Bridge Report:(4043)Tokuyama the second quarter of fiscal year ending March 2021

Hiroshi Yokota The President and Executive Officer | Tokuyama Corporation(4043) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Chemicals |

The President and Executive Officer | Hiroshi Yokota |

Address | FRONT PLACE AKIHABARA, 1-7-5, Sotokanda, Chiyoda-ku, Tokyo |

Year-end | End of March |

URL |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE(Actual) | Trading Unit | |

¥2,591 | 69,934,375 shares | ¥181,199 million | 12.4% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥70.00 | 2.7% | ¥316.75 | 8.2 x | ¥2,560.17 | 1.0x |

*The share price is the closing price on October 28th. Each figure except for ROE was taken from the brief report on results for the Second quarter of fiscal year ending March 2021. ROE was the previous term result.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2017 (results) | 299,106 | 39,720 | 33,998 | 52,165 | 147.78 | 0.00 |

Mar. 2018 (results) | 308,061 | 41,268 | 36,196 | 19,698 | 259.81 | 30.00 |

Mar. 2019 (results) | 324,661 | 35,262 | 33,400 | 34,279 | 493.26 | 50.00 |

Mar. 2020 (results) | 316,096 | 34,281 | 32,837 | 19,937 | 287.05 | 70.00 |

Mar. 2021 (estimates) | 300,000 | 28,000 | 28,000 | 22,000 | 316.75 | 70.00 |

*Unit: Yen, one million yen. The forecast is from the company. Net income is profit attributable to owners of the parent. Hereinafter the same applies.

On Oct. 1, 2017, Tokuyama Corporation changed its trading lot from 1,000 shares to 100 shares, while conducting 1-for-5 reverse split. DPS is total annual dividend taking mergence in consideration. EPS as well as DPS has not been recalculated retroactively.

This report outlines an overview of Tokuyama Corporation earnings results for the second quarter of fiscal year ending March 2021.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of Fiscal Year March 2021 Earnings Results

3. Fiscal Year March 2021 Earnings Estimates

4. The Next Medium-Term Management Plan

5. Conclusions

<Reference1: The Medium-Term Management Plan “Cornerstone of the Group’s Revitalization”>

<Reference2: Regarding Corporate Governance>

Key Points

- The sales for the second quarter of the term ending Mar. 2021 were 143.2 billion yen, down 6.2% year on year. Only the sales of specialty products increased. The domestic sales volume of caustic soda declined and the selling prices of petrochemical products were low. The export volumes of dental materials and other products such as lens-related materials decreased. Operating income was 12.9 billion yen, down 11.4% year on year. The decline in costs for raw materials and fuels, such as domestic naphtha, made a positive contribution, but the domestic sales volume of caustic soda declined and export prices were low. Fixed costs were less than expected despite periodic maintenance.

- The full-year forecast for the term ending Mar. 2021 was revised. Sales are estimated to fall 5.1% year on year to 300 billion yen and operating income is projected to drop 18.3% year on year to 28 billion yen. Sales were revised to 300 billion yen due to the exclusion of SunTox Co., Ltd. (subsidiary) from the scope of consolidation. The profit forecast was unchanged, but the breakdown by segment was revised. As for the exchange rates in the second half, it is assumed that 1 US dollar equals 105 yen (110 yen assumed at the beginning of the term; 107 yen in actual results for the first half), and the price of domestic naphtha is assumed to be 32,500 yen/kl (43,000 yen/kl assumed at the beginning of the fiscal year; 27,600 yen/kl in actual results for the first half), and raw material prices are expected to remain low. The dividend is to be 70.00 yen/share, the same amount as the previous term. The estimated payout ratio is 22.1%.

- Sales and profit declined due to weak sales of chemicals and the unavoidable impact of COVID-19 in the life & amenity business, but the overall result was steady thanks to the effect of the business portfolio, with specialty products performing well and cement shipments falling only slightly compared to overall domestic demand.

- An overview of each company’s financial results shows that 5G-related demand is starting to have an impact on earnings. While the spread of COVID-19 in Europe is a concern, the business environment is likely to remain robust in the second half. In addition, the company is aggressively reorganizing the corporate group to strengthen its business base, which is also noteworthy in terms of future profitability.

- Furthermore, the company presented the main concept of its next medium-term management plan, which will begin in the next fiscal year. Environment-related initiatives will play a central role in this plan. How can the company create business opportunities while reducing risks? We would like to pay attention to their concrete measures and path forward.

1. Company Overview

Tokuyama Corporation is a chemical manufacturer, which produces basic chemicals used for a variety of applications, including soda ash and caustic soda; semiconductor-related products, including polycrystalline silicon; cement, whose production volume is the 4th largest in Japan; fine chemical products, including materials for eye glasses, medicine ingredients, etc. It was founded in 1918. Its major strengths include cutting-edge products created with a wide array of unique technologies and the competitiveness of Tokuyama Factory, which has accumulated and integrated technologies in an advanced manner.

【1-1 Corporate history】

In 1918, the founder Katsujiro Iwai established “Nippon Soda Industry Co., Ltd.” with the aim of producing soda ash (sodium carbonate), which is a raw material for glass, inside Japan. The company is still the only Japanese manufacturer that keeps manufacturing soda ash.

In 1938, it started producing cement with the wet method from the byproducts in the soda ash manufacturing.

After the Second World War, it grew the inorganic business, and during the rapid economic growth period, it expanded the petrochemical business handling vinyl chloride, polypropylene, etc.

After the two oil shocks, it entered the high added value field, including electronic materials and fine chemicals. In 1984, the company launched the polycrystalline silicon business, which is now ranked in the top 3 in the world. In 1985, it started producing aluminum nitride powder, which is used for cooling down electronic parts, with its original reduction-nitridation method.

Since then, the company has expanded its business domains, including the fields of living and medicine handling materials for eye glasses, dental apparatus, etc., and environment and energy.

The revenue of the polycrystalline silicon business of “Tokuyama Malaysia,” which is a consolidated subsidiary established in Malaysia in 2009, dropped considerably due to the market downturn. Then, significant impairment losses were posted in the term ended Mar. 2015 and the term ended Mar. 2016, and no dividends were paid.

To cope with that situation, the company procured funds by issuing class shares in May 2016, for the purpose of “reconstructing its financial base.”

Under the vision of “new foundation,” the company produced and announced the 5-year Medium-Term Management Plan “Cornerstone of the Group's Revitalization,” and is working on important projects for reforming its corporate culture, redeveloping business strategies, etc. In the term ended Mar. 2018, it paid a dividend for the first time in 4 terms.

【1-2 Corporate ethos, etc.】

Tokuyama Corporation thoroughly revised its “corporate ethos” and “course of action,” which were enacted in 1989, and set the “Tokuyama’s vision” for new foundation, composed of “mission,” “aspirations,” and “values,” when designing the Medium-Term Management Plan “Cornerstone of the Group's Revitalization” in 2016. As we celebrate the 100th anniversary of our founding in 2018,to build the “Cornerstone of the Group’s Revitalization” and achieve sustainable growth for the coming 100 years, it is necessary to clarify its missions and aims.

Corporate activities, ranging from business strategies, are mostly linked to this vision.

Tokuyama’s vision

Mission | Centered on the field of chemistry, the Tokuyama Group will continue to create value that enhances people’s lives |

Aspirations | Shift from a focus on quantity to quality

(Fiscal 2025) *Global leader in advanced materials *Leader in its traditional businesses in Japan |

Values | *Customer satisfaction is the source of profits *A higher and broader perspective *Personnel who consistently surpass their predecessors *Integrity, perseverance, and a sense of fun |

【1-3 Business Description】

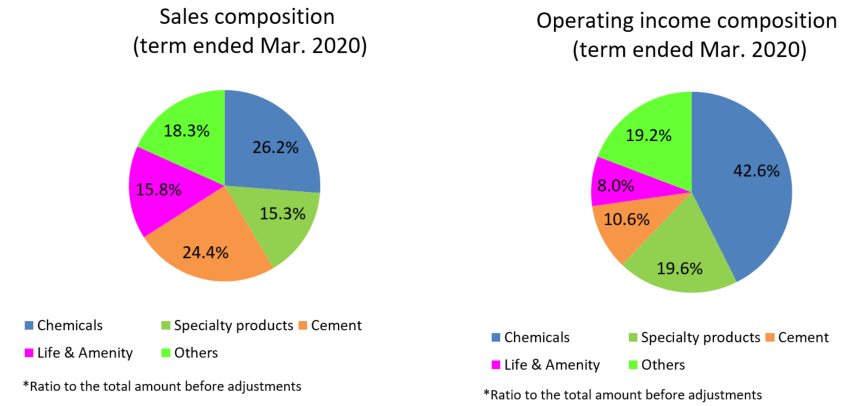

The business segments are “chemicals,” “specialty products,” “cement,” “life & amenity,” and “others.” (The first four segments are to be reported.)

◎ Chemicals

<Outline and major products>

Tokuyama Corporation handles basic chemicals that are indispensable for a broad range of applications in each industry, such as soda ash, caustic soda, and calcium chloride.

The company also operates business efficiently, for example, by using the chlorine and hydrogen produced during the process of manufacturing caustic soda for producing polycrystalline silicon.

With the goal of “becoming a company that will be chosen by customers forever,” the company strives to offer products and services that satisfy the needs of individual customers in a stable and timely manner.

Business | Characteristics | Major products |

Soda and calcium chloride | Since competition is fierce due to the sluggish domestic demand and the increase of imported products, the business environment is severe, and so Tokuyama Corporation is the only manufacturer of soda ash in Japan. Its missions and responsibility as a Japanese manufacturer are more significant than before, and it aims to maintain or enhance its competitiveness and establish a firm position in the domestic market based on its technologies and trusting relationships with customers, which have been nurtured since the establishment of the company. For silicate soda cullet, the company boasts the lion’s share in Japan, by taking advantage of the competitiveness in producing the cullet from soda ash and caustic soda and high production capacity. | Soda ash, calcium chloride, silicate soda, and sodium bicarbonate |

Chlor-alkali and vinyl chloride | The company produces 490,000 tons of caustic soda per year, which is the third largest in Japan. In addition, it manufactures a wide array of products by using chlorine, which is generated as a byproduct. This backs up its competitiveness. As another characteristic, its business performance is hardly affected by the consumption trend in a specific field, because its products are diverse. Vinyl chloride resin is derived 40% from petroleum and 60% from salt. From the viewpoint of the dependence on petroleum, vinyl chloride resin is a plastic that can save natural resources. Multilayered glass sashes made from vinyl chloride excel at keeping housing warm, and are effective for reducing the emissions of greenhouse gases by saving the energy for air-conditioning.

| Caustic soda, vinyl chloride monomer, propylene oxide, methylene chloride |

New organic chemicals | The industrial isopropyl alcohol (IPA) of Tokuyama Corporation can be characterized by its pollution-free manufacturing process, which does not emit air pollutants or industrial wastes. Its original direct hydration method for propylene received the Technological Advance Award of the Japan Petroleum Institute in 1974, the Mainichi Industrial Technology Award in 1975, and the Chemical Technology Award of the Chemical Society of Japan in 1976. In addition to energy-saving and low-cost features, the company can supply high-purity products, and so the quality of its products is highly evaluated. | Industrial isopropyl alcohol (IPA) |

Major products | Purposes of use |

Soda ash | Materials for glass, glass wool, soap and detergent; brine water; water treatment agents, etc. |

Calcium chloride | Anti-freezing agents, dust control, dehumidifying agents, waste liquid treatment, food additives |

(Provided by Tokuyama Corporation)

<Basic policy and measures>

By offering basic chemical materials and services that have high quality and cost competitiveness and satisfy the needs of customers, the company aims to contribute to the business growth of each customer and the stable, continuous increase in revenue for its core business.

Business | Primary measures |

Soda and calcium chloride | *To maintain stable supply and quality as the only manufacturer in Japan *To increase the production amount of granular calcium chloride for melting snow |

Chlor-alkali and vinyl chloride | *To enhance in-house power generation and quality of electrolysis for further reducing costs for caustic soda and chlorine *To expand the export of vinyl chloride monomer, and keep operating plants fully *To increase the profitability of chlorine-induced substances, such as vinyl chloride, propylene oxide, and chloromethane |

◎ Specialty products

<Outline and major products>

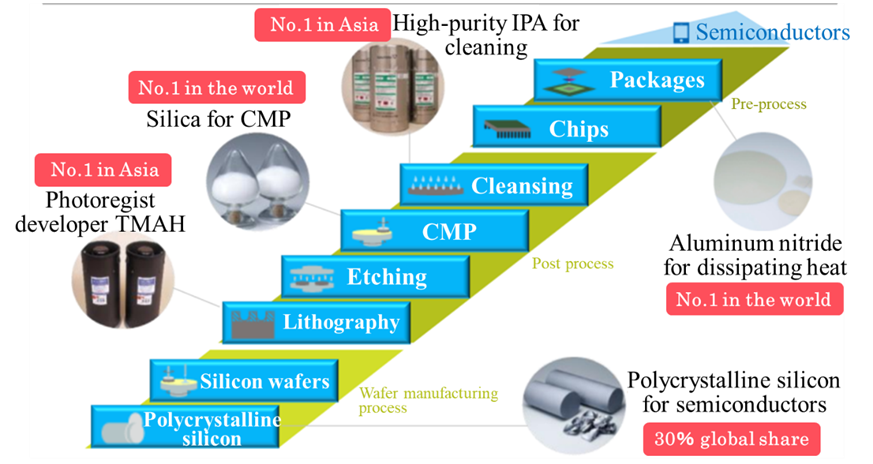

Tokuyama Corporation handles products in a broad range of fields, including energy, electronics, and the environment. For high-purity polycrystalline silicon used for semiconductors, the company has a remarkable share in the world. In addition, fumed silica, which is produced from byproducts, is used for silicone rubber, copier’s toner, etc. Aluminum nitride, which is excellent in heat release, is used for energy-saving products, such as inverters and LEDs, in addition to semiconductor manufacturing equipment, and high-purity chemicals for the electronic industry are used for producing semiconductors, liquid crystal panels, etc.

Business | Characteristics | Major products |

Electronic materials | Tokuyama Factory can produce 8,500 tons of polycrystalline silicon per year. This output is the highest in Japan. | Polycrystalline silicon for semiconductors |

Fumed silica | REOLOSIL, which was developed with the original technology of Tokuyama, is manufactured by hydrolyzing refined gases in oxyhydrogen flame at high temperatures under thoroughgoing management with a fully closed system for all processes from reactions to packaging. Accordingly, it is characterized by high purity, high dispersibility, and high-specific surface area, and used for various applications of use. The company has production facilities in not only Japan, but also China, strives to supply its products stably and continuously while optimizing its business, and aims to expand its business further while considering the global market. | Fumed silica |

Thermal management material | Tokuyama Corporation handles products for each purpose of use, which includes ceramics made by sintering granules and powder from aluminum nitride powder. With its original manufacturing and reduction-nitration methods, the company produces high-quality products with few impurities, and manufactures 840 tons of aluminum nitride products, the largest in the world. For aluminum nitride powder, it has over 70% global share. | Aluminum nitride |

IC chemicals/cleaning system | The company operates manufacturing and sales footholds for supplying products with higher purity to growing markets in Asia. | High-purity chemicals for the electronic industry, and positive photoresist developer |

Major products | Purposes of use |

Polycrystalline silicon | Semiconductors and wafer |

Fumed silica | Elastomers, sealants, liquid resin products, powder products |

Aluminum nitride | Thermal management materials for electronic parts |

High-purity chemicals for the electronic industry | Precise cleaning and drying for wafers, electronic devices, etc. |

(Polycrystalline silicon)

| (Ceramics “SHAPAL”)

|

(Provided by the company)

<Basic policy and measures>

To expand its business and revenue by supplying products that will be chosen by customers forever and proposing newly developed products.

Business | Primary measures |

Polycrystalline silicon | *To achieve the world’s highest quality and minimize cost by accurately grasping the most advanced products and the quality demanded by customers |

Fumed silica | *To enrich highly functional products following those for silicone and CMP *To reduce cost and add high value to products at Tokuyama Chemicals, which is subsidiary in China |

IC chemicals | *To pursue the better quality of products for cutting-edge semiconductors, and promote sales |

Thermal management material | *To enhance the output of aluminum nitride powder (from 480 tons/year to 600 tons/year; operation has started in Apr. 2018) *To commercialize silicon nitride, boron nitride and aluminum nitride fillers |

A wide array of semiconductor-related products that are indispensable for manufacturing semiconductors, such as polycrystalline silicon, for which the company has a 30% global share, and aluminum nitride for dissipating heat, are the cutting-edge materials created by combining a variety of element technologies, which have been developed and accumulated by the company for many years, and all of them are outstandingly competitive in the world.

(Taken from the reference materials of the company)

In the semiconductor manufacturing field, more miniaturized and three-dimensional semiconductors are being developed rapidly, as the capacity of semiconductors is increasing and their size is shrinking.

The “high-purity polycrystalline silicon for semiconductors” and “high-purity chemicals for the electronic industry” of Tokuyama Corporation are ultrahigh-purity materials for which impurities and residues, which would worsen yield, have been reduced to the maximum degree, and highly evaluated by semiconductor manufacturers, which are developing more miniaturized and three-dimensional products.

In addition, Tokuyama’s thermal management materials, which are indispensable for the stable operation of semiconductors, are highly evaluated.

As the power devices for in-vehicle apparatus, industrial equipment, and electric railways are having higher output and smaller size, the demand for thermal management materials is growing rapidly. Tokuyama Corporation supplies thermal management materials with high thermal conductivity and an extremely small amount of impurities developed with its original reduction-nitridation method, etc., such as aluminum nitride powder and ceramics, silicon nitride and boron nitride.

As shown in the above figure, the company plans to create larger business opportunities and meet demand by supplying a wide array of cutting-edge products rather than only specific products, which are used in the process of manufacturing semiconductors from raw materials.

◎ Cement

<Outline and major products>

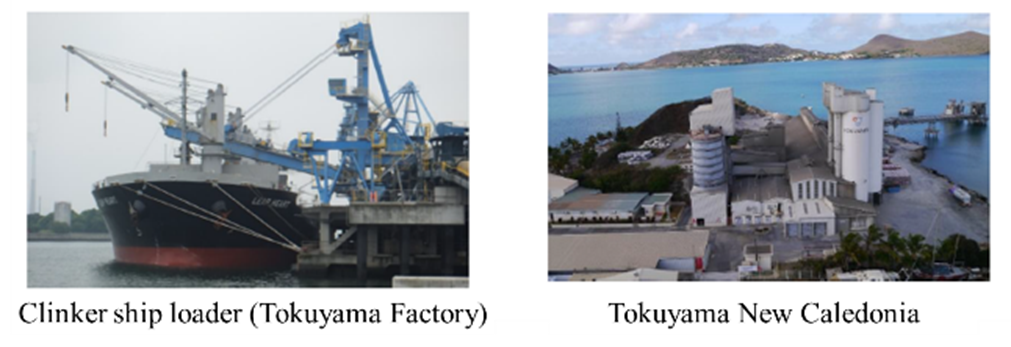

In 1938, Tokuyama Corporation started this business for the purpose of utilizing the byproducts generated at Tokuyama Factory. The cement and related products, such as cement solidifying agents, produced at Nanyo Plant of Tokuyama Factory are used as ready-mixed concrete and secondary concrete products for constructing structures, ports, bridges, roads, etc. that support housing, buildings, and lifelines for the living of people.

The company receives a large amount of wastes, including waste plastics and ash from the combustion of household garbage, from the inside and outside of the company, and uses them as raw materials and thermal energy for manufacturing cement, contributing to the development of a resources recycling society.

Business | Characteristics | Major products |

Cement | Nanyo Plant of Tokuyama Factory has the largest scale as a single factory in Japan. The cement business is the 4th largest in Japan, and community-based sales activities are conducted mainly in Tokyo, Osaka, Hiroshima, Takamatsu, and Fukuoka. The company built a cement testing laboratory in Tokyo, Osaka, Hiroshima, and Fukuoka. For the use of cement and cement solidifying agents, the company gives meticulous support to users by conducting a blending test before work and a management test after work.

In addition, Tokuyama M Tech Corp. manufactures and sells building materials made of cement and mortar. Tokuyama Corporation offers “Shikkui Lemarge,” an interior material produced with the original technology for producing a plaster sheet, “Fresco Graph,” the latest fresco technique developed by combining the classical fresco panting technique and the three-dimensional shaping technique with plaster, and so on. The company is pursuing new business opportunities with its technologies nurtured in the cement and building material fields. | Portland cement, blast furnace slag cement, cement solidifying agents |

Recycling and environment | A variety of recycling facilities, including low and high-water-content sludge and jagged waste treatment facilities, accept a broad range of wastes, including waste plastics, sludge, and glass wastes. | Waste treatment |

<Basic policy and measures>

The company will develop optimal systems for manufacturing, selling, and distributing products while flexibly responding to the changes in the business environment. It aims to enhance its competitiveness by maximizing the revenue from waste treatment by expanding export and reducing costs.

Business | Primary measures |

Cement | *To reduce costs by streamlining production processes, improving basic units, and increasing the capacity of receiving wastes *To secure revenue by expanding export while taking full advantage of Kiln No.4 (used for sintering cement) *Tokuyama M Tech will improve the infrastructure repair and reinforcement business |

Recycling and environment | *To use the most appropriate raw materials, promote the use of combustible wastes, and optimize the fuel plant business *To stably operate the existing business of recycling waste plasterboards, and create a new recycling business |

Tokuyama New Caledonia, which was acquired in Jun. 2013, serves as an exporter of clinker (chunks generated during the cement manufacturing process, from which cement is produced through pulverization), contributing to the increase in the revenue of the cement section.

In the mid to long-term, domestic demand will inevitably shrink due to the decline in population. Accordingly, the company will increase sales amounts by securing stable importers, improve the operation rate of cement factories, and accept more wastes, while discussing and proceeding with the operation of overseas pulverization plants following those of Tokuyama New Caledonia.

(Taken from the reference material of the company)

◎ Life & amenity

<Outline and major products>

This segment is constituted by the fine chemical and NF businesses operated by Tokuyama Corporation, and ion exchange membranes, dental materials, clinical testing systems, polyolefin films, resin sashes, etc. developed, manufactured, and sold by group companies.

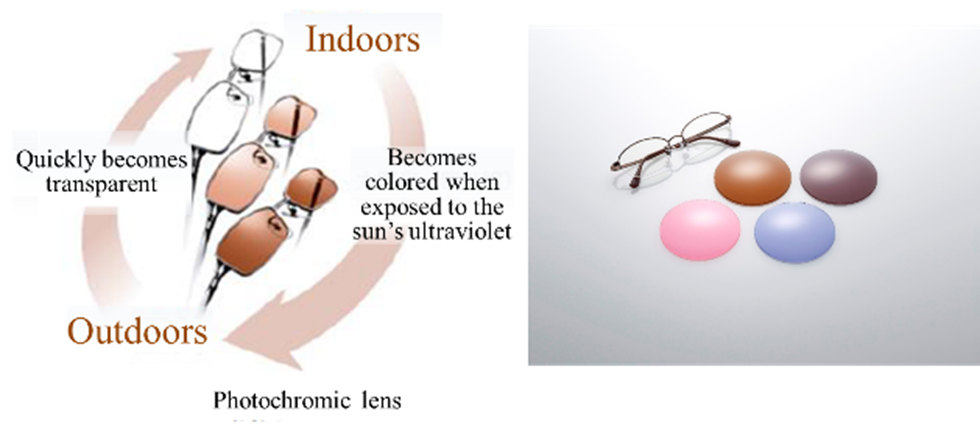

In the fine chemical business, the company handles mainly materials for eye glasses, generic medicine ingredients and intermediates, which were developed with its organic synthesis technology. In the NF business, the company manufactures and sells microporous films that block water, but allow air and moisture to penetrate.

Its overseas group companies include Shanghai Tokuyama Plastics, which manufactures and sells breathable films for disposable diapers, whose demand is growing rapidly in emerging countries, including China.

Business | Major products |

Fine chemicals | Medicine ingredients and intermediates (amino group protection agents and condensation agents), plastic lens-related materials (photochromic dye materials and hard coating agents) |

NF | Microporous films |

Tokuyama Dental Corporation | Manufacturing, import, export, and sale of dental materials |

A&T Corporation | Development, manufacturing, and sale of clinical testing reagents, devices, and systems |

SunTox Co., Ltd. | Manufacturing and sale of polyolefin films |

ASTOM Corporation | Manufacturing and sale of ion exchange membranes for desalination and concentration and electro-dialysis |

EXCEL SHANON Corporation | Manufacturing and sale of resin sashes, related products, and building materials for housing |

*SunTox Co., Ltd. became an equity-method affiliate on October 1, 2020. A&T Corporation is scheduled to become a wholly owned subsidiary of the company on February 1, 2021.

(Pharmaceutical products)

(Provided by the company)

<Basic policy and measures>

The company will secure an advantageous position inside and outside Japan, by establishing and fortifying customer-oriented development, manufacturing, and sales systems. It aims to expand its business, to contribute to the improvement of the living and health (quality of life) of people.

Business | Primary measures |

Fine chemicals | To expand the company’s share for photochromic dye materials for eye glasses, and cultivate the applications of use |

NF | To revitalize the Chinese business |

Dental device business | To accelerate the overseas business expansion mainly for esthetic restorative filling |

Medical diagnosis system business | To fortify the production system by enlarging Esashi Factory |

Polyolefin film business | To improve productivity by dismantling decrepit production equipment and constructing new equipment (from Oct. 2017) |

Ion exchange membranes | To deal with large-scale projects outside Japan |

Resin sashes | To promote the sales of zero energy houses |

In this segment, the company concentrates on the development of photochromic dye materials.

Photochromic dye materials are resin materials that change colors from colorless to gray, brown, etc., when illuminated by sunlight (ultraviolet rays), and return to the colorless state when the illumination stops.

Recently, the usage for sports-wear and driving wear has spread, the awareness of harmful ultraviolet rays has grown, and the cases of eye diseases, such as glaucoma, have increased due to aging population. In these circumstances, the use of photochromic dye materials is increasing.

The products of Tokuyama Corporation are characterized by “plenty of color variation based on the three primary colors: red, blue, and yellow,” “rapid coloration and de-coloration speeds,” “sufficient coloration performance even at high temperatures in the summer,” “excellent durability,” and “the capability of blocking over 99% of ultraviolet rays.”

The company will advertise these characteristics, aim to expand its share by meticulously meeting customer needs about product specifications and enriching its product lineup, improve visibility, and cultivate new applications of use by utilizing its product features, such as the blocking of ultraviolet rays.

(Taken from the reference material of the company)

◎ Others

This is the segment other than the segments to be reported: “chemicals,” “specialty products,” “cement,” and “life & amenity,” and includes overseas distributors, transportation business, and real estate business.

【1-4 Research and development】

Under the R&D slogan of “creating helpful value for living with chemical technology,” the company engages in R&D with the aim of (1) conducting R&D for customer-oriented business, (2) creating an only-one, No.1 technology by improving unique technologies and fusing them with new technologies, and (3) creating original products while emphasizing customer needs based on its technologies.

Tokuyama Corporation aims to carry out R&D for cutting-edge materials by utilizing its unique technologies for synthesizing inorganic and organic materials, increasing purity, inducing crystallization and deposition, controlling powder, and sintering materials, which have been nurtured by the company as a chemical manufacturer, and is actively engaged in open innovation with universities, while expecting the aging of society and the drastic growth and diffusion of environmentally friendly and ICT technologies, and by fusing these technologies with new technologies.

As R&D facilities in western and eastern Japan, the company has Tsukuba Research Laboratory in Tsukuba City, Ibaraki Prefecture, and Tokuyama Research Laboratory in Shunan City, Yamaguchi Prefecture.

Tsukuba Research Laboratory is developing cutting-edge technologies from the medium to long-term viewpoint and analysis technologies as basic technologies, conducting R&D in the dental material field, which is characterized by composite materials, and the organic fine chemical field, which is targeted at high value-added products.

Tokuyama Research Laboratory located in Tokuyama Factory is a foothold for R&D in the Tokuyama district.

There are some significant merits, such as the synergy of the development group in the Tokuyama district and various R&D teams and the easy exchange of information with the manufacturing section.

【1-5 Competitors】

Code | Corporate name | Sales | Growth rate | Operating income | Growth rate | Operating margin | ROE | ROA | Market cap | PER | PBR |

4005 | Sumitomo Chemical | 2,215,000 | -0.5% | 100,000 | -24.6% | 4.5% | 3.2 | 3.8 | 569,473 | 18.7 | 0.6 |

4042 | Tosoh | 700,000 | -11.0% | 60,000 | -26.5% | 8.6% | 10.1 | 9.7 | 551,337 | 14.3 | 1.0 |

4043 | Tokuyama | 300,000 | -5.1% | 28,000 | -18.3% | 9.3% | 12.4 | 8.6 | 181,199 | 8.2 | 1.0 |

4063 | Shin-etsu Chemical | 1,430,000 | -7.4% | 377,000 | -7.2% | 26.4% | 12.3 | 13.3 | 6,058,277 | 21.3 | 2.2 |

4118 | Kaneka | 560,000 | -6.9% | 21,000 | -19.3% | 3.8% | 4.2 | 3.1 | 203,660 | 19.5 | 0.6 |

4183 | Mitsui Chemicals | 1,170,000 | -13.3% | 40,000 | -44.7% | 3.4% | 7.0 | 4.4 | 564,436 | 19.5 | 1.0 |

4185 | JSR | 420,000 | -11.0% | 19,500 | -41.3% | 4.6% | 5.7 | 4.8 | 548,582 | 54.9 | 1.3 |

4205 | Zeon | 275,000 | -14.6% | 16,000 | -38.7% | 5.8% | 7.9 | 6.9 | 307,012 | 21.8 | 1.1 |

5711 | Mitsubishi Materials | 1,420,000 | -6.3% | 0 | - | - | -12.8 | 2.6 | 252,854 | -25.1 | 0.5 |

*Sales and operating income are the estimates for this term. The unit for them is million yen. ROE and ROA are the results for the previous term in units of %. The market cap, PER (forecast), and PBR (results) are the closing values on October 28. The unit is in millions of yen and the unit is two-fold.

Mitsui Chemicals will voluntarily apply IFRS from this fiscal year.

Tokuyama’s ROE and ROA are high among other companies in the same business, but its PBR is around 1. Further growth strategy must be appealed to.

【1-6 Characteristics and strengths】

①Cutting-edge products created with a variety of unique technologies

By fusing new technologies with unique technologies for synthesizing organic and inorganic materials, increasing purity, controlling powder, inducing crystallization and deposition, sintering, electrolysis, refining, reprocessing resources, and so on, which have been accumulated and polished for many years, Tokuyama Corporation has developed cutting-edge products, including inorganic chemicals, cement, silica, silicon, aluminum nitride, high-purity chemicals for semiconductors, lens materials, ion exchange membranes, films, resin, sensor materials, and dental materials.

For example, the company possesses an original reduction-nitridation technology for producing aluminum nitride powder, which is broadly used as a thermal management agent.

Its aluminum nitride powder, which has an extremely low amount of impurities, boasts a 70% or more global share because of its high competitiveness.

At present, its purity is at the world’s highest level. The company started producing polycrystalline silicon for the purpose of utilizing the hydrogen and chlorine generated at its electrolysis plant, and it is now ranked in the world’s top three. It can be said that its broad, profound technological base helped realize these achievements.

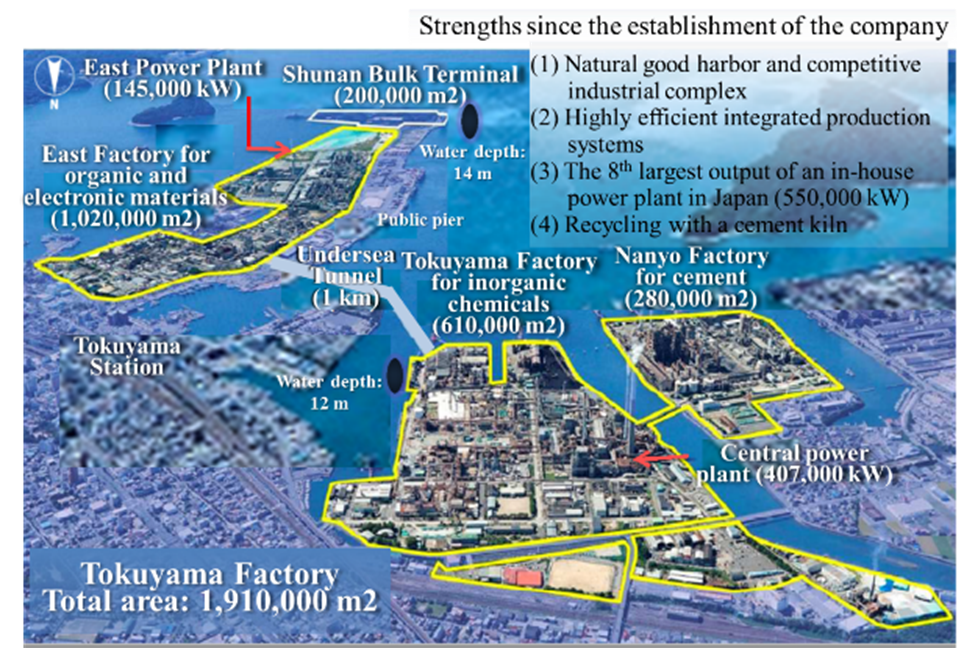

②Competitiveness of Tokuyama Factory, which has integrated and accumulated technologies in an advanced manner

Tokuyama Factory is indispensable for manufacturing products with its unique technologies at low cost and supplying them to customers around the world. It has one of the greatest port infrastructures in Japan and an in-house generation plant, with the following characteristics:

◇ | With the in-house power generation plant, whose output is the 7th largest in Japan, it can use electric power at competitive cost. |

◇ | Factories for producing inorganic and organic chemicals, cement, electronic materials, etc. are integrated, so as to utilize raw materials, products, by-products, and wastes mutually. |

◇ | The company has achieved zero emissions by using its wastes at a cement kiln (used for sintering cement). It also receives wastes from external enterprises in the Shunan industrial complex, making a social contribution for the environment. |

(Taken from the reference material of the company)

Since it has a natural harbor with a water depth of over 10 m, where large shipping vessels can be docked, it is possible to carry in and out large amounts of raw materials and products.

The highly efficient production and supply systems integrated and accumulated sophisticatedly at Tokuyama Factory boost the competitive advantage of Tokuyama Corporation.

Tokuyama Factory is the source of competitiveness of Tokuyama Corporation, but they recognize that the CO2 produced through the power generation using fossil fuels would affect the future of the company, as the ESG investment is now globally mainstream.

Then, they organized CO2 Project Group in November 2019 and implement various measures, to attain the goal: “to reduce CO2 emissions by 15% from the case in which any measures are not taken by fiscal 2030 with the reference year being fiscal 2013.”

(Primary measures)

(1) New technology development: Collection and utilization of CO2 | To develop technologies for collecting the CO2 emitted from Tokuyama Factory, technologies for utilizing the collected CO2, etc. in cooperation with external research institutes, such as universities. |

(2) Production of hydrogen with electric power derived from renewable energy | For the development of large-scale hydrogen production equipment compatible with electric power generated from fluctuating renewable energy, they will develop and demonstrate commercial-sized electrolytic cells and its process. |

(3) Adoption of renewable energy | *Biomass co-firing To start discussions to increase the use of biomass fuels at the company’s own thermal power generation equipment and reduce the consumption of fossil fuels. *Energy mix To produce scenarios about future environmental administration, energy situation, etc. and discuss the energy mix (power source composition) at factories in fiscal 2030. |

(4) Optimization of energy efficiency at Tokuyama Factory | To optimize the overall energy efficiency at Tokuyama Factory, by saving energy at each plant in the factory, achieving the flexible energy distribution among plants, and supplying heat and energy to the outside. |

As for the hydrogen production with electric power derived from renewable energy mentioned in the above section (2), the company aims to commercialize it in the future, and introduce the developed model inside and outside its region as one of measures for mitigating global warming.

As for the energy mix mentioned in the above section (3), the company started surveys and discussions based on the comprehensive partnership with Yamaguchi University in November 2019.

In June 2020, Tokuyama Factory was equipped with a stationary fuel-cell generator utilizing a fuel-cell system, which is mounted on the fuel-cell car “MIRAI” of Toyota Motor, and demonstrative driving with by-product hydrogen was started in cooperation with Toyota Motor Corporation.

A characteristic of this demonstrative driving is to use by-product hydrogen as fuel for a fuel-cell generator. Also, by-product hydrogen is produced secondarily when Tokuyama manufactures caustic soda with brine electrolysis.

Tokuyama takes the role of supplying by-product hydrogen stably, and the electric power generated by a fuel-cell generator is supplied to Tokuyama Factory with a rated output of 50 kW.

After this demonstrative research, Tokuyama will discuss the regional contribution model business utilizing by-product hydrogen as a leading Japanese comprehensive chemical maker with the capacity of supplying high-purity by-product hydrogen.

2. The second quarter of Fiscal Year March 2021 Earnings Results

(1) Overview of consolidated results

| FY 3/20 2Q | Ratio to sales | FY 3/21 2Q | Ratio to sales | YoY |

Sales | 152,749 | 100.0% | 143,289 | 100.0% | -6.2% |

Gross profit | 46,488 | 30.4% | 44,512 | 31.1% | -4.3% |

SGA | 31,876 | 20.9% | 31,570 | 22.0% | -1.0% |

Operating income | 14,612 | 9.6% | 12,941 | 9.0% | -11.4% |

Ordinary profit | 13,643 | 8.9% | 12,498 | 8.7% | -8.4% |

Quarterly net income | 10,400 | 6.8% | 9,994 | 7.0% | -3.9% |

* Unit: million yen. Net income belonging to its parent company. The same applies hereafter.

Sales and profits declined due to the sluggish sales of the company’s main products.

The sales were 143.2 billion yen, down 6.2% year on year. Only the sales of specialty products increased. The domestic sales volume of caustic soda declined and the selling prices of petrochemical products were low. The export volumes of dental devices and other equipments decreased. Operating income was 12.9 billion yen, down 11.4% year on year. The decline in costs for raw materials and fuels, such as domestic naphtha, made a positive contribution, but the domestic sales volume of caustic soda declined and export prices were low. Fixed costs were less than expected despite periodic maintenance.

(2) Trend in each segment

Sales | FY3/20 2Q | Composition ratio | FY3/21 2Q | Composition ratio | YoY |

Chemicals | 46,348 | 30.3% | 38,527 | 26.9% | -16.9% |

Specialty products | 24,603 | 16.1% | 26,052 | 18.2% | +5.9% |

Cement | 42,719 | 28.0% | 42,726 | 29.8% | +0.0% |

Life & amenity | 27,722 | 18.1% | 24,945 | 17.4% | -10.0% |

Others | 32,261 | 21.1% | 27,701 | 19.3% | -14.1% |

Adjustment | -20,905 | - | -16,664 | - | - |

Total | 152,749 | 100.0% | 143,289 | 100.0% | -6.2% |

Operating income |

|

|

|

|

|

Chemicals | 7,511 | 16.2% | 5,386 | 14.0% | -28.3% |

Specialty products | 2,813 | 11.4% | 2,746 | 10.5% | -2.4% |

Cement | 1,185 | 2.8% | 2,335 | 5.5% | +97.0% |

Life & amenity | 1,562 | 5.6% | 823 | 3.3% | -47.3% |

Others | 2,462 | 7.6% | 2,873 | 10.4% | +16.7% |

Adjustment | -923 | - | -1,222 | - | - |

Total | 14,612 | 9.6% | 12,941 | 9.0% | -11.4% |

* Unit: million yen. The composition ratio for profit means profit rate.

*Chemicals

Sales and profits declined.

Caustic soda | Domestic sales volume fell due to the impact of COVID-19, and profit decreased because of the slump in overseas markets. |

Vinyl chloride monomer | Despite the decrease in production costs as a result of the drop in domestic naphtha prices, profit declined as overseas markets became sluggish due to the impact of COVID-19. |

Vinyl chloride resin | Overseas demand was steady. The performance was on par with that in the same period last year thanks to the efforts to maintain the spread between raw material prices and selling prices. |

Soda ashes | Profit decreased as domestic sales volume dropped due to the impact of COVID-19. |

*Specialty products

Sales increased but profits declined.

Polycrystalline silicon for semiconductor wafer | Sales were strong due to the adoption of 5G and the spread of telework, so performance was unchanged from the same period last year. |

High purity chemicals for electronics industry | Profit increased due to the growth of sales volume mainly in overseas markets. |

Fumed silica | Profit declined as the sales volume dropped due to the impact of COVID-19. |

*Cement

Sales and profits increased.

Cement | The impact of COVID-19 on domestic shipments was limited. Profit rose as a result of the lower production costs due to lower raw material prices. |

*Life & amenity

Sales and profits declined.

Plastic lens-related materials | Profit decreased due to the decline in export volumes of photochromic materials for lenses for glasses to Europe and the United States caused by the spread of COVID-19. |

Microporous film | Profit increased thanks to the steady demand for sanitary products such as disposable diapers. |

Polyolefin film | Despite the sluggish growth in sales volume, profit augmented as the spread between raw material prices and selling prices was improved. |

Dental materials | Profit fell due to the decreased export volumes to Europe and the United States due to the impact of COVID-19. |

(3) Financial standing and cash flows

◎Primary balance sheet

| End of Mar. 2020 | End of Sep. 2020 |

| End of Mar. 2020 | End of Sep. 2020 |

Current assets | 203,849 | 197,240 | Current liabilities | 95,241 | 86,344 |

Cash and deposits | 81,524 | 82,032 | Trade payables | 42,795 | 39,454 |

Trade receivables | 72,929 | 63,270 | Noncurrent liabilities | 107,775 | 102,590 |

Inventories | 44,679 | 45,778 | Total liabilities | 203,017 | 188,935 |

Noncurrent assets | 179,597 | 182,065 | Net assets | 180,429 | 190,371 |

Property, plant and equipment | 123,192 | 122,976 | Shareholders’ capital | 165,874 | 173,495 |

Intangible assets | 1,657 | 1,653 | Retained earnings | 137,665 | 145,226 |

Investments and other assets | 54,747 | 57,435 | Total liabilities and net assets | 383,447 | 379,306 |

Total assets | 383,447 | 379,306 | Balance of interest-bearing debts | 116,341 | 110,307 |

*Unit: one million yen. Interest-bearing debts include lease obligations.

Total assets declined 4.1 billion yen from the end of previous term to 379.3 billion yen due to a decrease of trade receivable, etc.

Total liabilities were 188.9 billion yen, down 14 billion yen from the end of the previous term, due to a decrease in trade payables and interest-bearing debts, etc.

Net assets rose 9.9 billion yen from the end of the previous term to 190.3 billion yen due to an increase in retained earnings.

As a result, equity ratio rose 2.9 points from the end of the previous term to 46.9%.

DE ratio fell from 0.69 at the end of the previous term to 0.62.

◎ Cash Flow

| FY3/20 2Q | FY3/21 2Q | Increase/decrease |

Operating CF | 29,256 | 20,702 | -8,554 |

Investing CF | -10,728 | -11,237 | -509 |

Free CF | 18,528 | 9,465 | -9,063 |

Financing CF | -8,549 | -9,016 | -467 |

Cash and equivalents | 77,331 | 81,406 | +4,075 |

*Unit: million yen

The surplus of operating CF and free CF shrank due to the absence of compensation received.

The cash position improved.

(4) Topics

(1) Establishment of a joint venture for the production and sale of IPA in Taiwan

In October 2020, “Formosa Tokuyama Advanced Chemicals Co., Ltd.” was established in Taiwan as a joint venture with Formosa Plastic Corporation for the production and sale of electronic industrial-grade high-purity isopropyl alcohol (high-purity IPA).

The investment ratio is 50:50.

(Purpose of establishing a joint venture)

The semiconductor market is expected to continue to expand in the mid-to long-term due to the development of 5G, IoT, AI, etc., and the demand for high-purity IPA is projected to gradually increase in line with that. In addition, as the miniaturization of semiconductors continues, customer demands for high quality and stable supply are increasing.

Tokuyama’s high-purity IPA is manufactured by a unique direct hydration method featuring a low concentration of impurities and they have pursued further purification of the cleaning fluid used in the semiconductor manufacturing process to meet customer needs.

By establishing this joint venture, Tokuyama will construct an integrated production system from propylene, a raw material, in Taiwan, and establish a production and supply system that meets the needs of customers in Taiwan promptly in order to further expand the high-purity IPA business. The company will be able to streamline its operations and respond flexibly to growing demand in the future by integrating the supply chain in Taiwan.

The company plans to begin operations in January 2022.

(2) Introduction of “OMNICHROMA®,” a composite resin for dental fillings, in Japan

Tokuyama Dental Co., Ltd., a wholly owned subsidiary, decided to launch “OMNICHROMA®,” a photo-curable composite resin for dental fillings that is highly regarded around the world for its convenience in not requiring the selection of shades, in Japan in November 2020 as a specified insured medical material after receiving approval from the relevant Japanese authorities.

(Product description, etc.)

The product was first launched in February 2019 in North America, the world’s largest market for dental equipment, and has been recognized for its innovative concept and creative technology, including being awarded the 2020 TOP PRODUCT INNOVATION by THE DENTAL ADVISOR, a North American evaluation organization, and being named a Top 10 Game Changers in 2019-2020 for the second year in a row by Dental Products Report, the most-subscribed magazine for dental professionals in North America.

Natural teeth come in a wide variety of colors, and when restoring a missing tooth due to decay or fracture with a dental filling composite resin (CR), dentists had to select the best shade from dozens of different shades to match the color of the patient’s teeth, as well as keep a large number of CRs in stock.

In comparison, Tokuyama Dental has blended a spherical filler synthesized by the sol-gel method, a proprietary technology, and discovered that the structural color produced by the filler can be assimilated to a variety of natural tooth tones with just one filler, and has succeeded in developing CR that eliminates the hassle of shade selection and stock management.

Between April and June 2020, the company has approximately 3.0% share of the total light-curing CR market in North America, and it is working to expand sales in order to achieve further growth. The company plans to achieve global sales of 1 billion yen in the current fiscal year, including Japan.

In anticipation of future business expansion, the Tokuyama Group is expanding its production facilities at its Kashima Plant.

(3) Reorganization of the subsidiary A&T Corporation into a wholly owned subsidiary

In October 2020, the company announced that it would make A&T Corporation, a consolidated subsidiary for which the company currently holds 40.2% of its shares, a wholly owned subsidiary through a share exchange. The share exchange is scheduled to take place on February 1, 2021.

The company has been identifying problems related to its inability to grow its performance, but given the lack of resources in the immunodiagnostic field and for overseas expansion, it has been determined that there is a need to further strengthen the development of diagnostic reagents based on Tokuyama’s chemical synthesis technology and financial strength to expand the diagnostic system business.

The company will focus on this as one of its core businesses.

(4) Transferred the shares of the subsidiary SunTox Co., Ltd. and made it an equity-method affiliate

In October 2020, Tokuyama transferred a 46% stake in its 80%-owned subsidiary, SunTox Co., Ltd.., to Rengo Co., Ltd., which currently owns a 20% stake in SunTox Co., Ltd.

SunTox Co., Ltd. will be no longer a consolidated subsidiary of Tokuyama, but an equity-method affiliate of Tokuyama.

Rengo, which is focusing on the flexible packaging business, will work to strengthen the plastic film business of SunTox, while Tokuyama will continue to support the manufacturing side of the business.

The Tokuyama Group will concentrate its management resources on the focused areas of ICT, healthcare, and the environment, by promoting the selection and concentration of businesses.

3. Fiscal Year March 2021 Earnings Estimates

(1) Full-year earnings estimates

| FY 3/20 | Ratio to sales | FY 3/21 (Forecast) | Ratio to sales | YOY | Revised ratio | Progress ratio |

Sales | 316,096 | 100.0% | 300,000 | 100.0% | -5.1% | -3.2% | 47.8% |

Operating income | 34,281 | 10.8% | 28,000 | 9.3% | -18.3% | 0.0% | 46.2% |

Ordinary income | 32,837 | 10.4% | 28,000 | 9.3% | -14.7% | 0.0% | 44.6% |

Net income | 19,937 | 6.3% | 22,000 | 7.3% | +10.3% | 0.0% | 45.4% |

*Unit: million yen. The forecasts were announced by the company.

The company revised its sales forecast due to the exclusion of a subsidiary from the scope of consolidation. Profits were unchanged. Sales and profits declined.

Sales are estimated to fall 5.1% year on year to 300 billion yen and operating income is projected to drop 18.3% year on year to 28 billion yen. Sales were revised to 300 billion yen due to the exclusion of SunTox Co., Ltd. (subsidiary) from the scope of consolidation. The profit forecast was unchanged, but the breakdown by segment was revised.

As for the exchange rates in the second half, it is assumed that 1 US dollar equals 105 yen (110 yen assumed at the beginning of the term; 107 yen in actual results for the first half), and the price of domestic naphtha is assumed to be 32,500 yen/kl (43,000 yen/kl assumed at the beginning of the fiscal year; 27,600 yen/kl in actual results for the first half), and raw material prices are expected to remain low. The dividend is to be 70.00 yen/share, the same amount as the previous term. The estimated payout ratio is 22.1%.

(2) Trend in each segment

Sales | FY 3/20 | Ratio to sales | FY 3/21 (Forecast) | Ratio to sales | YOY | Revised ratio | Progress ratio |

Chemicals | 937 | 29.7% | 870 | 29.0% | -7.2% | 0.0% | 44.3% |

Specialty products | 544 | 17.2% | 610 | 20.3% | +12.1% | 0.0% | 42.7% |

Cement | 872 | 27.6% | 860 | 28.7% | -1.4% | 0.0% | 49.7% |

Life & amenity | 563 | 17.8% | 480 | 16.0% | -14.7% | -17.2% | 52.0% |

Others | 652 | 20.6% | 480 | 16.0% | -26.4% | 0.0% | 57.7% |

Adjustment | -409 | - | -300 | - | - | - | 55.5% |

Total | 3,160 | 100.0% | 3,000 | 100.0% | -5.1% | -3.2% | 47.8% |

Operating income |

|

|

| 0.0% |

|

|

|

Chemicals | 153 | 16.3% | 120 | 4.0% | -21.6% | -7.7% | 44.9% |

Specialty products | 70 | 12.9% | 75 | 2.5% | +7.1% | 0.0% | 36.6% |

Cement | 38 | 4.4% | 45 | 1.5% | +18.4% | +28.6% | 51.9% |

Life & amenity | 28 | 5.0% | 25 | 0.8% | -10.7% | -16.7% | 32.9% |

Others | 69 | 10.6% | 45 | 1.5% | -34.8% | +12.5% | 63.8% |

Adjustment | -18 | - | -30 | - | - | - | - |

Total | 342 | 10.8% | 280 | 9.3% | -18.1% | 0.0% | 46.2% |

*Unit: 100 million yen

Overseas market conditions for chemicals remained weak in the second half. Sales and profit for specialty products increased for the full year. Sales of cement continued to be steady in the second half. The life & amenity segment saw very sluggish shipments, particularly to Europe, in the first half due to the impact of COVID-19, but it is said to be recovering quickly.

4. The Next Medium-Term Management Plan

The current term is the final year of the company’s 5-year Medium-Term Management Plan “Cornerstone of the Group’s Revitalization.” The company is currently drawing up its next medium-term management plan and its basic stance is based on the following (1) through (4).

The company will aim for growth based on “electronics,” “healthcare,” and “environment.”

(1) Efforts to reduce CO2 emissions and commercialization in the environmental field

As President Yokota said in the previous Bridge Report (https://www.bridge-salon.jp/report_bridge/archives/eng/4043/20200715.html), with the global environment playing an increasingly important role, the company believes that it must reconsider its use of electricity generated from its own coal-fired power plants, which has been the source of its competitiveness, and set concrete goals for reduction of CO2 emissions and energy reduction, and a switch to alternative energy sources from a medium-to long term perspective.

The company has set a target of reducing CO2 emissions by 15% of the BAU ratio* (base yea 2013) by fiscal year 2030, but in light of the current difficult situation surrounding coal-fired thermal power plants, a new target and measures to achieve it are being formulated in the next medium-term management plan.

Also, the company will work to create business opportunities by reducing risks and at the same time opening up new environmental businesses.

*BAU rati It indicates the effect compared to the business-as-usual case, in which no specific measures are taken.

Specific considerations at present

◎ Energy mix

・Consideration of specific measures (short, medium and long term).

◎ Expanding the use of biomass fuel

・Expanding the amount of palm kernel shells (PKS) procured and reducing costs

・Development of new biomass fuel

◎ CCU (Carbon Capture and Utilization: a generic term for technology that uses CO2 to generate new energy)

・Search for use of captured CO2

◎ Hydrogen

・Development of renewable hydrogen

At present, the company is actively collaborating with universities and other companies to create new technologies that will contribute to the reduction of CO2 emissions and make the environmental field a pillar of its business.

(2) Optimize the business portfolio by promoting the environment, electronics, and healthcare businesses with cash earned from chemicals.

(3) Improve the overseas sales ratio by strengthening specific technologies and marketing

(4) Use IoT and DX to improve productivity

(5) Resolve material issues

Tokuyama has identified the following nine material issues and is working to increase corporate value through their resolution.

Environment | Contribution to the prevention of global warming Environment conservation |

Safety and Disaster Prevention, health and Safety | No accidents, no disasters |

Technical quality | Development of products and technologies to solve social issues Proper chemical management |

Society | Coexistence, collaboration and contribution to the local community Promotion of CSR procurement Human resource development Emphasis on diversity

|

5.Conclusions

Sales and profit declined due to weak sales of chemicals and the unavoidable impact of COVID-19 in the life & amenity business, but the overall result was steady thanks to the effect of the business portfolio, with specialty products performing well and cement shipments falling only slightly compared to overall domestic demand.

An overview of each company’s financial results shows that 5G-related demand is starting to have an impact on earnings. While the spread of COVID-19 in Europe is a concern, the business environment is likely to remain robust in the second half. In addition, the company is aggressively reorganizing the group to strengthen its business base, which is also noteworthy in terms of future profitability.

Furthermore, the company presented the main concept of its next medium-term management plan, which will begin in the next fiscal year. Environment-related initiatives will play a central role in this plan. How can the company create business opportunities while reducing risks? We would like to pay attention to their concrete measures and path forward.

<Reference1: The Medium-Term Management Plan “Cornerstone of the Group’s Revitalization”>

The company was forced to pass its dividend as it recorded heavy impairment losses in the terms ended Mar. 2015 and Mar. 2016. Needing a new driver for profit growth, the company drew up the 5-year Medium-Term Management Plan entitled “Cornerstone of the Group’s Revitalization” in May 2016 under the vision of “New foundation.”

With this plan, the company is tackling various important issues such as reforming its corporate culture and reconstructing business strategies.

(1) Outline of the Medium-Term Management Plan: “Cornerstone of the Group’s Revitalization”

①Assessment of the present state

◇ | The company has its business base in nonorganic and organic chemistry. Having endured the oil crisis of the 1970s, it has since been constantly growing its businesses by expanding into the field of specialty chemicals and overseas expansion. |

◇ | While the profitability of specialty product business increased during the second half of the 2000s, its general-purpose product business centered on chemicals and cement suffered a profitability decrease due to the shrinking domestic market. |

◇ | Since its founding, the company has always enjoyed its high-efficiency factories and one of the best in-house power generation capacities in Japan. On the back of these qualities, it has built a business based on chemicals and cement, and also been nurturing new fortes in the field of specialty chemicals such as high-purification, powder control, organic and nonorganic synthesis, crystal precipitation, and sintering. |

◇ | On the other hand, the company was not able to successfully relay its technological prowess built up through the specialty chemicals business onto business expansion, apart from the polycrystalline silicon for semiconductors. Therefore, there was a blank period in its creation of new businesses. |

◇ | In 2009, its net interest-bearing debts practically decreased to the no-debt level; however, it swelled rapidly due to the fundraising for its massive investment into its Malaysian business and its financial structure deteriorated drastically, marking a D/E ratio of 4.7 in FY2015.

|

Assessing its present state like this, and with the shrinking of domestic general-purpose product market for its traditional businesses and slowdown of growth rate of its electronic materials business forecast, the company believes it is essential to create a new driver for profit growth by overcoming the points listed below.

“Overconfidence and dependence on Tokuyama Factory”

“Inward and passive posture spread among employees”

“Corporate governance”

“Uncertainty surrounding the strategic direction of the Group and each department”

②Management policies

With the “Tokuyama’s vision” below, the company will place changing its business culture and a fundamental overhaul of business operations as its core business strategies, and aim to achieve these by FY 2025.

(Tokuyama’s vision)

Mission | Centered on the field of chemistry, the Tokuyama Group will continue to create value that enhances people’s lives |

Aspirations | Shift from a focus on quantity to quality

(Fiscal 2025) ・Global leader in advanced materials ・Leader in its traditional businesses in Japan |

Values | ・Customer satisfaction is the source of profits ・A higher and broader perspective ・Personnel who consistently surpass their predecessors ・Integrity, perseverance, and a sense of fun |

(Medium to Long Term Business Strategies)

Transition toward a robust business structure that is resilient against changes in the Company’s operating environment and is capable of sustainable growth |

Transition to a Group-wide low-cost structure by undertaking a comprehensive review of existing work practices |

(Restructuring business strategies)

| Aspirations | Methods | Key Indicators |

“Growth businesses” ・Specialty products ・Life & amenities ・New businesses | “Become a global leader in advanced materials through unique technologies” ・Thoroughly understand customers’ needs, and meet requirements through unique technologies | ・Adhere strictly to customer-oriented business activities ・Utilize open innovation ・Leverage alliances ・Review the research and development structure | EBITDA growth rate |

“Traditional businesses” ・Chemicals ・Cement | “Become a leader in Japan through strengthening competitiveness” ・Overcome competition in the general-purpose products market ・Become an entity that maintains a thirst for increased efficiency | ・Adopt a stringent approach toward maintaining and renewing investments; undertake strategic investments aimed at strengthening competitiveness ・Increase the efficiency of repairs and maintenance expenses by shortening the periods of periodic maintenance ・Strengthen cross-departmental improvement activities ・Leverage alliances | ROA, CCC |

(Drivers for growing businesses)

In the growing businesses, the company endeavors to utilize its unique technologies nurtured in the cutting-edge areas to develop products to respond to the society’s needs.

ICT and healthcare are the prospective fields.

In the ICT field, the company will expand the production line of aluminum nitride for thermal management materials, put boron nitride production into operation, and increase production of polycrystalline silicon.

In the healthcare field, the dental equipment and diagnostic medicines will occupy the company’s core business, while seeking further growths and not ruling out the possible M&A.

(Cross-departmental cost reduction activities)

The company will perform non-conventional, cross-departmental approaches and strategic capital investments to reduce the costs of principal items such as raw material and fuel, repair costs and logistics costs.

(Research & development)

To achieve the expansion of existing businesses and expand into the new business fields to utilize its unique technologies, the company will change its R&D structure so it is more in line with the general customer needs.

Also, it will embrace a more outward-looking R&D, involving a higher ratio of R&D personnel from operations department and group companies rather than from within.

(Capital investment plan and setting strategic investments)

The company plans to spend a cumulative total of 96 billion yen on capital investments from 2016 to 2020 (5 years). Of the total, 26% will be earmarked for new business extensions such as responding to demands for refinement of polycrystalline silicon and enhancing the thermal management materials, to lay down a stronger foothold.

At the same time, the 20 billion yen strategic investment will be set aside to expand the growth businesses and strengthen the competitiveness of traditional businesses, with the breakdown of 65% towards the traditional businesses and 35% for the growing businesses.

③Key challenges and countermeasures

The company identifies the following 4 key challenges and the measures.

Key challenges | Measures |

1. Change the Group’s organizational culture and structure | Steps will be taken to review personnel evaluation systems, actively promote the exchange of human resources between Group companies, and drastically reform structures and systems through a variety of initiatives including the vigorous introduction of outside personnel. |

2. Rebuild the Group’s business strategies | The Group will strictly adhere to a customer-oriented approach on the conduct of its business activities. At the same time, the Group will transition to a research and development structure that is in tune with customers’ needs. Through these means, energies will be channeled toward cultivating new business domains that employ unique technologies. The Group will reinforce management resources including personnel and information through alliance with other companies. |

3. Strengthen Group management | Each company of the Tokuyama Group will once again clarify its role and position. Seeking to contribute to the Group’s growth strategy as well as the reduction of costs, particular emphasis will be placed on further strengthening the management of the Group as a whole. |

4. Improve the Company’s financial position | Every effort will be made to restore the Company’s shareholders’ equity by steadily building up profits. Tokuyama will issue classified stock (preferred stock) to quickly stabilize the Company’s financial position, thereby ensuring that the Group is well positioned to flexibly pursue opportunities including M&As that are designed to accelerate the pace of growth. |

<Reference2: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with audits committee |

Directors | 9 directors, including 3 outside ones |

Auditors | 4 directors, including 3 outside ones |

◎ Corporate Governance Report

Last update date: Jun. 25, 2020

<Basic approach>

Under “Tokuyama’s Vision” set in 2016, our company defined the mission of the Tokuyama Group as “Centered on the field of chemistry, the Tokuyama Group will continue to create value that enhances people’s lives.” With the chemical technology that has been nurtured by the Tokuyama Group, we will create new value and keep offering it, to contribute to the happiness of people and the growth of society. We can create new value and keep offering it, only when we have trust and cooperation from stakeholders, including shareholders, customers, business partners, employees, and local communities, and this will lead to sustainable growth and the mid/long-term improvement in corporate value. To do so, it is necessary to constantly enrich corporate governance, which is an important managerial issue. This is our basic policy.

As a basic policy, the company follows the corporate governance code, respects the rights and equality of shareholders, cooperates with stakeholders in an appropriate manner, discloses information properly, secures transparency, ensures the independence of the board of directors, upgrades the supervisory function, streamlines the decision making process, clarifies responsibilities, conducts constructive dialogue with shareholders, and so on.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code >

Principles | Main reasons for not implementing |

Supplementary Principle 4-1-3【Succession plan for a chief executive officer】 | We carefully select a chief executive officer (president / executive officer), based on our corporate ethos and managerial strategies, but we think it is necessary to adopt a succession program for developing successors in a planned manner, and we will keep discussing it. As for the procedures, in order to secure fairness and transparency, the personnel committee first conducts deliberations carefully, submits proposals to the board of directors, and then the board of directors makes a resolution. |

Supplementary Principle 4-11-1【Policy for the diversity of members of the board of directors】 | As mentioned in “Principle 3-1 (iv) Policy and procedures for selecting and dismissing executives and appointing directors,” we care for the balance and diversity of members of the board of directors, but consider that it is necessary to secure diversity with respect to gender and internationality. We will keep discussing this matter. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 【the so-called strategically held shares】 | As part of its management strategy, the Company may strategically hold shares in listed companies according to its needs for maintenance and development of business relations, funding, and stable procurement of raw materials on business activities. As for these strategically held shares, we will reduce as many shares as possible with the aim of achieving efficient business administration. In fiscal year 2019, our company sold one listed stock, and the total number of listed stocks held by our company became 24. Every year, the board of directors examines economic rationality by comparing capital cost including risks and benefits, and checks whether it is appropriate to hold such shares, while considering the future outlook. Our company will exercise voting rights, while considering the contribution to corporate value of our company and invested enterprises. |

Principle 5-1 【Policy for the constructive dialogue with shareholders】 | Our company makes efforts to disclose not only the managerial and financial information of our company, but also non-financial information, such as our products and services, their environmental and social aspects, timely, appropriately, and understandably, in order to win the understanding and trust of shareholders and investors. Four our basic stance for disclosing information and timely disclosure system, please see “V-2. Other items regarding the corporate governance system, etc. (Outline of the timely disclosure system)” of this report. The section chief of the Publicity and IR Group will take the role of promoting and managing the constructive dialogue with shareholders and investors.

Talks are planned and carried out by the Public Relations and IR Div., which work closely with other internal departments such as the Corporate Planning Div., Business Administration Div., the Finance/Investment and Loan Div., the Corporate Social Responsibility Div., the General Affairs Div., the Research and Development Div., and the Sales Div.

As IR activities in which executives communicate with shareholders and investors directly, we hold a result briefing session for analysts and institutional investors 4 times a year, and participate in the conferences and small meetings held by securities firms when necessary. The Publicity and IR Group, which is in charge of IR activities, holds the interviews with institutional investors inside and outside Japan, a session for introducing our company to individual investors, and so on. For the details of other IR activities, please see “III-2. Situation of IR-related activities of this report.

The opinions, etc. of shareholders and investors received through dialogue are checked and shared at our IR meetings, which are attended by executives and relevant section chiefs, and distributed to each section of our company in the form of IR reports, to improve our corporate value by referring to them when designing our managerial and business strategies and adjusting our course of business operation. Concerning management of insider information, the Company has established company regulations with the aim of thoroughly managing information through non-disclosure agreement, etc. As for the management of insider information, we set in-company rules and manage such information thoroughly by producing a confidentiality pledge, etc. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, All Rights Reserved by Investment Bridge Co., Ltd.d. |