Bridge Report:(5290)Vertex the Fiscal Year Ended March 2025

President Akihide Tsuchiya | Vertex Corporation (5290) |

|

Company Information

Market | TSE Standard Market |

Industry | Glass, earthen, and stone products (manufacturing business) |

President | Akihide Tsuchiya |

HQ Address | 5-7-2 Kojimachi Chiyoda-ku Tokyo |

Year-end | March |

HP |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE Act. | Trading Unit | |

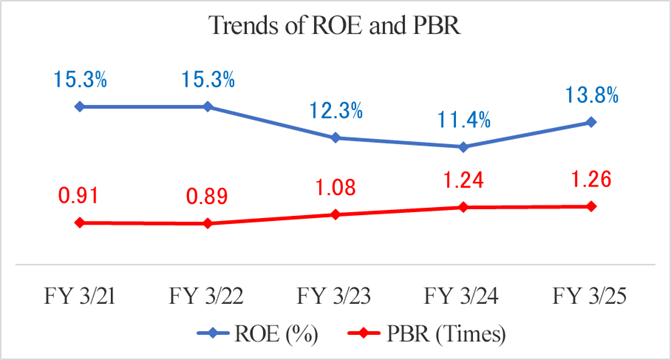

¥2,237 | 25,159,220 shares | ¥56,281 million | 13.8% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥65.00 | 2.9% | ¥173.42 | 12.9x | ¥1,442.51 | 1.6x |

* Stock price is as of closing on June 9, 2025. The number of shares issued is the number of outstanding shares as of the end of FY3/25, excluding treasury shares. The figures are rounded.

* A 3-for-1 stock split was executed on July 1, 2022. This stock split was taken into account, when calculating dividend yield, PER and PBR.

*ROE and BPS are the actual results for FY 3/25, and EPS and DPS are forecasts for FY 3/26.

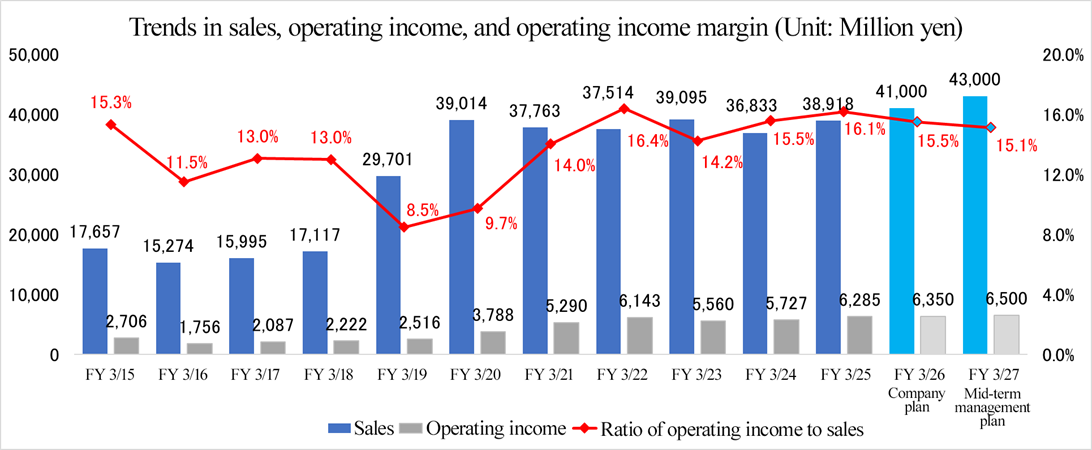

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2022 Act. | 37,514 | 6,143 | 6,434 | 4,242 | 160.90 | 26.27 |

March 2023 Act. | 39,095 | 5,560 | 5,837 | 3,742 | 140.86 | 30.00 |

March 2024 Act. | 36,833 | 5,727 | 5,849 | 3,728 | 143.86 | 40.00 |

March 2025 Act. | 38,918 | 6,285 | 6,449 | 4,826 | 190.60 | 60.00 |

March 2026 Est. | 41,000 | 6,350 | 6,500 | 4,290 | 173.42 | 65.00 |

*Unit: Million yen. The estimated values were provided by the company. Net income is the net income attributable to owners of the parent company. The same applies below.

*A 3-for-1 stock split was executed on July 1, 2022. DPS and EPS are recalculated retroactively. The dividend for FY 3/21 includes a commemorative dividend of 10.00 yen/share (30 yen before the 3-for-1 stock split).

This Bridge Report overviews the business performance for the fiscal year ended March 2025 and other information for Vertex Corporation.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended March 2025 Earnings Results

3. Fiscal Year Ending March 2026 Earnings Forecasts

4. Progress of the Third Mid-Term Management Plan

5. Conclusions

<Reference 1: The Third Mid-Term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2025, sales grew 5.7% year on year to 38,918 million yen and operating income rose 9.8% year on year to 6,285 million yen. Sales slightly fell below the forecast, but operating income exceeded the forecast, thanks to profitable large-scale projects. In the wake of reform of capital relationships among group companies, net income exceeded the forecast significantly, due to the posting of deferred transfer losses in the past as losses. Some measures are ongoing in accordance with the medium-term management plan, and they are steadily making medium/long-term projects for achieving their goals set in the medium-term plan.

- For the fiscal year ending March 2026, sales are expected to grow 5.3% year on year to 41 billion yen and operating income is projected to rise 1.0% year on year to 6,350 million yen. As they will make projects to compensate for the decline in the number of large-scale ones, sales and all kinds of profits excluding net income are forecast to grow. Due to the posting of deferred transfer losses in the previous fiscal year as losses, net income is forecast to drop. Regarding dividends, they plan to pay a common dividend of 65.00 yen/share, up 5.00 yen/share from the previous fiscal year. The expected payout ratio is 37.5%. They purchase treasury shares while monitoring the market environment, just like they did swiftly when share price nosedived in August last year and April this year.

- On March 27, 2025, the company announced the business merger with IHI Corporation, which handles segments that are indispensable for urban infrastructure. This business merger will enable the combination of the sewerage and flood control business, in which Vertex excels, and the segments of IHI, and they will be able to join projects for constructing underground tunnel reservoirs and underground rivers. In addition, their participation in large-scale infrastructure projects and other large-scale projects for high-standard roads, subways, etc., which are planned and conducted around Japan, will be accelerated. Furthermore, the fusion of the two companies’ technologies will enable the development of new products and materials. It is noteworthy what kinds of synergetic effects can be produced.

1. Company Overview

The core business of the company is to manufacture and sell a variety of precast concrete, which supports our daily lives.

(1) Company History

In 2014, three companies, NIPPON ZENITH PIPE CO., LTD., HANEX CO., LTD. (former name: HANEDA HUME PIPE CO., LTD.), and HANEDA CONCRETE INDUSTRIAL CO., LTD., merged into HANEDA ZENITH CO., LTD., which was then renamed HANEDA ZENITH HOLDINGS CO., LTD.

On October 1, 2018, HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. (based in Fukui Prefecture) established Vertex Corporation through joint stock transfer (which made HANEDA ZENITH HOLDINGS CO., LTD. and HOKUKON CO., LTD. wholly owned subsidiaries).

The companies set up a new business group.

In April 2019, HANEDA ZENITH CO., LTD., as the surviving company, absorbed HANEDA ZENITH HOLDINGS CO., LTD. (a merged company).

On April 1, 2021, VERTEX Co., Ltd. was born through absorption-type merger carried out by HANEDA ZENITH CO., LTD. as the surviving company and HOKUKON CO., LTD. as the merged company, which were the core business companies affiliated with VERTEX Corporation.

VERTEX Corporation aims to achieve sales and profit growth by increasing its market share and boosting profitability in the mature markets of concrete and piles, and the growing market of disaster prevention through a multitude of approaches, including creation of business synergy and enhancement of business efficiency.

(2) Variation in performance

Even after the management integration, they have engaged in the development of the management base and profit generation, so the company keeps growing while securing the highest level of profitability in this industry. From the fiscal year ending March 2025, they will aim to enter the next growth phase.

*ZENITH HANEDA HOLDINGS in FY3/15-FY3/18, Vertex Corporation from FY 3/19

(3) Long-term Vision

◎ Purpose

We offer new forms of security for the future of people worldwide with our unique ideas and one-of-a-kind technologies.

The corporate group has been creating new value and bringing peace of mind while facing changes in the natural environment and society. As a company that will continue to grow, it will strive to meet difficult needs with its one-of-a-kind technology and unique ideas and contribute to the realization of a sustainable society where people can live with peace of mind no matter where they live. The corporate group will continue to take on the challenge of creating new forms of security for the future of people around the world.

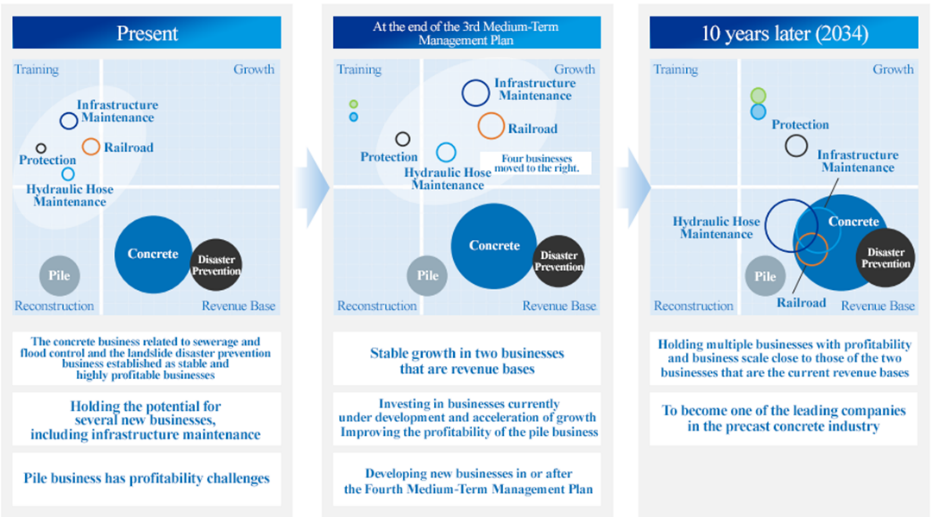

◎ VERTEX Vision 2034

The company has formulated the VERTEX Vision 2034 as well as its purpose to achieve in 10 years.

The first medium-term management plan (FY 3/20-FY 3/21) was a period to solidify the business and management foundations following the business integration, while the second medium-term management plan (FY 3/22-FY 3/24) was a period to strengthen the business and management foundations to ensure sustainable growth. In the subsequent third medium-term management plan (FY 3/25-FY 3/27), the company will focus on (1) strengthening the business portfolio, (2) promoting sustainability-oriented management, and (3) strengthening human capital, R&D, and digital transformation. After implementing the subsequent fourth and fifth medium-term management plans (FY 3/28-FY 3/33), the company aims to achieve sales of 100 billion yen and an operating income of 15 billion yen by 2034.

[The ideal state the company wants to realize in 10 years]

The company has also outlined the issues it must address in the next 10 years, such as the declining working population, aging infrastructure, global warming, and intensifying natural disasters, and has defined “the ideal sate it wants to realize in 10 years” as a countermeasure against these issues.

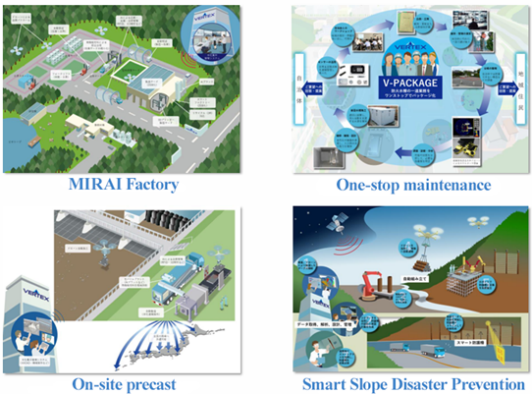

The ideal state the company wants to realize in 10 years | Measures |

MIRAI Factory | In light of the labor shortage, the company is promoting the creation of smart factories through automation and centralized management. |

One-stop Maintenance | To become a one-stop service provider by taking over the maintenance and management of infrastructure from the upstream |

Be precast ON-SITE | Precast concrete is to be precast onsite, instead of being delivered from the factory. |

Smart Slope Disaster Prevention | To realize smart slope-based disaster prevention by collecting a variety of data from satellites to detect and prevent disasters in advance |

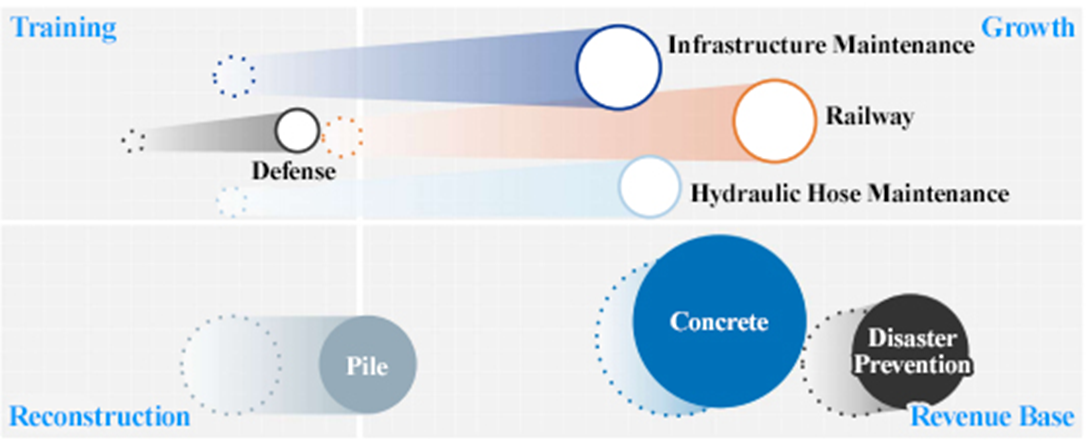

[Long-term business portfolio concept]

The company will work to strengthen its business portfolio in order to achieve VERTEX Vision 2034.

(Taken from the reference material of the company)

(4) Market Environment

The following are the points to keep in mind for understanding the company’s business environment:

◎ Demand for investment in disaster prevention and mitigation remains strong.

Public works-related expenditures, which are important in the construction industry, have remained stable for the past 10 years. In particular, a certain amount is allocated each year for infrastructure repairs and public works. In addition, as the proportion of existing infrastructure that is over 50 years old is projected to increase, it is expected that high levels of demand for investment in disaster prevention and mitigation will continue. In this environment, the company recognizes the importance of enriching its track record and increasing the market share of its products in line with its business model.

(Ratio of major social infrastructure that was constructed more than 50 years ago)

Agricultural drainage channels (approx. 50,000 km, core agricultural irrigation facilities) | 2019 | 2029 | - |

50% | 67% | - | |

Road bridges (approx. 730,000 bridges, bridges over 2 m) | 2020 | 2030 | 2040 |

30% | 55% | 75% | |

Sewer conduits (total length: approx. 470,000 km) | 2020 | 2030 | 2040 |

5% | 16% | 35% | |

Port wharf (approx. 5,000 facilities, water depth -4.5 m or deeper) | 2020 | 2030 | 2040 |

21% | 43% | 66% | |

Fire prevention water tanks (approx. 520,000 units) | 2020 | 2025 | 2035 |

35% | 40% | 58% |

(Taken from the reference material of the company)

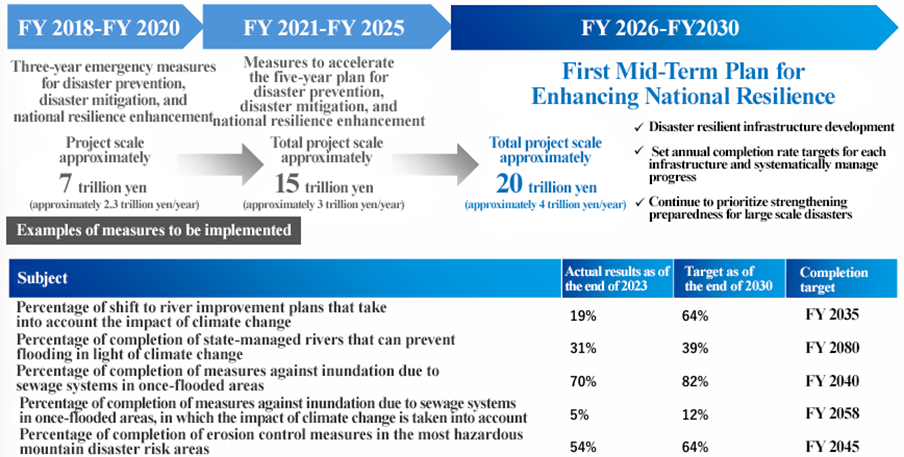

◎ Revision to the plan for enhancing national resilience

In accordance with the basic plan for enhancing national resilience, which was adopted at the Cabinet meeting in July 2024, they announced a draft of the first medium-term plan for enhancing national resilience in April 2025. The scale of the project is up about 30% from the previous measure for accelerating the five-year plan, and this is favorable for their core business.

(Taken from the reference material of the company)

◎ Workstyle reform and labor shortages on construction sites: Expansion of precast construction methods

Precast concrete is a concrete product that is manufactured in advance in a factory. It is highly efficient in terms of workability and is expected to be a solution to the labor shortage and rising labor costs on construction sites. On the other hand, casting concrete in-situ is a construction method in which reinforcing bars are assembled at the construction site and ready-mixed concrete is poured. Precast concrete has the advantage of being about 1/2 to 1/5 as efficient in terms of on-site work efficiency as compared to casting concrete in-situ, but the disadvantage is that it must be transported from a factory, which generates restrictions on transport routes and can result in high transport costs depending on the distance. On the other hand, casting in-situ can be flexibly adopted for special and large structures without the restrictions of transport routes, but it also has the disadvantages of being inferior to precast in terms of work efficiency and its quality varies depending on weather conditions and workers. Currently, the majority of construction work is done by casting in-situ due to its economic advantage in terms of direct construction costs, and precast construction accounts for only 13% of the total. However, with the shortage of skilled workers and the need to improve construction efficiency in line with the reform of work styles at construction sites, it is expected that the use of precast construction will become more common in the long term than it is now. If the usage ratio reaches the same level as overseas, the ratio of precast construction methods may exceed 50% in the medium/long term.

(5) Business Details

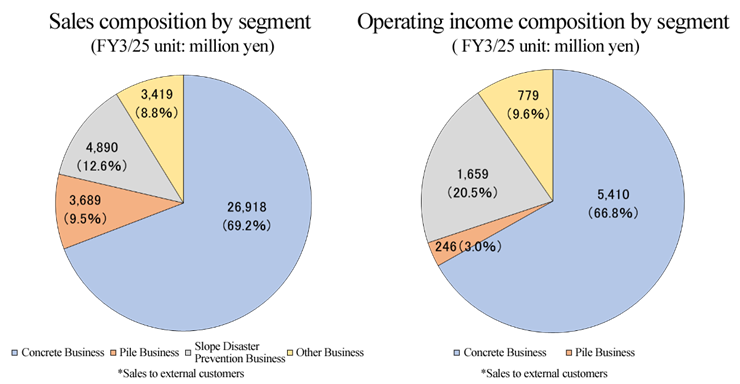

The company has four reporting segments, which are Concrete Business, Pile Business, Disaster Prevention Business, and Other Business. The “Disaster Prevention Business” will be renamed “Slope Disaster Prevention Business” in the fiscal year ended March 2025.

The following is a table showing the group companies operating each business segment:

Business | Group Companies |

Concrete Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Co., Ltd. (Osaka) Hokukon Product Co. LTD (Fukui Pref.) HOKKAN CONCRETE CO., LTD. (Gunma Pref.) Kyushu Vertex Co., Ltd. (Fukuoka Pref.) |

Pile Business | HOKUKON MATERIAL CO., LTD. (Fukui Pref.) |

Slope Disaster Prevention Business | Vertex Co., Ltd. (Tokyo) Vertex Construction Company (Osaka) Kyushu Vertex Co., Ltd. (Fukuoka Pref.) |

Other Business | WICERA Co., Ltd. (Gifu Pref.) iB Solution Corporation (Fukui Pref.) PROFLEX CO., LTD. (Saitama Prefecture) NX inc. (Tokyo; equity-method affiliate) |

[Concrete Business]

The company manufactures and sells precast concrete. This is the company's main business area, accounting for about 69% of total sales and 67% of total operating income. In particular, the company's mainstay products are those for flood control and sewage, and the company boasts the industry's top performance in this area.

(Each photo is taken from the reference material of the company.)

Name of Business | Overview and Main Products |

Flood control and sewerage business | With their rich product lineup and one-of-a-kind technologies, which can meet needs, they offer the best proposal for “prevention and mitigation of disasters,” such as measures against flood disasters and the construction of earthquake-resistant sewage facilities.

|

Road business | They not only construct road infrastructure, but also have a lot of products for safeguarding the lives of people. It contributes to the construction of “safe and reliable” roads.

|

Maintenance business | They propose optimal products and construction methods while taking into account lifecycle costs, as a measure against the deterioration of infrastructure that cannot be postponed. It contributes to the extension of service life of infrastructure that supports affluent citizens’ lives, society, and economy.

|

Railway business | Their lineup includes products made of rigorously selected materials, such as super-hard concrete and special mortar, to bring “safety and peace of mind” with outstanding technologies.

|

Housing and development business | Their lineup includes many products for withstanding large earthquakes, in order to develop towns resistant to earthquakes and disasters where people can live with peace of mind. In addition, they own earthquake-resistant water reservoirs of the No. 1 brand and unique toilets for disasters.  |

[Pile Business]

The company is developing a business that produces concrete piles used for building foundations. They manufacture and sell concrete piles, which are used for building foundations, and conduct piling.

[Slope Disaster Prevention Business]

The company manufactures and sells products for slope disaster prevention. Their lineup includes many construction methods and products developed in house through performance tests, for mountain roads and residential areas where disasters, such as the avalanche of rocks and mud, may occur.

[Other Business]

Other businesses include hydraulic hose maintenance, ceramics business, RFID business, concrete surveys & testing business, system development & sales business, and lactic acid bacteria business. They are operated by subsidiaries.

(6) Characteristics and Strength

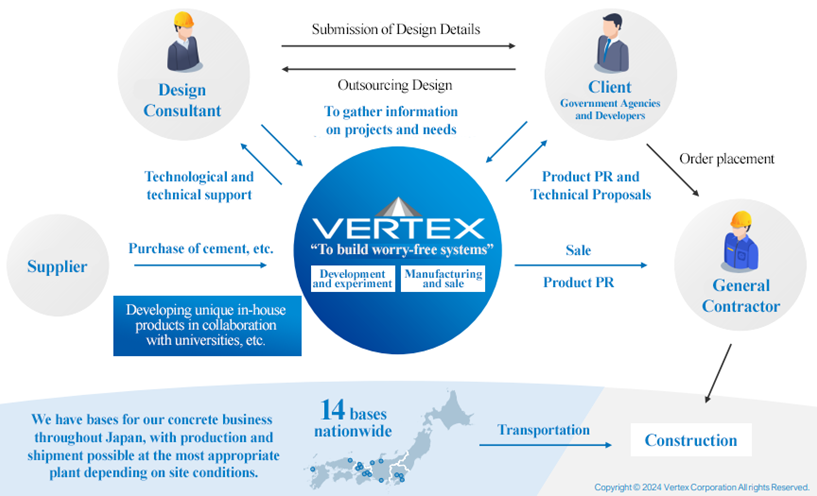

◎ Characteristics of the Business Model

Although general contractors are the company's direct customers, this model allows the company to market its products by offering proposals and support to design consultants and clients (government agencies and developers) from the early stages of a project. It is also a model that allows the company to introduce new products to the market ahead of competitors as a measure to address social issues, build a track record as a leading manufacturer, cultivate the market, establish a brand in the field, and increase sales.

(Taken from the reference material of the company)

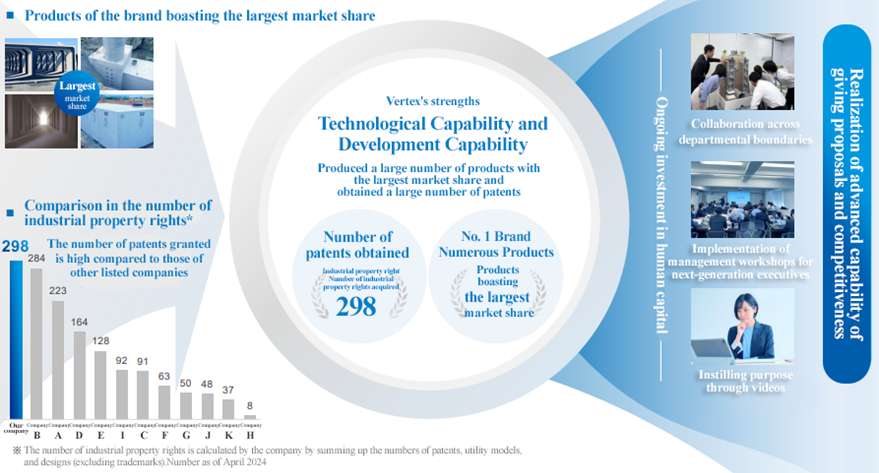

◎ Strengths

① Technical and development capabilities

The company has realized an advanced capability of giving proposals and competitiveness by systematically collaborating with all staff members, including sales and engineering staff, based on the technical and development capabilities shown by the number of patents acquired and the number of products ranked as No. 1 brand products.

(Taken from the reference material of the company)

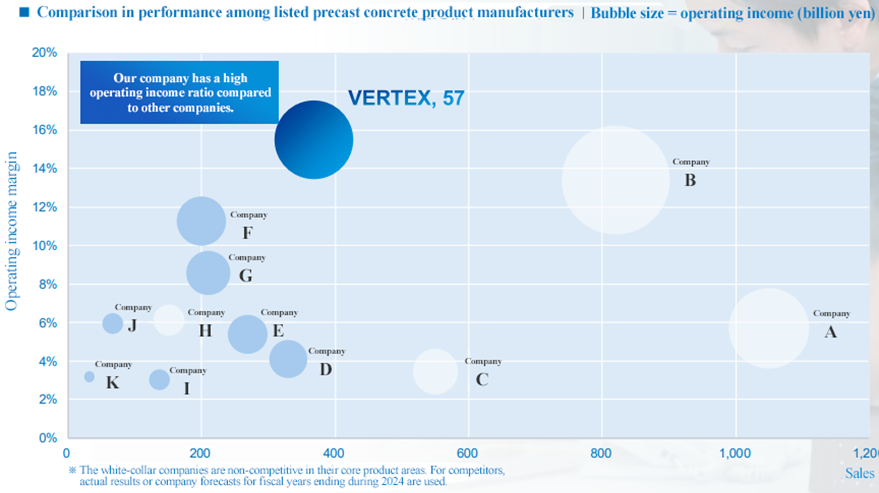

② Highest profit margin in the industry

By combining technical, development, sales and organizational capabilities, the company has achieved the highest profit margin in the industry.

(Taken from the reference material of the company)

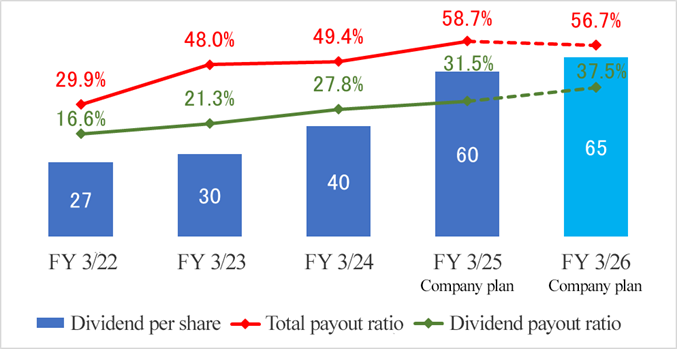

(7) Shareholder Return Policy

Regarding the dividends for fiscal year ended March 2025, they plan to upwardly revise the initial plan and pay 60 yen/share (disclosed on April 30). Payout ratio is 31.5% and total return ratio is 58.7%, nearly equal to the goals set in the medium-term management plan. In fiscal year ending March 2026, they plan to increase the dividend amount to 65 yen/share, while net income will decline.

They purchase treasury shares while monitoring the market environment, just like they did swiftly when share price nosedived in August last year and April this year.

(8) Management that takes capital costs into consideration

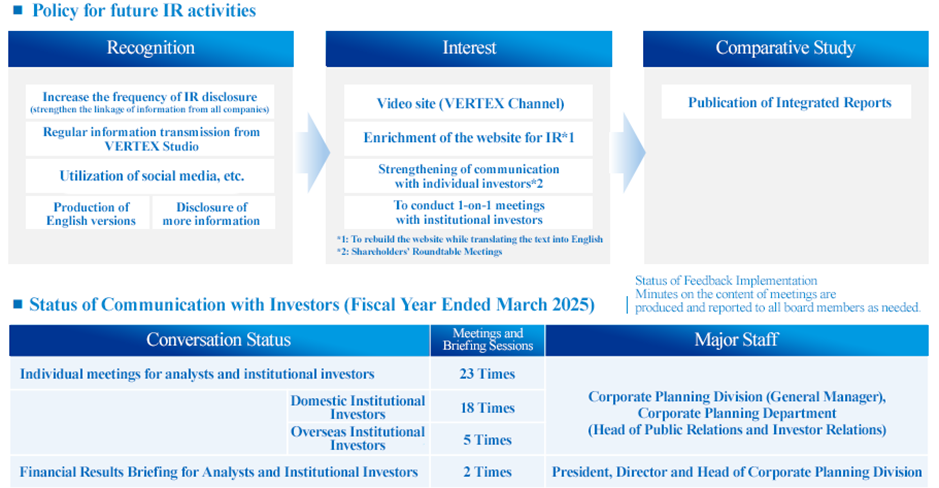

The company considers its current cost of capital to be 8-9% and continues to aim for long-term ROE improvement and curb capital costs in the long term.

In addition, during the period of the medium-term management plan, the company will be focusing on enhancing its IR activities, such as expanding English-support and disclosure, and will aim to improve corporate value through dialogue with shareholders and investors.

(Taken from the reference material of the company)

2. Fiscal Year Ended March 2025 Earnings Results

(1) Consolidated results

| FY 3/24 | Ratio to sales | FY 3/25 | Ratio to sales | YoY | The company’s forecast | Compared to the forecast |

Sales | 36,833 | 100.0% | 38,918 | 100.0% | +5.7% | 40,000 | -2.7% |

Gross profit | 12,173 | 33.0% | 13,236 | 34.0% | +8.7% | - | - |

SG&A | 6,446 | 17.5% | 6,950 | 17.9% | +7.8% | - | - |

Operating income | 5,727 | 15.5% | 6,285 | 16.2% | +9.8% | 6,000 | +4.8% |

Ordinary Income | 5,849 | 15.9% | 6,449 | 16.6% | +10.3% | 6,200 | +4.0% |

Net Income | 3,728 | 10.1% | 4,826 | 12.4% | +29.4% | 4,050 | +19.2% |

*The figures include those calculated by Investment Bridge Co., Ltd. as reference values, and may differ from actual values (the same applies hereinafter).

*Unit: Million yen.

Sales grew 5.7% year on year, and operating income rose 9.8% year on year.

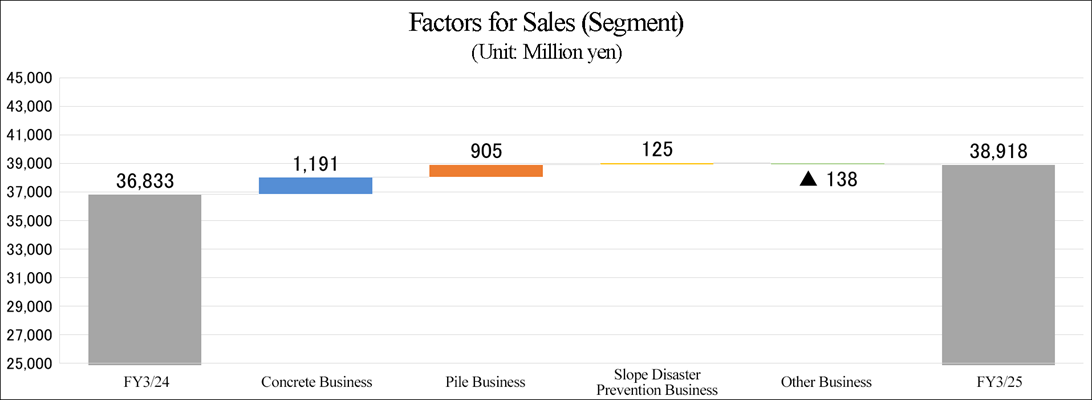

In fiscal year ended March 2025, sales increased 5.7% year on year to 38,918 million yen. Sales grew in the concrete, pile, and slope disaster prevention businesses, except other businesses, but fell below the initial forecast by 2.7%.

Operating income was 6,285 million yen, up 9.8% year on year. Profit, too, grew in the concrete, pile, and slope disaster prevention businesses, except other businesses, and exceeded the initial forecast by 4.8%. The posting of profitable large-scale projects contributed. Gross profit margin rose 1 point year on year to 34.0%. The ratio of SGA to sales rose 0.4 points year on year, but operating income margin increased 0.7 points year on year to 16.2%. As costs for compensation for damage posted as non-operating expenses decreased year on year from 54 million yen to 4 million yen, the growth rate of ordinary income exceeded that of operating income. In the wake of reform of capital relationships among group companies, net income increased significantly by 29.4% year on year, due to the posting of deferred transfer losses in the past as losses.

Some measures are ongoing in accordance with the medium-term management plan, and they are steadily making medium/long-term projects for achieving their goals set in the medium-term plan.

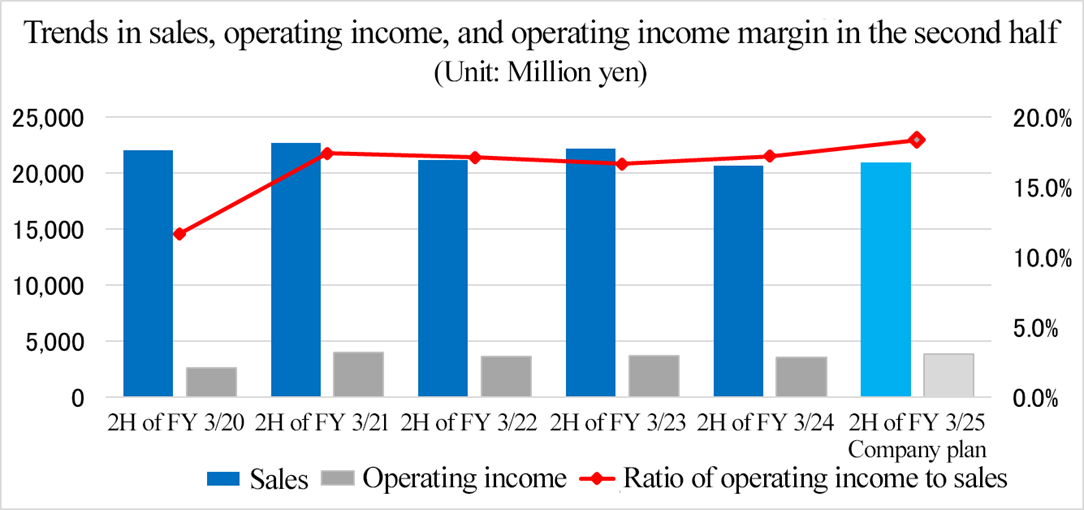

Results in the second half

In the second half of the fiscal year ended March 2025, sales and profit grew year on year, and operating income margin rose 1.1 points year on year to 18.3%. Sales, operating income, and operating income margin have been stably high.

(2) Trend of each segment

| FY 3/24 | Composition ratio | FY 3/25 | Composition ratio | YoY |

Concrete business | 25,726 | 69.8% | 26,918 | 69.2% | +4.6% |

Pile business | 2,783 | 7.6% | 3,689 | 9.5% | +32.5% |

Slope disaster prevention business | 4,765 | 12.9% | 4,890 | 12.6% | +2.6% |

Other business | 3,557 | 9.7% | 3,419 | 8.8% | -3.9% |

Total sales | 36,833 | 100.0% | 38,918 | 100.0% | +5.7% |

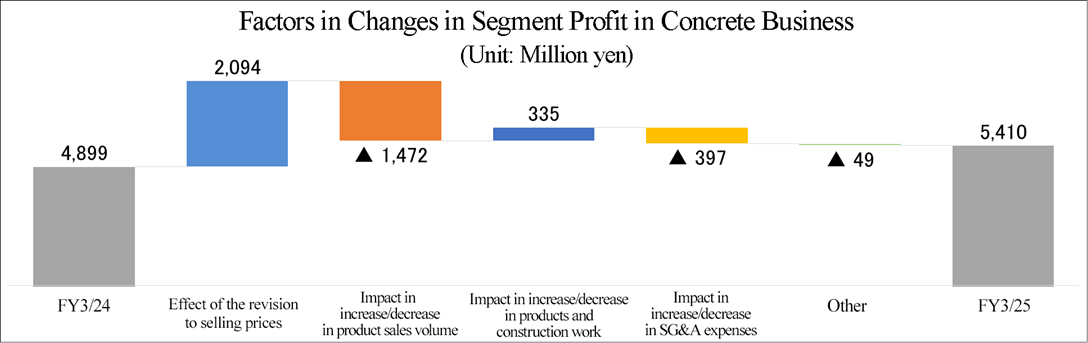

Concrete business | 4,899 | 19.0% | 5,410 | 20.1% | +10.4% |

Pile business | 81 | 2.9% | 246 | 6.7% | +200.7% |

Slope disaster prevention business | 1,557 | 32.7% | 1,659 | 33.9% | +6.6% |

Other business | 788 | 22.2% | 779 | 22.8% | -1.2% |

Adjustment amount | -1,600 | - | -1,810 | - | - |

Total operating income | 5,727 | 15.5% | 6,285 | 16.2% | +9.8% |

* Unit: thousand yen. The composition ratio of operating income means the ratio of operating income to sales.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

◎ Concrete Business (Sales and profit grew 4.6% and 10.4%, respectively, year on year.)

They received orders for large-scale projects, which hare profitable, in the Kyushu area in the first half of the fiscal year, and revised unit selling price, steadily improving profitability. As a result, sales grew 4.6% year on year to 26,918 million yen and profit rose 10.4% year on year to 5,410 million yen. Operating income margin rose 1.1 points year on year to 20.1%. Sales fell below the forecast, but profit exceeded the forecast.

◎ Pile Business (Sales and profit grew 32.5% and 200.7%, respectively, year on year.)

Continuous projects from the previous fiscal year and new projects scheduled at the beginning of the fiscal year progressed smoothly mainly in the first half of the fiscal year. As a result, sales grew 32.5% to 3,689 million yen, and profit rose 200.7% year on year to 246 million yen. Operating income margin rose 3.7 points to 6.7%. Both sales and profit exceeded the forecast.

◎ Slope Disaster Prevention Business (Sales and profit grew 2.6% and 6.6%, respectively, year on year.)

The sales quantities of products were healthy, and the number of orders for projects for preventing slope disasters exceeded the forecast. As a result, sales grew 2.6% year on year to 4,890 million yen, and profit rose 6.6% year on year to 1,659 million yen. Operating income margin declined 1.3 points year on year to 33.9%. Sales fell below the forecast, but profit exceeded the forecast.

◎ Others (Sales and profit declined 3.9% and 1.2%, respectively, year on year.)

In the hydraulic hose maintenance business, they received a healthy number of orders, but in the ceramics business, the shipments related to automobiles (EVs) and semiconductor manufacturing equipment were stagnant. As a result, sales decreased 3.9% year on year to 3,419 million yen, and profit declined 1.2% year on year to 779 million yen. Operating income margin rose 0.6 points year on year to 22.8%. Both sales and profit fell below the forecast.

(3) Financial position and cash flows

Financial position

| Mar. 2024 | Mar. 2025 |

| Mar. 2024 | Mar. 2025 |

Cash and Deposits | 13,921 | 17,323 | Trade Payables | 7,145 | 6,103 |

Trade Receivables | 13,283 | 10,935 | ST Interest-Bearing Debts | 3,294 | 3,065 |

Inventories | 4,904 | 5,492 | Current Liabilities | 13,817 | 11,960 |

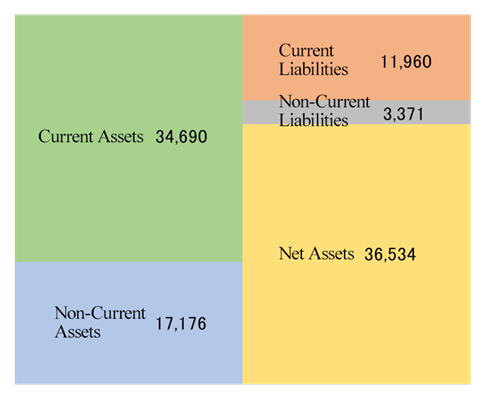

Current Assets | 32,803 | 34,690 | LT Interest-Bearing Debts | 1,458 | 844 |

Tangible Assets | 12,538 | 11,297 | Noncurrent Liabilities | 4,348 | 3,371 |

Intangible Assets | 3,784 | 3,424 | Net Assets | 33,859 | 36,534 |

Investment and Other Assets | 2,898 | 2,455 | Total Liabilities and Net Assets | 52,024 | 51,866 |

Noncurrent Assets | 19,221 | 17,176 | Total interest-bearing debt | 4,755 | 3,910 |

*Unit: Million yen. Trade receivables include electronically recorded ones, while trade payables include electronically recorded ones. Interest-bearing debt include lease obligations.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

The total assets as of the end of March 2025 stood at 51,866 million yen, down 158 million yen from the end of the previous fiscal year. Major factors in increasing assets include cash and deposits, inventory assets, and investment securities, while major factors in decreasing assets include accounts receivable, land, and goodwill. Major factors in increasing liabilities and net assets include reserve for bonuses and retained earnings due to the increase in net income attributable to shareholders of the parent company. Major factors in decreasing liabilities and net assets include accounts payable, short-term and long-term interest-bearing liabilities, income taxes payable, and liabilities for retirement benefits. The capital-to-asset ratio as of the end of March 2025 stood at 70.0%, up 5.5 points from the end of the previous fiscal year.

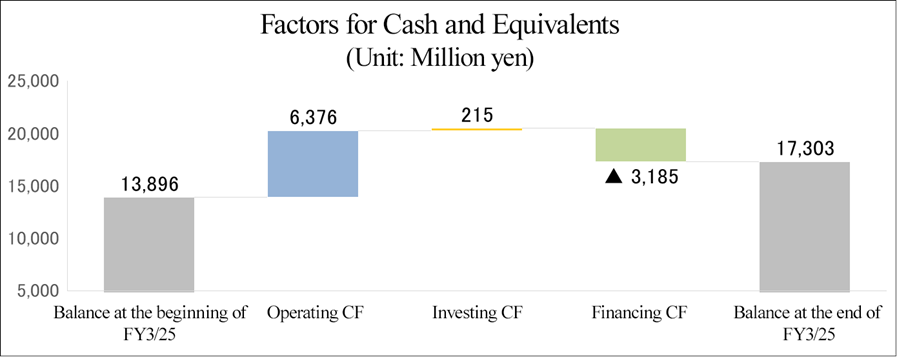

Cash Flow

| FY 3/24 | FY 3/25 | YoY | |

Operating CF | 5,592 | 6,376 | 783 | +14.0% |

Investing CF | -526 | 215 | 741 | - |

Free CF | 5,066 | 6,591 | 1,525 | +30.1% |

Financing CF | -2,152 | -3,185 | -1,033 | - |

Cash and equivalentsas of the end of the interim period | 13,896 | 17,303 | 3,406 | +24.5% |

*Unit: Million yen.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

In terms of cash flows, the cash inflow from operating activities grew due to the decrease in impairment losses, accounts payable, etc. In addition, due to the revenue from business transfer, the cash flow from investing activities turned positive, and the surplus of free cash flow also increased. The cash outflow from financing activities augmented, due to the decrease in short-term debt, the augmentation of purchase of treasury shares, increase in dividend payments, etc. As a result, the cash position as of the end of the fiscal year ended March 2025 was up 24.5% year on year.

(4) Shareholder return

◎ Policy for shareholder return (Period of the current medium-term management plan: FY 3/25 to FY 3/27)

◆ Dividend payout rati 30%

◆ Total return ratio: 50% or higher

◎ Dividend

The company plans to pay a dividend of 60 yen/share, up 20 yen from the previous fiscal year, and payout ratio is expected to be 31.5%.

◎ To Acquire Treasury Shares

The company continuously purchased treasury shares, in order to enhance shareholder returns, improve capital efficiency, and implement a flexible capital policy in response to changes in the business environment. Total return ratio stood at 58.7%, nearly equal to the goal set in the medium-term management plan.

◆ Acquisition period: (1) May 14 to July 22, (2) August 13 to October 11

◆ Total acquisition price: 1.3 billion yen ((1) 800 million yen, (2) 500 million yen)

3. Fiscal Year Ending March 2026 Earnings Forecasts

(1) Consolidated results

| FY 3/25 | Ratio to sales | FY 3/26 Est. | Ratio to sales | YoY |

Sales | 38,918 | 100.0% | 41,000 | 100.0% | +5.3% |

Operating Income | 6,285 | 16.2% | 6,350 | 15.5% | +1.0% |

Ordinary Income | 6,449 | 16.6% | 6,500 | 15.9% | +0.8% |

Net Income | 4,826 | 12.4% | 4,290 | 10.5% | -11.1% |

*Unit: Million yen.

Sales are projected to increase 5.3% year on year, and operating income 1.0% year on year.

On April 1, 2024, the company set the purpose of “We offer new forms of security for the future of people worldwide with our unique ideas and one-of-a-kind technologies.” In order to attain this purpose, the company formulated “the long-term vision VERTEX Vision 2034” to achieve in 10 years by 2034 and “the third medium-term management plan” for the period from 2024 to 2026. By implementing the management strategy set in the “the third medium-term management plan” without fail, they aim to ensure the peace of mind and improve corporate value further.

Sales, gross profit, operating income, and ordinary income are expected to grow, as they will secure projects to compensate for the decrease of large-scale projects. However, net income is expected to decrease due to the posting of deferred transfer losses in the previous year as deductible expenses. Operating income margin is assumed to be 15.5%, down 0.7 points from the previous fiscal year.

For dividends, they plan to pay a common dividend of 65.00 yen/share, up 5.00 yen/share from the previous fiscal year. The expected payout ratio is 37.5%. They purchase treasury shares while monitoring the market environment, just like they did swiftly when share price nosedived in August last year and April this year. For fiscal year ending March 2026, sales are expected to grow 5.3% year on year to 41 billion yen, and operating income is forecast to rise 1.0% year on year to 6,350 million yen.

The acquisition of IHI Corporation announced in March 2025 is being assessed, so it has not been taken into account in the forecast. The impact of the post-merger process on the medium-term management plan will be disclosed after the assessment.

Most of their businesses are related to the public-work projects in Japan, which arise out of domestic demand. Accordingly, the tariff measures of the Trump administration would not affect their businesses significantly. The raw materials for precast concrete are procured mainly inside Japan, so changes in exchange rates would produce little effect.

(2) Trend in each segment

| FY 3/25 | Composition ratio | FY 3/26 Est. | Composition ratio | YoY |

Concrete business | 26,918 | 69.2% | 28,100 | 68.5% | +4.4% |

Pile business | 3,689 | 9.5% | 3,400 | 8.3% | -7.8% |

Slope disaster prevention business | 4,890 | 12.6% | 5,500 | 13.4% | +12.5% |

Other business | 3,419 | 8.8% | 4,000 | 9.8% | +17.0% |

Total sales | 38,918 | 100.0% | 41,000 | 100.0% | +5.3% |

Concrete business | 5,410 | 20.1% | 5,400 | 19.2% | -0.2% |

Pile business | 246 | 6.7% | 240 | 7.1% | -2.6% |

Slope disaster prevention business | 1,659 | 33.9% | 1,760 | 32.0% | +6.1% |

Other business | 779 | 22.8% | 850 | 21.3% | +9.0% |

Adjustment amount | -1,810 | - | -1,900 | - | - |

Total operating income | 6,285 | 16.2% | 6,350 | 15.5% | +1.0% |

* Unit: million yen. The composition ratio of operating income means the ratio of operating income to sales.

* The disaster prevention business was renamed the slope disaster prevention business in the fiscal year ended March 2025.

In the concrete business, sales are expected to grow 4.4% year on year and profit is forecast to decline 0.2% year on year. Operating income margin is projected to drop 0.9 points year on year to 19.2%.

In the pile business, sales are projected to drop 7.8% year on year and profit is forecast to decline 2.6% year on year. Operating income margin is expected to rise 0.4 points year on year to 7.1%.

In the slope disaster prevention business, sales are expected to grow 12.5% year on year and profit is forecast to rise 6.1% year on year. Operating income margin is projected to decline 1.9 points year on year to 32.0%.

In the other businesses, sales and profit are expected to grow 17.0% and 9.0%, respectively, year on year. Operating income margin is projected to decrease 1.6 points year on year to 21.3%.

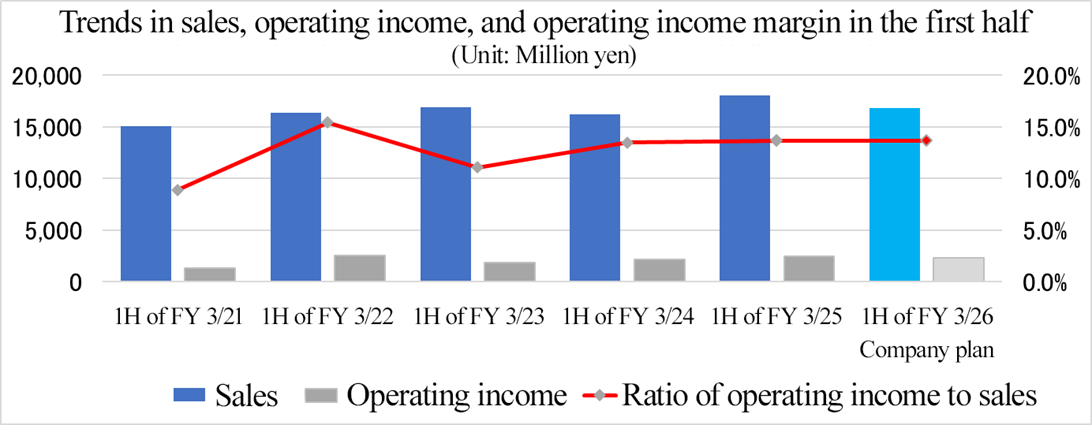

(3) Performance trend in the first half

In the first half of the fiscal year, sales and profit are projected to decline, as profitable large-scale projects were recorded in the previous fiscal year.

(4) Acquisition of treasury shares

The company plans to acquire up to 421,000 treasury shares during a period from April 11 to July 31, 2025.

The total acquisition price is up to 800,000,000 yen, and they account for 1.65% of the total number of outstanding shares, excluding treasury shares.

4. Progress of the Third Mid-Term Management Plan

For the first phase of VERTEX Vision 2034, it is forecast that sales will be 43 billion yen and operating income will be 6.5 billion yen, when the effects of exchange rate fluctuations, etc. are excluded. As the first step for achieving sales of 100 billion yen and an operating income of 15 billion yen, the company will invest in the fortification of the business portfolio and engage in the development of new business, which will drive the regrowth and long-term growth of their core business based on the established business foundation.

[Numerical goals]

Numerical goals (as of the announcement of the plan)

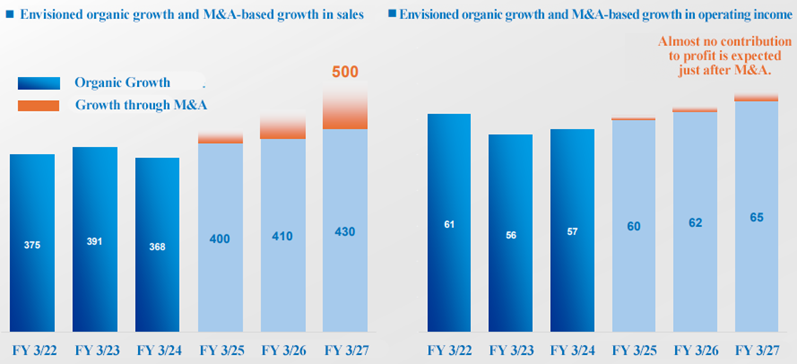

| FY 3/24 (Act.) | FY 3/25 (Mid-term management plan) | FY 3/26 (Mid-term management plan) | FY 3/27 (Mid-term management plan) | 3-year Cumulative total | Vision 2034 |

Sales | 368 | 400 | 410 | 430 | 1,240 | 1,000 |

Operating Income | 57 | 60 | 62 | 65 | 187 | 150 |

ROE | 11% | - | - | 14% | - | 20% |

*Unit: 100 million yen.

[Priority items]

Strengthening the business portfolio |

◆ Infrastructure business - Concrete and slope disaster prevention The company aim to increase revenues stably while considering the market growth. ◆ Business they will nurture - Maintenance, railway, defense, and hydraulic hose maintenance The company will invest in the future priority domains for growth. |

Strengthening promotion of human capital, R&D and DX |

Promoting sustainability-oriented management |

(Taken from the reference material of the company)

[Measures]

| ① Strengthening the business portfolio |

◆ In the concrete and slope disaster prevention businesses, which are the mainstay, they will promote the expansion of stable revenue in step with market growth. ◆ They will promote investment in the businesses of infrastructure maintenance, railroads, defense, and hydraulic hose maintenance, to grow them. ◆ In addition to organic growth, they will promote the reinforcement and expansion of the business portfolio through M&A. |

| ② Promoting sustainability-oriented management |

◆ With the aim of realizing an ideal state the company wants to realize in 10 years, they will establish a system for actualizing “MIRAI Factory,” “one-stop maintenance,” “on-site precast concrete,” and “smart slope disaster prevention.” ◆ Promotion of measures for carbon neutrality |

③ Strengthening promotion of human capital, R&D and DX |

◆ Further promotion of programs for human resources development and recruitment ◆ They will promote investment for growth to achieve an ideal state the company wants to realize in 10 years, in addition to the R&D and capital investment. ◆ They will develop information systems and ICT infrastructure, and further promote DX. |

① Progress of strengthening the business portfolio

[Core business: Concrete business]

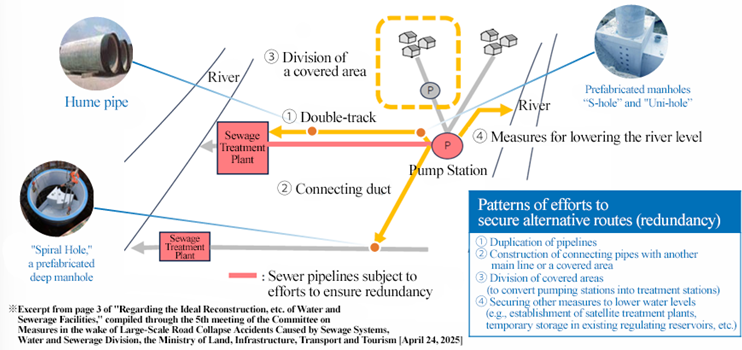

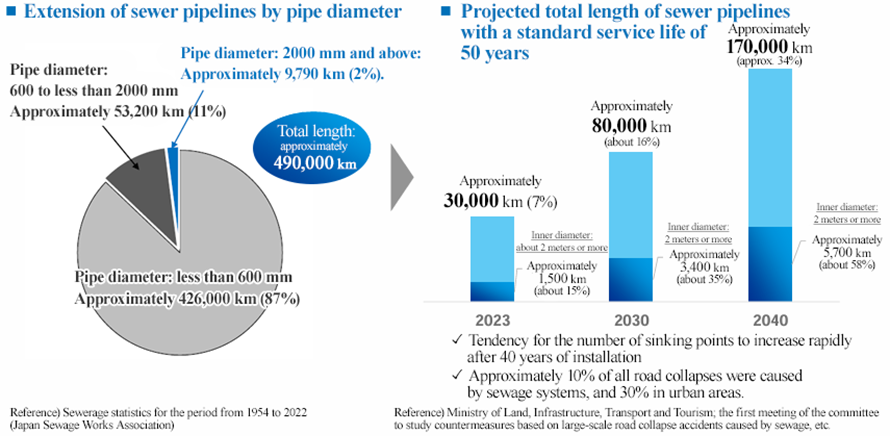

The Ministry of Land, Infrastructure, Transport and Tourism proposed a vision for securing alternate routes (redundancy) for large-scale sewerage systems, for redeveloping water supply and sewerage systems. The demand for their core products, including spiral holes, S-holes, and Hume pipes, is expected to grow.

(Taken from the reference material of the company)

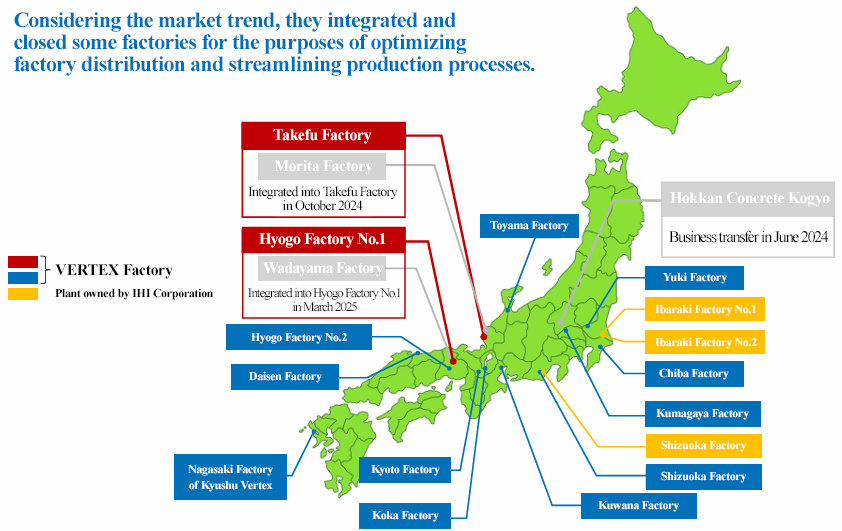

[Core business: Streamlining through the integration and closure of factories]

Considering the market trend, they will integrate and close some factories, in order to optimize the factory distribution and streamline production processes.

(Taken from the reference material of the company)

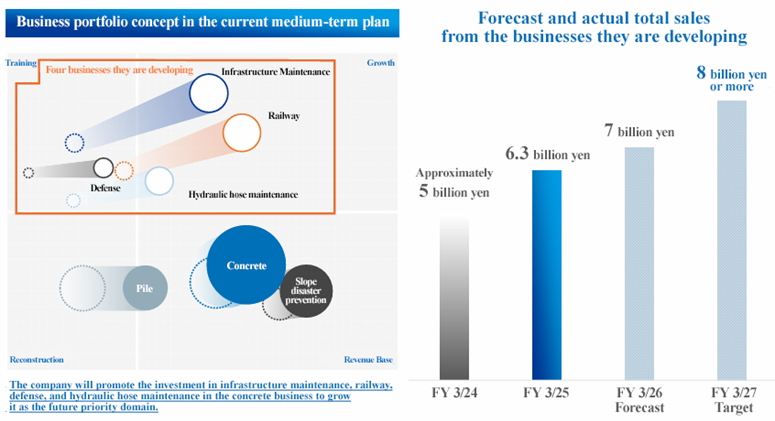

[Growing Businesses: forecasts and results]

In the current medium-term plan, they will promote the investment in infrastructure maintenance, railway, defense, and hydraulic hose maintenance in the concrete business to grow it as the future priority domain. They aim to achieve total sales of around 8 billion yen as of the end of the medium-term plan, and healthy growth with sales of around 6.3 billion yen this fiscal year.

(Taken from the reference material of the company)

[M&A (IHI Corporation)]

In order to reinforce and expand the business portfolio through M&A, they have signed a share transfer contract on March 27, 2025, to acquire all shares of IHI Corporation, which handles indispensable products for urban infrastructure. Through the business merger with IHI Corporation, the Vertex Group aims to take a leap forward toward a new stage.

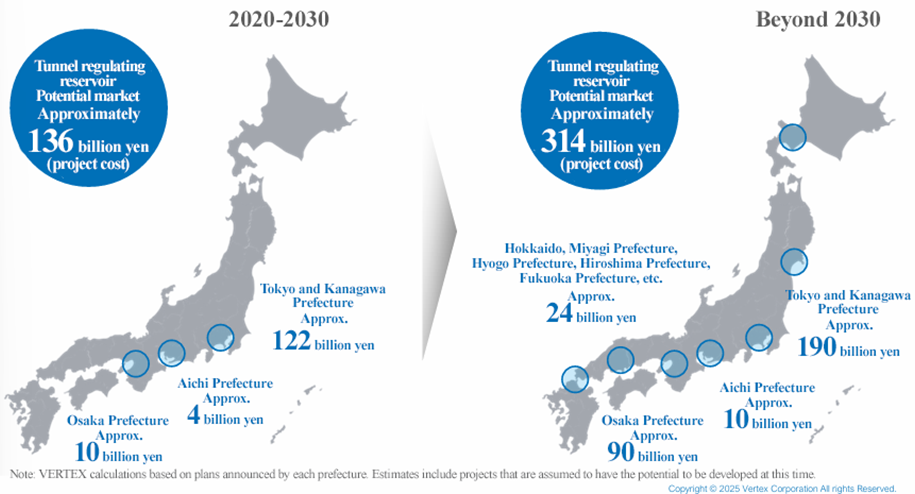

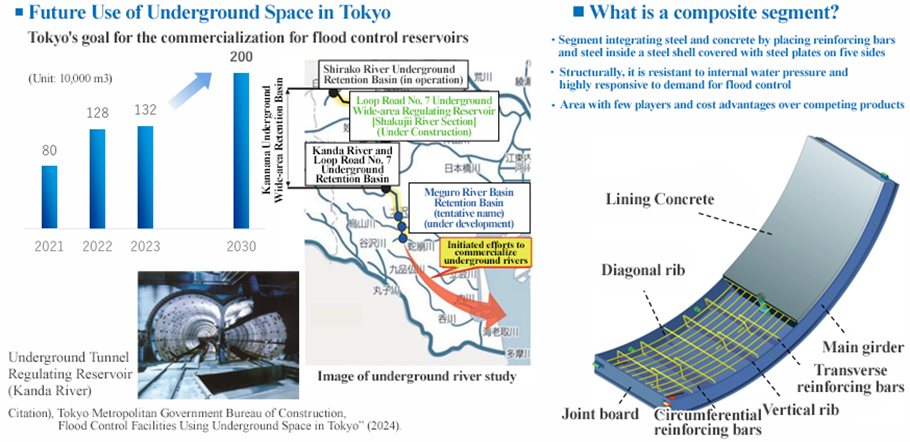

As torrential rain has increased in recent years, each local government plans to construct water reservoirs of underground tunnels for water control. The company estimates that there is a latent market with a scale of around 450 billion yen, where they can utilize synthetic segments from 2020.

(Taken from the reference material of the company)

<Aim and future developments>

◎ To reinforce the business foundation and trigger synergy by operating the sewerage and flood control business, which is the mainstay, in a broad range of fields

As the segments of IHI Corporation will be used in the sewerage and flood control business, in which the Vertex Group can exert its strength, they will be able to join projects for constructing water reservoirs of underground tunnels and underground rivers. As the products of IHI Corporation, such as synthetic segments, will be added to their product lineup, they will reinforce the business portfolio with the aim of operating a broad range of businesses in the sewerage and flood control domain, in which they have advantages.

(Taken from the reference material of the company)

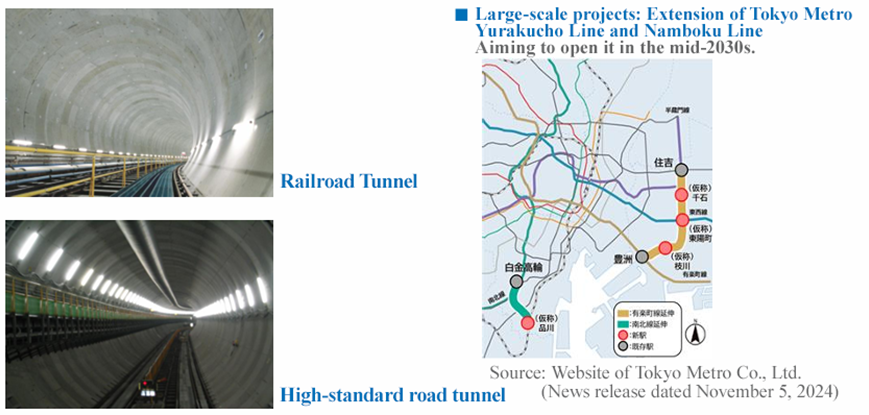

◎ The two companies will join hands, and participate in large-scale projects for infrastructure and others.

They will be able to contribute to the advance of social infrastructure, by joining large-scale projects for infrastructure, such as high-standard roads and subways, and others, which are planned and implemented around Japan, at an accelerated pace. The company estimates that there has been a latent market with a scale of around 250 billion yen in the field of roads, railways, etc. since 2020. By taking advantage of the track record of IHI Corporation, they aim to participate in large-scale projects for infrastructure, such as high-standard roads and subways, and others, which are planned and implemented around Japan.

(Taken from the reference material of the company)

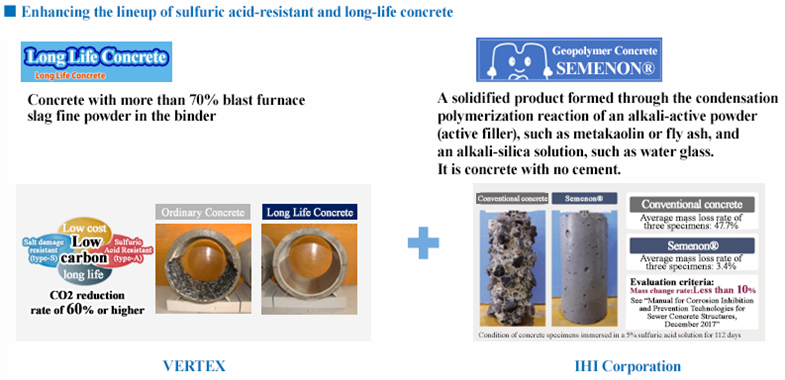

◎ To develop innovative materials and products by fusing the know-how for manufacturing, technology, and marketing of the two companies

Through the technological fusion of the two companies, they will develop new products and materials, and contribute to the establishment of a sustainable society. In particular, they plan to develop products for coping with the corrosive environment, such as sewerage pipes where hydrogen sulfide and sulfuric acid are produced.

(Taken from the reference material of the company)

[M&A strategy: Vision]

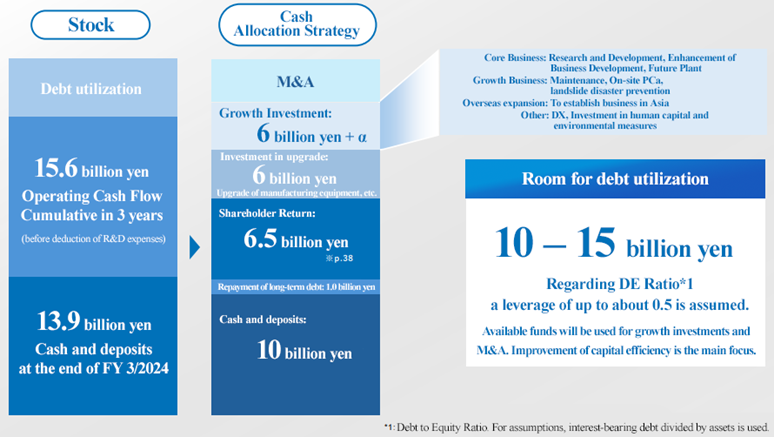

Even after acquiring IHI Corporation, they have a budget for M&A amounting to 8.5 to 13.5 billion yen, and aim to reinforce and expand the business portfolio through M&A.

M&A budget in the current medium-term management plan |

M&A budget: 10-15 billion yen (They set a budget for M&A based on mainly borrowings) The acquisition price of IHI Corporation is 1,264 million yen, so they still have a budget of 8.5 to 13.5 billion yen for M&A. |

In-house system for enhancing M&A |

To increase the volume and quality of information on projects by increasing personnel for M&A ◆Volume: To collect information on projects by utilizing all kinds of channels ◆Quality: To develop good relationships and aim to gather high-quality information |

Assumed targets of M&A |

◆Enterprises that are expected to enhance the functions of their existing business and operate business in peripheral areas, under the concept of pursuing the prevention and mitigation of disaster and the improvement in national resilience ◆Enterprises that offer products and services to the businesses the company is growing (in the fields of infrastructure maintenance, railways, and defense) ◆Enterprises that offer products and services that are popular in the public sector ◆Enterprises that are expected to reinforce or expand the business portfolio of the company (inducing synergy while taking advantage of the forte of the existing business) |

② Promotion of sustainability-oriented management

[Ideal state the company wants to realize in 10 years]

Through the shift to products with high added value, the gasification of steam boiler fuel, etc., they will steadily reduce Scope 1 and Scope 2 CO2 emissions, and accelerate the reduction of CO2 emissions by adopting the manufacturing method that does not require steam curing.

(Taken from the reference material of the company)

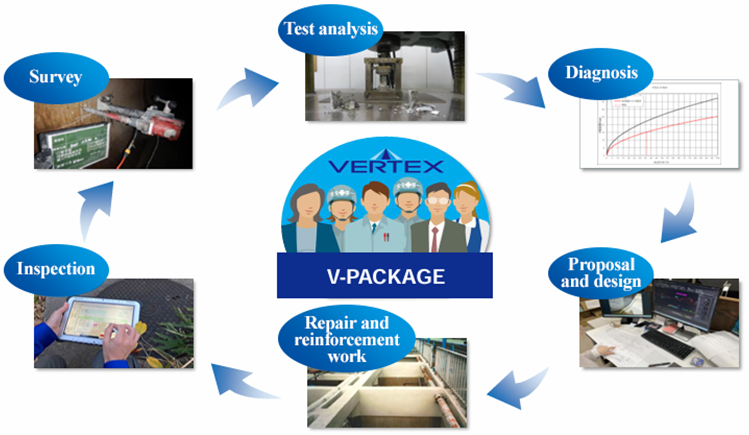

[One-stop maintenance]

They aim to improve added value, by providing “V-PACKAGE,” which is a package of a series of their services, including surveys, assessment, tests, analysis, diagnosis, design, proposal submission (products to repair or reinforcement), construction, and inspection.

(Taken from the reference material of the company)

In the wake of the collapse of a road in Yashio City, Saitama Prefecture, the Ministry of Land, Infrastructure, Transport and Tourism suggested the implementation of special intensive nationwide surveys on conduits with an inner diameter of 2 m or over that were built or renovated in 1994 or before, from the viewpoints of elements that would cause large-scale collapse and the impact of the accident. In addition, sewer pipelines used for over the service life: 50 years are expected to increase rapidly in the coming 20 years. Accordingly, it is imperative to manage sewerage systems.

(Taken from the reference material of the company)

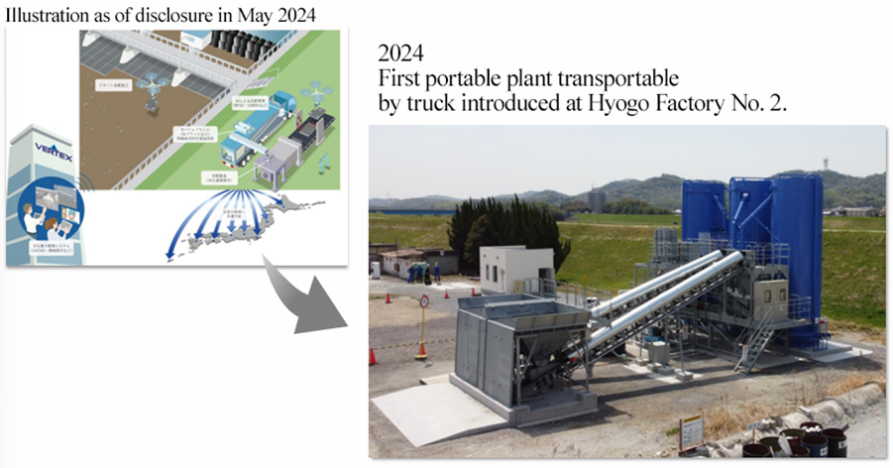

[On-site precast concrete]

They adopted a portable plant for practical use for the first time. They aim to establish a system for offering services anywhere for the precast concrete business 10 years from now.

(Taken from the reference material of the company)

③ Strengthening promotion of human capital, R&D, and DX

[Personnel development]

They will steadily implement personnel development programs based on the following contents, such as “a school for developing next-generation leaders” and “career design training.”

(Taken from the reference material of the company)

5. Conclusions

In the fiscal year ended March 2025, sales grew 5.7% and operating income rose 9.8%. Sales slightly fell below the forecast, but operating income exceeded the forecast, thanks to profitable large-scale projects. Some measures are ongoing in accordance with the medium-term management plan, and they are steadily making medium/long-term projects for achieving their goals set in the medium-term plan. For the fiscal year ending March 2026, which is the second year of the medium-term management plan, they announced an outlook calling for better results than the numerical goals in the second year of the medium-term management plan. The performance trend in the first half of the fiscal year is noteworthy, to see how much they can progress toward the completion of the medium-term management plan.

On March 27, 2025, the company announced the business merger with IHI Corporation, which handles segments that are indispensable for urban infrastructure. This business merger will enable the combination of the sewerage and flood control business, in which Vertex excels, and the segments of IHI, and they will be able to join projects for constructing underground tunnel reservoirs and underground rivers. In addition, their participation in large-scale infrastructure projects and other large-scale projects for high-standard roads, subways, etc., which are planned and conducted around Japan, will be accelerated. Furthermore, the fusion of the two companies’ technologies will enable the development of new products and materials. The impact of acquisition of IHI Corporation is being assessed, so synergetic effects were not taken into account in the initial forecast for fiscal year ending March 2026. The impact of the post-merger process on the medium-term management plan will be disclosed after the assessment. We are looking forward to seeing their numerical goals. It is noteworthy what kinds of synergetic effects can be produced.

Even after acquiring IHI Corporation, they have a budget for M&A amounting to 8.5 to 13.5 billion yen. Their targets for M&A are (1) enterprises that are expected to enhance the functions of their existing business and operate business in peripheral areas, under the concept of pursuing the prevention and mitigation of disaster and the improvement in national resilience, (2) enterprises that offer products and services to the businesses the company is growing (in the fields of infrastructure maintenance, railways, and defense), (3) enterprises that offer products and services that are popular in the public sector, and (4) enterprises that are expected to reinforce or expand the business portfolio of the company (inducing synergy while taking advantage of the forte of the existing business). We would like to pay attention to their future M&A strategy, too, with expectation.

<Reference 1: The Third Mid-Term Management Plan>

The company has formulated its third medium-term management plan covering the three-year period from the fiscal year ending March 2025 to the fiscal year ending March 2027.

As a plan for the first fiscal year based on VERTEX Vision 2034, the company plans to achieve 43 billion in organic sales and 6.5 billion in operating income. As the first step toward achieving 100 billion in sales and 15 billion in operating income in the future, the company will make growth investments to strengthen its business portfolio and work to regrow its core businesses, and nurture new businesses that will serve as a long-term growth driver.

[Numerical goals]

Numerical goals (Values as of the announcement of the plan)

| FY 3/25 (Mid-term Management plan) | FY 3/25 (Act.) | FY 3/26 (Mid-term Management plan) | FY 3/26 (Company forecast) | FY 3/27 (Mid-term Management plan) | 3-year Cumulative total | Vision 2034 |

Sales | 400 | 289.1 | 410 | 410 | 430 | 1,240 | 1,000 |

Operating income | 60 | 62.8 | 62 | 63.5 | 65 | 187 | 150 |

ROE | - | 13.8% | - | - | 14% | - | 20% |

*Unit: 100 million yen.

[Priority Items]

Strengthening the business portfolio |

◆ Core business - Concrete and slope disaster prevention Aiming for stable profit expansion in line with market growth. ◆ Growing business - Maintenance, railway, defense, and hydraulic hose maintenance To make investments for growth with a view to making these domains the focus of the company in the future. |

Strengthening promotion of human capital, R&D and DX |

Promoting sustainability-oriented management |

◎ Measures for core businesses

[Concrete Business]

The company will further strengthen its core business, which is the concrete business, in the area of rainwater flood prevention, where the market environment is healthy. The product portfolio has been established through the previous medium-term business plan, and the company will work to increase sales and profit by strengthening sales and adding more value to its products.

(Main efforts)

◆ Strengthening the sales of existing and new products

<New products in the concrete business>

Vortex valve |

| Spiral hole |

|

A device that controls the flow rate from the storage tank according to the water level without power, improving the storage capacity of rainwater harvesting facilities by up to 20% compared to conventional methods. | A manhole that allows rainwater to fall in a spiral along the inner wall, avoiding noise and vibration and allowing it to flow smoothly into the outflow pipe. |

◆ Further adding value to selected products

◆ Improving efficiency through consolidation and closure of concrete plants

The company has begun consolidating or closing factories and bases owned through past business integrations. In light of the problem with logistics in 2024 and market trends, the company will work to respecify the range of transportation from each plant and improve efficiency.

[Slope Disaster Prevention Business]

In recent years, awareness of disaster prevention and mitigation and national resilience has been on the rise as a measure against natural disasters that have become increasingly severe. In addition, more measures are to be taken to strengthen national resilience. In this environment, the company will continue to work on expanding sales of products for measures against landslides and rockfalls, while engaging in further research and development and value-adding activities.

<Main Products>

Loop Fence Landslide prevention, debris flow and driftwood prevention |

|

◆ High maintainability ◆ Flexible placement by adjusting cable mounting position ◆ To withstand soil, falling rocks, and snow accumulation |

◎ Measures for Growing Businesses

The company will promote investments in the infrastructure, railroad, defense, and hydraulic hose maintenance in the concrete business as domains to be focused on in the future. By the end of the third medium-term management plan, the company aims to achieve total sales of approximately 8 billion yen.

Business | Main measures |

Infrastructure maintenance | ◆ Strengthen sales by focusing on fire protection water tanks and agricultural water use, which have the largest share of the installation market ◆ Expand and deepen the customer base through one-stop services, including investigation, diagnosis, maintenance and management |

Railway | ◆ The company will cement the collaboration among itself, general contractors, and railway operators, and utilize its new materials to promote product development that meets customer needs. |

Hydraulic hose maintenance | ◆ PROFLEX, which will become a wholly owned subsidiary in 2023, has the advantage of excellent operations with an abundance of product numbers in stock and the ability to immediately deliver any quantities from a single unit nationwide, as well as the ability to design its own original caulking machines. The company will horizontally expand its business model, which has already been successful in the Kanto region by leveraging its strengths, to other regions. |

◎ M&A Strategy

In addition to organic growth, the company aims to strengthen and expand its business portfolio through M&A.

Strategic investment budget for M&A for the medium-term management plan period |

◆ The M&A investment budget is expected to be 10 to 15 billion yen, and a strategic M&A investment budget will be set up mainly using debt financing. |

Internal structure for strengthening M&A |

◆ Increase the quantity and quality of project information by strengthening M&A-related personnel ◆ Quantity: Collect project information using all channels ◆ Quality: Build good relationships and aim to collect high-quality information |

Direction for target companies of M&A |

◆ Companies that are expected to strengthen existing businesses and expand into peripheral areas based on disaster prevention, disaster mitigation, and national land resilience ◆ Companies that have products and services to offer to the growing businesses selected by the company (infrastructure maintenance, railways, and defense) ◆ Companies that provide strong products and services to government agencies ◆ Companies with businesses that are expected to strengthen and expand their business portfolio (businesses that can leverage the strengths of existing businesses and generate synergies) |

[Envisioned growth in existing businesses and growth through M&A]During the period of the third medium-term management plan, while there is great potential for sales growth through M&A, it is expected that profit will mainly come from organic growth (no profit contribution is expected in the initial stage of M&A, but improvements are expected during the PMI phase).

(Taken from the reference material of the company)

◎ Financial Strategy

The company has formulated a cash allocation plan for the current medium-term plan with the aim of achieving a balance sheet focused on capital efficiency.

(Taken from the reference material of the company)

[Details of investments for growth and upgrade]

In addition to the usual R&D and capital investments, the company has set an investment budget with an eye on “the ideal state it wants to achieve in 10 years.”

<Investment for growth: 6 billion yen + α> | |

Research and development, digital transformation and AI[1.5 to 2.5 billion yen] | ◆ Strengthen efforts in new materials development and innovative production technologies ◆ Productivity and business model innovation through DX and AI |

Realizing the Mirai (Future) Business[1.5 to 2.5 billion yen] | ◆ Strengthen efforts to realize the Mirai (Future) Business (online PCa, new material development and development of smart products) |

Realizing the MIRAI Factory [2.5 to 4 billion yen] | ◆ Strengthen efforts to realize the MIRAI Factory (production DX, AI and next-generation production optimization systems) |

Others [0.5 to 1 billion yen] | ◆ Strengthen efforts for growth, including environmental measures (CO2 reduction), human capital management, and overseas expansion |

<Investment for upgrade: 6 billion yen> | |

Production facilities[4 billion yen] | ◆ Improve competitiveness by strengthening the production base and improving cost and production efficiency |

Technology development[1 billion yen] | ◆ Improve profitability by improving existing products and developing new products based on customer needs |

Software and system related [1 billion yen] | ◆ Improve business operations through software and systems |

<Reference 2: Regarding Corporate Governance>

◎ Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 4 outside ones |

◎ Corporate Governance Report

Last updated in July 1, 2024

<Basic policy>

Our company’s basic policy regarding corporate governance is to strive to play active roles in management of the company group, and to enhance its corporate governance by establishing strategies and directions for the group, as well as to provide guidance and advice provided for the group companies, based on the recognition of the significance in establishing a corporate governance structure that brings efficient decision-making process, while securing transparency and soundness of the business.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Vertex Corporation follows all of the principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

[Principle 3-1: Enhancement of disclosure of information] | (i) Management principles, strategies, and plans Our company discloses its management plan and other information on its website. (ii) Basic Approach to Corporate Governance and Basic Policies Our company discloses on its website the guidelines that set forth its basic approach to corporate governance. (iii) Policies and Procedures for the Board of Directors in Determining the Compensation of Senior Management and Directors Remuneration for Directors (excluding Outside Directors) consists of base remuneration as fixed remuneration and stock options as non-monetary remuneration whose number is calculated based on performance indicators ("performance-linked non-monetary remuneration"). In light of their duties, outside directors receive only base remuneration. The standard remuneration ratio for each type of director (excluding directors who are members of the Audit Committee) is as follows: base remuneration: performance-linked non-monetary remuneration, etc. (short-term incentives): performance-linked non-monetary remuneration (long-term incentives) = 70:15:15 (if 100% of the performance indicators are achieved). The Compensation Committee deliberates and reports to the Board of Directors on the amount of remuneration for each director, and the Board of Directors respects and decides the amount of remuneration based on the report of the Committee. The compensation of directors who are members of the Audit Committee shall be decided by the Compensation Committee after deliberation and report to all directors who are members of the Audit Committee, and all directors who are members of the Audit Committee shall respect and discuss the content of such report. (iv) Policies and Procedures for Election and Dismissal of Senior Management and Nomination of Candidates for Directors (Policy) Regarding candidates for Directors who are not Audit and Supervisory Committee members, we appoint personnel with a wide range of perspectives and experience that can contribute to the development of the group, as well as management skills and sense to improve the group's corporate value. Candidates for Directors who are Audit and Supervisory Committee Members are selected from individuals who can fairly audit and supervise the execution of duties by Directors who are not Audit and Supervisory Committee Members based on their extensive experience and knowledge. (Selection Procedures) We established a discretionary Nominating Committee. The Nominating Committee deliberates on proposals for the election and dismissal of directors and makes recommendations on candidates for directors. Based on the respective recommendations, the committee reports to the Audit Committee the proposed candidates for directors who are not Audit Committee members, and the Board of Directors resolves the proposed candidates for directors who are Audit Committee members after obtaining the consent of the Audit Committee. (v) Explanation on the Election, Dismissal, and Nomination When Electing and Dismissing Senior Management and Nominating of Candidates for Directors In the case of the election and dismissal of Directors, we will publish in the Reference Document for the Notice of the General Meeting of Shareholders the biographies of the candidates for new directors determined by the Board of Directors based on the recommendation of the Nominating Committee, and the reasons for their election and dismissal. (Management Plan: https://www.vertex-grp.co.jp/ja/ir/management/plan.html) (Corporate Governance Guidelines: https:// www.vertex-grp.co.jp/ja/ir/management/governance.html) |

[Supplementary Principle 3-1-3: Initiatives for Sustainability] | In order to realize our management philosophy (brand vision) "To build safe society," we recognize that one of our management challenges is to balance "contributing to the realization of a sustainable society" and "achieving sustainable corporate growth," and we will identify issues of materiality and promote specific measures and goal-setting. We will continue to strengthen our efforts to realize a sustainable society and aim to be a company that earns the satisfaction and trust of society and stakeholders through the creation of new value. Please refer to our website for details of our sustainability initiatives and disclosures based on the TCFD. Our website: |

[Principle 5-1 Policy for constructive dialogue with shareholders] | We recognize that it is important for us to hold constructive dialogue with shareholders and investors aside from general meetings of shareholders to achieve sustainable growth and improve the medium/long-term corporate value, thus we assigned our Public Relations and IR Office in the Business Planning Department to be responsible for IR to handle individual meetings, post our company information on our website. In addition to disclosing information through the voluntary disclosure of the Tokyo Stock Exchange, we have established an internal system in which individual interviews are handled by appropriate persons selected from among the directors depending on the shareholder's wishes and the importance of the content of the interview. Furthermore, we hold semi-annual financial results briefing in which our executives including our Representative Director and President attend to present the financial results, business strategies, etc. |

[Measures for realizing business administration conscious of capital costs and share price] | For information on our initiatives for realizing business administration conscious of capital cost and share price, please refer to the third medium-term management plan in our website. (The third medium-term management plan: https://www.vertex-grp.co.jp/ja/ir/library/midplan/main/00/teaserItems1/07/linkList/00/link/3nd_midterm-plan.pdf) |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |