Bridge Report:(5290)Vertex Second Quarter of the Fiscal Year Ending March 2024

President Akihide Tsuchiya | Vertex Corporation (5290) |

|

Company Information

Market | TSE Standard Market |

Industry | Glass, earthen, and stone products (manufacturing business) |

President | Akihide Tsuchiya |

HQ Address | 5-7-2 Kojimachi Chiyoda-ku Tokyo |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE Act. | Trading Unit | |

1,505 | 25,972,195 shares | 39,088 million | 12.4% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

40.00 | 2.7% | 162.19 | 9.3 x | 1,190.24 | 1.3 x |

* Stock price is as of closing on November 21, 2023. The number of shares issued is the number of outstanding shares as of the end of the most recent quarter, excluding treasury shares. The figures are rounded.

* A 3-for-1 stock split was executed on July 1, 2022. This stock split was taken into account, when calculating dividend yield, PBR and PER.

*ROE is the actual results for FY 3/23, and EPS and DPS are forecasts for FY 3/24.

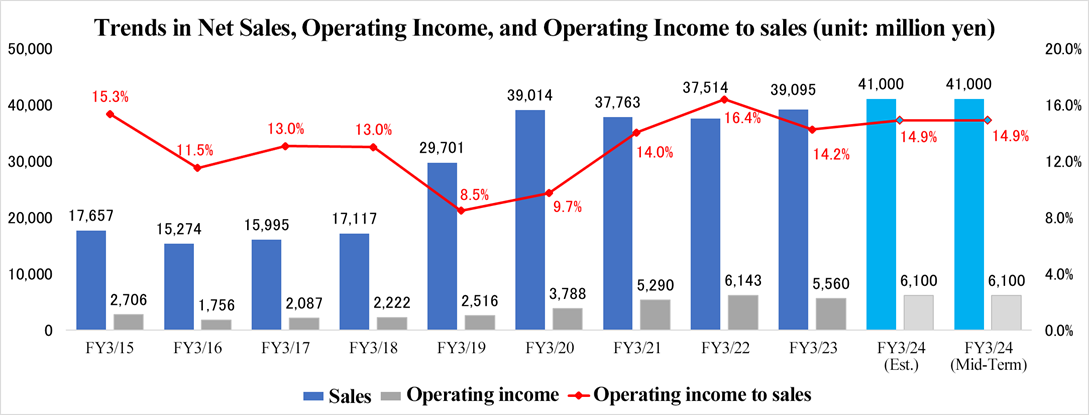

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2020 Act. | 39,014 | 3,788 | 3,959 | 2,336 | 87.34 | 20.00 |

March 2021 Act. | 37,763 | 5,290 | 5,635 | 3,759 | 142.80 | 30.00 |

March 2022 Act. | 37,514 | 6,143 | 6,434 | 4,242 | 160.90 | 26.27 |

March 2023 Act. | 39,095 | 5,560 | 5,837 | 3,742 | 140.86 | 30.00 |

March 2024 Est. | 41,000 | 6,100 | 6,300 | 4,200 | 162.19 | 40.00 |

*Unit: Million yen. The estimated values were provided by the company. Net income is the net income attributable to owners of the parent company. The same applies below.

*A 3-for-1 stock split was executed on July 1, 2022. DPS and EPS are recalculated retroactively back to FY 3/20. The dividend for FY 3/21 includes a commemorative dividend of 10.00 yen/share (30 yen before the 3-for-1 stock split).

This Bridge Report overviews the business performance for the second quarter of the fiscal Year Ending March 2024 and other information for Vertex Corporation.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year Ending March 2024 Earnings Results

3. Fiscal Year Ending March 2024 Earnings Forecasts

4. Progress of the Second Mid-Term Management Plan

5. Conclusions

<Reference 1: Regarding the Second Mid-Term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

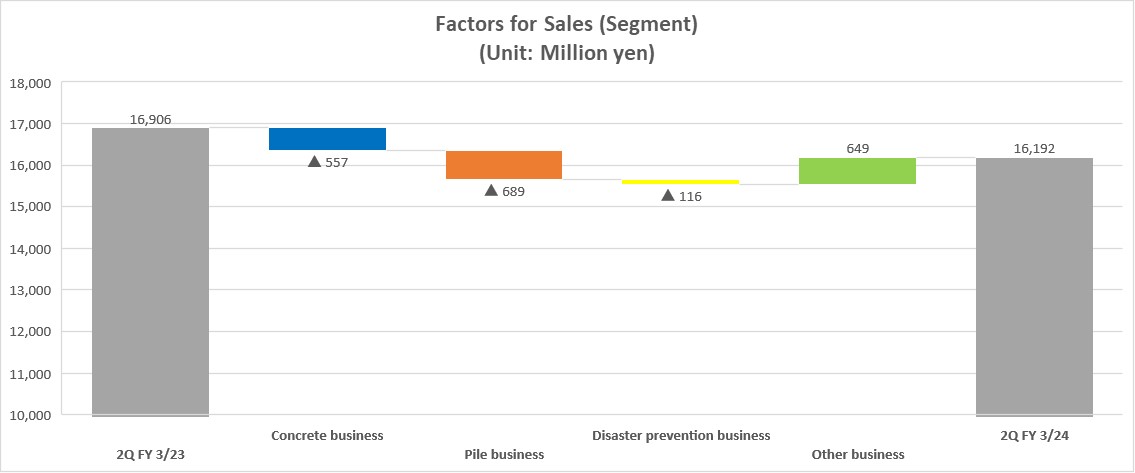

●In the second quarter of the fiscal year ending March 2024, sales declined 4.2% year on year to 16,192 million yen, and operating income increased 16.7% year on year to 2,178 million yen. In terms of sales, with the exception of other businesses, all businesses (the concrete business, disaster prevention business, and pile business) saw declines. On the other hand, profit grew due to sales of high-value-added products in the concrete business and the reflection of raw material price hikes in selling prices in the disaster prevention business. In the other businesses, both sales and profit increased year on year due to the acquisition of PROFLEX CO., LTD., which became a wholly-owned subsidiary of the company on October 4, 2022.

●At the end of the second quarter, the company's forecasts for the fiscal year ending March 2024 remain unchanged, with sales increasing 4.9% year on year to 41 billion yen and operating income rising 9.7% year on year to 6.1 billion yen. The company aims to increase sales and profit from the previous fiscal year despite the business environment continuing to be severe due to soaring material prices and rising logistics costs by reflecting these factors in unit sales prices, shifting to high-value-added products, and reducing costs. The company plans to pay an ordinary dividend of 40.00 yen/share, up 10.00 yen/share from the previous term. The expected dividend payout ratio is 24.2%. In addition to stable ordinary dividends, the company will consider special and commemorative dividends as appropriate and aim for a total return ratio of 30% through the acquisition of treasury shares.

●The 4.8 percentage point increase in gross profit margin in the first half of the year compared to the same period last year was a surprise. This was because Vertex Corporation conducted the projects for high-value-added products scheduled for the third quarter earlier than the expected timeline. On the other hand, the company's recent strong efforts to pass on higher raw material prices to sales prices and increase the ratio of high-value-added products are also expected to contribute to profit growth significantly. It remains to be seen whether the company will be able to raise unit sales price of products and the ratio of high-value-added products in the second half of the year.

1. Company Overview

Under the policy “To build safe society”, Vertex Corporation engages in the supply, installation, etc. of products required for developing social capital and infrastructure, including concrete products. Taking advantage of the competitiveness of products, the ability to propose technologies, and plenty of intellectual property, it became one of the companies that have the highest profitability in this industry. Its forte also includes the capability of responding to things in cooperation with group companies.

【1-1 Company History】

In 2014, three companies, NIPPON ZENITH PIPE CO., LTD., HANEX CO., LTD. (former name: HANEDA HUME PIPE CO., LTD.), and HANEDA CONCRETE INDUSTRIAL CO., LTD., merged into HANEDA ZENITH CO., LTD., which was then renamed HANEDA ZENITH HOLDINGS CO., LTD.

On October 1, 2018, HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. (based in Fukui Prefecture) established Vertex Corporation through joint stock transfer (which made HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. wholly owned subsidiaries).

The companies set up a new business group.

In April 2019, HANEDA ZENITH CO., LTD., as the surviving company, absorbed HANEDA ZENITH HOLDINGS CO., LTD. (a merged company).

On April 1, 2021, Vertex Co., Ltd. was born through absorption-type merger carried out by HANEDA ZENITH CO., LTD. as the surviving company and HOKUKON CO., LTD. as the merged company, which were the core business companies affiliated with Vertex Corporation.

Vertex Co., Ltd. aims to achieve sales and profit growth by increasing its market share and boosting profitability in the mature markets of concrete and piles, and the growing market of disaster prevention through a multitude of approaches, including creation of business synergy and enhancement of business efficiency.

*ZENITH HANEDA HOLDINGS in FY15/3-FY18/3, Vertex Corporation in FY19/3

【1-2 Raison d'etre】

The company has put out a mission statement: “To build safe society.”

For safe life everywhere in this country that is constantly afflicted with natural disasters, for confidence about peace and safety of families and friends living far away, and for growth and enrichment of the mind of children,

We must continue our pursuit

of the one-and-only technology that continuously satisfies difficult needs, of unique ideas that no one has ever come up with, and of a nationwide network that can swiftly deal with any unexpected events.

To overcome any kind of disaster, and to create safety that has not existed yet,

What we create is not just material things, but a new form of safety by racking our brains so that all people can continue to live everyday with smiles. |

The company understands that its social purpose is to contribute to realizing safe daily life by providing a variety of products that are essential for developing social capital and infrastructure for daily lives.

【1-3 Market Environment】

The following are the points to keep in mind for understanding the company’s business environment:

◎ Accelerated National Resilience Plan

The “Basic Plan for National Resilience,” which was approved by the Cabinet in June 2014 as a countermeasure against major earthquakes, such as the Southern Hyogo Prefecture Earthquake and the Great East Japan Earthquake, and powerful typhoons that cause damage in various regions every year was revised in December 2018 (four years later), and on June 17, 2021, a “Five-year Acceleration Plan for Disaster Preparedness, Reduction and National Resilience” was announced. As a result, Japan is accelerating efforts to strengthen and enhance its national resilience.

It is stated in the annual plan for 2021 that "We will increase efforts to strengthen national resilience and install a countermeasure system combining hardware and software. From fiscal 2022 onward, we will continue to secure a necessary budget to move forward the basic plan for disaster preparedness, reduction and national resilience across Japan, and to build sturdy homes that can withstand disasters as a national hundred-year plan.” (from (1) Purpose of formulation of an annual plan on page 2).

Further, one of the goals in implementing the “Five-year Acceleration Plan” for FY 2021 to FY 2025 is to contribute to the realization of carbon neutrality by FY 2050. Contents of the plan include “the response to climate change, large-scale earthquakes, etc.,” “managing aging infrastructure,” “utilizing the latest technologies such as digital technologies, and the introduction of innovations.”

Thus, the “Basic Plan for National Resilience” is expected to continue accelerating as a core policy in relation to focal topics such as climate change and carbon neutrality.

◎ Aging Social Capital

According to the Ministry of Land, Infrastructure, Transport and Tourism, Japan's social capital stock has been intensively developed during the rapid economic growth period, and there are concerns that it will quickly deteriorate hereafter. It is expected that over the next 20 years, the percentage of road bridges, tunnels, river management facilities, sewage systems, harbors, etc. constructed over 50 years ago will rise at an accelerated rate.

(Percentage of main social capital over 50 years since construction)

| March 2018 | March 2023 | March 2033 |

Road bridges (approx. 730,000 bridges) | Approx. 25% | Approx. 39% | Approx. 63% |

Tunnels (approx. 11,000 tunnels) | Approx. 20% | Approx. 27% | Approx. 42% |

River management facilities (approx. 10,000 facilities including sluices) | Approx. 32% | Approx. 42% | Approx. 62% |

Sewage pipes (total length: approx. 470,000 km) | Approx. 4% | Approx. 8% | Approx. 21% |

Port quays (approx. 5,000 facilities) | Approx. 17% | Approx. 32% | Approx. 58% |

Source: “Infrastructure Maintenance Information” provided by the Ministry of Land, Infrastructure and Transport

In 2035, about 58% of 520,000 fire cisterns, and in 2027, roughly 40% of 50,000 km of agricultural drainage channels will have been constructed over 50 years ago.

It is therefore necessary for the government to strategically maintain, manage and upgrade aging infrastructure. In the “Basic Plan for National Resilience,” the city plans to implement countermeasures against urban erosion 100% by 2040, including rainwater drainage facilities to prevent and reduce flood damage in sewage systems, and countermeasures against sediment disasters in sediment control systems 100% by 2045.

◎ Aging of construction workers and shortage of manpowe expansion of precast construction methods

The number of workers in the construction industry is declining. In addition, the labor shortage due to the declining birthrate and aging population has become a major issue in the construction industry. According to the data collected by the Ministry of Land, Infrastructure, Transport and Tourism, it is estimated that approximately one-third of workers in the construction industry are aged 55 and older while approximately 10% are those aged 29 and younger, resulting in a shortage of at least 500,000 skilled workers in 2025.

Various efforts have been made to resolve this issue including the use of the “precast construction” method. “Precast concrete” parts such as gutters, pipes, manholes, piles, bridge girders and parts of buildings are manufactured off-site and delivered to the construction site for assembly and installation.

In contrast, the current mainstream construction method is the “on-site construction” method, in which concrete products are manufactured on-site by pouring concrete into wooden or iron molds, assembled at the site, and then hardened.

If you just consider the initial costs of “on-site construction,” it has an economic advantage compared with “precast construction”; however, because the latter is superior in terms of design costs, shorter construction periods, lack of necessity to arrange traffic regulations, lack of related economic losses, as well as product quality, it is expected to gain ground moving forward.

【1-4 Business Details】

The company has four reporting segments, which are Concrete Business, Pile Business, Disaster Prevention Business, and Other Business.

The following is a table showing the group companies operating each business segment:

Business | Group Companies |

Concrete Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Co., Ltd. (Osaka) Hokukon Product Co.LTD (Fukui Pref.) HOKKAN CONCRETE CO.,LTD. (Gunma Pref.) Tohoku Haneda Concrete K.K. (Yamagata Pref.) Kyushu Vertex Co., Ltd. (Fukuoka Pref.) |

Pile Business | HOKUKON MATERIAL CO., LTD. (Fukui Pref.) |

Disaster Prevention Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) |

Other Business | WICERA Co., Ltd. (Gifu Pref.) M.T Giken Co., Ltd. (Osaka) iB Solution Corporation (Fukui Pref.) PROFLEX CO., LTD. (Saitama Prefecture) Universal Business Planning Co., Ltd. (Fukui Pref.) NX inc. (Tokyo; equity-method affiliate) |

【Concrete Business】

This business manufactures and sells secondary concrete products, sells other related products, and undertakes installation of products in the segments of anti-inundation & sewage system, road, maintenance, railroad, and housing & development.

Segment | Overview/main products and services |

Anti-inundation/sewage system Business | This segment offers the best proposal with a rich lineup of products developed reflecting the needs and the one-and-only technology in order to help adopt anti-disaster and disaster mitigation measures, such as measures against flood damage and renovation for anti-earthquake sewage facilities.

(Main products/services) ◎ Precast flood control basin (underground water tank) This facility prevents rainwater from flowing into rivers. In an underground precast flood control basin, a facility to prevent rainwater outflow is built underground while the space above the ground can be used for multiple purposes, such as including parks, athletic fields, and parking lots. Features include an economical half-precast structure, a rigid structure, an earthquake-resistant structural design, a shortened construction period, and relaxed backfilling requirements.

◎ Box culvert A box culvert is a box-shaped concrete structure that is installed primarily underground and used for holding waterways and communication lines. With a variety of uses, box culverts are utilized in myriad infrastructure projects, such as underpasses and reservoirs. Features include high safety, high quality, a significantly shortened construction period, a wide variety of construction methods, and the ability to meet local needs.

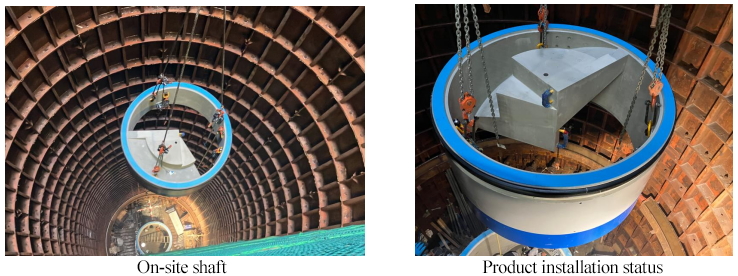

◎ Prefabricated round manhole As a pioneer of prefabricated manholes, the company offers an extensive lineup of manholes ranging from small ones (with the inner diameter of 300 mm) to extra-large ones (with the inner diameter of 2200 mm) in order to satisfy multifarious needs for manhole installation works. Features include safe lifting and lowering, high watertightness, binding between parts, compatibility with road surface height, contribution to restoration in the event of a disaster, flexible joints, earthquake resistance, and the ability to be installed even in narrow shafts. |

Road Business | Possessing a number of products that help not only with development of road infrastructure, but in protecting human lives as well, the company contributes to building safe roads.

(Main products/services) ◎ Precast guard fence (PGF) The precast guard fence is a rigid protective fence made of precast concrete for preventing vehicles from swerving off the road while ensuring the safety of the drivers and passengers. It is used at such places as roadsides, median strips, and concrete barrier parapets. Features include high safety, a shortened construction period, and diverse support.

◎ Span the Arch It is a culvert that can support ultra-large spans and consists of multiple components that are assembled on site in the shape of an arch for building grade separated crossings (underpasses) between tunnels and roads. It is highly effective against earthquakes, soft ground, and eccentric load. Features include a rigid joint structure, improved safety, excellent workability, and improved stability.

|

Maintenance Business | As measures against deterioration of infrastructure, this segment proposes optimal products and methods while taking into account life-cycle cost. It contributes to prolonging the life of infrastructure that is the basis supporting enriched daily life of the citizens and social economy.

(Main products/services) ◎ Ductal panel The ductal panel is a high-durability, thin-wall panel installed underground, which is made of ultra-high strength, fiber-reinforced concrete that is highly durable in a harsh environment in which damage from salt, frost, and wear occurs. It can prolong the life of constructions and cut down on the cost of maintenance and management.

◎ Maintenance of fire cisterns This service offers methods of repair and reinforcement of deteriorated fire cisterns against leakage of water caused by earthquakes and secondary disaster resulting from collapse of roads. Features include support covering everything, including investigation, inspection, repair, reinforcement design, and construction, solving issues for new construction, saving labor in construction, and significantly reducing costs.

|

Railroad Business | This segment offers safety via the lineup of products developed through vigorous pursuit of quality materials, such as ultra-high strength, fiber-reinforced concrete and special mortar.

(Main products/services) ◎ UFC home door slab Platform screen door slabs made of ultra-high-strength fiber reinforced concrete (UFC). Used to improve (replace) existing platform slabs that have insufficient bearing capacity at locations where platform screen doors (movable platform railings) are installed. Thin-walled and lightweight, making it possible to save labor in transporting and constructing the slab itself.

|

Housing/development Business | This segment offers an extended lineup of products resistant to massive earthquakes in order to develop earthquake- and disaster-resilient cities, including earthquake-proof water storage tanks, which are the segment’s top-selling product brand, and unique portable toilets for use in the event of disaster.

(Main products/services) ◎ HC fire cistern/HC earthquake-proof water storage tank The main products of this segment are precast fire cisterns and earthquake-proof water storage tanks. The fact that the fire cisterns and water storage tanks survived the Great Hanshin earthquake has proven their high reliability and safety. Features include products certified by the Fire Equipment and Safety Center of Japan, outstanding construction records, a wide range of optional specifications, a reliable earthquake-resistant design, and use for multiple purposes.

|

【Pile Business】

The company manufactures and sells centrifugal prestressed concrete piles, and undertakes piling works.

【Disaster Prevention Business】

The company manufactures and sells high-energy-absorption fences for preventing rocks from falling, and products for preventing such disaster as mudflows, avalanches, and debris flows, sells other related products, and undertakes installation works.

◎ Loop fence (high-energy-absorption fence for preventing rocks from falling) Displacement-control fence for preventing rocks from falling down, with displacement being small when the net catches falling rocks while the energy absorption capacity is enormous Capable of handling a rockfall impact of up to 1,500 kJ, the minimum overhang when capturing falling rocks, and prevention of falling rocks from piercing through.

| ◎ MJ net (ultra-high-energy-absorption fence for preventing rocks from falling) One of the world’s largest fences for preventing rocks from falling down that can withstand a falling rock energy of up to 3,000 kJ thanks to the combination of special wiring and props Features such as easy construction as there are few structures to be manufactured on site, and a slim shape that does not spoil the landscape that is in harmony with nature.

|

【Other Business】

The company engages in various business operations, including to manufacture and sell new ceramic products, rent equipment and sell materials, sell radio frequency identifiers (RFID; non-contact IC tags), conduct investigation and tests of concrete, develop and sell system development and sales business, planning, development and sales business of hydraulic components, and lactic acid bacteria business

【1-5 Characteristics and Strength】

(1) Product superiority and capability to make technological proposals

The company has developed its unique business model that is less susceptible to price competition by being involved in multiple project phases from designing to product promotion to technological proposal.

(Taken from the company’s website)

This strength is supported by three factors: "information gathering capability" for constantly collecting information from design consultants and government agencies to accurately grasp upstream needs; "development and experimentation" that use information and needs to develop and experiment with new products and devise ways to utilize technology; and "human resources" with an excellent spirit of inquiry that transforms needs into form.

① Capability of collecting information

The company precisely understands the needs of manufacturers and suppliers by not only selling products but also collecting information at all times from design consultants in charge of designing and the final clients, which are government and public agencies. It also is involved proactively with product promotion and technological proposal.

② Development and tests

Based on the information obtained and needs understood, the company develops new products internally and tests them in order to develop new products ahead of other companies and come up with ways to use them. In addition, collaboration with universities and other organizations allows efficient development and tests.

The fact that HANEDA ZENITH CO., LTD. and HOKUKON CO., LTD., which are the predecessor companies of Vertex Co., Ltd., gave their focus on technology seemingly contributes to the competitive superiority of the company that takes pride in its technologies.

③ Power of human resources

Talented staff full of curiosity, such as sales staff members with outstanding capabilities to make proposal that enable them to accurately grasp the market needs, and technical staff members who make it possible to develop and propose new products in view of needs and information, are in charge of information collection, development, and tests.

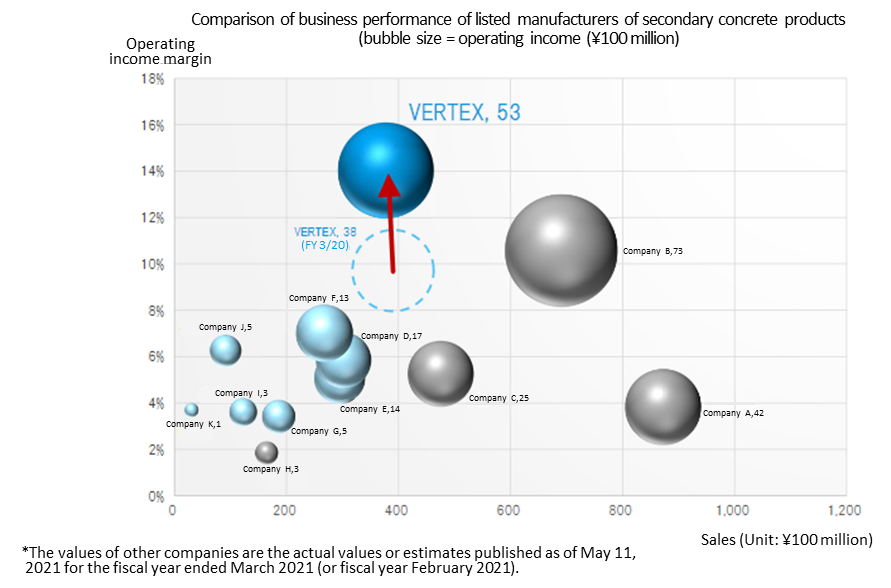

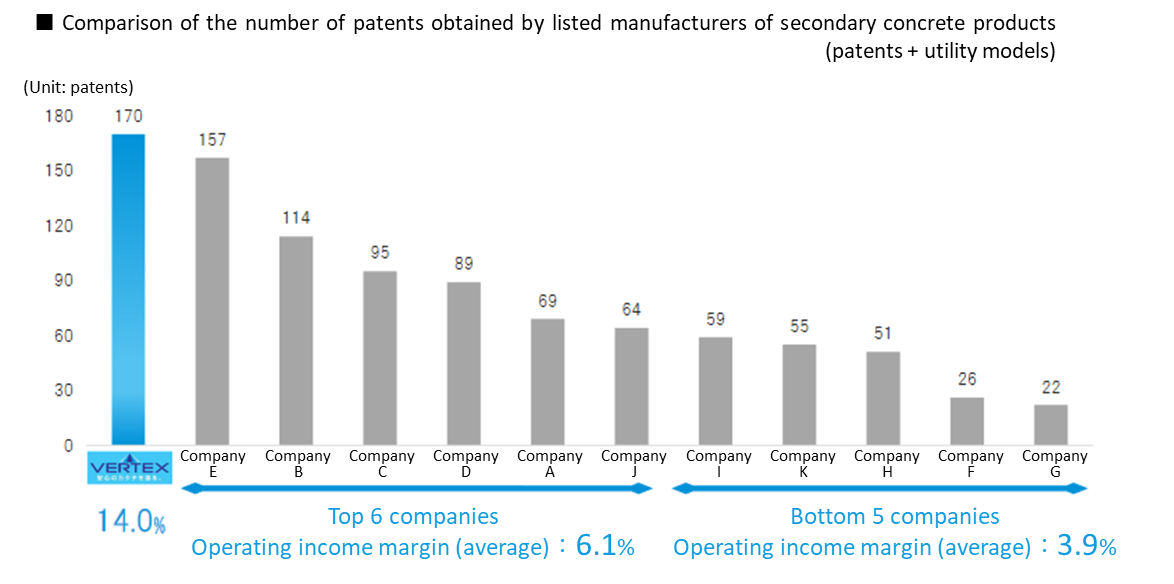

◎High profitability, and plentiful intellectual property as the source thereof

The company has achieved high profitability based on the aforementioned business model realized taking advantage of its exceptional technological capabilities.

(Taken from the reference material of the company; the light-blue bubbles indicate the trade in the company’s Concrete Business while the gray bubbles refer to the trade in its Pile Business.)

The intellectual property generated from proactive investment in research and development is the source of the company’s large income.

(Taken from the reference material of the company)

◎ Multifarious industry-leading products that have taken large share

The company carries out research and technological development and launches new products into the markets ahead of any other companies in order to create new markets. It improves and upgrades the products after the launch by seeking customers’ opinions as appropriate. While equivalent items launched by other companies are booming the markets, the company is exerting superiority as a leading manufacturer in terms of cost and quality, securing its position as the top brand.

These product development processes enable the company to have the following best-selling products:

Anti-inundation segment/ Sewage system segment |

|

Housing/ development segment |

|

◎Group’s extensive response capabilities

With Vertex Co., Ltd. and each of its group companies are in charge of a variety of business operations, the company is capable of taking in various demands of myriad parties concerned, ranging from manufacturers and suppliers to sellers. It will strive to further exert and strengthen the corporate group synergy.

【1-6 Dividend Policy and Shareholder Return】

In addition to stable payment of ordinary dividends, the company intends to pay shareholder return through acquisition of treasury shares with an expected total payout ratio being 30%, as well as to consider paying special and commemorative dividends as appropriate.

The company purchased treasury shares worth 549 million yen during the term ended March 2022 and treasury shares worth 766 million yen during the term ending March 2023.

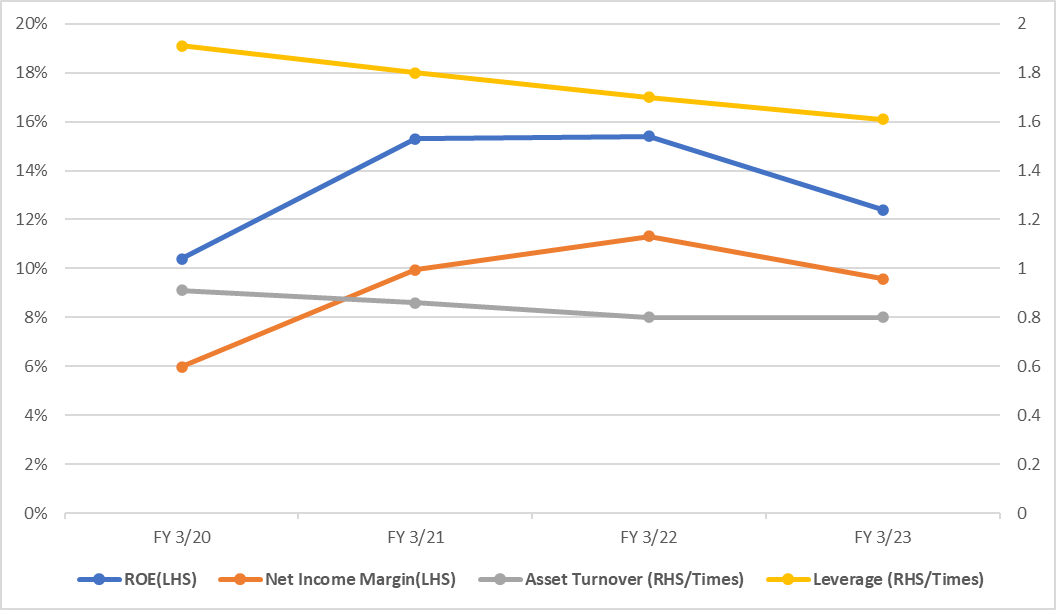

【1-7 Analysis of Return on Equity】

| FY 3/20 | FY 3/21 | FY 3/22 | FY 3/23 |

ROE (%) | 10.4 | 15.3 | 15.4 | 12.4 |

Net income margin (%) | 5.99 | 9.95 | 11.31 | 9.57 |

Total asset turnover (times) | 0.91 | 0.86 | 0.80 | 0.80 |

Leverage (times) | 1.91 | 1.80 | 1.70 | 1.61 |

ROE for the term ended March 2023 was down 3 points year on year due to a decrease in net income margin and leverage.

The medium-term business plan is aimed at maintaining a return on equity (ROE) of 10% or over in the fiscal year ending March 2024.

*Prepared by Investment Bridge Inc. based on disclosed material.

2. Second Quarter of the Fiscal Year Ending March 2024 Earnings Results

【(1) Overview of the consolidated results】

| 2Q FY 3/23 Cumulative total | Ratio to sales | 2Q FY 3/24 Cumulative total | Ratio to sales | YoY | The estimate at the beginning of FY | Compared to the estimate | |

Sales | 16,906 | 100.0% | 16,192 | 100.0% | -4.2% | 16,400 | -1.3% | |

Gross profit | 4,943 | 29.2% | 5,512 | 34.0% | +11.5% | - | - | |

SG&A | 3,075 | 18.2% | 3,333 | 20.6% | +8.4% | - | - | |

Operating income | 1,867 | 11.0% | 2,178 | 13.5% | +16.7% | 1,630 | +33.7% | |

Ordinary Income | 1,986 | 11.7% | 2,230 | 13.8% | +12.3% | 1,730 | +28.9% | |

Net Income Attributable to owners of the parent | 1,294 | 7.7% | 1,326 | 8.2% | +2.5% | 1,200 | +10.5% | |

*Unit: Million yen.

*The figures include those calculated by Investment Bridge Co., Ltd. as reference values, and may differ from actual values (the same applies hereinafter).

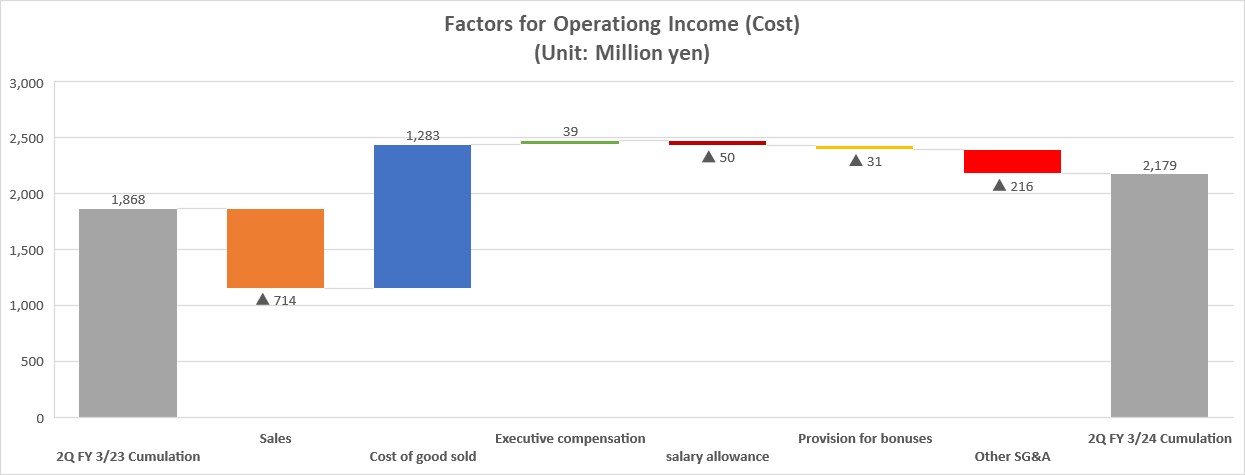

Sales down 4.2% year on year, operating income up 16.7% year on year

Cumulative sales in the second quarter of the fiscal year ending March 2024 fell 4.2% year on year to 16,192 million yen. In terms of sales, with the exception of other businesses, all businesses (the concrete business, disaster prevention business, and pile business) saw declines. While the concrete and disaster prevention businesses performed well, the sales of the pile business fell slightly short of the company's initial forecast due to a decline in demand.

Operating income increased 16.7% year on year to 2,178 million yen. In terms of profit, operating income increased due to sales of high-value-added products in the concrete business and the reflection of raw material price hikes in selling prices in the disaster prevention business. At the core operating company, Vertex Corporation, all kinds of profits of the business were significantly higher than initial forecasts due to conducting projects for high-value-added products that had been scheduled for the third quarter earlier than the expected timeline. Gross profit margin rose 4.8 percentage points year on year to 34%. Although the ratio of SG&A expenses to sales rose 2.4 percentage points year on year due to higher personnel and other expenses, operating income margin rose 2.5 percentage points year on year to 13.5%. Other major negative factors included 47 million yen in loss compensation expenses posted as non-operating expenses and 52 million yen in impairment losses posted as extraordinary losses. Thus, the growth rates of recurring profit and net income were lower than the growth rate of operating income.

*Prepared by Investment Bridge Inc. based on disclosed material.

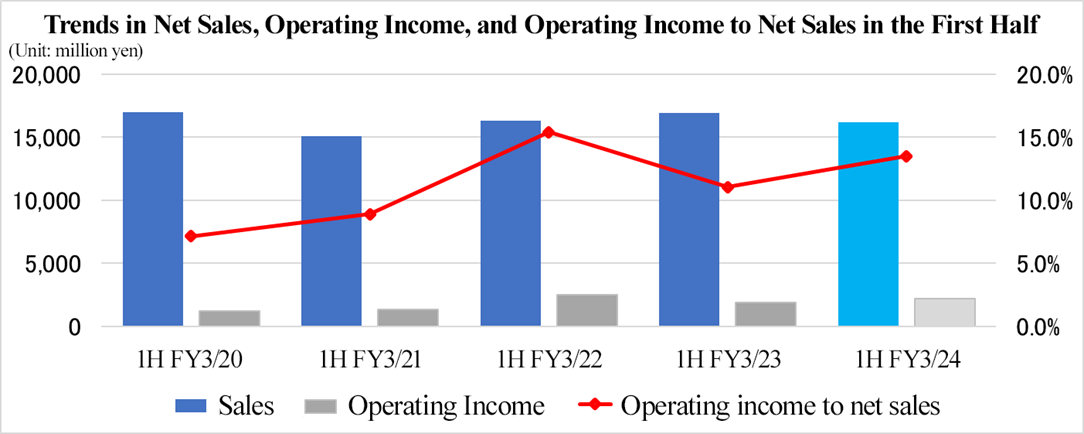

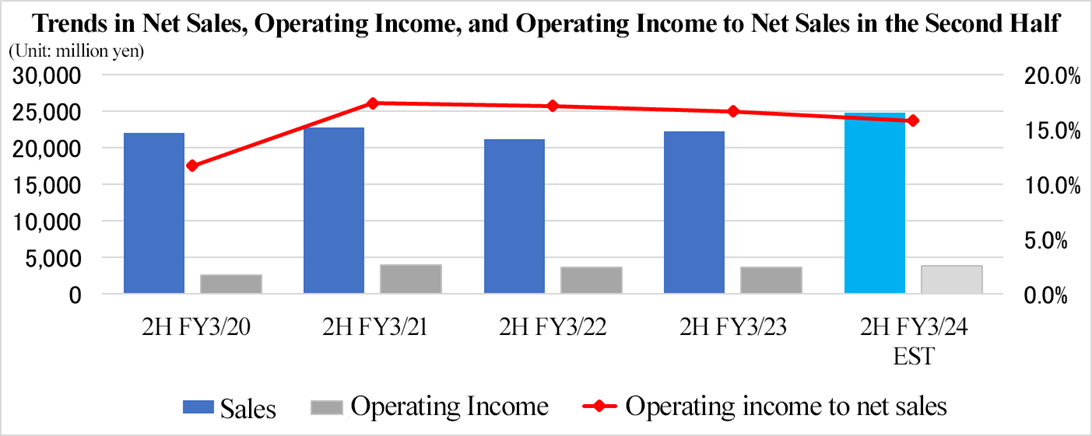

Results in the first half

In the first half of the fiscal year ending March 2024, sales decreased, and profit increased year on year, and operating income margin rose. Compared to the first half of the fiscal year ended March 2020, sales, operating income, and operating income margin were all at high levels.

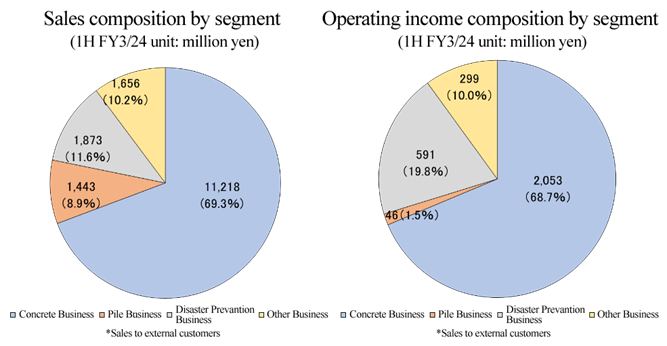

【(2)Trend of each segment】

| 2Q FY 3/23 | Ratio to sales | 2Q FY 3/24 | Ratio to sales | YoY |

Concrete business | 11,776 | 69.7% | 11,218 | 69.3% | -4.7% |

Pile business | 2,133 | 12.6% | 1,443 | 8.9% | -32.3% |

Disaster prevention business | 1,990 | 11.8% | 1,873 | 11.6% | -5.9% |

Other business | 1,007 | 6.0% | 1,656 | 10.2% | +64.5% |

Total sales | 16,906 | 100.0% | 16,192 | 100.0% | -4.2% |

Concrete business | 1,768 | 15.0% | 2,053 | 18.3% | +16.1% |

Pile business | 202 | 9.5% | 46 | 3.2% | -77.3% |

Disaster prevention business | 464 | 23.3% | 591 | 31.6% | +27.3% |

Other business | 113 | 11.3% | 299 | 18.1% | +163.5% |

Adjustment amount | -682 | - | -812 | - | - |

Total operating income | 1,867 | 11.0% | 2,178 | 13.5% | +16.7% |

* Unit: million yen. The composition ratio of operating income means the ratio of operating income to sales.

*Prepared by Investment Bridge Inc. based on disclosed material.

◎ Concrete Business (4.7% YoY decrease in sales, and 16.1% YoY increase in profit)

Increasing productivity by improving work processes to cope with chronic labor shortage is a major theme in the construction industry, and the promotion of and demand for precast concrete, which is expected to contribute to labor saving, safety improvement, shorter construction periods, and work style reform at construction sites, have been increasing year by year. In addition, countermeasures against flooding, in which the company has a competitive edge, have been positioned as an urgent issue in government policies for disaster prevention and disaster mitigation, and national resilience. Against this backdrop, overall shipment volume declined year on year, resulting in a 4.7% year on year decline in sales to 11,218 million yen. Still, the segment's income rose 16.1% year on year to 2,053 million yen due to sales of higher value-added products. The ratio of operating income to sales rose 3.3 percentage points year on year to 18.3%.

In the second quarter of the fiscal year ending March 2024, the unit price of products in the concrete business increased to 155% compared to the unit price in the fiscal year ended March 2020, which was 100%. This represented an increase of 19 points from the 136% recorded in the fiscal year ended March 2023. In addition, in the second quarter of the fiscal year ending March 2024, high-value-added products such as rainwater storage tanks, S-holes, SJ-BOX, and special products (track slabs), which the company is currently improving their sales, accounted for 66% of the total concrete business. (64% in the same period of the previous fiscal year).

◎ Pile Business (Sales declined 32.3% year on year and profit decreased 77.3% year on year)

Amid signs of a gradual recovery in construction demand, despite efforts to improve efficiency by narrowing down sales regions and projects and focusing on its strengths, sales declined 32.3% year on year to 1,443 million yen, and segment profit fell 77.3% year on year to 46 million yen, mainly due to a decrease in large projects compared to the same period of the previous fiscal year. The ratio of operating income to sales fell 6.3 percentage points year on year to 3.2%.

◎ Disaster Prevention Business (5.9% YoY decrease in sales, and 27.3% YoY increase in profit)

The government is implementing the "Five-Year Road Program for Disaster Prevention, Mitigation and National Resilience" as countermeasures against intensifying wind and flood damage, sediment disasters, and falling rock disasters. Amid this tailwind, product sales and profit increased due to the progress in passing on higher raw material prices to selling prices. Still, the volume of construction orders decreased, resulting in a 5.9% year on year decline in sales to 1,873 million yen and a 27.3% year on year rise in segment income to 591 million yen. The ratio of operating income to sales rose 8.3 percentage points year on year to 31.6%.

◎ Others (Sales increased 64.5% year on year, and profit increased 163.5% year on year)

The company engages in ceramics business, rental business, hydraulic hose-related business, etc. Sales and profits increased year on year due to the acquisition of PROFLEX CO., LTD., which became a wholly owned subsidiary on October 4, 2022. Net sales increased 64.5% YoY to 1,656 million yen and segment income increased 163.5% YoY to 299 million yen. In addition, operating income margin rose 6.8 points year on year to 18.1%.

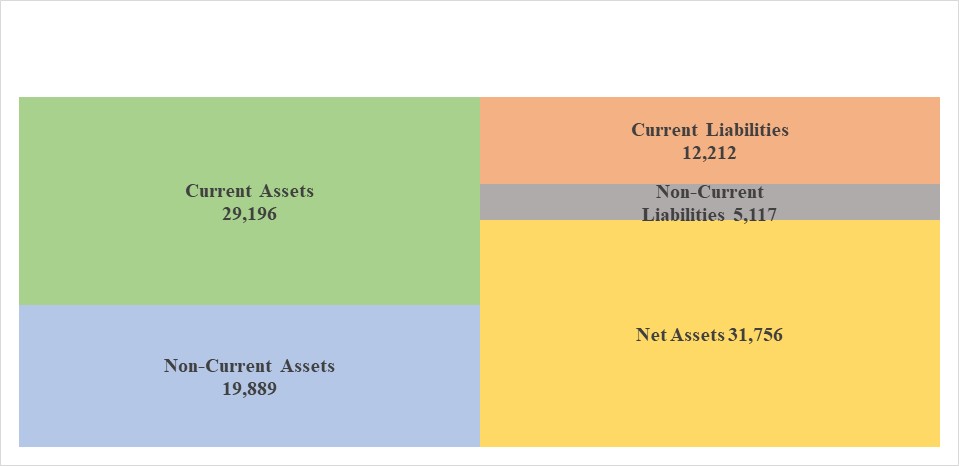

【(3)Financial position and cash flows】

Main Balance Sheet

| FY 3/23 | FY 9/23 |

| FY 3/23 | FY 9/23 |

Cash and Deposits | 11,017 | 12,459 | Trade Payables | 6,015 | 5,833 |

Trade Receivables | 12,720 | 10,381 | ST Interest-Bearing Debts | 3,588 | 3,339 |

Inventories | 5,123 | 5,743 | Current Liabilities | 12,901 | 12,212 |

Current Assets | 29,977 | 29,196 | LT Interest-Bearing Debts | 1,712 | 1,660 |

Tangible Assets | 12,596 | 12,663 | Noncurrent Liabilities | 5,357 | 5,117 |

Intangible Assets | 4,105 | 3,963 | Net Assets | 31,584 | 31,756 |

Investment and Other Assets | 3,163 | 3,262 | Total Liabilities and Net Assets | 49,843 | 49,086 |

Total Assets | 19,866 | 19,889 | Total interest-bearing debt | 5,301 | 4,999 |

*Unit: Million yen. Trade receivables include electronically recorded ones, while trade payables include electronically recorded ones.

*Interest-bearing debt does not include lease obligations.

*Prepared by Investment Bridge Inc. based on disclosed material.

Total assets at the end of September 2023 were 49,086 million yen, decreased 757 million yen from the end of the previous period. On the assets side, cash and deposits, inventories and investments and other assets were the main contributors to the increase, while trade receivables and goodwill were the main contributors to the decrease. On the liabilities and net assets side, the main factors of increase were provision for bonuses and retained earnings due to the increase in net profit attributable to shareholders of the parent company, while the main factors of decrease were trade payables, short-term and long-term interest-bearing debt and liabilities for retirement benefits. The equity ratio at the end of September 2023 was 64.1%, up 1.2 points from the end of the previous period.

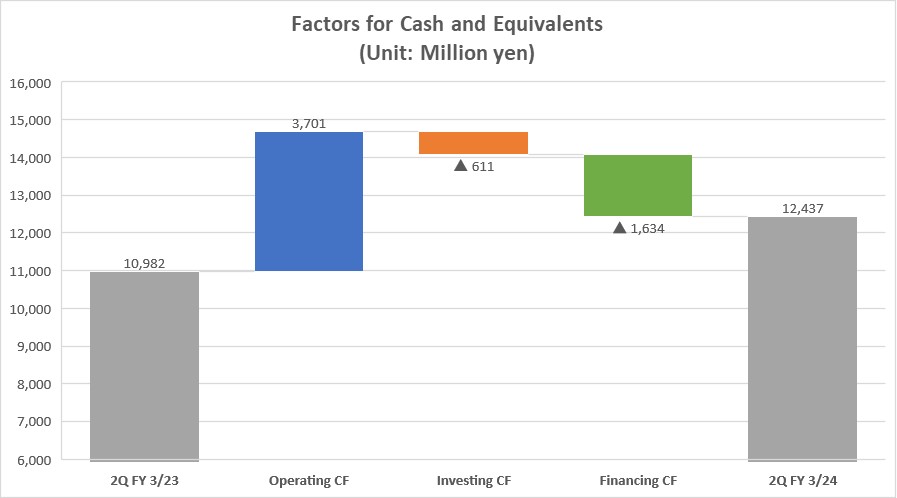

Cash Flow

| 2Q FY 3/23 Cumulative total | 2Q FY 3/24 Cumulative total | YoY | |

Operating CF | 2,827 | 3,701 | +873 | +30.9% |

Investing CF | -63 | -611 | -547 | - |

Free CF | 2,763 | 3,089 | +326 | +11.8% |

Financing CF | -1,474 | -1,634 | -159 | - |

Cash and equivalents | 13,419 | 12,437 | -981 | -7.3% |

*Unit: Million yen.

*Prepared by Investment Bridge Inc. based on disclosed material.

Regarding cash flow, the cash inflow from operating activities expanded due to quarterly net income before taxes, an increase in goodwill amortization, and a decrease in retirement benefit liabilities and trade payables. In addition, although the cash outflow from investing activities increased due to a smaller decline in time deposits and an increase in expenditures for acquiring intangible fixed assets, the surplus in the free cash flow increased. On the other hand, the cash outflow from financing activities increased due to a decrease in short-term loans payable and a decrease in income from long-term loans payable.

As a result, the cash position at the end of the second quarter was down 7.3% from the previous period.

(4) Major Investments (unit: million yen)

Acquisition of tangible fixed assets | 628 | Formwork, machinery, furniture, fixtures, and building fittings at Vertex Co., Ltd, plant renovation at WICERA Co., Ltd., etc. |

Acquisition of intangible fixed assets | 45 | Development of software for in-house use at Vertex Co., Ltd |

(5) Main Topics

◎ Exhibiting at trade shows

Sewerage Exhibition '23 Sapporo (Aug. 1-4) – Vertex Group |

◆ "The rainwater storage tank M.V. P. System" "Vortex Valve" "Spiral Hole" "Disaster Toilet Tank" ◆ Products for coping with falling rocks “Loop Fence" and "MJ Net" ◆ Concrete waterproofing and corrosion prevention method “VER Corrosion Prevention Method” ◆ “Inspection Master” for DX of work inspection ◆ “In-metal tag,” an RFID tag with built-in metal |

Fire-Safety Tokyo 2023 (Jun. 15-18) – Vertex Group |

◆ Method for repair and reinforcement of existing fire protection tanks ◆ Underground water tank investigation and inspection technology “Skeletank” ◆ Dedicated fire-fighting management system ◆ Disaster toilet tank ◆ Inspection master |

NEPCON CHINA 2023 (Jul. 19-21) -WICERA Co., Ltd. |

◆Ultra-precision press-formed parts of ceramic |

2023 Forestry, Forestry & Environmental Machinery Exhibition & Demonstration (11/12-13)- PROFLEX CO., LTD. |

◆In-house production of hydraulic hoses to reduce cost and delivery time |

Railroad Technology Exhibition 2023 (11/8-10) - Vertex Group |

◆ Seismic reinforcement of existing columns “CB panel method” ◆ Ultra-high strength fiber reinforced concrete platform wall “Lightweight precast C-type platform fence foundation method” ◆ Other railway-related products and infrastructure inspection technologies ◆ Rock fall protection fence |

◎To Acquire Treasury Shares

The company continuously purchased treasury shares, in order to enhance shareholder returns, improve capital efficiency, and implement a flexible capital policy in response to changes in the business environment.

Date of resolution by the Board of Directors to repurchase treasury shares | Total number of shares acquired | Total acquisition cost |

May 12, 2022 | 588,700 shares | 699,950,700 yen |

March 9, 2023 | 220,000 shares | 298,282,600 yen |

May 11, 2023 | 202,000 shares | 299,993,200 yen |

Date of resolution by the Board of Directors to repurchase treasury shares | Total number of shares to be acquired | Total value of future acquisitions |

November 9, 2023 | 335,000 shares | 500,000,000 yen |

3. Fiscal Year Ending March 2024 Earnings Forecasts

(1) Earnings Forecasts

| FY 3/23 | Ratio to sales | FY 3/24 Est. | Ratio to sales | YoY |

Sales | 39,095 | 100.0% | 41,000 | 100.0% | +4.9% |

Operating Income | 5,560 | 14.2% | 6,100 | 14.9% | +9.7% |

Ordinary Income | 5,837 | 14.9% | 6,300 | 15.4% | +7.9% |

Net Income Attribute to Owners of Parent | 3,742 | 9.6% | 4,200 | 10.2% | +12.2% |

*Unit: Million yen.

Sales are projected to increase 4.9% year on year, and operating income 9.7% year on year.

To realize its management philosophy of “To build safe society,” the company has formulated a medium-term management plan that will end in the term ending March 2024, which strives to provide peace of mind for the future and further increase its corporate value. In addition, the company will continue to make maximum use of tangible and intangible assets within the group, such as technology, research & development, human resources, and equipment, and sincerely develop and supply innovative products to help solve the problems in the construction industry and Japan.

With the end of the second quarter, the company's forcast for the term ending March 2024 remains unchanged, with 4.9% year-on-year increase in sales to 41 billion yen and a 9.7% year-on-year increase in operating income to 6.1 billion yen. Although the business environment continues to be severe due to soaring material prices and rising logistics costs, the company aims to increase sales and profits from the previous fiscal year by reflecting this in unit sales prices, shifting to high value-added products, and working to reduce costs. Operating income margin is expected to rise 0.7 points year on year to 14.9%.

The company maintained its dividend plan of 40.00 yen/share, up 10.00 yen/share from the previous term. The expected dividend payout ratio is 24.2%. In addition to stable ordinary dividends, the company plans to consider special dividends and commemorative dividends as appropriate and aims for a total return ratio of 30% through the acquisition of treasury shares.

(2) Trend in each segment

| FY 3/23 | Composition ratio | FY 3/24 Est. | Composition ratio | YoY |

Concrete business | 27,202 | 69.6% | 29,080 | 70.9% | +6.9% |

Pile business | 4,045 | 10.3% | 3,370 | 8.2% | -16.7% |

Disaster prevention business | 4,909 | 12.6% | 4,950 | 12.1% | +0.8% |

Other business | 2,938 | 7.5% | 3,600 | 8.8% | +22.5% |

Total sales | 39,095 | 100.0% | 41,000 | 100.0% | +4.9% |

Concrete business | 4,882 | 17.9% | 5,580 | 19.2% | 14.3% |

Pile business | 263 | 6.5% | 210 | 6.2% | -20.4% |

Disaster prevention business | 1,276 | 26.0% | 1,180 | 23.8% | -7.6% |

Other business | 544 | 18.5% | 590 | 16.4% | +8.3% |

Adjustment amount | -1,407 | - | -1,460 | - | - |

Total operating income | 5,560 | 14.2% | 6,100 | 14.9% | +9.7% |

* Unit: million yen. The composition ratio of operating income means the ratio of operating income to sales.

An increase in sales and profit in the concrete business is expected to contribute to year-on-year sales and profit growth for the entire company. On the other hand, the pile business is expected to see a year-on-year decline in sales and profit.

(3)Progress rate and second half performance trends

| 1H FY3/24 Act. | FY3/24 Company plan | Progress rate |

Sales | 16,192 | 41,000 | 39.5% |

Operating Income | 2,178 | 6,100 | 35.7% |

Ordinary Income | 2,230 | 6,300 | 35.4% |

Net Income Attribute to Owners of Parent | 1,326 | 4,200 | 31.6% |

*Unit: million yen.

| Sales | Operating Income | ||||

| 1H FY3/24 Act. | FY3/24 Company plan | Progress rate | 1H FY3/24 Act. | FY3/24 Company plan | Progress rate |

Concrete business | 11,218 | 29,080 | 38.6% | 2,053 | 5,580 | 36.8% |

Pile business | 1,443 | 3,370 | 42.8% | 46 | 210 | 21.9% |

Disaster prevention business | 1,873 | 4,950 | 37.8% | 591 | 1,180 | 50.1% |

Other business | 1,656 | 3,600 | 46.0% | 299 | 590 | 50.7% |

Adjustment amount | - | - | - | -812 | -1,460 | - |

Total | 16,192 | 41,000 | 39.5% | 2,178 | 6,100 | 35.7% |

* Unit: million yen.

Although the results of the first half were below 50% of the company's full-year forecast for both sales and all kinds of profits, the company's earnings tend to be biased toward the second half of the year in most years. In the first half, although sales fell slightly short of the company's forecast, all kinds of profits were significantly above the company's forecast, and the company is on track to achieve its full-year plan. By segment, the disaster prevention business and other businesses are showing high rates of progress.

4. Progress of the Second Mid-term Management Plan

The progress of the second medium-term management plan (please see Reference 1 below for more details) in each business is as follows.

(1) Management indicator

The company’s target for the final term of the plan (the term ending March 2024) is to achieve 6.1 billion yen in operating income and maintain 10.0% or higher in ROE, however, they achieved the planned values in the term ended March 2022, the first term of the plan, which was earlier than planned. On the other hand, in the term ended March 2023, profit declined due to the impact of soaring raw material prices, and operating income fell short of the company's plans for the second and third years. The company aims to achieve the targets of the final year of the medium-term management plan in the term ending March 2024.

| FY 3/22 Plan. | FY 3/22 Act. | FY 3/23 Plan. | FY 3/23 Act. | FY 3/24 Plan. |

Sales | 390.0 | 375.1 | 400.0 | 390.9 | 410.0 |

Operating Income | 55.0 | 61.4 | 58.0 | 55.6 | 61.0 |

Operating Profit Margin | 14.1% | 16.4% | 14.5% | 14.2% | 14.9% |

Ordinary Income | 57.0 | 64.3 | 60.0 | 58.3 | 63.0 |

Net Income | 38.0 | 42.4 | 40.0 | 37.4 | 42.0 |

ROE | - | 15.4% | - | 12.4% | 10.0% or more |

*Unit: Hundred million yen.

(2) Progress in the basic policies

The company upholds the following basic policies.

(1) Promote organic growth by pursuing our core business | We aim to maximize the future cash flow by enhancing the ability to generate operating cash flow by leveraging organic growth of our core business. |

(2) Develop growing businesses and obtain new revenue opportunities | We strengthen our initiatives to develop growing businesses and acquire new revenue opportunities (develop new areas, new categories, new products, and new business) for our further growth. |

(3) Establish a business management base that allows sustainable growth | Continuing from the previous mid-term management plan, we aim to improve sustainable corporate value by establishing a management base through enforcement of group governance and the establishment of a risk management system and to implement ESG initiatives. |

The progress of each policy is as described below.

① Promote organic growth by pursuing our core business

◎Examples of high-value-added products (anti-flooding)

◆A spiral hole was constructed in front of the Cabinet Office (Nagatacho) in Tokyo. The Chubu Sewerage Office of the Tokyo Metropolitan Government's Bureau of Sewerage adopted this project to shorten the construction period for on-site high drop manholes for rainwater drainage. The standard is φ2000 (new type) with a height of 48.5 m.

(From the company's website)

◎ Example (anti-flooding)

◆ Construction of ultra-deep rectangular manholes and spiral holes in Kyoto. The Kyoto City Water and Sewerage Bureau selected us to precast a special manhole (a pump room, stairwells, and a drop-off room) cast in-situ utilizing the inside of a shield launching shaft for rainwater storage pipes. Size: □ 4.1 m × 2.5 m □ 2.8 m × 2.8 mH = 22 m φ2000.

(From the company's website)

◎ Case study (falling rocks and sediment, supplemental site)

◆ Loop fence type E was installed on a ridge in Osutaka, Gunma Prefecture. Installed on a slope where the entire slope collapsed due to the landslide caused by Typhoon No. 19 in 2019, it has captured falling rocks and sediment twice so far.

(From the company's website)

② Develop growing businesses and obtain new revenue opportunities

◎ Example (railroad)

◆ Construction of an under-track slab for a LRT streetcar system in Utsunomiya City, Tochigi Prefecture. The slab under the track, which was originally planned to be cast on site, was precast, contributing to shortening the construction period. Full precast section: approximately 140 m, half precast section: approximately 10 km.

(From the company's website)

◎ Example (Entry into airport maintenance [RFID Group])

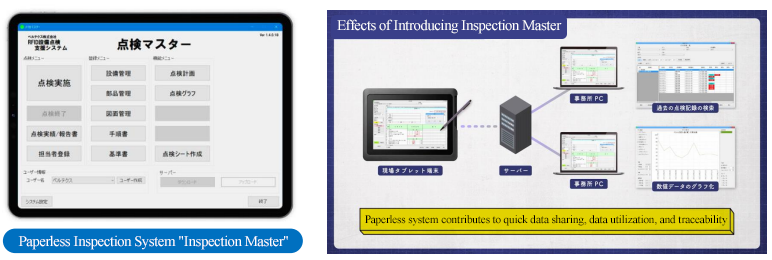

◆ Narita International Airport Corporation has adopted the company's "Inspection Master" package system for use in the periodic replacement and repair of aviation lighting on the runway and in facility inspections. The "Inspection Master" system is expected to expand its sales channels in the field of maintenance work at other airports in the future, as it enables paperless and DX-oriented on-site forms by using tablet terminals. In addition to airports, "Inspection Master" has a proven track record in the infrastructure field, including highways, railroads, and electric power, and has been adopted by many major manufacturing customers. In the future, there is expected to be an even greater need for more efficient work due to the longer service life of facilities and the shortage of labor.

(From the company's website)

③ Establish a business management base that allows sustainable growth

The following establishments and enhancements were carried out.

◎Redevelopment of programs for developing and recruiting human resources

Vertex Academy, which will serve as the central educational and training institution for the Vertex Group, was established and began operations. In addition, the Human Resources Development Group was established and the educational program was reorganized starting April 2022. For all of the executives and employees of the group (about 1,100 people), the company provided the Level-specific Training that develops abilities and qualification required by the responsibilities of each rank and fosters awareness for new hires, young employees, middle-level employees, newly appointed managers, and newly appointed senior management staff, the Academic Training that develops abilities and fosters awareness required for generalists, based on the recruitment from all of the companies in the group, and also the Department-specific Training intended to provide opportunities to learn professional knowledge and develop abilities, by selecting participants from each department, on top of the All Employees Training intended to promote knowledge and awareness in compliance and harassments, etc. In terms of academic training, we invited outside instructors and held a new in-house training program, "Next Generation Management and Executive Development Workshop," aimed at fostering employees with a management mindset. Participants were divided into four groups and will work for about a year to develop next-generation managers and executives and to revitalize the business through new business development. Furthermore, on October 4, 2023, an exchange meeting "VOX" was held with Original Engineering Consultants Co., Ltd. At this exchange meeting, the two themes of "PPP/PFI and public-private partnerships" and "human resource development and human capital enhancement" were discussed and many ideas were shared.

◎Development of information systems and ICT infrastructure, and promotion of DX

At Vertex, the new core system has been operational since May 2023.

In addition, the personnel and employment system has been in operation since February 2022.

At Vertex Construction, the new core system has been in operation since April 2021.

◎Establishment of systems for group governance and risk control

The company gave a lecture about compliance to all employees of the Vertex Group in 2021 and 2022.

They are carrying it out for the fiscal year 2023 as well.

In addition, a strengthening of internal audits is planned, with one additional employee hired, with the plan to carrying out internal audit at about 150 sites in three years is underway.

◎Development and strengthening of the business portfolio management function

The company reviewed the strategies and measures for small-scale businesses. The company is continuously developing the business portfolio management function.

◎Development of a sustainability promotion system

The company has set up a Sustainability Committee and is promoting further sustainability measures from February 2023 onward.

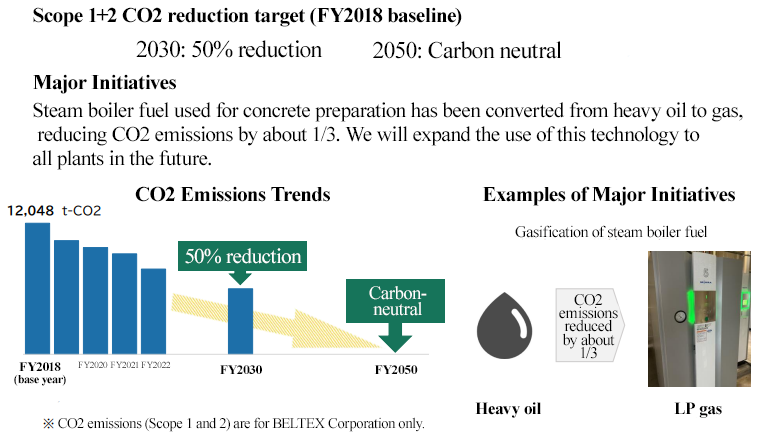

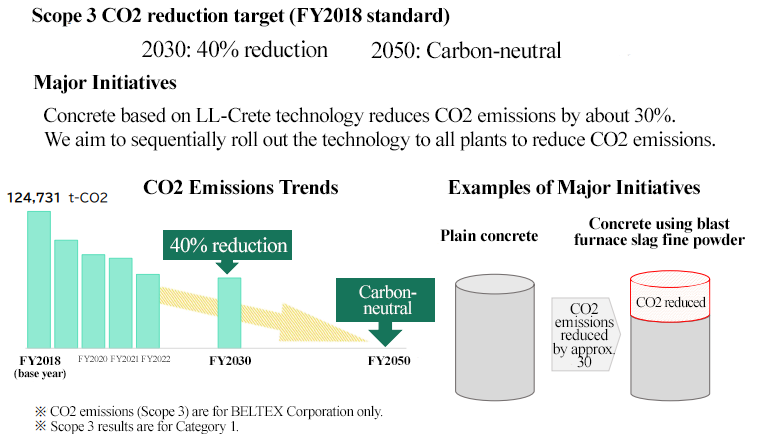

◎Example of Initiatives(Environment)

(From the company's website)

◎ Examples of Initiatives (Diversity Council)

The company has established the Diversity Council as a subordinate organization of the Sustainability Committee. Aiming to create an open workplace and company where diversity is respected, the committee will discuss how to create a working environment and human resources/welfare systems that are comfortable for women in particular and also promote various initiatives. The company intends to continue to further strengthen its sustainability initiatives, to enhance its corporate value over the medium/long term.

5. Conclusions

The company's results in the second quarter of the fiscal year ending 2024 showed a 4.2% year on year decline in sales and a 16.7% year on year increase in operating income. In terms of sales, with the exception of other businesses, all businesses (the concrete business, disaster prevention business, and pile business) saw declines. Operating income increased due to sales of high-value-added products in the concrete business and the reflection of raw material price hikes in selling prices in the disaster prevention business. Compared to the company's forecast for the first half, sales in the concrete and disaster prevention businesses were favorable, but sales in the pile business fell slightly short of the forecast at the beginning of the period due to a decline in demand. On the other hand, at the core operating company, Vertex Corporation, all kinds of profits of the business were significantly higher than initial forecasts due to conducting projects for high-value-added products that had been scheduled for the third quarter earlier than the expected timeline. This fiscal year is the final year of the medium-term management plan, and the numerical targets for the final year are the same as the company's full-year forecast for both net sales and all kinds of profits. Compared to the company's full-year forecast, the progress rate of first-half performance was less than 50% for both sales and all kinds of profits, but the company's earnings tend to be larger in the second half of each year, and it is making steady progress toward achieving the numerical targets of its medium-term management plan. The 4.8 percentage point increase in gross profit margin in the first half of the year compared to the same period of the previous fiscal year was a surprise. This was because Vertex Corporation for high-value-added products that had been scheduled for the third quarter earlier than the expected timeline. On the other hand, the company's recent strong efforts to pass on higher raw material prices to sales prices and increase the ratio of high-value-added products are also expected to contribute to profit growth significantly. The focus will be on performance and gross profit margin trends in the second half to see if the company will be able to achieve its numerical targets for the final year of its medium-term management plan. In particular, we would like to pay attention to how much it can increase the unit sales price of products and the ratio of high-value-added products, which are the keys to achieving its goals.

In addition, the third medium-term management plan is expected to start in the fiscal year ending March 2025. It is highly likely that measures that will serve as hints for the next medium-term management plan will materialize. Hence, we will continue to pay close attention to future developments and announcements.

<Reference 1: Regarding the Second Mid-Term Management Plan>

The company formulated and announced the second mid-term management plan for the three years from the term ending March 2022 to the term ending March 2024.

【The second mid-term management plan】

(1) Recognition of the business environment

As mentioned in Section 1 Outline of the company “1-3 Market environment,” the external environment includes the acceleration of the National Resilience Plan, the deterioration of social capital, and the shortage of manpower due to the declining birthrate and aging population in the construction industry, and the internal environment (the company’s factors) includes the company’s strengths such as:

*Advanced technologies and capabilities of design, development, and marketing, and a broad customer base

*A large number of original products boasting the largest market share and differentiated products

*Sound financial standing and ample funds.

The company recognizes that its challenges are:

*Rise in the average age of employees and difficulty in recruitment

*Development of the core business following the concrete business

*Acquisition of the business portfolio management function putting importance on capital efficiency.

It considers that there is room for streamlining after merger, mainly for production and sales systems.

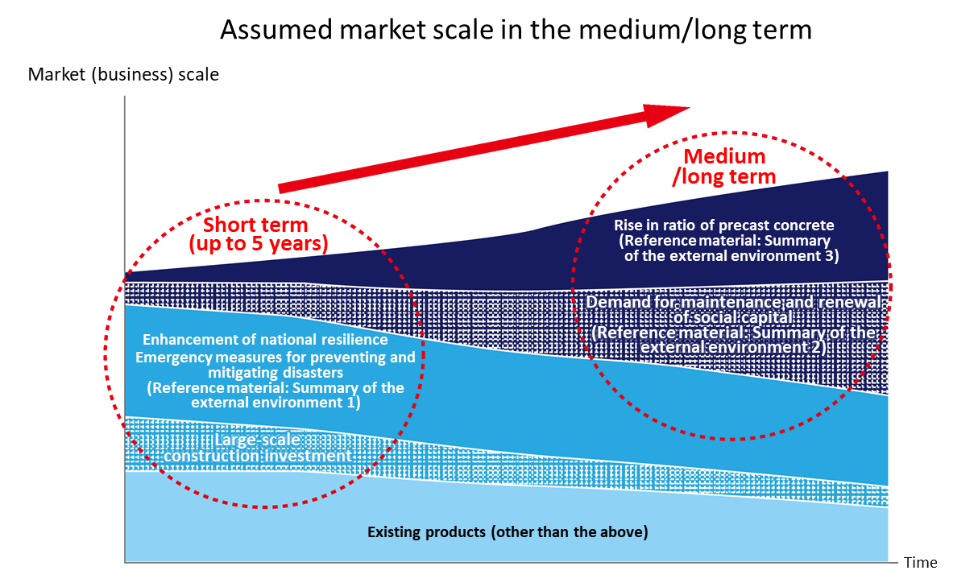

Under this environment, the target markets of the company are expected to expand in the medium/long term. From the medium/long-term viewpoint, the drivers for market expansion are considered to be “the rise in ratio of precast concrete due to the shortage of manpower” and “the growth of demand for maintenance and renewal of deteriorated social capital.”

As for “the rise in ratio of precast concrete,” the demand for concrete products is expected to grow.

As for “the growth of demand for maintenance and renewal of deteriorated social capital,” they plan to broadly meet the demand by taking advantage of their capabilities of proposing “inspection and reinforcement of infrastructure” in the upstream area and “repair, reinforcement, and renewal” in the downstream area, providing materials and products, and conducting construction.

(Taken from the reference material of the company)

(2) Basic policy and positioning of the second mid-term management plan

The company upholds the following basic policy.

To promote the organic growth of the core business by pursuing it further | The company aims to maximize cash flows in the future by enhancing the capacity to generate operating cash flow through the organic growth of the core business. |

To grow promising businesses and seize new earning opportunities | For further growth, the company will enhance efforts to nurture promising businesses and seize new earning opportunities (in new areas and categories, launching new products and businesses). |

To establish a management base for enabling sustainable growth | Continuously from the previous mid-term plan, the company will improve its management base by tightening group governance and establishing a risk control system, and implement ESG measures, with the aim of improving corporate value in a sustainable manner. |

Positioning the period of this mid-term management plan as “the period for strengthening the company’s business and management base for realizing sustainable growth without fail,” the company plans to forge ahead for attaining big hairy audacious goals (BHAGs): commemorate the 10th anniversary of establishment in October 2028 and to acquire the greatest brand power as an enterprise that offers reliability and safety.

(3) Measures and goals in each segment

① Concrete business

Outlook for the business environment | *Due to the impact of the novel coronavirus, the outlook for private investment remains uncertain, but public investment will be healthy. *To cope with natural disasters, which are getting graver, flood control basins (rainwater storage tanks) and rainwater drainage facilities will be constructed. To make structure earthquake-proof and cope with the deterioration of infrastructure, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. |

Major measures and policies | 1. To propose a lineup of high value-added products by utilizing the technological development capacity 2. To upgrade the centers for shipping general-purpose products for increasing customer satisfaction level 3. To pursue the business of maintaining and renewing existing infrastructure and promote the sales of products for preventing inundation and mitigating disasters and for transportation infrastructure 4. To improve the production and shipment efficiencies by integrating factories |

② Pile business

Outlook for the business environment | *Due to the impact of the novel coronavirus, private construction investment will be sluggish. *The recovery in this term is estimated to be gentle, and it is assumed that the recovery to the level in the previous term will be achieved around FY 3/23. Meanwhile, it is expected that there will be demand from distribution facilities, warehouses, suburban stores such as drugstores, etc. *From the viewpoint of prevention and mitigation of disasters, the demand for safety of foundations for buildings is growing. |

Major measures and policies | 1. To promote the sales of profitable products (high support piles and SC piles) and promote the selected order receipt for a lineup of less profitable products 2. To enhance and promote marketing while coping with the novel coronavirus 3. To improve existing construction methods and develop new construction methods |

③ Disaster prevention business

Outlook for the business environment | *For measures against natural disasters, which are getting graver and more frequent, including flood control (erosion control), forest conservation in areas where there is a risk of forest disaster, works for preventing landslides on road slopes and embankments, and works for preventing the collapse of slops adjacent to railways due to torrential rain, “the five-year acceleration campaign for preventing and mitigating disasters and enhancing national resilience” will begin with a total budget of about 15 trillion yen for five years from this fiscal year. *The measures for preventing natural disasters at transportation infrastructure will be strengthened. |

Major measures and policies | 1. To develop new products in the fields of prevention of fall of rocks, landslides, and avalanches 2. To improve existing products and enrich the product lineup 3. To enhance marketing in the transportation infrastructure field |

④ Other businesses

Business | Primary measures |

Ceramics business | To enter new industries and growing fields and evolve production technologies Example: radio wave absorbing ceramics |

Business of surveys and tests of concrete | To expand the business on inspection of fire cisterns, conduct fundamental research for surveys, and establish technologies |

Business of development and sale of systems | To expand business by developing systems for networks, security, and special tasks |

RFID business | Sales promotion targeting not only the markets of maintenance and preventive maintenance, but also the entire market of paperless slips/forms. |

(4) Group-wide measures

In order to achieve sustainable growth, the company will establish and strengthen a management base through mainly the following measures.

* Redevelopment of programs for developing and recruiting personnel

* Establishment of information systems and ICT infrastructure, and promotion of DX

* Building of systems for group governance and risk control

* Development and enhancement of the business portfolio management function

* Establishment of a sustainability promotion system

(5) Financial and investment strategies

It is assumed that the three-year cumulative operating cashflow is 14 billion yen.

For strengthening the core business, growing promising businesses, and seizing new earning opportunities, the company will allocate 9.8 billion yen to “investment in equipment renewal,” “equipment investment for adding high value and enhancing competitiveness,” “investment in R&D,” “investment in DX for improving productivity,” “start-up investment and M&A,” etc.The company will return 4.2 billion yen to shareholders, with a total return ratio of 30%.

(6) Investment in R&D and intellectual property

For evolving business models, the company will invest in R&D actively.

The company will put more energy into cross-sectoral R&D. Based on the collaboration among the industrial, academic, governmental, and private sectors, the company will strengthen its existing businesses and engage in research and development of products and production technologies that would generate revenues in the future.

Targeting clients, the company will establish a new marketing style based on plenty of know-how, experiences, patents, etc.

The company puts importance on “intellectual property” as important managerial resources that support growth and profitability as the output of R&D investment.

By further strengthening the capability to create intellectual property, the company aims to maintain and enhance business competitiveness.

(7) Numerical goals (Values as of the announcement of the plan)

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 377.0 | 390.0 | 400.0 | 410.0 | 2.8% |

Operating income | 52.9 | 55.0 | 58.0 | 61.0 | 4.9% |

Operating income margin | 14.0% | 14.1% | 14.5% | 14.9% | - |

Ordinary income | 56.3 | 57.0 | 60.0 | 63.0 | 3.8% |

Net income | 37.5 | 38.0 | 40.0 | 42.0 | 3.8% |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

The company aims to keep ROE 10% or higher.

◎ Goals in each segment

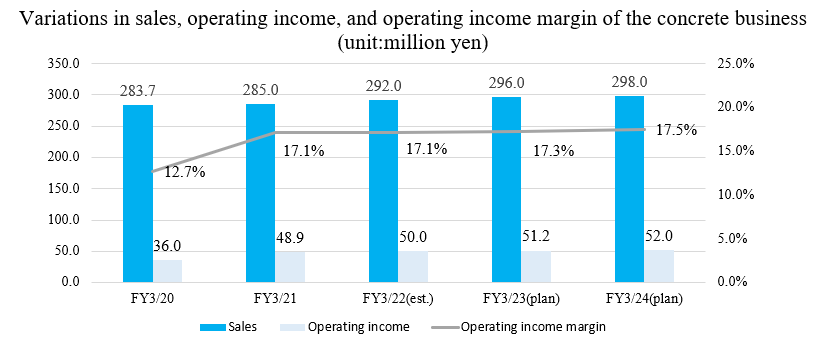

*Concrete business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 285.0 | 292.0 | 296.0 | 298.0 | 1.5% |

Operating income | 48.9 | 50.0 | 51.2 | 52.0 | 2.1% |

Operating income margin | 17.1% | 17.1% | 17.3% | 17.5% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

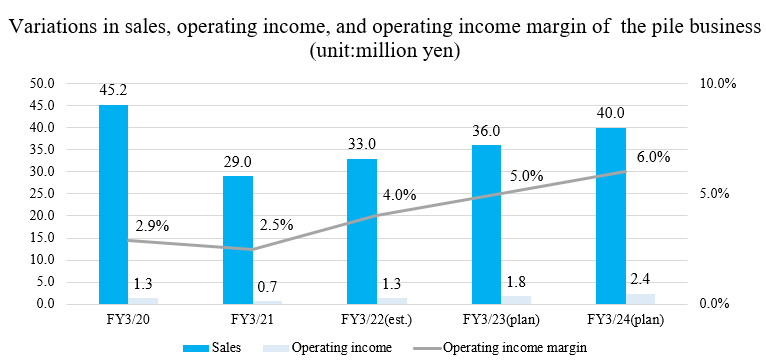

*Pile business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 29.0 | 33.0 | 36.0 | 40.0 | 11.3% |

Operating income | 0.7 | 1.3 | 1.8 | 2.4 | 50.8% |

Operating income margin | 2.5% | 4.0% | 5.0% | 6.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

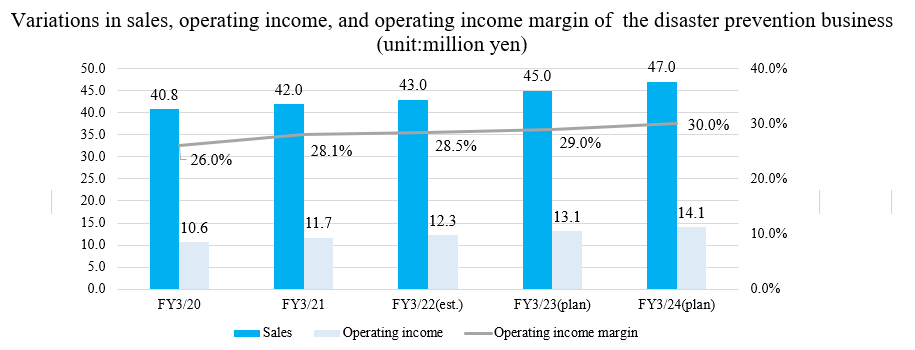

*Disaster prevention business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 42.0 | 43.0 | 45.0 | 47.0 | 3.8% |

Operating income | 11.7 | 12.3 | 13.1 | 14.1 | 6.4% |

Operating income margin | 28.1% | 28.5% | 29.0% | 30.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

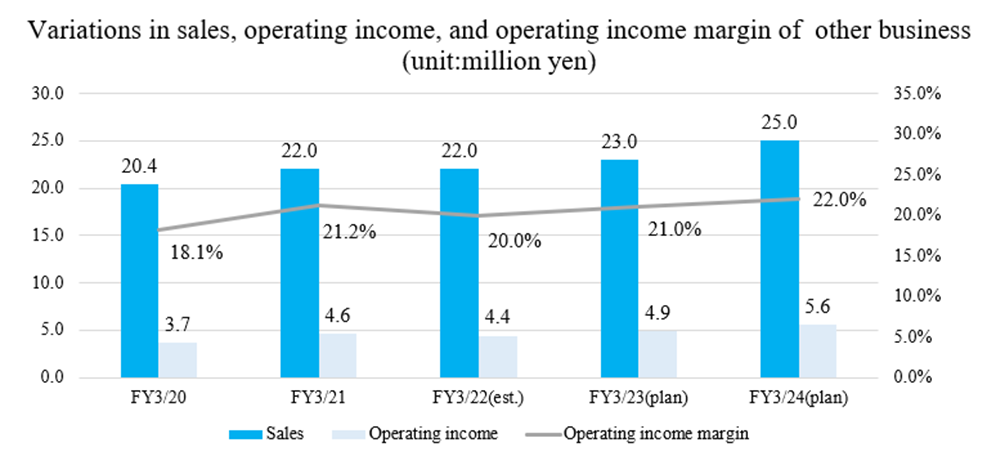

*Other business

| FY 3/21 | FY 3/22 (est.) | FY 3/23 (plan) | FY 3/24 (plan) | CAGR |

Sales | 22.0 | 22.0 | 23.0 | 25.0 | 4.4% |

Operating income | 4.6 | 4.4 | 4.9 | 5.6 | 6.8% |

Operating income margin | 21.2% | 20.0% | 21.0% | 22.0% | - |

*Unit: 100 million yen. CAGR means the average annual growth rate during the period from FY 3/21 to FY 3/24. It was calculated by Investment Bridge with reference to the material of the company.

<Reference2: Regarding Corporate Governance>

◎ Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

◎ Corporate Governance Report

Last updated in July 11, 2023

<Basic policy>

Our company’s basic policy regarding corporate governance is to strive to play active roles in management of the company group, and to enhance its corporate governance by establishing strategies and directions for the group, as well as to provide guidance and advice provided for the group companies, based on the recognition of the significance in establishing a corporate governance structure that brings efficient decision-making process, while securing transparency and soundness of the business.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

[Supplementary Principle 2-4 (1) Ensuring Diversity in the Appointment of Core Personnel] | Our company believes that having diversity in human resources and developing such human resources lead to improvement of the medium/long-term corporate value, and actively hires women and mid-career employees. While we promote mid-career hires to management positions based on a comprehensive evaluation of their skills and experience, we recognize that the number of female hires to management positions is currently insufficient, partly because there are few female employees in the civil engineering industry. To increase the number of female employees, we have set the ratio of new female hires at 50% or higher, and we will strive to develop human resources and improve the internal environment to increase the ratio of female employees as our core human resources in the future. Since our corporate group’s business domain is only in the country, we do not have employment history of foreigners for management positions, however, we base our assessments and appointments on individual’s skill and experience comprehensively in accordance with our future expansion of the business domain as well as the scope of our business. |

【Supplementary Principle 4-11-3: Analysis and Evaluation of Effectiveness of the Board of. Directors as a whole】 | Analysis and evaluation of the effectiveness of the Board of Directors as a whole and its disclosure will be considered in the future. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 3-1: Enhancement of disclosure of information】 | (i) Management principles, strategies, and plans Our company discloses its management plan and other information on its website. (ii) Basic Approach to Corporate Governance and Basic Policies Our company discloses on its website the guidelines that set forth its basic approach to corporate governance. (iii) Policies and Procedures for the Board of Directors in Determining the Compensation of Senior Management and Directors Remuneration for Directors (excluding Outside Directors) consists of base remuneration as fixed remuneration and stock options as non-monetary remuneration whose number is calculated based on performance indicators ("performance-linked non-monetary remuneration"). In light of their duties, outside directors receive only base remuneration. The standard remuneration ratio for each type of director (excluding directors who are members of the Audit Committee) is as follows: base remuneration: performance-linked non-monetary remuneration (short-term incentives): performance-linked non-monetary remuneration (long-term incentives) = 70:15:15 (if 100% of the performance indicators are achieved). The Compensation Committee deliberates and reports to the Board of Directors on the amount of remuneration for each director, and the Board of Directors respects and decides the amount of remuneration based on the report of the Committee. The compensation of directors who are members of the Audit Committee shall be decided by the Compensation Committee after deliberation and report to all directors who are members of the Audit Committee, and all directors who are members of the Audit Committee shall respect and discuss the content of such report. (iv) Policies and Procedures for Election and Dismissal of Senior Management and Nomination of Candidates for Directors (Policy) Regarding candidates for Directors who are not Audit and Supervisory Committee members, we appoint personnel with a wide range of perspectives and experience that can contribute to the development of the group, as well as management skills and sense to improve the group's corporate value. Candidates for Directors who are Audit and Supervisory Committee Members are selected from individuals who can fairly audit and supervise the execution of duties by Directors who are not Audit and Supervisory Committee Members based on their extensive experience and knowledge. (Selection Procedures) We established a discretionary Nominating Committee.The Nominating Committee deliberates on proposals for the election and dismissal of directors and makes recommendations on candidates for directors. Based on the respective recommendations, the committee reports to the Audit Committee the proposed candidates for directors who are not Audit Committee members, and the Board of Directors resolves the proposed candidates for directors who are Audit Committee members after obtaining the consent of the Audit Committee. v) Explanation on the Election, Dismissal, and Nomination When Electing and Dismissing Senior Management and Nominating of Candidates for Directors In the case of the election and dismissal of Directors, we will publish in the Reference Document for the Notice of the General Meeting of Shareholders the biographies of the candidates for new directors determined by the Board of Directors based on the recommendation of the Nominating Committee, and the reasons for their election and dismissal. (Management Plan: https://www.vertex-grp.co.jp/ja/ir/management/plan.html) (Corporate Governance Guidelines: )https://www.vertex-grp.co.jp/ja/ir/management/governance.html |

[Supplementary Principle 3-1-3: Initiatives for Sustainability] | In order to realize our management philosophy (brand vision) "To build safe society," we recognize that one of our management challenges is to balance "contributing to the realization of a sustainable society" and "achieving sustainable corporate growth," and we will identify issues of materiality and promote specific measures and goal-setting. We will continue to strengthen our efforts to realize a sustainable society and aim to be a company that earns the satisfaction and trust of society and stakeholders through the creation of new value. Please refer to our website for details of our sustainability initiatives and disclosures based on the TCFD. Our website https://www.vertex-grp.co.jp |

[Principle 5-1 Policy for constructive dialogue with shareholders] | We recognize that it is important for us to hold constructive dialogue with shareholders and investors aside from general meetings of shareholders to achieve sustainable growth and improve the medium/long-term corporate value, thus we assigned our Business Planning Department to be responsible for IR to handle individual meetings, post our company information on our website. In addition to disclosing information through the voluntary disclosure of the Tokyo Stock Exchange, we have established an internal system in which individual interviews are handled by appropriate persons selected from among the directors depending on the shareholder's wishes and the importance of the content of the interview. Furthermore, we hold semi-annual financial results briefing in which our executives including our Representative Director and President attend to present the financial results, business strategies, etc. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |