Bridge Report:(6089)WILL GROUP fiscal year ended March 2022

Shigeru Ohara, Representative director and President | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | TSE, Prime Market |

Industry | Services |

Chairman | Shigeru Ohara |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act.) | Trading Unit | |

¥1,180 | 22,852,200 shares | ¥26,965 million | 33.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER(Est.) | BPS (Act.) | PBR (Act.) |

¥44.00 | 3.7% | ¥148.98 | 7.9x | ¥505.08 | 2.3x |

*Stock prices as of the close on June 9, 2022. Each number is from the financial results for the fiscal year ended March 2022.

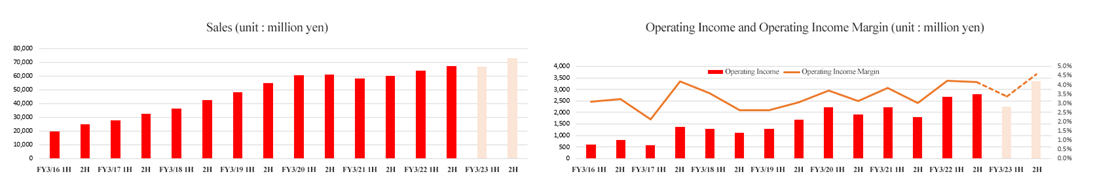

Transition in Consolidated Performance (Voluntary adoption of IFRS)

Fiscal Year | Sales | Operating Income | Ordinary Income, Pretax Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2019(Act.) | 103,300 | 2,957 | 2,876 | 1,539 | 69.46 | 18.00 |

March 2020(Act.) | 121,916 | 4,145 | 4,057 | 2,380 | 107.07 | 23.00 |

March 2021(Act.) | 118,249 | 4,030 | 3,788 | 2,363 | 106.35 | 24.00 |

March 2022(Act.) | 131,080 | 5,472 | 5,293 | 3,286 | 147.03 | 34.00 |

March 2023(Est.) | 140,000 | 5,600 | 5,490 | 3,330 | 148.98 | 44.00 |

*Estimated by the Company. (Unit: Million yen or yen)

This Bridge Report reviews fiscal year ended March 2022 earnings results and fiscal year ending March 2023 earnings estimates.

Contents

Key Points

1. Company Overview

2.Fiscal Year ended March 2022 Earning Results

3. Fiscal Year ending March 2023 Earnings Estimates

4. Progress of Medium-term Management Plan “WILL-being 2023”

5. Conclusions

<Reference 1: Progress of Medium-term Management Plan “WILL-being 2023”>

<Reference 2: Regarding Corporate Governance>

Key Points

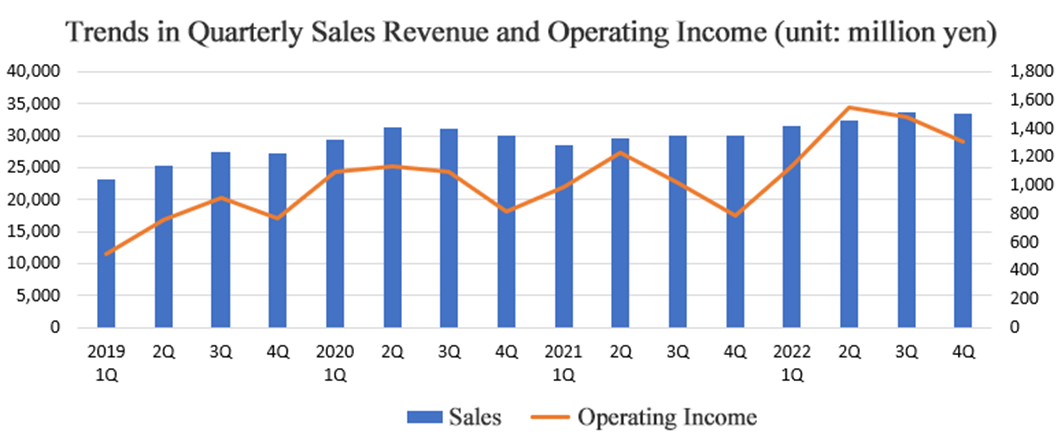

- The sales revenue in the term ended March 2022 stood at 131,080 million yen, up 10.9% year on year, driven by the overseas WORK business. Overseas demand for personnel remains healthy. Gross profit increased 19.6% year on year, exceeding the sales growth rate, to 28,765 million yen. Gross profit margin improved by 1.6 points due to the Perm SHIFT, marking a record high since the company listing. Operating income increased 35.8% year on year to 5,472 million yen. Although the temporary profit in the previous term (950 million yen) disappeared and upfront investments (1 billion yen) were made in key fields of the domestic WORK business (construction, nursing care, and start-up personnel support), these factors were offset by the increase in gross profit, leading to double-digit growth of profit. Operating income and operating income margin reached the management goal set in the mid-term management plan a year earlier than planned. Both sales and profit exceeded the earnings forecast that was upwardly revised for the third time.

- In the term ending March 2023, sales revenue is projected to rise 6.8% year on year to 140 billion yen and operating income to grow 2.3 % year on year to 5.6 billion yen. The company aims to increase both sales revenue and operating income, to exceed the management goal set in the mid-term management plan and hit a record high. The company plans to pay a dividend of 44 yen/share, up 10 yen/share year on year. The expected payout ratio is 29.5%. The expected total return ratio is 30.2%.

- In the term ended March 2022, almost all indices, such as sales revenue, gross profit margin, operating income, ROIC and equity ratio, exceeded the earnings forecast. As of now, it is expected that mid-term management goals except ROIC will be achieved in the term ending March 2023 as well. While the company plans to implement an upfront investment of 1.3 billion yen in accordance with the mid-term management plan, they will aim to achieve the goal for ROIC through the revision of invested capital, etc.

- While the four priority strategies set out in the mid-term management plan are mostly progressing in accordance with the plan, recruitment and dispatch of staff in the fields of strategical investment: “construction” and “nursing care” are delayed more than expected, and the progress of the improvement of productivity based on the Digital Shift and the service for foreigners living in Japan is not quite satisfactory either. The company will aim for accomplishing all items in this term.

- This term is the last year of the mid-term management plan “WILL-being 2023.” While sales and profit are forecast to decrease in the first half of the term from the previous term (the second half of the previous term), sales, profit and operating income margin in the second half are all expected to hit a record high for a half-year term. We would like to pay close attention to the progress in each quarter for the achievement of all goals set out in the mid-term management plan.

- On the other hand, the interest of investors will be shifting to the strategies and measures in the next mid-term management plan. Expectations will be held especially in regard to what kind of steps the company will take to achieve results in the construction engineer field and the nursing care business support field, which are strategical fields, but still present many challenges.

1. Company Overview

WILL GROUP, INC. is a holding company that provides HR services specialized at each category such as dispatching sales support staff, call center operators and manufacturing line staff primarily to food manufacturing, and supporting nursing facilities’ personnel recruitment and temporary staffing. The main feature of the Company is the “hybrid placement service,” by which permanent employees of Will Group called "field supporters" are stationed at the dispatched workplace. Will Group differentiates itself from its competitors by implementing its hands-on policy as it endeavors to develop new businesses.

There are group companies, including WILLOF WORK, Inc., which deals with the outsourcing of sales, call center operation and nursing care, for Startups, Inc., which is engaged in startup human resources support, WILLOF CONSTRUCTION, Inc., which offers construction engineer human resource services, and overseas subsidiaries that offer staffing services mainly in Asia and Oceania.

【1-1 WILL Vision and Management Philosophy】

WILL Vision is advocated as creating a strong brand with high expected value and becoming No. 1 in the business fields of “working,” “interesting,” “learning” and “living.”

Working | Business field to support “Working” |

Interesting | Business field to support “Interesting” |

Learning | Business field to support “Learning” |

Living | Business field to support “Living” |

【1-2 Business Content】

The business have been classified into three segments: domestic WORK business, overseas WORK business, and others.

Domestic WORK business

In Japan, the company provides personnel introduction, temporary staffing, and outsourcing contracts specializing in categories such as the sales support field, call center, factory, nursing care, and childcare. It also offers personnel support for start-ups.

Sales support field: WILLOF WORK, Inc., and CreativeBank Inc.

The telecommunications sector accounts for more than 50% of total sales, while the apparel sector makes up more than 10%, and others account for more than 30%. As for sales support for the telecommunications field, the company conducts sales of smartphones, etc. at home electronics mass retailers, manages sales staff, and temporary staffing for operations such as collecting and reporting sales information. The company also undertakes team-type temporary staffing (hybrid temporary staffing), sales operations, and personnel introduction.

Call center field: WILLOF WORK, Inc.

Customers are companies that operate call centers and companies that use telemarketing services. The number of customers is increasing, mainly for telecommunications companies and BPOs (continuously outsourcing part of business processes to external companies) and financial institutions. The company is responsible for dispatching staff engaged in after-sales service, consultation, and receiving complaints, and providing team-type temporary staffing (hybrid temporary staffing) and introducing personnel. It also undertakes customer telemarketing operations at its own call center.

Factory segment: WILLOF WORK, Inc.

The company is responsible for dispatching staff who would engage in light work such as manufacturing, inspection, quality control, sorting, and packing mainly in the food manufacturing industry, which is not easily affected by the economy, as well as providing team type temporary staffing (hybrid temporary staffing), outsourcing of production process operations and personnel introduction.

Nursing care and childcare field: WILLOF WORK, Inc.

The company undertakes temporary staffing and personnel introduction to companies that operate nursing care facilities and childcare facilities.

HR support for startups: for Startups, Inc.

It is a business that supports growing industries (ventures, start-up companies, etc.) centered on HR (Human Resources). It operates the information platform "START-UP DB (Startup Database)", which is the largest platform specializing in the growing industry fields in Japan.

Construction engineer field: WILLOF CONSTRUCTION, Inc.,

The company dispatches construction management engineers and introduces personnel to the construction industry in Japan, especially to general contractors and subcontractors.

Other fields: BORDERLINK, INC., etc.

The company dispatches ALTs (foreign language teaching assistants) and IT engineers and introduces human resources.

Overseas WORK Business

In the ASEAN and Oceania regions, the company dispatches and introduces personnel for government-affiliated projects, engineers, finance, legal affairs, etc.

WILL GROUP Asia Pacific Pte. Ltd., Good Job Creations (Singapore) Pte. Ltd., Scientec Consulting Pte. Ltd.,

The Chapman Consulting Group Pte. Ltd., Oriental Aviation International Pte. Ltd., Ethos BeathChapman,

Quay Appointments Pty Ltd., u & u Holdings Pty Ltd., DFP Recruitment Holdings Pty Ltd,

Asia Recruit Holdings Sdn.Bhd.

Others

The company is working on expanding the domain of HRTech with the aim of strengthening the development of new platforms that provide a community for human resources such as system engineers through concept rental management and the expansion of forms of businesses other than the labor-intensive business. An example of these platforms is "Enport," a foreign worker support service.

WILL GROUP, INC., etc.

2. Fiscal Year ended March 2022 Earnings Results

【2-1 Consolidated earnings results (IFRS)】

| FY 3/21 | Share | FY 3/22 | Share | YoY Change | Compared to the Revised forecast |

Sales | 118,249 | 100.0% | 131,080 | 100.0% | +10.9% | +0.8% |

Gross Profit | 24,056 | 20.3% | 28,765 | 21.9% | +19.6% | +1.3% |

SG & A | 20,463 | 17.3% | 23,585 | 18.0% | +15.3% | - |

Operating Income | 4,030 | 3.4% | 5,472 | 4.2% | +35.8% | +9.4% |

Pretax Profit | 3,788 | 3.2% | 5,293 | 4.0% | +39.7% | +5.9% |

Net Income | 2,363 | 2.0% | 3,286 | 2.5% | +39.0% | +10.3% |

*Unit: Million yen. Net profit is the net profit attributable to owners of the parent company. The same applies hereafter. The revised forecast is increase and decrease to the forecasts announced in February 2022.

Sales and Profit Increased

The sales in the term ended March 2022 were 131,080 million yen, up 10.9% year on year. The Overseas WORK business is leading the growth. Demand for human resources outside Japan remains strong. Gross profit grew 19.6% year on year to 28,765 million yen, exceeding the increase rate of sales. Perm SHIFT improved the gross profit margin by 1.6 points. It recorded the highest since the company's listing. Operating income rose 35.8% year on year to 5,472 million yen. The company posted an extraordinary profit of 950 million yen in the same period of the previous term, but not this term. Upfront investment of 1,000 million yen was made in the domestic WORK business's focus areas (construction, nursing care, and start-up personnel support). However, gross profit growth offset these expenses, and the company achieved a double-digit profit increase. Operating income and operating margin met the management targets of the medium-term management plan one year ahead of schedule. Both sales and profit exceeded the earnings forecast that was upwardly revised for the third time.

.

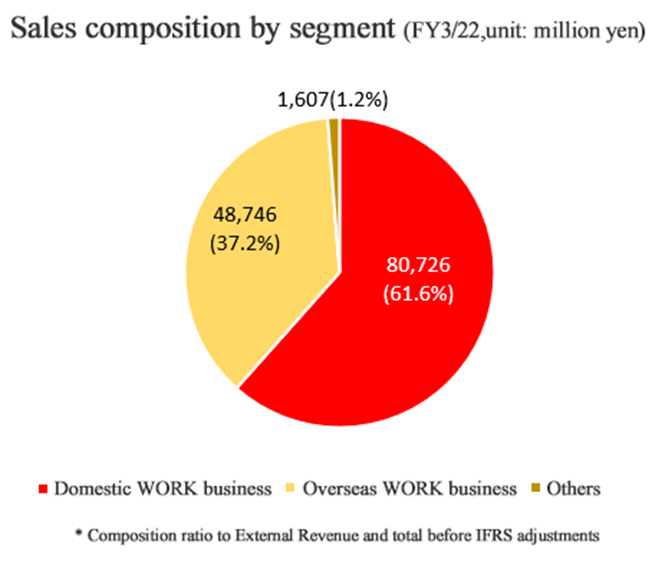

【2-2 Trend by Segment】

| FY 3/21 | Share and Profit margin | FY 3/22 | Share and Profit margin | YoY | Compared to the revised forecast |

Domestic WORK business | 80,050 | 67.7% | 80,726 | 61.6% | +0.8% | -0.4% |

Overseas WORK business | 36,920 | 31.2% | 48,746 | 37.2% | +32.0% | +2.8% |

Other | 1,278 | 1.1% | 1,607 | 1.2% | +25.7% | +1.9% |

Revenue | 118,249 | 100.0% | 131,080 | 100.0% | +10.9% | +0.8% |

Domestic WORK business | 4,763 | 6.0% | 4,448 | 5.5% | -6.6% | -1.3% |

Overseas WORK business | 1,942 | 5.3% | 3,348 | 6.9% | +72.4% | +17.3% |

Others | -413 | - | -342 | - | - | - |

Adjustments | -2,262 | - | -1,981 | - | - | - |

Operating Profit | 4,030 | 3.4% | 5,472 | 4.2% | +35.8% | +9.4% |

*Unit: Million yen. Sales revenue is external revenue.

Domestic WORK business

Sales are in line with the same period in the previous term and profit decreased year on year.

Demand decreased in the apparel area of the outsourcing field, areas such as sales promotion, and the factory outsourcing field, due to the lingering impact of the spread of the novel coronavirus.

On the other hand, demand remained steady and robust in telecommunications business in the sales outsourcing field, the call center outsourcing field, the nursing care field, and the start-up personnel support field.

Taking into consideration the conditions during the pandemic and after the pandemic subsides, the company focused on developing customers for new services, such as sales agency services and remote contact center services.

In terms of profit, it decreased due to upfront investment for increasing the number of sales staff and consultants for personnel introduction in the nursing care field and the construction engineers staffing field.

Overseas WORK business

Sales and profits increased from the previous fiscal year.

Regarding human resources services provided in the ASEAN and Oceanian regions, measures such as city lockdowns were taken due to the spread of the novel coronavirus, but demand for human resources was strong, and the performance of both temporary staffing and personnel introduction was favorable.

Personnel expenses, which had been curtailed, increased, and the revenue from government subsidies for employment support as a countermeasure against the spread of the novel coronavirus in Singapore, which was recorded in the previous fiscal year, decreased.

Personnel introduction sales significantly grew, leading to a growth in gross profit margin and an increase in profit.

Other

Sales increased and loss decreased from the previous fiscal year.

The company worked on enhancing the development of new platforms such as "Enport," which is a support service for foreigners.

Loss shrank, although the number of users showed little growth due to lasting difficulties in coming to Japan caused by the restrictions on entry to Japan stemming from the spread of the novel coronavirus, and further investments were made in the development of a new platform as well.

【2-3 Financial Position and Cash Flow】

Balance Sheet

| Mar. 21 | Mar. 22 | Increase/ decrease |

| Mar. 21 | Mar. 22 | Increase/ decrease |

Current Assets | 23,570 | 27,289 | +3,719 | Current liabilities | 24,790 | 29,361 | +4,571 |

Cash | 7,455 | 8,973 | +1,518 | Operating debts, other debts | 13,760 | 15,297 | +1,537 |

receivables, other receivables | 14,694 | 17,458 | +2,764 | Other current liabilities | 2,048 | 1,836 | -212 |

Non-Current Assets | 23,190 | 25,061 | +1,871 | Non-current liabilities | 11,943 | 9,867 | -2,076 |

Tangible fixed assets | 1,082 | 1,223 | +141 | Other financial debts | 6,563 | 6,285 | -278 |

Right-of-use assets | 5,715 | 6,809 | +1,094 | Total liabilities | 36,733 | 39,228 | +2,495 |

Goodwill | 6,155 | 6,514 | +359 | Total equity | 10,027 | 13,121 | +3,094 |

Other Intangible Assets | 6,049 | 6,154 | +105 | Equity attributable to owners of the parent augmented | 8,240 | 11,398 | +3,158 |

Total assets | 46,760 | 52,350 | +5,590 | Total liabilities and equity | 46,760 | 52,350 | +5,590 |

|

|

|

| Borrowings | 8,788 | 7,988 | -800 |

*Unit: Million yen

Total assets increased by 5.5 billion yen from the end of the previous fiscal year to 52.3 billion yen due to the increase in receivables. Total liabilities increased by 2.4 billion yen to 39.2 billion yen due to an increase in other financial liabilities.

Total equity increased 3.0 billion yen year on year to 13.1 billion yen due to an increase in retained earnings. Equity attributable to owners of the parent augmented increased by 4.2% year on year to 21.8%, EBITDA-adjusted debt-to-equity ratio decreased by 0.2 points to 0.9x, goodwill-adjusted equity attributable to owners of the parent decreased by 0.1points to 0.4x, and adjusted net debt-to-equity ratio decreased by 0.2 points to -0.1x.

◎Cash Flow

| FY3/21 | FY3/22 | Increase/decrease |

Operating cash flow (A) | 4,316 | 4,350 | +34 |

Investing cash flow (B) | -433 | -306 | +127 |

Free cash flow (A+B) | 3,883 | 4,044 | +161 |

Financing cash flow | -2,646 | -2,959 | -313 |

Cash, equivalents at term-end | 7,455 | 8,973 | +1,518 |

*Unit: Million yen

Free CF is increased from the previous term. The cash outflow from financing activities increased, due to increase in payments from changes in ownership interests in subsidiaries that do not result in change in scope of consolidation.

The cash position has increased.

3. Fiscal Year ending March 2023 Earnings Estimates

【3-1 Consolidated Earnings Estimate】

| FY 3/22 | Share | FY 3/23 (Est.) | Share | YoY |

Sales | 131,080 | 100.0% | 140,000 | 100.0% | +6.8% |

Gross Profit | 28,765 | 21.9% | 31,580 | 22.6% | +9.8% |

SG & A | 23,585 | 18.0% | - | - | - |

Operating Income | 5,472 | 4.2% | 5,600 | 4.0% | +2.3% |

Pretax Profit | 5,293 | 4.0% | 5,490 | 3.9% | +3.7% |

Profit attributable to owners of parent | 3,286 | 2.5% | 3,330 | 2.4% | +1.3% |

*unit 100 million yen.

Aiming for increase in sales and profit, exceeding the management goals set in the mid-term management plan and reaching the highest record.

Sales are expected to increase 6.8% year on year to 140 billion yen, and operating income is forecast to rise 2.3% year on year to 5.6 billion yen. The company plans to increase the dividend by 10 yen/share from the initial plan or 10 yen/share from the previous term to 44 yen/share. The expected payout ratio is 29.5%. The forecasted total return ratio is 30.2%.

【3-2 Earnings Estimate in Each Segment】

| FY 3/22 | Share and Profit margin | FY 3/23(Est.) | Share and Profit margin | YoY |

Domestic WORK Business | 80,726 | 61.6% | 88,980 | 63.6% | +10.2% |

Overseas WORK Business | 48,746 | 37.2% | 49,030 | 35.0% | +0.6% |

Other | 1,607 | 1.2% | 1,980 | 1.4% | +23.2% |

Revenue | 131,080 | 100.0% | 140,000 | 100.0% | +6.8% |

Domestic WORK Business | 4,448 | 5.5% | 5,690 | 6.4% | +28.1% |

Overseas WORK Business | 3,348 | 6.9% | 2,580 | 5.3% | -22.8% |

Other | -342 | - | -190 | - | - |

Adjustments | -1,981 | - | -2,480 | - | - |

Operating profit | 5,472 | 4.2% | 5,600 | 4.0% | +2.3% |

*Unit: 100 million yen

Domestic WORK business

Sales and profit are expected to increase.

* Sales support field

The apparel and sales support field will be expanded. Moreover, the company will pursue the improvement of gross profit margin by increasing the number of on-site company employees and thus reducing outsourcing expenses.

* Call center field

Projecting an increase of tasks entrusted to the company due to the growing demand for outsourcing. The company will pursue the improvement of gross profit margin by raising the ratio of tasks with which they are entrusted.

* Factory field

Expecting increases in personnel dispatch, the introduction of foreign personnel stemming from the ban on entry to Japan being lifted, and the number of foreigners the company manages. They will pursue the growth of personnel introduction sales and income from management entrusted to the company.

* Nursing care field

A rise in personnel introduction sales which is a focus area is anticipated due to employment placement dispatching.

*HR support for startups field

The number of recruitment opportunities remains at a high level, showing stable growth. Upfront expenses for recruiting consultants, etc. will increase, taking into account the number of recruitment opportunities.

* Construction management engineers fields

Projecting an increase in working staff due to rising numbers of new graduates and inexperienced recruits. Although upfront costs such as expenses for recruitment and sales staff will rise, gross profit margin will grow.

| FY3/22 | FY3/23 (Est.) | YoY |

Sales |

|

|

|

Sales support | 195.1 | 206.6 | +5.9% |

Call center | 170.4 | 184.2 | +8.1% |

Factory | 183.1 | 191.1 | +4.4% |

Care support | 136.7 | 147.6 | +8.0% |

HR support for startups | 23.4 | 28.0 | +19.7% |

Construction management engineers | 57.8 | 83.0 | +43.6% |

Operating Income |

|

|

|

Sales support | 16.1 | 18.7 | +16.1% |

Call center | 11.7 | 13.0 | +11.1% |

Factory | 12.5 | 14.5 | +16.0% |

Care support | 2.9 | 7.1 | +144.8% |

HR support for startups | 6.0 | 5.7 | -5.0% |

Construction management engineers | -5.5 | -4.3 | -21.8% |

*Unit: 100 million yen

◎Overseas WORK business

Sales increased and profits decreased.

Demand for personnel introduction is projected to calm down in comparison with the previous term. A decrease in personnel introduction sales and an increase of recruitment and personnel costs are expected.

4. Progress of Medium-term Management Plan "WILL-being 2023"

(1) Quantitative goals

In the term ended March 2022, almost all indices such as sales revenue, gross profit margin, operating income, ROIC and equity ratio exceeded the goals.

As of now, it is expected that mid-term management goals except ROIC will be achieved in the term ending March 2023 as well. While the company plans to implement an upfront investment of 1.3 billion yen in accordance with the mid-term management plan, they will aim to achieve the goal for ROIC through the revision of invested capital, etc.

| FY3/22 | FY3/23 | ||

| Plan | Earnings Results | Plan | Earnings Forecast |

Revenue | 1,210 | 1,310 | 1,335 | 1,400 |

Gross Profit Margin | 21.2% | 21.9% | 22.6% | 22.6% |

S&GA | 222 | 235 | 248 | 259 |

Operating Income | 34.0 | 54.7 | 53.5 | 56.0 |

Operating Income Margin | 2.8% | 4.2% | 4.0% | 4.0% |

ROIC | 12.0% | 17.9% | 20.0% | 18.6% |

Capital Adequacy Ratio | 19.0% | 21.8% | 22.0% | 24.8% |

Total Propensity to reduce | 30.6% | 23.6% | 30.0% | 30.2% |

*Unit: 100 million yen

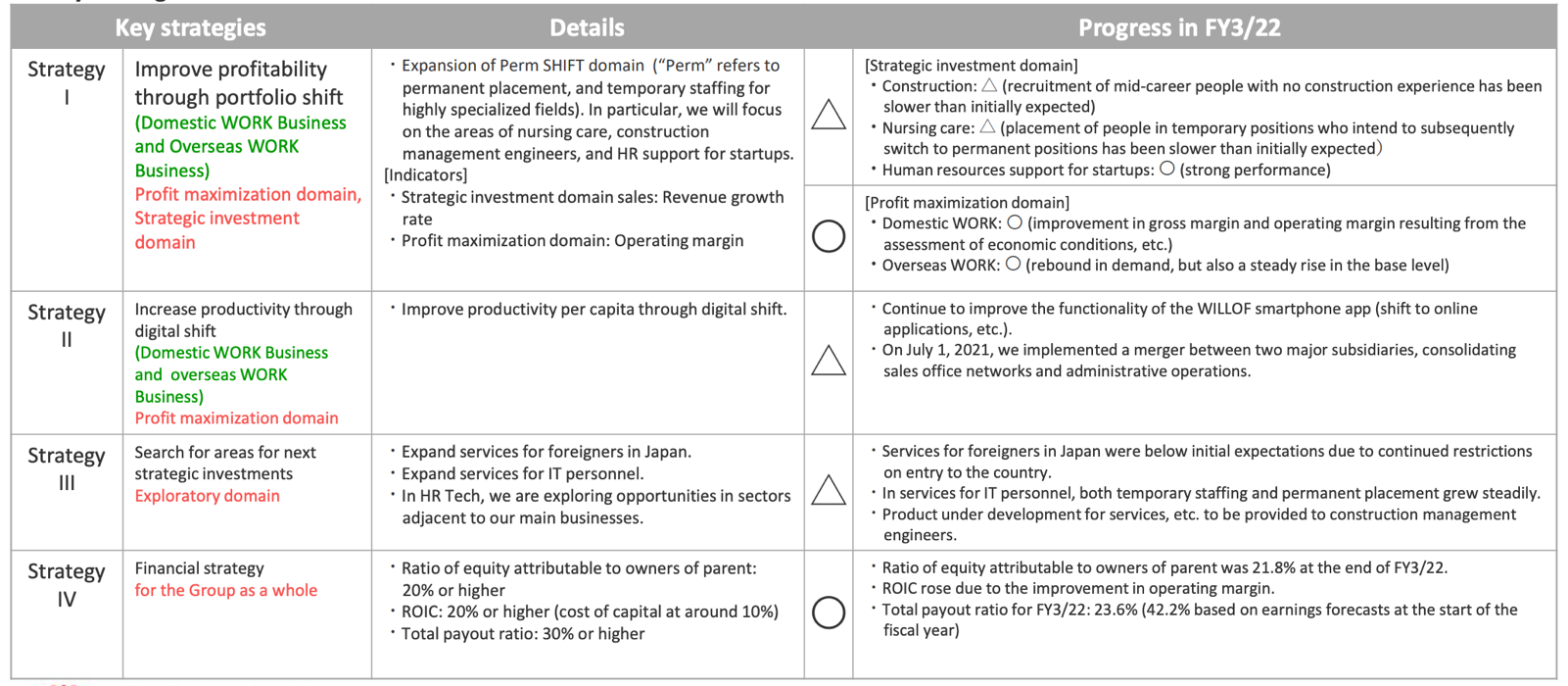

(2) Progress of priority strategies

While the four priority strategies set out in the mid-term management plan are mostly progressing in accordance with the plan, recruitment and the dispatch of staff in the fields of strategical investment: “construction” and “nursing care” are delayed more than expected, and the progress of the improvement of productivity based on the Digital Shift and the service for foreigners living in Japan is not quite satisfactory either. The company will aim to accomplish all items in this term.

(Reference material of the company)

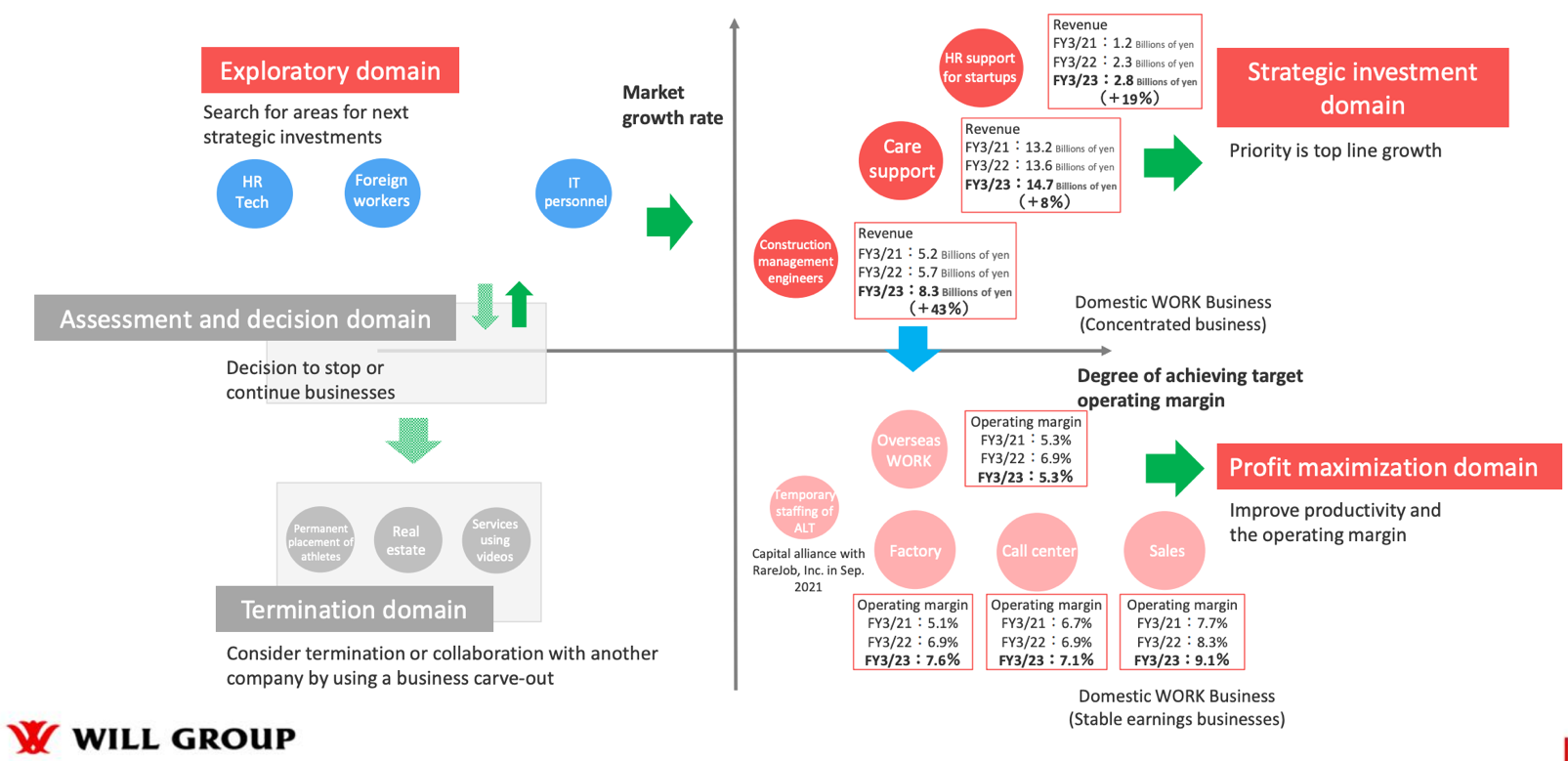

(3) Progress of business portfolio shift

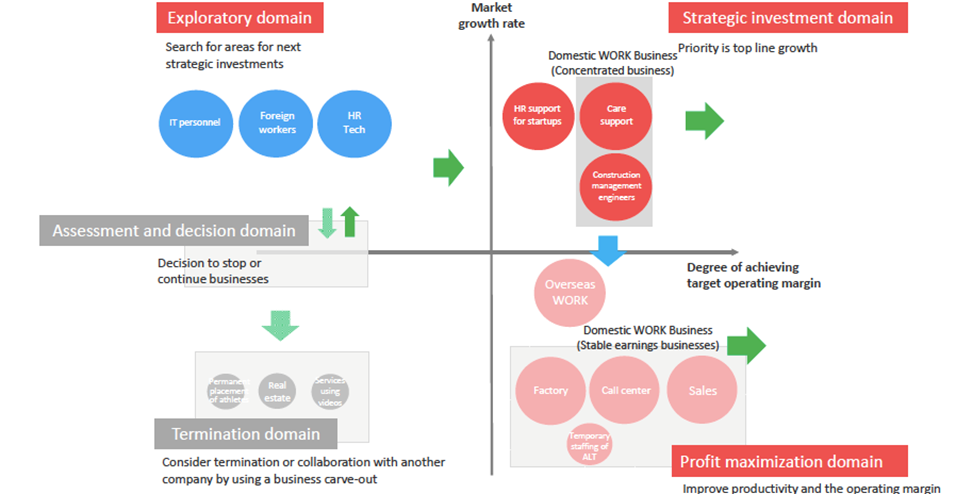

The company classifies and operates individual businesses in the five fields of “profit maximization,” “strategical investments,” “exploration,” “assessment” and “withdrawal,” and aims to “realize a profitable structure based on the WORK SHIFT strategy,” which is their basic policy.

While there are some delays in the progress in the fields of “construction” and “nursing care,” the plan is progressing steadily as a whole.

(Reference material of the company)

◎Progress in the construction engineers field

*Sales

The number of working staff has increased due to the recruitment of new graduates and inexperienced mid-career recruits who joined the company in the first quarter, and quarterly sales are steadily growing.

*Number of hires

The number of inexperienced mid-career recruit shows solid growth. 236 new graduates joined the company in April 2022.

*Number of working personnel, working rate, and retention rate

Occupancy rates have remained high. Retention rate shows a slightly downward trend. The company will pursue improvement through trainings, a follow-up system, etc.

*Monthly average working hours and average wage

Unit operating costs are declining due to a decrease in overtime hours and an increase in the number of new graduates and inexperienced workers.

◎Progress in the nursing care area

*Sales

Temporary staffing sales remained steady.

*Number of contracts for temporary staffing with prospects for future permanent placement and personnel introduction

The number of orders and hires is lower than planned due to low awareness of the temporary staffing with prospects for future permanent placement. The company will work toward building foundations in this term.

*Number of temporary personnel with prospects for future permanent placement and the employees in the personnel introduction section

New orders show a recovery trend since the start of 2022 and the number of working staff displays an upward trend.

*Number of temporary personnel with prospects for future permanent placement and the employees in the personnel introduction section

The company will rebuild the system for temporary personnel with prospects for future permanent placement and strengthen the recruitment again.

5. Conclusions

This fiscal year is the final year of the "WILL-being 2023" medium-term management plan. While sales and profits are expected to decrease in the first half compared to the previous year (compared to the second half of the previous year), sales, profits, and operating profit margin are expected to reach record highs on a half-year basis in the second half of the year.

We will closely monitor the company's quarterly progress toward achieving almost all the mid-term management plan targets.

Meanwhile, investors' attention will shift to the strategies and measures of the next medium-term management plan. In particular, we look forward to seeing what steps the company will take to improve its performance in the areas of construction engineers and nursing care business support, where strategic investments are still needed.

<Reference 1: Basic Policy of Medium-term Management Plan “WILL-being 2023”>

The company is implementing the medium-term management plan "WILL-being 2023" targeting the term ending March 2023.

【1-1 Update of the medium-term management plan】

Although the basic policy announced last year has not changed, the plan has been updated in light of the various impacts and changes in society due to the spread of novel coronavirus.

(1) Updated points

1. Changes in The Business Climate

The company believes that the changes that had been predicted in "society," "Business," and "job seekers" have been accelerated by the novel coronavirus crisis, and the future of working styles has been fast-tracked by several years.

"Society"

Global population growth and aging in developed countries, unstable political conditions, and progress in the movement toward the realization of a sustainable society (SDGs)

"Business"

Increasing demand for outsourcing, significant changes in individual work styles due to technological evolution, and a rise in investment in human resources for sustainable growth

"Job seekers"

With the spread of telework, the number of workers who want a work style free from constraints of time and place is increasing. Also, the number of senior workers is increasing since we are moving towards prolonging the lifetime employment as people live to 100 years old.

(2) Medium/long-term growth scenario

The company aspires to achieve dramatic growth in the future by increasing profitability and actively investing in growth fields.

The current operating profit margin is about 3%, but the company aims for a double-digit profit margin in the future.

(3) Clearly demarcate the business portfolio

The company will build a business portfolio in the following five domains to transform into a highly profitable company.

Domains | Positioning | Performance indicators |

Profit maximization domain | Businesses that prioritize the improvement of gross profit margin and productivity rather than sales growth and market share expansion to increase operating margin | Operating margin |

Strategic investment domain | Businesses in which the company invest intensively so that they will become the medium- to the long-term pillars of the group | Revenue growth rate |

Exploration domain | Businesses that could be the pillars of the group in the future for which the company determines whether to invest or not (businesses that can be expected to have operating profit or operating margin of a specific size or larger) | Selected for each business |

Identification domain | Businesses for which the company should determine whether to continue them, as they could not achieve target KPIs in the "exploration area" | Selected for each business |

Withdrawal domain | Businesses that should promptly prepare for withdrawal because it will be challenging to create operating profit and operating CF above a particular scale in the future. | - |

【1-2 Basic policy】

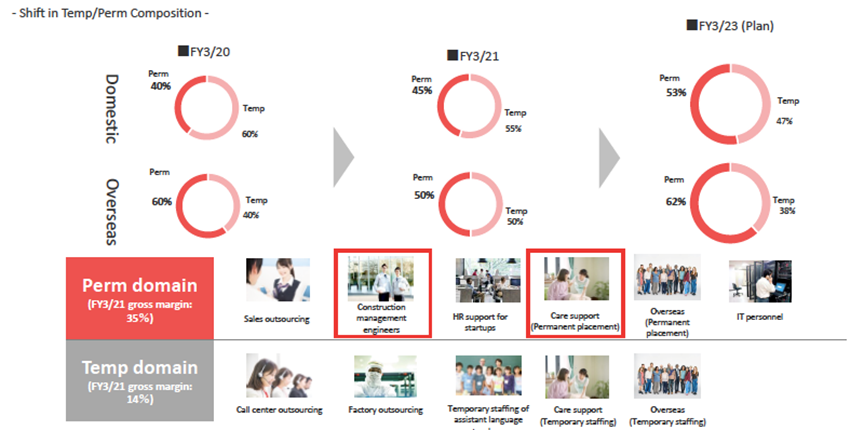

It advocates "high profitability through the WORK SHIFT strategy."

The WORK SHIFT strategy is a strategy to increase operating profit margin through portfolio shift and digital shift.

Portfolio shift | The company aims to maximize and optimize growth opportunities by expanding the "permanent employment: Perm domain (permanent)," such as introducing human resources and dispatching human resources to highly specialized areas. This is called the Perm SHIFT. The gross profit margin for the Perm domain in the term ended March 2021 was 35%. |

Digital shift | The company aims to maximize and optimize employment opportunities centered on productivity improvement and business stability by promoting the digitalization of "fixed-term employment: Temp domain (temporary)" such as temporary staffing and business contracting. The gross profit margin for the Temp domain for the term ended March 2021 was 14%. |

Until now, the company has operated businesses in multiple categories, focusing on inexperienced and unqualified casual temporary staffing. Moving forward, it will expand the Perm domain portfolio, which has a high-profit margin, and increase the productivity in the Temp domain, improve the profit margin to transform into a highly profitable structure.

【1-3 Business portfolio management】

Based on the "positioning" of the above five domains, the company will classify and operate individual businesses as follows, aiming for "high profitability through the WORK SHIFT strategy," which is the basic policy.

(Reference material of the company)

【1-4 Priority Strategy】

The company will promote the following four strategies.

Strategy | Applicable domains |

Strategy 1: Improving profitability through shifting portfolios | Profit maximization domain Strategic investment domain |

Strategy 2: Improving productivity through a digital shift | |

Strategy 3: Search for the next strategic investment domain | Exploration domain |

Strategy 4: Financial strategy | Group-wide |

Strategy 1: Improving profitability through portfolio shift

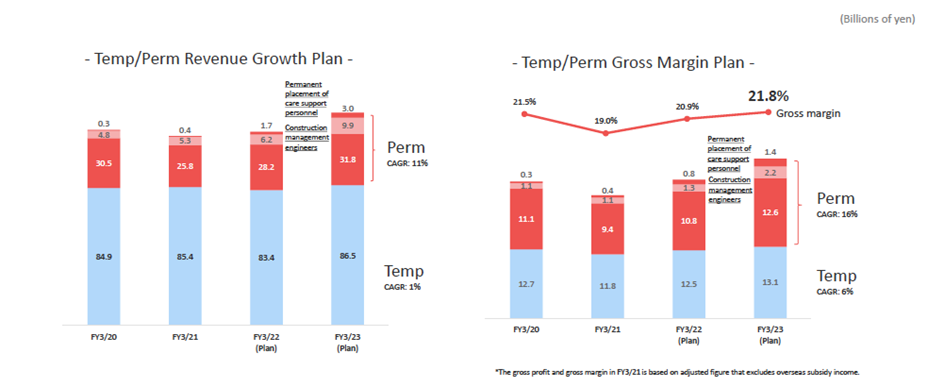

Improvement of gross profit margin by Perm SHIFT

The company will expand the sales of personnel introduction and temporary staffing to highly specialized areas both in Japan and overseas (Perm SHIFT).

In particular, the company will focus on the areas of nursing care and dispatching construction engineers.

In the term ending March 2023, the ratio of sales of the Perm domain is estimated to exceed 50% in Japan and overseas. Moreover, the gross profit margin rate will increase from 19.0% in the term ended March 2021 to 21.8%.

(Reference material of the company)

(Reference material of the company)

◎Construction management engineers field

The company will focus on hiring inexperienced personnel instead of its previous approach of focusing on hiring experienced personnel. The company will improve the high turnover rate and become the best in the construction engineer dispatching area.

The company will double the sales of 5.2 billion yen in the term ended March 2021 to 10 billion yen in the term ending March 2023.

In addition, it will significantly increase the number of inexperienced employees from 90 to 1,000.

To this end, in "customer acquisition," the company will enhance sales in the civil engineering area, which is a strength of experienced engineers, as well as private housing, plants, and subcontractor areas, that are easy to accept inexperienced personnel. The company will also increase sales personnel to improve sales in these areas.

In terms of "recruitment," the company will build a system that allows recruiting 400 new graduates and inexperienced mid-career per year. The number of new graduates recruited in April 2021 was 131.

Regarding the "retention rate," the training period before joining the company will be extended to close the gap after joining the company. It will also enhance the follow-up system for operating staff. The company believes that the know-how for improving the retention rate that it has accumulated so far will be effective.

The company plans to make upfront investments of 600 million yen in both the term ending March 2022 and the term ending March 2022, for a total of 1.2 billion yen to increase personnel and recruitment.

◎Care support field

The company will raise the sales ratio of personnel introduction from 3% in the term ended March 2021 to 16% in the term ending March 2023 to improve the profit margin.

It will also expand sales from 13.2 billion yen in the term ended March 2021 to 18.3 billion yen in the term ending March 2023.

Of this, the company will increase personnel introduction sales from 400 million yen to 3 billion yen. The number of personnel introduced will increase from 700 to 2,700.

In "personnel introduction," the company will increase the number of agents from 38 in the term ended March 2021 to 93 by the term ending March 2023 and acquire orders that utilize its customer base of temporary staffing. The company will also improve employment placement dispatching.

In "dispatching personnel," the company will open four new bases by the term ending March 2023 and actively hire foreign workers such as technical intern trainees and workers with specific skills.

In addition, the company will conduct follow-ups of staff and improve matching accuracy in order to "improve the retention rate."

The company plans to make upfront investments of 200 million yen for both the term ending March 2022 and the term ending March 2023, for a total of 400 million yen for increasing personnel and recruitment.

Fields other than care support and construction

In the profit maximization area, although top-line growth is gradual, the company aims to raise the gross profit margin by shifting to more profitable projects.

Sales support field | Perm domain | * Seize the opportunity to popularize 5G terminals to expand the sales in the stable communication field continuously * Strengthen the hiring of full-time on-site employees to increase sales agency services with a high gross profit margin |

Call center field | Temp domain | * Continue to expand financial projects with a high gross profit margin * Increase the market share per project and switch from dispatching staff to outsourcing to improve the gross profit margin * For novel coronavirus-related bidding projects, the company will actively work on profitability and, when it is possible, shift personnel after the end of the project. |

Factory field | Temp domain | * In preparation for deregulation of immigration policies after the end of the pandemic, the company will continue to strengthen the recruitment of foreign workers and aim to improve profitability by increasing the market share of the stable food sector. * In fields other than food, the company will shift to expanding receiving orders for electrical, electronic, and automobile parts fields, which have a higher gross profit margin than logistics, and consumer goods, even if it is same in terms of light work. |

Overseas WORK business | Perm domain Temp domain | * Expanding the group share within customers by sharing customers who are operating on a multinational level at all companies based in Australia and Singapore * Exploring new HR businesses that are different from dispatching and introducing personnel |

Strategy 2: Improving productivity through a digital shift

The company aims at productivity improvement through a digital shift centered on "efficiency through online operations and automation," "efficiency through centralized data management," "efficiency through telework and online interviews," and "efficiency associated with the integration of consolidated subsidiaries."

Strategy 3: Searching for areas for next strategic investments

HR Tech

The company will search for the next strategic investment businesses by repeating trials and errors.

By searching for businesses with high operating profit margins, the company aims to improve consolidated operating profit margins in the future.

Currently, the company is working on "LAPRAS," which handles the introduction of engineer personnel using AI, "Hour Money "and "Visa Money," foreigner employment management tools, and "ENPORT," a foreigner work support service. As the company solves the issues it faces, it will consider whether it should make upfront investments and develop into a growth business.

As for the services that target foreign workers, Visa Money and ENPORT, the company plans to increase the number of service users through Myanmar subsidiaries, Vietnamese subsidiaries and partners, and Indonesian partners from 15,000 in the term ended March 2021 to 80,000 in the term ending March 2023.

Strategy 4: Financial strategy

The company has set targets for three indicators as follows.

Financial items | Index | Goal | Overview |

Financial soundness | Ownership equity ratio attributable to owners of parent | Over 20% | The company will improve future growth investment and financial position. The ownership equity ratio attributable to owners of parent was 18% in the term ended March 2021. |

Capital efficiency | ROIC | Over 20% | The company will improve profitability and capital efficiency. ROIC was 14% in the term ended March 2021. WACC was at about 11%. |

Shareholder return | Total payout ratio | Over 30% | While securing growth investment, the company will enhance the return of profits. |

<Reference2: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with board of company auditor(s) |

Directors | 7 directors, including 3 external ones |

Auditors | 3 auditors, including 3 external ones |

Corporate Governance Report Updated on November 22, 2021

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

As of November 22, 2021, the company follows all the principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Cross held shares】

(1) Policies Regarding Cross-holding

Our company does not own any cross-held shares. We shall not own any such stocks in the future except cases where, taking into consideration the creation of business opportunities and the development, maintenance and strengthening of transactions and cooperative relations, we conclude that possessing such stocks will contribute to an increase in middle and long-term value of our company. After our company owns such stocks, if we decide, as per the policies mentioned above, that the benefit from owning these stocks is insufficient, we shall swiftly cut down these stocks.

(2) Details of discussion regarding cross-held shares

In the case of our company possessing cross-held shares, the board of directors will periodically evaluate the economic rationality, such as return on investment, regarding merits, risks and capital costs of possessing such stocks as well as future prospects and make a decision on whether to keep holding such stocks.

(3) Criteria for the Exercise of Voting Rights regarding Cross-held Shares

Regarding the exercise of voting rights related to cross-held shares, instead of unilaterally making a decision, decisions will be made on each item of the agenda individually, from a point of view of increasing company value in the middle and long-term as well as increasing returns for shareholders, while respecting the management policies and strategies of the company being invested in.

【Principle 5-1 Policies related to Constructive Interaction with Shareholders】

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website. Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director and executive officers in charge of the management headquarters aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy and continuity with regard to management and business strategies, financial information etc.

(2) The management headquarters takes a central role, and the management planning, general affairs, financial affairs, accounting, legal affairs departments, and IT department and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair and suitable fashion.

(3) As a means for interaction, we shall engage in the enrichment of company information sessions for shareholders.

(4) The opinions and worries of shareholders understood in our interactions will be quarterly reviewed appropriately and effectively in all our company meetings through the representative director and executive officers in charge of the management headquarters.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |