for business execution in the future. |

【Principle 4-9 Criteria and Eligibility for Independence of Independent Outside Directors】 | In addition to the requirements of the Companies Act, the Board of Directors appoints candidates who it believes, based on their knowledge and experience, can actively provide appropriate opinions regarding the management of the company and other matters based on the same objective perspective as ordinary shareholders, after confirming that they substantially meet the criteria of the Tokyo Stock Exchange for determining the independence of independent directors. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

[Supplementary Principle 2-4 (1) Ensuring diversity in the appointment of core human resources] [Supplementary Principle 3-1 (3) Initiatives for Sustainability】

| The corporate group has formulated a “Sustainability Policy” based on its management philosophy and promotes sustainability management in line with this policy. Sustainability-related initiatives and policies on human resources development, including ensuring the diversity of human resources, and policies on the development of the internal environment, are disclosed in the Annual Securities Report under “2. Policies and Initiatives on Sustainability.” The status regarding the promotion of diversity in the core workforce is as follows. (1) Women The percentage of women at the end of each financial year is as follows. The promotion of female managers is progressing at the headquarters in Japan as well as throughout the group, and we will further improve the working environment and provide career development support to develop female leaders at the executive officer level and above, who will play core management roles in the future. 【Headquarters (Japan)】 Female employees/all employees (%) 62.9% in 2023, 61.6% in 2022, 44.4% in 2021. Female managerial positions/All managerial positions (excluding executive officers) (%) 44.2% in 2023, 42.6% in 2022, 19.4% in 2021. Female Executive Officers/All Executive Officers (%) 16.7% in 2023, 16.7% in 2022, 16.7% in 2021. 【Corporate Group】 Female employees/all employees (%) 68.5% in 2023, 67.5% in 2022, 58.6% in 2021. Female managerial positions/All managerial positions (excluding executive officers) (%) 59.7% in 2023, 56.9% in 2022, 36.5% in 2021. Female Executive Officers/All Executive Officers (%) 31.8% in 2023, 28.6% in 2022, 25.0% in 2021. (2) Foreign Nationals Approximately 50% of the group’s 759 employees (as of March 31, 2023) are locally hired employees residing overseas, and most of the key positions including CEO in the overseas group companies are occupied by highly qualified local human resources. In addition, our company is promoting the hiring of human resources regardless of nationality at our headquarters in Japan. As of the end of March 2023, the ratio of foreign nationals to all employees at the Japanese headquarters was 3.6%. In addition, the ratio of foreign employees in managerial positions was 1.1%. |

[Principle 3-1 Enhancement of Disclosure of Information] | (i) Our company’s Goals (Management Philosophy, etc.), Management Strategy, and Management Plan Our management philosophy is “To promote the greater wellbeing of all our stakeholders — patients, business partners, shareholders, and employees — we strive constantly to offer professional, high-quality services to support all aspects of new drug development,” and we aim to achieve sustainable growth and to improve corporate value over the medium/long term. In order to achieve this, the company has established a three-year Medium-term Management Plan ending in the fiscal year ending March 2025, which was announced in Plan for Compliance with Listing Maintenance Criteria for the Prime Market. Details of the management strategy and management plan are disclosed in the Annual Securities Report and other documents. (ii) Basic Approach and Basic Policy on Corporate Governance Based on Each of the Principles in this Code Our basic approach on corporate governance is described in “I. Basic Approach” of this report. An overview of our company’s corporate governance, including the above, is disclosed on our company’s website. (iii) Policies and Procedures for the Board of Directors in Determining Remuneration for Executives and Directors Compensation of the company's directors shall be paid within the limits of the total compensation approved by the General Meeting of Shareholders. The Compensation Committee, which consists of 3 or more members, the majority of whom are outside directors, discusses and reports on the decisions and procedures of such policies in consultation with the Board of Directors, to ensure objectivity, transparency, and fairness. Further details are disclosed in “4. Status of corporate governance, (4) Compensation of directors and officers” in Annual Securities Report. (iv) Policies and Procedures for the Board of Directors’ Selection and Dismissal of Executives and Nomination of Candidates for Directors and Executive Officers The appointment and nomination of candidates for executive directors and executive officers are made through the resolution of the Board of Directors based on the candidates' insight and integrity of character appropriate for senior management with regard to compliance with laws, regulations, and corporate ethics, their ability to make decisions accurately and promptly, as well as individual knowledge, experience and ability, taking into consideration the overall balance between the Board of Directors, including outside directors, and the management team as a whole. In addition, the reappointment (or non-reappointment) is resolved by the Board of Directors, based on whether the expected performance and results have been achieved on a constant basis. Candidates for outside directors who are not members of the Audit Committee are appointed and reappointed by the resolution of the Board of Directors in line with the criteria and qualities set out in Principle 4-9. In addition to the criteria and qualities set out in Principle 4-9, at least one candidate for outside director as a member of the Audit Committee shall have sufficient knowledge of finance and accounting matters and shall be appointed or reappointed by the resolution of the Board of Directors, subject to the consent of the Audit Committee. In addition, the Board of Directors takes into consideration the selection and termination of the CEO as one of the most crucial decisions and comprehensively considers whether the company can respond to changes in the overall business environment, formulate or promote proactive management strategies, and continuously improve its business performance. Furthermore, the training of candidates to succeed the CEO is also carried out through knowledge training and planned rotations. With respect to the decisions and procedures of said policy, objectivity, transparency and fairness are ensured through consultations and reports by a Nomination Committee consisting of at least three members, the majority of whom are outside directors, in consultation with the Board of Directors. (v) Explanation of Individual Election and Dismissal of Executives, and Nomination of Candidates for Directors and Corporate Auditors by the Board of Directors Based on the (iv) Above With regard to the nomination of candidates for non-audit committee members and audit committee members as directors, the professional backgrounds and the reasons for the nomination of each candidate shall be stated in the Notice of Convocation of the General Meeting of Shareholders. |

<Principle 5-1 Policy for constructive dialogue with shareholders> | Through constructive dialogue with shareholders (including institutional and individual investors as potential shareholders), our company aims for sustainable growth in corporate value, which is the common goal of our company and shareholders. In the “Plan for Compliance with Listing Maintenance Criteria” disclosed in conjunction with the selection of the Prime Market, our company is committed to strengthening accountability, is continuously promoting enhanced disclosure of information, and is promoting dialogue with investors in Japan and overseas. The company has continuous, constructive, transparent, fair dialogue regarding business performance, managerial strategies, capital policies, risks, corporate governance systems, etc. with the following method. ・Dialogue with shareholders is led by the Managing Director CFO. Considering the purpose and effect of the interview, and the attributes of shareholders, the dialogue method is examined thoroughly by the senior management such as CEO and the Managing Director CFO. ・As for IR, mainly the financial affairs department and the public relations division gather necessary information from relevant sections of the company, prepare reference material and give explanations in an understandable manner, to enrich the dialogue with shareholders.

・In addition to the Ordinary General Meeting of Shareholders, financial results briefings, and briefings for individual investors, our company provides opportunities for the dialogue through individual meetings with domestic and overseas institutional investors, by disclosing IR information on our company’s website, including English versions, through phone calls and emails from individual investors, and reflects questions, requests, information on participants at briefings, and survey results in our IR activities. ・Shareholders’ interests and concerns grasped through the dialogue with them are reported to the senior managing director CFO and the information is utilized for analyzing business administration, discussing how to disclose information, etc.

・Concerning IR activities and the dialogue with shareholders, the company manages insider information appropriately in accordance with in-company rules. The quiet period, in which the company refrains from having dialogue about financial results, is from the day after the closing date of each quarter to the date of brief reporting. |

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |