| WILL GROUP, INC. (6089) |

|

||||||||

Company |

WILL GROUP, INC. |

||

Code No. |

6089 |

||

Exchange |

First Section of Tokyo Stock Exchange |

||

Industry |

Service |

||

President |

Ryosuke Ikeda |

||

Address |

1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

||

Year-end |

End of March |

||

URL |

|||

*Share price as of closing on the end of June 8, 2016 The number of shares issued is the number of shares issued at the end of the most recent quarter, excluding treasury shares. ROE and BPS based on previous term's results.

|

||||||||||||||||||||||||

|

|

* Estimates are by Will Group. A 1:200 share split was carried out in October 2013, and a 1:2 share split in September 2014 and September 2015.

* Net Income means Net Income attributable to owners of the parent since FY March 2016. |

| Key Points |

|

| Company Overview |

|

Working

Interesting Learning Life

Field of business for supporting people in "working"

Field of business for supporting people in "playing" Field of business for supporting people in "learning" Field of business for supporting people in "living" [History]

The predecessor of this corporate group was Saintmedia, Inc., a company established in Kita-ku, Osaka-shi in January 1997, which operated telemarketing business. Saintmedia, Inc., is now a consolidated subsidiary. In the meantime, in August 1997, Big Aid Co., Ltd. which undertook short-term businesses, was established in Naniwa-ku, Osaka-shi, and Mr. Ryosuke Ikeda, the current Representative Director and President, joined Big Aid Co., Ltd. as one of its co-founders in October 1997. In February 2000, the two companies merged, with Saintmedia, Inc. being the surviving company, hoping to produce synergetic effects between telemarketing and task undertaking business, and Mr. Ikeda was appointed as the president of this new company. Since then, this business group has operated personnel services with Saintmedia, Inc. as its core company, creating new businesses and restructuring existing businesses to keep pace with market changes. In April 2006, Will Holdings, Inc. (renamed to Will Group, Inc. in June 2012) was founded as a pure holding company, shifting to group business administration in order to improve the expertise of operational companies and optimize managerial resources. The Company was listed in the second section of the Tokyo Stock Exchange in December 2013, then in December 2014, designated to the first section of the Tokyo Stock Exchange.

[Business Contents]

"Sales outsourcing," "call center outsourcing" and "factory outsourcing" businesses are primary sources of its revenue. In parallel , Will Group has been sowing seeds for various personnel-related businesses as future pillars for growth, and sales and profits thereof are recorded in the "other" segment.Sales composition ratio by segment are sales outsourcing business 39%, call center outsourcing business 22%, factory outsourcing business 23%. Those by business type are worker dispatch 64% ( hybrid dispatch 30%, general dispatch 24%), task undertaking 25%, staff introducing 3%, others 8%. Sales outsourcing business

Through the sales activities at consumer electronics mass retailers, mobile phone shops, etc., Will Group is supporting the expansion of clients' products and services.The main commercial goods Will Group handles are mobile devices, such as smartphones, and broadband internet services. Will Group dispatches teams of workers (hybrid dispatch) who attend to customers, explain products, solicit applications, etc., manage sales staff members, gather and report sales information, etc., as well as carrying out general worker dispatch and undertaking tasks. In recent years, Will Group, as part of its efforts to explore new markets, has been expanding into the apparel industry and Recruitment Process Outsourcing business. In September 2015, Will Group has been endeavoring the planning and management of sales promotion by making CreativeBank Inc. into an affiliate Call center outsourcing business

Will Group dispatches phone operators to companies operating call centers and others conducting telemarketing services. Will Group focuses on telecommunications companies within the call center industry and dispatches teams of workers (hybrid dispatch) who provide information, deliver goods, offer after-sales and consulting services, listen to, deal with and solve complaints, and so on, as well as carrying out general worker dispatch. Will Group owns call centers and undertakes telemarketing tasks for clients. Factory outsourcing business

Will Group offers technologies and personnel management know-how for the production process in the manufacturing field, to improve the productivity of each client. FAJ Inc. dispatches teams of workers (hybrid dispatch) who engage in the tasks of manufacturing, inspection, quality control, sorting, packaging, etc. to mainly food manufacturing industry, which receives relatively low effects of economic fluctuations within the manufacturing industry, as well as carrying out general worker dispatch and undertaking tasks.

Others

As future pillars for growth, Will Group has been sowing seeds for various new businesses including dispatch to offices, dispatch in sports industry, dispatch of care staff, dispatch of assistant language teachers, dispatch of IT engineers, staff introduction in internet business, overseas staff service, shared housing, 3D cloud. Related sales and profits are recorded.

* ROE (return on equity) is "net income to sales ratio (net income rate÷sales)" multiplied by "total asset turnover ratio (sales÷total assets)" multiplied by "leverage (total assets÷own capital, reciprocal number of equity ratio)". ROE = net income to sales ratio × total asset turnover ratio × leverage

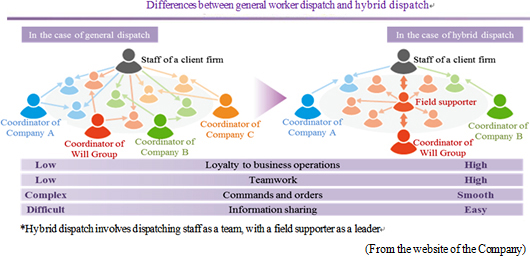

* The data in the table above is based upon figures taken from the official earnings announcement filings, and total assets and capital required to calculate the data above are averages for the term (Using the values at the end of the previous and current terms, and therefore the data listed in the official earnings announcement filings and the data above do not necessarily coincide because they use term end equity ratio). In many cases of general worker dispatch, staff dispatched from several staffing companies are put together at a workplace, which complicates the chain of command and information sharing between client firms and the dispatched staff. In general, full-time coordinators support dispatched staff, but they normally do not stay in the workplaces of dispatched workers. Therefore, it is difficult for the full-time employees of staffing companies to deal with various troubles that occur at home appliance retailers, call centers, etc. on a daily basis. Meanwhile, in the "hybrid worker dispatch" system of Will Group, the full-time employees called field supporters (FS) work with dispatched workers in each workplace, while managing, instructing, and educating dispatched workers there. Accordingly, the staff of client companies only have to give orders and instructions to FS. This system streamlines the chain of command and quickens information sharing, and thereby improves business efficiency.  Hybrid dispatch - enabling expanded in-store share

Hybrid dispatching is also the driving force behind expanding in-store share (i.e., the proportion of Will Group dispatch and contract staff out of the total number of such staff at a specific client company). To be specific, the Company increases the in-store share by first developing the standard dispatch market and then shifting into its strong area of hybrid dispatch. By turning the trust in the team gained through hybrid dispatch into opportunities for task undertaking, the Company can increase profitability and strengthen relations with the clients

What enables hybrid dispatch?

It is impossible to run a team unless "a field supporter, who is a full-time employee, becomes the most competent among dispatched personnel and then gives instructions." At Will Group, most of the section chiefs and managers, including President Ikeda, joined the Company as new graduates, worked at the site and experienced all of the events that occur in the field of personnel dispatch. It is this hands-on policy that makes hybrid dispatch possible. If, on the other hand, a person with no hands-on experience is assigned to a workplace as a boss to form the dispatched workers into a team, it would be impossible to solve problems and troubles, and dispatched workers would end up quitting soon and the full-time employee on the ground would become like a dispatched worker (compromising all dispatched workers' loyalty to the Company). For this reason, even if a competitor attempts to put together a team like Will Groups does, it would take several years before that competitor could offer quality comparable to it.

|

| Fiscal Year March 2016 Earnings Results |

Sales increased 38.2% from the previous term, and ordinary income increased 54.6% from the previous term.

Sales were 45,028 million yen, up 38.2% year on year. While the sales of each of the 3 major businesses for smartphone-related and food manufacturing grew as high as 21-37% year on year, the sales of new business, including the dispatch of caregivers, rose steadily. In detail, the sales of worker dispatch business increased 27.8% year on year, because the group met the demand in the general worker dispatch field and shifted to hybrid worker dispatch smoothly. The sales of the task undertaking business, including the sales outsourcing business, grew 27.4% year on year.As for income, gross profit margin declined because the sales share of new business, which is under development, increased, and SG&A augmented 35.4% year on year, because personnel and recruitment costs increased due to business expansion, but it was offset by the significant growth of sales. Operating income was 1,429 million yen, up 52.2% year on year. Net income was 692 million yen, up 26.4% year on year, as an extraordinary loss of 123 million yen, including a loss on valuation of investment securities of 110 million yen, was posted. Meanwhile, EBITDA increased by 54.8% from 1,091 million yen in the previous term to 1,688 million yen. The number of employees as of the end of the term was up 258 year on year at 929, out of which the number of field supporters was 287, up 102 year on year. Dividend per share, including a commemorative dividend (for the 10th anniversary of the establishment of the holding company) of 10 yen/share, was 20 yen. (Since the 2-for-1 share split was conducted in September 2015, dividend per share virtually increased 16 yen to 40 yen.)  Sales outsourcing business

Sales were 17,359 million yen, up 33.0% year on year. The profit in this business segment was 1,219 million yen, up 17.2% year on year. The transactions for undertaking the task of the combined sale of mobile devices and sideline products, such as optical line services and tablets, increased, CreativeBank Inc., which operates the ad agency business specializing IT, became a subsidiary in September 2015, producing some effect of consolidation, and the services targeted at governments, which was started in April 2015, were healthy. As for income, the cost for personnel, recruitment, etc. augmented due to business expansion, but the increase in gross profit made up for it, as sales rose and the profitable business of undertaking tasks grew.

Call center outsourcing business

Sales were 9,938 million yen, up 21.8% year on year. The profit in this segment was 641 million yen, up 22.5% year on year. As the smartphone market expanded, the demand for operators who give instructions on how to operate terminals as after-sale services grew. Sales increased, because the in-store share for existing transactions expanded and the group met new demand. As for income, the augmentation of the costs for personnel, recruitment, etc. due to business expansion was offset.

Factory outsourcing business

Sales were 10,346 million yen, up 37.3% year on year. The profit in this segment was 568 million yen, up 32.9% year on year. As business footholds increased, the sales for food manufacturing industry such as delicatessen food, sweets, lunchboxes, etc. for convenience stores rose by around 48% from about 3.9 billion yen to about 5.7 billion yen. As the number of business partners rose, the transactions with enterprises in the non-food manufacturing field increased. As for income, the augmentation of the costs for personnel, recruitment, etc. due to business expansion was offset.

Other business

Sales were 7,838 million yen, up 92.5% year on year. The profit in this segment was 106 million yen (a loss of 117 million yen in the previous term). The sales of the caregiver dispatch business, whose footholds were improved, grew (50 million yen for the term ended March 2014 → 500 million yen for the term ended March 2015 → 2.6 billion yen for the term ended March 2016), and the sales of the office dispatch business rose, because the group acquired new projects. As for overseas business, Scientec Consulting (offering staffing services to mainly multi-national enterprises in Singapore), which became a consolidated subsidiary in August 2014, contributed to full-year sales. In addition, incomes grew or improved for many businesses under development, including the online staffing service, which has a high profit rate.

|

| Fiscal Year March 2017 Earnings Estimates |

|

With the two representative directors, the group will implement mid-term managerial plans. Mr. Ikeda will be in charge of overseas business and new fields in Japan, while Mr. Ohara will be in charge of the domestic personnel field. Mr. Ohara, who has been appointed as representative director / president / COO, has been working with Mr. Ikeda and contributing to the growth of the Will Group, since the early years of this group. Mr. Ohara's strength is his extensive knowledge in the fields of personnel business.  Sales expected to increase 26.6% from the previous term, and ordinary income to increase 9.6% from the previous term.

Sales are estimated to grow 26.6% year on year to 57 billion yen. The sales of the factory outsourcing business are estimated to increase 20.4% year on year, as clients, who have production sites around Japan, will establish other business footholds and make inroads into the distribution field. The sales of the sales outsourcing business are estimated to rise 13.5% year on year, thanks to the combined sale of smartphones and sideline products and the full-term contribution of CreativeBank, which became a subsidiary in September 2015. The sales of the call center outsourcing business are estimated to grow 15.4% year on year, thanks to the demand for operators who give after-sale services for smartphones. The sales of other business are estimated to increase 81.0% year on year, mainly because of the caregiver dispatch business whose footholds will be actively increased.Operating income is estimated to grow 11.9% year on year to 1.6 billion yen. Operating cost is forecasted to augment 27.1% year on year to 55.4 billion yen, as the prior investment cost for improving IT and recruitment systems will be posted and goodwill amortization will increase, but this will be offset by sales growth. Since the revenue from subsidies (65 million yen in the previous term) is not expected, non-operating revenue is estimated to decline, but extraordinary loss/profit is expected to improve (in the previous term, a loss on valuation of investment securities amounting to 110 million yen, etc. were posted as extraordinary loss). Accordingly, net income is estimated to grow 22.8% year on year to 850 million yen. EBITDA, too, is projected to rise as high as 20.8% year on year to 2,040 million yen. As for dividends, the group plans to pay a term-end dividend of 20 yen/share (the ordinary dividend will be increase by 10 yen/share, without paying a commemorative dividend of 10 yen/share). The group plans to distribute profits to shareholders with the goal of achieving a total return ratio of 30% by the term ending March 2020. Total return ratio, by the way, means the sum of the ratio of dividends and acquisition of treasury shares to net income.  |

| Medium Term Business Plan "Will Vision 2020" |

|

"Will Vision 2020" - Working (business area supporting "working"), Interesting (business area supporting "playing"), Learning (business area supporting "learning") and Life (business area supporting "living") - creates a high expectation-value developing company in the 4 business areas and this will be operated under the "WILL Vision" to strive to be the No.1 player in each area. To achieve the sales and operating income mentioned above, the group has set the following 3 business targets as the priority strategic areas: Priority Strategic Areas

(1) Making the 3 current main businesses into No.1 in each industry(2) Establishing 3 new business fields as core businesses (3) Establishing a certain scale of business other than HR services (1) Making 3 current main businesses into No.1 in each industry

There are 3 key-points: 1) in-store share expansion of the company group clients; 2) expansion of business operating area; 3) diversification of related business areas.The general worker dispatch market shrank dramatically at the time of the bankruptcy of Lehman Brothers by 37% between 2008 and 2010, and eventually it bottomed out, and has since been staying at a constant level. Right after the Lehman Brothers' collapse, the group also suffered a drop in sales and profit, but from the term ending March 2011, the group has managed to turn themselves around with increased sales and profit on the back of share expansion (by the term ending March 2016, the group had 6 consecutive terms of increased sales and profit).  (2) Establishing 3 new business fields as core businesses

On top of the 3 main profit-making bases - "dispatch of sales staff to undertake sales tasks" (sales outsourcing business), "dispatch of operators to undertake call center tasks" (call center outsourcing business) and "dispatch of light-duty staff to undertake tasks at factories, etc." (factory outsourcing business) - the group is going to build 3 new pillars of business. As part of this, the group has already begun nurturing 8 different business areas.

Human resources dispatch specialized in the Internet/IoT areas is also going strong. In this field, the impact over the top-line may be small but it is characterized by a high profitability. With the brand "NET jinzai bank," the group is operating businesses (such as CxO) of introducing managerial personnel to clients. The general manager of this division has won the Headhunter of the Year awarded by BizReach, Inc. 2 years in a row.  (3) Establishing a certain scale of business other than human resources services

These are strategies beyond the medium-term business plans, looking towards the year 2030, and there are 4 key-points:1) Investing in ventures via corporate venture capitals (6 companies in term ending March 2016) 2) M&A/Minor investments (2 companies in term ending March 2016) 3) Alliance (1 company in term ending March 2017) 4) In-house new business models (example: house-share business etc.) As an example of 3) Alliance, in April 2016 the group entered into a capital and business alliance with Ligua Inc. (Chuo-ku, Osaka; Norihiko Kawase, representative director and president). Ligua is a company specializing in management and health support businesses such as the sale of CRM systems, contracting out account book services, and running industry information portal websites for osteopathic clinics and acupuncture & moxibustion clinics, and they currently support over 2,500 clinics. In April, the group obtained 180 stocks, equivalent to 5.3% of Ligua's total voting rights, for 72 million yen, and the group is poised to start offering worker dispatch and operational support services to the osteopathic and acupuncture & moxibustion clinics, who are Ligua's clients. |

| Conclusions |

|

|

| Reference: Regarding corporate governance |

◎ Corporate Governance Report

On June 21, 2016, the company submitted the report on corporate governance since the corporate governance code entered into force.<Main principles the company failed to follow and reasons> Currently, the ratio of overseas investors to our company's shareholders is low, and so the notice of an ordinary general meeting of shareholders and brief financial reports are provided only in Japanese. From now on, we will improve the IR documents in English one after another. When the ratio of overseas investors exceeds 10%, we will think about the use of the electronic voting platform, the English translation of convocation notices, etc. Although we have the English version of our website, the ratio of overseas investors to our company's shareholders is low, and so the notice of an ordinary general meeting of shareholders and brief financial reports are provided only in Japanese. From now on, we will improve the IR documents in English one after another. When the ratio of overseas investors exceeds 10%, we will think about the use of the electronic voting platform, the English translation of convocation notices, etc. <Main principle that are disclosed> (A) Policy about strategically held stocks Our company intends to hold strategically necessary stocks while comprehensively considering the creation of business opportunities, the development, maintenance, and strengthening of business and cooperative relations, etc. (B) Standards for exercising the voting rights related to strategically held stocks We exercise voting rights from the mid to long-term viewpoint of the improvement of corporate value and return to shareholders, while respecting the managerial policies, strategies, etc. of companies to be invested, rather than making a judgment in a uniform manner. When there are transactions between related parties, important items are approved by the director in charge of the management department and discussed at a meeting of the board of directors, and then a resolution is made in accordance with in-company rules. The transactions between the executives of our group companies and related parties are checked regularly. The conditions and policies for transactions are disclosed with the convocation notices for general meetings of shareholders, the securities report, etc. (1) We disclose our corporate ethos, business strategy and mid-term management plan in our website. In our ongoing mid-term management plan, our goal is to have consolidated sales of 100 billion yen and an operating income of 4 billion yen by the term ending March 2020.

(2) This is as written in Section 1-1 titled "Basic Policy" of this document. For the detailed policies and efforts, please refer to the particular item in this report.

(3) The policy for determining the remunerations of our directors are written in Section 2-1 "Regarding Directors' Remunerations" of this document.

(4) When appointing executives and nominating candidate directors, we consider appropriate, swift decision making, proper risk control, business supervision, the balance between corporate functions and each division of group companies in a comprehensive manner in accordance with in-company rules. When nominating candidate auditors, we consider the knowledge of finance and accounting, the familiarity with our company's business field, and diverse perspectives regarding business administration in a comprehensive manner. Under these policies, the representative director and executives in charge check contents, and the board of directors makes a resolution.

(5) The candidate directors and auditors, their biographies, etc. are written in reference materials for a general meeting of shareholders, which are described in the convocation notice for a general meeting of shareholders in our website.

Our regulations for the board of directors specify the items to be discussed by the board of directors in accordance with laws and regulations. In addition, the regulations for duties and rights, etc. specify the scope of power of the management. Our board members consist of 6 directors, including 2 independent external directors. We plan to keep 2 or more independent external directors, while considering the business category, scale, characteristics, organizational design, environment, etc. of our corporate group. Our company selects candidates for independent external directors who meet the standards set forth in the Companies Act and the Tokyo Stock Exchange. When nominating candidate directors, we consider appropriate, swift decision making, proper risk control, business supervision, the balance between corporate functions and each division of group companies in a comprehensive manner, in accordance with in-company rules. Under these policies, the representative director and executives in charge check contents, and the board of directors makes a resolution. Business reports and reference materials for general meetings of shareholders disclose the positions of each director and each auditor at other listed companies, etc. The board of directors is operated as follows, and we have confirmed its effectiveness. a. As a general rule, a meeting is held once a month, to discuss important items timely and make a resolution.

b. Documents are distributed or explained in advance, and we perform an active argument while setting sufficient deliberation time, where we examine managerial issues to be solved.

c. External executives with a variety of experience examine our management issues from multifaceted perspectives.

d. In order to discuss an important matter precisely and perform more strategic arguments, the board of directors reviews matters that should be discussed when necessary.

e. We report the progress or results of resolved projects and supervise the execution of duties of each director.

Directors and auditors are selected from those who possess broad knowledge of business, financial affairs, laws and regulations, organizations, etc. and trained if necessary when they are appointed. Even after appointment, they have opportunities to attend lectures, networking events, etc. with external experts in the Companies Act and business trends, so that they are trained continuously. Our company produced disclosure policies composed of "Basic policy for information disclosure," "Standards for information disclosure," "Methods for information disclosure," "Future outlook" and "Quiet period," and they are available on our website. In addition, the policies for promoting the constructive talks with shareholders are as follows: (1) In our investor relations activities, the representative director and directors in charge of the management department talk positively to facilitate good communication about corporate strategies, business strategies, financing information, etc. while emphasizing fairness, accuracy, and continuity.

(2) Under the leadership of the management department, the heads of the management planning, general affairs, financial affairs, accounting, and legal affairs section cooperate with one another organically, to disclose information timely, fairly, and properly.

(3) For facilitating communication, we will enrich our briefing sessions for shareholders and so on.

(4) The opinions, concerns, etc. of shareholders grasped through talks will be conveyed to each section of our company via the representative director or the directors in charge of the management department in an appropriate and effective manner.

(5) We will thoroughly implement the regulations for the management of inside information, including the setting of quiet periods, under the disclosure policies.

* The disclosed documents related to the above are available at our website: http://willgroup.co.jp/ir Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016 Investment Bridge Co., Ltd. All Rights Reserved. |