Bridge Report:(5290)Vertex Fiscal Year ended March 2021

President Akihide Tsuchiya | Vertex Corporation (5290) |

|

Company Information

Market | TSE 2nd Section |

Industry | Glass, earthen, and stone products (manufacturing business) |

President | Akihide Tsuchiya |

HQ Address | 5-7-2 Kojimachi Chiyoda-ku Tokyo |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE Act. | Trading Unit | |

¥3,080 | 10,184,450 shares | ¥31,368 million | 15.3% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥65.00 | 2.1% | ¥433.64 | 7.1x | ¥2,986.87 | 1.0x |

* Stock price is as of closing on July 5, 2021. Number of shares issued is as of June 30, 2021. All figures are taken from the brief report on results of the term ended March 2021.

Earnings Trends

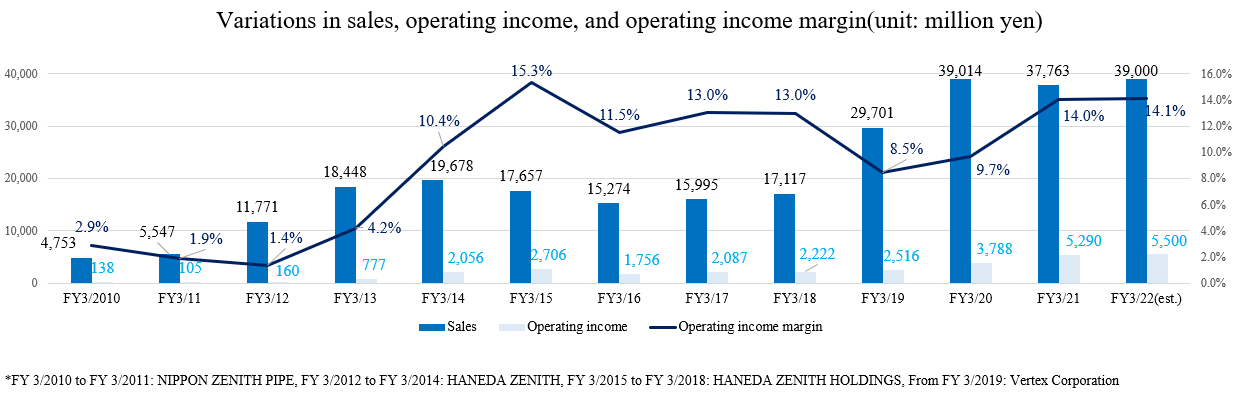

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 Act. | 29,701 | 2,516 | 2,694 | 5,934 | 712.28 | 70.00 |

March 2020 Act. | 39,014 | 3,788 | 3,959 | 2,336 | 262.01 | 60.00 |

March 2021 Act. | 37,763 | 5,290 | 5,635 | 3,759 | 428.41 | 90.00 |

March 2022 Est. | 39,000 | 5,500 | 5,700 | 3,800 | 433.64 | 65.00 |

*Unit: Million yen. The estimated values were provided by the company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply. The dividend for the term ended March 2021 includes the commemorative dividend of 30.00 yen/share.

This report includes the outline of financial results of Vertex Corporation for the term ended March 2021, its mid-term management plan, and the interview with President Tsuchiya.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2021 Earnings Results

3. Fiscal Year ending March 2022 Earnings Forecasts

4. Second Mid-Term Management Plan

5. Interview with President Tsuchiya

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Under the policy “To build safe society”, Vertex Corporation engages in the supply, installation, etc. of products required for developing social capital and infrastructure, including concrete products. Taking advantage of the competitiveness of products, the ability to propose technologies, and plenty of intellectual property, it became one of the companies that have the highest profitability in this industry. Its forte also includes the capability of responding to things in cooperation with group companies.

- The sales for the term ended March 2021 were 37,763 million yen, down 3.2% year on year. The impact of the novel coronavirus on the entire company was minor, but the sales from the pile business segment declined, due to the sluggish demand in the private sector. Operating income grew 39.6% year on year to 5,290 million yen. Gross profit rose 10.9% (while gross profit margin increased 3.8 points), thanks to the improvement in profitability of the concrete business, etc. Meanwhile, SGA decreased 6.3% year on year, through the revision to marketing methods, etc. All profits exceeded the respective initial and revised estimates.

- For the term ending March 2022, sales are estimated to be 39 billion yen, up 3.3% year on year, and operating income is projected to be 5.5 billion yen, up 4.0% year on year. The concrete and disaster prevention businesses will keep performing well. The pile business, which was sluggish in the previous term, is expected to recover. As this term is the initial fiscal year of the second mid-term management plan, the company aims to reach the estimated earnings without fail, in order to attain the target sales of 41 billion yen and the target operating income of 6.1 billion yen in the term ending March 2024, which is the final fiscal year of the mid-term plan. The dividend is to be an ordinary dividend of 65.00 yen/share. It will be virtually up 5.00 yen/share from the previous term, in which the company also paid a commemorative dividend of 30.00 yen/share. The estimated payout ratio is 21.0%.

- The company formulated and announced the second mid-term management plan for the three years from the term ending March 2022 to the term ending March 2024. Under the basic policies: “promotion of organic growth through the improvement of the core business,” “growth of promising businesses and acquisition of new earning opportunities,” and “development of a management base for enabling sustainable growth,” the company recognizes these terms as “the period for strengthening the business and management base for achieving sustainable growth without fail” and aims to “achieve sales of 41 billion yen, an operating income of 6.1 billion yen, and an operating income margin of 14.9%, and keep ROE 10%” by the last term, the term ending March 2024.

- We interviewed President Tsuchiya about his own mission, the company’s competitive advantage and issues, his message to shareholders and investors, etc. He said, “We’ve seen the effects of business mergers in 2014 and 2018, but the exertion of synergetic effects is still 10-20%. Full effects are still to be exerted. There remain many things our corporate group should conduct and want to do. Please expect more synergetic effects. While taking pride in being a leader in this industry, our company aims to have the greatest corporate brand power with which all employees work proactively and offer ‘reliability and safety’ with the same vision. We would appreciate your support from the medium/long viewpoint.”

- President Tsuchiya served as leader taking the initiative in conducting simulations and drawing up scenarios for bringing out synergetic effects through business mergers from 2014 and improved revenues in accordance with the scenarios. This fact is considered to be an important point when seeing the future of the company. As the president, who has engaged in the reform of the corporate group, said “the exertion of synergetic effects is still only 10-20%,” we would like to expect a lot from them.

- Needless to say, the business environment assumed in 2014 and 2018 will be different from the actual business environment, and we cannot deny the possibility that an unexpected event like the novel coronavirus pandemic will occur. We would like to pay attention to the concrete progress of their measures in the new mid-term management plan, including the response to such uncertainties. The important missions of Vertex Corporation as the largest company in this industry include the promotion of understanding and brand development for securing human resources, which is one of challenges to be dealt with.

1. Company Overview

Under the policy “To build safe society”, Vertex Corporation engages in the supply, installation, etc. of products required for developing social capital and infrastructure, including concrete products. Taking advantage of the competitiveness of products, the ability to propose technologies, and plenty of intellectual property, it became one of the companies that have the highest profitability in this industry. Its forte also includes the capability of responding to things in cooperation with group companies.

【1-1 Company History】

In 2014, three companies, NIPPON ZENITH PIPE CO., LTD., HANEX CO., LTD. (former name: HANEDA HUME PIPE CO., LTD.), and HANEDA CONCRETE INDUSTRIAL CO., LTD., merged into HANEDA ZENITH CO., LTD., which was then renamed HANEDA ZENITH HOLDINGS CO., LTD.

On October 1, 2018, HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. (based in Fukui Prefecture) established Vertex Corporation through joint stock transfer (which made HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. wholly owned subsidiaries).

The companies set up a new business group.

In April 2019, HANEDA ZENITH CO., LTD., as the surviving company, absorbed HANEDA ZENITH HOLDINGS CO., LTD. (a merged company).

On April 1, 2021, Vertex Co., Ltd. was born through absorption-type merger carried out by HANEDA ZENITH CO., LTD. as the surviving company and HOKUKON CO., LTD. as the merged company, which were the core business companies affiliated with Vertex Corporation.

Vertex Co., Ltd. aims to achieve sales and profit growth by increasing its market share and boosting profitability in the mature markets of concrete and piles, and the growing market of disaster prevention through a multitude of approaches, including creation of business synergy and enhancement of business efficiency.

【1-2 Raison d'etre】

The company has put out a mission statement: “To build safe society.”

For safe life everywhere in this country that is constantly afflicted with natural disasters, for confidence about peace and safety of families and friends living far away, and for growth and enrichment of the mind of children,

We must continue our pursuit

of the one-and-only technology that continuously satisfies difficult needs, of unique ideas that no one has ever come up with, and of a nationwide network that can swiftly deal with any unexpected events.

To overcome any kind of disaster, and to create safety that has not existed yet,

What we create is not just material things, but a new form of safety by racking our brains so that all people can continue to live everyday with smiles. |

The company understands that its social purpose is to contribute to realizing safe daily life by providing a variety of products that are essential for developing social capital and infrastructure for daily lives.

【1-3 Market Environment】

The following are the points to keep in mind for understanding the company’s business environment:

(1) Accelerated National Resilience Plan

The “Basic Plan for National Resilience,” which was approved by the Cabinet in June 2014 as a countermeasure against major earthquakes, such as the Southern Hyogo Prefecture Earthquake and the Great East Japan Earthquake, and powerful typhoons that cause damage in various regions every year was revised in December 2018 (four years later), and on June 17, 2021, a “Five-year Acceleration Plan for Disaster Preparedness, Reduction and National Resilience” was announced.

As a result, Japan is accelerating efforts to strengthen and enhance its national resilience.

It is stated in the annual plan for 2021 that "We will increase efforts to strengthen national resilience and install a countermeasure system combining hardware and software. From fiscal 2022 onward, we will continue to secure a necessary budget to move forward the basic plan for disaster preparedness, reduction and national resilience across Japan, and to build sturdy homes that can withstand disasters as a national hundred-year plan.” (from (1) Purpose of formulation of an annual plan on page 2).

Further, one of the goals in implementing the “Five-year Acceleration Plan” for FY 2021 to FY 2025 is to contribute to the realization of carbon neutrality by FY 2050. Contents of the plan include “the response to climate change, large-scale earthquakes, etc.,” “managing aging infrastructure,” “utilizing the latest technologies such as digital technologies, and the introduction of innovations.”

The “Basic Plan for National Resilience” is expected to continue accelerating as a core policy in relation to focal topics such as climate change and carbon neutrality.

(2) Aging Social Capital

According to the Ministry of Land, Infrastructure, Transport and Tourism, Japan's social capital stock was intensively developed during the rapid economic growth period, and there are concerns that it will quickly deteriorate hereafter. It is expected that over the next 20 years, the percentage of road bridges, tunnels, river management facilities, sewage systems, harbors, etc. constructed over 50 years ago will rise at an accelerated rate.

(Percentage of main social capital over 50 years since construction)

| March 2018 | March 2023 | March 2033 |

Road bridges (approx. 730,000 bridges) | Approx. 25% | Approx. 39% | Approx. 63% |

Tunnels (approx. 11,000 tunnels) | Approx. 20% | Approx. 27% | Approx. 42% |

River management facilities (approx. 10,000 facilities including sluices) | Approx. 32% | Approx. 42% | Approx. 62% |

Sewage pipes (total length: approx. 470,000 km) | Approx. 4% | Approx. 8% | Approx. 21% |

Port quays (approx. 5,000 facilities) | Approx. 17% | Approx. 32% | Approx. 58% |

Source: “Infrastructure Maintenance Information” provided by the Ministry of Land, Infrastructure and Transport

In 2035, about 58% of 520,000 fire cisterns, and in 2027, roughly 40% of 50,000 km of agricultural drainage channels will have been constructed over 50 years ago.

It is therefore necessary for the government to strategically maintain, manage and upgrade aging infrastructure. In the “Basic Plan for National Resilience,” the city plans to implement countermeasures against urban erosion 100% by 2040, including rainwater drainage facilities to prevent and reduce flood damage in sewage systems, and countermeasures against sediment disasters in sediment control systems 100% by 2045.

(3) Aging of construction workers and shortage of manpowe expansion of precast construction methods

The number of workers in the construction industry is declining. In addition, the labor shortage due to the declining birthrate and aging population has become a major issue in the construction industry. According to the data collected by the Ministry of Land, Infrastructure, Transport and Tourism, it is estimated that approximately one-third of workers in the construction industry are aged 55 and older while approximately 10% are those aged 29 and younger, resulting in a shortage of at least 500,000 skilled workers in 2025.

Various efforts have been made to resolve this issue including the use of the “precast construction” method. “Precast concrete” parts such as gutters, pipes, manholes, piles, bridge girders and parts of buildings are manufactured off-site and delivered to the construction site for assembly and installation.

In contrast, the current mainstream construction method is the “on-site construction” method, in which concrete products are manufactured on-site by pouring concrete into wooden or iron molds, assembled at the site, and then hardened.

If you just consider the initial costs of “on-site construction,” it has an economic advantage compared with “precast construction”; however, because the latter is superior in terms of design costs, shorter construction periods, lack of necessity to arrange traffic regulations, lack of related economic losses, as well as product quality, it is expected to gain ground moving forward.

【1-4 Business Details】

The company has four reporting segments, which are Concrete Business, Pile Business, Disaster Prevention Business, and Other Business.

The following is a table showing the group companies operating each business segment:

Business | Group Companies |

Concrete Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) HOKUKON PRODUCT, K.K. (Fukui Pref.) Hokkan Concrete Kogyo Co., Ltd. (Gunma Pref.) Universal Business Planning Co., Ltd. (Fukui Pref.) Tohoku Haneda Concrete K.K. (Yamagata Pref.) Kyushu Vertex Co., Ltd. (Fukuoka Pref.) Kikuichi Kensetsu K.K. (Tokyo; equity-method affiliate) |

Pile Business | HOKUKON MATERIAL CO., LTD. (Fukui Pref.) |

Disaster Prevention Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) |

Other Business | WICERA Co., Ltd. (Gifu Pref.) M.T Giken Co., Ltd. (Osaka) iB Solution Corporation (Fukui Pref.) Hanex Road Co., Ltd. (Tokyo) NX inc. (Tokyo; equity-method affiliate) |

(1) Concrete Business

This business manufactures and sells secondary concrete products, sells other related products, and undertakes installation of products in the segments of anti-inundation & sewage system, road, maintenance, railroad, and housing & development.

Segment | Overview/main products and services |

Anti-inundation/sewage system | This segment offers the best proposal with a rich lineup of products developed reflecting the needs and the one-and-only technology in order to help adopt anti-disaster and disaster mitigation measures, such as measures against flood damage and renovation for anti-earthquake sewage facilities.

(Main products/services) ◎ Precast flood control basin (underground water tank) This facility prevents rainwater from flowing into rivers. In an underground precast flood control basin, a facility to prevent rainwater outflow is built underground while the space above the ground can be used for multiple purposes, such as including parks, athletic fields, and parking lots.

◎ Box culvert A box culvert is a box-shaped concrete structure that is installed primarily underground and used for holding waterways and communication lines. With a variety of uses, box culverts are utilized in myriad infrastructure projects, such as underpasses and reservoirs.

◎ Prefabricated round manhole As a pioneer of prefabricated manholes, the company offers an extensive lineup of manholes ranging from small ones (with the inner diameter of 300 mm) to extra-large ones (with the inner diameter of 2200 mm) in order to satisfy multifarious needs for manhole installation works. |

Road | Possessing a number of products that help not only with development of road infrastructure, but in protecting human lives as well, the company contributes to building safe roads.

(Main products/services) ◎ Precast guard fence (PGF) The precast guard fence is a rigid protective fence made of precast concrete for preventing vehicles from swerving off the road while ensuring the safety of the drivers and passengers. It is used at such places as roadsides, median strips, and concrete barrier parapets.

◎ Span the Arch It is a culvert that can support ultra-large spans and consists of multiple components that are assembled on site in the shape of an arch for building grade separated crossings (underpasses) between tunnels and roads. It is highly effective against earthquakes, soft ground, and eccentric load.

|

Maintenance | As measures against deterioration of infrastructure, this segment proposes optimal products and methods while taking into account life-cycle cost. It contributes to prolonging the life of infrastructure that is the basis supporting enriched daily life of the citizens and social economy.

(Main products/services) ◎ Ductal panel The ductal panel is a high-durability, thin-wall panel installed underground, which is made of ultra-high strength, fiber-reinforced concrete that is highly durable in a harsh environment in which damage from salt, frost, and wear occurs. It can prolong the life of constructions and cut down on the cost of maintenance and management.

◎ Maintenance of fire cisterns This service offers methods of repair and reinforcement of deteriorated fire cisterns against leakage of water caused by earthquakes and secondary disaster resulting from collapse of roads.

|

Railroad | This segment offers safety via the lineup of products developed through vigorous pursuit of quality materials, such as ultra-high strength, fiber-reinforced concrete and special mortar.

(Main products/services) ◎ Platform screen door slab While the number of train stations that have installed facilities for preventing passengers from falling from the platforms is rising, some stations are encountering difficulty in installing such facilities because their existing floor slabs cannot bear the load of movable platform gates (platform screen doors). This product not only is lighter than the conventional products, but can be installed easily as well.

|

Housing/development | This segment offers an extended lineup of products resistant to massive earthquakes in order to develop earthquake- and disaster-resilient cities, including earthquake-proof water storage tanks, which are the segment’s top-selling product brand, and unique portable toilets for use in the event of disaster.

(Main products/services) ◎ HC fire cistern/HC earthquake-proof water storage tank The main products of this segment are precast fire cisterns and earthquake-proof water storage tanks. The fact that the fire cisterns and water storage tanks survived the Great Hanshin earthquake has proven their high reliability and safety. The fire cisterns and water tanks have been installed in great number.

|

(2) Pile Business

The company manufactures and sells centrifugal prestressed concrete piles, and undertakes piling works.

(3) Disaster Prevention Business

The company manufactures and sells high-energy-absorption fences for preventing rocks from falling, and products for preventing such disaster as mudflows, avalanches, and debris flows, sells other related products, and undertakes installation works.

◎ Loop fence (high-energy-absorption fence for preventing rocks from falling) Displacement-control fence for preventing rocks from falling down, with displacement being small when the net catches falling rocks while the energy absorption capacity is enormous

| ◎ MJ net (ultra-high-energy-absorption fence for preventing rocks from falling) One of the world’s largest fences for preventing rocks from falling down that can withstand a falling rock energy of up to 3,000 kJ thanks to the combination of special wiring and props

|

(Taken from the reference material of the company)

(4) Other Business

The company engages in various business operations, including to manufacture and sell new ceramic products, rent equipment and sell materials, sell radio frequency identifiers (RFID; non-contact IC tags), conduct investigation and tests of concrete, develop and sell systems, and rent real estate.

【1-5 Characteristics and Strength】

(1) Product superiority and capability to make technological proposals

The company has developed its unique business model that is less susceptible to price competition by being involved in multiple project phases from designing to product promotion to technological proposal.

(Taken from the company’s website)

What underpin the strength are the capability of collecting information, development and tests, and the power of human resources.

① Capability of collecting information

The company precisely understands the needs of manufacturers and suppliers by not only selling products but also collecting information at all times from design consultants in charge of designing and the final clients, which are government and public agencies. It also is involved proactively with product promotion and technological proposal.

② Development and tests

Based on the information obtained and needs understood, the company develops new products internally and tests them in order to develop new products ahead of other companies and come up with ways to use them. In addition, collaboration with universities and other organizations allows efficient development and tests.

The fact that HANEDA ZENITH CO., LTD. and HOKUKON CO., LTD., which are the predecessor companies of Vertex Co., Ltd., gave their focus on technology seemingly contributes to the competitive superiority of the company that takes pride in its technologies.

③ Power of human resources

Talented staff full of curiosity, such as sales staff members with outstanding capabilities to make proposal that enable them to accurately grasp the market needs, and technical staff members who make it possible to develop and propose new products in view of needs and information, are in charge of information collection, development, and tests.

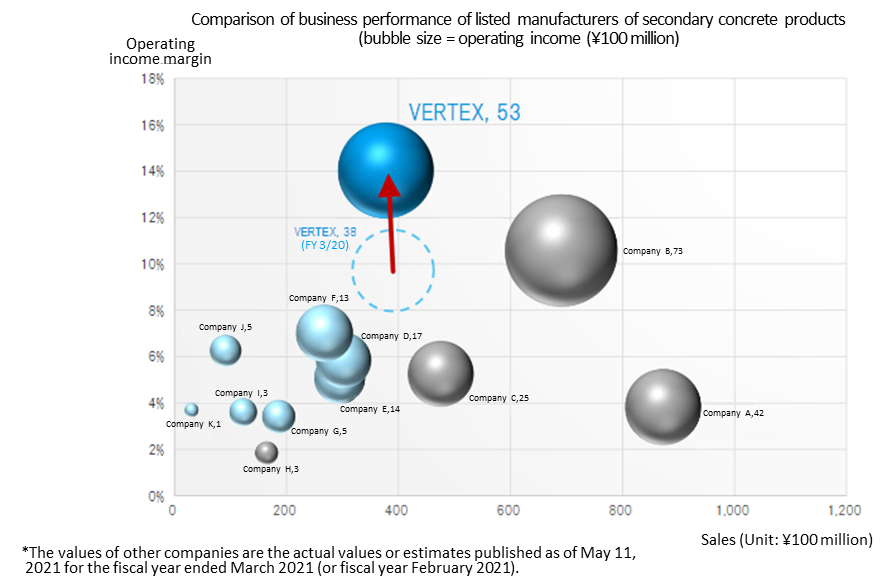

(2) High profitability, and plentiful intellectual property as the source thereof

The company has achieved high profitability based on the aforementioned business model realized taking advantage of its exceptional technological capabilities.

(Taken from the reference material of the company; the light-blue bubbles indicate the trade in the company’s Concrete Business while the gray bubbles refer to the trade in its Pile Business.)

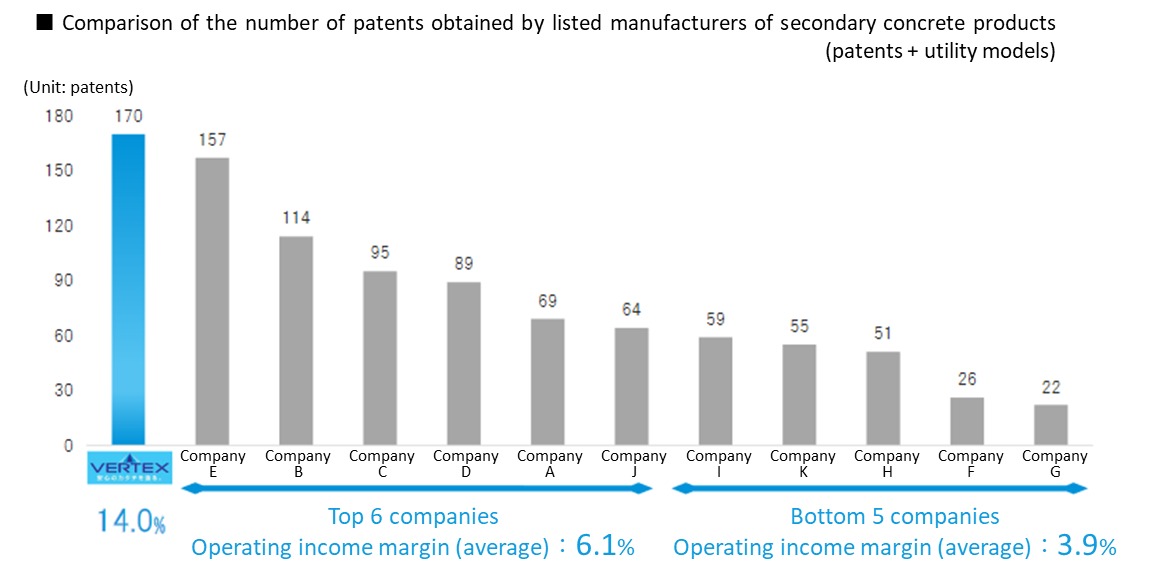

The intellectual property generated from proactive investment in research and development is the source of the company’s large income.

(Taken from the reference material of the company)

(3) Multifarious industry-leading products that have taken large share

The company carries out research and technological development and launches new products into the markets ahead of any other companies in order to create new markets. It improves and upgrades the products after the launch by seeking customers’ opinions as appropriate. While equivalent items launched by other companies are booming the markets, the company is exerting superiority as a leading manufacturer in terms of cost and quality, securing its position as the top brand.

These product development processes enable the company to have the following best-selling products:

Anti-inundation segment/ Sewage system segment |

|

Housing/ development segment |

|

(4) Group’s extensive response capabilities

With Vertex Co., Ltd. and each of its group companies are in charge of a variety of business operations, the company is capable of taking in various demands of myriad parties concerned, ranging from manufacturers and suppliers to sellers. It will strive to further exert and strengthen the corporate group synergy.

【1-6 Dividend Policy and Shareholder Return】

In addition to stable payment of ordinary dividends, the company intends to pay shareholder return through acquisition of treasury shares with an expected total payout ratio being 30%, as well as to consider paying special and commemorative dividends as appropriate.

It will acquire up to 200,000 treasury shares (accounting for about 1.7% of the total number of issued shares) by the end of the fiscal year ending March 2022 as necessary.

【1-7 Analysis of Return on Equity】

| FY 3/20 | FY 3/21 |

ROE (%) | 10.4 | 15.3 |

Net income margin (%) | 5.99 | 9.95 |

Total asset turnover (times) | 0.91 | 0.86 |

Leverage (times) | 1.91 | 1.80 |

The medium-term business plan is aimed at maintaining a return on equity (ROE) of 10% or over in the fiscal year ending March 2024. Net income margin is estimated at 9.7% for the fiscal year ending March 2022. The company will be able to keep ROE at a high level in a more stable manner if it successfully improves total asset turnover.

2. Fiscal Year ended March 2021 Earnings Results

【2-1 Overview of the consolidated results】

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YoY | Difference from the initial estimate | Difference from the revised estimate |

Sales | 39,014 | 100.0% | 37,763 | 100.0% | -3.2% | -5.6% | +0.7% |

Gross profit | 10,146 | 26.0% | 11,248 | 29.8% | +10.9% | - | - |

SG&A | 6,357 | 16.3% | 5,958 | 15.8% | -6.3% | - | - |

Operating Income | 3,788 | 9.7% | 5,290 | 14.0% | +39.6% | +32.3% | +10.2% |

Ordinary Income | 3,959 | 10.1% | 5,635 | 14.9% | +42.3% | +40.9% | +10.5% |

Net Income | 2,336 | 6.0% | 3,759 | 10.0% | +60.9% | +50.4% | +10.6% |

*Unit: Million yen. The revised forecast was announced in February 2021.

Sales dropped, but profit rose, exceeding the estimate.

Sales were 37,763 million yen, down 3.2% year on year. The impact of the novel coronavirus on the entire company was minor, but the sales from the pile business segment declined, due to the sluggish demand in the private sector.

Operating income grew 39.6% year on year to 5,290 million yen. Gross profit rose 10.9% (while gross profit margin increased 3.8 points), thanks to the improvement in profitability of the concrete business, etc. Meanwhile, SG&A decreased 6.3% year on year, through the revision to marketing methods, etc.

Ordinary income grew 42.3% year on year to 5,635 million yen. Revenues from subsidies of 133 million yen were posted as non-operating revenues.

Net income rose 60.9% year on year to 3,759 million yen, there were no longer expenses for retirement benefits or closing factories, which were posted as extraordinary losses in the term ended March 2020.

Profits exceeded the initial and revised estimates.

For the merger of core business companies, the company designed a personnel affairs system suited for new companies to be established through merger and started operating it in April.

The company also integrated accounting systems. For release in the spring of 2022 or later, it is proceeding with the project for establishing a new mission-critical system.

【2-2 Trend of each segment】

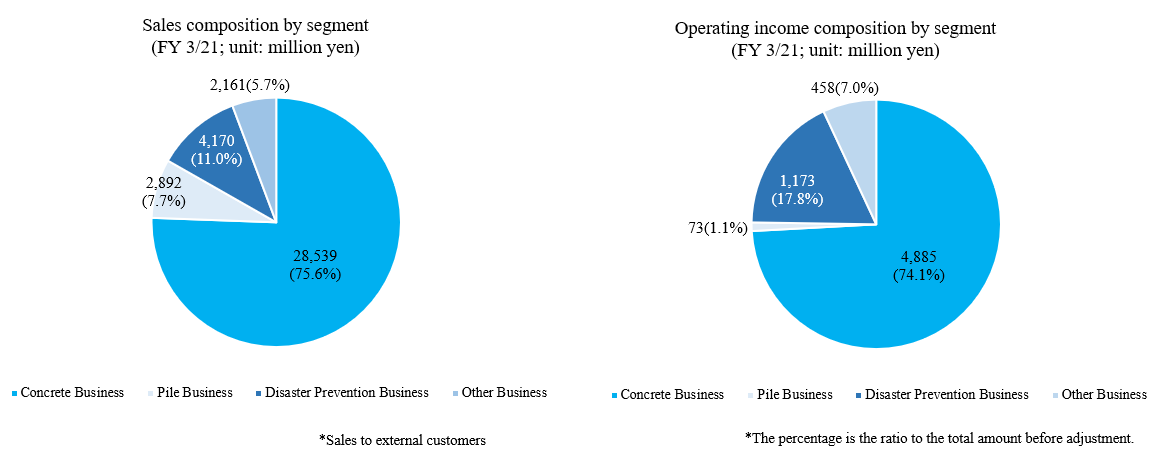

| FY 3/20 | Composition ratio | FY 3/21 | Composition ratio | YoY | Difference from the initial estimate |

Concrete business | 28,372 | 72.7% | 28,539 | 75.6% | +0.6% | -5.6% |

Pile business | 4,520 | 11.6% | 2,892 | 7.7% | -36.0% | -17.5% |

Disaster prevention business | 4,083 | 10.5% | 4,170 | 11.0% | +2.1% | +1.7% |

Other business | 2,039 | 5.2% | 2,161 | 5.7% | +6.0% | +0.3% |

Total sales | 39,014 | 100.0% | 37,763 | 100.0% | -3.2% | -5.6% |

Concrete business | 3,602 | 12.7% | 4,885 | 17.1% | +35.6% | +31.5% |

Pile business | 128 | 2.8% | 73 | 2.6% | -42.3% | -58.7% |

Disaster prevention business | 1,061 | 26.0% | 1,173 | 28.2% | +10.6% | +9.7% |

Other business | 367 | 18.0% | 458 | 21.2% | +24.8% | +5.4% |

Adjustment amount | -1,370 | - | -1,300 | - | - | - |

Total operating income | 3,788 | 9.7% | 5,290 | 14.0% | +39.6% | +32.3% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

◎ Concrete business

Sales and profit grew. Profit exceeded the initial estimate significantly.

Sales

The impact of the novel coronavirus was minor, and sales were unchanged from the previous term, but fell below the initial estimate, because the company revised the method for handling less profitable products, etc.

The company unified the brands of earthquake-proof water tanks and box culverts, which are core products, and continued sales promotion.

Profit

Revised selling prices were penetrated in FY 3/21, too. The company continued the concentration of products among production sites and the reduction of costs for long-distance transportation.

It curtailed operating expenses by voluntarily limiting marketing activities and revising marketing methods.

It concentrated on receiving orders for products with high added value. The production system that flexibly responds to the status of order receipt turned out to be effective.

◎ Pile business

Sales and profit dropped, falling below the initial estimates.

Sales

Demand in the public sector was underpinned by orders for construction work in accordance with the Basic Plan for National Resilience, but demand in the private sector was sluggish, as housing starts decreased and private investment in non-housing construction decreased considerably due to the novel coronavirus. Sales fell below even the figure estimated while assuming more rigorous selection of orders to receive.

Profit

Costs and selling prices were reconsidered, and gross profit margin had been improving until the first half, but sales dropped unexpectedly in the second half, so the profit posted in the first half shrank.

◎ Disaster prevention business

Sales and profit grew, exceeding the initial estimates.

As the order backlog was low at the beginning of the term, sales declined in the first half, but increased in the second half, thanks to steady shipment. Especially, the shipment of loop fences for blocking falling rocks was healthy. Profit rose.

Through the enrichment of the lineup of products for preventing the fall of rocks, it became possible to meet a broad range of needs. The company also worked on the shortening of turnaround time by increasing suppliers of parts and outsourcers for processing.

◎ Other

Sales and profit grew, exceeding the initial estimates.

The sales and profit in the ceramics business were unchanged from the previous term.

Sales and profit grew in all of the concrete survey/testing business, the system development/sale business, and the construction material sale business.

The lease of real estate, mainly at old factory sites, produced stable revenues.

【2-3 Financial position and cash flows】

Main Balance Sheet

| End of Mar. 2020 | End of Mar. 2021 | Increase/ decrease |

| End of Mar. 2020 | End of Mar. 2021 | Increase/ decrease |

Current Assets | 26,711 | 30,376 | +3,665 | Current Liabilities | 13,256 | 14,190 | +934 |

Cash and Deposits | 8,574 | 11,761 | +3,186 | Trade Payables | 7,062 | 6,519 | -543 |

Trade Receivables | 13,326 | 13,593 | +266 | ST Interest-Bearing Debts | 2,843 | 3,687 | +844 |

Noncurrent Assets | 15,335 | 15,888 | +553 | Noncurrent Liabilities | 5,775 | 5,826 | +50 |

Tangible Assets | 11,604 | 11,881 | +277 | LT Interest-Bearing Debts | 1,684 | 1,618 | -66 |

Intangible Assets | 152 | 280 | +127 | Net Defined Benefit Liability | 1,974 | 2,068 | +93 |

Investment, Other Assets | 3,578 | 3,726 | +148 | Total Liabilities | 19,031 | 20,016 | +985 |

Total Assets | 42,046 | 46,265 | +4,218 | Net Assets | 23,014 | 26,248 | +3,233 |

|

|

|

| Retained Earnings | 18,506 | 21,708 | +3,201 |

|

|

|

| Total Liabilities and Net Assets | 42,046 | 46,265 | +4,218 |

*Unit: Million yen. Trade receivables include electronically recorded ones, while trade payables include electronically recorded ones.

Total assets grew 4.2 billion yen from the end of the previous term to 46.2 billion yen, due to the increase in cash and deposits, etc. Total liabilities augmented 900 million yen to 20 billion yen, due to the rise in short-term debts, etc. Net assets rose 3.2 billion yen to 26.2 billion yen, due to the rise in retained earnings, etc.

Capital-to-asset ratio rose 2 points from the end of the previous term to 56.6%. D/E ratio was 0.20, unchanged from the end of the previous term.

Cash Flow

| FY 3/20 | FY 3/21 | Increase/decrease |

Operating CF | 2,942 | 4,223 | +1,280 |

Investing CF | -1,157 | -397 | +759 |

Free CF | 1,785 | 3,825 | +2,040 |

Financing CF | -1,504 | -638 | +865 |

Cash and equivalents | 7,706 | 10,893 | +3,187 |

*Unit: Million yen.

The surpluses of operating CF and free CF grew, due to the increase in net income before taxes and other adjustments, etc.

The cash position improved.

【2-4 Topics】

◎ Merger of consolidated subsidiaries

On April 1, 2021, HANEDA ZENITH CO., LTD. and HOKUKON CO., LTD., which are consolidated subsidiaries, merged as HANEDA ZENITH absorbed HOKUKON.

Its purpose is to streamline business administration by integrating the managerial resources of respective subsidiaries and improve the corporate value of the entire corporate group.

3. Fiscal Year ending March 2022 Earnings Forecasts

【3-1 Earnings Forecasts】

| FY 3/21 | Ratio to sales | FY 3/22 Est. | Ratio to sales | YoY |

Sales | 37,763 | 100.0% | 39,000 | 100.0% | +3.3% |

Operating Income | 5,290 | 14.0% | 5,500 | 14.1% | +4.0% |

Ordinary Income | 5,635 | 14.9% | 5,700 | 14.6% | +1.1% |

Net Income | 3,759 | 10.0% | 3,800 | 9.7% | +1.1% |

*Unit: Million yen.

Sales and profit are estimated to grow.

Sales are estimated to be 39 billion yen, up 3.3% year on year, and operating income is projected to be 5.5 billion yen, up 4.0% year on year.

The concrete and disaster prevention businesses will keep performing well. The pile business, which was sluggish in the previous term, is expected to recover.

As this term is the initial fiscal year of the second mid-term management plan, the company aims to reach the estimated earnings without fail, in order to attain the target sales of 41 billion yen and the target operating income of 6.1 billion yen in the term ending March 2024, which is the final fiscal year of the mid-term plan.

The dividend is to be an ordinary dividend of 65.00 yen/share. It will be virtually up 5.00 yen/share from the previous term, in which the company also paid a commemorative dividend of 30.00 yen/share. The estimated payout ratio is 21.0%.

【3-2 Trend in each segment】

| FY 3/21 | Composition ratio | FY 3/22 Est. | Composition ratio | YoY |

Concrete business | 285.0 | 75.4% | 292.0 | 74.9% | +2.5% |

Pile business | 29.0 | 7.7% | 33.0 | 8.5% | +13.8% |

Disaster prevention business | 42.0 | 11.1% | 43.0 | 11.0% | +2.4% |

Other business | 22.0 | 5.8% | 22.0 | 5.6% | 0.0% |

Total sales | 378.0 | 100.0% | 390.0 | 100.0% | +3.3% |

Concrete business | 48.9 | 17.2% | 50.0 | 17.1% | +2.2% |

Pile business | 0.7 | 2.4% | 1.3 | 3.9% | +85.7% |

Disaster prevention business | 11.7 | 27.9% | 12.3 | 28.6% | +5.1% |

Other business | 4.6 | 20.9% | 4.4 | 20.0% | -4.3% |

Total operating income | 52.9 | 14.0% | 55.0 | 14.1% | +4.0% |

* Unit: 100 million yen. The composition ratio of operating income means the ratio of operating income to sales.

The sales and profit of the pile business are expected to grow by double digits.

The concrete and disaster prevention businesses are expected to remain healthy this term.

4. Second Mid-Term Management Plan

The company formulated and announced the second mid-term management plan for the three years from the term ending March 2022 to the term ending March 2024.

【4-1 Review of the previous mid-term management plan】

(1) Positioning of the previous mid-term management plan and the state of achievement of numerical goals

In the previous mid-term management plan (FY 3/20 to FY 3/21), the company set the priority measures: “to further improve existing businesses,” “to bring out company-wide synergy,” and “establish a management base,” and aimed to achieve “sales of 38.9 billion yen, an operating income of 3.9 billion yen, an operating income margin of 10%, and an ROE of 10%” in the final year ending March 2022. The company reached “sales of 38.9 billion yen” in the term ended March 2020, and “an operating income of 3.9 billion yen, an operating income margin of 10%, and an ROE of 10%” in the term ending March 2021, one year earlier than planned.

(2) Activities in two and a half years after business merger and challenges

The company recognizes that their efforts for tightening governance, restructuring the corporate group, implementing M&A, and bringing out synergy from business merger steadily paid off.

The company plans to continue the development of a management base.

Challenge | At the time of business merger | Present |

Tightening of governance | Company with the board of auditors Total number of executives: 15 Number of outside executives: 4 (26.7%) | Company with the audit committee Total number of executives: 8 Number of outside executives: 3 (37.5%) |

Restructuring of the corporate group and M&A | 14 consolidated subsidiaries 3 equity-method affiliates | 12 consolidated subsidiaries 2 equity-method affiliates |

April 2019: Transformed Kikuichi Kensetsu into an equity-method affiliate. April 2020: Transformed DC (present: Kyushu-Vertex) into a consolidated subsidiary. | ||

Integration/abolishment of business bases | No. of marketing offices: 47 No. of production sites: 16 | No. of marketing offices: 33 No. of production sites: 15 |

Product strategy | Unification of brands for core products, and active selection of items for sale | |

R&D | To conduct R&D, including fundamental research and development of various processes for handling real estate | |

Establishment of a management base | *Started operating a new personnel system of the new company established through merger in April 2021. *Programs for personnel development and recruitment: It is necessary to reestablish them while assuming that they will do business while coping with the novel coronavirus. *In the development phase for a new mission-critical system to be released in the spring of 2022 *M&A, entry to new fields, development and improvement of the business portfolio management function will be continued. | |

As for R&D, the corporate group is pursuing 49 existing themes and 31 new themes.

(Examples)

*Development of “long-life concrete (LL Crete),” which is environmentally friendly (reducing CO2 emissions and preserving natural resources), durable, and low-cost

*Slabs for half-precast tracks for next-generation light rain transit (LRT)

*Products for preventing the fall of rocks

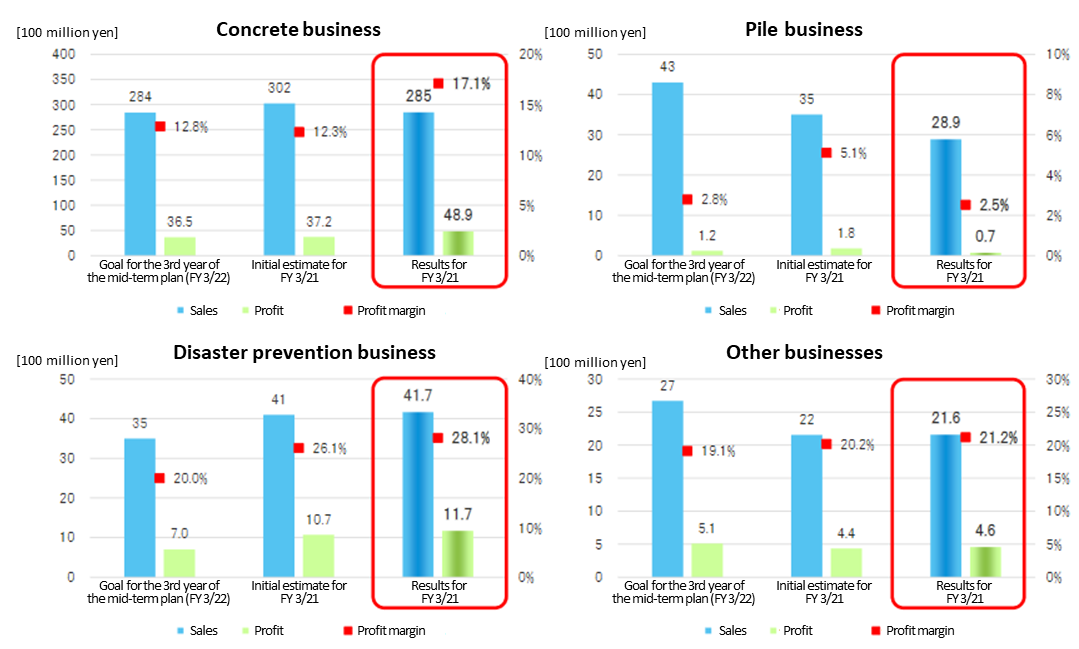

(3) Results in each segment

For the concrete and disaster prevention businesses, results exceeded the estimates, but the pile business did not reach the estimate, so the company revised strategies.

(Taken from the reference material of the company)

【4-2 The second mid-term management plan】

(1) Recognition of the business environment

As mentioned in Section 1 Outline of the company “1-3 Market environment,” the external environment includes the acceleration of the National Resilience Plan, the deterioration of social capital, and the shortage of manpower due to the declining birthrate and aging population in the construction industry, and the internal environment (the company’s factors) includes the company’s strengths such as:

*Advanced technologies and capabilities of design, development, and marketing, and a broad customer base

*A large number of original products boasting the largest market share and differentiated products

*Sound financial standing and ample funds.

The company recognizes that its challenges are:

*Rise in the average age of employees and difficulty in recruitment

*Development of the core business following the concrete business

*Acquisition of the business portfolio management function putting importance on capital efficiency.

It considers that there is room for streamlining after merger, mainly for production and sales systems.

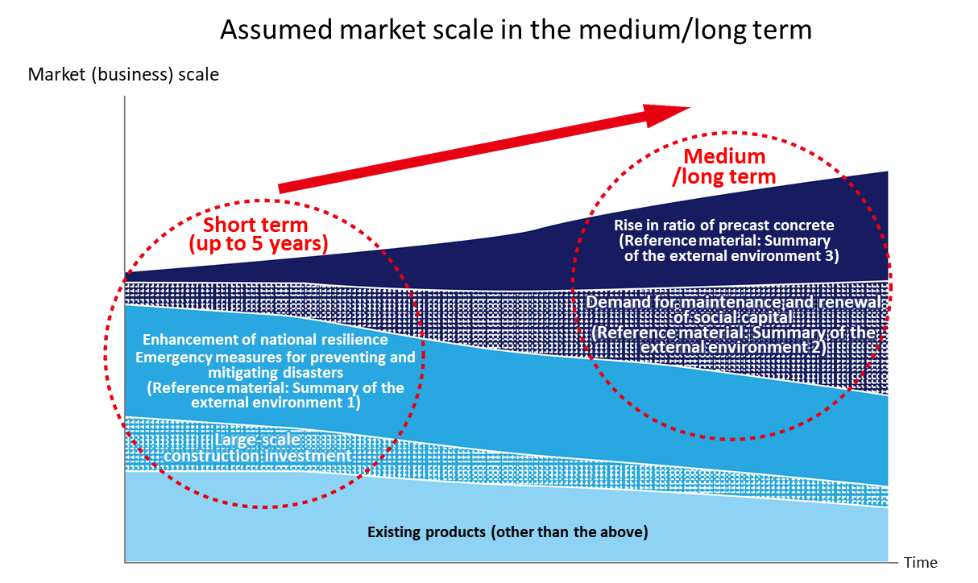

Under this environment, the target markets of the company are expected to expand in the medium/long term. From the medium/long-term viewpoint, the drivers for market expansion are considered to be “the rise in ratio of precast concrete due to the shortage of manpower” and “the growth of demand for maintenance and renewal of deteriorated social capital.”

As for “the rise in ratio of precast concrete,” the demand for concrete products is expected to grow.

As for “the growth of demand for maintenance and renewal of deteriorated social capital,” they plan to broadly meet the demand by taking advantage of their capabilities of proposing “inspection and reinforcement of infrastructure” in the upstream area and “repair, reinforcement, and renewal” in the downstream area, providing materials and products, and conducting construction.

(Taken from the reference material of the company)

(2) Basic policy and positioning of the second mid-term management plan

The company upholds the following basic policy.

To promote the organic growth of the core business by pursuing it further | The company aims to maximize cash flows in the future by enhancing the capacity to generate operating cash flow through the organic growth of the core business. |

To grow promising businesses and seize new earning opportunities | For further growth, the company will enhance efforts to nurture promising businesses and seize new earning opportunities (in new areas and categories, launching new products and businesses). |

To establish a management base for enabling sustainable growth | Continuously from the previous mid-term plan, the company will improve its management base by tightening group governance and establishing a risk control system, and implement ESG measures, with the aim of improving corporate value in a sustainable manner. |

Positioning the period of this mid-term management plan as “the period for strengthening the company’s business and management base for realizing sustainable growth without fail,” the company plans to forge ahead for attaining big hairy audacious goals (BHAGs): commemorate the 10th anniversary of establishment in October 2028 and to acquire the greatest brand power as an enterprise that offers reliability and safety.

(3) Measures and goals in each segment

① Concrete business

Outlook for the business environment | *Due to the impact of the novel coronavirus, the outlook for private investment remains uncertain, but public investment will be healthy. *To cope with natural disasters, which are getting graver, flood control basins (rainwater storage tanks) and rainwater drainage facilities will be constructed. To make structure earthquake-proof and cope with the deterioration of infrastructure, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. |

Major measures and policies | 1. To propose a lineup of high value-added products by utilizing the technological development capacity 2. To upgrade the centers for shipping general-purpose products for increasing customer satisfaction level 3. To pursue the business of maintaining and renewing existing infrastructure and promote the sales of products for preventing inundation and mitigating disasters and for transportation infrastructure 4. To improve the production and shipment efficiencies by integrating factories |

② Pile business

Outlook for the business environment | *Due to the impact of the novel coronavirus, private construction investment will be sluggish. *The recovery in this term is estimated to be gentle, and it is assumed that the recovery to the level in the previous term will be achieved around FY 3/23. Meanwhile, it is expected that there will be demand from distribution facilities, warehouses, suburban stores such as drugstores, etc. *From the viewpoint of prevention and mitigation of disasters, the demand for safety of foundations for buildings is growing. |

Major measures and policies | 1. To promote the sales of profitable products (high support piles and SC piles) and promote the selected order receipt for a lineup of less profitable products 2. To enhance and promote marketing while coping with the novel coronavirus 3. To improve existing construction methods and develop new construction methods |

③ Disaster prevention business

Outlook for the business environment | *For measures against natural disasters, which are getting graver and more frequent, including flood control (erosion control), forest conservation in areas where there is a risk of forest disaster, works for preventing landslides on road slopes and embankments, and works for preventing the collapse of slops adjacent to railways due to torrential rain, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. *The measures for preventing natural disasters at transportation infrastructure will be strengthened. |

Major measures and policies | 1. To develop new products in the fields of prevention of fall of rocks, landslides, and avalanches 2. To improve existing products and enrich the product lineup 3. To enhance marketing in the transportation infrastructure field |

④ Other businesses

Business | Primary measures |

Ceramics business | To enter new industries and growing fields and evolve production technologies Example: radio wave absorbing ceramics |

Business of surveys and tests of concrete | To expand the business on inspection of fire cisterns, conduct fundamental research for surveys, and establish technologies |

Business of development and sale of systems | To expand business by developing systems for networks, security, and special tasks |

RFID business | To promote sales targeting the entire market of electronic ledgers, in addition to products for maintenance and preventive maintenance |

(4) Group-wide measures

In order to achieve sustainable growth, the company will establish and strengthen a management base through mainly the following measures.

* Redevelopment of programs for developing and recruiting personnel

* Establishment of information systems and ICT infrastructure, and promotion of DX

* Building of systems for group governance and risk control

* Development and enhancement of the business portfolio management function

* Establishment of a sustainability promotion system

(5) Financial and investment strategies

It is assumed that the three-year cumulative operating cashflow is 14 billion yen.

For strengthening the core business, growing promising businesses, and seizing new earning opportunities, the company will allocate 9.8 billion yen to “investment in equipment renewal,” “equipment investment for adding high value and enhancing competitiveness,” “investment in R&D,” “investment in DX for improving productivity,” “start-up investment and M&A,” etc.

The company will return 4.2 billion yen to shareholders, with a total return ratio of 30%.

(6) Investment in R&D and intellectual property

For evolving business models, the company will invest in R&D actively.

The company will put more energy into cross-sectoral R&D. Based on the collaboration among the industrial, academic, governmental, and private sectors, the company will strengthen its existing businesses and engage in research and development of products and production technologies that would generate revenues in the future.

Targeting clients, the company will establish a new marketing style based on plenty of know-how, experiences, patents, etc.

The company puts importance on “intellectual property” as important managerial resources that support growth and profitability as the output of R&D investment.

By further strengthening the capability to create intellectual property, the company aims to maintain and enhance business competitiveness.

(7) Numerical goals

◎ Company-wide goals

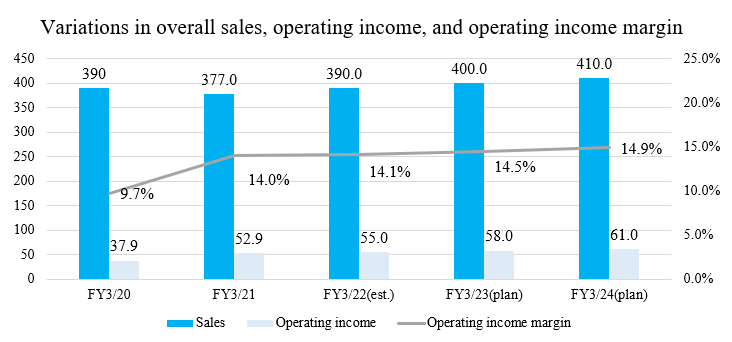

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 377.0 | 390.0 | 400.0 | 410.0 | 2.8% |

Operating income | 52.9 | 55.0 | 58.0 | 61.0 | 4.9% |

Operating income margin | 14.0% | 14.1% | 14.5% | 14.9% | - |

Ordinary income | 56.3 | 57.0 | 60.0 | 63.0 | 3.8% |

Net income | 37.5 | 38.0 | 40.0 | 42.0 | 3.8% |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

The company aims to keep ROE 10% or higher.

◎ Goals in each segment

*Concrete business

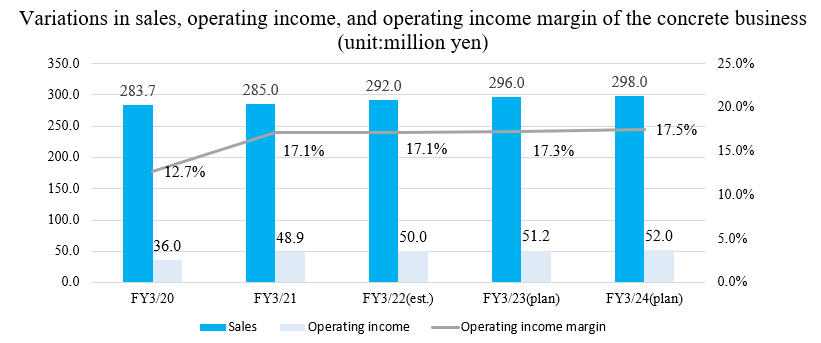

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 285.0 | 292.0 | 296.0 | 298.0 | 1.5% |

Operating income | 48.9 | 50.0 | 51.2 | 52.0 | 2.1% |

Operating income margin | 17.1% | 17.1% | 17.3% | 17.5% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

*Pile business

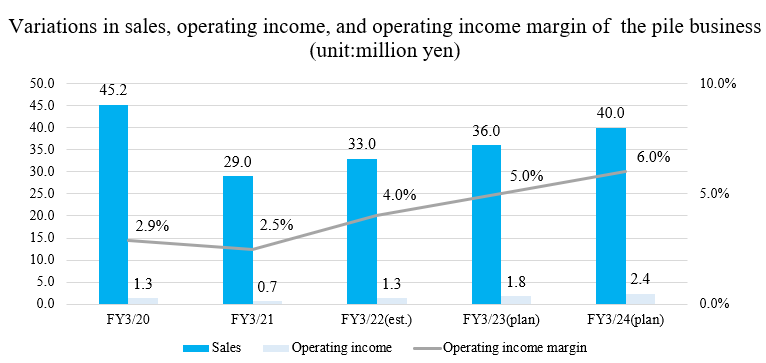

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 29.0 | 33.0 | 36.0 | 40.0 | 11.3% |

Operating income | 0.7 | 1.3 | 1.8 | 2.4 | 50.8% |

Operating income margin | 2.5% | 4.0% | 5.0% | 6.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

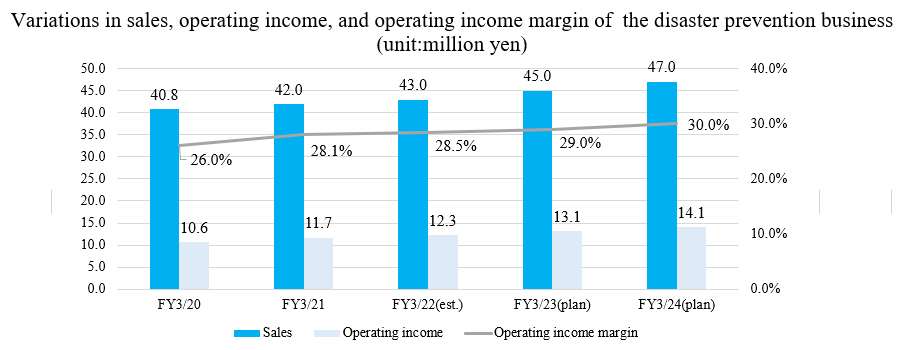

*Disaster prevention business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 42.0 | 43.0 | 45.0 | 47.0 | 3.8% |

Operating income | 11.7 | 12.3 | 13.1 | 14.1 | 6.4% |

Operating income margin | 28.1% | 28.5% | 29.0% | 30.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

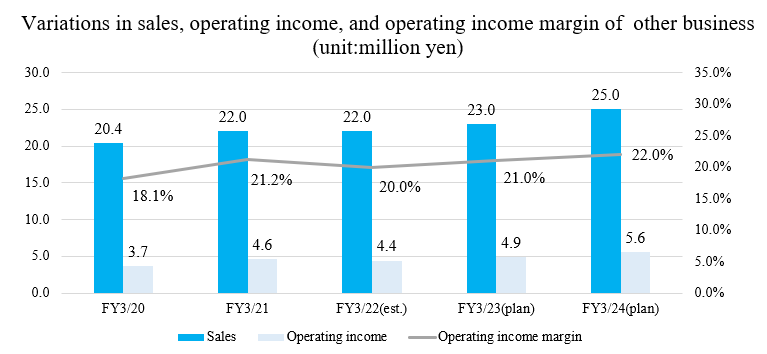

*Other business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 22.0 | 22.0 | 23.0 | 25.0 | 4.4% |

Operating income | 4.6 | 4.4 | 4.9 | 5.6 | 6.8% |

Operating income margin | 21.2% | 20.0% | 21.0% | 22.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

5. Interview with President Tsuchiya

We asked the president of the company, Mr. Tsuchiya, about his mission, the company's competitive edge, issues, and messages to shareholders and investors.

Q: "Mr. Tsuchiya, you were hired by NIPPON ZENITH PIPE in 2005, and you were promoted to a managing executive officer in 2011. You then took the position of a director of HANEDA ZENITH HOLDINGS in 2013, a managing director of HANEDA ZENITH HOLDINGS in 2014, the president of HANEDA ZENITH HOLDINGS in 2017, and finally the president at Vertex Corporation in 2018. You have been involved in a series of management mergers as a member of the management. What part have you played in the process?"

At that time, the secondary concrete product industry had absolutely no concept of pursuing the efficacy of synergies created by business integration. Almost all of an estimated 500 to 800 concrete companies in Japan are privately owned, so this was unavoidable.

However, the era of rapid economic growth has already ended and the market has been steadily declining.

As a managing director of NIPPON ZENITH PIPE, I was aware that we needed to innovate our business. When the president asked me for my opinion on management mergers, I replied that we should do it by all means. We repeated simulations on how to utilize sites and products to bring out synergies. The vision we created at that time was the beginning of our management mergers.

In the simulations, we put aside the industry standard mindset of “manufacturing the maximum quantity of products to lower costs,” and instead of pursuing the advantage of scale in a mature market, we made it our policy to prioritize value-added products even if this meant that quantity would decrease, and the president approved it.

After the management merger in 2014, opposition and friction occurred as expected, but when we actually put the plan into action, profits began increasing steadily. I, myself, was surprised when I saw distinct synergetic effects.

I believed that a business integration between the two companies (HOKUKON and HANEDA ZENITH) would be highly mutually beneficial in regions and business fields, and shared my expectations on profit increases with HOKUKON, and as a result of ensuing negotiations, Vertex Corporation was established as a joint holding company of HANEDA ZENITH and HOKUKON in 2018.

HOKUKON was not a listed company yet, but its scale was large and boasted many impressive achievements, so I imagine that there must have been some in-house opposition, however, the employer advocated the significance of a smooth transition, and convinced all employees to support the merger. We were therefore able to establish Vertex Corporation and for this, I am deeply grateful.

Once we started moving the project forward, I feel that we were able to begin the transformation process at a much faster pace than expected thanks to the capability of the HOKUKON staff, although there must have been some confusion at first.

Q: "Thank you. I think that this interview is very important in understanding your company. And next, I’d like to ask what your mission is as the president, and what do you believe you must accomplish?”

Our company mission statement is “to create reliable shapes.” Within the company, the staff is constantly reminded of Vertex’s aim to become synonymous with the idea of safety and security. “Safety and security = Vertex.” We do not intend to limit this to the secondary concrete product industry, but to apply it to various aspects of our business. I am promoting the vision that we aim to become an embodiment of the idea of safety and security, to represent it as a company. I believe that one of my missions is to realize this as an industry leader.

In order to accomplish this, I must create a company environment in which the staff unites and pushes forward to realize this vision. I believe that this is my key role. The company must be a place where each and every employee maintains a high motivation and feel that it is an enjoyable workplace.

Although there has not been a significant increase in sales, we are completing a system wherein there will be a steady increase in profit. It has only been a short time since the establishment of Vertex Corporation in 2018, and unfortunately, I can’t say that every staff member is on the same page. Even though I originally came from NIPPON ZENITH PIPE, as a result of endeavoring for 10 years in merging Hanex and Haneda Concrete Industrial, staff that originally came from two separate companies now work autonomously.

Although it may take some time, I am confident that I can create an autonomous and motivated organization, so I will put forward my best efforts to achieve results in the management merger with HOKUKON.

Q: "What do you believe to be your company’s competitive edge? "

I think that our individual competencies and qualities, such as in sales, planning, technological capabilities and product quality, are all far above the industry average. In particular, the number of patents acquired indicates superior technology, and this is a great advantage.

However, we are not dealing with, for example, the integration of cutting-edge technologies such as ICT and high-performance electronic devices, so it is difficult to manufacture products that are outstanding compared with those of other manufacturers, and there will also be competing products. It’s important to be aware of this and not be prideful.

The ability to combine the advanced skills of each individual rather than using the strength of each individual separately to do business what I believe to be our true strength and competitive edge. I call this the “strength of all.”

In our industry in general, we put our utmost efforts in sales and in manufacturing separately. This should go without saying, but in this case, you can only achieve the outcome of “1 + 1 = 2.”

We place a great deal of importance on cooperation between departments, and not on the vertical division of power.

For example, our sales force needs to make proposals to customers and design consultants while understanding design, so it is indispensable to cooperate with the design section. In addition, information on products collected by sales representatives is relayed to the factory, and proposals are also made by the factory to sales representatives.

Pushing aside the vertical division, each department coordinates tasks with other departments by sharing information and working together, to demonstrate more than what would have been possible individually. “1+1 becomes more than 2.” This is the strength of all.

Our company has a sales force specifically targeting design consultants, in addition to one for public agencies, as well as one for construction contractors.

In general, the workflow goes like this for government constructions: public agencies hire consulting firms to produce designs, construction contractors bid on contracts based on those designs, the public agency submits orders to the contractors who won the bid, and construction contractors purchase our products.

Our sales targets are three groups; public agencies, design consultants, and construction contractors, but we only have one piece of information. It would be highly inefficient to give sales presentations to each group individually because we would not be able to see the big picture. In this respect, we place great importance on cross-sectoral collaboration for sales as well.

Seeing that we have a high number of sales to design consultants, some competitors increase their sales force targeting design consultants and increase their efforts in that field. However, the truth is that even if you just imitate that, the whole will not function properly.

It is not enough to just create the outward form. It is only when you have the organizational capability driven by “the strength of all” that the company functions properly.

Q: "I think you need to further refine “the strength of all” in order to achieve stronger synergy effects through mergers. What is needed to make this possible?"

It is necessary for all employees to be clearly aware of their roles.

One of my favorite expressions is, "Your position is your role."

Titles such as president or department head do not exist to indicate hierarchical relationships, but merely indicate the roles that each position should play. What is my role? What must I do now? It is essential to become an autonomous person who thinks, decides and takes action proactively. This is indispensable to enhance “the strength of all,” so messages are constantly being sent within the company.

Q: "Next, I would like to ask about the new medium-term management plan. First of all, what is the background and reason for setting the goal, ‘Aiming at No. 1 Corporate Brand in Providing Safety and Security’?"

To put it simply, we have been stubbornly endeavoring in things that involve only our strengths, and the societies of each era came to demand it.

A typical example of this is the concrete box culvert.

The SJ-BOX box culvert with an earthquake-resistant rubber ring, which is a box-shaped concrete structure buried mainly in the ground and used to house waterways and communication lines, was developed by NIPPON ZENITH PIPE in 2007 to protect social infrastructures from earthquake damage. Following this, seismic resistance became highly sought after for buildings and structures as a result of the Mid-Niigata Prefecture earthquake and the Great East Japan Earthquake and today, our seismic box culverts hold the largest share in the industry, as well as among all box culverts across the board.

In recent years, the demand for rockfall protection fences, which had already been supplied on a regular basis, has been increasing amid the occurrence of heavy rain damage caused by falling rocks and landslides.

It’s not that we anticipated what would come, but that our expertise came to be sought after by society. Therefore, I would like to reiterate our message that our efforts are contributing to the security and safety of society, with confidence. In order to achieve our ideal state, the Medium-term Management Plan, which sets forth measures and numerical targets to be met over the next three years, is the first step.

Q: “Please elaborate on the key points of your Medium-term Management Plan.”

Regarding the first key point of our basic policy, that is, "Promoting organic growth by pursuing core businesses," we will continue to strive to be the leading runner in providing safety and security to society while ensuring that demand is taken into account, as we are able to offer a variety of solutions to pressing issues such as flooding, landslides, and falling rocks.

As I mentioned earlier, we will also focus on furthering the development of synergies through integration.

Regarding the second point, "Cultivation of Promising Businesses and Acquisition of New Revenue Opportunities," we will develop promising areas we currently deal with. However, I think we need to look beyond the next five years and also work to transform our business model.

Rather than just selling off differentiated products, we will pursue a solution providing business by making use of a wide range of capabilities that can handle everything from upstream investigation and diagnosis to downstream planning, actual construction and maintenance, as well as management by RFID.

In addition, although we cannot say that it is in full swing yet, I would like to continue to put efforts into open innovation.

Q: "Please elaborate on issues that you are struggling to overcome, such as the shortage of human resources.”

One is the diversification of revenue structures.

Even though there are four segments, the sales and profits of the concrete business and the disaster prevention business account for about 90% of the total amounts.

It is difficult to create a company environment where the staff feel secure in enjoying their work which I mentioned earlier, with only these two segments. However, there are categories in the concrete business that we do not handle yet, including some areas of interest, so I would like to explore investment opportunities including M&A.

In addition, the Sales Promotion Office was newly established to search for new business outside of the concrete and disaster prevention fields.

Another is securing human resources.

The concrete industry is a very dull industry, so we struggle to hire new graduates.

However, we are confident that we are contributing to the realization of a safe and secure everyday life for the Japanese people, and in order to make this known, we must engage in brand promotion activities.

It is also necessary for not just our company but the entire concrete industry to participate in a movement to evolve. Unfortunately, even though there are more than 500 companies operating in this industry throughout Japan, the population has very little awareness of it.

When I spoke with the employers of other companies in the industry with an awareness of these issues, I learned that there are others who feel the same way as I do.

It is our responsibility as the industry leader to expand this circle of likeminded companies and strengthen our ability to convey messages.

From the perspective of securing, training and retaining human resources, a reform of work style is an important point.

In addition to systems of working hours and paid holidays, we have made significant progress in organizing our products in the last two and a half years.

One product comes in various sizes and types, but by eliminating generic products and concentrating on high-value added products, it was possible to significantly reduce the burden of sales and design.

With the merger with HOKUKON, the reform of work styles has only just begun, but since the core systems will be unified in May 2022, I’d like to use that as an opportunity to start advancing it steadily.

Q: "Thank you. And finally, may I ask you for a message to shareholders and investors?"

Although we experienced a drop in revenue in the FY ended March 2021, we saw a significant increase in profit, which exceeded our expectations.

Although the effect of the sequential management merger has emerged, we have seen only 10-20% of synergetic effects. This is where I will demonstrate my true skills. As a group, there are things that must be done, as well as many things I would still like to do. I would like you to look forward to further enhanced synergetic effects.

With pride as the industry leader, I will endeavor to inspire all staff members to act autonomously with the same intent to shape the No. 1 corporate brand in providing safety and security, so I would appreciate your kind support from the medium/long-term viewpoint.

6. Conclusions

President Tsuchiya served as leader taking the initiative in conducting simulations and drawing up scenarios for bringing out synergetic effects through business mergers from 2014 and improved revenues in accordance with the scenarios. This fact is considered to be an important point when seeing the future of the company. As the president, who has engaged in the reform of the corporate group, said “the exertion of synergetic effects is still only 10-20%,” we would like to expect a lot from them.

Needless to say, the business environment assumed in 2014 and 2018 will be different from the actual business environment, and we cannot deny the possibility that an unexpected event like the novel coronavirus pandemic will occur. We would like to pay attention to the concrete progress of their measures in the new mid-term management plan, including the response to such uncertainties.

The important missions of Vertex Corporation as the largest company in this industry include the promotion of understanding and brand development for securing human resources, which is one of challenges to be dealt with.

<Reference: Regarding Corporate Governance>

Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

Auditors | - |

Corporate Governance Report

Last updated on May 21, 2021.

<Basic policy>

By providing high-quality, affordable, valuable products, we aim to contribute to the improvement and stability of the living environment and achieve the sustainable growth and development of our company. Accordingly, our basic policy for corporate governance is to make appropriate, swift decisions, conduct business operations, and carry out transparent, sound business administration while putting importance on shareholders.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code >

Principles | Reasons for not implementing the principles |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | IR is mainly dealt with by the corporate planning division. When disclosing brief financial reports, it cooperates with mainly the business administration division. In addition, executives of the management not only hold a briefing session for investors, but also conduct individual interviews with shareholders, investors, analysts, and others, to share their opinions, etc. inside our company, and disclose information so that they will become familiar with the business environment of our corporate group. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

<Principle 1-4 Strategically held shares> | We plan to strategically hold shares only if this is expected to contribute to the sustainable growth and mid/long-term corporate value of our corporate group. As for the exercise of voting rights of strategically held shares, we comprehensively discuss whether this would contribute to the improvement of value of the issuing company and whether this would degrade the corporate value of our corporate group. |

【Supplementary Principle 4-11-2 Preconditions for securing the effectiveness of the board of directors】

| Important concurrent jobs of candidate and incumbent directors will be disclosed every year via documents, such as business reports. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are provided by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |