Bridge Report:(6089)WILL GROUP Fiscal year ending March 2022 second quarter

Shigeru Ohara, Representative director and President | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | First Section, TSE |

Industry | Services |

Chairman | Shigeru Ohara |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act.) | Trading Unit | |

¥1,272 | 22,637,000 shares | ¥28,794 million | 35.1% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER(Est.) | BPS (Act.) | PBR (Act.) |

¥34.00 | 2.7% | ¥112.55 | 11.3x | ¥370.13 | 3.4x |

*Stock prices as of the close on December 6, 2021. The number of shares outstanding, DPS and EPS are from the financial results for second quarter of fiscal year ending March 2022. ROE and BPS are from the previous results.

Transition in Consolidated Performance (IFRS from the term ended March 2019)

Fiscal Year | Sales | Operating Income | Ordinary Income, Pretax Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2018(Act.) | 79,197 | 2,417 | 2,437 | 1,210 | 57.44 | 18.00 |

March 2019(Act.) | 103,300 | 2,957 | 2,876 | 1,539 | 69.46 | 18.00 |

March 2020(Act.) | 121,916 | 4,145 | 4,057 | 2,380 | 107.07 | 23.00 |

March 2021(Act.) | 118,249 | 4,030 | 3,788 | 2,363 | 106.35 | 24.00 |

March 2022(Est.) | 130,000 | 4,500 | 4,410 | 2,510 | 112.55 | 34.00 |

*Estimated by the Company. (Unit: Million yen or yen)

This Bridge Report reviews fiscal year ending March 2022 second quarter earnings results and fiscal year ending March 2022 earnings estimates.

Contents

Key Points

1. Company Overview

2.Fiscal Year March 2022 Second Quarter Earning Results

3. Fiscal Year March 2022 Earnings Estimates

4. Progress of Medium-term Management Plan “WILL-being 2023”

5. Conclusions

<Reference 1: Progress of Medium-term Management Plan “WILL-being 2023”>

<Reference 2: Regarding Corporate Governance>

Key Points

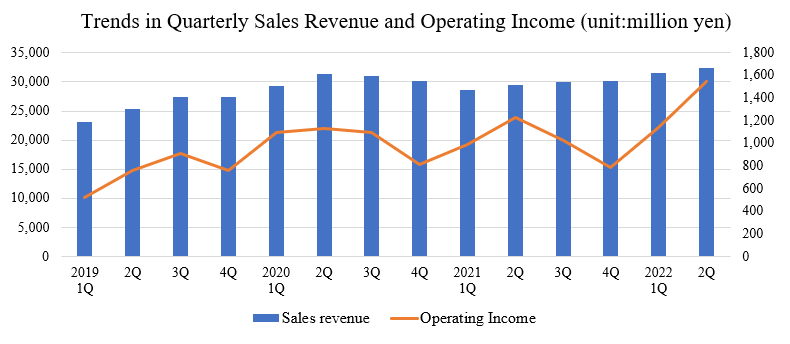

- The sales in the second quarter of the term ending March 2022 were 63,913 million yen, up 9.9% year on year. The Overseas WORK business is leading the growth. Demand for human resources outside Japan remains strong. Gross profit grew 17.7% year on year to 14,035 million yen, exceeding the increase rate of sales. Perm SHIFT improved the gross profit margin by 1.5 points. Operating income rose 20.9% year on year to 2,685 million yen. The company posted an extraordinary profit of 700 million yen in the same period of the previous term, but not this term. Upfront investment of 500 million yen was made in the domestic WORK business's focus areas (construction, nursing care, and start-up personnel support). However, gross profit growth offset these expenses, and the company achieved a double-digit profit increase. Both sales and profit exceeded the revised estimates.

- The full-year earnings estimates were revised upwardly in August and November 2021. Sales are expected to increase 9.9% year on year to 130 billion yen, and operating income is forecast to rise 11.7% year on year to 4.5 billion yen. Assuming that the impact of the novel coronavirus will subside, the company intends to implement its original plan of making upfront investments of 1.3 billion yen for recruiting construction engineers and improving the sales system (600 million yen), and enhancing the consultant personnel system for introducing human resources in the nursing care, IT, and start-up fields (700 million yen). The base budget (operating income), which does not take into account the upfront investments amounting to 1.3 billion yen, is 5.8 billion yen, which is much larger than the budget for the term ended March 2020 (4.1 billion yen) before the pandemic. The dividend forecast, too, has been revised. The company plans to increase the dividend by 9 yen/share from the initial plan or 10 yen/share from the previous term to 34 yen/share. The expected payout ratio is 30.2%. The forecasted total return ratio is 30.7%.

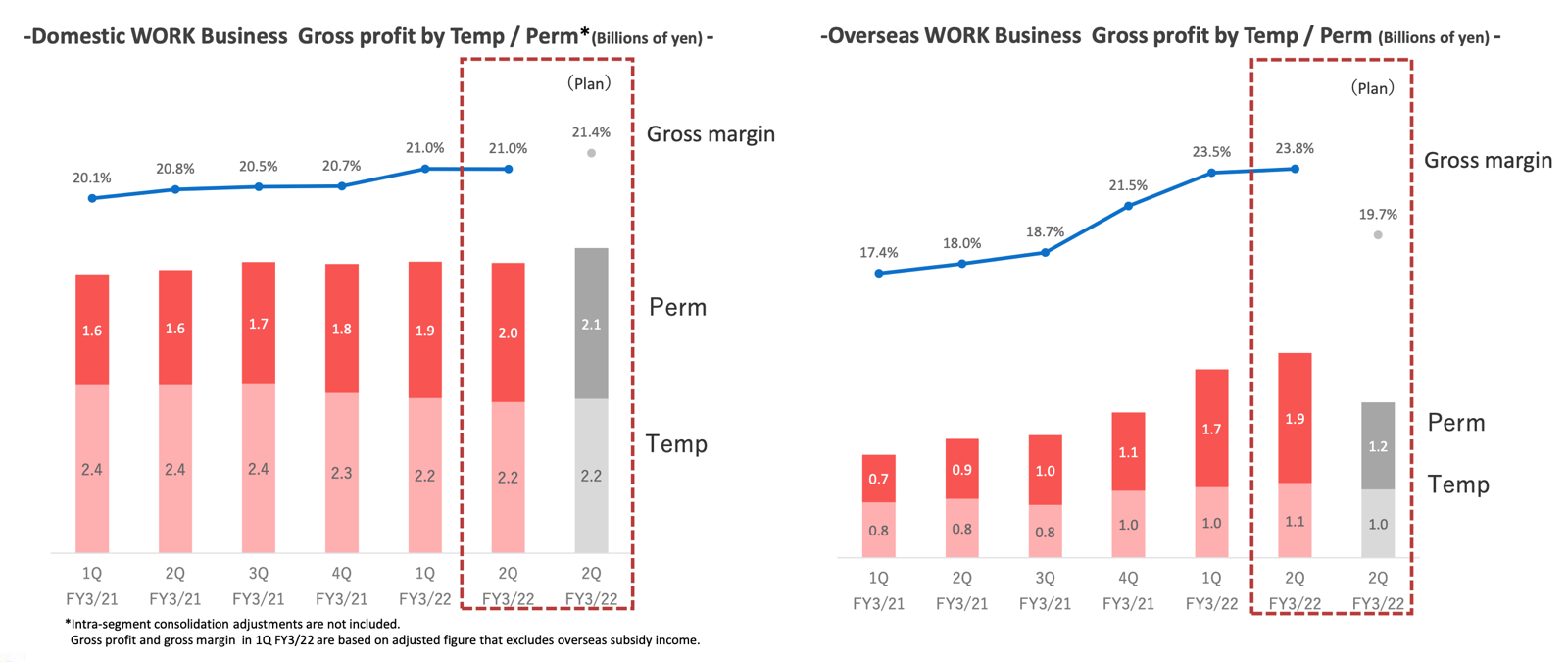

- The four priority strategies of the medium-term management plan WILL-being 2023 are generally progressing as planned. Gross profit margin, which is the company’s main focus, is slightly below the target for the domestic WORK business and exceeds the target for the overseas WORK business. Overall, profit margin is steadily improving thanks to the Perm SHIFT strategy.

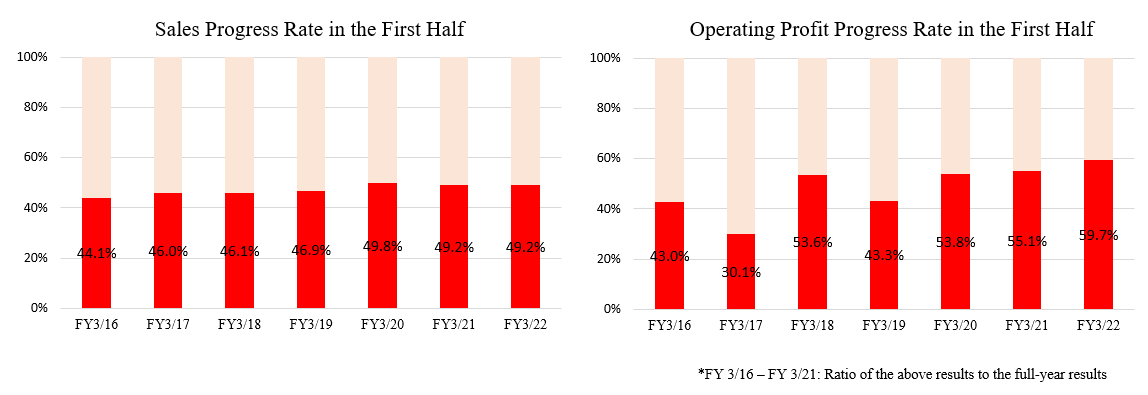

- At the beginning of the term, profit was expected to decrease due to upfront investments. However, the company is forecast to record a profit growth even if it invests 1.3 billion yen as planned due to the solid performance of the overseas WORK business, which will be able to absorb these expenses. The progress rate in the first half is 49.2% for sales and 59.7% for operating income. Even after the two upward revisions, the financial results are still high compared to those in the past few years. Thus, we would like to pay attention to how much the company will earn sales and profit from the third quarter onward.

- Recruitment and employment in the construction engineers field, which the company is focusing on, are proceeding smoothly. However, the number of orders and hiring for personnel introduction in the nursing care area are below the estimates. Expanding the scale of the domestic WORK business, which accounts for a large portion of sales and increasing profitability are essential for the company's growth. Therefore, we would like to keep an eye on their progress.

1. Company Overview

WILL GROUP, INC. is a holding company that provides HR services specialized at each category such as dispatching sales support staff, call center operators and manufacturing line staff primarily to food manufacturing, and supporting nursing facilities’ personnel recruitment and temporary staffing. The main feature of the Company is the “hybrid placement service,” by which permanent employees of Will Group called "field supporters" are stationed at the dispatched workplace. Will Group differentiates itself from its competitors by implementing its hands-on policy as it endeavors to develop new businesses.

There are group companies, including WILLOF WORK, Inc., which deals with the outsourcing of sales and call center operation, CreativeBank Inc., which carries out sales promotion, WILLOF FACTORY, Inc., which offers services specializing in manufacturing, and overseas subsidiaries that offer staffing services mainly in Asia and Oceania.

【1-1 WILL Vision and Management Philosophy】

WILL Vision is advocated as creating a strong brand with high expected value and becoming No. 1 in the business fields of “working,” “interesting,” “learning” and “living.”

Working | Business field to support “Working” |

Interesting | Business field to support “Interesting” |

Learning | Business field to support “Learning” |

Living | Business field to support “Living” |

【1-2 Business Content】

Since the management scope has expanded due to the increase of the business domain, the management system has been changed in the term ending March 2021 and the business segments have been reorganized into three segments: domestic WORK business, overseas WORK business, and others.

Domestic WORK business

In Japan, the company provides personnel introduction, temporary staffing, and outsourcing contracts specializing in categories such as the sales support field, call center, factory, nursing care, and childcare. It also offers personnel support for start-ups.

Sales support field: WILLOF WORK, Inc., and CreativeBank Inc.

The telecommunications sector accounts for more than 50% of total sales, while the apparel sector makes up more than 10%, and others account for more than 30%. As for sales support for the telecommunications field, the company conducts sales of smartphones, etc. at home electronics mass retailers, manages sales staff, and temporary staffing for operations such as collecting and reporting sales information. The company also undertakes team-type temporary staffing (hybrid temporary staffing), sales operations, and personnel introduction.

Call center field: WILLOF WORK, Inc.

Customers are companies that operate call centers and companies that use telemarketing services. The number of customers is increasing, mainly for telecommunications companies and BPOs (continuously outsourcing part of business processes to external companies) and financial institutions. The company is responsible for dispatching staff engaged in after-sales service, consultation, and receiving complaints, and providing team-type temporary staffing (hybrid temporary staffing) and introducing personnel. It also undertakes customer telemarketing operations at its own call center.

Factory segment: WILLOF WORK, Inc.

The company is responsible for dispatching staff who would engage in light work such as manufacturing, inspection, quality control, sorting, and packing mainly in the food manufacturing industry, which is not easily affected by the economy, as well as providing team type temporary staffing (hybrid temporary staffing), outsourcing of production process operations and personnel introduction.

Nursing care and childcare field: WILLOF WORK, Inc.

The company undertakes temporary staffing and personnel introduction to companies that operate nursing care facilities and childcare facilities.

HR support for startups: for Startups, Inc.

It is a business that supports growing industries (ventures, start-up companies, etc.) centered on HR (Human Resources). It operates the information platform "START-UP DB (Startup Database)", which is the largest platform specializing in the growing industry fields in Japan.

Other fields: WILLOF CONSTRUCTION, Inc., BORDERLINK, INC., etc.

The company dispatches construction engineers, and introduces human resources. It also dispatches ALTs (foreign language teaching assistants) and engineers and introduces human resources.

Overseas WORK Business

In the ASEAN and Oceania regions, the company dispatches and introduces personnel for government-affiliated projects, engineers, finance, legal affairs, etc.

WILL GROUP Asia Pacific Pte. Ltd., Good Job Creations (Singapore) Pte. Ltd., Scientec Consulting Pte. Ltd.,

The Chapman Consulting Group Pte. Ltd., Oriental Aviation International Pte. Ltd., Ethos BeathChapman,

Quay Appointments Pty Ltd., u & u Holdings Pty Ltd., DFP Recruitment Holdings Pty Ltd,

Asia Recruit Holdings Sdn.Bhd.

Others

The company is working on expanding the domain of HRTech with the aim of strengthening the development of new platforms that provide a community for human resources such as system engineers through concept rental management and the expansion of forms of businesses other than the labor-intensive business. Examples of these platforms are "Hour Money," a working time management system for foreigners, and "Enport," a foreign worker support service.

WILL GROUP, INC., etc.

2. Fiscal Year March 2022 Second Quarter Earnings Results

【2-1 Consolidated earnings results (IFRS)】

| FY 3/21 2Q | Share | FY 3/22 2Q | Share | YoY Change | Compared to the forecast 1 | Compared to the forecast 2 |

Sales | 58,177 | 100.0% | 63,913 | 100.0% | +9.9% | +8.7% | +0.7% |

Gross Profit | 11,921 | 20.5% | 14,035 | 22.0% | +17.7% | +14.9% | +3.6% |

SG & A | 9,916 | 17.0% | 11,473 | 18.0% | +15.7% | - | - |

Operating Income | 2,221 | 3.8% | 2,685 | 4.2% | +20.9% | +123.8% | +34.3% |

Pretax Profit | 2,085 | 3.6% | 2,716 | 4.2% | +30.2% | +136.2% | +39.3% |

Quarterly Profit | 1,304 | 2.2% | 1,698 | 2.7% | +30.2% | +161.2% | +44.0% |

*Unit: Million yen. Quarterly profit is the quarterly profit attributable to owners of the parent company. The same applies hereafter. Compared to the forecast 1 and compared to the forecast 2 are ratios to the second quarter forecasts announced in May 2021 and August 2021, respectively.

Sales and Profit Increased, Both Sales and Profit Exceeded the Estimates

The sales in the second quarter of the term ending March 2022 were 63,913 million yen, up 9.9% year on year. The Overseas WORK business is leading the growth. Demand for human resources outside Japan remains strong. Gross profit grew 17.7% year on year to 14,035 million yen, exceeding the increase rate of sales. Perm SHIFT improved the gross profit margin by 1.5 points. Operating income rose 20.9% year on year to 2,685 million yen. The company posted an extraordinary profit of 700 million yen in the same period of the previous term, but not this term. Upfront investment of 500 million yen was made in the domestic WORK business's focus areas (construction, nursing care, and start-up personnel support). However, gross profit growth offset these expenses, and the company achieved a double-digit profit increase. Both sales and profit exceeded the revised estimates.

【2-2 Trend by Segment】

| FY 3/21 2Q | Share and Profit margin | FY 3/22 2Q | Share and Profit margin | YoY | Compared to the forecast 1 | Compared to the forecast 2 |

Domestic WORK business | 39,596 | 68.1% | 39,594 | 61.9% | -0.0% | -2.9% | -1.4% |

Overseas WORK business | 17,901 | 30.8% | 23,709 | 37.1% | +32.4% | 36.4% | 4.6% |

Other | 678 | 1.2% | 609 | 1.0% | -10.2% | -1.8% | -9.1% |

IFRS adjustments | 0 | - | 0 | - | - | - | - |

Revenue | 58,177 | 100.0% | 63,913 | 100.0% | +9.9% | +8.7% | +0.7% |

Domestic WORK business | 2,415 | 6.1% | 2,160 | 5.5% | -10.6% | +20.0% | +6.9% |

Overseas WORK business | 1,013 | 5.7% | 1,676 | 7.1% | +65.4% | +146.5% | +43.2% |

Other | -196 | - | -205 | - | - | - | - |

Adjustments + IFRS | -1,010 | - | -946 | - | - | - | - |

Adjustment | 2,221 | 3.8% | 2,685 | 4.2% | +20.9% | +123.8% | +34.3% |

*Unit: Million yen. Sales revenue is external revenue.

Domestic WORK business

Sales are in line with the same period in the previous term and profit decreased year on year. Profit exceeded the estimate.

Demand remained sluggish in the sales outsourcing field, excluding telecommunications business, and the factory outsourcing field due to the spread of the novel coronavirus.

Demand remained steady and robust in telecommunications business in the sales outsourcing field, the call center outsourcing field, the nursing care and childcare field, and the start-up personnel support field.

Taking into consideration the conditions during the pandemic and after the pandemic subsides, the company focused on developing customers for new services, such as sales agency services and remote contact center services.

Profit decreased due to upfront investment for increasing the number of sales staff and consultants for personnel introduction in the nursing care field and the construction engineers staffing field.

Overseas WORK business

Regarding human resources services provided in the ASEAN and Oceanian regions, measures such as city lockdowns were taken due to the spread of the novel coronavirus, but demand for human resources was strong, and the performance of both temporary staffing and personnel introduction was favorable.

Personnel expenses, which had been curtailed, increased, and the revenue from government subsidies for employment support as a countermeasure against the spread of the novel coronavirus in Singapore, which was recorded in the previous fiscal year, decreased. However, profit grew due to the increase in sales.

Other

Sales decreased, and loss increased year on year. Both sales and profit were lower than expected.

With the aim of expanding businesses other than labor-intensive business, the company worked on enhancing the development of new platforms such as "Hour Money," which is a working time management system for foreign workers, and "Enport," which is a support service for foreigners.

Loss augmented as the company continued to invest in new platform development.

【2-3 Financial Position and Cash Flow】

Balance Sheet

| Mar. 21 | Sep. 21 | Increase/ decrease |

| Mar. 21 | Sep. 21 | Increase/ decrease |

Current Assets | 23,570 | 22,127 | -1,443 | Current liabilities | 24,790 | 24,711 | -79 |

Cash | 7,455 | 5,995 | -1,460 | Operating debts, other debts | 13,760 | 13,687 | -73 |

receivables, other receivables | 14,694 | 14,820 | +126 | Other current liabilities | 2,048 | 2,976 | +928 |

Non-Current Assets | 23,190 | 22,523 | -667 | Non-current liabilities | 11,943 | 8,988 | -2,955 |

Tangible fixed assets | 1,082 | 1,101 | +19 | Other financial debts | 6,563 | 5,114 | -1,449 |

Right-of-use assets | 5,715 | 5,371 | -344 | Total liabilities | 36,733 | 33,699 | -3,034 |

Goodwill | 6,155 | 6,044 | -111 | Total equity | 10,027 | 10,950 | +923 |

Other Intangible Assets | 6,049 | 5,756 | -293 | Equity attributable to owners of the parent augmented | 8,240 | 9,889 | +1,649 |

Total assets | 46,760 | 44,650 | -2,110 | Total liabilities and equity | 46,760 | 44,650 | -2,110 |

|

|

|

| Borrowings | 8788 | 8282 | -506 |

*Unit: Million yen

Total assets decreased by 2.1 billion yen from the end of the previous fiscal year to 44.6 billion yen due to a decrease in cash and deposits. Total liabilities decreased by 3.0 billion yen to 33.6 billion yen due to a decrease in other financial liabilities.

Total equity increased ¥0.9 billion year on year to ¥10.9 billion due to an increase in retained earnings. Equity attributable to owners of the parent augmented increased by 4.5% year on year to 22.1%, EBITDA-adjusted debt-to-equity ratio decreased by 0.5 points to 1.0x, goodwill-adjusted equity attributable to owners of the parent decreased by 0.2 points to 0.5x, and adjusted net debt-to-equity ratio increased by 0.1 points to 0.2x.

Cash Flow

| FY3/21 2Q | FY3/22 2Q | Increase/decrease |

Operating cash flow (A) | 2,452 | 2,115 | -337 |

Investing cash flow (B) | -163 | 147 | +310 |

Free cash flow (A+B) | 2,289 | 2,262 | -27 |

Financing cash flow | -1,989 | -3,661 | -1,672 |

Cash, equivalents at term-end | 6,312 | 5,995 | -317 |

*Unit: Million yen

Free CF is almost unchanged from the previous term. The cash outflow from financing activities increased, due to increase in payments from changes in ownership interests in subsidiaries that do not result in change in scope of consolidation.

The cash position has dropped.

【2-4 Topics】

Selecting the Prime Market as the new market segment

In July 2021, the company received the primary results from the Tokyo Stock Exchange regarding compliance with the listing maintenance standards in the new market segment. The results confirmed that the company conforms to the listing maintenance standards of the Prime Market.

In response to this, the company selected the Prime Market as the new market segment of the Tokyo Stock Exchange.

The company will proceed with the prescribed procedures according to the application schedule set by the Tokyo Stock Exchange.

3. Fiscal Year March 2022 Earnings Estimates

【3-1 Consolidated Earnings Estimate】

| FY 3/21 | Share | FY 3/22 (Est.) | Share | YoY | Revision rate | Progress rate |

Sales | 118,249 | 100.0% | 130,000 | 100.0% | +9.9% | +7.4% | 49.2% |

Gross Profit | 24,056 | 20.3% | 28,220 | 21.7% | +17.3% | +10.1% | 49.7% |

SG & A | 20,463 | 17.3% | - | - | - | - | - |

Operating Income | 4,030 | 3.4% | 4,500 | 3.5% | +11.7% | +32.4% | 59.7% |

Pretax Profit | 3,788 | 3.2% | 4,410 | 3.4% | +16.4% | +34.9% | 61.6% |

Profit attributable to owners of parent | 2,363 | 2.0% | 2,510 | 1.9% | +6.2% | +36.4% | 67.6% |

*unit 100 million yen. Revision rate is the rate of revision from the initial forecast.

Earning estimates are revised.

The full-year earnings estimates were revised upwardly in August and November 2021. Sales are expected to increase 9.9% year on year to 130 billion yen, and operating income is forecast to rise 11.7% year on year to 4.5 billion yen. Assuming that the impact of the novel coronavirus will subside, the company intends to implement its original plan of making upfront investments of 1.3 billion yen for recruiting construction engineers and improving the sales system (600 million yen), and enhancing the consultant personnel system for introducing human resources in the nursing care, IT, and start-up fields (700 million yen). The base budget (operating income), which does not take into account the upfront investments amounting to 1.3 billion yen, is 5.8 billion yen, which is much larger than the budget for the term ended March 2020 (4.1 billion yen) before the pandemic. The dividend forecast, too, has been revised. The company plans to increase the dividend by 9 yen/share from the initial plan or 10 yen/share from the previous term to 34 yen/share. The expected payout ratio is 30.2%. The forecasted total return ratio is 30.7%.

【3-2 Earnings Estimate in Each Segment】

| FY 3/21 | Share and Profit margin | FY 3/22 (Est.) | Share and Profit margin | YoY | Revision Rate | Progress Rate |

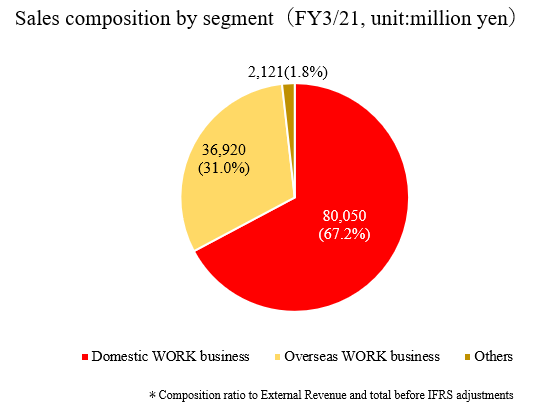

Domestic WORK Business | 80,050 | 67.7% | 81,180 | 62.4% | +1.4% | -3.4% | 48.8% |

Overseas WORK Business | 36,920 | 31.2% | 47,200 | 36.3% | +27.8% | +33.4% | 50.2% |

Other | 2,121 | 1.8% | 1,610 | 1.2% | -24.1% | +2.5% | 37.8% |

IFRS adjustments | -843 | -0 | 0 | - | - | - | - |

Revenue | 118,249 | 100.0% | 130,000 | 100.0% | +9.9% | +7.4% | 49.2% |

Domestic WORK Business | 4,253 | 5.3% | 4,500 | 5.5% | +5.8% | +3.2% | 48.0% |

Overseas WORK Business | 1,106 | 3.0% | 2,510 | 5.3% | +126.9% | +70.7% | 66.8% |

Other | -166 | - | -320 | -19.9% | +92.8% | +10.3% | 64.1% |

Adjustments + IFRS adjustments | -1,163 | - | -2,200 | - | - | - | - |

Operating Income | 4,030 | 3.4% | 4,500 | 3.5% | +11.7% | +32.4% | 59.7% |

*Unit: 100 million yen

Domestic WORK business

Sales and profit are expected to increase.

* Sales support field

The company will continuously expand the stable telecommunications field. In addition, it will improve the recruitment of full-time on-site employees to expand sales agency business with a high gross profit margin.

* Call center field

The company will continue to expand financial projects with a high gross profit margin. It will also increase the market share per site and promote the switch from dispatching personnel to outsourcing.

* Factory field

The company aims to increase its market share in the stable food field. In fields other than food, it will shift from logistics and consumer goods to expanding receiving orders in the electrical and electronic fields, which have high gross profit margins.

* Nursing care field

Personnel dispatch sales are expected to increase due to opening new branches (1 base). Also, a rise in personnel introduction sales is anticipated due to an increase in the number of consultants and employment placement dispatching.

*HR support for startups field

The number of job openings has returned to the level before the spread of the novel coronavirus. Although it is necessary to keep an eye on the situation, the number of job openings is expected to remain steady.

In addition, as digital transformation is accelerating during the novel coronavirus crisis, the demand for job openings from start-up companies that provide innovative services to respond to future changes in the environment will increase.

The company will continue to improve the recruitment of sales personnel in anticipation of the revitalization of the recruitment market after the novel coronavirus subsides.

* Construction management engineers fields

As the company aims to expand the dispatching of inexperienced personnel, an upfront investment of 600 million yen (200 million yen in the term ended March 2021) is estimated to be made to increase the number of personnel in order to expand the sales system and follow-up system

* Others

ALT dispatch continues to increase. The company will expand the dispatching and introduction of IT personnel.

| FY3/21 | FY3/22 (Est.) | YoY | Compared to initial forecast |

Sales |

|

|

|

|

Sales support | 192.2 | 193.9 | +1.8% | -3.5% |

Call center | 168.6 | 169.7 | +0.7% | +0.6% |

Factory | 205.8 | 184.0 | -10.6% | -5.4% |

Care support | 132.1 | 141.0 | +6.7% | -9.8% |

HR support for startups | 12.7 | 22.0 | +73.2% | +23.6% |

Construction management engineers | 52.7 | 58.0 | +10.1% | -6.1% |

Others | 37.8 | 43.0 | +13.8% | +7.0% |

Operating Income |

|

|

|

|

Sales support | 16.4 | 16.5 | +17.0% | -1.8% |

Call center | 11.3 | 11.0 | -1.8% | -0.9% |

Factory | 12.5 | 12.8 | +28.0% | +12.3% |

Care support | 3.8 | 4.5 | +18.4% | -35.7% |

HR support for startups | 1.5 | 4.5 | +200.0% | +150.0% |

Construction management engineers | 0.5 | -5.6 | - | - |

Others | 5.2 | 3.9 | +8.6% | +15.2% |

*unit 100 million yen

Overseas WORK business

Sales and profits increased.

The impact of the government subsidy income of about 700 million yen the company received in the previous fiscal year will end. However, the recovery of personnel introduction sales will make up for it. Sales of temporary staffing are expected to remain steady. The exchange rate is conservatively estimated.

4. Progress of Medium-term Management Plan "WILL-being 2023"

(1) Progress of priority strategies

The four priority strategies are progressing as planned as a whole.

Strategy | Applicable domains |

|

Strategy 1: Improving profitability by shifting portfolios | Profit maximization domain Strategic investment domain | -In Japan, the introduction of human resources in the nursing care field is below the estimate. Outside Japan, the gross profit margin target was significantly exceeded due to the steady progress of personnel introduction.

-The recruitment of inexperienced and mid-career construction engineers has been progressing steadily.

-Regarding temporary staffing with prospects for future permanent placement in the nursing care field, the number of orders and the number of hires are smaller than initially expected due to the low popularity among nursing care facilities and staff. From the third quarter onward, the company will rebuild its business structure and work to increase orders and hires. |

Strategy 2: Improving productivity through a digital shift | -The company will continue to enhance the functions of the WILLOF smartphone app (online application, etc.).

-On July 1, 2021, the company merged its major subsidiaries, WILLOF WORK and WILLOF FACTORY, to integrate sales bases and management operations. | |

Strategy 3: Search for the next strategic investment domain | Exploration domain | -Services targeting foreigners, such as foreign worker support services (ENPORT, etc.), continued to be impacted by the entry ban of foreigners to Japan due to the spread of the novel coronavirus. However, the services have been recently resumed.

-In the Tech area, the company is exploring business opportunities related to its main businesses. |

Strategy 4: Financial strategy | Group-wide | -The ratio of equity attributable to owners of parent is 22.1%, exceeding the target value: 20.0%.

-Although the total return ratio in the initial earnings estimate is 30%, the company increased the dividend forecast by 9 yen/share from the initial forecast because the earnings estimates have been revised upwardly twice, and the ratio of equity attributable to owners of parent has exceeded the target. As a result, total return ratio is expected to be 30.7%. |

(2) Progress of shifting of portfolios

Gross profit margin, which is the company’s main focus, is slightly below the target for the domestic WORK business and exceeds the target for the overseas WORK business. Overall, profit margin is steadily improving due to the Perm SHIFT strategy.

(Reference material of the company)

(3) Progress in the construction engineers field

*Sales

In the first quarter, sales decreased year on year, but in the second quarter, sales increased year on year due to the employment of new graduates.

* Number of hires

In the second quarter, recruitment of mid-career and inexperienced personnel remained healthy.

*Number of working personnel, working rate, and retention rate

The ratio of working personnel has remained at a high level close to 100%, with 97.5% in the first quarter and 99.6% in the second quarter.

Retention rate, which has remained above 70%, will be increased through training and follow-up systems.

*Monthly average working hours and average wage

Wage is declining due to the decrease in overtime hours and the increase of new graduates and inexperienced employees.

(4) Progress in the nursing care area

*Sales

Temporary staffing sales are steady.

*Number of contracts for temporary staffing with prospects for future permanent placement and personnel introduction

The numbers of orders and hires are below the plan, due to low popularity of temporary staffing with prospects for future permanent placement. The company will rebuild its system in the second half.

*Number of temporary workers in service

The number of temporary workers in service remains unchanged. Orders are on a recovery trend, and the company will enhance recruitment.

*Number of temporary personnel with prospects for future permanent placement and the employees in the personnel introduction section

The company will rebuild the system for temporary personnel with prospects for future permanent placement and strengthen the recruitment again.

5. Conclusions

At the beginning of the term, profit was expected to decrease due to upfront investments. However, the company is forecast to record a profit growth even if it invests 1.3 billion yen as planned due to the solid performance of the overseas WORK business, which will be able to absorb these expenses.

The progress rate in the first half is 49.2% for sales and 59.7% for operating income. Even after the two upward revisions, the financial results are still high compared to those in the past few years. Thus, we would like to pay attention to how much the company will earn sales and profit from the third quarter onward.

Recruitment and employment in the construction engineers field, which the company is focusing on, are proceeding smoothly. However, the number of orders and hiring for personnel introduction in the nursing care area are below the estimates. Expanding the scale of the domestic WORK business, which accounts for a large portion of sales and increasing profitability are essential for the company's growth. Therefore, we would like to keep an eye on their progress.

<Reference 1: Progress of Medium-term Management Plan “WILL-being 2023”>

The company is implementing the medium-term management plan "WILL-being 2023" targeting the term ending March 2023.

【1-1 Update of the medium-term management plan】

Although the basic policy announced last year has not changed, the plan has been updated in light of the various impacts and changes in society due to the spread of novel coronavirus.

(1) Updated points

1. Changes in The Business Climate

The company believes that the changes that had been predicted in "society," "Business," and "job seekers" have been accelerated by the novel coronavirus crisis, and the future of working styles has been fast-tracked by several years.

"Society"

Global population growth and aging in developed countries, unstable political conditions, and progress in the movement toward the realization of a sustainable society (SDGs)

"Business"

Increasing demand for outsourcing, significant changes in individual work styles due to technological evolution, and a rise in investment in human resources for sustainable growth

"Job seekers"

With the spread of telework, the number of workers who want a work style free from constraints of time and place is increasing. Also, the number of senior workers is increasing since we are moving towards prolonging the lifetime employment as people live to 100 years old.

(2) Medium/long-term growth scenario

The company aspires to achieve dramatic growth in the future by increasing profitability and actively investing in growth fields.

The current operating profit margin is about 3%, but the company aims for a double-digit profit margin in the future.

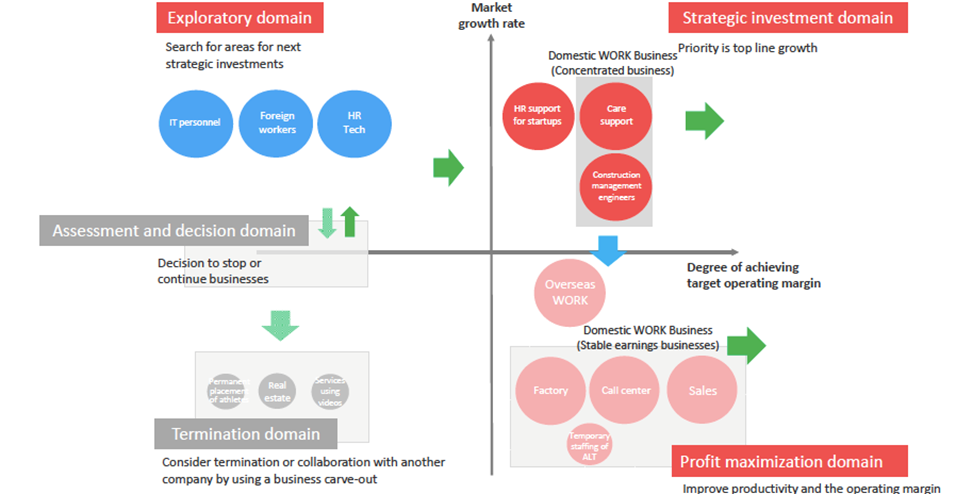

(3) Clearly demarcate the business portfolio

The company will build a business portfolio in the following five domains to transform into a highly profitable company.

Domains | Positioning | Performance indicators |

Profit maximization domain | Businesses that prioritize the improvement of gross profit margin and productivity rather than sales growth and market share expansion to increase operating margin | Operating margin |

Strategic investment domain | Businesses in which the company invest intensively so that they will become the medium- to the long-term pillars of the group | Revenue growth rate |

Exploration domain | Businesses that could be the pillars of the group in the future for which the company determines whether to invest or not (businesses that can be expected to have operating profit or operating margin of a specific size or larger) | Selected for each business |

Identification domain | Businesses for which the company should determine whether to continue them, as they could not achieve target KPIs in the "exploration area" | Selected for each business |

Withdrawal domain | Businesses that should promptly prepare for withdrawal because it will be challenging to create operating profit and operating CF above a particular scale in the future. |

|

【1-2 Basic policy】

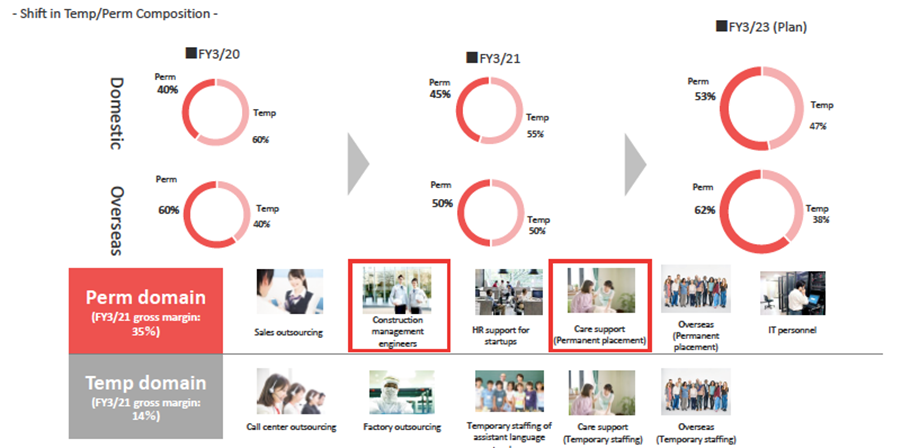

It advocates "high profitability through the WORK SHIFT strategy."

The WORK SHIFT strategy is a strategy to increase operating profit margin through portfolio shift and digital shift.

Portfolio shift | The company aims to maximize and optimize growth opportunities by expanding the "permanent employment: Perm domain (permanent)," such as introducing human resources and dispatching human resources to highly specialized areas. This is called the Perm SHIFT. The gross profit margin for the Perm domain in the term ended March 2021 was 35%. |

Digital shift | The company aims to maximize and optimize employment opportunities centered on productivity improvement and business stability by promoting the digitalization of "fixed-term employment: Temp domain (temporary)" such as temporary staffing and business contracting. The gross profit margin for the Temp domain for the term ended March 2021 was 14%. |

Until now, the company has operated businesses in multiple categories, focusing on inexperienced and unqualified casual temporary staffing. Moving forward, it will expand the Perm domain portfolio, which has a high-profit margin, and increase the productivity in the Temp domain, improve the profit margin to transform into a highly profitable structure.

【1-3 Business portfolio management】

Based on the "positioning" of the above five domains, the company will classify and operate individual businesses as follows, aiming for "high profitability through the WORK SHIFT strategy," which is the basic policy.

(Reference material of the company)

【1-4 Priority Strategy】

The company will promote the following four strategies.

Strategy | Applicable domains |

Strategy 1: Improving profitability through shifting portfolios | Profit maximization domain Strategic investment domain |

Strategy 2: Improving productivity through a digital shift | |

Strategy 3: Search for the next strategic investment domain | Exploration domain |

Strategy 4: Financial strategy | Group-wide |

Strategy 1: Improving profitability through portfolio shift

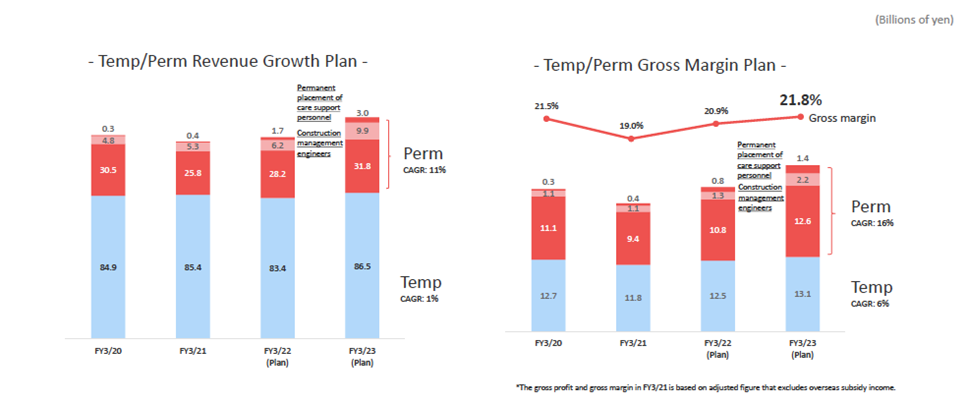

Improvement of gross profit margin by Perm SHIFT

The company will expand the sales of personnel introduction and temporary staffing to highly specialized areas both in Japan and overseas (Perm SHIFT).

In particular, the company will focus on the areas of nursing care and dispatching construction engineers.

In the term ending March 2023, the ratio of sales of the Perm domain is estimated to exceed 50% in Japan and overseas. Moreover, the gross profit margin rate will increase from 19.0% in the term ended March 2021 to 21.8%.

(Reference material of the company)

(Reference material of the company)

Construction management engineers field

The company will focus on hiring inexperienced personnel instead of its previous approach of focusing on hiring experienced personnel. The company will improve the high turnover rate and become the best in the construction engineer dispatching area.

The company will double the sales of 5.2 billion yen in the term ended March 2021 to 10 billion yen in the term ending March 2023.

In addition, it will significantly increase the number of inexperienced employees from 90 to 1,000.

To this end, in "customer acquisition," the company will enhance sales in the civil engineering area, which is a strength of experienced engineers, as well as private housing, plants, and subcontractor areas, that are easy to accept inexperienced personnel. The company will also increase sales personnel to improve sales in these areas.

In terms of "recruitment," the company will build a system that allows recruiting 400 new graduates and inexperienced mid-career per year. The number of new graduates recruited in April 2021 was 131.

Regarding the "retention rate," the training period before joining the company will be extended to close the gap after joining the company. It will also enhance the follow-up system for operating staff. The company believes that the know-how for improving the retention rate that it has accumulated so far will be effective.

The company plans to make upfront investments of 600 million yen in both the term ending March 2022 and the term ending March 2022, for a total of 1.2 billion yen to increase personnel and recruitment.

Care support field

The company will raise the sales ratio of personnel introduction from 3% in the term ended March 2021 to 16% in the term ending March 2023 to improve the profit margin.

It will also expand sales from 13.2 billion yen in the term ended March 2021 to 18.3 billion yen in the term ending March 2023.

Of this, the company will increase personnel introduction sales from 400 million yen to 3 billion yen. The number of personnel introduced will increase from 700 to 2,700.

In "personnel introduction," the company will increase the number of agents from 38 in the term ended March 2021 to 93 by the term ending March 2023 and acquire orders that utilize its customer base of temporary staffing. The company will also improve employment placement dispatching.

In "dispatching personnel," the company will open four new bases by the term ending March 2023 and actively hire foreign workers such as technical intern trainees and workers with specific skills.

In addition, the company will conduct follow-ups of staff and improve matching accuracy in order to "improve the retention rate."

The company plans to make upfront investments of 200 million yen for both the term ending March 2022 and the term ending March 2023, for a total of 400 million yen for increasing personnel and recruitment.

Fields other than care support and construction

In the profit maximization area, although top-line growth is gradual, the company aims to raise the gross profit margin by shifting to more profitable projects.

Sales support field | Perm domain | * Seize the opportunity to popularize 5G terminals to expand the sales in the stable communication field continuously * Strengthen the hiring of full-time on-site employees to increase sales agency services with a high gross profit margin |

Call center field | Temp domain | * Continue to expand financial projects with a high gross profit margin * Increase the market share per project and switch from dispatching staff to outsourcing to improve the gross profit margin * For novel coronavirus-related bidding projects, the company will actively work on profitability and, when it is possible, shift personnel after the end of the project. |

Factory field | Temp domain | * In preparation for deregulation of immigration policies after the end of the pandemic, the company will continue to strengthen the recruitment of foreign workers and aim to improve profitability by increasing the market share of the stable food sector. * In fields other than food, the company will shift to expanding receiving orders for electrical, electronic, and automobile parts fields, which have a higher gross profit margin than logistics, and consumer goods, even if it is same in terms of light work. |

Overseas WORK business | Perm domain Temp domain | * Expanding the group share within customers by sharing customers who are operating on a multinational level at all companies based in Australia and Singapore * Exploring new HR businesses that are different from dispatching and introducing personnel |

Strategy 2: Improving productivity through a digital shift

The company aims at productivity improvement through a digital shift centered on "efficiency through online operations and automation," "efficiency through centralized data management," "efficiency through telework and online interviews," and "efficiency associated with the integration of consolidated subsidiaries."

Strategy 3: Searching for areas for next strategic investments

HR Tech

The company will search for the next strategic investment businesses by repeating trials and errors.

By searching for businesses with high operating profit margins, the company aims to improve consolidated operating profit margins in the future.

Currently, the company is working on "LAPRAS," which handles the introduction of engineer personnel using AI, "Hour Money "and "Visa Money," foreigner employment management tools, and "ENPORT," a foreigner work support service. As the company solves the issues it faces, it will consider whether it should make upfront investments and develop into a growth business.

As for the services that target foreign workers, Visa Money and ENPORT, the company plans to increase the number of service users through Myanmar subsidiaries, Vietnamese subsidiaries and partners, and Indonesian partners from 15,000 in the term ended March 2021 to 80,000 in the term ending March 2023.

Strategy 4: Financial strategy

The company has set targets for three indicators as follows.

Financial items | Index | Goal | Overview |

Financial soundness | Ownership equity ratio attributable to owners of parent | Over 20% | The company will improve future growth investment and financial position. The ownership equity ratio attributable to owners of parent was 18% in the term ended March 2021. |

Capital efficiency | ROIC | Over 20% | The company will improve profitability and capital efficiency. ROIC was 14% in the term ended March 2021. WACC was at about 11%. |

Shareholder return | Total payout ratio | Over 30% | While securing growth investment, the company will enhance the return of profits. |

【1-5 Numerical target】

The company will continue to increase sales and improve the operating profit margin while making upfront investments (FY 3/22: approximately 1.3 billion yen, FY 3/23: approximately 1.3 billion yen).

Within the Perm domain, the company will strive to rapidly grow the sales of the introduction of construction engineers and nursing care personnel and improve the profit margin accordingly.

All companies

| FY 3/20 | FY 3/21 | FY 3/22 (Plan) | FY 3/23 (Plan) | CAGR/ Increase Rate |

Revenue | 1,219 | 1,182 | 1,210 | 1,335 | +6.3% |

YoY | +18% | -3% | +2% | +10% | - |

Gross Profit Margin | 20.8% | 20.3% | 21.2% | 22.6% | +2.3pt |

S&GA | 214 | 204 | 222 | 248 | +10.3% |

Expense for upfront investment | - | - | 13 | 13 | - |

Operating Income | 41.4 | 40.3 | 34.0 | 53.5 | +15.2% |

Operating Income Margin | 3.4% | 3.4% | 2.8% | 4.0% | +0.6pt |

ROIC | 14% | 14% | 12% | 20% | +6pt |

Capital Adequacy Ratio | 11.7% | 17.7% | 19.0% | 22.0% | +4.3pt |

Total Propensity to reduce | 25.1% | 22.9% | 30.6% | 30.0% | +7.1pt |

*unit 100 million yen. CAGR/ Increase Rate is the rate of growth from the result of FY 3/21 to the plan of FY 3/22. Investment Bridge Inc, calculated based on the source from WILL Group Inc.

Temp domain、Perm domain

| FY 3/20 | FY 3/21 | FY 3/22 (Plan) | FY 3/23 (Plan) | CAGR/Increase rate |

Temp domain |

|

|

|

|

|

Sales | 849 | 854 | 834 | 865 | +0.6% |

Gros Profit | 127 | 118 | 125 | 131 | +5.4% |

Perm domain |

|

|

|

|

|

Sales | 356 | 315 | 361 | 447 | +19.1% |

Construction management engineers | 48 | 53 | 62 | 99 | +36.7% |

Nursing care personnel agency | 3 | 4 | 17 | 30 | +173.9% |

Dispatching of nursing care personnel | - | 128 | - | 153 | +9.3% |

Gros Profit | 125 | 109 | 129 | 162 | +21.9% |

Construction management engineers | 11 | 11 | 13 | 22 | +41.4% |

Dispatching of nursing care personnel | 3 | 4 | 8 | 14 | +87.1% |

*unit 100 million yen. CAGR/ Increase Rate is the rate of growth from the result of FY 3/21 to the plan of FY 3/23. Investment Bridge Inc, calculated based on the source from WILL Group Inc.

<Reference2: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with board of company auditor(s) |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 3 external ones |

Corporate Governance Report Updated on November 22, 2021

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

As of November 22, 2021, the company follows all the principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Cross held shares】

(1) Policies Regarding Cross-holding

Our company does not own any cross-held shares. We shall not own any such stocks in the future except cases where, taking into consideration the creation of business opportunities and the development, maintenance and strengthening of transactions and cooperative relations, we conclude that possessing such stocks will contribute to an increase in middle and long-term value of our company. After our company owns such stocks, if we decide, as per the policies mentioned above, that the benefit from owning these stocks is insufficient, we shall swiftly cut down these stocks.

(2) Details of discussion regarding cross-held shares

In the case of our company possessing cross-held shares, the board of directors will periodically evaluate the economic rationality, such as return on investment, regarding merits, risks and capital costs of possessing such stocks as well as future prospects and make a decision on whether to keep holding such stocks.

(3) Criteria for the Exercise of Voting Rights regarding Cross-held Shares

Regarding the exercise of voting rights related to cross-held shares, instead of unilaterally making a decision, decisions will be made on each item of the agenda individually, from a point of view of increasing company value in the middle and long-term as well as increasing returns for shareholders, while respecting the management policies and strategies of the company being invested in.

【Principle 5-1 Policies related to Constructive Interaction with Shareholders】

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website. Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director and executive officers in charge of the management headquarters aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy and continuity with regard to management and business strategies, financial information etc.

(2) The management headquarters takes a central role, and the management planning, general affairs, financial affairs, accounting, legal affairs departments, and IT department and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair and suitable fashion.

(3) As a means for interaction, we shall engage in the enrichment of company information sessions for shareholders.

(4) The opinions and worries of shareholders understood in our interactions will be quarterly reviewed appropriately and effectively in all our company meetings through the representative director and executive officers in charge of the management headquarters.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

| This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd., All Rights Reserved. |

To view back numbers of Bridge Reports on WILL GROUP, INC. (6089) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/