Bridge Report:(5290)Vertex the second quarter of fiscal Year Ending March 2023

President Akihide Tsuchiya | Vertex Corporation (5290) |

|

Company Information

Market | TSE Standard Market |

Industry | Glass, earthen, and stone products (manufacturing business) |

President | Akihide Tsuchiya |

HQ Address | 5-7-2 Kojimachi Chiyoda-ku Tokyo |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE Act. | Trading Unit | |

¥1,324 | 26,378,539 shares | ¥34,925 million | 15.4% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥25.00 | 1.9% | ¥163.72 | 8.1x | ¥1,095.47 | 1.2x |

* Stock price is as of closing on November 29, 2022. The number of shares issued is the number of outstanding shares as of the end of the most recent quarter, excluding treasury shares. The figures are rounded.A 3-for-1 stock split is scheduled on July 1, 2022. This stock split was taken into account, when calculating dividend yield and PER.

*ROE is the actual results for FY 3/22, and EPS and DPS are forecasts for FY 3/23.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 Act. | 29,701 | 2,516 | 2,694 | 5,934 | 239.42 | 23.33 |

March 2020 Act. | 39,014 | 3,788 | 3,959 | 2,336 | 87.34 | 20.00 |

March 2021 Act. | 37,763 | 5,290 | 5,635 | 3,759 | 142.80 | 30.00 |

March 2022 Act. | 37,514 | 6,143 | 6,434 | 4,242 | 160.90 | 26.27 |

March 2023 Est. | 39,000 | 6,200 | 6,500 | 4,350 | 163.72 | 25.00 |

*Unit: Million yen. The estimated values were provided by the company.

*A 3-for-1 stock split was executed on July 1, 2022. DPS and EPS are recalculated retroactively back to FY 3/19. The dividend for FY 3/21 includes a commemorative dividend of 10.00 yen/share (30 yen before the 3-for-1 stock split).

This Bridge Report overviews the business performance for the second quarter of fiscal Year Ending March 2023 and other information for Vertex Corporation.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of fiscal Year Ending March 2023 Earnings Results

3. Fiscal Year Ending March 2023 Earnings Forecasts

4. Progress of the Second Mid-Term Management Plan

5. Conclusions

<Reference 1: Regarding the Second Mid-Term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

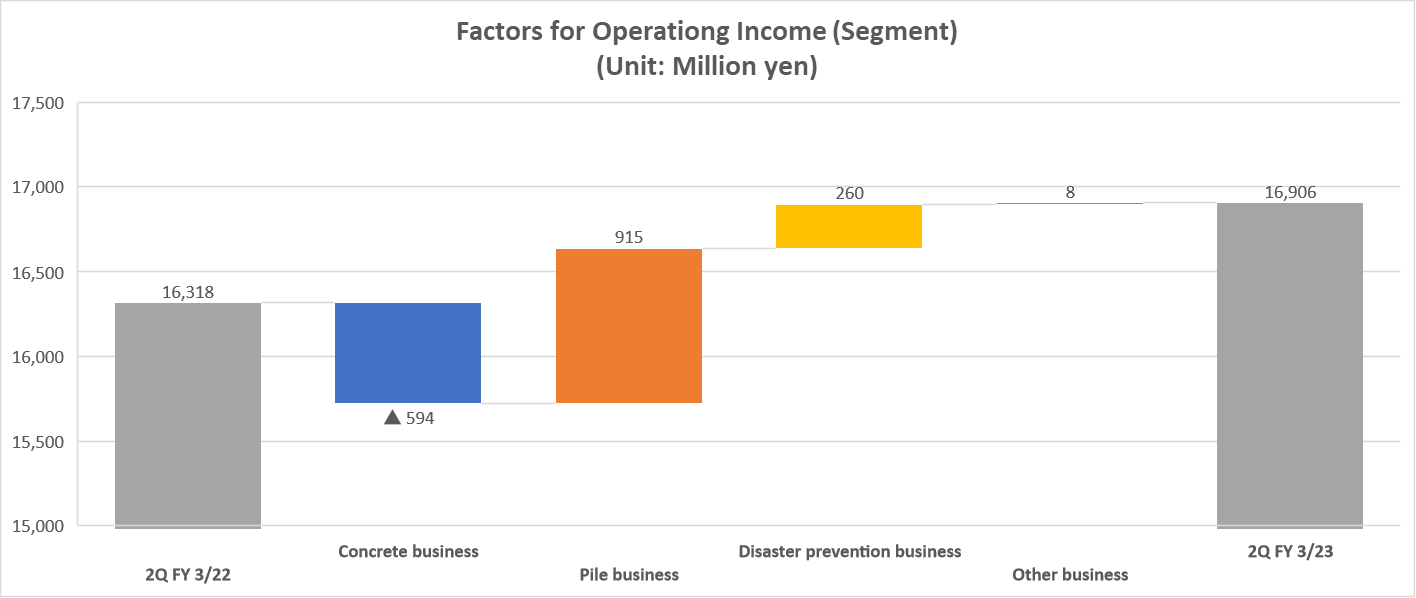

- In the 2Q of the term ending March 2023, sales increased 3.6% year on year to 16,906 million yen, and operating income declined 25.7% year on year to 1,867 million yen. Sales were generally in line with the company's initial forecast due to steady sales in the piling and disaster prevention businesses. In terms of profit, however, all kinds of profits fell short of the company's forecasts at the beginning of the period and results in the same period of the previous year due to the concentration of shipments of large value-added projects in the first half of the previous year and higher raw material prices in the concrete business.

- At the end of the first half, there were no revisions to the company's initial forecast for the term ending March 2023. Net sales are projected to increase 4.0% year on year to 39 billion yen, and operating income is expected to rise 0.9% year on year to 6.2 billion yen. Despite the difficult business environment due to rising raw material prices, the company will continue to increase selling prices and shift to high value-added products. The company maintains its initial dividend forecast of 25.00 yen/share. The dividend payout ratio is expected to be 15.3%. The company has already purchased approximately 700 million yen of its own stock during the first half, and in addition to stable ordinary dividends, it plans to consider paying special and commemorative dividends as appropriate, as well as share buybacks, with a target total return ratio of 30%.

- Although the results in the first half were less than 50% of the company's forecast for sales and all kinds of profits, the company's performance tends to be better in the second half of the fiscal year. Despite the difficult environment due to rising raw material prices, the company's performance in the second half of the year will be closely watched to see whether it can achieve its full-year forecast by increasing sales, raising selling prices, and shifting to high value-added products.

1. Company Overview

Under the policy “To build safe society”, Vertex Corporation engages in the supply, installation, etc. of products required for developing social capital and infrastructure, including concrete products. Taking advantage of the competitiveness of products, the ability to propose technologies, and plenty of intellectual property, it became one of the companies that have the highest profitability in this industry. Its forte also includes the capability of responding to things in cooperation with group companies.

【1-1 Company History】

In 2014, three companies, NIPPON ZENITH PIPE CO., LTD., HANEX CO., LTD. (former name: HANEDA HUME PIPE CO., LTD.), and HANEDA CONCRETE INDUSTRIAL CO., LTD., merged into HANEDA ZENITH CO., LTD., which was then renamed HANEDA ZENITH HOLDINGS CO., LTD.

On October 1, 2018, HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. (based in Fukui Prefecture) established Vertex Corporation through joint stock transfer (which made HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. wholly owned subsidiaries).

The companies set up a new business group.

In April 2019, HANEDA ZENITH CO., LTD., as the surviving company, absorbed HANEDA ZENITH HOLDINGS CO., LTD. (a merged company).

On April 1, 2021, Vertex Co., Ltd. was born through absorption-type merger carried out by HANEDA ZENITH CO., LTD. as the surviving company and HOKUKON CO., LTD. as the merged company, which were the core business companies affiliated with Vertex Corporation.

Vertex Co., Ltd. aims to achieve sales and profit growth by increasing its market share and boosting profitability in the mature markets of concrete and piles, and the growing market of disaster prevention through a multitude of approaches, including creation of business synergy and enhancement of business efficiency.

【1-2 Raison d'etre】

The company has put out a mission statement: “To build safe society.”

For safe life everywhere in this country that is constantly afflicted with natural disasters, for confidence about peace and safety of families and friends living far away, and for growth and enrichment of the mind of children,

We must continue our pursuit

of the one-and-only technology that continuously satisfies difficult needs, of unique ideas that no one has ever come up with, and of a nationwide network that can swiftly deal with any unexpected events.

To overcome any kind of disaster, and to create safety that has not existed yet,

What we create is not just material things, but a new form of safety by racking our brains so that all people can continue to live everyday with smiles. |

The company understands that its social purpose is to contribute to realizing safe daily life by providing a variety of products that are essential for developing social capital and infrastructure for daily lives.

【1-3 Market Environment】

The following are the points to keep in mind for understanding the company’s business environment:

◎ Accelerated National Resilience Plan

The “Basic Plan for National Resilience,” which was approved by the Cabinet in June 2014 as a countermeasure against major earthquakes, such as the Southern Hyogo Prefecture Earthquake and the Great East Japan Earthquake, and powerful typhoons that cause damage in various regions every year was revised in December 2018 (four years later), and on June 17, 2021, a “Five-year Acceleration Plan for Disaster Preparedness, Reduction and National Resilience” was announced. As a result, Japan is accelerating efforts to strengthen and enhance its national resilience.

It is stated in the annual plan for 2021 that "We will increase efforts to strengthen national resilience and install a countermeasure system combining hardware and software. From fiscal 2022 onward, we will continue to secure a necessary budget to move forward the basic plan for disaster preparedness, reduction and national resilience across Japan, and to build sturdy homes that can withstand disasters as a national hundred-year plan.” (from (1) Purpose of formulation of an annual plan on page 2).

Further, one of the goals in implementing the “Five-year Acceleration Plan” for FY 2021 to FY 2025 is to contribute to the realization of carbon neutrality by FY 2050. Contents of the plan include “the response to climate change, large-scale earthquakes, etc.,” “managing aging infrastructure,” “utilizing the latest technologies such as digital technologies, and the introduction of innovations.”

Thus, the “Basic Plan for National Resilience” is expected to continue accelerating as a core policy in relation to focal topics such as climate change and carbon neutrality.

◎Aging Social Capital

According to the Ministry of Land, Infrastructure, Transport and Tourism, Japan's social capital stock has been intensively developed during the rapid economic growth period, and there are concerns that it will quickly deteriorate hereafter. It is expected that over the next 20 years, the percentage of road bridges, tunnels, river management facilities, sewage systems, harbors, etc. constructed over 50 years ago will rise at an accelerated rate.

(Percentage of main social capital over 50 years since construction)

| March 2018 | March 2023 | March 2033 |

Road bridges (approx. 730,000 bridges) | Approx. 25% | Approx. 39% | Approx. 63% |

Tunnels (approx. 11,000 tunnels) | Approx. 20% | Approx. 27% | Approx. 42% |

River management facilities (approx. 10,000 facilities including sluices) | Approx. 32% | Approx. 42% | Approx. 62% |

Sewage pipes (total length: approx. 470,000 km) | Approx. 4% | Approx. 8% | Approx. 21% |

Port quays (approx. 5,000 facilities) | Approx. 17% | Approx. 32% | Approx. 58% |

Source: “Infrastructure Maintenance Information” provided by the Ministry of Land, Infrastructure and Transport

In 2035, about 58% of 520,000 fire cisterns, and in 2027, roughly 40% of 50,000 km of agricultural drainage channels will have been constructed over 50 years ago.

It is therefore necessary for the government to strategically maintain, manage and upgrade aging infrastructure. In the “Basic Plan for National Resilience,” the city plans to implement countermeasures against urban erosion 100% by 2040, including rainwater drainage facilities to prevent and reduce flood damage in sewage systems, and countermeasures against sediment disasters in sediment control systems 100% by 2045.

◎Aging of construction workers and shortage of manpowe expansion of precast construction methods

The number of workers in the construction industry is declining. In addition, the labor shortage due to the declining birthrate and aging population has become a major issue in the construction industry. According to the data collected by the Ministry of Land, Infrastructure, Transport and Tourism, it is estimated that approximately one-third of workers in the construction industry are aged 55 and older while approximately 10% are those aged 29 and younger, resulting in a shortage of at least 500,000 skilled workers in 2025.

Various efforts have been made to resolve this issue including the use of the “precast construction” method. “Precast concrete” parts such as gutters, pipes, manholes, piles, bridge girders and parts of buildings are manufactured off-site and delivered to the construction site for assembly and installation.

In contrast, the current mainstream construction method is the “on-site construction” method, in which concrete products are manufactured on-site by pouring concrete into wooden or iron molds, assembled at the site, and then hardened.

If you just consider the initial costs of “on-site construction,” it has an economic advantage compared with “precast construction”; however, because the latter is superior in terms of design costs, shorter construction periods, lack of necessity to arrange traffic regulations, lack of related economic losses, as well as product quality, it is expected to gain ground moving forward.

【1-4 Business Details】

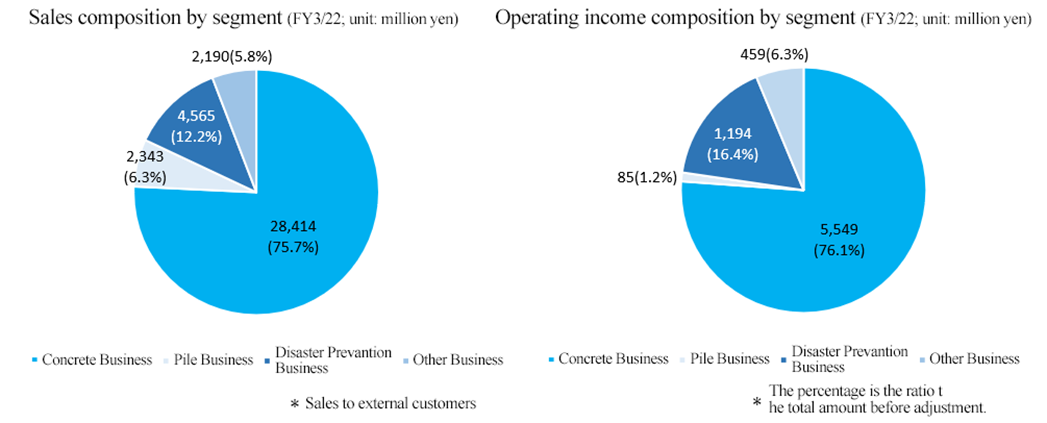

The company has four reporting segments, which are Concrete Business, Pile Business, Disaster Prevention Business, and Other Business.

The following is a table showing the group companies operating each business segment:

Business | Group Companies |

Concrete Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) HOKUKON PRODUCT, K.K. (Fukui Pref.) Hokkan Concrete Kogyo Co., Ltd. (Gunma Pref.) Universal Business Planning Co., Ltd. (Fukui Pref.) Tohoku Haneda Concrete K.K. (Yamagata Pref.) Kyushu Vertex Co., Ltd. (Fukuoka Pref.) |

Pile Business | HOKUKON MATERIAL CO., LTD. (Fukui Pref.) |

Disaster Prevention Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) |

Other Business | WICERA Co., Ltd. (Gifu Pref.) M.T Giken Co., Ltd. (Osaka) iB Solution Corporation (Fukui Pref.) Hanex Road Co., Ltd. (Tokyo) PROFLEX CO., LTD. (Saitama Prefecture) NX inc. (Tokyo; equity-method affiliate) |

【Concrete Business】

This business manufactures and sells secondary concrete products, sells other related products, and undertakes installation of products in the segments of anti-inundation & sewage system, road, maintenance, railroad, and housing & development.

Segment | Overview/main products and services |

Anti-inundation/sewage system | This segment offers the best proposal with a rich lineup of products developed reflecting the needs and the one-and-only technology in order to help adopt anti-disaster and disaster mitigation measures, such as measures against flood damage and renovation for anti-earthquake sewage facilities.

(Main products/services) ◎ Precast flood control basin (underground water tank) This facility prevents rainwater from flowing into rivers. In an underground precast flood control basin, a facility to prevent rainwater outflow is built underground while the space above the ground can be used for multiple purposes, such as including parks, athletic fields, and parking lots.

◎ Box culvert A box culvert is a box-shaped concrete structure that is installed primarily underground and used for holding waterways and communication lines. With a variety of uses, box culverts are utilized in myriad infrastructure projects, such as underpasses and reservoirs.

◎ Prefabricated round manhole As a pioneer of prefabricated manholes, the company offers an extensive lineup of manholes ranging from small ones (with the inner diameter of 300 mm) to extra-large ones (with the inner diameter of 2200 mm) in order to satisfy multifarious needs for manhole installation works.

|

Road | Possessing a number of products that help not only with development of road infrastructure, but in protecting human lives as well, the company contributes to building safe roads.

(Main products/services) ◎ Precast guard fence (PGF) The precast guard fence is a rigid protective fence made of precast concrete for preventing vehicles from swerving off the road while ensuring the safety of the drivers and passengers. It is used at such places as roadsides, median strips, and concrete barrier parapets. ◎ Span the Arch It is a culvert that can support ultra-large spans and consists of multiple components that are assembled on site in the shape of an arch for building grade separated crossings (underpasses) between tunnels and roads. It is highly effective against earthquakes, soft ground, and eccentric load.

|

Maintenance | As measures against deterioration of infrastructure, this segment proposes optimal products and methods while taking into account life-cycle cost. It contributes to prolonging the life of infrastructure that is the basis supporting enriched daily life of the citizens and social economy.

(Main products/services) ◎ Ductal panel The ductal panel is a high-durability, thin-wall panel installed underground, which is made of ultra-high strength, fiber-reinforced concrete that is highly durable in a harsh environment in which damage from salt, frost, and wear occurs. It can prolong the life of constructions and cut down on the cost of maintenance and management.

◎ Maintenance of fire cisterns This service offers methods of repair and reinforcement of deteriorated fire cisterns against leakage of water caused by earthquakes and secondary disaster resulting from collapse of roads.

|

Railroad | This segment offers safety via the lineup of products developed through vigorous pursuit of quality materials, such as ultra-high strength, fiber-reinforced concrete and special mortar.

(Main products/services) ◎ Platform screen door slab While the number of train stations that have installed facilities for preventing passengers from falling from the platforms is rising, some stations are encountering difficulty in installing such facilities because their existing floor slabs cannot bear the load of movable platform gates (platform screen doors). This product not only is lighter than the conventional products, but can be installed easily as well.

|

Housing/development | This segment offers an extended lineup of products resistant to massive earthquakes in order to develop earthquake- and disaster-resilient cities, including earthquake-proof water storage tanks, which are the segment’s top-selling product brand, and unique portable toilets for use in the event of disaster.

(Main products/services) ◎ HC fire cistern/HC earthquake-proof water storage tank The main products of this segment are precast fire cisterns and earthquake-proof water storage tanks. The fact that the fire cisterns and water storage tanks survived the Great Hanshin earthquake has proven their high reliability and safety. The fire cisterns and water tanks have been installed in great number.

|

【Pile Business】

The company manufactures and sells centrifugal prestressed concrete piles, and undertakes piling works.

【Disaster Prevention Business】

The company manufactures and sells high-energy-absorption fences for preventing rocks from falling, and products for preventing such disaster as mudflows, avalanches, and debris flows, sells other related products, and undertakes installation works.

◎ Loop fence (high-energy-absorption fence for preventing rocks from falling) Displacement-control fence for preventing rocks from falling down, with displacement being small when the net catches falling rocks while the energy absorption capacity is enormous

| ◎ MJ net (ultra-high-energy-absorption fence for preventing rocks from falling) One of the world’s largest fences for preventing rocks from falling down that can withstand a falling rock energy of up to 3,000 kJ thanks to the combination of special wiring and props

|

(Taken from the reference material of the company)

【Other Business】

The company engages in various business operations, including to manufacture and sell new ceramic products, rent equipment and sell materials, sell radio frequency identifiers (RFID; non-contact IC tags), conduct investigation and tests of concrete, develop and sell systems, and rent real estate.

【1-5 Characteristics and Strength】

(1) Product superiority and capability to make technological proposals

The company has developed its unique business model that is less susceptible to price competition by being involved in multiple project phases from designing to product promotion to technological proposal.

(Taken from the company’s website)

What underpin the strength are the capability of collecting information, development and tests, and the power of human resources.

① Capability of collecting information

The company precisely understands the needs of manufacturers and suppliers by not only selling products but also collecting information at all times from design consultants in charge of designing and the final clients, which are government and public agencies. It also is involved proactively with product promotion and technological proposal.

② Development and tests

Based on the information obtained and needs understood, the company develops new products internally and tests them in order to develop new products ahead of other companies and come up with ways to use them. In addition, collaboration with universities and other organizations allows efficient development and tests.

The fact that HANEDA ZENITH CO., LTD. and HOKUKON CO., LTD., which are the predecessor companies of Vertex Co., Ltd., gave their focus on technology seemingly contributes to the competitive superiority of the company that takes pride in its technologies.

③ Power of human resources

Talented staff full of curiosity, such as sales staff members with outstanding capabilities to make proposal that enable them to accurately grasp the market needs, and technical staff members who make it possible to develop and propose new products in view of needs and information, are in charge of information collection, development, and tests.

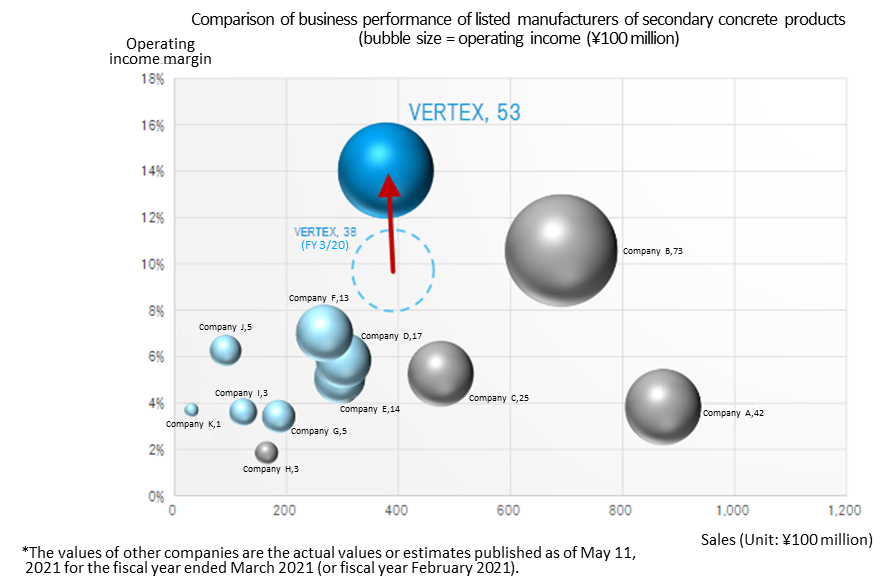

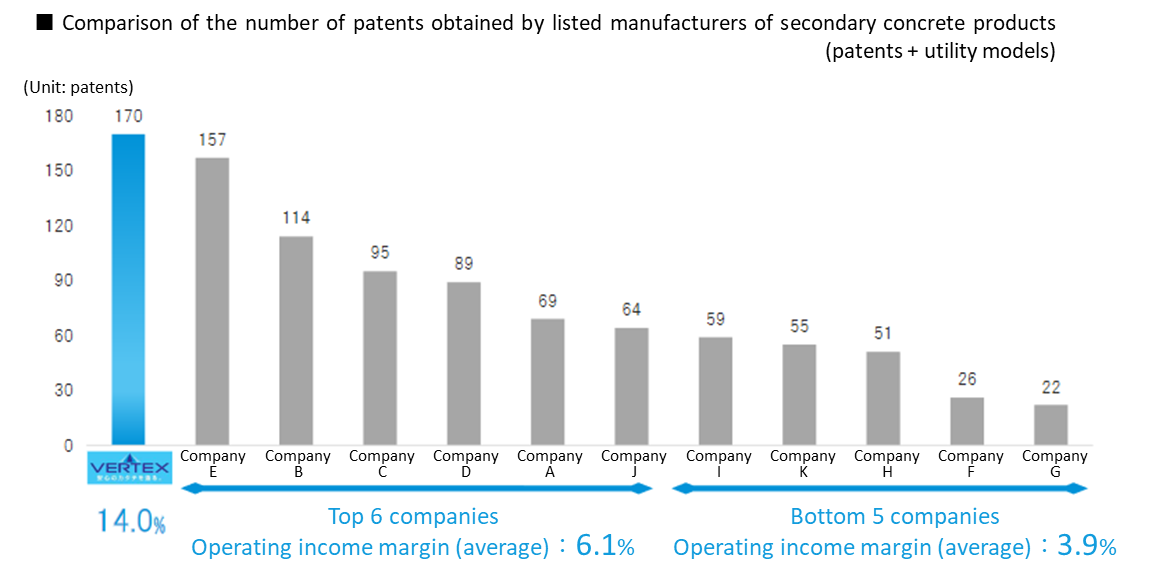

◎High profitability, and plentiful intellectual property as the source thereof

The company has achieved high profitability based on the aforementioned business model realized taking advantage of its exceptional technological capabilities.

(Taken from the reference material of the company; the light-blue bubbles indicate the trade in the company’s Concrete Business while the gray bubbles refer to the trade in its Pile Business.)

The intellectual property generated from proactive investment in research and development is the source of the company’s large income.

(Taken from the reference material of the company)

◎ Multifarious industry-leading products that have taken large share

The company carries out research and technological development and launches new products into the markets ahead of any other companies in order to create new markets. It improves and upgrades the products after the launch by seeking customers’ opinions as appropriate. While equivalent items launched by other companies are booming the markets, the company is exerting superiority as a leading manufacturer in terms of cost and quality, securing its position as the top brand.

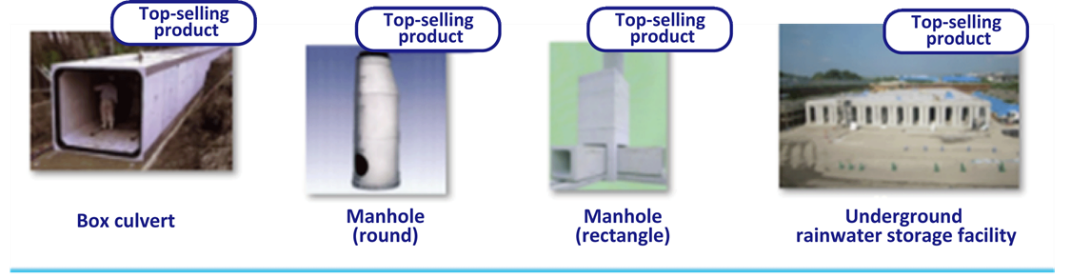

These product development processes enable the company to have the following best-selling products:

Anti-inundation segment/ Sewage system segment |

|

Housing/ development segment |

|

◎Group’s extensive response capabilities

With Vertex Co., Ltd. and each of its group companies are in charge of a variety of business operations, the company is capable of taking in various demands of myriad parties concerned, ranging from manufacturers and suppliers to sellers. It will strive to further exert and strengthen the corporate group synergy.

【1-6 Dividend Policy and Shareholder Return】

In addition to stable payment of ordinary dividends, the company intends to pay shareholder return through acquisition of treasury shares with an expected total payout ratio being 30%, as well as to consider paying special and commemorative dividends as appropriate.

The company purchased treasury shares worth 549 million yen during the term ended March 2022 and treasury shares worth 699 million yen during the term ending March 2023.

【1-7 Analysis of Return on Equity】

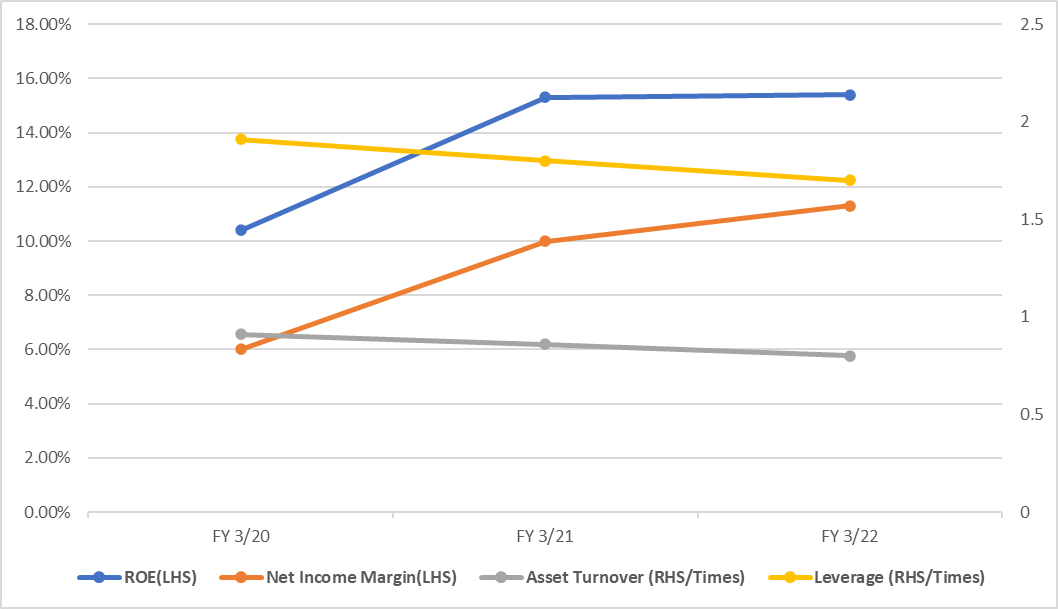

| FY 3/20 | FY 3/21 | FY 3/22 |

ROE (%) | 10.4 | 15.3 | 15.4 |

Net income margin (%) | 5.99 | 9.95 | 11.31 |

Total asset turnover (times) | 0.91 | 0.86 | 0.80 |

Leverage (times) | 1.91 | 1.80 | 1.70 |

In the term ended March 2022, despite the drop in total asset turnover ratio and leverage, ROE increased 0.1 points year on year because of the increased margin.

The medium-term business plan is aimed at maintaining a return on equity (ROE) of 10% or over in the fiscal year ending March 2024.

*Prepared by Investment Bridge Inc. based on disclosed material.

2. The second quarter of fiscal Year Ending March 2023 Earnings Results

【(1) Overview of the consolidated results】

| 2Q of FY 3/22 | Ratio to sales | 2Q of FY 3/23 | Ratio to sales | YoY | The estimate at the beginning of FY | Compared to the estimate |

Sales | 16,318 | 100.0% | 16,906 | 100.0% | +3.6% | 16,400 | +3.1% |

Gross profit | 5,472 | 33.5% | 4,943 | 29.2% | -9.7% | - | - |

SG&A | 2,958 | 18.1% | 3,075 | 18.2% | +4.0% | - | - |

Operating Income | 2,513 | 15.4% | 1,867 | 11.0% | -25.7% | 2,050 | -8.9% |

Ordinary Income | 2,644 | 16.2% | 1,986 | 11.7% | -24.9% | 2,150 | -7.6% |

Net Income | 1,768 | 10.8% | 1,294 | 7.7% | -26.8% | 1,450 | -10.8% |

*Unit: Million yen.

*The figures include those calculated by Investment Bridge Co., Ltd. as reference values, and may differ from actual values (the same applies hereinafter).

*Prepared by Investment Bridge Inc. based on disclosed material.

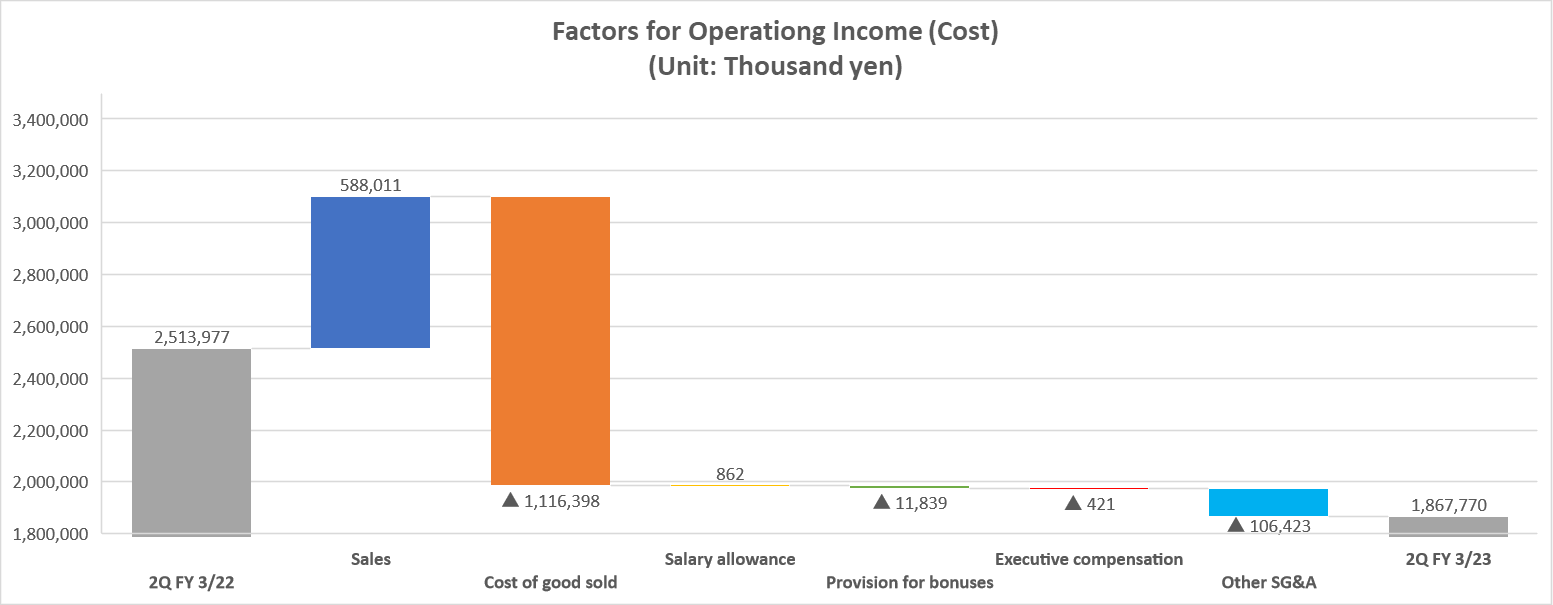

*▲ in expense items indicates an increase in expenses.

Sales up 3.6% year on year, operating income down 25.7% year on year

In the second quarter of FY 3/23, sales increased 3.6% year on year to 19,606 million yen. In terms of sales, the concrete business posted a year-on-year decline, while the pile business and the disaster prevention business increased year on year. In addition, as the pile business and the disaster prevention business performed well, sales were generally in line with the company's plan at the beginning of the period.

Operating income decreased 25.7% year on year to 1,867 million yen. In terms of profit, the concrete business was affected by the concentration of shipments of large value-added properties in the first half of the previous year and higher raw material prices, causing all kinds of profits to fall short of the company's forecasts made at the beginning of the fiscal year and results in the same period of the previous year. Raw material prices rose for all items, including cement, reinforcing steel, and aggregates, which are the main raw materials. Gross profit margin declined 4.3 points year on year to 29.2%. The ratio of high value-added products, such as rainwater harvesting tanks, S-HOLE, SJ-BOX, and special products (track slabs), for which the company is currently strengthening sales, reached 69%, up 4 points from 65% in Q1 of FY 3/22. The ratio of SG&A expenses to sales rose 0.1 points year on year, and the ratio of operating income to sales fell 4.4 points year on year to 11.0%. Other significant non-operating income included 43 million yen in compensation income recorded under non-operating income, and 56 million yen in gain on partial termination of retirement benefit plan recorded under extraordinary income.

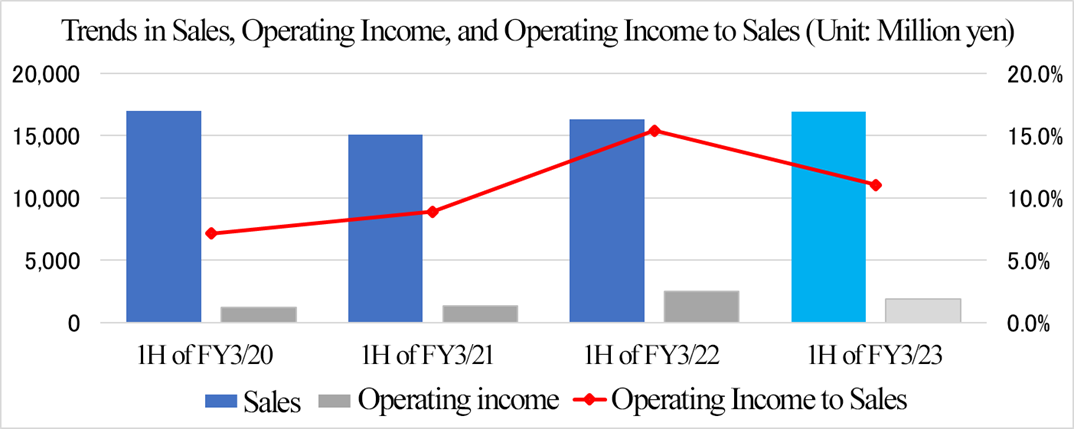

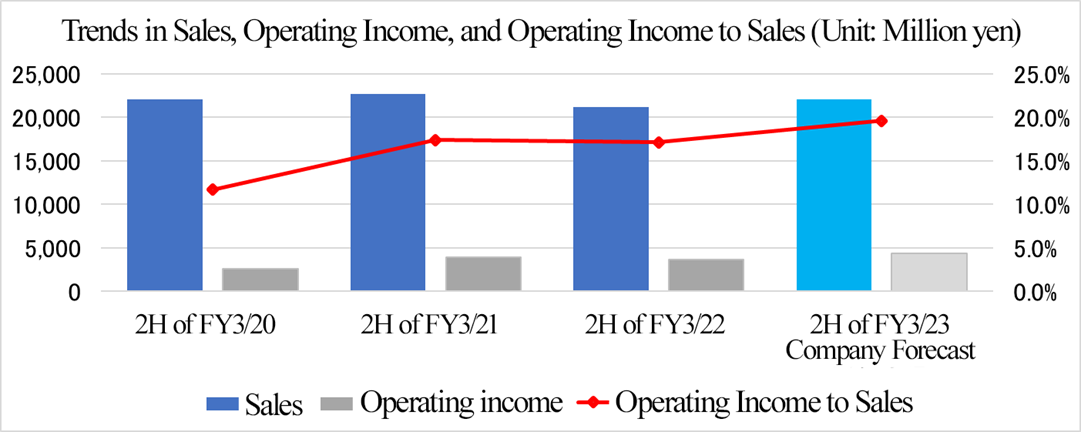

Performance in the first half of the year

In the first half of FY 3/23, sales increased and operating income declined year on year, and the ratio of operating income to sales declined, but compared to the first half of FY 3/20 and the first half of FY 3/21, sales, operating income, and the ratio of operating income to sales were all at high levels.

【(2)Trend of each segment】

(1) Revenue

| 1H of FY 3/22 | Ratio to sales | 1H of FY 3/23 | Ratio to sales | YoY |

Concrete business | 12,370 | 75.8% | 11,776 | 69.7% | -4.8% |

Pile business | 1,218 | 7.5% | 2,133 | 12.6% | +75.0% |

Disaster prevention business | 1,730 | 10.6% | 1,990 | 11.8% | +15.0% |

Other business | 999 | 6.1% | 1,007 | 6.0% | +0.8% |

Total sales | 16,318 | 100.0% | 16,906 | 100.0% | +3.6% |

Concrete business | 2,491 | 20.1% | 1,768 | 15.0% | -29.0% |

Pile business | 60 | 4.9% | 202 | 9.5% | +237.0% |

Disaster prevention business | 375 | 21.7% | 464 | 23.3% | +23.6% |

Other business | 195 | 19.5% | 113 | 11.3% | -41.7% |

Adjustment amount | -608 | - | -682 | - | - |

Total operating income | 2,513 | 15.4% | 1,867 | 11.0% | -25.7% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

*Prepared by Investment Bridge Inc. based on disclosed material.

◎ Concrete Business (4.8% YoY decrease in sales, and 29.0% YoY decrease in profit)

Increasing productivity by improving work processes to cope with chronic labor shortage is a major theme in the construction industry, and the promotion of and demand for precast concrete, which is expected to contribute to labor saving, safety improvement, shorter construction periods, and work style reform at construction sites, have been increasing year by year. In addition, countermeasures against flooding, in which the company has a competitive edge, have been positioned as an urgent issue in government policies for disaster prevention and disaster mitigation, and national resilience. Against this backdrop, the company improved its product mix in line with its strategic shift to high value-added products, and reviewed and revised its handling method and unit prices of mainly general-purpose and purchased products. However, both sales and profit declined year on year due to the concentration of shipments of large value-added properties in the first half of the previous year and higher raw material prices. In addition, the ratio of operating income to sales declined 5.1 points year on year to 15.0%.

◎ Pile Business (Sales increased 75.0% year on year and profit increased 237.0% year on year)

Compared to the first half of the previous year, when private-sector demand was sluggish due to the COVID-19 pandemic, demand increased due to a recovery in the private sector's motivation for capital investment, and the company promoted streamlining by narrowing down its sales regions and projects, as well as order-taking activities specialized in its strengths, and increased sales prices and reduced production costs while closely monitoring trends in raw material prices. The company's various measures were successful, resulting in a significant year-on-year increase in both sales and profit. In addition, the ratio of operating income to sales rose 4.6 points year on year to 9.5%.

◎ Disaster Prevention Business (15.0% YoY increase in sales, and 23.6% YoY increase in profit)

The government is promoting the "Five-Year Road Program for Disaster Prevention, Mitigation and National Resilience" as a countermeasure against increasingly severe wind and flood damage. While benefiting from this tailwind, the company achieved a significant YoY increase in both sales and profit due to steady growth in the promotion of disaster prevention/mitigation and national resilience measures, strengthened activities in the medium energy zone market, and steady progress in shipments of rockfall protection fences and collapsed sediment protection fences for the private sector. In addition, the ratio of operating income to sales rose 1.6 points year on year to 23.3%.

◎ Others (Sales increased 0.8% year on year, and profit decreased 41.7% year on year)

Initial investments in consumables and other items in the leasing business had a negative impact, resulting in a significant decrease in profit despite higher sales year on year. The ratio of operating income to sales fell 8.2 points year on year to 11.3%.

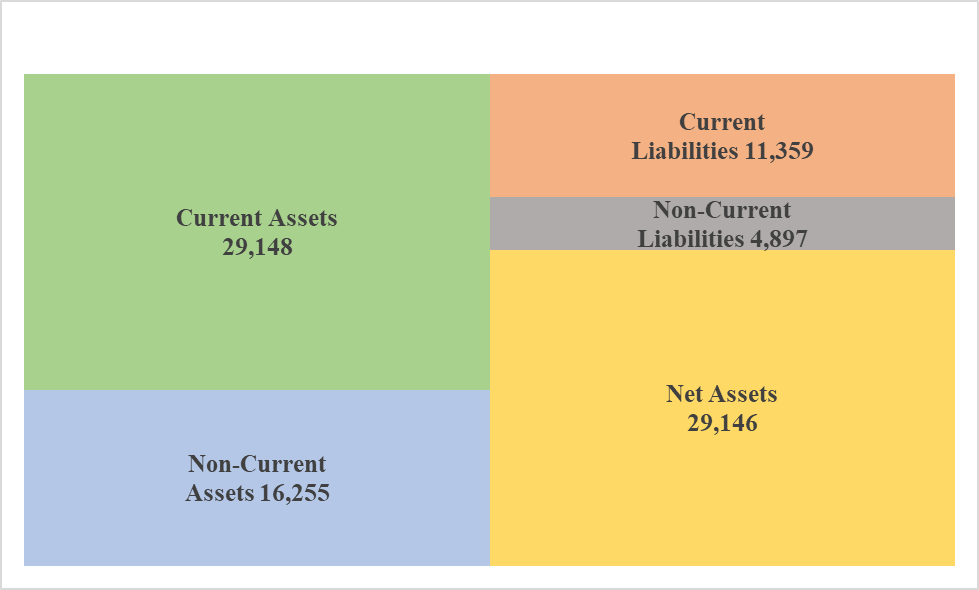

【(3)Financial position and cash flows】

Main Balance Sheet

| End of Mar. 2022 | End of Sep. 2022 |

| End of Mar. 2022 | End of Sep. 2022 |

Cash and Deposits | 12,905 | 13,446 | Trade Payables | 6,476 | 5,902 |

Trade Receivables | 12,689 | 9,525 | ST Interest-Bearing Debts | 3,205 | 3,142 |

Inventories | 4,769 | 5,797 | Current Liabilities | 13,171 | 11,359 |

Current Assets | 31,143 | 29,148 | LT Interest-Bearing Debts | 836 | 848 |

Tangible Assets | 12,396 | 12,394 | Noncurrent Liabilities | 5,052 | 4,897 |

Intangible Assets | 360 | 359 | Net Assets | 29,196 | 29,146 |

Investment and Other Assets | 3,520 | 3,501 | Total Liabilities and Net Assets | 47,419 | 45,404 |

Total Assets | 16,276 | 16,255 | Total interest-bearing debt | 4,042 | 3,991 |

*Unit: Million yen. Trade receivables include electronically recorded ones, while trade payables include electronically recorded ones.

*Prepared by Investment Bridge Inc. based on disclosed material.

Total assets at the end of September 2022 were 45,404 million yen, down 2,015 million yen from the end of the previous period. On the assets side, cash and deposits and inventories were the main contributors to the increase, while accounts receivable were the main contributors to the decrease. On the liabilities and net assets side, the main factors of increase were long-term accounts payable and allowance for stock benefits, while the main factors of decrease were accounts payable, accrued consumption tax, and liabilities for retirement benefits. The equity ratio at the end of September 2022 was 63.6%, up 2.3 points from the end of the previous period.

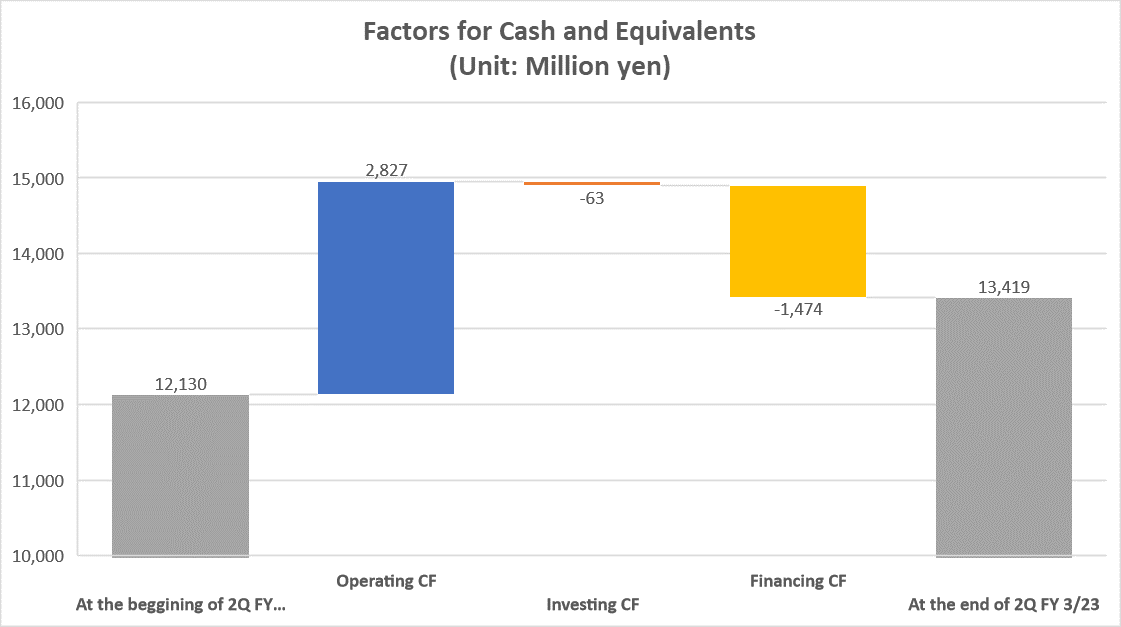

Cash Flow

| 1H of FY 3/22 | 1H of FY 3/23 | Increase/decrease | YoY |

Operating CF | 2,173 | 2,827 | 653 | +30.0% |

Investing CF | -863 | -63 | 799 | - |

Free CF | 1,310 | 2,763 | 1,452 | +110.9% |

Financing CF | -1,636 | -1,474 | 162 | - |

Cash and equivalents | 10,567 | 13,419 | 2,851 | +27.0% |

*Unit: Million yen.

*Prepared by Investment Bridge Inc. based on disclosed material.

From a cash flow perspective, the cash inflow from operating activities increased due to a smaller decrease in accounts payable trade and a smaller increase in inventories. In addition, a decrease in time deposits and a decrease in expenditures for the purchase of property, plant, and equipment contributed to a narrowing of the cash outflow from investing activities, resulting in an increase in free cash flow. In addition, a decrease in repayment of long-term debt contributed to a narrowing of the cash outflow from financing activities. As a result, the cash position at the end of the first half was up 27.0% year on year.

【(4) Major Investments (million yen)】

Acquisition of tangible fixed assets | 876 | Plant test rooms, office renovation, machinery, and formwork at Vertex, construction of manufacturing building at Kyushu Vertex, machinery at HOKUKON MATERIAL and WICERA, etc.. |

Acquisition of intangible fixed assets | 2 | Development of software for internal use at Vertex |

【(5)Topics】

◎To Establish a Second-tier Subsidiary in Vietnam

In May 2022, the company announced its plan to establish a subsidiary (a second-tier subsidiary of Vertex Corporation) in the Socialist Republic of Viet Nam to achieve further growth, for the purpose of strengthening its design and development operations, as well as promoting new market development.

The establishment is scheduled on October 1, 2022.

◎To Implement a Stock Split

The company decided to execute a 3-for-1 stock split on July 1, 2022, to improve the liquidity of its shares and expand its shareholder base, by lowering the amount per unit of investment.

◎To Acquire Treasury Shares

The company purchased treasury shares, as resolved by the Board of Directors on May 12, 2022, in order to enhance shareholder returns, improve capital efficiency, and implement a flexible capital policy in response to changes in the business environment. The total number of shares purchased was 588,700 at a total cost of 699,950,700 yen.

◎Adoption of Stock-based Benefit Trust for Employees

In May 2022, the company announced its intention to adopt the Stock-based Benefit Trust for Employees as an incentive plan for employees of the company and its group, and entered into a trust agreement with the trustee, Resona Bank, Limited., on May 30.

The purpose of the buyback was to boost morale and motivate employees to contribute to improving the company's performance and increasing its corporate value over the medium term. In setting up the plan, 134,000 shares of the company's stock (approximately 400 million yen) were acquired on May 30.

◎Acquisition of Shares of PROFLEX CO., LTD. (Making it a Subsidiary)

The company made PROFLEX CO., LTD. a wholly-owned subsidiary on October 4, 2022. Since its establishment in 1970, PROFLEX CO., LTD. has consistently specialized in the maintenance needs of hydraulic hoses used in construction machinery and industrial equipment, and has planned, designed, manufactured, and sold hydraulic hoses and fittings. The company is particularly strong in its lineup of overseas standard products and special products, and has the largest product lineup in the industry due to its continuous accumulation of in-house designed products since its establishment. PROFLEX CO., LTD. is the domestic distributor for Parker Hannifin Corporation, the No. 1 global manufacturer of hydraulic hoses, and sells its products. By incorporating PROFLEX's expertise and technology in hydraulic components and effectively utilizing the Group's customer base and other assets, the company aims to strengthen its ability to meet maintenance needs in both the public and private sectors, thereby enhancing its corporate value on a sustainable basis.

Exhibition

The Vertex Group exhibited at Sewerage Exhibition '22 Tokyo (August 17-20), WICERA Co., Ltd. exhibited at Techno Frontier 2022 (July 20-22), and iB Solution Corporation exhibited at Interop Tokyo 2022 (June 15-17).

Production of Offering Programs

The company produced special programs aimed at giving stakeholders a deeper understanding of the company's business.

3. Fiscal Year Ending March 2023 Earnings Forecasts

【3-1 Earnings Forecasts】

| FY 3/22 | Ratio to sales | FY 3/23 Est. | Ratio to sales | YoY |

Sales | 37,514 | 100.0% | 39,000 | 100.0% | +4.0% |

Operating Income | 6,143 | 16.4% | 6,200 | 15.9% | +0.9% |

Ordinary Income | 6,434 | 17.2% | 6,500 | 16.7% | +1.0% |

Net Income | 4,242 | 11.3% | 4,350 | 11.2% | +2.5% |

*Unit: Million yen.

Sales are projected to increase 4.0% year on year, and operating income 0.9% year on year.

At the end of the first half, the company's forecast for FY 3/23 remains unchanged from those at the beginning of the period, calling for sales increasing 4.0% year on year to 39 billion yen and operating income rising 0.9% year on year to 6.2 billion yen.

Despite the difficult business environment due to soaring material prices and rising logistics costs, the company aims to increase sales and profit by raising unit sales prices, promoting a shift to high value-added products, and cutting costs. The ratio of operating income to sales is expected to decrease 0.5 points year on year to 15.9%.

The company maintains its initial dividend forecast of 25.00 yen/share. The dividend payout ratio is expected to be 15.3%. The company has already repurchased approximately 700 million yen of its own stock during the first half, and in addition to stable ordinary dividends, it plans to consider paying special and commemorative dividends as appropriate, as well as share buybacks, with a target total return ratio of 30%.

(2)Trend in each segment

| FY 3/22 | Composition ratio | FY 3/23 Est. | Composition ratio | YoY |

Concrete business | 28,414 | 75.7% | 28,910 | 74.1% | +1.7% |

Pile business | 2,343 | 6.2% | 2,910 | 7.5% | +24.2% |

Disaster prevention business | 4,565 | 12.2% | 4,780 | 12.3% | +4.7% |

Other business | 2,190 | 5.8% | 2,400 | 6.2% | +9.5% |

Adjustment amount | 37,514 | 100.0% | 39,000 | 100.0% | +4.0% |

Total sales | 5,549 | 19.5% | 5,550 | 19.2% | +0.0% |

Concrete business | 85 | 3.6% | 130 | 4.5% | +52.9% |

Pile business | 1,194 | 26.2% | 1,240 | 25.9% | +3.8% |

Disaster prevention business | 459 | 21.0% | 480 | 20.0% | +4.6% |

Other business | -1,144 | - | -1,200 | - | - |

Adjustment amount | 6,143 | 16.4% | 6,200 | 15.9% | +0.9% |

* Unit: 100 million yen. The composition ratio of operating income means the ratio of operating income to sales.

The company expects to increase sales and profits in all segments year on year.

(3) Progress rate and second half performance trends

| 1H of FY3/23 Act. | FY3/23 Plan. | Progress Rate |

Sales | 16,906 | 39,000 | 43.4% |

Operating Income | 1,867 | 6,200 | 30.1% |

Ordinary Income | 1,986 | 6,500 | 30.6% |

Net Income | 1,294 | 4,350 | 29.7% |

* Unit: 100 million yen.

| Sales | Operating Income | ||||

| 1H of FY3/22 Act. | FY3/23 Plan. | Progress Rate | 1H of FY3/23 Act. | FY3/23 Plan. | Progress Rate |

Concrete business | 11,776 | 28,910 | 40.7% | 1,768 | 5,55 | 31.9% |

Pile business | 2,133 | 2,910 | 73.3% | 202 | 130 | 156.1% |

Disaster prevention business | 1,990 | 4,780 | 41.6% | 464 | 1,240 | 37.5% |

Other business | 1,007 | 2,400 | 42.0% | 113 | 480 | 23.7% |

Adjustment amount | - | - | - | -682 | -1,200 | - |

Total | 16,906 | 39,000 | 43.4% | 1,867 | 6,200 | 30.1% |

* Unit: 100 million yen.

Although the results in the first half are less than 50% of the company's full-year forecast for both sales and profit, the company's performance tends to be better in the second half of the year in most years. Despite the difficult environment due to rising raw material prices, the company aims to achieve the company's plan by increasing selling prices and shifting to high-value-added products. The progress rate is high in the pile business.

4. Progress of the Second Mid-term Management Plan

The progress of the second medium-term management plan (please see Reference 1 below for more details) in each business is as follows.

(1) Management indicator

The company’s target for the final term of the plan (the term ending March 2024) is to achieve 6.1 billion yen in operating income and maintain 10.0% or higher in ROE, however, they achieved the planned values in the term ended March 2022, the first term of the plan, which was earlier than planned.

| FY 3/22 Act. | FY 3/22 Plan. | FY 3/23 Plan. | FY 3/24 Plan. |

Sales | 375.1 | 390.0 | 400.0 | 410.0 |

Operating Income | 61.4 | 55.0 | 58.0 | 61.0 |

Operating Profit Margin | 16.4% | 14.1% | 14.5% | 14.9% |

Ordinary Income | 64.3 | 57.0 | 60.0 | 63.0 |

Net Income | 42.4 | 38.0 | 40.0 | 42.0 |

ROE | 15.4% |

|

| Over 10.0% |

*Unit: Hundred million yen.

(2) Progress in the basic policies

The company upholds the following basic policies.

(1) Promote organic growth by pursuing our core business | We aim to maximize the future cash flow by enhancing the ability to generate operating cash flow by leveraging organic growth of our core business. |

(2) Develop growing businesses and obtain new revenue opportunities | We strengthen our initiatives to develop growing businesses and acquire new revenue opportunities (develop new areas, new categories, new products, and new business) for our further growth. |

(3) Establish a business management base that allows sustainable growth | Continuing from the previous mid-term management plan, we aim to improve sustainable corporate value by establishing a management base through enforcement of group governance and the establishment of a risk management system and to implement ESG initiatives. |

The progress of each policy is as described below.

① Promote organic growth by pursuing our core business

◎ Promote the improvement of the product mix and the raising of unit selling prices of products

◆ Construction of a precast reservoir in the Higashi-Iwatsuki area flood control project. In order to reduce flood damage in the Higashi-Iwatsuki area, rainwater from the rainwater trunk line located on the south side of Higashi-Iwatsuki Park is temporarily stored in the reservoir during heavy rains. Extension: The scale will be 17,900 m3 (44 m x 66 m internal air space, 7 m internal height).

◆ 2020 - Construction of Loop Fence D type as pavement repair work in the jurisdiction of Fukushima Administration Office, Tohoku Expressway. The fence was installed as a countermeasure against possible mudslides from streams and rivers located behind the Kunimi service area. Extension: a scale of 474 m (H-3.0 m,…, L-207 m H-2.0 m,…, L-267 m)

◎ Capital Investment

◆ As a manufacturing base for disaster prevention products in the Kyushu area and as part of BCP measures, a manufacturing building was constructed at the Nagasaki Plant of Kyushu Vertex Co., Ltd. The building will be completed on November 1, 2022, with an area of 6835.3 m2 (building are 1312.8 m2, other are 5522.5 m2). The main equipment will be one hoist-type bridge crane and two indoor overhead cranes.

◎Product Development

◆ Double fence development experiments were conducted in the disaster prevention business. This is an unprecedented type of protective fence with two types of fences of different structures on the front and back sides of the support pillars. The double net faces ensure smooth load transfer in the event of falling rock impact and improved performance in capturing falling rocks.

② Develop growing businesses and obtain new revenue opportunities

◎ Making PROFLEX CO., LTD. a Wholly Owned Subsidiary

◆ On October 4, 2022, the company made PROFLEX CO., LTD. a wholly-owned subsidiary. The company aims to sustainably enhance its corporate value by effectively utilizing the customer base and other assets of the company group.

③ Establish a business management base that allows sustainable growth

The following establishments and enhancements were carried out.

* Redevelopment of programs for developing and recruiting human resources

Vertex Academy, which will serve as the central educational and training institution for the Vertex Group, was established and began operations. In addition, the Human Resources Development Group was established and the educational program was reorganized starting April 2022.

For all of the executives and employees of the group (about 1,100 people), the company provided the Level-specific Training that develops abilities and qualification required by the responsibilities of each rank and fosters awareness for new hires, young employees, middle-level employees, newly appointed managers, and newly appointed senior management staff, the Academic Training that develops abilities and fosters awareness required for generalists, based on the recruitment from all of the companies in the group, and also the Department-specific Training intended to provide opportunities to learn professional knowledge and develop abilities, by selecting participants from each department, on top of the All Employees Training intended to promote knowledge and awareness in compliance and harassments, etc.

In the academic training program, participants were divided into two groups, and basic training was held on July 7, 8, 11 and 12, targeting all employees who wished to participate, and although participation was not mandatory, approximately 130 people came from all over the country. The company will continue its efforts to strengthen human capital at all levels.

* Development of information systems and ICT infrastructure, and promotion of DX

Vertex is preparing a new core system, whose operation is scheduled to begin in August 2022.

Operation of the HR and employment systems have been started since February 2022.

In Vertex Construction, the operation of the new mission-critical system has been started since April 2021.

* Establishment of systems for group governance and risk control

The company gave a lecture about compliance to all employees of the Vertex Group in 2021

They are preparing it for the fiscal year 2022 as well.

One internal auditor was added. The plan of carrying out internal audit at about 150 sites in three years is underway.

* Development and strengthening of the business portfolio management function

The company reviewed the strategies and measures for small-scale businesses. The company is continuously developing the business portfolio management function.

* Development of a sustainability promotion system

In October 2021, the company established a "Sustainability Council" to discuss sustainability-related policies and identify material issues. The company plans to establish a "Sustainability Committee" and disclose sustainability information by April 2023 in order to further strengthen its sustainability efforts and enhance its corporate value over the medium to long term.

5. Conclusions

In the first half of FY 3/23, the company's pile and disaster prevention businesses performed well, with sales exceeding the company's initial forecast by 506 million yen. Operating income, on the other hand, fell 183 million yen short of the company's initial projection due to higher raw material prices. Regarding the performance in each segment, sales in the concrete business declined 594 million yen year on year, while operating income fell 723 million yen year on year. At first glance, the concrete business was very sluggish, but this was due to a reaction to the concentration of shipments of large value-added properties in the first half of the previous year. Compared to the first half of FY 3/21, sales of the concrete business increased 704 million yen and operating income 282 million yen, confirming that the concrete business is also growing steadily. Although the results in the first half are less than 50% of the company's full-year forecast for both sales and profit, the company's performance tends to be better in the second half of the year in most years. Despite the difficult environment due to rising raw material prices, it remains to be seen in the second half whether the company will achieve its full-year forecasts through sales growth, higher sales prices, and a shift to high value-added products. Regarding the shift to high value-added products, the company expects to increase sales of rainwater harvesting tanks, S-HOLE, SJ-BOX, and special products (track slabs). In the first half of FY 3/23, the ratio of these high value-added products rose to 69%. It remains to be seen how much the percentage of these high value-added products will increase in the future and how much impact they will have on improving the company's profitability.

<Reference 1: Regarding the Second Mid-Term Management Plan>

The company formulated and announced the second mid-term management plan for the three years from the term ending March 2022 to the term ending March 2024.

【Review of the previous mid-term management plan】

(1) Positioning of the previous mid-term management plan and the state of achievement of numerical goals

In the previous mid-term management plan (FY 3/20 to FY 3/21), the company set the priority measures: “to further improve existing businesses,” “to bring out company-wide synergy,” and “establish a management base,” and aimed to achieve “sales of 38.9 billion yen, an operating income of 3.9 billion yen, an operating income margin of 10%, and an ROE of 10%” in the final year ending March 2022. The company reached “sales of 38.9 billion yen” in the term ended March 2020, and “an operating income of 3.9 billion yen, an operating income margin of 10%, and an ROE of 10%” in the term ending March 2021, one year earlier than planned.

(2) Activities in two and a half years after business merger and challenges

The company recognizes that their efforts for tightening governance, restructuring the corporate group, implementing M&A, and bringing out synergy from business merger steadily paid off.

The company plans to continue the development of a management base.

Challenge | At the time of business merger | Present |

Tightening of governance | Company with the board of auditors Total number of executives: 15 Number of outside executives: 4 (26.7%) | Company with the audit committee Total number of executives: 8 Number of outside executives: 3 (37.5%) |

Restructuring of the corporate group and M&A | 14 consolidated subsidiaries 3 equity-method affiliates | 12 consolidated subsidiaries 1 equity-method affiliates |

April 2020: Transformed DC (present: Kyushu-Vertex) into a consolidated subsidiary. | ||

Integration/abolishment of business bases | No. of marketing offices: 47 No. of production sites: 16 | No. of marketing offices: 33 No. of production sites: 15 |

Product strategy | Unification of brands for core products, and active selection of items for sale | |

R&D | To conduct R&D, including fundamental research and development of various processes for handling real estate | |

Establishment of a management base | *Started operating a new personnel system of the new company established through merger in April 2021. *Programs for personnel development and recruitment: It is necessary to reestablish them while assuming that they will do business while coping with the novel coronavirus. *In the development phase for a new mission-critical system to be released in the spring of 2022 *M&A, entry to new fields, development and improvement of the business portfolio management function will be continued. | |

As for R&D, the corporate group is pursuing 49 existing themes and 31 new themes.

(Examples)

*Development of “long-life concrete (LL Crete),” which is environmentally friendly (reducing CO2 emissions and preserving natural resources), durable, and low-cost

*Slabs for half-precast tracks for next-generation light rain transit (LRT)

*Products for preventing the fall of rocks

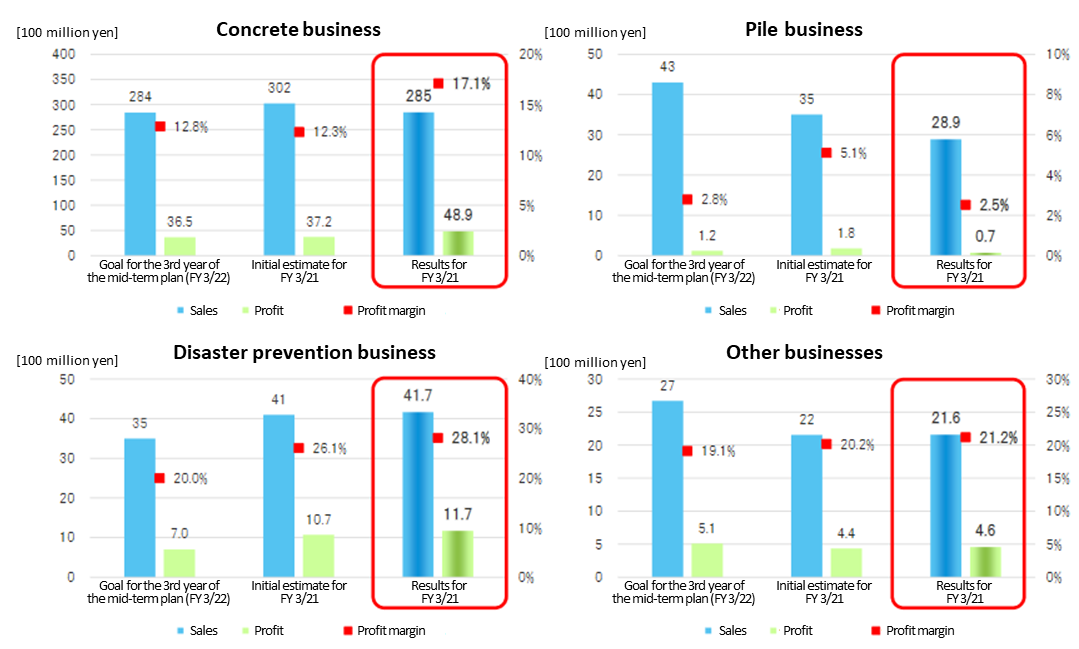

(3) Results in each segment

For the concrete and disaster prevention businesses, results exceeded the estimates, but the pile business did not reach the estimate, so the company revised strategies.

(Taken from the reference material of the company)

【The second mid-term management plan】

(1) Recognition of the business environment

As mentioned in Section 1 Outline of the company “1-3 Market environment,” the external environment includes the acceleration of the National Resilience Plan, the deterioration of social capital, and the shortage of manpower due to the declining birthrate and aging population in the construction industry, and the internal environment (the company’s factors) includes the company’s strengths such as:

*Advanced technologies and capabilities of design, development, and marketing, and a broad customer base

*A large number of original products boasting the largest market share and differentiated products

*Sound financial standing and ample funds.

The company recognizes that its challenges are:

*Rise in the average age of employees and difficulty in recruitment

*Development of the core business following the concrete business

*Acquisition of the business portfolio management function putting importance on capital efficiency.

It considers that there is room for streamlining after merger, mainly for production and sales systems.

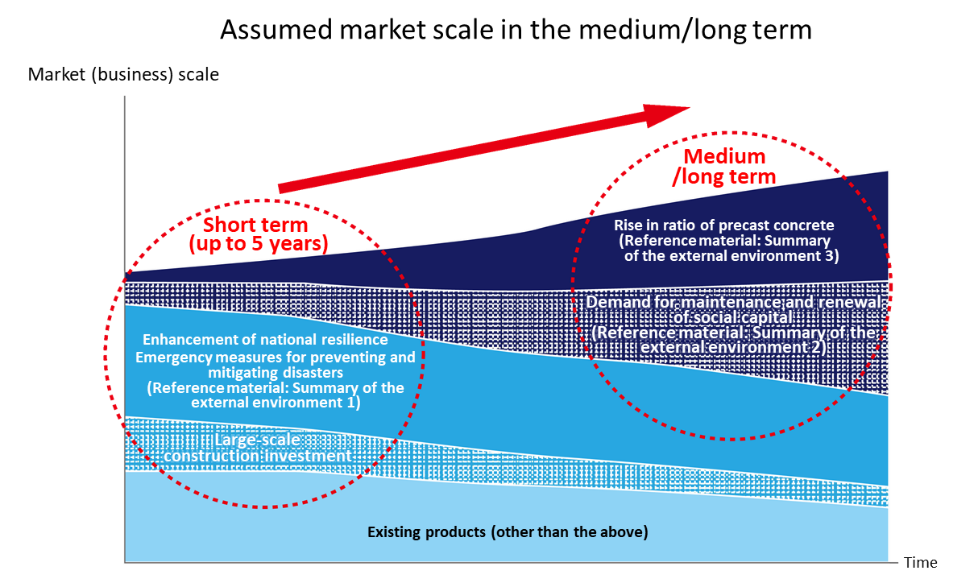

Under this environment, the target markets of the company are expected to expand in the medium/long term. From the medium/long-term viewpoint, the drivers for market expansion are considered to be “the rise in ratio of precast concrete due to the shortage of manpower” and “the growth of demand for maintenance and renewal of deteriorated social capital.”

As for “the rise in ratio of precast concrete,” the demand for concrete products is expected to grow.

As for “the growth of demand for maintenance and renewal of deteriorated social capital,” they plan to broadly meet the demand by taking advantage of their capabilities of proposing “inspection and reinforcement of infrastructure” in the upstream area and “repair, reinforcement, and renewal” in the downstream area, providing materials and products, and conducting construction.

(Taken from the reference material of the company)

(2) Basic policy and positioning of the second mid-term management plan

The company upholds the following basic policy.

To promote the organic growth of the core business by pursuing it further | The company aims to maximize cash flows in the future by enhancing the capacity to generate operating cash flow through the organic growth of the core business. |

To grow promising businesses and seize new earning opportunities | For further growth, the company will enhance efforts to nurture promising businesses and seize new earning opportunities (in new areas and categories, launching new products and businesses). |

To establish a management base for enabling sustainable growth | Continuously from the previous mid-term plan, the company will improve its management base by tightening group governance and establishing a risk control system, and implement ESG measures, with the aim of improving corporate value in a sustainable manner. |

Positioning the period of this mid-term management plan as “the period for strengthening the company’s business and management base for realizing sustainable growth without fail,” the company plans to forge ahead for attaining big hairy audacious goals (BHAGs): commemorate the 10th anniversary of establishment in October 2028 and to acquire the greatest brand power as an enterprise that offers reliability and safety.

(3) Measures and goals in each segment

① Concrete business

Outlook for the business environment | *Due to the impact of the novel coronavirus, the outlook for private investment remains uncertain, but public investment will be healthy. *To cope with natural disasters, which are getting graver, flood control basins (rainwater storage tanks) and rainwater drainage facilities will be constructed. To make structure earthquake-proof and cope with the deterioration of infrastructure, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. |

Major measures and policies | 1. To propose a lineup of high value-added products by utilizing the technological development capacity 2. To upgrade the centers for shipping general-purpose products for increasing customer satisfaction level 3. To pursue the business of maintaining and renewing existing infrastructure and promote the sales of products for preventing inundation and mitigating disasters and for transportation infrastructure 4. To improve the production and shipment efficiencies by integrating factories |

② Pile business

Outlook for the business environment | *Due to the impact of the novel coronavirus, private construction investment will be sluggish. *The recovery in this term is estimated to be gentle, and it is assumed that the recovery to the level in the previous term will be achieved around FY 3/23. Meanwhile, it is expected that there will be demand from distribution facilities, warehouses, suburban stores such as drugstores, etc. *From the viewpoint of prevention and mitigation of disasters, the demand for safety of foundations for buildings is growing. |

Major measures and policies | 1. To promote the sales of profitable products (high support piles and SC piles) and promote the selected order receipt for a lineup of less profitable products 2. To enhance and promote marketing while coping with the novel coronavirus 3. To improve existing construction methods and develop new construction methods |

③ Disaster prevention business

Outlook for the business environment | *For measures against natural disasters, which are getting graver and more frequent, including flood control (erosion control), forest conservation in areas where there is a risk of forest disaster, works for preventing landslides on road slopes and embankments, and works for preventing the collapse of slops adjacent to railways due to torrential rain, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. *The measures for preventing natural disasters at transportation infrastructure will be strengthened. |

Major measures and policies | 1. To develop new products in the fields of prevention of fall of rocks, landslides, and avalanches 2. To improve existing products and enrich the product lineup 3. To enhance marketing in the transportation infrastructure field |

④ Other businesses

Business | Primary measures |

Ceramics business | To enter new industries and growing fields and evolve production technologies Example: radio wave absorbing ceramics |

Business of surveys and tests of concrete | To expand the business on inspection of fire cisterns, conduct fundamental research for surveys, and establish technologies |

Business of development and sale of systems | To expand business by developing systems for networks, security, and special tasks |

RFID business | Sales promotion targeting not only the markets of maintenance and preventive maintenance, but also the entire market of paperless slips/forms. |

(4) Group-wide measures

In order to achieve sustainable growth, the company will establish and strengthen a management base through mainly the following measures.

* Redevelopment of programs for developing and recruiting personnel

* Establishment of information systems and ICT infrastructure, and promotion of DX

* Building of systems for group governance and risk control

* Development and enhancement of the business portfolio management function

* Establishment of a sustainability promotion system

(5) Financial and investment strategies

It is assumed that the three-year cumulative operating cashflow is 14 billion yen.

For strengthening the core business, growing promising businesses, and seizing new earning opportunities, the company will allocate 9.8 billion yen to “investment in equipment renewal,” “equipment investment for adding high value and enhancing competitiveness,” “investment in R&D,” “investment in DX for improving productivity,” “start-up investment and M&A,” etc.The company will return 4.2 billion yen to shareholders, with a total return ratio of 30%.

(6) Investment in R&D and intellectual property

For evolving business models, the company will invest in R&D actively.

The company will put more energy into cross-sectoral R&D. Based on the collaboration among the industrial, academic, governmental, and private sectors, the company will strengthen its existing businesses and engage in research and development of products and production technologies that would generate revenues in the future.

Targeting clients, the company will establish a new marketing style based on plenty of know-how, experiences, patents, etc.

The company puts importance on “intellectual property” as important managerial resources that support growth and profitability as the output of R&D investment.

By further strengthening the capability to create intellectual property, the company aims to maintain and enhance business competitiveness.

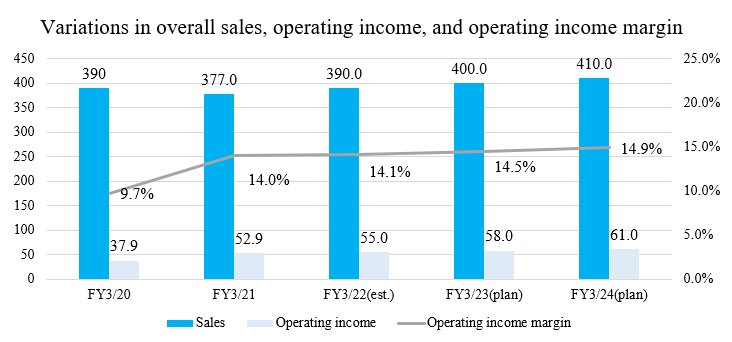

(7) Numerical goals (Values as of the announcement of the plan)

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 377.0 | 390.0 | 400.0 | 410.0 | 2.8% |

Operating income | 52.9 | 55.0 | 58.0 | 61.0 | 4.9% |

Operating income margin | 14.0% | 14.1% | 14.5% | 14.9% | - |

Ordinary income | 56.3 | 57.0 | 60.0 | 63.0 | 3.8% |

Net income | 37.5 | 38.0 | 40.0 | 42.0 | 3.8% |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

The company aims to keep ROE 10% or higher.

◎ Goals in each segment

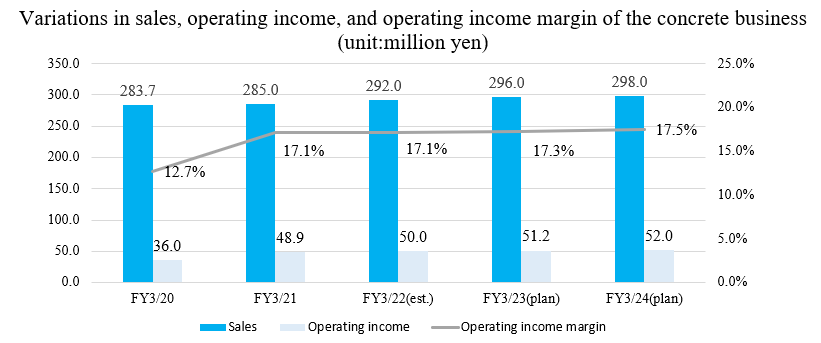

*Concrete business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 285.0 | 292.0 | 296.0 | 298.0 | 1.5% |

Operating income | 48.9 | 50.0 | 51.2 | 52.0 | 2.1% |

Operating income margin | 17.1% | 17.1% | 17.3% | 17.5% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

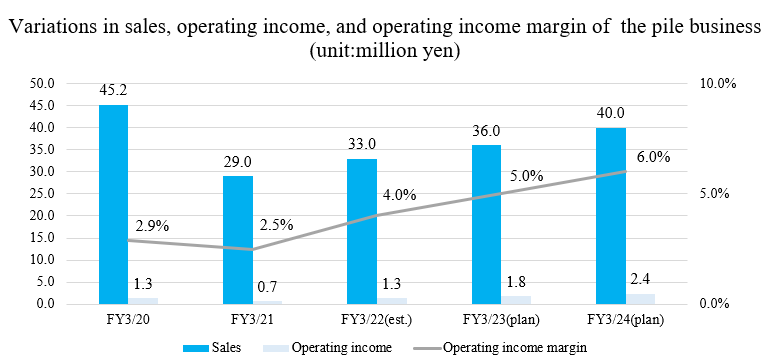

*Pile business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 29.0 | 33.0 | 36.0 | 40.0 | 11.3% |

Operating income | 0.7 | 1.3 | 1.8 | 2.4 | 50.8% |

Operating income margin | 2.5% | 4.0% | 5.0% | 6.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

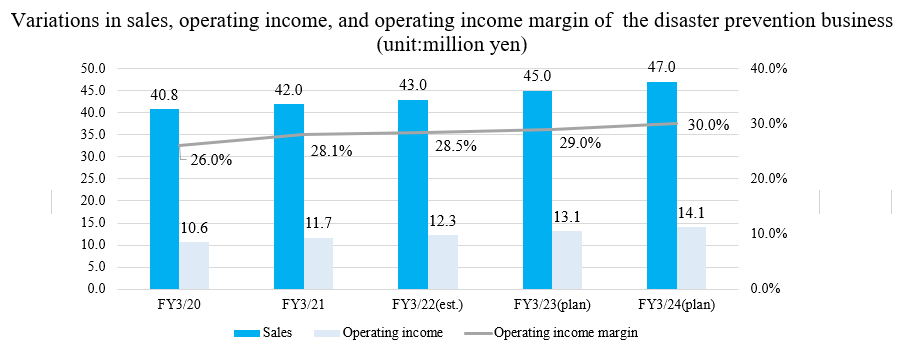

*Disaster prevention business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 42.0 | 43.0 | 45.0 | 47.0 | 3.8% |

Operating income | 11.7 | 12.3 | 13.1 | 14.1 | 6.4% |

Operating income margin | 28.1% | 28.5% | 29.0% | 30.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

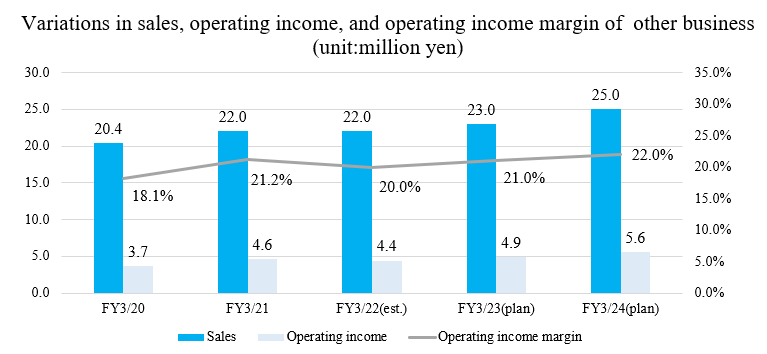

*Other business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 22.0 | 22.0 | 23.0 | 25.0 | 4.4% |

Operating income | 4.6 | 4.4 | 4.9 | 5.6 | 6.8% |

Operating income margin | 21.2% | 20.0% | 21.0% | 22.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

<Reference2: Regarding Corporate Governance>

◎Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

◎Corporate Governance Report

Last updated in July 27, 2022

<Basic policy>

Our company’s basic policy regarding corporate governance is to strive to play active roles in management of the company group, and to enhance its corporate governance by establishing strategies and directions for the group, as well as to provide guidance and advice provided for the group companies, based on the recognition of the significance in establishing a corporate governance structure that brings efficient decision-making process, while securing transparency and soundness of the business.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Subject Code]

The following contents are based on the code after the revision made in June 2021.

Principles | Reasons for not implementing the principles | |

[Supplementary Principle 2-4 (1) Ensuring Diversity in the Appointment of Core Personnel] | Our company believes that having diversity in human resources and developing such human resources lead to improvement of the medium/long-term corporate value, and actively hires women and mid-career employees. We hire mid-career employees and promote them to management positions by comprehensively considering their skill and experience. -On the other hand, we recognize that the number of appointments of women for management positions is still insufficient. Thus, moving forward, we will work on establishing the development of our human resources as well as in-house environment, to increase the ratio of female managers. -Since our corporate group’s business domain is only in the country, we do not have employment history of foreigners for management positions, however, we base our assessments and appointments on individual’s skill and experience comprehensively in accordance with our future expansion of the business domain as well as the scope of our business. | |

[Supplementary Principle 3-1 (3) Initiatives on Sustainability, etc.] | Our company has been striving to solve social issues through our businesses. In recent years, our company recognizes that sustainability is an important challenge for our management, while the environment surrounding companies has been constantly changing in a great deal, therefore, we established the Sustainability Council in October 2021 for the purpose of strengthening our sustainability initiatives that further serve in both solving social issues and growing our business. We will publish the status of our initiatives on our website and IR Library around this term, while we continue our discussion on building plans and investing in human assets and intellectual properties. | |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 3-1: Enhancement of disclosure of information】 | (i) Management principles, strategies, and plans Our company discloses its management plan and other information on its website. (ii) Basic Approach to Corporate Governance and Basic Policies Our company discloses on its website the guidelines that set forth its basic approach to corporate governance. (iii) Policies and Procedures for the Board of Directors in Determining the Compensation of Senior Management and Directors Remuneration for Directors (excluding Outside Directors) consists of base remuneration as fixed remuneration and stock options as non-monetary remuneration whose number is calculated based on performance indicators ("performance-linked non-monetary remuneration"). In light of their duties, outside directors receive only base remuneration. The standard remuneration ratio for each type of director (excluding directors who are members of the Audit Committee) is as follows: base remuneration: performance-linked non-monetary remuneration (short-term incentives): performance-linked non-monetary remuneration (long-term incentives) = 70:15:15 (if 100% of the performance indicators are achieved). The Compensation Committee deliberates and reports to the Board of Directors on the amount of remuneration for each individual director, and the Board of Directors decides the amount of remuneration by respecting the content of such report. The amount of remuneration for directors who are members of the Audit Committee shall be decided by the Compensation Committee through deliberation and report to all directors who are members of the Audit Committee, and all directors who are members of the Audit Committee shall decide the amount of remuneration after respecting and discussing the contents of such report. (iv) Policies and Procedures for Election and Dismissal of Senior Management and Nomination of Candidates for Directors (Policy) Our company selects candidates for non-audit committee members of the Board of Directors who have a broad perspective and experience that can contribute to the development of our corporate group, and who possess management skills and management sense, in order to enhance the corporate value of our corporate group. Candidates for Directors who are Audit Committee members are selected from among those who can fairly audit and supervise the execution of duties by Directors who are not Audit Committee members from the perspective of their numerous experiences and insights. (Selection Procedures) We established a discretionary Nominating Committee.The Nominating Committee deliberates on proposals for the election and dismissal of directors and makes recommendations on candidates for directors. Based on the respective recommendations, the committee reports to the Audit Committee the proposed candidates for directors who are not Audit Committee members, and the Board of Directors resolves the proposed candidates for directors who are Audit Committee members after obtaining the consent of the Audit Committee. v) Explanation on the Election, Dismissal, and Nomination When Electing and Dismissing Senior Management and Nominating of Candidates for Directors In the case of the election and dismissal of Directors, we will publish in the Reference Document for the Notice of the General Meeting of Shareholders the biographies of the candidates for new directors determined by the Board of Directors based on the recommendation of the Nominating Committee, and the reasons for their election and dismissal. (Management Plan: https://www.vertex-grp.co.jp/ja/ir/management/plan.html) (Corporate Governance Guidelines: https://www.vertex-grp.co.jp/ja/ir/management/governance.html) |

[Principle 5-1 Policy for constructive dialogue with shareholders] | We recognize that it is important for us to hold constructive dialogue with shareholders and investors aside from general meetings of shareholders to achieve sustainable growth and improve the medium/long-term corporate value, thus we assigned our Business Planning Department to be responsible for IR to handle individual meetings, post our company information on our website, and disclose information by utilizing the voluntary disclosure system in the Tokyo Stock Exchange. For individual meetings, we have established our internal system, sending appropriate personnel among our directors based on shareholders’ request and the level of significance of the meeting agenda to handle the meetings. -Furthermore, we hold semi-annual financial results briefing in which our executives including our Representative Director and President attend to present the financial results, business strategies, etc. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |