Bridge Report:(5290)Vertex second quarter of fiscal year ending March 2022

President Akihide Tsuchiya | Vertex Corporation (5290) |

|

Company Information

Market | TSE 2nd Section |

Industry | Glass, earthen, and stone products (manufacturing business) |

President | Akihide Tsuchiya |

HQ Address | 5-7-2 Kojimachi Chiyoda-ku Tokyo |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE Act. | Trading Unit | |

¥3,025 | 10,184,450 shares | ¥30,807 million | 15.3% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥65.00 | 2.1% | ¥438.70 | 6.9x | ¥2,986.87 | 1.0 |

* Stock price is as of closing on December 1, 2021. Number of shares issued, DPS and EPS are taken from financial results for the second quarter of fiscal year ending 2022. ROE and EPS are taken from the previous term.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 Act. | 29,701 | 2,516 | 2,694 | 5,934 | 712.28 | 70.00 |

March 2020 Act. | 39,014 | 3,788 | 3,959 | 2,336 | 262.01 | 60.00 |

March 2021 Act. | 37,763 | 5,290 | 5,635 | 3,759 | 428.41 | 90.00 |

March 2022 Est. | 39,000 | 5,500 | 5,700 | 3,800 | 438.70 | 65.00 |

*Unit: Million yen. The estimated values were provided by the company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply. The dividend for the term ended March 2021 includes the commemorative dividend of 30.00 yen/share.

This Bridge Report overviews the business performance for the second quarter of fiscal year ending March 2022 and other information for Vertex Corporation.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of Fiscal Year ending March 2022 Earnings Results

3. Fiscal Year ending March 2022 Earnings Forecasts

4. Progress of the Second Mid-Term Management Plan

5. Conclusions

<Reference 1: Regarding Second Mid-Term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

- Under the policy “To build safe society”, Vertex Corporation engages in the supply, installation, etc. of products required for developing social capital and infrastructure, including concrete products. Taking advantage of the competitiveness of products, the ability to propose technologies, and plenty of intellectual property, it became one of the companies that have the highest profitability in this industry. Its forte also includes the capability of responding to things in cooperation with group companies.

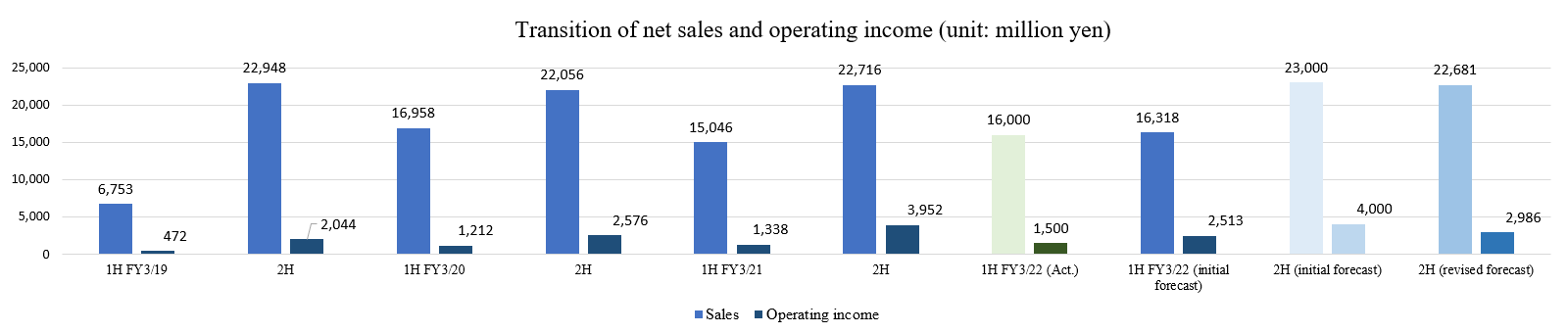

- The sales for the second quarter of the term ending March 2022 were 16,318 million yen, up 8.5% year on year. The impact of the novel coronavirus was minor, as only the pile business segment saw a decline in sales. Operating income rose 87.8% year on year to 2,513 million yen. As Vertex Co., Ltd., which is their central business company, raised selling prices and curtailed the cost of sales while revising the method of handling less profitable products, etc., gross profit increased 30.0% year on year while gross profit margin rose 5.5 points year on year, and the increase rate of SG&A was as low as 3.0% year on year. All kinds of profits exceeded the initial and revised forecasts.

- There is no change in the earnings forecasts. In the term ending March 2022, sales are estimated to grow 3.3% year on year to 39 billion yen and operating income is projected to rise 4.0% year on year to 5.5 billion yen. The concrete and disaster prevention businesses remain healthy. The pile business is expected to recover from the downturn in the previous term. This term is the first year of the second mid-term management plan, and they are aiming to achieve the earnings forecasts without fail, to earn their target of “sales of 41 billion yen and an operating income of 6.1 billion yen” in the term ending March 2024, which is the final year of the mid-term plan. The company plans to pay an ordinary dividend of 65.00 yen/share, up 5.00 yen/share from the previous term, in which a commemorative dividend of 30.00 yen/share was paid. The expected payout ratio is 14.8%.

- Due to its business structure, the company has seasonality. Namely, sales and profit tend to become larger in the second half. In particular, profit in the second half tends to become much higher than that in the first half. For the current term ending March 2022, the company upwardly revised the forecasts for the first half, but refrained from revising the full-year forecasts, while considering uncertainties over the novel coronavirus, the trends of raw material prices, etc., but it seems that the profit in the second half will be much lower than usual. We would like to keep an eye on their performance from the third quarter.

- On the other hand, the company established Vertex Academy, which will become the central educational/training institution of the Vertex Group, while recognizing that it is necessary to secure, develop, and train personnel. It is unlikely that this will produce good results in a short period of time, but we would like to pay attention to their efforts to strengthen human capital, including the above mentioned.

1. Company Overview

Under the policy “To build safe society”, Vertex Corporation engages in the supply, installation, etc. of products required for developing social capital and infrastructure, including concrete products. Taking advantage of the competitiveness of products, the ability to propose technologies, and plenty of intellectual property, it became one of the companies that have the highest profitability in this industry. Its forte also includes the capability of responding to things in cooperation with group companies.

【1-1 Company History】

In 2014, three companies, NIPPON ZENITH PIPE CO., LTD., HANEX CO., LTD. (former name: HANEDA HUME PIPE CO., LTD.), and HANEDA CONCRETE INDUSTRIAL CO., LTD., merged into HANEDA ZENITH CO., LTD., which was then renamed HANEDA ZENITH HOLDINGS CO., LTD.

On October 1, 2018, HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. (based in Fukui Prefecture) established Vertex Corporation through joint stock transfer (which made HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. wholly owned subsidiaries).

The companies set up a new business group.

In April 2019, HANEDA ZENITH CO., LTD., as the surviving company, absorbed HANEDA ZENITH HOLDINGS CO., LTD. (a merged company).

On April 1, 2021, Vertex Co., Ltd. was born through absorption-type merger carried out by HANEDA ZENITH CO., LTD. as the surviving company and HOKUKON CO., LTD. as the merged company, which were the core business companies affiliated with Vertex Corporation.

Vertex Co., Ltd. aims to achieve sales and profit growth by increasing its market share and boosting profitability in the mature markets of concrete and piles, and the growing market of disaster prevention through a multitude of approaches, including creation of business synergy and enhancement of business efficiency.

【1-2 Raison d'etre】

The company has put out a mission statement: “To build safe society.”

For safe life everywhere in this country that is constantly afflicted with natural disasters, for confidence about peace and safety of families and friends living far away, and for growth and enrichment of the mind of children,

We must continue our pursuit

of the one-and-only technology that continuously satisfies difficult needs, of unique ideas that no one has ever come up with, and of a nationwide network that can swiftly deal with any unexpected events.

To overcome any kind of disaster, and to create safety that has not existed yet,

What we create is not just material things, but a new form of safety by racking our brains so that all people can continue to live everyday with smiles. |

The company understands that its social purpose is to contribute to realizing safe daily life by providing a variety of products that are essential for developing social capital and infrastructure for daily lives.

【1-3 Market Environment】

The following are the points to keep in mind for understanding the company’s business environment:

(1) Accelerated National Resilience Plan

The “Basic Plan for National Resilience,” which was approved by the Cabinet in June 2014 as a countermeasure against major earthquakes, such as the Southern Hyogo Prefecture Earthquake and the Great East Japan Earthquake, and powerful typhoons that cause damage in various regions every year was revised in December 2018 (four years later), and on June 17, 2021, a “Five-year Acceleration Plan for Disaster Preparedness, Reduction and National Resilience” was announced.

As a result, Japan is accelerating efforts to strengthen and enhance its national resilience.

It is stated in the annual plan for 2021 that "We will increase efforts to strengthen national resilience and install a countermeasure system combining hardware and software. From fiscal 2022 onward, we will continue to secure a necessary budget to move forward the basic plan for disaster preparedness, reduction and national resilience across Japan, and to build sturdy homes that can withstand disasters as a national hundred-year plan.” (from (1) Purpose of formulation of an annual plan on page 2).

Further, one of the goals in implementing the “Five-year Acceleration Plan” for FY 2021 to FY 2025 is to contribute to the realization of carbon neutrality by FY 2050. Contents of the plan include “the response to climate change, large-scale earthquakes, etc.,” “managing aging infrastructure,” “utilizing the latest technologies such as digital technologies, and the introduction of innovations.”

The “Basic Plan for National Resilience” is expected to continue accelerating as a core policy in relation to focal topics such as climate change and carbon neutrality.

(2) Aging Social Capital

According to the Ministry of Land, Infrastructure, Transport and Tourism, Japan's social capital stock has been intensively developed during the rapid economic growth period, and there are concerns that it will quickly deteriorate hereafter. It is expected that over the next 20 years, the percentage of road bridges, tunnels, river management facilities, sewage systems, harbors, etc. constructed over 50 years ago will rise at an accelerated rate.

(Percentage of main social capital over 50 years since construction)

| March 2018 | March 2023 | March 2033 |

Road bridges (approx. 730,000 bridges) | Approx. 25% | Approx. 39% | Approx. 63% |

Tunnels (approx. 11,000 tunnels) | Approx. 20% | Approx. 27% | Approx. 42% |

River management facilities (approx. 10,000 facilities including sluices) | Approx. 32% | Approx. 42% | Approx. 62% |

Sewage pipes (total length: approx. 470,000 km) | Approx. 4% | Approx. 8% | Approx. 21% |

Port quays (approx. 5,000 facilities) | Approx. 17% | Approx. 32% | Approx. 58% |

Source: “Infrastructure Maintenance Information” provided by the Ministry of Land, Infrastructure and Transport

In 2035, about 58% of 520,000 fire cisterns, and in 2027, roughly 40% of 50,000 km of agricultural drainage channels will have been constructed over 50 years ago.

It is therefore necessary for the government to strategically maintain, manage and upgrade aging infrastructure. In the “Basic Plan for National Resilience,” the city plans to implement countermeasures against urban erosion 100% by 2040, including rainwater drainage facilities to prevent and reduce flood damage in sewage systems, and countermeasures against sediment disasters in sediment control systems 100% by 2045.

(3) Aging of construction workers and shortage of manpowe expansion of precast construction methods

The number of workers in the construction industry is declining. In addition, the labor shortage due to the declining birthrate and aging population has become a major issue in the construction industry. According to the data collected by the Ministry of Land, Infrastructure, Transport and Tourism, it is estimated that approximately one-third of workers in the construction industry are aged 55 and older while approximately 10% are those aged 29 and younger, resulting in a shortage of at least 500,000 skilled workers in 2025.

Various efforts have been made to resolve this issue including the use of the “precast construction” method. “Precast concrete” parts such as gutters, pipes, manholes, piles, bridge girders and parts of buildings are manufactured off-site and delivered to the construction site for assembly and installation.

In contrast, the current mainstream construction method is the “on-site construction” method, in which concrete products are manufactured on-site by pouring concrete into wooden or iron molds, assembled at the site, and then hardened.

If you just consider the initial costs of “on-site construction,” it has an economic advantage compared with “precast construction”; however, because the latter is superior in terms of design costs, shorter construction periods, lack of necessity to arrange traffic regulations, lack of related economic losses, as well as product quality, it is expected to gain ground moving forward.

【1-4 Business Details】

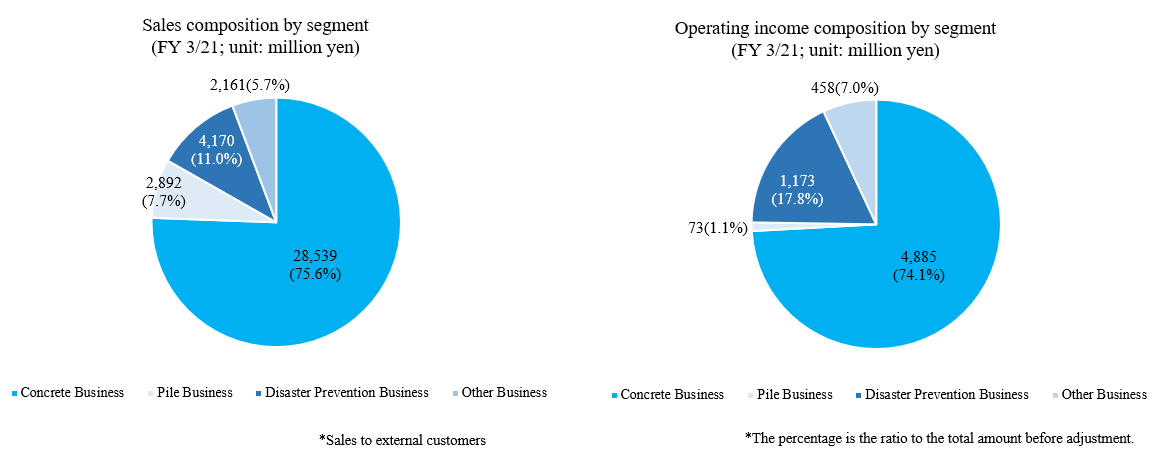

The company has four reporting segments, which are Concrete Business, Pile Business, Disaster Prevention Business, and Other Business.

The following is a table showing the group companies operating each business segment:

Business | Group Companies |

Concrete Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) HOKUKON PRODUCT, K.K. (Fukui Pref.) Hokkan Concrete Kogyo Co., Ltd. (Gunma Pref.) Universal Business Planning Co., Ltd. (Fukui Pref.) Tohoku Haneda Concrete K.K. (Yamagata Pref.) Kyushu Vertex Co., Ltd. (Fukuoka Pref.) Kikuichi Kensetsu K.K. (Tokyo; equity-method affiliate) |

Pile Business | HOKUKON MATERIAL CO., LTD. (Fukui Pref.) |

Disaster Prevention Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) |

Other Business | WICERA Co., Ltd. (Gifu Pref.) M.T Giken Co., Ltd. (Osaka) iB Solution Corporation (Fukui Pref.) Hanex Road Co., Ltd. (Tokyo) NX inc. (Tokyo; equity-method affiliate) |

(1) Concrete Business

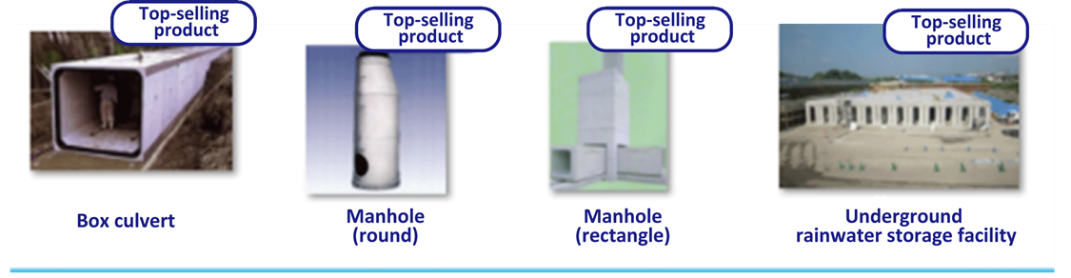

This business manufactures and sells secondary concrete products, sells other related products, and undertakes installation of products in the segments of anti-inundation & sewage system, road, maintenance, railroad, and housing & development.

Segment | Overview/main products and services |

Anti-inundation/sewage system | This segment offers the best proposal with a rich lineup of products developed reflecting the needs and the one-and-only technology in order to help adopt anti-disaster and disaster mitigation measures, such as measures against flood damage and renovation for anti-earthquake sewage facilities.

(Main products/services) ◎ Precast flood control basin (underground water tank) This facility prevents rainwater from flowing into rivers. In an underground precast flood control basin, a facility to prevent rainwater outflow is built underground while the space above the ground can be used for multiple purposes, such as including parks, athletic fields, and parking lots.

◎ Box culvert A box culvert is a box-shaped concrete structure that is installed primarily underground and used for holding waterways and communication lines. With a variety of uses, box culverts are utilized in myriad infrastructure projects, such as underpasses and reservoirs.

◎ Prefabricated round manhole As a pioneer of prefabricated manholes, the company offers an extensive lineup of manholes ranging from small ones (with the inner diameter of 300 mm) to extra-large ones (with the inner diameter of 2200 mm) in order to satisfy multifarious needs for manhole installation works.

|

Road | Possessing a number of products that help not only with development of road infrastructure, but in protecting human lives as well, the company contributes to building safe roads.

(Main products/services) ◎ Precast guard fence (PGF) The precast guard fence is a rigid protective fence made of precast concrete for preventing vehicles from swerving off the road while ensuring the safety of the drivers and passengers. It is used at such places as roadsides, median strips, and concrete barrier parapets.

◎ Span the Arch It is a culvert that can support ultra-large spans and consists of multiple components that are assembled on site in the shape of an arch for building grade separated crossings (underpasses) between tunnels and roads. It is highly effective against earthquakes, soft ground, and eccentric load.

|

Maintenance | As measures against deterioration of infrastructure, this segment proposes optimal products and methods while taking into account life-cycle cost. It contributes to prolonging the life of infrastructure that is the basis supporting enriched daily life of the citizens and social economy.

(Main products/services) ◎ Ductal panel The ductal panel is a high-durability, thin-wall panel installed underground, which is made of ultra-high strength, fiber-reinforced concrete that is highly durable in a harsh environment in which damage from salt, frost, and wear occurs. It can prolong the life of constructions and cut down on the cost of maintenance and management.

◎ Maintenance of fire cisterns This service offers methods of repair and reinforcement of deteriorated fire cisterns against leakage of water caused by earthquakes and secondary disaster resulting from collapse of roads.

|

Railroad | This segment offers safety via the lineup of products developed through vigorous pursuit of quality materials, such as ultra-high strength, fiber-reinforced concrete and special mortar.

(Main products/services) ◎ Platform screen door slab While the number of train stations that have installed facilities for preventing passengers from falling from the platforms is rising, some stations are encountering difficulty in installing such facilities because their existing floor slabs cannot bear the load of movable platform gates (platform screen doors). This product not only is lighter than the conventional products, but can be installed easily as well.

|

Housing/development | This segment offers an extended lineup of products resistant to massive earthquakes in order to develop earthquake- and disaster-resilient cities, including earthquake-proof water storage tanks, which are the segment’s top-selling product brand, and unique portable toilets for use in the event of disaster.

(Main products/services) ◎ HC fire cistern/HC earthquake-proof water storage tank The main products of this segment are precast fire cisterns and earthquake-proof water storage tanks. The fact that the fire cisterns and water storage tanks survived the Great Hanshin earthquake has proven their high reliability and safety. The fire cisterns and water tanks have been installed in great number.

|

(2) Pile Business

The company manufactures and sells centrifugal prestressed concrete piles, and undertakes piling works.

(3) Disaster Prevention Business

The company manufactures and sells high-energy-absorption fences for preventing rocks from falling, and products for preventing such disaster as mudflows, avalanches, and debris flows, sells other related products, and undertakes installation works.

◎ Loop fence (high-energy-absorption fence for preventing rocks from falling) Displacement-control fence for preventing rocks from falling down, with displacement being small when the net catches falling rocks while the energy absorption capacity is enormous

| ◎ MJ net (ultra-high-energy-absorption fence for preventing rocks from falling) One of the world’s largest fences for preventing rocks from falling down that can withstand a falling rock energy of up to 3,000 kJ thanks to the combination of special wiring and props

|

(Taken from the reference material of the company)

(4) Other Business

The company engages in various business operations, including to manufacture and sell new ceramic products, rent equipment and sell materials, sell radio frequency identifiers (RFID; non-contact IC tags), conduct investigation and tests of concrete, develop and sell systems, and rent real estate.

【1-5 Characteristics and Strength】

(1) Product superiority and capability to make technological proposals

The company has developed its unique business model that is less susceptible to price competition by being involved in multiple project phases from designing to product promotion to technological proposal.

(Taken from the company’s website)

What underpin the strength are the capability of collecting information, development and tests, and the power of human resources.

① Capability of collecting information

The company precisely understands the needs of manufacturers and suppliers by not only selling products but also collecting information at all times from design consultants in charge of designing and the final clients, which are government and public agencies. It also is involved proactively with product promotion and technological proposal.

② Development and tests

Based on the information obtained and needs understood, the company develops new products internally and tests them in order to develop new products ahead of other companies and come up with ways to use them. In addition, collaboration with universities and other organizations allows efficient development and tests.

The fact that HANEDA ZENITH CO., LTD. and HOKUKON CO., LTD., which are the predecessor companies of Vertex Co., Ltd., gave their focus on technology seemingly contributes to the competitive superiority of the company that takes pride in its technologies.

③ Power of human resources

Talented staff full of curiosity, such as sales staff members with outstanding capabilities to make proposal that enable them to accurately grasp the market needs, and technical staff members who make it possible to develop and propose new products in view of needs and information, are in charge of information collection, development, and tests.

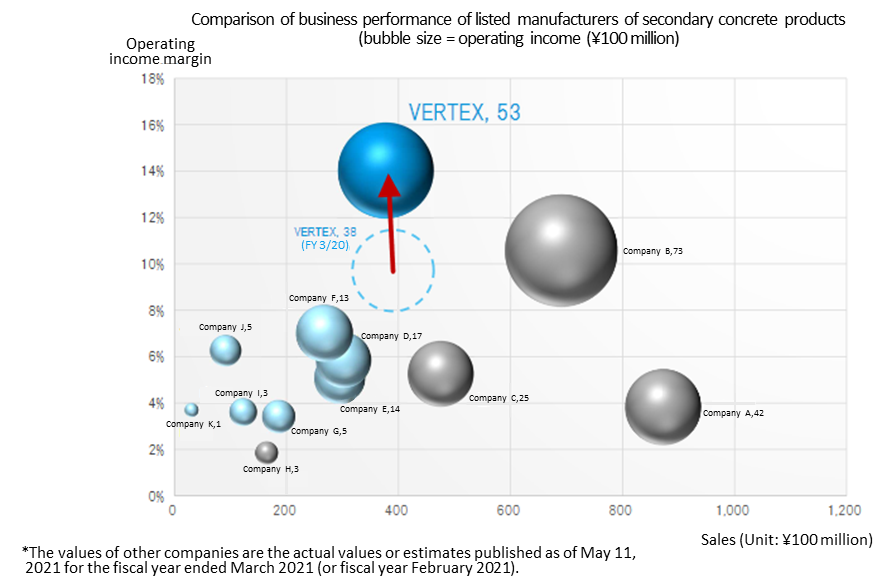

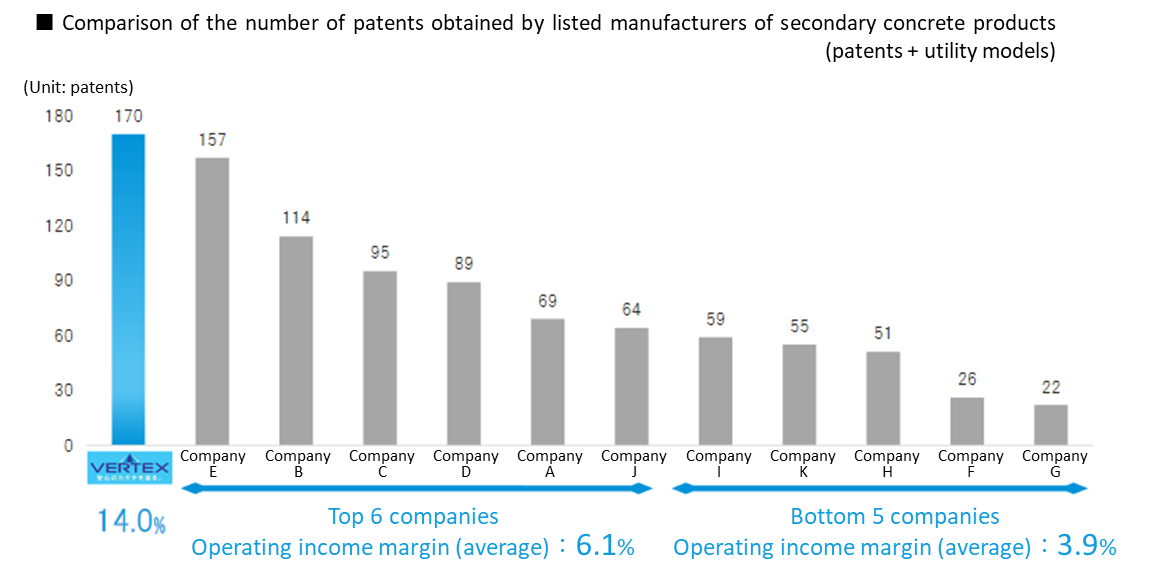

(2) High profitability, and plentiful intellectual property as the source thereof

The company has achieved high profitability based on the aforementioned business model realized taking advantage of its exceptional technological capabilities.

(Taken from the reference material of the company; the light-blue bubbles indicate the trade in the company’s Concrete Business while the gray bubbles refer to the trade in its Pile Business.)

The intellectual property generated from proactive investment in research and development is the source of the company’s large income.

(Taken from the reference material of the company)

(3) Multifarious industry-leading products that have taken large share

The company carries out research and technological development and launches new products into the markets ahead of any other companies in order to create new markets. It improves and upgrades the products after the launch by seeking customers’ opinions as appropriate. While equivalent items launched by other companies are booming the markets, the company is exerting superiority as a leading manufacturer in terms of cost and quality, securing its position as the top brand.

These product development processes enable the company to have the following best-selling products:

Anti-inundation segment/ Sewage system segment |

|

Housing/ development segment |

|

(4) Group’s extensive response capabilities

With Vertex Co., Ltd. and each of its group companies are in charge of a variety of business operations, the company is capable of taking in various demands of myriad parties concerned, ranging from manufacturers and suppliers to sellers. It will strive to further exert and strengthen the corporate group synergy.

【1-6 Dividend Policy and Shareholder Return】

In addition to stable payment of ordinary dividends, the company intends to pay shareholder return through acquisition of treasury shares with an expected total payout ratio being 30%, as well as to consider paying special and commemorative dividends as appropriate.

It acquired 175,000 treasury shares (accounting for about 1.7% of the total number of issued shares) within the fiscal year ending March 2022.

【1-7 Analysis of Return on Equity】

| FY 3/20 | FY 3/21 |

ROE (%) | 10.4 | 15.3 |

Net income margin (%) | 5.99 | 9.95 |

Total asset turnover (times) | 0.91 | 0.86 |

Leverage (times) | 1.91 | 1.80 |

The medium-term business plan is aimed at maintaining a return on equity (ROE) of 10% or over in the fiscal year ending March 2024. Net income margin is estimated at 9.7% for the fiscal year ending March 2022. The company will be able to keep ROE at a high level in a more stable manner if it successfully improves total asset turnover.

2. Second Quarter of Fiscal Year ending March 2022 Earnings Results

【2-1 Overview of the consolidated results】

| 2Q of FY 3/21 | Ratio to sales | 2Q of FY 3/22 | Ratio to sales | YoY | Difference from the initial estimate | Difference from the revised estimate |

Sales | 15,046 | 100.0% | 16,318 | 100.0% | +8.5% | +2.0% | +2.0% |

Gross profit | 4,210 | 28.0% | 5,472 | 33.5% | +30.0% | - | - |

SG&A | 2,871 | 19.1% | 2,958 | 18.1% | +3.0% | - | - |

Operating Income | 1,338 | 8.9% | 2,513 | 15.4% | +87.8% | +67.6% | +19.7% |

Ordinary Income | 1,541 | 10.2% | 2,644 | 16.2% | +71.5% | +65.3% | +18.1% |

Net Income | 1,162 | 7.7% | 1,768 | 10.8% | +52.2% | +36.0% | +19.5% |

*Unit: Million yen. The revised forecast was announced in September 2021.

Both sales and profit increased, and profit exceeded the forecasts.

The sales for the second quarter of the term ending March 2022 were 16,318 million yen, up 8.5% year on year. The impact of the novel coronavirus was minor, as only the pile business segment saw a decline in sales. Operating income rose 87.8% year on year to 2,513 million yen. As Vertex Co., Ltd., which is their central business company, raised selling prices and curtailed the cost of sales while revising the method of handling less profitable products, etc., gross profit increased 30.0% year on year while gross profit margin rose 5.5 points year on year, and the increase rate of SG&A was as low as 3.0% year on year. All kinds of profits exceeded the initial and revised forecasts.

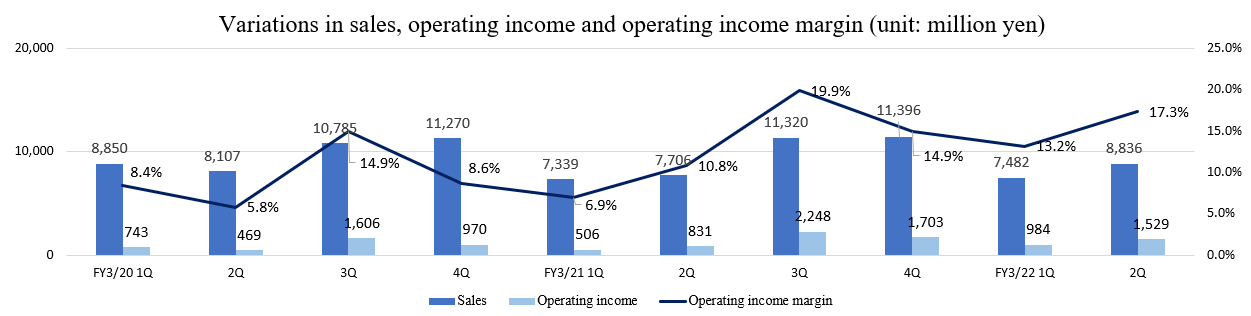

Both sales and profits increased on a quarterly basis compared to the previous quarter and to the same period last year. The operating profit margin also increased significantly.

【2-2 Trend of each segment】

| 2Q of FY 3/21 | Composition ratio | 2Q of FY 3/22 | Composition ratio | YoY |

Concrete business | 11,072 | 73.6% | 12,373 | 75.8% | +11.8% |

Pile business | 1,758 | 11.7% | 1,218 | 7.5% | -30.7% |

Disaster prevention business | 1,288 | 8.6% | 1,730 | 10.6% | +34.3% |

Other business | 999 | 6.6% | 1,038 | 6.4% | +3.9% |

Adjustment amount | -72 | - | -42 | - | - |

Total sales | 15,046 | 100.0% | 16,318 | 100.0% | +8.5% |

Concrete business | 1,486 | 13.4% | 2,491 | 20.1% | +67.6% |

Pile business | 105 | 6.0% | 60 | 4.9% | -43.2% |

Disaster prevention business | 281 | 21.9% | 375 | 21.7% | +33.4% |

Other business | 136 | 13.7% | 195 | 18.8% | +42.8% |

Adjustment amount | -672 | - | -608 | - | - |

Total operating income | 1,338 | 8.9% | 2,513 | 15.4% | +87.8% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

◎ Concrete business

Sales and profit grew.

While the demand for precast concrete products has been growing in the construction field, the company strived to reduce costs appropriately and revised the method of handling less profitable products while focusing on the cementing of relationships with existing customers, and raised unit selling prices.

In addition, the company shipped large-sized special properties in the Tokai and Hokuriku regions.

◎ Pile business

Sales and profit dropped.

While the recovery from the downturn in demand caused by the novel coronavirus is still gentle, the company improved labor productivity by rationalizing staffing.

The company also strived to receive orders, mainly with the Hyper-straight method and the FP-BESTEX method using nodular piles, but it failed to secure sufficient revenues.

◎ Disaster prevention business

Sales and profit grew.

It was still imperative to take measures against the fall of rocks in the mountain area. The company made active efforts to receive orders for products, such as loop fences and MJ nets, for securing a market share, while engaging in R&D with experiments using actual products.

◎ Other

Sales and profit grew.

Ceramics business, leasing business, and system development business were generally performing well.

【2-3 Financial position and cash flows】

Main Balance Sheet

| End of Mar. 2021 | End of Sep. 2021 | Increase/ decrease |

| End of Mar. 2021 | End of Sep. 2021 | Increase/ decrease |

Current Assets | 30,376 | 27,664 | -2,712 | Current Liabilities | 14,190 | 11,854 | -2,336 |

Cash and Deposits | 11,761 | 11,336 | -424 | Trade Payables | 6,519 | 5,287 | -1,232 |

Trade Receivables | 13,593 | 10,665 | -2,927 | ST Interest-Bearing Debts | 3,687 | 3,862 | +175 |

Noncurrent Assets | 15,888 | 16,331 | +442 | Noncurrent Liabilities | 5,826 | 5,415 | -410 |

Tangible Assets | 11,881 | 12,346 | +464 | LT Interest-Bearing Debts | 1,618 | 1,151 | -466 |

Intangible Assets | 280 | 319 | +38 | Net Defined Benefit Liability | 2,068 | 2,071 | +3 |

Investment, Other Assets | 3,726 | 3,665 | -61 | Total Liabilities | 20,016 | 17,270 | -2,746 |

Total Assets | 46,265 | 43,995 | -2,270 | Net Assets | 26,248 | 26,725 | +476 |

|

|

|

| Retained Earnings | 21,708 | 22,688 | +979 |

|

|

|

| Total Liabilities and Net Assets | 46,265 | 43,995 | -2,270 |

*Unit: Million yen. Trade receivables include electronically recorded ones, while trade payables include electronically recorded ones.

Total assets decreased by 2.2 billion yen from the end of the previous fiscal year to 43.9 billion yen due to a decrease in notes and accounts receivable-trade. Total liabilities decreased by 2.7 billion yen to 17.2 billion yen due to a decrease in notes and accounts payable-trade. Net assets increased by 0.4 billion yen to 26.7 billion yen due to an increase in retained earnings.

The capital adequacy ratio rose 3.8 points from the end of the previous fiscal year to 60.4%, and the debt-equity ratio fell 0.01 points from the end of the previous fiscal year to 0.19x.

Cash Flow

| 2Q of FY 3/21 | 2Q of FY 3/22 | Increase/decrease |

Operating CF | 2,401 | 2,173 | -227 |

Investing CF | -262 | -863 | -600 |

Free CF | 2,138 | 1,310 | -828 |

Financing CF | -205 | -1,636 | -1,431 |

Cash and equivalents | 9,640 | 10,567 | +927 |

*Unit: Million yen.

The operating CF decreased due to the augmentation of the payment amount of income taxes, etc. The investing CF increased and the free CF shrank, due to the augmentation of expenditure for acquiring tangible assets, etc.

The financing CF grew, due to the decline in revenues from long-term borrowing, the augmentation of expenditure for acquiring treasury shares, etc.

The cash position improved.

【2-4 Topics】

The company selected the new market category Standard Market

In July 2021, the company received a notification on the results of the first judgment regarding their compliance with the criteria for maintaining the listing in the new market category from Tokyo Stock Exchange, and confirmed that the company satisfies the criteria for maintaining the listing on the Standard Market. Then, the company decided to select the new market category Standard Market.

The company will complete the specified procedure for applying for the selection of the new market category.

3. Fiscal Year ending March 2022 Earnings Forecasts

【3-1 Earnings Forecasts】

| FY 3/21 | Ratio to sales | FY 3/22 Est. | Ratio to sales | YoY | Progress rate |

Sales | 37,763 | 100.0% | 39,000 | 100.0% | +3.3% | 41.8% |

Operating Income | 5,290 | 14.0% | 5,500 | 14.1% | +4.0% | 45.7% |

Ordinary Income | 5,635 | 14.9% | 5,700 | 14.6% | +1.1% | 46.4% |

Net Income | 3,759 | 10.0% | 3,800 | 9.7% | +1.1% | 46.5% |

*Unit: Million yen.

There is no change in the earnings forecasts. Sales and profit are estimated to grow.

Sales are estimated to be 39 billion yen, up 3.3% year on year, and operating income is projected to be 5.5 billion yen, up 4.0% year on year.

The concrete and disaster prevention businesses will keep performing well. The pile business, which was sluggish in the previous term, is expected to recover.

As this term is the initial fiscal year of the second mid-term management plan, the company aims to reach the estimated earnings without fail, in order to attain the target sales of 41 billion yen and the target operating income of 6.1 billion yen in the term ending March 2024, which is the final fiscal year of the mid-term plan.

The dividend is to be an ordinary dividend of 65.00 yen/share. It will be virtually up 5.00 yen/share from the previous term, in which the company also paid a commemorative dividend of 30.00 yen/share. The estimated payout ratio is 14.8%.

【3-2 Trend in each segment】

| FY 3/21 | Composition ratio | FY 3/22 Est. | Composition ratio | YoY | Progress rate |

Concrete business | 28,557 | 75.6% | 29,200 | 74.9% | +2.3% | 42.4% |

Pile business | 2,893 | 7.7% | 3,300 | 8.5% | +14.1% | 36.9% |

Disaster prevention business | 4,170 | 11.0% | 4,300 | 11.0% | +3.1% | 40.2% |

Other business | 2,290 | 6.1% | 2,200 | 5.6% | -3.9% | 47.2% |

Adjustment amount | -147 | - | 0 | - | - | - |

Total sales | 37,763 | 100.0% | 39,000 | 100.0% | +3.3% | 41.8% |

Concrete business | 4,885 | 17.1% | 5,000 | 17.1% | +2.4% | 49.8% |

Pile business | 73 | 2.5% | 130 | 3.9% | +78.1% | 46.2% |

Disaster prevention business | 1,173 | 28.1% | 1,230 | 28.6% | +4.9% | 30.5% |

Other business | 458 | 20.0% | 440 | 20.0% | -3.9% | 44.3% |

Adjustment amount | -1,300 | - | -1,300 | - | - | 46.8% |

Total operating income | 5,290 | 14.0% | 5,500 | 14.1% | +4.0% | 45.7% |

* Unit: 100 million yen. The composition ratio of operating income means the ratio of operating income to sales.

The sales and profit of the pile business are expected to grow by double digits.

The concrete and disaster prevention businesses are expected to remain healthy this term.

4. Progress of the Second Mid-term Management Plan

The progress, etc. of each business with respect to the second mid-term management plan are as follows.

(1) Progress of each business

① Concrete business

For preventing flooding and mitigating disaster, rainwater harvesting pipes and tanks, at which the company excels, have been adopted in various regions.

The AS form method has been adopted for repairing decrepit headrace channels for the purpose of maintaining and refurbishing existing infrastructure.

Amid the shortage of workforce at construction sites, the needs for precast concrete for large-scale structures are growing and the demand for box culverts is increasing.

The long-lasting concrete LL Concrete, which was developed by the company, has been adopted, because there is concern over the deterioration of concrete as the water in rainwater storage tanks has a high level of salt.

*LL Concrete, which is produced by blending the bonding material with the fine powder of blast furnace slag with a ratio of over 70%, has high chemical resistance against salt damage and sulfuric acid, and can cut CO2 emissions by 70% compared with ordinary concrete.

② Pile business

The market recovery is gentle, but the company is promoting the sales of highly profitable products (high support piles and SC piles), receiving orders for less profitable products selectively, enhancing and promoting marketing activities while coping with the novel coronavirus, improving existing construction methods, and developing new methods in a steady manner.

③ Disaster prevention business

As part of new product development, the company added new models of MJ Net, an ultra-high energy absorbing fence for preventing rocks from falling, for 300 KJ and 500 KJ to their product lineup, to meet the needs from customers.

The company continuously receives orders for items for preventing rocks from falling toward transportation infrastructure.

④ Other business

◎Ceramics business

The company invested in equipment for evolving production technologies, installing rotary press machines and automatic inspection equipment.

◎RFID business

The company released a versatile system, which enables paperless operations in any field or industry.

(2) Group-wide measures

① Redevelopment of programs for developing and recruiting human resources

The company established Vertex Academy, which will become the central educational/training institution of the Vertex Group.

The academy plans to hold the first training for fiscal 2021 in March 2022, for all employees of Vertex Co., Ltd., who can participate voluntarily.

As of now, 124 employees accounting for about 25% of all employees have applied for the training.

With the aim of improving and developing human resources further, the company plans to develop and enrich the programs.

In addition, HR Development Group was established in Vertex Co., Ltd.

② Development of information systems and ICT infrastructure, and promotion of DX

Vertex is preparing for the operation of a new mission-critical system and HR and employment systems. The operation of the new mission-critical system is to be started in August 2022, and the operation of the HR and employment systems are to be started in February 2022.

In Vertex Construction, the operation of the new mission-critical system has been started since April 2021.

③ Establishment of systems for group governance and risk control

From June to August 2021, the company gave a lecture about compliance to all employees of the Vertex Group. 100% of employees attended it.

One internal auditor was added. The plan of carrying out internal audit at about 150 sites in three years is underway.

④ Development and strengthening of the business portfolio management function

The company reviewed the strategies and measures for small-scale businesses. The company is continuously developing the business portfolio management function.

⑤ Development of a sustainability promotion system

The company established a sustainability council.

Its purpose is to discuss the path the Vertex Group should follow to contribute to society while looking ahead 20 years, and realize their vision.

The company solicited applications from all employees and selected council members from applicants, and the activities of the council started with 25 members.

The first meeting was held in October 2021, and a workshop was held for choosing important items to be dealt with.

(3) Others

① Commercialization of a new cooling/heating system utilizing underground heat

The Lining Borehole Ground Heat Exchanger can halve the drilling cost while securing heat storage. By combining it with the heat balance control unit, which was developed by the company and can improve the efficiency of use of heat, it is possible to reduce electricity costs by about 50% compared with the air-cooled type and construction costs by about 30% compared with the conventional method. Through this, the company actualized the systematization of energy-saving and low-cost equipment.

② Participation in exhibitions

The company participated in various exhibitions to promote their products.

5. Conclusions

Due to its business structure, the company has seasonality. Namely, sales and profit tend to become larger in the second half. In particular, profit in the second half tends to become much higher than that in the first half. For the current term ending March 2022, the company upwardly revised the forecasts for the first half, but refrained from revising the full-year forecasts, while considering uncertainties over the novel coronavirus, the trends of raw material prices, etc., but it seems that the profit in the second half will be much lower than usual. We would like to keep an eye on their performance from the third quarter.

On the other hand, the company established Vertex Academy, which will become the central educational/training institution of the Vertex Group, while recognizing that it is necessary to secure, develop, and train personnel. It is unlikely that this will produce good results in a short period of time, but we would like to pay attention to their efforts to strengthen human capital, including the above mentioned.

<Reference 1: Regarding the Second Mid-Term Management Plan>

The company formulated and announced the second mid-term management plan for the three years from the term ending March 2022 to the term ending March 2024.

【Review of the previous mid-term management plan】

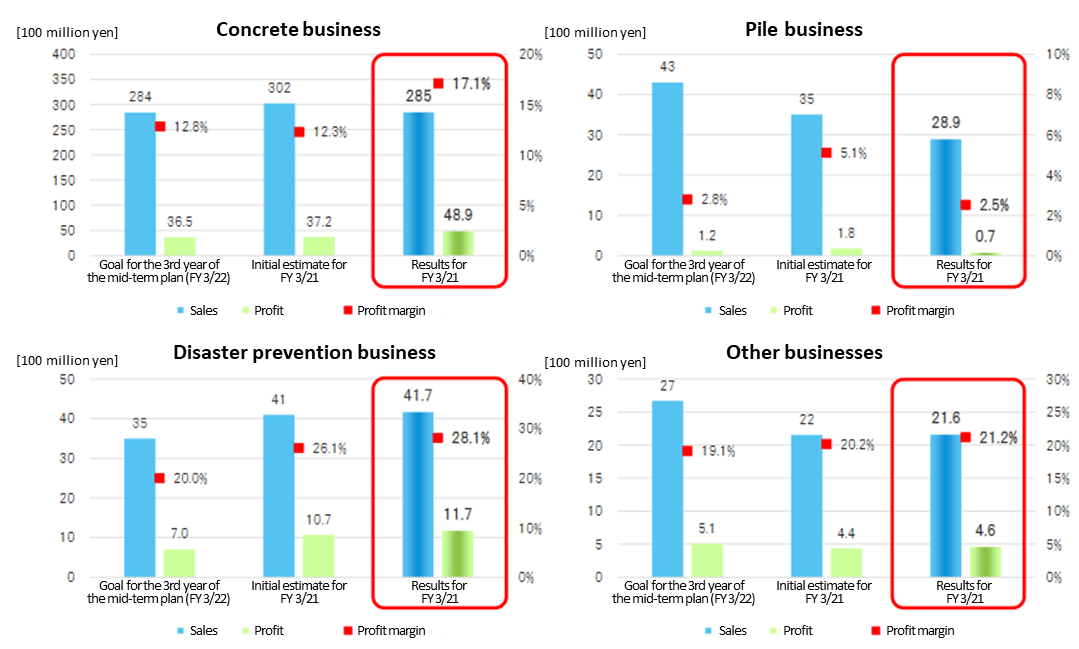

(1) Positioning of the previous mid-term management plan and the state of achievement of numerical goals

In the previous mid-term management plan (FY 3/20 to FY 3/21), the company set the priority measures: “to further improve existing businesses,” “to bring out company-wide synergy,” and “establish a management base,” and aimed to achieve “sales of 38.9 billion yen, an operating income of 3.9 billion yen, an operating income margin of 10%, and an ROE of 10%” in the final year ending March 2022. The company reached “sales of 38.9 billion yen” in the term ended March 2020, and “an operating income of 3.9 billion yen, an operating income margin of 10%, and an ROE of 10%” in the term ending March 2021, one year earlier than planned.

(2) Activities in two and a half years after business merger and challenges

The company recognizes that their efforts for tightening governance, restructuring the corporate group, implementing M&A, and bringing out synergy from business merger steadily paid off.

The company plans to continue the development of a management base.

Challenge | At the time of business merger | Present |

Tightening of governance | Company with the board of auditors Total number of executives: 15 Number of outside executives: 4 (26.7%) | Company with the audit committee Total number of executives: 8 Number of outside executives: 3 (37.5%) |

Restructuring of the corporate group and M&A | 14 consolidated subsidiaries 3 equity-method affiliates | 12 consolidated subsidiaries 2 equity-method affiliates |

April 2019: Transformed Kikuichi Kensetsu into an equity-method affiliate. April 2020: Transformed DC (present: Kyushu-Vertex) into a consolidated subsidiary. | ||

Integration/abolishment of business bases | No. of marketing offices: 47 No. of production sites: 16 | No. of marketing offices: 33 No. of production sites: 15 |

Product strategy | Unification of brands for core products, and active selection of items for sale | |

R&D | To conduct R&D, including fundamental research and development of various processes for handling real estate | |

Establishment of a management base | *Started operating a new personnel system of the new company established through merger in April 2021. *Programs for personnel development and recruitment: It is necessary to reestablish them while assuming that they will do business while coping with the novel coronavirus. *In the development phase for a new mission-critical system to be released in the spring of 2022 *M&A, entry to new fields, development and improvement of the business portfolio management function will be continued. | |

As for R&D, the corporate group is pursuing 49 existing themes and 31 new themes.

(Examples)

*Development of “long-life concrete (LL Crete),” which is environmentally friendly (reducing CO2 emissions and preserving natural resources), durable, and low-cost

*Slabs for half-precast tracks for next-generation light rain transit (LRT)

*Products for preventing the fall of rocks

(3) Results in each segment

For the concrete and disaster prevention businesses, results exceeded the estimates, but the pile business did not reach the estimate, so the company revised strategies.

(Taken from the reference material of the company)

【The second mid-term management plan】

(1) Recognition of the business environment

As mentioned in Section 1 Outline of the company “1-3 Market environment,” the external environment includes the acceleration of the National Resilience Plan, the deterioration of social capital, and the shortage of manpower due to the declining birthrate and aging population in the construction industry, and the internal environment (the company’s factors) includes the company’s strengths such as:

*Advanced technologies and capabilities of design, development, and marketing, and a broad customer base

*A large number of original products boasting the largest market share and differentiated products

*Sound financial standing and ample funds.

The company recognizes that its challenges are:

*Rise in the average age of employees and difficulty in recruitment

*Development of the core business following the concrete business

*Acquisition of the business portfolio management function putting importance on capital efficiency.

It considers that there is room for streamlining after merger, mainly for production and sales systems.

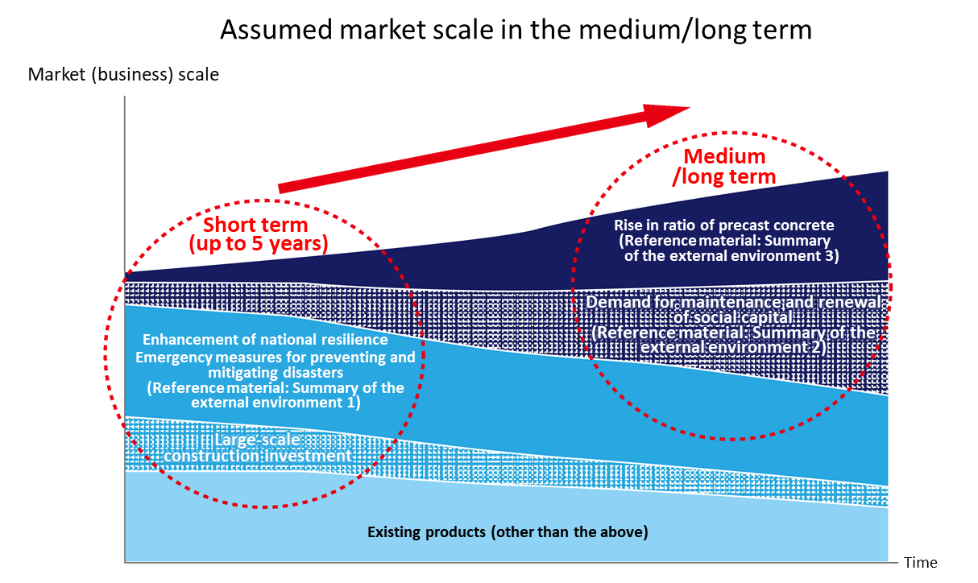

Under this environment, the target markets of the company are expected to expand in the medium/long term. From the medium/long-term viewpoint, the drivers for market expansion are considered to be “the rise in ratio of precast concrete due to the shortage of manpower” and “the growth of demand for maintenance and renewal of deteriorated social capital.”

As for “the rise in ratio of precast concrete,” the demand for concrete products is expected to grow.

As for “the growth of demand for maintenance and renewal of deteriorated social capital,” they plan to broadly meet the demand by taking advantage of their capabilities of proposing “inspection and reinforcement of infrastructure” in the upstream area and “repair, reinforcement, and renewal” in the downstream area, providing materials and products, and conducting construction.

(Taken from the reference material of the company)

(2) Basic policy and positioning of the second mid-term management plan

The company upholds the following basic policy.

To promote the organic growth of the core business by pursuing it further | The company aims to maximize cash flows in the future by enhancing the capacity to generate operating cash flow through the organic growth of the core business. |

To grow promising businesses and seize new earning opportunities | For further growth, the company will enhance efforts to nurture promising businesses and seize new earning opportunities (in new areas and categories, launching new products and businesses). |

To establish a management base for enabling sustainable growth | Continuously from the previous mid-term plan, the company will improve its management base by tightening group governance and establishing a risk control system, and implement ESG measures, with the aim of improving corporate value in a sustainable manner. |

Positioning the period of this mid-term management plan as “the period for strengthening the company’s business and management base for realizing sustainable growth without fail,” the company plans to forge ahead for attaining big hairy audacious goals (BHAGs): commemorate the 10th anniversary of establishment in October 2028 and to acquire the greatest brand power as an enterprise that offers reliability and safety.

(3) Measures and goals in each segment

① Concrete business

Outlook for the business environment | *Due to the impact of the novel coronavirus, the outlook for private investment remains uncertain, but public investment will be healthy. *To cope with natural disasters, which are getting graver, flood control basins (rainwater storage tanks) and rainwater drainage facilities will be constructed. To make structure earthquake-proof and cope with the deterioration of infrastructure, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. |

Major measures and policies | 1. To propose a lineup of high value-added products by utilizing the technological development capacity 2. To upgrade the centers for shipping general-purpose products for increasing customer satisfaction level 3. To pursue the business of maintaining and renewing existing infrastructure and promote the sales of products for preventing inundation and mitigating disasters and for transportation infrastructure 4. To improve the production and shipment efficiencies by integrating factories |

② Pile business

Outlook for the business environment | *Due to the impact of the novel coronavirus, private construction investment will be sluggish. *The recovery in this term is estimated to be gentle, and it is assumed that the recovery to the level in the previous term will be achieved around FY 3/23. Meanwhile, it is expected that there will be demand from distribution facilities, warehouses, suburban stores such as drugstores, etc. *From the viewpoint of prevention and mitigation of disasters, the demand for safety of foundations for buildings is growing. |

Major measures and policies | 1. To promote the sales of profitable products (high support piles and SC piles) and promote the selected order receipt for a lineup of less profitable products 2. To enhance and promote marketing while coping with the novel coronavirus 3. To improve existing construction methods and develop new construction methods |

③ Disaster prevention business

Outlook for the business environment | *For measures against natural disasters, which are getting graver and more frequent, including flood control (erosion control), forest conservation in areas where there is a risk of forest disaster, works for preventing landslides on road slopes and embankments, and works for preventing the collapse of slops adjacent to railways due to torrential rain, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. *The measures for preventing natural disasters at transportation infrastructure will be strengthened. |

Major measures and policies | 1. To develop new products in the fields of prevention of fall of rocks, landslides, and avalanches 2. To improve existing products and enrich the product lineup 3. To enhance marketing in the transportation infrastructure field |

④ Other businesses

Business | Primary measures |

Ceramics business | To enter new industries and growing fields and evolve production technologies Example: radio wave absorbing ceramics |

Business of surveys and tests of concrete | To expand the business on inspection of fire cisterns, conduct fundamental research for surveys, and establish technologies |

Business of development and sale of systems | To expand business by developing systems for networks, security, and special tasks |

RFID business | Sales promotion targeting not only the markets of maintenance and preventive maintenance, but also the entire market of paperless slips/forms. |

(4) Group-wide measures

In order to achieve sustainable growth, the company will establish and strengthen a management base through mainly the following measures.

* Redevelopment of programs for developing and recruiting personnel

* Establishment of information systems and ICT infrastructure, and promotion of DX

* Building of systems for group governance and risk control

* Development and enhancement of the business portfolio management function

* Establishment of a sustainability promotion system

(5) Financial and investment strategies

It is assumed that the three-year cumulative operating cashflow is 14 billion yen.

For strengthening the core business, growing promising businesses, and seizing new earning opportunities, the company will allocate 9.8 billion yen to “investment in equipment renewal,” “equipment investment for adding high value and enhancing competitiveness,” “investment in R&D,” “investment in DX for improving productivity,” “start-up investment and M&A,” etc.

The company will return 4.2 billion yen to shareholders, with a total return ratio of 30%.

(6) Investment in R&D and intellectual property

For evolving business models, the company will invest in R&D actively.

The company will put more energy into cross-sectoral R&D. Based on the collaboration among the industrial, academic, governmental, and private sectors, the company will strengthen its existing businesses and engage in research and development of products and production technologies that would generate revenues in the future.

Targeting clients, the company will establish a new marketing style based on plenty of know-how, experiences, patents, etc.

The company puts importance on “intellectual property” as important managerial resources that support growth and profitability as the output of R&D investment.

By further strengthening the capability to create intellectual property, the company aims to maintain and enhance business competitiveness.

(7) Numerical goals

◎ Company-wide goals

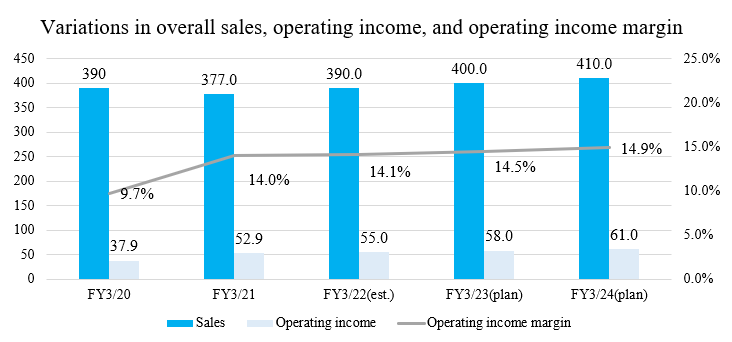

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 377.0 | 390.0 | 400.0 | 410.0 | 2.8% |

Operating income | 52.9 | 55.0 | 58.0 | 61.0 | 4.9% |

Operating income margin | 14.0% | 14.1% | 14.5% | 14.9% | - |

Ordinary income | 56.3 | 57.0 | 60.0 | 63.0 | 3.8% |

Net income | 37.5 | 38.0 | 40.0 | 42.0 | 3.8% |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

The company aims to keep ROE 10% or higher.

◎ Goals in each segment

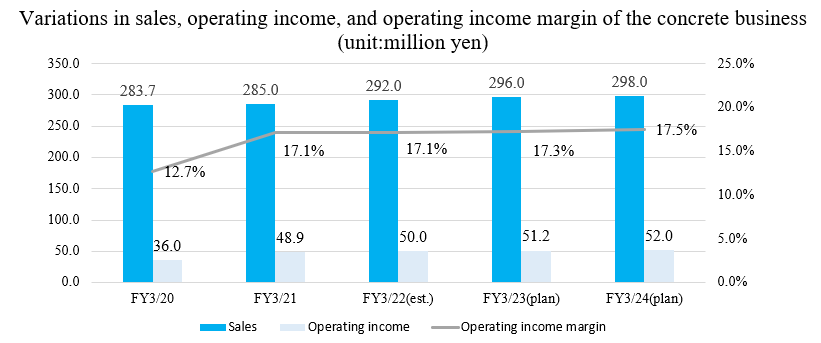

*Concrete business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 285.0 | 292.0 | 296.0 | 298.0 | 1.5% |

Operating income | 48.9 | 50.0 | 51.2 | 52.0 | 2.1% |

Operating income margin | 17.1% | 17.1% | 17.3% | 17.5% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

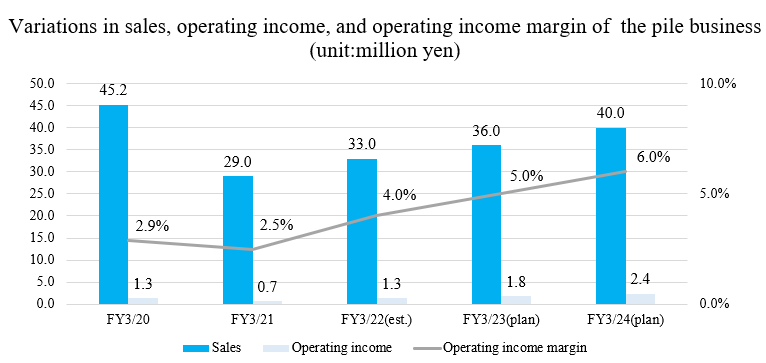

*Pile business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 29.0 | 33.0 | 36.0 | 40.0 | 11.3% |

Operating income | 0.7 | 1.3 | 1.8 | 2.4 | 50.8% |

Operating income margin | 2.5% | 4.0% | 5.0% | 6.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

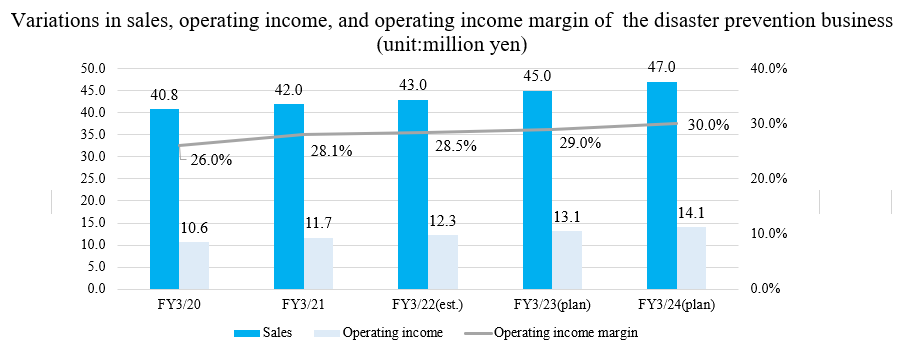

*Disaster prevention business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 42.0 | 43.0 | 45.0 | 47.0 | 3.8% |

Operating income | 11.7 | 12.3 | 13.1 | 14.1 | 6.4% |

Operating income margin | 28.1% | 28.5% | 29.0% | 30.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

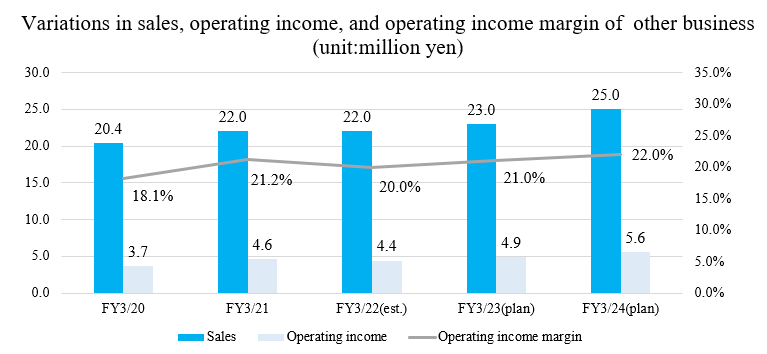

*Other business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 22.0 | 22.0 | 23.0 | 25.0 | 4.4% |

Operating income | 4.6 | 4.4 | 4.9 | 5.6 | 6.8% |

Operating income margin | 21.2% | 20.0% | 21.0% | 22.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

<Reference2: Regarding Corporate Governance>

Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

Auditors | - |

Corporate Governance Report

Last updated on July 9, 2021.

<Basic policy>

By providing high-quality, affordable, valuable products, we aim to contribute to the improvement and stability of the living environment and achieve the sustainable growth and development of our company. Accordingly, our basic policy for corporate governance is to make appropriate, swift decisions, conduct business operations, and carry out transparent, sound business administration while putting importance on shareholders.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code >

Principles | Reasons for not implementing the principles |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | IR is mainly dealt with by the corporate planning division. When disclosing brief financial reports, it cooperates with mainly the business administration division. In addition, executives of the management not only hold a briefing session for investors, but also conduct individual interviews with shareholders, investors, analysts, and others, to share their opinions, etc. inside our company, and disclose information so that they will become familiar with the business environment of our corporate group. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

<Principle 1-4 Strategically held shares> | We plan to strategically hold shares only if this is expected to contribute to the sustainable growth and mid/long-term corporate value of our corporate group. As for the exercise of voting rights of strategically held shares, we comprehensively discuss whether this would contribute to the improvement of value of the issuing company and whether this would degrade the corporate value of our corporate group. |

【Supplementary Principle 4-11-2 Preconditions for securing the effectiveness of the board of directors】

| Important concurrent jobs of candidate and incumbent directors will be disclosed every year via documents, such as business reports. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are provided by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |