Bridge Report:(6089)WILL GROUP second quarter of fiscal year ending March 2023

Shigeru Ohara Representative director and President | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | TSE, Prime Market |

Industry | Services |

Chairman | Shigeru Ohara |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act.) | Trading Unit | |

¥1,268 | 22,595,250 shares | ¥28,651 million | 33.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER(Est.) | BPS (Act.) | PBR (Act.) |

¥44.00 | 3.5% | ¥147.47 | 8.6x | ¥505.08 | 2.5x |

*Stock prices as of the close on December 15, 2022. The number of shares issued is obtained by deducting the number of treasury shares from the number of shares issued as of the end of the latest quarter. ROE and BPS are the actual values in the previous term.

*DPS and EPS are the company’s forecasts for this term.

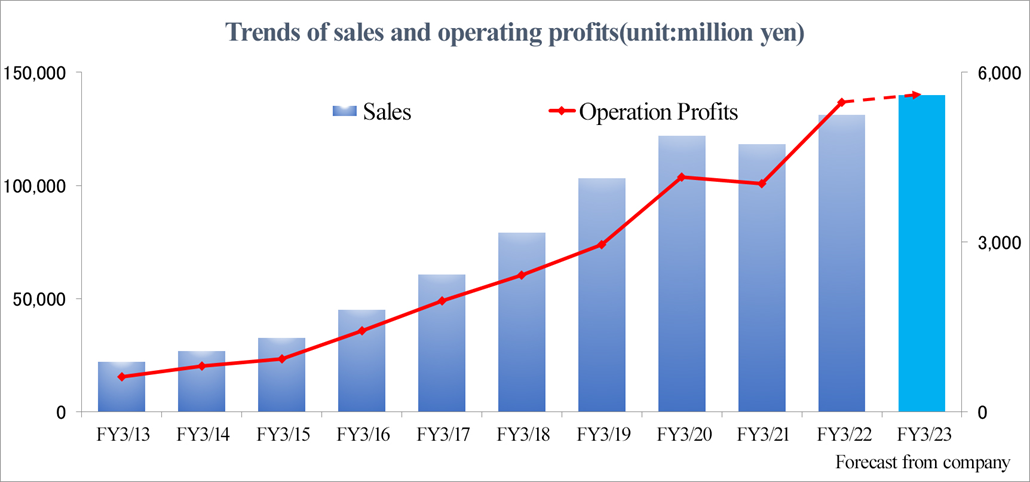

Transition in Consolidated Performance (Voluntary adoption of IFRS)

Fiscal Year | Sales | Operating Income | Ordinary Income, Pretax Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2019(Act.) | 103,300 | 2,957 | 2,876 | 1,539 | 69.46 | 18.00 |

March 2020(Act.) | 121,916 | 4,145 | 4,057 | 2,380 | 107.07 | 23.00 |

March 2021(Act.) | 118,249 | 4,030 | 3,788 | 2,363 | 106.35 | 24.00 |

March 2022(Act.) | 131,080 | 5,472 | 5,293 | 3,286 | 147.03 | 34.00 |

March 2023(Est.) | 140,000 | 5,600 | 5,490 | 3,330 | 147.47 | 44.00 |

*Estimated by the Company. (Unit: Million yen or yen)

This Bridge Report reviews second quarter of fiscal year ending March 2023 earnings results and fiscal year ending March 2023 earnings estimates.

Contents

Key Points

1. Company Overview

2. Second Quarter of Fiscal Year ending March 2023 Earning Results

3. Fiscal Year ending March 2023 Earnings Estimates

4. Progress of Medium-term Management Plan “WILL-being 2023”

5. Conclusions

<Reference 1: Basic policy of Medium-term Management Plan “WILL-being 2023”>

<Reference 2: Regarding Corporate Governance>

Key Points

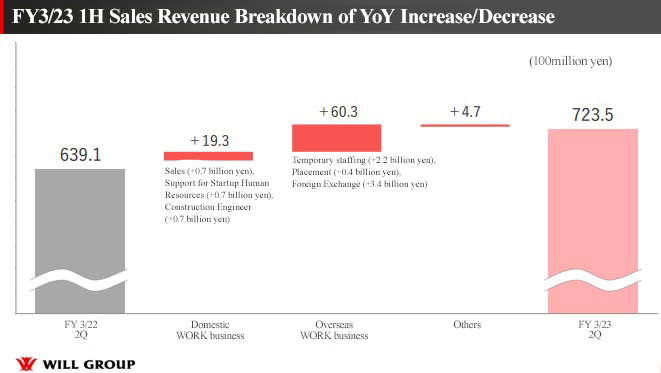

- The sales revenue in the second quarter of the term ending March 2023 was 72,358 million yen, up 13.2% year on year. Operating profit was 2,934 million yen, up 9.3% year on year. While the domestic WORK business was sluggish due to the spread of COVID-19, the overseas WORK business performed well thanks to the exchange rates, etc., contributing to the growth of sales and profit. As Perm SHIFT progressed, the gross profit margins of both the domestic and overseas WORK businesses increased year on year.

- As the first half of the term has ended, the company’s forecast for the term ending March 2023 is unchanged, calling for a sales revenue of 140 billion yen, up 6.8% from the previous term, and an operating profit of 5.6 billion yen, up 2.3% from the previous term. The company aims to make both sales revenue and operating profit exceed the management goals set in the mid-term management plan and hit a record high. The plan of paying a dividend of 44 yen/share, up 10 yen/share from the previous term, has been left unchanged. The expected payout ratio is 29.5%. The projected total return ratio is 30.2%.

- This term is the final fiscal year of the mid-term management plan. Regarding financial goals, the company is now expected to achieve the goals set in the mid-term management plan, except ROIC. On the other hand, it seems that the company is not satisfied with the progress of some priority strategies, such as the staffing support for start-up firms, construction engineers, expansion of the nursing-care domain, improvement in profitability of the domestic WORK business, utilization of digital technologies, and expansion of services for non-Japanese residents in Japan, as they are promoting them actively. With expectations, we would like to see whether they can make up for the delay in these strategies and complete all of them.

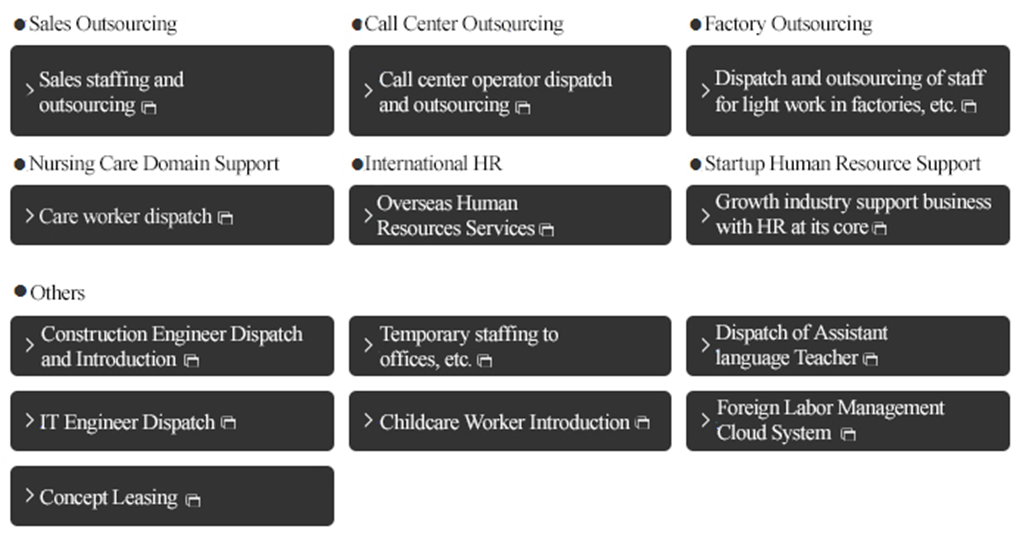

1. Company Overview

WILL GROUP, INC. is a holding company that provides HR services specialized at each category such as dispatching sales support staff, call center operators and manufacturing line staff primarily to food manufacturing, supporting nursing facilities’ personnel recruitment, dispatch of workers, such as construction engineers, temporary staffing and category-specific human resources services. The main feature of the Company is the “hybrid placement service,” by which permanent employees of Will Group called "field supporters" are stationed at the dispatched workplace. Will Group differentiates itself from its competitors by implementing its hands-on policy as it endeavors to develop new businesses.

There are group companies, including WILLOF WORK, Inc., which deals with the outsourcing of sales, call center operation and nursing care, for Startups, Inc., which is engaged in startup human resources support, WILLOF CONSTRUCTION, Inc., which offers construction engineer human resource services, and overseas subsidiaries that offer staffing services mainly in Asia and Oceania.

【1-1 WILL Vision and Management Philosophy】

WILL Vision is advocated as creating a strong brand with high expected value and becoming No. 1 in the business fields of “working,” “interesting,” “learning” and “living.”

Working | Business field to support “Working” |

Interesting | Business field to support “Interesting” |

Learning | Business field to support “Learning” |

Living | Business field to support “Living” |

Will Group, which adopted a holding company system in 2006, operates services such as temporary staffing, recruitment and outsourcing in Japan and overseas with the mission of becoming a “change agent group” that brings positive change to individuals and organizations. The number of consolidated employees exceeds 3,000, and the group consists of over 50 brand development companies. The group is centered on the holding company, Will Group Inc., and aims to be No.1 in the business areas of "working," "playing," "learning," and "living" by demonstrating group synergies.

【1-2 Business Content】

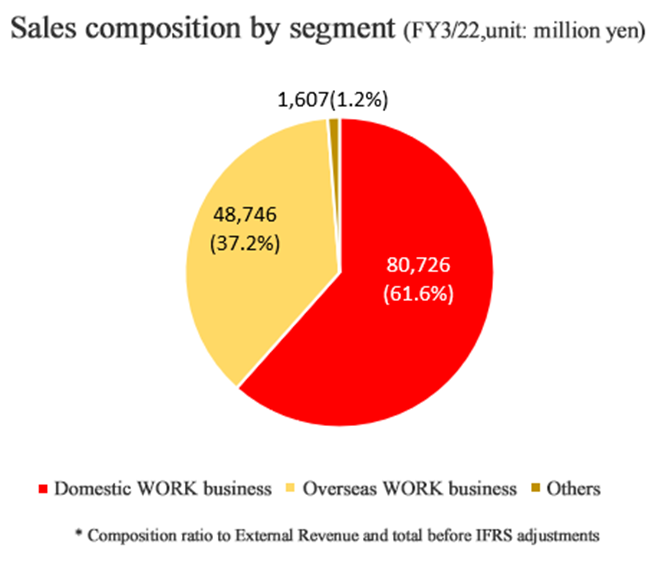

The business has been classified into three segments: domestic WORK business, overseas WORK business, and others.

Domestic WORK business

In Japan, the company provides personnel introduction, temporary staffing, and outsourcing contracts specializing in categories such as the sales support field, call center, factory, nursing care, childcare and construction engineers, etc. It also offers personnel support for start-ups.

◎Sales support field: WILLOF WORK, Inc., and CreativeBank INC.

This section mainly provides mass consumer electronics retailers with sales support to help them expand the sales of their products and services and assist leading IT companies in planning and managing product promotion campaigns. Regarding sales support for mass consumer electronics retailers, the company supports the sale of smartphones, manages store staff, places staff to collect and communicate sales information, assembles teams (through its hybrid temporary staffing), undertakes sales tasks, and introduces personnel. In addition, the company offers services such as the recruitment of full-time and part-time staff to clients with high direct employment needs using its recruitment and staffing capabilities to provide the best fit to the apparel industry.

◎Call center field: WILLOF WORK, Inc.

This section provides client companies that operate call centers and client companies that offer telemarketing services with support in building trust with end users. The company mainly specializes in communication companies and BPO (continuously outsourcing part of the business process to an external company), to which it dispatches personnel and teams (hybrid temporary staffing) and introduces human resources who engage in after-sales service, consultation, receiving complaints, etc. It also has its own call center and undertakes telemarketing operations.

◎Factory segment: WILLOF WORK, Inc.

This section offers technologies and HR management know-how in the production process to its clients in the manufacturing industry, to improve their productivity. The company focuses on the food manufacturing industry, which is relatively unaffected by economic changes, to which it dispatches workers who perform light work such as production, inspection, quality control, sorting, and packing. It also dispatches teams (through its hybrid temporary staffing), undertakes production tasks, and introduces personnel.

◎Nursing care and childcare field: WILLOF WORK, Inc.

This section dispatches nursing care staff to companies that operate nursing care facilities and provides services that ensure the stable operation of nursing care facilities. The company offers employment services for facilities with high direct employment needs by dispatching experienced nursing care staff and teams (hybrid temporary staffing), undertaking facility operations, and introducing workers.

◎HR support for startups: for Startups, Inc.

It is a business that supports growing industries (ventures, start-up companies, etc.) centered on HR (Human Resources). It operates the information platform "START-UP DB (Startup Database)", which is the largest platform specializing in the growing industry fields in Japan.

◎Construction engineer field: WILLOF CONSTRUCTION, Inc.,

The company dispatches construction management engineers and introduces personnel to the construction industry in Japan, especially to general contractors and subcontractors.

◎Other fields: BORDERLINK, INC., etc.

The company offers services such as temporary staffing for offices and construction sites. It also dispatches ALTs (assistant language teachers) and engineers and offers staffing and personnel introduction services for nursery staff. In addition, the company operates Tech Residence, a rental housing that provides a community for human resources working in the tech field, such as IT engineers, and is building platforms in the HR Tech field, such as Visa Money, a cloud system for foreign labor management.

Overseas WORK Business

In the ASEAN and Oceania regions, the company dispatches and introduces personnel for government-affiliated projects, engineers, finance, legal affairs, etc.

WILL GROUP Asia Pacific Pte. Ltd., Good Job Creations (Singapore) Pte. Ltd., Scientec Consulting Pte. Ltd.,

The Chapman Consulting Group Pte. Ltd., Oriental Aviation International Pte. Ltd., Ethos BeathChapman,

Quay Appointments Pty Ltd., u & u Holdings Pty Ltd., DFP Recruitment Holdings Pty Ltd,

Asia Recruit Holdings Sdn.Bhd.

Others

The company is working on expanding the domain of HRTech with the aim of strengthening the development of new platforms that provide a community for human resources such as system engineers through concept rental management and the expansion of forms of businesses other than the labor-intensive business. An example of these platforms is "Enport," a foreign worker support service.

WILL GROUP, INC., etc.

【1-3 Strengths and Characteristics】

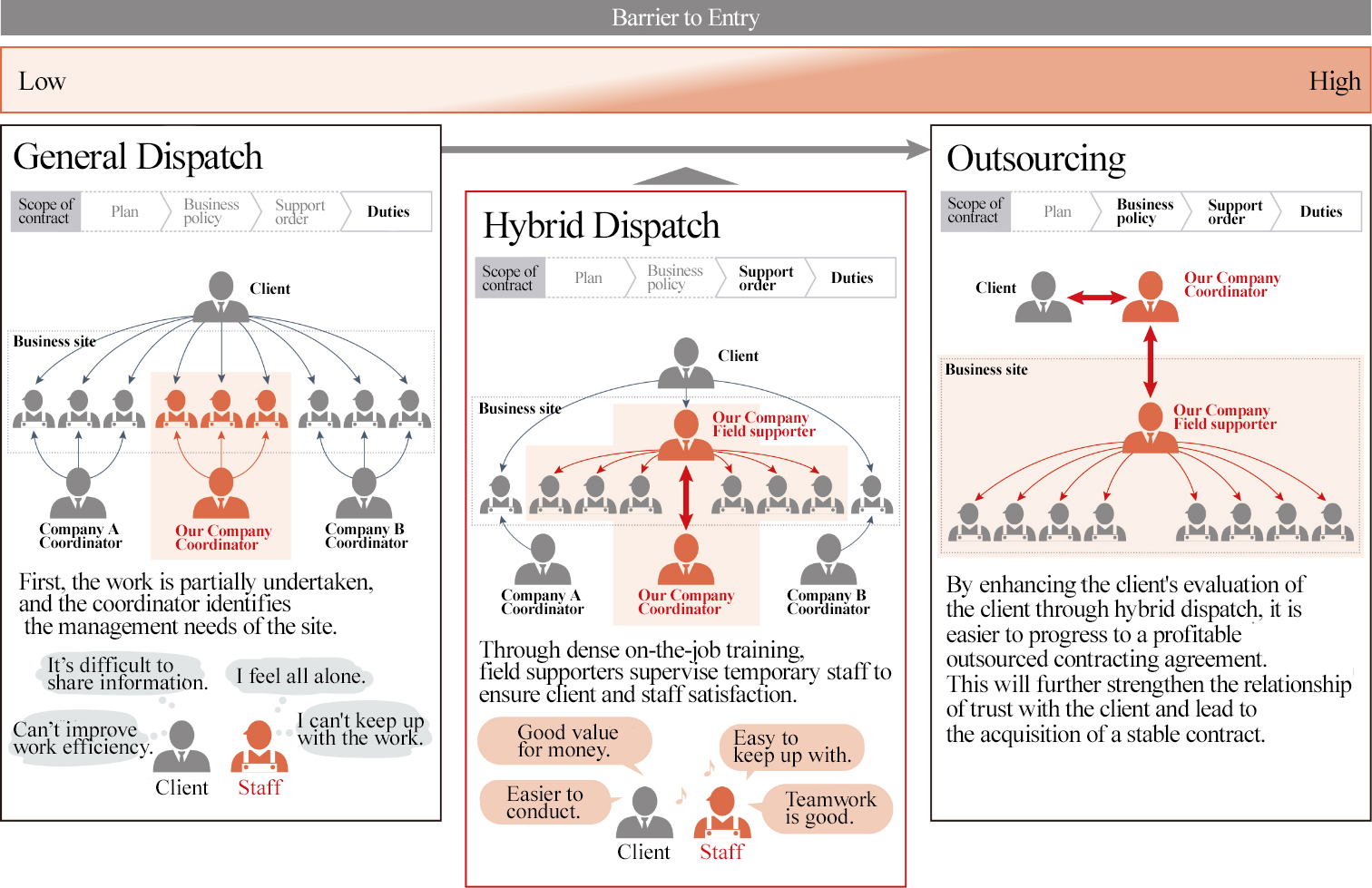

Hybrid temporary staffing

To progress from providing general dispatch services to offering highly profitable task-undertaking services, the corporate group has strategically introduced a unique service called "Hybrid temporary staffing." Hybrid temporary staffing is a service that allows the company's employees (field supporters) and temporary staff to work together as a team to respond to customer needs quickly and accurately. The company is increasing profitability and expanding its market share in three main businesses: sales, call centers, and light work in factories.

(Reference material of the company)

Category-specific temporary staffing

The corporate group operates businesses offering human resources services in industries including telecommunications, call centers, light work in factories, and nursing care. Specializing in such specific categories allows the company to provide high-quality services as a specialist in these fields. By grasping the business needs of each category and creating a system that can respond flexibly to them, the company has won the trust of both clients and staff.

(Reference material of the company)

【1-4 Business performance】

*The Japanese standards had been applied until FY 3/18, and IFRS has been applied since FY 3/19.

The company, founded in Osaka in 1997, started by offering human resources services and has gradually expanded its business domain. In 2006, the company shifted to a holding company system. In the second half of 2008, sales temporarily declined due to the Lehman Brothers collapse, but the company achieved a V-shaped recovery in 2011 through aggressive sales activities in Japan. Two years later, in 2013, the company was listed on the stock exchange, and in just one year, it was listed on the First Section of the Tokyo Stock Exchange. Since its inception, the company's earnings have maintained a growth trend. Due to the spread of COVID-19, the company was not able to increase sales and profit for the 10th consecutive term, but the company is returning to a growth trend.

2. Second Quarter of Fiscal Year ending March 2023 Earnings Results

【2-1 Consolidated earnings results (IFRS)】

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY | Initial Forecast | Ratio to the forecast |

Sales | 63,913 | 100.0% | 72,358 | 100.0% | +13.2% | 67,000 | +8.0% |

Gross Profit | 14,035 | 22.0% | 16,215 | 22.4% | +15.5% | 14,930 | +8.6% |

SG & A | 11,473 | 18.0% | 13,428 | 18.6% | 17.0% | 12,680 | +5.9% |

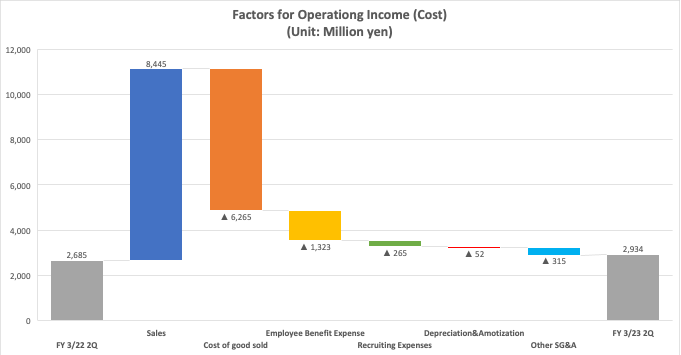

Operating Income | 2,685 | 4.2% | 2,934 | 4.1% | +9.3% | 2,250 | +30.4% |

Pretax Profit | 2,716 | 4.2% | 2,947 | 4.1% | +8.5% | 2,190 | +34.6% |

Net Income | 1,698 | 2.7% | 1,743 | 2.4% | +2.7% | 1,250 | +39.5% |

*Unit: Million yen.

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

*▲ in expenses represents the augmentation of the expenses.

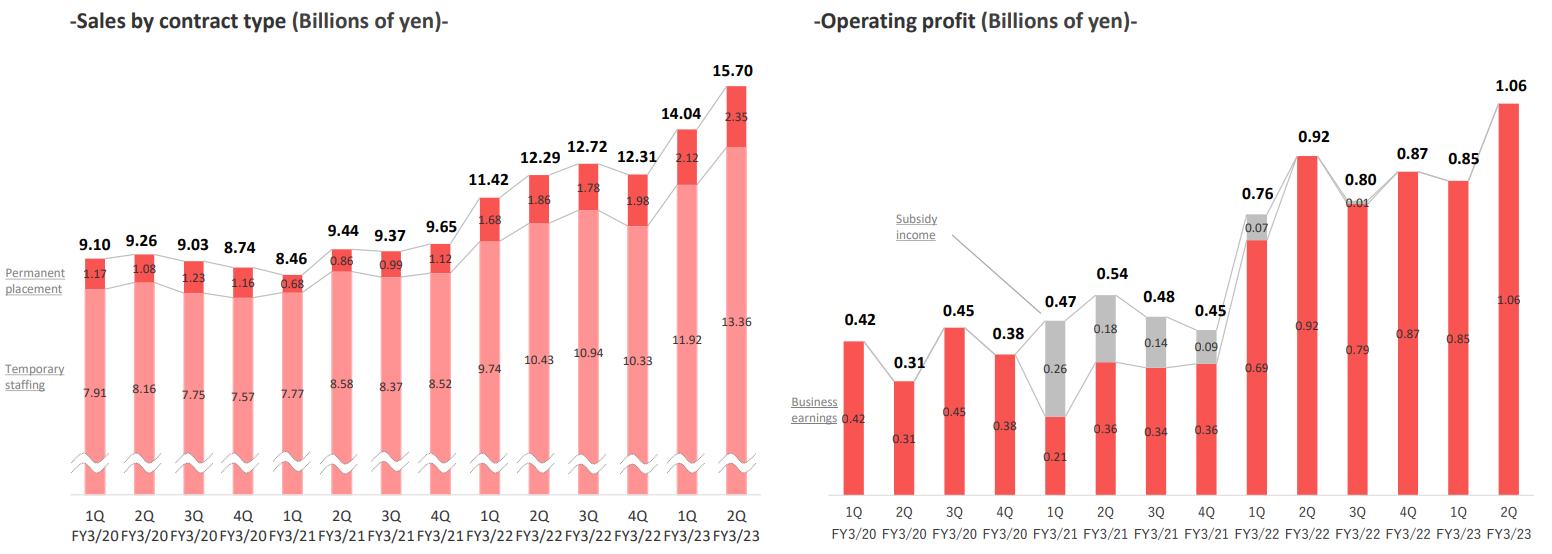

Sales and operating profit grew 13.2% and 9.3%, respectively, year on year.

Sales revenue increased 13.2% year on year to 72,358 million yen, and operating profit rose 9.3% year on year to 2,934 million yen.

The Will Group implemented the “WORK SHIFT Strategy” for the purpose of increasing operating profit margin through the portfolio shift and the digital shift, in order to complete the mid-term management plan “WILL-being 2023,” whose final fiscal year is the term ending March 2023.

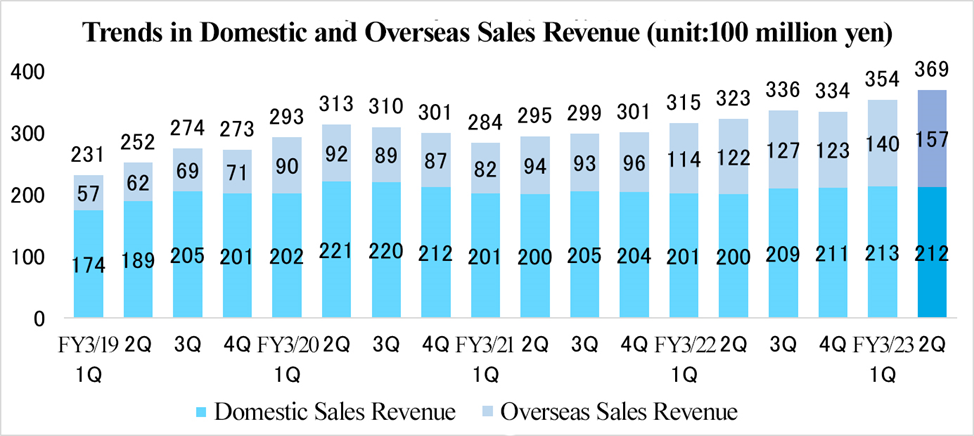

Due to the resurgence of COVID-19, domestic sales revenue was sluggish, but overseas sales revenue was healthy in the businesses of introducing and dispatching workers, and exchange rates, too, contributed. Sales revenue increased 8.44 billion yen year on year, while the change in exchange rates accounted for 3.4 billion yen. In addition, sales revenue was 5.35 billion yen larger than the initial forecast, while the change in exchange rates accounted for 5 billion yen.

Operating profit grew, as overseas sales revenue increased and gross profit rose, although the company made an upfront investment of 470 million yen strategically. Operating profit grew 240 million yen year on year, while the change in exchange rates accounted for 230 million yen. In addition, operating profit was 680 million yen larger than the initial forecast, while the change in exchange rates accounted for 300 million yen.

Gross profit was 16,215 million yen, up 8.6% year on year, exceeding the sales growth rate. Thanks to Perm SHIFT, gross profit margin improved 0.4 points year on year, and exceeded the initial forecast by 0.1 points. Quarterly gross profit margin decreased 0.5 points from 22.7% in the first quarter (Apr.-Jun.) to 22.2% in the second quarter (Jul.-Sep.) but remained high. On the other hand, the ratio of SGA to sales increased 0.6 points year on year. As a result, operating profit margin declined 0.1 points year on year to 4.1%.

The upfront investment in the strategic investment field (construction, start-up business, and nursing-care) in the second quarter (Apr.-Sep.) was 470 million yen, falling below the forecast by 200 million yen. The company plans to carry over a part of the unused budget in the third quarter or later.

【2-2 Trend of quarterly results】

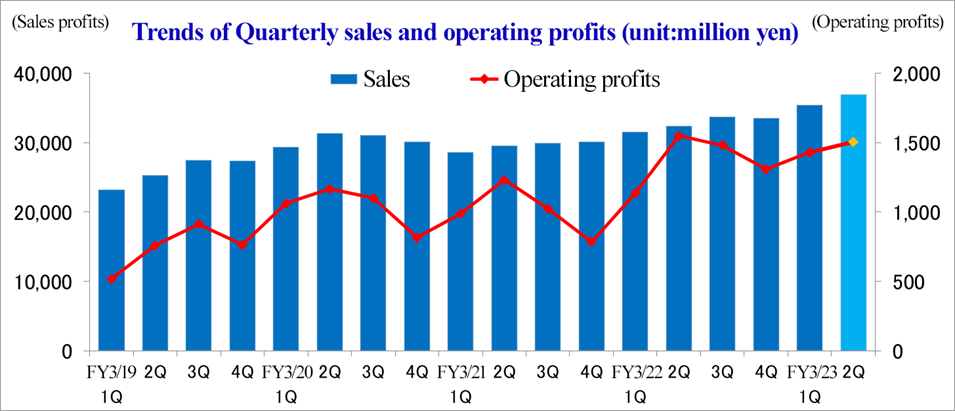

Sales and profit in the second quarter (Jul.-Sep.) of the term ending March 2023 increased from the first quarter (Apr.-Jun.), but profit slightly declined year on year, while sales grew year on year.

In the second quarter (Jul.-Sep.) of the term ending March 2023, overseas operating profit remained healthy, but domestic one was stagnant due to the resurgence of COVID-19. In the second quarter (Jul.-Sep.) of the term ending March 2023, operating profit grew 1.5 billion yen from the first quarter (Apr.-Jun.), while the change in exchange rates accounted for 200 million yen.

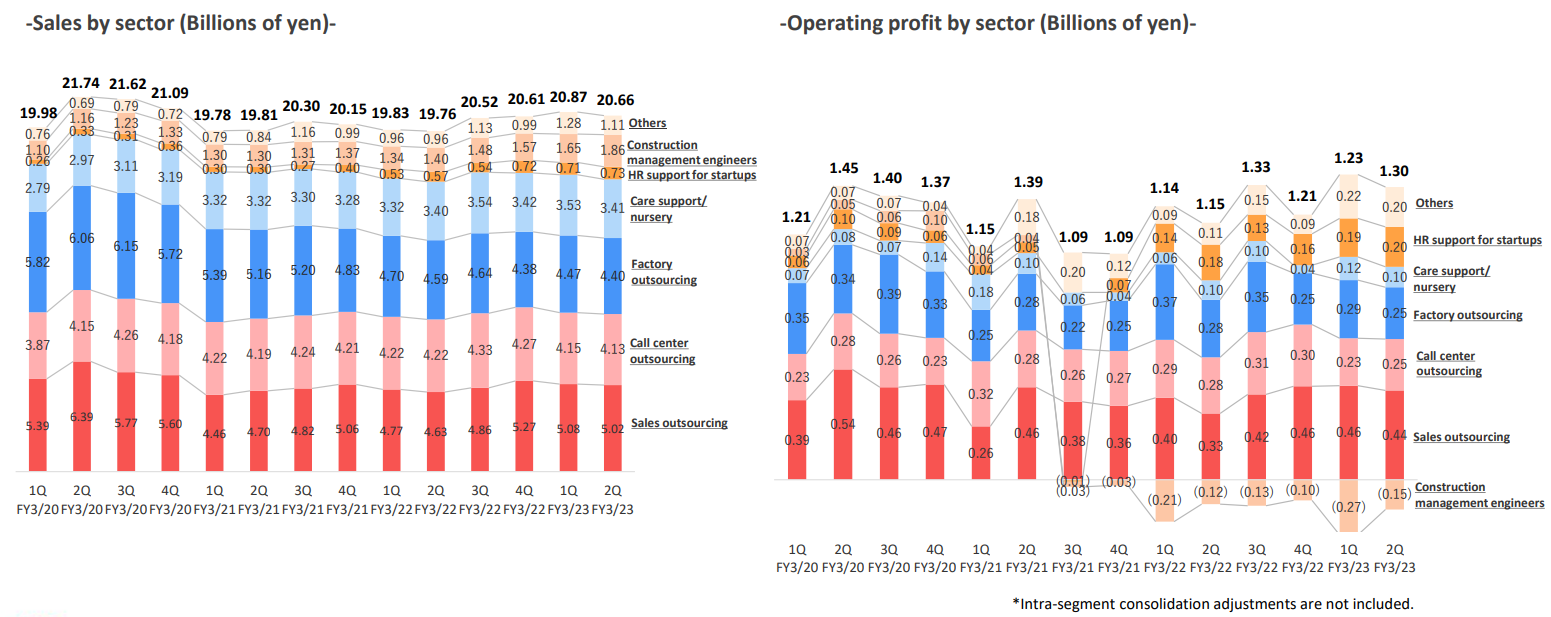

【2-3 Trend by Segment】

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY |

Domestic WORK business | 39,594 | 62.0% | 41,525 | 57.4% | +4.9% |

Overseas WORK business | 23,709 | 37.1% | 29,744 | 41.1% | +25.5% |

Other | 609 | 1.0% | 1,088 | 1.5% | +78.7% |

Revenue | 63,913 | 100.0% | 72,358 | 100.0% | +13.2% |

Domestic WORK business | 2,160 | 59.5% | 2,277 | 56.4% | 5.4% |

Overseas WORK business | 1,676 | 46.2% | 1,914 | 47.4% | +14.2% |

Others | -205 | -5.6% | -156 | -3.9% | - |

Adjustments | -946 | - | -1,101 | - | - |

Operating Profit | 2,685 | - | 2,934 | - | +9.3% |

*Unit: Million yen.

(Reference material of the company)

Domestic WORK business

Sales revenue grew 4.9% year on year to 41,525 million yen, and profit rose 5.4% year on year to 2,277 million yen.

Sales revenue was healthy in the fields of staffing support for start-up firms and construction engineers, but it was sluggish in the other fields, due to the resurgence of COVID-19 from July to September 2022. On the other hand, the company concentrated on the increase of customers for new services, such as sales outsourcing and home-based contact centers, for the age of leading a daily life while coping with the novel coronavirus in each field.

Profit increased as sales revenue grew and gross profit rose, while the company made an upfront investment for increasing marketing and consulting staff in the fields of construction engineers and staffing support for start-up firms, in preparation for Perm Shift (personnel introduction services and dispatching human resources to highly specialized areas).

In the second quarter, the number of workers in service dropped due to the spread of COVID-19, except the field of construction engineers. In addition, the company made an upfront investment in the field of construction engineers (300 million yen) and the field of staffing support for start-up firms (100 million yen).

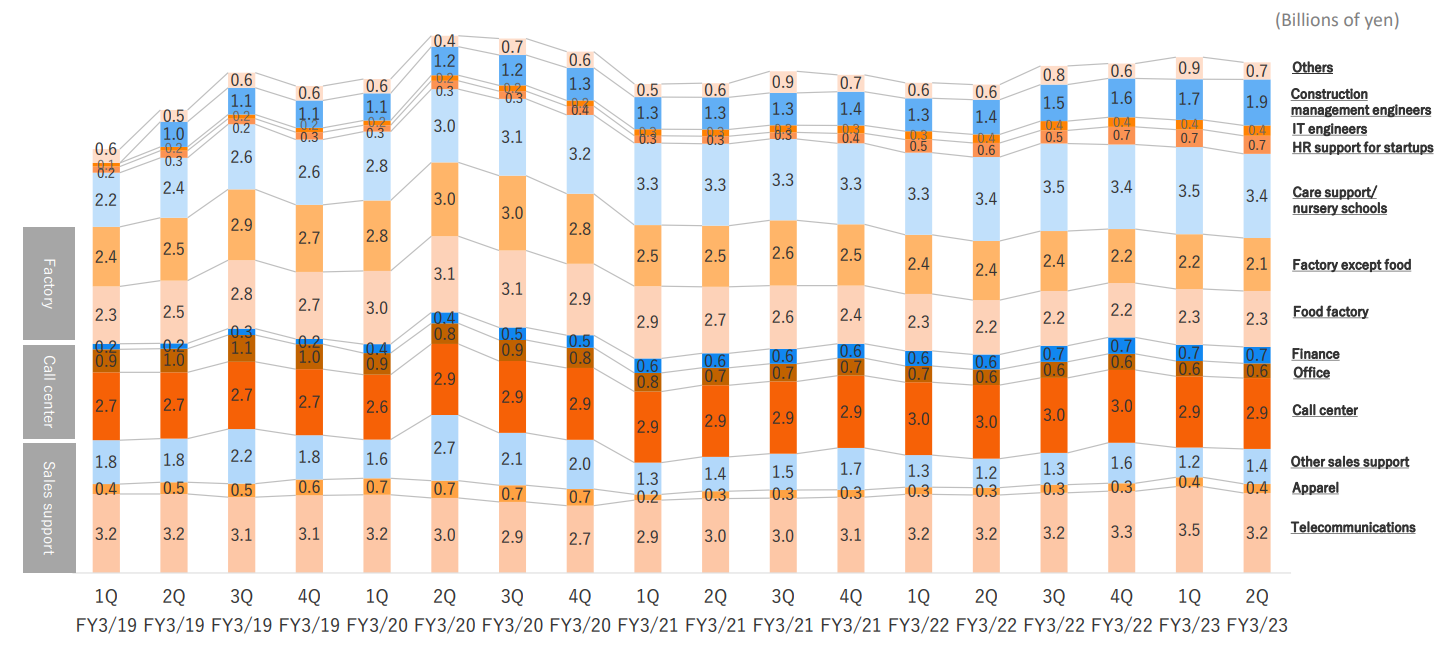

(Reference material of the company)

(Reference material of the company)

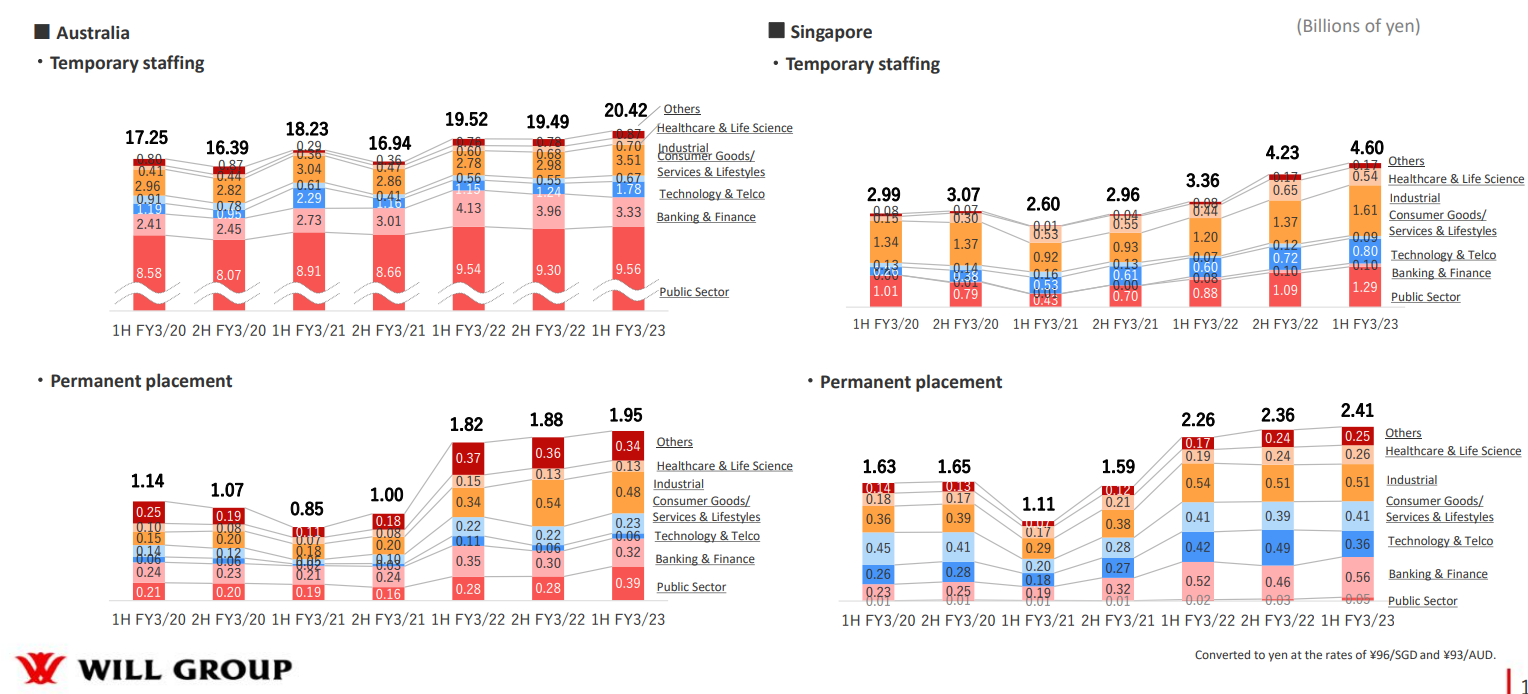

Overseas WORK business

Sales revenue grew 25.5% year on year to 29,744 million yen, and profit rose 14.2% year on year to 1,914 million yen.

The sales revenues of the businesses of introducing and dispatching workers were healthy, as economic recovery was seen due to the lifting of restrictions on entry to both Australia and Singapore and the number of job openings hit a record high in both countries, showing high demand for workers. In particular, the dispatch of workers to governments and administrative organizations in both countries was stable.

Profit increased, as the sales from introduction of personnel grew, raising gross profit, and the yen depreciation progressed, while personnel expenses, etc. augmented and the revenue from governmental subsidies for supporting employment to cope with the novel coronavirus in Singapore, which was posted in the same period of the previous year, dropped.

In addition, the yen weakened against the Australian dollar and the Singaporean dollar, producing a favorable effect. Thanks to this favorable effect, sales revenue and operating profit increased 5 billion yen and 300 million yen, respectively, compared with the forecast, and sales revenue and operating profit grew 3.4 billion yen and 230 million yen, respectively, year on year.

(Reference material of the company)

*Unit: Million yen.

(Reference material of the company)

Other

Sales revenue grew 78.7% year on year to 1,088 million yen, and segment loss was 156 million yen (205 million yen in the same period of the previous year).

In the aspect of sales revenue, the company kept enhancing the development of new platforms, such as “Enport,” a service for supporting non-Japanese people in living in Japan, to expand businesses other than the labor-intensive business.

In the aspect of profit, SGA decreased, as the company downsized the service for non-Japanese workers although there emerged a sign of lifting of restrictions on the entry of foreign workers and others to Japan while the company continued the investment in development of new platforms.

【2-4 Financial Position and Cash Flow】

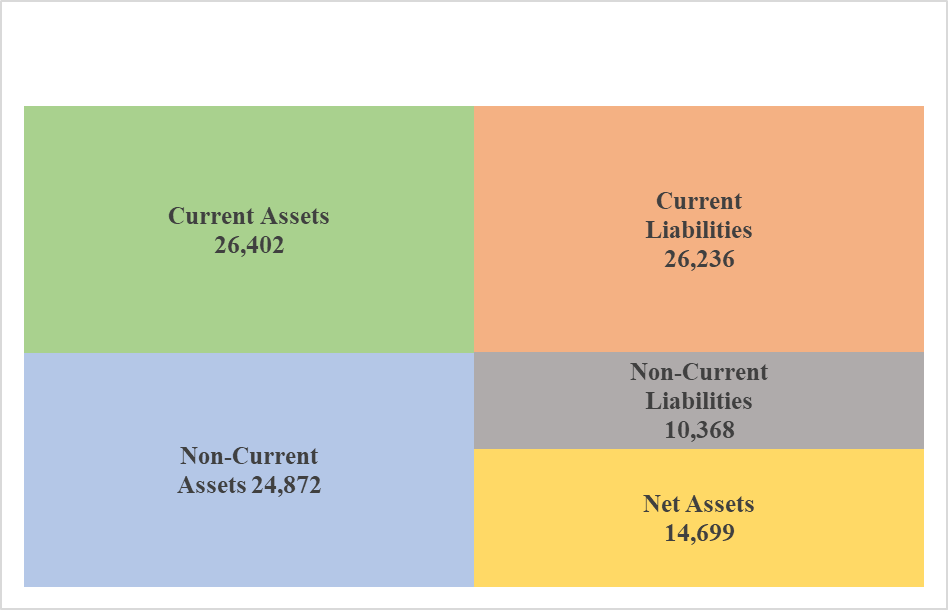

◎Balance Sheet

| Mar. 22 | Sep. 22 |

| Mar. 22 | Sep. 22 |

Current Assets | 27,289 | 26,402 | Current liabilities | 29,361 | 26,236 |

Cash | 8,973 | 7,102 | Operating debts, other debts | 15,297 | 16,293 |

Receivables, other receivables | 17,458 | 18,013 | Other current liabilities | 1,836 | 1,928 |

Non-Current Assets | 25,061 | 24,872 | Non-current liabilities | 9,867 | 10,368 |

Tangible fixed assets | 1,223 | 1,158 | Other financial debts | 6,285 | 5,923 |

Right-of-use assets | 6,809 | 6,260 | Total liabilities | 39,228 | 36,605 |

Goodwill | 6,514 | 6,796 | Total equity | 13,121 | 14,669 |

Other Intangible Assets | 6,154 | 6,182 | Equity attributable to owners of the parent augmented | 11,398 | 13,431 |

Other Financial Assets | 1,208 | 1,274 | Total liabilities and equity | 52,350 | 51,275 |

Total assets | 52,350 | 51,275 | Borrowings | 7,988 | 8,529 |

*Unit: Million yen

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

The total assets as of the end of September 2022 stood at 51,275 million yen, down 1,074 million yen from the end of the previous term. The primary factors in increasing assets were accounts receivable, other receivables, other current assets, and goodwill affected by exchange rates through the yen depreciation, while the primary factors in decreasing assets were cash & deposits and use rights. The primary factors in increasing liabilities and net assets were accounts payable, other payables, income taxes payable, debts, retained earnings, and the effect of exchange rate changes of marketing organizations outside Japan among other capital components, while the primary factors in decreasing liabilities and net assets were other financial liabilities among current and non-current liabilities, and non-controlling interest.

The ratio of equity of owners of the parent company increased 4.4% from the end of the previous term to 26.2%, exceeding the target value of 20% set in the mid-term management plan. The interest-bearing liability ratio after EBITDA adjustment increased 0.1 points to 0.8, the ratio of equity of owners of the parent company after adjustment of goodwill rose 0.1 points to 0.5, and the DE ratio after adjustment grew 0.2 points to 0.1.

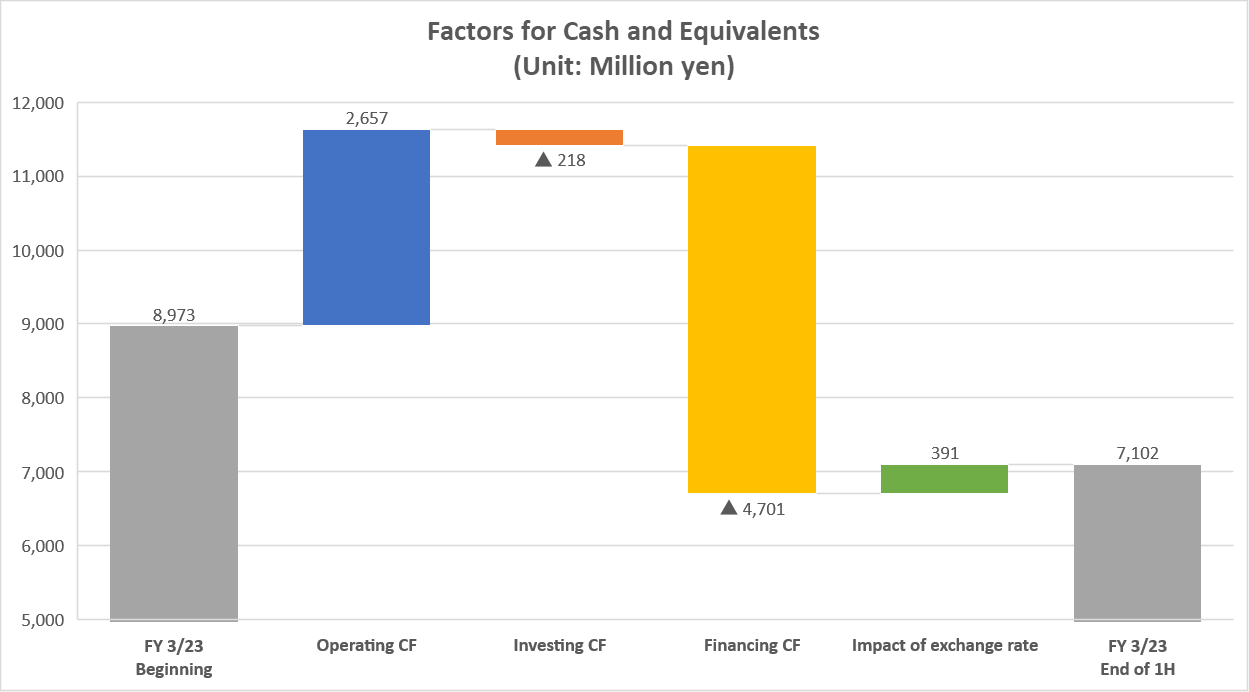

◎Cash Flow

| FY3/22 2Q | FY3/23 2Q | Increase/decrease |

Operating cash flow (A) | 2,115 | 2,657 | 542 |

Investing cash flow (B) | 147 | -218 | -365 |

Free cash flow (A+B) | 2,262 | 2,439 | 177 |

Financing cash flow | -3,661 | -4,701 | -1,040 |

Cash, equivalents at term-end | 5,995 | 7,102 | 1,107 |

*Unit: Million yen

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

In the aspect of cash flows, the cash inflow from operating activities expanded due to the increase in pretax profit and operating payables, etc. The cash flow from investing activities turned negative due to the expenditure for investment activities, etc., but the surplus of free cash flow expanded. On the other hand, the cash outflow from financing activities augmented, due to the decrease in short-term debt, the increase in payments from changes in ownership interests in subsidiaries that do not result in change in scope of consolidation. As a result, the term-end cash position increased 18.5% year on year.

3. Fiscal Year ending March 2023 Earnings Estimates

【3-1 Consolidated Earnings Estimate】

| FY 3/22 | Ratio to sales | FY 3/23 (Est.) | Ratio to sales | YoY |

Sales | 131,080 | 100.0% | 140,000 | 100.0% | +6.8% |

Gross Profit | 28,765 | 21.9% | 31,580 | 22.6% | +9.8% |

SG & A | 5,472 | 4.2% | 5,600 | 4.0% | +2.3% |

Operating Income | 5,293 | 4.0% | 5,490 | 3.9% | +3.7% |

Pretax Profit | 3,286 | 2.5% | 3,330 | 2.4% | +1.3% |

Profit attributable to owners of parent | 131,080 | 100.0% | 140,000 | 100.0% | +6.8% |

*Unit: Million yen.

Sales and operating profit are expected to increase 6.8% and 2.3%, respectively, from the previous term.

As the first half of the term has ended, the company’s forecast for the term ending March 2023 is unchanged, calling for a sales revenue of 140 billion yen, up 6.8% from the previous term, and an operating profit of 5.6 billion yen, up 2.3% from the previous term. The company aims to make both sales revenue and operating profit exceed the management goals set in the mid-term management plan and hit a record high.

The plan of paying a dividend of 44 yen/share, up 10 yen/share from the previous term, has been left unchanged. The expected payout ratio is 29.5%. The projected total return ratio is 30.2%.

The performance in the first half of the term exceeded the forecast of the company, but it is projected that the domestic WORK business will fall below the forecast as mentioned below.

Sales revenue is forecast to fall below the initial forecast, as the receipt of orders for new projects was delayed due to the resurgence of COVID-19 from July to September and the number of workers in service did not increase, although the initial forecast called for the improvement in performance of the domestic WORK business from the third quarter. On the other hand, the overseas WORK business is projected to exceed the initial forecast, as the demand for workers is expected to remain strong in the third quarter and following quarters and the change of exchange rates will produce a favorable effect.

Operating profit is projected to fall below the initial forecast, because the sales revenue of the domestic WORK business is expected to decline, and the company plans to invest about 200 million yen strategically in the third quarter or later. On the other hand, the sales revenue of the overseas WORK business is projected to exceed the initial forecast, due to exchange rates, etc.

| FY3/23 Results in 1H | FY 3/23 Company plan | Progress rate |

Sales revenue | 72,358 | 140,000 | 51.7% |

Operating profit | 2,934 | 5,600 | 52.4% |

Profit attributable to owners of parent | 1,743 | 3,330 | 52.3% |

*Unit: Million yen.

【3-2 Estimate in Each Segment】

| FY 3/22 | FY 3/23 (Est.) | YoY | FY 3/23 (Initial Est.) | Increase/decrease to Initial Est. | Change to Initial Est. |

Domestic WORK Business | 80,726 | 84,850 | +5.1% | 88,980 | -4,130 | -4.6% |

Overseas WORK Business | 48,746 | 52,780 | +8.3% | 49,030 | +3,750 | +7.7% |

Other | 1,607 | 2,350 | +46.2% | 1,980 | +370 | +19.1% |

Revenue | 131,080 | 140,000 | 6.8% | 140,000 | 0 | 0.0% |

Domestic WORK Business | 4,448 | 4,440 | -0.2% | 5,690 | -1,250 | -22.0% |

Overseas WORK Business | 3,348 | 3,630 | +8.4% | 2,580 | +1,040 | +40.4% |

Other | -342 | -190 | -44.4% | -190 | 0 | - |

Adjustments | -1,981 | -2,270 | +14.6% | -2,480 | +210 | - |

Operating profit | 5,472 | 5,600 | +2.3% | 5,600 | 0 | 0.0% |

*Unit: Million yen.

Domestic WORK business

Sales revenue is projected to increase 5.1% from the previous term to 84,550 million yen, and operating profit is expected to decline 0.2% from the previous term to 4,440 million yen.

Domain | Difference between the earnings forecast and the outlook |

Sales outsourcing domain | The business has progressed as planned as a whole, despite the effects of the termination of contracts for existing large-scale projects, etc. |

Call center outsourcing domain | The number of workers in service decreased due to the revision to the recruitment plans of existing clients in addition to the resurgence of COVID-19. The company will work on strengthening order acquisition. |

Factory outsourcing domain | The sales of services of introducing workers and management of employment of non-Japanese workers decreased, as clients continued production adjustment and the number of non-Japanese workers who have entered Japan fell below the assumed number. The company will work on the curtailment of costs. |

Nursing-care business domain | The sales from introduction of workers declined due to the resurgence of COVID-19 and the revision to the policy for dispatch of workers. The company will work on the curtailment of costs. |

Start-up personnel support domain | The business performed well. The company will enhance the recruitment of workers, including consultants. |

Construction engineer’s domain | The recruitment of inexperienced workers fell behind the schedule. The company will work on the expansion of recruitment channels. |

Overseas WORK business

It is projected that sales revenue will rise 8.3% from the previous term to 52,780 million yen and operating profit will increase 8.4% from the previous term to 3,630 million yen.

In addition to the effect of exchange rates, the demand for personnel introduction is expected to remain strong in the third quarter and the following quarters.

| FY3/23 1H | FY3/23 (Initial Est.) | FY3/23 (Est.) | YoY |

Sales of Domestic WORK business | 415.2 | 889.8 | 848.5 | -4.6% |

Sales support | 100.9 | 206.6 | 203.2 | -1.6% |

Call center | 82.8 | 184.2 | 166.8 | -9.5% |

Factory | 88.7 | 191.1 | 182.6 | -4.5% |

Nursing care | 69.3 | 147.6 | 135.9 | -7.9% |

HR support for startups | 14.3 | 28.0 | 28.0 | 0.0% |

Construction engineers | 35.1 | 83.0 | 76.8 | -7.4% |

Sales of Overseas WORK business | 297.4 | 490.3 | 527.8 | +7.7% |

Operating Income of Domestic WORK business | 22.7 | 56.9 | 44.4 | -22.0% |

Sales support | 9.0 | 18.7 | 17.8 | -4.9% |

Call center | 4.8 | 13.0 | 8.6 | -34.0% |

Factory | 5.4 | 14.5 | 11.0 | -24.4% |

Nursing care | 2.1 | 7.1 | 4.0 | -43.7% |

HR support for startups | 3.8 | 5.7 | 5.7 | 0.0 |

Construction engineers | -4.2 | -4.3 | -5.8 | - |

Operating Income of Overseas WORK business | 19.1 | 25.8 | 36.3 | +40.4% |

*Unit: 100 million yen

4. Progress of Medium-term Management Plan "WILL-being 2023"

(1) Quantitative goals

In the term ended March 2022, almost all indices such as sales revenue, gross profit margin, operating income, ROIC and equity ratio exceeded the goals.

In the term ending March 2023, the company plans to make an upfront investment of 1.3 billion yen in accordance with the medium-term management plan. Regarding financial targets, excluding ROIC, the company expects to achieve the targets set in the medium-term management plan. They will aim to achieve the goal for ROIC through the revision of invested capital, etc.

| FY3/22 | FY3/23 | ||

| Plan | Earnings Results | Plan | Earnings Forecast |

Revenue | 1,210 | 1,310 | 1,335 | 1,400 |

Gross Profit Margin | 21.2% | 21.9% | 22.6% | 22.6% |

S&GA | 222 | 235 | 248 | 259 |

Operating Income | 34.0 | 54.7 | 53.5 | 56.0 |

Operating Income Margin | 2.8% | 4.2% | 4.0% | 4.0% |

ROIC | 12.0% | 17.9% | 20.0% | 18.6% |

Capital Adequacy Ratio | 19.0% | 21.8% | 22.0% | 24.8% |

Total Propensity to reduce | 30.6% | 23.6% | 30.0% | 30.2% |

*Unit: 100 million yen

(2) Progress of priority strategies

The four key strategies are progressing as planned. However, it is necessary to change the worker dispatch strategy in the strategic investment area of Nursing Care. Moreover, the progress of improving productivity through a digital shift and enhancing services for foreigners living in Japan has not been satisfactory. The company aims to achieve a quick recovery in the areas where progress has been delayed and accomplish all items of its priority strategies.

◎ Strategy I: Improving profitability through a portfolio shift (Domestic WORK business and overseas WORK business) - profit maximization areas and strategic investment areas

Details | |

◆Expand Perm (personnel introduction services and dispatching human resources to highly specialized areas). In particular, the company is focusing on supporting the fields of nursing care, construction engineers, and start-up personnel support (index) ・Strategic investment area = sales growth rate ・Profit maximization area = operating profit margin | |

Progress in the second quarter of the term ending March 2023 | |

△ | <Strategic investment area> ◆Construction: 〇 (Increase of new graduates and inexperienced mid-career hires) ◆Nursing care: △ (The number of orders is sluggish due to the resurgence of the novel coronavirus. The strategy for temp-to-perm hiring was changed in the 1st quarter.) ◆ Start-up personnel support: 〇 (excellent progress) |

△ | <Profit maximization area> ◆Domestic W: △ (The pace of improvement in operating profit margin slowed down due to sluggish sales because of the resurgence of the novel coronavirus. Costs will be reviewed from the third quarter) ◆Overseas W: 〇 (Even after excluding the impact of foreign exchange, the improvement pace steadily increased) |

◎ Strategy II: Improving productivity through a digital shift (Domestic WORK business and overseas WORK business) - Profit maximization area

Details | |

◆Improve productivity per person through the digital shift. | |

△ | ◆The company continued enhancing the WILLOF smartphone app functions (online application, etc.). In April 2022, the company started a staffed chat support. ◆The company integrated the core system (dispatch management) for construction engineers into the existing system. |

◎ Strategy III: Search for the next strategic investment area Exploration area

Details | |

◆Expansion of services for foreign residents in Japan ・Expansion of IT personnel services ◆Exploring the development of areas peripheral to core businesses in HR Tech | |

△ | ◆In May 2022, technical intern trainees and foreigners with specified skills came to Japan, but services for foreigners living in Japan fell below the company's initial estimates. ◆In IT human resources services, both orders for temporary staffing and personnel introduction services increased steadily. ◆The company is developing products such as construction engineers-related services. |

◎ Strategy IV: Financial strategy Group-wide

Details | |

◆Ratio of equity attributable to owners of the parent company: 20% or more ◆ROIC: 20% or higher (Capital cost is about 10%) ◆Total payout rati 30% or higher | |

○ | ◆The ratio of equity attributable to owners of the parent company is 26.2% as of the second quarter of the term ending March 2023. ◆The company aims to achieve target ROIC by increasing operating profit. ◆Total return ratio forecast for the term ending March 2023: 30.2% |

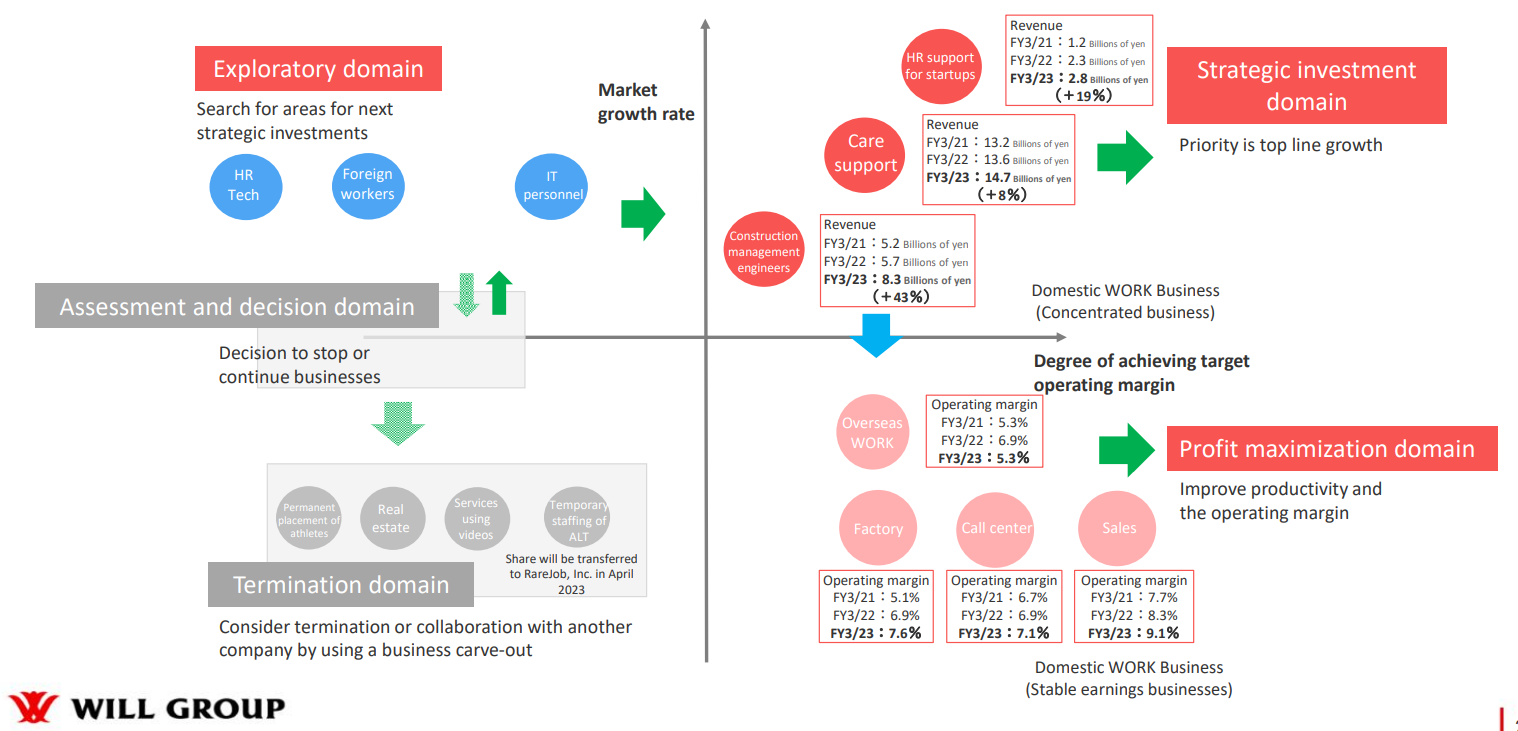

(3) Progress of business portfolio shift

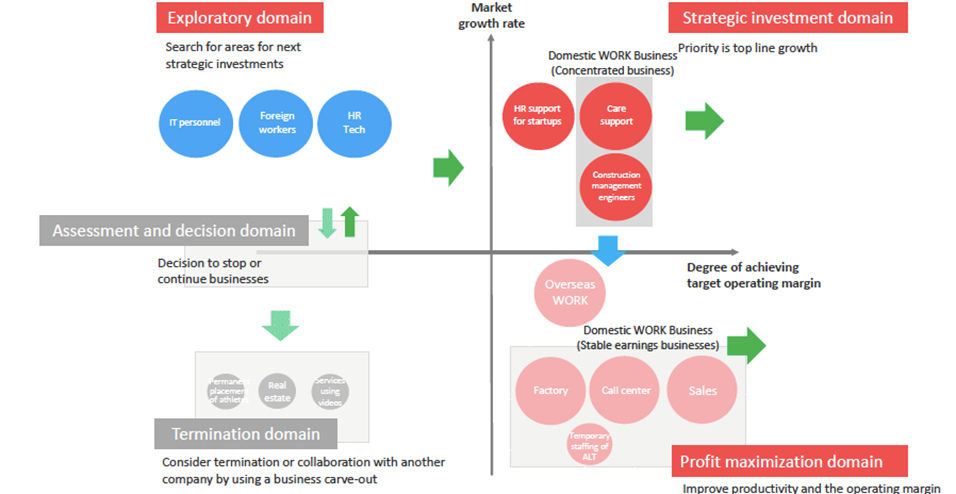

The company classifies and operates individual businesses in the five fields of “profit maximization,” “strategical investments,” “exploration,” “assessment” and “withdrawal,” and aims to “realize a profitable structure based on the WORK SHIFT strategy,” which is their basic policy. Although there are some delays in progress, the company is making steady progress overall.

(Reference material of the company)

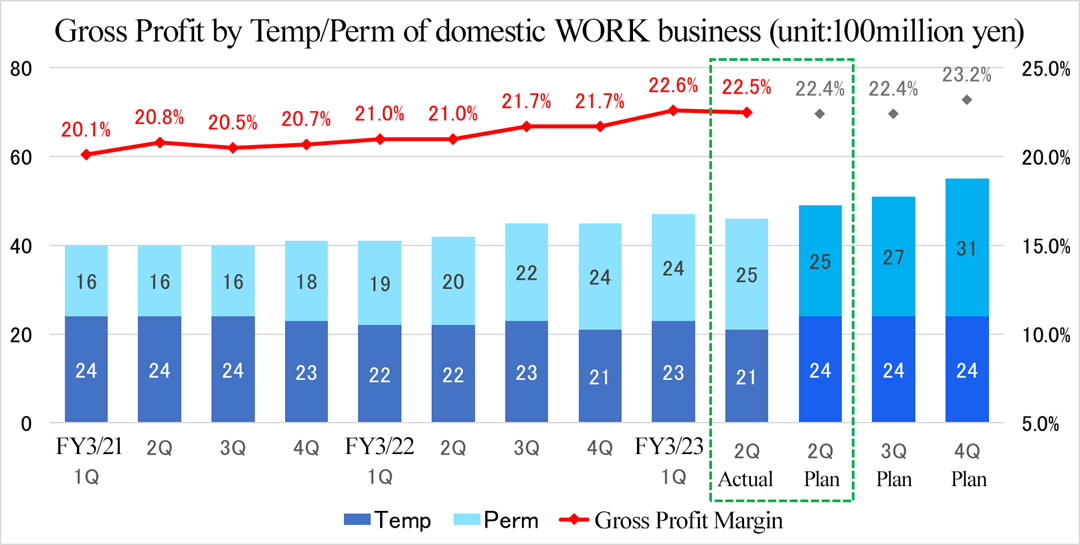

◎Progress of domestic WORK business

The domestic WORK business is progressing as planned. Gross profit for the second quarter (July-September) of the term ending March 2023 fell short of the company's forecast. Still, gross profit margin exceeded the forecast due to an increase in the ratio of the Perm area.

*Does not include consolidation adjustments within the segments. Gross profit and gross profit margin are figures after the adjustment, excluding the impact of overseas subsidy income.

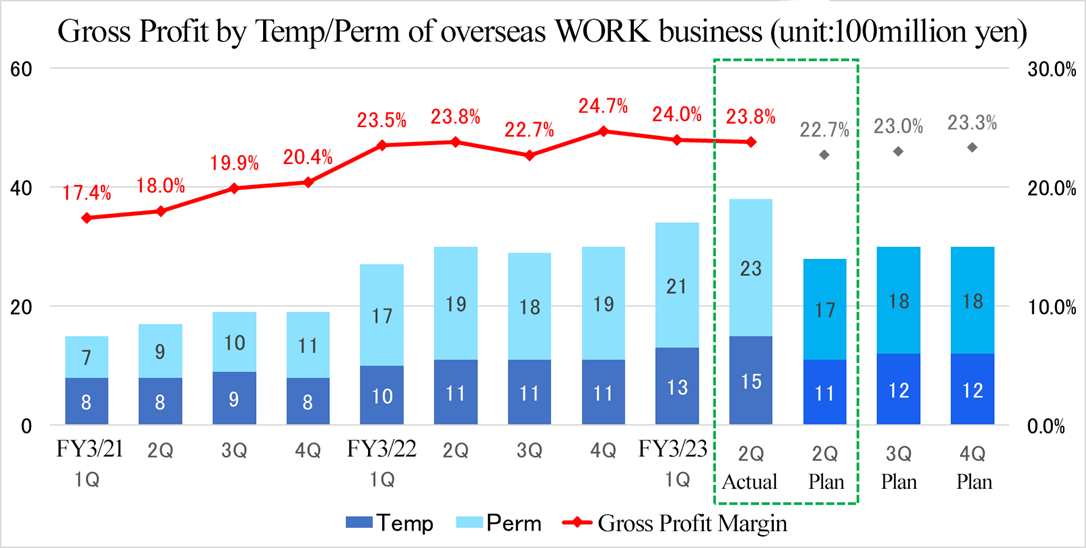

◎ Progress of overseas WORK business

In the overseas WORK business, the gross profit margin in the second quarter (July-September) of the term ending March 2023 decreased in comparison to the fourth quarter (January-March) of the term ended March 2022 and the first quarter of the term ending March 2023 (April- June). However, gross profit for the second quarter (July-September) of the term ending March 2023 is exceeding the forecast by far due to an increase in the profit of Temp (temporary staffing).

◎Progress in the construction engineers field

◆Sales

Quarterly sales are steadily increasing due to an increase of workers in service because of the increase in the number of new graduates and inexperienced mid-career workers.

◆Number of hires

The number of inexperienced mid-career recruit shows solid growth. 236 new graduates (131 graduates in previous term) joined the company in April 2022.

◆Number of working personnel, working rate, and retention rate

The number of workers in service is steadily increasing. In addition, the ratio of workers in service remains high. The company keeps working on improving the retention rate of workers.

◆Average contract price and average overtime hours (monthly)

The average contract price for new graduates and inexperienced employees has risen by 3%-5%/year due to negotiations with customers to increase charges. On the other hand, monthly overtime hours are on a downward trend.

Fiscal Year | FY3/21 | FY3/22 | FY3/23 | |||||||

Quarter | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q |

Sales(100 million yen) | 13.0 | 13.0 | 13.1 | 13.7 | 13.4 | 14.0 | 14.8 | 15.7 | 16.5 | 18.6 |

No. of hires(people) | 61 | 62 | 92 | 95 | 204 | 97 | 146 | 154 | 399 | 239 |

Working rate | 99.4% | 98.2% | 98.7% | 99.7% | 97.5% | 99.6% | 99.7% | 99.0% | 97.6% | 98.9% |

Retention rate | 76.6% | 72.9% | 72.3% | 71.7% | 72.4% | 71.2% | 72.4% | 70.9% | 74.6% | 74.9% |

No. of working personnel | 550 | 546 | 576 | 613 | 690 | 729 | 775 | 854 | 1088 | 1211 |

Average contract price(thousand yen) | - | - | - | - | 651 | 650 | 643 | 644 | 650 | 655 |

Average overtime hours(hours) | - | - | - | - | 29 | 26 | 27 | 29 | 26 | 25 |

*The ratio of workers in service for the 1st quarter of FY 2022 and the 1st quarter of FY 2023 are the ratio for June, excluding the impact of the new graduate training period. The ratio of workers in service for the cumulative period is 90.4% in the 1st quarter of FY March 2022 and 89.6% in the 1st quarter of FY March 2023.

◎Progress in the nursing care area

◆Sales

Temporary staffing sales are affected by a decline in the number of active personnel, while personnel introduction services sales remain steady.

◆Personnel introduction sales and personnel introduction contract price

Personnel introduction contract price is on an upward trend as the company focused on experienced personnel. In addition, personnel introduction sales in the second quarter of the term ending March 2023 decreased from the previous quarter (April-June) but are on an upward trend.

◆ Number of dispatched workers

Due to the decrease of new projects due to the resurgence of the novel coronavirus in July-September, the number of dispatched workers in the second quarter of the term ending March 2023 decreased from the previous quarter (April-June).

◆ Number of employees in the personnel introduction department

The company plans to maintain the current number of workers in the personnel introduction department for this term.

Fiscal Year | FY3/21 | FY3/22 | FY3/23 | |||||||

Quarter | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q |

Sales(100 million yen) | 33.2 | 33.2 | 33.0 | 32.8 | 33.2 | 34.0 | 35.4 | 34.2 | 35.3 | 34.1 |

Personnel introduction contract price(thousand yen) | - | - | - | - | 464 | 444 | 493 | 532 | 545 | 541 |

Personnel introduction sales(100 million yen) | - | - | - | - | 1.6 | 1.4 | 1.3 | 1.4 | 1.8 | 1.7 |

Number of dispatched workers(people) | 5,226 | 5,188 | 5,169 | 5,226 | 5,112 | 5,152 | 5,319 | 5,341 | 5,241 | 5,195 |

Number of employees in the personnel introduction department(people) | 42 | 38 | 36 | 40 | 53 | 46 | 43 | 37 | 37 | 33 |

5. Conclusions

In the first half of the term ending March 2023, sales revenue exceeded the initial forecast by about 8% and operating profit exceeded the initial forecast by about 30%, showing healthy performance. This is because the overseas WORK business for introducing and dispatching workers performed well, although the domestic WORK business was sluggish due to the resurgence of COVID-19. The performance in the first half proved the good balance of the company’s business portfolio, although it was supported by the yen depreciation. As the performance in the first half was favorable, the progress rate toward the full-year forecast is over 50% for sales revenue and all kinds of profits. In this situation, the company refrained from revising the full-year earnings forecast upwardly. This is because the sales revenue of the domestic WORK business is projected to fall below the initial forecast, as the receipt of orders for new projects was delayed due to the resurgence of COVID-19 from July to September, and the number of workers in service did not increase. Profit is expected to fall below the forecast, because the company will make an upfront investment in the second half as planned, by using the budget that was not used in the first half. Although there is a risk of resurgence of COVID-19, the company is expected to continue the shift to the Perm field and the expansion of the overseas WORK business. Their performance in the third quarter is noteworthy for seeing how much they can progress toward the forecast for this term.

This term is the final fiscal year of the mid-term management plan. Regarding financial goals, the company is now expected to achieve the goals set in the mid-term management plan, except ROIC. On the other hand, it seems that the company is not satisfied with the progress of some priority strategies, such as expansion of the nursing-care domain, improvement in profitability of the domestic WORK business, utilization of digital technologies, and expansion of services for non-Japanese residents in Japan, as they are promoting them actively. It is noteworthy whether they can make up for the delay in these strategies and complete all of them.

In addition, a new mid-term management plan is expected to be started next term. We are looking forward to seeing what kind of mid-term management plan will be produced. It is expected that the company will start some measures that reflect the next mid-term management plan in the second half of this term. We would like to pay attention to their future new releases with expectations.

<Reference 1: Basic Policy of Medium-term Management Plan “WILL-being 2023”>

The company is implementing the medium-term management plan "WILL-being 2023" targeting the term ending March 2023.

【1-1 Update of the medium-term management plan】

Although the basic policy announced last year has not changed, the plan has been updated in light of the various impacts and changes in society due to the spread of novel coronavirus.

(1) Updated points

1. Changes in The Business Climate

The company believes that the changes that had been predicted in "society," "Business," and "job seekers" have been accelerated by the novel coronavirus crisis, and the future of working styles has been fast-tracked by several years.

"Society"

Global population growth and aging in developed countries, unstable political conditions, and progress in the movement toward the realization of a sustainable society (SDGs)

"Business"

Increasing demand for outsourcing, significant changes in individual work styles due to technological evolution, and a rise in investment in human resources for sustainable growth

"Job seekers"

With the spread of telework, the number of workers who want a work style free from constraints of time and place is increasing. Also, the number of senior workers is increasing since we are moving towards prolonging the lifetime employment as people live to 100 years old.

(2) Medium/long-term growth scenario

The company aspires to achieve dramatic growth in the future by increasing profitability and actively investing in growth fields.

The current operating profit margin is about 3%, but the company aims for a double-digit profit margin in the future.

(3) Clearly demarcate the business portfolio

The company will build a business portfolio in the following five domains to transform into a highly profitable company.

Domains | Positioning | Performance indicators |

Profit maximization domain | Businesses that prioritize the improvement of gross profit margin and productivity rather than sales growth and market share expansion to increase operating margin | Operating margin |

Strategic investment domain | Businesses in which the company invest intensively so that they will become the medium- to the long-term pillars of the group | Revenue growth rate |

Exploration domain | Businesses that could be the pillars of the group in the future for which the company determines whether to invest or not (businesses that can be expected to have operating profit or operating margin of a specific size or larger) | Selected for each business |

Identification domain | Businesses for which the company should determine whether to continue them, as they could not achieve target KPIs in the "exploration area" | Selected for each business |

Withdrawal domain | Businesses that should promptly prepare for withdrawal because it will be challenging to create operating profit and operating CF above a particular scale in the future. | - |

【1-2 Basic policy】

It advocates "high profitability through the WORK SHIFT strategy."

The WORK SHIFT strategy is a strategy to increase operating profit margin through portfolio shift and digital shift.

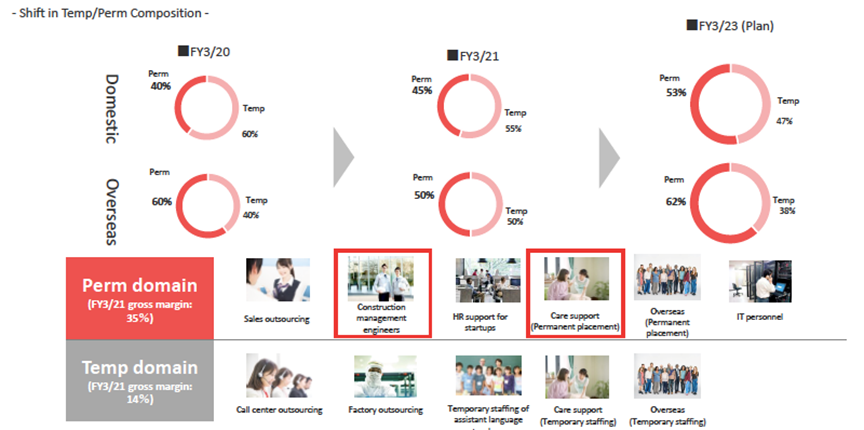

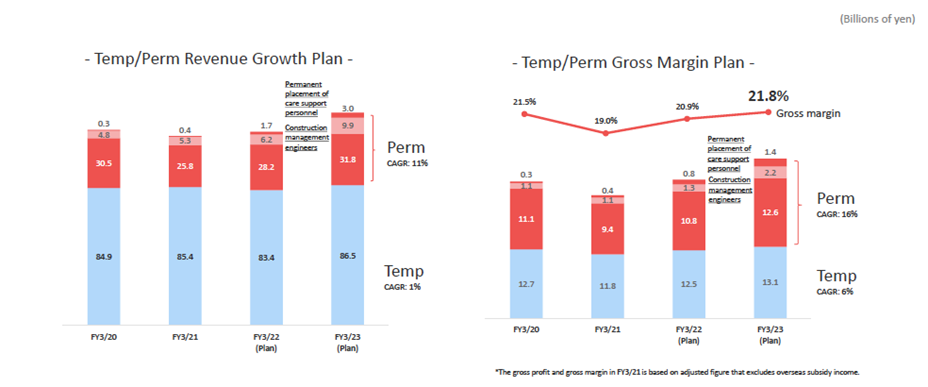

Portfolio shift | The company aims to maximize and optimize growth opportunities by expanding the "permanent employment: Perm domain (permanent)," such as introducing human resources and dispatching human resources to highly specialized areas. This is called the Perm SHIFT. The gross profit margin for the Perm domain in the term ended March 2021 was 35%. |

Digital shift | The company aims to maximize and optimize employment opportunities centered on productivity improvement and business stability by promoting the digitalization of "fixed-term employment: Temp domain (temporary)" such as temporary staffing and business contracting. The gross profit margin for the Temp domain for the term ended March 2021 was 14%. |

Until now, the company has operated businesses in multiple categories, focusing on inexperienced and unqualified casual temporary staffing. Moving forward, it will expand the Perm domain portfolio, which has a high-profit margin, and increase the productivity in the Temp domain, improve the profit margin to transform into a highly profitable structure.

【1-3 Business portfolio management】

Based on the "positioning" of the above five domains, the company will classify and operate individual businesses as follows, aiming for "high profitability through the WORK SHIFT strategy," which is the basic policy.

(Reference material of the company)

【1-4 Priority Strategy】

The company will promote the following four strategies.

Strategy | Applicable domains |

Strategy 1: Improving profitability through shifting portfolios | Profit maximization domain Strategic investment domain |

Strategy 2: Improving productivity through a digital shift | |

Strategy 3: Search for the next strategic investment domain | Exploration domain |

Strategy 4: Financial strategy | Group-wide |

Strategy 1: Improving profitability through portfolio shift

Improvement of gross profit margin by Perm SHIFT

The company will expand the sales of personnel introduction and temporary staffing to highly specialized areas both in Japan and overseas (Perm SHIFT).

In particular, the company will focus on the areas of nursing care and dispatching construction engineers.

In the term ending March 2023, the ratio of sales of the Perm domain is estimated to exceed 50% in Japan and overseas. Moreover, the gross profit margin rate will increase from 19.0% in the term ended March 2021 to 21.8%.

(Reference material of the company)

(Reference material of the company)

◎Construction management engineers field

The company will focus on hiring inexperienced personnel instead of its previous approach of focusing on hiring experienced personnel. The company will improve the high turnover rate and become the best in the construction engineer dispatching area.

The company will double the sales of 5.2 billion yen in the term ended March 2021 to 10 billion yen in the term ending March 2023.

In addition, it will significantly increase the number of inexperienced employees from 90 to 1,000.

To this end, in "customer acquisition," the company will enhance sales in the civil engineering area, which is a strength of experienced engineers, as well as private housing, plants, and subcontractor areas, that are easy to accept inexperienced personnel. The company will also increase sales personnel to improve sales in these areas.

In terms of "recruitment," the company will build a system that allows recruiting 400 new graduates and inexperienced mid-career per year. The number of new graduates recruited in April 2021 was 131.

Regarding the "retention rate," the training period before joining the company will be extended to close the gap after joining the company. It will also enhance the follow-up system for operating staff. The company believes that the know-how for improving the retention rate that it has accumulated so far will be effective.

The company plans to make upfront investments of 600 million yen in both the term ending March 2022 and the term ending March 2022, for a total of 1.2 billion yen to increase personnel and recruitment.

◎Care support field

The company will raise the sales ratio of personnel introduction from 3% in the term ended March 2021 to 16% in the term ending March 2023 to improve the profit margin.

It will also expand sales from 13.2 billion yen in the term ended March 2021 to 18.3 billion yen in the term ending March 2023.

Of this, the company will increase personnel introduction sales from 400 million yen to 3 billion yen. The number of personnel introduced will increase from 700 to 2,700.

In "personnel introduction," the company will increase the number of agents from 38 in the term ended March 2021 to 93 by the term ending March 2023 and acquire orders that utilize its customer base of temporary staffing. The company will also improve employment placement dispatching.

In "dispatching personnel," the company will open four new bases by the term ending March 2023 and actively hire foreign workers such as technical intern trainees and workers with specific skills.

In addition, the company will conduct follow-ups of staff and improve matching accuracy in order to "improve the retention rate."

The company plans to make upfront investments of 200 million yen for both the term ending March 2022 and the term ending March 2023, for a total of 400 million yen for increasing personnel and recruitment.

Fields other than care support and construction

In the profit maximization area, although top-line growth is gradual, the company aims to raise the gross profit margin by shifting to more profitable projects.

Sales support field | Perm domain | * Seize the opportunity to popularize 5G terminals to expand the sales in the stable communication field continuously * Strengthen the hiring of full-time on-site employees to increase sales agency services with a high gross profit margin |

Call center field | Temp domain | * Continue to expand financial projects with a high gross profit margin * Increase the market share per project and switch from dispatching staff to outsourcing to improve the gross profit margin * For novel coronavirus-related bidding projects, the company will actively work on profitability and, when it is possible, shift personnel after the end of the project. |

Factory field | Temp domain | * In preparation for deregulation of immigration policies after the end of the pandemic, the company will continue to strengthen the recruitment of foreign workers and aim to improve profitability by increasing the market share of the stable food sector. * In fields other than food, the company will shift to expanding receiving orders for electrical, electronic, and automobile parts fields, which have a higher gross profit margin than logistics, and consumer goods, even if it is same in terms of light work. |

Overseas WORK business | Perm domain Temp domain | * Expanding the group share within customers by sharing customers who are operating on a multinational level at all companies based in Australia and Singapore * Exploring new HR businesses that are different from dispatching and introducing personnel |

Strategy 2: Improving productivity through a digital shift

The company aims at productivity improvement through a digital shift centered on "efficiency through online operations and automation," "efficiency through centralized data management," "efficiency through telework and online interviews," and "efficiency associated with the integration of consolidated subsidiaries."

Strategy 3: Searching for areas for next strategic investments

HR Tech

The company will search for the next strategic investment businesses by repeating trials and errors.

By searching for businesses with high operating profit margins, the company aims to improve consolidated operating profit margins in the future.

Currently, the company is working on "LAPRAS," which handles the introduction of engineer personnel using AI, "Hour Money "and "Visa Money," foreigner employment management tools, and "ENPORT," a foreigner work support service. As the company solves the issues it faces, it will consider whether it should make upfront investments and develop into a growth business.

As for the services that target foreign workers, Visa Money and ENPORT, the company plans to increase the number of service users through Myanmar subsidiaries, Vietnamese subsidiaries and partners, and Indonesian partners from 15,000 in the term ended March 2021 to 80,000 in the term ending March 2023.

Strategy 4: Financial strategy

The company has set targets for three indicators as follows.

Financial items | Index | Goal | Overview |

Financial soundness | Ownership equity ratio attributable to owners of parent | Over 20% | The company will improve future growth investment and financial position. The ownership equity ratio attributable to owners of parent was 18% in the term ended March 2021. |

Capital efficiency | ROIC | Over 20% | The company will improve profitability and capital efficiency. ROIC was 14% in the term ended March 2021. WACC was at about 11%. |

Shareholder return | Total payout ratio | Over 30% | While securing growth investment, the company will enhance the return of profits. |

<Reference 2: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with auditor(s) |

Directors | 7 directors, including 3 external ones |

Auditors | 3 auditors, including 3 external ones |

Corporate Governance Report Updated on June 6, 2022

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

【Supplementary Principle 3-1-3 Enhancement of Disclosure of Information】

(1) Sustainability Initiatives. This corporate group hopes to grow sustainably together with society as a company that creates positive changes in the world, with the mission of “becoming a “change agent group” that brings positive change to individuals and organizations.” Under the recognition that addressing all sustainability issues, including environmental, social and governance issues, is an important management issue that also leads to risk reduction and profit opportunities, the company’s Board of Directors has defined their material issues and KPIs, and has been promoting initiatives to address these issues through corporate activities based on their management philosophy “MISSION, VISION, and VALUE.” Further, in April 2022, the company established the Sustainability Committee, chaired by the Representative Director and President, as a deliberative body for sustainability activities. The Committee consists of internal directors of the company and directors of their major domestic subsidiaries, which discusses, examines, and formulates sustainability-related activity policies and action plans. It also monitors the progress of KPI promotion regarding material issues and reports the details of the committee discussions to the Board of Directors. Details of the company’s sustainability initiatives were disclosed in their Integrated Report in December 2021, as well as on their corporate website. In addition, the company will continue to enhance disclosure of information on investment in human capital and intellectual property, etc., to achieve sustainable growth in corporate value.

(2) Climate Change Initiatives. The corporate group has set a goal of “reducing total CO2 emissions by 20% by the term ending March 31, 2031, from the term ended March 31, 2020.” The scope of CO2 calculation includes not only CO2 emissions from offices, but also employees’ business activities and the entire life cycle of services. The company will work together with their clients, business partners, and employees to engage in a wide range of global warming prevention activities. In addition, for risks related to climate change and the impact on their business and other activities, the four categories of “Governance,” “Strategy,” “Risk Management,” and “Guiding Principles and Objectives,” were analyzed using multiple scenarios (2.0 degrees centigrade, and 4.0 degrees centigrade) based on the TCFD framework and were discussed by the Board of Directors. The details will be disclosed on the company’s website. The company will continue to disclose information in a stepwise manner and enhance the quality and quantity of overall disclosed contents. (Sustainability Initiatives: https://willgroup.co.jp/sustainability/index.html)

(Environmental Initiatives: )https://willgroup.co.jp/sustainability/environment/

<Disclosure Based on the Principles of the Corporate Governance Code>

【Supplementary Principle 2-4-1 Ensuring Diversity Within the Company, Including Promotion of Women’s Activities】

In an era where market conditions are rapidly changing and a future is difficult to predict, the company recognizes the importance of utilizing diverse perspectives and values in corporate management, in order to create new business opportunities without being bound by the current business domain. Therefore, the corporate group actively and continuously hires and promotes diverse human resources, including women, non-Japanese nationals, and mid-career workers with a variety of work experiences, and promotes initiatives such as development of a working environment that makes the most of individual characteristics and abilities, as well as management-level education. They will continue to work to have a ratio of core personnel equal to respective employee ratios by 2030. (1) Promotion of Female Core Personnel. In recent years, the company has been actively promoting the advancement of women, and has conducted career development training for young employees, as well as management training for managers. While the percentage of female employees among full-time employees is 41.6%, the percentage of female managers is 31.9%, falling below the percentage of female employees. Aiming to increase the ratio of female managers to 40% by 2030, the company will continue to improve the workplace environment, foster career awareness, etc., and increase the number of female employees who will be involved in management decision-making in the future.

【Principle 3-1 Enhancement of Disclosure of Information】

(1) Management philosophy, management strategy, and the mid-term management plan are disclosed on the company’s website.

(Management Philosophy: https://willgroup.co.jp/profile/policy.html)

(The Mid-term Management Plan: )https://willgroup.co.jp/ir/strategy.html

(2) It is as stated in I-1 “Basic Approach” of this report. For specific policies and initiatives based on this, please refer to each section of this report.

(3) The company’s policy for determining the remuneration for directors is described in II-1 “Matters Relating to Institutional Structure and Organizational Operation, etc. [Relating to Remuneration of Directors]” of this report.

(4) The election and appointment of executives and nomination of candidates for directors are comprehensively reviewed from the viewpoint of the right personnel for the right position, in accordance with internal rules, taking into consideration accurate and prompt decision making, appropriate risk management, monitoring of execution of duties, and the balance that can cover each function of the company and each business division of the group companies. Furthermore, in nominating candidates for corporate auditors, they are comprehensively reviewed from the viewpoint of the right personnel for the right position, while ensuring the balance between their knowledge in finance and accounting, knowledge in the company’s business areas, and their diverse perspectives on corporate management. Based on these policies, the Nominating Committee (formerly the Selection Committee), which includes independent outside directors, deliberates in advance, and the Board of Directors makes a resolution. Similarly, the dismissal of executives is discussed in advance by the Nominating Committee (formerly the Selection Committee), which includes independent outside directors, in accordance with internal rules, and is resolved at the Board of Directors meeting.

(5) Candidates for directors and corporate auditors as well as the reason for their election and their career are stated in the reference material for the General Meeting of Shareholders on a case-by-case basis. For reference material for each General Meeting of Shareholders, please refer to the Notice of Convocation of the General Meeting of Shareholders posted on the company’s website. In the event of dismissal, appropriate disclosure will be made in a timely manner in accordance with policies and procedures. (Notice of Convocation of the General Meeting of Shareholders: https://willgroup.co.jp/ir/library/report.html)

【Principle 5-1 Policies related to Constructive Interaction with Shareholders】

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website. (Disclosure policy: https://willgroup.co.jp/ir/disclosure/)

Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director, and executive officers in charge of the management headquarters aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy, and continuity with regard to management and business strategies, financial information etc.

(2) The management headquarters takes a central role, and the management planning, general affairs, financial affairs, accounting, legal affairs department and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair, and suitable fashion.

(3) As a means of dialogue, the company holds company briefings for individuals, as well as financial results briefings for institutional investors. In addition, the company will continue to enhance IR activities by posting video clips of briefings, contents of question-and-answer sessions, and other information on the company’s website.

(4) Individual meetings with shareholders will be conducted, with the IR team of the Finance Department as the point of contact. Based on the shareholder’s request and the purpose of the meeting, executives, directors including outside directors, or corporate auditors will meet with the shareholders and provide appropriate responses within a reasonable scope.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

(6) In addition to establishing a quiet period in accordance with the Disclosure Policy, the Company will operate and thoroughly implement rules and regulations regarding the management of insider information.

※ The disclosed documents relating to the above items can be found on the company’s website (https://willgroup.co.jp/ir/index.html).

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |