Bridge Report:(4634)Toyo Ink SC the second quarter of the Fiscal Year ending December 2022

Satoru Takashima President | Toyo Ink SC Holdings, Co., Ltd. (4634) |

|

Company Information

Market | TSE Prime Market |

Industry | Chemical (Manufacturing) |

President | Satoru Takashima |

HQ Address | 2-2-1 Kyobashi, Chuo-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

¥1,914 | 58,286,544 shares | ¥111,560 million | 4.4% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥90.00 | 4.7% | ¥229.30 | 8.3x | ¥3,911.64 | 0.5 x |

* Share price as of closing on August 31. Number of shares outstanding, DPS, and EPS are from the brief financial report for the second quarter of the fiscal year ending December 2022. ROE and PBR are based on actual results of the previous term end.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2018 (Act.) | 290,208 | 15,276 | 15,429 | 11,847 | 202.93 | 85.00 |

December 2019 (Act.) | 279,892 | 13,174 | 13,847 | 8,509 | 145.72 | 90.00 |

December 2020 (Act.) | 257,675 | 12,909 | 12,543 | 6,019 | 103.06 | 90.00 |

December 2021 (Act.) | 287,989 | 13,005 | 15,442 | 9,492 | 169.36 | 90.00 |

December 2022 (Est.) | 310,000 | 13,000 | 14,000 | 12,500 | 229.30 | 90.00 |

*Unit: million yen, yen. Estimates are those of the Company. Net income is net income attributable to the shareholders of the parent company. Hereinafter the same shall apply.

A 1-for-5 reverse split was conducted on July 1, 2018.

This Bridge Report provides Toyo Ink SC Holdings, Co., Ltd.’s earnings results for the second quarter of the Fiscal Year ending December 2022, and more.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year ending December 2022 Earnings Results

3. Fiscal Year ending December 2022 Earnings Forecasts

4. Future Focuses

<Reference 1: Mid-Term Management Plan SIC-II (2021-2023)>

<Reference 2: Regarding Corporate Governance>

Key Points

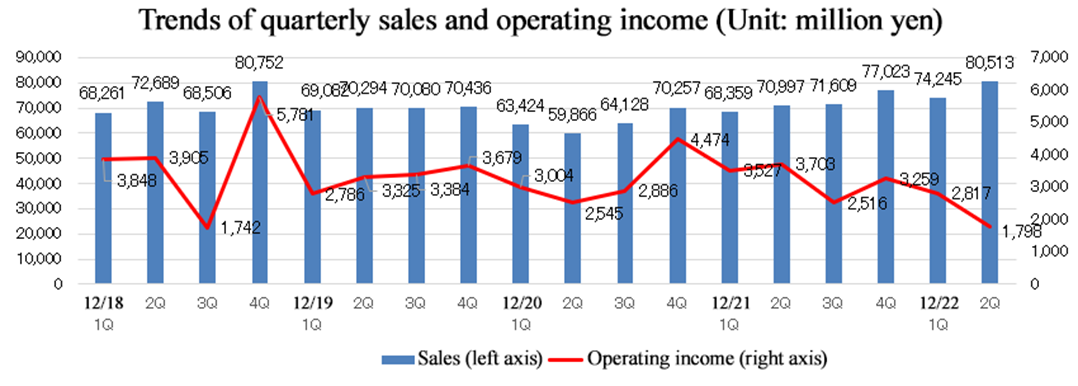

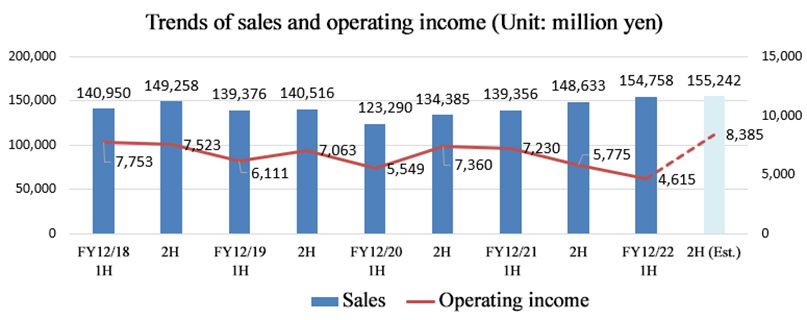

- In the second quarter of the term ending December 2022, sales increased 11.1% year on year to 154.7 billion yen. Sales rose in the major segments, especially overseas sales of packaging-related materials such as liquid inks and pressure-sensitive adhesives and adhesives grew. Operating income decreased 36.2% year on year to 4.6 billion yen. Although there was an increase in sales (+1.8 billion yen) and price revisions (+8.9 billion yen), raw material prices augmented (-11.6 billion yen), energy prices soared (-900 million yen), and expenses increased due to a rise in sales volume and increased logistics costs (-1.2 billion yen) which resulted in a decrease in profit. Net income increased 33.1% year on year to 8.4 billion yen. With the dissolution of the capital tie-up with Sakata Inx Corporation, the company sold its shares and posted a gain of 4.7 billion yen on selling investment securities.

- Earnings forecasts were revised at the time of the announcement of the financial results for the first quarter (May 13). Sales for the term ending December 2022 were revised upwardly to 310 billion yen, up 7.6% year on year, while operating income was revised downwardly to 13 billion yen, the same level as that in the previous term. In addition to enhancing procurement of raw materials and striving to ensure a stable supply to customers, foreign currency translation has also been impacted due to the yen's depreciation and foreign currency appreciation, so sales have exceeded expectations. On the other hand, the prices of raw materials and energy are rising more than cost reductions and reflection in prices, and this impact is forecasted to continue. Net income has been revised upwardly due to recording a gain on the sale of Sakata Inx shares. Sales were revised upwardly, and profits were revised downwardly in all segments. There is no revision to the dividend forecast, which is 90.00 yen/share like in the previous term. The expected payout ratio is 39.1%.

- Soaring raw material prices, which significantly reduced profits in the previous term, will continue to affect the company's earnings in the current term. The cost increase, including rising energy prices, is projected to be 12.5 billion yen in the first half and 10.4 billion yen in the second half, and 22.9 billion yen for the full year. This is expected to be absorbed by the price revisions (including cost reductions) of 9.1 billion yen for the first half, 11.9 billion yen for the second half, and 21.0 billion yen for the full year. Operating income in the second half is expected to grow significantly from the second half of the previous year and also from the first half of this year. Thus, in the short term, we would like to pay attention to whether price revisions will proceed as expected.

- From a medium-term perspective, we would like to keep an eye on the progress of the medium-term management plan, including the full-scale overseas expansion of EV-related materials in the colorants and functional materials business, the shift to high-value-added products such as functional products and environmentally friendly products in the polymers and coatings business, the sales expansion of environmentally friendly products in the packaging materials business overseas, and the reorganization of subsidiaries and the acceleration of structural reforms in the printing and information business.

1. Company Overview

Toyo Ink SC Holdings is Japan’s top manufacturer of printing inks. Using the processing technologies of pigments and polymers that are the raw materials of inks, the Company manufactures various products such as LCD color filter materials and electromagnetic shielding films. The Toyo Ink Group is comprised of Toyo Ink SC Holdings, 61 consolidated subsidiaries in and outside Japan, and 7 equity method affiliate companies. They are operating business in 24 countries around the world (The end of December 2021).

Under the long-term scheme “Scientific Innovation Chain 2027 (SIC 27),” whose concept is to contribute to the improvement of sustainability of ordinary citizens, life, and the global environment by innovatively thinking, scientifically executing, and connecting each activity by each and every employee, it is aiming for a transformation to have a corporate structure that enables sustainable growth towards 2027.

1-1 Corporate History

The origin of Toyo Ink dates back to 1896, when founder Kamataro Kobayashi opened Kobayashi’s Ink Shop as sole proprietorship in Nihonbashi, Tokyo. In 1907, it was reorganized and renamed as Toyo Ink Manufacturing Co., Ltd. During the Meiji period, many newspapers and magazines, including the Yomiuri Shimbun (founded in 1874) and the Asahi Shimbun (founded in 1879), were launched. The government also printed an increasing number of materials including textbooks to enhance educational levels under the policy of increasing wealth and military power. Under these circumstances, the demand for printing inks expanded rapidly.

Initially, inks in the Japanese market were mostly imported products; however, as the national policy favored high quality domestically produced inks, the Company, with its advanced technological skills, successfully expanded its business with clients such as the Printing Bureau of the Ministry of Finance and other government bodies, in addition to private printing companies. Exports also grew during the same time. The Company’s rapid growth was also due in part to the early introduction of integrated manufacturing system from raw materials (pigments, polymers) to finished products (printing inks). Another contributing factor may be that the Company, since its inception, had strong ties with Toppan Printing Co., Ltd., which, by then, was among Japan's largest printing companies. The Company survived the difficult times of the Great Kanto Earthquake and the World War II and experienced rapid growth again during the period of high economic growth after the war. The Company was listed on the Second Section of the Tokyo Stock Exchange in 1961 and moved to the First Section of the Tokyo Stock Exchange in 1967.

The Company is expanding its businesses from manufacturing of printing inks to other fields such as LCD color filters, using its wide range of technologies and know-how cultivated through manufacturing and processing of raw materials such as pigments and polymers. In 2011, the Company adopted a holding company system for further expansion and growth of the Group, and changed its name to Toyo Ink SC Holdings, Co., Ltd.

1-2 Management Philosophy etc.

“The Toyo Ink Group’s Corporate Philosophy System” was established in April 1993. It consists of three parts, namely, corporate philosophy, corporate policies, and guiding principles. The Philosophy embodies the original roots of the brand of the corporate group and serves as guidelines that each employee of the Group should always keep in mind and act on as a business professional. In April 2014, “improving shareholder satisfaction” was added to its guiding principles. With this revision, the Company is aiming to improve satisfaction of all stakeholders.

<Toyo Ink Management Philosophy>

Management philosophy | People-oriented management |

|

|

Corporate policies | We, the Toyo Ink Group, endeavor to be a company that contributes to the enrichment of life and culture throughout the world. *Contribute to the affluence and culture of people worldwide. *Create lifestyle value for the new age. *Provide advanced technology and quality products and services. |

|

|

Guiding principles | *Provide knowledge that enhances customer trust and satisfaction. *Respect the materialization of all employees' dreams. *Act as a responsible citizen in harmony with society and the environment *Respect shareholders' rights, improve shareholder value and enhance market valuation. |

All employees must always carry this philosophy system printed on a credo card, read it out in the 5-minute meeting every week at each division, and repeatedly confirm its meaning through discussion. This way, the employees are expected to have deeper understanding and implement the philosophy.

Furthermore, the “Toyo Ink Group Management Philosophy” is printed on the first page of every single issue of the Company's in-house magazine, which is published for the Group's unity and circulated to the entire Group including the overseas locations. Also, the above-mentioned credo has “Japanese/English” version as well as “Chinese/English” version to share and spread the management philosophy globally.

1-3 Market Environment

◎ Overview

(Market trend)

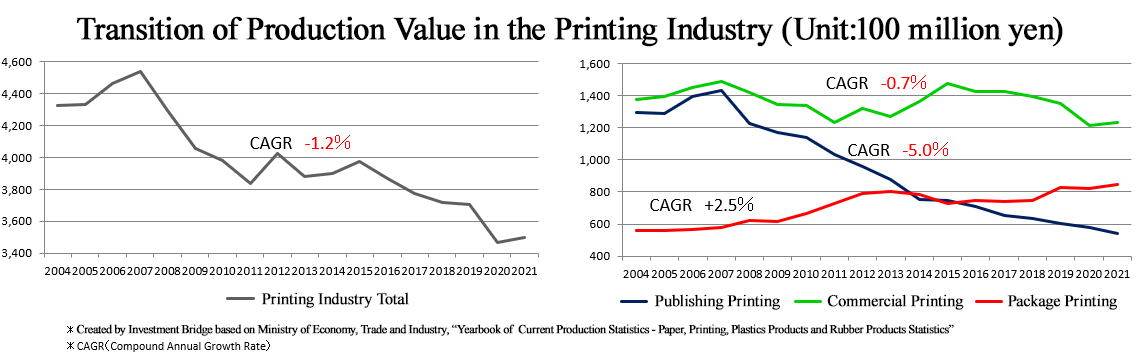

The production value of the Japanese printing industry is declining especially in the realm of publication printing of newspapers and magazines as a result of increasing digitization and aliteracy. Specifically, it fell sharply in 2020 due to the impact of the novel coronavirus etc.

In the realm of commercial printing, on the other hand, of posters, catalogues, fliers, POP, etc. demand is fairly steady. Furthermore, printing on food and pharmaceutical packages and plastic containers is steadily increasing at the compound annual growth rate (CAGR) of 2.5% for 17 years from 2004 to 2021.

Meanwhile, overseas, especially in newly emerging countries, both printing on papers (offset printing) and printing on film of food packages (gravure printing, flexographic printing) are expected to grow, and the Company is focusing on responding to the demand.

As innovation of printing machine is progressing, quality of printing is enhancing. Overseas local inks, in many cases, cannot respond to such demand for high quality, which may lead to more demand of excellent Japanese ink.

Also, with the growing global awareness of the environment, the needs for environmentally friendly products such as biomass inks are expanding, and ink companies are working on the development of new products that utilize their unique technologies.

◎ Other companies in the industry

There are six major listed companies including Toyo Ink in the ink industry in Japan.

While (4631) DIC is the number one company in the world, (4634) Toyo Ink SC Holdings, Co., Ltd. is the top runner in Japanese printing ink industry, and ranks first or second in most product categories. Globally, the Company is ranked fifth.

|

| Sales | Sales growth rate | Operating income | Profit growth rate | Operating margin | Total market value | PER | PBR | ROE |

4116 | Dainichiseika Color & Chemicals Mfg. Co., Ltd. | 128,000 | +5.0% | 5,200 | -30.2% | 4.1% | 33,447 | 8.7 | 0.3 | 5.9 |

4631 | DIC | 1,100,000 | +28.6% | 50,000 | +16.6% | 4.5% | 238,368 | 9.1 | 0.7 | 1.3 |

4633 | SAKATA INX | 221,000 | +21.8% | 5,000 | -32.6% | 2.3% | 52,980 | 11.1 | 0.7 | 6.1 |

4634 | Toyo Ink SCHD | 310,000 | +7.6% | 13,000 | +0.0% | 4.2% | 111,560 | 8.3 | 0.5 | 4.4 |

4635 | Tokyo Printing Ink Mfg. Co., Ltd. | 43,850 | +5.9% | 725 | +7.3% | 1.7% | 6,318 | 8.7 | 0.2 | 2.9 |

4636 | T&K TOKA | 46,470 | +4.5% | 1,180 | +416.7% | 2.5% | 24,076 | 17.2 | 0.5 | 5.8 |

*Sales and operating income are based on forecasts of each company for this FY. ROE and PBR are based on actual results of the previous term end.

*Unit: million yen, times. Total market value is as of closing on August 31, 2022.

1-4 Business Description

◎ Concerning “printing inks”

Followings are the summary of printing inks, one of the major product categories of the Company, categorized by “raw materials” and “types and purposes of use.”

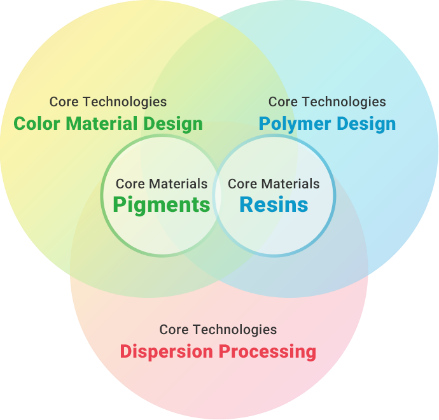

<Composing elements of printing inks>

Pigments (organic pigments, inorganic pigments, etc.) | Pigments are powders that are used to provide color and are insolvent to water and oil. |

Varnish (synthetic polymers, lipids, fluxing materials, etc.) | Varnish is a combination of lipids, natural polymers, synthetic polymers, etc. in a solvent. It diffuses pigments, transfers and fixes them to printing materials. |

Additives (lubricant, hardening agent, etc.) | Additives used to adjust so-called printability such as drying performance and fluidity, as well as printing effect. |

High-level dispersion technologies are required when various inks are produced by combining the above three raw materials.

Since its foundation, the Company has also been expanding its business categories by exploring application of these raw materials in the process of manufacturing them.

<Types and intended use of major printing inks>

Types | Characteristics and Intended Use |

Planographic inks | Typical printing ink on paper. They are used for printing magazines, posters, fliers, etc. |

Gravure inks | Because of their capacity to express detailed gradation, it is suitable for printing photo images. Currently, they are mainly used for printing films such as food wrapping materials. |

Screen inks | They are mainly used for printing on materials that are difficult to be printed with other methods, including industrial products such as meters and gauges of cars, circuit board formation, and CDs/DVDs. |

Flexographic inks | They are used to print on the surface of cardboard boxes, films and clothes. |

UV curing inks | Because they dry instantly without using a heat drier in the drying process, they are used for UV curing printing that does not directly generate CO2. They are environmentally friendly inks that do not generate Volatile Organic Compounds (VOC). |

◎ Business segments

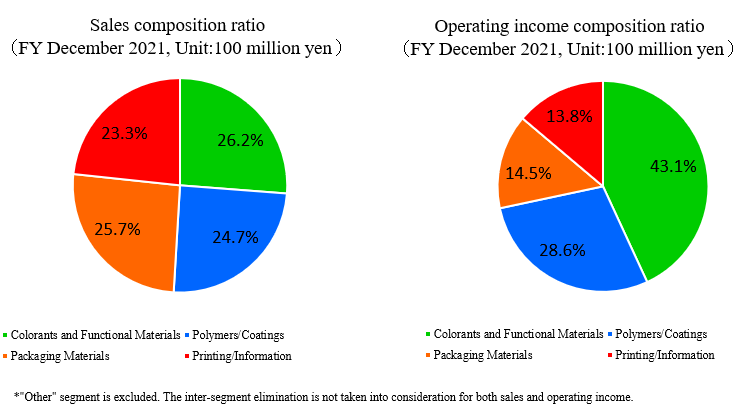

The business activities of the Company are classified into four segments: the “Colorants & Functional Materials Related Business,” “Polymers & Coatings Related Business,” “Printing & Information Related Business”, and “Packaging Materials Related Business”.

The “Printing & Information Related Business” mainly deals with planographic inks that are used for printing on papers (offset inks, etc.). The “Packaging Materials Related Business” deals with gravure inks and flexographic inks that are used for printing on films of food packages. The “Colorants & Functional Materials Related Business” deals with products related to pigments that are also the raw materials of printing inks as core materials. The “Polymers & Coatings Related Business” began with polymers that are the main raw materials of inks and their design technologies.

☆Colorants and Functional Materials Related Business

| FY Dec.21 |

Sales | 74,995 |

Operating Income | 5,391 |

Operating Margin | 7.2% |

*Unit: million yen

Sub segment | Major products |

General-purpose chemicals | Pigments and pigment dispersions |

High-performance chemical products | High performance pigments, CF(color filter) paste |

Display materials | Resist inks for LCD color filter |

Plastic colorants | Plastic colorants, functional plastic colorants |

Other Colorants/Functional Materials | Recording material coatings, functional dispersions, inkjet inks, developed products |

|

|

Based on the organic pigments that are the main raw materials for printing inks, and by integrating their color material technologies, organic chemical synthetic technologies and high-level dispersion technologies, the Company offers materials that are used in various fields. Especially, it created higher functional LCD color filter materials using their nano-level dispersion technologies through integration of technologies that have been accumulated from their ink and painting materials production experiences.

Furthermore, the Company’s dispersion processing technologies are used not only for organic pigments but also for inorganic materials such as carbon nanotube (CNT), which leads to expansion of its business in the new energy field such as secondary battery materials.

☆Polymers & Coatings Related Business

| FY Dec.21 |

Sales | 70,736 |

Operating Income | 3,570 |

Operating Margin | 5.0% |

*Unit: million yen

Sub segment | Major products |

Functional films and tapes | Adhesive tapes, marking films, electromagnetic shielding films |

Adhesives | Pressure sensitive adhesives, Adhesives, laminating adhesives, hot-melts |

Can coatings and polymers | Can coatings, polymers, functional hard coatings |

Other Polymers/Coatings | Medical products, natural extracts, developed products |

|

|

For this segment, the Company develops functional polymers as the core materials with different functional features. Using unique technologies that have been developed for many years, the Company creates new functions to cultivate new demand and open new markets in electronics, energy, health care and other fields.

☆Packaging Materials Related Business

| FY Dec.21 |

Sales | 73,645 |

Operating Income | 1,813 |

Operating Margin | 2.5% |

*Unit: million yen

Sub segment | Major products |

Liquid inks | Gravure inks, flexographic inks, gravure solvent |

Gravure equipment, plate making | Gravure equipment/plate making, gravure and flexographic platemaking |

|

|

For this segment, the Company deals with printing inks and equipment used in packages such as gravure printing and flexographic graphic printing.

In the field of food packaging materials, etc., the Company is dedicated to developing environmentally friendly products using water-based ink to assure their safety to the consumers.

☆Printing & Information Related Business

| FY Dec.21 |

Sales | 66,695 |

Operating Income | 1,730 |

Operating Margin | 2.6% |

*Unit: million yen

Sub segment | Major products |

Offset inks | Offset inks, newspaper inks, UV curable inks, metal decorating inks |

Printing materials and equipment | Printing inspection devices, printing materials |

Printing and information, others | Screen inks, other developed products |

|

|

This segment is the base segment of the Company since its establishment. For this segment, the Company deals mainly with printing inks used for printing on paper.

The Company offers not only printing inks but also sales of machinery/equipment, support for streamlining customers’ printing process, and support and tools for color management and color universal design.

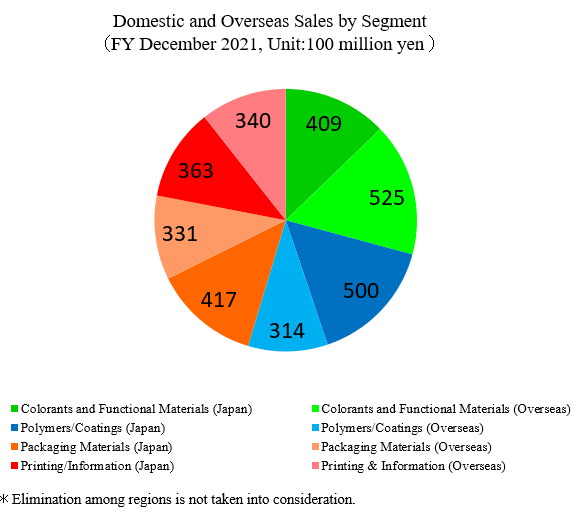

◎ Overseas expansion

While the Company is improving profitability by offering high-value-added products in the Japanese market, where a rapid growth is not expected, it is aggressively expanding its business from both production and sales perspectives in the overseas market where future growth is expected.

Development of its overseas manufacturing structures was almost completed during the previous Midterm Business Plan, and the Company is carrying out both raw material procurement and production at local sites.

As of the end of December 2021, the Company has about 44 overseas consolidated subsidiaries in a wide range of countries around the world.

| Sales | YoY | Operating Income | YoY |

Japan | 1,735 | +7.2% | 73 | +13.1% |

Asia | 1,136 | +20.2% | 48 | -18.6% |

Europe | 211 | +17.3% | 13 | +155.4% |

The Americas | 162 | +27.7% | 1 | - |

Adjustment | -364 | - | -5 | - |

Consolidated total | 2,880 | +11.8% | 130 | +0.7% |

*Unit: 100 million yen

1-5 ROE Analysis

| FY 12/ 17 | FY 12/ 18 | FY 12/ 19 | FY 12/ 20 | FY 12/21 |

ROE (%) | 4.8 | 5.4 | 3.9 | 2.8 | 4.4 |

Net income margin (%) | 4.32 | 4.08 | 3.04 | 2.34 | 3.30 |

Total asset turnover [times] | 0.65 | 0.77 | 0.75 | 0.68 | 0.73 |

Leverage [times](x) | 1.72 | 1.72 | 1.72 | 1.76 | 1.84 |

In general, it is desirable to continue to boost profitability and efficiency to achieve a ROE of 8%, which is said to be the value that should be pursued by Japanese companies.

1-6 Characteristics and Strengths

(1) Strong technological edge

As described above, the Company has been manufacturing in-house its core materials, pigments and polymers, which are the raw materials of printing inks. Its technological capacities form the basis of high-quality printing ink production and lead to expansion of business areas and product range such as, LCD color filter materials, adhesive bonds and adhesive compounds.

(From the Company’s HP)

(2) Excellent problem-solving skills

One of the reasons for the Company to be at the top of the Japanese printing inks industry is its excellent problem-solving capability in all aspects of printing.

The Company not only produces and supplies printing inks but also studies elements related to “printing” as a whole including plate making and images. Such efforts enable the Company to make technological proposals, demonstrate advanced service skills, and obtain high customer satisfaction.

(3) Environmental concerns

The Company is a forerunner in CO2 emission reduction as well as production of eco-friendly inks such as non-VOC inks, water-based inks, and UV inks. In the newly developed countries, too, the environmental regulations are becoming tighter, and the needs for environmentally friendly products are increasing. The Company is also working on assuring safety such as chemical substances control and manufacturing a line of products that meet the Swiss Ordinance, ahead of other companies.

(4) Uniqueness of management strategies

The Company considers M&A as one of the options for exploring new markets with its technological edge, if M&A is expected to bring synergy effects to the Company. However, it is not intending to implement M&A just to increase the size of businesses. It is also taking an initiative in the printing ink industry to establish “local production for local consumption” policy in the overseas market for enhancing efficiency (e.g., reduction in transport mileage) and social contribution (e.g., utilization of local products) purposes.

2. Second Quarter of the Fiscal Year ending December 2022 Earnings Results

(1) Business Results

| FY 12/ 21 2Q | Ratio to sales | FY 12/ 22 2Q | Ratio to sales | YoY |

Sales | 139,356 | 100.0% | 154,758 | 100.0% | +11.1% |

Gross profit | 29,918 | 21.5% | 27,870 | 18.0% | -6.8% |

SG&A | 22,688 | 16.3% | 23,254 | 15.0% | +2.5% |

Operating Income | 7,230 | 5.2% | 4,615 | 3.0% | -36.2% |

Ordinary Income | 8,662 | 6.2% | 6,728 | 4.3% | -22.3% |

Net Income | 6,319 | 4.5% | 8,410 | 5.4% | +33.1% |

*Unit: million yen. Accounting Standard for Revenue Recognition has been applied from the first quarter of the term ending December 2022. The figures for the second quarter of the term ending December 2021 are figures before its application, but since the impact is minor, the year-on-year comparison does not reflect the accounting standards. The same applies to the tables below.

Sales increased, but profit decreased.

Sales increased 11.1% year on year to 154.7 billion yen. Sales rose in the major segments, especially overseas sales of packaging-related materials such as liquid inks and pressure-sensitive adhesives and adhesives grew. Operating income decreased 36.2% year on year to 4.6 billion yen. Although there was an increase in sales (+1.8 billion yen) and price revisions (+8.9 billion yen), raw material prices augmented (-11.6 billion yen), energy prices soared (-900 million yen), and expenses increased due to a rise in sales volume and increased logistics costs (-1.2 billion yen) which resulted in a decrease in profit. Net income increased 33.1% year on year to 8.4 billion yen. With the dissolution of the capital tie-up with Sakata Inx Corporation, the company sold its shares and posted a gain of 4.7 billion yen on selling investment securities.

(2) Trends by Segment

| FY 12/ 21 2Q | Ratio to sales | FY 12/ 22 2Q | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Colorant/Functional materials | 36,796 | 26.4% | 39,373 | 25.4% | +7.0% |

Polymers/Coatings | 33,614 | 24.1% | 38,144 | 24.6% | +13.5% |

Packaging materials | 35,406 | 25.4% | 39,988 | 25.8% | +12.9% |

Printing/Information | 32,633 | 23.4% | 36,332 | 23.5% | +11.3% |

Others/Adjustments | 904 | - | 919 | - | - |

Total | 139,356 | 100.0% | 154,758 | 100.0% | +11.1% |

Operating Income |

|

|

|

|

|

Colorant/Functional materials | 2,723 | 7.4% | 1,501 | 3.8% | -44.9% |

Polymers/Coatings | 1,989 | 5.9% | 1,497 | 3.9% | -24.7% |

Packaging materials | 1,271 | 3.6% | 470 | 1.2% | -63.0% |

Printing/Information | 858 | 2.6% | 588 | 1.6% | -31.5% |

Others/Adjustments | 388 | - | 558 | - | - |

Total | 7,230 | 5.2% | 4,615 | 3.0% | -36.2% |

*Unit: million yen

☆Colorants and Functional Materials Related Business

Sales increased and profit decreased.

Sales of functional dispersions for inkjets and lithium-ion batteries grew, but sales of materials for display and colorants were sluggish. The company proceeded with price revisions in response to soaring raw material prices, but could not absorb them, resulting in a decrease in profit.

(Materials for display)

Sales increased 8%. The company expanded the sales of insulating paste in China and Taiwan, but demand was sluggish from the second half of the first half of the fiscal year.

(Colorants)

Sales increased 5%. Domestic sales for containers and building material industries were strong, and overseas sales for the solar cell industry were robust. However, sales for OA equipment and automotive industries were sluggish.

(Pigments)

Sales rose 6%. Sales for the packaging industry grew, but demand for offset pigments was sluggish.

(Inkjet)

Sales increased 18%. Sales for commercial printing and signs fields were strong, and sales were also favorable overseas, mainly in China and Europe.

(Functional Dispersion)

Sales increased 185%. Regarding the lithium-ion battery dispersants, the company proceeded with building a 4-pole production system (Europe, the U.S., China, and Japan).

☆Polymers & Coatings Related Business

Sales increased while profit decreased.

Sales increased due to overall growth centered on functional films for electronics. High value-added products for 5G and other applications performed well, but profits from packaging and industrial material fields declined due to soaring raw material prices.

(Packaging and industrial materials)

Sales increased 13%. Sales of pressure-sensitive adhesives and adhesives for food packaging and labels were strong, but they were greatly affected by soaring raw material prices.

(Electronics)

Sales grew 14%. Sales of functional films and adhesives for panels in South Korea increased.

(Medical/Health Care)

Sales increased 13%. While sales of patches increased, sales of adhesives for the health care field in China were sluggish due to the impact of the lockdown in Shanghai.

☆Packaging Materials Related Business

Sales increased while profit decreased.

Overseas demand in the food packaging field is growing steadily, and sales in Japan are increasing due to the adoption of environmentally friendly products. The company proceeded with price revisions in response to soaring raw material prices, but could not absorb them, resulting in a decrease in profit.

(Domestic liquid ink)

Sales grew 8%. Sales of flexible food packaging and refill pouches were strong, and sales of environmentally friendly products such as biomass ink improved.

(Overseas liquid ink)

Sales increased 21%. Sales of environmentally friendly products such as water-based ink for flexible packaging applications grew in India, South Korea, and Taiwan. Sales of middle-grade products expanded in Southeast Asia and India due to capital investment, but were significantly affected by the sharp rise in raw material prices.

☆Printing & Information Related Business

Sales increased while profit decreased.

Sales increased due to an increase in sales of functional inks for packaging purposes, mainly overseas. Although the company promoted structural reforms and price revisions, profit decreased due to the impact of soaring raw material prices.

(Offset inks)

Sales grew 13%. The commercial printing market continues to shrink in the long term, but the overseas market is recovering. The company promoted cost reduction and human resource shift through structural reforms, including the integration of domestic sales companies and spin-off companies.

(Functional inks)

Sales increased 13%. Sales of environmentally friendly products such as biomass UV ink for packaging grew. The company has worked to develop overseas markets for metal inks and new applications for screen inks.

(3) Financial standing and cash flows

◎Main Balance Sheet

| End of December 2021 | End of June 2022 | Increase /Decrease |

| End of December 2021 | End of June 2022 | Increase /Decrease |

Current Assets | 223,589 | 237,827 | +14,238 | Current liabilities | 112,125 | 119,466 | +7,341 |

Cash | 64,816 | 62,453 | -2,363 | Payables | 68,221 | 66,996 | -1,225 |

Receivables | 94,297 | 97,791 | +3,494 | ST Interest Bearing Liabilities | 24,042 | 27,437 | +3,395 |

Inventories | 59,570 | 71,222 | +11,652 | Noncurrent liabilities | 67,823 | 66,094 | -1,729 |

Noncurrent Assets | 183,306 | 186,831 | +3,525 | LT Interest Bearing Liabilities | 55,415 | 55,289 | -126 |

Tangible Assets | 111,716 | 122,887 | +11,171 | Total Liabilities | 179,948 | 185,561 | +5,613 |

Intangible Assets | 2,225 | 2,882 | +657 | Net Assets | 226,947 | 239,096 | +12,149 |

Investment, Others | 69,364 | 61,060 | -8,304 | Retained Earnings | 151,740 | 152,923 | +1,183 |

Total assets | 406,896 | 424,658 | +17,762 | Total liabilities and net assets | 406,896 | 424,658 | +17,762 |

|

|

|

| Interest Bearing Liabilities Balance | 79,457 | 82,726 | +3,269 |

*Unit: million yen

Total assets increased 17.7 billion yen from the end of the previous term to 424.6 billion yen, mainly owing to an increase in inventories and tangible assets, despite a decrease in cash.

Total liabilities increased 5.6 billion yen from the end of the previous fiscal year to 185.5 billion yen due to an increase in short-term interest bearing liabilities. Net assets grew 12.1 billion yen from the end of the previous fiscal year to 239.0 billion yen due to an increase in retained earnings and valuation difference on available-for-sale securities and a reduction in the deficit of the foreign exchange translation adjustment account.

As a result, equity ratio rose 0.4 points from the end of the previous fiscal year to 54.1%.

◎Cash Flow

| FY 12/21 2Q | FY 12/22 2Q | Increase/Decrease |

Operating Cash Flow | 7,311 | -262 | -7,573 |

Investing Cash Flow | -10,053 | 1,512 | +11,565 |

Free Cash Flow | -2,742 | 1,250 | +3,992 |

Financing Cash Flow | -8,472 | -6,155 | +2,317 |

Term End Cash and Equivalents | 63,075 | 58,802 | -4,273 |

*Unit: million yen

Operating CF recorded a deficit due to a decrease in accounts payable (increased in the same period of the previous year). Investing CF and free CF recorded a surplus due to an increase in income from the sale of investment securities due to the dissolution of the capital alliance with SAKATA INX.

The cash position has deteriorated.

(4) Topics

(1) Dissolution of the capital alliance with Sakata Inx Corporation and continuation of the business alliance

Since 1999, Toyo Ink SC Holdings and Sakata Inx have collaborated in the various fields of production and logistics. Many years have passed since the start of the partnership, and the approaches to cross-shareholding and the environment surrounding the industry have changed significantly. Thus, on February 21, 2017, both companies sold a portion of the shares held by each other and agreed to continue holding the remaining shares.

After that, while the company considered the promotion of partnerships worthy of cross-shareholding, it also discussed the need to review the policy of mutual shareholding in light of the reduction in cross-shareholdings required by the principles of the recent Corporate Governance Code. As a result, both companies agreed that selling the shares held by each other while continuing the business partnership would contribute to improving corporate value.

The two companies will continue to promote their business alliance in the face of the severe business environment surrounding the industry, such as the decline in demand for printing ink due to digital transformation and the sharp rise in costs, mainly raw material and logistics costs, to maintain and improve high-quality services.

As mentioned above, due to the sale of Sakata Inx shares, a gain of 4.7 billion yen on the sale of investment securities was recorded as extraordinary income.

(2) Merging seven consolidated subsidiaries to reorganize printing and information business

In July 2022, the company decided to merge the wholly owned subsidiary, Toyo Ink Co., Ltd., and another six wholly-owned subsidiaries (Toyo Ink Hokkaido Co., Ltd., Toyo Ink Tohoku Co., Ltd., Toyo Ink Chushikoku Co., Ltd., Toyo Ink Kyushu Co., Ltd., Toyo Ink Graphics Co., Ltd., and Toyo Ink Graphics Nishinihon Co., Ltd.) to reorganize the printing and information business.

(Purpose of Merger)

Toyo Ink Co., Ltd. is developing various products in the printing-related market, and the other six companies have sold these products in each of their areas.

This business integration will create a flexible organizational structure that can respond quickly to the market environment to promote further structural reforms in printing and information business.

In addition, the company will strive to improve operational efficiency through DX, provide sustainable value to customers through solutions and services centered on environmentally friendly product lines, and strengthen initiatives to expand into new markets, such as the development of environmentally friendly packaging products and high-performance products that respond quickly to social needs.

The company will also shift human resources to growth fields.

(Merger Method)

Toyo Ink Co., Ltd. will be the surviving company through an absorption-type merger, and the other six companies will be dissolved.

The merger date is scheduled for January 1, 2023.

(3) Issuing Toyo Ink Group Integrated Report 2022

In July 2022, the Toyo Ink Group Integrated Report 2022 was issued.

It explains the company's philosophy, the strengths that form the foundation and process of value creation, and the progress of the medium-term management plan SIC-II.

In the representative’s message, President Takashima said, "We will transform ourselves into a corporate group that meets the expectations of the children who will lead the future based on being a company that creates lifestyles and culture."

The company announced its support of the TCFD recommendations in November 2020, and in this integrated report, it identifies risks and opportunities and discloses information to demonstrate its proactive stance toward responding to climate change.

In addition to conducting analysis with the scenarios where temperature rises 1.5°C and 4°C, it calculated the impact of the carbon tax.

https://schd.toyoinkgroup.com/ja/ir/archives/pdflib/report/2022/integrated_report2022ja.pdf

(4) Improving the governance system and reducing cross-shareholdings

In March 2022, the company transitioned from a company with auditors to a company with an audit and supervisory committee.

Along with this, the company reduced the total number of directors and auditors from 16 when it was a company with auditors to 11 directors and increased the number of outside directors to 6 (of which 5 are independent directors), increasing the ratio of outside directors to 55%.

The company continues to optimize strategically held shares.

The ratio of strategic shareholding to net assets stepwisely decreased from 19.5% in 2017 to 7.4% in the first half of 2022.

3. Fiscal Year ending December 2022 Earnings Forecasts

(1) Business forecasts

| FY 12/ 21 | Ratio to sales | FY 12/ 22 Est. | Ratio to sales | YoY | Revision ratio |

Sales | 287,989 | 100.0% | 310,000 | 100.0% | +7.6% | +5.1% |

Operating Income | 13,005 | 4.5% | 13,000 | 4.2% | -0.0% | -10.3% |

Ordinary Income | 15,442 | 5.4% | 14,000 | 4.5% | -9.3% | -6.7% |

Net Income | 9,492 | 3.3% | 12,500 | 4.0% | +31.7% | +25.0% |

* Unit: million yen. Forecasts are the figures announced by the Company.

Revised earnings forecast, sales and operating income grew

Earnings forecasts were revised at the time of the announcement of the financial results for the first quarter (May 13). Sales for the term ending December 2022 were revised upwardly to 310 billion yen, up 7.6% year on year, while operating income was revised downwardly to 13 billion yen, the same level as that in the previous term. In addition to enhancing procurement of raw materials and striving to ensure a stable supply to customers, foreign currency translation has also been impacted due to the yen's depreciation and foreign currency appreciation, so sales have exceeded expectations. On the other hand, the prices of raw materials and energy are rising more than cost reductions and reflection in prices, and this impact is forecasted to continue. Net income has been revised upwardly due to recording a gain on the sale of Sakata Inx shares. Sales were revised upwardly, and profits were revised downwardly in all segments.

*Major factors contributing to year-on-year growth in operating income

Price revision +20 billion yen: In addition to the price revisions implemented in Japan and overseas in the first half, the company will promote revisions to realize appropriate prices that match the soaring raw material prices.

Sales expansion +3.2 billion yen: Sales increase due to overseas growth and sales expansion of environmentally friendly products, as well as the sales expansion of high-value-added products such as electronics

Cost reduction +1 billion yen

*Major negative factors impacting operating income year on year

Raw material prices -21.2 billion yen: Raw material prices will continue to soar in the second half

Energy price -1.7 billion yen: energy costs are expected to continue rising

Cost increase -1.8 billion yen: Costs are expected to increase due to an increase in expenses due to increased sales volume, and an increase in logistics costs and depreciation expenses

There is no revision to the dividend forecast, which is 90.00 yen/share like in the previous term. The expected payout ratio is 39.1%.

(2) Trends by Segment

Sales | FY 12/21 | FY 12/22 Est. | YoY | Revision ratio |

Colorant/Functional materials | 750 | 800 | +6.7% | +3.9% |

Polymers/Coatings | 707 | 780 | +10.3% | +5.4% |

Packaging materials | 736 | 800 | +8.7% | +5.3% |

Printing/Information | 667 | 700 | +4.9% | +6.1% |

Others/Adjustment | 19 | 20 | +5.3% | +0.0% |

Total | 2,880 | 3100 | +7.6% | +5.1% |

Operating Income |

|

|

|

|

Colorant/Functional materials | 54 | 49 | -9.3% | -10.9% |

Polymers/Coatings | 36 | 43 | +19.4% | -10.4% |

Packaging materials | 18 | 21 | +16.7% | -16.0% |

Printing/Information | 17 | 14 | -17.6% | -17.6% |

Others/Adjustment | 5 | 3 | -40.0% | - |

Total | 130 | 130 | -0.0% | -10.3% |

* Unit: 100 million yen.

(Priority measures in each segment)

☆Colorants and Functional Materials Related Business

Sales will increase, and profits will decrease (prior to revision: sales and profits will increase).

Short-term measures: To promote price revisions

The company will promote price revisions of 1.3 billion yen in the second half to absorb the impact of soaring raw material prices (1.6 billion yen in the second half, 3.4 billion yen for the full year) as much as possible.

For pigments, in addition to the third price revision, a new surcharge system was introduced in July 2022.

Additional price revisions will be implemented for plastic colorants, and inkjet ink prices will also be revised.

Priority measures: To accelerate the establishment of earnings pillars in growing markets

Regarding EV-related materials (lithium-ion battery dispersion), Hungary has started full-scale operations. The company will improve sales and development activities in four regions and four production bases.

In the digital field, the company will work to expand its share in the display materials industry in China and Taiwan. In addition to strengthening the sales system by utilizing local partners, the company will promote mass production tests for customers. The company aims to acquire new customers for pastes and expand sales of environmentally friendly products such as low-temperature curing products.

Regarding environmental and recycling initiatives, the company will expand its lineup of plastic colorants that maintain various functions to meet changing social needs. It will also boost sales of solar cells in China and India and develop biodegradable and recyclable products.

☆Polymers & Coatings Related Business

Increase in sales and profit(Same as before correction).

Short-term measures: To promote price revisions

The company will promote price revisions of 3.3 billion yen in the second half to absorb the impact of soaring raw material prices (3.1 billion yen in the second half, 7.2 billion yen for the full year) as much as possible.

In June 2022, pressure-sensitive adhesives underwent their fourth price revision, and laminating adhesives their third price revision. The company is promoting additional price revisions for paints, resins, and hot melts and aims to reach an agreement during the third quarter.

The company will grasp raw materials and costs for each item in real time and appropriately reflect them in price revisions.

Priority measures: Expansion of globally top product lines and the transformation of the profit structure

The company will concentrate resources on functional and environmentally friendly products to shift from expanding sales to pursuing high added value. The company will intensively work on achieving results in its development themes in a short period. Priority materials include functional films for China, coating materials and HC agents for foldable devices, and optical urethane adhesives. The company will also focus on developing globally top product lines, such as functional films for Beyond-5G, semiconductor-related materials, and structural adhesives.

The company aims to quickly recover its investment by improving the operation rate of production facilities that it has added in China, India, the United States, and South Korea.

Since the overseas production facilities that have been expanded under the medium-term management plan SIC-II are expected to reach full capacity, the next expansion plan will be formulated with India, the United States, and China as priority areas.

☆Packaging Materials Related Business

Increase in sales and profit (Same as before correction).

Short-term measures: To promote price revisions

The company will promote price revisions of 3.9 billion yen in the second half to absorb as much as possible the impact of soaring raw material prices (2.6 billion yen in the second half and 5.8 billion yen for the full year).

In Japan, following the price revisions in May 2021 and December 2021, the third price revision in June 2022 is in progress.

Overseas, the company will steadily proceed with price revisions that reflect cost increases.

Priority measures: Becoming a leading environmentally friendly company and accelerating growth investment in all its overseas markets

Regarding environmentally friendly products, the company will promote the development and sales expansion of products that contribute to CO2 and plastic reduction, such as water-based inks and biomass inks.

The company will focus on capital investment and new product development to accelerate overseas expansion.

The company has started the operations of the new factory in China (Jiangmen) and the expansion of line in India.

In Southeast Asia and India, the company will aggressively expand the sales of environmentally friendly newly developed products, high-end products, and middle-grade products. It will respond quickly to customer needs by taking advantage of the company's strength of being able to synthesize resins locally.

The new plant in Turkey will also be actively expanding its sales into the European and American markets.

☆Printing & Information Related Business

Sales increased while profit decreased (Before the revision, sales and income decreased).

Short-term measures: To promote price revisions

The company will promote price revisions of 2.6 billion yen in the second half to absorb the impact of soaring raw material prices (2.3 billion yen in the second half, 4.8 billion yen for the full year) as much as possible.

In Japan, following the price revision in August 2021, the second price revision in February 2022 is in progress.

Overseas, the company will steadily proceed with price revisions that reflect cost increases.

Priority measures: To promote reforms to become a profitable business that is compatible with the market environment

As mentioned in "Topics," the company will reorganize its subsidiaries as part of its structural reforms. It will optimize the sales system through the integration and consolidation of companies and shift human resources to growing fields.

The company will expand the sales of functional inks for packaging and accelerate the growth of environmentally friendly products.

For UV inks, the company is promoting relying on biomass through its unique resins and energy-saving LED-UV compatible products and will expand sales in the Japanese and European packaging markets.

As for metal inks, the company will accelerate overseas expansion by leveraging its track record as the leading company in the Japanese market.

4. Future Focuses

Soaring raw material prices, which significantly reduced profits in the previous term, will continue to affect the company's earnings in the current term. The cost increase, including rising energy prices, is projected to be 12.5 billion yen in the first half and 10.4 billion yen in the second half, and 22.9 billion yen for the full year. This is expected to be absorbed by the price revisions (including cost reductions) of 9.1 billion yen for the first half, 11.9 billion yen for the second half, and 21.0 billion yen for the full year. Operating income in the second half is expected to grow significantly from the second half of the previous year and also from the first half of this year. Thus, in the short term, we would like to pay attention to whether price revisions will proceed as expected.

From a medium-term perspective, we would like to keep an eye on the progress of the medium-term management plan, including the full-scale overseas expansion of EV-related materials in the colorants and functional materials business, the shift to high-value-added products such as functional products and environmentally friendly products in the polymers and coatings business, the sales expansion of environmentally friendly products in the packaging materials business overseas, and the reorganization of subsidiaries and the acceleration of structural reforms in the printing and information business.

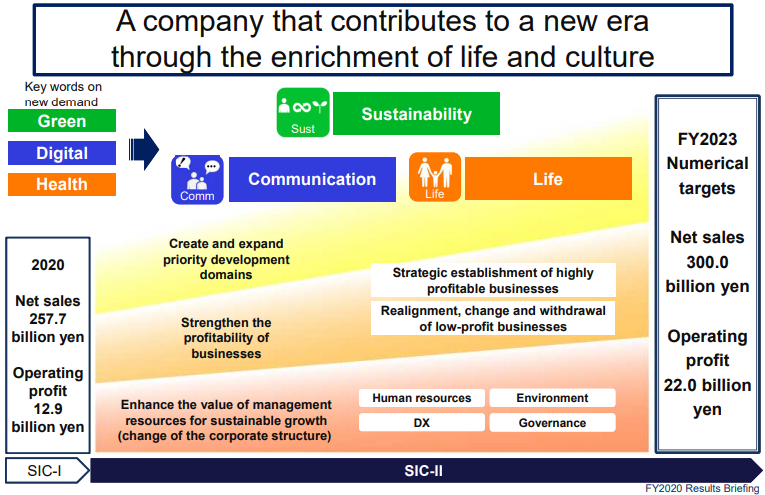

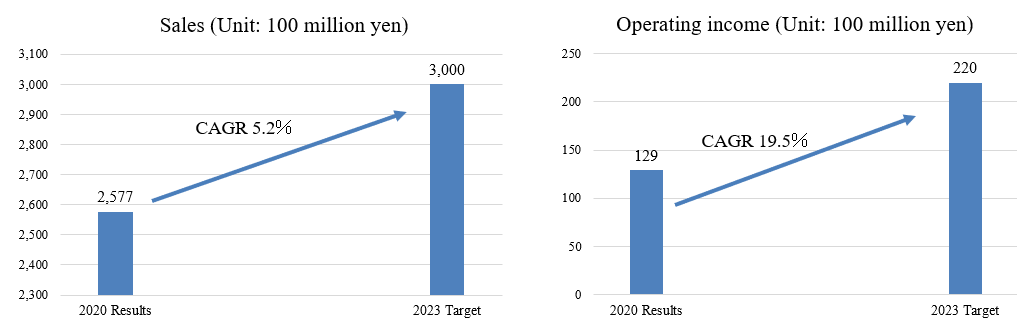

<Reference 1: Mid-Term Management Plan SIC-II (2021-2023)>

Under the 10-year long-term scheme, Scientific Innovation Chain 2027 (SIC27), aimed at achieving sustainable growth by 2027, the company breaks down the scheme into three 3-year mid-term management plans. They hope to clarify problems and roles in each stage, and to act steadily to realize an ideal future. Following the first stage of the scheme, Mid-Term Management Plan SIC-I (FY 2018-FY 2020), the second stage, Mid-Term Management Plan SIC-II (2021-2023) began in Jan. 2021.

<Summary of the Previous Mid-Term Management Plan SIC-I (2018-2020)>

Due to the significant changes in the external environment, including the skyrocketing of material prices, the changes in the market structure, and the coronavirus pandemic, the company failed to achieve its goals, but it was able to shift revenue sources to the polymers/coating and packaging material businesses, which are the prioritized area, and allocated resources to new businesses.

In addition, the company was able to proceed with the priority measure of promoting environmentally friendly products and distributed them in overseas areas too. With this, the company thinks they were able to produce results to some extent.

On the other hand, it was clarified that the company needs to further accelerate structural reform mainly in the Printing & Information Related Business, create pillars of new products and businesses, and respond to rapid changes in the market structure amid the coronavirus crisis.

<Recognition of the External Environment>

As for the novel coronavirus, the situation is improving gradually in FY 2021, but we must wait for the economic recovery to the pre-pandemic level until FY 2022 or later. The overseas market is expected to recover earlier than the domestic market.

The future outlook remains uncertain and the business and market environments will remain harsh, but the company recognizes this adverse condition as a chance to change.

They set the keywords of the growing markets as “Green”, “Digital”, and “Health”.

<Ideal State>

The company aims to become “a company that contributes to a new era through the enrichment of life and culture.”

As mentioned above, the company defined the keywords of the growing markets as “Green”, “Digital”, and “Health”, and set their priority development areas as “sustainability”, “communication”, and “life”.

The company aims to realize an ideal state under the three policies: (1) Strengthen the profitability of businesses (2) Create more priority areas of development, and (3) Enhance the value of management resources for sustainable growth.

(Taken from the Company’s material)

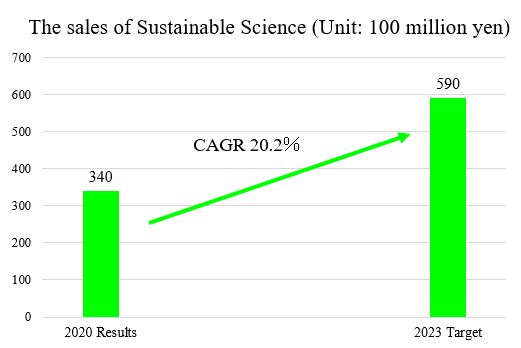

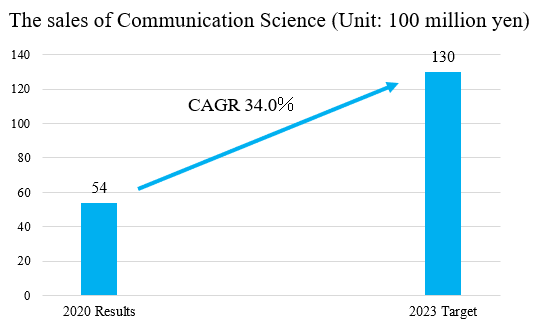

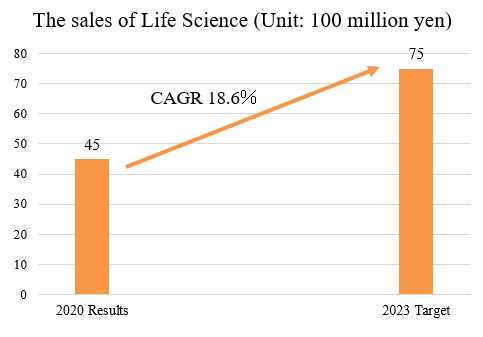

<Numerical Goals>

The company aims to achieve sales of 300.0 billion yen, an operating income of 22.0 billion yen, an operating income margin of 7% or higher, and a ROE of 7% or higher in the term ending Dec. 2023.

<Basic Policy 1: Measures to Strengthen Segments’ Profitability>

⊚ Measures for increasing revenues in each segment

Colorant/Functional materials | Establish an earning pillar in growing markets -EV: To handle materials related to lithium-ion batteries -Digital: To expand the market share of resist inks for flat panel display (FPD) in China, and handle resist inks for image sensors and inkjet inks -Plastic colorants: To reorganize facilities and promote products with high added value |

Polymers/Coatings | ◆ Overseas expansion of the adhesives business and the entry to growing markets with new polymers -Packaging/industrial materials: To expand business outside Japan, by enhancing its production capacity and enriching the lineup of environmentally friendly products -5G and IoT: To establish a position in the 5G market and enter the semiconductor market -Medical/healthcare: To expand and develop the lineup of related products |

Packaging materials | ◆ Make products environmentally friendly and expand its business mainly in the Asian market -To commercialize the recycling of packages -To intensively invest in overseas growing markets in China, India, Turkey, Southeast Asia, etc. |

Printing/Information | ◆ Evolution into a profitable business that has adapted to the market environment -To promote functional inks for packages, such as paper containers, and the industrial field -To launch the color/communication business |

*From FY 2021, inkjet inks are included in the business of colorants/functional materials business rather than the printing/information business.

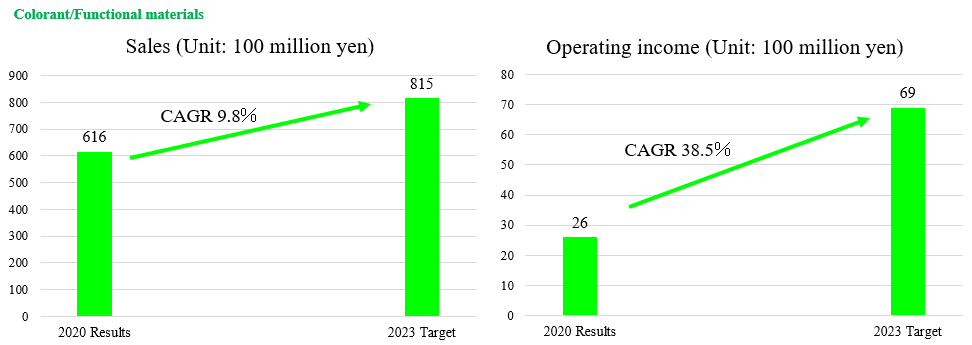

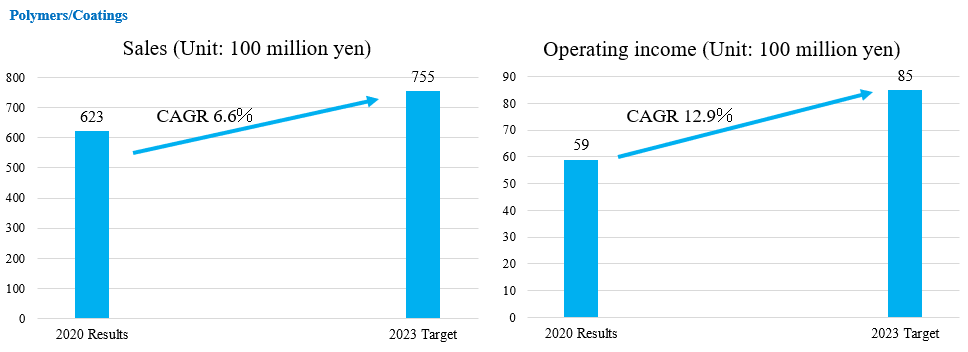

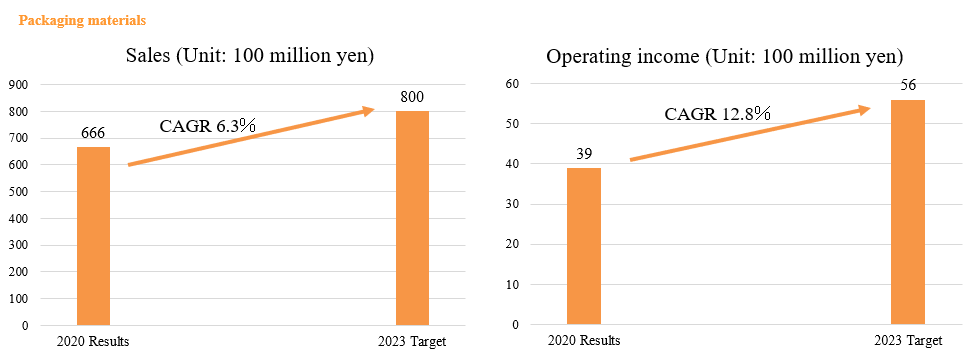

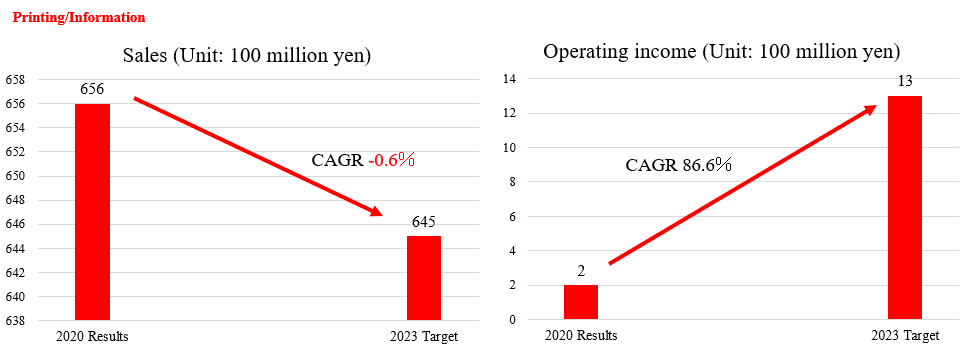

The target sales and operating income in each segment are as follows.

<Basic Policy 2: Create and Expand Priority Development Domains>

⊚ Three priority development domains

In the three priority development domains, the company will focus on the following points.

Sustainable Science | ◆ Realization of a sustainable society

(Major items to be developed) -Environmentally friendly packages made from biomass and recycled materials -Materials of lithium-ion batteries for EVs and new energy |

| |

Communication Science | ◆ Contribute to 5G and IoT societies with key materials

(Major items to be developed) -Optical control materials for IoT and sensors -Low-dielectric materials, functional films, etc. for 5G and semiconductors |

| |

Life Science | ◆ Make the lives of people affluent and healthy

(Major items to be developed) -Patch-type medicines -Inkjet inks for digital printing |

|

⊚ Reform of the development structure

The company will strengthen the R&D structure in the priority development domains.

Research institutes will be established in the main company of each segment. These institutes will act as the specialized department for mid-term development strategies, dealing with them in a span of two to five years, and accelerate the creation of new products and businesses.

Colorants/Functional materials | Advanced Material Development Laboratory |

Polymers/Coatings | Polymer Material Development Laboratory |

Packaging materials | Functional Material Development Laboratory |

Printing/Information |

For longer-term development, Holdings R&D laboratories and Production Technology Research Laboratory will be in charge, and proceed with R&D in cooperation with other institutes.

⊚ Investment plan

The company will concentrate investments in growing markets.

For SIC-II, it plans to invest a total of 40 billion yen. In detail, 29% will be invested in colorants/functionals materials, 31% in polymers/coatings, 25% in packaging materials, and 11% in printing/information.

In six years, with the focus on the next three years (SIC-III), the company plans to invest about 20 billion yen in colorants/functional materials, about 30 billion yen in polymers/coatings, and about 40 billion yen in packaging materials.

The company plans to construct/upgrade factories for each segment as follows: (1) For colorants/functional materials, factories for EV-related materials in Japan, China, the U.S., and Europe, (2) for polymers/coating, factories for pharmaceuticals (Moriyama Factory), new polymer synthesis (Kawagoe Plant), and adhesives (the U.S., China, and India) and (3) for packaging materials, factories in Turkey, India, China, and Indonesia.

<Basic Policy 3: Enhance the Value of Management Resources for Sustainable Growth>

For reforming the corporate culture, the company will implement the following measures.

⊚ Reform of workstyles and HR systems

The company will strengthen a performance-based evaluation system.

Based on the declaration of empowerment of women, the company will raise the ratio of female managers in Japan from 4% to 8%.

It will recruit not only new graduates, but also various workers throughout the year.

It will discern the optimal scale of workforce and conduct appropriate staffing.

As remote work has become common, the company will reform its offices for innovation.

⊚ Promotion of Digital Transformation (DX)

The company recognizes DX as an important management mission for achieving sustainable growth and will promote it in each department.

Department | Measures |

Sales | -Digital marketing -Development of new business models |

Production | -Smart factories -Improvement of processes by IoT |

Technology development | -Materials informatics -Acceleration of development |

Management | -Promotion of Robotic Process Automation (RPA) -Education for promoting DX |

⊚ Transformation of the governance structure

In particular, the company will improve the independence of directors and auditors, secure transparency, adopt a performance-based remuneration system, strengthen risk management, and reduce strategically held shares.

⊚ Promotion of environment-conscious management

As the company is deeply aware of environmental issues, it will focus on the development and promotion of environmentally friendly products, and contribute to the development of a sustainable society.

Social issues | Products/services |

Energy saving | -High-sensitive UV curing -EB (electron beam) curing |

Measures for VOC | -To make them water-base -To make them solvent-free |

Reduction of CO2 emissions | -Biomass products |

Reduction of food loss | -To retain freshness -To supply of materials for retort pouches |

Recycling of waste plastics | -Biodegradation -Recycling system |

In addition, the company will actively address the problem of climate change, by reducing CO2 emissions and saving energy, to realize the Carbon Neutrality 2050 vision, which is promoted by the government. In 2020, Kawagoe Plant received the Chairperson Award of The Energy Conservation Grand Prize, Japan.

⊚ Cash flow policy

The company puts importance on the balance between financial soundness and investment/return to shareholders.

For financial soundness, the company will keep capital-to-asset ratio at the appropriate level and secure liquidity on hand.

It will actively conduct the investment in equipment, technologies, and human resources, and M&As.

It will also continue to pay dividends stably. In Feb. 2021, the company purchased treasury shares at a price of 5 billion yen, and will plan to purchase more treasury shares depending on the situation.

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an Audit and Supervisory Committee |

Directors | 11 directors, including 6 external ones(5 of which are independent directors) |

◎ Corporate Governance Report

The latest update: March 30, 2022.

<Basic policy>

Our corporate group shifted to the holding company structure on April 1, 2011. Under the holding company structure, our company aims to improve the value of the entire corporate group by strengthening its strategic function, promoting speedy business administration, and achieve a good balance between the optimization of the entire group and the optimization of each business.

Our group’s framework for business administration is constituted by the “ethos of the Toyo Ink Group,” which is composed of management philosophy and ethos, which summarize the basic policies for group management, and the course of action, and the “CSR value system,” which is composed of the CSR charter and course of action, which clearly describe the stance toward social responsibility.

Our group aims to contribute to the improvement of sustainability of residents, life, and the earth environment and become “an enterprise that can create lifestyles and cultures that would spread around the world” as set in the management ethos, through science-based manufacturing, by putting the “ethos of the Toyo Ink Group” and the “CSR value system” into practice.

In order to create tangible and intangible values as an enterprise and fulfill social responsibility, it is indispensable to self-evaluate corporate activities from the viewpoint of stakeholders and carry out well-balanced business administration for economic, social, personnel, and environmental affairs.

To do so, our company will:

・Appropriately enforcing the approval rules and the affiliate company management rules applicable to each group company, in order to delegate business execution functions to each operating company as well as to strengthen corporate governance

・Establishing internal control systems

・Improving guidance and monitoring functions by strengthening the legal functional systems such as General Meetings of Shareholders, the Board of Directors, the Audit and Supervisory Committee, and Independent Auditors.

・Enhancing management transparency through prompt, accurate, and extensive information disclosure

・Strengthening and enhancing compliance systems

・Promoting environmental protection on the global level

and foster good relationships with stakeholders, including shareholders, business partners, local communities, and employees, and enhance corporate governance.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

The following is the description of the principles set forth in the Corporate Governance Code after the revision made in June 2021 (including the principles for the Prime Market to be applicable after April 4, 2022).

Principle | Disclosure contents |

Principle 1-4. | The economic rationality of strategically held shares is discussed annually at the board of directors’ meeting. The company will examine the benefits and transaction status associated with the cross-holding as compared to the cost of capital for each individual stock, and if the cross-holding of the stock is determined not to be appropriate, the company will proceed with reduction based on the status of the issuing company and market trends. In the previous fiscal year, all strategically held shares of eleven companies and part of strategically held shares of two companies were sold. The voting rights of strategically held shares are exercised appropriately for each bill, after considering qualitatively and comprehensively whether the bill would contribute to the mid/long-term improvement in the value of the share issuing company, whether the bill would contribute to the common interests of shareholders, including Toyo Ink SC Holdings, and the effects on the corporate group and business, etc. Furthermore, if there are special circumstances such as significant loss of corporate value or occurrence of a serious compliance violation at the issuing company, or if there is concern that our corporate value as a shareholder will be impaired, based on adequate amount of information collected through dialogue with the issuing company, etc., we will carefully determine the pros and cons of exercising the voting rights of strategically held shares. |

(Supplementary Principle 2-4 ①) | Our company has set a goal of increasing the ratio of female managers to 8% in Japan by FY 2023. We will continue encouraging female employees to step forward with confidence and courage to take on jobs and roles, by providing career training for female employees who are next-generation leaders. With regard to the percentages of foreign nationals and mid-career employees in the management positions in Japan, we do not believe it is necessary to set a numerical target, taking into account that our hiring and development policies do not discriminate employees based on their nationality or work experience. We strive to ensure diversity in accordance with the policy described below. As of January 2022, female employees account for 4.5% of managerial positions, foreign nationals less than 1%, and mid-career employees 34%. The human resources development policy for ensuring diversity and the internal environment improvement policy are as described below. [Development of Human Resources with Global Perspectives and Capabilities] We train human resources under our basic policy to develop capabilities through various practical experience related to overseas business, both in Japan and overseas. Looking toward the future, we are also promoting human resources development through practical training at our overseas subsidiaries, mainly for young and mid-level employees.

[Promoting Diversity to Revitalize the Organization] Under our policy to (1) provide information and education for employees to accept and leverage their characteristics, and (2) actively appoint women to management positions, we have launched a diversity promotion project in 2021, to establish an environment, design systems, and study development measures, in which diverse human resources to play active roles. |

(Supplementary Principle 3-1 ③) | In the long-term vision SIC27, Tokyo Ink Group has included sustainability initiatives in its basic policies of the medium-term management plan, having set forth a concept of “Sustainable Growth” in which our sustainable growth contributes to improving the sustainability of society. In addition, as a practical long-term goal for the Group’s CSR and sustainability activities, we have formulated the Sustainability Vision “TSV2050/2030,” and set a target for CO2 emission reduction in 2030 in order to achieve carbon neutrality in 2050. We will continue to promote the disclosure of information based on the TCFD recommendations through our website and integrated reports, including the establishment of structures and analysis of climate change scenarios. With regard to human capital, we are actively investing in human resources as our most important resources, and have been promoting establishment of Toyo Ink vocational schools, adoption of a job rotation system, women’s active involvement for propelling diversity, and thorough occupational health and safety as a manufacturer. With regard to the creation of new intellectual property, we have reformed our R&D structure to promote the development of new products and the creation of new businesses that accurately meet social needs. Moreover, we strive to promote open innovation and acquire patents strategically. We will also proactively disclose such information through integrated reports, etc. |

Principle 5-1. | Toyo Ink SC Holdings considers shareholders and investors as important stakeholders, respects shareholders’ rights, and strives to improve shareholder value, with the aim of “Respect for Shareholder Rights and Enhancement of Shareholder Value」(ShS:Shareholder Satisfaction)” as a course of action. Especially, the constructive dialogue with shareholders and investors is recognized as an important factor. The company appoints directors in charge of financial affairs, general affairs, and IR, realizes the information sharing among related sections through organic cooperation, promotes the dialogue with shareholders through the general affairs section and the dialogue with investors through the publicity section, and reports their opinions that are considered important to directors in charge, when necessary. As for the management of insider information, the company produced the regulations for the prevention of insider transactions, the regulations for protecting and managing information, etc. The management of insider information is included in the standards for business activities as a concrete course of action. A guidebook is distributed to all employees of the corporate group, and the employees are educated regularly to diffuse the rules for managing insider information. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |