Bridge Report:(6089)WILL GROUP the Fiscal Year March 2020

Ryosuke Ikeda, Chairman and CEO | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | First Section, TSE |

Industry | Services |

Chairman | Ryosuke Ikeda |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Act.) | Trading Unit | |

¥728 | 22,226,097shares | ¥16,180 million | 50.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥14.00 | 1.9% | ¥44.98 | 16.2 x | ¥235.46 | 3.1 x |

*Stock prices as of the close on May 29, 2020. The number of shares issued is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter.

* ROE and BPS are the actual value based on the end of the previous year.

Transition in Consolidated Performance (IFRS from the term ended March 2019)

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2017(Act.) | 60,599 | 1,963 | 1,980 | 1,011 | 54.23 | 14.00 |

March 2018(Act.) | 79,197 | 2,417 | 2,437 | 1,210 | 57.44 | 18.00 |

March 2019(Act.) | 103,300 | 2,957 | 2,876 | 1,539 | 69.46 | 18.00 |

March 2020(Act.) | 121,916 | 4,145 | 4,057 | 2,380 | 107.07 | 23.00 |

March 2021(Est.) | 120,000 | 2,000 | 2,000 | 1,000 | 44.98 | 14.00 |

*Estimated by the Company. (Unit: Million yen or yen)

This Bridge Report reviews fiscal year March 2020 earnings results and fiscal year March 2021 earnings estimates of WILL GROUP, INC.

Contents

Key Points

1. Company Overview

2. Summary of the mid-term management plan (Will Vision 2020: FY 3/17 to FY 3/20)

3. Fiscal Year March 2020 Earnings Results

4. Fiscal Year March 2021 Earnings Estimates

5. The new mid-term management plan

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the term ended March 2020, sales revenue was 121.9 billion yen, up 18.0% year on year, and operating profit was 4.1 billion yen, up 40.1% year on year. These results exceeded the target sales of 100 billion yen and the target operating profit of 4 billion yen in the mid-term management plan. As for sales, the sales of the factory outsourcing business and 3 focused businesses grew, while the performance of sales outsourcing and call center outsourcing businesses were healthy. As for profit, the COVID-19 pandemic became the factor that reduced profit by 200 million yen, but the profitability of each business segment improved, thanks to the reduction of outsourcing costs, the increase of profitable transactions, the revision of contract conditions, etc. The dividend is to be 23 yen/share, up 5 yen/share (payout rati 21.5%).

- For the term ending March 2021, sales and operating profit are estimated to decline 1.6% and 51.8%, respectively. Some businesses, such as nursing-care and childcare businesses, are not easily affected by the pandemic, but the forecast was conservative as a whole. The dividend is to be 14 yen/share (estimated payout rati 31%). Since the forecast is conservative, the company plans to revise the dividend, etc. flexibly, while discerning the impact of the pandemic carefully.

- Due to the uncertainties over the business environment due to the COVID-19 pandemic, the company put off the announcement of the new mid-term management plan, whose initial year is the term ending March 2021, but they explained their policies. In Japan, the company will make efforts to expand the profitable domain (the introduction of workers in the nursing-care and childcare fields, where the shortage of manpower is lingering, and the dispatch of workers to specialized fields, such as construction and IT fields), and improve the productivity in the domain of dispatch of workers and undertaking of tasks, which are the current core businesses. Outside Japan, the company will put energy into the expansion of the domain of dispatch of workers and undertaking of tasks, whose volatility is low, in order to establish a stable revenue base.

1. Company Overview

WILL GROUP, INC. is a holding company that provides HR services specialized at each category such as dispatching sales support staff, call center operators and manufacturing line staff primarily to food manufacturing, and supporting nursing facilities’ personnel recruitment and temporary staffing. The main feature of the Company is the “hybrid placement service,” by which permanent employees of Will Group work alongside temporary staff in the dispatched workplace. Will Group differentiates itself from its competitors by implementing its hands-on policy as it endeavors to develop new businesses.

There are 48 group companies (15 companies inside Japan and 33 companies outside Japan as of the end of March 2019), including WILLOF WORK, Inc., which deals with the outsourcing of sales and call center operation, CreativeBank Inc., which carries out sales promotion, WILLOF FACTORY, Inc., which offers services specializing in manufacturing, and overseas subsidiaries that offer staffing services mainly in Asia and Oceania.

【WILL Vision】

Creating a strong brand with high expected value and becoming No. 1 in the business fields of “working,” “interesting,” “learning” and “living.”

Working: | Business field to support “Working” |

Interesting: | Business field to support “Interesting” |

Learning: | Business field to support “Learning” |

Living: | Business field to support “Living” |

1-1 Business Description

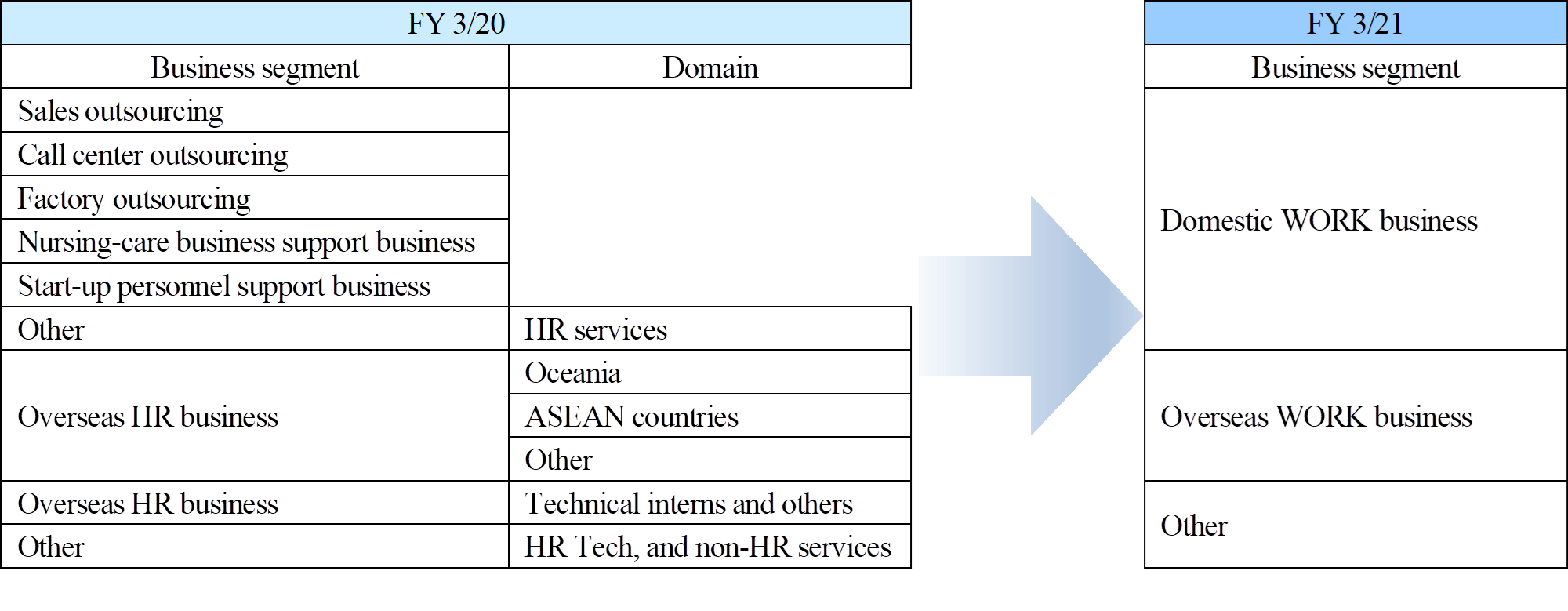

Through the expansion of the business domain, the scope of management expanded. Then, in order to strengthen company-wide strategies, the company will adjust its business segments and change its management system in the term ending March 2021.

As for the domestic WORK business, the company will shift from the business operation focusing on the provision of “employment opportunities” to the business operation focusing on the provision of “growth opportunities.” In detail, the company will shift to the introduction of workers and the dispatch of workers to specialized fields, and improve profitability, to grow while increasing revenue. For the overseas WORK business, considering the fact that the business foundations have been established in ASEAN countries and Oceania through active M&A conducted until the previous term, the company will prioritize the improvement in business stability over the expansion of the business scale, and strive to maximize and optimize employment opportunities through the dispatch of workers and the undertaking of tasks.

(Source: Company)

Sales and Profit by Segment

| FY3/19 | FY3/20 | YoY |

|

| FY 3/20 | Ratio/profit margin |

Sales outsourcing | 22,207 | 23,149 | +4.2% |

| Domestic WORK business | 84,438 | 69.2% |

Call center outsourcing | 15,724 | 16,459 | +4.7% |

| Overseas WORK business | 36,074 | 29.5% |

Factory outsourcing | 20,885 | 23,745 | +13.7% |

| Other | 1,549 | 1.3% |

Nursing-care business support business | 9,310 | 11,142 | +19.7% |

|

|

|

|

Overseas HR business | 26,275 | 36,131 | +37.5% |

|

|

|

|

Start-up personnel support business | 1,049 | 1,262 | +20.4% |

|

|

|

|

Other domestic business (new field busines) | 8,151 | 10,172 | +24% |

|

|

|

|

IFRS adjustments | -302 | -146 | - |

| IFRS adjustments | -146 | - |

Sales | 103,300 | 121,916 | +18.0% |

| Sales | 121,916 | - |

Sales outsourcing | 1,537 | 1,790 | +16.4% |

| Domestic WORK business | 5,061 | 6.0% |

Call center outsourcing | 833 | 994 | +19.3% |

| Overseas WORK business | 971 | 2.7% |

Factory outsourcing | 1,038 | 1,349 | +29.9% |

| Other | -352 | - |

Nursing-care business support business | 182 | 349 | +91.5% |

|

|

|

|

Overseas HR business | 425 | 964 | +126.9% |

|

|

|

|

Start-up personnel support business | 269 | 308 | +14.6% |

|

|

|

|

Other domestic business (new field busines) | 143 | -87 | - |

|

|

|

|

Adjustments + IFRS adjustment | -1,473 | -1,525 | - |

| Adjustments + IFRS Adjustments | -1,535 | - |

Consolidated Operating Income | 2,957 | 4,145 | +40.1% |

| Consolidated Operating Income | 4,145 | 3.4% |

2. Summary of the mid-term management plan (Will Vision 2020: FY 3/17 to FY 3/20)

The company achieved the target sales of 100 billion yen and the target operating profit of 4 billion yen for the term ended March 2020. While growing the 3 major businesses stably, the company has established 3 new businesses as business pillars. As for the creation of businesses exceeding a certain scale, the company has created some businesses in the HR service field, including the dispatch and introduction of construction engineers, but there remained some issues with the creation of businesses exceeding a certain scale in the fields other than the HR service field. Net profit rose considerably, but the dividend amount that was revised upwardly in January 2020 has been left unchanged considering the pandemic, so the total return ratio was 25.1%, falling below the target value: 30%.

Summary

Goals set in Will Vision 2020 | Evaluation | Review | |

Management goals (FY 3/20) | Sales: 100 billion yen Operating profit: 4 billion yen | 〇 | Sales: 121.9 billion yen (achieving the goal one year earlier than expected) Operating profit: 4.1 billion yen*2 (including the effects of the IFRS adjustment) CAGR: 28% for sales and 30% for operating profit (Organic: 15% for sales and 16% for operating profit) *2: It includes the effect of the spread of COVID-19: negative 200 million yen |

Goals in intensive strategies | To make the 3 major businesses No. 1 in each business field | △ | Not as planned, but each business has grown stably. For FY 3/16, sales were 40 billion yen and operating profit was 2.5 billion yen. For FY 3/20, sales were 63.3 billion yen and operating profit was 4.1 billion yen. * CAGR: 12% for sales and 13% for operating profit

|

To establish 3 new businesses as pillars | 〇 | Three businesses established as pillars of business For FY 3/16, sales were 3.9 billion yen and operating profit was 0 yen. For FY 3/20, sales were 48.5 billion yen and operating profit was 1.6 billion yen. * CAGR: 87% for sales and 164% for operating profit | |

To create businesses exceeding a certain scale in the fields other than the HR service field | △ | In the field of HR services, such as the dispatch and introduction of construction engineers, the company created businesses exceeding a certain scale, but the company has not created businesses exceeding a certain scale in fields other than the HR service field. | |

Return to shareholders | Total return rati 30% | △ | For FY 3/20, total return rati 25.1% * The dividend for FY 3/20 was 23 yen/share, which was 5 yen/share larger than the initial estimate: 18 yen/share |

Sales growth rate: 28% (organic: 15%), operating profit rate: 30% (organic: 16%)

| 3/16 | 3/17 | 3/18 | 3/19 | 3/20 |

|

| 3/16 | 3/17 | 3/18 | 3/19 | 3/20 |

3 core businesses | 400 | 492 | 554 | 588 | 633 |

| Organic | 414 | 525 | 604 | 667 | 728 |

3 focused businesses | 40 | 98 | 210 | 366 | 485 |

| M&A | 36 | 81 | 188 | 365 | 491 |

Businesses in new fields | 9 | 16 | 27 | 81 | 101 |

| Sales revenue | 450 | 605 | 791 | 1,033 | 1,219 |

Sales revenue | 450 | 605 | 791 | 1,033 | 1,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 16/3 | 17/3 | 18/3 | 19/3 | 20/3 |

|

| 16/3 | 17/3 | 18/3 | 19/3 | 20/3 |

3 core businesses | 25 | 30 | 35 | 34 | 41 |

| Organic | 24 | 29 | 33 | 37 | 43 |

3 focused businesses | 0 | 2 | 5 | 9 | 16 |

| M&A | 1 | 3 | 6 | 8 | 13 |

Businesses in new fields | 0 | 0 | -1 | 1 | -1 |

| IFRS adjustments | - | - | - | 4 | 3 |

IFRS adjustments | - | - | - | 4 | 3 |

| Adjustments | -11 | -12 | -15 | -19 | -19 |

Adjustments | -11 | -12 | -15 | -19 | -19 |

| Operating Income | 14.2 | 19.6 | 24.2 | 29.5 | 41.4 |

Operating Income | 14.2 | 19.6 | 24.2 | 29.5 | 41.4 |

|

|

|

|

|

|

|

*Unit: 100 Million yen

3. Fiscal Year March 2020 Earnings Results

3-1 Business Performance (IFRS)

| FY3/19 | Share | FY3/20 | Share | YoY Change | Initial forecast | Divergence |

Sales | 103,300 | 100.0% | 121,916 | 100.0% | +18.0% | 120,000 | +1.6% |

Gross Profit | 20,305 | 19.7% | 25,402 | 20.8% | +25.1% | - | - |

SG & A | 17,406 | 16.8% | 21,422 | 17.6% | +23.1% | - | - |

Operating Income | 2,957 | 2.9% | 4,145 | 3.4% | +40.1% | 4,000 | +3.6% |

Ordinary Income | 2,876 | 2.8% | 4,057 | 3.3% | +41.0% | 3,800 | +6.8% |

Profit attributable to owners of parent | 1,539 | 1.5% | 2,380 | 2.0% | +54.6% | 1,970 | +20.8% |

*Unit: Million yen

Sales and operating profit grew 18.0% and 40.1%, respectively, year-on-year.

Sales revenue was 121.91 billion yen, up 18.0% year on year. While the 3 core businesses, mainly the factory outsourcing business and the overseas HR business, increased considerably, the sales outsourcing business and the call center outsourcing business were healthy. Namely, sales grew in all segments.

Operating profit was 4.14 billion yen, up 40.1% year on year. The spread of COVID-19 decreased profit by 200 million yen, but the profitability of each segment improved thanks to the reduction of outsourcing costs, the increase of profitable transactions, the revision to contract conditions, etc. Through the decrease in tax burden ratio (from 39.7% to 33.1%), net profit rose 54.6% year on year to 2.38 billion yen. EBITDA (operating profit + depreciation/amortization), on which the company puts importance, increased 34.3% year on year from 4.57 billion yen to 6.13 billion yen.

3-2 Trend by Segment

| FY3/19 | Share | FY3/20 | Share | YoY Change | Initial forecast | Divergence |

Sales outsourcing | 22,207 | 21.5% | 23,149 | 19.0% | +4.2% | 22,600 | +2.4% |

Call center outsourcing | 15,724 | 15.2% | 16,459 | 13.5% | +4.7% | 15,750 | +4.5% |

Factory outsourcing | 20,885 | 20.2% | 23,745 | 19.5% | +13.7% | 25,000 | -5.0% |

Care support | 9,310 | 9.0% | 11,142 | 9.1% | +19.7% | 10,500 | +6.1% |

Overseas HR | 26,275 | 25.4% | 36,131 | 29.6% | +37.5% | 35,100 | +2.9% |

Startup personnel support | 1,049 | 1.0% | 1,262 | 1.0% | +20.3% | 1,300 | -2.9% |

Others domestic business (in new fields) | 8,151 | 7.9% | 10,172 | 8.3% | +24.8% | 9,750 | +4.3% |

Consolidated Sales | -302 | - | -146 | - | - | - | - |

Sales outsourcing | 103,300 | 100.0% | 121,916 | 100.0% | +18.0% | 120,000 | +1.6% |

Call center outsourcing | 1,537 | 6.9% | 1,790 | 7.7% | +16.4% | 1,550 | +15.5% |

Factory outsourcing | 833 | 5.3% | 994 | 6.0% | +19.3% | 720 | +38.2% |

Care support | 1,038 | 5.0% | 1,349 | 5.7% | +29.9% | 1,360 | -0.8% |

Overseas HR | 182 | 2.0% | 349 | 3.1% | +91.5% | 470 | -25.6% |

Startup personnel support | 425 | 1.6% | 964 | 2.7% | +126.9% | 740 | +30.4% |

Others domestic business (in new fields) | 269 | 25.7% | 308 | 24.5% | +14.5% | 310 | -0.4% |

Adjustments | 143 | 1.8% | -87 | -0.9% | - | 160 | - |

Consolidated operating income | -1,473 | - | -1,525 | - | - | -1,300 | - |

Sales outsourcing | 2,957 | 2.9% | 4,145 | 3.4% | +40.1% | 4,000 | +3.6% |

*Unit: Million yen

The Three Mainstay Businesses

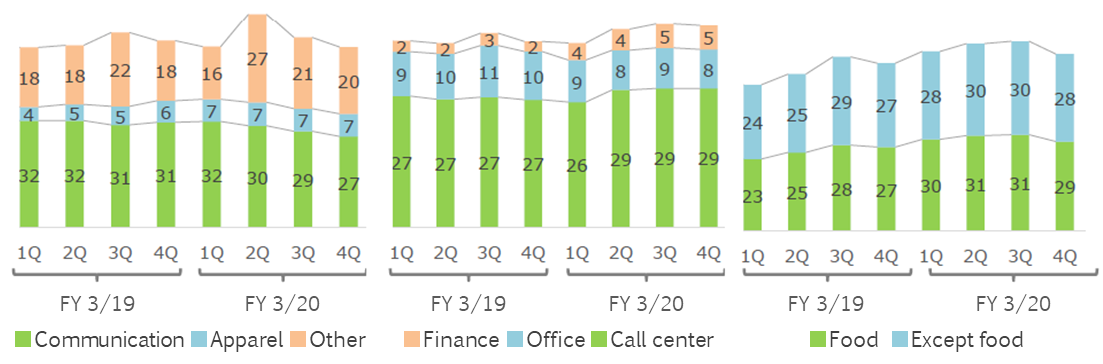

As for Sales OS, based on the stable revenue in the communications field, the apparel domain expanded, and other domains, too, expanded thanks to the support for shift to Windows 10. As for profit, gross profit rate improved due to the reduction of outsourcing costs, etc. As for Call Center OS, sales grew with the improvement in profitability as the efforts for increasing profitable transactions, including financial ones, paid off. As for Factory OS, sales increased as the investment in business bases in the previous term reaped revenue, and gross profit rate improved thanks to the revision to the conditions of contracts with clients and the increase of contracts for undertaking tasks. The number of foreign workers is about 3,700 as of the end of the term ended March 2020.

Sales by field (100 million yen)

Sales outsourcing | Call center outsourcing | Factory outsourcing |

| ||

(Source: Company)

Three focused businesses

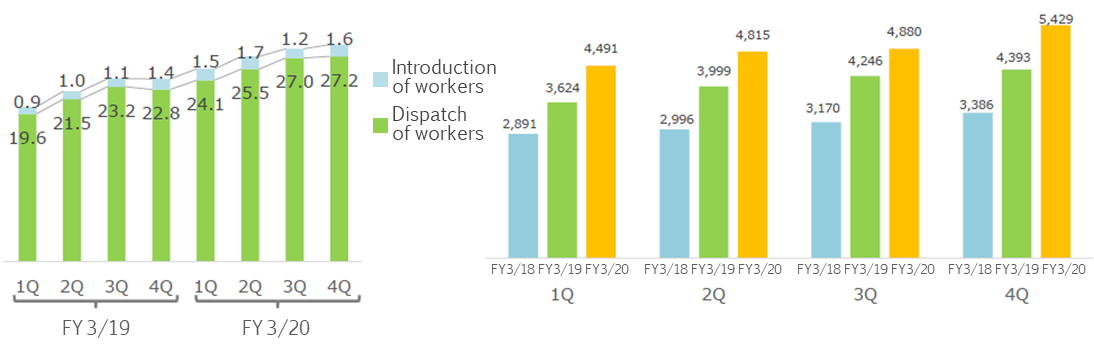

For the care support business, the number of bases that have been operated for 3 years or longer, when the revenue at its height, increased by 3, and the utilization of the nationwide network contributed to the introduction of workers, boosting sales. As for the overseas HR business, the two companies (u&u and CCG), which are new consolidated subsidiaries, performed well and contributed to sales growth. As for the existing subsidiaries in Australia and Singapore, the worker dispatch business was healthy, but the performance of the worker introduction business declined, because it is easily affected by the economic condition. Sales grew 9.85 billion yen in value terms. The consolidated subsidiaries acquired in the term ended March 2019 account for 3 billion yen, and the consolidated subsidiaries acquired in the term ended March 2020 account for 6 billion yen. As for profit, the contribution of new consolidated subsidiaries and the increase in gross profit from the dispatch of workers covered the decline in sales from the introduction of workers, the augmentation of costs for the intermediate holding company, and the effects of exchange rates. As for the startup personnel support business, sales and profit grew thanks to the business expansion, as the number of transactions for introducing workers increased from 385 to 432. On March 13, 2020, the subsidiary “for Startups, Inc.” was listed in Mothers of TSE. In addition, the company formed a business tie-up with Crunchbase Inc., which offers “Crunchbase,” the world’s largest database of venture firms, and launched services.

Variation in the sales for each contract [100 million yen] and the number of staff members in service in the care support business

(Source: Company)

Other

While the existing businesses, including ALT and childcare staff services, expanded steadily, the staffing service for construction engineers provided by WILLOF CONSTRUCTION, Inc., which was reorganized into a consolidated subsidiary in June 2018, performed well. As for profit/loss, the upfront investment (260 million yen) in foreign workers and HRTech fields was a burden, and the cost for withdrawing from unprofitable businesses amounting to 70 million yen was posted in the second quarter.

3-3 Situation of consolidated subsidiaries

There is the impact of the spread of COVID-19, but it is temporary, and there is no impairment risk in subsidiaries as of now.

| Start period | Investment Balance |

| 3/19 | 3/20 | YoY |

WILLOF CONSTRUCTION | 6/2018 | 26.9 | Sales | 41.8 | 47.9 | +14.8% |

Footholds: Tokyo Metropolitan Area and Tohoku | Stock holding ratio | 100% | Profit | 3.6 | 3.2 | -8.9% |

The Chapman CG | 1/2019 | 14.7 | Sales | 12.9 | 14.5 | +12.1% |

Foothold: Singapore | Stock holding ratio | 51% | Profit | 3.4 | 4.5 | +31.6% |

u&u Holdings | 4/2019 | 13.2 | Sales | 53.5 | 61.6 | +15.1% |

Foothold: Brisbane | Stock holding ratio | 60% | Profit | 5.4 | 5.4 | -1.0% |

DFP Recruitment Holdings | 1/2018 | 7.6 | Sales | 101.8 | 111.9 | +9.9% |

Foothold: Melbourne | Stock holding ratio | 80% | Profit | 3.1 | 3.1 | +0.1% |

* Unit: 100 million yen. To exclude the effects of exchange rates, the amounts were converted under the assumption that 1 Singapore dollar = 75 yen and 1 Australian dollar = 70 yen.

* Regardless of the timing of disclosure of consolidated results, actual sales and profit are the results in the consolidated accounting period from April to March.

* Investment balance = Goodwill balance + Identifiable intangible asset balance. Profit is the pretax profit, excluding the amortization of identifiable intangible assets, internal transactions, and temporary expenses.

3-4 Financial Position and Cash Flow

Balance Sheet

| Mar. 19 | Mar. 20 |

| Mar. 19 | Mar. 20 |

Cash, equivalents | 6,862 | 5,944 | Borrowings | 3,924 | 3,177 |

Current Assets | 22,536 | 22,041 | Total Current Liabilities | 21,081 | 21,566 |

Right-of-use Assets | 6,160 | 6,200 | Borrowings | 7,529 | 6,533 |

Goodwill | 5,322 | 5,654 | Total Non-Current Liabilities | 17,091 | 15,909 |

Other Intangible Assets | 4,515 | 5,455 | Total Equity | 5,224 | 7,123 |

Non-Current Assets | 20,861 | 22,558 | Total Liabilities and Equity | 43,398 | 44,600 |

*Unit: Million yen

Term-end total assets were 44.6 billion yen, up 1.2 billion yen from the end of the previous term. In the debit side, goodwill increased 330 million yen through M&A, and other intangible assets rose 940 million yen through the allocation of acquisition costs, etc. In the credit side, borrowings and translation adjustments declined 740 million yen and 1.28 billion yen, respectively, while retained earnings and non-controlling interest increased 1.95 billion yen and 860 million yen, respectively, and capital surplus grew 330 million yen, through the sale of some shares after the listing of “for Startups, Inc.” The ratio of equity attributable to owners of the parent was 11.7% (9.7% at the end of the previous term).

Cash Flow

| FY3/19 | FY3/20 | YoY Change | |

Operating cash flow | 2,803 | 4,997 | +2,194 | +78.3% |

Investing cash flow | -5,634 | -3,035 | +2,599 | - |

Financing cash flow | 564 | -2,720 | -3,284 | - |

Cash, equivalents at term-end | 6,862 | 5,944 | -918 | -13.4% |

*Unit: Million yen

The company secured an operating CF of 4.99 billion yen, as pretax profit was 4.05 billion yen (2.87 billion yen in the previous term), depreciation and amortization amounted to 1.99 billion yen (1.58 billion yen in the previous term), and the paid income tax was 1.47 billion yen (1.14 billion yen in the previous term). Investing CF is mainly attributable to M&A, and financing CF is due to the repayment of borrowings, the payment of dividends, etc.

3-5 Impact of the Spread of COVID-19 and Policies for Coping with it

Impact of the Spread of COVID-19

Will Group adopted measures to ensure the priority is the safety of its employees. Although some businesses such as the nursing care support business and the start-up personnel support business were not affected or were mildly affected, the three main businesses and the three focused businesses were affected as a whole.

Three Main Businesses

Sales Outsourcing Business (accounting for 19% of consolidated sales) In the telecommunications domain (accounting for 51% of segment sales), home electronics mass retailers and carrier shops were closed, and the number of operating staff decreased due to the shortened business hours at the stores that continued to operate. Also, new projects were postponed. In the apparel domain (accounting for 12% of segment sales), the number of operating personnel decreased due to closing of department stores and shopping centers and the reduced business hours. Also, there was a decrease in the number of projects as it was impossible to deliver merchandise due to the suspension of overseas factory operations. In the domain of sales promotion and others (accounting for 37% of segment sales), after the government requested citizens to refrain from holding events, there was a series of cancellations of events and exhibitions, and thus, sales decreased. |

Call Center Outsourcing Business (accounting for 13% of consolidated sales) In the call center and financial domain (accounting for 80% of segment sales), the number of operating personnel decreased due to social distancing (leaving one seat empty between operators) and shortening the reception time as part of the measures to prevent the spread of the novel coronavirus. Also, new projects were postponed. On the other hand, offices (accounting for 20% of segment sales) were not significantly affected as they switched to telecommuting. |

Factory Outsourcing Business (accounting for 19% of consolidated sales) In the food domain (accounting for 51% of segment sales), although inbound travel and production of tourism souvenir products decreased, demand for ready-made meals was strong. Hence, the impact of the coronavirus on the domain was minor. Domains other than the food domain (accounting for 49% of segment sales) were affected, as the production of machinery and electrical machinery-related projects is expected to fall from April, and a significant decrease in existing projects is estimated. |

Three Focused Businesses

Nursing Care Support Business (accounting for 9% of consolidated sales) There is no impact on both temporary staffing (accounting for 95% of segment sales) and personnel introduction (accounting for 5% of segment sales). Regarding staffing, securing personnel is steadily progressing due to the inflow of personnel from other service industries (restaurants, etc.). |

Overseas HR Business (accounting for 30% of consolidated sales) In Australia (accounting for 78% of segment sales), personnel introduction decreased due to a decrease of orders from companies and the suspension of the screening process due to travel restrictions. As for temporary staffing, government-affiliated, IT, finance, and legal domains, in which the company has many transactions, are mildly affected, but orders from other fields excluding the previously mentioned decreased. In Asia (accounting for 22% of segment sales), the number of existing projects for both personnel introduction and temporary staffing has decreased, but the company expects the large-scale government employment support to make a positive impact. |

Start-up Personnel Support Business (accounting for 1% of consolidated sales) Although the number of job offers is decreasing, the number of job offers for executives and engineers remains strong. |

Other Business (accounting for 8% of the consolidated sales)

Sales from temporary staffing of construction engineers decreased due to the suspension of some construction work centered in the Tokyo metropolitan area after the declaration of the state of emergency, but the impact was minor. The demand for personnel introduction services decreased in the Tokyo metropolitan area, but recovery is expected after the emergency declaration is lifted. In other areas, the number of orders for ALT dispatch after April has decreased by about 30% in metropolitan areas. If the temporary school closure period is extended, further decrease is expected. |

Future Policy for Coping with the Situation

Going forward, Will Group will continue to operate its business while maintaining its current resources and keeping an eye on the post-pandemic situation. Specifically, to maintain the employment of the staff and employees enrolled, the company will assign personnel to businesses that are less affected by the spread of the coronavirus. The company will also work to secure profits and stabilize cash flow by reviewing new investment plans. However, it will carefully assess the situation and respond flexibly without being restricted by the above policy.

4. Fiscal Year March 2021 Earnings Estimates

4-1 Consolidated Earnings Estimate (IFRS)

| FY 3/20 | FY 3/21 | YoY |

Sales | 1,219.1 | 1,200.0 | -1.6% |

Domestic WORK Business | 844.3 | 836.2 | -1.0% |

Overseas WORK Business | 360.7 | 348.7 | -3.3% |

Other | 15.4 | 15.0 | -3.2% |

IFRS adjustments | -1.4 | - | - |

Operating Income | 41.4 | 20.0 | -51.8% |

Domestic WORK Business | 50.6 | 35.0 | -30.8% |

Overseas WORK Business | 9.7 | 3.4 | -64.4% |

Other | -3.5 | -4.1 | - |

Adjustments | -18.6 | -24.6 | - |

IFRS adjustments | 3.3 | 10.2 | - |

Profit attributable to owners of parent | 23.8 | 10.0 | -58.0% |

EBITDA | 61.3 | 40.0 | -34.8% |

*Unit: 100 Million yen

Considering the impact of the spread of COVID-19, it is estimated that sales and operating profit will decline 1.6% and 51.8%, respectively, year on year.

In the baseline budget, sales are 135 billion yen and operating profit is 4.2 billion yen. Under the assumption that the novel coronavirus pandemic will start subsiding in July 2020 and the performance will recover in the fourth quarter, it was estimated, in the baseline budget, that the novel coronavirus will decrease sales by 15 billion yen and operating profit by 2.2 billion yen, and the earnings forecast for the term ending March 2021 was produced. EBITDA is projected to decline 34.8% year on year to 4 billion yen. While discerning the impact of the pandemic carefully, the company will take measures swiftly.

The reason why the baseline budget shows that operating profit will be unchanged, being 4.2 billion yen although sales will grow 10.7% year on year is that the company took into account new investments in brand promotion, IT, etc. (amounting to 900 million yen).

The term-end dividend is to be 14 yen/share (estimated total return rati 31.1%). It may be revised according to their business performance.

Assumptions for exchange rates and sensitivity

| FY 3/20 Act. | FY 3/21 Assumptions | Sensitivity Sales | Sensitivity Operating Income |

Australia dollar | ¥74 | ¥70 | ¥380 million | ¥10 million |

Singapore dollar | ¥79 | ¥75 | ¥80 million | ¥0 million |

* Sensitivity: Effect of 1-yen fluctuation

4-2 Estimates by segment and Current situation

| FY 3/20 Sales | FY 3/21 Sales | YoY | FY 3/20 Operating Income | FY 3/21 Operating Income | YoY |

Domestic WORK Business | 844.3 | 836.2 | -1.0% | 50.6 | 35.0 | -30.8% |

Sales | 231.4 | 197.0 | -14.9% | 17.9 | 12.3 | -30.9% |

Call center | 164.5 | 164.0 | -0.4% | 9.9 | 8.9 | -9.8% |

Factory | 237.4 | 234.8 | -1.1% | 13.4 | 9.6 | -28.8% |

Nursing-care business support business | 120.5 | 132.5 | +9.9% | 3.6 | 4.2 | +18.1% |

Start-up personnel support business | 12.6 | 7.9 | -37.3% | 3.0 | 0.1 | -96.7% |

Other | 77.2 | 100.0 | +29.4% | 2.5 | -0.1 | - |

Overseas WORK Business | 360.7 | 348.7 | -3.3% | 9.7 | 3.4 | -64.3% |

Singapore, etc./Australia | 360.7 | 348.7 | -3.3% | 9.7 | 3.4 | -64.3% |

*Unit: 100 Million yen

In the sales support field, operation declined due to the restriction on shop operation, and sales promotion has been affected by the voluntary restraint of holding events. Gross profit is decreasing, due to the increase of paid holidays and leave compensations. In the call center field, operation declined, but some workers dealt with the situation by teleworking. However, the number of new orders decreased, and gross profit is dropping due to the augmentation of paid holidays. In the factory field, the impact on food products is minor, but orders for other products are dropping due to the decrease of production. Gross profit, too, is dropping, due to the increase of paid holidays and leave compensations. In the nursing-care and childcare fields, the number of new orders increased, and recruitment is healthy thanks to the inflow of workers from other fields. In the startup personnel support field, general job opportunities are decreasing, but the job vacancies for executives and engineers remain abundant. As for other fields, the ALT dispatch is affected by the temporary closure of schools, but the dispatch of construction engineers is stable, despite the decrease of new orders, and the impact of the pandemic on them is minor.

5. The new mid-term management plan

Will Group has not determined its new mid-term management plan, which was scheduled to be announced, saying that, “amid the pandemic of the novel coronavirus, the business environment surrounding our company is unclear, and it is difficult to set rational numerical targets.” The company will carefully assess the impact of the spread of COVID-19 on the businesses and will announce it as soon as the details become clear. However, the company explained its ideas for the new mid-term management plan.

5-1 Challenges and Policies to Establish the New Mid-Term Management Plan

The priority themes for the company are “responding to environmental changes” (fierce competition, technological advances, work style reforms, declining working population, etc.), “improving operating profit ratio” (around 3% in the previous mid-term management plan), and dealing with “high-level financial leverage.” As for “responding to environmental changes,” in Japan, the company will strategically shift from increasing employment opportunities to increasing growth opportunities and will also focus on foreign workers. Outside Japan, the company will continue its strategy of growing employment opportunities. As for “high-level financial leverage,” the company will set financial targets.

Additionally, the company will tackle the following five issues: (1) securing job seekers in Japan, (2) creating new business models based on long-term prospects, (3) diluting company-wide strategies by increasing the number of subsidiaries with different business models, (4) sustainability management (ESG/SDGs) initiatives, and (5) coping with the spread of the novel coronavirus. Regarding (1), Will Group will shift to a brand unification strategy with “Chance-Making Company” as the brand vision in the domestic human resources field (under the brand vision of “Chance-Making Company,” Will Group has unified the subsidiaries under the title of WILLOF). As for (2), the company will work to create a new business model from a long-term perspective. In (3), the company will review the business portfolio management to regroup the business segments and strengthen the corporate strategy. Concerning (4), the company will set basic policies, initiatives, goals, etc. in the new mid-term management plan period. As for (5), the company will assess the situation and respond flexibly.

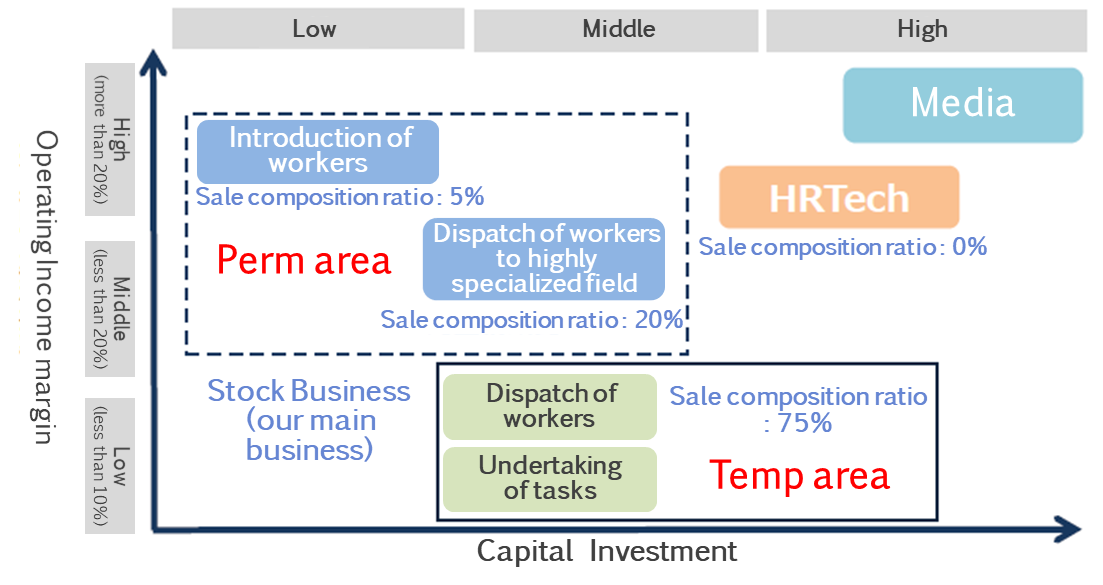

5-2 High Profitability Based on the WORK SHIFT Strategy

Under the WORK SHIFT strategy, the company will promote the Portfolio Shift (shifting businesses) and the Digital Shift (shifting work styles) to respond to the environmental changes and improve profitability. The WORK SHIFT strategy is a strategy that “shifts” the business and work styles to increase operating profit ratio.

Portfolio Shift (shifting businesses) | Japan and overseas | Growth through a Perm SHIFT (personnel introduction and temporary staffing in highly specialized areas) Maximize and optimize opportunities Maximizing and optimizing employment opportunities through a Temp (temporary staffing and undertaking of tasks) SHIFT |

Digital Shift (shifting work styles) | Japan | Improving productivity in the Temp area |

Priority Strategies

The following five strategies are listed as priority strategies.

Strategy I: Domestic Work Business: improving profitability through a PERM SHIFT

The company will expand personnel introduction in the areas of nursing care and childcare, where staff shortages are common, and also temporary staffing in areas of high expertise.

Strategy II: Domestic WORK Business: improving profitability through a Digital SHIFT

Will Group will increase productivity per person by using the Digital SHIFT.

Strategy III: Overseas WORK Business: improving stability with a Temp SHIFT

The company will expand the Temp area with low volatility to build a stable profit base. It will also establish an overseas group brand and strengthen synergies.

Strategy IV: Other Businesses: construction of a Platform that breaks away from the labor-intensive businesses

Aiming to break away from the labor-intensive businesses, the company will develop, build, and strengthen a new platform while going through the process of trial and error.

Strategy V: Group-wide: Financial Strategy

Capital efficiency ROIC: 20% or higher | ・Aiming for ROIC of 20% or higher by improving profitability and capital efficiency (performance for the term ending March 2020: 14%) ・WACC is about 7%-9% |

Financial health Equity rati 20% or higher | ・Aiming for an equity ratio of 20% or higher for investments in future growth and strengthening its financial position (Performance for the term ending March 2020: 11.7%) |

Shareholder return Total payout rati 30% or higher | ・Maintain stable shareholder returns with a total payout ratio of 30% to ensure profitable investments in future growth while improving payout. |

(Source: Company)

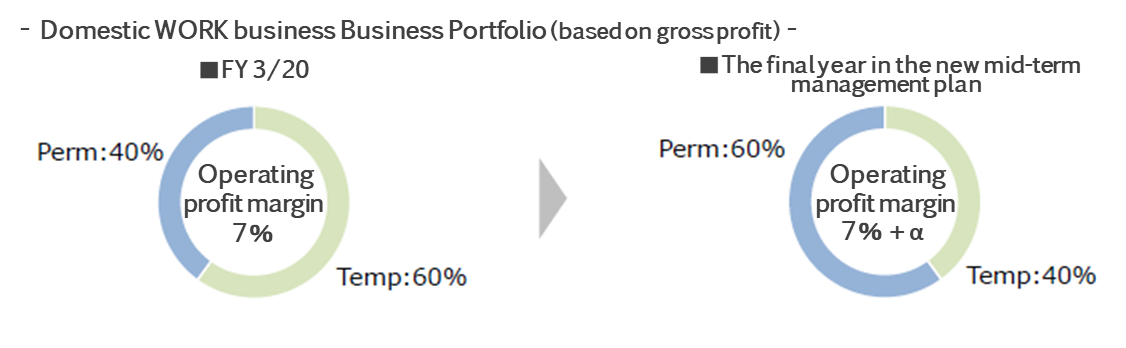

Domestic WORK business

In October 2019, the Will Group’s major domestic companies switched from a multi-brand strategy to a unified brand strategy, integrating the service brand under the title “WILLOF,” and set “Chance-Making Company” as the brand vision. Regarding business development, Will Group will shift from its previous approach to business development, which was focusing on the provision of “employment opportunities,” to a new approach focusing on the provision of “growth opportunities.” Also, the company will work to improve profitability (the company will develop business while keeping a balance between growth and profitability).

Specifically, the company is working on improving profitability through a Perm (personnel introduction and temporary staffing to highly specialized areas) SHIFT and through a Digital SHIFT in the Temp (temporary staffing and undertaking of tasks) area. In the Perm SHIFT, the company will shift to increasing the introduction of workers in the fields of nursing care and childcare, which always see labor shortage, as well as dispatching personnel to highly specialized areas such as construction, IT engineering, and BtoB sales agents. Also, in the Digital SHIFT, the company will strive to improve productivity by enhancing efficiency through moving its operations online and automation and utilizing in-house education and HR technology to improve productivity in staffing.

(Source: Company)

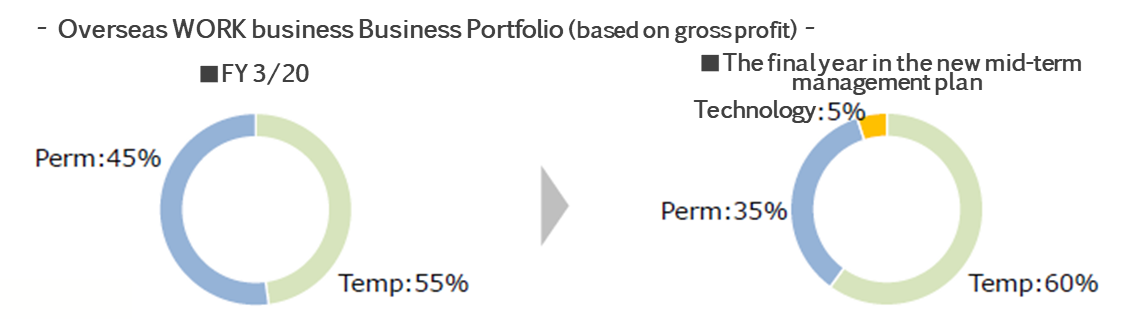

Overseas WORK Business

Through aggressive M&A until the previous term, Will Group established a business base in the ASEAN and Oceania regions. In the future, the company will work on the Temp SHIFT by focusing on the stability of the business rather than expanding its scale. Since overseas subsidiaries tend to dispatch staff to highly specialized and stable areas such as government-affiliated projects, IT engineering, accounting & finance, and legal affairs, the company will enhance management stability by further focusing on temporary staffing. Also, Will Group will create new overseas group brands, and pursue synergies between subsidiaries, such as joint development of HR products and cross-selling.

(Source: Company)

6. Conclusions

In the fourth quarter of the term ended March 2020, COVID-19 decreased sales by about 1 billion yen and operating profit by about 200 million yen. For the term ending March 2021, the pandemic is estimated to decrease sales by about 15 billion yen and operating profit by 2.2 billion yen in the first and second quarters, and it is assumed that the business performance will bottom out in the third quarter and return to the pre-pandemic state in the fourth quarter. For the term ending March 2022, it can be expected that profit will rebound, although the balance with upfront investment needs to be considered. It is reassuring that the 3 focused businesses and the dispatch of construction engineers, which led sales growth in the previous mid-term management plan, can be expected to contribute to profit, too. The fields of nursing care/childcare, startup personnel support, and dispatch of construction engineers are not easily affected by the pandemic.

In addition, the new mid-term management plan, which will begin this term, is interesting. The company has apparently expanded its businesses by actively developing new businesses and conducting M&A, but their new mid-term management plan is a little bit different, as it aims to grow while considering profitability and stability. The details are still to be disclosed, but we would like to pay attention to them as well as their “high-level financial leverage.”

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with company auditor(s) |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 3 external ones |

◎ Corporate Governance Report Updated on June 19, 2019

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Cross held shares】

(1) Policies Regarding Cross-holding

Our company does not own any cross-held shares. We shall not own any such stocks in the future except cases where, taking into consideration the creation of business opportunities and the development, maintenance and strengthening of transactions and cooperative relations, we conclude that possessing such stocks will contribute to an increase in middle and long-term value of our company. After our company owns such stocks, if we decide, as per the policies mentioned above, that the benefit from owning these stocks is insufficient, we shall swiftly cut down these stocks.

(2) Details of discussion regarding cross-held shares

In the case of our company possessing cross-held shares, the board of directors will periodically evaluate the economic rationality, such as return on investment, regarding merits, risks and capital costs of possessing such stocks as well as future prospects and make a decision on whether to keep holding such stocks.

(3) Criteria for the Exercise of Voting Rights regarding Cross-held Shares

Regarding the exercise of voting rights related to cross-held shares, instead of unilaterally making a decision, decisions will be made on each item of the agenda individually, from a point of view of increasing company value in the middle and long-term as well as increasing returns for shareholders, while respecting the management policies and strategies of the company being invested in.

【Principle 5-1 Policies related to Constructive Interaction with Shareholders】

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website. Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director and executive officers in charge of the finance department aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy and continuity with regard to management and business strategies, financial information etc.

(2) The finance department takes a central role, and the management planning, general affairs, financial affairs, accounting, and legal affairs departments and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair and suitable fashion.

(3) As a means for interaction, we shall engage in the enrichment of company information sessions for shareholders.

(4) The opinions and worries of shareholders understood in our interactions will be reviewed appropriately and effectively in all our company meetings through the representative director and executive officers in charge of the finance department.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, Investment Bridge Co., Ltd., All Rights Reserved. |

To view back numbers of Bridge Reports on WILL GROUP, INC. (6089) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/