Bridge Report:(2986)LA Fiscal Year ended December 2024

President Eiichi Wakita | LA Holdings Co., Ltd. (2986) |

|

Company Information

Market | Growth Market of Tokyo Stock Exchange and Main Board of Fukuoka Stock Exchange |

Industry | Real estate |

President | Eiichi Wakita |

HQ Address | Kokusai Hamamatsucho Building 9F, 1-9-18 Kaigan, Minato-ku, Tokyo |

Year-end | December |

Homepage | https://lahd.co.jp/ |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

6,760 yen | 6,308,875 shares | 42,647 million yen | 28.6% | 100 shares | |

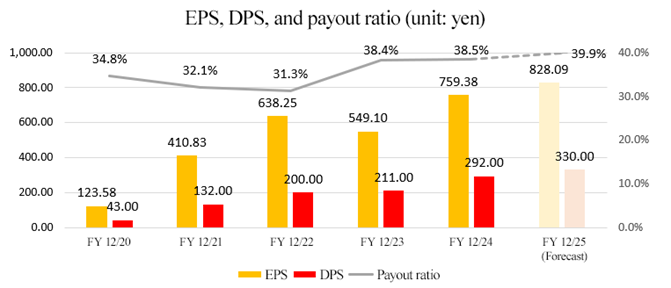

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

330.00 yen | 4.9% | 828.09 yen | 8.2x | 2,915.56 yen | 2.3x |

*Share price as of closing on April 3. All figures were taken from the financial statements for the fiscal year ended December 2024.

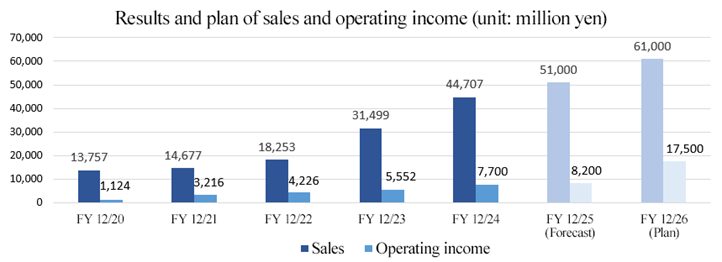

Earnings Trend

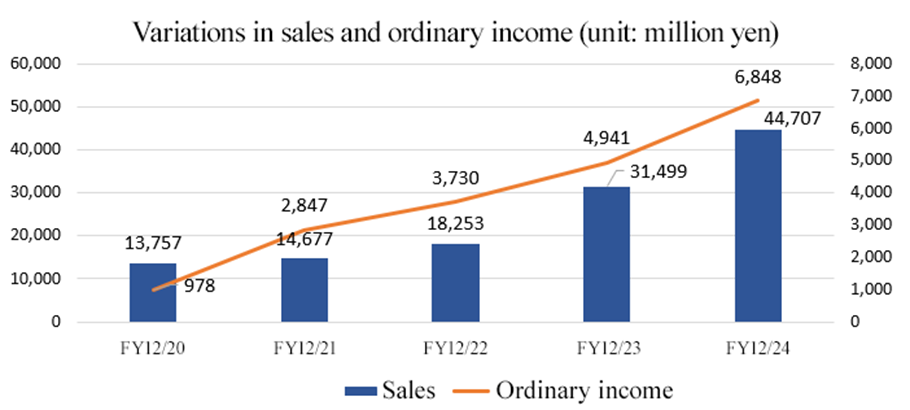

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2021 Act. | 14,677 | 3,216 | 2,847 | 1,959 | 410.83 | 132.00 |

December 2022 Act. | 18,253 | 4,226 | 3,730 | 3,381 | 638.25 | 200.00 |

December 2023 Act. | 31,499 | 5,552 | 4,941 | 3,293 | 549.10 | 211.00 |

December 2024 Act. | 44,707 | 7,700 | 6,848 | 4,713 | 759.38 | 292.00 |

December 2025 Est. | 51,000 | 8,200 | 7,400 | 5,100 | 828.09 | 330.00 |

December 2026 Plan | 61,000 | 17,500 | 16,700 | 11,600 | - | - |

*Unit: million yen. Estimates are those of the company. Net income is profit attributable to owners of the parent. The figures for the fiscal year ending December 2026 (plan) were taken from the medium-term management plan.

This report includes the LA Holdings Co., Ltd.'s financial results for the fiscal year ended December 2024, the Medium-term Management Plan, and the interview with President Wakita.

Table of Contents

Key Points

1. Company Overview

2. Medium-term Management Plan

3. Fiscal Year ended December 2024 Earnings Results

4. Fiscal Year ending December 2025 Earnings Forecasts

5. Interview with President Wakita

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

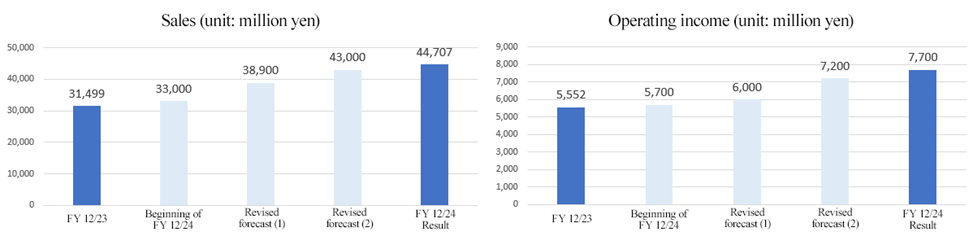

- In the fiscal year ended December 2024, sales and profit grew considerably, as sales, operating income, and ordinary income hit a record high for the fifth consecutive fiscal year. Sales grew 41.9% year on year to 44.7 billion yen. Regarding the new real estate sales, office buildings of income-producing properties, commercial buildings, and new condominiums sold well. In addition, in the land planning sales, the company sold 6 packages in urban areas. Regarding the revitalized real estate sales, high-priced properties sold well. Operating income rose 38.7% year on year to 7.7 billion yen. Like in the previous fiscal year, the strategy of adding high value turned out to be effective. The ratio of operating income to sales declined 0.4 points year on year, but sales and profit exceeded the earnings forecasts that have been revised twice.

- For the fiscal year ending December 2025, too, sales and profit are expected to grow. It is projected that sales will increase 14.1% year on year to 51 billion yen and operating income will rise 6.5% year on year to 8.2 billion yen. All of the three business segments will continue business operations based on the policy set in the medium-term management plan. They plan to pay a dividend of 330.00 yen/share, up 38 yen/share from the previous fiscal year. The expected payout ratio is 39.9%.

- The target profits set in the “medium-term management plan for the period from 2023 to 2025,” which was announced on February 14, 2023, were achieved in the fiscal year ended December 2024 one year earlier than expected, so the company has formulated and announced a new plan for the period until 2026. The company aims to achieve “sales of 61 billion yen and an operating income of 17.5 billion yen in the fiscal year ending December 2026, the last year of the plan,” achieve further growth of the existing businesses from 2027, actively operate new businesses, including the “M&A support business” and the “corporate investment business,” launched in August 2024, in order to create new revenue earning opportunities.

- We interviewed President Wakita about the overview of the financial results for the fiscal year ended December 2024, the medium-term management plan, etc. He said, “First of all, we will fortify our business base by the end of 2026, while taking full advantage of the current market environment and our competitive advantage. Then, we will create new revenue earning opportunities by endeavoring to launch new businesses centered around realty based on the growth of our existing business from 2027. For the fiscal year ending December 2026, which is the last fiscal year of the medium-term management plan, we are projected to earn ‘sales of 61 billion yen and an operating income of 17.5 billion yen,’ but I think that we will be able to achieve sales of 100 billion yen after that.”

- In the previous report in August 2024, President Wakita commented, “As financial institutions raised our credit lines significantly, we became able to pursue the growth of our business by increasing the number of projects, and some effects have been already produced.” Actually, their results exceeded the forecasts that have been revised twice. As this trend has not been changed recently, the forecast for the fiscal year ending December 2025, which calls for “sales rising 14.1% year on year to 51 billion yen and operating income growing 6.5% year on year to 8.2 billion yen,” seems to be achievable. The company has just launched the “M&A support business” and the “corporate investment business” aimed at operating businesses in their unique way, but they are about to produce some results steadily. We would like to pay more attention to the performance of the company, as “sales of 100 billion yen” came in sight.

1. Company Overview

LA Holdings operates three core businesses: new real estate sales, revitalized real estate sales, and real estate leasing. “L'attrait Premium-Renovation®,” the flagship series for revitalized real estate sales, features planning and design to provide “quality” that matches the needs of wealthy people, with prices ranging from 100 million yen to 900 million yen, aiming for high prices and high added value. The company has established a distinctive position that no other company can occupy. It is also focusing on operating its business in Kyushu and Okinawa.

[1-1 History]

The predecessor of the company was L'attrait Nijuichi, Co., Ltd. (currently L'attrait Co., Ltd.), established in December 1990 for the purpose of buying/selling real estate, acting as a sales agent, managing rental properties, and buying/selling golf memberships. Due to the expansion of its business, the company was listed on the “Hercules Market” of Osaka Exchange in June 2006.

As a result of the downturn in business performance after the Lehman shock, Eiichi Wakita (currently the representative director and president of LA Holdings Co., Ltd.) was entrusted with the restructuring of the business and was invited to join the company in February 2012 (appointed as the representative director and president of L'attrait Co., Ltd. in March 2013).

Under the leadership of Wakita, who has developed a track record in building design and real estate development since his twenties, the restructuring of the business has progressed steadily with increased capital and changes in management strategies.

In July 2020, L'attrait Co., Ltd. established LA Holdings Co., Ltd., which acquired shares of L’attrait, and got listed on JASDAQ (Growth) of Tokyo Stock Exchange (L'attrait Co., Ltd. was delisted in June 2020). At the same time, Mr. Wakita was appointed as representative director and president of LA Holdings Co., Ltd.

In April 2022, the TSE market was reorganized and the company was listed on the Growth market.

[1-2 Corporate Philosophy]

The Corporate Philosophy and Management Philosophy of the Group are as follows:

Corporate Philosophy | Creating “attractive products and services” to realize a “prosperous and attractive society” for people |

Management Philosophy of the Group

1 | To establish a corporate culture that is free and open-minded and grow stably by fostering the wisdom and creativity of our employees while swiftly adapting to the new economic environment in the new era and taking into account new and innovative management without being bound by established business models, grow steadily, and pursue coexistence and co-prosperity with society. |

2 | While being constantly aware that “homes shape people's hearts and lives,” we not only pursue the original functionality and livability of homes, but also provide sophisticated and attractive products that are compatible with local communities and the environment while anticipating changes in times and trends, to realize business administration that can meet clients’ needs. |

3 | To strive for management that contributes to the creation of local living environments by providing “homes that enrich people's hearts” through clean and fair corporate activities that value the lifestyles of local communities. |

4 | To create a working environment in which people can work together to exert their abilities fully through dedication and diligence to live a pleasant life full of enthusiasm, optimism, and ambition. |

5 | Based on the principle that “client satisfaction and employee motivation support a company,” we aim to manage business in harmony with society by ensuring an appropriate profit return. |

[1-3 Business Environment]

The main business environment in which the company operates is as follows:

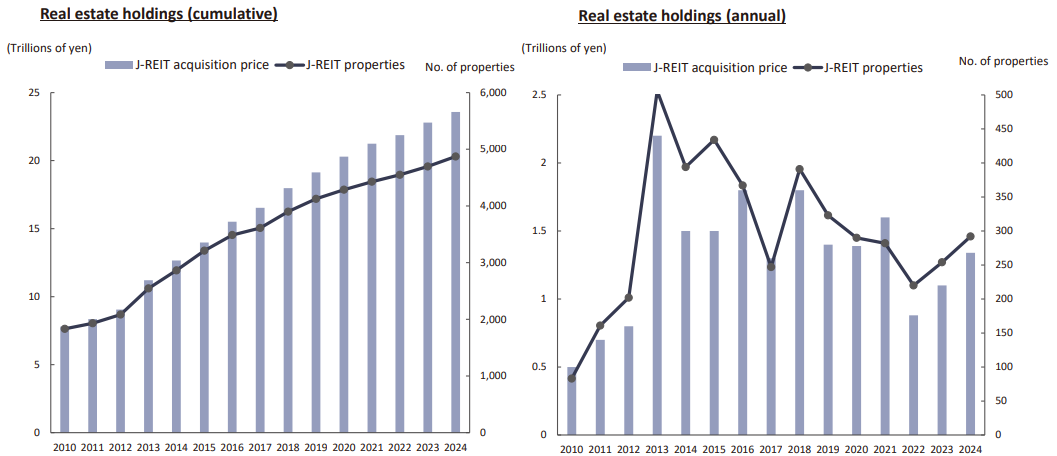

◎ Real estate investment market

The amount of J-REIT properties acquired in 2024 was 1,344.6 billion yen, up 21.8% from the previous year, exceeding 1 trillion yen for two years in a row.

(Source: the reference material of the company)

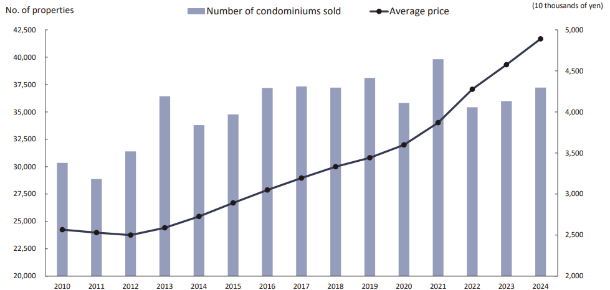

◎ Second-hand condominium market in the Tokyo metropolitan area

In 2024, the number of second-hand condominium units in the Tokyo Metropolitan Area drew 3.4% from the previous year, showing a year-on-year growth for 2 years in a row. The average price of condominium units was 48.9 million yen, up 2.6% from the previous year, showing a year-on-year growth for 4 years in a row, which indicates healthy performance.

(Source: the reference material of the company)

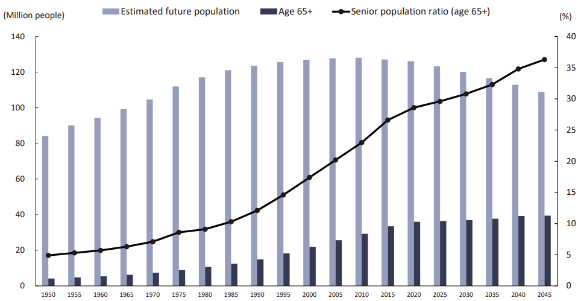

◎ Variations in elderly population and future projections

The total population reached a peak in 2010, and has been declining since then, but the ratio of people aged 65 years or older will keep increasing until 2043. Accordingly, the social needs for healthcare facilities, in which the company actively invests, are expected to grow further.

(Source: the reference material of the company)

[1-4 Business Description]

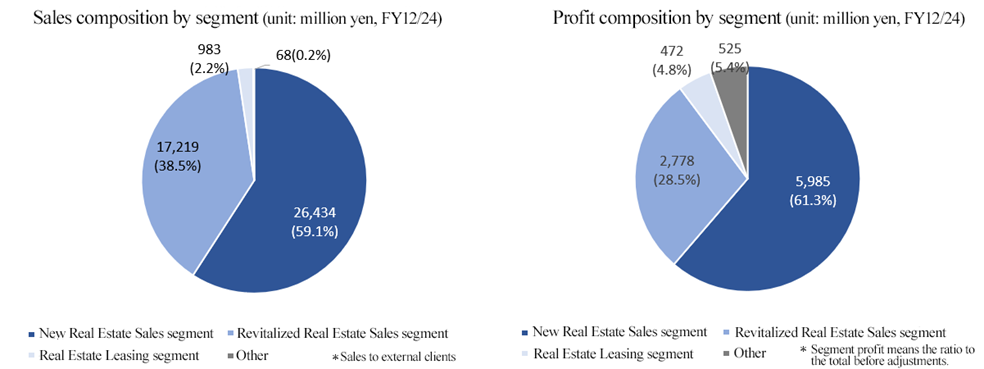

The three reportable business segments are the “New Real Estate Sales segment,” the “Revitalized Real Estate Sales segment,” and the “Real Estate Leasing segment.” The business segment “Other,” which is not included in the reportable segments, includes real estate brokerage services and businesses derived from other businesses.

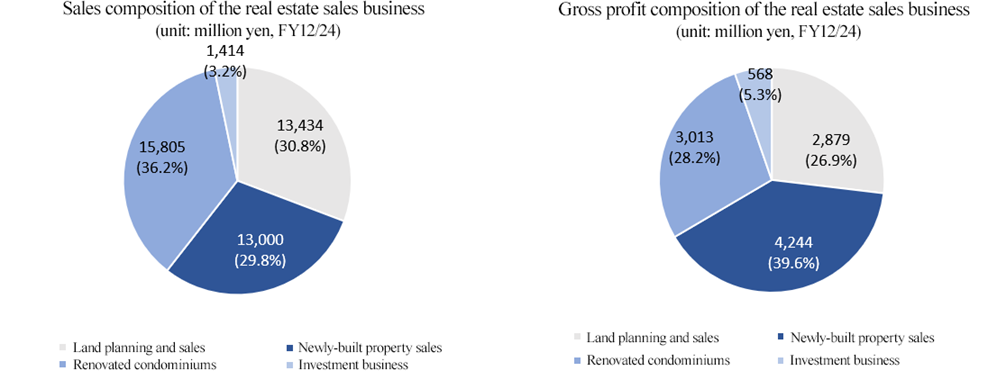

In addition, sales and gross profit from “Newly-built property sales” and “Land planning and sales” in the “New Real Estate Sales segment” and from “Renovated condominiums” and “Investment business” in the “Revitalized Real Estate Sales segment” are disclosed in the financial statements and other materials.

*Segment profit is obtained by subtracting selling and non-operating expenses from the gross profit of each segment.

(1) New real estate sales business

(i) Development work | <Overview> ◎ Profit-generating real estate development (L'attrait Co., Ltd.) Developmental services for rental residences, including residential condominiums, and urban commercial buildings, such as buildings for retail shops and office buildings, to be sold to investment corporations and general corporations.

◎ Development of new condominiums for sale (L'attrait Co., Ltd. and FAN STYLE Co., Ltd.) Developmental services for new condominiums, to be sold to general customers and others.

<Characteristics> By participating in land procurement and product development, the company is able to pay attention to the overall design of the building and the smallest details. It can also focus on aspects such as structure, earthquake resistance, fire resistance, energy savings, eco-friendliness, air quality, and sound insulation. By conducting business from product development to sales, including procurement and planning, the company creates “attractive products and services” in anticipation of the needs of society.

・Rental residences The company creates and establishes brands such as “THE DOORS,” a luxury rental residence that offers different values from the existing ones and extraordinary emotional experience value.

・Urban commercial buildings The company is working to continuously improve the brand strength of the “A*G” series, which focuses on areas with high potential as prime future locations and is based on the concept of “small but brilliant,” and the “THE EDGE” series, which is based on the concept of “an office that is different from typical offices and like home” as an office brand that has uncovered potential needs among the core group of tenants.

・New condominiums for sale By creating series such as “L'attrait Residence” by L'attrait Co., Ltd. and “rêve” by FAN STYLE Co., Ltd., the company is providing new value to lifestyle-oriented targets under the keywords: “innovative design,” “unique world view,” and “cutting-edge.”

The strength of these product developments is that the land information can be used effectively to increase procurement opportunities. |

(ii) Land planning and sales | Among the land L'attrait Co., Ltd. is considering as a site in its development work, the company will sell the land and the business plan as a set, after carrying out development planning and certain procedures, to other companies in the same industry for relatively prime sites that did not ultimately meet the criteria for product development. The benefit for buyers is that they can reduce the time required for development. |

(iii) Purchase and resale work for new condominiums | L'attrait Co., Ltd. buys and sells newly built properties developed by other developers after reviewing their location, development concept, safety, design, habitability, and profitability. By leveraging the know-how developed to date, the company provides value-added sales by coordinating household goods, furniture, and interior furnishings to suit the property, along with advice and references for home loans. |

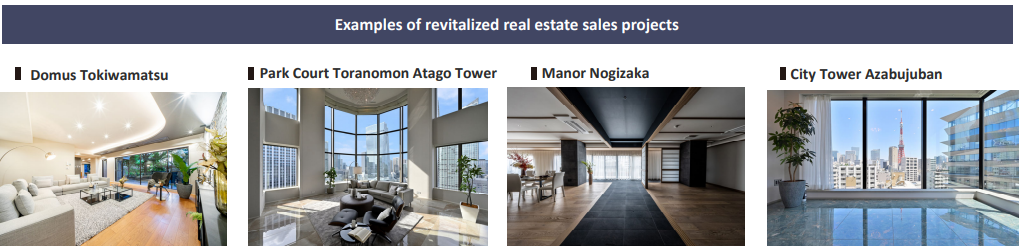

(2) Revitalized real estate sales business

(i) Sale of renovated condominium units | <Overview> L'attrait Co., Ltd. and L'attrait Residential Co., Ltd. purchase second-hand condominium units, plan and draft the details of renovation of each unit*1 to restore them as sophisticated residences, which are then sold by L'attrait Residential Co., Ltd. to general customers and other parties.

When purchasing properties, the company carefully reviews and selects properties based on location, price, size, etc., and buys them, using information on the settlement of debts through brokers, real estate agents, servicers, and financial institutions.

<Characteristics> Used condominiums are furnished with interiors and amenities similar to those in new ones, enabling highly functional, individually renovated condominiums to be sold to customers at more reasonable prices than newly built properties with the same conditions. Focusing on the premium area in the high price range, the company has created a series of three condominiums with different concepts: “L'attrait Premium-Renovation®,” “BILLION RESIDENCE®,” a high-grade mansion worth 1 billion yen or higher, and “Hi▶La▶Re,” priced between 70 million yen and 150 million yen per unit. The series offers attractive products at rare and unique locations with sophisticated living spaces. |

(ii) Renovation and sale of individual buildings | <Overview> L'attrait Co., Ltd. acquires a single building among company-owned employee dormitories, company housing, and rental condominiums in the Tokyo metropolitan area, completely renovates the building, and L'attrait Residential Co., Ltd. sells each unit to general customers, etc.

<Characteristics> Due diligence is carried out on the entire building by utilizing the renovation know-how of L'attrait Co., Ltd. Based on this, a complete renovation (renovation of a single building*2, conversion*3) is carried out, for not only private areas, but also common areas, to significantly renew the functionality of the building and make it attractive for sale. The company prepares building management plans, repair plans, financial budgets, etc., formulates management associations, appoints management specialists, and focuses on improving the living environment so that residents can live with peace of mind after they move in. |

(iii) Investment business | <Overview> L'attrait Co., Ltd. purchases a single building among office buildings, company-owned employee housing, and rental residences in the Tokyo metropolitan area, and uses the renovation know-how of the company to carry out detailed due diligence on the entire building in order to increase profitability.

Based on this due diligence, cost management related to building management, etc., is carried out, while the building is converted or revitalized to improve its ability to attract tenants or occupants, increase profitability, improve cash flow, and then sell it (to corporate and individual investors). |

(3) Real estate leasing business

LA Asset Co., Ltd. and L'attrait Co., Ltd. lease and manage real estate owned as fixed assets, and manage the leasing to tenants of properties held as real estate for sale.

The business of leasing of real estate owned by the company includes (1) to construct or acquire healthcare facilities, residential hotels, and commercial facilities and then lease individual buildings to operators, and (2) to construct or acquire office buildings and rental residences and then lease each unit separately.

*1: Renovation of each unit

This refers to the renovation of second-hand condominiums that have been in use for a certain period of time after construction, by reviewing the interior, layout, housing equipment, etc., to improve their functionality and restore them as sophisticated residences comparable to newly-built ones.

*2: Renovation of a single building

A comprehensive review of a building that has declined in value, including the repair history of the building, to improve the overall value of the building (value enhancement) by updating outdated facilities and adding new features to the building.

*3: Conversion

Renovation that involves changing the purposes of use of the building, such as converting an office building into an apartment building and converting dormitories or company housing into a commercial facility.

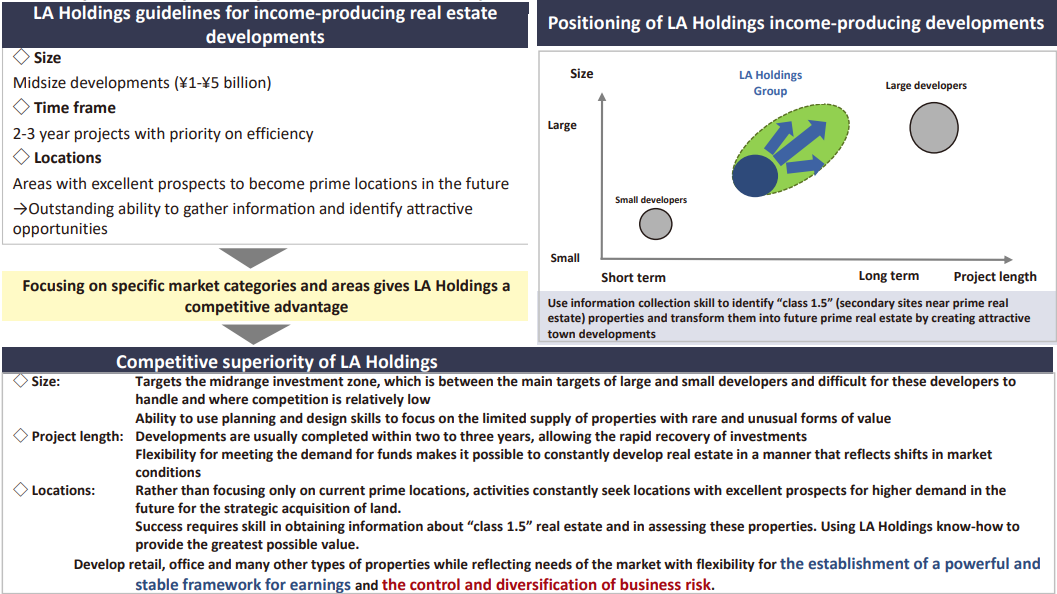

[1-5 Characteristics, strengths and competitive advantages]

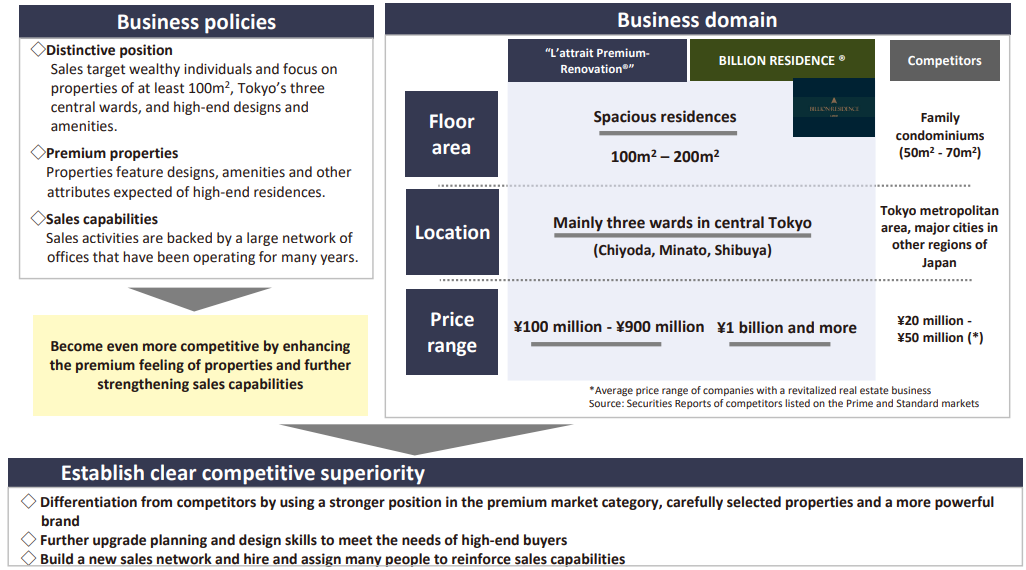

The company's primary competitive advantage is its unique positioning in new and revitalized real estate sales.

(1) New real estate sales

In terms of the scale of development, they focus on medium-scale development costing 1-5 billion yen.

In terms of development areas, the company focuses on finding areas with high potential to become “prime areas in the future,” and it has a significant advantage in the ability to gather information and identify the best areas to achieve it.

Furthermore, with regard to the development period, they focus on projects whose development period is not long, but 2-3 years and put importance on efficiency.

In this way, the company has found a competitive advantage by focusing on specific markets and areas and has established a unique position by finding white spaces that are difficult for other companies to deal with.

Through this, the company has achieved both “the establishment of a robust and stable revenue base” and “curtailment and dispersion of business risks.”

(Source: the reference material of the company)

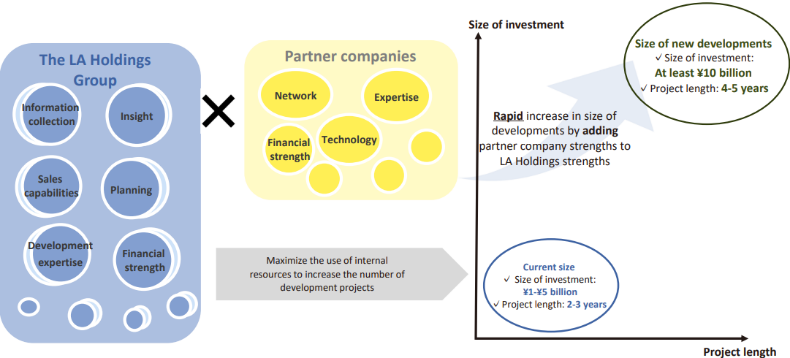

In addition, the company has recently expanded their business domains, including large-scale development projects, through collaborative projects with partner companies.

(Source: the reference material of the company)

(2) Revitalized real estate sales

The core series “L'attrait Premium-Renovation®” is characterized by plans and designs for offering “high quality” to match the needs of wealthy people. Prices also ranging from 100 million yen to 900 million yen, aiming for high prices and high added value.

In addition, the company targets “100 m2 or over” in terms of size and “three wards in the urban center” in terms of area, thereby establishing a unique position that other companies are not dealing with. In addition, the company is making efforts to secure more advantages by establishing new sales networks, recruiting personnel, and actively promoting them to strengthen selling capabilities.

(Source: the reference material of the company)

[1-6 Comparison with competitors]

We compared the major indicators of LA Holdings and major listed companies that sell revitalized real estate.

LA Holdings ranks second in the ratio of operating income and first in terms of ROE, indicating high profitability, which is pursued by the President Wakita.

Code | Corporate name | Sales | Sales growth rate | Operating income | Income growth rate | Operating income margin | ROE | Market cap | PER | PBR |

2975 | Star Mica Holdings | 64,061 | +14.7% | 6,298 | +14.0% | 9.8% | 12.8% | 30,056 | 8.5 | 1.2 |

2986 | LA Holdings | 51,000 | +14.1% | 8,200 | +6.5% | 16.1% | 28.6% | 41,575 | 8.0 | 2.3 |

3294 | e'grand | 30,000 | +9.8% | 1,730 | -14.1% | 5.8% | 17.9% | 9,287 | 8.6 | 0.9 |

8934 | Sun Frontier Fudousan | 100,000 | +25.2% | 20,870 | +18.6% | 20.9% | 15.3% | 94,780 | 6.7 | 1.2 |

8940 | Intellex | 46,365 | +8.6% | 2,063 | +121.6% | 4.4% | 3.5% | 7,636 | 5.6 | 0.6 |

*Unit: million yen and times. Sales and operating income are the forecasts for this fiscal year, taken from the latest brief financial reports of respective companies. Market cap, PER, and PBR are based on the closing price on Feb. 27, 2025.

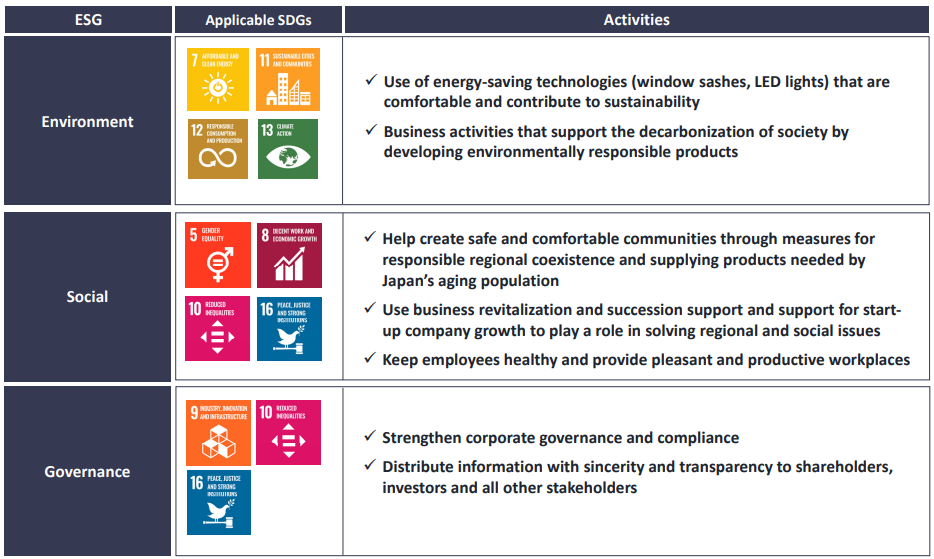

[1-7 Sustainability]

The company will take the following measures for dealing with ESG issues.

(Source: the reference material of the company)

2. Medium-term Management Plan

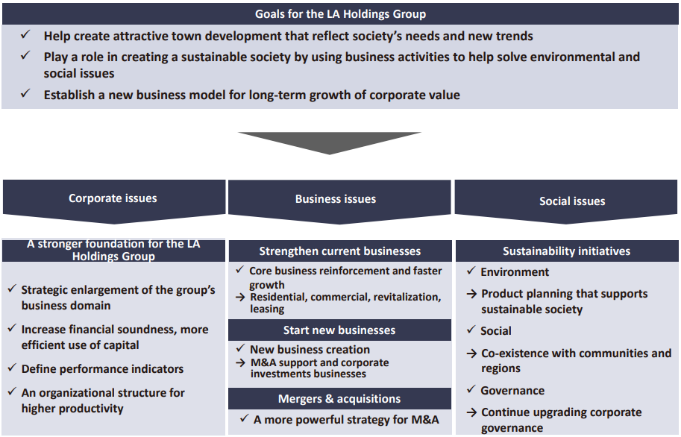

The target profits set in the “medium-term management plan for the period from 2023 to 2025,” which was announced on February 14, 2023, were achieved in the fiscal year ended December 2024 one year earlier than expected, so the company has formulated and announced a new plan for the period until 2026. The company intends to steadily attain the new forecasts, and create new revenue earning opportunities and further grow its existing businesses from the fiscal year 2027 onward.

[2-1 Basic policy]

They aim to “help create attractive town development that reflect society’s needs and new trends,” “play a role in creating a sustainable society by using business activities to help solve environmental and social issues,” and “establish a new business model for long-term growth of corporate value” and consider the following three as business issues.

① Pursuit of existing business

② Creation of new business

③ Promotion of M&A

(Source: the reference material of the company)

[2-2 Business issues]

(1) Pursuit of existing business

The company will pursue higher added value and realize sustainable profit growth with product planning that makes the most of its strengths.

It will promote regional revitalization and rural development by expanding its business to major local cities.

*New real estate sales business

The company engages in multiple projects for developing residential and commercial income-producing properties not only in the Tokyo Metropolitan Area, but also in Nagoya, Kyoto, Fukuoka, and Okinawa prefectures.

*Revitalized real estate sales business

The “L'attrait Premium-Renovation®” series priced in the order of 100 to 900 million yen sold well.

In addition, the company is strengthening the sales of BILLION RESIDENCE®, a new brand that is priced at over one billion yen.

It will strive to boost profit on a continuous basis by enhancing high-priced properties and providing high added value in the premium real estate market while giving a central focus to these two brands.

(Source: the reference material of the company)

With regard to "BILLION RESIDENCE®," the company rigorously selects mansions and supplies them based on the experience and know-how nurtured in the “L'attrait Premium-Renovation®” business for many years and the company’s broad information network.

The company is working on multiple projects, including “Hi▶La▶Re” that is priced between 70 million yen and less than 150 million yen per condominium unit, in the downtown area in Tokyo.

*Real estate leasing business

The company is securing stable revenue and optimizing its portfolio of rental properties by acquiring excellent rentable assets, such as healthcare facilities.

The company will conduct active investment in healthcare facilities, which are strongly demanded by society, with the aim of investing 2 billion yen every fiscal year. In order to expand business scale, it is indispensable to fortify the revenue base through not only one-shot-revenue business, but also recurring-revenue business, which is expected to help secure stable revenues. In particular, the company will allocate managerial resources to healthcare facilities with a high profit margin.

(Source: the reference material of the company)

(2) Creation of new businesses

In August 2024, the company announced that it would launch “M&A support business” and “corporate investment business” as new businesses that would be new revenue sources, under the policy set in the medium-term management plan, in order to achieve sustainable growth and improve corporate value in the medium/long term.

The company has been obtaining a lot of information on transactions on a daily basis through M&A, strategic alliance, the establishment and operation of funds, the investment in funds, etc. and have been discussing multiple transactions in diverse business types and categories or negotiating for them.

The company decided to start the two new businesses for the purpose of establishing a new revenue base to improve profitability by utilizing the know-how and networks for M&A and investment in enterprises, management know-how, information on transactions of diverse business types and categories in Japan, etc. the company has accumulated so far.

◎ M&A support business

In Japan, M&A is carried out actively in all kinds of business categories and industries, as there is the problem with business succession and the domestic market is shrinking, so the related support business domain is expanding.

Under these circumstances, the corporate group considers mergers and acquisitions (M&A) as an important growth strategy and got registered as an organization that offers M&A support services.

The company signed a memorandum of understanding on operational cooperation with StormHarbour Japan Ltd. in December 2023.

It will make optimal and strategic proposals as an M&A support advisor while utilizing networks and communication of management executives and taking into account growth strategies of enterprises and market conditions.

The company’s M&A is targeted as a broad range of small and medium-sized enterprises in all kinds of fields. In particular, the company plans to support enterprises and others that own real estate in the improvement of business administration and so on by raising the profitability of owned assets, efficiently using them, or the like while taking advantage of the company’s management know-how.

◎ Corporate investment business

LA Holdings established LA/BSP Vision Fund Investment Limited Partnership, which is funded jointly by the company and BSP Asset Management Co., Ltd., in February 2022. LA Holdings acquired FAN STYLE Co., Ltd., a real estate developer based in Okinawa Prefecture, as a wholly owned company on December 30, 2022 and is making investments in venture funds for business revitalization and succession for small- and medium-sized enterprises (SMEs) and venture funds in the Kyushu region.

With the aim of realizing sustainable business growth, LA Holdings intends to enhance cooperation with leading medium-sized companies in local communities, increase its corporate value, and expand its business.

It will target such companies as leading medium-sized companies that take a higher share in specific markets, companies that have been confronted with issues of business succession, including the lack of successors, and companies that possess their own unique products and services and have competitive edges in markets with high entry barriers as M&A candidates.

Furthermore, regarding funds in which LA Holdings will invest, the company will establish and operate next-generation funds targeting venture companies that are in the middle and later phases in various fields, further enhance this business in the Kyushu region, and promote investment in venture funds for business revitalization and succession for SMEs and venture funds in other regions.

[2-3 Corporate Issues]

LA Holdings has recognized the following issues regarding enhancement of its corporate group’s business foundation and thus intends to take necessary measures against each issue:

Issues | Measures |

Expansion of the business portfolio | LA Holdings will continuously strive to expand and optimize its business portfolio by taking on challenges and branching out into new business areas in which it can make the most of its corporate group’s business resources, such as fields in which it has a significant competitive edge and markets that are expected to grow considerably on a continuous basis. |

Enhancement of the financial base | In order to realize sustainable profit growth, LA Holdings will strike a balance between investment in future growth and shareholder returns while endeavoring to optimize its financial base. LA Holdings will keep equity ratio at 20% or higher and increase financial soundness and capital efficiency. |

Development of business indicators | LA Holdings will aim at an ROE of 20% or higher and a dividend payout ratio of 40%. |

Development of a highly productive organization | LA Holdings will generate high organizational capacities and increase productivity across its corporate group by establishing an organizational structure that allows each employee to demonstrate his or her abilities and skills. LA Holdings will proactively recruit and develop human resources with highly specialized skills and know-how. |

[2-4 Numerical goal]

(1) A company-wide goal

In the fiscal year ending December 2026, which is the last fiscal year of the “medium-term management plan,” the company forecasts “sales of 61 billion yen and an operating income of 17.5 billion yen.”

The fiscal year ending December 2025 falls on the 35th anniversary of inauguration of the company’s business, so all of executives and employees plan to make the utmost effort to grow business and improve corporate value further.

| FY 12/20 | FY 12/21 | FY 12/22 | FY 12/23 | FY 12/24 | FY 12/25 (Forecast) | FY 12/26 (Plan) |

Sales | 13,757 | 14,677 | 18,253 | 31,499 | 44,707 | 51,000 | 61,000 |

Operating income | 1,124 | 3,216 | 4,226 | 5,552 | 7,700 | 8,200 | 17,500 |

Ordinary income | 978 | 2,847 | 3,730 | 4,941 | 6,848 | 7,400 | 16,700 |

Net income | 650 | 1,959 | 3,381 | 3,293 | 4,713 | 5,100 | 11,600 |

EPS (Yen) | 123.58 | 410.83 | 638.25 | 549.10 | 560.3 | 816.4 | - |

*Unit: million yen.

(2) Profit plan by each segment

| FY 12/23 | FY 12/24 | FY 12/25 (Forecast) | FY 12/26 (Plan) |

Gross profit | 8,509 | 11,390 | 11,900 | 21,800 |

New real estate sales segment | 5,262 | 7,123 | 9,500 | 19,400 |

Gross profit margin | 34.4% | 26.9% | 25.6% | 41.2% |

Revitalized real estate sales segment | 2,635 | 3,582 | 1,950 | 1,950 |

Gross profit margin | 17.4% | 20.8% | 15.0% | 15.0% |

Real estate leasing segment | 572 | 616 | 450 | 450 |

Gross profit margin | 56.4% | 62.6% | 50.0% | 50.0% |

Other | 41 | 68 | 0 | 0 |

*Unit: million yen.

[2-5 Future financial strategy]

◎ Envisioned image of total assets

While aiming to conduct strategic investment for growth and return profit to shareholders stably, the company will strive to improve capital efficiency, grow profit significantly every fiscal year, and keep capital-to-asset ratio 20% or higher (the capital-to-asset ratio in FY 12/24 was 25.2%) while aiming to achieve total assets of 100 billion yen.

Internally, the company will pursue the stable growth of the real estate development business, which earns one-shot revenues, and the real estate leasing business, which earns recurring revenues.

Externally, the company will conduct investment for growth in order to realize M&A or strategic cooperation with enterprises that are expected to exert synergy.

[2-6 Return to shareholders]

The company recognizes the return of profit to shareholders as one of important issues for management.

As the basic policy, the company used to aim to achieve a payout ratio of 30% or higher, but the company has raised the target payout ratio to 40%.

As the company will commemorate the 35th anniversary of L'attrait and the 5th anniversary of LA Holdings, the company aims to “improve corporate value sustainably” and “maximize the return of profit.”

3. Fiscal Year ended December 2024 Earnings Results

[3-1 Business Results]

| FY 12/23 | Ratio to sales | FY 12/24 | Ratio to sales | YoY | Comparison with the revised forecast |

Sales | 31,499 | 100.0% | 44,707 | 100.0% | +41.9% | +4.0% |

Gross profit | 8,509 | 27.0% | 11,390 | 25.5% | +33.9% | - |

SG&A expenses | 2,957 | 9.4% | 3,689 | 8.3% | +24.8% | - |

Operating income | 5,552 | 17.6% | 7,700 | 17.2% | +38.7% | +7.0% |

Ordinary income | 4,941 | 15.7% | 6,848 | 15.3% | +38.6% | +5.4% |

Net income | 3,293 | 10.5% | 4,713 | 10.5% | +43.1% | +4.7% |

*Unit: million yen. Revised forecasts are ratios to the earnings forecasts announced in November 2024.

Sales and profit grew considerably. Sales, operating income, and ordinary income hit a record high for the fifth consecutive year.

Sales grew 41.9% year on year to 44.7 billion yen. Office buildings of income-producing properties, commercial buildings, and new condominiums sold well. In addition, in the land planning sales, the company sold 6 packages in urban areas. Regarding the revitalized real estate sales, high-priced properties sold well.

Operating income rose 38.7% year on year to 7.7 billion yen. Like in the previous fiscal year, the strategy of adding high value turned out to be effective. The ratio of operating income to sales declined 0.4 points year on year, but sales and profit exceeded the earnings forecasts that have been revised twice.

[3-2 Trend in each segment]

| FY 12/23 | Composition ratio | FY 12/24 | Composition ratio | YoY |

Sales |

|

|

|

|

|

Real estate sale business | 30,444 | 96.6% | 43,654 | 97.6% | +43.4% |

New real estate sales segment | 15,301 | 48.6% | 26,434 | 59.1% | +72.8% |

Land planning and sales | 1,550 | 4.9% | 13,434 | 30.0% | +766.2% |

Newly-built property sales | 13,750 | 43.7% | 13,000 | 29.1% | -5.5% |

Revitalized real estate sales segment | 15,142 | 48.1% | 17,219 | 38.5% | +13.7% |

Renovated condominiums | 10,862 | 34.5% | 15,805 | 35.4% | +45.5% |

Investment business | 4,279 | 13.6% | 1,414 | 3.2% | -67.0% |

Real estate leasing segment | 1,014 | 3.2% | 983 | 2.2% | -3.0% |

Total sales | 31,499 | 100.0% | 44,707 | 100.0% | +41.9% |

Gross profit |

|

|

|

|

|

Real estate sale business | 7,896 | 25.9% | 10,706 | 24.5% | +35.6% |

New real estate sales segment | 5,262 | 34.4% | 7,123 | 26.9% | +35.4% |

Land planning and sales | 221 | 14.3% | 2,879 | 21.4% | +1202.7% |

Newly-built property sales | 5,040 | 36.7% | 4,244 | 32.6% | -15.8% |

Revitalized real estate sales segment | 2,634 | 17.4% | 3,582 | 20.8% | +36.0% |

Renovated condominiums | 1,825 | 16.8% | 3,013 | 19.1% | +65.1% |

Investment business | 808 | 18.9% | 568 | 40.2% | -29.7% |

Real estate leasing segment | 571 | 56.4% | 616 | 62.6% | +7.9% |

Total gross profit | 8,509 | 27.0% | 11,390 | 25.5% | +33.9% |

*Unit: million yen. “Sales” means “sales to external customers.” The composition ratio of profit means gross profit margin. The profit in a business segment in brief financial reports, etc. is obtained by subtracting selling expenditure and non-operating expenses from the gross profit in the business segment.

(1) Real estate sale business

Sales grew 43.4% year on year, and gross profit rose 35.6% year on year.

① New real estate sales segment

Sales grew 72.8% year on year, and gross profit rose 35.4% year on year.

The company completed 4 new condominiums and started handing over condominium units.

Regarding the land planning sales, the company sold 6 packages, including expensive properties in urban areas.

Sales hit a record high, as the company sold 3 office buildings of the “THE EDGE” Series as income-producing properties, 2 commercial buildings of the “A*G” series, and new condominiums.

② Revitalized real estate sales segment

Sales grew 13.7% year on year, and gross profit rose 36.0% year on year.

“L'attrait Premium-Renovation®” series sold well, and the sales of this series hit a record high.

In the investment business, they sold all of land, buildings, etc. in Shibuya-ku, Tokyo.

(2) Real estate leasing segment

Sales decreased 3.0% year on year, and gross profit increased 7.9% year on year.

Sales declined, but the assets they hold, such as healthcare facilities, were managed stably.

(3) Target value of each management indicator

Management indicators (ROE, equity ratio, and payout ratio) exceeded the forecast values in fiscal year ended December 2024, like in fiscal year ended December 2023.

| Goals for FY 12/23 | Results in FY 12/23 | Goals for FY 12/24 | Results in FY 12/24 |

Gross profit margin | 20% or more | 27.0% | 20% or more | 25.5% |

Ordinary income margin | 10% or more | 15.7% | 10% or more | 15.3% |

Capital-to-asset ratio | 20% or more | 24.6% | 20% or more | 25.2% |

ROE | 20% or more | 25.0% | 20% or more | 28.6% |

Payout ratio | 30% or more | 38.4% | 30% or more | 38.5% |

[3-3 Financial Condition and Cash Flow]

◎ Main BS

| End of December 2023 | End of December 2024 | Increase/ Decrease |

| End of December 2023 | End of December 2024 | Increase/ Decrease |

Current assets | 49,880 | 63,141 | +13,260 | Current liabilities | 19,859 | 24,785 | +4,926 |

Cash and deposits | 12,783 | 13,545 | +762 | Short-term interest-bearing liabilities | 17,321 | 20,433 | +3,112 |

Real estate for sale | 15,693 | 18,041 | +2,348 | Noncurrent liabilities | 26,137 | 28,330 | +2,192 |

Real estate for sale in process | 20,463 | 29,317 | +8,854 | Long-term interest-bearing liabilities | 25,438 | 27,523 | +2,084 |

Noncurrent assets | 11,323 | 8,098 | -3,225 | Total labilities | 45,997 | 53,116 | +7,119 |

Tangible assets | 10,190 | 6,737 | -3,453 | Net assets | 15,212 | 18,131 | +2,918 |

Investments and other assets | 1,094 | 1,319 | +225 | Retained earnings | 11,948 | 15,343 | +3,395 |

Total assets | 61,209 | 71,247 | +10,037 | Total liabilities, net assets | 61,209 | 71,247 | +10,037 |

*Unit: million yen.

Total assets increased 10 billion yen from the end of the previous fiscal year to 71.2 billion yen, due to the increase in inventory assets, etc.

Total liabilities augmented 7.1 billion yen from the end of the previous fiscal year to 53.1 billion yen, due to the increase in short-term and long-term interest-bearing liabilities, etc.

Net assets grew 2.9 billion yen from the end of the previous fiscal year to 18.1 billion yen, due to the increase in retained earnings, etc.

Capital-to-asset ratio increased 0.6 points from the end of the previous fiscal year to 25.2%.

◎ Cash Flow

| FY 12/23 | FY 12/24 | Increase/Decrease |

Operating Cash Flow | -3,202 | -1,755 | +1,447 |

Investing Cash Flow | -1,403 | -708 | +694 |

Free Cash Flow | -4,605 | -2,464 | +2,141 |

Financing Cash Flow | 7,773 | 3,200 | -4,572 |

Cash, Equivalents | 12,689 | 13,426 | +736 |

*Unit: million yen.

The cash outflow from operating activities and the deficit of free cash flow decreased, thanks to the rise in net income before taxes and other adjustments.

The cash inflow from financial activities shrank, due to the decrease in revenues caused by the issuance of shares through the exercise of share acquisition rights.

The cash position improved.

[3-4 Topics]

◎ Revision to the articles of incorporation

In February 2025, the board of directors adopted a proposal for the revision to the articles of incorporation.

(Purpose of the revision to the articles of incorporation)

As about 5 years passed after the shift to the holding company structure, they will revise business descriptions and add or revise the purposes of business mentioned in Article 2 of the Articles of Incorporation (Purposes), in order to swiftly operate businesses in the future, as the businesses of the corporate group have expanded and diversified.

(Details of the revision)

They added the following new purposes of business.

This is due to the start of the “M&A support business” and the “corporate investment business” based on the medium-term management plan.

* | Brokerage, arrangement, consulting, and advisory for M&A, and investment or capital injection into enterprises and businesses inside and outside Japan |

* | Investment and capital injection into investment partnerships, limited partnerships for investment, etc., and management thereof |

* | Real estate investment advisory |

* | Services, consulting, information processing/provision, and solution provision for digital transformation (DX) |

The revision will become effective after a resolution is made at the 5th annual meeting of shareholders to be held on March 28, 2025.

4. Fiscal Year ending December 2025 Earnings Forecasts

[4-1 Earnings Forecast]

| FY 12/24 | Ratio to sales | FY 12/25 Est | Ratio to sales | YoY |

Sales | 44,707 | 100.0% | 51,000 | 100.0% | +14.1% |

Operating income | 7,700 | 17.2% | 8,200 | 16.1% | +6.5% |

Ordinary income | 6,848 | 15.3% | 7,400 | 14.5% | +8.1% |

Net income | 4,713 | 10.5% | 5,100 | 10.0% | +8.2% |

*Unit: million yen. The forecast figures were announced by the company.

Sales and profit are expected to grow.

It is projected that sales will increase 14.1% year on year to 51 billion yen and operating income will rise 6.5% year on year to 8.2 billion yen.

All of the three business segments will continue business operations based on the policy set in the medium-term management plan.

They plan to pay a dividend of 330.00 yen/share, up 38 yen/share from the previous fiscal year. The expected payout ratio is 39.9%.

[4-2 Initiatives in each business]

① New real estate sales segment

The company will actively develop “A*G” series, a commercial building, “THE EDGE,” an office building, and “THE DOORS” series, a classy rental residence in the business of development of income-producing properties, which is a growth driver, and plan products with competitive advantages to pursue high added value, while aiming to improve its brand power and expand target areas, including major local cities. In addition, in the condominium business, the company will promote the “L'attrait Residence” brand in major local cities. In Okinawa, the company will strive to expand the business of the “rêve” series brand, fortify the company’s business foundation, and establish a unique position where the company can exert competitive advantages.

② Revitalized real estate sales segment

The company will concentrate on the core business, that is, the sale of renovated condominium units, including the “L'attrait Premium-Renovation®” series priced at over 100 million yen per unit, and the high-grade mansion “Billion-Residence®” priced at over 1 billion yen per house. In addition to the products that match the needs of a broad range of customers, they supply products with high added value, which have competitive advantages free from price-cutting wars, based on their planning and designing skills, to establish a unique position.

③ Real estate leasing segment

They will actively invest in healthcare facilities for which social needs are high, to optimize their rental portfolio and secure stable revenues, and concentrate on the fostering of an optimal relationship with the company entrusted with the management of healthcare facilities and the further improvement in operation, to maintain their high revenue earning capacity.

5. Interview with President Wakita

We interviewed the President Wakita about the overview of financial results for the fiscal year ended December 2024, the medium-term management plan, a message toward shareholders and investors, etc.

Q: Please comment on the financial results for the fiscal year ending December 2024.

As I mentioned when talking about financial results for the first half of the year, our financial condition and past achievements have been recognized, leading to a considerable increase in credit from financial institutions.

Up until now, our basic approach was to secure sales and profit by elevating the profitability of each property through price strategy, rather than focusing on the number of properties sold. However, in step with the improvement of our fundraising capabilities this time, we succeeded in speedily finishing projects of a volume we had not been able to handle previously, boosting our performance during the fiscal year. As a result, we managed to significantly build up both sales and profit.

As interest rates for loans have risen, financial institutions have started to select whom they finance, which means further advantage in the business environment for our company.

The situation is unchanged in the fiscal year ending December 2025.

Q:Please comment on the medium-term management plan.

We managed to achieve the targets for all kinds of profits in the "medium-term management plan for the period from 2023 to 2025,” which was presented on February 14, 2023, in the fiscal year ended December 2024, a year earlier than planned. Therefore, we formulated and announced a new plan for the period until 2026.

We forecast “sales of 61 billion yen and an operating profit of 17.5 billion yen” for the fiscal year ending December 2026. After achieving them without fail, from 2027 we will create new revenue opportunities by proactively developing new businesses including the “M&A support business” and “corporate investment business,” which were launched in August 2024, in addition to the further growth of existing businesses.

As our total assets in the fiscal year ended December 2024 exceeded 70 billion yen, we set 80 billion yen as our target for now, but at this point we consider 100 billion yen to be within achievable range.

We intend to steadily increase large-scale projects, owing to the increase in credit from financial institutions, while keeping up our high added value strategy.

Q: “M&A support business” and “corporate investment business” have just been launched, but please tell us about their achievements and progress.

As for the “M&A support business,” construction companies for which we intermediated reached a basic agreement about their M&A recently.

Our M&A intermediation style lies in directly connecting the pipeline between the owners or CEOs from the network of small and medium-sized businesses. We do not generate profit by focusing on the number of projects as major M&A intermediary companies do, but complete each and every case with careful consideration. The parties concerned can thus feel reassured when negotiating, and we believe that this is what characterizes our approach.

We also have available staff with an abundance of experience concerning the actual M&A procedures such as due diligence, not only matching based on my network. Therefore, we shall provide assistance with M&A based on a solid system.

As labor shortage is a significant challenge in the construction industry, we believe that many similar cases will arise from now on as well.

With regard to “corporate investment business,” the acquisition of FAN STYLE Co., Ltd., a real estate developer in Okinawa, as a subsidiary, and the following initiatives are important subjects of our case study.

While FAN STYLE is a number one company in Okinawa, credit lines have been significantly increased for them as a result of refinements made after becoming our subsidiary. The case of FAN STYLE gives an extremely clear message when it comes to explaining our regional strategy.

Based on such achievements in Okinawa and Kyushu, we are currently making solemn preparations to produce results in Hokkaido.

As one of our group management philosophies states, "To strive for management that contributes to the creation of local living environments by providing 'homes that enrich people's hearts' through clean and fair corporate activities that value the lifestyles of local communities." As such, we position regional revitalization as an extremely important theme.

As we have pursued various developments and initiatives, including building relationships with regional financial institutions and leading regional companies, we have come to the conclusion that in order to truly solve regional problems and realize regional revitalization, our company or our group companies do not necessarily have to be at the center. In order for a company that should play a leading role in regional revitalization to grow, in some cases it may be more appropriate for it to temporarily partner with a construction company in the same industry.

We believe that being flexible in considering and responding to such issues will increase our contacts with local companies and financial institutions and deepen our relationships, which will lead to increased corporate value for our group in the medium/long term.

Therefore, we would like you to understand that our new businesses, the “M&A Support Business” and the “Corporate Investment Business,” are not merely about earning brokerage fees or capital gains, but are business developments unique to our company that aim to achieve growth in various patterns while realizing regional revitalization.

Q: Thank you very much. Lastly, please give a message to shareholders and investors.

First of all, we will make maximum use of the current market environment and our competitive advantage to properly reinforce our business foundations by the end of 2026. After the achievement thereof, we will create various revenue opportunities from 2027 by taking bold challenges at new businesses centered on real estate, underpinned by the growth of existing businesses.

While we forecast “sales of 61 billion yen and an operating profit of 17.5 billion yen” for the fiscal year ending December 2026, which is the last fiscal year of the “medium-term management plan,” we believe that the goal of 100 billion in sales has come in sight.

Moreover, as our new recent action, we have started to engage in joint business with our partner companies.

Although our total assets are steadily growing, when it comes to promoting a business while considering the balance with equity ratio, working on a project on the scale of 10 billion yen just by ourselves still seems risky after all.

Amid such situation, we began an initiative where our company sets up everything when launching a project, based on our abundant know-how and achievements concerning “manufacturing,” following which our partner companies, such as funds, provide the funding to complete the project.

This means that we can develop large-scale projects off the balance sheet and further boost our sales and profit.

We will always pursue uniqueness and aim for steady growth and expansion of market capitalization, so we would appreciate your support.

6. Conclusions

In the previous report in August 2024, President Wakita commented, “As financial institutions raised our credit lines significantly, we became able to pursue the growth of our business by increasing the number of projects, and some effects have been already produced.” Actually, their results exceeded the forecasts that have been revised twice.

As this trend has not been changed recently, the forecast for the fiscal year ending December 2025, which calls for “sales rising 14.1% year on year to 51 billion yen and operating income growing 6.5% year on year to 8.2 billion yen,” seems to be achievable.

The company has just launched the “M&A support business” and the “corporate investment business” aimed at operating businesses in their unique way, but they are about to produce some results steadily. We would like to pay more attention to the performance of the company, as “sales of 100 billion yen” came in sight.

<Reference: Regarding Corporate Governance>

◎ Organizational structure and composition of directors and auditors

Organizational structure | Company with an audit and supervisory board |

Directors | 5 including 2 outside directors (including 2 independent officers) |

Auditors | 3 including 2 outside directors (including 2 independent officers) |

◎ Corporate Governance Report

Update date: May 23, 2024

<Basic policy>

We recognize that corporate governance means the basic framework of corporate management for fulfilling social responsibility toward stakeholders, including shareholders, customers, employees, business partners, and local communities. We will continue corporate governance-related strategies, while concentrating on the establishment of a better management base.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

The company follows all of the basic principles of the Corporate Governance Code.

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |