Bridge Report:(3645)Medical Net the term ended May 2022

Chairman & CEO Dai Hirakawa | Medical Net, Inc. (3645) |

|

Company Information

Market | TSE Growth |

Industry | Information and Communications |

Chairman & CEO | Dai Hirakawa |

HQ Address | Takara Building, 1-34-14 Hatagaya, Shibuya-ku, Tokyo |

Year-end | End of May |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Act.) | Trading Unit | |

¥439 | 8,815,870 shares | ¥3,870 million | 26.1% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥2.50 | 0.6% | ¥21.51 | 20.4x | ¥193.73 | 2.3x |

*The share price is the closing price as of August 5. Number of shares issued is taken from the latest brief report on earnings results. The number of treasury shares was subtracted from the number of shares issued.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2019 (Actual) | 1,964 | 176 | 182 | 102 | 9.49 | 1.00 |

May 2020 (Actual) | 2,570 | 106 | 103 | 79 | 9.26 | 0.75 |

May 2021 (Actual) | 2,904 | 331 | 336 | 129 | 15.36 | 4.00 |

May 2022 (Actual) | 3,745 | 449 | 454 | 384 | 43.98 | 4.00 |

May 2023 (Forecast) | 4,500 | 320 | 321 | 190 | 21.51 | 2.50 |

*Estimates are those of the company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

*In June 2021, a 2-for-1 stock split was conducted. The stock split was reflected in EPS and DPS.

*From FY 5/22, the company has applied the “Accounting Standard for Revenue Recognition,” etc. The accounting standards, etc. have been retroactively applied to the net sales from FY 5/19.

This report briefly describes the financial results of Medical Net, Inc. in the term ended May 2022, etc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended May 2022 Earnings Results

3. Fiscal Year Ending May 2023 Earnings Forecasts

4. Conclusions

<Reference 1: Future Growth Strategy-Concentration on Preventive Medicine and Treatment of Presymptomatic Diseases>

<Reference 2: Regarding Corporate Governance>

Key Points

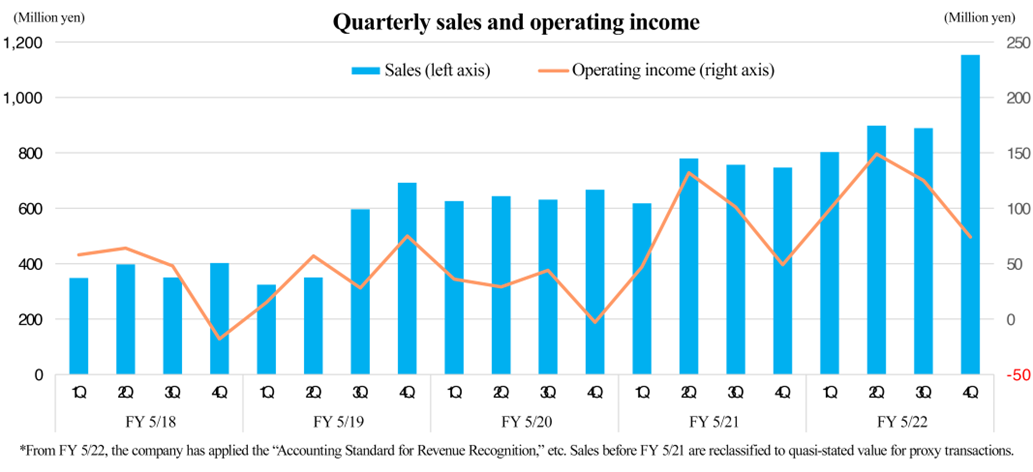

- In the term ended May 2022, sales and operating income grew 29.0% and 35.8%, respectively, year on year. The three core businesses showed a double-digit sales growth, and operating income margin rose from 11.4% in the previous term to 12.0%, thanks to the curtailment of augmentation of SGA. In the media platform business, the company promoted streamlining and enriched its services. In the medical institution management support business, consolidated subsidiaries contributed to its performance. Sales and all kinds of profits hit a record high, exceeding the company’s forecast. The company paid a term-end dividend of 4.00 yen/share.

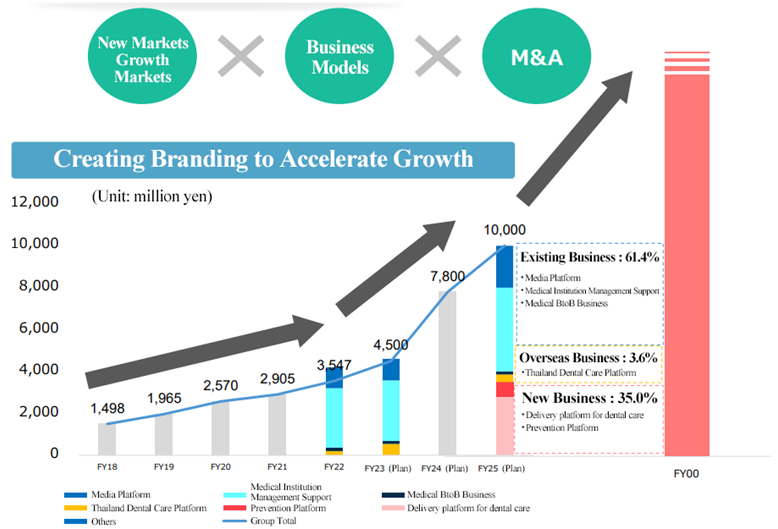

- In the term ending May 2023, sales are expected to grow 20.1% year on year, and operating income is projected to drop 28.9% year on year. In the media platform business, which is the mainstay, the company will keep strengthening services for improving usability and the customer satisfaction level. In the medical institution management support business, the company will strive to improve its revenue model. For the sale of dental apparatus materials and pharmaceutical products, they will form alliances with Okamura, Noechi Pharmaceutical, and Okamura Osaka. The growth of revenues is expected also through the mutual sale of dental apparatus in Japan and Thailand. In the medical BtoB business, they will enhance their earning capacity for each service. In terms of profit, SGA is forecast to augment, due to the active investment for acquiring competent personnel and the upfront investment for new businesses.

- The term ended May 2022 can be called “the year for making a leap forward,” in which sales and profit increased considerably for the second consecutive year, thanks to the alliance strategy and the acquisition of new consolidated subsidiaries as well as the effects of COVID-19. As a favorable trend, the sales of the medical platform business are increasing, while profit margin remains high and the number of subscribers is increasing. The revenue base is steadily growing. In addition, the company is taking advantage of the growth of the membership base for promoting the medical institution management support business and the medical BtoB business. In Thailand, they operate the business of trading dental goods while expanding the dental clinic management business, so further growth is expected. For the term ending May 2023, it is forecast that sales will increase 20.1%, but ordinary income will decline 29.2%. This is because the company will continue active investment for maintaining significant growth. It seems that the management status of dental clinics is improving as they provide preventive care against lifestyle diseases, etc. Dental clinics will become able to allocate funds to advertisement. Profit is projected to drop in the term ending May 2023, but we can keep recognizing Medical Net as a rapidly growing enterprise. We consider that its stock is still undervalued.

1. Company Overview

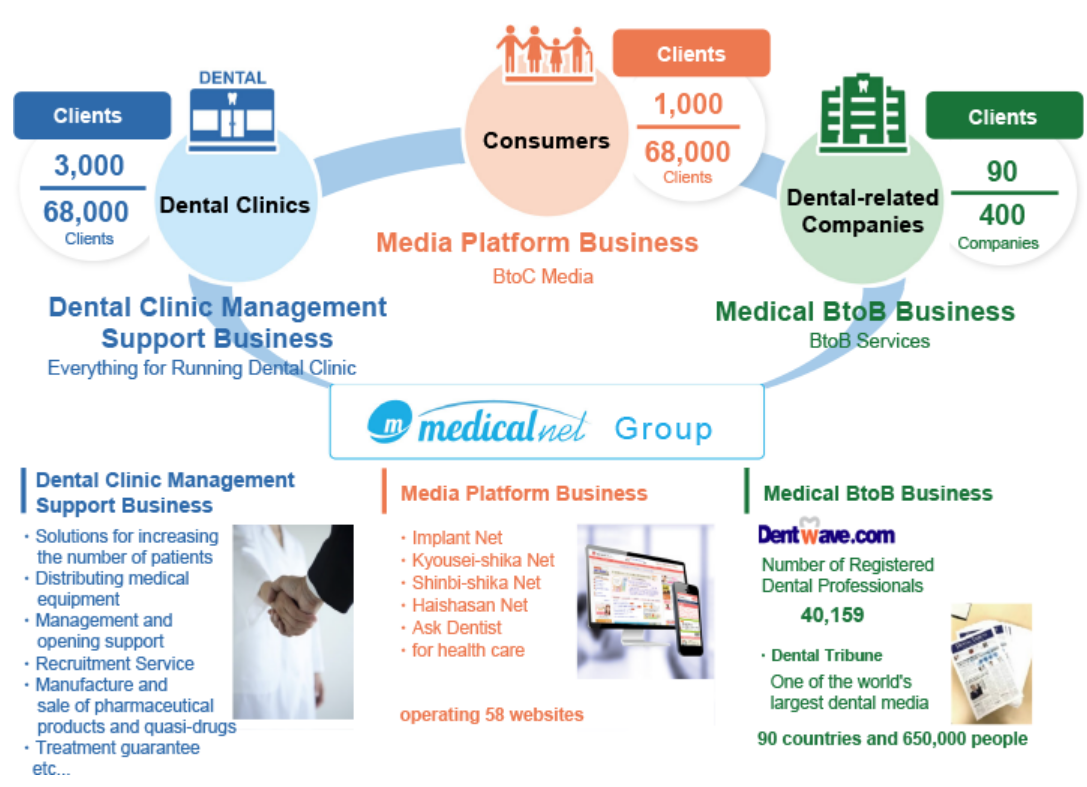

With the corporate philosophy of "Use of the internet to improve the quality of life and health of people and make them smile," the company provides comprehensive support for managing dental clinics through its Dental Care Platform Business. It also offers helpful information related to medical care, including dental care, beauty care, and lifestyle through its Services for Consumers and supports marketing for dentistry-related companies through its Services for Enterprises.

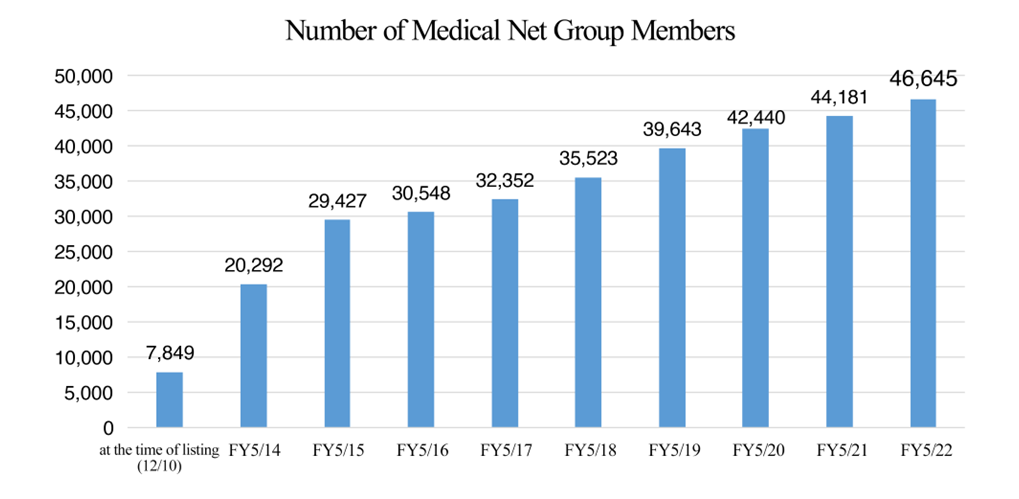

Medical Net is the only company with a business model that connects consumers, dental clinics, and dentistry-related companies. As of the end of May 2022, the number of members of the Medical Net Group reached 46,645, which constitutes a significant asset.

【1-1 Corporate History】

2000 | Apr. | Japan Internet Media Center was established and began a portal site operation business and a website production business. |

Sep. | A portal site, "Implant Net", was launched. | |

2001 | Jun. | Japan Medical Net Communications, Inc. (present Medical Net, Inc.) was established. |

2002 | Feb. | The portal sites Kyousei Shika Net (Orthodontic Dentistry Net) and Shinbi Shika Net (Esthetic Dentistry Net) were launched. |

2005 | Apr. | The portal site Beauty Treatments and Popularity Ranking was launched. |

2006 | Oct. | Started the SEM business. |

2007 | Aug. | Business and capital tie-up with So-net M3, Inc. (present name: M3, Inc.) which was listed in the First Section of TSE. |

2009 | Mar. | Mobile! Haisha-san Net (Mobile! Dentist Net) was launched. |

2010 | Dec. | Listed in the Mothers of TSE. |

2012 | Nov. | Acquired Blanc Networks Inc. as a consolidated subsidiary and developed a BtoB medical business. |

2014 | Sep. | Healthcare information site "4healthcare" was launched. |

Oct. | Beauty care information website Bi LAB. (Beauty LAB.) was launched. | |

2015 | Jan. | Mamma Mia, a child-rearing information website for mothers, was launched. |

2015 | Sep. | Business and capital tie-up with MiRTeL Co., Ltd. |

2016 | Dec. | A corporate name changed to Medical Net, Inc. |

2017 | Apr. | The public childcare app Moopen was launched. |

| May | Entered into a business alliance with Dental Tribune International. |

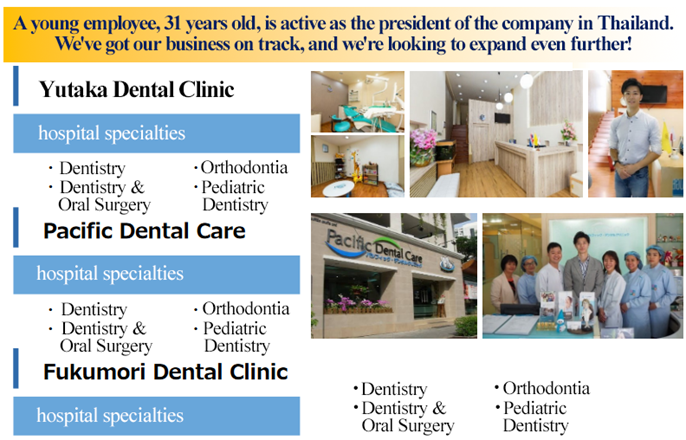

| Sep. | Success Sound Co., Ltd. (present Medical Net Thailand Co., Ltd.) became a consolidated subsidiary and began operating a dental clinic in Bangkok. |

| Oct. | Launched the Dental Tribune Japanese Edition as its sole agent in Japan. |

| Dec. | Medical Net Thailand Co., Ltd. renovated and reopened the Yutaka Dental Clinic. |

2018 | Feb. | Established the Fukuoka branch. |

| Dec. | Acquired shares of Okamura Co., Ltd. and made it a wholly owned subsidiary (started a dental dealer business). |

2020 | Feb. | Absorbed and merged a consolidated subsidiary Blanc Networks, Inc. |

Sep. | Acquired a patent for a new halitosis sensor system for dental clinics, developed through joint research with Okayama University. | |

Oct. | Made Pacific Dental Care Co., Ltd. a consolidated subsidiary (second-tier subsidiary). | |

2021 | Jun. | Made Noechi Pharmaceutical Co., Ltd. into a consolidated subsidiary (second-tier subsidiary) and started manufacturing and selling pharmaceuticals and quasi-drugs. |

2022 | Mar. | Made NU-DENT Co., Ltd., D.D. DENT Co., Ltd., and Fukumori Dental Clinic Co., Ltd. into consolidated subsidiaries (second-tier subsidiaries). |

2022 | Apr. | Moved from the Mothers to the Growth Market of TSE, following the reclassification of TSE's market divisions. |

2022 | May | Established the consolidated subsidiary (second-tier subsidiary) Okamura Osaka Co., Ltd. |

Many companies targeted dentists and tried to operate their business centered on Internet advertising. However, they could not develop continuous sales to dentists, the majority of which are individual business owners, so most of them withdrew.

However, Medical Net has narrowed down its target to self-paid medical treatments (not covered by medical insurance) among dentists and has emphasized not only business success, but also the vision at the time of its founding. It has also exerted continuous efforts for dentists to increase the understanding and dissemination of new treatments, improve local medical care, create an environment where dentists can concentrate on treatment, and provide patients with information on better treatment methods. As a result of all these efforts, the company has won overwhelming sympathy from many dentists and has become a one-of-a-kind company with a business model that connects consumers, dental clinics, and dentistry-related companies.

【1-2 Corporate Philosophy, etc.】

With the corporate philosophy of "Use of the internet to improve the quality of life and health of people and make them smile," the company formulated its mission statement consisting of the following mission, vision, and value.

MISSION | Use of the Internet to improve the quality of life and health of people and make them smile |

VISION | Provide innovative services to the public and medical facility operators to become the top Company in Japan in the dental care platform business and the specialized domain platform business |

VALUE | No change, no progress (an inexhaustible challenge) ◇Passion: aspiration, initiative, responsibility, and mindfulness ◇Speed: consciousness, ideas, judgment, words, and actions ◇Teamwork: cooperation, competition, synergy, and altruism ◇Respect: appreciation, thoughtfulness, respect, and sincerity |

The company emphasizes instilling its philosophy and vision in all employees and carries out various initiatives.

The change of the company name in December 2016 is also a message from the management to the people inside and outside the company that the company will pursue its corporate philosophy more thoroughly than ever before.

CEO Dai Hirakawa and COO Yuji Hirakawa have discussed these values several times when holding group training sessions every two months to nurture mid-career employees and during mid-career hiring.

In addition, the company has started a system to quantitatively and qualitatively evaluate the efforts and achievements to realize the vision of each business unit and employee.

Through this evaluation system, the company aims to diffuse its vision and philosophy further to build a stronger organization.

【1-3 Market Environment】

◎Dental Care Market

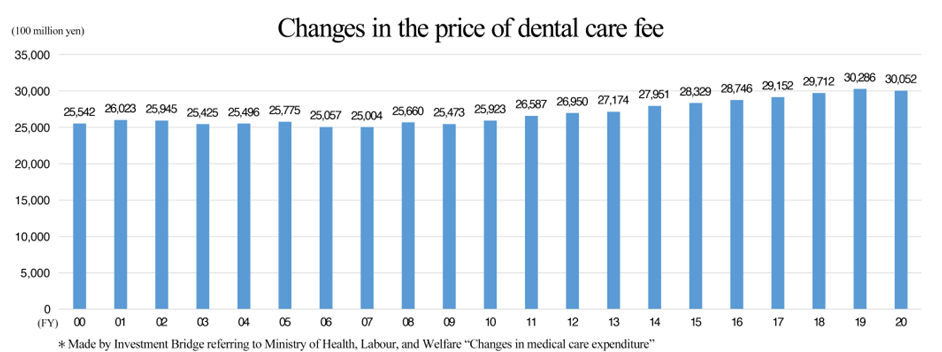

According to a survey by the Ministry of Health, Labor and Welfare, dental care and medical expenses in the fiscal year 2020 were about 3.0 trillion yen, a slight decrease of 0.8% from the previous year.

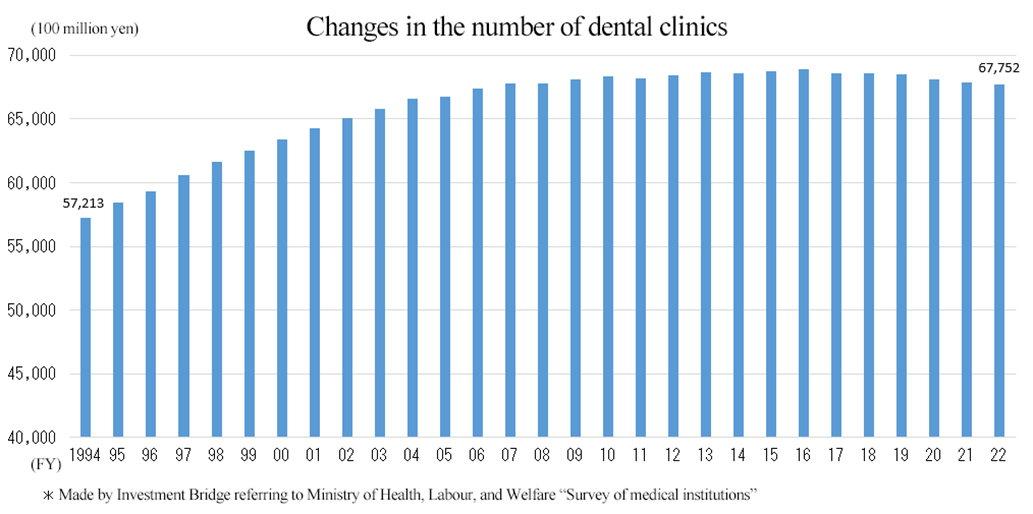

At the end of May 2022, there were 67,752 dental clinics, a slight decline from the same month of the last year.

However, due to the spread of the novel coronavirus, the demand for self-paid medical treatments (not covered by medical insurance) such as implants and orthodontic treatment rose due to the increased awareness of oral hygiene. Thus, dental and medical expenses from April 2021 to February 2022 increased compared with the same period of the previous year by 5.5%, showing a recovery trend.

Despite the spread of self-paid medical care such as implants and teeth whitening, as well as increased awareness of oral hygiene, dental clinics are in excessive competition amid continuous policies to curb medical costs, and the business environment surrounding them continues to be severe.

Dental clinics seem to have a substantial need for effective measures centered on increasing the number of customers.

◎ Internet Advertising Market

Internet advertising, an essential solution for dentists to attract customers in the medical institution management support business, continues to grow rapidly.

According to Dentsu's "Advertising Expenditures in Japan in 2021," Japan's total advertising expenditures fell by 11.2% in 2020, partly due to the impact of the novel coronavirus, but recovered, increasing by 10.4% in 2021.

On the other hand, Internet advertising sales increased by 5.9% in 2020. In 2021, it increased by 21.4%, exceeding the four media advertising expenses (newspaper, magazine, radio, and TV media advertising expenses combined) for the first time, leading the Japanese advertising market.

This trend is expected to continue, and Internet advertising will become increasingly important as a marketing tool for dentists.

【1-4 Business Description】

<Service overview>

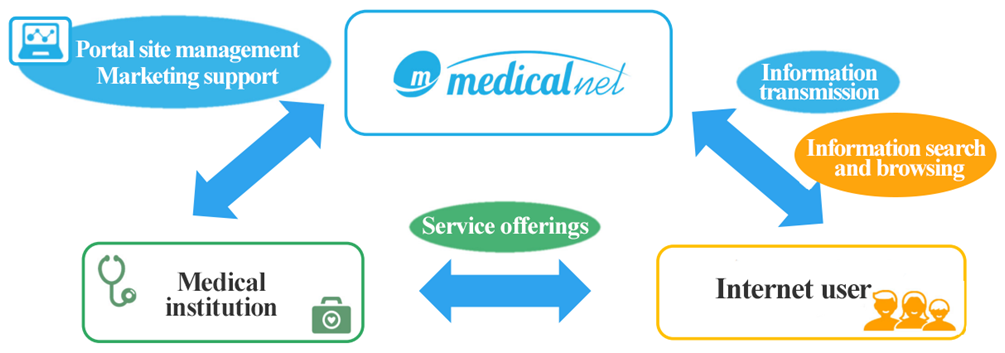

Under the corporate philosophy of "Use of the internet to improve the quality of life and health of people and make them smile," the company offers the following services to consumers, dental clinics, and dentistry-related companies.

(For consumers)

Under the theme of understanding and popularizing dental treatment, the company's various portal sites provide helpful information for consumers, such as information on the most suitable dental clinic, basic dental knowledge, and explanations of specialized treatments such as implants.

In addition, the company focuses not only on dentistry, but also on a wide range of services such as medical care, beauty care, and lifestyle.

(For dental clinics)

The company offers management support services to the highly competitive dental clinic industry from various aspects.

The company provides comprehensive support such as website creation and online marketing to attract customers, human resources, and career support by operating a job search website for dental professionals, the introduction of consumables and dental materials required for daily dental treatment, and highly controlled medical equipment. The company also offers comprehensive support for opening new dental clinics regarding property, equipment/infrastructure, websites, attracting customers, etc.

(For dentistry-related companies)

The company supports dentistry-related companies that want to expand their business for dental clinics.

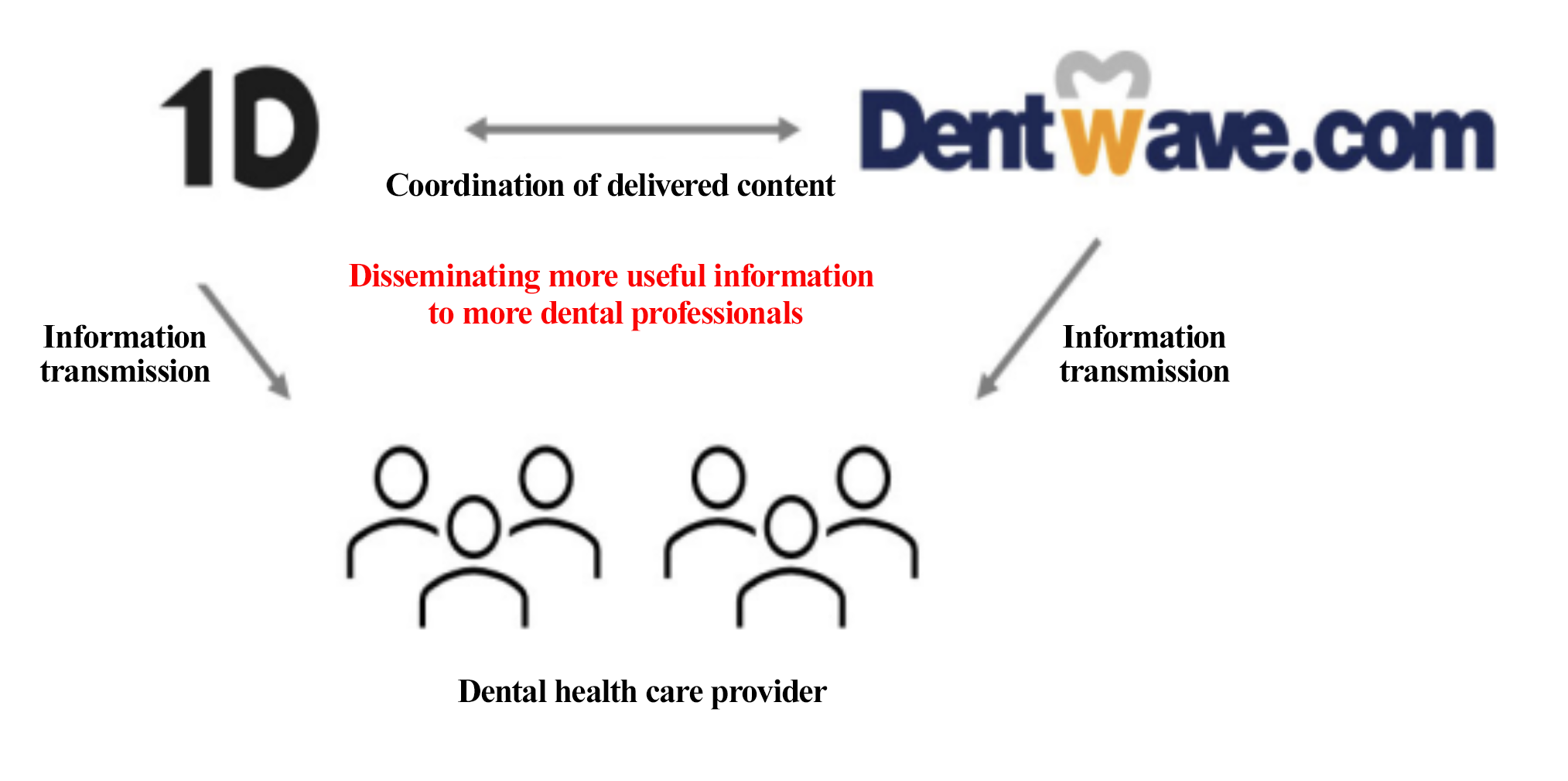

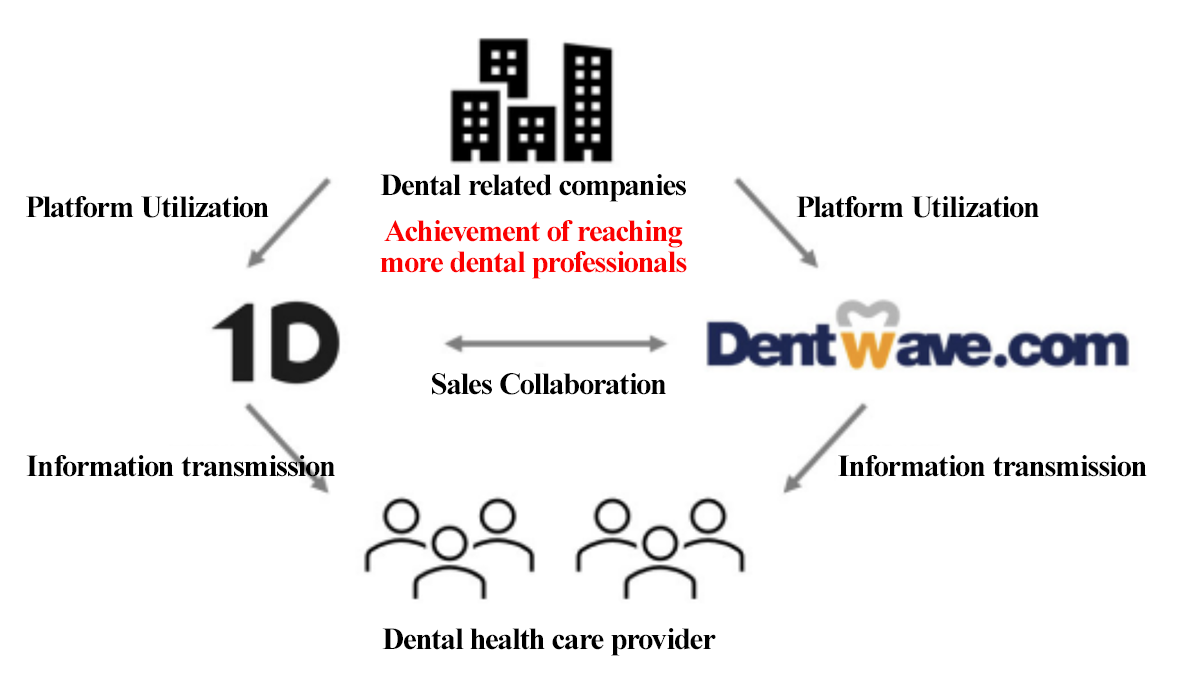

Dentwave.com, operated by Medical Net and one of the Japan's largest comprehensive dental care information websites, plays a key role here, with 40,159 registered dental care professionals as of May 2022.

In addition to advertisements such as banner advertisements on Dentwave.com and e-mail magazines, Dent Research, an online survey for registrants, is also highly evaluated as an effective tool for marketing. It can perform quick and highly accurate surveys, flexibly supports screening for details such as occupation, specialty, age, and area, and is used by many dentistry-related companies.

Moreover, the company creates websites, landing pages, catalogs, etc., for academic societies and companies and supports the planning, attracting customers, and operation of dental conventions and dental events.

<Segments to be reported>

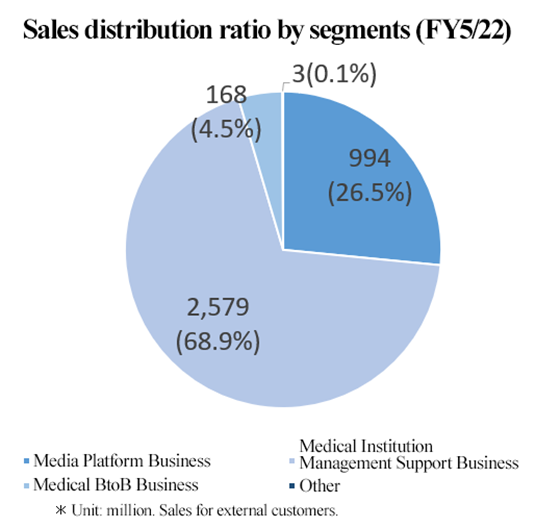

There are three segments for disclosure: Media Platform Business, Medical Institution Management Support Business, and Medical BtoB Business.

(1) Media Platform Business

The company develops and operates websites that provide information specializing in the body, health, and beauty.

It operates a total of 58 websites in dentistry, beauty care/salons, and child-rearing from various perspectives.

(Dental field)

Implant Net | A portal site that specializes in disseminating information on dental implants, which are special self-paid treatments. | ・Implant Net (nationwide version) ・Implant Net (smartphone version) |

Kyousei Shika Net (Orthodontic Net) | A portal site that specializes in disseminating information on orthodontic treatments, which are special self-paid treatments. | ・Kyousei Shika Net (Orthodontic Net) (nationwide version) ・Kyousei Shika Net (Orthodontic Net) (smartphone version) |

Shinbi Shika Net (Esthetic Dentistry Net) | A portal site that specializes in disseminating information on esthetic treatments, which are special self-paid treatments. | ・Shinbi Shika Net (Esthetic Dentistry Net) (nationwide version) ・Shinbi Shika Net (Esthetic dentistry Net) (smartphone version)

|

Other dentistry-related services | Haisha-san Net (Dentist Net) | A portal site that targets a wide range of customers by introducing dental clinics that mainly provide treatments covered by insurance, such as cavity treatments and periodontal disease treatments. |

Ask Dentist | Dental Q&A website where dentists answer questions and consultations about teeth and oral cavities from Internet users. | |

Denty, a dental recruitment website | It is a recruitment website that specializes in the dental industry. Taking advantage of its track record of operating dental portal sites, the company strives to disseminate job information from the perspective of job seekers. |

In addition to the search for dental clinic and introduction of dental clinics and dentists, the main portal sites post content such as treatment explanations and frequently asked questions and their answers as information for patients.

(Beauty Care and Salon Field)

Beauty salon-related websites | Targeting women with a high sense of beauty, the company operates eight websites, including the portal site Beauty Treatments and Popularity Ranking, which provides information on beauty salons. |

Cosmetic surgery-related websites

| Targeting women with a high sense of beauty, it operates three websites, mainly the portal site "Curious! Cosmetic Surgery Overall Ranking," which provides information on cosmetic surgery. |

The main contents are beauty salon searches, introductions, overall popularity rankings, campaign popularity rankings, course popularity rankings, experience reports about impressions of treatments received at beauty salons, etc.

*Business Model

Each portal site is operated with income from advertising fees, targeting dental clinics, beauty salons, and the like as customers.

Internet users can freely search and view information on dental clinics and beauty salons on each portal site.

The specifics of advertising revenue are mainly (1) the initial creation fee and monthly posting fee for the client introduction page and (2) the monthly posting fee for banner advertisements that link to the client's webpage.

The revenue model is a recurring-revenue business since the contract format is, in principle, a 12-month continuous contract (automatic renewal).

(2) Medical Institution Management Support Business

① SEM Business

The company offers SEO (search engine optimization) services to display websites at a higher position in the search engine's search results and management services for listing advertising (search-linked advertising) on portal sites operated by Yahoo Japan Corporation and Google LLC.

(A) SEO

The company provides SEO services for clients, who utilize search engines to attract customers to their websites and disseminate information through their websites, by analyzing the search engine's display ranking criteria (algorithm) and optimizing the website's state, to improve the keyword evaluation for websites by the search engine and display in a higher position in the search engine's search results.

There is a monthly flat-rate service that displays search results of the website at a higher position in Yahoo! JAPAN or Google with multiple keywords and a performance fee service that charges according to the ranking of the website in Yahoo! JAPAN or Google search results using specific keywords.

(B) Listing advertisement (search-linked advertisement)

The company provides listing advertising (search-linked advertising) management services on portal sites operated by Yahoo Japan Corporation and Google LLC.

Listing Ads are advertisements that are displayed in the ad space set on the search results page of search engines, and the advertiser is charged only when an Internet user clicks on the ad.

To realize highly cost-effective advertising operations for clients, the company offers comprehensive services ranging from proposals for keywords and advertisement manuscripts to adjustment of bid prices and budget management on the operational side.

② Website Creation and Maintenance for Enterprises

The company is mainly engaged in website creation and maintenance for clients related to body, health, and beauty (dental clinics, beauty salons, etc.).

The company works on web designs emphasizing cleanliness and luxury so that Internet users can feel at ease about the dental clinics and beauty salons. The company, which specializes in dentistry, beauty care, and beauty salons, also uses its unique medical and beauty care knowledge to create websites that can convey information to Internet users in an easy-to-understand manner, such as posting the views of patients and clients regarding medical and beauty care.

Moreover, the company has started offering a web reception support system equipped with artificial intelligence (AI) functions. This is the first initiative in the dental industry.

③ Distribution Business

The company is engaged in advertisement placement, mainly newspaper inserts and distribution services for other companies' products with a focus on its clients.

④ Overseas Dental Business

The company has started the management of dental clinics in Bangkok, Thailand. The management of dental clinics in Thailand is the first step of the company's efforts toward popularizing advanced Japanese dental care in overseas countries.

In March 2022, the company made NU-DENT Co., Ltd. and D.D.DENT Co., Ltd. into consolidated subsidiaries and started the sale of dental equipment materials and pharmaceuticals in Thailand.

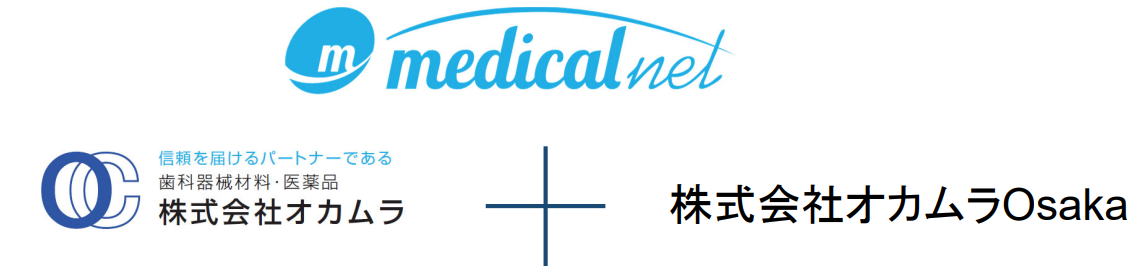

⑤ Dental Dealer Business

The dental dealer business is a dental equipment materials and pharmaceutical sales business operated by Okamura Co., Ltd., which was consolidated in December 2018. In May 2022, the company established Okamura Osaka Co., Ltd. and expanded into western Japan in addition to the Tokyo metropolitan area and plans to scale up further.

⑥ Pharmaceutical Manufacturing and Sale Business

In June 2021, the company made Noechi Pharmaceutical Co., Ltd. a consolidated subsidiary and launched the pharmaceutical manufacturing and sales business.

(3) Medical BtoB Business

The company operates a BtoB website for comprehensive information on dental care, Dentwave.com, that connects dental care professionals and dentistry-related companies.

As of the end of May 2022, the website has registered 40,159 dental professionals, becoming one of the largest websites in Japan.

Through this membership, the company offers services such as advertising solutions, research, and commissioned management of conventions to dentistry-related companies. In February 2020, it merged and absorbed Blanc Networks, which it operates.

In addition, the company has a business alliance with Dental Tribune International, the world's largest dental media outlet. The company operates the Japanese version of Dental Tribune. Dental Tribune has 650,000 dentists in 90 countries around the world as its users, and publishes a magazine.

[1-5 Characteristics and Strengths]

(1) The only company with a platform that connects consumers, dental clinics, and dentistry-related companies

(From the website of the company)

The company has built a platform that connects consumers, dental clinics, and dentistry-related companies, mainly in dental care. No other companies have created such a platform, which is a significant feature of the company.

Through this strong and unique platform, the company provides numerous services for consumers, dental clinics, and dentistry-related companies, and this is a substantial competitive advantage.

The company believes that it is highly challenging for new companies to enter the market, given the solid positioning it has built over the roughly 20 years since its founding.

◎ For consumers: to provide highly reliable, fair, and neutral information through its media outlets

The company, which has built and operated many media outlets while directly communicating with dentists and other specialists, has a wealth of specialized knowledge in dental care.

Therefore, it can provide consumers with highly reliable and easy-to-understand information. The quality of this information is high to the extent that doctors sometimes use the content of the websites operated by the company when explaining to patients.

Regarding content with more specialized themes, the company asks dentists to write it based on a relationship of trust it has built up with them over many years.

Regarding themes with various opinions, the company asks multiple dentists to express their views and also mention the disadvantages of treatment methods, providing consumers with fair and neutral information.

Most of the company's sales come from services for dentists, and under its vision and philosophy, it always provides dentists with advice that emphasizes the perspective of consumers and users, which has led to further improvement in the company's reliability.

◎ For dentists: Comprehensive web services × various offline services × consulting services

The company, which has built various in-house media platforms and websites for businesses, offers comprehensive services from website construction to planning and implementation of SEM measures. The company also proposes omnidirectional services even in offline areas, such as recruitment, insurance, specialized equipment, and office supplies.

In addition, the company offers a wide range of management support consulting services for dental clinics by understanding the dentist’s specialized field and issues, then identifying and analyzing the business conditions and proposing personnel, equipment, and business plans that combine effectively sending and attracting customers using the Internet and offline business.

◎ For dentistry-related companies: approaches to becoming excellent dental clinics and conducting market research

As mentioned above, the company operates Dentwave.com, a website for dental professionals with the highest number of members.

Many members are in good financial condition and are willing to expand their business. Manufacturers and suppliers such as medical device manufacturers and wholesalers can advertise and propose products and services to these excellent customers.

(2) Stable earnings structure through the subscription model business

Ad placements in the portal site operation business are, in principle, 12-month continuous contracts (automatic renewal). Therefore, the revenue model is a recurring-revenue business, which brings stability to the company's revenue base.

The company intends to develop new customers and further strengthen its business foundation.

Medical Net's earnings model

(From the reference material of the company)

(3) Overwhelming number of members

The number of members of the Medical Net Group, which consists of members engaged in dental care, reached 46,645 at the end of the fiscal year ended May 2022, an increase of 5.9 times since the listing.

These members are customers of the business targeting dental clinics and also support the company's business base as they are essential assets in the business targeting dentistry-related companies.

The company estimates that there are about 100,000 dentists in Japan and aims to increase membership to 80,000, or 80% of the total.

(Created by Investment Bridge based on the company's data)

【1-6 ROE Analysis】

| FY 5/16 | FY 5/17 | FY 5/18 | FY 5/19 | FY 5/20 | FY 5/21 | FY 5/22 |

ROE (%) | 14.0 | 5.6 | 5.8 | 6.4 | 6.0 | 11.6 | 26.1 |

Net income margin (%) | 14.51 | 6.47 | 5.88 | 5.20 | 3.09 | 4.46 | 10.27 |

Total asset turnover (times) | 0.75 | 0.74 | 0.82 | 1.00 | 1.36 | 1.51 | 1.42 |

Leverage (x) | 1.29 | 1.18 | 1.20 | 1.24 | 1.44 | 1.72 | 1.78 |

*From FY 5/22, the company has applied the “Accounting Standard for Revenue Recognition,” etc. The values of net income margin and total asset turnover from FY 5/16 are the ones obtained after retroactively applying said accounting standards, etc.

In FY 5/21, ROE considerably exceeded 8%, thanks to the evident improvements in total asset turnover and leverage, as it is generally said that Japanese enterprises should aim to achieve an ROE of 8%.

ROE rose further in FY 5/22, thanks to the significant rise in net income margin.

2. Fiscal Year Ended May 2022 Earnings Results

(1) Business Results

| FY 5/21 | Ratio to Sales | FY 5/22 | Ratio to Sales | YoY | Company Forecast | Ratio to Forecast |

Net Sales | 2,904 | 100.0% | 3,745 | 100.0% | +29.0% | 3,547 | +5.6% |

Gross Profit | 1,178 | 40.6% | 1,460 | 39.0% | +23.9% | - | - |

SG&A | 846 | 29.2% | 1,010 | 27.0% | +19.3% | - | - |

Operating Income | 331 | 11.4% | 449 | 12.0% | +35.8% | 420 | +7.1% |

Ordinary Income | 336 | 11.6% | 454 | 12.1% | +35.1% | 419 | +8.4% |

Net Income | 129 | 4.5% | 384 | 10.3% | +196.8% | 356 | +8.1% |

*Unit: million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

*From FY 5/22, the company has applied the “Accounting Standard for Revenue Recognition,” etc. Said standard has been retrospectively applied also to the results in FY 5/21.

Significant increases in sales and profit

Sales grew to 3,745 million yen, up 29.0% year on year. The three core businesses – the media platform business, the medical institution management support business and the medical BtoB business – showed a double-digit sales growth.

As the global impact of COVID-19 has calmed down, the advertising market has considerably recovered and the total advertisement expenses in Japan significantly exceeded those in the previous year. Moreover, Internet advertisement expenses are favorable, continuing to maintain a high growth rate, amid the background of the rapid digitalization of the society. The sales of the Internet-based service industry, to which the company belongs, also remain at a level exceeding that in the previous year. On the other hand, the dental market continues to face an unfavorable situation caused by little growth in the medical expenses for dental care and the expansion of excessive competition among dental clinics. However, demand for self-paid care such as implants and orthodontic treatment has increased due to a rise in awareness regarding oral hygiene brought about by COVID-19, and medical expenses for dental care show a recovering trend.

Amid such situation, the company engaged in expanding smartphone advertisements and building new services to pursue the improvement of client satisfaction alongside forging ahead with streamlining the media platform business. Regarding the medical institution management support business, the company endeavored to expand the business, turning Noechi Pharmaceutical Co, Ltd. into a consolidated subsidiary in June 2021 and newly establishing Okamura Osaka by the subsidiary Okamura in May 2022. Furthermore, they have expanded the business range overseas, turning the second clinic Pacific Dental Care Co., Ltd. into a consolidated subsidiary (second-tier subsidiary) in October 2020 and turning the third clinic Fukumori Dental Care Co., Ltd. into a consolidated subsidiary (second-tier subsidiary) in March 2022 in Thailand as well as turning NU-DENT Co., Ltd. and D.D.DENT Co., Ltd., which engage in dental goods trading business in Bangkok, into consolidated subsidiaries (second-tier subsidiaries). Regarding the medical BtoB business, the business has expanded owing to the manifestation of the effects of reorganization stemming from the absorption-type merger with Blanc Net Co., Ltd. in February 2020.

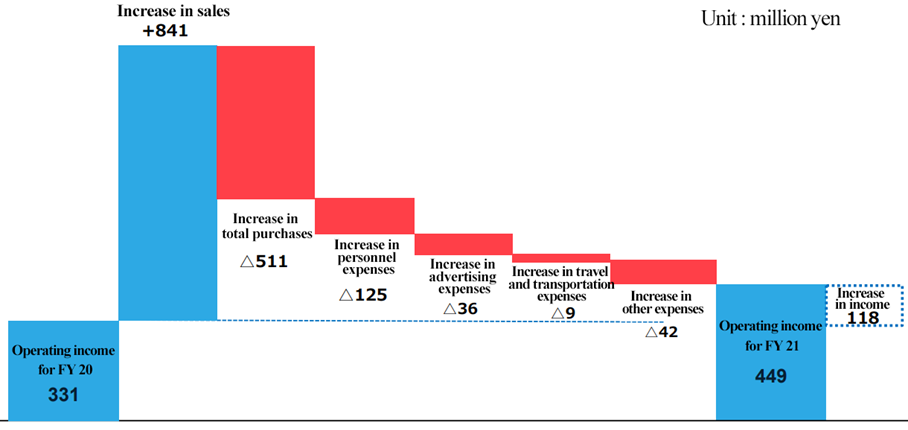

Operating income increased to 449 million yen, up 35.8% year on year. While gross profit margin dropped from 40.6% in the previous term to 39.0%, the ratio of SG&A expenses to sales was reduced from 29.2% in the previous term to 27.0% and operating income margin improved from 11.4% in the previous term to 12.0%.

The major causes for fluctuations in operating income are as follows.

*FY 20 is FY 5/21, FY 21 is FY 5/22

(Taken from the reference material of the company)

Foreign exchange gain increased in non-operating income, expenses related to transfer-restricted shares were recorded in non-operating expenses, ordinary income grew to 454 million yen, up 35.1% year on year, a gain on negative goodwill of 84 million yen was recorded in extraordinary profit, the loss on valuation of investment securities of 81 million yen recorded in extraordinary loss in the previous term is no longer posted, and net income increased to 384 million yen, up 196.8% year on year.

In addition, sales and sales cost in FY 5/22 decreased 611 million yen due to the application of the Accounting Standard for Revenue Recognition (Corporate Accounting Standard No. 29, March 31, 2020), etc. There is no impact on any kind of profit.

Sales and all kinds of profits hit a record high, exceeding the company’s forecast.

The company paid a term-end dividend of 4.00 yen per 1 share.

(2) Trend in each segment

| FY 5/21 | Ratio to Sales | FY 5/22 | Ratio to Sales | YoY |

Media platform business | 891 | 30.7% | 994 | 26.5% | +11.6% |

Medical institution management support business | 1,876 | 64.6% | 2,579 | 68.9% | +37.5% |

Medical BtoB business | 134 | 4.6% | 168 | 4.5% | +25.8% |

Other | 3 | 0.1% | 3 | 0.1% | -2.0% |

Adjustment | -1 | - | -0.9 | - | - |

Total sales | 2,904 | 100.0% | 3,745 | 100.0% | +29.0% |

Media platform business | 589 | 66.2% | 616 | 62.0% | +4.5% |

Medical institution management support business | 82 | 4.4% | 207 | 8.1% | +151.5% |

Medical BtoB business | 58 | 43.8% | 58 | 34.6% | -0.8% |

Other | 3 | 100% | 3 | 100% | -2.0% |

Adjustments | -403 | - | -436 | - | - |

Total operating income | 331 | 11.4% | 449 | 12.0% | +35.8% |

*Unit: million yen.

*Ratio of operating income to sales is operating income margin. “Other” indicates business of undertaking administrative tasks, a business segment not included in reported segments.

◎Media platform business

Sales stood at 994 million yen, up 11.6% year on year, and operating income was 616 million yen, up 4.5% year on year.

While advertisement expenses on the Internet advertisement market are in an expansionary phase, the dental field continued to face an unfavorable situation caused by the sluggish growth of the medical expenses for dental care and the expansion of excessive competition among dental clinics. However, a rise in the number of patients in the voluntary care field was observed due to a growth in demand for effects that good oral environment has on decreasing the infection risk, stemming from the COVID-19 pandemic. Amid such situation, steps have been taken to address the impact of changes in the Google algorithm (the process of determining the most appropriate page for the search keyword) and demand for voluntary treatment grew, leading to a rise in the motivation of dental clinics to post advertisements. Consequently, major websites performed well, with sales of “Orthodontics Net” increasing 13.8% year on year and sales of “Implant Net” growing 23.7% year on year.

Regarding the beauty care and salon field, the total scale of the beauty salon market declined to 327 billion yen in 2021 (down 2.4% year on year). Despite continuous declarations of the emergency state and applications of priority measures to prevent the spread mainly in metropolitan areas such as Tokyo in 2021, the second year of the COVID-19 pandemic, salons did not stop their operation and the awareness of living with COVID-19 has spread, and as a path to the subsiding of the pandemic can be seen now, the situation is changing from fiscal 2020. Amid such circumstances, the company aimed for the monetization of portal sites such as “I want to know! Cosmetic Surgery General Ranking,” a site specialized in cosmetic surgery, and “Beauty Salon Top List,” a site specialized in beauty salons. Furthermore, the company continued to expand smartphone advertisements and developed a system for offering new services alongside working toward elevating the recognition of each portal site. Moreover, the company made endeavors to expand the business, acquiring the Let’s BEAUTY business operated by Let’s ENJOY TOKYO, Inc. through simplified absorption-type merger in June 2021. However, the situation regarding the posting of advertisements on portal sites in the cosmetics and beauty field remains unfavorable. Amid such circumstances, sales of “I want to know! Cosmetic Surgery General Ranking” grew 1.7% year on year and sales of “Beauty Salon Top List” declined 4.5% year on year, facing hardship. Moreover, regarding the health care general site “for health care,” the company launched an e-commerce site and aimed for the monetization of the portal site alongside expanding the variety of content with the objective of realizing a healthy society starting with the mouth.

◎Medical institution management support business

Sales grew to 2,579 million yen, up 37.5% year on year, and operating income increased to 207 million yen, up 151.5% year on year.

(SEM services)

Internet advertisement media expenses were favorable in 2021 as well and among them, the scale of the programmatic advertising market achieved a rapid growth, centered on major platform providers. Amid such situation, sales grew due to the increase in the number of listing advertisement operation service clients and diversification of provided services, impacted by the expansion of the market scale, stemming from the shift to programmatic advertising.(SEO services)

As it is difficult to seek performance results for multiple keywords in a short period of time due to a change in the system, there is a rise in clients who seek search-linked advertising as a method to substitute SEO services. Amid such situation, sales grew as the company devised a way to deal with the algorithm used in search engines such as Google, recovered the order in which the client’s site appears when searching, launched new services, etc.

(Website creation and maintenance services for companies)

The orders for website creation and maintenance for companies, which are part of one-stop solution services, were favorable, leading to sales growth.

(Service of supporting dental clinics in opening and management)

Marketing activities in the sale of dental medicine devices and materials as well as the service of supporting dental clinics in management were impacted by COVID-19. However, thanks to the expansion of service options for support in management, establishment of a specialized portal site “Medisapo,” etc. the recognition of the service improved, leading to an increase in sales.

(Operation of dental clinics)

While the company was impacted by the COVID-19 pandemic, they continued proactive marketing activities targeting Japanese companies in Bangkok to bring them to undergo health examinations. Furthermore, they endeavored to raise the number of patients by actively approaching the Japanese community in Bangkok. They turned Pacific Dental Care Co., Ltd. into a consolidated subsidiary in the second quarter of the previous term, operating the second dental clinic in Bangkok, Thailand, which contributed throughout the term, leading to sales growth. Moreover, the company turned Fukumori Dental Clinic Co., Ltd. into a consolidated subsidiary (sub-subsidiary) in March 2022, operating the third dental clinic in Bangkok, Thailand.

(Wholesale of materials for dental instruments and pharmaceutical products)

Sales of the subsidiary Okamura increased due to the expansion of sales channels and proactive marketing activities. Furthermore, the company turned Noechi Pharmaceutical Co, Ltd. into a consolidated subsidiary in the first quarter, manufacturing and selling pharmaceuticals and quasi-drugs, which contributed to the expansion of the business. In addition, the consolidated subsidiary Okamura newly established Okamura Osaka in May 2022. They shall develop the product appeal and marketing capability fostered in Tokyo in the Kansai region and aim for business development throughout Japan.

◎Medical BtoB business

Sales grew to 168 million yen, up 25.8% year on year, and operating income was 58 million yen (down 0.8% year on year).

Following an absorption-type merger with Blanc Net Co., Ltd. in February 2020, the company performed favorably as a result of working toward the expansion of business achievements through streamlining work based on effective utilization of management resources and flexible placement of human resources, as well as acquiring new clients, receiving large-scale orders, etc. They formed a business alliance with 1D Inc., which operates “ID,” the largest dental medicine media in Japan, whose strong point is a network with young dentists and dental hygienists. Strengthening the cooperation with “Dentwave.com,” the company has reinforced digital provision of information to dental medicine professionals as well as digital marketing of dental medicine-related companies. As offline dental shows and exhibitions have been cancelled and postponed in recent years due to the COVID-19 pandemic, dental medicine professionals have been highly interested in gathering and providing information. While they used to have no choice but to rely on digital media, a transition to a new era where they select and utilize digital media from their own will has begun. Based on this, the company endeavored to develop new services in order to acquire dental medicine professional members, by holding the Online Dental Show twice (DDS2021 and DDS2022), etc.

(3) Financial Condition and Cash Flows

◎Main BS

| End of May 2021 | End of May 2022 |

| End of May 2021 | End of May 2022 |

Current assets | 1,505 | 2,077 | Current liabilities | 722 | 1,300 |

Cash and deposits | 868 | 1,133 | Trade payable | 111 | 259 |

Trade receivable | 465 | 664 | Non-current liabilities | 124 | 116 |

Non-current assets | 602 | 1,076 | Long term interest-bearing liabilities | 124 | 111 |

Property, plant and equipment | 39 | 106 | Total liabilities | 846 | 1,416 |

Intangible assets | 204 | 477 | Net assets | 1,260 | 1,737 |

Investments and other assets | 358 | 492 | Retained earnings | 1,283 | 1,634 |

Total assets | 2,107 | 3,154 | Total liabilities and net assets | 2,107 | 3,154 |

*Unit: million yen.

Total assets stood at 3,154 million yen, up 1,047 million yen from the end of the previous term. This is mainly due to the increase of 265 million yen in cash and deposits, 193 million yen in accounts receivable (part of trades receivable), 99 million yen in products, 273 million yen in goodwill, 42 million yen in investment securities and 56 million yen in long-term prepaid expenses.

Total liabilities stood at 1,416 million yen, up 569 million yen from the end of the previous term. This is mainly due to accounts payable (trades payable) increasing by 148 million yen and short-term loans increasing by 390 million yen.

Total net assets grew 477 million yen from the end of the previous term to 1,737 million yen. This was caused mainly by the growth of 53 million yen in capital surplus and decrease of 51 million yen in treasury stock in addition to recording profit attributable to owners of the parent of 384 million yen and paying dividends of 34 million yen from the surplus.

Equity ratio was 54.1% (59.0% at the end of the previous term).

◎Cash Flow

| FY 5/21 | FY 5/22 | Increase/decrease | YoY |

Operating Cash Flow | 391 | 342 | -49 | -12.6% |

Investing Cash Flow | -87 | -355 | -267 | - |

Free Cash Flow | 303 | -12 | -316 | - |

Financing Cash Flow | -34 | 282 | 316 | - |

Balance of Cash and Equivalents at Year-end | 868 | 1,128 | 260 | +29.9% |

*Unit: million yen.

Cash and cash equivalents at the end of FY 5/22 stood at 1,128 million yen, up 260 million yen from the end of the previous term.

There was an income of 342 million yen in operating cash flow. This was caused by increase in payables, recording net income before taxes, etc. despite the growth of trades receivable and payment of income taxes, etc.

There was an expenditure of 355 million yen in investing cash flow. This was caused by purchase of investment securities, purchase of shares of subsidiaries resulting in change in scope of consolidation, etc. despite proceeds from withdrawal of time deposits.

There was an income of 282 million yen in financing cash flow. This was caused by net increase in short-term loans, etc. despite the repayments of long-term loans payable.

(4) Topics

◎ Impact of COVID-19

From a long-term perspective, the impact on shareholder value is positive.

When the state of emergency was declared in April 2020, the number of patients for dental clinics declined, especially in the area of insured care, and the outlook was uncertain, leading to a decrease in advertising by dental clinics. However, the impact on the company was limited. After the state of emergency was lifted, the number of patients increased, especially in the field of free dental practice, and the impact of the COVID-19 crisis was not seen, and conversely, dentists were more willing to advertise. Although the company had expected the impact of COVID-19 to be negative in the short term, sales of advertising services in the media platform business increased, and sales in the medical institution management support and medical BtoB businesses also exceeded the previous year's levels, and sales, operating income, and ordinary income continued to reach record highs in FY 5/22, like in FY 5/21.

One positive impact is increased demand for a good oral environment to reduce the risk of infectious diseases. Cleanliness of the mouth and reduction in the number of bacteria will help prevent aspiration pneumonia and viral diseases. In addition, expanding sales of various preventive devices to prevent nosocomial infection of viruses will also be a long-term positive factor. As an example, in March 2020, the company collaborated with an outside company to sell "Marugoto Antimicrobial Coating" for dental clinics. Based on the above, from a long-term perspective through May 2025, the company sees the impact of the COVID-19 crisis on shareholder value as positive.

◎Capital and Business Alliance with Write Up Co.

(Taken from the reference material of the company)

Details of the capital alliance

Write Up plans to acquire either up to 107,800 shares of Medical Net's common stock (ratio to the total number of shares issued: 1.00%) or in the number of shares or in the amount of 51 million yen, through a market purchase within 6 months from July 15, 2022.

Details of the Business Alliance

Write Up provides various DX services under the vision of “enabling all small and medium-sized enterprises nationwide to earn profit." Through this business alliance with Write Up, the two companies will work together to implement the following measures.

1.Provide "JSaaS," a support system for utilizing subsidies and grants provided by Write Up, to approximately 40,000 members of the dental care platform business operated by the company.

2.Jointly hold webinars for Medical Net members on the utilization of subsidies and grants and DX promotion for business operations and provide extensive support for their business management.

3.Propose the use of Dentwave to Write Up customers.

◎Established Okamura Osaka Co., Ltd. and entered the dental equipment and pharmaceutical sales business in the Kansai region.

(Taken from the reference material of the company)

The consolidated subsidiary Okamura Co., Ltd. established Okamura Osaka Co., Ltd. on May 18, 2022. Through this establishment, Okamura will leverage the product competitiveness and sales capability it has cultivated in Tokyo, in the Kansai region. The company expects to generate sales of about 400 million yen in the first year by utilizing the Medical Net Group's customer network in the Kansai region and by expanding sales channels for PB products, which is one of the Okamura's strengths.

In the future, the company aims to expand its business nationwide.

◎The partnership with FP Design, a provider of financial consulting for osteopathic clinics, insurance and financial services, begins

(From the reference material of the company)

The company formed a business alliance with FP Design, a group company of Rigua (7090), which is listed on the Growth Market of TSE and provides operation and management support services for orthopedic clinics, and began providing financial consulting for dental clinics and asset planning services for individual dentists on June 28, 2022.

Through this alliance, the company will provide a wide range of support for the transition from a "family business," which depends on employers (dentists), to a "business" in the dental industry, thereby resolving issues in the dental industry. The company and FP Design will exchange know-how to provide more effective and efficient services to dental clinics (dentists), enabling one-stop management support for dental clinics and life planning support for individual dentists from opening and operation to retirement, thereby building the dental care platform business that the company aims for. The company plans to provide management support services and educational programs for dental clinics and financial services for asset building for individual dental clinic managers by leveraging the knowledge, assets, and recognition of the management support services of both parties. With the goal of "leading the family-centered dental industry into business and providing problem-solving consulting services in the dental industry," the company will continue to create an environment in which dentists can focus on dental care by expanding its menu of management support services for dental clinics and promoting support for dental clinic managers.

◎The company starts alliance with Synchro Food, the operator of store design.com

(From the reference material of the company)

The company formed a business alliance with Synchro Food (3963), which is listed on the Prime Market of TSE and operates websites for all phases of a restaurant's lifecycle and provides a platform for comprehensive services to support the restaurant business, on May 17, 2022, and began providing interior design and construction support services for opening or renovating a dental clinic.

The company's "Medisupport," a website dedicated to its opening and management support services, will be linked with "Store Design.COM" operated by Synchro Food, and the company will introduce interior design companies listed on "Store Design.COM" to medical practitioners who are in need of opening or renovating their shops. Store Design.COM is a service that introduces store design and construction companies to people who are considering opening or renovating new facilities (restaurants, commercial facilities, beauty salons, apparel stores, hotels, etc.). In addition to searching by service area and business category, it is also possible to search by design image. This not only increases the number of interior design options, but also provides comprehensive support for the interior design and construction of properties, thereby not only reducing initial costs at the time of opening, but also providing speedy opening support.

◎The company acquires all shares of NU-DENT and D.D.DENT and make them consolidated subsidiaries, and launches general dental goods trading business in Thailand

(Taken from the reference material of the company)

In addition to the dental clinic management business, on March 31, 2022, the company acquired all outstanding shares of NU-DENT and D.D.DENT, which are engaged in the general dental goods trading company business in Thailand, and made them consolidated subsidiaries (second-tier subsidiaries) in order to promote the establishment of a dental platform in Thailand. The company aims to become the No. 1 dental goods trading company in Thailand by advancing the concept of DX promotion in the dental goods trading business owned by NU-DENT and D.D.DENT.

◎Fukumori Dental Clinic, the third clinic in Bangkok, Thailand, has become a consolidated subsidiary (second-tier subsidiary), expanding the dental clinic management business.

In September 2017, the subsidiary Medical Net Thailand Co., Ltd. began operating dental clinics in Bangkok, Thailand. Following Pacific Dental Care Co., Ltd. acquired in October 2020, the company made its third clinic, Fukumori Dental Clinic Co., Ltd., a consolidated subsidiary (second-tier subsidiary) in March 2022, expanding its business in Thailand. The company will continue to aim for the spread of advanced Japanese dental care in overseas countries. In addition to expanding new markets through commercialization, the company aims to bring smiles to the faces of people around the world through the healthy development of the dental care environment.

(Taken from the reference material of the company)

◎Launched E-commerce on the "for health care" platform

The comprehensive healthcare website "for health care" (https://forhealthcare.jp/) was revamped and e-commerce was launched in August 2021.

Until now, the focus has been on dental treatment media, but in the future, the site will be linked to the development and strengthening of preventive medicine to realize a healthy society from around the oral cavity. Furthermore, by utilizing data such as patients' PHR (Personal Health Record*), the company aims to create a "health, medical, dental, and cosmetic" platform that will contribute to the detection of hidden "unwellness," thereby contributing to the promotion of healthy life expectancy for all people.

*Personal Health Record refers to the collection and centralized storage of data related to a patient's medical care, nursing care, and health.

Major contents of "for health care"

・Mouth problems: Provides solutions for those who have mouth problems such as tooth decay, mouth ulcers, sensory sensitivity, gingivitis, dry mouth, and bad breath.

・Oral Health: Provides information on toothpaste, dental products, gum disease, diabetes, myocardial infarction, malignant tumors, etc. to help prevent diseases and promote health through oral care.

・Oral beauty: Information on oral care, beauty care and salons, including teeth alignment, whitening, oral massage, oral spa, cosmetic treatment, and skincare.

(Part of the "for health care" home page)

◎ The Company Launches "Medisupport," a Website to Solve Issues for Dental Clinics and Dentists

MEDISupport, a website that provides solutions to a wide range of issues, from the opening and management of dental clinics and business succession to private issues such as inheritance and post-retirement life planning for individual dentists, has been established.

"Medisupport" website |

Overview of the website "MEDISupport"

■ Management support: General management support ranging from clerical services for personnel and labor affairs, general affairs, and accounting to strategy development and management.

■ Opening support: One-stop support from property selection to attracting patients after opening, allowing for preparation for opening a clinic while concentrating on medical practice.

■ Real estate support: Provides support from rental properties for opening dental clinics, business succession and other dental clinic projects, to individual real estate sales and purchases, including inheritance.

■Support for individual concerns: Offers life planning for inter vivos gifts and retirement.

◎"Dentwave.com," a Comprehensive Information Site for Dental Professionals, Begins Business Alliance with "1D"

In November 2021, the company formed a business alliance with 1D Corporation, which operates "1D" (https://oned.jp/), one of the largest media for dental professionals in Japan, to strengthen the linkage between Medical Net's "Dentwave.com" (https://www.dentwave.com/) and "1D." By forming an alliance with "1D," one of the largest dental media in Japan, which has particular strength in networking with young dentists and dental hygienists, the company will strengthen the transmission of information for dental professionals through digital media and digital marketing support for dentistry-related companies.

Details of the Business Alliance

Alliance in the dissemination of news, columns, and other information, and the organization of webinars, online events, etc. | Alliance in sale of marketing support services for dentistry-related companies |

|

|

(Taken from the reference material of the company)

Capital and business alliance with Change the World Inc. and underwriting of third-party allotment of new shares

(Taken from the reference material of the company)

Amid the growing need to realize a sustainable society, CHANGE THE WORLD Inc. is developing the "CHANGE for Biz" business (support for companies in switching to 100% renewable energy) and the "CHANGE" business (solar power plants you can buy with your smartphone). Aiming to promote renewable energy and increase Japan's energy self-sufficiency through clean power and realize "self-carbon offsetting," whereby people can reduce their own CO2 emissions, the company has been operating a web service called "CHANGE, a purchase of solar power plants by smartphone " which allows anyone to easily purchase solar power plants by smartphone from 1 watt (approx... 250 yen) in installments from July 2017.

Through this capital and business alliance, the company will cooperate with CHANGE THE WORLD to support and encourage the realization of carbon neutrality in the dental industry and promote carbon neutrality. Furthermore, the company aims to contribute to society by promoting this initiative in the medical and healthcare fields and "increasing smiles" across the globe.

The company acquires all shares of Noechi-Yakuhin Co., Ltd. and makes it a consolidated subsidiary to begin the manufacturing and sale of pharmaceuticals and quasi-drugs.

|

(Taken from the reference material of the company)

The company will be able to develop and manufacture OTC drugs for the dental market, and will also start the development and manufacturing of OTC drugs for the general public, not limited to the dental market, in order to achieve whole body health starting from the oral health area, thereby expanding its business field. In addition, by leveraging synergies with existing businesses, the company will provide private brand products at reasonable prices to its client dental clinics, and will also utilize requests from clients in new product development. Furthermore, the company will enter the B-to-C field by starting sale of over-the-counter (OTC) drugs to general consumers.

◎The company starts providing a hybrid office work service for dental clinics

(Taken from the reference material of the company)

In collaboration with SABU Corporation, a provider of fully online clerical services specializing in dental clinics, the company began offering a hybrid type of clerical service for dental clinics in February 2021.

Hybrid office work service

The challenge in the management of dental institutions, where more than 80% of dentists are general practitioners, is that the dentists themselves are often managers, and they are responsible for many back-office operations, human resources management, and general management tasks while providing medical services. This was a major burden for dentists.

Through the collaboration between the company and SABU, they will provide a hybrid office work service that is more efficient and can even handle the COVID-19 pandemic, thereby contributing to solving a major problem in the management of dental clinics nationwide.

This collaboration will enable one-stop management support for dental clinics by providing a wide range of online and offline services, from post-opening dental clinic management support to dental clinic promotion and patient attraction.

◎The company starts providing the industry's first dental online medical service for dentists utilizing an intraoral camera

(Taken from the reference material of the company)

The company offers Dental Online, the industry's first online consultation service using an intraoral camera for dentistry, which was jointly developed with iRidge (3917), which supports O2O (Online to Offline)/ (Online Merges with Offline) for companies using smartphones.

Online consultation service using an intraoral camera

This is the industry's first service that allows patients to be examined while checking their oral conditions in real time using a dental intraoral camera provided to the patient in advance by the dental clinic and video chat via smartphones. During the online consultation with the doctor, the patient can operate the intraoral camera himself/herself and send a video of the condition of the affected area, which is expected to provide a more appropriate diagnosis than a consultation based only on a medical interview. Patients will be able to easily select a dentist that suits their needs before seeing a doctor, and will be able to choose a good dentist regardless of their area of residence, since the burden of visiting a dentist will be reduced. Through "Dental Online," the company will strive to improve convenience for both dentists and patients by matching dentists who are actively engaged in DX and advanced treatment with patients who want to choose a good dentist.

◎Patented “New Halitosis Sensor System in Dental Clinics” through joint research with Okayama University

Halitosis Sensor System This halitosis sensor system is designed to provide comprehensive support from "examination to diagnosis and treatment." The sensor tip is brought close to each tooth and the odor level is measured. Currently, Okayama University is conducting research and development with a view to predicting future diseases by detecting the state of oral hygiene, the level of periodontal disease, and graphically displaying the results based on diagnostic criteria. The company is also considering the possibility of integrating blood tests through joint research with Mirtel Corporation, with whom it has a capital alliance to combine "testing for pre-symptomatic diseases" and "early detection of diseases" to trigger lifestyle improvements, thereby discovering new diseases and realizing individualized medical approaches for individuals prone to halitosis. This halitosis sensor system was presented at the 11th Japan Halitosis Society Meeting held in June 2020 as "Research on Optimization of Intraoral Local Odor Collection Methods." |

(Taken from the reference material of the company) |

3. Fiscal Year Ending May 2023 Earnings Forecasts

(1) Full-year Earnings Forecasts

| FY 5/22 | Ratio to Sales | FY 5/23 (Est.) | Ratio to Sales | YoY |

Net Sales | 3,745 | 100.0% | 4,500 | 100.0% | +20.1% |

Operating Income | 449 | 12.0% | 320 | 7.1% | -28.9% |

Ordinary Income | 454 | 12.1% | 321 | 7.1% | -29.2% |

Net Income | 384 | 10.3% | 190 | 4.2% | -50.7% |

*Unit: million yen.

*Estimates are those of the company.

For FY 5/23, it is forecasted that sales will grow 20.1% and operating income decline 28.9%.

For the term ending May 2023, it is projected that sales will grow 20.1% year on year to 4.5 billion yen, operating income will drop 28.9% year on year to 320 million yen, ordinary income will decline 29.2% year on year to 321 million yen, and net income will decrease 50.7% year on year to 190 million yen.

In the media/platform business, which is the mainstay, the company will continuously make its website compatible with new terminals, including smartphones and tablet PCs, to vitalize the website, and keep improving its services while increasing the usability of the portal site and the customer satisfaction level. In addition, the company will strive to create new services and expand revenues. In the medical institution management support business, the company will strive to expand the share of its SEM services in the programmatic ad market in the medical field, by utilizing the experience accumulated based on its original ad operation standards for complying with the guidelines for medical ads, and improve its revenue model by offering new services as its basic policy. For the services of producing and maintaining websites, the company will keep creating high-quality websites and aim to attract new clients.

Regarding the operation of dental clinics in Bangkok, Thailand, the company aims to further expand the business of operating dental clinics in Thailand, in cooperation with Fukumori Dental Clinic Co., Ltd., which is the third consolidated subsidiary. In addition, the company will strive to expand the dental goods trading business of NU-DENT and D. D. DENT, which were acquired as (second-tier) consolidated subsidiaries in Bangkok, Thailand in March 2022, and expand the overseas business expansion.

Regarding the sale of dental apparatus materials and pharmaceutical products, the company aims to expand the scale of the wholesale of dental apparatus materials and pharmaceutical products in cooperation with Okamura, Noechi Pharmaceutical, and Okamura Osaka. In Noechi Pharmaceutical’s business of planning, producing, and selling pharmaceutical products, they will develop and sell new products. When it becomes possible to conduct the dental goods trading business in Japan and Thailand, they become able to sell Japanese dental equipment in Thailand and vice versa. The company is expected to increase revenues, by expanding the sales channels of private-brand products of consolidated subsidiaries by utilizing synergetic effects inside the corporate group.

In the medical BtoB business, the company will make continuous efforts to increase its earning capacity in services of research, operation of conventions, and providing ad solutions by utilizing the membership base of medical professionals and others, which is the base for steady growth. In addition, the company will implement new measures, including the holding of digital online shows, in order to attract more dental professionals.

In the services of supporting the opening and management of dental clinics, the company will enrich the lineup of management support services and keep improving the earning capacity.

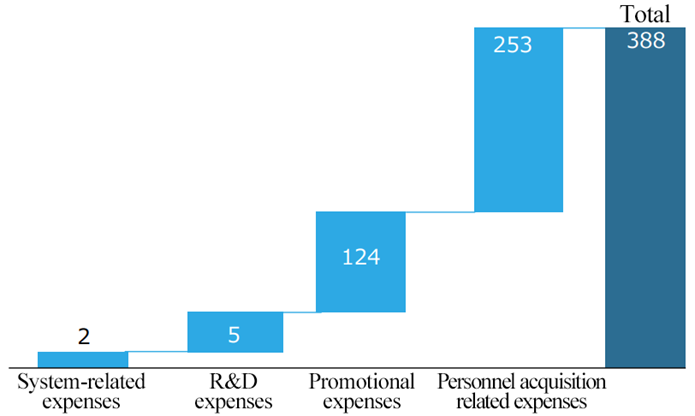

Furthermore, the company will actively invest in the employment of excellent personnel, in order to strengthen the organizational structure for expanding business contents and domains. SGA is projected to augment, due to the upfront investment policy for new businesses.

The company will continue active investment for growth.

Human investment | ・Personnel cost is projected to augment 41.8% year on year. ・Recruitment of 27 mid-career workers ・Enhancement of recruitment of professionals ・The company plans to employ 12 new graduates in Apr. 2023. |

Business investment | ・New business ・V-shaped recovery and further expansion of the medical BtoB business ・Overseas expansion of the dental business ・Expansion of the dental dealer business ・Synergy in the business of selling pharmaceutical and quasi-pharmaceutical products ・Collaborative research with colleges |

Future investment for growth [million yen]

(Taken from the reference material of the company)

(2) Initiatives in each business

Business | Initiatives |

Media platform Dentistry and beauty care | ・To strengthen human resources ・To improve and enrich services, and enhance the promotion of services with sales staff ・To improve specialized contents ・To help enhance general health by treating the mouth |

Medical institution management support business | ・Cultivation of new channels and establishment of a revenue model ・Comprehensive support, including the support for the opening and management of dental clinics via multiple channels and the life support for individual dentists ・To find projects for supporting the opening and management of clinics through seminars, colleges, and study groups ・To expand the dental dealer business ・Sale of pharmaceutical and quasi-pharmaceutical products ・Expansion of the dental business in Thailand |

Medical B to B | ・To enhance measures for increasing members ・Development of new services, and enhancement of sale ・Holding of digital and real dental shows |

Business development and management plans | ・New business ・Continuity of collaborative research with Okayama University |

(3) Assumptions for the plans

Sales are expected to grow in each business.

Business | Sales condition |

Media platform | In the dental field, the number of orders received is expected to be healthy like in the previous year. In the beauty field, the company will launch new business and aim to grow. |

Medical institution management support business | To strengthen the system, launch new business, release new products, and brush up the earning capacity of existing businesses, revenues are projected to expand. Synergy will emerge between the pharmaceutical products sale business and the dental dealer business, and both businesses are expected to grow. In Thailand, the company aims to increase revenues by starting the dental dealer business in addition to the business of supporting dental clinics in management. |

Medical B to B | The company will make efforts to increase sales by enriching the services of Dentwave.com and releasing new services. |

Cost of goods purchased and personnel expenses are projected to augment.

Expenses | Outlook |

Cost of sales (procurement amount)

| The amount of goods purchased will increase, due to the sales growth of the dental dealer business and the start of the pharmaceutical goods sale business. The company will make efforts to diversify its services, by enriching its existing websites and developing new websites, and labor costs are forecasted to augment through business expansion. |

SGA (personnel expenses) | Costs for human resources and new services are projected to augment, as the company will fortify its organizational structure. |

4. Conclusions

The term ended May 2022 can be called “the year for making a leap forward,” in which sales and profit increased considerably for the second consecutive year, thanks to the alliance strategy and the acquisition of new consolidated subsidiaries as well as the effects of COVID-19. As a favorable trend, the sales of the media platform business are increasing, while profit margin remains high, and the number of subscribers is increasing. The revenue base is steadily growing. In this business, the dental segment performed well, but the beauty care/salon segment struggled, but it can be expected to rebound, and it can be said that there is room for improvement. In addition, the company is taking advantage of the growth of the membership base for promoting the medical institution management support business and the medical BtoB business. The contribution of Okamura and Noechi Pharmaceutical to revenues has just begun, so we would like to expect their full-scale contribution. The medical institution management support business, whose sales grew considerably in FY 5/22, accounts for a significant proportion of sales, but its profit margin is low. There is significant room for improving profit margin, and the potential of contributing to overall profit is high. In Thailand, the company has expanded the dental clinic management business, and acquired an enterprise that operates the general trading business in the dental field as a consolidated subsidiary, so further expansion can be expected.

For FY 5/23, it is forecasted that sales will grow 20.1%, but ordinary income will decline 29.2%. This is because the company will continue active investment for maintaining high growth. In Japan, the shortage of IT personnel is evident, and if the company cannot recruit personnel as planned, recruitment cost will fall below the forecast for FY 5/23 (253 million yen), boosting profit. While the spread of COVID-19 produces a favorable effect, the management conditions of dental clinics have improved, through the preventive care against lifestyle diseases. Accordingly, dental clinics will become able to allocate their funds to advertisement.

For FY 5/23, profit is projected to drop, but we can keep recognizing Medical Net as a rapidly growing enterprise. Its stock price has been low, and we consider that its stock is still undervalued.

(Produced by Investment Bridge with reference to the brief financial report)

◎Shareholder benefits (original QUO cards)

1,000 yen for shareholders holding 100 or more shares for 1 or more years

1,500 yen for shareholders holding 600 or more shares for 1 or more years

1,500 yen for shareholders holding 1,000 or more shares for 1 or more years and less than 3 years

2,000 yen for shareholders holding 1,000 or more shares for 3 or more years

<Reference 1: Future growth strategy-Concentration on preventive medicine and healthcare for presymptomatic diseases>

While aiming to grow further, the company considers that important keywords are “preventive medicine and healthcare for presymptomatic diseases.”

A significant environmental change is occurring in the dental field, where the company secured a position as the only one enterprise.

In Japan, dental therapy used to imply the treatment of cavities.

On the other hand, in Europe and the U.S., it is generally considered that periodontal diseases would cause various diseases, including arteriosclerosis, myocardial infarction, brain infarction, diabetes, and Alzheimer's disease, so keeping teeth healthy would prevent such diseases.

It is expected that the concept of “preventive dentistry and dental care for presymptomatic diseases,” which would contribute to general health and longevity, will be considered as important also in Japan.

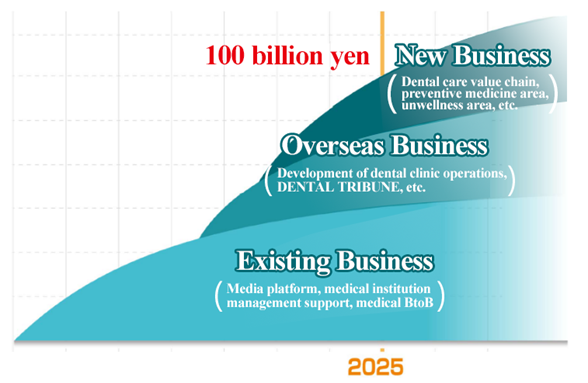

In addition to the existing recurring-revenue business, the company will operate “overseas business,” including the operation of dental clinics and the utilization of Dental Tribune, and “new business,” including preventive medicine and healthcare for presymptomatic diseases, and develop brands for accelerating growth, with the aim of achieving sales of 10 billion yen in the term ending May 2025.

-For achieving sales of 10 billion yen in the term ending May 2025

(Taken from the reference material of the company)

Future growth strategy and driver

(Taken from the reference material of the company)

<Reference 2: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organizational Type | Company with audit & supervisory board |

Directors | 5 directors, including 1 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

◎Corporate Governance Report

Last update date: August 31, 2022

<Basic Concept>

Our basic policy for corporate governance is to fulfill social responsibilities toward all stakeholders, including shareholders, clients, end users, employees, and local communities, as a member of the corporate society based on the soundness, efficiency, and transparency of our business administration, while maximizing the interests of shareholders.

To do so, we will tighten our corporate governance according to changes in the business environment without resting on our laurels and strive to maximize our corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

It is written that “Our company follows all of the basic principles of the Corporate Governance Code.”

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (Medical Net, Inc.: 3645) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.