Bridge Report:(2986)LA Fiscal Year ended December 2023

President Eiichi Wakita | LA Holdings Co., Ltd.(2986) |

|

Company Information

Market | Growth Market of Tokyo Stock Exchange and Main Board of Fukuoka Stock Exchange |

Industry | Real estate |

President | Eiichi Wakita |

HQ Address | Kokusai Hamamatsucho Building 7F, 1-9-18 Kaigan, Minato-ku, Tokyo |

Year-end | December |

Homepage | https://lahd.co.jp/ |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

4,550 yen | 6,246,775 shares | 28,422 million yen | 25.0% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

220.00 yen | 4.8% | 560.30 yen | 8.1x | 2,409.00 yen | 1.9x |

*Share price as of closing on February 22. All figures were taken from the financial statements for FY 12/2023.

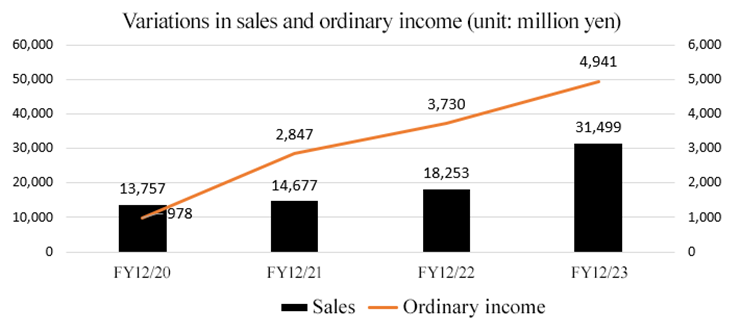

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2020 Act. | 13,757 | 1,124 | 978 | 650 | 123.58 | 43.00 |

December 2021 Act. | 14,677 | 3,216 | 2,847 | 1,959 | 410.83 | 132.00 |

December 2022 Act. | 18,253 | 4,226 | 3,730 | 3,381 | 638.25 | 200.00 |

December 2023 Act. | 31,499 | 5,552 | 4,941 | 3,293 | 549.10 | 211.00 |

December 2024 Est. | 33,000 | 5,700 | 5,000 | 3,500 | 560.30 | 220.00 |

December 2025 Plan | 51,000 | 8,200 | 7,400 | 5,100 | 816.40 | TBD |

*Unit: million yen. Estimates are those of the company. Net income is profit attributable to owners of the parent. The figures for the fiscal year ending December 2025 were taken from the medium-term management plan (FY 12/2023 to FY 12/2025).

This report includes the brief description of LA Holdings Co., Ltd., the trend of their business performance, and the interview with President Wakita.

Table of Contents

Key Points

1. Company Overview

2. Medium-term Management Plan

3. Fiscal Year ended December 2023 Earnings Results

4. Fiscal Year ending December 2024 Earnings Forecasts

5. Interview with President Wakita

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- LA Holdings operates three core businesses: new real estate sales, revitalized real estate sales, and real estate leasing. “L'attrait Premium-Renovation®,” the flagship series for revitalized real estate sales, features planning and design to provide “quality” that matches the needs of wealthy people, with prices ranging from 100 million yen to 900 million yen, aiming for high prices and high added value. The company has established a distinctive position that no other company can occupy. It is also focusing on operating its business in Kyushu and Okinawa.

- In the “medium-term management plan” (FY 12/2023 to FY 12/2025), they aim to achieve “sales of 51 billion yen and an ordinary income of 7.4 billion yen” in the fiscal year ending December 2025, by mainly pursuing their existing business.

- In the fiscal year ended December 2023, sales grew 72.6% year on year to 31.4 billion yen. In the business of development of income-producing properties, office buildings and commercial buildings sold well. In the revitalized real estate sales business, high-priced properties sold well, so annual sales reached 10 billion yen for the first time since the inauguration of their business. Operating income rose 31.4% year on year to 5.5 billion yen. SGA augmented 65.3% year on year, but the strategy of offering high added value turned out to be effective, increasing profit significantly. Operating income margin increased 8.2 points year on year.

- For the fiscal year ending December 2024, it is expected that sales will grow 4.8% year on year to 33 billion yen and operating income will rise 2.7% year on year to 5.7 billion yen. They will continue the operation of the three business segments in accordance with the policy of the medium-term management plan. They plan to pay a dividend of 220.00 yen/share, up 9 yen/share from the previous fiscal year. The expected payout ratio is 39.3%.

- We interviewed President Wakita about the company’s competitive advantage, his message to shareholders and investors, etc. He said, “As a manufacturing company, our goal is not to increase the number of units sold, but rather to thoroughly avoid commoditization and constantly pursue high added value. We would like you to know that a major feature of our company is that we are able to set our own market price” and “Although we are still a small company, we will always pursue uniqueness and aim for steady growth and expansion of market capitalization, so we would appreciate your support.”

- The comparison of their major indicators with those of other major listed companies that sell revitalized real estate indicates that their operating income margin is the second highest and ROE is the highest although sales are small. Their high profitability is remarkable, as President Wakita aims for. The company is also the only one that has a PBR of much higher than 1. We would like to pay attention to what kinds of products they will create as a “company engaging in production.”

1. Company Overview

LA Holdings operates three core businesses: new real estate sales, revitalized real estate sales, and real estate leasing. “L'attrait Premium-Renovation®,” the flagship series for revitalized real estate sales, features planning and design to provide “quality” that matches the needs of wealthy people, with prices ranging from 100 million yen to 900 million yen, aiming for high prices and high added value. The company has established a distinctive position that no other company can occupy. It is also focusing on operating its business in Kyushu and Okinawa.

[1-1 History]

The predecessor of the company was L'attrait Nijuichi, Co., Ltd., established in December 1990 for the purpose of buying/selling real estate, acting as a sales agent, managing rental properties, and buying/selling golf memberships. Following the expansion of its business, the company was listed on the “Hercules Market” of Osaka Exchange in June 2006.

Due to a subsequent downturn in business performance, Eiichi Wakita (currently the representative director and president of LA Holdings Co., Ltd.) was entrusted with the restructuring of the business and was invited to join the company in December 2012 (appointed as the representative director and president of L'attrait Co., Ltd. in March 2013).

Under the leadership of Wakita, who has developed a track record in building design and real estate development since his twenties, the restructuring of the business has progressed steadily with increased capital and changes in management strategies.

In July 2020, L'attrait Co., Ltd. established LA Holdings Co., Ltd., which acquired shares of L’attrait, and got listed on JASDAQ (Growth) of Tokyo Stock Exchange (L'attrait Co., Ltd. was delisted in June 2020). In the same month, Mr. Wakita was appointed as representative director and president of LA Holdings Co., Ltd.

In April 2022, the TSE market was reorganized and the company was listed on the Growth market.

[1-2 Corporate Philosophy]

The Corporate Philosophy and Management Philosophy of the Group are as follows:

Corporate Philosophy | Creating “attractive products and services” to realize a “prosperous and attractive society” for people |

Management Philosophy of the Group

1 | To establish a corporate culture that is free and open-minded and grow stably by fostering the wisdom and creativity of our employees while swiftly adapting to the new economic environment in the new era and taking into account new and innovative management without being bound by established business models, grow steadily, and pursue coexistence and co-prosperity with society |

2 | While being constantly aware that “homes shape people's hearts and lives,” we not only pursue the original functionality and livability of homes, but also provide sophisticated and attractive products that are compatible with local communities and the environment while anticipating changes in times and trends, to realize business administration that can meet clients’ needs. |

3 | To strive for management that contributes to the creation of local living environments by providing “homes that enrich people's hearts” through clean and fair corporate activities that value the lifestyles of local communities. |

4 | To create a working environment in which people can work together to exert their abilities fully through dedication and diligence to live a pleasant life full of enthusiasm, optimism, and ambition. |

5 | Based on the principle that “client satisfaction and employee motivation support a company,” we aim to manage business in harmony with society by ensuring an appropriate profit return. |

[1-3 Business Environment]

The main business environment in which the company operates is as follows:

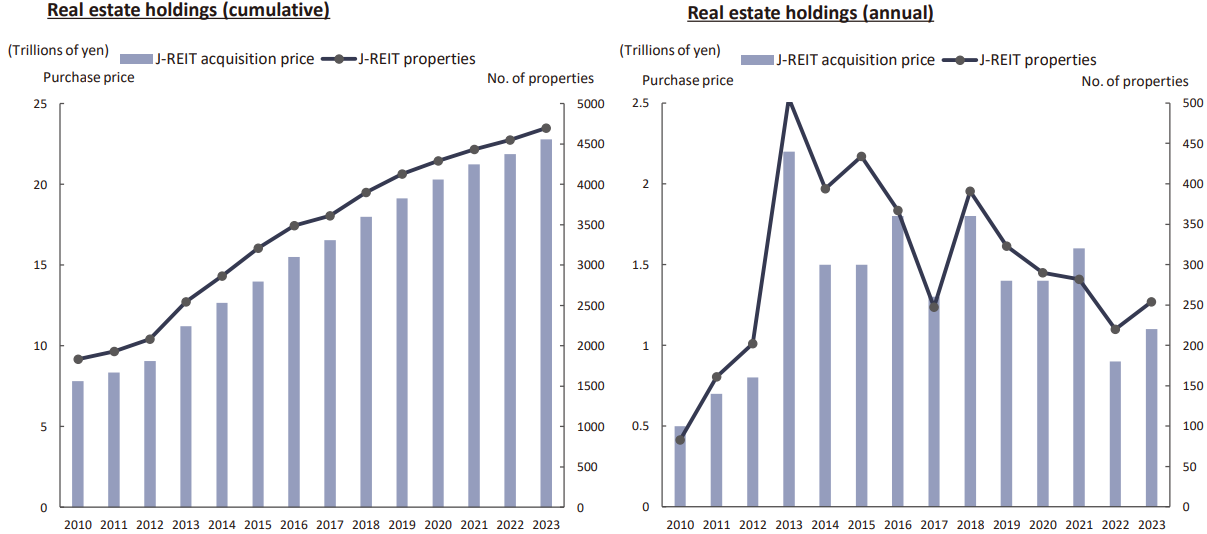

◎ Real estate investment market

The acquisition cost of J-REIT properties in 2023 increased by 26% from the previous year to 1,104.3 billion yen, exceeding 1 trillion yen for the first time in two years.

Demand for real estate investment continues to remain strong.

(Source: the reference material of the company)

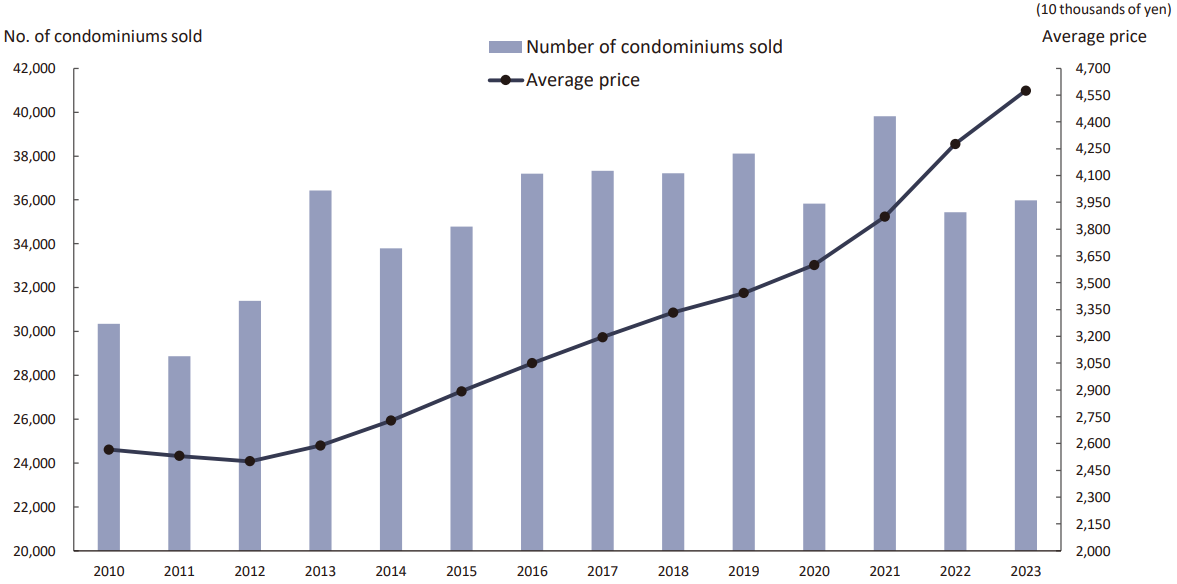

◎ Second-hand condominium market in the Tokyo metropolitan area

The number of contracts concluded for second-hand condominiums in the Tokyo metropolitan area was 35,987 in 2023, showing an increase of 1.6% from the previous year and the first increase in two years.

When looking at the properties sold in each price range, we can see that the number and proportion of properties sold in the price range above 50 million yen are expanding.

(Source: the reference material of the company)

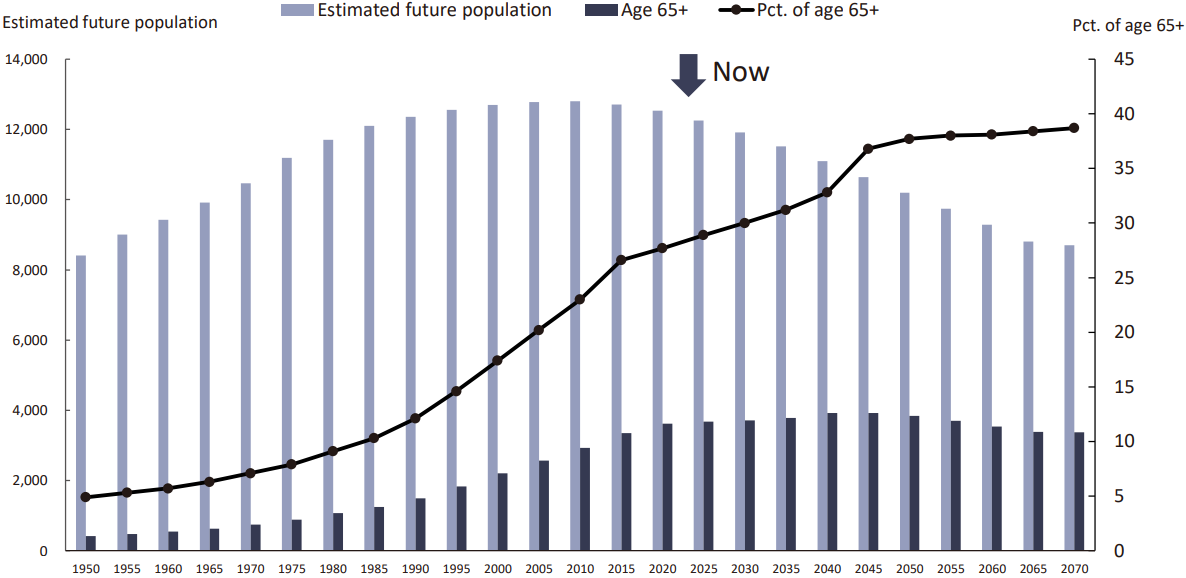

◎ Variations in elderly population and future projections

While the total population peaked in 2010 and began to decline, the proportion of the population aged 65 and over will continue to rise until 2045, and demand for the high value-added, high-priced condominiums handled by the company will remain strong.

(Source: the reference material of the company)

[1-4 Business Description]

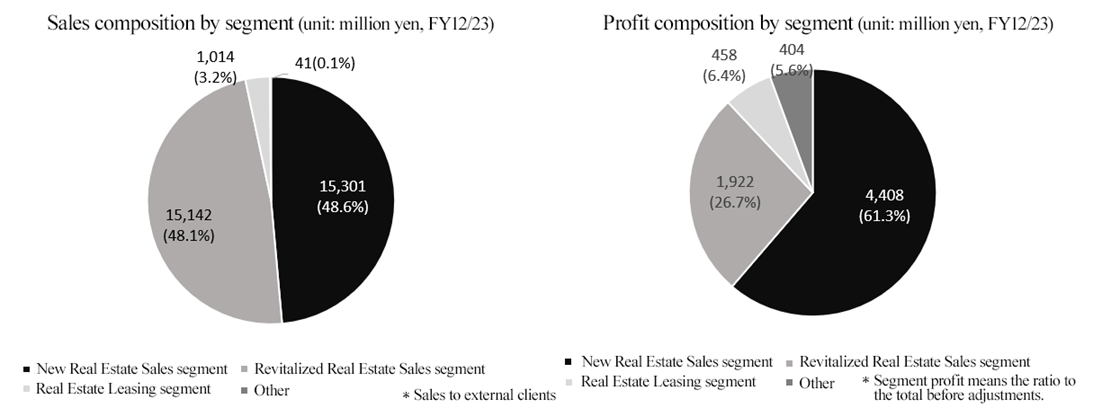

The three reportable business segments are the “New Real Estate Sales segment,” the “Revitalized Real Estate Sales segment,” and the “Real Estate Leasing segment.” The business segment “Other,” which is not included in the reportable segments, includes real estate brokerage services and businesses derived from other businesses.

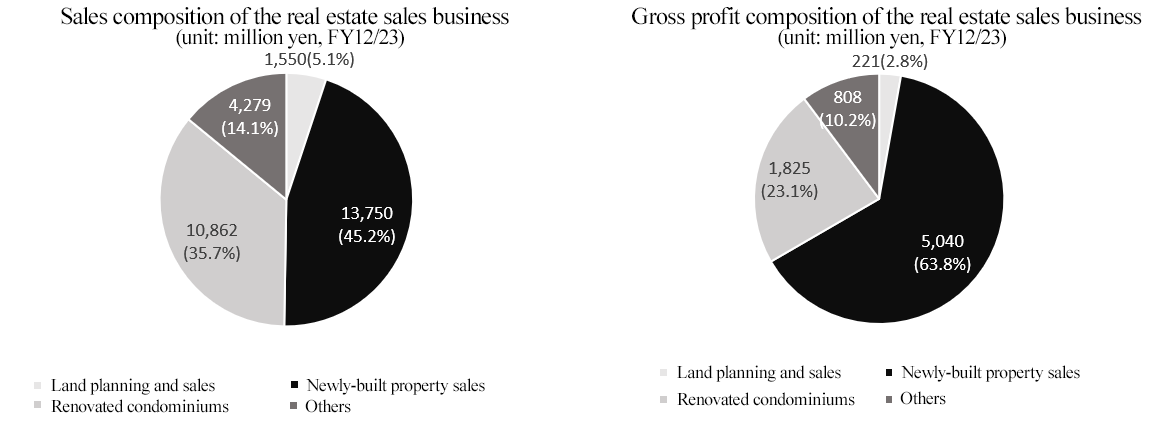

In addition, sales and gross profit from “Land planning and sales” and “Newly-built property sales” in the “New Real Estate Sales segment” and from “Renovated condominiums” and “Others” in the “Revitalized Real Estate Sales segment” are disclosed in the financial statements and other materials.

*Segment profit is obtained by subtracting selling and non-operating expenses from the gross profit of each segment.

(1) New real estate sales business

(i) Development work | <Overview> ◎ Profit-generating real estate development (L'attrait Co., Ltd.) Developmental services for rental residences, including residential condominiums, and urban commercial buildings, such as buildings for retail shops and office buildings, to be sold to investment corporations and general corporations.

◎ Development of new condominiums for sale (LA Holdings Co., Ltd. and FAN STYLE Co., Ltd.) To perform development work and sell condominiums to general customers and others

<Characteristics> By participating in land procurement and product development, the company is able to pay attention to the overall design of the building and the smallest details. It can also focus on aspects such as structure, earthquake resistance, fire resistance, energy savings, eco-friendliness, air quality, and sound insulation. By conducting business from product development to sales, including procurement and planning, the company creates “attractive products and services” in anticipation of the needs of society.

・Rental residences The company creates and establishes brands such as “THE DOORS,” a luxury rental residence that offers different values from the existing ones and extraordinary emotional experience value.

・Urban commercial buildings The company is working to continuously improve the brand strength of the “A*G” series, which focuses on areas with high potential as prime future locations and is based on the concept of “small but brilliant,” and the “THE EDGE” series, which is based on the concept of “an office that is different from typical offices and like home” as an office brand that has uncovered potential needs among the core group of tenants.

・New condominiums for sale By creating series such as “L'attrait Residence” by L'attrait Co., Ltd. and “rêve GRANDIT” by FAN STYLE Co., Ltd., the company is providing new value to lifestyle-oriented targets under the keywords: “innovative design,” “unique world view,” and “cutting-edge.”

The strength of these product developments is that the land information can be used effectively to increase procurement opportunities. |

(ii) Land planning and sales | Among the land L'attrait Co., Ltd. is considering as a site in its development work, the company will sell the land and the business plan as a set, after carrying out development planning and certain procedures, to other companies in the same industry for relatively prime sites that did not ultimately meet the criteria for product development. The benefit for buyers is that they can reduce the time required for development. |

(iii) Purchase and resale work for new condominiums | L'attrait Co., Ltd. buys and sells newly built properties developed by other developers after reviewing their location, development concept, safety, design, habitability, and profitability. By leveraging the know-how developed to date, the company provides value-added sales by coordinating household goods, furniture, and interior furnishings to suit the property, along with advice and references for home loans. |

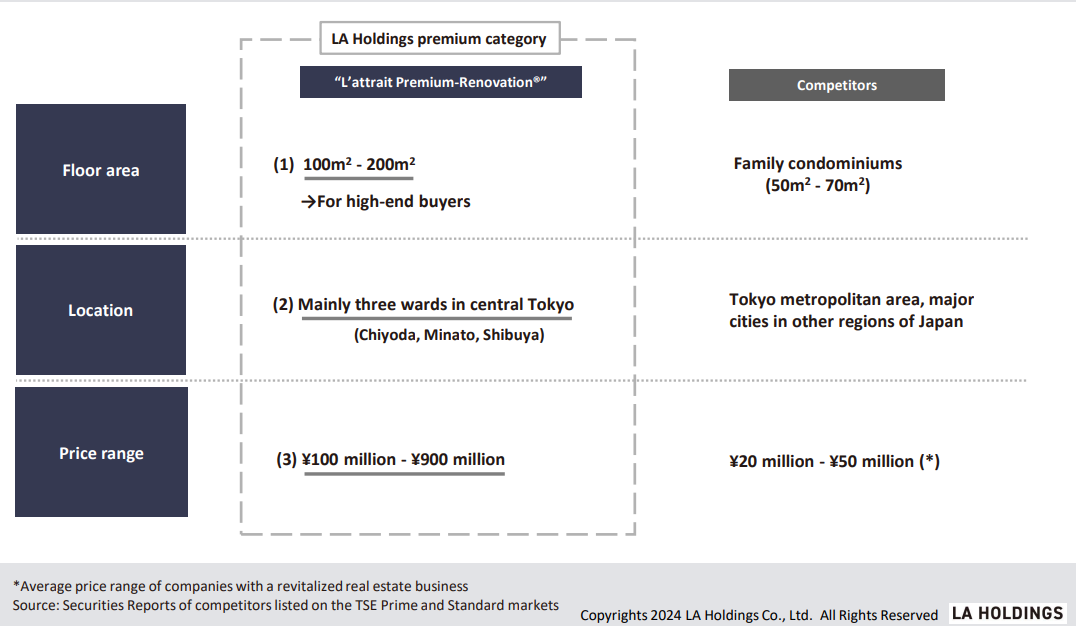

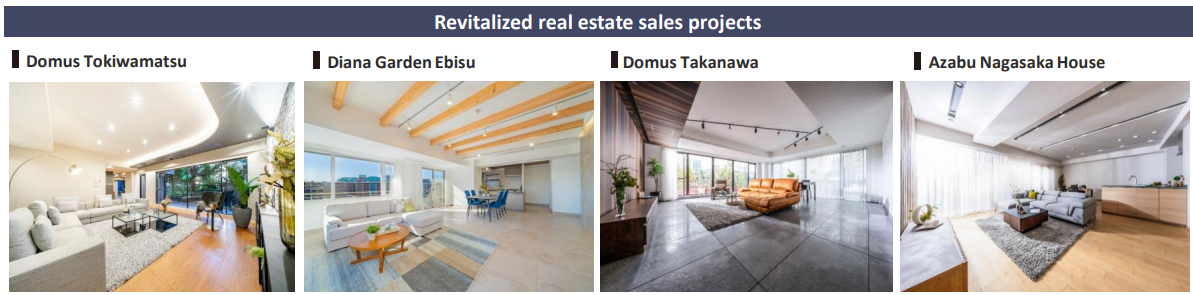

(2) Revitalized real estate sales business

(i) Sale of renovated condominium units | <Overview> L'attrait Co., Ltd. and L'attrait Residential Co., Ltd. purchase second-hand condominium units, plan and draft the details of renovation of each unit*1 to restore them as sophisticated residences, which are then sold by L'attrait Residential Co., Ltd. to general customers and other parties.

When purchasing properties, the company carefully reviews and selects properties based on location, price, size, etc., and buys them, using information on the settlement of debts through brokers, real estate agents, servicers, and financial institutions.

<Characteristics> Used condominiums are furnished with interiors and amenities similar to those in new ones, enabling highly functional, individually renovated condominiums to be sold to customers at more reasonable prices than newly built properties with the same conditions. Focusing on the premium area in the high price range, the company has created a series of two condominiums with different concepts: “L'attrait Premium-Renovation®,” priced at 100 million yen or over per unit, and “Hi▶La▶Re,” priced between 70 million yen and 100 million yen per unit. The series offers attractive products at rare and unique locations with sophisticated living spaces.

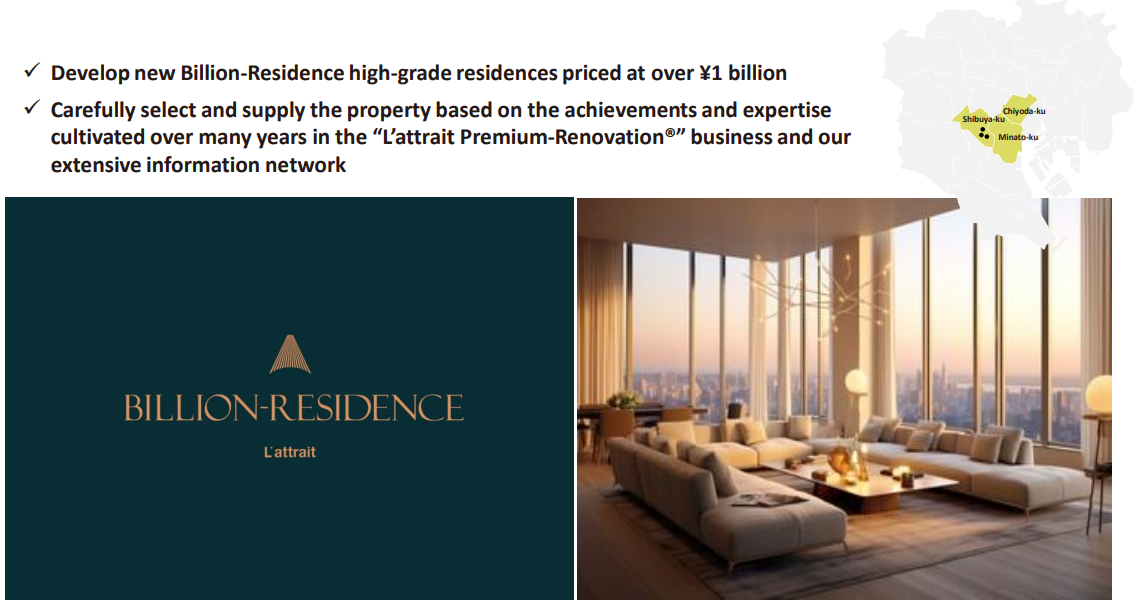

Furthermore, with the aim of creating new value, the company started developing “Billion Residence,” high-grade mansions worth over 1 billion yen. |

(ii) Renovation and sale of individual buildings | <Overview> L'attrait Co., Ltd. acquires a single building among company-owned employee dormitories, company housing, and rental condominiums in the Tokyo metropolitan area, completely renovates the building, and L'attrait Residential Co., Ltd. sells each unit to general customers, etc.

<Characteristics> Due diligence is carried out on the entire building by utilizing the renovation know-how of L'attrait Co., Ltd. Based on this, a complete renovation (renovation of a single building*2, conversion*3) is carried out, for not only private areas, but also common areas, to significantly renew the functionality of the building and make it attractive for sale. The company prepares building management plans, repair plans, financial budgets, etc., formulates management associations, appoints management specialists, and focuses on improving the living environment so that residents can live with peace of mind after they move in. |

(iii) Investment project

| <Overview> L'attrait Co., Ltd. purchases a single building among rental office buildings, company-owned employee housing, and rental residences in the Tokyo metropolitan area, and uses the renovation know-how of the company to carry out detailed due diligence on the entire building in order to increase profitability.

Based on this due diligence, cost management related to building management, etc., is carried out, while the building is converted or revitalized to improve its ability to attract tenants or occupants, increase profitability, improve cash flow, and then sell it (to corporate and individual investors). |

(3) Real estate leasing business

LA Asset Co., Ltd. and L'attrait Co., Ltd. lease and manage real estate owned as fixed assets, and manage the leasing to tenants of pre-resale properties held as real estate for sale.

The business of leasing of real estate owned by the company includes (1) to construct or acquire healthcare facilities, residential hotels, and commercial facilities and then lease individual buildings to operators, and (2) to construct or acquire office buildings and rental residences and then lease each unit separately.

*1: Renovation of each unit

This refers to the renovation of second-hand condominiums that have been in use for a certain period of time after construction, by reviewing the interior, layout, housing equipment, etc., to improve their functionality and restore them as sophisticated residences comparable to newly-built ones.

*2: Renovation of a single building

A comprehensive review of a building that has declined in value, including the repair history of the building, to improve the overall value of the building (value enhancement) by updating outdated facilities and adding new features to the building.

*3: Conversion

Renovation that involves changing the purposes of use of the building, such as converting an office building into an apartment building and converting dormitories or company housing into a commercial facility.

[1-5 Characteristics, strengths and competitive advantages]

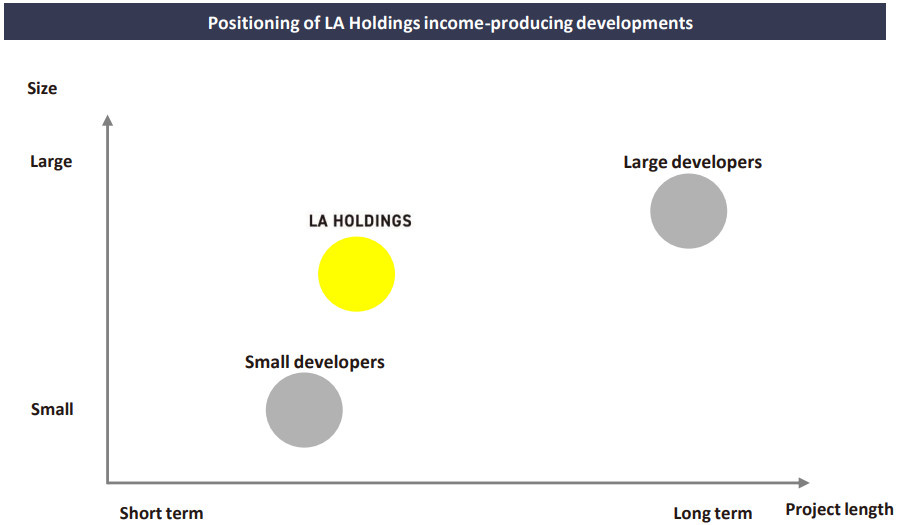

The company's primary competitive advantage is its unique positioning in new and revitalized real estate sales.

(1) New real estate sales

In terms of the scale of development, they focus on medium-scale development costing 1-4 billion yen.

In terms of development areas, the company focuses on finding areas with high potential to become “prime areas in the future,” and it has a significant advantage in the ability to gather information and identify the best areas to achieve this.

Furthermore, with regard to the development period, they focus on projects whose development period is not long, but 2-3 years and put importance on efficiency.

In this way, the company has found a competitive advantage by focusing on specific markets and areas and has established a unique position by finding white spaces that are difficult for other companies to deal with.

(Source: the reference material of the company)

(2) Revitalized real estate sales

“L'attrait Premium-Renovation®,” a flagship series, features planning and design to provide “quality” that matches the needs of the rich, with prices ranging from 100 million yen to 900 million yen, aiming for high prices and high added value.

In addition, the company targets “100 m2 or over” in terms of size and “three wards in the urban center” in terms of area, thereby establishing a unique position that other companies are not dealing with.

(Source: the reference material of the company)

2. Medium-term management plan

The “medium-term management plan (FY 12/2023 to FY 12/2025)” announced in February 2023 is ongoing.

[2-1 Basic policy]

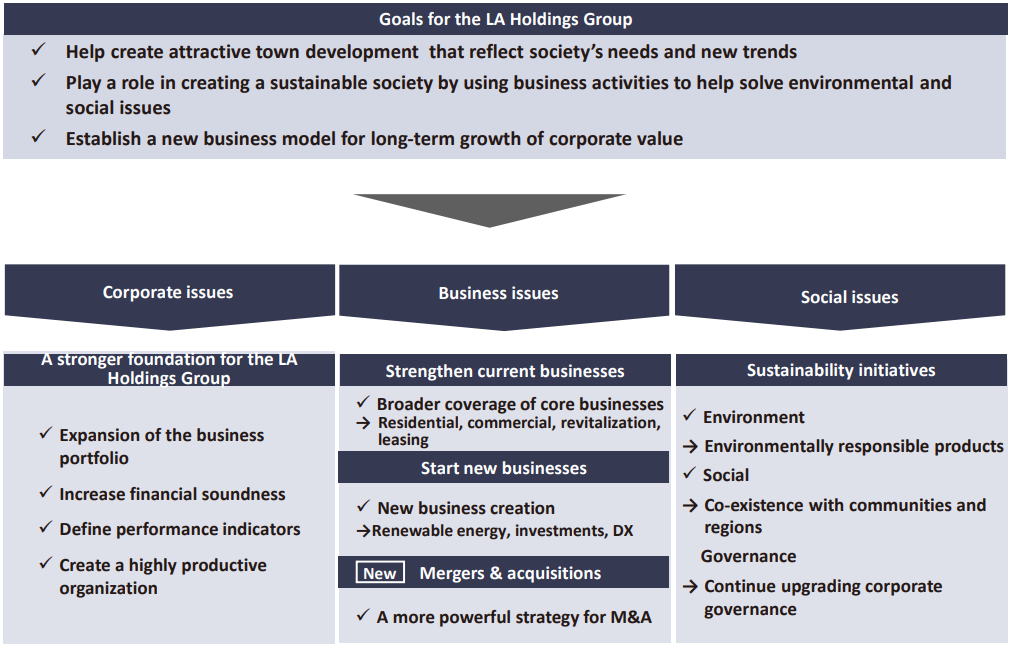

They aim to “help create attractive town development that reflect society’s needs and new trends,” “play a role in creating a sustainable society by using business activities to help solve environmental and social issues,” and “establish a new business model for long-term growth of corporate value” and consider the following three as business issues.

① Pursuit of existing business

② Creation of new business

③ Promotion of M&A

(Taken from the reference material of the company)

[2-2 Business issues]

(1) Pursuit of existing business

They will strive to enrich their core business.

*New real estate sales business

They engage in multiple projects for developing residential and commercial income-producing properties in the Tokyo Metropolitan Area.

The office building “THE EDGE” (Shimomeguro), which was completed in June 2023, has an office space with a depth of about 24 m and a width of about 3 m similar to a wooden house called “a bed for an eel.” They planned this building while considering the diversity of communication with others arising out of physical distance as an important keyword.

In Kyoto and Okinawa, they are developing condominiums, including “L'attrait Residence,” “rêve GRANDIT,” and “rêve REALISER.”

*Revitalized real estate sales business

The “L'attrait Premium-Renovation®” series priced in the order of 100 to 900 million yen sold well. By concentrating on high-priced properties, mainly this series, they aim to grow profit continuously in the premium real estate field. They also focus on the sale of “Hi‣La‣Re” priced at 70 to 100 million yen.

Furthermore, they started handling the high-grade mansion “Billion-Residence” priced at 1 billion yen or higher, with the aim of creating new value.

They rigorously select mansions and supply them based on the experience and know-how nurtured in the “L'attrait Premium-Renovation®” business for many years and their broad information network.

(Source: the reference material of the company)

*Real estate leasing business

They will secure stable revenues and optimize their rental portfolio by acquiring excellent rentable assets.

In particular, they will conduct active investment in healthcare facilities, which are strongly demanded by society, with the aim of investing 2 billion yen every fiscal year. In order to expand business scale, it is indispensable to fortify the revenue base through not only one-shot-revenue business, but also recurring-revenue business, which is expected to help secure stable revenues. In particular, they will allocate managerial resources to healthcare facilities with a high profit margin.

(2) Creation of new business

They engage in renewable energy business, investment business, and DX business.

Renewable energy business | They completed a wooden biomass power generation plant that uses unused lumber from thinning as fuel, which is owned by the subsidiary LA Asset. They will promote decarbonization measures for realizing a recycling energy society. |

Investment business | They have established a venture fund for venture firms in the middle or later stage, and inject capital into the fund for venture business revitalization and business succession in Kyushu and venture funds. |

DX business | They invested in a startup firm that promotes DX in construction sites. They will keep discussing M&A for enterprises promoting DX. |

(3) Promotion of M&A

On December 30, 2022, LA Holdings acquired FAN STYLE Co., Ltd., a real estate development company in Okinawa, as a 100% subsidiary.

They will keep cooperating with influential local medium-sized enterprises for continuous business growth, and strive to improve their corporate value and expand their business scale further.

They plan to promote M&A targeting “midsize regional companies with a high share of a particular market sector,” “companies that are having difficulty locating a new owner,” and “companies with distinctive products or services and that have a superior position in a market with high barriers to new entrants.”

[2-3 Future outlook]

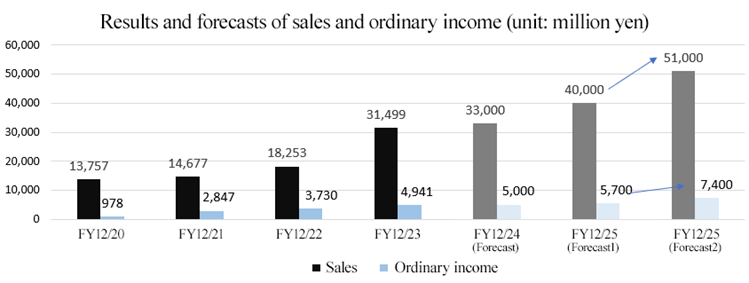

On January 18, 2024, the forecasts in the “medium-term management plan” (FY 12/2023 to FY 12/2025) were revised upwardly.

(Background of the upward revision)

As the company’s credit lines specified by financial institutions increased thanks to the improvement in credibility, the company procured large-scale real estate steadily. By adding high value to products, they plan to increase sales and profit every fiscal year and post a record-high profit, but it is forecast that construction periods will become longer and the construction of buildings will be delayed, due to the delay in supply of materials caused by wars around the world, the skyrocketing of building materials caused by the rise in commodity prices attributable to global economic situations, the chronic shortage of construction workers, the limitation of overtime work and the shift to the five-day week system in the construction industry, which will be imposed in FY 2024.

Under these circumstances, the forecasts for each fiscal year are conservative, but in FY 12/2025, which is the last fiscal year of the “medium-term management plan,” the new real estate sales segment plans to complete and sell large-scale properties, while the revitalized real estate sales business is expected to earn sales of over 10 billion yen. Furthermore, they will further expand the real estate leasing business, which is focused on the investment in healthcare facilities, and the business of the subsidiary FAN STYLE in Okinawa, and actively promote M&A, so consolidated sales are expected to exceed 50 billion yen, showing a significant growth alongside profit. Accordingly, the forecasts for the fiscal year ending December 2025 have been revised upwardly.

The fiscal year ending December 2025 falls on the 35th anniversary of inauguration of their business, so all of executives and employees plan to make the utmost effort to grow business and improve corporate value further.

| FY 12/20 | FY 12/21 | FY 12/22 | FY 12/23 | FY 12/24 (Forecast) | FY 12/25 (Forecast 1) | FY 12/25 (Forecast 2) |

Sales | 13,757 | 14,677 | 18,253 | 31,499 | 33,000 | 40,000 | 51,000 |

Operating income | 1,124 | 3,216 | 4,226 | 5,552 | 5,700 | 6,400 | 8,200 |

Ordinary income | 978 | 2,847 | 3,730 | 4,941 | 5,000 | 5,700 | 7,400 |

Net income | 650 | 1,959 | 3,381 | 3,293 | 3,500 | 4,000 | 5,100 |

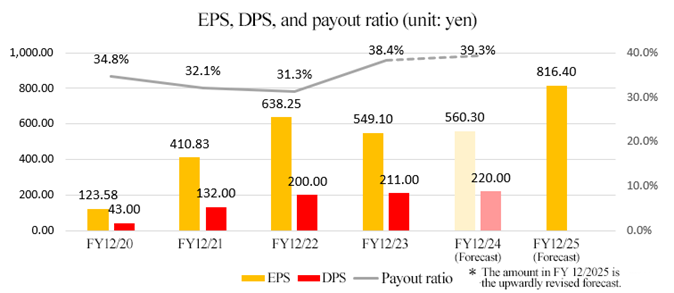

EPS (Yen) | 123.58 | 410.83 | 638.25 | 549.10 | 560.3 | 640.3 | 816.4 |

*Unit: million yen. The forecast for FY 12/2025 has been revised upwardly from “Forecast 1” to “Forecast 2.”

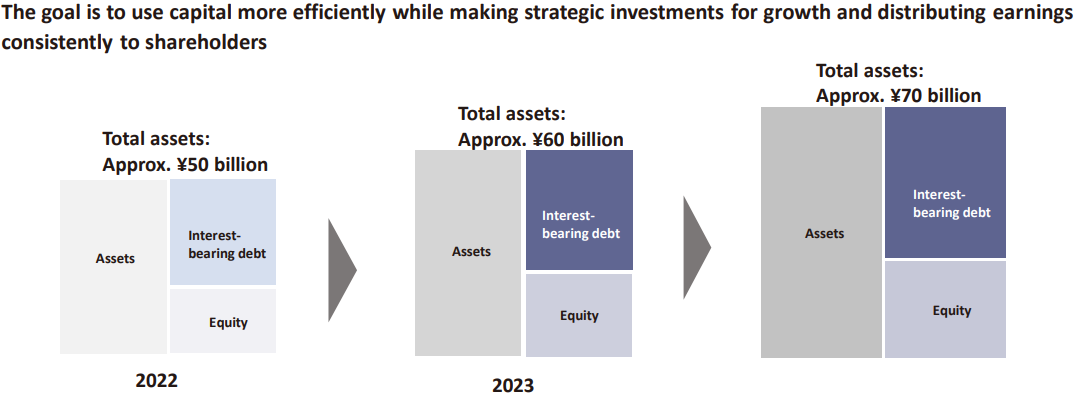

[2-4 Envisioned image of total assets]

While aiming to conduct strategic investment for growth and return profit to shareholders stably, they will strive to improve capital efficiency, grow profit significantly every fiscal year, and keep capital-to-asset ratio 20% or higher (the capital-to-asset ratio in FY 12/2023 was 24.6%) while aiming to achieve total assets of 70 billion yen.

Internally, they will pursue the stable growth of the real estate development business, which earns one-shot revenues, and the real estate leasing business, which earns recurring revenues.

Externally, they will conduct investment for growth in order to realize M&A or strategic cooperation with enterprises that are expected to exert synergy.

(Source: the reference material of the company)

[2-5 Return to shareholders]

They recognize the return of profit to shareholders as one of important issues for management, and their basic policy is to aim to return profit so that payout ratio will be 30% or higher, while comprehensively considering the fortification of the corporate structure, future business operation, earnings forecasts, etc. They aim to raise the dividend amount every fiscal year.

3. Fiscal Year ended December 2023 Earnings Results

[3-1 Business Results]

| FY 12/22 | Ratio to sales | FY 12/23 | Ratio to sales | YoY | Comparison with the forecast |

Sales | 18,253 | 100.0% | 31,499 | 100.0% | +72.6% | +5.0% |

Gross profit | 6,015 | 33.0% | 8,509 | 27.0% | +41.5% | - |

SG&A expenses | 1,788 | 9.8% | 2,957 | 9.4% | +65.3% | - |

Operating income | 4,226 | 23.2% | 5,552 | 17.6% | +31.4% | +1.0% |

Ordinary income | 3,730 | 20.4% | 4,941 | 15.7% | +32.5% | +2.9% |

Net income | 3,381 | 18.5% | 3,293 | 10.5% | -2.6% | -3.1% |

*Unit: million yen.

Significant growth of sales and profit. Sales, operating income, and ordinary income hit a record high for the third consecutive fiscal year.

Sales grew 72.6% year on year to 31.4 billion yen. In the business of new real estate sales, the company sold 7 packages of land and business plans. In the business of development of income-producing properties, office buildings and commercial buildings sold well. In the revitalized real estate sales business, high-priced properties sold well, so annual sales reached 10 billion yen for the first time since the inauguration of their business.

Operating income rose 31.4% year on year to 5.5 billion yen. SGA augmented 65.3% year on year, but the strategy of offering high added value turned out to be effective, increasing profit significantly. Operating income margin increased 8.2 points year on year.

Net income decreased 2.6% year on year to 3.2 billion yen, because the company posted an extraordinary loss of 100 million yen due to the loss on sale of investment securities, the loss on sale of shares of affiliated companies, etc. caused by the redevelopment of the portfolio of investment targets.

The forecast dividend was revised from 210.00 yen/share to 211.00 yen/share.

[3-2 Trend in each segment]

| FY 12/22 | Composition ratio | FY 12/23 | Composition ratio | YoY |

Sales |

|

|

|

|

|

Real estate sale business | 17,227 | 94.4% | 30,444 | 96.7% | +76.7% |

New real estate sales segment | 11,159 | 61.1% | 15,301 | 48.6% | +37.1% |

Land planning and sales | 2,557 | 14.0% | 1,550 | 4.9% | -39.4% |

Newly-built property sales | 8,601 | 47.1% | 13,750 | 43.7% | +59.9% |

Revitalized real estate sales segment | 6,067 | 33.2% | 15,142 | 48.1% | +149.6% |

Renovated condominiums | 6,067 | 33.2% | 10,862 | 34.5% | +79.0% |

Others | 0 | 0.0% | 4,279 | 13.6% | - |

Real estate leasing segment | 897 | 4.9% | 1,014 | 3.2% | +13.1% |

Total sales | 18,253 | 100.0% | 31,499 | 100.0% | +72.6% |

Gross profit |

|

|

|

|

|

Real estate sale business | 5,415 | 31.4% | 7,896 | 25.9% | +45.8% |

New real estate sales segment | 4,390 | 39.3% | 5,262 | 34.4% | +19.9% |

Land planning and sales | 579 | 22.7% | 221 | 14.3% | -61.8% |

Newly-built property sales | 3,810 | 44.3% | 5,040 | 36.7% | +32.3% |

Revitalized real estate sales segment | 1,025 | 16.9% | 2,634 | 17.4% | +157.0% |

Renovated condominiums | 1,025 | 16.9% | 1,825 | 16.8% | +78.0% |

Others | - | - | 808 | 18.9% | - |

Real estate leasing segment | 470 | 52.4% | 571 | 56.4% | +21.5% |

Total gross profit | 6,015 | 33.0% | 8,509 | 27.0% | +41.5% |

*Unit: million yen. “Sales” means “sales to external customers.” The composition ratio of profit means gross profit margin. The profit in a business segment in brief financial reports, etc. is obtained by subtracting selling expenditure and non-operating expenses from the gross profit in the business segment.

(1) Real estate sale business

Sales grew 76.7% year on year, and gross profit rose 45.8% year on year.

① New real estate sales segment

Sales grew 37.1% year on year, and gross profit increased 19.9% year on year.

The addition of high value turned out to be effective, and the sale in the business of development of income-producing properties, which is the mainstay, contributed to profit.

They sold 7 packages of land and business plans.

As income-producing properties, they sold the office building “THE EDGE” (Shibuya-ku, Tokyo), the commercial buildings “A*G Futakotamagawa” (Setagaya-ku, Tokyo), “A*G SAKAE” (Nagoya City, Aichi Prefecture), and “A*G Nishinakasu” (Fukuoka City, Fukuoka Prefecture). The newly built condominiums “L'attrait Residence Meinohama” (Fukuoka City, Fukuoka Prefecture) and “rêve GRANDIT YAESE” (Okinawa Prefecture) were completed, and all units were delivered to customers.

② Revitalized real estate sales segment

Sales grew 149.6% year on year, and gross profit rose 157.0% year on year.

In the business of sale of renovated condominium units, which is the mainstay, the “L'attrait Premium-Renovation®” series priced at over 100 million yen per unit with the keywords: “3 wards in the urban center,” “100 m2,” and “high quality” sold well, while prices rose.

In investment projects, the sale of land and buildings (Shibuya-ku, Tokyo), etc. contributed to profit.

(2) Real estate leasing segment

Sales increased 13.1% year on year, and gross profit increased 21.5% year on year.

In Sapporo, the company owns 5 healthcare facilities, and plans to construct a new facility.

As the first project in Kumamoto Prefecture, the company acquired the land and building of the old “Queen’s Hill Koganaka,” which consists of housing for elderly people with nursing-care services, an office for supporting at-home nursing care, a day service center, and a clinic (Yatsushiro City, Kumamoto Prefecture).

As the second project in Kumamoto Prefecture based on the capital and business alliance with URBAN LiKE, they plan to build a healthcare facility.

[3-3 Financial Condition and Cash Flow]

◎Main BS

| End of December 2022 | End of December 2023 | Increase/ Decrease |

| End of December 2022 | End of December 2023 | Increase/ Decrease |

Current assets | 39,316 | 49,880 | +10,563 | Current liabilities | 16,068 | 19,859 | +3,790 |

Cash and deposits | 9,482 | 12,783 | +3,300 | Short-term interest-bearing liabilities | 13,155 | 17,321 | +4,165 |

Real estate for sale | 12,495 | 15,693 | +3,197 | Noncurrent liabilities | 23,183 | 26,137 | +2,954 |

Real estate for sale in process | 16,343 | 20,463 | +4,120 | Long-term interest-bearing liabilities | 22,241 | 25,438 | +3,196 |

Noncurrent assets | 11,343 | 11,323 | -19 | Total labilities | 39,251 | 45,997 | +6,745 |

Tangible assets | 10,368 | 10,190 | -177 | Net assets | 11,417 | 15,212 | +3,795 |

Investments and other assets | 935 | 1,094 | +158 | Retained earnings | 9,043 | 11,948 | +2,905 |

Total assets | 50,669 | 61,209 | +10,540 | Total liabilities, net assets | 50,669 | 61,209 | +10,540 |

*Unit: million yen.

Inventory assets increased 7.3 billion yen from the end of the previous fiscal year, so total assets rose 10.5 billion yen from the end of the previous fiscal year to 61.2 billion yen.

Short and long-term interest-bearing liabilities augmented 7.3 billion yen from the end of the previous fiscal year, so total liabilities augmented 6.7 billion yen from the end of the previous fiscal year to 45.9 billion yen.

Net assets grew 3.7 billion yen from the end of the previous fiscal year to 15.2 billion yen, due to the increase in retained earnings, etc.

Capital-to-asset ratio increased 2.3 points from the end of the previous fiscal year to 24.6%.

◎ Cash Flow

| FY 12/22 | FY 12/23 | Increase/Decrease |

Operating Cash Flow | -3,061 | -3,202 | -140 |

Investing Cash Flow | -1,479 | -1,403 | +75 |

Free Cash Flow | -4,541 | -4,605 | -64 |

Financing Cash Flow | 6,932 | 7,773 | +841 |

Cash, Equivalents | 9,482 | 12,689 | +3,206 |

*Unit: million yen.

The cash inflow from financing activities grew, due to the increase of proceeds from issuance of shares resulting from exercise of subscription rights to shares, the decrease in purchase of treasury shares, etc. The cash position improved.

[3-4 Topics]

① Listed on the main board of Fukuoka Stock Exchange

In June 2023, the company got listed on the main board of Fukuoka Stock Exchange.

The company is listed concurrently on the Growth Market of Tokyo Stock Exchange.

(Purpose of the listing)

The company aims to actively expand its business in Kyushu and Okinawa. The purpose of the listing is to improve its social credibility and popularity further and contribute to regional economies, in order to achieve the aim.

② Conclusion of a capital and business alliance contract with URBAN LiKE INC.

In December 2023, the company concluded a capital and business alliance contract with URBAN LiKE INC. (Arao City, Kumamoto Prefecture; listed on TOKYO PRO Market; securities code: 2992).

(Overview of URBAN LiKE INC.)

Established in February 2008.

The company's core business is the sale of custom-built and ready-built houses in Kumamoto Prefecture and surrounding areas, and it continues to expand its area under the concept of "building foreign-looking houses with high-quality Japanese materials." Currently, they receive over 100 orders annually. The company continues to grow steadily as a housing company with overwhelmingly high customer satisfaction, with more than half of orders attributable to the introduction from other customers.

Currently, the company is highly supported by young families in their 20s to 30s, and has become the number one housing company in the southern Fukuoka and northern Kumamoto areas in terms of the number of houses sold in its trade area, establishing its position as a leading company in the Kyushu region.

In July 2021, the company was listed in TOKYO PRO Market, and has been steadily improving its performance with the housing, real estate, and welfare-related facility businesses as its pillars.

Particularly, in the welfare-related facility business, the company is cementing the cooperation with welfare service providers in Kumamoto, Fukuoka, Saga, and Miyazaki prefectures, and focusing on the construction and sales of group homes for the disabled in the Kyushu region.

(Purpose of capital and business alliance)

LA Holdings is considering the operation of joint business with leading local companies as candidates, based on the policy of the "2023-2025 Medium-Term Management Plan," with a focus on regional revitalization and the stimulation of the local economy. The company also believes that solving regional and social issues as material issues for the realization of a sustainable society, and that contributing to the local economy through the business is very important in promoting efforts to achieve the SDGs.

In Kumamoto Prefecture, Taiwan Semiconductor Manufacturing Corporation (TSMC), the world's largest semiconductor manufacturer, established a subsidiary named "JASM" as a joint venture with a Japanese company. The first plant in Kikuyo Town, Kumamoto Prefecture, was completed in February 2024 (full-scale operation is scheduled to begin in December 2024), and the construction of the second plant has also been determined.

The new plant is expected to hire a large number of workers, and TSMC's expansion is expected to be a catalyst for related companies to locate in the vicinity, creating demand for housing in the neighborhood and surrounding areas by construction workers, TSMC expatriates, and employees of related companies.

Accordingly, the construction of a new plant in Kikuyo Town, and the establishment of related companies in the surrounding areas such as Otsu Town and Koshi City have led to increase in land prices. Along with the rise in rents due to increased rental demand, a significant shortage in the supply of rental properties has become evident, and this has begun to affect the entire prefecture of Kumamoto.

In light of the above situation, LA Holdings sees the capital and business alliance with URBAN LiKE as a good opportunity to develop new business centered on Kumamoto Prefecture, and the company will actively utilize the group's expertise in the planning, development, operation, and management of real estate along with URBAN LiKE's sales network (seven offices in Kumamoto Prefecture, seven offices in Fukuoka Prefecture, and one office in Saga Prefecture). The company intends to obtain timely and useful information on real estate development, create new businesses, promote mutual business operations, and accelerate the speed of growth, while contributing to further business development, regional revitalization, and the stimulation of the local economy.

In addition, LA Holdings considers proactive investment in healthcare facilities, which are in high demand by society, as one of its growth strategies in Japan's rapidly aging society.

We recognize that the development and expansion of the supply of healthcare facilities is a major social issue, and we currently own a total of 11 healthcare facilities, including five in Hokkaido, four in Aichi Prefecture, and two in the Tokyo metropolitan area. Through the capital and business alliance, the company intends to operate a wide range of welfare-related facility businesses such as paid elderly care homes, as well as group homes for the disabled and other health care facilities in the Kyushu area.

*As mentioned above, the company acquired the land and building of the former "Queen's Hill Koganaka" (Yatsushiro City, Kumamoto Prefecture), which consists of a serviced housing for the elderly, an in-home nursing-care support office, a day service center, and a clinic, as its first project in Kumamoto Prefecture. A healthcare facility is also planned as the second project in Kumamoto Prefecture based on the capital and business alliance with URBAN LiKE.

(Details of capital and business alliance)

◎ Details of the Business Alliance

*Promotion of real estate planning and development business

*Operation and promotion of a wide range of welfare-related facility businesses in the Kyushu region

*Promoting business through collaboration between the two companies and accelerating the speed of growth

*Complementation of management resources by both companies

◎ Details of Capital Alliance

LA Holdings acquired 32,500 common shares of URBAN LiKE (15.06% of the total number of outstanding shares) from a major shareholder (representative director) of the company on December 18, 2023.

Furthermore, the representative director of URBAN LiKE plans to acquire the shares of LA Holdings in the future.

◎ Dispatch of directors

At URBAN LiKE's annual shareholders’ meeting held in January 2024, Shigeru Nakano, an Executive Officer of LA Holdings, was appointed as an outside director of URBAN LiKE.

③ The subsidiary Fun Style starts the revitalized real estate business

Fun Style Corporation, which became a wholly owned subsidiary on December 30, 2022, started a revitalized real estate business in February 2024.

(Overview of Fun Style Corporation)

Established in November 2002. The company develops and sells its own brand of condominiums, the "rêve Series," in Okinawa Prefecture, and also engages in a wide range of real estate businesses such as real estate brokerage.

The company aims to become the No. 1 supplier of condominiums in Okinawa Prefecture.

(Background of starting a revitalized real estate business)

The number of contracts for pre-owned condominiums in the Tokyo metropolitan area in recent years has exceeded that for newly built condominiums, indicating higher demand for renovation, which creates new value on the supply side of pre-owned condominiums. The company believes that this situation will spread to regional areas in the near future.

In Okinawa Prefecture, demand for pre-owned condominiums is expected to grow, and Fun Style will launch a revitalized real estate business by utilizing its expertise in this business, which the company group has been working on as one of the pillars of its business in the Tokyo metropolitan area.

(Specific project)

As the first project, the company acquired "TORII MANSION," an apartment building in Yomitan-son, Nakagami-gun, Okinawa Prefecture, and began sales in February 2024 after renovating one building.

*Outline of the first project "TORII MANSION"

Large-scale housing for foreigners living in Yomitan-son, Nakagami-gun, in the central part of Okinawa Prefecture.

All 16 units are spacious with over 150 sq. meters of 4LDK including corner rooms and balconies on 3 sides, making it possible to accommodate the various lifestyles of buyers.

Yomitan Village is famous for being the most populated village in Japan. Due to the recent Okinawa boom, the population has been increasing year by year, and posted land prices have been rising significantly. The company believes that the demand for housing in this area will continue to increase in the future.

The U.S. military base of Kadena is located nearby, and besides actual demand, the company is expecting buyers who have investment purposes, with foreigners employed by the military as tenants.

4. Fiscal Year ending December 2024 Earnings Forecasts

[4-1 Earnings Forecast]

| FY 12/23 | Ratio to sales | FY 12/24 Est | Ratio to sales | YoY |

Sales | 31,499 | 100.0% | 33,000 | 100.0% | +4.8% |

Operating income | 5,552 | 17.6% | 5,700 | 17.3% | +2.7% |

Ordinary income | 4,941 | 15.7% | 5,000 | 15.2% | +1.2% |

Net income | 3,293 | 10.5% | 3,500 | 10.6% | +6.3% |

*Unit: million yen. Estimates are those of the company.

Sales and profit are expected to grow.

Sales are projected to rise 4.8% year on year to 33 billion yen, while operating income is forecast to increase 2.7% year on year to 5.7 billion yen.

They will continue the operation of the three business segments in accordance with the policy of the medium-term management plan. The increase rates of sales and profit are single-digit, but they consider this fiscal year as the phase for securing a foothold for expanding sales and profit sustainably and stably.

They plan to pay a dividend of 220.00 yen/share, up 9 yen/share from the previous fiscal year. The expected payout ratio is 39.3%.

[4-2 Initiatives in each business]

① New real estate sales segment

The company will actively develop housing and commercial facilities in the business of development of income-producing properties, which is a growth driver, and plan products with competitive advantages to pursue high added value, while aiming to improve its brand power and expand target areas, including major local cities.

In the condominium business, they will promote the “L'attrait Residence” brand in major local cities. In Okinawa, they will strive to expand the business of the “rêve GRANDIT” brand, fortify their business foundation, and establish a position where they can exert competitive advantages.

② Revitalized real estate sales segment

The company will concentrate on the core business, that is, the sale of renovated condominium units, including the “L'attrait Premium-Renovation®” series priced at over 100 million yen per unit, the “Hi▶La▶Re” series, and the high-grade mansion “BILLION-RESIDENCE” priced at over 1 billion yen per house.

They will establish a unique position by providing not only products that meet the needs of a broad range of customers, but also high value-added products with significant the competitive advantage, that is, being free from the pricing war thanks to their planning and designing capabilities.

③ Real estate leasing segment

While concentrating on the fostering of relationships with existing operators and the search for new excellent operators, they will actively invest in healthcare facilities, which are strongly demanded by society, to optimize the rental portfolio and secure stable revenues.

Based on the capital and business alliance contract concluded with URBAN LiKE INC. in Dec. 2023, they will expand the welfare facility business, including group homes for disabled people and healthcare facilities, such as fee-charging nursing homes, in Kyushu.

5. Interview with President Wakita

We asked President Wakita about the company's competitive advantages and his message to shareholders and investors.

Q: First of all, please tell us about your company's competitive advantages.

Our company has demonstrated competitive advantages in sales of both new real estate and revitalized real estate by establishing a unique position that is not shared with other companies.

When I became involved in the management of our company in 2012, I thought it was important to focus on things that other companies were not doing, as we were a small company and didn't have a lot of capital.

In new real estate sales, we are focusing on medium-sized development with a budget of 1 billion to 4 billion yen, and with regard to development areas, we are making efforts to discover areas with high potential to become "prime locations of the future." We believe that our discerning eye and ability to gather information are great advantages.

By focusing on specific markets and areas, we are able to find the white space that is difficult for other companies to reach, and established a unique position.

In the area of revitalized real estate sales, our main series, “L'attrait Premium-Renovation®,” is characterized by planning and design that provide “high quality” that matches the needs of wealthy people, and the prices range from 100 million yen to 900 million yen, as we are pursuing high prices and high added value.

In terms of size, we target “100 square meters or over,” and in terms of area, we target “the three central wards of Tokyo,” and we are also operating this business in a unique position that other companies do not share.

Regarding the renovation of second-hand real estate, we started working on properties worth 50 million yen as we emphasize efficiency and differentiation, even though the general price of properties for renovation was 20 million to 30 million yen when we first started the business. As almost everyone who heard about it said that there was no way it would sell, I was confident that it would be a success.

While newly built condominiums are supplied to the mass market, revitalized second-hand properties may be expensive. However, if one wealthy customer likes a property that has “high quality,” “sufficient space,” and “a prime location,” it will be a business.

Having concentrated and specialized on these points ahead of other companies is a major factor that allowed us to gain our competitive advantages.

Q: You call your company a "manufacturing company."

When it comes to real estate companies, there may be a strong image that "sales power" and "the number of units sold" represent competitiveness. However, instead of aiming to increase the number of units sold, our company is thoroughly committed to avoiding commoditization and is always pursuing high added value.

Partly because I had been involved in architectural design and real estate development before I became involved in the management of our company, our approach is not to “buy buildings, renovate them, and aim to maximize the number of units sold.” We are a “manufacturing company” that always develops its business with these mindsets: “create something that does not exist,” “create new value by ourselves,” and “search for businesses that allow us to set the market price.”

We have established a corporate culture in which employees are able to freely work on manufacturing and are encouraged to take on new challenges, and we believe that this is the essential source of our competitive advantages.

Q: What needs to be done to further refine such competitive advantages?

As a real estate business, our goal is to further increase our company's credit line and strengthen our ability to raise funds.

When it comes to manufacturing, if you succeed in developing something worth 1 billion yen, it's only natural that you'll want to take on a bigger development project next time.

However, the current development scale is at most 4 billion yen, not 10 billion or 20 billion yen.

Therefore, the most important point is to further strengthen our strength so that we can take on such challenges.

Even now, employees from other companies who have seen our manufacturing process from the outside are joining our company because they want to try their hand at it. We would like to make our company more attractive to more people by increasing our ability to raise funds and continually creating good products.

Q: Next, please tell us about your objectives and initiatives for expanding into Kyushu and Okinawa.

I happened to receive some information about Fukuoka, and given that Tokyo is highly competitive, I believed that we needed to take a proactive approach and diversify our business portfolio. Thus, we decided to start our business in Kyushu from Fukuoka.

To achieve this, it is important for us to collaborate with local communities and local companies rather than going out on our own, so we got listed on the Main Board of Fukuoka Stock Exchange and concluded a capital and business alliance agreement with URBAN LiKE INC. in Kumamoto Prefecture.

In Kumamoto Prefecture, TSMC, the world's largest manufacturing company for semiconductors, recently completed its first factory and has also decided to construct a second one. The expansion of TSMC has spurred the establishment of related companies nearby, and there is growing demand for housing in the nearby and surrounding areas from construction workers, TSMC expatriates, and employees of related companies. We aim to contribute to the local economy and steadily expand our business.

Regarding Okinawa, on December 30, 2022, we acquired FAN STYLE Co., Ltd., a real estate development company in Okinawa, as a wholly owned subsidiary.

As the company has a wealth of know-how regarding development and condominium business in Okinawa Prefecture, in addition to building strong relationships with partner companies, we expect it to make a significant contribution to business development in Okinawa.

We would like to gain an advantage in regions by having the number one company in the region join our group.

Q: Thank you. Finally, please give a message to shareholders and investors.

We recognize that our responsibility as a listed company is to generate solid profits and return profits to our shareholders.

Regarding shareholder returns, we believe that achieving a good balance between income gains and capital gains will lead to improved evaluations in the real estate industry. Therefore, we will strive to increase dividends every fiscal year based on earnings expansion, aiming for a stock price increase and a dividend payout ratio of 30% or higher.

In the real estate industry, it is important to strengthen the ability to procure funds through indirect financing. In order to do so, it is known that building up a track record without overdoing it over a three-year cycle helps raise the credit rating at financial institutions better than trying to significantly increase the numbers each fiscal year.

Although we are forecasting single-digit sales and profit increases for this fiscal year, we have been able to increase inventory by 7.3 billion yen, and preparations for steady growth from next fiscal year onward are well underway.

Furthermore, as I mentioned earlier, as a manufacturing company, our goal is not to increase the number of units sold, but rather to thoroughly avoid commoditization and constantly pursue high added value. We would like you to know that a major feature of our company is that we are able to set our own market price.

In addition to growth as a company, we will also focus on revitalization of regions and communities, which is possible only because we are a small to medium-sized real estate company.

Our goal is to revitalize regions and create jobs, which will ultimately lead to improved productivity and GDP expansion for Japan as a whole.

Although we are still a small company, we will always pursue uniqueness and aim for steady growth and expansion of market capitalization, so we would appreciate your support.

6. Conclusions

The comparison of their major indicators with those of other major listed companies that sell revitalized real estate indicates that their operating income margin is the second highest and ROE is the highest although sales are small. Their high profitability is remarkable, as President Wakita aims for.

The company is also the only one that has a PBR of much higher than 1.

We would like to pay attention to what kinds of products they will create as a “manufacturing company.”

Code | Corporate name | Sales | Sales growth rate | Operating income | Income growth rate | Operating income margin | ROE | Market cap | PER | PBR |

2975 | Star Mica Holdings | 54,157 | +10.8% | 5,028 | +3.8% | 9.3% | 12.0% | 18,088 | 6.3 | 0.8 |

2986 | LA Holdings | 33,000 | +4.8% | 5,700 | +2.7% | 17.3% | 25.0% | 28,422 | 8.1 | 1.9 |

3294 | e'grand | 27,278 | +5.8% | 2,080 | -21.3% | 7.6% | 17.9% | 10,027 | 7.4 | 0.9 |

8934 | Sun Frontier Fudousan | 79,000 | -4.6% | 16,700 | +12.0% | 21.1% | 15.3% | 82,591 | 7.1 | 1.0 |

8940 | Intellex | 48,543 | +17.7% | 769 | +8.4% | 1.6% | 0.8% | 4,903 | 18.6 | 0.4 |

*Unit: million yen and times. Sales and operating income are the forecasts for this fiscal year, taken from the latest brief financial reports of respective companies. Market cap, PER, and PBR are based on the closing price on Feb. 22, 2024.

<Reference: Regarding Corporate Governance>

◎Organizational structure and composition of directors and auditors

Organizational structure | Company with an audit and supervisory board |

Directors | 5 including 2 outside directors (including 2 independent officers) |

Auditors | 3 including 2 outside directors (including 2 independent officers) |

◎Corporate Governance Report

Update date: June 15, 2023

<Basic policy>

We recognize that corporate governance means the basic framework of corporate management for fulfilling social responsibility toward stakeholders, including shareholders, customers, employees, business partners, and local communities. We will continue corporate governance-related strategies, while concentrating on the establishment of a better management base.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

The company follows all of the basic principles of the Corporate Governance Code.

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |