| Toyo Ink SC Holdings, Co., Ltd. (4634) |

|

||||||||

Company |

Toyo Ink SC Holdings, Co., Ltd. |

||

Code No. |

4634 |

||

Exchange |

TSE 1st Section |

||

Industry |

Chemical (Manufacturing) |

||

President and CEO |

Katsumi Kitagawa |

||

Address |

2-2-1 Kyobashi, Chuo-ku, Tokyo |

||

Year-end |

End of December |

||

HP |

|||

* Share price as of closing on the end of March 19. Number of shares outstanding is as of the end of the previous term. ROE and BPS are based on actual results of the previous term end. ROE is actual value for 9-months settlement and its12-months conversion value is 6.8%. It plans to change the trading unit to 100 shares on July 1, 2018 and implement consolidation of shares (consolidate 5 shares in 1 share).

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. Net income is net income attributable to the shareholders of the parent company.

The values of December 2017 are for 9 months. |

| Key Points |

|

| Company Profile |

|

Initially, inks in the Japanese market were mostly imported products; however, as the national policy favored high quality domestically produced inks, the Company, with its advanced technological skills, successfully expanded its business with clients such as the Printing Bureau of the Ministry of Finance and other government bodies, in addition to private printing companies. Exports also grew during the same time. The Company's rapid growth was also due in part to the early introduction of integrated manufacturing system from raw materials (pigments, resins) to finished products (printing inks). Another contributing factor may be that the Company, since its inception, had strong ties with Toppan Printing Co., Ltd., which, by then, was among Japan's largest printing companies. The Company survived the difficult times of the Great Kanto Earthquake and the World War II and experienced rapid growth again during the period of high economic growth after the war. The Company was listed on the Second Section of the Tokyo Stock Exchange in 1961 and moved to the First Section of the Tokyo Stock Exchange in 1967. The Company is expanding its businesses from manufacturing of printing inks to other fields such as LCD film materials, using its wide range of technologies and know-how cultivated through manufacturing and processing of raw materials such as pigments and resins. In 2011, the Company adopted a holding company system for further expansion and growth of the Group, and changed its name to Toyo Ink SC Holdings, Co., Ltd.. In April 2014, "improving shareholder satisfaction" was added to its guiding principles. With this revision, the Company is aiming to improve satisfaction of all stakeholders.  Furthermore, the "Toyo Ink Group Corporate Philosophy" is printed on the first page of every single issue of the Company's in-house magazine, which is published for the Group's unity and circulated to the entire Group including the overseas locations. Also, the above-mentioned credo has "Japanese/English" version as well as "Chinese/English" version to share and spread the corporate philosophy globally. ◎ Overview (Market trend) In the realm of commercial printing, on the other hand, of posters, catalogues, fliers, POP, etc. demand is fairly steady. Furthermore, printing on food and pharmaceutical packages and plastic containers is steadily increasing at the compound annual growth rate (CAGR) of 2.4% from 2004 to 2016.  As innovation of printing machine is progressing, quality of printing is enhancing. Overseas local inks, in many cases, cannot respond to such demand for high quality, which may lead to more demand of excellent Japanese ink. (Printing houses and printing ink manufacturers)

According to the "Census of Manufactures 2014: Report by Industry" by METI, there were 25,843 business entities in the printing and related industries in 2014. 25,446 (98.5%) of them are small and medium-sized enterprises with fewer than 100 employees.

Thus, the Company's customers seek direct dealings with the Company. As a result, nearly 80% of the Company's domestic sales come from direct sales to its customers. These strong relationships with the customers are among the Company's major characteristics. ◎ Other companies in the industry

There are six major listed companies including Toyo Ink in the ink industry in Japan.While (4631) DIC is the number one company in the world, Toyo Ink is the top runner in Japanese printing ink industry, and ranks first or second in most product categories. Globally, the Company is ranked third (The second is a European firm). (4633) SAKATA INX is the second largest shareholder of the Company. The Company and SAKATA INX complement each other mainly in logistical aspects. The two companies concluded a capital and business alliance agreement in 2000.  ◎ Concerning "printing inks"  Since its foundation, the Company has also been expanding its business categories by exploring application of these raw materials in the process of manufacturing them.  ◎ Business segments

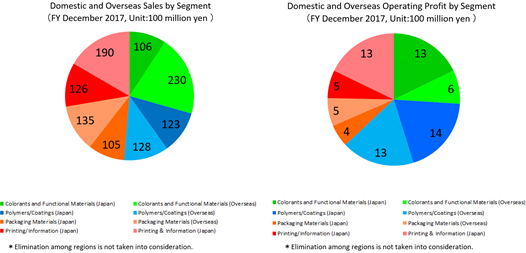

The business activities of the Company are classified into four segments: the "Colorants & Functional Materials Related Business," "Polymers & Coatings Related Business," "Printing & Information Related Business", and "Packaging Materials Related Business".The "Printing & Information Related Business" mainly deals with planographic inks that are used for printing on papers (offset inks, etc.). The "Packaging Materials Related Business" deals with gravure inks and flexographic inks that are used for printing on films of food packages. The "Colorants & Functional Materials Related Business" deals with products related to pigments that are also the raw materials of printing inks as core materials. The "Polymers & Coatings Related Business" began with resins that are the main raw materials of inks and their design technologies.    Furthermore, the Company's dispersion processing technologies are used not only for organic pigments but also for inorganic materials such as carbon nanotube (CNT), which leads to expansion of its business in the new energy field such as secondary battery materials. They constitute about 40% of the Company's operating income.       The Company offers not only printing inks but also sales of machinery/equipment, support for streamlining customers' printing process, and support and tools for color management and color universal design. ◎ Overseas expansion

While the Company is improving profitability by offering high-value-added products in the Japanese market, where a rapid growth is not expected, it is aggressively expanding its business from both production and sales perspectives in the overseas market where future growth is expected.Development of its overseas manufacturing structures was almost completed during the previous Midterm Business Plan, and the Company is carrying out both raw material procurement and production at local sites. As of the end of Decembewr 2017, the Company has about 50 overseas consolidated subsidiaries and 50 production sites in a wide range of countries around the world.    (1) Strong technological edge

As described above, the Company has been manufacturing in-house pigments and resins, which are the raw materials of printing inks. Its technological capacities form the basis of high quality printing ink production and lead to expansion of business areas and product range such as, LCD color filter materials, adhesive bonds and adhesive compounds.

(2) Excellent problem solving skills

One of the reasons for the Company to be at the top of the Japanese printing inks industry is its excellent problem solving capability in all aspects of printing.The Company not only produces and supplies printing inks but also studies elements related to "printing" as a whole including plate making and images. Such efforts enable the Company to make technological proposals, demonstrate advanced service skills, and obtain high customer satisfaction. (3) Environmental concerns

The Company is a forerunner in CO2 emission reduction as well as production of eco-friendly inks such as non-VOC inks, water-base inks, and UV inks. In the newly developed countries, too, the environmental regulations are becoming tighter, and the needs for environmentally friendly products are increasing. The Company is also working on assuring safety such as chemical substances control and manufacturing a line of products that meet the Swiss Ordinance, ahead of other companies.

(4) Uniqueness of management strategies

The Company considers M&A as one of the options for exploring new markets with its technological edge, if M&A is expected to bring synergy effects to the Company. However, it is not intending to implement M&A just to increase the size of businesses. It is also taking an initiative in the printing ink industry to establish "local production for local consumption" policy in the overseas market for enhancing efficiency (e.g. reduction in transport mileage) and social contribution (e.g. utilization of local products) purposes.

|

| Fiscal Year December 2017 Earnings Results |

Sales and profit increased.

Sales were 280.1 billion yen, up 4.3% year on year. The media materials and adhesives performed well. Operating income was 20.5 billion yen, up 6.8% year on year. Although there was a surge in prices of raw materials such as naphtha and titanium oxide, it was offset by the expanded sales of high function products.

☆Colorants and Functional Materials Related Business

Sales and profit increased.(Chemicals) Sales decreased, but profit grew. Although sales of pigments were sluggish for the printing field, sales of pigments for paints and plastics grew. Sales expansion of highly transparent dispersions for automotive paints progressed. (Display materials) Sales and profit increased. Both domestic and overseas sales were strong because of increased demand for large televisions. Adoption of new green and adoption to a panel manufacturer in China advanced. (Colorants) Sales and profit increased. Sales of colorants for master batch for containers were steady in Japan. For the overseas business, while sales of the compound for home appliance OA recovered in South East Asia, the sluggish automotive market in the US and a surge in raw material prices affected the sales and profit. New design colorants began to perform well, and new development using the global network steadily progressed. ☆Polymers & Coatings Related Business

Sales and profit increased.(Coating materials) Sales and profit increased. Sales of conductive adhesive films for smartphones and electronic-related self-adhesive films were healthy. (Adhesives) Sales increased, but profit declined. Sales of adhesives for electronics and laminating adhesives for packaging grew both in Japan and overseas. But profit was affected by a surge in raw material prices. (Coatings, resin) Sales and profit decreased. As for coating materials for cans, sales of coatings for coffee cans remained sluggish. Overseas sales expanded as a result of the adoption of environmentally friendly products in the European and the US markets, but the overall sales were affected by a surge in raw material prices. As for resin, although sales of high-value-added products expanded, profit was affected by a surge in raw material prices. ☆Packaging Materials Related Business

Sales leveled off. Profit decreased. (Flexible packaging materials) Sales increased, but profit decreased. The company aggressively invested in evaluation facilities and introduced high-performance surface-printed gravure ink and high-performance biomass products to the Japanese market and the sales increased. In overseas markets, although sales were impacted by tighter environmental regulations and domestic consumption slump in China, the sales of new products increased in other areas and sales of aqueous products in Taiwan and South Korea also grew. (Construction materials) Sales increased but profit decreased. Products for wallpapers and furniture performed well both in Japan and overseas. But profit was affected by a surge in raw material prices. (Cardboard boxes) Sales and profit decreased. Although the demand for cardboard boxes was steady, profit was largely affected by declining surface areas for printing. ☆Printing & Information Related Business

Sales and profit decreased.(Offset inks) Sales and profit decreased. Domestically, although the company launched new products and implemented cost cuts, these measures did not cover the market downturn. Overseas, although sales expanded in India, Brazil and Turkey, the European and US markets shrank. (Functional inks) Sales and profit increased. Sales of power-saving UV curing inks were healthy both in Japan and Europe due to expanded sales of new products and increased demand. Sales of metal inks expanded in Asia, and sales of inkjet inks expanded in China and Europe.  Consequently, equity ratio rose 0.6 points from 58.4% at the end of the previous term to 59.0%.  (4) Topics

◎ Received the Minister of the Environment Prize for the 27th Global Environment Awards The company received the Minister of the Environment Prize for the 27th Global Environment Awards (Sponsored by Fuji Sankei Group, Co-hosted by Ministry of Economy, Trade and Industry, Ministry of the Environment etc.). In 1992, the Global Environment Awards were created based on a special collaboration with the World Wildlife Foundation (WWF) Japan as an honorary system targeted at industry to achieve "symbiosis with industrial development and the global environment." Its primary goals are to highlight new technologies or products contributing to activities that prevent global warming and the realization of a recycling-based society, promote environmental conservation activities and projects, explore the social system of the 21st century, and further raise environmental consciousness to preserve the global environment. There are 7 judging criteria, including "Contributing to the symbiosis of economy development and the global environment," "Having high environmental philosophy and action plans for the realization of a sustainable society," "Having originality and leadership" and "Remarkable environmental improvement effect in technology/product development." The company was awarded for its contribution to the realization of a sustainable society through the development of biomass products. (Reasons for award) "In the field of information publishing and packaging, the company is actively developing biomass products, which are organic resources of renewable biological origin. It is pioneering the industry with biomass products such as offset inks, gravure inks and laminate adhesives and contributing to the realization of a sustainable society through printed materials and packaging materials. To fulfill the social responsibility as the industry leader, all the plant-based inks supplied by the company have acquired biomass marks certified by Japan Organic Resources Association. By using raw materials derived from plants, it is expected to reduce CO2 emissions from printed materials for information publications and packaging materials. The company also contributes to address issues related to resource depletion by promoting desulfurization materials."(From the Global Environment Awards web-site) It is the second award following the reception of the Minister of Economy, Trade and Industry Prize of the 21st Earth Environment Awards as Toyo Ink Co., Ltd. |

| Fiscal Year December 2018 Earnings Estimate |

Sales and profit are estimated to grow.

Sales are estimated to be 300 billion yen, up 7.1% year on year. Sales are forecasted to grow in all segments. Operating income is projected to rise by 4.9% year on year to 21.5 billion yen. The impact of soaring prices of raw materials such as naphtha will continue, but it will be offset by an increase in sales volume and sales of high-function products, and profit is expected to increase for all segments except for the Printing & Information Related Business. The dividend will be 17.00 yen/share, an increase of 1 yen from the previous term. The expected dividend payout ratio is 36.8%. Assumed exchange rates are 1 US dollar = 110 yen (average of 112.0 yen in the previous term), 1 euro = 130 yen (average of 127.2 yen in the previous term) and 1 yuan = 17 yen (average of 16.6 yen in the previous term).   |

| Mid-term Management Plan "SIC-I" (FY 2018 to FY 2020) |

|

<Basic policies>

The theme is "Frequent challenges" By positioning the next medium-term management plan SIC-I (FY2018 - FY2020) as a period for building a foundation for sustainable growth in the next 100-year range, we will take successive measures for innovative change. (1) Transformation of existing businesses and development of new businesses for growth (2) Promotion of manufacturing innovation to increase sustainability (3) Overhaul of management foundation <Numerical Goal>

Whole Company

The company will set up a strategic investment frame separately from the traditional capital investment frame to expand priority domains and create new businesses, and it will make aggressive investment to achieve the plan.  <Major measures>

(1) Transformation of Existing Businesses and Development of New Businesses for Growth To raise the growth capacity in overseas markets, it will promote the integration of global bases that have been established so far and the expansion of product lineups and will develop diverse businesses. For pigment dispersions for inkjet inks and inks, in addition to manufacturing environmentally friendly products in China (Zhuhai), it will increase items in Japan, the US and France. For laminate adhesives, it will try to increase sales in the food packaging market in cooperation with global bases that operate liquid ink business. The company aims for increased sales of 53 billion yen compared with the term ended Dec. 2017. The company will promote the development of new materials with a focus on pigments and resins and create new values by combining synthesis, dispersion and film formation technologies, which are its core technologies, to enter new markets and new areas. Particularly, it will focus on electronics-related materials and medical/healthcare products in the Polymers & Coatings Related Business. It aims for increased sales of 16 billion yen compared with the term ended Dec. 2017. The company set 6 priority domains in the SIC-I. To achieve sustainable growth, it will challenge the development of new business models centered on solution proposals that go beyond merely providing products and will link them to the activities in the "SIC-II" and "SIC-III" phases.  [Sensor-related business]

The domains are mobility, medical/healthcare and IoT.The company will focus on rapidly increasing "sensors" in the fast growing IoT market. In addition to "manufacturing" centered on chemicals, it will also try to develop sensor-related businesses that incorporate new technologies and provide "information and systems." (Major products/services) The major products/services are image sensor materials and sensor devices. In the "SIC -II" and "SIC -III" phases, development of data business based on sensing data will also be considered. [Waste-heat from living related business]

The domains are mobility, IoT and energy.Focusing on "waste-heat from living" which is unused in the surroundings of the living, the company will develop technologies to efficiently recycle the heat and work on a business that provides recycling energy solutions. (Major products/services) Heat resistant adhesive film, super heat resistant insulation/heat conductive film, high heat management parts, etc. [Healthcare related business]

The domain is medical/healthcare.Based on the adhesive patch business platform, the company will steadily expand its pharmaceutical business base and strengthen development and sales of peripheral healthcare-related materials. (Major products/services) Tapes for blood glucose test strips, medical adhesives, biocompatible polymers, next-generation adhesive patches, etc. [Natural materials related business]

The domain is natural materials.The company aims to further develop businesses of new functional natural materials making full use of edible pigments and bamboo-related products business platforms and advance the expansion of biomass products to further contribute to the low-carbon society. (Major products/services) Edible pigment products, Kuma bamboo grass related products, biomass inks, functional food materials, etc. (2) Promotion of Manufacturing Innovation to Increase Sustainability

Until now, the company has been working on building a manufacturing network by proactively expanding overseas bases, building safe and secure manufacturing with consideration for the environment, and developing a global chemical substance management and trade management systems.During the SIC-I phase, to contribute to the improvement of sustainability of ordinary citizens, life, and the global environment, it will tackle innovation in manufacturing for sustainable growth including the company itself and aim to achieve both contributing to sustainability and securing profitability. (Example of actions) (3) Overhaul of Management Foundation

It will drive forward global integration of business systems to reform existing business, create new businesses and reform manufacturing. It will also work on strengthening the management foundation including recruitment of personnel for reform and institutional reform (i.e. complete transition to defined contribution pension system, commencement of retirement age of 65). In addition, it will implement CSR activities integrated with management and contribute to the improvement of the sustainability of ordinary citizens, life and the global environment. It will strengthen the foundation to continuously create innovations. (Example of actions) |

| Interview with President Kitagawa |

|

Q: "In your opinion, what are the characteristics of the Toyo Ink Group and the source of its competitiveness?"

A: "The Toyo Ink Group is further expanding its business fields without being limited to ink and growing. We are focusing on cooperation between industry, government and academia to further refine our technical capability which is the source of our competitiveness." As a result, 52% of our sales are from inks and 48% from chemicals, indicating that about half of sales came from chemicals, and on profit basis, 65% of profit is from chemicals while 35% of profit is from inks. In the future, under the long-term scheme "SIC 27," we will expand our business domains from "chemical" to "science" and achieve the "sales of approximately 500 billion yen and an operating income of approximately 50 billion yen in 2027" as stated in the SIC-III. We would like investors, especially individual investors, to know that the Toyo Ink Group has been growing by expanding its business without being limited to ink and we are further pursuing dramatic growth by broadening the fields of our activities. To realize sustainable growth, it is necessary to further refine our technical capability, which is the source of our competitiveness. In addition to our core technology related to organic chemistry originating from ink, we must improve the technical capabilities in non-organic chemistry fields such as electronics and biotechnology in the future. Because our efforts alone are limited, we have been focusing on collaboration among industry, government and academia. Since the 1980's, we have set up technology trends for the next 10 or 20 years and have been dispatching our staff to leading domestic and overseas universities. Together with about 50 universities both in Japan and overseas, we have been actively working on the development and application of new technologies, and our technology base has been strengthened. Q: "Please tell us the overview of your long-term scheme, "Scientific Innovation Chain 2027."

A: "It is a concept to contribute to the improvement of sustainability of ordinary citizens, life, and the global environment by innovatively thinking and scientifically executing and connecting each activity by each and every employee. It is a long-term scheme aiming for creating a corporate structure that enables sustainable growth towards 2027. We will clarify the challenges and roles in a mid-term management plan every 3 years and act steadily towards our future goals." We position our "corporate philosophy" consisting of corporate philosophy, corporate policies, and guiding principles as an unchanging pillar that goes beyond the era. The long-term scheme is formulated to implement the corporate philosophy on 10-year basis according to the times and to share a vision with all employees. In the past 20 years, we established long-term visions such as "TAKE OFF 2007" and "SCC 2017." By sharing the visions of the coming 10 years with everyone, we avoid being swayed by short-term events, overcome large external factors and grow. Even for the long-term scheme "SIC 27," all of us will steadily implement our own roles and build on them, and the whole company will walk towards the realization of the goals. The long-term scheme system established as our identity should become a major driving force to realize sustainable growth towards our 200th anniversary in 2096 and thereafter. <Scientific Innovation Chain 2027 (SIC27) Overview> "SIC27" is a long-term scheme to realize a sustainable corporate structure that enables sustainable growth towards 2027 based on the concept to contribute to the improvement of sustainability of ordinary citizens, life, and the global environment by innovatively thinking and scientifically executing and connecting each activity by each and every employee. How are they going to grow their business? The key words are "wide-range of domains" and "competitive technology platform." (Wide range of domains) To realize a healthy lifestyle, rich mind and sustainable society, we set 11 domains including mobility (e.g. automobile, aerospace, automatic driving related), medical/healthcare (e.g. drug products, medical equipment materials, sanitary materials), IoT (e.g. sensor devices), and energy (e.g. energy harvesting, battery related materials). We aim to become a robust entity that will strategically develop business and absorb some market changes with the whole group. (Competitive technology platform) As I mentioned earlier, the source of our competitiveness is diverse technological capabilities. In order to build a technology platform which is the most important foundation for enabling business development in 11 domains, we actively incorporate science, which is a new field for us, such as bio-technology, agriculture-science and data science, in addition to our core chemicals, and we will further refine various technologies more deeply, widely and newly. A mid-term management plan that is established every 3 years represents specific steps towards 2027. We will clarify the challenges and roles and act steadily towards the goals. The "SIC-I" that started this fiscal year is for 3 years in which we begin our reform. With the theme "Frequent challenges," we will try to start working on most of the elements that should be reformed in the next 10 years during this phase. We will build on innovative challenges, change failures to learning and acquire diverse methods. In the following "SIC-II" phase, we will produce positive results based on the frequent challenges made during the "SIC-I" phase, and, in the "SIC-III" phase, we will achieve transformation and build a sustainable corporate structure. At the "SIC-III" phase, we will also start preparations aiming for further growth towards 2037. SIC 27 was not developed by our top management alone. It was developed through repeated discussions on many subjects by all of our employees, from young employees to executives, in 19 countries for 2 years, and I am very pleased that we managed to develop such a powerful long-term plan with full of thoughts. I would like to express my appreciation to all of our employees. I always tell our employees, "Do not be afraid of change!" and "Take risk! We will not blame one or two failures. Challenge!" There will be difficulties that we have never experienced in the long course of 10 years, but I am determined to continue to challenge as the entire company and to achieve transformation into a sustainable corporate structure. Q: "Lastly, please give messages to the investors."

A: "We would like to ask for your support to our company that is making company-wide efforts to transform into a sustainable corporate structure from a mid- to long-term perspective." In addition, as mentioned earlier, although we have "ink" in the company name, our revenue is generated mainly from non-ink products, and in the process of realizing the long-term scheme "SIC 27," such a profit structure will become clearer. I hope investors, especially individual investors who are also consumers, will understand our attitude and thoughts. As for the return of profits to shareholders, we are intending to pay stable and persistent dividends with a payout target ratio of 30 to 40%, taking into account investment for growth and retained earnings. For ROE, which is an important management indicator, we aim for over 10%. Unfortunately, the current level is around 5 to 6%, but we hope to realize ROE that responds to the expectations of investors by improving profitability rather than utilizing financial leverage. We would like to ask for your support to our company that is making company-wide efforts to transform into a sustainable corporate structure from a mid- to long-term perspective. |

| Conclusions |

|

On the other hand, looking at the stock price performance over the past five years, unfortunately the company shares are lower than TOPIX and major competitors. Although it exceeds the leading DIC in the most recent year, it's performance is comparable to TOPIX. Since the performance at hand is not bad at all, investors are expecting to see ROE improvement of around 5 to 6%. We also would like to pay attention to the speed of improvement of profit rate through sales expansion of high function products and continuous cost reduction.  |

| <Reference : Regarding Corporate Governance> |

◎Corporate Governance Report

The latest update: Jul. 4, 2017.

|

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |