Bridge Report:(3916)Digital Information Technologies the Fiscal Year Ended June 2025

President Satoshi Ichikawa | Digital Information Technologies Corporation (3916) |

|

Company Information

Exchange | TSE Prime Market |

Industry | Information and Communications |

President | Satoshi Ichikawa |

HQ Address | FORECAST Sakurabashi, 4-5-4 Hatchobori, Chuo-ku, Tokyo |

Year-end | End of June |

Homepage |

Stock Information

Share Price | Number of shares issued | Total Market Cap | ROE (Actual) | Trading Unit | |

¥2,451 | 15,501,820 shares | ¥37,994 million | 29.0% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Times) |

¥75.00 | 3.1% | ¥149.55 | 16.4 x | ¥548.77 | 4.5 x |

*The share price is the closing price on October 14. The figures were taken from the brief report on financial results in the fiscal year ended June 2025.

Consolidated Earnings

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (yen) | DPS (yen) |

Jun. 2022 (Actual) | 16,156 | 2,004 | 2,004 | 1,439 | 94.38 | 40.00 |

Jun. 2023 (Actual) | 18,149 | 2,039 | 2.059 | 1,447 | 95.18 | 36.00 |

Jun. 2024 (Actual) | 19,888 | 2,424 | 2,409 | 1,686 | 112.83 | 46.00 |

Jun. 2025 (Actual) | 24,159 | 3,013 | 3,027 | 2,178 | 147.38 | 72.00 |

Jun. 2026 (Forecast) | 26,000 | 3,050 | 3,050 | 2,200 | 149.55 | 75.00 |

*Unit: million yen. The forecast is from the company. Net income is net income attributable to shareholders of the parent company. Hereinafter the same will apply. Dividends for fiscal year ended June 2022 include a commemorative dividend of 8.00 yen/share.

This Bridge Report introduces the earnings results for the fiscal year ended June 2025, the earnings forecasts for the fiscal year ending June 2026, and other information of Digital Information Technologies Corporation.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended June 2025 Earnings Results

3. Fiscal Year Ending June 2026 Earnings Forecasts

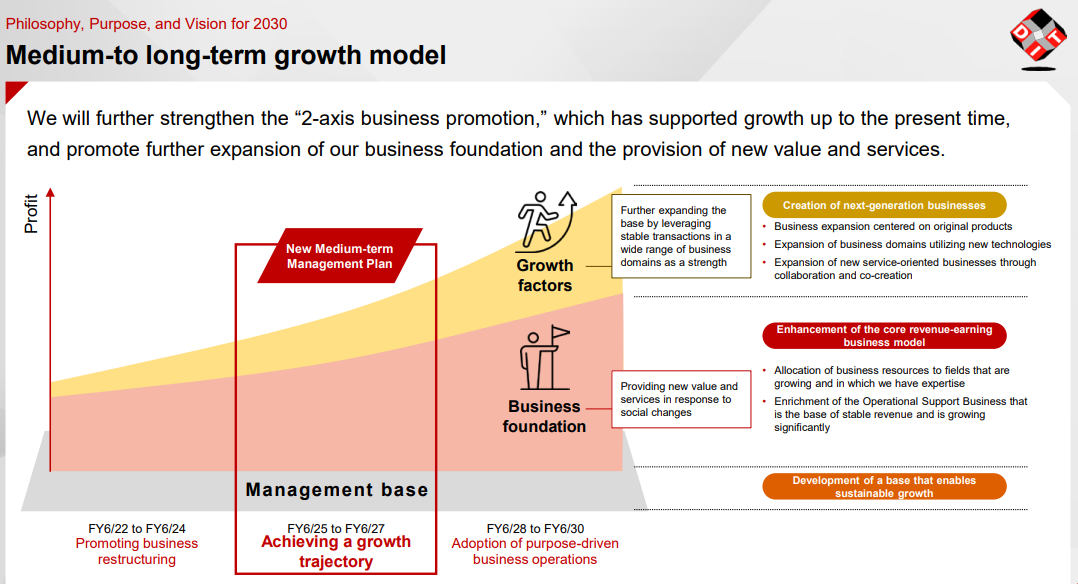

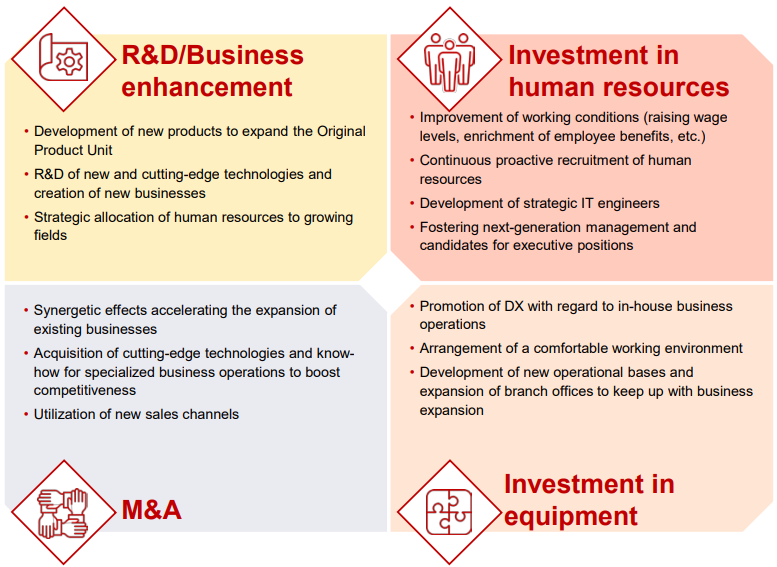

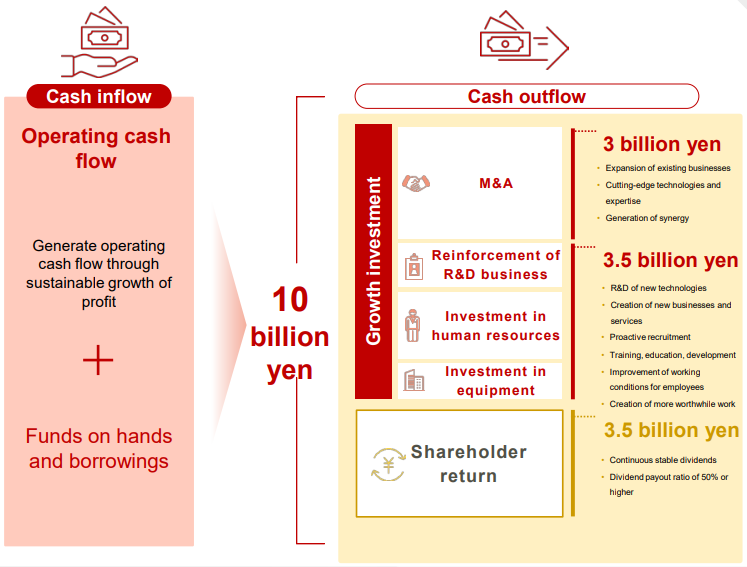

4. Regarding the Vision for 2030 and the Medium-term Management Plan

5. Message from President Ichikawa

6. Conclusions

<Reference 1: Vision for 2030>

<Reference 2: New Medium-term Management Plan>

<Reference 3: Regarding Corporate Governance>

Key Points

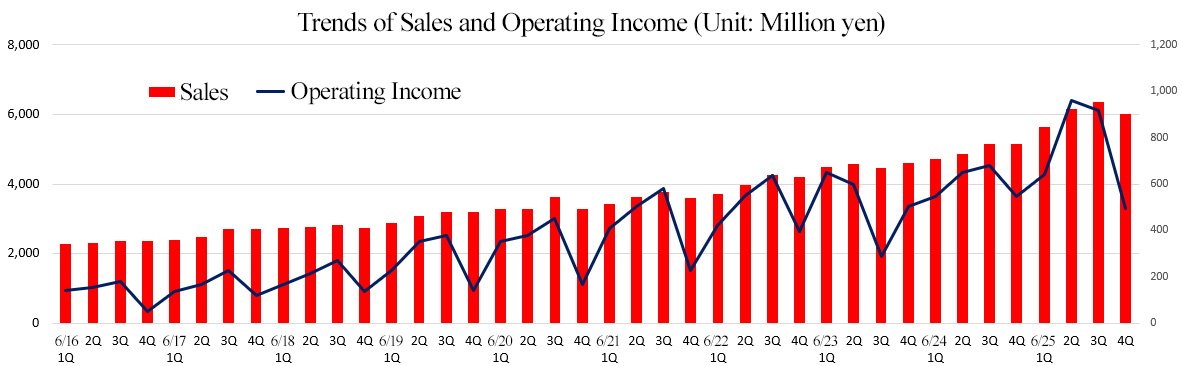

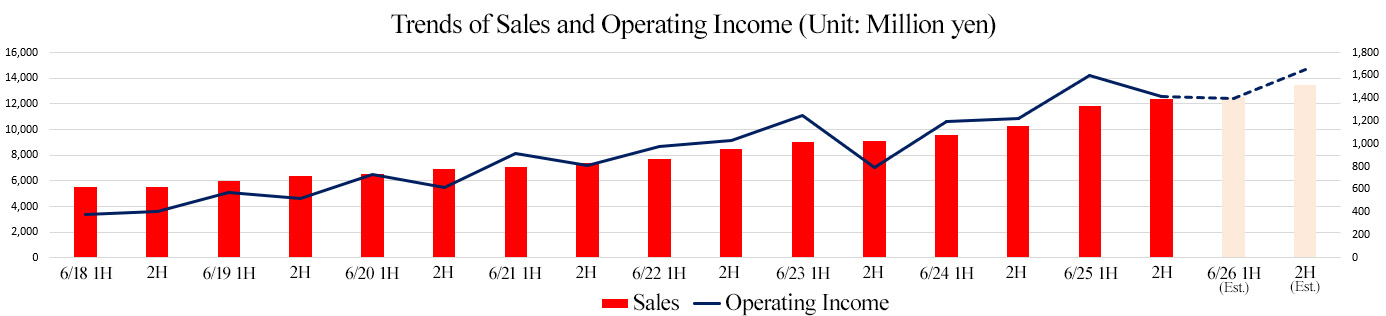

- In the fiscal year ended June 2025, sales rose 21.5% year on year to 24,159 million yen. The sales of the Software Development Business and the System Sales Business grew by double digits. As the subsidiary acquired through M&A contributed, the sales of the Product Solutions Unit increased over two times. Operating income rose 24.3% year on year to 3,013 billion yen. Thanks to the sales growth, gross profit grew 24.3% year on year. As they dealt with unprofitable projects in the fiscal year before last, the average revenue per project increased, and the sales of in-house products grew, gross profit margin increased 0.5 points year on year. The expenses for improving the salaries of employees, goodwill amortization through M&A, etc. augmented in parallel with the expansion of their business scale, but this augmentation was offset, and profit increased by double digits. Both sales and profit grew for 15 consecutive fiscal years, hitting a record high and exceeding the upwardly revised forecast.

- For the fiscal year ending June 2026, it is projected that sales will grow and profit will slightly increase, achieving a year-on-year growth in sales and profit for 16 consecutive fiscal years. Sales are expected to rise 7.6% year on year to 26 billion yen, while operating income is forecast to grow 1.2% year on year to 3,050 million yen. Enterprises’ willingness to invest in IT is expected to remain strong this fiscal year, but the U.S. tariff policy forced some automobile-related enterprises, which are main clients of the company, to adjust their budgets, so the outlook is conservative. Profit is projected to rise slightly as they will conduct upfront investment, although gross profit is expected to grow to some degree thanks to the improvement in average spending per client and in-house solutions. For the first half of FY 6/2026, profit is forecast to decline year on year and from the second half of FY 6/2025, as there will be no longer the sale of software for producing New Year’s cards and one-time public high-budget projects posted in the first half of FY 6/2025, but profit is expected to recover from the second half of FY 6/2026. They plan to pay a dividend of 75.00 yen/share, up 3.00 yen/share from the previous fiscal year. The expected payout ratio is 50.5%.

- We asked President Ichikawa to give a message toward shareholders and investors. He said, “Some automobile-related companies, which are our major clients, now need to adjust their budgets because of the tariff policy enacted by the U.S. government, and the business environment around our company is not favorable; however, even when the environment is not ideal, it is necessary to make investment with determination in order to pursue medium- and long-term growth. While we plan to invest 300 million yen in generative AI, IoT security, and human capital this fiscal year, so profit will increase only at a single-digit rate, we intend to fulfill your expectations by recouping the invested money as quickly as possible and getting our growth back on track in the next fiscal year and subsequent years. We would sincerely appreciate your continued support and understanding.”

- This fiscal year, they will invest 300 million yen in generative AI, IoT security, and human capital. In order to pursue growth, they will continue investment in the next and following fiscal years, and strive to recoup the investment as soon as possible by producing results. Over the past few years, the company has actively carried out M&A, and by strengthening human resources and enriching the lineup of products and services, they were able to earn significant sales and profit in FY 6/2025. Going forward, they will consider M&A in the embedded solution field.

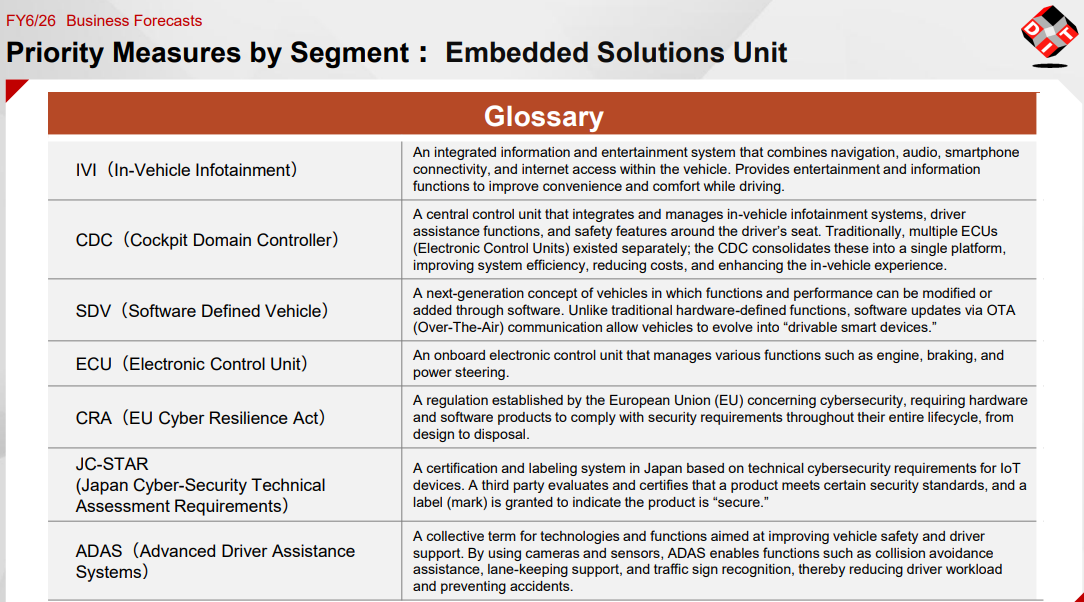

- The outlook for the trend of budgets of automobile-related enterprises, which are major clients of the company, remains uncertain, but for survival, they cannot reduce investment in in-vehicle infotainment (IVI), an information and entertainment system that integrates a navigation system, audio devices, smartphone linkage, access to the Internet, etc., a cockpit domain controller (CDC), a central control unit for integrating and managing an infotainment system around the driver’s seat of a vehicle, driving-support and safety functions, and so on, software defined vehicles (SDVs), which are next-generation vehicles for which functions and performance can be modified or added with software after purchase, etc. The expectations toward DIT seem to remain significant. We would like to pay attention to the progress of the medium-term management plan, while monitoring the performance in FY 6/2026 in the short term.

1. Company Overview

Digital Information Technologies Corporation is an independent information service company. Its sales are mostly from the undertaking of the development of business systems, embedded devices, etc. for clients mainly in the fields of finance, communications, etc. The company concentrates on the expansion of its products based on its original technologies, including "WebARGUS," a website security solution, and "xoBlos," an Excel work innovation platform. The company has a variety of characteristics, such as "multifaceted, diverse information technologies" and "organizational strategies of partial and total optimizations."

1-1 Corporate History

The late Norikazu Ichikawa (former Director and Chairperson), who obtained programming qualifications while he was working at Nippon Telegraph and Telephone Public Corporation, discovered a new world of computers and was attracted to its future potential. He awakened his spirit of challenge, decided to leave the company, and become independent.

In 1996, he was appointed president of Toyo Computer System, Inc. as the successor to one of his acquaintances. He expanded its business area starting from business system development, and then computer sales business (current: system sales business), embedded product development validation business and operation support businesses turning Toyo Computer System Inc. into a multifaceted and diverse IT company. In 2002, he established Toyo IT Holdings Corporation, which is the predecessor of current Digital Information Technologies Corporation, by separating several companies under the same group and establishing subsidiaries with 100% ownership. In 2006, he integrated four subsidiaries into one company and renamed it to the current company name. In addition, in January 2011, he established DIT America, LLC in Kansas, U.S.A. Digital Information Technologies Corporation was listed on JASDAQ of Tokyo Stock Exchange (TSE) in June 2015, listed on the second section of TSE in May 2016 and listed on the first section of TSE in March 2017. In July 2018, Mr. Satoshi Ichikawa, who used to be Representative Director and Senior Managing Officer, took up the office of Representative Director and President to rejuvenate the management structure under the business environment where change is accelerating and make a system to enable prompt decision-making.

In April 2022, the company was listed on the Prime Market of TSE, through the restructuring of the stock market.

1-2 Corporate Philosophy, etc.

|

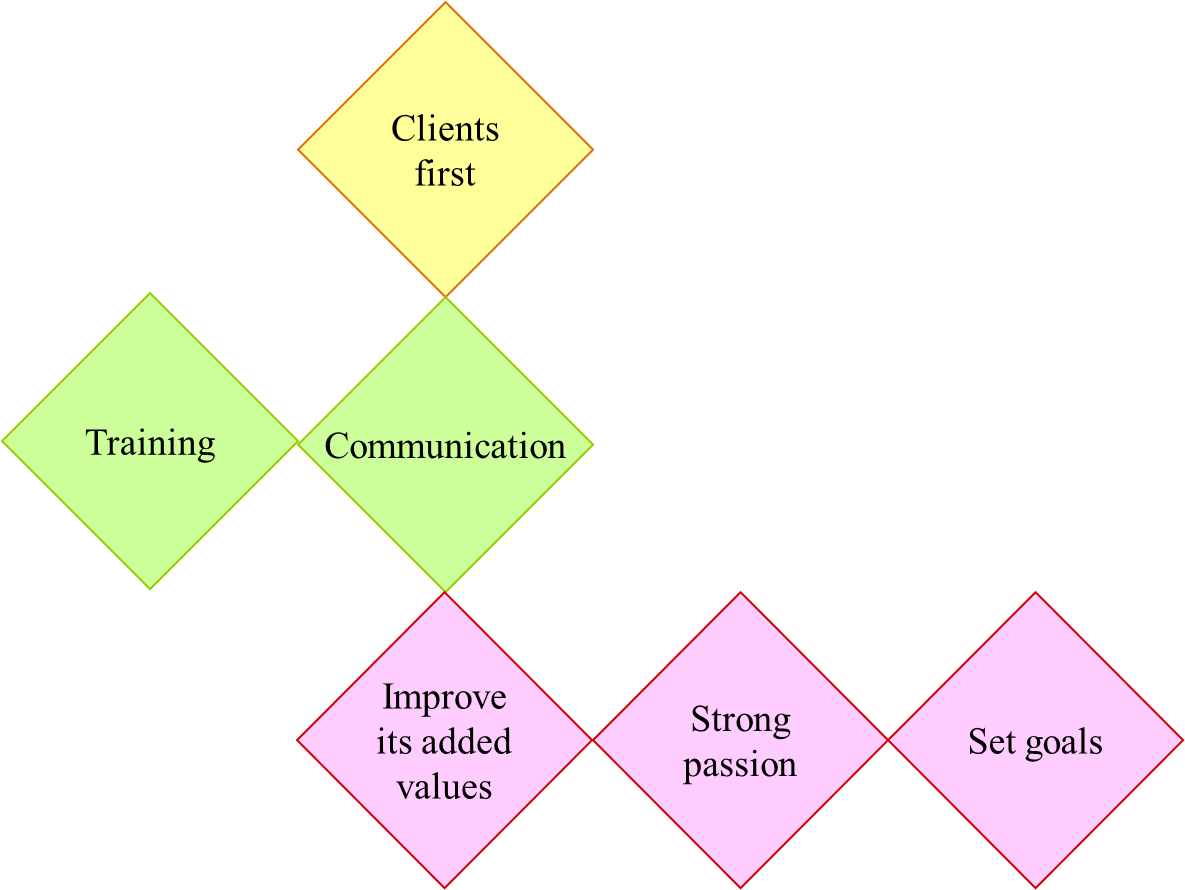

Our logo is a collection of cubes with an infinite number of stairs. This collection is our company itself, and each cube represents each employee. The 6 facets of the cubes represent six values which all employees share and consider valuable. Our corporate identity represents these values in three tiers; clients, company and employees. |

(From the company's website)

(From the company's website)

The above diagram is the unfoldment of the cube. According to the president Ichikawa, it emphasizes “clients first; this is where it all starts." Furthermore, the logo represents “training employees” and “communication with clients and among employees.” These are important values to the company. Additionally, we implore employees to “improve its added values,” “have passion” and “have a sense of purpose.”

Employees are to uphold this company policy as their creed and follow these principles at all times.

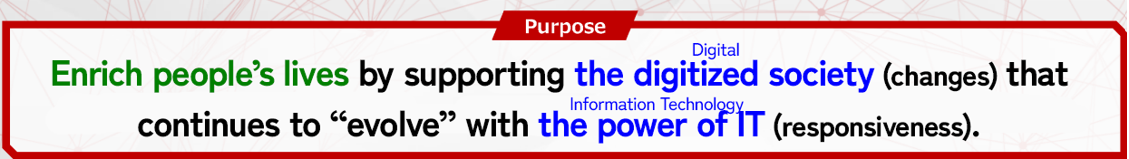

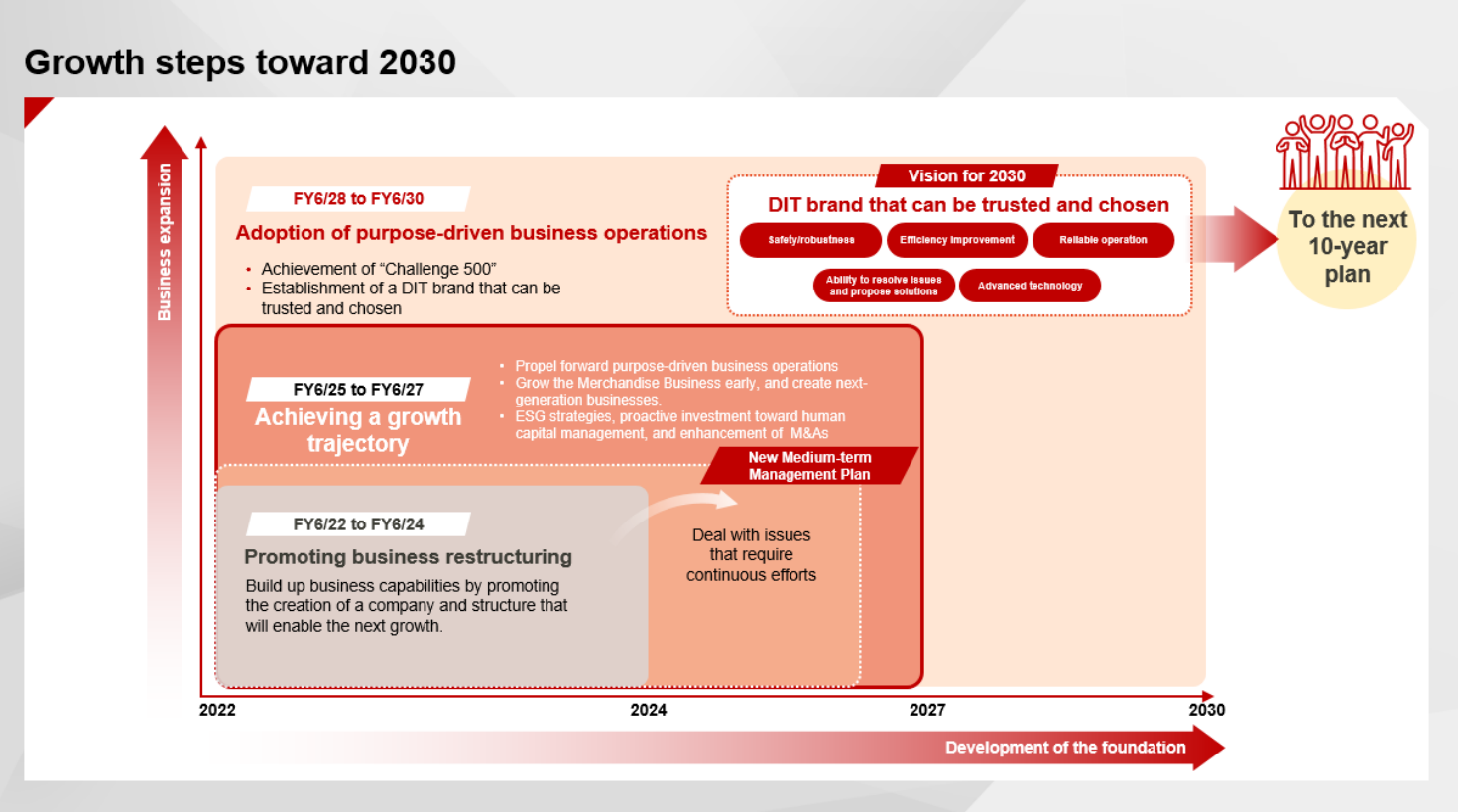

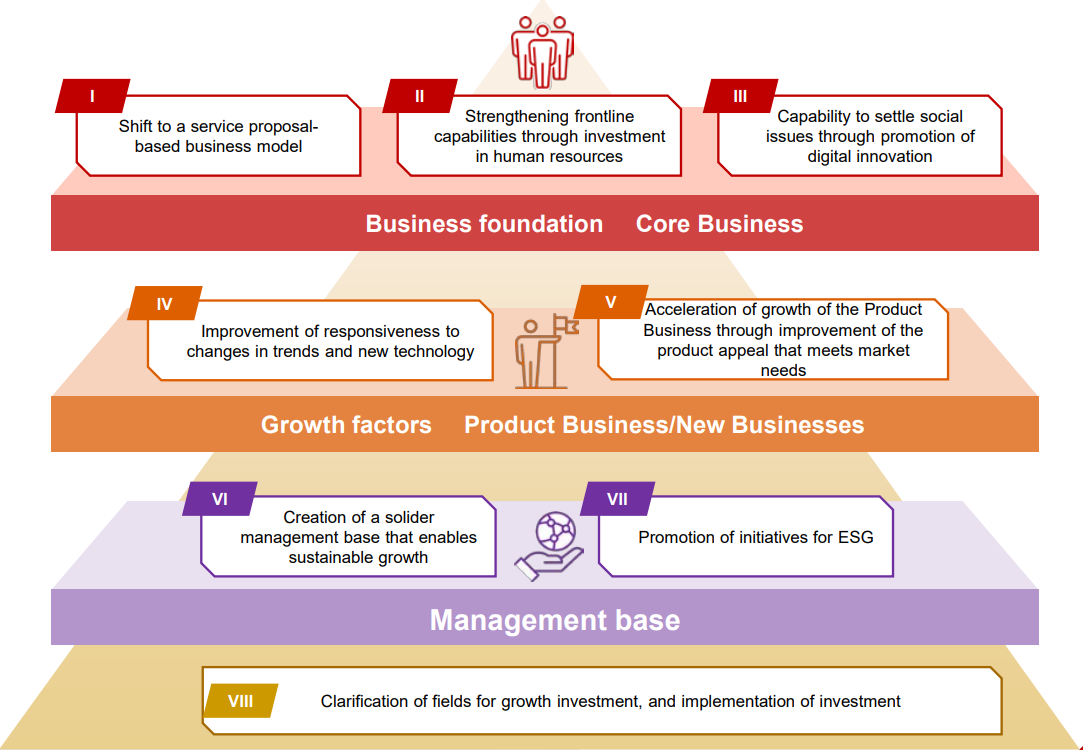

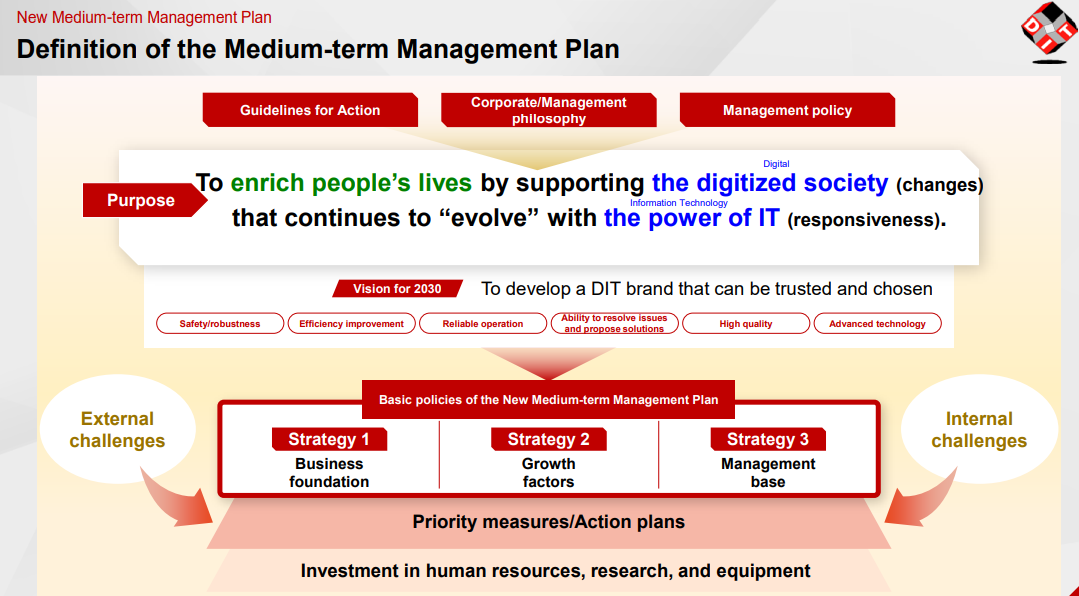

In August 2024, they set a new “purpose,” which indicates the linkage between corporate ethos and the meanings of existence, when formulating a new medium-term management plan.

(Taken from the reference materials of Digital Information Technologies Corporation)

Recognizing the risk that the company will be left behind the times soon unless they take measures in response to changes in the world, they consider that it is not good to maintain the status quo and defined “responsiveness” as taking on challenges constantly, while positioning it as an important concept.

They believe that their company’s mission is to contribute to society by offering value tailored to changes in the times and achieving continuous growth and enrich the lives of various stakeholders.

1-3 Market environment

The outlines of the market environment and growth potential of each business unit of the company mentioned in Section 1-4 “Business Description” are as follows.

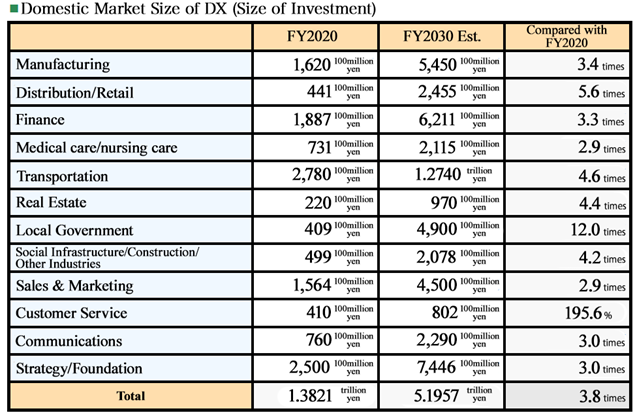

(1) Business Solutions Unit

IT solutions that contribute to labor elimination and operational efficiency improvement, especially DX, are becoming increasingly important issues for companies, and according to a survey by Fuji Chimera Research Institute, Inc., active investment is being made in DX in every industry. The domestic DX market in 2030 is expected to expand to 5.2 trillion yen, 3.8 times the amount in fiscal year 2020.

(Source: Fuji Chimera Research Institute Inc. "The Future Prospects for Digital Transformation Market in 2022- Market Edition/Vendor Strategy Edition")

*This material was provided by Digital Information Technologies Corporation and published by Investment Bridge Co., Ltd.

(2) Embedded Solutions Unit

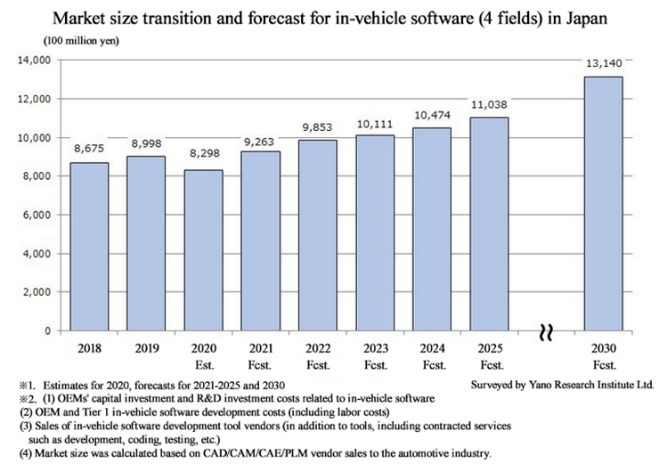

According to the Yano Research Institute Ltd., the market for domestic in-vehicle software continued to expand until 2019, but new car sales decreased in 2020 due to COVID-19. However, after that, capital investment and R&D investment, especially for CASE (Connected, Autonomous/Automated, Shared & Service, and Electric), are expected to continue to expand, and this growth is expected to continue at an upward trend until 2030. The in-vehicle software (in the four fields) market is predicted to reach 1,103.8 billion yen in 2025 and 1,314 billion yen in 2030.

(Source "In-Vehicle Software Market Research 2020," Yano Research Institute Ltd.)

*This material was provided by Digital Information Technologies Corporation and published by Investment Bridge Co., Ltd.

(3) Product Solutions Unit (former Original Product Unit)

① Market of information security products

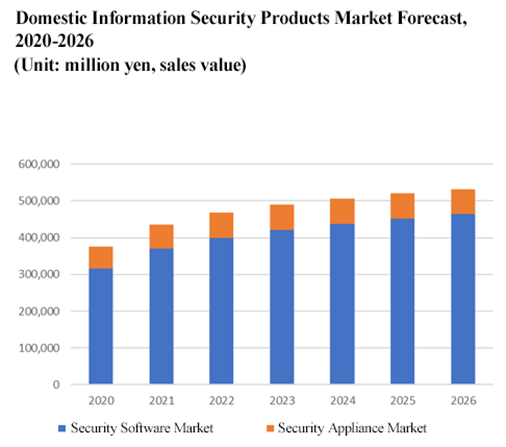

Due to the spread of COVID-19, corporate work styles have shifted from office work to remote working, and activities in the digital space have increased, resulting in the increase of security risks such as phishing attacks, malware infections, security breaches of corporate systems, and unauthorized ID use. International Data Corporation Japan, which specializes in IT research, estimates that the domestic security software market in 2021 was 370.3 billion yen (based on sales), up 17.2% from the previous fiscal year, and is expected to expand to 463.7 billion yen by 2026.

(Source "Latest Domestic Information Security Market Forecast, May 2022," IDC Japan K.K.)

*This material was provided by Digital Information Technologies Corporation and published by Investment Bridge Co., Ltd.

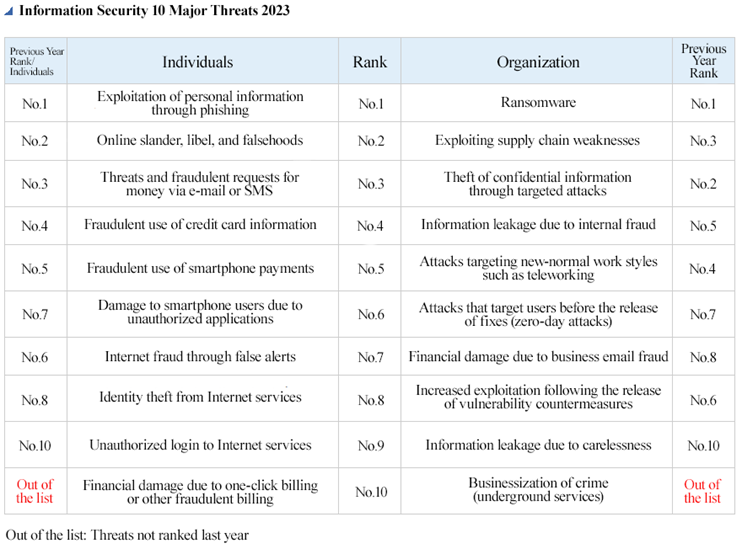

Additionally, as cybersecurity risks increase, damage caused by ransomware is rapidly rising.

Ransomware, a word coined by combining Ransom and Software, is malware that infects a computer with a virus and makes it unusable by locking it or encrypting its files and then demands a ransom in exchange for restoring the computer.

Every year, the Information-technology Promotion Agency, Japan (IPA) selects threat candidates from information security incidents that occurred in the previous year and are considered to have had a large impact on society and forms the “Top 10 Threats Selection Committee,” consisting of approximately 200 members including information security field researchers and business executives, which deliberates and votes on threat candidates, and then determines and announces the “Top 10 Information Security Threats.” In the “Top 10 Information Security Threats 2023,” based on the threats that occurred in 2022, “damage caused by ransomware” was ranked first in the organizational field for the third consecutive year from 2021. Thus, it is a major threat to society.

(From the website of the Information-technology Promotion Agency, Japan (IPA))

② Market of products for streamlining business operations

RPA (Robotic Process Automation), which is a system for supporting the significant streamlining of business operations, is attracting attention.

RPA means the automation of processes using robots. By using technologies, such as artificial intelligence (AI) and machine learning, in which AI learns things through repetition, white-collar tasks, especially back-office ones, are handled. Just by registering procedures of human tasks on an operation screen, it is possible for them to handle the tasks using various apps, including software, browsers, and cloud.

It is expected to spread rapidly, as one mean for reforming the ways of working, which is an issue to be overcome by Japanese enterprises.

According to “Survey on the trend of utilization of RPA in Japan in 2024” conducted by MM Research Institute, Ltd. (as of March 2024), 15% of SMEs with annual sales of less than 5 billion yen adopted RPA. This percentage is up 3 points from the previous year. The ratio of such SMEs has been increasing, and 23% of enterprises are making preparations or thinking of adopting RPA. Accordingly, it is expected that “the growth will continue.”

Among medium-sized and leading enterprises with annual sales of 5 billion yen or over, 44% adopted RPA. This percentage is down 1 point from the previous survey, showing sluggish growth. Since it exceeded 40% in FY 2021, it has been flat. The ratio of enterprises that are thinking of adopting RPA was 18%, showing no significant change, but over half of medium-sized and leading enterprises are trying to actualize company-wide automation by utilizing all kinds of tools, including RPA. As part of such efforts, some enterprises that have adopted RPA are combining generative AI and RPA to automate a wider range of operations. The ratio of enterprises that started utilizing RPA on a full-scale basis is still as low as 10%, but 21% of enterprises have conducted tentative operation or partially started RPA, and 53% are making preparations or having discussions on RPA. Accordingly, there are significant expectations.

Like this, RPA has been adopted by all sorts of enterprises, including SMEs, and it is expected that the scope of application will expand when combined with generative AI.

1-4 Business Description

1. Segments

There are two segments: software development business and system sales business. The software development business consists of 3 business units: Business Solutions Unit, Embedded Solutions Unit and the Product Solutions Unit (former Original Product Unit).

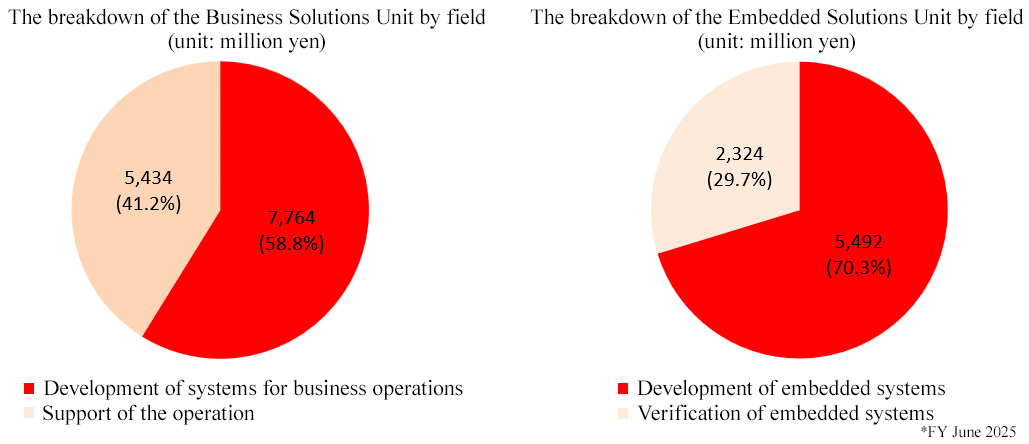

The Business Solutions Unit develops systems for business operations and supports the operation of such systems, while the Embedded Solutions Unit develops and inspects embedded systems.

|

|

(1) Software Development Business

① Business Solutions Unit

(Business system development unit)

The sales for this business unit is mostly from custom development for end-users and information systems companies which are clients’ subsidiaries in a wide variety of industries including finance, medicine/pharmacy, communications, distribution and transportation as well as for leading SI vendors.

Specifically, development for websites and key systems, front and back office operations, new system development and maintenance development with technologies developed in each area. The company has developed trustworthy relationships with leading companies in each area which enables them to secure stable orders.

(Operation support unit)

Main clients include communications carriers, total human service corporations and information system companies which are airlines subsidiaries.

This “business unit to support clients’ daily operations through IT” has stable revenue as it is an ongoing business in line with the business website domains of leading companies.

Specific business includes:

*Support desk operation for end-users who use various business systems.

*Build and maintain infrastructure (servers and networks).

*Efficient system operations in line with the latest technology trends.

② Embedded Solutions Unit

(Embedded product development unit)

This business unit is trusted by leading manufacturers to directly develop custom software for in-vehicle devices, mobile devices, information home appliances and communication devices.

For in-vehicle devices, mobile devices and information home appliances, the unit develops custom software for overall systems including firmware, device business unit controls and applications.

It focuses on Auto-Drive related field with new technology, as well as infotainment for in-vehicle devices as the demand for this market is expected to grow. In addition, it undertakes software development for wireless base stations and communication module devices for communication devices.

(Embedded product verification unit)

This business unit verifies and makes suggestions to improve qualities and functions of products through its verification service.

It provides verification services domestically and internationally (North America, Asia, Europe, etc.) including laboratory tests using specialized devices to verify product operation and function, field tests to verify products in the actual environments, as well as overall system tests conducted as the final quality verification from the perspectives of the third party.

Some of the overseas field tests are designated to its subsidiary, DIT America, LLC, which provides fast service with verification of product usability from the perspective of local staff.

The range of products for verification includes in-vehicle devices, medical devices, communication devices and mobiles.

③ Product Solutions Unit (former Original Product Unit)

As a growth field, the business develops and sells products with unique technologies. It also handles products with high social needs through its alliances.

Currently, the company strongly focuses on the sales of two products, “WebARGUS,” a system security solution, which detects tampered website simultaneously as it occurs and instantly restores the original normal condition, “xoBlos,” an Excel work innovation platform, which features data decomposition and restoration as well as meeting various forms of data business processing needs, “DD-CONNECT,” electronic contract outsourcing service, etc.

There are other products such as “APMG (Anti Phishing Mail Gateway),” a solution to prevent damages from phishing and illegal use of brands by automatically adding electronic signatures on e-mails, and “Shield CMS” a CMS (content management system), which enables editing and updating websites easily.

The business title was renamed the “Product Solutions Unit” in the first quarter of the fiscal year ending June 2025, in response to the growth of the Original Product Unit (increase of SI transactions linked to original products and services) and the addition of a subsidiary.

(2) System Sales Business

The company and its subsidiary, DIT Marketing Service Co., Ltd., sell “Rakuichi,” a business support mission-critical system, for small and medium enterprises, manufactured by Casio Computer Co., Ltd.

The sales area is started at Kanagawa first and expanded to Tokyo, Chiba, Gunma, Ehime, and Shizuoka successively. The Company provides substantial support for their users to increase the client retention rate. In addition, they set up a call center to attract and build a new client base. The number of sales for “Rakuichi” has been recorded to be the highest across all agencies for 20 consecutive years.

2. Main Strategic Products

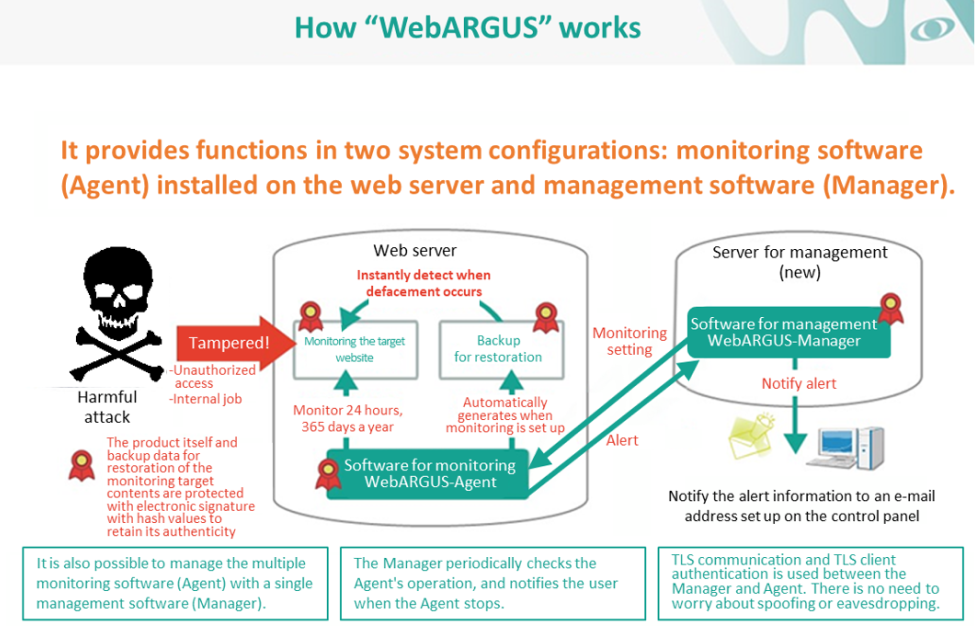

(1) "WebARGUS," a server security solution

WebARGUS is a new security solution which detects tampered system instantaneously and immediately restores it to its original state. By detecting and restoring immediately when incident occurs, WebARGUS protects various corporate servers from damage caused by malicious and unknown cyber-attacks and simultaneously prevents the escalation of the damage from viruses spreading via the tampered server.

(Taken from the reference materials of Digital Information Technologies Corporation)

◎ Increasing tampering of websites

According to the incident report published by “JPCERT Coordination Center (*)”, about 100 cases are reported every month, and websites including the ones of government agencies are constantly exposed to threats, whether the case is major or minor.

“JPCERT Coordination Center” (*): This center receives reports concerning computer security incidents including hacking via internet and service disturbance in Japan. It also supports measures, grasps how the problems are generated, analyzes the methods, investigates and advises on measures to prevent recurrences from a technical point of view.

◎ The background of the development of "WebARGUS"

Under these circumstances, the company, which had already released a solution called “APMG” to prevent damage from phishing and illegal use of brand by automatically adding electronic signature in e-mails, started developing “WebARGUS,” based on a core security technology in the spring of 2013, after 2 years of research. Then in July 2014, it released “WebARGUS.”

The major characteristic and strength of the company is that it has a variety of rich IT related technologies and has a highly standardized core security technology. This is because its engineers have a mindset to embrace challenges and are not afraid to take risks. Thus, they are not satisfied with just developing custom products. This is strongly influenced by the company’s organization strategy represented by its corporate culture and in-house company system which will be explained later in this report.

◎ The features and overview of the product

Instant detection and restoration for minimizing tampered system to nearly zero |

Provide protection from tampering by a fake identity posing as a registered member, internal attack and new methods which can be difficult to protect from. |

It detects with high accuracy and uses “electronic signature” technology which protects from even 1 bit of tampering. |

Protects from high level attacks aimed at applications and settings files. |

The CPU load (usage rate) on a server is less than 1% while it is monitoring on a regular mode. |

Equipped with preservation of evidence function which stores the tampered files as evidence. |

When a website has been tampered with, it can take an average of one month to restore. This is because the restoration process includes disabling the website, identifying the damaged files, strengthening protection, website restoration and re-enabling the website. For an e-commerce related website, the damage can be serious, including a drop-in sales, time and effort to announce the re-enabling of the website and the difficulties in re-attracting clients who left the website.

On the other hand, if “WebARGUS” is installed, because it instantly detects and restores websites when tampered with, the condition of a system can be maintained in the normal state. Thus, the website does not need to be disabled in a rush when the application detects a threat. Companies can concentrate on pursuing the cause and strengthening protection while its website is kept open to public.

Most of the detection software detects tampered website with a periodic monitoring on pre-configured, specified timing or intervals. With this method, there will be a time lag between when the website is tampered with and when it was detected, so it is inevitable for the website to be tampered. In addition, if the interval is shortened to reduce the time lag, there are other challenges such as increasing CPU load.

On the other hand, when some kind of event occurs (such as data deletion or addition excluding browsing), “WebARGUS” conducts real time scanning to detect the event. Therefore, such problems do not occur.

The major feature of this product is that it is also equipped with an instant restoring function which enables restoration to the original state in less than 0.1 seconds after the detection (average time under the demo environment: 0.03 seconds per file). This instant restoration is its unique technology.

The annual license fee of “WebARGUS” is JPY528,000 (incl. tax) per OS with support.

This also includes free update modules for minor version updates.

◎ Introduction and sales

When WebARGUS was released, the sales growth was rather slow because general understanding of website security was mainly about protection against hacking into a computer system and awareness about “tampering” was limited. However, the acknowledgment that “software for detection is needed as well as for protection” is growing rapidly due to the more frequent mentioning of the independent administrative agency, “IPA (Information Processing Association),” taking measures to prevent defacement. This agency is established to support the IT national strategy from a technical and personnel aspect perspective and is supervised by the Ministry of Economy, Trade and Industry.

In addition, the Ministry of Economy, Trade and Industry added "establishing mechanisms to respond to cybersecurity risks related to 'detection of attacks' and 'recovery'" as new important items in the revised points of the "Cybersecurity Management Guidelines" announced on November 16, 2017. Furthermore, there is a strong demand for stable operation of servers that support core business and business infrastructure in BCP (Business Continuity Planning) and BCRP (Business Continuity and Resiliency Planning) in recent years, and as a result, business inquiries about such mechanisms have increased even further.

Under these circumstances, the company has carried out promotion and marketing including organizing seminars for target users who recognize the necessity for a higher level of security, and participation in exhibitions.

It focuses on agency sales to strengthening marketability.

They have been actively involved in development collaborations with data centers and cloud service corporations. Furthermore, the company is expected to expand its business overseas as well as product sales in Japan. The company is preparing to provide support for the tampering of systems across the globe.

◎ Strengthening the feature of merchandise

Initially, WebARGUS was only available for Linux, but a Windows version was released in April 2016, and the enterprise edition, which was targeted at large-scale companies in September 2017. In February 2018, the company began offering a next-generation cloud WAF (WebARGUS Fortify), which dramatically strengthens the functionality of comprehensive web security. In particular, because of the release of the enterprise edition, which was targeted at large-scale companies, an increasing number of large companies (mainly listed companies) adopt WebARGUS.

The company also began offering “SaaS” in May 2018 to enhance user convenience and further popularize the products, and collaborated in full scale with With-Secure Corporation, a Finnish cyber security company, in June 2018. The company established a total security provision system using the complementary relationship between With-Secure’s “F-Secure RADAR,” a vulnerability scanning tool for IT system, and DIT’s “WebARGUS.”

It began collaboration with Secure Age, a cyber security company based in Singapore, on information leakage measures (encryption technology) in December 2019 and with SSH Communication Security, a cyber security company based in Finland, on access route optimization in January 2020. The company will continue to establish such alliances actively.

The company enhanced the varieties of the security solution products through various measures including the above alliance, and it is also considering expanding the range of applications of products in anticipation of needs for security measures for the IoT generation, including WebARGUS for embedded products.

For example, the spread and penetration of automatic driving have made the securement of safety an important mission for the companies providing automatic driving systems, and it is expected that the field where they work actively will grow further.

As for the embedded edition, the company started up an official project and is continuously carrying out discussions and technical investigation of concrete business plans for its commercialization. Although commercialization will take time, the company aims to realize it earlier through the accumulation of its steady business accomplishments.

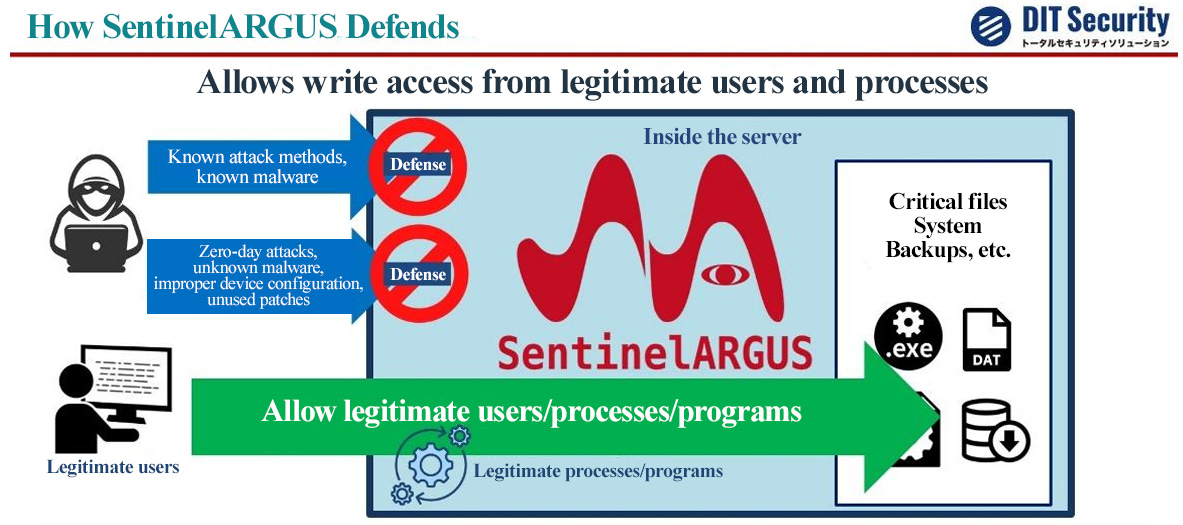

◎ Expansion of the security domain: WebARGUS for Ransomware

A rapidly increasing number of people suffer from ransomware.

In this situation, the company released the Intel 64 version of "WebARGUS for Ransomware," in November 2022, followed by the ARM64 version in January 2023 which is equipped with the function to block the malicious programs to change or delete important data on a real-time basis and protect important data from various risks (such as cyberattacks, inside jobs, and encryption of data by ransomware), in addition to “WebARGUS,” which detects website falsification and repair the websites instantly.

As there are many command patterns of ransomware, “WebARGUS for Ransomware” can block about 30 command patterns. The company believes that there is no other product of its kind with such a wide range of control patterns. By combining it with the conventional "WebARGUS," it is possible to establish stronger server-side security.

First, the company announced to existing "WebARGUS" users, especially the current enterprise version users, that the data protection function has been added to the product, and the introduction of the product as a replacement for the existing "WebARGUS" has begun.

In July 2025, the company has begun full-scale operation of "Sentinel ARGUS," which is mounted with the functions to prevent the augmentation of damage by ransomware and block unauthorized access to important data, as a new product for meeting the needs in the market of security products. They plan to actively develop new services, to enhance their services in the domain of cyber security, which is increasingly demanded as part of the national policy.

(Taken from the reference materials of Digital Information Technologies Corporation)

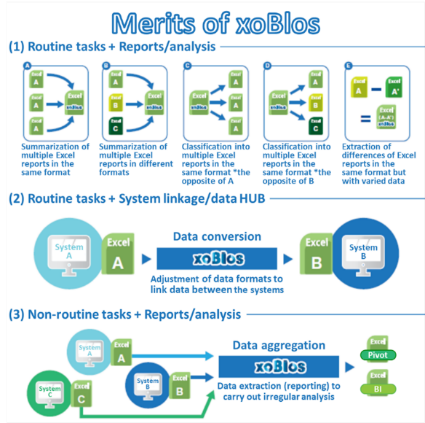

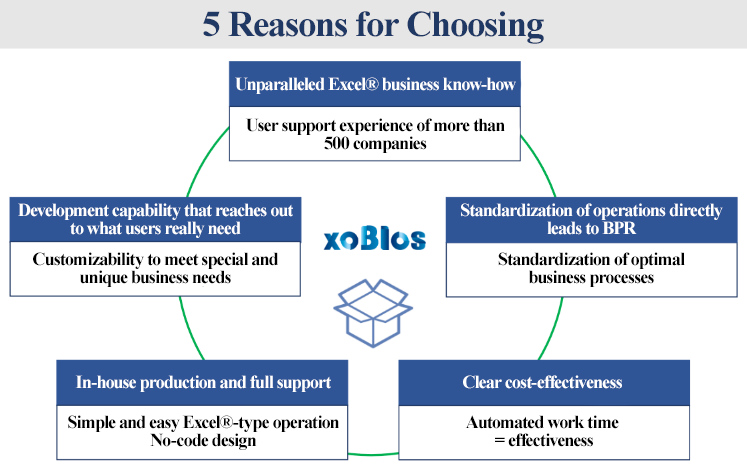

(2) “xoBlos,” an Excel® work innovation platform

Even in advanced corporations with a high level of IT, there are numerous Excel®-based tasks including manual operations in the office. Most non-routine tasks consist of repetitive manual operations such as processing Excel® reports by manually inputting data from paper reports, aggregating totals from multiple Excel® sheets and visualizing and analyzing CSV data extracted from packaged system.

The company's original-brand, "xoBlos," entirely automates these inefficient Excel®-based tasks and provides drastic improvements to workflow.

(From the company's website)

◎ Background of development

Many corporations use Excel®, the major spreadsheet software, for generating quotations and invoices. However, in cases where they generate these documents in different formats for each client according to the clients’ requirements, manual input is mandatory because it is difficult to tally, sort and analyze in a systematic way. For this, the company developed “xoBlos,” an Excel® work innovation platform, to automate tasks and significantly improve workflow efficiency.

◎ Product feature, overview and an example of introduction

Enables management of different data formats for tallying and processing |

Enables increased efficiency with current Excel® spreadsheets. |

Process up to dozens of times faster than using macros. |

Can be embedded into other packaged products as an engine to output Excel® spreadsheets. |

xoBlos was released about ten years ago with the aim of drastically improving the efficiency of work using Excel®. It is now receiving considerably more attention due to its efficiency “to create a company-wide platform which covers everything from improving work efficiency to providing information useful in managerial decisions, while diverting workflow from areas currently using Excel®,” in addition to the convenience and relatively cheap introduction cost, because work-style reform trends centered on revising long work hours grow stronger. Indeed, the times have caught up with xoBlos and the company.

For further enhancement of product competitiveness, the company strengthened the automatic processing of Excel® work by providing a function linked with RPA* products and other systems in February 2018. This function can be operated on a PC client as well as a Web Server, leading to improvements in convenience for wider users.

The domestic RPA market is projected to double to 80,000 million yen in the next few years, and RPA-related services, which occupy 80% of the market, are expected to have a higher growth rate than RPA tool products, which occupy only 20%. Based on this, xoBlos, which can be considered as an RPA-related service, is anticipated to have high growth potential.

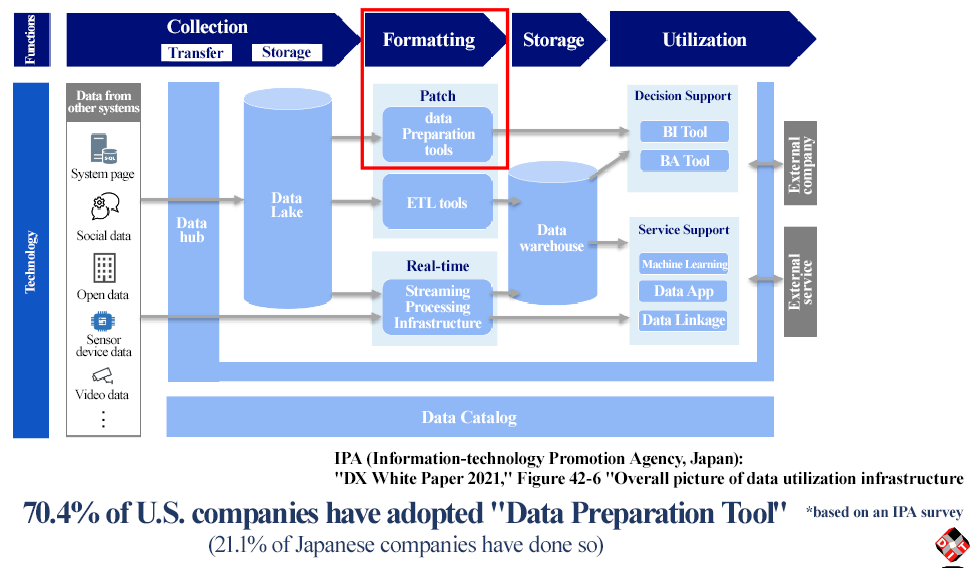

In addition, the company has recently clearly introduced the concept of an “Excel®-type data preparation tool.”

“Data Preparation Tool” is a tool that enables both IT department and business department users to easily and quickly confirm and format data. While about 70% of companies in the U.S. have adopted this tool, only 20% of companies in Japan have done so.

To effectively utilize collected data in the field, it is necessary to process and format data neatly for analysis and system integration. However, in reality, there are discrepancies in expression, erroneous conversions, missing values, and format differences scattered throughout the data, and 50-80% of the work is spent on correcting them. Some of these tasks have been streamlined through the use of macros and VBA, but since the settings depend on individuals, there is a possibility that ongoing work cannot be continued when there are personnel changes.

On the other hand, xoBlos, an “Excel®-type data preparation tool,” can clean and format data that have different formats and styles automatically, allowing for output in the desired format. Additionally, since it is possible to design without code, it can prevent the drawbacks of personalization.

The company aims to promote the value of xoBlos as a “data preparation tool” in order to further increase the number of installations.

|

|

(Taken from the reference materials of Digital Information Technologies Corporation)

◎ Toward further value improvement of the platform “xoBlos Plus-One Concept”

“xoBlos” is already highly rated as a work innovation platform that supports in bringing significant operational efficiency by fully automatizing the inefficient work based on Excel®, but the company started taking initiatives to make it a platform that offers more high-added value to clients to respond to the changing times and customer needs.

“xoBlos Plus-One Concept” is the result of the above initiatives.

The main concept of “xoBlos Plus-One Concept” is “improvement of data value.”

Companies carry out various activities, and they have different systems for the management of each activity.

For example, a company has a system for ERP, which drafts a plan for the appropriate distribution of resources including personnel, things, capital and information, and their effective utilization, at the top, and other systems for CRM for customer management, inventory management, management of acceptance & placement of orders, attendance data, personnel, and accounts.

A large amount of data is extracted from each system, and in recent years, there has been a skyrocketing need for enhancement of operational efficiency and visualization of a company’s own state by integrating and combining the data, instead of handling them individually.

However, realization of the above is not easy for a company as it requires a large number of work hours and involves huge costs.

In such a situation, clients who installed xoBlos, which processes data efficiently at high speed, achieved efficiency in reporting and are able to utilize the data of by integrating and combining the data easily at a reasonable cost.

Also, it is one of the major features of “xoBlos Plus-One Concept” that it allows the use of data in a desired format of each division and department, from the upstream management team to downstream departments of production, sales, general affairs and administration.

It plans to link various systems on xoBlos through tie-ups with manufacturers and propose a concrete image of “xoBlos Plus-One Concept” to its client companies.

Many companies, including the following case studies, have achieved significant improvements in operational efficiency.

* Prepared by Investment Bridge Co., Ltd. based on materials provided by the company and interviews.

*Case of adoption: JCB Co., Ltd.-Addressing In-House System Development Needs with xoBlos

(Background behind considering the adoption of xoBlos)

At JCB Co., Ltd. (hereinafter “JCB”), a credit card company, a significant portion of operations involved individual employees manually aggregating and verifying data output from various systems using Excel®. To improve operational efficiency, JCB had been using a macro developed by an external vendor; however, issues such as a lack of flexibility during operational changes and rising costs emerged. Considering the need for sustainability and long-term operability, JCB sought an in-house solution. Upon learning about xoBlos, which allows users to build a company-wide platform while utilizing existing Excel®-based workflows, JCB recognized its efficiency, user-friendliness, and relatively low implementation cost, and contacted DIT for consultation.

(Status of xoBlos implementation)

Until recently, xoBlos had mainly been used as a tool for centralized management of forms/ledgers across departments, with DIT handling customization and delivery on a contract basis.

However, in recent years, reflecting the growing trend toward low-code and no-code applications, demand for in-house system development has been increasing. As corporate IT literacy improves, the understanding has spread that if users are capable of using basic Excel® functions, they can also easily operate xoBlos. Consequently, xoBlos adoption has been steadily expanding.

On the other hand, when automation and efficiency are prioritized above all else, leading to outsourcing development to external vendors or relying on in-house employees to develop macros, there is a significant risk that business continuity will be compromised. This occurs as “each system becomes a black box,” where only the external vendor or the employee who developed the system possesses detailed knowledge.

Recognizing this issue, more companies are adopting the idea of independently organizing their business processes while operating systems that are sustainable and adaptable. JCB, likewise, has adopted xoBlos as an in-house development tool, installing it on individual employees’ terminals for use.

JCB has entered its third year since adopting xoBlos. In the first year, the implementation began as a PoC (Proof of Concept) within two small departments. While conducting verifications with a limited number of users, DIT concurrently developed and provided user manuals and samples essential for individual in-house development, responding to specific customer needs over the course of a year.At the time of initial introduction, there were around 10 accounts. However, as JCB realized the effectiveness of xoBlos, the number of departments utilizing it expanded, and currently, the number of accounts is approximately 50.

* A PoC (Proof of Concept) is a test or experiment conducted to demonstrate the feasibility of a new idea, technology, or concept before proceeding to full-scale development.

The increasing need for in-house development, as illustrated above, has contributed to the expansion of xoBlos adoption.At JCB, to further promote internal development, new members are recruited every six months for comprehensive training sessions. Employees who participate in these programs work on developing xoBlos applications for actual business operations.As a result, as of May 2025, the number of business processes developed using xoBlos was 85, and 53 employees acquired xoBlos development skills, indicating rapid progress in the company’s in-house development initiatives.

(Diversification of Business Models)

In JCB's case, customized manuals and samples were provided free of charge, as the company viewed this as an opportunity to thoroughly gather customer needs and feedback. However, DIT plans to leverage this experience to enhance profitability through value-added services, such as paid educational packages designed to help clients effectively utilize xoBlos.

◎ Customers and Sales Methods

Currently, the company promotes the value of xoBlos as a "data preparation tool" as previously mentioned to make xoBlos a more marketable product and is working on various sales initiatives.

*Target customer

Initially, the company was mainly making introductions to medium-sized companies, but as the need for efficiency in on-site work has increased, there have also been more introductions to large companies. Currently, about 70% of newly introduced companies are large companies. At present, the company made introductions to over 560 companies. In terms of new installations, the company is focusing not only on increasing the number of corporate customers, but also on introducing xoBlos to major companies where significant license increases can be expected internally.

In August 2020, it began using a subscription mode to expand sales stably and improve profitability.

Particularly, they are actively promoting the adoption of xoBlos, targeting mainly the industries of architecture, real estate, local government, and retail, which are facing challenges in DX while needing to improve efficiency and conduct work-style reform.

*OEM

The company is also focusing on OEM providing the powerful features of xoBlos as an option for project management tools and RPA products handled by other companies.

In December 2022, a new optional OEM service called "xoBlos for OBPM" was launched, which allows project management data accumulated in the integrated project management tool "OBPM Neo" developed and provided by System Integrator Co., Ltd. (TSE Standard, 3826) to be processed and formatted into Excel® reports.

"OBPM Neo" is a project management tool that can comprehensively manage project-related data, including costs and profits, progress, personnel, risks, obstacles, and issues. Although it has screens and functions that enable various analyses, customers faced the challenge of having to spend additional time aggregating and processing data and creating reports, especially for custom reports required for meetings. To address this issue, both companies conducted discussions and decided to offer "xoBlos for OBPM" as a new optional OEM service for OBPM Neo.

By using "xoBlos for OBPM," the manual collection and processing work can be automated, resulting in up to 90% reduction in work hours. Standard templates for frequently used reports (such as budget vs. actual analysis, quality analysis, and operational status) are prepared for OBPM Neo data, and additional templates will be added regularly.

Additionally, by using the xoBlos client, users can edit templates and create custom report templates that meet their specific information and formatting needs.

Moreover, several other projects, including RPA, are currently underway.

*Agencies

Regarding sales activities, the company is marketing products by utilizing a wide range of customers, bases, and sales capabilities of Dai-ko Electronic Communication Co., Ltd. (8023, TSE Standard), one of its main agencies, through joint seminars and other events. The company has built a network of about 30 agencies, including Dai-ko Electronic Communication.

The company plans to continue strengthening its agency network but will also aim to clarify its target audience for agency selection, focusing on agencies that have expertise in approaching local governments, experience with IT subsidy introduction, and have their own products that are easy to coordinate with xoBlos.

*Advertising and Promotion for Increased Awareness

In addition to conventional outbound sales, the company is also working to strengthen inbound sales, which increase customer inquiries while enhancing information dissemination.

As part of its information dissemination efforts, the company is conducting webinars and advertising and promotional activities, including the use of social media in conjunction with company’s other products such as WebARGUS and shield cms.

Regarding advertising and promotion, the planning and sales department, which is newly established in FY 6/23 under the Product Solutions Division, which is responsible for the company's products, including xoBlos, is working to optimize marketing and advertising activities.

* Provision of the xoBlos Starter Kit

The company offers the xoBlos Starter Kit for promoting xoBlos.

Most clients want to solve trouble, but don’t know concrete measures for solving trouble.

Accordingly, the company designs and execute the procedures for initial setting and automation within the price range (up to 3 million yen) of the xoBlos Starter Kit. Clients can use them as they are, and if they want more systems, the company undertakes the development of them or gives instructions to them for solving issues.

Like this, the company can promote the adoption of xoBlos by selling the introductory package at the price 3 million yen, which is relatively affordable for clients and worth taking some man-hours for the company.

The company is actively proceeding with business negotiations by utilizing the xoBlos Starter Kit, and discussing new solutions combining xoBlos and AI technologies.

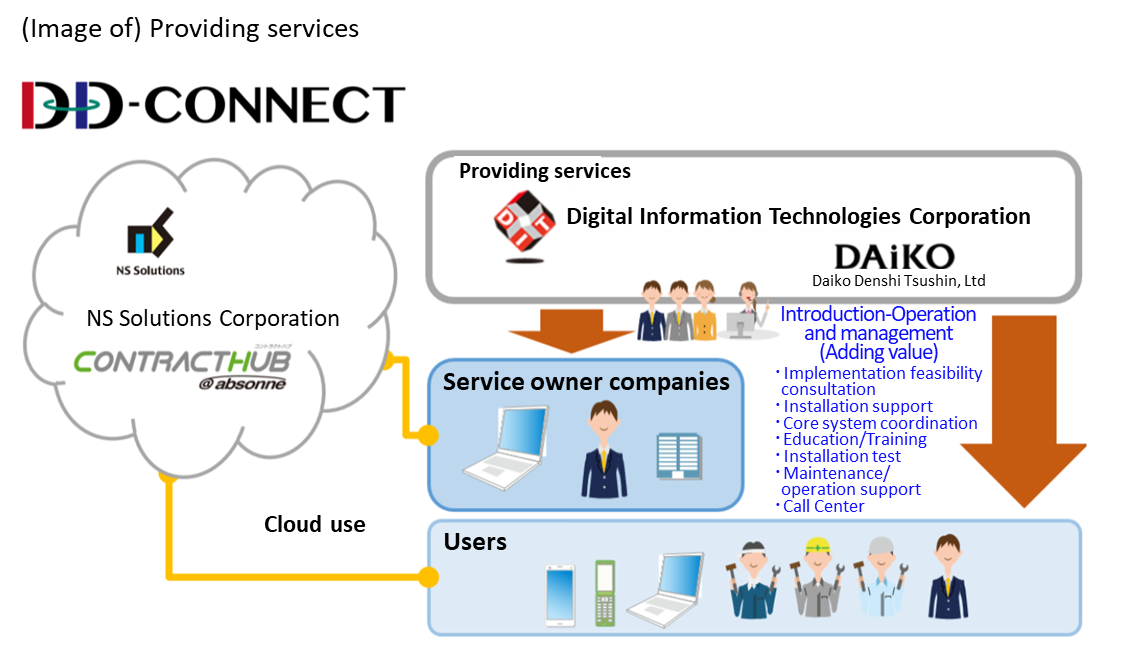

(3) Electronic Contract Outsourcing Service, DD-CONNECT

In September 2020, the company signed a partnership agreement with NS Solutions Corporation to sell the electronic contract cloud CONTRACTHUB @absonne, which has had the largest share of sales in the electronic contract service market for six consecutive years.

In October 2020, the company started selling DD-CONNECT, an outsourcing system that handles a series of services from the introduction to operation and maintenance of CONTRACTHUB on behalf of customers.

(Overview of CONTRACTHUB and DD-CONNECT)

CONTRACTHUB has been deployed mainly by large companies in various industries since the service started in 2013 and is now a pioneer of electronic contract services used by more than 130,000 users.

Since it can be flexibly linked with ERP and sales systems, it can improve the productivity of various operations related to contracts, and both the vendor and the customer can review the electronic contract history, including its conclusion and revisions, on the cloud. Thus, it can improve the efficiency of contract management tasks.

DIT's DD-CONNECT is a series of services that offer testing support related to the introduction of CONTRACTHUB, operation support, and maintenance support. Since DD-CONNECT provides the necessary services collectively, it is easier to introduce than an electronic contract system software package alone. Therefore DD-CONNECT is expected to contribute to further cost reduction and labor-saving.

By regularly sharing human resources and knowledge with NS Solutions, the company provides a wide range of higher value-added electronic contract services, such as measures to improve the efficiency of domestic companies' contract operations and the promotion of going paperless and Hanko (Japanese stamp)-less.

(Taken from the reference materials of Digital Information Technologies Corporation)

(Strengths and Features)

"DD-CONNECT" can be easily and seamlessly linked with other systems for order receipt/placement and billing. This feature sets it apart from other electronic contract systems and is one of its forte.

(Successful Implementations)

Currently, the product is mainly used by major housing equipment manufacturers, construction, and real estate-related companies. The company's main target industries and customers include those with high potential for DX and digitalization, including local governments.

As the electronic contract system is suitable for construction contracts, the company has steadily met the needs for complying with the electronic bookkeeping law.

The company offers its customers added value in terms of support for the installation, operation and management of its cloud system, CONTRACTHUB, and this is highly valued by its customers.

Furthermore, product development, including functional improvements, is carried out by NS Solutions, which means that the company has a significant advantage as it requires little investment.

Initially, the company and its partner, Daiko Electronics Communication Inc. (TSE Standard, 8023), each conducted their own sales activities, but in order to better utilize each other's strengths, the company clarified the division of roles: Daiko Electronics Communication is responsible for sales, while the company is responsible for installation and maintenance operations, which require technical support.

Sales and profit grew considerably, as their efforts for not only introducing “DD-CONNECT,” but also developing peripheral systems to be linked with the existing mission-critical systems of client companies paid off.

(4) Highly Secure Website Creation Platform, “shield cms”

In September 2021, the company released shield cms, a website creation platform equipped with a cyber security function that instantly detects website tampering and restores the website in less than 0.1 seconds.

*CMS: Contents Management System. It is a broad term for a system that integrates and systematically manages digital content such as text and images that make up web content and performs necessary processing such as distribution.

(Background of the release)

Many website creation platforms are based on open-source models that can be used free of charge or their modified ones. Although they are easy to use and convenient, they are easily targeted by cyber-attacks because their mechanism is well known. Moreover, as cyber-attacks are becoming more diverse and complex, the needs for products that can automatically prevent them are increasing.

(The product's features)

shield cms incorporates the company's security product WebARGUS as the standard equipment. It detects tampering simultaneously as it occurs and instantly restores the original condition. It also alerts the system administrator the occurrence of website tampering. The time from tampering to the recovery/alert notification is less than 0.1 seconds, and the actual damage can be reduced to zero.

In addition, as a CMS function, even beginners can easily create a website with the "Edit as you exactly see it" function that combines and arranges various design parts on the screen, and you can also add HTML input, CSS, and JavaScript so that you can create your own original design.

1-5 Characteristics and strengths

(1) Multifaceted and diverse IT company

The company has expanded its business areas by flexibly responding to the progress of information technology, from business system development business to computer sales (current: system sales), embedded product development and verification business, and operational support business as well as working on its original products based on its technical strengths which have been developed during the process of business expansion.

One of the major characteristics of the company is that it is a multifaceted and diverse IT company and has a wide range of business activities and provides own-brand product with originality.

In order to improve the strengths and characteristics of the company, it is essential to acquire new technology and improve the on-site capabilities.

The company has been providing training and education to the employees; however, it is establishing a stronger education system, as it is important to have the latest knowledge ahead of customers in times of rapid changes.

From the perspective of diversity, the company is also working to create an environment in which female employees can easily demonstrate their abilities.

It is making efforts to provide not only on the job training, but also training on managerial skills to promote female employees from mid-level positions to managerial positions including executive positions.

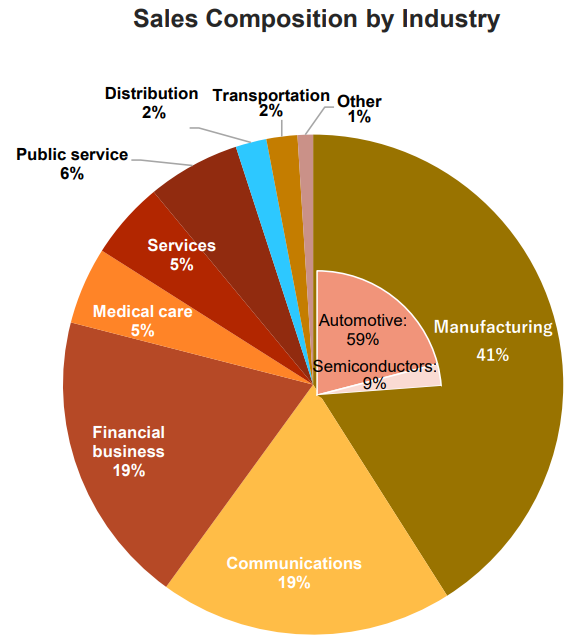

(2) A wide range of customer base

There are about 2,900 client companies. Main clients for the software development business are listed companies and their affiliates, while main clients for the system sales business are small and medium-sized enterprises. Since the business categories of clients are diverse as shown below and stable long-term business is mainly operated, its business base is stable.

The ratio of sales of end users, including information system subsidiaries, is about 80%.

Another characteristic of the company is that the sales in the in-vehicle system domain, which is expected to grow significantly thanks to autonomous driving, EVs, etc., in the manufacturing field account for over 50%.

(From the company's FY6/25 financial results presentation)

(3) Organizational strategies of partial and total optimization

Another significant characteristic of the company is that it has an organizational strategy with two opposite factors, partial and total optimization in a well-balanced manner.

For partial optimization, the company has specialized companies under an in-house company system which aim to be the best in each field. It also provides training and produces entrepreneurs with innovative spirits.

For total optimization, the company pursues synergy between companies while respecting independence of each in-house company; through scrap and build done by the headquarters, collaboration between each in-house company and development of new business areas.

(Outlines of in-house companies and each headquarters)

Headquarters | In-house company | Overview |

Client Service (CS) Headquarters | Business Solution Company | This company develops a proposal style SI business to provide solutions for clients. Especially in the fields of finance, communications and distribution, based on the business knowledge and technical foundations cultivated over many years, this company undertakes design and development of a wide range of software such as general-purpose systems, website systems, mission-critical systems and information systems for leading companies in each industry. It also provides a new business area, ASP business for "Insurance Pharmacy Integrated Management System (Phant's)." |

e-business Services Company | This company provides website system architecture and maintenance for e-commerce websites and service websites for clients mainly for finance and major retail industries for many years. It provides a service to suit clients’ requirements with technologies which it has developed through experience. | |

Support Business Company | This company’s engineers have a wide range of knowledge enabling it to provide one stop optimal IT environment (service) to suit clients' requirements including support for introducing systems, infrastructure-building, network operation management and middleware development. | |

Technology Solution (TS) Headquarters | Embedded Product Solution Company | This company specializes in control system development focused on embedded systems for in-vehicle devices, communication devices, industrial equipment and digital home appliances. It has many engineers with highly specialized skills for embedded system development. Because of the physical conditions of hardware, embedded systems development can be very restrictive, and requires a meticulous level of problem-solving that differs from general application development. |

Quality Engineering Company | This company has a wide range of software validation and verification businesses from in-vehicle devices such as car navigation systems to medical devices, communication infrastructure and mobile terminals. It gives priority to improving the quality of products and provides total service from planning, designing, implementing, operating, and analyzing tests to consulting. It has collaborated with DIT America, LLC, a local subsidiary in the U.S.A. since 2011. It also provides verification services overseas. | |

Western Japan Business Headquarters | Western Japan Company | Activities are based west of Nagoya, with a focus on Osaka. DIT takes part in three businesses: business system development and operational support, mobile and web application development, and embedded systems development (in-vehicle devices and security-related matters). Recently, the company is aiming to expand into the IoT and Web service businesses, taking advantage of multi-skilling. |

Ehime Company | This company is located in Ehime and provides a high added-value one stop service for product development to meet the regionally specific requirements for a variety of industries and businesses as well as sales of software and system devices, operation and system support, and contributes to local revitalization. It also employs engineers locally at a multi-purpose IT development center to tackle the engineer shortage in the other companies, which enables nearshore development. | |

Product Solution (PS) Headquarters | Composed of IT Security Business Division, xoBlos Business Division, and DX Business Division. | |

Management Planning Headquarters | Composed of Management Planning division, Management Promotion division, IR Division, Group Control Division, and R&D Division. | |

Management Headquarters | Human Resources Planning Division, General Affairs Division, Accounting Division, and Partner Promotion Division. | |

(4) Development and sales of original own-brand products

The company has developed a variety of original own-brand products like “xoBlos” and “WebARGUS” with its unique technologies cultivated over many years. The company has a rich lineup, including the electronic contract outsourcing service “DD-CONNECT” based on partnership contracts. The ratio of sales of the Product Solutions Unit, which has a high profit margin, has increased to around 10%. They are making efforts to increase it further as a primary revenue source.

2. Fiscal Year Ended June 2025 Earnings Results

2-1 Consolidated business results

| FY 6/24 | Ratio to sales | FY 6/25 | Ratio to sales | YoY | Ratio to revised forecast |

Sales | 19,888 | 100.0% | 24,159 | 100.0% | +21.5% | +0.7% |

Gross Profit | 4,945 | 24.9% | 6,145 | 25.4% | +24.3% | - |

SG&A | 2,520 | 12.7% | 3,131 | 13.0% | +24.3% | - |

Operating Income | 2,424 | 12.2% | 3,013 | 12.5% | +24.3% | +3.9% |

Ordinary Income | 2,409 | 12.1% | 3,027 | 12.5% | +25.7% | +4.4% |

Net Income | 1,686 | 8.5% | 2,178 | 9.0% | +29.1% | +12.1% |

*Unit: million yen. Net income is interim net income attributable to shareholders of the parent company. Hereinafter the same will apply. “Ratio to revised forecast” means the ratio to the earnings forecast announced in February 2025.

Sales and profit grew by double digits, hitting a record high.

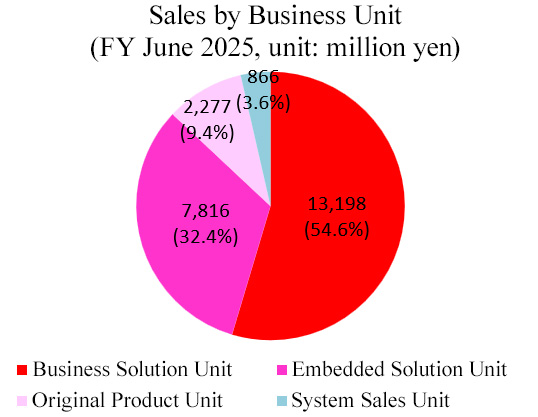

Sales rose 21.5% year on year to 24,159 million yen. The sales of the Software Development Business and the System Sales Business grew by double digits. As the subsidiary acquired through M&A contributed, the sales of the Product Solutions Unit increased over two times.

Operating income rose 24.3% year on year to 3,013 billion yen. Thanks to the sales growth, gross profit grew 24.3% year on year. As they dealt with unprofitable projects in the fiscal year before last, the average revenue per project increased, and the sales of in-house products grew, gross profit margin increased 0.5 points year on year. The expenses for improving the salaries of employees, goodwill amortization through M&A, etc. augmented in parallel with the expansion of their business scale, but this augmentation was offset, and profit increased by double digits.

Both sales and profit grew for 15 consecutive fiscal years, hitting a record high and exceeding the upwardly revised forecast.

2-2 Trends by segment

| FY 6/24 | Composition ratio | FY 6/25 | Composition ratio | YoY | Ratio to revised forecast |

Software Development Business | 19,159 | 96.3% | 23,292 | 96.4% | +21.6% | +0.4% |

System Sales Business | 728 | 3.7% | 866 | 3.6% | +18.9% | +8.3% |

Total sales | 19,888 | 100.0% | 24,159 | 100.0% | +21.5% | +0.7% |

Software Development Business | 2,366 | 12.4% | 2,934 | 12.6% | +24.0% | - |

System Sales Business | 58 | 8.0% | 79 | 9.2% | +36.1% | - |

Adjustment | - | - | 0 | - | - | - |

Total operating income | 2,424 | 12.2% | 3,013 | 12.5% | +24.3% | +3.9% |

*Unit: million yen. Sales mean sales to external clients. The composition ratio of operating income means the ratio of operating income to sales. “Ratio to revised forecast” means the ratio to the earnings forecast announced in February 2025.

(Sales trends by business unit)

| FY 6/24 | Composition ratio | FY 6/25 | Composition ratio | YoY | Ratio to revised forecast |

Sales |

|

|

|

|

|

|

Business Solutions | 11,165 | 56.1% | 13,198 | 54.6% | +18.2% | +0.7% |

Business System Development | 6,243 | 31.4% | 7,764 | 32.1% | +24.4% | - |

Operational Support | 4,922 | 24.7% | 5,434 | 22.5% | +10.4% | - |

Embedded Solutions | 6,897 | 34.7% | 7,816 | 32.4% | +13.3% | -1.1% |

Embedded System Development | 5,098 | 25.6% | 5,492 | 22.7% | +7.7% | - |

Embedded System Verification | 1,799 | 9.0% | 2,324 | 9.6% | +29.2% | - |

Product Solutions | 1,095 | 5.5% | 2,277 | 9.4% | +107.9% | +3.5% |

System Sales Business | 728 | 3.7% | 866 | 3.6% | +19.0% | +8.3% |

Total | 19,888 | 100.0% | 24,159 | 100.0% | +21.5% | +0.7% |

Gross Profit |

|

|

|

|

|

|

Business Solutions | 2,852 | 25.5% | 3,347 | 25.4% | +17.4% | - |

Business System Development | 1,646 | 26.4% | 2,042 | 26.3% | +24.1% | - |

Operational Support | 1,205 | 24.5% | 1,305 | 24.0% | +8.3% | - |

Embedded Solutions | 2,228 | 32.3% | 2,507 | 32.1% | +12.5% | - |

Embedded System Development | 1,690 | 33.2% | 1,795 | 32.7% | +6.2% | - |

Embedded System Verification | 537 | 29.8% | 711 | 30.6% | +32.4% | - |

Product Solutions | 394 | 36.0% | 917 | 40.3% | +132.7% | - |

System Sales Business | 268 | 36.8% | 285 | 32.9% | +6.3% | - |

Total | 4,945 | 24.9% | 6,145 | 25.4% | +24.3% | - |

*Unit: million yen. The composition ratio of sales is the ratio to total sales. The composition ratio of gross profit means the ratio of gross profit to sales for each business segment. “Ratio to revised forecast” means the ratio to the earnings forecast announced in February 2025.

◎ Software Development Business

Both sales and profit increased.

*Business Solutions Unit

Sales and profit grew by double digits, as demand was strong, the effect from unprofitable projects in the previous fiscal year were eliminated, and System Products Co., Ltd., which became a subsidiary of DIT, contributed.

・Business System Development

Regarding the development of financial systems, their strategy for recovery in anticipation of the strong willingness to invest turned out to be effective. Sales from development of systems in the public, telecommunication, and manufacturing sectors also increased. They posted sales of System Products Co., Ltd. As a result, sales grew significantly. In terms of profit, short-term public projects, which were profitable, contributed as there was special demand. (contributed until the third quarter.)

The impact of the unprofitable projects in the fiscal year before last subsided completely. While they make continuous efforts to receive orders for projects, they manage each project thoroughly, by confirming detailed requirements with clients at the time of order receipt and rigorously checking the progress of each project while involving all group companies.

・Operational Support

Their business domain has expanded steadily, as the domain of development of cloud infrastructure grew, but the receipt of orders regarding Salesforce, for which they carried out new promotional activities, was delayed for reasons attributable to cooperative enterprises, so sales increased, but profits increased only slightly. The number of business inquiries about Salesforce is increasing steadily.

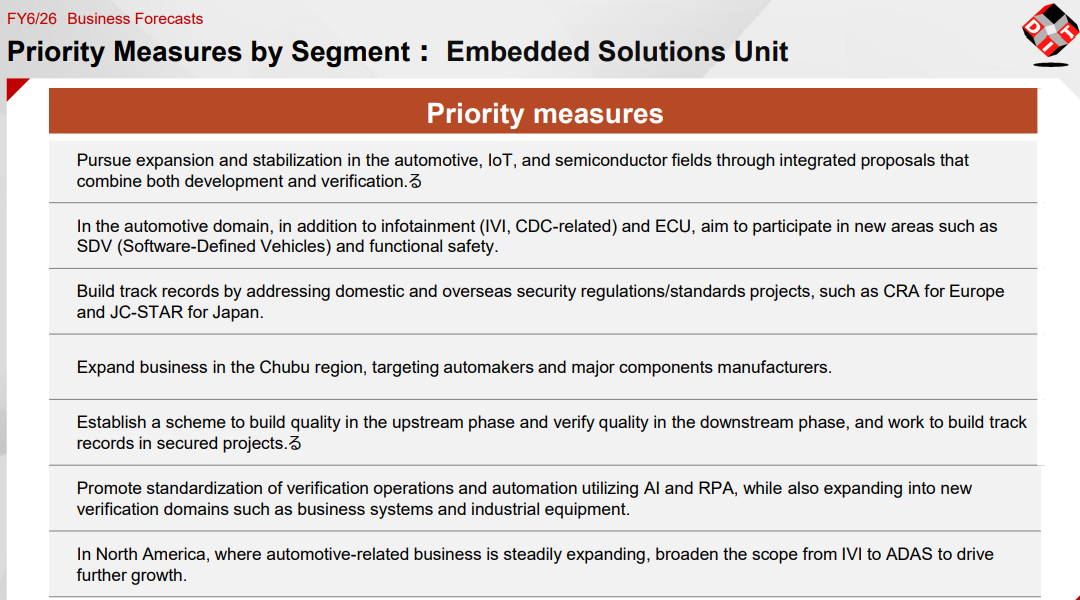

* Embedded Solutions Unit

In the fourth quarter (Apr. to Jun. 2025), demand for some products shrank due to the U.S. trade policy, etc., but in the entire fiscal year, automobile manufacturers’ willingness to invest remained strong, so automotive products contributed to overall performance. Sales and profit grew by double digits, as projects including both development and inspection met customer needs steadily.

・Embedded System Development

The sales of systems for semiconductors and mobile devices were stagnant, but the demand for in-vehicle systems, mainly R&D projects, remained strong. Sales and profit increased, as the sales of IoT systems for home appliances kept growing.

・Embedded System Verification

The performance of the business for the industries of pharmaceutical products, 5G, etc. was stagnant due to the cycle of projects, but they received an order for IVI from a leading automobile parts manufacturer and planned a proof of concept (PoC) using AI in cooperation with a leading manufacturing company, showing good performance. Sales and profit increased by double digits.

*Product Solutions Unit

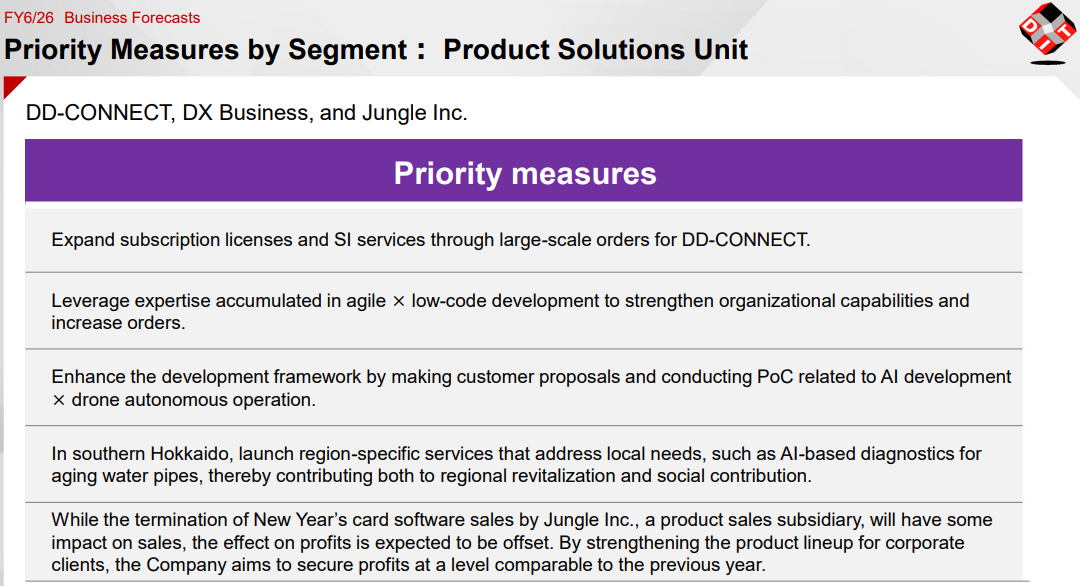

Sales and profits more than doubled, as they posted sales from development projects related to DD-CONNECT, which is an electronic contract service, and sales of 708 million yen from Jungle, Inc., which became a subsidiary of DIT, in addition to the accumulation of existing sales of licenses. Gross profit margin, too, rose significantly.

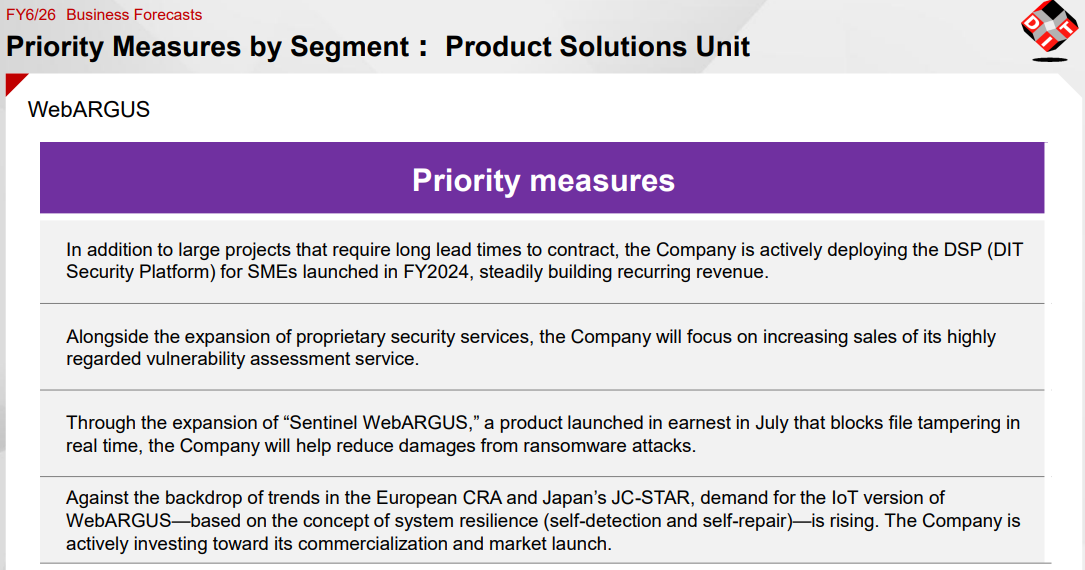

“WebARGUS”

Sales and profit grew steadily, as the sales of licenses from existing clients increased. Grasping the market needs for security products for small and medium-sized enterprises, they started offering DIT Security Platform (DSP) services with an insurance policy.

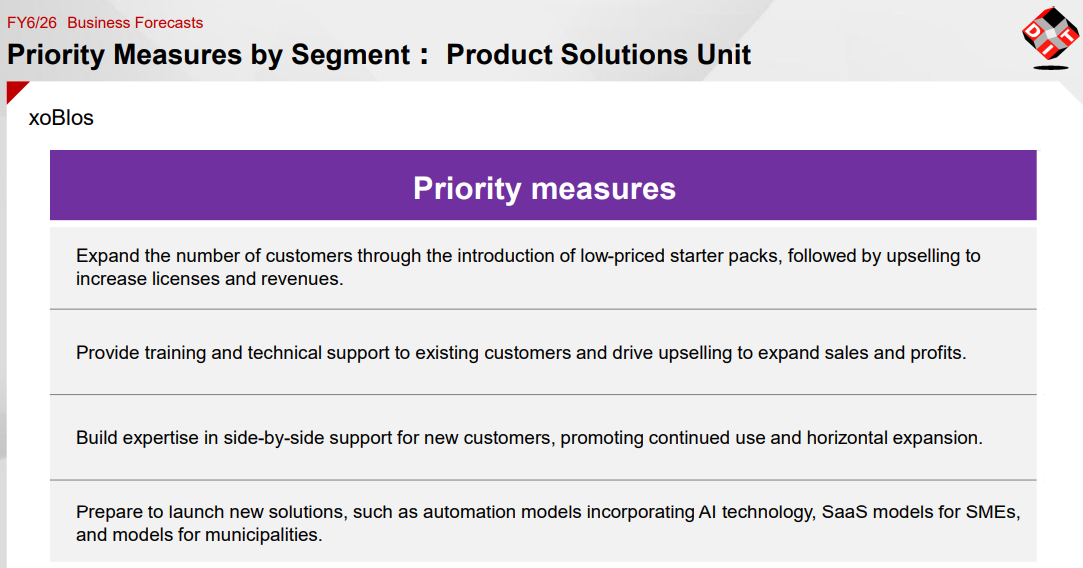

“xoBlos”

In addition to the promotion and cross-selling of products among existing clients, the effects of strengthening the sales structure, such as participating in exhibitions, are continuing. So sales and profit grew.

“Other”

Regarding DD-CONNECT, an electronic contract service, sales and profit continue to be strong, as good results were produced by the business of offering comprehensive services, including the development of peripheral systems at the time of installation, to mainly leading companies in the housing construction field. Their business has progressed from the introductory phase to the growth phase, and started contributing to business performance. Jungle, Inc. significantly contributed to the full-year performance, although the special demand of products related to New Year’s greeting cards peaked in the second quarter has subsided. This type of cross-segment cooperation, customer support, and project creation are increasing, and synergies between businesses are expanding.

◎ Systems Sales Business

Both sales and profit increased.

The rush to buy due to the revision of the Electronic Bookkeeping Act and the introduction of a new invoice system has subsided, but sales grew, as they took over the business of handling “Rakuichi” in the Hokuriku region. Sales and profit grew, offsetting expenses, including goodwill amortization.

2-3 Financial condition and cash flow

◎Main BS

| End of June 2024 | End of June 2025 | Increase/ Decrease |

| End of June 2024 | End of June 2025 | Increase/ Decrease |

Current assets | 8,536 | 9,474 | +937 | Current liabilities | 2,673 | 2,791 | +117 |

Cash and deposits | 4,615 | 5,354 | +738 | Accounts payable | 733 | 857 | +123 |

Trade receivables | 3,579 | 3,736 | +156 | Fixed liabilities | 485 | 297 | -187 |

Noncurrent assets | 1,680 | 1,797 | +116 | Total labilities | 3,158 | 3,088 | -70 |

Tangible fixed assets | 207 | 188 | -18 | Net assets | 7,058 | 8,182 | +1,123 |

Intangible fixed assets | 862 | 691 | -170 | Retained earnings | 6,783 | 8,170 | +1,387 |

Investments and other assets | 610 | 916 | +306 | Treasury stock | -831 | -1,315 | -484 |

Total assets | 10,217 | 11,271 | +1,053 | Total liabilities, net assets | 10,217 | 11,271 | +1,053 |

*Unit: Million yen. Trade receivables include contract asset.

Total assets increased 1,053 million yen from the end of the previous fiscal year to 11,271 million yen, mainly due to an increase in cash and deposits. Total liabilities stood at 3,088 million yen, nearly unchanged from the end of the previous fiscal year. Net assets grew 1,123 million yen from the end of the previous fiscal year to 8,182 million yen, mainly due to an increase in retained earnings and treasury stock.

As a result, equity ratio rose 3.5 points from the end of the previous fiscal year, remaining at a high level of 71.6%.

◎ Cash Flow

| FY 6/24 | FY 6/25 | Increase/Decrease |

Operating Cash Flow | 1,741 | 2,394 | +652 |

Investing Cash Flow | -595 | 10 | +606 |

Free Cash Flow | 1,146 | 2,405 | +1,258 |

Financing Cash Flow | -804 | -1,546 | -741 |

Cash, Equivalents | 4,506 | 5,337 | +830 |

*Unit: Million yen

The surpluses of operating cash flow and free cash flow augmented, due to the increase in net income before taxes and other adjustments, etc.

The cash outflow from financial activities augmented, due to the increase in expenses for acquiring treasury shares, etc.

Cash position increased.

(4) Topics

① DIT enhanced the business bases in Japan.

DIT is striving to enhance its local bases with the aim of steadily handling the escalating demand.

In June 2025, it announced an organizational restructuring for the fiscal year 2025. It segmented the business functions, converting the conventional four-division structure into a six-division structure.

Under these circumstances, the company newly established Western Japan Business Headquarters that consists of West Japan Regional Company and Ehime Regional Company. DIT will further strengthen its resources by imparting the insight and know-how of West Japan Regional Company, which has many years of business experience, to Ehime Regional Company where a number of young employees work. DIT will fully satisfy the needs of local companies based in Ehime, many of which hope to entrust tasks to DIT because it is deeply rooted in the local community, and it also endeavors to expand its business in the Kansai, Chugoku, Shikoku, and Kyushu regions.

Furthermore, in Hokkaido where DIT has been focusing on fortifying its business base in recent years, it took part in “Hakodate Future Investment Conference,” an event for regional revitalization held in Hakodate, Hokkaido, in May 2025. It plans to conduct proactive activities, including participation in such events, in order not only to foster its brand recognition there, but also to perform heightened recruitment activities by making the most of its Hakodate base.

② DIT released Sentinel ARGUS, a new security solution.

In July 2025, DIT started the operation of Sentinel ARGUS, a solution to ransomware attacks.

Sentinel ARGUS is a system that, as a watcher that protects business data, blocks any attempt at file modification (change, addition, or deletion) made by other programs or users than those with authorization in a real-time manner and ensures that important files are completely protected from external threats such as computer viruses and unauthorized access.

Security control has been an issue that faces companies these days because targeted attacks, including ransomware attacks, have become increasingly cleverer and more sophisticated. DIT released Web ARGUS, which quickly detects falsifications of websites and restores the falsified websites in less than 0.1 seconds, in 2014 and the system has been installed in 3,000 or more servers, including ones used in major financial institutions. Sentinel ARGUS is a security product that uses DIT’s further advanced technology and firmly prevents any modification to files due to computer viruses or other similar threats.

3. Fiscal Year Ending June 2026 Earnings Forecasts

3-1 Full-year earnings forecast

| FY 6/25 | Ratio to sales | FY 6/26 (Est.) | Ratio to sales | YoY |

Sales | 24,159 | 100.0% | 26,000 | 100.0% | +7.6% |

Operating Income | 3,013 | 12.5% | 3,050 | 11.7% | +1.2% |

Ordinary Income | 3,027 | 12.5% | 3,050 | 11.7% | +0.7% |

Net Income | 2,178 | 9.0% | 2,200 | 8.5% | +1.0% |

*Unit: Million yen. The estimated values are from the company.

Sales and profit are expected to rise for the 16th consecutive fiscal year.

Sales are expected to rise 7.6% year on year to 26 billion yen, while operating income is forecast to grow 1.2% year on year to 3 billion yen, achieving a year-on-year growth in sales and profit for 16 consecutive fiscal years. Enterprises’ willingness to invest in IT is expected to remain strong this fiscal year, but the U.S. tariff policy forced some automobile-related enterprises, which are main clients of the company, to adjust their budgets, so the outlook is conservative.

Profit is projected to rise slightly as they will conduct upfront investment, although gross profit is expected to grow to some degree thanks to the improvement in average spending per client and in-house solutions. They plan to pay a dividend of 75.00 yen/share, up 3.00 yen/share from the previous fiscal year. The expected payout ratio is 50.5%.

Profit is forecast to decline year on year and from the second half of FY 6/2025, as there will be no longer the sale of software for producing New Year’s cards and one-time public high-budget projects posted in the first half of FY 6/2025 in addition to the above factors, but profit is expected to recover from the second half of FY 6/2026.

3-2 Trend of each business unit and initiatives for this fiscal year

(Trend of sales)

| FY 6/25 | Composition ratio | FY 6/26 (Est.) | Composition ratio | YoY |

Software Development Business | 23,292 | 96.4% | 25,100 | 96.5% | +7.8% |

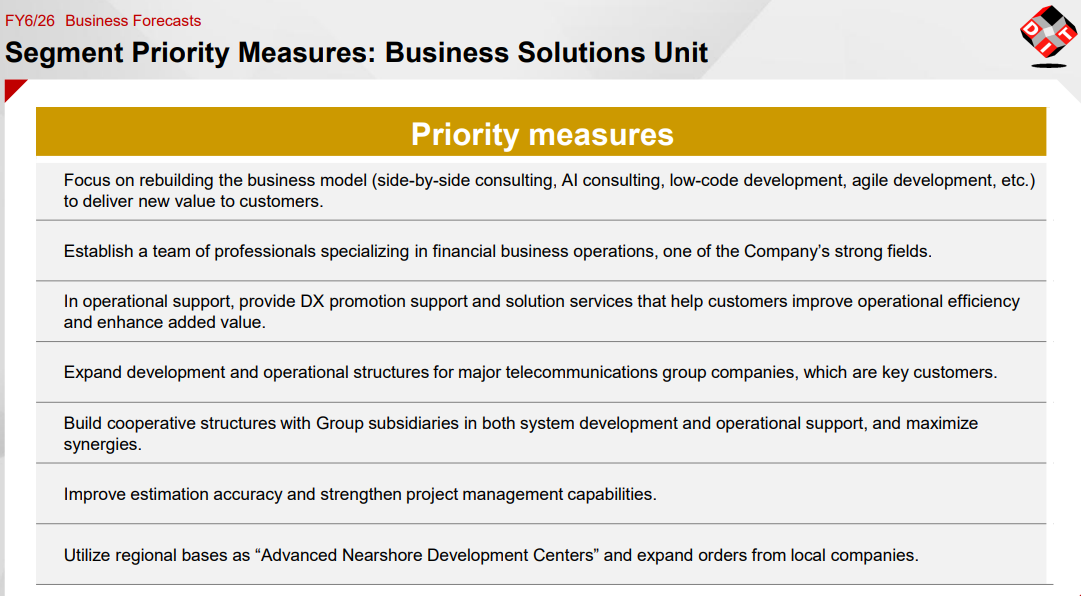

Business Solutions Unit | 13,198 | 54.6% | 14,400 | 55.4% | +9.1% |

Business System Development | 7,764 | 32.1% | 8,600 | 33.1% | +10.8% |

Operational Support | 5,434 | 22.5% | 5,800 | 22.3% | +6.7% |

Embedded Solutions | 7,816 | 32.4% | 8,400 | 32.3% | +7.5% |

Embedded System Development | 5,492 | 22.7% | 6,000 | 23.1% | +9.2% |

Embedded System Verification | 2,324 | 9.6% | 2,400 | 9.2% | +3.3% |

Product Solutions Unit | 2,277 | 9.4% | 2,300 | 8.8% | +1.0% |

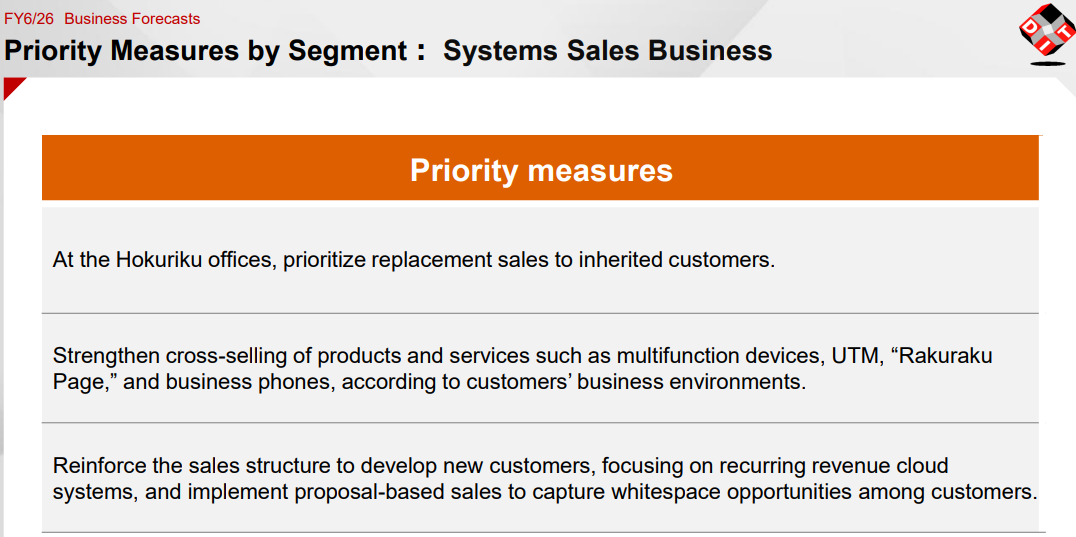

System Sales Business | 866 | 3.6% | 900 | 3.5% | +3.9% |