Bridge Report:(3916)Digital Information Technologies the second quarter of the fiscal year ending June 2023

President Satoshi Ichikawa | Digital Information Technologies Corporation (3916) |

|

Company Information

Exchange | TSE Prime Market |

Industry | Information and Communications |

President | Satoshi Ichikawa |

HQ Address | FORECAST Sakurabashi, 4-5-4 Hatchobori, Chuo-ku, Tokyo |

Year-end | End of June |

Homepage |

Stock Information

Share Price | Number of shares issued | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,645 | 15,501,820 shares | ¥25,500 million | 28.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥36.00 | 2.2% | ¥102.37 | 16.1 x | ¥364.12 | 4.5 x |

*The share price is the closing price on March 14th. The number of outstanding shares, EPS, and DPS are based on financial results for the second quarter of the term ending June 2023. ROE and BPS are the results in the previous fiscal year..

Consolidated Earnings

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (yen) | DPS (yen) |

Jun. 2019(Actual) | 12,355 | 1,095 | 1,106 | 737 | 48.07 | 16.00 |

Jun. 2020 (Actual) | 13,495 | 1,352 | 1,357 | 978 | 64.18 | 20.00 |

Jun. 2021 (Actual) | 14,444 | 1,722 | 1,730 | 1,196 | 78.47 | 24.00 |

Jun. 2022(Actual) | 16,156 | 2,004 | 2,004 | 1,439 | 94.38 | 40.00 |

Jun. 2023 (Forecast) | 18,000 | 2,250 | 2,250 | 1,561 | 102.37 | 36.00 |

**Unit: million yen. The forecast is from the company. A 2-for-1 share split was implemented on April 1, 2018. EPS and BPS were retroactively recalculated.

*Net income is net income attributable to shareholders of the parent company. Hereinafter the same will apply. Dividends for FY6/22 include a commemorative dividend of 8.00 yen/share.

This Bridge Report introduces the earning results for the second quarter of the fiscal year ending June 2023 and other information of Digital Information Technologies Corporation.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of the Fiscal Year ending June 2023 Earnings Results

3. Fiscal Year ending June 2023 Earnings Forecasts

4. Conclusions

<Reference 1: Vision for 2030 and New Medium-term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

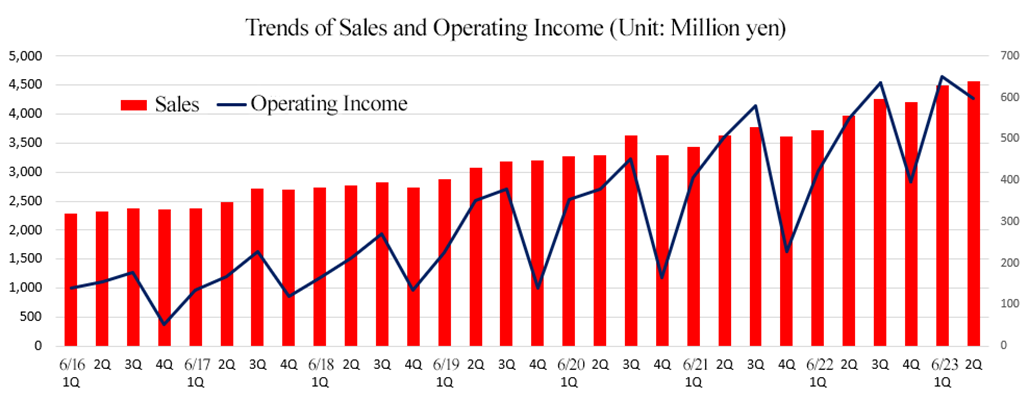

- In the second quarter of the fiscal year ending June 2023, net sales grew 18.0% year on year to 9,068 million yen. The software development business, which is the company’s core business, grew, and the system sales business rebounded. Operating income increased 28.4% year on year to 1,249 million yen. Due to the sales growth, gross profit rose 19.5%, and gross profit margin increased 0.4 points, offsetting the augmentation of selling, general, and administrative expenses. Operating income margin increased 1.1 points, reaching a record high. Profitability continues to improve, and both sales and profit reached a record high in the first half of the year. Even on a quarterly basis, the sales in the second quarter reached a record high.

- There is no change in the earnings forecast. The net sales for the year ending June 2023 are expected to be 18 billion yen, up 11.4% year on year, and operating income is expected to be 2.25 billion yen, up 12.2% year on year. All business segments will increase sales, with double-digit sales growth in the business solution and embedded solution businesses. Operating income margin is expected to rise 0.1 points to 12.5%, due to the expansion of contract projects and the increase in the proportion of in-house product business. The company expects to increase sales and profit for the 13th consecutive year. Depending on the trends in medical projects, there may be an impact on new project development due to personnel allocation, but the company plans to capture strong demand in the embedded solution business. The planned ordinary dividend is 36.00 yen per share, up 4.00 yen per share from the previous year's ordinary dividend of 32.00 yen per share. The expected dividend payout ratio is 35.4%.

- The company has emphasized the importance of interfacing with customers and has proceeded with projects based on agreements, which has effectively prevented large unprofitable projects from occurring. However, the medical project in this term grew significantly in scale, leading to the delay in its progress. The company plans to reflect on this as a lesson and use it as an opportunity for growth.

- The company's earnings are expected to have some lost profit due to the delay of the large entrusted medical project. We would like to pay attention to their sales, profit, and profitability trend in the third quarter, including whether the robust embedded solutions business will be able to offset this loss or not, and whether the somewhat sluggish in-house product business will recover.

1. Company Overview

Digital Information Technologies Corporation is an independent information service company. Its sales are mostly from the undertaking of the development of business systems, embedded devices, etc. for clients mainly in the fields of finance, communications, etc. The company concentrates on the expansion of its products based on its original technologies, including "WebARGUS," a website security solution, and "xoBlos," an Excel work innovation platform. The company has a variety of characteristics, such as "multifaceted, diverse information technologies" and "organizational strategies of partial and total optimizations."

1-1 Corporate History

The late Norikazu Ichikawa (former Director and Chairperson) discovered a new world of computers and obtained programming qualifications while he was working at Nippon Telegraph and Telephone Public Corporation.

In 1996, he was appointed president of Toyo Computer System, Inc. as the successor to one of his acquaintances. He expanded its business area starting from business system development, and then computer sales business (current: system sales business), embedded product development validation business and operation support businesses turning Toyo Computer System Inc. into a multifaceted and diverse IT company.

In 2002, he established Toyo IT Holdings Corporation, which is the predecessor of current Digital Information Technologies Corporation, by separating several companies under the same group and establishing subsidiaries with 100% ownership. In 2006, he integrated four subsidiaries into one company and renamed it to the current company name.

In addition, in January 2011, he established DIT America, LLC in Kansas, U.S.A. Digital Information Technologies Corporation was listed on JASDAQ of Tokyo Stock Exchange (TSE) in June 2015, listed on the second section of TSE in May 2016 and listed on the first section of TSE in March 2017.

In July 2018, Mr. Satoshi Ichikawa, who used to be Representative Director and Senior Managing Officer, took up the office of Representative Director and President to rejuvenate the management structure under the business environment where change is accelerating and make a system to enable prompt decision-making.

In April 2022, the company was listed on the Prime Market of TSE, through the restructuring of the stock market.

1-2 Corporate Philosophy

Our logo is a collection of cubes with an infinite number of stairs. This collection is our company itself, and each cube represents each employee. The 6 facets of the cubes represent six values which all employees share and consider valuable. Our corporate identity represents these values in three tiers; clients, company and employees. |

(From the company's website)

(From the company's website)

The above diagram is the unfoldment of the cube. According to the president Ichikawa, it emphasizes “clients first; this is where it all starts." Furthermore, the logo represents “training employees” and “communication with clients and among employees.” These are important values to the company. Additionally, we implore employees to “improve its added values,” “have passion” and “have a sense of purpose.”

Employees are to uphold this company policy as their creed and follow these principles at all times.

1-3 Market environment

The outlines of the market environment and growth potential of each business unit of the company mentioned in Section 1-4 “Business Description” are as follows.

(1) Business Solution Unit

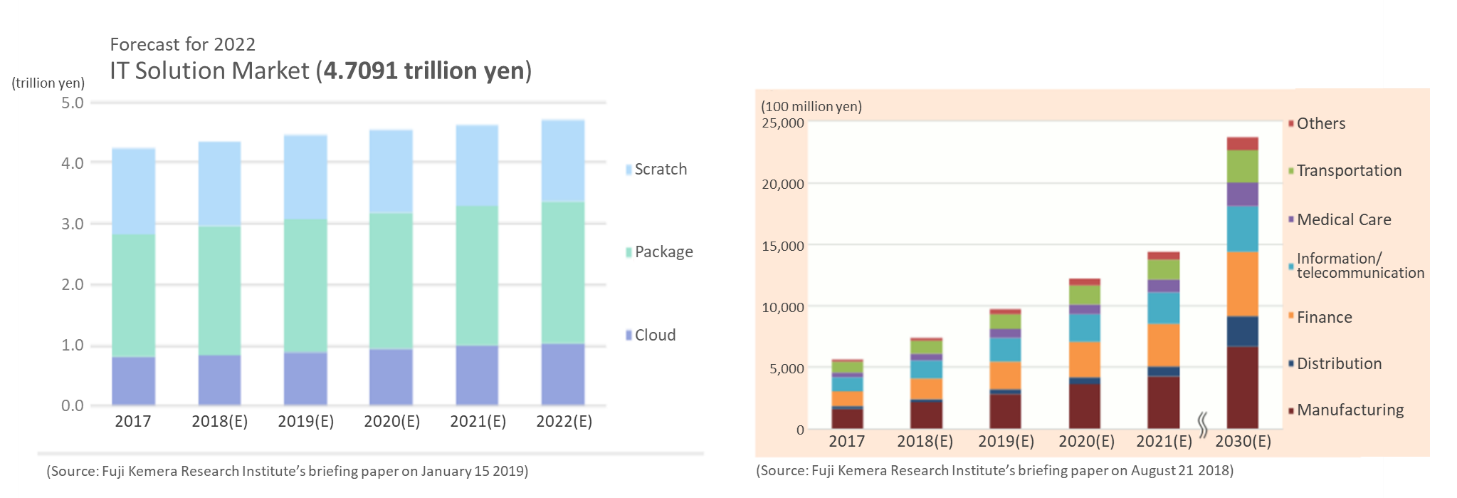

The market of IT solutions, which helps deal with the shortage of manpower and the streamlining of business operations, has grown steadily. Cloud services & packaged software have been adopted by small and medium-sized enterprises and large companies.

In addition, digital transformation (DX), including the use of AI, IoT, RPA, and robotics, is expected to progress rapidly.

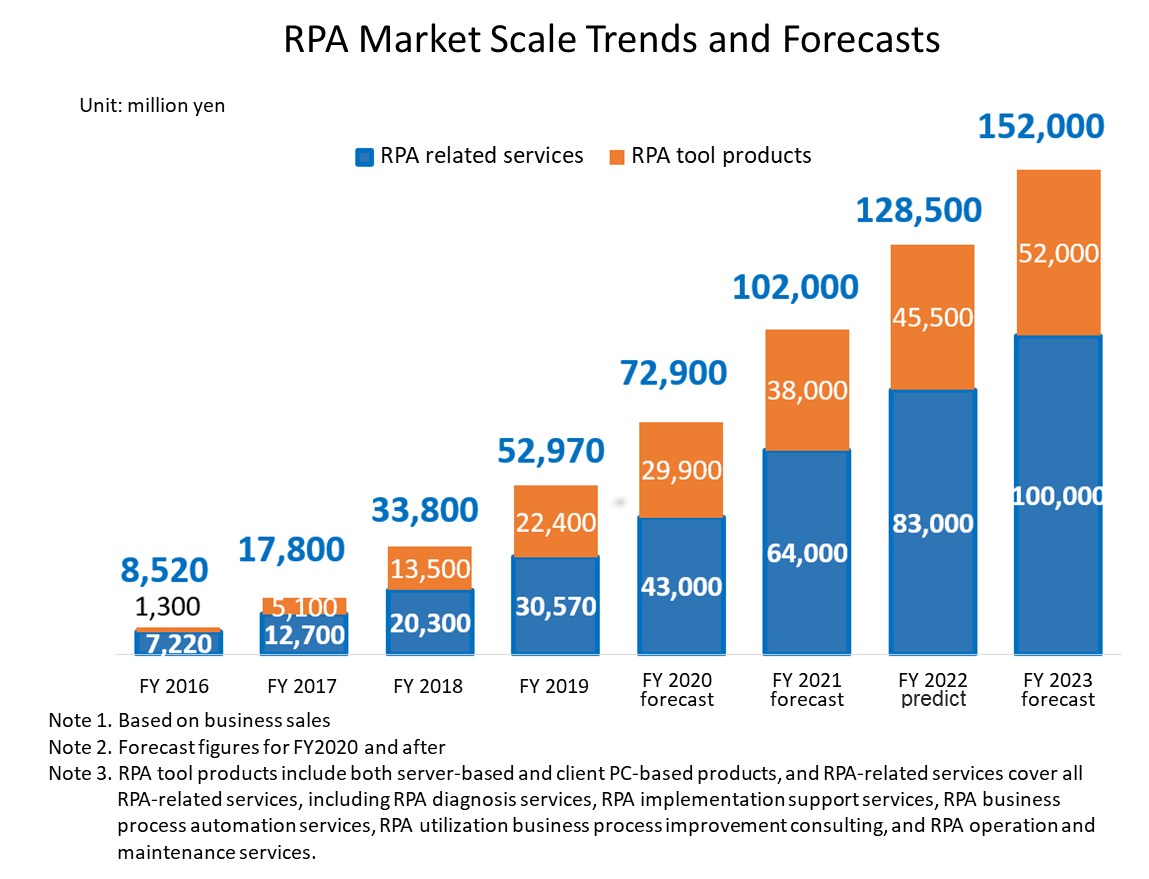

(Taken from the reference materials of Digital Information Technologies Corporation)

(2) Embedded Solution Unit

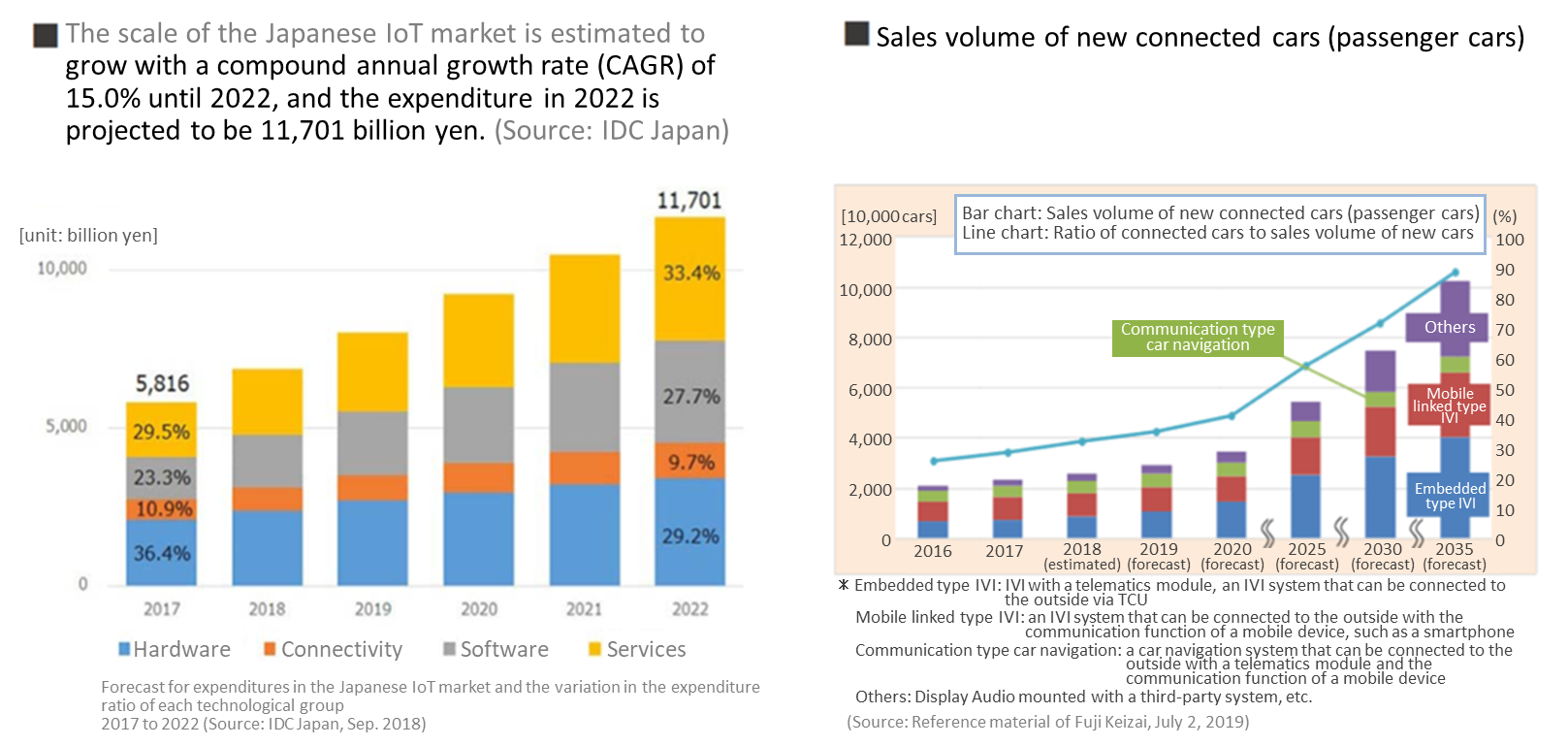

The Japanese IoT market, especially services, is expected to grow considerably.

The industry of in-vehicle devices is forecasted to see the rapid growth of “connected cars,” which would create a variety of value, by having the functions as ICT terminals, obtaining various data, including vehicle states and surrounding road conditions, with sensors, and collecting and analyzing them via networks.

(Taken from the reference materials of Digital Information Technologies Corporation)

(3) Original Product Unit

① WebARGUS

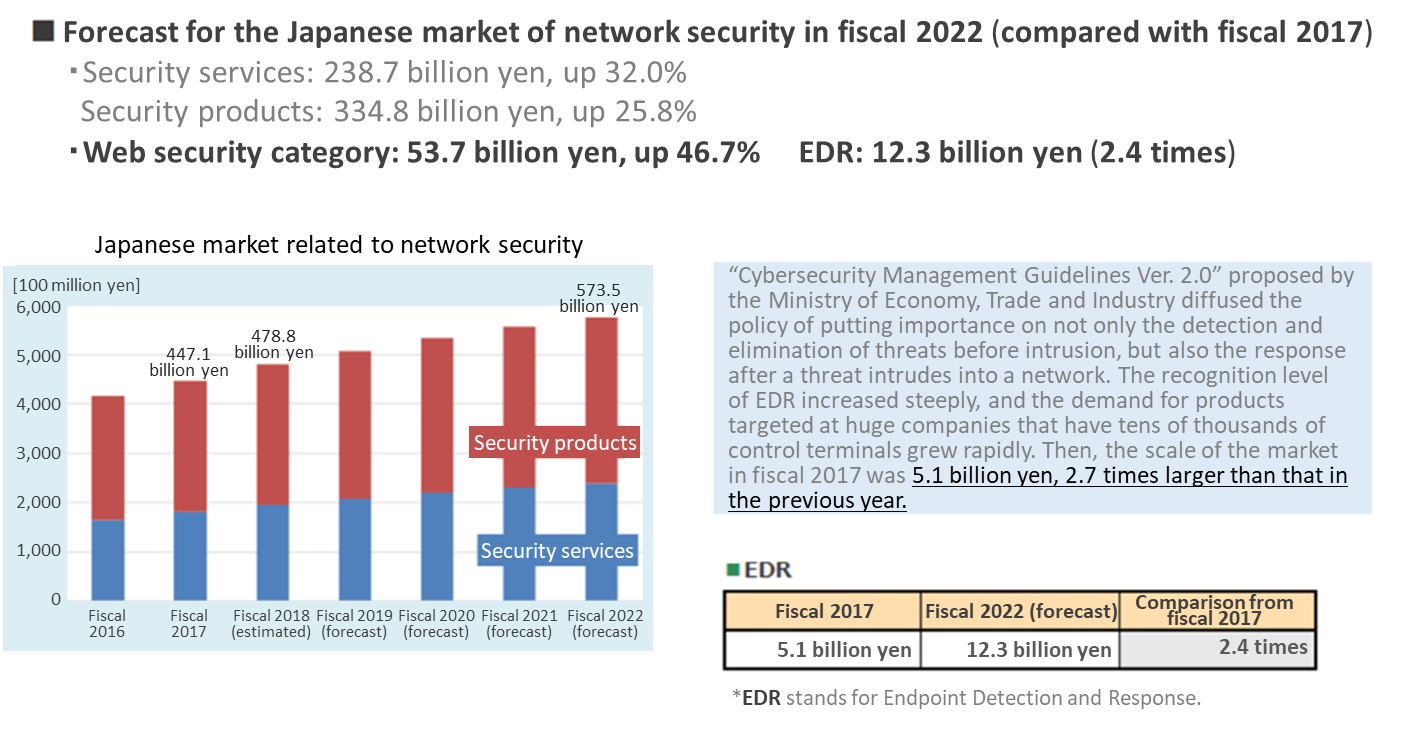

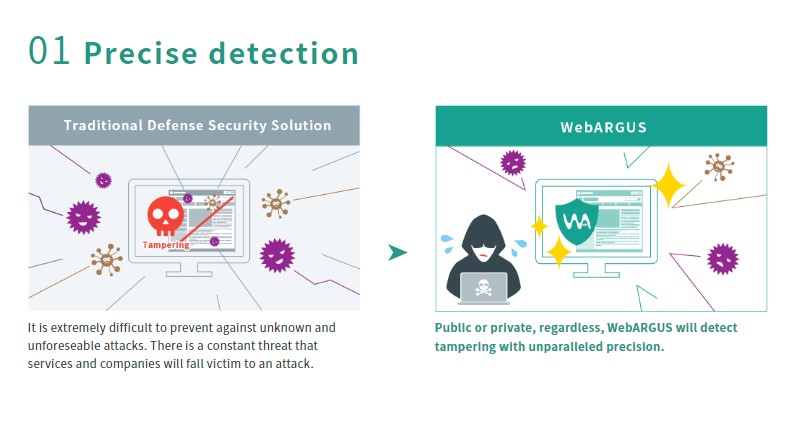

In the Japanese market of network security, both products and services are estimated to grow, and there are growing needs for the detection and elimination of threats before intrusion, as well as response after intrusion.

(Taken from the reference materials of Digital Information Technologies Corporation)

② xoBlos

RPA (Robotic Process Automation), which is a system for supporting the significant streamlining of business operations, is attracting attention.

RPA means the automation of processes using robots. By using technologies, such as artificial intelligence (AI) and machine learning, in which AI learns things through repetition, white-collar tasks, especially back-office ones, are handled. Just by registering procedures of human tasks on an operation screen, it is possible for them to handle the tasks using various apps, including software, browsers, and cloud.

It is expected to spread rapidly, as one mean for reforming the ways of working, which is an issue to be overcome by Japanese enterprises.

(Created by the company based on Yano Research Institute's "2021 RPA Market Actual Conditions and Prospects")

1-4 Business Description

1. Segments

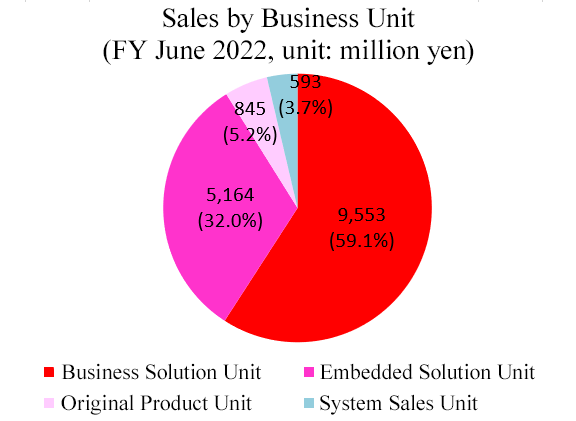

There are two segments: software development business and system sales business. The software development business consists of 3 business units: business solution unit, embedded solution unit and original product unit.

(1) Software Development Business

①Business Solution Unit

(Business system development unit)

The sales for this business unit is mostly from custom development for end-users and information systems companies which are clients’ subsidiaries in a wide variety of industries including finance, medicine/pharmacy, communications, distribution and transportation as well as for leading SI vendors.

Specifically, development for websites and key systems, front and back office operations, new system development and maintenance development with technologies developed in each area. The company has developed trustworthy relationships with leading companies in each area which enables them to secure stable orders.

(Operation support unit)

Main clients include communications carriers, total human service corporations and information system companies which are airlines subsidiaries.

This “business unit to support clients’ daily operations through IT” has stable revenue as it is an ongoing business in line with the business website domains of leading companies.

Specific business includes:

*Support desk operation for end-users who use various business systems.

*Build and maintain infrastructure (servers and networks).

*Efficient system operations in line with the latest technology trends.

②Embedded Solution Unit

(Embedded product development unit)

This business unit is trusted by leading manufacturers to directly develop custom software for in-vehicle devices, mobile devices, information home appliances and communication devices. For in-vehicle devices, mobile devices and information home appliances, the unit develops custom software for overall systems including firmware, device business unit controls and applications.

It focuses on Auto-Drive related field with new technology, as well as infotainment for in-vehicle devices as the demand for this market is expected to grow. In addition, it undertakes software development for wireless base stations and communication module devices for communication devices.

(Embedded product verification unit)

This business unit verifies and makes suggestions to improve qualities and functions of products through its verification service.

It provides verification services domestically and internationally (North America, Asia, Europe, etc.) including laboratory tests using specialized devices to verify product operation and function, field tests to verify products in the actual environments, as well as overall system tests conducted as the final quality verification from the perspectives of the third party.

Some of the overseas field tests are designated to its subsidiary, DIT America, LLC, which provides fast service with verification of product usability from the perspective of local staff.

The range of products for verification includes in-vehicle devices, medical devices, communication devices and mobiles.

③Original Product Unit

As a growth field, the business develops and sells products with unique technologies. It also handles products with high social needs through its alliances.

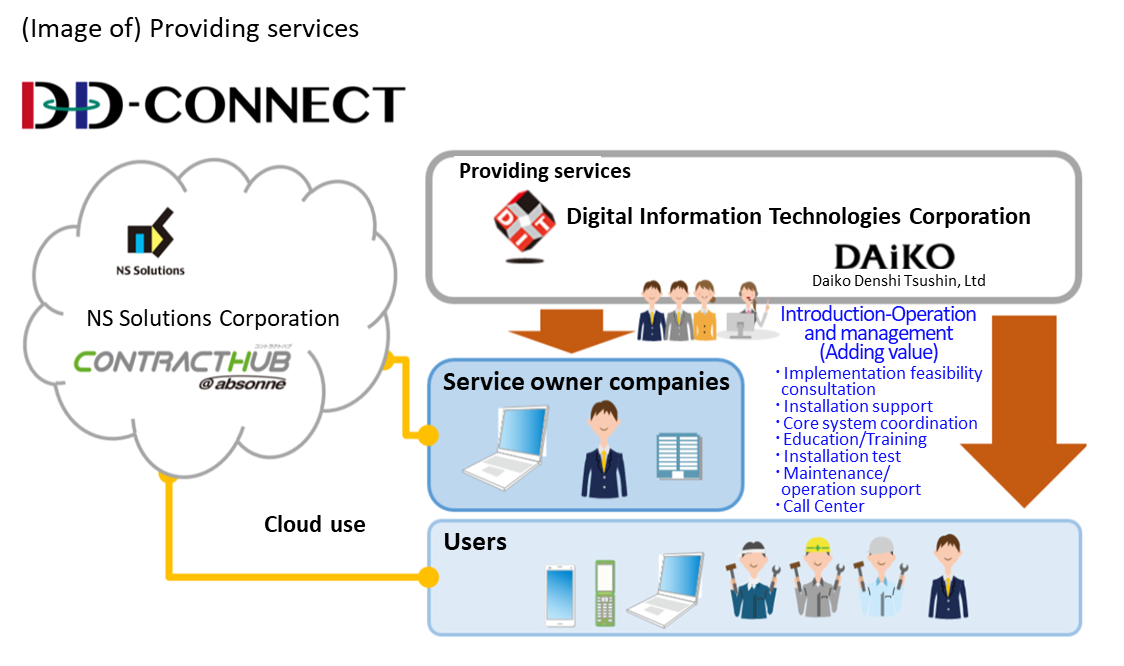

Currently, the company strongly focuses on the sales of two products, “WebARGUS,” a system security solution, which detects tampered website simultaneously as it occurs and instantly restores the original normal condition, “xoBlos,” an Excel work innovation platform, which features data decomposition and restoration as well as meeting various forms of data business processing needs, “DD-CONNECT,” electronic contract outsourcing service, DD-CONNECT, etc.

There are other products such as “APMG (Anti Phishing Mail Gateway),” a solution to prevent damages from phishing and illegal use of brands by automatically adding electronic signatures on e-mails, and “Shield CMS” a CMS (content management system), which enables editing and updating websites easily.

(2) System Sales Business

The company and its subsidiary, DIT Marketing Service Co., Ltd., sell “Rakuichi,” a business support mission-critical system, for small and medium enterprises, manufactured by Casio Computer Co., Ltd.

The sales area is started at Kanagawa first and expanded to Tokyo, Chiba, Gunma and Ehime successively. The Company provides substantial support for their users to increase the client retention rate. In addition, they set up a call center to attract and build a new client base. The number of sales for “Rakuichi” has been recorded to be the highest across all agencies for 18 consecutive years.

2. Main Strategic Products

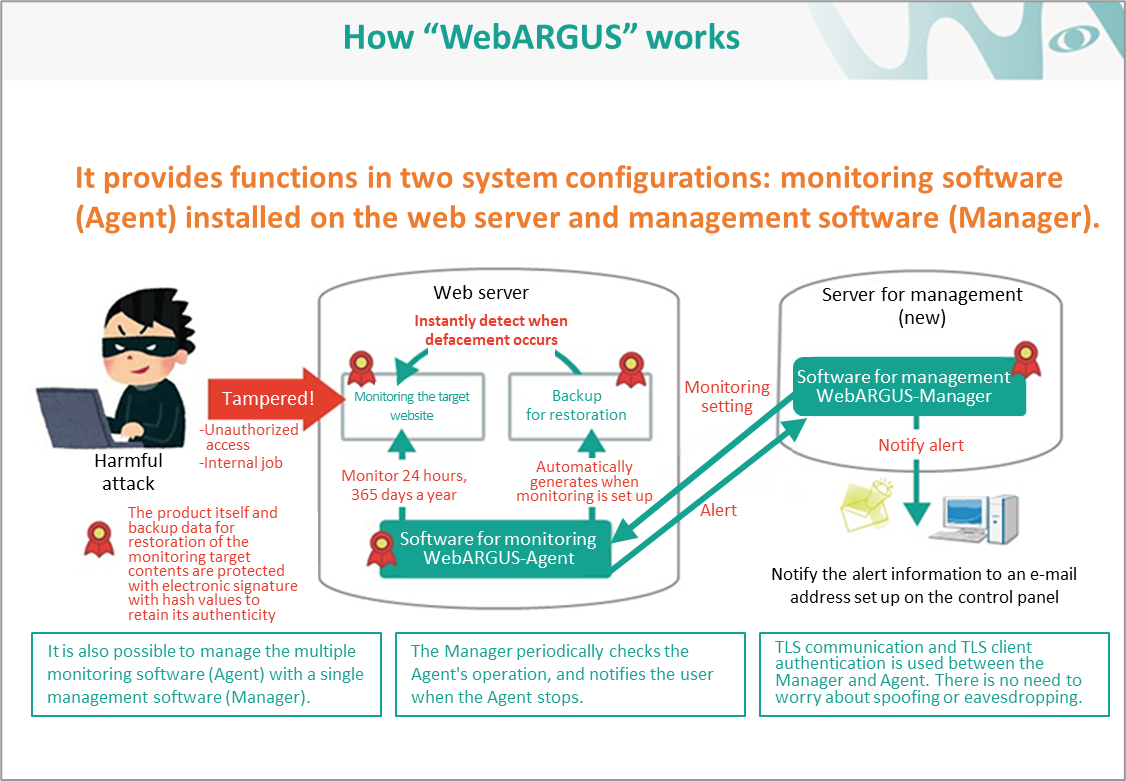

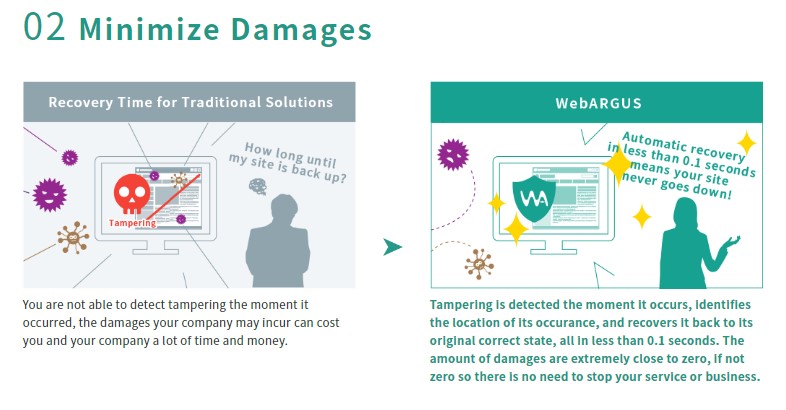

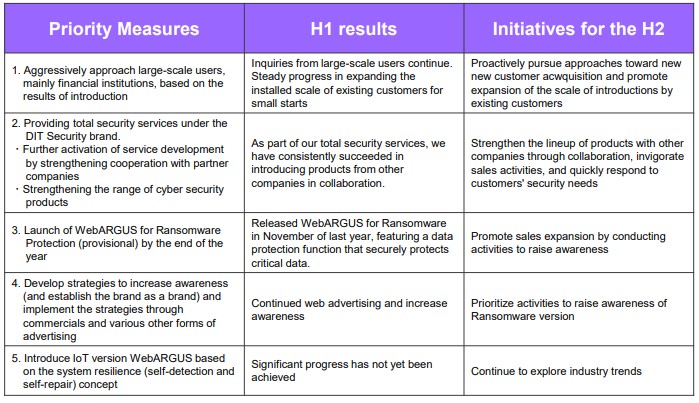

(1) "WebARGUS," a server security solution

WebARGUS is a new security solution which detects tampered system instantaneously and immediately restores it to its original state. By detecting and restoring immediately when incident occurs, WebARGUS protects various corporate servers from damage caused by malicious and unknown cyber-attacks and simultaneously prevents the escalation of the damage from viruses spreading via the tampered server.

(Taken from the reference materials of Digital Information Technologies Corporation)

Increasing tampering of websites

According to the incident report published by “JPCERT Coordination Center (*)”, about 100 cases are reported every month, and websites including the ones of government agencies are constantly exposed to threats, whether the case is major or minor.

“JPCERT Coordination Center” (*): This center receives reports concerning computer security incidents including hacking via internet and service disturbance in Japan. It also supports measures, grasps how the problems are generated, analyzes the methods, investigates and advises on measures to prevent recurrences from a technical point of view.

The background of the development of "WebARGUS"

Under these circumstances, the company, which had already released a solution called “APMG” to prevent damage from phishing and illegal use of brand by automatically adding electronic signature in e-mails, started developing “WebARGUS,” based on a core security technology in the spring of 2013, after 2 years of research. Then in July 2014, it released “WebARGUS.”

The major characteristic and strength of the company is that it has a variety of rich IT related technologies and has a highly standardized core security technology. This is because its engineers have a mindset to embrace challenges and are not afraid to take risks. Thus, they are not satisfied with just developing custom products. This is strongly influenced by the company’s organization strategy represented by its corporate culture and in-house company system which will be explained later in this report

The features and overview of the product

Instant detection and restoration for minimizing tampered system to nearly zero |

Provide protection from tampering by a fake identity posing as a registered member, internal attack and new methods which can be difficult to protect from. |

It detects with high accuracy and uses “electronic signature” technology which protects from even 1 bit of tampering. |

Protects from high level attacks aimed at applications and settings files. |

The CPU load (usage rate) on a server is less than 1% while it is monitoring on a regular mode. |

Equipped with preservation of evidence function which stores the tampered files as evidence. |

When a website has been tampered with, it can take an average of one month to restore. This is because the restoration process includes disabling the website, identifying the damaged files, strengthening protection, website restoration and re-enabling the website. For an e-commerce related website, the damage can be serious, including a drop-in sales, time and effort to announce the re-enabling of the website and the difficulties in re-attracting clients who left the website.

On the other hand, if “WebARGUS” is installed, because it instantly detects and restores websites when tampered with, the condition of a system can be maintained in the normal state. Thus, the website does not need to be disabled in a rush when the application detects a threat. Companies can concentrate on pursuing the cause and strengthening protection while its website is kept open to public.

Most of the detection software detects tampered website with a periodic monitoring on pre-configured, specified timing or intervals. With this method, there will be a time lag between when the website is tampered with and when it was detected, so it is inevitable for the website to be tampered. In addition, if the interval is shortened to reduce the time lag, there are other challenges such as increasing CPU load.

On the other hand, when some kind of event occurs (such as data deletion or addition excluding browsing), “WebARGUS” conducts real time scanning to detect the event.

The major feature of this product is that it is also equipped with an instant restoring function which enables restoration to the original state in less than 0.1 seconds after the detection (average time under the demo environment: 0.03 seconds per file). This instant restoration is its unique technology.

The annual license fee of “WebARGUS” is JPY528,000 (incl. tax) per OS with support.

This also includes free update modules for minor version updates.

Introduction and sales

When WebARGUS was released, the sales growth was rather slow because general understanding of website security was mainly about protection against hacking into a computer system and awareness about “tampering” was limited. However, the acknowledgment that “software for detection is needed as well as for protection” is growing rapidly due to the more frequent mentioning of the independent administrative agency, “IPA (Information Processing Association),” taking measures to prevent defacement. This agency is established to support the IT national strategy from a technical and personnel aspect perspective and is supervised by the Ministry of Economy, Trade and Industry.

In addition, the Ministry of Economy, Trade and Industry added "establishing mechanisms to respond to cybersecurity risks related to 'detection of attacks' and 'recovery'" as new important items in the revised points of the "Cybersecurity Management Guidelines" announced on November 16, 2017. Furthermore, there is a strong demand for stable operation of servers that support core business and business infrastructure in BCP (Business Continuity Planning) and BCRP (Business Continuity and Resiliency Planning) in recent years, and as a result, business inquiries about such mechanisms have increased even further.

Under these circumstances, the company has carried out promotion and marketing including organizing seminars for target users who recognize the necessity for a higher level of security, and participation in exhibitions.

It focuses on agency sales to strengthening marketability.

They have been actively involved in development collaborations with data centers and cloud service corporations.

Furthermore, the company is expected to expand its business overseas as well as product sales in Japan. The company is preparing to provide support for the tampering of systems across the globe.

Strengthening the feature of merchandise

Initially, WebARGUS was only available for Linux, but a Windows version was released in April 2016, and the enterprise edition, which was targeted at large-scale companies in September 2017. In February 2018, the company began offering a next-generation cloud WAF (WebARGUS Fortify), which dramatically strengthens the functionality of comprehensive web security. In particular, because of the release of the enterprise edition, which was targeted at large-scale companies, an increasing number of large companies (mainly listed companies) adopt WebARGUS.

The company also began offering “SaaS” in May 2018 to enhance user convenience and further popularize the products, and collaborated in full scale with With-Secure Corporation, a Finnish cyber security company, in June 2018. The company established a total security provision system using the complementary relationship between With-Secure’s “F-Secure RADAR,” a vulnerability scanning tool for IT system, and DIT’s “WebARGUS.”

It began collaboration with Secure Age, a cyber security company based in Singapore, on information leakage measures (encryption technology) in December 2019 and with SSH Communication Security, a cyber security company based in Finland, on access route optimization in January 2020. The company will continue to establish such alliances acively.

The company enhanced the varieties of the security solution products through various measures including the above alliance, and it is also considering expanding the range of applications of products in anticipation of needs for security measures for the IoT generation, including WebARGUS for embedded products.

For example, the spread and penetration of automatic driving have made the securement of safety an important mission for the companies providing automatic driving systems, and it is expected that the field where they work actively will grow further.

As for the embedded edition, the company started up an official project and is continuously carrying out discussions and technical investigation of concrete business plans for its commercialization. Although commercialization will take time, the company aims to realize it earlier through the accumulation of its steady business accomplishments.

◎ Expansion of the security domain: WebARGUS for Ransomware

A rapidly increasing number of people suffer from ransomware, which is a kind of malware that encrypts files to make them unusable and demand a ransom payment for decrypting these files.

In this situation, the company released the Intel 64 version of "WebARGUS for Ransomware," in November 2022, followed by the ARM64 version in January 2023 which is equipped with the function to block the malicious programs to change or delete important data on a real-time basis and protect important data from various risks (such as cyberattacks, inside jobs, and encryption of data by ransomware), in addition to “WebARGUS,” which detects website falsification and repair the websites instantly.

As there are many command patterns of ransomware, “WebARGUS for Ransomware Protection (provisional name)” can block about 30 command patterns. The company believes that there is no other product of its kind with such a wide range of control patterns. By combining it with the conventional "WebARGUS," it is possible to establish stronger server-side security.

First, the company announced to existing "WebARGUS" users, especially the current enterprise version users, that the data protection function has been added to the product, and the introduction of the product as a replacement for the existing "WebARGUS" has begun.

The final installation of functions will be completed by the end of this fiscal year, and full-scale deployment is scheduled to begin in the next fiscal year.

(Taken from the website of Digital Information Technologies Corporation)

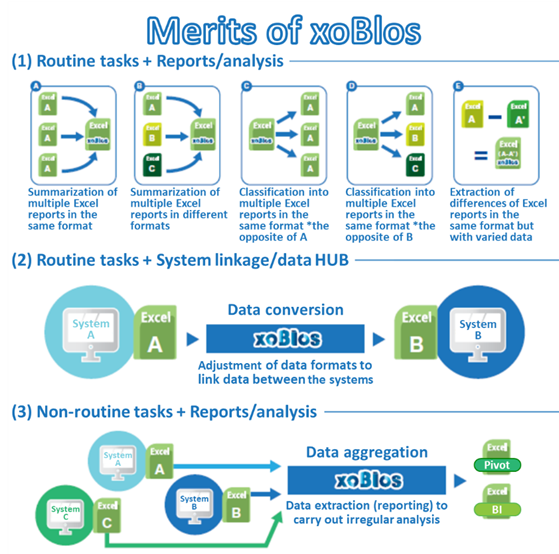

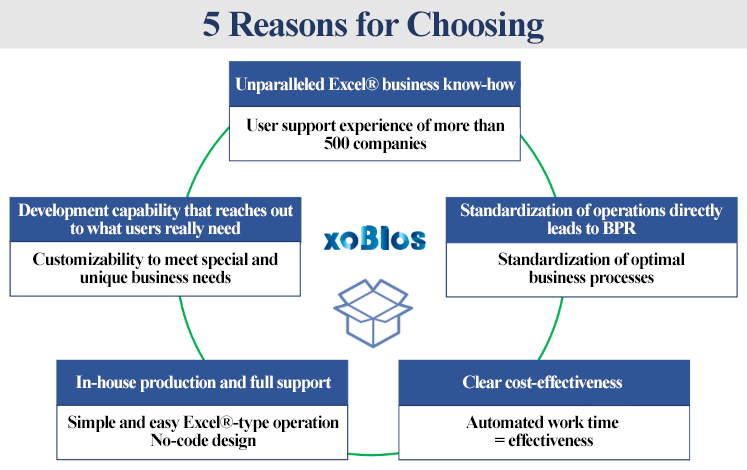

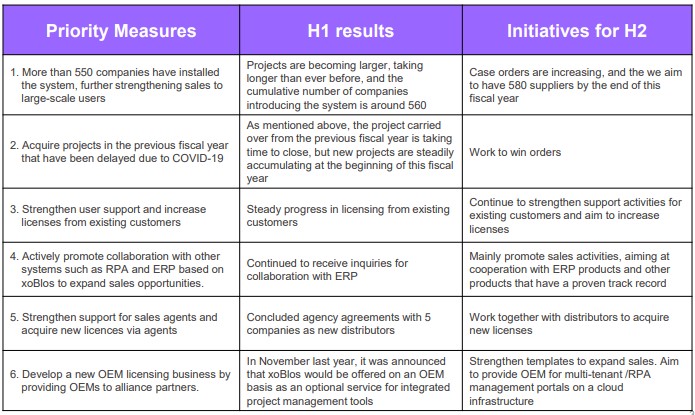

(2) “xoBlos,” an Excel® work innovation platform

Even in advanced corporations with a high level of IT, there are numerous Excel®-based tasks including manual operations in the office. Most non-routine tasks consist of repetitive manual operations such as processing Excel® reports by manually inputting data from paper reports, aggregating totals from multiple Excel® sheets and visualizing and analyzing CSV data extracted from packaged system.

The company's original-brand, "xoBlos," entirely automates these inefficient Excel®-based tasks and provides drastic improvements to workflow.

(Taken from the reference materials of Digital Information Technologies Corporation)

Background of development

Many corporations use Excel®, the major spreadsheet software, for generating quotations and invoices. However, in cases where they generate these documents in different formats for each client according to the clients’ requirements, manual input is mandatory because it is difficult to tally, sort and analyze in a systematic way.

For this, the company developed “xoBlos,” an Excel® work innovation platform, to automate tasks and significantly improve workflow efficiency.

Product feature, overview and an example of introduction

Enables management of different data formats for tallying and processing |

Enables increased efficiency with current Excel® spreadsheets. |

Process up to dozens of times faster than using macros. |

Can be embedded into other packaged products as an engine to output Excel® spreadsheets. |

xoBlos was released about ten years ago with the aim of drastically improving the efficiency of work using Excel®. It is now receiving considerably more attention due to its efficiency “to create a company-wide platform which covers everything from improving work efficiency to providing information useful in managerial decisions, while diverting workflow from areas currently using Excel®,” in addition to the convenience and relatively cheap introduction cost, because work-style reform trends centered on revising long work hours grow stronger. Indeed, the times have caught up with xoBlos and the company.

For further enhancement of product competitiveness, the company strengthened the automatic processing of Excel® work by providing a function linked with RPA* products and other systems in February 2018. This function can be operated on a PC client as well as a Web Server, leading to improvements in convenience for wider users.

The domestic RPA market is projected to double to 80,000 million yen in the next few years, and RPA-related services, which occupy 80% of the market, are expected to have a higher growth rate than RPA tool products, which occupy only 20%. Based on this, xoBlos, which can be considered as an RPA-related service, is anticipated to have high growth potential.

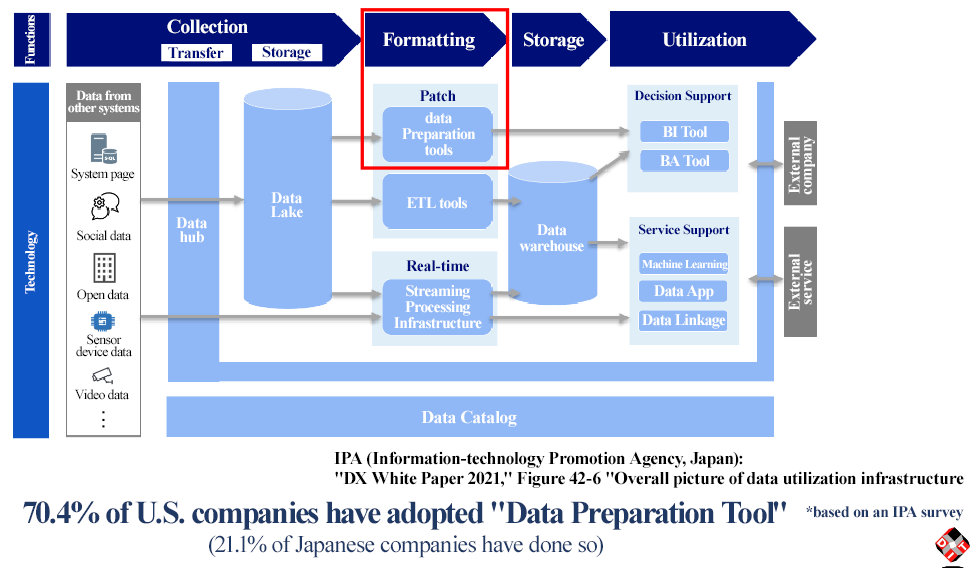

In addition, the company has recently clearly introduced the concept of an "Excel®-type data preparation tool.”

"Data Preparation Tool" is a tool that enables both IT department and business department users to easily and quickly confirm and format data. While about 70% of companies in the U.S. have adopted this tool, only 20% of companies in Japan have done so.

To effectively utilize collected data in the field, it is necessary to process and format data neatly for analysis and system integration. However, in reality, there are discrepancies in expression, erroneous conversions, missing values, and format differences scattered throughout the data, and 50-80% of the work is spent on correcting them. Some of these tasks have been streamlined through the use of macros and VBA, but since the settings depend on individuals, there is a possibility that ongoing work cannot be continued when there are personnel changes.

On the other hand, xoBlos, an "Excel®-type data preparation tool," can clean and format data that have different formats and styles automatically, allowing for output in the desired format. Additionally, since it is possible to design without code, it can prevent the drawbacks of personalization.

The company aims to promote the value of xoBlos as a "data preparation tool” in order to further increase the number of installations.

|

|

(Taken from the reference materials of Digital Information Technologies Corporation)

Toward further value improvement of the platform “xoBlos Plus-One Concept”

“xoBlos” is already highly rated as a work innovation platform that supports in bringing significant operational efficiency by fully automatizing the inefficient work based on Excel®, but the company started taking initiatives to make it a platform that offers more high-added value to clients to respond to the changing times and customer needs.

“xoBlos Plus-One Concept” is the result of the above initiatives.

The main concept of “xoBlos Plus-One Concept” is “improvement of data value.”

Companies carry out various activities, and they have different systems for the management of each activity.

For example, a company has a system for ERP, which drafts a plan for the appropriate distribution of resources including personnel, things, capital and information, and their effective utilization, at the top, and other systems for CRM for customer management, inventory management, management of acceptance & placement of orders, attendance data, personnel and accounts.

A large amount of data is extracted from each system, and in recent years, there has been a skyrocketing need for enhancement of operational efficiency and visualization of a company’s own state by integrating and combining the data, instead of handling them individually.

However, realization of the above is not easy for a company as it requires a large number of work hours and involves huge costs.

In such a situation, clients who installed xoBlos, which processes data efficiently at high speed, achieved efficiency in reporting and are able to utilize the data of by integrating and combining the data easily at a reasonable cost.

Also, it is one of the major features of “xoBlos Plus-One Concept” that it allows the use of data in a desired format of each division and department, from the upstream management team to downstream departments of production, sales, general affairs and administration.

Although it is still a “concept” at present, the company has just begun to carry out activities for its realization, and it plans to link various systems on xoBlos through tie-ups with manufacturers, and propose a concrete image of “xoBlos Plus-One Concept” to its client companies.

Many companies, including the following case studies, have achieved significant improvements in operational efficiency.

*Summary based on Investment Bridge's excerpt from the company's material

*A sample use case: Shibukawa City Hall in Gunma Prefecture “Scheduled to install xoBlos aiming to improve the efficiency of administrative work”

(Background of installation of xoBlos)

With the progress of the information society, Shibukawa City Hall started actively using IT in 2007 to improve administrative services and enhance efficiency. In 2018, the City Hall formulated the “Shibukawa City Information Technology Promotion Basic Policy,” and in the following 2019, established the “Shibukawa City Information Technology Promotion Implementation Plan,” with the goal of improving administrative efficiency. Specifically, it is aiming to streamline administrative activities using AI, IoT and RPA.

(Reasons for choosing xoBlos)

Initially, the City Hall was considering installing RPA. However, after the vender interviewed the HR Department, it found that Microsoft Excel® is used in many work processes. Based on the result, the City Hall was advised that, for streamlining the work, tools such as xoBlos that is specialized for Excel® would be better for the staff, as they can be handled more easily and results can be obtained more easily, too, compared with other tools such as RPA that can handle general computer works.

Based on the advice, the City Hall compared the Excel® macro function, RPA, and xoBlos.

Macro function of Excel® has a disadvantage that maintenance cannot be performed if a staff member who has detailed knowledge on the function is transferred, and the City Hall actually experienced such an issue before.

Furthermore, although RPA can run applications and software other than Excel®, it requires a lot of man-hours and specialized skills to create automated programs and ensure stable operation.

Meanwhile, xoBlos is easy to use, even for people who are not familiar with IT and will also help the City Hall improve efficiency, as there are many work processes that require Excel® at the City Hall.

(How to use xoBlos)

The City Hall’s HR Department annually conducts a questionnaire called a staff survey, in which all 700 employees are asked about their request for transfer and their workplace. They used xoBlos for the calculation of this survey.

Before the installation of xoBlos, the employees filled in the designated survey form on a computer or by hand, and submitted it in a sealed envelope to the HR Department. The HR Department checked them one by one, transcribed the data of over 700 people onto a file using Excel®, and filed them as reference material for personnel transfer.

Because there were so many descriptive questions such as “Request of transfer (name of department)” and “Request for a workplace,” the data were huge. Furthermore, because sensitive information was contained in the answers, only 1 person at the HR Department was in charge of the transcription work. Due to confidentiality, the person needed to work at night or in the conference room.

According to the calculation by the City Hall, it took the person 78 man-hours to aggregate the data.

Upon using xoBlos, the City Hall, in collaboration with the vender, first revised the questionnaire survey format to make it compatible with xoBlos.

Next, they imported employees’ personal data such as email addresses and dates of birth to xoBlos, and set personal information of each employee in a questionnaire form in advance via xoBlos. The questionnaire was then sent by xoBlos to each employee by a batch email.

When the response was sent back by email, the files were saved in a specified folder and aggregated by xoBlos. The contents of the questionnaire were then automatically displayed in a list, which made it possible to check who has submitted and who has not at a glance. Finally, as for printing and filing the questionnaire, using an extension application developed by the vendor, the City Hall was also able to print the data all at once from xoBlos and prepare for filing the report with one click.

As a result, the required time for finishing the task was reduced from 78 hours to 7 hours after the installation of xoBlos. The impact of efficiency improvement was extremely large.

(Comments on the use of xoBlos)

The use of xoBlos this time was experimental, and because most of the installation processes, such as formulating a new process, creating a new format, and configuring xoBlos, were conducted by the vendor, it was extremely easy for the City Hall to handle the set xoBlos.

Furthermore, because xoBlos is already installed and used on the existing client computers, there was no need for new capital investment associated with the installation.

The City Hall felt that it was very rare that a new IT initiative could be implemented so smoothly like this.

(Future policy and development)

Because the City Hall was able to confirm the effect of xoBlos in the demonstration experiment at the HR Department, they are willing to expand the use of xoBlos in other departments and other tasks in the future. Because there are so much work using Excel® in the City Hall, they believe that a significant efficiency improvement effect can be expected using xoBlos.

The City Hall also needs to visualize the current work process to streamline the work by xoBlos. In the process, they need to review work and identify which works are not necessary. In this regard, according to the City Hall, installation of xoBlos is a good opportunity not only for improving work efficiency, but also for raising awareness on work.

Customers and Sales Methods

Currently, the company promotes the value of xoBlos as a "data preparation tool" as previously mentioned to make xoBlos a more marketable product and is working on various sales initiatives.

*Target customer

Initially, the company was mainly making introductions to medium-sized companies, but as the need for efficiency in on-site work has increased, there have also been more introductions to large companies. Currently, about 70% of newly introduced companies are large companies. At present, the company made introductions to over 560 companies. In terms of new installations, the company is focusing not only on increasing the number of corporate customers, but also on introducing xoBlos to major companies where significant license increases can be expected internally.

In August 2020, it began using a subscription mode to expand sales stably and improve profitability.

Particularly, they are actively promoting the adoption of xoBlos, targeting mainly the industries of architecture, real estate, local government, and retail, which are facing challenges in DX while needing to improve efficiency and conduct work-style reform.

*OEM

The company is also focusing on OEM providing the powerful features of xoBlos as an option for project management tools and RPA products handled by other companies.

In December 2022, a new optional OEM service called "xoBlos for OBPM" was launched, which allows project management data accumulated in the integrated project management tool "OBPM Neo" developed and provided by System Integrator Co., Ltd. (TSE Standard, 3826) to be processed and formatted into Excel® reports.

"OBPM Neo" is a project management tool that can comprehensively manage project-related data, including costs and profits, progress, personnel, risks, obstacles, and issues. Although it has screens and functions that enable various analyses, customers faced the challenge of having to spend additional time aggregating and processing data and creating reports, especially for custom reports required for meetings. To address this issue, both companies conducted discussions and decided to offer "xoBlos for OBPM" as a new optional OEM service for OBPM Neo.

By using "xoBlos for OBPM," the manual collection and processing work can be automated, resulting in up to 90% reduction in work hours. Standard templates for frequently used reports (such as budget vs. actual analysis, quality analysis, and operational status) are prepared for OBPM Neo data, and additional templates will be added regularly.

Additionally, by using the xoBlos client, users can edit templates and create custom report templates that meet their specific information and formatting needs.

Moreover, several other projects, including RPA, are currently underway.

*Agencies

Regarding sales activities, the company is marketing products by utilizing a wide range of customers, bases, and sales capabilities of Dai-ko Electronic Communication Co., Ltd. (8023, TSE Standard), one of its main agencies, through joint seminars and other events. The company has built a network of about 30 agencies, including Dai-ko Electronic Communication.

The company plans to continue strengthening its agency network, but will also aim to clarify its target audience for agency selection, focusing on agencies that have expertise in approaching local governments, experience with IT subsidy introduction, and have their own products that are easy to coordinate with xoBlos.

*Advertising and Promotion for Increased Awareness

In addition to conventional outbound sales, the company is also working to strengthen inbound sales, which increase customer inquiries while enhancing information dissemination.

As part of its information dissemination efforts, the company is conducting webinars and advertising and promotional activities, including the use of social media in conjunction with company’s other products such as WebARGUS and Shield CMS.

Regarding advertising and promotion, the newly established planning and sales department is working to optimize marketing and advertising activities under the Product Solutions Division, which is responsible for the company's products, including xoBlos.

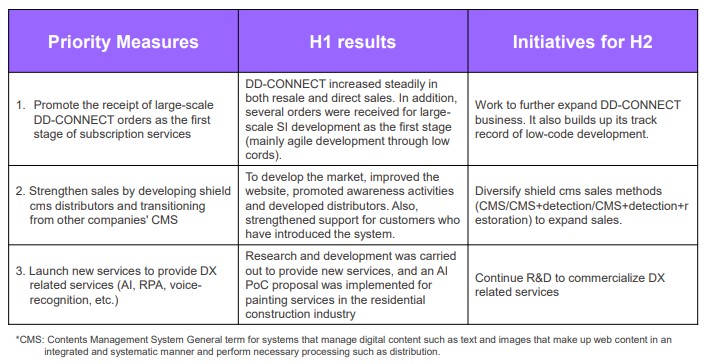

③ Electronic Contract Outsourcing Service, DD-CONNECT

In September 2020, the company signed a partnership agreement with NS Solutions Corporation to sell the electronic contract cloud CONTRACTHUB @absonne, which has had the largest share of sales in the electronic contract service market for four consecutive years.

In October 2020, the company started selling DD-CONNECT, an outsourcing system that handles a series of services from the introduction to operation and maintenance of CONTRACTHUB on behalf of customers.

(Overview of CONTRACTHUB and DD-CONNECT)

CONTRACTHUB has been deployed mainly by large companies in various industries since the service started in 2013 and is now a pioneer of electronic contract services used by more than 130,000 users.

Since it can be flexibly linked with ERP and sales systems, it can improve the productivity of various operations related to contracts, and both the vendor and the customer can review the electronic contract history, including its conclusion and revisions, on the cloud. Thus, it can improve the efficiency of contract management tasks.

DIT's DD-CONNECT is a series of services that offer testing support related to the introduction of CONTRACTHUB, operation support, and maintenance support. Since DD-CONNECT provides the necessary services collectively, it is easier to introduce than an electronic contract system software package alone. Therefore DD-CONNECT is expected to contribute to further cost reduction and labor-saving.

By regularly sharing human resources and knowledge with NS Solutions, the company provides a wide range of higher value-added electronic contract services, such as measures to improve the efficiency of domestic companies' contract operations and the promotion of going paperless and Hanko (Japanese stamp)-less.

(Taken from the reference materials of Digital Information Technologies Corporation)

(Strengths and Features)

"DD-CONNECT" can be easily and seamlessly linked with other systems for order receipt/placement and billing. This feature sets it apart from other electronic contract systems and is one of its forte.

(Successful Implementations)

Currently, the product is mainly used by major housing equipment manufacturers, construction, and real estate-related companies. The company's main target industries and customers include those with high potential for DX and digitalization, including local governments.

As the electronic contract system is suitable for construction contracts, the company has steadily met the needs for complying with the electronic bookkeeping law.

The company offers its customers added value in terms of support for the installation, operation and management of its cloud system, CONTRACTHUB, and this is highly valued by its customers.

Furthermore, product development, including functional improvements, is carried out by Nippon Steel Solutions, which means that the company has a significant advantage as it requires little investment.

Initially, the company and its partner, Daiko Electronics Communication Inc. (TSE Standard, 8023), each conducted their own sales activities, but in order to better utilize each other's strengths, the company clarified the division of roles: Daiko Electronics Communication is responsible for sales, while the company is responsible for installation and maintenance operations, which require technical support.

④ Highly Secure Website Creation Platform, “shield cms”

In September 2021, the company released shield cms, a website creation platform equipped with a cyber security function that instantly detects website tampering and restores the website in less than 0.1 seconds.

The company aims to introduce it to 100 companies in three years.

*CMS: Contents Management System. It is a broad term for a system that integrates and systematically manages digital content such as text and images that make up web content and performs necessary processing such as distribution.

(Background of the release)

Many website creation platforms are based on open-source models that can be used free of charge or their modified ones. Although they are easy to use and convenient, they are easily targeted by cyber-attacks because their mechanism is well known. Moreover, as cyber-attacks are becoming more diverse and complex, the needs for products that can automatically prevent them are increasing.

(The product's features)

Shield cms incorporates the company's security product WebARGUS as the standard equipment. It detects tampering simultaneously as it occurs and instantly restores the original condition. It also alerts the system administrator the occurrence of website tampering. The time from tampering to the recovery/alert notification is less than 0.1 seconds, and the actual damage can be reduced to zero.

In addition, as a CMS function, even beginners can easily create a website with the "Edit as you exactly see it" function that combines and arranges various design parts on the screen, and you can also add HTML input, CSS, and JavaScript so that you can create your own original design.

1-5 Characteristics and strengths

(1) Multifaceted and diverse IT company

The company has expanded its business areas by flexibly responding to the progress of information technology, from business system development business to computer sales (current: system sales), embedded product development and verification business, and operational support business as well as working on its original products based on its technical strengths which have been developed during the process of business expansion.

One of the major characteristics of the company is that it is a multifaceted and diverse IT company and has a wide range of business activities and provides own-brand product with originality.

In order to improve the strengths and characteristics of the company, it is essential to acquire new technology and improve the on-site capabilities.The company has been providing training and education to the employees; however, it is establishing a stronger education system, as it is important to have the latest knowledge ahead of customers in times of rapid changes.

From the perspective of diversity, the company is also working to create an environment in which female employees can easily demonstrate their abilities.

It is making efforts to provide not only on the job training, but also training on managerial skills to promote female employees from mid-level positions to managerial positions including executive positions.

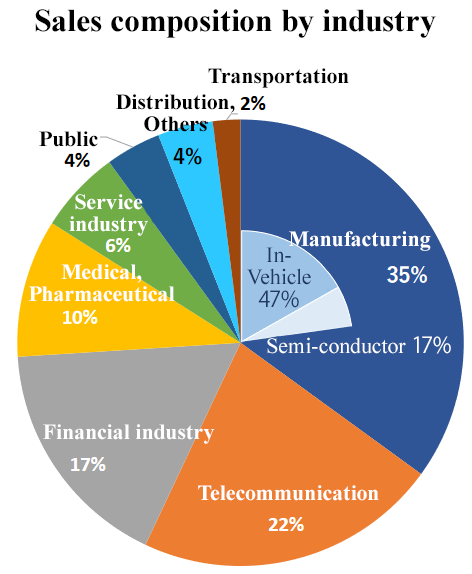

(2) A wide range of customer base

There are about 2,800 client companies. Main clients for the software development business are listed companies and their affiliates, while main clients for the system sales business are small and medium-sized enterprises. Since the business categories of clients are diverse as shown below and stable long-term business is mainly operated, its business base is stable.

The ratio of sales of end users, including information system subsidiaries, is about 80%.

(Taken from the financial briefing materials FY6/22 )

(3) Organizational strategies of partial and total optimization

Another significant characteristic of the company is that it has an organizational strategy with two opposite factors, partial and total optimization in a well-balanced manner.

For partial optimization, the company has specialized companies under an in-house company system which aim to be the best in each field. It also provides training and produces entrepreneurs with innovative spirits.

For total optimization, the company pursues synergy between companies while respecting independence of each in-house company; through scrap and build done by the headquarters, collaboration between each in-house company and development of new business areas.

(Overview of each in-house company)

Main business unit | Company name | Overview |

Business system development unit | Business Solution Company | This company develops a proposal style SI business to provide solutions for clients. Especially in the fields of finance, communications and distribution, this company undertakes design and development of a wide range of software such as general-purpose systems, website systems, mission-critical systems and information systems for leading companies in each industry. It also provides a new business area, ASP business for "Insurance Pharmacy Integrated Management System (Phant's)." |

e-business Services Company | This company provides website system architecture and maintenance for e-commerce websites and service websites for clients mainly for finance and major retail industries for many years. It provides a service to suit clients’ requirements with technologies which it has developed through experience. | |

Operation support unit | Support Business Company | This company’s engineers have a wide range of knowledge enabling it to provide one stop optimal IT environment (service) to suit clients' requirements including support for introducing systems, infrastructure-building, network operation management and middleware development. |

Embedded product development unit | Embedded Product Solution Company | This company specializes in control system development focused on embedded systems for in-vehicle devices, communication devices, industrial equipment and digital home appliances. It has many engineers with highly specialized skills for embedded system development. Because of the physical conditions of hardware, embedded systems development can be very restrictive, and requires a meticulous level of problem-solving that differs from general application development. |

Embedded product verification unit | Quality Engineering Company | This company has a wide range of software validation and verification businesses from in-vehicle devices such as car navigation systems to medical devices, communication infrastructure and mobile terminals. It gives priority to improving the quality of products and provides total service from planning, designing, implementing, operating and analyzing tests to consulting. It has collaborated with DIT America, LLC, a local subsidiary in the U.S.A. since 2011. It also provides verification services overseas. |

(Combination) | Western Japan Company | Activities are based west of Nagoya, with a focus on Osaka. DIT takes part in three businesses: business system development and operational support, mobile and web application development, and embedded systems development (in-vehicle devices and security-related matters). Recently, the company is aiming to expand into the IoT and Web service businesses, taking advantage of multi-skilling. |

Ehime Company | This company is located in Ehime and provides a high added-value one stop service for product development to meet the regionally specific requirements for a variety of industries and businesses as well as sales of software and system devices, operation and system support, and contributes to local revitalization. It also employs engineers locally at a multi-purpose IT development center to tackle the engineer shortage in the other companies, which enables nearshore development. |

(4) Development and sales of original own-brand products

As mentioned above, the company has developed a variety of original own-brand products like “xoBlos” and “WebARGUS” with its unique technologies. They are growing to be the primary source of revenue in the future.

In the fiscal year ended June 2021, the company expanded its lineup by releasing the electronic contract outsourcing service DD-CONNECT based on its partnership agreement with NS Solutions Corporation. The company will nurture it as a pillar of future profits.

2. Second quarter of the Fiscal Year ending June 2023 Earnings Results

2-1 Consolidated business results

| FY 6/22 2Q | Ratio to sales | FY 6/23 2Q | Ratio to sales | YoY |

Sales | 7,685 | 100.0% | 9,068 | 100.0% | +18.0% |

Gross Profit | 1,931 | 25.1% | 2,308 | 25.5% | +19.5% |

SG&A | 958 | 12.5% | 1,058 | 11.7% | +10.4% |

Operating Income | 973 | 12.7% | 1,249 | 13.8% | +28.4% |

Ordinary Income | 981 | 12.8% | 1,268 | 14.0% | +29.2% |

Net Income | 686 | 8.9% | 892 | 9.8% | +29.9% |

*Unit: million yen. Net income is quarterly net income attributable to shareholders of the parent company. Hereinafter the same will apply.

Sales and profit grew, both hitting a record high in the first half of the year

In the second quarter of the fiscal year ending June 2023, net sales grew 18.0% year on year to 9,068 million yen. The software development business, which is the company’s core business, grew, and the system sales business rebounded. Operating income increased 28.4% year on year to 1,249 million yen. Due to the sales growth, gross profit rose 19.5%, and gross profit margin increased 0.4 points, offsetting the augmentation of selling, general, and administrative expenses. Operating income margin increased 1.1 points, reaching a record high. Profitability continues to improve, and both sales and profit reached a record high in the first half of the year. Even on a quarterly basis, the sales in the second quarter reached a record high.

2-2 Trends by segment

| FY 6/22 2Q | Ratio to sales | FY 6/23 2Q | Ratio to sales | YoY |

Software Development Business | 7,393 | 96.2% | 8,742 | 96.4% | +18.3% |

System Sales Business | 292 | 3.8% | 325 | 3.6% | +11.2% |

Total sales | 7,685 | 100.0% | 9,068 | 100.0% | +18.0% |

Software Development Business | 945 | 12.8% | 1,203 | 13.8% | +27.3% |

System Sales Business | 27 | 9.4% | 46 | 14.3% | +69.4% |

Adjustment | 0 | - | 0 | - | - |

Total operating income | 973 | 12.7% | 1,249 | 13.8% | +28.4% |

*Unit: million yen. Sales mean sales to external clients. The composition ratio of operating income means the ratio of operating income to sales.

(Sales trends by business unit)

| FY 6/22 2Q | Ratio to sales | FY 6/23 2Q | Ratio to sales | YoY |

Business Solution Unit | 4,558 | 59.3% | 5,250 | 57.9% | +15.2% |

Business System | 2,701 | 35.1% | 2,965 | 32.7% | +9.8% |

Operation Support | 1,856 | 24.2% | 2,284 | 25.2% | +23.1% |

Embedded Solution Unit | 2,443 | 31.8% | 3,089 | 34.1% | +26.4% |

Embedded Product Development | 1,853 | 24.1% | 2,250 | 24.8% | +21.4% |

Embedded Product Verification | 589 | 7.7% | 839 | 9.3% | +42.4% |

Original Product Unit | 391 | 5.1% | 402 | 4.4% | +2.8% |

System Sales Unit | 292 | 3.8% | 325 | 3.6% | +11.3% |

Total sales | 7,685 | 100.0% | 9,068 | 100.0% | +18.0% |

*Unit: million yen. Composition ratio to total net sales.

◎Software Development Business

Both sales and profit increased.

*Business solution unit

Sales and profit have increased due to strong demand and the expansion of project sizes.

Although the performance of system development in the financial sector, the company's main market, remained flat due to a shift of personnel to more profitable areas, the company has successfully acquired projects in public administration, communications, manufacturing, and ERP (SAP) related fields. The company continues to focus on undertaking projects and has seen an increase in the number of projects and contract amounts.

However, profit growth was slight due to re-evaluation during the transition phase of a large pharmaceutical project.

In operational support, the volume and scope of work handled expanded as business reforms of major clients slowed down. Sales of 270 million yen from Simplism, which was acquired through M&A, also contributed to a significant increase in sales and profit. Simplism is already generating synergies in terms of the appropriate allocation of personnel to follow up on existing customers and to deploy resources for new customers.

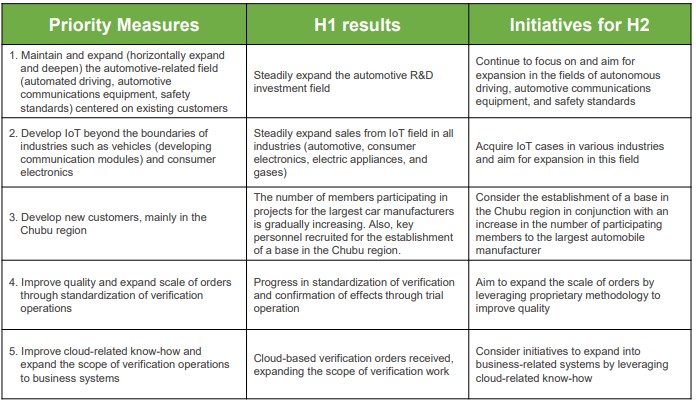

*Embedded solution unit

In the automotive and semiconductor-related business, investment in R&D of connected cars and automated driving expanded, resulting in a significant increase in sales and profit. Inter-company collaboration has also been successful, and orders for both embedded development and verification are increasing, leading to improved profitability.

While it is common for development and verification to be outsourced to other companies, the company employs an in-house company system, which enables appropriate verification because they are organizationally separate, and customers also benefit in terms of speed from the ability to respond seamlessly.

Embedded development has contributed to a significant increase in sales and profit due to the strong research and development investment in the automotive industry, as well as steady growth in IoT-related areas such as mobile and household appliances.

In the embedded verification business, sales of in-vehicle systems grew significantly. The company has seen a significant increase in sales and profit, thanks to the strong performance of the 5G, energy, and pharmaceutical industries.

*Original Product Unit

License sales from the subscription model have steadily increased, but xoBlos had only a single-digit increase in sales due to poor performance.

“WebARGUS”

Sales remained strong due to an increase in license sales. November 2022, the anti-ransomware version was released.

“xoBlos”

While horizontal expansion among existing customers remained strong, new customer acquisition was hindered due to delays in releasing the platform version linked with RPA. As a result, both sales and profit dropped year on year.

“Other”

The electronic contract service "DD-CONNECT" has seen an increase of orders, and have begun to contribute to sales and profit.

◎System Sales Business

Double-digit sales and profit growth.

The impact of the two-year special demand for services of coping with reduced tax rate has subsided, and the restrictions on face-to-face sales due to the pandemic have gradually eased, leading to a recovery trend.

The opening of a sales office in the Chubu region (Shizuoka) has also had an effect.

2-3 Financial condition and cash flow

◎Main BS

| End of June 2022 | End of December 2022 | Increase/Decrease |

| End of June 2022 | End of December 2022 | Increase/Decrease |

Current assets | 6,917 | 7,477 | +560 | Current liabilities | 1,960 | 2,041 | +80 |

Cash and deposits | 3,843 | 4,194 | +350 | Accounts payable | 592 | 628 | +36 |

Trade receivables | 2,841 | 2,980 | +139 | Fixed liabilities | 168 | 181 | +12 |

Noncurrent assets | 764 | 797 | +33 | Total labilities | 2,129 | 2,222 | +93 |

Tangible fixed assets | 144 | 147 | +3 | Net assets | 5,552 | 6,052 | +500 |

Investments and other assets | 409 | 460 | +51 | Retained earnings | 4,954 | 5,462 | +508 |

Total assets | 7,681 | 8,275 | +593 | Total liabilities, net assets | 7,681 | 8,275 | +593 |

*Unit: Million yen. Trrade receivables include contract asset.

Total assets increased by 593 million yen from the end of the previous period to 8,275 million yen, mainly due to an increase in cash and deposits. Total liabilities decreased 93 million yen to 2,222 million yen. Net assets increased 500 million yen YoY to 6,052 million yen due to an increase in retained earnings.

As a result, the equity ratio rose 0.8 percentage points from the end of the previous period to 73.1%.

◎Cash Flow

| FY 6/22 2Q | FY 6/23 2Q | Increase/Decrease |

Operating Cash Flow | 416 | 790 | +374 |

Investing Cash Flow | 189 | -41 | -231 |

Free Cash Flow | 605 | 748 | +143 |

Financing Cash Flow | -221 | -394 | -173 |

Cash, Equivalents | 3,713 | 4,183 | +470 |

*Unit: Million yen

Both operating CF and free CF expanded positive range, mainly due to an increase in income before income taxes and minority interests. Cash position increased.

3. Fiscal Year ending June 2023 Earnings Forecasts

3-1 Full-year earnings forecast

| FY 6/22 | Ratio to sales | FY 6/23 Est | Ratio to sales | YoY | Rate of progress |

Sales | 16,156 | 100.0% | 18,000 | 100.0% | +11.4% | 50.4% |

Operating Income | 2,004 | 12.4% | 2,250 | 12.5% | +12.2% | 55.5% |

Ordinary Income | 2,004 | 12.4% | 2,250 | 12.5% | +12.3% | 56.4% |

Net Income | 1,439 | 8.9% | 1,561 | 8.7% | +8.5% | 57.1% |

*Unit: Million yen. The estimated values are from the company.

Sales and profit are expected to grow for the 13th consecutive term

There is no change in the earnings forecast. The net sales for the year ending June 2023 are expected to be 18 billion yen, up 11.4% year on year, and operating income is expected to be 2.25 billion yen, up 12.2% year on year. All business segments will increase sales, with double-digit sales growth in the business solution and embedded solution businesses. Operating income margin is expected to rise 0.1 points to 12.5%, due to the expansion of contract projects and the increase in the proportion of in-house product business. The company expects to increase sales and profit for the 13th consecutive year. Depending on the trends in medical projects, there may be an impact on new project development due to personnel allocation, but the company plans to capture strong demand in the embedded solution business. The planned ordinary dividend is 36.00 yen per share, up 4.00 yen per share from the previous year's ordinary dividend of 32.00 yen per share. The expected dividend payout ratio is 35.4%.

3-2 Trend of each business unit.

(Trend of sales)

| FY 6/22 | Ratio to sales | FY 6/23 Est | Ratio to sales | YoY | Revision rate | Rate of progress |

Software Development Business | 15,562 | 96.3% | 17,400 | 96.7% | +11.8% | 0.0% | 50.2% |

Business Solution Unit | 9,553 | 59.1% | 10,520 | 58.4% | +10.1% | -3.5% | 49.9% |

Embedded Solution Unit | 5,164 | 32.0% | 6,000 | 33.3% | +16.2% | +9.1% | 51.5% |

Original Product Unit | 845 | 5.2% | 880 | 4.9% | +4.1% | -12.0% | 45.7% |

System Sales Unit | 593 | 3.7% | 600 | 3.3% | +1.2% | 0.0% | 54.2% |

Total | 16,156 | 100.0% | 18,000 | 100.0% | +11.4% | 0.0% | 50.4% |

*Unit: Million yen

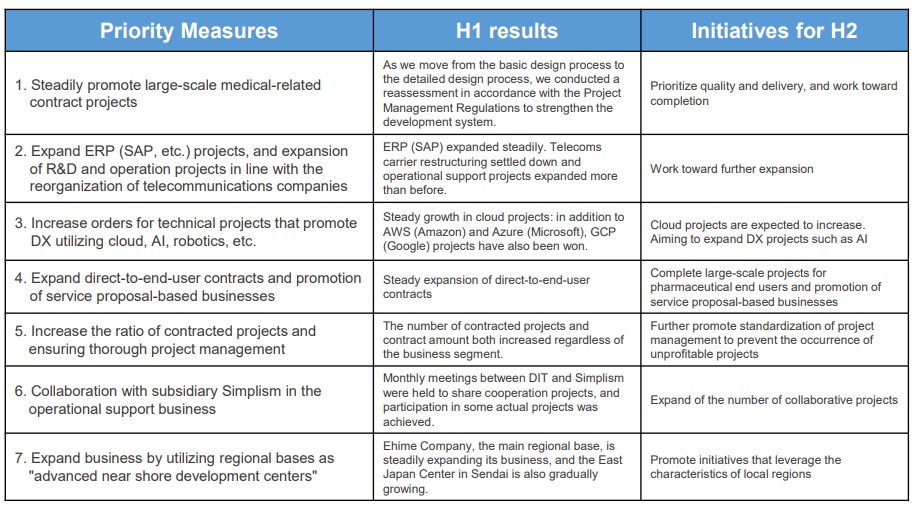

Some forecast values in each segment have been revised in consideration of current demand trends, with an upward revision for the embedded solution business and downward revisions for the business solution and in-house product businesses. The overall plan for the software development business remains unchanged.

◎Business Solution Unit

<Initiatives for the second half>

The sales in the first half of the year were almost as expected. Although the company is taking into account trends that require close monitoring, such as an increase in the number of personnel assigned to medical contracting projects, it will continue to strive to meet firm DX needs in the second half of the fiscal year.

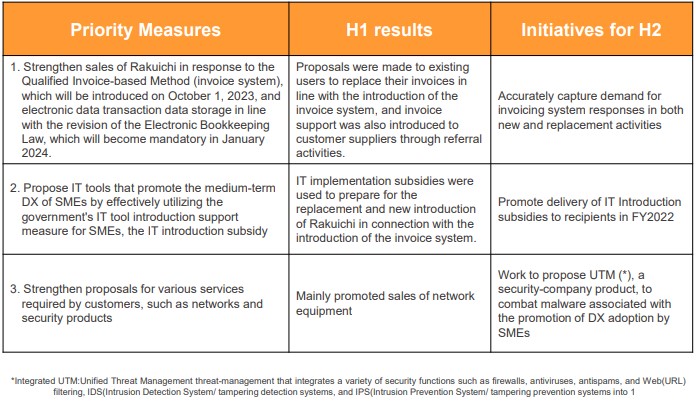

(Taken from the reference materials of Digital Information Technologies Corporation)

The largest medical contract project in the company's history involved re-confirming the requirements demanded by the other party when moving to the detailed design process, so the other party and the company jointly re-examined man-hours, personnel allocation, costs, etc. in order to achieve optimal development.

Although there has been a delay from the initial assumption, the company will focus on development, prioritizing quality and delivery, since this is an important project in terms of the future direction of the company.

◎Embedded Solution Unit

<Initiatives for the second half>

The willingness to conduct automotive-related investments is strong, and sales and profit have increased more than expected in the first half. Inter-company cooperation in development and verification has also contributed more than expected, so efforts will be continued to vigorously meet demand in the second half and the company expect substantial growth.

(Taken from the reference materials of Digital Information Technologies Corporation)

Regarding the standardization of embedded verification, the company is pursuing the increase in productivity by eliminating individual-based disparities by using automation tools and unifying the verification process for each industry and product. As mentioned above, the company will concentrate on receiving more orders for testing only.

◎Original Product Unit

<Initiatives for the second half>

Due to delays in new product launches for "xoBlos," etc., progress in the first half fell slightly short of expectations. Recently, inquiries related to DD-CONNECT and anti-ransomware versions have increased, so sales activities will be strengthened to steadily capture demand.

*WebARGUS

(Taken from the reference materials of Digital Information Technologies Corporation)

*xoBlos

(Taken from the reference materials of Digital Information Technologies Corporation)

*New products and digital transformation

(Taken from the reference materials of Digital Information Technologies Corporation)

◎System Sales Unit

<Initiatives for the second half>

Progress in the first half was roughly as expected and favorable. Efforts will be made to steadily meet increased demand due to changes in systems, such as the invoice system.

(Taken from the reference materials of Digital Information Technologies Corporation)

4. Conclusions

The company has emphasized the importance of interfacing with customers and has proceeded with projects based on agreements, which has effectively prevented large unprofitable projects from occurring. However, the medical project in this term grew significantly in scale, leading to the delay in its progress. The company plans to reflect on this as a lesson and use it as an opportunity for growth.

The company's earnings are expected to have some lost profit due to the delay of the large entrusted medical project. We would like to pay attention to their sales, profit, and profitability trend in the third quarter, including whether the robust embedded solutions business will be able to offset this loss or not, and whether the somewhat sluggish in-house product business will recover.

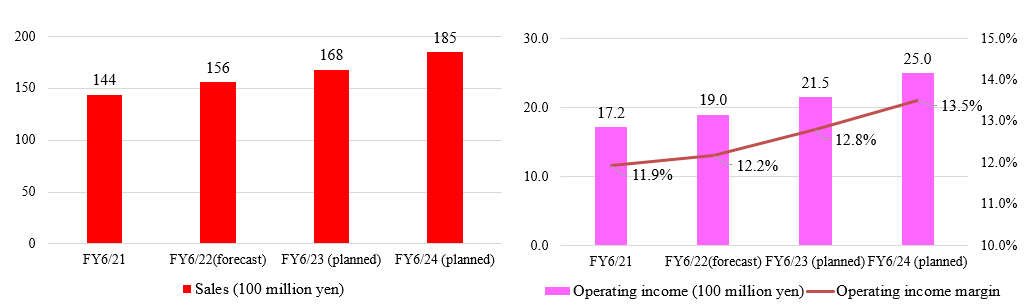

<Reference 1: Vision for 2030 and New Medium-term Management Plan>

In August 2021, the company announced its long-term vision, Vision for 2030, and the New Medium-Term Management Plan: Aiming to Become a Trusted and Chosen IT Brand.

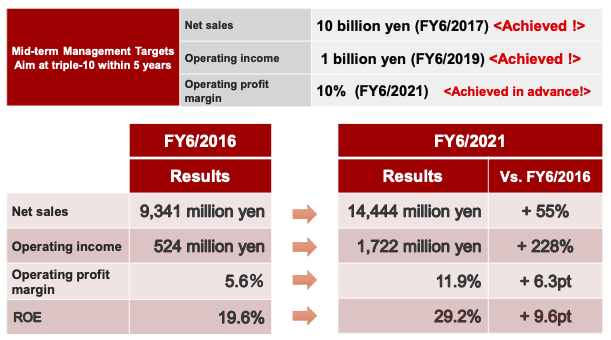

(1) Summary of the Previous Medium-term Management Goals (FY 6/2017 to FY 6/2021)

(Overview)

In alignment with the previous medium-term management plan, the company has been promoting its business while solidifying its business foundation through stable transactions in a wide range of existing business domains and pursuing growth by providing new value centered on its own products.

The goal was to achieve the “Triple 10,” sales of 10,000 million yen, an operating income of 1,000 million yen, and an operating income margin of 10% within five years. In the fiscal year ended June 2017, this was achieved in sales, in the fiscal year ended June 2019 in operating income, and in the fiscal year ended June 2020 in operating income margin, ahead of schedule. In the fiscal year ended June 2021, they were able to further increase each target.

(Taken from company data)

Sales have increased for 11 consecutive fiscal years, with an average growth rate (CAGR) of 8.6% over the past 10 years. The average growth rate for the five years up to the previous medium-term management target was 9.1%.

Operating income has increased for 11 consecutive fiscal years, with an average growth rate of 31.1% over the past 10 years. The five-year average growth rate up to the previous medium-term management target was 26.9%.

Operating income margin improved by 6.3 points over the five years of the previous mid-term management target, and ROE, as well, increased significantly.

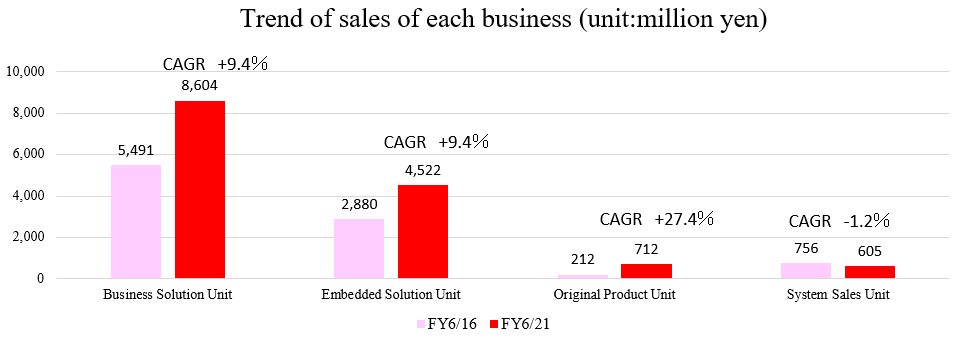

(Results in each business domain)

The business solution and embedded solution units, which are the mainstay of their business, both expanded steadily and contributed significantly to stable growth.

The company's original product unit, which is a growth factor, expanded its lineup of products and services.

The system sales business shifted resources to focused businesses in response to the decline in sales of the mainstay Rakuichi sales.

(Results)

The results of the previous medium-term management plan are as follows:

Continued to increase sales and profits through strategic initiatives | -Shifted resources to highly profitable businesses and domains by promoting the optimization of the business portfolio -Oriented toward business in high-profit areas close to end users -Strategically expanded high-profit businesses (in-vehicle, IoT, infrastructure construction, ERP, etc.) -Prevented failure of large projects through appropriate risk management |

Steady growth of the original product unit | -Strengthened the product competitiveness of WebARGUS, their cyber security product, and large-scale users commenced its operation -Expanded the security business domain under the DIT Security brand name -Strengthened the product competitiveness of xoBlos, a solution for improving business efficiency, and increased the number of customers to over 500 |

Steady performance despite the novel coronavirus crisis | -Focused on and expanded operations that were less affected by the novel coronavirus (operational support, social infrastructure, and public sector) -Received orders from customers affected by the novel coronavirus on a priority basis, ahead of other companies |

Profitability of near-shore bases | -Matsuyama (Ehime Company), a regional base, strengthened and turned profitable |

Decline of the system sales business | -In the middle of the fiscal year, there was an extraordinary demand as the government reduced tax rates for daily necessities, but the impact of the novel coronavirus was significant and the business shrank. Shifted resources to focused businesses. |

Strengthening of inter-sectoral cooperation | -Dealt with the expansion of the scale of entrusted projects through collaboration among group companies |

Increase of collaborating companies | -Increased collaborating companies in various fields, including Daiko Denshi Tsushin, Ltd. |

M&A unrealized | -The company was prepared, but no parties who would exert synergies were found |

Dividend policy | -Achieved the target of a dividend payout ratio of 30% or higher (30.8% for the fiscal year ended June 2021) |

Even among customers who cut their budgets due to the novel coronavirus crisis, the company's competence and quality were highly evaluated, and the company suffered less damage than its competitors.

Regarding M&A, the company intends to expand its human resources in operational support and embedded development.

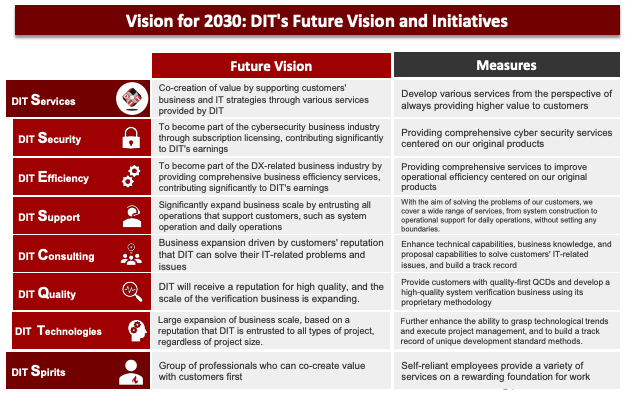

(2) DIT Group's Vision for 2030

DIT Group's vision for 2030 is to build a trusted and selected DIT brand.

To this end, as professionals, the company will provide a higher level of value in terms of services: safety and robustness, efficiency improvement, safe operation, problem-solving and proposal capabilities, high quality, and advanced technology.

(Taken from company data)

(Business environment)

With the full-scale arrival of the digital society, the DIT Group recognizes that it will enter an era of shakeout in which only the companies that can respond to changes such as the acceleration of DX, the shortage of IT human resources, threats to cyber security, and the increasing needs for societal issues such as the reformation of work styles will survive.

These changes that the IT industry is facing are an opportunity for the DIT Group that excels at responding to change, to make its presence known more than ever. The DIT Group will transform itself further to be even more responsive to changes, and focus on staying close to customers and increasing their value.

(Management goals)

The company has set Challenge 500, an endeavor to achieve sales of 50,000 million yen.

| FY 6/2021 | FY 6/2030 | |

Organic Growth | New Business, M&A, etc. | ||

Sales | 14,400 million yen | 30,000 million yen or more (+8.5%) | 50,000 million yen or more (+14.8%) |

Operating Income | 1,720 million yen | 4,000 million yen or more (+9.8%) | 5,000 million yen or more (+12.6%) |

*The CAGR is indicated within parentheses.

The company plans to increase the payout ratio to 35% or higher by the fiscal year ending June 2030.

(Steps to realize the vision)

The company will realize DIT Group's vision for 2030 through the following three steps.

FY 6/2022 to FY 6/2024 | Promotion of business structure reform | To build up business capabilities by promoting the creation of a company and structure that will enable the next stage of growth. |

FY 6/2025 to FY 6/2027 | Realization of growth track | To establish a business style and place the business as a whole on a growth track. |

FY 6/2028 to FY 6/2030 | Establishment of the DIT brand | To establish a DIT brand that is trusted and selected by all stakeholders. |

(Medium to long-term growth model)

The company will further strengthen its business promotion based on two major activities that has supported corporate growth to date.

In terms of the business base, they will further expand and stabilize it by continuously investing management resources in areas with growth potential and further expanding the business domain through comprehensive capability.

In terms of growth factors, they will provide new value and services through business expansion based on original products, expansion of business domains through the application of new technologies, and the expansion of new service-type businesses through collaboration and co-creation.

(SDGs: Contributing to the realization of a sustainable society)

They will strive to contribute to a sustainable society through appropriate corporate management and the introduction of their original products to customers etc.

In terms of corporate management, they will contribute to a sustainable society through appropriately prioritizing the enhancement of employee benefits, promoting diversity by appointing women to managerial positions, updating governance style, etc.

As for contributions via the introduction of original products, they will contribute to the establishment of a safe and secure Internet society and the improvement of social productivity through the introduction of their security product (WebARGUS) and products related to the reformation of work styles (xoBlos, DD-CONNECT).

(3) New Medium-term Management Plan (FY 6/2022 to FY 6/2024)

(Basic strategies)

The company will promote the three basic strategies: (1) Strengthening the management base: building structure and environment, (2) Core business: strengthening on-site capabilities, and (3) Product business: strengthening product competitiveness, aiming to build a company that can achieve long-term growth toward 2030.

(Outline of each basic strategy)

① Strengthening the Management Base

The company will promote the reinforcement of the corporate structure, improvement of the working environment, and strengthening of human resources as priority measures to strengthen the management base.

In so doing, they will achieve further improvement in profitability by supporting the business strategy of strengthening on-site capabilities and product competitiveness, to create a healthier cycle for strong growth as a company.

*Basic policies:

1 | Standardization of various methods, development and utilization of IPs, and appropriate allocation of human resources to strengthen on-site capabilities. |

2 | Enhancement of the ability to respond to changes in the market and technology promptly. |

3 | Constant optimization of the business portfolio. |