Bridge Report:(2593)ITO EN the first half of the fiscal year April 2020

ITO EN, LTD. (Common stock: 2593, Preferred stock: 25935) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

President | Daisuke Honjo |

Address | 47-10, Honmachi 3-chome, Shibuya-ku, Tokyo |

Year-end | April |

URL |

Stock Information

<Common Stock>

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥5,740 | 88,181,412 shares | ¥506,161 million | 9.9% | 100 shares | |

DPS (Forecast) | Dividend yield (Actual) | EPS (Actual) | PER (Actual) | BPS (Actual) | PBR (Actual) |

¥40.00 | 0.7% | ¥114.21 | 50.3 times | ¥1,229.28 | 4.7 times |

* The share price is the closing price on December 16. The number of shares issued, DPS and EPS were taken from the results in the second quarter of April 2020. ROE and BPS were taken from the results in the last year-end.

<Preferred Stock>

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥2,420 | 33,056,421 shares | ¥79,996 million | 9.9% | 100 shares | |

DPS (Forecast) | Dividend yield (Actual) | EPS (Actual) | PER (Actual) | BPS (Actual) | PBR (Actual) |

¥50.00 | 2.1% | ¥124.16 | 19.5 times | ¥1,234.28 | 2.0 times |

* The share price is the closing price on December 16. The number of shares issued, DPS and EPS were taken from the results in the second quarter of April 2020. ROE and BPS were taken from the results in the last year-end.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (Common stock) | DPS (Common stock) |

April 2016 (Actual) | 465,579 | 17,243 | 15,074 | 8,615 | 67.37 | 40.00 |

April 2017 (Actual) | 475,866 | 21,774 | 21,524 | 13,693 | 108.77 | 40.00 |

April 2018 (Actual) | 494,793 | 22,043 | 21,441 | 12,553 | 99.79 | 40.00 |

April 2019 (Actual) | 504,153 | 22,819 | 23,211 | 14,462 | 116.02 | 40.00 |

April 2020 (Forecast) | 498,000 | 23,000 | 22,800 | 14,200 | 114.21 | 40.00 |

* The forecasted values were provided by the company.

* Unit: Million yen or yen

This Bridge Report outlines the results of ITO EN for the first half of the fiscal year ending April 2020 and the outlook for the term ending April 2020.

Table of Contents

Key Points

1. Company Overview

2. First Half of the Fiscal Year Ending April 2020 Earnings Results

3. The Fiscal Year Ending April 2020 Financial Estimates

4. Brand Strategies

5. Conclusions

<Reference: Regarding Corporate Governance>

Key points

- For the first half of the term ending April 2020, sales dropped 3.6% year on year, but operating income rose 6.8% year on year, being 5.3% higher than the initial estimate. Sales dropped due to the downturn of the beverage market caused by unfavorable weather, including lingering rain and low temperatures in July and the typhoons, etc. in September and October, but gross profit rate improved, as the company has put importance on profitability since the second half of the previous term, while sales commissions and transportation costs declined. Expecting that advertisement would not be effective due to bad weather, the company curtailed the expenses for advertisement. Accordingly, operating income rate improved 0.5 points to 5.3%.

- As for the full-year forecast, it is estimated that sales will decline 1.2% year on year while operating income will rise 0.8% year on year. The estimated sales have been revised downwardly, but the estimated profit is unchanged. Sales are projected to be in line with the initial estimate in the second half, but unable to offset the decline in sales in the first half. As for profit, the decline in sales and the augmentation of advertisement costs for renewing core products will be offset by the improvement in profitability.

- In the first half of this term, the efforts for improving profitability that have been made since the second half of the previous term paid off, and profit increased amid the stringent business environment. From now on, the company will tighten revenue management, and promote the sales of mainly “Oi Ocha,” “Kenko Mineral Mugicha,” and the bottled black coffee of “Tully’s Coffee,” and develop “TEAs’ TEA” and sugar-free Aojiru (Green juice), which are being revitalized, for the purpose of expanding sales. Outside Japan, Walmart started selling “Oi Ocha” and “Jasmine Tea” throughout the U.S. in October.

1. Company Overview

ITO EN mainly manufactures and sells beverages (including green tea, coffee, and vegetable juice), and tea leaves, and also operates restaurants and conducts franchise (FC) business of Tully’s Coffee, etc., manufactures and sells supplements via its subsidiaries. In Japan, the company has the largest share of 34% (as of December 2018) in the market of green tea beverages, including “Oi Ocha.” In addition, it owns a variety of popular product brands, such as “Kenko Mineral Mugicha” (healthy mineral barley tea) which is the bestselling caffeine-free tea beverage, “Ichinichibun no Yasai” (One Day Veggie), the most selling 100% vegetable beverage, and “TULLY’S COFFEE” which is the top-selling bottle-shaped canned black coffee product developed in cooperation with Tully’s Coffee Japan Co., Ltd.. Each of them has achieved an annual sales quantity of over 10 million cases (“Oi Ocha” has sold more than about 90 million cases).

The ITO EN Group is composed of 31 consolidated subsidiaries, including Tully’s Coffee Japan Co., Ltd. and Chichiyasu Company, and 3 companies accounted for using the equity method. With the aim of becoming a “Global Tea Company,” it is developing the ITO EN brand and cultivating new green tea markets in the U.S. (mainly New York), Australia, China, and Southeast Asia.

Management Principle “Always Putting the Customer First”

1-1.Five Concepts for Product Development since the Establishment of the Company

|

1-2.Outline of the business

The business of ITO EN is classified into the Tea Leaves and Beverages Business, which manufactures and sells tea leaves and beverages, the Restaurant Business, in which Tully’s Coffee Japan Co., Ltd. operates specialty coffee shops and FC business, and The Others, in which Mason Distributors, Inc. (Florida, the U.S.) manufactures and sells supplements.

For the term ended April 2019, the sales of ITO EN (non-consolidated) accounted for 85.2% of the Tea Leaves and Beverages Business (78.2% of consolidated sales). As for the composition of the sales(non-consolidated), tea leaves make up 9.4%, beverages 89.7%, and others 0.9%.

| Sales | Composition ratio | YoY | Operating income | Composition ratio | YoY |

Tea Leaves and Beverages Business (A) | 462,841 | 91.8% | +1.6% | 19,806 | 4.3% | +3.4% |

Restaurant Business | 34,555 | 6.9% | +6.1% | 3,504 | 10.1% | +7.8% |

Others | 6,756 | 1.3% | +2.1% | 771 | 11.4% | -17.9% |

Adjustment | - | - | - | -1,263 | - | - |

Total (Consolidated sales/operating income) | 504,153 | 100.0% | +1.9% | 22,819 | 4.5% | +3.5% |

ITO EN (non-consolidated):B (composition rati B/A) | 394,495 | 78.2% | +2.9% | 15,851 | 4.0% | +3.0% |

* Unit: Million yen

Product brands representative of ITO EN, LTD. that have sold over 10 million cases annually

1-3. Growth Strategy: Converting sugar-free drinks from around the world into beverage products

The share of sugar-free beverages in the domestic beverage market has increased from 8% to 49% in the past 30 years. According to the questionnaire survey conducted by the company in 2019, 47% of all respondents said that they consciously tried to avoid taking sugar, etc. from beverages for their health in their everyday lives.

The company has the largest market share in domestic sugar-free tea beverage sales, and has been working on cultivating sugar-free beverage markets worldwide. On December 2, the company launched “Mainichi ippai no oishii matcha (A Cup of Delicious Matcha Every Day)” with the concept of “Matcha in the centuries of life” It is sugar-free, and is characterized by its rich flavor that comes from green tea leaves. By using 220-ml bottle cans, the company has made it possible for consumers to easily enjoy the taste of highly valuable matcha anywhere.

(Source: the company)

1-4. Efforts to spread the value of tea

The company aims to contribute to solving social issues through tea and to realize "rich life" society. As part of this initiative, the company held the 2nd "ITO EN Health Forum" at Shibuya Hikarie (Shibuya-ku, Tokyo) with the theme of "Wisdom of living 100 years of life with tea--the power of tea and catechins," providing an opportunity to think about "wisdom that enriches 100 years of life with tea" together with experts and to get to know the results of ITO EN's research and development.

In addition, the company is focusing on developing directly-managed stores that convey the appeal of tea, and is also researching the health value of matcha in Japan. As for directly-managed stores, on October 31, 2019, the company opened the teahouse, “Saryo ITO EN Yokohama,” on the 1st floor of Yokohama Hammerhead (Yokohama-shi, Kanagawa Prefecture), where people can experience the style of Japan and become familiar with tea. On November 1, 2019, the company opened “ocha room ashita ITO EN,” which is its first restaurant, event space, and product sales integrated store, on the 10th floor of Shibuya Scramble Square.

(Source: the company)

In the October 2018 research on the health value of matcha in Japan, it was confirmed that matcha has the effect of improving cognitive function. In August 2019, the company began a study to verify the mechanism for improvement of cognitive function in the brain as joint research with RIKEN, the Institute of Physical and Chemical Research. In addition, as for the prevention of dementia with matcha, demonstration experiments regarding effects of dementia prevention were initiated in November 2018 as joint research with Shimadzu Corporation and MCBI Inc., which provides testing services for dementia, etc. in a biotech company founded by University of Tsukuba.

1-5. CSR and ESG Initiatives

The company also works on strengthening governance and contributing to society and the environment.

Value propositions enabled by community-based sales

The company has installed disaster-relief vending machines in all prefectures in case of power outages caused by disasters. Those vending machines can generate electricity with hand crank generators and provide products for free at the time of disaster. In addition, the company proposes installing the Wellness Vending Machine that has an appealing power for the value of health. The Wellness Vending Machine can sell beverages in three types of containers, including tea beverages in plastic bottles, sugar-free coffee in bottle-shaped cans, and aojiru juice, apple cider vinegar, and black vinegar in cartons, in the machine, which enhances the appeal of the value of health. A growing number of companies install the vending machine in their offices as a part of their welfare programs. Moreover, as well as vending machines, the company has concluded agreements with many municipalities that the company will preferentially provide beverages as relief supplies during large-scale disasters.

(Source: the company)

"Make Japan Beautiful Through Tea Project"

Since 2010, "Make Japan Beautiful Through Tea Project" has been implemented to support environmental conservation and maintenance activities in various parts of Japan. In this campaign, in addition to giving donations to local governments, ITO EN employees participate in environmental conservation and maintenance activities as an environmental activity to promote awareness and understanding of each activity.

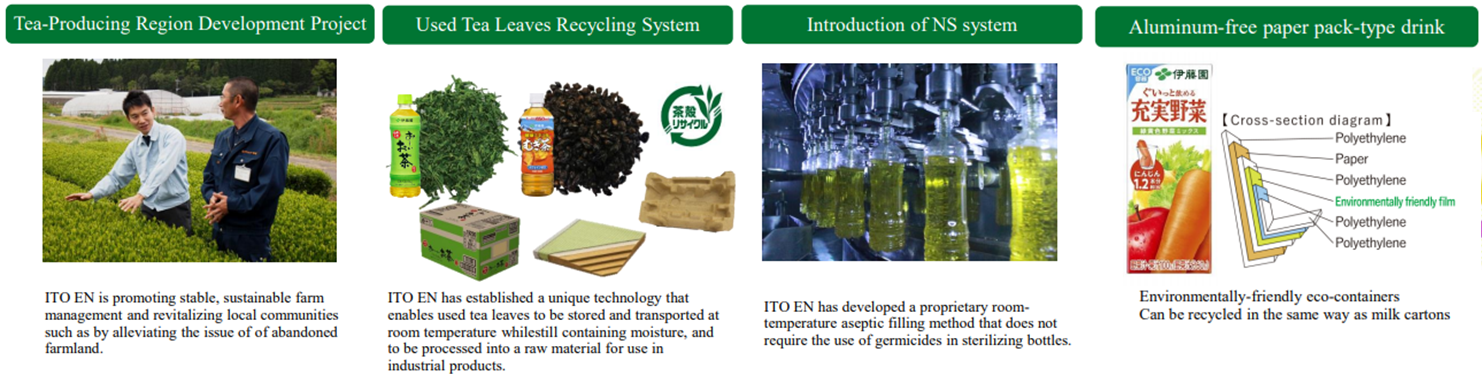

Promotion of sustainable management

As a part of sustainable management, the company engages in the business of cultivating tea production areas in order to revitalize local communities, such as promoting stable and sustainable agricultural management and utilizing abandoned cultivation land. The company has also introduced its own method of aseptic filling, which does not require disinfectants for sterilizing bottles.

As for the environment, the company endeavors to make contributions with its system for recycling used barley tea leaves for storing them at the room temperature while they are still wet and using them in transportation and industrial products, and also by adopting an ECO container, “aluminum-less paper carton,” which is environmentally-friendly and can be recycled like milk cartons.

In addition, as a part of its social contributions, the company has been running the “ITO EN Oi Ocha New Haiku Contest,” one of the largest creative contests in Japan, since 1989 as well as tea taster activities in order to support reconstruction efforts in areas affected by natural disasters. The "ITO EN Oi Ocha New Haiku Contest" has also been certified by “beyond 2020 program” promoted by the government, and will celebrate its 31st anniversary in 2020. In tea taster activities, the company creates “opportunities of communication” through tea and provides them to people in areas affected by natural disasters.

(Source: the company)

2. First Half of the Fiscal Year Ending April 2020 Earnings Results

2-1. Variation in monthly sales volume

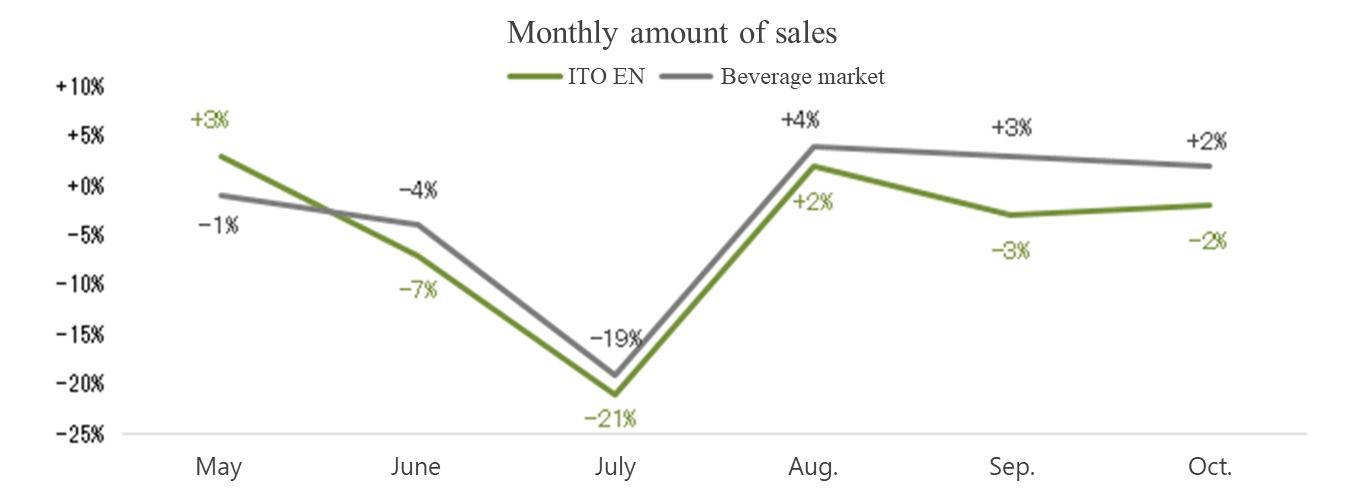

In June, the company raised the prices of products in large plastic bottles one by one, and engaged in sales while focusing on profitability by controlling bargain sales of all products. On the other hand, sales were significantly affected by the weather, and in July, rainfall and low temperatures drastically reduced sales volumes. Although the sales volume in August increased from the previous year due to recovery from decreased sales volume caused by confusion in logistics last year, the beverage market was sluggish in September and October due to increased rainfall in Japan caused by typhoons. As for respective products, sales of large plastic bottle products were sluggish due to unfavorable weather. Sales of vegetable/fruit drinks and coffee, etc. in plastic bottles significantly dropped, however, sales of mainstay products in personal size (525/600 ml) such as “Oi Ocha Green Tea” were healthy, and black tea beverages have been revitalized.

2-2.Consolidated earnings of First Half

| 1H of FY 4/19 | Ratio to sales | 1H of FY 4/20 | Ratio to sales | YOY | Initial Estimate | Difference from the estimate |

Sales | 275,468 | 100.0% | 265,471 | 100.0% | -3.6% | 276,500 | -4.0% |

Gross Profit | 129,511 | 47.0% | 126,923 | 47.8% | -2.0% | - | - |

SG&A expenses | 116,299 | 42.2% | 112,815 | 42.5% | -3.0% | - | - |

Operating Income | 13,212 | 4.8% | 14,107 | 5.3% | +6.8% | 13,400 | +5.3% |

Ordinary Income | 13,819 | 5.0% | 13,872 | 5.2% | +0.4% | 14,000 | -0.9% |

Profit attributable to owners of parent | 8,698 | 3.2% | 8,925 | 3.4% | +2.6% | 9,000 | -0.8% |

*unit: million yen

Sales declined due to weather, but operating income exceeded the initial estimate thanks to profitability-emphasized sales activities.

Sales were 265.47 billion yen, down 3.6% year on year. Thanks to the effect of the opening of new shops, the sales of Tully’s Coffee increased 3.7% year on year, but the non-consolidated sales of ITO EN declined 4.1% year on year, and the sales of the business in North America decreased 9.0% (6.4% in the dollar) year on year, due to the change in the commercial distribution system from the previous term. The sales of other overseas businesses, mainly in China, decreased 5.8% year on year (increased in the yuan), due to the yuan depreciation against the yen.

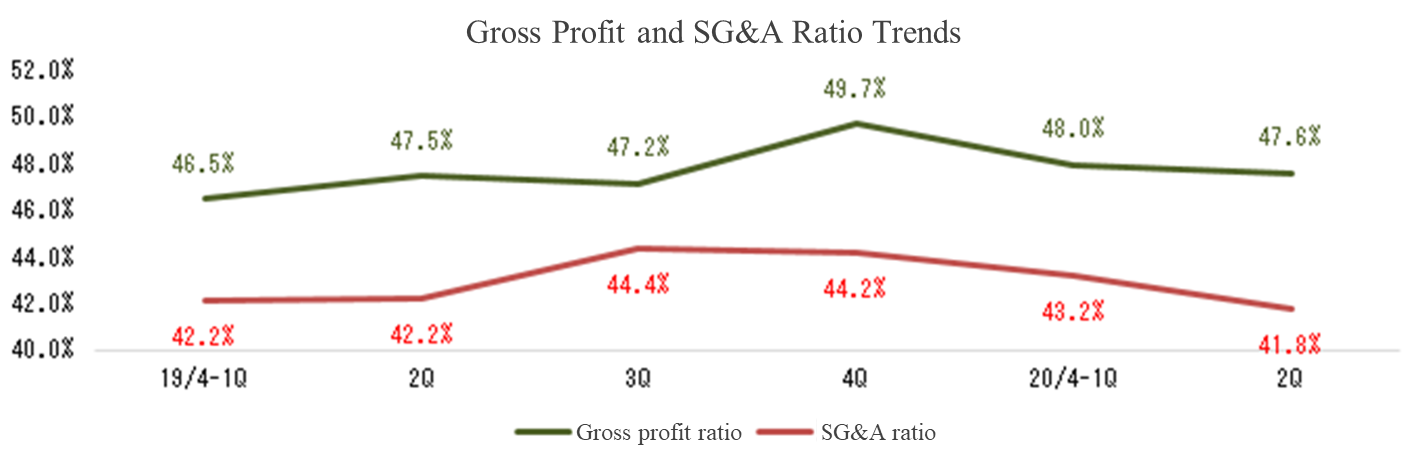

Operating income was 14.1 billion yen, up 6.8% year on year. Since the second half of the previous term, the company has strengthened customer management and negotiated for revising wholesale prices, and the prices of large-sized plastic-bottled products were raised in June. Then, gross profit rate increased 0.8 points. On the other hand, SGA decreased 3.0% year on year, because advertisement cost dropped as the company reduced advertising activities considering the unfavorable weather and there was a recoil from the active promotion for releasing new products in the same period of the previous year, while sales commissions and transportation costs decreased as the company put importance on profitability. Operating income rate improved 0.5 points to 5.3%.

Since an exchange loss of 330 million yen was posted (an exchange gain of 480 billion yen was posted in the same period of the previous year), ordinary income was unchanged from the previous term, but net income increased 2.6% year on year to 8.92 billion yen, thanks to the improvement in extraordinary gain/loss because the loss from the disposal of inventory assets was no longer posted.

Major Components of SG&A

| 1H of FY 4/19 | Ratio to sales | 1H of FY 4/20 | Ratio to sales | YOY |

Selling commission | 47,633 | 17.3% | 44,488 | 16.8% | -6.6% |

Advertising cost | 7,255 | 2.6% | 6,408 | 2.4% | -11.7% |

Freight cost | 8,246 | 3.0% | 8,082 | 3.0% | -2.0% |

Depreciation and amortization | 5,595 | 2.0% | 5,665 | 2.1% | +1.3% |

Others | 47,570 | 17.3% | 48,172 | 18.1% | +1.3% |

total | 116,299 | 42.2% | 112,815 | 42.5% | -3.0% |

*unit: million yen

Sales in each company

| 1H of FY 4/19 | Ratio to sales | 1H of FY 4/20 | Ratio to sales | YOY |

ITO EN (Non-consolidated) | 217,725 | 73.9% | 208,881 | 73.8% | -4.1% |

Tully`s Coffee Japan Co., Ltd. | 16,981 | 5.8% | 17,609 | 6.2% | +3.7% |

Chichiyasu Company | 7,479 | 2.5% | 7,366 | 2.6% | -1.5% |

Other Domestic Subsidiaries | 31,808 | 10.8% | 30,587 | 10.8% | -3.8% |

US Business (unit: thousand dollars) | 17,373 | 5.9% | 15,806 | 5.6% | -9.0% |

Other Overseas Subsidiaries | 3,217 | 1.1% | 3,030 | 1.1% | -5.8% |

Elimination of Internal Transactions | -19,115 | - | -17,538 | - | - |

Consolidated Sales | 275,468 | - | 265,471 | - | -3.6% |

ITO EN (Non-consolidated) | 9,185 | 4.2% | 10,983 | 5.3% | +19.6% |

Tully`s Coffee Japan Co., Ltd. | 1,875 | 11.0% | 1,759 | 10.0% | -6.2% |

Chichiyasu Company | 200 | 2.7% | 260 | 3.5% | +30.0% |

Other Domestic Subsidiaries | 1,377 | 4.3% | 889 | 2.9% | -35.4% |

US Business (unit: thousand dollars) | 819 | 4.7% | 388 | 2.5% | -52.6% |

Other Overseas Subsidiaries | 573 | 17.8% | 573 | 18.9% | +0.0% |

Elimination of Internal Transactions | -817 | - | -745 | - | - |

Consolidated Sales | 13,212 | 4.8% | 14,107 | 5.3% | +6.8% |

average to the US dollar in the term | ¥111.16 |

| ¥108.01 |

|

|

*unit: million yen

The sales of Tully’s Coffee increased, but its profit dropped due to the augmentation of recruitment costs, but new shops have been opened at good locations one after another, so annual profit is estimated to rise. The sales of Chichiyasu were sluggish due to weather, but profitability improved as the prices of yogurt were raised in April. The U.S. business earned sales of 146,344 thousand dollars (down 6.4% year on year) and an operating income of 3,598 thousand dollars (down 51.2% year on year). Distant Lands Trading Company, Inc. (hereinafter called “DLT”), which produces and sells coffee beans, lost a distribution channel as its major client underwent M&A, and is struggling.

2-3.Financial Status and Cash Flows (CF)

Main balance sheet

| End of Apr. 2019 | End of Oct. 2019 |

| End of Apr. 2019 | End of Oct. 2019 |

Cash and deposits | 63,738 | 63,494 | Trade payables | 30,181 | 27,569 |

Trade receivables | 56,581 | 57,768 | Accrued expenses | 24,839 | 26,019 |

Inventories | 43,588 | 45,354 | Interest-bearing debts | 56,542 | 55,842 |

Total current assets | 177,449 | 178,974 | Lease obligations | 12,501 | 10,911 |

Property, plant and equipment | 84,186 | 83,647 | Net defined benefit liability | 10,313 | 10,504 |

Intangible fixed assets | 18,956 | 17,374 | Total liabilities | 153,058 | 148,685 |

Investments and other assets | 23,389 | 23,088 | Total net assets | 150,923 | 154,399 |

Total fixed assets | 126,532 | 124,110 | Total liabilities and net assets | 303,981 | 303,085 |

*unit: million yen

There is no significant change in the financial standing. The total assets as of the end of the first half were 303.08 billion yen, down 890 million yen from the end of the previous term. Capital-to-asset ratio was 50.5% (49.2% as of the end of the previous term).

Cash Flows (CF)

| 1H of FY 4/19 | 1H of FY 4/20 | YoY | |

Operating CF (A) | 12,138 | 13,595 | +1,457 | +12.0% |

Investing CF (B) | -5,049 | -4,652 | +397 | - |

Free CF (A+B) | 7,089 | 8,943 | +1,854 | +26.2% |

Financing CF | -8,209 | -8,059 | +150 | - |

Balance of cash and cash equivalents at end of period | 60,435 | 62,435 | +2,000 | +3.3% |

*unit: million yen

Pretax profit (13.31 billion yen → 13.68 billion yen) and depreciation (6.64 billion yen → 6.66 billion yen) were almost unchanged year on year, but working capital declined as the company put importance on profitability, so operating CF increased 12.0% year on year to 13.59 billion yen. Investing CF changed through the purchase of property, plant and equipment and intangible fixed assets, while financing CF changed due to the acquisition of treasury shares, the repayment of financial lease obligations, and the payment of dividends. The term-end balance of cash and cash equivalents was 62.43 billion yen, up 3.3% from the end of the same period of the previous year.

3. The Fiscal Year Ending April 2020 Financial Estimates

3-1. Consolidated Earnings

| FY 4/19 Results | Ratio to sales | FY 4/20 Forecast | Ratio to sales | YOY | Initial Estimate | Difference from the estimate |

Sales | 504,153 | 100.0% | 498,000 | 100.0% | -1.2% | 510,000 | -2.4% |

Gross profit | 240,375 | 47.7% | 241,000 | 48.4% | +0.3% | 243,649 | -1.1% |

SG&A expenses | 217,555 | 43.2% | 218,000 | 43.8% | +0.2% | 220,648 | -1.2% |

Operating income | 22,819 | 4.5% | 23,000 | 4.6% | +0.8% | 23,000 | +0.0% |

Ordinary income | 23,211 | 4.6% | 22,800 | 4.6% | -1.8% | 22,800 | +0.0% |

Net income | 14,462 | 2.9% | 14,200 | 2.9% | -1.8% | 14,200 | +0.0% |

*unit: million yen

It is estimated that sales will drop 1.2% while operating income will rise 0.8% from the previous term.

The estimated sales have been revised downwardly, but the estimated profit is unchanged. Sales are projected to be in line with the initial estimate in the second half, but annual sales will be affected by the significant decline in July. As for profit, the decline in sales and the augmentation of advertisement costs for renewing core products in the fourth quarter (Feb. to Apr.) will be offset by the improvement in gross profit rate based on thoroughgoing management of income and expenditure, the rationalization of sales commissions, etc. Accordingly, the estimates for operating income and following ones in the above table have not been revised.

Major Components of SG&A

| FY 4/19 Results | Ratio to sales | FY 4/20 Forecast | Ratio to sales | YOY | Initial Estimate | Difference from the estimate |

Selling commission | 84,760 | 16.8% | 83,774 | 16.8% | -1.2% | 85,540 | -2.1% |

Advertising cost | 11,544 | 2.3% | 12,001 | 2.4% | +4.0% | 12,774 | -6.1% |

Freight cost | 15,210 | 3.0% | 15,274 | 3.1% | +0.4% | 15,490 | -1.4% |

Depreciation and amortization | 11,296 | 2.2% | 11,029 | 2.2% | -2.4% | 11,096 | -0.6% |

Others | 94,745 | 18.8% | 95,922 | 19.3% | +1.2% | 95,748 | +0.2% |

Total | 217,555 | 43.2% | 218,000 | 43.8% | +0.2% | 220,648 | -1.2% |

*unit: million yen

Performance in each company

| FY 4/19 Results | Ratio to sales | FY 4/20 Forecast | Ratio to sales | YOY | Initial Estimate | Difference from the estimate |

ITO EN (Non-consolidated) | 394,495 | 73.0% | 389,600 | 73.0% | -1.2% | 400,500 | -2.7% |

Tully`s Coffee Japan Co., Ltd. | 34,568 | 6.4% | 36,300 | 6.8% | +5.0% | 36,300 | +0.0% |

Chichiyasu Company | 14,409 | 2.7% | 14,216 | 2.7% | -1.3% | 14,580 | -2.5% |

Other Domestic Subsidiaries | 58,788 | 10.9% | 57,007 | 10.7% | -3.0% | 59,169 | -3.7% |

US Business (unit: thousand dollars) | 32,385 | 6.0% | 30,997 | 5.8% | -4.3% | 33,350 | -7.1% |

Other Overseas Subsidiaries | 5,783 | 1.1% | 5,560 | 1.0% | -3.9% | 5,902 | -5.8% |

Elimination of Internal Transactions | -36,276 | - | -35,680 | - | - | -39,801 | - |

Consolidated Sales | 504,153 | - | 498,000 | - | -1.2% | 510,000 | -2.4% |

ITO EN (Non-consolidated) | 15,851 | 4.0% | 17,000 | 4.4% | +7.2% | 16,200 | +4.9% |

Tully`s Coffee Japan Co., Ltd. | 3,504 | 10.1% | 3,520 | 9.7% | +0.5% | 3,510 | +0.3% |

Chichiyasu Company | 269 | 1.9% | 410 | 2.9% | +52.4% | 350 | +17.1% |

Other Domestic Subsidiaries | 2,029 | 3.5% | 1,386 | 2.4% | -31.7% | 1,583 | -12.4% |

US Business (unit: thousand dollars) | 1,658 | 5.1% | 1,169 | 3.8% | -29.5% | 1,710 | -31.6% |

Other Overseas Subsidiaries | 1,080 | 18.7% | 1,063 | 19.1% | -1.6% | 1,034 | +2.8% |

Elimination of Internal Transactions | -1,572 | - | -1,548 | - | - | -1,387 | - |

Consolidated Operating Income (Profit Ratio) | 22,819 | 4.5% | 23,000 | 4.6% | +0.8% | 23,000 | +0.0% |

average to the US dollar in the term | ¥111.27 |

| ¥108.88 |

|

| ¥108.00 |

|

*unit: million yen

4. Brand strategies

ITO EN (non-consolidated)

| 1H of FY 4/19 | Ratio to sales | 1H of FY 4/20 | Ratio to sales | YOY |

Tea leaves | 16,902 | 7.8% | 16,198 | 7.8% | -4.2% |

Beverages | 199,013 | 91.4% | 191,043 | 91.4% | -4.0% |

Others | 1,810 | 0.8% | 1,638 | 0.8% | -9.5% |

Sales | 217,725 | 100.0% | 208,881 | 100.0% | -4.1% |

Japanese Tea/Healthy Tea | 113,965 | 52.3% | 111,325 | 53.3% | -2.3% |

Chinese Tea | 9,172 | 4.2% | 9,642 | 4.6% | +5.1% |

Vegetable | 25,013 | 11.5% | 23,347 | 11.2% | -6.7% |

Fruit | 5,683 | 2.6% | 4,694 | 2.2% | -17.4% |

Coffee | 21,366 | 9.8% | 19,530 | 9.4% | -8.6% |

Black tea | 3,155 | 1.5% | 3,833 | 1.8% | +21.5% |

Functional | 5,053 | 2.3% | 4,869 | 2.3% | -3.6% |

Mineral water | 6,510 | 3.0% | 5,490 | 2.6% | -15.7% |

Carbonated | 7,609 | 3.5% | 7,065 | 3.4% | -7.2% |

Others | 1,482 | 0.7% | 1,243 | 0.6% | -16.1% |

Total sales of beverages | 199,013 | 91.4% | 191,043 | 91.4% | -4.0% |

*unit: million yen

4-1. Oi Ocha

It appears that a 34% share of the market of green tea beverages has been achieved in the first half of the term. The sales of Oi Ocha, which is commemorating its 30th anniversary, declined 5% year on year, due to the sluggish performance of “Oi Ocha Shinryoku” and “Oi Ocha with Matcha” and the decrease of large plastic bottle products caused by unfavorable weather. However, the sales volume of the flagship personal size products (525 ml and 600 ml) increased 2%, with “Oi Ocha Ryokucha” becoming the top seller in all business categories.

Oi Ocha has become a very familiar drink for Japanese people. However, aiming to further increase market share, an increase of drinkers will be pursued by promoting functionality, enhancing “Oi Ocha Roasted Green Tea” and “Oi Ocha Roasted Rice Tea with Matcha,” and marketing closely connected to Japanese culture and various regions, so that it can be well-loved as “more familiar Japanese tea.”

As “More Familiar Japanese Tea”

Efforts will be taken so that the tea can be well-loved as “more familiar Japanese tea,” with the keywords “regionality,” “cherry blossoms,” and “haikus.”

(Source: the company)

Under the keyword “regionality,” packages adorned with famous places and specialties from around Japan will be used for different regions. Under the keyword “cherry blossoms,” they will continue the “Let’s plant cherry blossom trees for the future in our city” project, which was started in January 2019 to cherish the mindset of enjoying the four seasons unique to Japan. This project donates part of the sales of certain Oi Ocha products to cherry tree planting activities throughout Japan, in collaboration with the Japan Cherry Blossom Association (public interest incorporated association). The first tree planting took place in Konan-shi, Kochi Prefecture in April 2019. Under the keyword “haikus,” the “ITO EN Oi Ocha Shinhaiku Contest,” which has been held for 30 years, will be enhanced. Currently, haikus are submitted not only from Japan but from around the world, and at the 30th contest, which took place in 2019, there were submissions from countries such as Croatia, Bulgaria, and India, and the total number of submissions was approximately 2 million, which was the highest-ever figure. The total number of submissions over the past 30 years is approximately 35.7 million.

Increasing the number of drinkers

By promoting the functionality of “Oi Ocha Strong Green Tea” and enhancing “Oi Ocha Roasted Green Tea” and “Oi Ocha Roasted Rice Tea with Matcha,” the number of drinkers will be further increased.

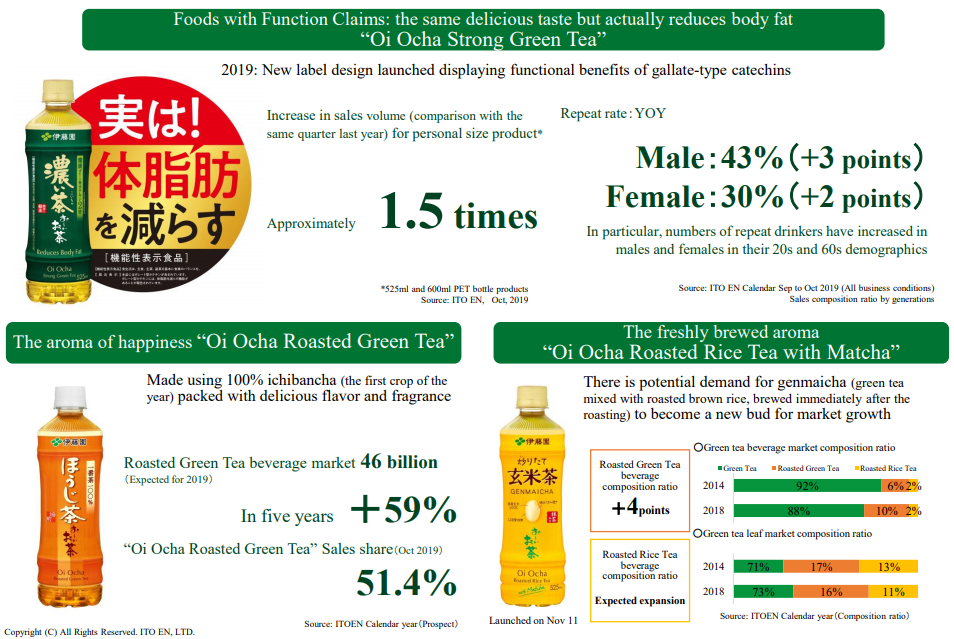

“Oi Ocha Strong Green Tea” is a green tea beverage that contains gallate-type catechins that have been reported to reduce body fat. Sale indicating the functionality of gallate-type catechins began in August 2019. In the first half of the term, the sales of this product in the personal size increased by approximately 50% year on year, and the product is currently performing well. Up to now, this product has been popular among middle-aged and older men, but the number of male and female consumers in their 20s is increasing, and repeat consumption among people in their 60s is also increasing. For men, repeat consumption rate was 43%, which was 3-point increase from the same period last year, while it was 30% for women, which was 2-point increase.

The lineup will be strengthened with “Oi Ocha Roasted Green Tea” and “Oi Ocha Roasted Rice Tea with Matcha.” In 2019, the market of hojicha (roasted green tea) beverages is expected to be worth 46 billion yen, and is a growing market that has expanded 59% in five years. “Oi Ocha Roasted Green Tea” uses 100% “ichibancha,” which is rich in umami and aroma, and is the top brand with a 51.4% share of the market of hojicha (roasted green tea) beverages (as of October 2019). Nearly 10 million cases have been sold. On the other hand, “Oi Ocha Fresh Genmaicha” is genmaicha beverage which is extracted immediately after roasting rice. They struggled to reproduce the fragrance of genmaicha made in a teapot, but this difficult hurdle was cleared, and the renewed product was launched on November 11. Genmaicha accounts for 11% of the company’s leaf product sales (green tea accounts for 73% and hojicha makes up 16%), but genmaicha only makes up 2% of beverage product sales (green tea 88%, hojicha 10%). Therefore, there is high potential demand for genmaicha beverages, and if demand can successfully be stirred, sales can increase more than fivefold.

(Source: the company)

4-2. Tea Leaves

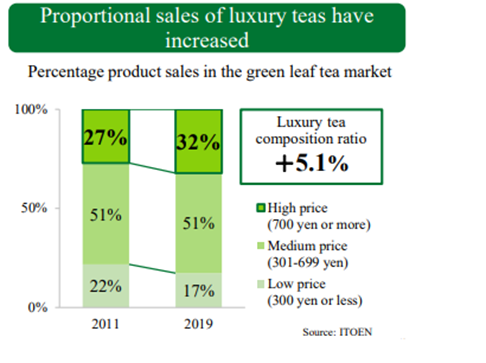

In the first half of the term, the sales of green tea leaves decreased 4.2% year due to bad weather, but the sales of high-quality leaves (1000-1500 yen per pack) were strong. In the three categories of high price (700 yen or more), medium price (301-699 yen), and low price (300 yen or less), the proportion of low-price sales decreased from 22% to 17%, while the proportion of high-price sales increased from 27% to 32% (the proportion of medium price sales was unchanged at 51%). As educational activities, the company gives suggestions for “delicious tea” from ITO EN “Tea Tasters,” and “grand tea ceremonies” and “seminars on how to prepare delicious tea” are held 1,500 times per year. The idea is to stimulate the market of tea leaves by offering chances to experience “ichibancha,” which is delicious tea with an umami flavor.

The demand for easy-to-make delicious tea is growing, centered on older households that are already familiar with tea. In the market of tea leaves, the share of Easy-to-Use products, which was 25% in 2011, has increased to 41% in 2018 (purchase amounts for Easy-to-Use green tea leaf products among people in their 50s and 60s have increased by 67% between 2011 and 2018). Therefore, as product development which is in tune with the times, the company is focusing on Easy-to-Use products such as teabags and instant tea products. This also responds to the demand for individualized products. The company is also one of the few companies investing in production lines for Easy-to-Use products, and it has a 50% share in the market of Easy-to-Use green tea leaves.

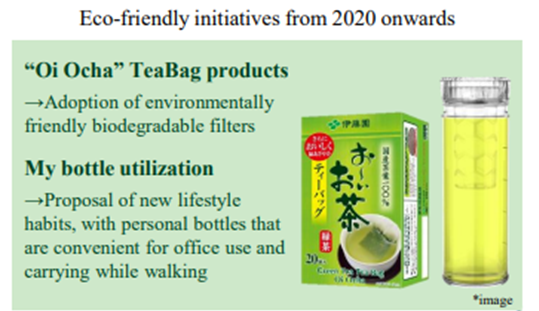

As an environmental initiative for 2020 onwards, the adoption of environmentally friendly biodegradable filters to Oi Ocha teabag products is being planned. In addition, new ways of living will be introduced through the use of personal bottles which are convenient for office use and carrying around.

|

|

(Source: the company)

4-3. Barley Tea

The barley tea beverage “Kenko Mineral Mugicha” (healthy mineral Barley Tea), with its “kettle-quality flavor,” has been gaining recognition for its summertime mineral replenishment, and since it is a caffeine-free tea beverage, it is gaining popularity across age groups. In the first half of the term, the sales of thirst-quenching beverages were sluggish due to bad weather, but thanks in part to contributions from the new product “Kenko Mineral Mugicha Sukkiri Kenko Blend,” the total sales of Kenko Mineral Mugicha increased 0.7% year on year. While all companies released new products, the 47% market share was maintained. There was a strong trend in which consumers who started drinking in summer continued to drink in autumn and winter. In the previous term, figures for spring and summer (May-August) increased 14% year on year, but figures for autumn and winter (September-January) had a greater growth rate, increasing 22% year on year. Kenko Mineral Mugicha is becoming established as a yearlong product, and is about to achieve an annual sales volume of 40 million cases. Additionally, the adoption of a roasting technology, which will be the first of its kind worldwide, is planned for March 2020. It is said that this technology will make it possible to have a more fragrant and pleasant aftertaste as well as a more stable supply of ingredients for barley tea products.

4-4. Black Tea and Vegetable Beverages

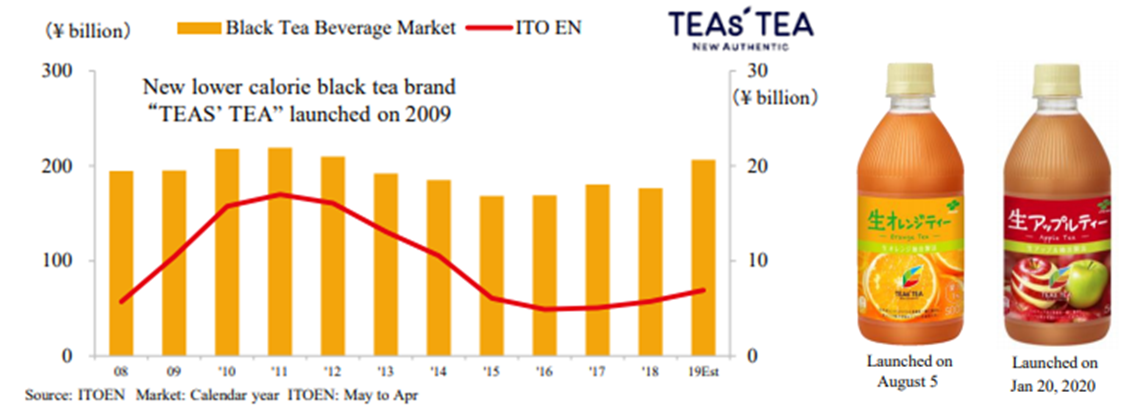

As for black tea beverages, “TEAs’ TEA,” which was born in the United States, has been revitalized. In 2009, it was reverse-imported to the Japanese market as a new low-calorie black tea brand. Its sales grew steadily, but sales had fallen in the past few years due to difficult competition with flavored water. In the first half of the term, existing products sold well. Additionally, the new product introduced in August, “Raw Orange Tea,” which is fruit tea made with “raw” fruit, launched well, with sales exceeding 12 million bottles after approximately one month of sales. It is a new type of black tea beverage (fruit tea) made with raw orange slices that have been extracted together with black tea, in addition to orange juice made with oranges that have been squeezed whole, including the peels. The sale of “Raw Apple Tea” made with “raw” apple slices is planned for January 2020.

(Source: the company)

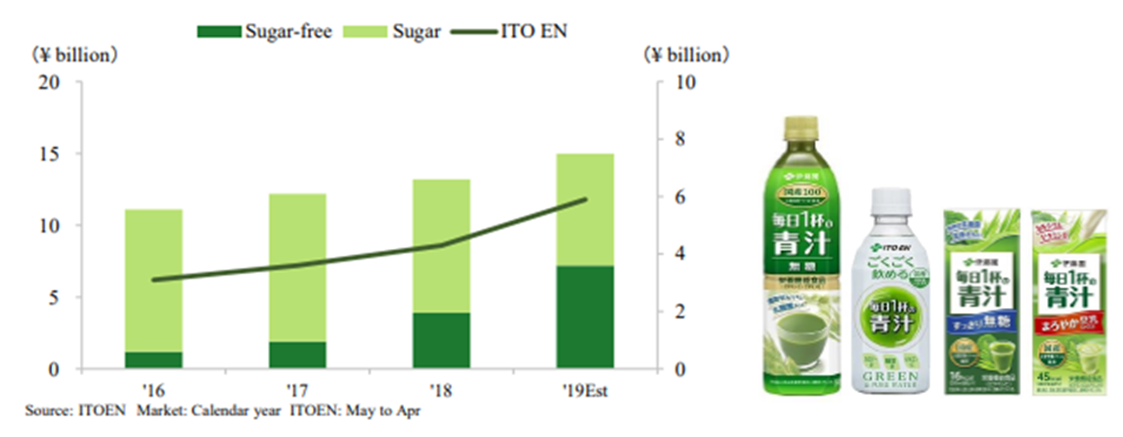

As for vegetable beverages, the sales of sugar-free Aojiru (Green Juice) are growing. It can be purchased easily at stores and vending machines and consumed easily as a beverage. Consumers highly evaluate it from the aspects of taste and health, saying “It’s delicious and goes well with our meals” and “It’s healthy and increases our intake of vegetables.” The sales in FY 4/20 are estimated to grow about 2 times from the previous term.

(Source: the company)

4-5. Tully’s Coffee

The sales of the subsidiary Tully’s Coffee Japan in the first half of this term increased 3.7% year on year, as 80% of shops had to suspend operation due to the typhoons in October, but many shops were established at good locations and the sales of black tea beverages were healthy. Due to the augmentation of costs for recruitment and human resources and the suspension of operation caused by the typhoons, operating income decreased 6.2% year on year, but it is projected that annual sales and annual operating income will grow 5.0% and 0.5%, respectively, year on year. In cooperation with Medina Farm in Guatemala, the company released “Guatemala Antigua Medina” (2,200 yen/200 g) in September and “&TEA Peach Melba Royal Milk Tea” on November 1. The effect of the consumption tax hike is minor, so it can be expected that the shops opened at good locations will contribute further in the second half of this term. The number of shops at the end of this term is to be 758, up 23 from the end of the previous term.

The original “coffee school” held at some shops is highly evaluated. Customers can learn the knowledge of coffee and how to brew delicious coffee from coffee masters and advisors, who are certified by the in-company qualification system of Tully’s Coffee. In 2019, the school will be held about 3,500 times.

As for coffee, the performance of plastic-bottled coffee was stagnant, but bottled black coffee sold well, occupying the largest market share.

4-6. Overseas strategy

In the first half of this term, overseas sales declined due to the effects of exchange rates, but the needs are shifting from sugar-containing beverages to sugar-free beverages globally, so the company’s business chances are expanding. As for ITO EN in North America, the composition ratio of sugar-free beverages rose from 46.6% in 2014 to 57.6% in 2018, and the sales volume of “Oi Ocha” in May to September 2019 was 23% larger than that in the previous term. In October, the subsidiary ITO EN in North America started selling “Oi Ocha” and “Jasmine Tea” in Walmart stores throughout the U.S. Recyclable plastic bottles are used for both products, so it can be expected that these products will not only contribute to revenue directly, but also improve the mid/long-term brand popularity of ITO EN and contribute to the expansion of sales channels.

In China, too, the sales composition of sugar-free beverages of ITO EN (Shanghai) increased from 49.4% in 2014 to 87.9% in 2018, and sales dropped year on year due to the yuan depreciation, but the sales volume of “Oi Ocha” in May to September 2019 was 20% larger than that in the previous term.

The company sells “Oi Ocha” in over 30 countries around the world, and the global sales volume during a 5-month period from May to September 2019 was up 13% year on year. As obesity rate is increasing globally and the sugary drink tax is increasingly adopted, “health” is now a global trend. The number of overweight people who fall under obese people is about 712 million, accounting for about 10% of the global population, and it is said that 22 countries have adopted “sugary drink tax.”

5. Conclusions

The efforts for improving profitability that have been made since the second half of the previous term paid off, and profit increased amid the stringent business environment. From now on, the company will tighten revenue management, and promote the sales of mainly “Oi Ocha,” “Kenko Mineral Mugicha,” and the bottled black coffee of “Tully’s Coffee,” and develop “TEAs’ TEA” and sugar-free Aojiru, for the purpose of expanding sales. While some beverage makers release alcoholic beverages, the company plans to brush up its competitive domains and brands, focus on the field of sugar-free beverages, where the company has advantages, and develop a new brand. We would like to pay attention to how much the company can increase sales while keeping a good balance with profitability.

In the business in North America, DLTC is sluggish, but the company started selling “Oi Ocha” and “Jasmine Tea” at Walmart stores throughout the U.S. in October. As the needs are shifting from sugar-containing beverages to sugar-free ones globally, they are expected to contribute to not only revenue, but also the mid/long-term improvement in the brand popularity of ITO EN and the expansion of sales channels. The performance of DLTC is estimated to remain sluggish, and it is noteworthy how the company will cope with it.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 12 directors, including 3 outside ones |

Auditors | 4 auditors, including 3 outside ones |

◎Corporate Governance Report:Updated December 2, 2019

Basic Policy

“Always Putting the Customer First” is the ITO EN Group’s management philosophy. In the ITO EN Group’s Basic Policies, the basis of our business administration to take corporate social responsibility in cooperation with interested parties such as the government, local communities, consumers, shareholders, clients, suppliers, and financial institutions, in order to achieve sustainable growth and development as well as increasing our corporate value. This management philosophy is the fundamental policy behind our group’s corporate ethics and the unchanging truth that supports our corporate governance. Based on this philosophy, all the executives and employees of our group will actively pursue an operation that works towards a sustainable society while responding to the trust of all the interested parties. To realize an appropriate form of corporate governance, our company, which has a board of auditors, carries out audits in which the auditors inquire the business conditions, the decision-making processes, etc. of the representative directors, the directors in charge or the employees of our group companies. The auditors attend every meeting of the board of directors in order to give their objective and impartial opinions on the audit situations concerning the company in general or individual issues, and audit the business execution by the directors in accordance with the audit policies set out by the board of auditors.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

【Supplementary Principle 4-11 (1) Policies for the balance, diversity, and scale of the Board of Directors】

The number of members of the Board of Directors of our company is up to the limit specified by our articles of incorporation. As for its composition, the Board of Directors is basically composed of the necessary and appropriate number of members for making effective decisions and securing substantial discussions. Although there are no female directors as of the date of submission of this report, we will make efforts to appoint female directors from the viewpoint of securing diversity in gender and internationality, and expertness.

(Article 6 of ITO EN’s Guidelines (Composition of the Board of Directors))

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

In principle, our company will not hold any shares of other companies, unless it is considered that the shareholding would smooth transactions, procurement, or fund raising. If the shareholding is not expected to contribute to the improvement in mid/long-term corporate value, we will reduce the number of shares we hold step by step. As for the shares of listed companies we hold in accordance with the above proviso (hereinafter called “strategically held shares”), we check whether the return of invested capital exceeds capital cost for each stock at the annual meeting of the board of directors. From the viewpoint of maintaining and cementing the mid/long-term relations with business partners, we check the meanings of shareholding, and confirm at the meetings of the board of directors that we will sell or reduce the shares whose economic rationality and meanings have diluted after consulting with the parties concerned. As for the exercise of voting rights for strategically held shares, we check the contents of each bill and comprehensively judge whether it will contribute to the improvement in corporate value of our company and the invested company, before exercising them. (Article 14 of the Guidelines of our company-Policy for strategic shareholding)

【Principle 1-7 Transactions among related parties】

If our company makes a transaction with an executive, a major shareholder, or the like, we will discuss said transaction at a meeting of the board of directors to obtain their approval, unless the conditions for said transaction are the same as those for general transactions so that said transaction will not harm the common interests of our company and shareholders, etc. (Article 13 of the Guidelines of our company-System for managing transactions among related parties)

【Principle 5-1 Policy for constructive dialogue with shareholders】

After grasping its own capital cost accurately, our company listens to the voices of shareholders and pays proper attention to their interests and concerns through the constructive dialogue between the management and shareholders, revises its business portfolio, explicitly explains its management policies including the investment in equipment, R&D, and human resources, and win the understanding of shareholders. (Article 16 of the Guidelines of our company-Policy for constructive dialogue with shareholders)

For details, please see the report titled “Situation of IR-related activities.”

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ITO EN, LTD. (2593) and Bridge Salon (IR seminar), please go to our website at the following URL.www.bridge-salon.jp/