Bridge Report:(6089)WILL GROUP the first half of fiscal year March 2020

Ryosuke Ikeda, Chairman and CEO | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | First Section, TSE |

Industry | Services |

Chairman | Ryosuke Ikeda |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Act.) | Trading Unit | |

¥1,199 | 22,246,297 | ¥26,673 million | 16.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥18.00 | 1.5% | ¥88.57 | 13.5x | ¥309.28 | 3.9x |

*Stock prices as of the close on December 6, 2019. The number of shares issued is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter.

* ROE and BPS are the actual value based on JGAAP as of the end of the previous year.

Transition in Consolidated Performance (IFRS from the term ending March 2020)

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2016 | 45,028 | 1,429 | 1,468 | 692 | 36.38 | 20.00 |

March 2017 | 60,599 | 1,963 | 1,980 | 1,011 | 54.23 | 14.00 |

March 2018 | 79,197 | 2,422 | 2,441 | 1,222 | 57.44 | 18.00 |

March 2019 | 103,603 | 2,547 | 2,636 | 1,231 | 55.58 | 18.00 |

March 2020 Est | 120,000 | 4,000 | 3,800 | 1,970 | 88.57 | 18.00 |

*Estimated by the Company. (Unit: Million yen or yen)

*2 for 1 stock splits were conducted in December 2016. (EPS of the term ending March 2016 has been revised retroactively.)

This Bridge Report reviews the first half of fiscal year March 2020 earnings results and fiscal year March 2020 earnings estimates of WILL GROUP, INC.

Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year March 2020 Earnings Results

3. Fiscal Year March 2020 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the term ending March 2020, sales and operating profit grew 25.3% and 74.4%, respectively, year-on-year. The 3 focused businesses, which are the main driver for growth, saw a 43.1% year-on-year sales growth, while the sales of the 3 mainstay businesses increased 11.6% year-on-year. Further, the sales of the business in new fields increased 38.5% year-on-year. Regarding profit performance, despite posting losses for withdrawing from money-losing businesses, and the deterioration in the profitability of the business in new fields due to upfront investments, the profit of the 3 focused businesses increased 14.9% year-on-year as the profit of the care support business, where upfront investment ran its course, expanded almost 5 times year-on-year. Additionally, the profit of the mainstay businesses increased 53% year-on-year thanks to improved profitability.

- The full-year forecast is unchanged, and sales and operating profit are expected to grow 16.2% and 34.9%, respectively, year-on-year (They aim to achieve an operating profit of 4 billion yen in the mid-term management plan). For the second half, the company took into account the decrease of orders for non-food products in the factory outsourcing business due to customers’ production adjustments, which was not expected at the beginning of the term, and the upfront investment in the care support business and HR Tech field. The term-end dividend is projected to be 18 yen per share (The estimated payout ratio is 20.3%), and total return ratio will be over 35% if they hit the upper limit of 300 million yen for acquiring treasury shares, which is currently being carried out.

- It has become difficult to expand the top-line results for the sales outsourcing business and the call center outsourcing business, as their markets have already matured. However, in the first half, the company improved profitability and achieved a major profit growth by strategically narrowing down targets and performing a solid on-site operation. For the next mid-term management plan, they are expected to steadily increase profit in the 3 businesses including the factory outsourcing business. As for this term, the company aims to achieve its mid-term goal of 4 billion yen in operating profit. However, considering the unexpectedly good results in the first half and the company’s irregular results in the second half, the company might go beyond the 4 billion yen in operating profit, which the company had projected.

1. Company Overview

WILL GROUP, INC. is a holding company that provides HR services specialized at each category such as dispatching sales support staff, call center operators and manufacturing line staff primarily to food manufacturing, and supporting nursing facilities’ personnel recruitment and temporary staffing. The main feature of the Company is the “hybrid placement service,” by which permanent employees of Will Group work alongside temporary staff in the dispatched workplace. Will Group differentiates itself from its competitors by implementing its hands-on policy as it endeavors to develop new businesses to achieve the goal of ¥100 billion in sales.

There are 48 group companies (15 companies inside Japan and 33 companies outside Japan as of the end of March 2019), including WILLOF WORK, Inc., which deals with the outsourcing of sales and call center operation, CreativeBank Inc., which carries out sales promotion, WILLOF FACTORY, Inc., which offers services specializing in manufacturing, and overseas subsidiaries that offer staffing services mainly in Asia and Oceania.

【WILL Vision】

Creating a strong brand with high expected value and becoming No. 1 in the business fields of “working,” “interesting,” “learning” and “living.”

Working: | Business field to support “Working” |

Interesting: | Business field to support “Interesting” |

Learning: | Business field to support “Learning” |

Living: | Business field to support “Living” |

1-1 Business Description

While operating the three core businesses of “sales outsourcing,” “call center outsourcing,” and “factory outsourcing” and the three strategic growth businesses of “care support,” “overseas HR,” and “startup personnel support,” Will Group is nurturing a variety of businesses (not limited to staffing services).

As for the sales composition in the term ending March 2019, sales outsourcing business accounted for 21%, call center outsourcing business 15%, factory outsourcing business 20%, care support business 9%, overseas HR business 25%, startup personnel support business 1%, and other 8%.

Sales Outsourcing Business WILLOF WORK, INC. CreativeBank INC.

Dispatch of contract staff to provide storefront sales services at apparel, consumer electronics mass retail and cellular phone shops and outsourcing of related business processes are conducted in this business segment. CreativeBank INC. was turned into a consolidated subsidiary in September 2015 and earnings derived from planning/operation of its sales promotion are booked in this segment (A comprehensive support structure has been facilitated to provide sales promotion operations and sales support).

Call Center Outsourcing Business WILLOF WORK, INC.

Will Group dispatches call center operators to companies operating call centers and telemarketing services including communications companies, while providing contract staffing for office and personnel recruitment services. The company is also able to provide a telemarketing outsourcing service at its own call centers.

Factory Outsourcing Business WILLOF FACTORY, INC.

The consolidated subsidiary FAJ, INC. provides production outsourcing involving simple tasks (inspection, quality management, sorting, packing, etc.) and places contract staff to the food manufacturing industry (lunch boxes at convenience stores, prepared food), which is least affected by economies’ ups and downs.

Strengths of the worker dispatch business of Will Group: hybrid dispatch

The worker dispatch service of Will Group is unique in that its full-time employees called field supporters (FS) work with temporary staff, while managing, instructing, and educating them on a daily basis in each workplace. This is a strength of the company. As loyal field supporters engage in hands-on management, the company can offer high-quality services, grasp and respond to customer needs swiftly, receive exclusive orders, expand its in-store share, and establish a robust customer base.

Care Support Business WILLOF WORK, INC.

Inexperienced workers are recruited and educated, and then dispatched as assistants to certified care workers. Will Group offers not only full-time jobs but also jobs with flexible working styles, to make the working environments comfortable to contract staff. This business was started in the fiscal year ended March 2014, as the staffing market grew considerably because of the shortage of care workers. The company has conducted upfront investment while prioritizing business expansion over profit, and entered the recoupment phase in the term ended March 2019.

Overseas HR Business

Scientec Consulting Pte. Ltd. (Singapore; reorganized into a subsidiary in August 2014), Asia Recruit Holdings Sdn. Bhd. (Malaysia; reorganized into a subsidiary in June 2016), Ethos Corporation Pty Ltd. (Australia; reorganized into a subsidiary in January 2017), DFP Recruitment Holdings Pty Ltd. (Australia; reorganized into a subsidiary in January 2018), etc. became consolidated subsidiaries of Will Group, to conduct personnel services, including the contract staffing and the recruitment of personnel, in ASEAN countries and the Oceanian region.

Startup Personnel Support Business for Startups, Inc.

In cooperation with leading entrepreneurs and investors in Japan, the company offers services of introducing candidate executives, including CxO and board members, to promising venture firms whose IPO has been completed or scheduled.

In other businesses, Will Group offers businesses that are at the investment stage: dispatch of assistant language teachers (ALTs), recruitment of personnel in the sporting field, dispatch of IT engineers, recruitment and dispatch of nursery staff, recruitment of medical doctors specialized for clinic, media for the placement of foreign part-time workers, dispatch and recruitment of construction engineers, and funds (incubation and HRTech)

2. First Half of Fiscal Year March 2020 Earnings Results

2-1 Business Performance (IFRS)

| 1H of FY3/19 | Share | 1H of FY3/20 | Share | YoY Change | Initial forecast | Divergence |

Sales | 48,470 | 100.0% | 60,736 | 100.0% | +25.3% | 58,000 | +4.7% |

Gross Profit | 9,782 | 20.2% | 12,712 | 20.9% | +30.0% | - | - |

SG & A | 8,534 | 17.6% | 10,540 | 17.4% | +23.5% | - | - |

Operating Income | 1,279 | 2.6% | 2,230 | 3.7% | +74.4% | 1,400 | +59.3% |

Ordinary Income | 1,255 | 2.6% | 2,200 | 3.6% | +75.3% | 1,400 | +57.1% |

Profit attributable to owners of parent | 698 | 1.4% | 1,280 | 2.1% | +83.2% | 800 | +60.0% |

(Unit: Million yen)

Sales and operating profit grew 25.3% and 74.4%, respectively, year-on-year.

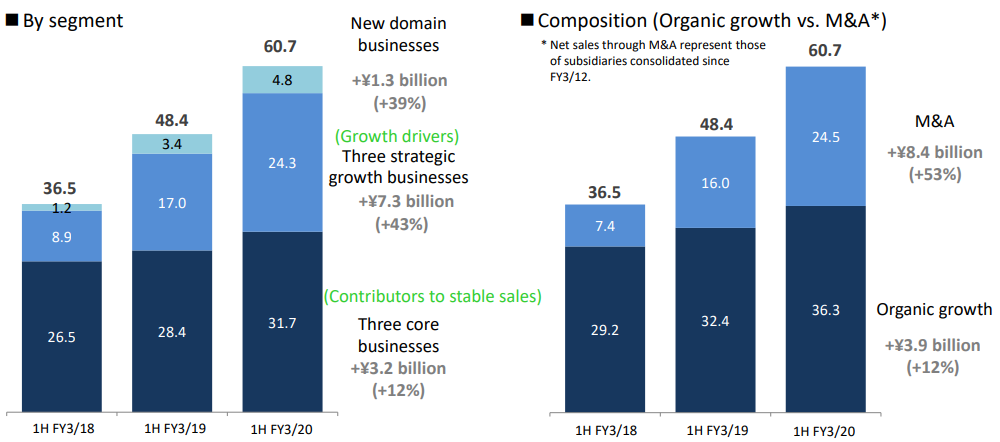

Sales were 60,736 million yen, up 25.3% year-on-year. The sales of the 3 focused businesses, which are the main driver for growth, were 24,309 million yen, up 43.1% year-on-year, while sales of the 3 mainstay businesses, which are the earnings base, were 31,669 million yen, up 11.6% year-on-year. Additionally, the business in new fields, which is to drive growth for the next mid-term management plan, was 4,754 million yen, up 38.5% year-on-year thanks to the contribution of the business of dispatching and introducing construction engineers.

Moreover, by dividing the factors contributing to the growth in sales into organic and M&A factors, organic factors contributed to a 12% year-on-year increase in sales (3.9 billion yen), and M&A contributed to a 53% year-on-year increase (8.4 billion yen). This illustrates that the company has achieved a good balance in growth for M&A and organic factors and kept the growth sustainable.

Regarding profit performance, thanks to the improved profitability of the 3 businesses, the profit for the mainstay businesses was 2,060 million yen, up 53% year-on-year. Further, as the profit of the care support business, where upfront investment ran its course, expanded by almost 5 times year-on-year, the profit of the focused businesses was 731 million yen, up 14.9% year-on-year, offsetting the upfront investment in the overseas HR business. Despite posting losses for withdrawing from money-losing businesses and the deterioration in the profitability of the business in new fields due to upfront investments (from 28 million to -88 million yen), there was a boost thanks to the IFRS adjustments and consolidated adjustments, as a result of which operating profit was 2,230 million yen, up 74.4% year-on-year (950 million yen).

*Unit: billion yen

(Source: Company)

The three mainstay businesses refer to the sales outsourcing, call center outsourcing, and factory outsourcing businesses. They are the core businesses for the corporate group. However, their market has already been matured, thus the company has been concentrating on polishing the operation while focusing on profitability. On the other hand, the 3 focused businesses refer to the care support, overseas HR, and the startup personnel support businesses. They are the main growth drivers for the company and considered important businesses for achieving the goals of the ongoing mid-term management plan. Furthermore, a new domain is currently being developed to be the main growth driver for the next mid-term management plan as the business in a new field.

2-2 Trend by Segment

| 1H of FY3/19 | Share | 1H of FY3/20 | Share | YoY Change |

Sales outsourcing | 10,809 | 22.3% | 11,778 | 19.4% | +9.0% |

Call center outsourcing | 7,762 | 16.0% | 8,013 | 13.2% | +3.2% |

Factory outsourcing | 9,813 | 20.2% | 11,878 | 19.6% | +21.0% |

Care support | 4,353 | 9.0% | 5,341 | 8.8% | +22.7% |

Overseas HR | 12,100 | 25.0% | 18,374 | 30.3% | +51.9% |

Startup personnel support | 536 | 1.1% | 594 | 1.0% | +10.7% |

Others domestic business (in new fields) | 3,431 | 7.1% | 4,754 | 7.8% | +38.5% |

Consolidated Sales | 48,470 | 100.0% | 60,736 | 100.0% | +25.3% |

Sales outsourcing | 638 | 5.9% | 900 | 7.6% | +41.2% |

Call center outsourcing | 284 | 3.7% | 501 | 6.3% | +76.8% |

Factory outsourcing | 424 | 4.3% | 659 | 5.5% | +55.3% |

Care support | 28 | 0.6% | 139 | 2.6% | +386.1% |

Overseas HR | 474 | 3.9% | 433 | 2.4% | -8.5% |

Startup personnel support | 134 | 25.0% | 159 | 26.8% | +18.4% |

Others domestic business (in new fields) | 28 | 0.8% | -88 | -1.9% | - |

Adjustments | 170 | - | 369 | - | - |

Consolidated operating income | 1,279 | 2.6% | 2,230 | 3.7% | +74.4% |

*Unit: Million yen

The Three Mainstay Businesses

The sales for the factory outsourcing business was 11,878 million yen, up 21% year-on-year as it has covered demand for the food products field and such, where demand is healthy for home meal replacement, by proactively increasing business sites. The markets targeted by this business are growing, and resuming the expansion of business sites for further growth after the state of contracted equilibrium caused by the closing of sites in the wake of Lehman’s collapse started to yield results. Thanks to the stable income of the communications domain, the expansion of profit in the apparel domain, and the increased profit of other domains against the backdrop of the practical transition to Windows 10, sales of the sales outsourcing business were 11,778 million yen, up 9% year-on-year. The sales of the call center outsourcing business were 8,013 million yen, up 3.2% year-on-year as the efforts for making high-profitability transactions, such as financial-related ones, paid off. As the markets for both businesses have matured, the development of business sites has run its course, thus the company is focusing on developing new services.

As for profit, thanks to the improved profitability in the 3 businesses, profit has dramatically increased. The profit for the sales outsourcing business was 900 million yen, up 41.2% year-on-year thanks to the decline in outsourcing ratio. For example, in a situation where the company is entrusted with providing 50 people, the company is obliged to provide 50 people. However, when the company alone can’t accommodate the number, it has to rely on outsourcing for personnel dispatching to cover the shortage, thus the cost of sales ratio increases. During the first half of this term, the company is seeking self-sufficiency by hiring full-time employees for professions, etc. and the effort has started to pay off. Regarding the call center outsourcing business, the company not only focused on high-profitability projects, such as the financial-related projects, but also prioritized concentrating on the customers and the work fields with which it can do long-term projects instead of short-term projects for 3 or 4 months and the results of that decision are starting to show. The profit was 501 million yen, up 76.8% year-on-year. As for the factory outsourcing business, in addition to the major expansion of sales, the company reconsidered the terms and contracts with low-profitability customers, etc. As a result, the profit was 659 million yen, up 55.3% year-on-year.

The Three Focused Businesses

Thanks to the business expansion of the bases that have been established until the previous term, the sales of the care support business were 5,341 million yen, up 22.7% year-on-year; additionally, thanks to the consolidation of 2 new companies, the sales of the overseas HR business was 18,374 million yen, up 51.9% year-on-year.

Regarding the profit performance of the care support business, the number of business establishments that have been operated for 3 or more years increased and the sales ratio from the introduction of nursing staff expanded. Consequently, gross profit ratio improved and the profit jumped from 28 million yen, the profit of the same quarter in the previous year, to 139 million yen. However, the profit for the overseas HR business was 433 million yen, down 8.5% year-on-year due to the rise in costs of intermediary holding companies and deteriorated profitability of some subsidiaries. Meanwhile, thanks to expanding operations and improving productivity, the profit for startup personnel support business was 159 million yen, up 18.4% year-on-year.

As for the overseas HR business, the chairman and CEO Ikeda has been serving concurrently as the CEO of the intermediary holding company until now. However, as it is necessary to enter the phase of seeking cooperation and synergy between overseas subsidiaries in the future, a new CEO was selected from inside the subsidiaries. Under the new structure, the company plans to accelerate personnel development, cross-selling within the group, cost reduction, etc. During the process, it hired necessary members, and costs increased. Moreover, the profitability of DFP Recruitment Holdings Pty Ltd. (hereinafter DFP), which conducts personnel services, including the dispatching and introduction of personnel for government agencies, telecommunications companies, energy corporations, consumer electronics manufacturers, etc. in Australia, has worsened. The reasons behind the deteriorated earnings are the completion of high-profitability projects for the introduction of personnel, and the volume discounts which were given for large-scale transactions. However, the volume discounts are also considered as an upfront investment for expanding the transactions in the future, and, thus, DFP does not need to perform impairment.

Other Domestic Business (in new fields)

WILLOF CONSTRUCTION, Inc., which dispatches and introduces construction engineers and became a consolidated subsidiary in June 2018, contributed to the business performance from the beginning of the term, thanks to which sales were 4,754 million yen, up 38.5% year-on-year. Regarding profit and loss, posting losses for withdrawing from money-losing businesses and upfront investments for the HR Tech field became a burden.

2-3 Financial Position and Cash Flow

◎Balance Sheet

| Mar. 2019 | Sep. 2019 |

| Mar. 2019 | Sep. 2019 |

Cash, equivalents | 6,862 | 4,177 | Trade and Other Payables | 12,872 | 12,146 |

Trade and other receivables | 14,852 | 15,222 | Borrowings | 3,924 | 3,328 |

Current Assets | 22,536 | 20,316 | Other Financial Liabilities | 941 | 1,569 |

Tangible Fixed Assets | 1,420 | 1,371 | Total Current Liabilities | 21,081 | 19,915 |

Right-of-use Assets | 6,160 | 6,156 | Borrowings | 7,529 | 8,217 |

Goodwill | 5,747 | 6,937 | Other Financial Liabilities | 8,169 | 8,589 |

Other Intangible Assets | 3,427 | 3,270 | Total Non-Current Liabilities | 16,831 | 17,601 |

Non-Current Assets | 20,200 | 21,492 | Total Equity Attributable to Owners of Parent | 4,197 | 3,542 |

Total Assets | 42,736 | 41,809 | Total Equity | 4,822 | 4,292 |

*Unit: Million yen

The total assets at the end of the first half were 41,809 million yen, down 927 million yen from the end of the previous term. Non-Current assets increased as u&u Holdings Pty Ltd and other 2 companies, which conduct personnel services, including the dispatch and introduction of personnel mainly for government agencies and major corporations in Australia, became consolidated subsidiaries in April 2019. On the other hand, due to giving short put options to the non-controlling-interest shareholders, etc. the equity attributable to owners of the parent (capital surplus) decreased. Equity ratio was 8.5% (9.8% at the end of the previous term).

Moreover, in the period from September 20 to December 30, 2019, the company is acquiring treasury shares with an upper limit of 300,000 shares (1.35% of the number of shares outstanding excluding treasury shares) worth 300 million yen. The purchase progress rate as of the end of October 2019 is 28.8% (acquired a total of 86,500 shares).

◎Cash Flow Summary

| 1H of FY3/19 | 1H of FY3/20 | YoY Change | |

Operating cash flow | 803 | 1,394 | +591 | +73.6% |

Investing cash flow | -3,293 | -2,625 | +668 | - |

Free cash flow | -2,490 | -1,231 | +1,259 | - |

Financing cash flow | 576 | -1,215 | -1,791 | - |

Cash, equivalents at term-end | 7,249 | 4,177 | -3,072 | -42.4% |

*Unit: Million yen

As profit before taxes was 2,200 million yen (1,255 million yen in the same period of the previous year), depreciation and amortization expenses were 857 million yen (720 million yen in the same period of the previous year), corporate income tax was -967 million yen (-590 million yen in the same period of the previous year), etc., the company secured an operating cash flow of 1,394 million yen. The investing cash flow came from capital investments and M&A related expenses and the financing CF came from the reduction of interest-bearing liabilities and the payment of dividends

3. Fiscal Year March 2020 Earnings Estimates

3-1 Performance Forecast (Consolidated Earnings)

| FY3/19 Act | Share | FY3/20 Est. | Share | YoY Change |

Sales | 103,303 | 100.0% | 120,000 | 100.0% | +16.2% |

Operating Income | 2,979 | 2.9% | 4,000 | 3.3% | +34.9% |

Ordinary Income Before Income Taxes | 2,898 | 2.8% | 3,800 | 3.2% | +31.7% |

Profit attributable to owners of parent | 1,554 | 1.5% | 1,970 | 1.6% | +27.5% |

*Unit: Million yen

The full-year forecast unchanged, and sales and operating profit expected to grow 16.2% and 34.9%, respectively, year-on-year.

In the plan for the second half, the company took into account the decrease of orders for non-food products in the factory outsourcing business due to customers’ production adjustments, which was not expected at the beginning of the term, and the upfront investment in the care support business and HR Tech field. For this reason, the forecast was left unchanged. However, it is generally a conservative forecast.

The term-end dividend is to be 18 yen/share (the estimated payout ratio is 20.3%). The mid-term management plan set the target total shareholder return at 30% for the term ending March 2020, and total return ratio will be over 35% if they hit the upper limit of 300 million yen for acquiring treasury shares, which is currently being carried out.

3-2 Unification of Service Brands Unification of corporate names under the title of “WILLOF” in October 2019

In October 2019, the company unified the brands to have high name recognition through integration into one brand and to increase the efficiency of the recruitment process. Increasing recruitment efficiency is indispensable for further increasing earnings and profitability of existing businesses. Till now, the receipt of orders was given top priority and every company and service in the group would receive the orders through their respective brands but currently, the orders cannot be responded to due to the labor shortages. Thus, initiatives will be taken from now on to give maximum priority to increasing recruitment efficiency and order receipt capacity.

Furthermore, since seizing growth opportunities through the creation of a new brand is also the aim of brand unification, a brand vision called “Chance-Making Company” was also set up. “Chance-Making Company” is the process of presenting growth opportunities through work to men and women of all ages including foreign workers. The corporate strategy and services will be reconsidered from the basics in order to create a brand that can give abundant growth opportunities.

(Source: Company)

4. Conclusions

It has become difficult to expand the top-line results for the sales outsourcing and call center outsourcing businesses, as their markets have already matured. However, in the first half, the company improved profitability and achieved a major profit growth by strategically narrowing down targets and performing a solid on-site operation. The company’s mid-term goal of 4 billion yen in operating profit has come within the achievable range, and for the next mid-term management plan, they are expected to steadily increase profit for the 3 businesses, including the factory outsourcing business.

The full-year earnings forecast is unchanged, but as for the second half, the company (Chairman/CEO Ikeda) admitted that it’s extremely conservative. The factory outsourcing business has customers in the industries related to electric appliances, precision equipment, and home appliances, and, thus there is some uncertainty regarding trade negotiations between the United States and China and the effects of production adjustments are starting to show. Additionally, achieving an operating profit of 4 billion yen in this term is of utmost importance. However, considering the growth in the next term onwards, investment in the care support business and the HR Tech field is necessary at this timing and the company seems to consider allocating an additional budget for it. However, considering the unexpectedly good results in the first half and the company’s irregular results in the second half, the company might offset upfront investments and go beyond the forecasted 4 billion yen in operating profit.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with company auditor(s) |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 3 external ones |

◎ Corporate Governance Report Updated on June 19, 2019

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Cross held shares】

(1) Policies Regarding Cross-holding

Our company does not own any cross-held shares. We shall not own any such stocks in the future except cases where, taking into consideration the creation of business opportunities and the development, maintenance and strengthening of transactions and cooperative relations, we conclude that possessing such stocks will contribute to an increase in middle and long-term value of our company. After our company owns such stocks, if we decide, as per the policies mentioned above, that the benefit from owning these stocks is insufficient, we shall swiftly cut down these stocks.

(2) Details of discussion regarding cross-held shares

In the case of our company possessing cross-held shares, the board of directors will periodically evaluate the economic rationality, such as return on investment, regarding merits, risks and capital costs of possessing such stocks as well as future prospects and make a decision on whether to keep holding such stocks.

(3) Criteria for the Exercise of Voting Rights regarding Cross-held Shares

Regarding the exercise of voting rights related to cross-held shares, instead of unilaterally making a decision, decisions will be made on each item of the agenda individually, from a point of view of increasing company value in the middle and long-term as well as increasing returns for shareholders, while respecting the management policies and strategies of the company being invested in.

【Principle 5-1 Policies related to Constructive Interaction with Shareholders】

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website. Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director and executive officers in charge of the finance department aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy and continuity with regard to management and business strategies, financial information etc.

(2) The finance department takes a central role, and the management planning, general affairs, financial affairs, accounting, and legal affairs departments and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair and suitable fashion.

(3) As a means for interaction, we shall engage in the enrichment of company information sessions for shareholders.

(4) The opinions and worries of shareholders understood in our interactions will be reviewed appropriately and effectively in all our company meetings through the representative director and executive officers in charge of the finance department.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019, Investment Bridge Co.,Ltd., All Rights Reserved. |

To view back numbers of Bridge Reports on WILL GROUP, INC. (6089) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/