Bridge Report:(4290)Prestige International Second Quarter of the Fiscal Year Ending March 2024

Shinichi Tamagami, CEO | Prestige International Inc.(4290) |

|

Company Information

Market | TSE Prime |

Industry | Provision of services |

CEO | Shinichi Tamagami |

HQ address | 2-4-1 Kojimachi, Chiyoda-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Number of shares issued (End of the Fiscal Year) | Total Market Cap | ROE Act. | Trading Unit | |

¥580 | 128,095,592shares | ¥74,295 million | 14.5% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥12.00 | 2.1% | ¥40.70 | 14.3x | ¥305.35 | 1.9x |

*Stock price as of closing on January 17. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the previous fiscal year (FY 2023 ended March).

*BPS and ROE are the actual results for the FY 2023 ended March. The figures are rounded off.

*DPS and EPS are the company's estimates for FY 2024 ending March

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Profit Attributable to Owners of Parent | EPS | DPS |

March 2020 Act. | 42,377 | 4,959 | 5,364 | 3,193 | 24.95 | 7.00 |

March 2021 Act. | 40,617 | 5,233 | 5,453 | 2,968 | 23.18 | 7.00 |

March 2022 Act. | 46,744 | 6,842 | 7,151 | 4,357 | 34.02 | 8.50 |

March 2023 Act. | 54,562 | 7,840 | 8,378 | 5,318 | 41.62 | 11.00 |

March 2024 Est. | 56,500 | 8,200 | 8,700 | 5,200 | 40.70 | 12.00 |

* The estimated figures are based on the disclosure material made by the Company. Units: million yen. In October 2019, a 2-for-1 stock split was conducted (EPS and DPS were adjusted retroactively).

* The company has adopted the "Accounting Standard for Revenue Recognition (ASBJ Statement No. 29)" etc. at the beginning of the fiscal year ended March 2022.

This report outlines the financial results of Prestige International Inc. for the second quarter of the fiscal year ending March 2024, etc.

Table of Contents

Key Points

1. Corporate Overview

2. Medium-Term Business Plan

3. Second Quarter of the Fiscal Year Ending March 2024 Earnings Results

4. Fiscal Year Ending March 2024 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

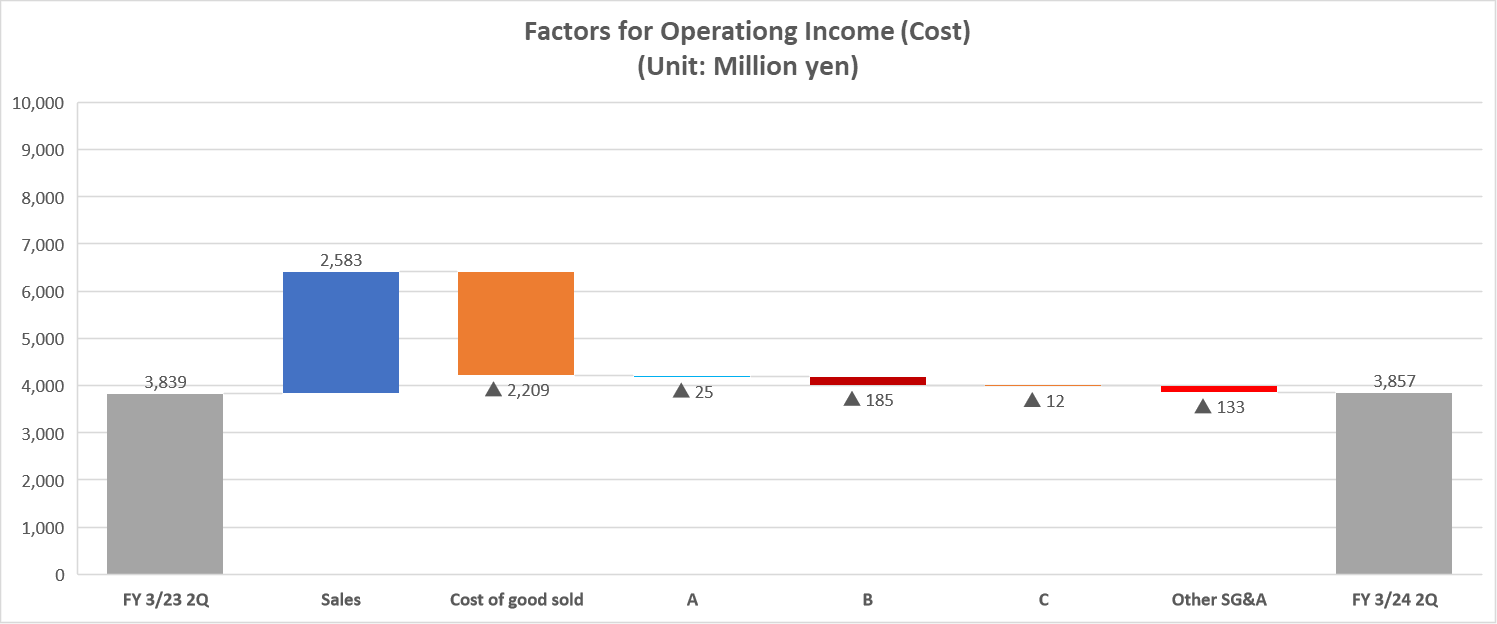

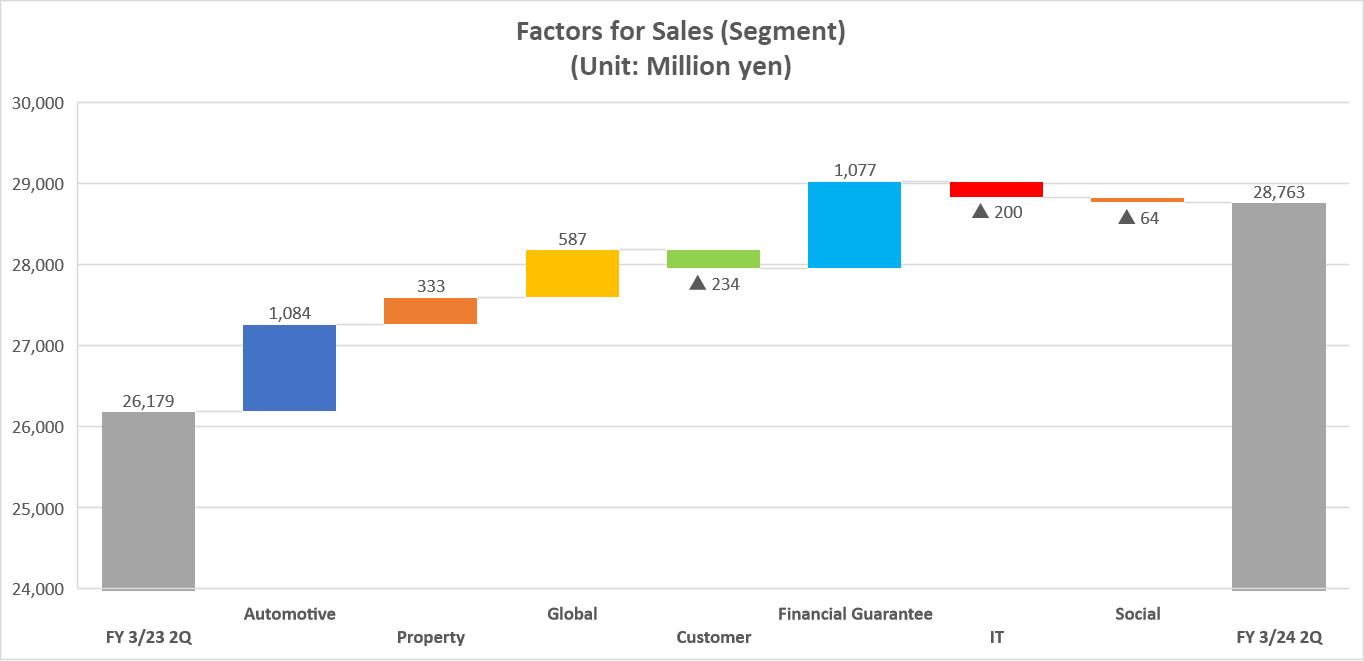

- In the second quarter of the fiscal year ending March 2024, sales were 28,763 million yen, up 9.9% year on year. Although sales in the Customer Business dropped due to the shrinkage of vaccine-related business, the mainstay Automotive Business as well as the Financial Guarantee Business and Global Business performed healthily and sales grew 2,583 million yen year on year. Operating profit increased 0.5% year on year to 3,857 million yen. While operating profit in the Customer Service decreased like sales did, this decrease was offset by the growth of the existing businesses, such as the Automotive Business and Financial Guarantee Business, and operating profit increased 17 million yen year on year.

- The second quarter has ended and there is no revision to their forecast for the fiscal year ending March 2024 with sales of 56.5 billion yen, up 3.6% year on year, and an operating profit of 8.2 billion yen, up 4.6% year on year. Due to the shrinkage of the vaccine-related business, the sales and profit of the Customer Business are forecast to decline, but the existing businesses will drive growth, increasing sales and profit, as earning opportunities in new mobility society will increase in the Automotive Business and the number of travelers will increase in the Global Business.The company keeps plan to pay an annual dividend of 12.00 yen/share (an interim dividend of 6.00 yen/share and a year-end dividend of 6.00 yen/share), up 1 yen/share from 11.00 yen/share in the previous fiscal year, which was up 2.50 yen/share from the year before the previous. The expected payout ratio is 29.5%.

- The first half of the fiscal year has ended and the progress rate towards the full-year forecast is around 50% for sales and all kinds of profits, showing a steady progress. Attention will be paid to whether they can overcome the decline of vaccine-related business and reach the full-year forecast through the effects of their characteristic portfolio in the second half as well.

1. Corporate Overview

The company operates BPO business in Japan and overseas under the management philosophy of “To listen to end-user (consumer) inconveniences and troubles, and lead to solutions.” Their main services include a roadside assistance service provided to automobile insurance subscribers (receiving requests by phone and offering on-site services), a healthcare program dealing with injuries and illnesses which Japanese nationals suffered during their overseas stay (https://www.hcpg.jp/), a house maintenance service provided to condominium residents based on a contract with the management company of the property, etc. (stopping water leakage, lock opening, housecleaning, etc.) and a parking area assistance service for companies managing parking lots. Although all these services are familiar, the company operates in the form of B2B business, which in other words means that they do business using the name of a client enterprise (a non-life insurance company, an automobile-related company, a real estate management company, or the like) when providing the service, and the company name “Prestige International” is thus not often heard.

(1) Group Philosophy and Group Operating Policy

Group Philosophy

To listen to end-user (consumer) inconveniences and troubles, engage in business creation that will lead to solutions, and grow as a company that contributes by providing solutions to social issues through that development.

Group Operating Policy

Prestige International Group strives to become a necessary part of our community, trusted by client enterprises and offering solutions that end users appreciate. While their desire is to continually contribute to society, they also aim to become a global company, prospering together with client enterprises, shareholders, employees, and local communities.

(2) Outline of business segments

Segment | Business outline |

Automotive | Automobile-related services: roadside assistance, accident reception, customer support, automobile extended warranty, emergency call service, etc. |

Property | Services for real estate management companies: on-site responses to housing equipment issues, housing equipment extended warranty service, housing services, pet assistance service, etc. Services for parking lot operations: regular patrol service, device maintenance, etc. |

Global | Overseas-related services: Japanese-language support services on a 24-hour, claim agent services, healthcare program, credit card business denominated in U.S. dollars etc. for Japanese expatriates and overseas travelers. |

Customer | Contact center-related services: customer relationship management, product warranty business and arrangements for the repair of products, municipal-related business etc. |

Financial Guarantee | Financial guarantee services: rent guarantee, medical expense guarantee, child support payment guarantee, nursing care guarantee etc. |

IT | IT-related services: SCM solutions, various IT solution business, etc. |

(3) History

The motive for founding the company in October 1986 lay in the CEO, Tamagami’s wish for “being able to have access to high-quality and heartfelt services like in Japan even while staying overseas,” coming from his experience of inconveniences due to the differences in language and culture when he lived overseas for seven years. In the following year, the company started business in New York and launched a service for 24-hour response in Japanese to inquiries from Japanese travelers who encountered trouble. After that, the company widened its scope of the services while broadening the network to major cities in Asia and Europe. The company also developed their business in Japan and expanded their range.

Prestige International Inc. was listed on the NASDAQ Japan market in July 2001 and opened a contact center attending to emergency requests 24 hours a day, 365 days a year in Akita City, Akita Prefecture (current “Akita BPO Main Campus” WEST Wing, approx. 650 seats) in October 2003. The BPO bases, opened with the philosophy of “long-term and stable securing of human resources is what makes it possible to provide a stable service to customers,” grew in scale, having the EAST Wing (approx. 550 seats) in 2007 and the Satellite Wing (approx. 300 seats) in 2012. The high-quality infrastructure is highly regarded by clients and the center also plays a part in generating new employment opportunities in Akita in addition to its role as a showroom. Following the listing on the Second Section of the TSE in December 2012, the company’s stock was listed on the First Section of the TSE in December 2013. In April 2022, the company was listed on the Prime Market of TSE in the wake of the TSE market restructuring.

(4) Strengths

The strengths of the company lie in the stable recurring-revenue business, service operational bases which support their high-quality service, and consequently the achievement of high profitability and management efficiency.

Moreover, the company offers not only response to phone inquiries, but also one-stop solutions based on assistance services such as on-site response. On-site response by the company itself and the countrywide network are high barriers to entry, so those are competitive advantages of the company.

① Stable recurring-revenue business

As the company offers mainly value-added services (special insurance contracts) to the existing customers of their client enterprises, such as non-life insurance companies, the fluctuation of revenues due to the external environment is relatively insignificant. The principal outsourcing contract fee is calculated by multiplying the number of users eligible for the service by the unit price of the services. The increase of users eligible for the service and usage rate per user eligible for the service is reflected in the outsourcing contract fee in the following year. The numbers of participating enterprises and users grew especially in regard to the response to automobile-related trouble owing to better recognition of the company, bringing about a continuous increase of users eligible for the service and elevation of the usage rate. This is further reinforced by the fact that automobile manufacturers and sales companies are striving to expand service income. In the real estate-related service, condominium developers, etc., who used to be dependent on the pay-per-product service of selling off the properties, are enhancing recurring-revenue business in the same way, also bringing tailwind. Furthermore, the Healthcare Program (responding to health problems associated with overseas assignments), which the company operates as an overseas business, is supported by the global development of enterprises aiming for the remarkably growing overseas market.

② Service operation bases which support high-quality services

In order to offer high quality services, the company operates contact centers and on-site assistance teams in Japan. In addition, the company has a global network of 28 operational bases in 18 countries mainly to provide services of the Global Business.

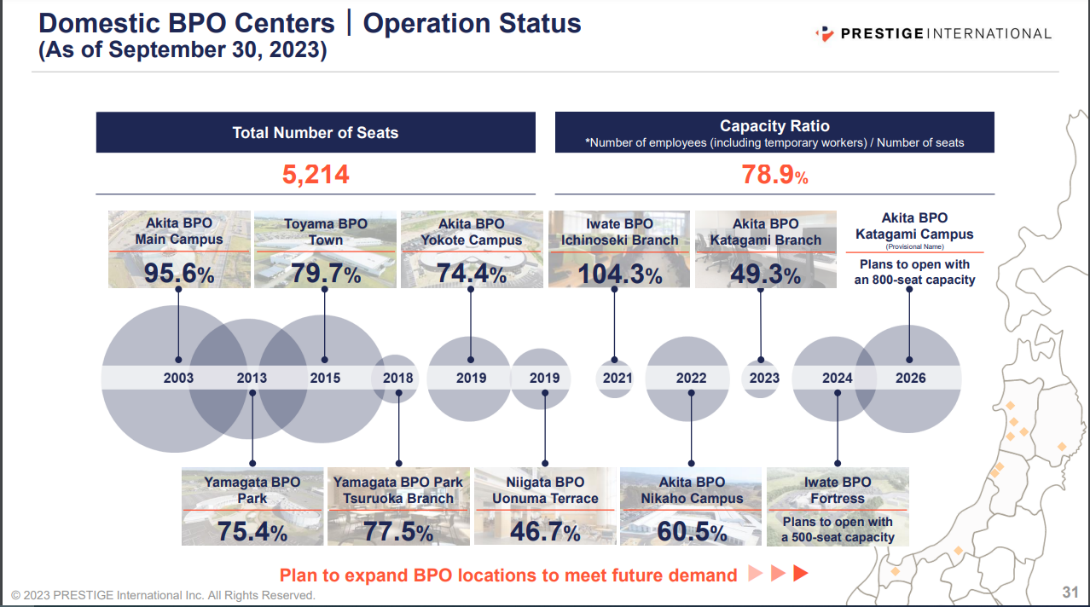

③ Nine BPO operation bases in Japan

(Source: the company’s presentation materials)

The company has nine contact centers, which are BPO operation bases – Akita BPO Main Campus (Akita City, Akita Prefecture), Yamagata BPO Park (Sakata City, Yamagata Prefecture), Toyama BPO Town (Imizu City, Toyama Prefecture), Yamagata BPO Park Tsuruoka Branch (Tsuruoka City, Yamagata Prefecture), Akita BPO Yokote Campus (Yokote City, Akita Prefecture), Niigata BPO Uonuma Terrace (Uonuma City, Niigata Prefecture), Iwate BPO Ichinoseki Branch (Ichinoseki City, Iwate Prefecture), Akita BPO Nikaho Campus (Nikaho City, Akita Prefecture) and Akita BPO Katagami Branch. They were opened in cities in the countryside, placing importance on personnel stability. Furthermore, the centers currently operate at an occupancy rate of 78.9 %. The company assumes that an occupancy of approx 80% is the best in order to respond to the BCP at the operational bases in case of emergency and accept orders, etc. of irregular business, and so forth. As the current situation is close to this state, they will go on to open operational bases in Ichinoseki City, Iwate Prefecture, and Katagami City, Akita Prefecture, and engage in stable and proactive recruitment “focused on the area” when viewed from the overall perspective by recruiting in each region.

④ Providing in-house operated on-site response in major cities throughout Japan

On-site response for the Road Assist (automobile-related), Home Assist (real estate-related), and Park Assist (parking lot-related) are operated and managed wholly by Premier Assist Inc., a group company, in major cities throughout Japan.

Staff who assist clients with trouble on the site are full-time employees, all wearing crisp clean uniforms, and the company regularly gives lectures on manners, etc., sparing no effort in initiatives for elevating the service quality. The on-site response by full-time employees of Premier Assist Inc. is highly regarded and constitutes the source of the company’s competitiveness.

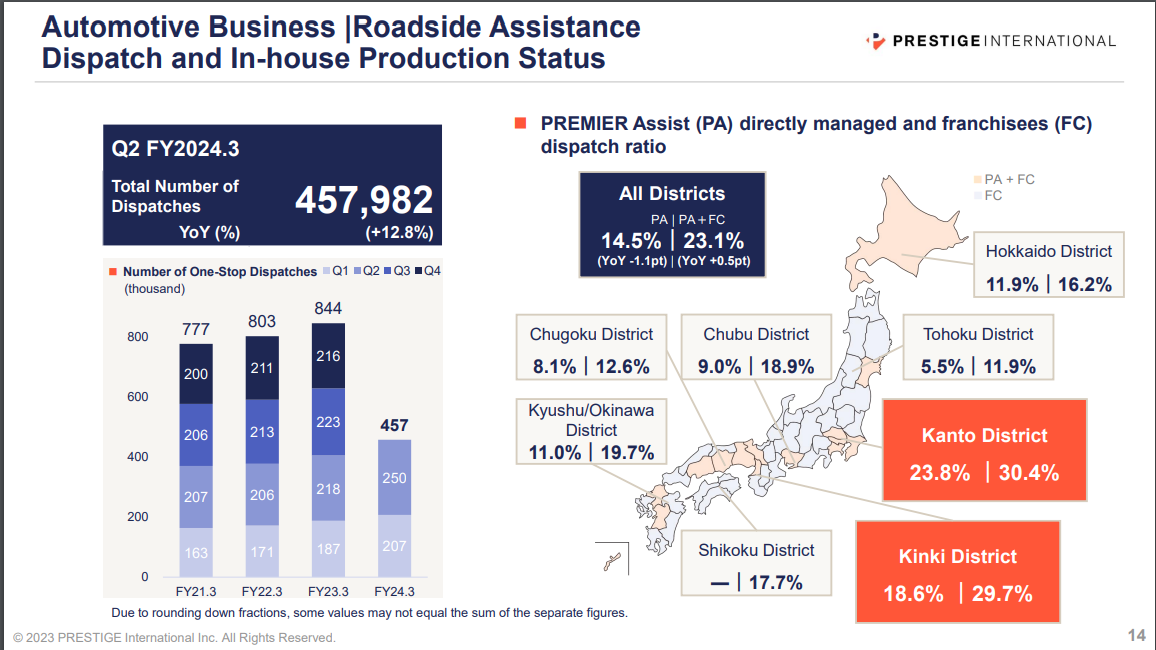

(Source: the company’s presentation materials)

⑤ Offering services globally

The company has expanded its network to 28 operational bases in 18 countries in the world (As of September 30, 2023), introducing medical institutions and assessing medical care fees in the event of getting ill or injured overseas, and cultivating a network of hospitals which allow cashless payments for the examination at each operational base overseas. The company provides various services at each operational base 24 hours a day, 365 days a year multilingually, such as in Japanese and English.

*As of June 2023

(Source: the company’s website)

2. Medium-Term Business Plan

On May 14, 2021, the company announced its three-year medium-term business plan started in FY 2022.

(1) Overview

① Achieving the next stage of growth

The company has continued stable growth by receiving more orders from major non-life insurance companies and automobile manufacturers, leveraging strengths in automotive and customer field operations, such as roadside assistance and warranty, and customer support operations by utilizing its own knowledge.

The pandemic has brought about major changes in the way individuals and businesses operate. It is also assumed that future innovations in communication and technology will create a variety of services and also highlight social issues. In such an environment, simply extending existing services will diminish their value and lead to their decline.

The company aims to grow further as a “value creation company” by building a knowledge platform that utilizes IT and DX, reducing and reviewing man-hours, and providing unique value by responding to further customer needs.

Specifically, the company have the following goals:

*Continuing over 10% sales growth

*Increasing the total number of seats in the BPO bases to over 6,000 by FY 2026 (4,500 at the end of the previous medium-term business plan); Deciding to invest in expansion to have 500 seats in FY 2024 and 800 seats in FY 2026.

*Expanding the Premier Assist brand, increasing the number of on-site support staff from 550 at the end of the previous medium-term business plan to 880 (653 at the end of March 2023).

② Long Term Vision & Medium-Term Business Plan

Considering that the world’s challenges 10 years from now will include post-digital, an aging society, widening regional disparities, and environmental issues, the company’s long-term vision is to “create services that solve social issues as a value creation company.”

The vision of the medium-term business plan 2022-2024 is as follows.

1. Creating service areas that can only be realized by PI | Providing the highest quality operation and field services through their personnel and IT |

2. Stable and continuous growth | Use IT to improve the quality of on-site work capabilities through customer service and field services at local BPO sites, accumulate knowledge, and recirculate it as a new service |

3. Create and maintain employment in regional cities | *Yamagata BPO Garden (500 seats) upgraded to Yamagata BPO Park (1,000 seats) *Opened in March 2021 *Akita BPO Main Campus Nikaho Branch (300 seats) upgraded to Akita BPO Nikaho Campus (500 seats) *Opened in April 2022 *Iwate BPO Fortress (500 seats) scheduled to open in 2024 |

4. Creating an inclusive work environment | Enable women’s career advancement, aiming to increase the ratio of female managers to 50%, (40.5% as of FY 2023 September), employment of people with disabilities, utilization of sports personnel |

③ Creating a PI-DX model

DX will be a key measure to achieve growth.

The company promote the adoption and utilization of the model in three phases.

STEP 1 | Aim to unify the systems used in contact centers | *Simplification Support and education for systems that differ from client to client *BCP Support Establishing support systems for other sites and teams by sharing a common system *Operate PI’s Original System *Enable further knowledge building and sharing |

STEP 2 | Making it possible to provide PI knowledge utilization services to new fields through a common system | *System sharing Spot services can be provided based on service scale, target industries, and companies *Subscription No initial investment required, reducing installation costs. New contract models can be provided. |

STEP 3 | Aiming to provide new customer value through knowledge sharing | *Creation of Unique Service Value of PI *Strengthen ties with a society that is Turning Towards DX *Value creation Business development from the customer’s perspective |

(2) Strategy in each segment

[Automotive]

Aiming to provide further value through IT for roadside assistance and customer support.

In pursuit of quality + speed + customer value (further satisfaction), the company will expand the bases of their on-site assistance team for Premier Assist, build an IT/DX-based education system (knowledge management) for insurance, and build CASE-compliant services for automobile manufacturers.

In terms of customer support, the company is considering the creation of new customer services that utilize accident report receipts and the provision of services through a platform for new non-life insurance markets other than automobile insurance.

[Property (Home Assist)]

Providing a standard model of “housing” support by combining BPO and IT.

In order to “create businesses that satisfy residents’ needs”, “expand touch points (consignment work) in the real estate business,” and “collaborate to expand satisfaction of residents’ needs,” they will share and utilize IT knowledge and develop partners for last-mile reforms.

Expanding the number of condominium units to which they offer services, including home assistance services, from 720,000 at the end of the previous medium-term business plan to 850,000 by FY 2024. They will increase their share in condominium units nationwide (approximately 6.73 million units) from 10.5% to 12.6%. In February 2022, the company expanded its area of collaboration with a major energy company to provide plumbing repair services. They aim to expand business horizontally in the infrastructure (energy-related) and real estate (condominiums, detached houses, and rental properties) industries.

The target number of requests (number of on-site support services of Home Assist service for FY 2024 is 300,000.

In addition, the insurance market in the pet industry is growing at a double-digit rate on average annually, and demand is expected to continue to grow in the future due to the development of animal medical care and pets becoming family members. Therefore, they will enter the pet industry by utilizing the know-how they have cultivated so far, such as consultation, house visits, and assistance services for transporting pets when they become ill.

[Global]

The company will expand their services from two aspects: HCP (Healthcare Program), an existing service, and MSP (Medical Support Program), a new service, and strengthen the overseas bases’ infrastructure.

Specifically, they will conduct fieldwork with expatriates and Japanese overseas residents to resolve concerns about medical treatment barriers such as pre-symptomatic disease treatment & prevention, language, customs, and culture, and expand the service lineup by carefully identifying their needs. In addition, by providing PI knowledge as a common platform, seamless support will be provided between the client company’s head office personnel, overseas subsidiaries, and members of the company’s service.

* HCP: A service with expatriates as members in comprehensive contracts with companies expanding overseas

* MSP: A service that can be subscribed on an individual basis by Japanese overseas residents as well as expatriates.

The company targets to acquire 20,000 MSP members through fieldwork for expatriates and Japanese overseas residents, and to provide “safety and security” to 460,000 long-term overseas residents related to private companies, not including permanent residents, out of 1.35 million Japanese people residing overseas.

[Customer]

It serves as a gateway to expand the company’s services and contributes to the creation of unique businesses while responding to diverse requests by leveraging the know-how accumulated. Specifically, the company will focus on the following three points.

◎High value-added working environment

In order to develop infrastructure as an environment where employees work responsibly and achieve low turnover, they will provide PI’s unique employee training in a win-win relationship with their clients.

◎Strengthening BCP compatibility

In order to continue stable operations in a secure environment, the company will unify systems and build a support system that includes other teams and other bases.

◎Providing PI knowledge utilization services based on unified systems

Providing high quality spot services according to services through system sharing.

[Financial Guarantee]

Aiming for sustainable growth through three initiatives: “building up recurring revenues” by increasing the subscription ratio of existing clients and acquiring new clients; “expanding strategies that lead to social significance” such as medical cost coverage, long-term care coverage, and childcare cost coverage; and “providing social infrastructure through guarantee schemes” to spread consumer security and safety.

[IT]

Aiming to increase the value of services that can only be provided by “human.”

The company will work to create value in customer experience by realizing a platform for utilizing knowledge for business, providing services tailored to customer needs through IT, and linking with applications. In addition, the company’s IT services can provide spot services, depending on the service scale, and can be tailored according to target industries and companies. It is also characterized by the fact that it does not require an initial investment, reduces installation costs, and can also offer new contract models such as subscriptions. Iwate BPO Fortress, scheduled for completion in FY 2024, will serve as a base for the company’s IT strategy and will be used to develop and create new services.

[Social]

At the women's sport team ‘Aranmare’, all basketball, volleyball, and handball teams participate in the top league.

The company conduct nutrition education activities at the local elementary schools led by Aranmare players and hold handball classes for children with disabilities. At “Orangery,” in-office day care centers, the company is working to expand childcare services by contributing to the community by opening the facility as a local nursery to strengthen ties with the local community and respond to local needs. In addition, the company have opened a childcare center during school holidays, aiming to create a working environment where everyone wants to work without difficulty. In addition to this, “PI Re-Turn Fund” is working on a regional development project that aims to provide services to social contribution projects.

(3) Regional development and ESG

The company aims to expand the number of BPO bases to 9 in 5 prefectures and increase the number of seats to 6,000. The company believes that its own growth will resonate with the growth of local communities through the creation and maintenance of jobs and is building a “model of returning profits to local communities” in which profits earned in local communities are reinvested in the communities.

In terms of ESG, the company will further deepen the “model of returning profits to local communities,” “promotion of women’s advancement,” “health and productivity management,” “sports, nursery school” and “regional revitalization business” mainly in the field of “S: social.” In addition, the company will appropriately disclose information on initiatives such as improving the workplace environment, sharing their management vision, and strengthening governance, and will continue to maintain healthy conversations with the market.

In May 2022, the company announced their support for the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD). In addition, in order to achieve net zero CO2 emissions by 2050, the company have set a goal of reducing CO2 emissions by 50% by 2030, and strengthen efforts to increase the ratio of renewable energy in their electricity consumption by promoting energy-saving activities and switching to EVs for company vehicles, etc.

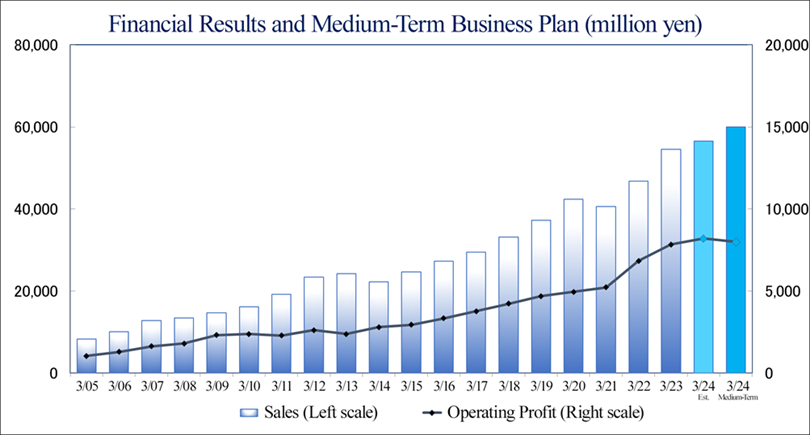

(4) Financial targets and performance trends

The company will organically combine each strategy to expand “business areas that only PI can achieve” three-dimensionally. Consolidated financial targets for FY 2024 are as follows.

| FY 3/21 | FY 3/22 | FY 3/23 | FY 3/24 Est. | Medium-Term Business Plan |

Sales | 40,617 | 46,744 | 54,562 | 56,500 | 60,000 |

Operating Profit | 5,233 | 6,842 | 7,840 | 8,200 | 8,000 |

ROA | 6.6% | 8.6% | 9.3% | 10% | 10% |

ROE | 10.0% | 13.4% | 14.5% | 13% | 13% |

Total Return Ratio | 30.2% | 34.6% | 26.4% | 39.2% | 30% or higher |

*Unit: million yen

<Progress of financial targets laid out in the Medium-Term Business Plan >

◆In FY 2022, the first year of the medium-term business plan, and in FY 2023, the second year of the plan, the targets were achieved, and sales and operating profit reached record highs.

◆In the company plan for FY 2024, which is the final year of the medium-term business plan, the company expects sales to be 56.5 billion yen, which would fall 3.5 billion yen short of the figures set forth in the medium-term business plan, due to a change in the accounting method for some outsourcing expenses following a contract change requested by a client in the Automotive Business. However, the company aims to achieve an operating profit of 8.2 billion yen, up 200 million yen from the medium-term business plan.

*Produced by Investment Bridge Co., Ltd. based on disclosed material.

3. Second Quarter of the Fiscal Year Ending March 2024 Earnings Results

(1) Consolidated Business Results

| 2Q of FY3/23 | Ratio to Sales | 2Q of FY3/24 | Ratio to Sales | YoY | Company’s estimates revised on Oct. 25 | Difference from the estimates |

Sales | 26,179 | 100.0% | 28,763 | 100.0% | +9.9% | 26,500 | +8.5% |

Gross Profit | 6,329 | 24.2% | 6,704 | 23.3% | +5.9% | - | - |

SG&A | 2,490 | 9.5% | 2,846 | 9.9% | +14.3% | - | - |

Operating Profit | 3,839 | 14.7% | 3,857 | 13.4% | +0.5% | 3,800 | +1.5% |

Ordinary Profit | 4,039 | 15.4% | 4,071 | 14.2% | +0.8% | 4,000 | +1.8% |

Quarterly Profit Attributable to Owners of Parent | 2,458 | 9.4% | 2,357 | 8.2% | -4.1% | 2,400 | -1.8% |

*Unit: million yen

*The figures include the figures calculated by Investment Bridge Co., Ltd. as reference values and may differ from the actual figures. (The same applies below.)

*A: Salaries and Allowance, B: Allowance for Doubtful Accounts C: Reserve for Bonuses

*Produced by Investment Bridge Co., Ltd. based on disclosed material.

▲ in the cost item indicates an increase in cost.

Sales and operating profit grew 9.9% and 0.5%, respectively, year on year.

Sales were 28,763 million yen, up 9.9% year on year. They changed the contract form in vaccine-related business this fiscal year and undertook tasks at a smaller scale. Despite a drop of sales such in the Customer Business, due to this shrinkage of vaccine-related business, the mainstay Automotive Business as well as the Financial Guarantee Business and Global Business performed healthily, capturing demand against the backdrop of the recovery of socioeconomic activities, and sales grew 2,583 million yen year on year.

Operating profit increased 0.5% year on year to 3,857 million yen. While operating profit in the Customer Business decreased like sales did, this decrease was offset by the growth of the existing businesses, such as the Automotive Business and Financial Guarantee Business, and operating profit increased 17 million yen year on year. As the profit margin of the vaccine-related business was high in the same period of the previous fiscal year, the impact of the decline in the profit of the Customer Business was significant. Consequently, the increase rate of profit fell short of that of sales.

Gross profit margin dropped 0.9 points year on year to 23.3% and the ratio of SGA to sales augmented 0.4 points year on year. As a result, operating profit margin declined 1.3 points year on year to 13.4%. In addition, the increase rate of ordinary profit exceeded that of operating profit as interest on securities and investment gain on equity method, posted as non-operating profits, increased year on year. On the other hand, quarterly net profit attributable to owners of parent decreased due to increase in corporation taxes.

While sales, operating profit and ordinary profit exceeded the initial forecast for the second quarter, quarterly net profit attributable to owners of parent fell slightly short of the forecast.

(2) Trends by Segment

| Cumulative 2Q of FY3/23 | Composition ratio/profit margin | Cumulative 2Q of FY3/24 | Composition ratio/profit margin | YoY |

Automotive Business | 11,150 | 42.6% | 12,234 | 42.5% | +9.7% |

Property Business | 3,182 | 12.2% | 3,515 | 12.2% | +10.5% |

Global Business | 3,353 | 12.8% | 3,940 | 13.7% | +17.5% |

Customer Business | 4,534 | 17.3% | 4,300 | 15.0% | -5.2% |

Financial Guarantee Business | 3,210 | 12.3% | 4,287 | 14.9% | +33.5% |

IT Business | 383 | 1.5% | 183 | 0.6% | -52.3% |

Social Business | 364 | 1.4% | 300 | 1.0% | -17.4% |

Consolidated Sales | 26,179 | 100.0% | 28,763 | 100.0% | +9.9% |

Automotive Business | 1,328 | 11.9% | 1,502 | 12.3% | +13.1% |

Property Business | 183 | 5.8% | 227 | 6.5% | +24.2% |

Global Business | 352 | 10.5% | 408 | 10.4% | +16.0% |

Customer Business | 1,137 | 25.1% | 776 | 18.0% | -31.7% |

Financial Guarantee Business | 786 | 24.5% | 1,028 | 24.0% | +30.7% |

IT Business | 132 | 34.5% | 21 | 11.5% | -83.7% |

Social Business | -81 | - | -118 | - | - |

Consolidated Operating Profit | 3,839 | 14.7% | 3,857 | 13.4% | +0.5% |

*Unit: million yen

*Produced by Investment Bridge Co., Ltd. Based on disclosed material.

Automotive Business (accounting for 42.6% of sales in cumulative 2Q of FY 2024)

Sales and profit grew 9.7% and 13.1%, respectively, year on year.

In the Automotive Business, which offers mainly Road Assist services for non-life insurance companies and automobile manufacturers, sales increased owing to the growth of Road Assist services for bicycles in addition to a steady rise in the number of vehicles covered by direct non-life insurance, despite the impact which the change in the form of contract with some clients had on posting sales. The form of contract with some clients was changed to the cost-reimbursement contract, leading to an impact of 954 million yen. The total number of Road Assist cases in the second quarter of the fiscal year ending March 2024 increased 12.8% year on year to 457,982.

Operating profit grew owing to the increase of in-house Road Assist services, despite the augmentation of costs caused by increases in towing distance and rate. Operating profit margin increased 0.4 points year on year to 12.3%.

In addition, the number of bases directly operated by Premier Assist in the second quarter of the fiscal year ending March 2024 was 32, increasing by 1 from the end of the previous fiscal year.

Road assistance by Premier Assist | FY3/21 Act. | FY3/22 Act. | FY3/23 Act. | 2Q of FY3/24 Act. |

No. of bases directly managed by Premier Assist | 31 | 31 | 31 | 32 |

No. of franchisees of Premier Assist Franchises equipped with portable EV chargers | 42 - | 63 - | 85 - | 96 69 |

No. of staff members at bases directly managed by Premier Assist | 217 | 235 | 254 | 274 |

No. of vehicles owned by Premier Assist | 202 | 210 | 222 | 233 |

Tow trucks | 42 | 51 | 56 | 63 |

Electric tow trucks | 1 | 2 | 45 | 51 |

Car-carrying vehicles | 72 | 72 | 80 | 80 |

Service cars | 77 | 78 | 78 | 84 |

Special vehicles exclusively for motorcycles* | 2 | 2 | 2 | 2 |

Motorcycles | 9 | 7 | 6 | 4 |

*Produced by Investment Bridge Co., Ltd. with reference to the company’s presentation materials

Property Business (accounting for 12.2% of sales in 2Q of FY 2024)

Sales and profit grew 10.5% and 24.2%, respectively, year on year.

In the Property Business, which offers the repair of condominiums, apartments for rent and detached houses, maintenance of paid parking lots, etc., sales grew owing to the expansion of target areas and increase in the use of the Park Assist service in addition to healthy performance of existing Home Assist services.

Although the cost of personnel expenses, etc. augmented as a result of proceeding with suitable allocation of staff in Home Assist, operating profit increased as investments in the construction of a new base for on-site Park Assist services were completed and profitability improved due to the elevation of occupancy rate. Moreover, operating profit margin increased 0.7 points year on year to 6.5%. The total number of Home Assist cases in the second quarter of the fiscal year ending March 2024 declined 16.5% year on year to 69,934, while the total number of Park Assist cases increased 10.3% year on year to 172,644.

Material items regarding the house maintenance service of Premier Assist | FY3/21 Act. | FY3/22 Act. | FY3/23 Act. | 2Q of FY3/24 Act. |

No. of bases | 13 | 14 | 14 | 14 |

No. of staff members | 110 | 129 | 136 | 134 |

No. of cases [thousand] | 135 | 155 | 156 | 69 |

Share in Premier Assist | 37.8% | 35.9% | 34.2% | 37.1% |

Materials items regarding the parking area assistance service of Premier Assist | FY3/21 Act. | FY3/22 Act. | FY3/23 Act. | 2Q of FY3/24 Act. |

No. of bases | 11 | 11 | 11 | 10 |

No. of staff members | 230 | 247 | 263 | 265 |

No. of cases [thousand] | 257 | 291 | 319 | 172 |

*Produced by Investment Bridge Co., Ltd. with reference to the company’s presentation materials

Global Business (accounting for 13.7% of sales in cumulative 2Q of FY 2024)

Sales and profit grew 17.5% and 16.0%, respectively, year on year.

In the Global Business, which offers claim agent services for overseas travel insurance and Healthcare Program (HCP), a medical care support service for expatriates, sales grew owing to the expansion of areas covered by claim agent services in addition to the increase in the use of the Overseas Travel Accident Insurance (OTAI) and Japanese Help Desk (JHD), capturing demand stemming from the increase in the number of overseas travelers.

Operating profit grew, driven by the steady performance of the Healthcare Program, etc., despite the increase in payment fees paid to local partner banks in the U.S. Credit Card Business (CARD). Progress in price revision, etc. of the Healthcare Program in step with inflation also contributed to the growth in sales and profit. Operating profit margin declined 0.1 points year on year to 10.4%.

Customer Business (accounting for 15.0% of sales in cumulative 2Q of FY 2024)

Sales and profit decreased 5.2% and 31.7%, respectively, year on year.

In the Customer Business, which offers customer support services, they changed the contract form in vaccine-related business this fiscal year and received consignment at a smaller scale. The extent of decline in sales caused by the shrinkage of vaccine-related business was suppressed by issue improvement and growth of existing projects.

Operating profit dropped further, impacted by the rise in costs from supplementing staff, etc. in step with the increase in business operations in projects which had decreased during the coronavirus crisis. Moreover, operating profit margin declined 7.0 points year on year to 18.1%.

Financial Guarantee Business (accounting for 14.9% of sales in cumulative 2Q of FY 2024)

Sales and profit increased 33.5% and 30.7%, respectively, year on year.

In the Financial Guarantee Business, which provides financial guarantee services related to living, such as rent or medical expenses, sales significantly grew owing to the expansion of existing services in addition to the steady increase of contracts for the Rent Guarantee Business and the Medical Expense Guarantee Business operated by a group company Entrust Inc.

Operating profit increased owing to growth in sales, while operating profit margin fell 0.5 points year on year to 24.0%.

IT Business (accounting for 0.6% of sales in cumulative 2Q of FY 2024)

Sales and profit decreased 52.3% and 83.7%, respectively, year on year.

In the IT Business, which offers IT solutions, sales declined after acceptance inspections concentrated in the second quarter of the previous fiscal year, in addition to cancellations of the license and delay in acceptance inspection of supply chain management systems.

Operating profit dropped, due to the decrease in sales. Moreover, operating profit margin declined 22.7 points year on year to 11.9%.

Social Business (accounting for 1.0% of sales in cumulative 2Q of FY 2024)

Sales decreased 17.4% year on year, and operating loss expanded 36 million yen year on year.

In the Social Business, which manages women’s sport teams “Aranmare” and operates childcare and regional revitalization businesses, sales declined despite an increase in income from sponsors after the women’s sport team “Aranmare Yamagata” (volleyball) was promoted to the V1 league.

Regarding operating profit, deficit expanded year on year due to the augmentation of expenses for enhancement of team assets and expenses for activities of each team.

(3) Financial Condition and Cash Flows

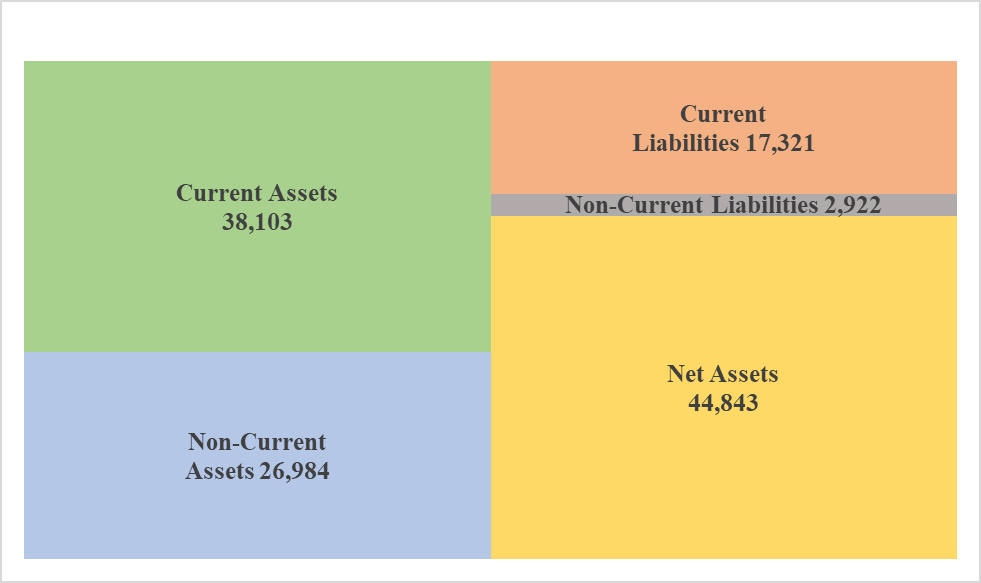

◎Financial Condition

| Mar. 2023 | Sep. 2023 |

| Mar. 2023 | Sep. 2023 |

Cash and deposits | 21,671 | 21,048 | Trade payables | 1,349 | 1,270 |

Trade receivables | 5,304 | 5,970 | Short-term borrowings | 125 | 125 |

Advances paid | 6,549 | 8,912 | Current liabilities | 15,701 | 17,321 |

Inventories | 306 | 386 | Long-term borrowings | 250 | 187 |

Current assets | 35,892 | 38,103 | Asset retirement obligation | 1,885 | 1,927 |

Buildings and structures | 11,085 | 11,087 | Noncurrent liabilities | 2,753 | 2,922 |

Tangible Assets | 13,697 | 14,748 | Liabilities | 18,455 | 20,244 |

Intangible Assets | 2,025 | 2,146 | Net assets | 41,817 | 44,843 |

Investments and Others | 8,657 | 10,089 | Total liabilities and net assets | 60,273 | 65,087 |

Noncurrent assets | 24,380 | 26,984 | Total Interest-bearing liabilities | 375 | 312 |

*Unit: million yen

*Interest-bearing liabilities = Borrowings (excluding lease obligations)

*Produced by Investment Bridge Co., Ltd. based on disclosed material.

The total assets as of the end of September 2023 stood at 65,087 million yen, up 4,814 million yen from the end of the previous year. In the section of assets, trade receivables, advances paid, tangible fixed assets, others, and investment securities, etc., increased assets. In the section of liabilities and net assets, contract liabilities, other current liabilities, and retained earnings through the increase in quarterly net profit attributable to owners of parent increased liabilities and net assets. The liquidity of assets is high, current assets account for approx 58% of total assets. Capital-to-asset ratio remains as high as 64.3%.

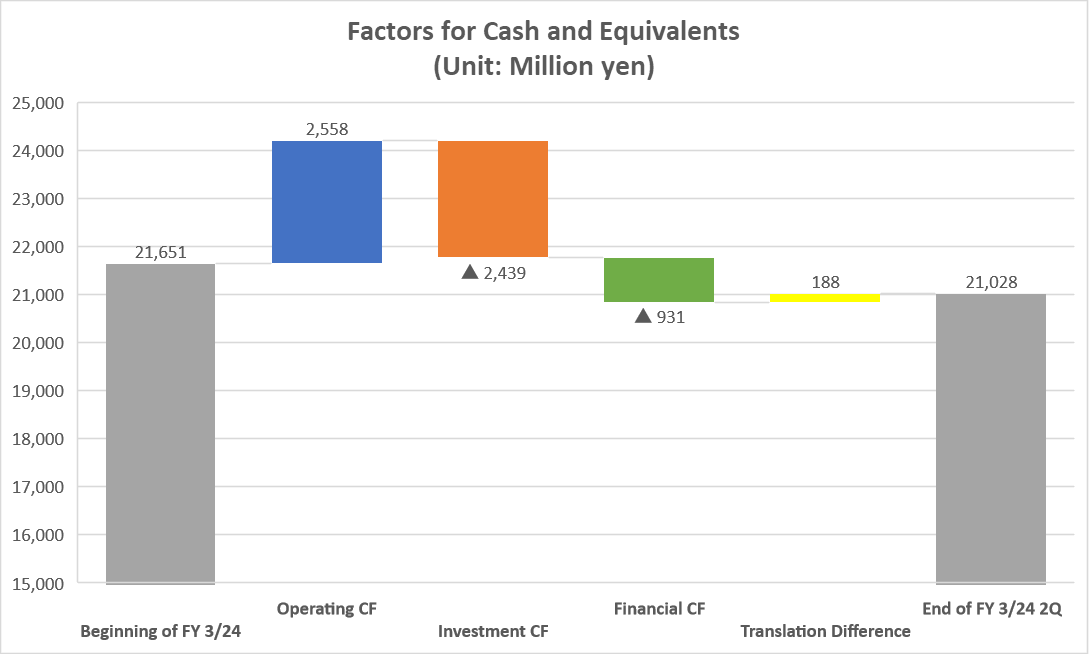

◎Cash Flow

| Cumulative 2Q of FY3/23 | Cumulative 2Q of FY3/24 | Increase/ decrease | YoY |

Operating Cash Flow | 2,821 | 2,558 | -262 | -9.3% |

Investment Cash Flow | -1,310 | -2,439 | -1,129 | - |

Free Cash Flow | 1,510 | 119 | -1,391 | -92.1% |

Financial Cash Flow | -1,046 | -931 | 115 | - |

Cash and Equivalents at Year End | 19,099 | 21,028 | 1,929 | +10.1% |

*Unit: million yen

*Produced by Investment Bridge Co., Ltd. based on disclosed material.

In terms of cash flows, the cash inflow from operating activities decreased due to the increases in trade receivables, advances paid, and other assets, etc. The cash outflow from investment activities expanded and the surplus of free cash flow shrank, as the increases in expenses for acquiring tangible and intangible fixed assets and investment securities. On the other hand, the cash outflow from financial activities shrank due to the decrease in expense by repayment of short-term debt. Accordingly, the cash position of second quarter of the fiscal year ending March 2024 increased by 10.1% year on year.

(4) Sustainability

◎Initiatives for promotion of women’s advancement

Viewing the creation of an employment environment where young people and women can work while having a dream and contribute to the local society as an important basic strategy, they launched WEPRO (Woman Excite Project) in FY 2018. They completely changed the activity policy in FY 2023 and enhanced activities to allow for further growth of all employees through WEPRO, regardless of sex.

Indicators and Targets | |

① Aiming to increase the ratio of female managers to 50% by FY 2023 ② A company that enables employees to pursue job satisfaction by making the most of their individual abilities, regardless of age and gender ③ Promotion of working-style transformation in response to stages of life | |

Initiatives and results in 2Q of FY3/24 | ||

Project for supply of sanitary products | ◆Supply of sanitary products in order to build a workplace environment which is easy to work at, relieving anxieties and worries of female employees. ◆Regarded as a “good initiative” by over 99% of female employees. | |

One on One interviews | ◆One on One interviews conducted with female employees at a supervisor or a higher position in order to look into obstacles in career enhancement. ◆368 concerned employees and directors (for promotion of women’s advancement) led a direct dialogue. | |

Ratio of female managers | ◆In FY 2023, the ratio of female managers reached 40.5%. ◆They are aiming to increase the ratio of female managers to 50% through trainings, etc. | |

Ratio of male employees who took childcare leave | ◆The ratio of male employees who took childcare leave in FY 2023 reached 58.3%. ◆It increased 34.8 points from FY 2022. | |

Material issues regarding the empowerment of women | ||

Ratio of female employees | End of Sep. 2023 | 73.3% |

End of Mar. 2023 | 73.4% | |

Ratio of female managers | End of Sep. 2023 | 40.5% |

End of Mar. 2023 | 40.6% | |

Ratio of female employees who took childcare leave | End of Sep. 2023 | 120.0% |

End of Mar. 2023 | 97.7% | |

Ratio of eligible male employees who took childcare leave | End of Sep. 2023 | 58.3% |

End of Mar. 2023 | 23.5% | |

Ratio of female employees who returned to work after childcare leave | End of Sep. 2023 | 97.8% |

End of Mar. 2023 | 96.6% | |

Ratio of male employees who returned to work after childcare leave | End of Sep. 2023 | 100.0% |

End of Mar. 2023 | 100.0% | |

*The subjects are the employees of Prestige International.

*Produced by Investment Bridge Co., Ltd. with reference to the company’s presentation materials

◎ Regional revitalization – Akita BPO Nikaho Campus

Akita BPO Nikaho Campus won the “Tohoku New Office Promotion Award”, which are Nikkei New Office Awards presented to offices that are recognized as exemplars of arrangement of future office environment in the Tohoku block, and “The Chief of Tohoku Bureau of Economy, Trade and Industry Award”. The Nikkei New Office Award is a program for awarding offices packed with originality and ideas with the objective of spreading and promoting the creation of “new offices.”

◎ Aranmare for regional vitalization

The company launched the business titled “Aranmare” with the hope of revitalizing a region and allowing more women to flourish, established a basketball team (Akita) and a volleyball team (Yamagata) in 2015, and a handball team (Toyama) in 2016.

Their concept is “Teams loved by the local community and growing together with the community. Teams creating more opportunities for women to play active roles in society and becoming symbols of encouragement for women”.

The “Aranmare Cup” is continuously held while expanding the number of participating schools and target areas with the wish of realizing further regional revitalization by providing a platform for the development and growth of future athletes. After “Aranmare Cup YOKOTE,” which took place in January 2022, (basketball, held for the third time in FY 2023), they are aiming for continuous organization of “Aranmare Cup SAKATA,” a volleyball tournament for high school students held for the first time this year, with the goal of supporting regional revitalization by expanding the tournament scale in future.

(5) Recent topics

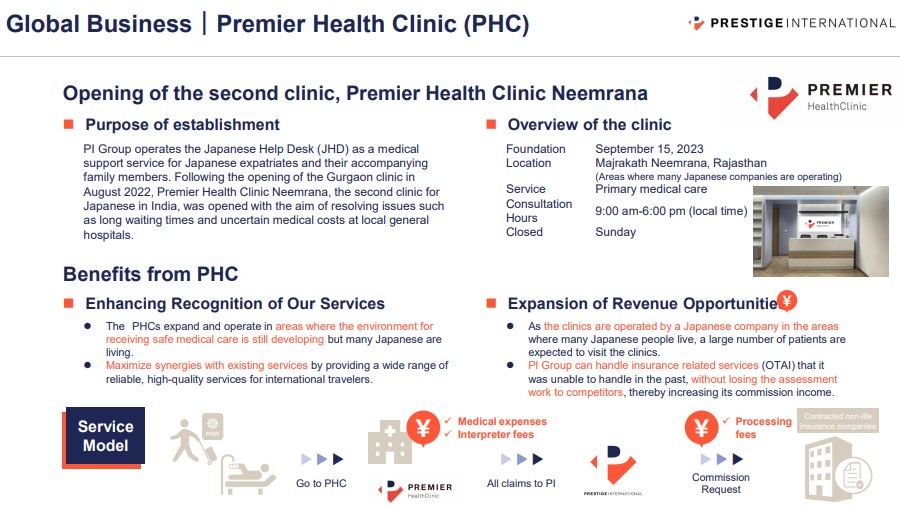

◎ Second clinic for Japanese nationals in India “Premier Health Clinic Neemrana”

Prestige Global Solutions inc., a consolidated subsidiary, opened a second clinic for Japanese nationals, “Premier Health Clinic Neemrana,” in collaboration with the local Indian corporation P. I. PRESTIGE INTERNATIONAL INDIA PRIVATE LIMITED. A clinic for Japanese nationals operated by the local Indian corporation P. I. PRESTIGE INTERNATIONAL INDIA PRIVATE LIMITED was opened in August 2022 in Gurgaon, where many Japanese expatriates live, with the objective of resolving issues such as the high number of patients, long waiting times and unclear medical expenses at local general hospitals. Neemrana was chosen as a potential area for opening a new clinic, as there is an industrial park exclusively for Japanese enterprises and many expatriates live there.

The opening of “Premier Health Clinic Neemrana” was determined considering convenience as the area is far away from “Premier Health Clinic Gurgaon,” although it has similar issues as Gurgaon. Like the first clinic, Japanese interpreting staff is available at all times, allowing for casual medical examinations with transparent medical expenses, and even travelers may have an examination by paying the actual expenses. They will go on to open the same clinics not only in India, but also in Asia and Central and South America, expanding the business of overseas services for Japanese nationals.

(Source: the company’s presentation materials)

◎ The end of acquisition of treasury stock

The acquisition of treasury shares, resolved at a Board of Directors’ meeting held on October 27th, 2023, ended on November 30th with the following results.

◆Total number of acquired shares: 766,600

◆Total acquisition price: Approx. 499 million yen

◆Acquisition period: November 6th to November 30th, 2023

◆Total number of treasury shares acquired until November 30th, 2023: Approx. 1,347,000

Total acquisition price: Approx. 918 million yen

4. Fiscal Year Ending March 2024 Earnings Estimates

(1) Consolidated Earnings Estimates (million yen)

| FY3/23 Act. | Ratio to Sales | FY3/24 Est. | Ratio to Sales | YoY |

Sales | 54,562 | 100.0% | 56,500 | 100.0% | +3.6% |

Operating Profit | 7,840 | 14.4% | 8,200 | 14.5% | +4.6% |

Ordinary Profit | 8,378 | 15.4% | 8,700 | 15.4% | +3.8% |

Profit Attributable to Owners of Parent | 5,318 | 9.7% | 5,200 | 9.2% | -2.2% |

Sales and operating profit are expected to rise 3.6% and 4.6%, respectively, year on year.

At the end of the second quarter, there are no revision for the fiscal year ending March 2024, sales are expected to grow 3.6% year on year to 56.5 billion yen and operating profit is projected to rise 4.6% year on year to 8.2 billion yen.

In the fiscal year ending March 2024, due to the shrinkage of the vaccine-related business, the sales and profit of the Customer Business are forecast to decline, but the existing businesses will drive growth, increasing sales and profit, as earning opportunities in new mobility society will increase in the Automotive Business and the number of travelers will increase in the Global Business. In addition, Entrust Inc. (7191), which is a group company operating the Financial Guarantee Business, is expected to keep performing well. Operating profit margin is expected to increase 0.1 points from the previous year to 14.5%. On the other hand, profit attributable to owners of parent is forecast to decline from the previous year, because of the taxation reduction for raising wages applied in the fiscal year ended March 2023.

The company keeps plan to pay an annual dividend of 12.00 yen/share (an interim dividend of 6.00 yen/share and a year-end dividend of 6.00 yen/share), up 1 yen/share from 11.00 yen/share in the previous year, which was up 2.50 yen/share from the year before the previous. The expected payout ratio is 29.5%.

(2) Outlook and major strategies in each segment (million yen)

| FY3/23 Act. | Composition ratio/profit margin | FY3/24 Est. by the Company | Composition ratio/profit margin | YoY |

Automotive Business | 23,281 | 42.7% | 24,170 | 44.3% | +3.8% |

Property Business | 6,482 | 11.9% | 7,700 | 14.1% | +18.8% |

Global Business | 6,732 | 12.3% | 7,730 | 14.2% | +14.8% |

Customer Business | 9,588 | 17.6% | 7,040 | 12.9% | -26.6% |

Financial Guarantee Business | 6,937 | 12.7% | 8,500 | 15.6% | +22.5% |

IT Business | 878 | 1.6% | 630 | 1.2% | -28.3% |

Social Business | 662 | 1.2% | 730 | 1.3% | +10.3% |

Consolidated Sales | 54,562 | 100.0% | 56,500 | 100.0% | +3.6% |

Automotive Business | 2,861 | 12.3% | 3,680 | 15.2% | +28.6% |

Property Business | 429 | 6.6% | 790 | 10.3% | +84.1% |

Global Business | 694 | 10.3% | 770 | 10.0% | +10.9% |

Customer Business | 2,392 | 24.9% | 970 | 13.8% | -59.5% |

Financial Guarantee Business | 1,501 | 21.6% | 2,100 | 24.7% | 39.8% |

IT Business | 183 | 20.8% | 130 | 20.6% | -29.1% |

Social Business | -224 | - | -240 | - | - |

Consolidated Operating Profit | 7,840 | 14.4% | 8,200 | 14.5% | +4.6% |

*Unit: million yen

Automotive Business

The company estimates that sales and profit will grow 3.8% and 28.6%, respectively, from the previous year. Through the revision to the types of contracts with some clients, accounting methods will be changed, and it is expected that sales will increase slightly, while profit will rise considerably through the improvement in profitability. Operating profit margin is expected to increase by 2.9 points from the previous year.

[Growth strategy]

In parallel with the evolution of automobiles, the company aims to enrich services in the fields of roadside assistance, accident handling, and telematics for EV solutions.

◎ Automobile non-life insurance, automobile makers, rental cars, lease, etc.

<EV domain>

As EVs will become dominant in new car sales by 2030, EVs are expected to be more popular. Under these circumstances, the company will strive to improve the added value of existing services and aim to increase new clients by developing new services for EVs. In detail, the company has started “a service of on-site recharging for EVs” nationwide, to solve the problem of “running out of electricity,” which is one of major concerns over EVs with improved added value. The company will increase power supply capacity, and expand target areas.

<Connected car domain>

As the connected (telematics) technology will be advanced in Japan, the penetration rate of connected cars is expected to exceed 72.3% by 2035. In addition, it is forecast that in-vehicle devices equipped with a telecommunication function will be installed in existing vehicles and the safety and security services will be increasingly offered to connected cars. Amid such environment, they will promote the evolution from a provider of the Road Assist service demanded by rescue agencies into a provider of telematics services based on a visual mechanism.

Property Business

The company estimates that sales and profit will grow 18.8% and 84.1%, respectively, from the previous year. For home maintenance, the company aims to increase sales by expanding sales channels of the service of visiting individual customers to solve trouble in their houses and improve productivity by streamlining the system for dispatching staff. Operating profit margin is expected to rise 3.6 points from the previous year.

[Growth strategy]

◎ Home Assist Business (related to housing)

The on-site assistance service of repairing housing equipment will become available to individuals and owners of detached houses on a one-shot basis in addition to condominium associations accompanied by management firms on a subscription basis. In addition, the company will continue the promotion of the extended warranty for housing equipment, targeting housing developers. Furthermore, the company is developing a service of looking after pet animals and an emergency home visit service as pet care assistance business, with the aim of evolving the business from “Home Assist” to “Life Assist.”

◎ Park Assist Business (related to parking lot)

The company will add value, such as EV recharging services, to existing services, to enrich services in the parking area business domain, and propose its services for mobility hubs. In addition, the company aims to expand target areas and improve the quality of its services in cooperation with the Automotive Business section, in parallel with the expansion of the domain of services. Furthermore, the company aims to expand its share in the growing car-sharing market, by taking full advantage of the strengths of the existing business in the field of parking lot business.

Global Business

The company estimates that sales and profit will grow 14.8% and 10.9%, respectively, from the previous year. Thanks to the recovery of the number of overseas travelers and expatriates, it is expected that the company’s services will be used more frequently. Operating profit margin is projected to decline 0.3 points from the previous year.

[Growth strategy]

◎ Expatriates, their family members, and short-term overseas residents (travelers, international students, business travelers, and others)

While recognizing the help desks of overseas medical institutions (Japanese Help Desk [JHD]), for which demand has grown through the pandemic, as the bases for disseminating the brand of the Global Business, the company will continue active investment to JHD. In addition, the company aims to improve face-to-face services and generate synergetic effects between JHD and Overseas Travel Accident Insurance (OTAI) or the Healthcare Program (HCP), by opening a directly-managed Premier Health Clinic (PHC) mainly in regions where access to healthcare is bad, such as India and Mexico. For the U.S. credit card business, the company will strive to enhance promotion inside and outside Japan, with the aim of popularizing it among expatriates before assignment and increasing opportunities to use it after assignment.

Customer Business

The company estimates that sales and profit will drop by 26.6% and 59.5%, respectively, year on year, due to the shrinkage of the vaccine-related business. Operating profit margin is projected to drop by 11.1% from the previous year.

[Growth strategy]

◎ Customer (CRM)

“Distribution, finance, municipalities, and manufacturing,” for which there are many urgent requests and inquiries that require a high level of hospitality, account for 30% of the call center market. In this market, the company targets enterprises that agree with the company’s philosophy, culture, and strategies with BPO bases in local cities, and aims to cement partnership with them. In detail, the company will achieve a low turnover rate so that human resources will accumulate know-how and be able to offer high-quality services, and take full advantage of the merits of local BPO bases for exerting its advantages. In addition, the company strives to accumulate know-how and improve the quality of services through the stable employment while keeping the ratio of full-time employees high, to secure profitability. Furthermore, the company will cope with the shortage of manpower, by increasing productivity per worker through the analysis of busy periods, reshuffling of personnel, cross-training, and utilization of resources through multitask operations (operators managing multiple teams according to busyness).

◎ Warranty and repair

The company will develop a unique model with added value, by adding the on-site repair service of their home appliances to the existing warranty service. The company offers one-stop services by (1) operating contact centers, (2) distributing devices, and (3) having original IT systems that can analyze losses, for warranty business. Concrete services include the arrangement of on-site repair, the placement of orders for components, and repair at customers’ houses or shops.

Financial Guarantee Business

The company estimates that sales and profit will increase 22.5% and 39.8%, respectively, year on year. The expansion of the Medical Expense Guarantee business is expected in addition to the healthy performance of the group company Entrust Inc. Operating profit margin is expected to rise 3.1 points from the previous year.

IT Business

The company estimates that sales and profit will drop 28.3% and 29.1%, respectively, year on year. The decline in sales and profit is projected due to the decrease in delivery of systems for supply chain management and contact centers. Operating profit margin is expected to decline 0.2 points from the previous year.

Social Business

The company estimates that sales will increase 10.3% and operating loss will augment 16 million yen year on year, due to the increase of kids enrolled in the childcare business and the number of spectators in the sports business.

(3) Progress rate

| Cumulative 2Q of FY3/24 Act. | FY3/24 Est. by the Company | Progress Rate |

Sales | 28,763 | 56,500 | 50.9% |

Operating Profit | 3,857 | 8,200 | 47.0% |

Ordinary Profit | 4,071 | 8,700 | 46.8% |

Profit Attributable to Owners of Parent | 2,357 | 5,200 | 45.3% |

*Unit: million yen

| Sales | Operating Profit | ||||

2Q of FY3/24 Act. | FY3/24 Est. by the Company | Progress Rate | 2Q of FY3/24 Act. | FY3/24 Est. by the Company | Progress Rate | |

Automotive Business | 12,234 | 24,170 | 50.6% | 1,502 | 3,680 | 40.8% |

Property Business | 3,515 | 7,700 | 45.7% | 227 | 790 | 28.8% |

Global Business | 3,940 | 7,730 | 51.0% | 408 | 770 | 53.1% |

Customer Business | 4,300 | 7,040 | 61.1% | 776 | 970 | 80.1% |

Financial Guarantee Business | 4,287 | 8,500 | 50.4% | 1,028 | 2,100 | 49.0% |

IT Business | 183 | 630 | 29.1% | 21 | 130 | 16.7% |

Social Business | 300 | 730 | 41.2% | -118 | -240 | - |

Total | 28,763 | 56,500 | 50.9% | 3,857 | 8,200 | 47.0% |

*Unit: million yen

The second quarter of the fiscal year has ended and the progress rate towards the full-year forecast is around 50% for sales and all kinds of profits, showing a steady progress.

5. Conclusions

Regarding the cumulative financial results for the first half of the fiscal year ending March 2024, excepting the quarterly net profit attributable to owners of parent, sales and all kinds of profits grew year on year, exceeding the forecast for the second quarter, which is impressive considering the significant drop in sales and profit of vaccine-related business, etc. This was achieved thanks to the healthy performance of the Financial Guarantee Business and Global Business in addition to the mainstay Automotive Business, capturing demand against the backdrop of the recovery of socioeconomic activities. The results show the high quality of Prestige International, which stably keeps growing every year owing to their decentralized business portfolio. The second quarter of the fiscal year has ended and the progress rate toward the full-year forecast is around 50% for sales and all kinds of profits, indicating a steady progress. Although sales may end up falling short in the last year of the medium-term business plan, it is increasingly likely that the target operating profit will be achieved. Attention will be paid to whether they can overcome the decline of vaccine-related business and reach the full-year forecast through the effects of their characteristic portfolio in the second half as well.

They are proactively developing growth strategies for each business in this fiscal year. They are working toward the expansion of service options in EV and connected fields in the Automotive Business, while in the Property Business they are planning to develop services which can be joined by individuals and paid when used in addition to services collectively joined by separate associations of condominiums with a maintenance company, and sell these services to owners of detached houses. Furthermore, in the Customer Business, they are going to add on-site repair services for household appliances to other guarantee services (warranties) they currently offer. Moreover, they aim to increase contracts for child support payment guarantee in addition to medical expense guarantee at their group company Entrust Inc. We would like to hold expectations and pay attention to the progress of the growth strategies in this fiscal year, which are likely to drive their growth in the next fiscal year.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organizational Type | Company with auditors |

Directors | 6 directors, including 3 external ones |

Auditors | 4 auditors, including 2 external ones |

◎Corporate Governance Report (Latest Update: June 30, 2023)

Basic PolicyIn our company, we understand corporate governance as the basic framework of corporate management in relation to respective stakeholders including end-users, client companies, shareholders, employees, and local communities.

We believe that enhancing and strengthening corporate governance is our responsibility to increase shareholder profits and corporate value, and have set the following policies

1. Respect the rights of shareholders and ensure their equality.

2. Cooperate with each stakeholder in an appropriate manner.

3. Ensure transparency through appropriate disclosure of corporate information.

4. Work to build a board of directors and other structures that enable fair, transparent, swift, and decisive decision-making.

5. Engage in appropriate dialogue with shareholders.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company is fully compliant with the Principles of Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure content |

■Principle 1-4 (Policy for Strategic Shareholding) | (1) Policy for strategic shareholding In cases where our group holds shares for purposes other than pure investment, we target those that enable us to maintain a medium/long-term relationship, expand transactions, and create synergies with business partners. We hold shares with the policy of enhancing the corporate value of our group as a result of holding the shares of the issuing company, which we believe will lead to the benefit of shareholders and investors. Following this policy, we examine the medium/long-term economic rationality and future prospects every quarter at the board of directors’ meeting, and proceed with the reduction of shares that do not have sufficient significance or do not match the policy. We also examine and verify individually whether the benefits and risks of holding shares are in line with the capital cost, and disclose the outline of those that are highly important.

(2) Exercise of voting rights for strategically held shares In cases where our group holds shares for purposes other than pure investment, we believe that the appropriate exercise of voting rights will promote the strengthening of corporate governance and lead to long-term value improvement and sustainable growth of the company. Therefore, we exercise voting rights for all strategically held shares as a principle. In addition, when exercising voting rights, we judge the pros and cons of each proposal based on the situation of the invested company and the trading relationship with that company. |

■Supplementary Principle 2-4-1 (Ensuring Diversity in the Appointment of Core Personnel) | Our group considers contributing to local communities by creating employment environments in regional cities where young people and women can work and live with dreams to be an important basic strategy. We are continuing our efforts to respect the diversity of every working employee and to create an inclusive work environment that enables the realization of diverse workstyles.

(1) Percentage of Female Employees As of March 31, 2023, our group’s ratio of female employees was 65.3% and the ratio of female managers was 34.5%. In FY 2018, our company launched a project to promote the advancement of women (Woman Exciting Project), elected a director in charge of promoting the advancement of women from among its employees, actively promoted female managers, and implemented other measures within our corporate group. It intends to continue these measures.

(2) Percentages of Mid-career Hires and Non-Japanese Employees Our corporate group has a high ratio of mid-career hires, with 83.2% of new hires in FY 2022 (1,211) being mid-career hires. In particular, 100% of new hires at our overseas offices are mid-career hires, and we employ not only Japanese nationals, but also a diverse range of nationalities, including local nationals. Thus, we have not set a specific target for the future, as we have always striven to secure excellent human resources regardless of whether they are new graduates, mid-career hires, or nationalities, and we intend to continue to do so.

For details of our company's employee ratio, please refer to Appendix 3 of this report.

(3) Status of internal environment development for ensuring diversity With the aim of reforming workstyles to accommodate life stages and creating a comfortable work environment that makes the most of individual abilities, the following initiatives are being implemented. Establishment of an in-house childcare facility "Orangerie" Adoption of a "New Life Support System" that provides various support for both men and women when major life events such as marriage, childbirth, and nursing care occur Adoption of a "Job Return System" that allows employees who have been forced to resign due to reasons such as not having the qualification to take childcare leave within one year of joining the company to return to work Adoption of a "Time-Off System by the Hour" that allows employees to take paid leave in one-hour increments, enabling flexible work styles Adoption of a system that regards same-sex partners as spouses in the application of employment rules and various regulations. |

■Supplemental Principle 3-1-3 (Sustainability Initiatives, etc.) | <Efforts on Sustainability> Our corporate group has established a Sustainability Policy and, in accordance with the Group's Management Philosophy, aims to be a company that contributes to society by solving social problems and that can prosper together with society and local communities. We believe that efforts for a sustainable society are a responsibility placed on companies, and that it is important to achieve both growth as a company and fulfill our social responsibilities. In order to realize these goals, our corporate group has established the "Material Issues for Sustainability" as a driving force to create new value based on "empathy born from human relationships," and as a company trusted by society under proper corporate governance, we will work together as a group to realize a sustainable society through a variety of services.

For details, please refer to Appendix 2 of this report.

<Investment in Human Capital, etc.> As an investment in human capital, we have adopted a system aimed at creating an environment where employees can demonstrate their strengths in a safe and secure environment, and we will strengthen our human capital by building an environment where employees are empowered to voice their opinions and ideas to their managers. We will create a corporate culture in which each employee can demonstrate their own strengths and establish a system that enables them to work with a sense of fulfillment.

<Investment in Intellectual Property, etc.> Our group operates a BPO business that provides "services that only people can provide" to end-users on behalf of client companies, based on our management philosophy of "solving end-users' inconvenience and trouble." To create service areas that can only be realized by our group, which respond to changes in the times and values such as the "Contact Center (BPO base)" that receives feedback from end-users, the "Field" that provides services directly to end-users on-site, and the "IT" that supports services that only people can perform, we position the "business model" that utilizes talented human resources, which is essential to our BPO business, and the "trust and reputation" as a good partner with client companies, end-users, and local communities, as important intellectual property and intangible assets for our group's value creation. To respond to growing customer needs, we are investing in the creation of the PI-DX model as a "value creation company" that responds to changes in the times.

Step 1: Unify the systems used in the contact center

Step 2: Provide PI knowledge utilization services using a common system to new fields

Step 3: Aim to provide new customer value through knowledge sharing

<Addressing Climate Change> On May 13, 2022, our corporate group announced its endorsement of the TCFD recommendations. In order to accurately understand how the risks and opportunities associated with climate change will affect our corporate management, including our finance, we are collecting and analyzing data and disclosing climate-related information based on the TCFD framework.

For details, please refer to "Sustainability - Environmental Initiatives." Sustainability-Environmental Initiatives URL: https://ssl4.eir-parts.net/doc/4290/tdnet/2194078/00.pdf |

■Principle 5-1 (Policy on Constructive Dialogue with Shareholders) | In order to achieve sustainable and stable growth and increase corporate value, our corporate group engages in constructive dialogue with investors to provide them with opportunities to deepen their understanding of our business activities and our group's management philosophy. We strive to proactively disclose information that is required by laws and regulations, as well as information deemed important to investors, with the department in charge of IR taking a central role, in cooperation with related internal departments. In addition to holding the General Meeting of Shareholders at BPO bases, our company conducts tours of BPO locations for institutional investors. We also hold company briefing sessions for individual investors as appropriate. Our company's basic policy regarding systems and initiatives to promote constructive dialogue with shareholders and investors is as follows.

1. The CEO or IR officer attends face-to-face meetings with shareholders as a fundamental approach to establishing constructive dialogue.

2. The IR officer establishes a cross-functional structure that can collaborate with other departments.

3. We strive to understand the shareholder structure and implement measures to promote constructive dialogue with shareholders, for example, by sending shareholder newsletters and holding earnings briefings after financial results are announced.

4. The CEO and IR officer regularly provide feedback on the dialogue status to the board of directors. They also provide regular feedback to the management of group companies, such as Prestige Core Solutions, which handles domestic BPO businesses, and Prestige Global Solutions, which handles overseas BPO businesses.

5. As necessary measures to ensure fairness among shareholders, the health of the market, and the freedom of shareholders to buy and sell shares, during earnings briefings and meetings with shareholders, we explain already disclosed information in greater detail and do not provide explanations about facts that correspond to important information that has not been disclosed. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (Prestige International Inc.: 4290) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.