Bridge Report:(6089)WILL GROUP Fiscal Year ended March 2025

Yuichi Sumi Representative director and President | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | TSE, Prime Market |

Industry | Services |

Chairman | Yuichi Sumi |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act.) | Trading Unit | |

¥915 | 22,882,436 shares | 20,937 million | 6.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER(Est.) | BPS (Act.) | PBR (Act.) |

¥44.00 | 4.8% | ¥68.38 | 13.4x | ¥760.08 | 1.2x |

*Stock prices as of the close on May 20, 2025. The number of shares issued is obtained by deducting the number of treasury shares from the number of shares issued as of the end of fiscal year ended March 2025. ROE and BPS are the actual values in the previous term.

*DPS and EPS are the company’s forecasts for this term.

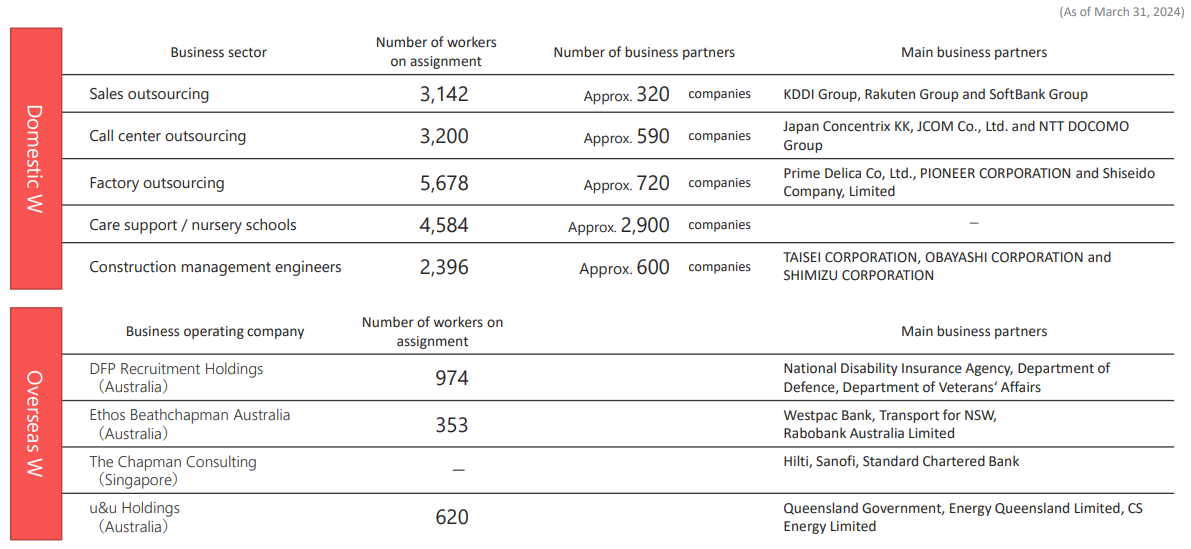

Transition in Consolidated Performance (Voluntary adoption of IFRS)

Fiscal Year | Sales | Operating Income | Ordinary Income, Pretax Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2022(Act.) | 131,080 | 5,472 | 5,293 | 3,286 | 147.03 | 34.00 |

March 2023(Act.) | 143,932 | 5,318 | 5,146 | 3,236 | 143.20 | 44.00 |

March 2024(Act.) | 138,227 | 4,525 | 4,417 | 2,778 | 122.37 | 44.00 |

March 2025(Act.) | 139,705 | 2,338 | 2,177 | 1,155 | 50.64 | 44.00 |

March 2026(Est.) | 134,600 | 2,500 | 2,380 | 1,560 | 68.38 | 44.00 |

*Estimated by the Company. Unit: Million yen or yen.

This Bridge Report reviews of fiscal year ended March 2025 earnings results and fiscal year ending March 2026 earnings estimates.

Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2025 Earnings Results

3. Fiscal Year ending March 2026 Earnings Estimates

4. Progress of key strategies and major initiatives of Medium-Term Management Plan “WILL-being 2026”

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

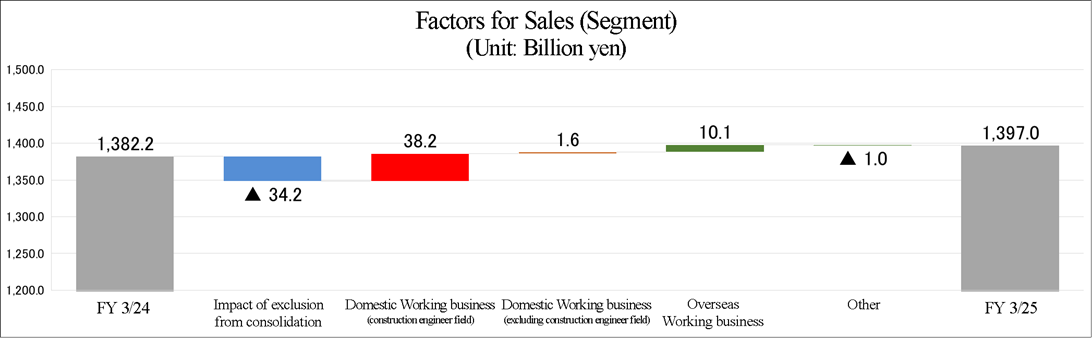

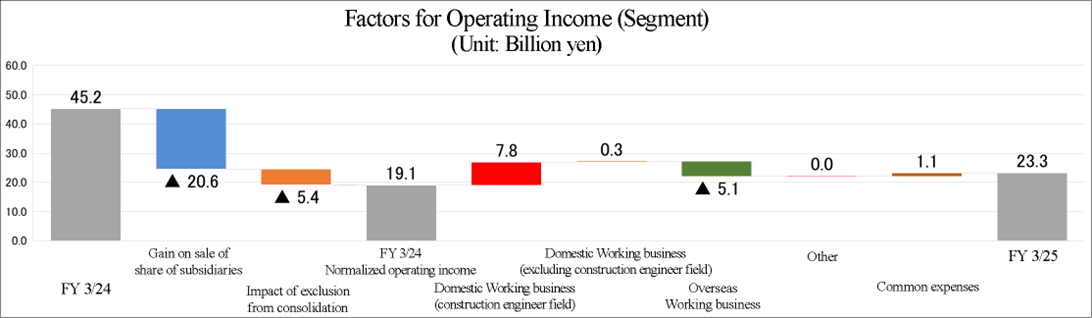

- In the fiscal year ended March 2025, sales revenue rose 1.1% year on year to 139.75 billion yen. Operating income dropped 48.3% year on year to 2,338 million yen. In terms of sales, the strategic investment field, including the construction engineer field in the domestic Working business, expanded steadily. In terms of profit, all kinds of profits decreased as forecast, due to the disappearance of temporary gain from sale of shares in subsidiaries and the exclusion of the subsidiaries from the scope of consolidation. On the other hand, normalized operating income rose 22.0% year on year, as the rise in profit due to the steady monetization of the construction engineer field in the domestic Working business significantly exceeded the drop in profit due to the goodwill impairment loss, etc. in the overseas Working business.(*Normalized operating income: operating income excluding the temporary gain from sale of shares in subsidiaries and the effect of exclusion of the subsidiaries from the scope of consolidation posted in the same period of the previous year)

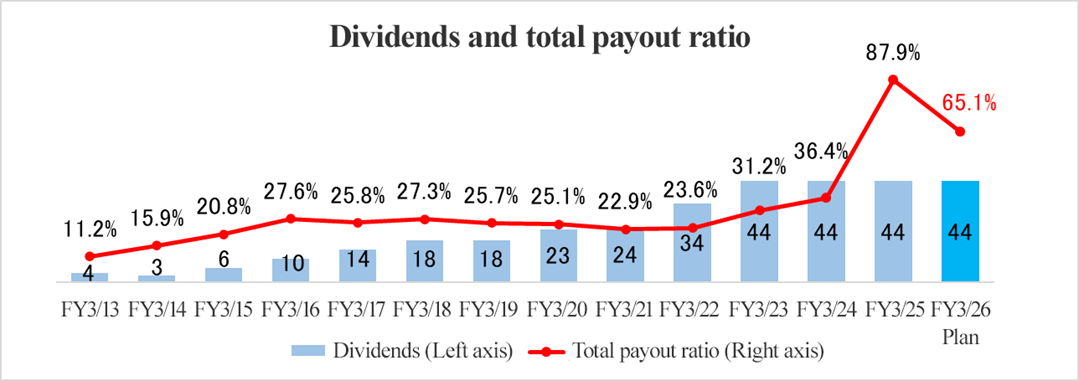

- For the fiscal year ending March 2026, sales revenue is expected to decline 3.7% year on year to 134.6 billion yen and operating income is projected to rise 6.9% year on year to 2.5 billion yen. Regarding sales revenue, the sales revenue of the domestic Working business is forecast to grow mainly in the construction engineer field, and the sales revenue of the overseas Working business is projected conservatively. Regarding operating income, the operating income of the domestic Working business is expected to grow like the sales revenue, but the revenue from government subsidies in the overseas Working business is not taken into account in the forecast.They plan to pay a dividend of 44 yen/share, unchanged from the previous fiscal year. The expected payout ratio is 64.3%. Total payout ratio is forecast to be 65.1%.

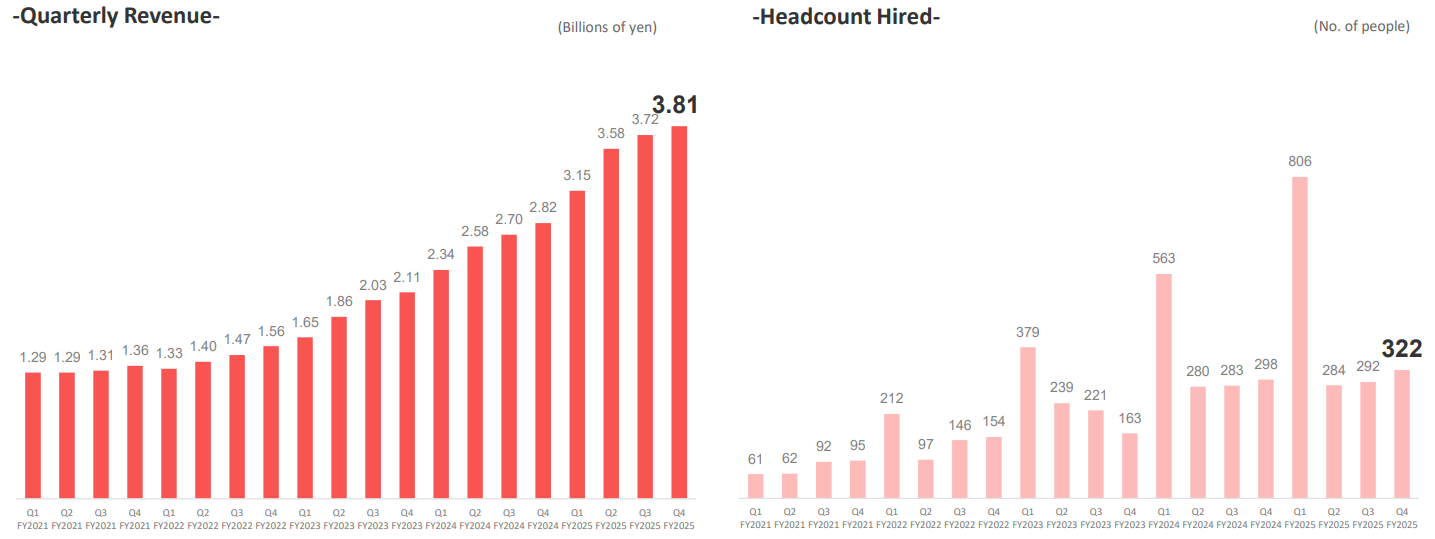

- In the fiscal year ended March 2025, they planned to recruit 1,200 people in the construction engineer field, but actually they recruited 1,704 people. Thanks to the accumulation of recruitment know-how and the cooperation with external agents, the recruitment of inexperienced people, including new graduates, progressed smoothly. In the construction engineer field, the negotiations with clients about unit prices turned out to be effective, and the average contract price for inexperienced workers, including workers fresh out of college, is increasing. It is noteworthy whether they can expand the performance in the construction engineer field in the fiscal year ending March 2026, by training increased employees and improving retention rate.

1. Company Overview

While it is said that the balance between labor supply and demand will worsen as the number of workers in the production and clerical fields will become excessive, while the number of experts who can lead technological innovation and apply new technologies to business will become insufficient (which will be hereinafter called “the vocational mismatch”) in Japan in the late 2020s, the corporate group is striving to solve “the vocational mismatch” by offering human resources services, and “maximize and optimize the career paths for helping workers become experts.” The corporate group offers services of introducing and dispatching workers, undertaking tasks, and supporting the employment of non-Japanese workers in Japan, while specializing in some occupations, such as sales, marketing, call center operation, clerical work, factory work, nursing care, construction, and IT. They also offer human resources services for mainly white-collar occupations not only in Japan, but also in Singapore and Australia. The corporate group possesses a well-balanced portfolio, including sales support, call center, factory work, nursing care business support, construction engineer, and overseas staffing, without placing excessive emphasis on a specific business area, so that their business can grow stably and sustainably.

[1-1 WILL Vision and Management Philosophy]

The corporate group's management philosophy is to continue delivering positive choices to workers.

◆The MISSION is to be a Change Agent Group that positively transforms individuals and organizations.

◆VISION is to create a brand developing company with high expected value in the "Working,” "Interesting,” "Learning" and "Living" domains, and to be the best in each domain.

Working | Business field to support “Working” |

Interesting | Business field to support “Interesting” |

Learning | Business field to support “Learning” |

Living | Business field to support “Living” |

◆VALUE is Believe in Your Possibility

[1-2 Strengths]

① Pursuits of better results | ◆ Capability of operating business while specializing in some categories ◆ They meet the needs of clients, and pursue better results as the clients’ partner. |

② Capability of training personnel | ◆ To train inexperienced workers with their on-the-job training programs, such as hybrid dispatch (full-time employees are stained to give on-site support to dispatched workers), so that they will become helpful soon |

③ Improvement in retention rate | ◆ They improved retention rate in the fields where turnover rate is high, by improving on-site communication via hybrid dispatch, etc. and their follow-up system. |

Hybrid dispatch is a unit dispatch model in which full-time employees called “field supporters (FS)” are stationed and support the staff of client companies and dispatched staff. This system in which field supporters support dispatched staff at each workplace is suited for the dispatch of non-Japanese workers (field supporters who are full-time non-Japanese employees who graduated from Japanese college). Hybrid dispatch has characteristics: (1) Workers are very loyal when engaging in tasks, (2) teamwork is strong, (3) the chain of command is smooth, and (4) information can be shared easily, compared with ordinary dispatch.

The company boasts the large number of dispatched workers in service: about 20,000 in the domestic Working business and about 4,000 in the overseas Working business.

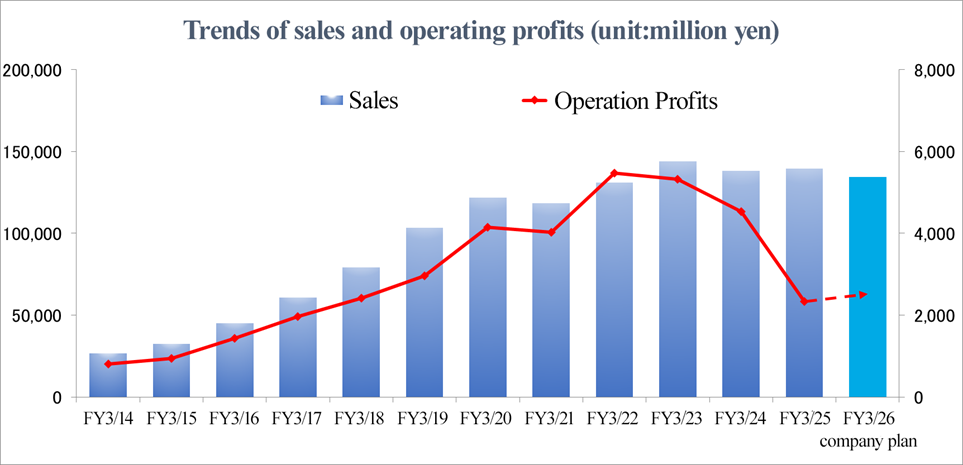

[1-3 Overseas M&A strategy so far]

In addition to the organic growth (expansion of the existing domain and the internal growth due to the foray into new domains), the company utilized M&A actively, and achieved high growth. In addition, they specified targets and schemes, and carried out M&A strategically, achieving high growth after M&A.

① Targets | <Domain of human resources services, such as the dispatch and introduction of workers> ◆ Promising countries, regions, and enterprises ◆ Enterprises for which it is possible to design a plan of business succession from the founding owner ◆ Enterprises whose customers or business categories are characteristic |

② Acquisition scheme | <Earnout scheme> ◆ To first acquire a company with an ownership ratio of over 50%, as a consolidated subsidiary ◆ To gradually make each acquired company a fully-owned subsidiary in 1 to 3 years. |

③ After M&A | ◆ To take over business from founding owners through a succession period ◆ To pursue synergetic effects on costs, by integrating the back-office functions of consolidated subsidiaries ◆ To promote cross-selling among consolidated subsidiaries |

[1-4 Business description]

Business segments

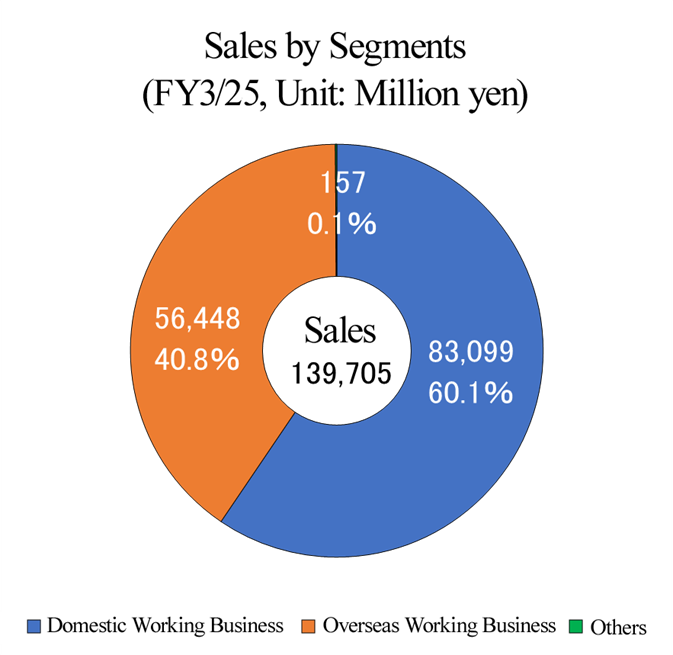

The company has three business segments: the domestic Working business, the overseas Working business, and other business. The domestic business accounts for 60% of consolidated sales, while the overseas business makes up 40%.

One of the strengths of the corporate group is their business portfolio that allows the company to grow stably and sustainably, without placing excessive emphasis on specific business domains, while the economic situation and markets are changing rapidly.

*External revenues before deduction of intersegment revenues.

Domestic Working business

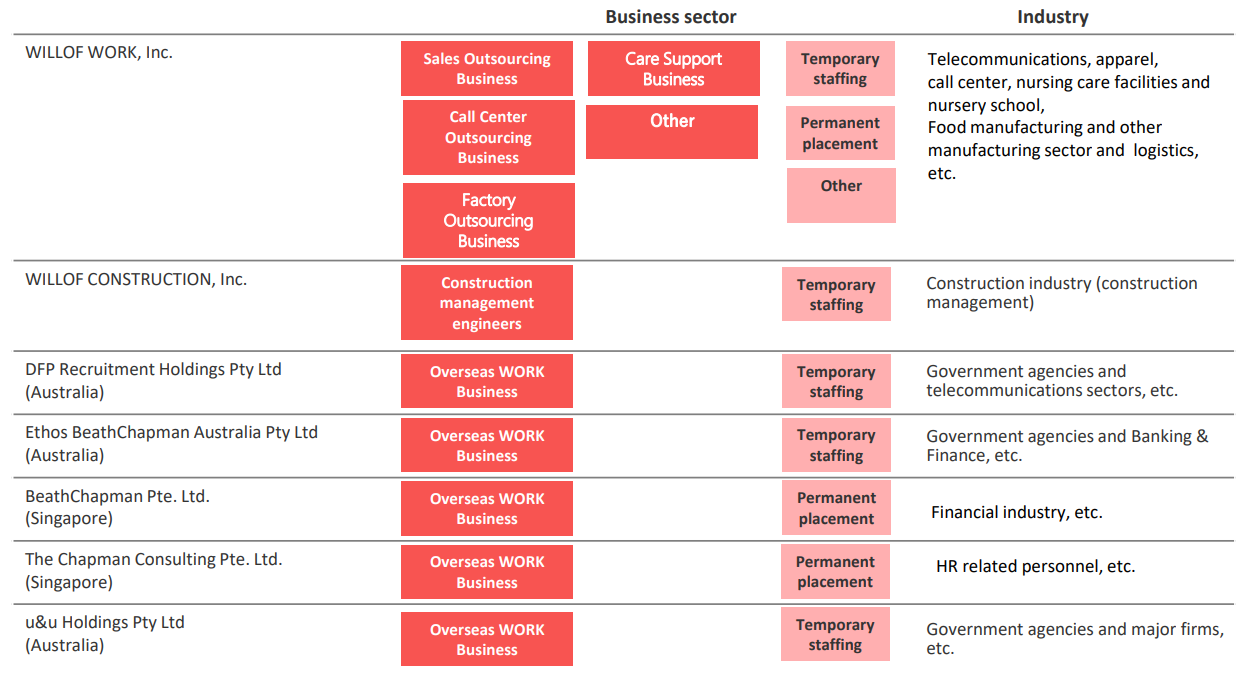

The company dispatches and introduces personnel and undertakes tasks in each of the sales support, call center, factory, nursing care, and construction engineer field in Japan.

Overseas Working Business

The company offers HR services, including the dispatch and introduction of personnel, mainly in Singapore and Australia. Regarding the dispatch of personnel, they dispatch workers to mainly governments, municipalities, etc., which are not easily affected by economic swings. Regarding the introduction of personnel, they operate business in a broad range of fields, including information and telecommunications.

Others

Other businesses include the business of supporting DX in the private sector and local governments.

[Major group companies]

(Reference material of the company)

[Main business partners of each business domain and each operating company]

(Reference material of the company)

[1-5 Business performance]

*The Japanese standards had been applied until fiscal year ended March 2018, and IFRS has been applied since fiscal year ended March 2019.

The company was established in Osaka in 1997, started human resources services for the manufacturing industry in 2000, and entered new business domains, including sales, call center operation, overseas business, nursing care, and construction, achieving sustainable growth. By specializing specific categories (occupations), they acquired a top-level share in each category, although they made inroads into each field later than competitors. In 2013, the company went public and was designated to the First Section of the Tokyo Stock Exchange in just one year. Despite the impact of the COVID-19 pandemic, the company's performance has been on an upward trend since its establishment. The decrease in profit in the fiscal year ended March 2025 was significant, because the result in the fiscal year ended March 2024 includes the temporary profit from the gain on sale of shares of subsidiaries.

2. Fiscal Year ended March 2025 Earnings Results

[2-1 Consolidated earnings results (IFRS)]

| FY 3/24 | Ratio to sales | FY 3/25 | Ratio to sales | YoY |

Sales | 138,227 | 100.0% | 139,705 | 100.0% | +1.1% |

Gross Profit | 30,446 | 22.0% | 29,383 | 21.0% | -3.5% |

SG&A | 28,314 | 20.5% | 27,270 | 19.5% | -3.7% |

Operating Income | 4,525 | 3.3% | 2,338 | 1.7% | -48.3% |

Pretax Profit | 4,417 | 3.2% | 2,177 | 1.6% | -50.7% |

Net Income | 2,778 | 2.0% | 1,155 | 0.8% | -58.4% |

*Unit: Million yen.

Sales grew 1.1% year on year, but profit dropped 48.3% year on year.

Sales revenue rose 1.1% year on year to 139,705 million yen, but operating income declined 48.3% year on year to 2,338 million yen.

The corporate group worked on the expansion of the construction engineer field and the enhancement of dispatch of full-time employees and support for employment of non-Japanese workers, to achieve the regrowth of the domestic Working business, which is the basic policy set in the medium-term management plan “WILL-being 2026,” which will end in the fiscal year ending March 2026.

Sales revenue was healthy, except that in the entrusted call center field in Japan. In particular, the sales revenue in the construction engineer field, in which they conduct strategic investment, has grown steadily, securing profitability. For the purpose of improving their capability of recruitment in Japan, they aired TV commercials in 18 prefectures, including those in the Kanto area, which is the largest commercial area for the company, to promote the brand “WILLOF,” and implemented promotional strategies utilizing web commercials and social media. In the overseas business, they controlled costs for strengthening the profit earning structure as main clients curbed recruitment for a long period of time due to the inflation after the rapid growth of demand for human resources in the post-COVID period subsided, and continued measures for securing sustainable revenues amid the sluggish demand for human resources.

Operating income dropped as forecast, due to the disappearance of temporary gain from sale of shares in subsidiaries and the exclusion of the subsidiaries from the scope of consolidation. On the other hand, normalized operating income rose 22.0% year on year, as the rise in profit due to the steady monetization of the construction engineer field in the domestic Working business significantly exceeded the drop in profit due to the goodwill impairment loss, etc. in the overseas Working business. (*Normalized operating income: operating income excluding the temporary gain from sale of shares in subsidiaries and the effect of exclusion of the subsidiaries from the scope of consolidation posted in the same period of the previous year.) Gross profit margin dropped 1 point year on year, and gross profit declined 3.5% year on year. In addition, the ratio of SG&A expenses decreased 1 point year on year to 19.5%. Accordingly, operating income margin declined 1.6 points year on year to 1.7%. EBITDA (operating income + depreciation and amortization) decreased 28.1% year on year to 4.89 billion yen.

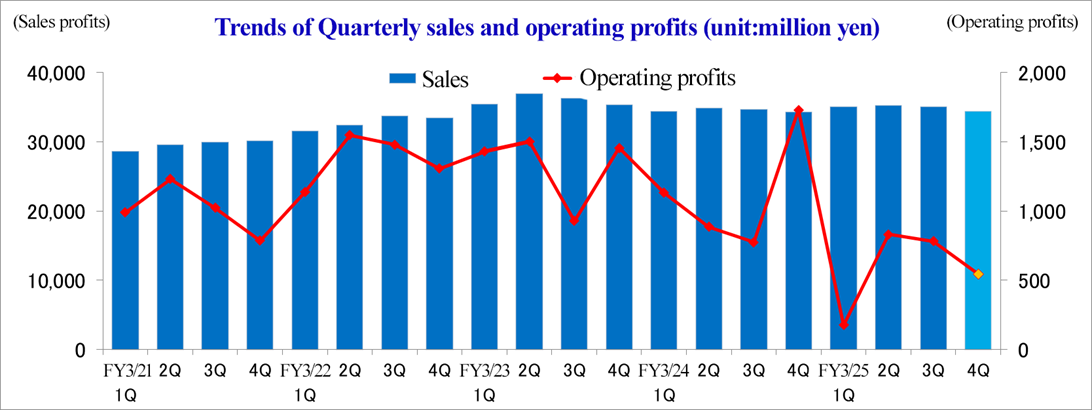

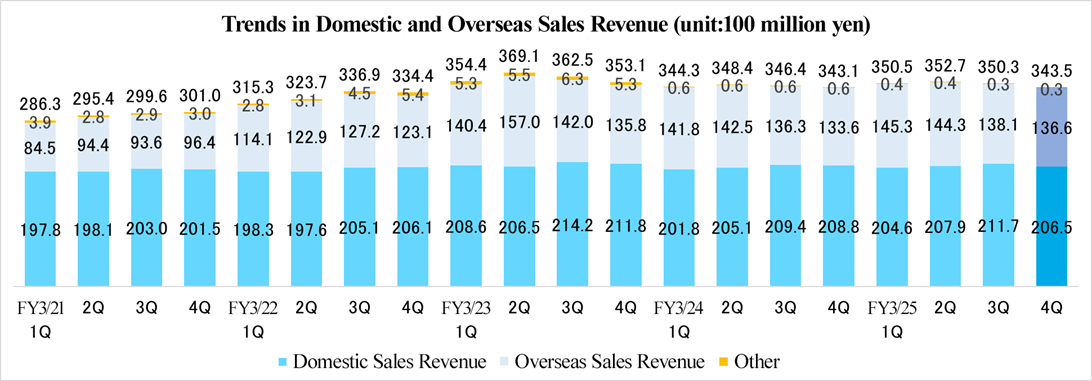

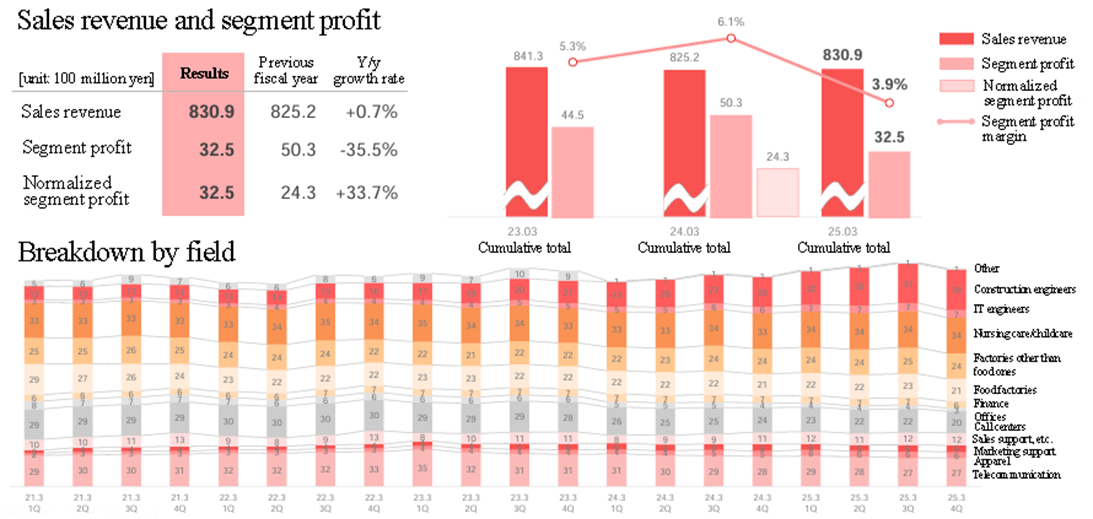

[2-2 Trend of quarterly results]

In the fourth quarter of the fiscal year ended March 2025 (Jan. to Mar.), sales grew and profit dropped year on year. The yen depreciation increased sales by about 700 million yen. On the other hand, the gain on sale of subsidiaries posted in the same period of the previous fiscal year decreased profit. In the fiscal year ended March 2025, the performance of the domestic business was almost unchanged, but in the overseas business, sales and profit, excluding the effects of exchange rates, decreased in the businesses of dispatch and introduction of workers. From the previous quarter (Oct. to Dec.), sales and profit declined due to seasonal factors. Operating income was affected by not only the decline in gross profit, but also the upfront posting of recruitment expenses in the construction engineer field. In the fiscal year, they spent a total of 420 million yen (170 million yen in 1Q, 180 million yen in 2Q, 20 million yen in 3Q, and 40 million yen in 4Q) for promotion.

[2-3 Trend by Segment]

| FY 3/24 | Ratio to sales | FY 3/25 | Ratio to sales | YoY |

Domestic Working business | 82,528 | 59.7% | 83,099 | 59.5% | +0.7% |

Overseas Working business | 55,432 | 40.1% | 56,448 | 40.4% | +1.8% |

Other | 266 | 0.2% | 157 | 0.1% | -41.0% |

Revenue | 138,227 | 100.0% | 139,705 | 100.0% | +1.1% |

Domestic Working business | 5,038 | 74.5% | 3,251 | 72.9% | -35.5% |

Overseas Working business | 1,946 | 28.8% | 1,432 | 32.1% | -26.4% |

Others | -225 | -3.3% | -223 | -5.0% | - |

Adjustments | -2,235 | - | -2,121 | - | - |

Operating Profit | 4,525 | - | 2,338 | - | -48.3% |

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

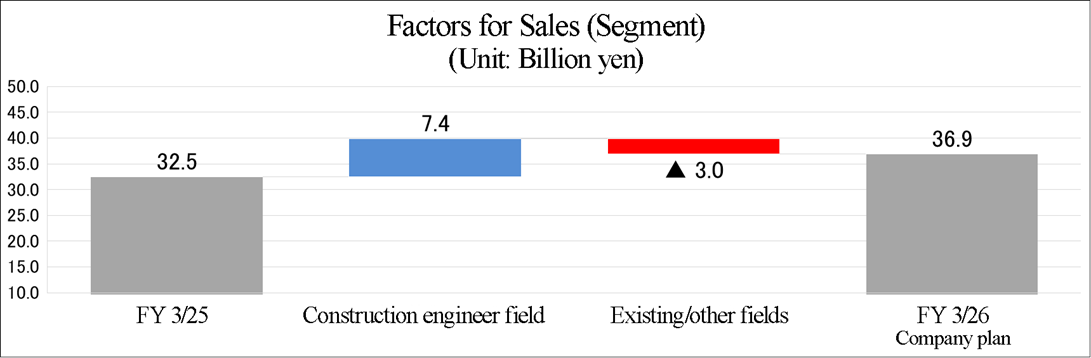

◎ Breakdown of changes in performance of the domestic Working business

A year-on-year change in sales was +3.82 billion yen in the construction engineer field, +620 million yen in the IT engineer field, +580 million yen in the sales support field, +550 million yen in the factory segment, +250 million yen in the field of nursing-care business support, -1.89 billion yen in the call center field, and -3.42 billion yen due to the exclusion from the scope of consolidation.

A year-on-year change in operating income was +780 million yen in the construction engineer field, +90 million yen in the field of nursing-care business support, +50 million yen in the sales support field, +30 million yen in the factory segment, -70 million yen in the call center field, and -70 million yen in other fields.

◎ Breakdown of changes in performance of the overseas Working business

A year-on-year change in sales was -1.39 billion yen in the worker dispatch business, -520 million yen in the personnel introduction business, and +2.9 billion yen due to exchange rates.

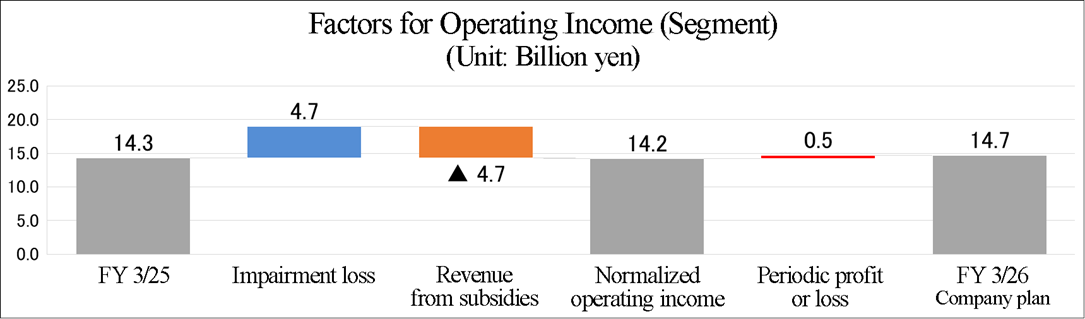

A year-on-year change in operating income was +220 million yen due to the reduction of SGA expenses, +350 million yen thanks to the increase in the revenue from subsidies, +100 million yen due to exchange rates, -700 million yen due to the drop in gross profit, and -470 million yen due to the posting of impairment loss.

Domestic Working business

Sales revenue increased 0.7% year on year to 83,099 million yen, while segment profit decreased 35.5% year on year to 3,251 million yen.

Regarding the domestic Working business, which dispatches and introduces personnel and undertakes tasks in each of the sales support, call center, factory, nursing care, and construction engineer field in Japan, the call center field has been sluggish, but the other field have been healthy. Regarding “the number of recruits per year” among key performance indicators (KPIs) in the construction engineer field, on which they concentrate the most, over 1,700 people, including new graduates, joined the company, hitting a record high in fiscal year ended March 2025 (142% of the planned number). The increase of dispatched workers contributed to the growth of sales revenue in the domestic Working business. Their negotiations for contract prices have progressed favorably, due to the strong demand for personnel.

Profit decreased, due to the disappearance of temporary gain from sale of shares in subsidiaries, which was posted in the fiscal year ended March 2024, and the exclusion of the subsidiaries from the scope of consolidation.

On the other hand, normalized operating income, excluding the temporary gain from sale of shares in subsidiaries, which was posted in the fiscal year ended March 2024, and the effect of the exclusion from the scope of consolidation, rose 33.7% year on year, as the monetization of the construction engineer field exceeded the forecast.

Regarding the sales in each domain, the sales in the construction engineer field and the IT engineer field were healthy.

(Reference material of the company)

(Reference material of the company)

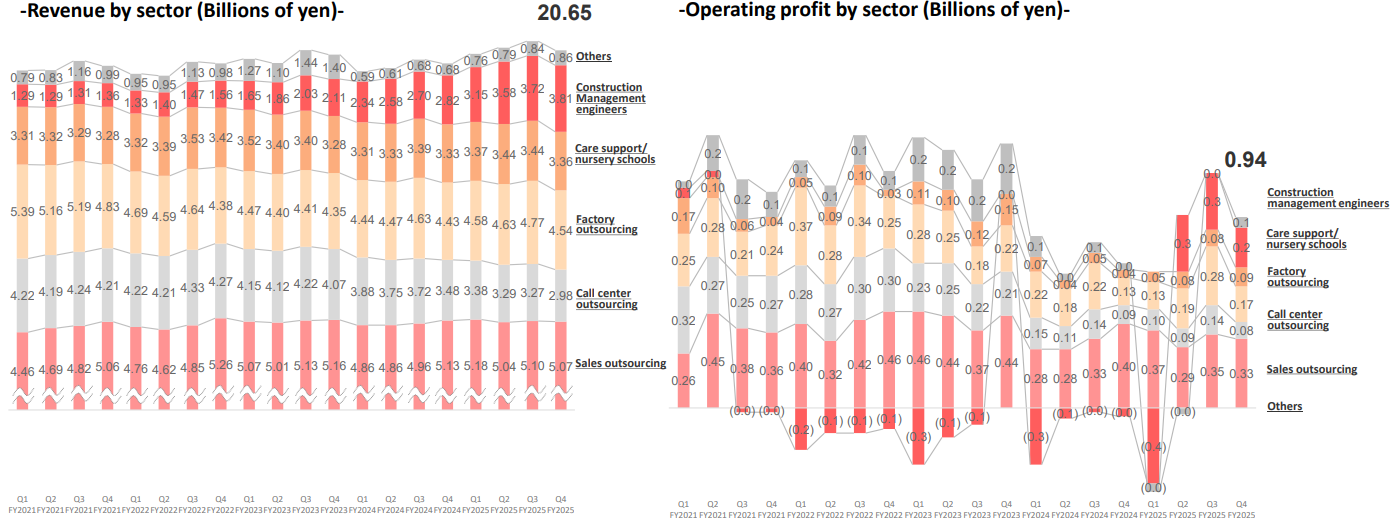

Overseas Working business

Sales revenue grew 1.8% year on year to 56,448 million yen, and the profit in this segment dropped 26.4% year on year to 1,432 million yen.

Regarding the overseas Working business, which is operated in mainly Singapore and Australia, sales grew as the yen weakened from the previous fiscal year while main clients have curbed recruitment.

Profit declined, as the impairment loss of goodwill related to the consolidated subsidiary in Australia amounted to 473 million yen, although the decline in gross profit was offset by the effect of exchange rates, the revenue from government subsidies in Singapore, and continuous cost control for the prolonged market downturn.

(Reference material of the company)

(Reference material of the company)

Other

Sales revenue decreased 40.7% year on year to 157 million yen, while a segment loss of 223 million yen was posted (a loss of 225 million yen was posted in the previous fiscal year).

The sales in other businesses decreased, due to the sale of real estate as well as the transfer of “Visamane,” a system for managing the employment of non-Japanese workers, in fiscal year ended March 2024, and “ENPORT mobile,” a mobile communications business for non-Japanese people, in fiscal year ended March 2025. The sales in other businesses decreased, due to the sale of real estate as well as the transfer of “Visamane,” a system for managing the employment of non-Japanese workers, in fiscal year ended March 2024, and “ENPORT mobile,” a mobile communications business for non-Japanese people, in fiscal year ended March 2025.

[2-4 Progress toward forecast KPIs]

Priority strategy | KPI | Evaluation | |||||

KPI | Initial plan | Result | Ratio to the forecast | ||||

Domestic Working | Strategy I | Further growth and monetization of the construction engineer field | Number of recruits per year | 1,200 | 1,704 | 142.0% | ○ |

Retention rate | 71.3% | 68.4% | -2.9pt | × | |||

Strategy II | Regrowth of the domestic Working business (excluding the construction engineer field) | Number of newly dispatched full-time employees | 3,274 | 3,450 (up 196 from the end of the previous fiscal year) | 105.4% | ○ | |

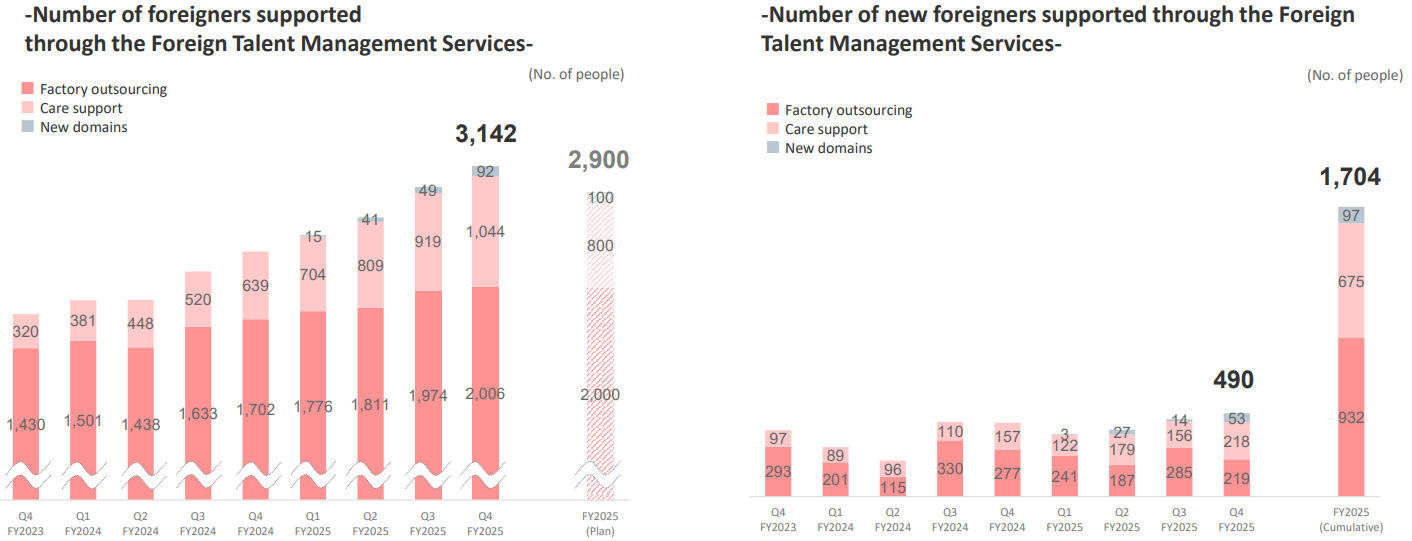

Increase in the number of non-Japanese employees for which the company supports employment | 2,900 | 3,142 (up 801 from the end of the previous fiscal year) | 108.3% | ○ | |||

In the construction engineer field, the recruitment of inexperienced employees, including employees fresh out of college, progressed healthily, as they accumulated recruitment know-how and cooperated with external agents. They will make continuous efforts to improve retention rate. In fields other than the construction engineer field, the number of dispatched full-time employees in service increased steadily, as the struggling fields were covered by other fields. The number of non-Japanese employees for which the company supports employment increased steadily, as they strove to improve retention rate.

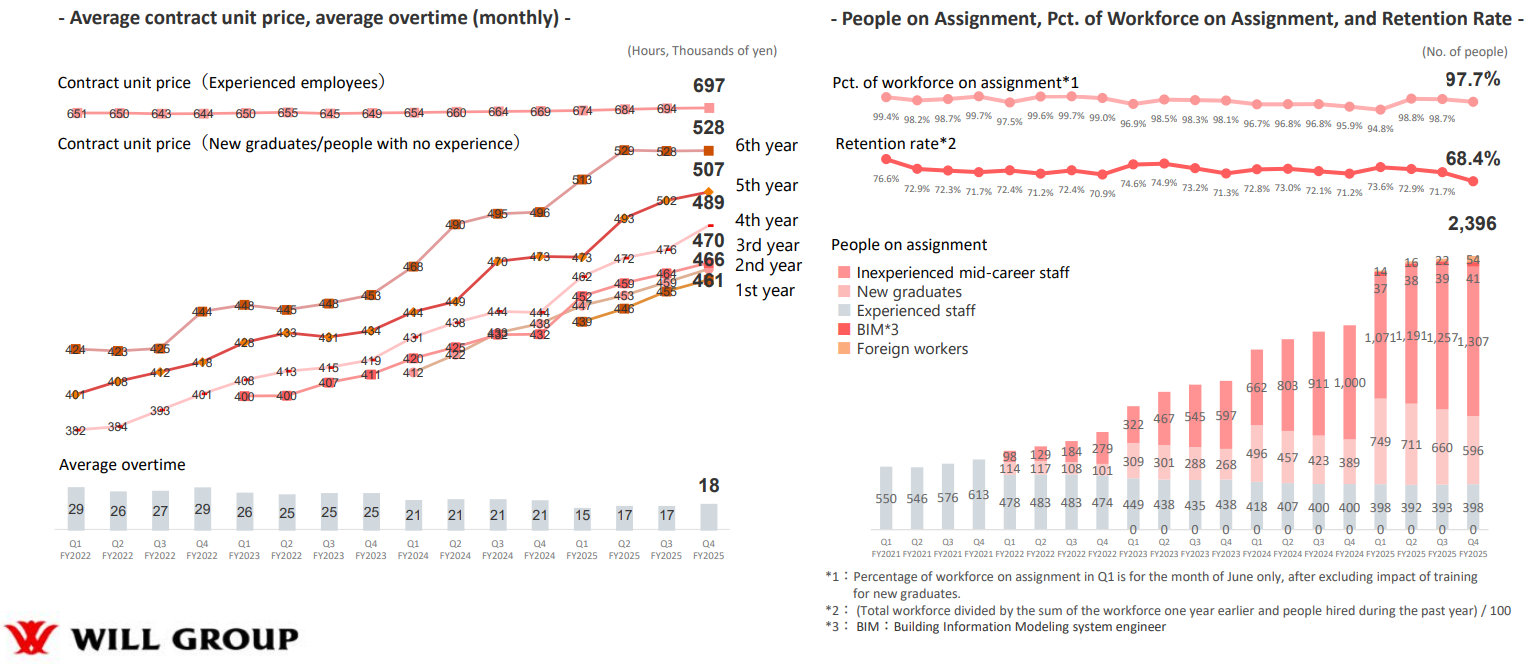

◎ Strategy I (domestic Working business): Further growth and monetization of the construction engineer field (Progress of the construction engineer field (1))

Sales were healthy thanks to the rise in contract price, and quarterly sales grew successively. The number of recruits in the fiscal year was 1,704, considerably exceeding the annual plan (1,200), as they accumulated recruitment know-how and cooperated with external agents.

(Reference material of the company)

*In the first quarter, 453 new graduates (260 new graduates in the previous fiscal year) are included.

◎ Strategy I (domestic Working business): Further growth and monetization of the construction engineer field (Progress of the construction engineer field (2))

The average contract price of workers fresh out of college and inexperienced workers rose around 6% year on year in the fourth quarter (Jan. to Mar.) thanks to the negotiation for prices with clients, and retention rate declined 3.3 points from the previous fourth quarter (Oct. to Dec.), as the number of inexperienced employees who have resigned increased. They will strive improve retention rate, by assessing workplaces, interviewing workers as follow-up activities, providing initiatives for qualifications, revising the salary evaluation system, and so on.

(Reference material of the company)

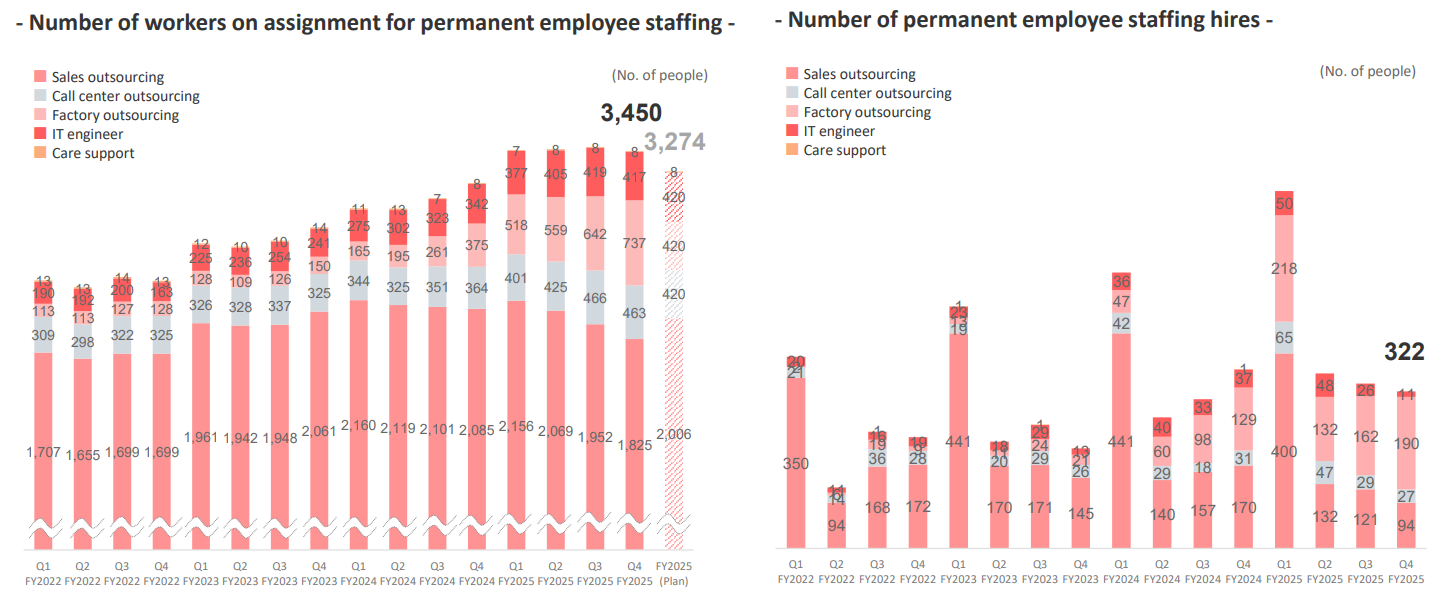

◎ Strategy II: Regrowth of domestic Working business (other than the construction engineer field) (Progress of the dispatch of full-time employees)

The number of dispatched full-time employees in service exceeded the annual plan. The growth of the sales support field was sluggish, but other fields, including the factory segment, were healthy. The number of full-time employees hired in the fourth quarter (Jan. to Mar.) declined year on year, but the annual number grew 16% from the previous fiscal year. The number of recruits has been steadily increasing.

(Reference material of the company)

◎ Strategy II: Regrowth of domestic Working business (other than the construction engineer field) (Progress of the support for employment of non-Japanese workers)

The number of non-Japanese employees for which the company supports employment reached the annual plan, as they strove to improve retention rate, but the number of new non-Japanese employees for which the company supports employment was somewhat sluggish. In order to achieve further growth, it is important to receive more orders. Accordingly, in the factory segment, they will increase marketing staff to approach new clients in the manufacturing market, whose scale is large and where demand for workers is significant, and also approach new clients in the field of nursing-care business support.

(Reference material of the company)

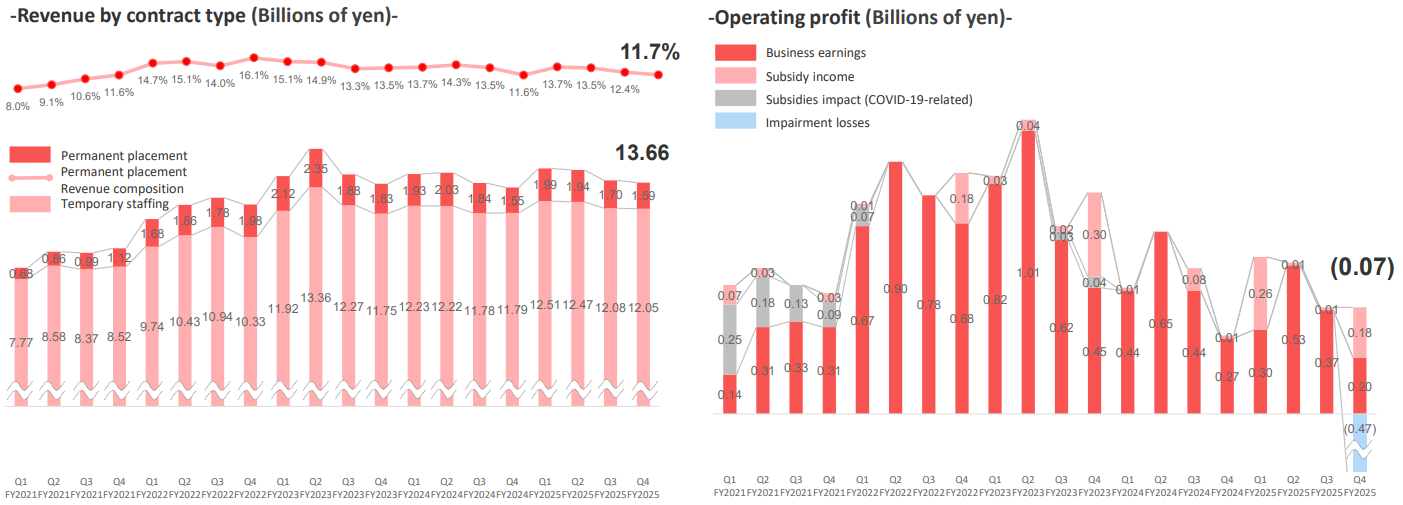

◎ Change in the gross profit composition by service

The ratio of gross profit in the target fields of their priority strategy (the dispatch of full-time employees, the undertaking of tasks, and support for employment of non-Japanese workers) expanded steadily from 29.8% in the last fiscal year of the previous medium-term management plan (fiscal year ended March 2023) to 43.6% in fiscal year ended March 2025. Accordingly, gross profit margin rose from 18.5% in the last fiscal year of the previous medium-term management plan (fiscal year ended March 2023) to 20.2% in fiscal year ended March 2025.

[2-5 Financial Position and Cash Flow]

◎ Balance Sheet

| Mar. 2024 | Mar. 2025 |

| Mar. 2024 | Mar. 2025 |

Current Assets | 26,129 | 26,551 | Current liabilities | 24,533 | 25,208 |

Cash | 7,106 | 6,936 | Operating debts, other debts | 16,485 | 16,956 |

Receivables, other receivables | 17,512 | 18,136 | Other current liabilities | 2,437 | 2,297 |

Non-Current Assets | 25,413 | 23,371 | Non-current liabilities | 9,490 | 7,354 |

Tangible fixed assets | 1,275 | 1,109 | Other financial debts | 4,837 | 3,636 |

Right-of-use assets | 5,071 | 4,381 | Total liabilities | 34,024 | 32,563 |

Goodwill | 8,737 | 8,166 | Total equity | 17,518 | 17,359 |

Other Intangible Assets | 6,109 | 5,605 | Equity attributable to owners of the parent augmented | 17,508 | 17,392 |

Other Financial Assets | 1,158 | 2,160 | Total liabilities and equity | 51,543 | 49,923 |

Total assets | 51,543 | 49,923 | Borrowings | 5,930 | 6,605 |

*Unit: Million yen

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

The total assets as of the end of March 2025 stood at 49,923 million yen from the end of the previous fiscal year, down 1,620 million yen from the end of the previous fiscal year. In the section of assets, major factors in decreasing assets were cash & deposits, assets of use rights, other non-current assets, other intangible assets, goodwill due to impairment loss, exchange rates, etc., and investments posted with the equity method. Major factors in increasing assets were accounts receivables, other receivables, and other financial assets due to the transfer and lending after the exclusion from the scope of the equity method, the acquisition of investment securities, etc. In the section of liabilities and net assets, major factors in decreasing them were other financial liabilities, accrued corporate income tax, translation adjustments of business entities outside Japan, and non-controlling interests. Major factors in increasing them are debts, operating payables, other payables, retained earnings due to the posting of net income attributable to owners of the parent company, and other equity instruments. The ratio of equity attributable to owners of the parent company rose 0.8% from the end of the previous fiscal year to 34.8%.

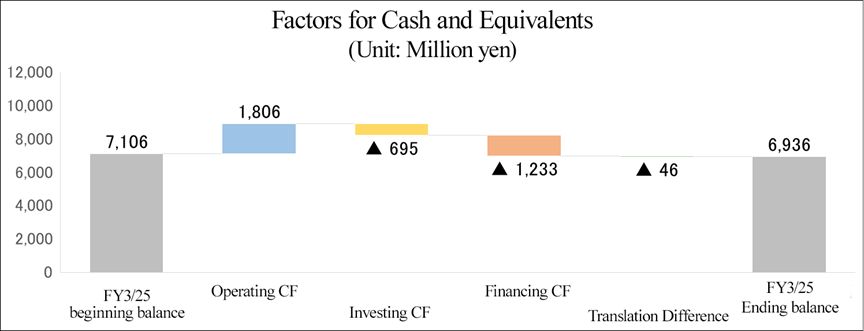

◎ Cash Flow

| FY 3/24 | FY 3/25 | YoY | |

Operating cash flow (A) | 3,828 | 1,806 | -2,022 | -52.8% |

Investing cash flow (B) | -575 | -695 | -120 | - |

Free cash flow (A+B) | 3,253 | 1,111 | -2,142 | -65.8% |

Financing cash flow | -6,232 | -1,233 | 4,999 | - |

Cash, equivalents at term-end | 7,106 | 6,936 | -170 | -2.4% |

*Unit: Million yen

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

In terms of cash flows, the cash inflow from operating activities shrank due to the decrease in pretax profit, the increase in operating receivables, the decline in operating payables, etc. The cash outflow from investment activities augmented due to the rise in expenditure for acquiring securities and offering loans, and the surplus of free cash flow decreased. On the other hand, the cash outflow from financial activities shrank due to the augmentation of short-term debts, the decrease in expenditure due to the repayment of long-term debts, etc. Accordingly, the year-end cash position dropped 2.4% from the previous fiscal year.

3. Fiscal Year ending March 2026 Earnings Estimates

[3-1 Consolidated Earnings Estimate]

| FY 3/25 | Ratio to sales | FY 3/26 (Est.) | Ratio to sales | YoY |

Sales | 139,705 | 100.0% | 134,600 | 100.0% | -3.7% |

Gross Profit | 29,383 | 21.0% | 29,360 | 21.8% | -0.1% |

Operating Income | 2,338 | 1.7% | 2,500 | 1.9% | +6.9% |

Pretax Profit | 2,177 | 1.6% | 2,380 | 1.8% | +9.3% |

Profit attributable to owners of parent | 1,155 | 0.8% | 1,560 | 1.2% | +35.0% |

*Unit: Million yen

Sales decreased 3.7% year on year, but operating income increased 6.9% year on year.

For the fiscal year ending March 2026, sales revenue is expected to decline 3.7% year on year to 134.6 billion yen and operating income is projected to rise 6.9% year on year to 2.5 billion yen.

In the domestic Working business, they will work on the expansion of the construction engineer field, the support for employment of non-Japanese workers, and the dispatch of more full-time employees, in accordance with the priority strategies set in the current medium-term plan. For expanding the construction engineer field, they will enhance the recruitment of inexperienced workers and implement measures for maintaining or improving retention rate and raising the average contract price. For dispatching more full-time employees, they carry out measures for brushing up their recruitment capacity by continuing the promotion of the WILLOF brand and strive to maintain or increase the number of workers in service. For the support for employment of non-Japanese workers, they will keep receiving orders from clients in the factory segment and the field of nursing-care business support, and recruit more workers in each region. In the overseas Working business, they conduct strategic cost management without degrading business value and prepare for the rebound of demand for introduction and dispatch of workers by securing excellent personnel for consultancy, despite the risk of economic downturn in each country and the concern over the prolongation of sluggishness of the markets of introduction and dispatch of workers.

Accordingly, sales revenue is forecast to decline 3.7% year on year, as the domestic Working business is expected to grow mainly in the construction engineer field and the forecast for the overseas Working business is conservative.

Operating income is expected to rise 6.9% year on year, as the operating income of the domestic Working business is expected to grow like the sales revenue, but the revenue from government subsidies in the overseas Working business is not taken into account in the forecast. Segment profit is projected to grow in each of the domestic Working business and the overseas Working business. In addition, normalized operating income, excluding the temporary profit and loss posted in the same period of the previous year, (operating income excluding the impairment loss and revenue from government subsidies in the overseas Working business and gain on sale of real estate in Other Businesses) is expected to rise 10.4% year on year. Operating income margin is projected to increase about 0.2 points year on year, through the strategic promotion of the medium-term management plan. EBITDA (Operating income + Depreciation & amortization + Impairment loss) is projected to decline 6.9% year on year to 4.56 billion yen.

They plan to pay a dividend of 44 yen/share, unchanged from the previous fiscal year. The expected payout ratio is 64.3%. Total payout ratio is forecast to be 65.1%.

[3-2 Priority strategy]

In order to achieve the sustainable growth of the corporate group, it is important to realize the regrowth of the domestic Working business. Accordingly, they will pursue the regrowth of the domestic Working business as the basic policy, actively carry out upfront investment for regrowth, and establish a foundation for achieving exponential growth by changing the profit earning structure during the period of the current medium-term plan.

◆Strategy Ⅰ Further growth of the construction engineer field and generation of profit

They will make the construction engineer field, which was monetized as planned in fiscal year ended March 2025, a business pillar in fiscal year ending March 2026.

◆Strategy Ⅱ Regrowth of the domestic Working business (excluding the construction engineer field)

They will engage in the expansion of the businesses of support for employment of non-Japanese workers and the dispatch of full-time employees. In order to expand the business of support for employment of non-Japanese workers, they will increase marketing staff to receive more orders, and cement alliances with local corporations, schools, etc. for local recruitment. In order to expand the business of dispatch of full-time employees, they will apply the recruitment know-how nurtured in the construction engineer field and sales support field to the factory segment. In addition, they will promote and strengthen the corporate brand, while forecasting that the recruitment environment will become harsher.

◆Strategy Ⅲ Stable growth of the overseas Working business

In both Singapore and Australia, main clients still curb recruitment after the steep growth of demand for workers in the post-COVID period subsided, and the market outlook remains unclear. Under these circumstances, they will strive to expand the sales from introduction of personnel after the recovery of demand while securing excellent consulting personnel, and make efforts to increase the sales from dispatch of workers in the domains where administration, etc. are stable, control costs, and tighten governance, in order to reduce the downside risk and enhance business stability.

[3-3 Estimate in Each Segment]

[Revenue]

| FY 3/25 Result | FY 3/26 Company Plan | YoY (Increase/ Decrease) | YoY (Increase/ Decrease Ratio) |

Domestic Working Business | 831.1 | 840.5 | +9.4 | +1.1% |

Overseas Working Business | 564.5 | 504.7 | -59.8 | -10.6% |

Other | 1.3 | 0.6 | -0.6 | -50.1% |

Revenue | 1,397.0 | 1,346.0 | -51.0 | -3.7% |

*Unit: 100 million yen.

[Operating Profit]

| FY 3/25 Result | FY 3/26 Company Plan | YoY (Increase/ Decrease) | YoY (Increase/ Decrease Ratio) |

Domestic Working Business | 32.5 | 36.9 | +4.4 | +13.7% |

Overseas Working Business | 14.3 | 14.7 | 0.4 | +2.9% |

Other | -2.2 | -3.1 | -0.9 | - |

Adjustments | -21.2 | -23.5 | -2.3 | - |

Operating profit | 23.3 | 25.0 | +1.6 | +6.9% |

*Unit: 100 million yen.

Domestic Working business

Sales revenue is expected to grow 1.1% year on year, thanks to the significant growth of the construction engineer field. Profit is projected to rise 13.7% year on year, due to the significant growth of the construction engineer field. The forecasts for fields other than construction engineers are conservative.

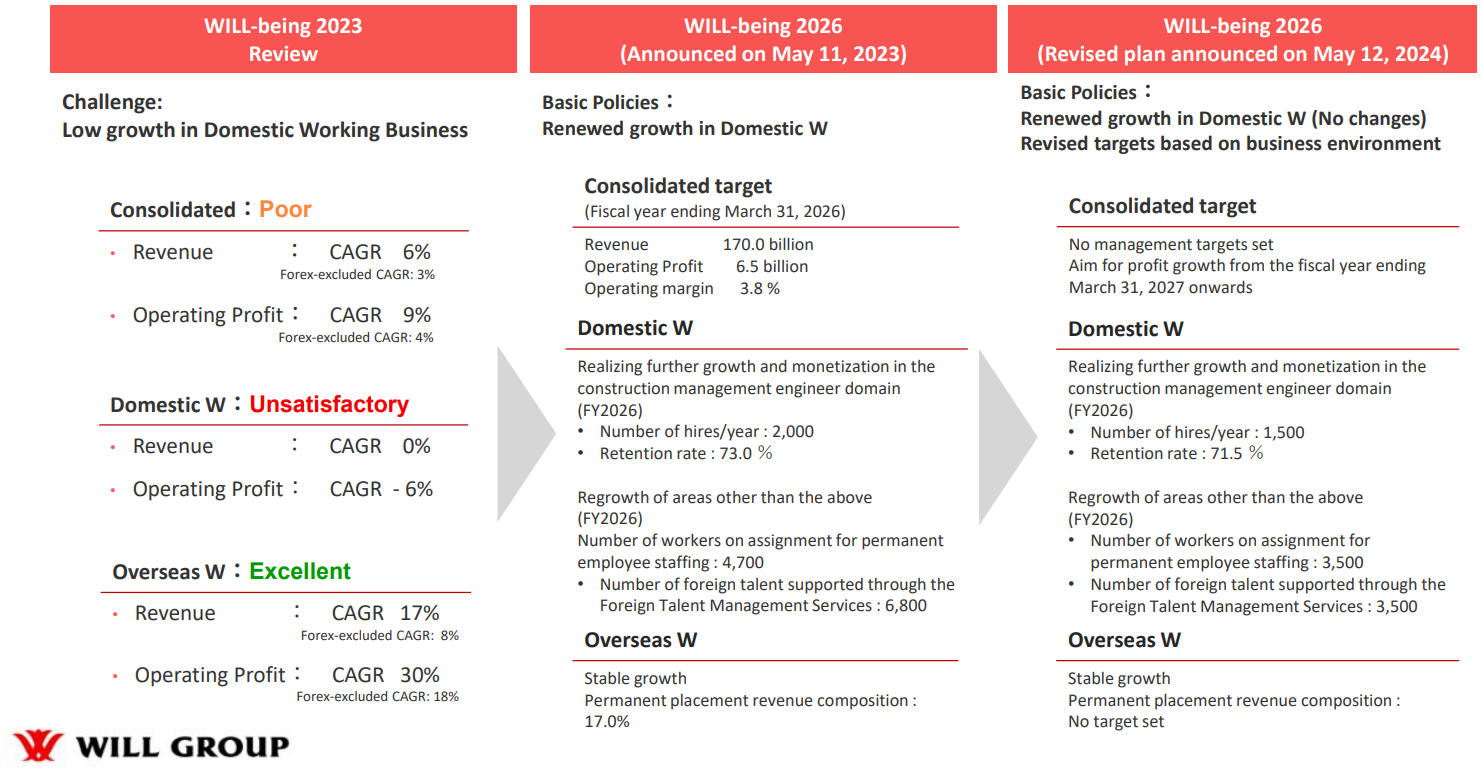

Priority strategy | KPI | Plan for FY 3/26 | ||

Domestic Working | Strategy Ⅰ | Further growth and monetization of the construction engineer field | Number of recruits per year | 1,500 |

Retention rate | 71.5% | |||

Strategy Ⅱ | Regrowth of the domestic Working business (excluding the construction engineer field) | Increase in the number of newly dispatched full-time employees | 3,500 | |

Increase in the number of non-Japanese employees for which the company supports employment | 3,500 | |||

Overseas Working business

Sales revenue is conservatively projected to decline 10.6% year on year, under the assumption that the market condition will remain harsh. The profit in this segment is expected to rise 2.9% year on year, as they will strengthen the profit earning structure by controlling SGA expenses. Normalized segment profit, excluding the temporary profit or loss (impairment loss and the revenue from government subsidies) posted in the previous fiscal year, is forecast to grow 3.3% year on year.

For fiscal year ending March 2026, it is assumed that 1 Australian dollar = 91 yen (100 yen in fiscal year ended March 2025) and 1 Singaporean dollar = 104 yen (114 yen in fiscal year ended March 2025). Regarding foreign exchange sensitivity per year, a 1-yen appreciation/depreciation of the yen with respect to the Australian dollar would change sales revenue by 370 million yen and profit by 10 million yen, while that with respect to the Singaporean dollar would change sales revenue by 150 million yen and profit by 10 million yen.

[3-4 Shareholder Return]

[Dividend Forecast]

As the shareholder return policy set in the medium-term management plan (fiscal year ended March 2024 to fiscal year ending March 2026), they will not decrease the dividend amount and achieve a total payout ratio of 30% or higher. Without decreasing the dividend amount, they will maintain or increase the dividend amount from the previous fiscal year. In addition, they will discuss the acquisition of treasury shares in a flexible manner according to the progress of business, while aiming to achieve a total payout ratio of 30% or higher.

The dividend for fiscal year ending March 2026 is expected to be unchanged from the previous fiscal year (44 yen/share), in accordance with the shareholder return policy. Total payout ratio is projected to be 65.1%.

[Shareholder return]

The company has a shareholder benefit system for promoting shareholders to hold shares in the medium/long term.

Continuous shareholding period*1 | 100-199 shares | 200 or more shares | Shareholder benefit yield*2 | Dividend yield |

Less than 1 year | Quo Card worth 500 yen | Quo Card worth 1,000 yen | 0.5% | 4.5% |

Less than 2 years | Quo Card worth 1,000 yen | Quo Card worth 2,000 yen | 1.0% | |

Less than 3 years | Quo Card worth 1,500 yen | Quo Card worth 3,000 yen | 1.5% | |

3 years or over | Quo Card worth 2,000 yen | Quo Card worth 4,000 yen | 2.0% |

*1: A continuous shareholding period starts on the record date, that is, March 31. The period will be considered to be less than 2 years, if a shareholder is listed in the shareholder register of the company with the same shareholder number twice in a row, less than 3 years if three times in a row, and 3 years or over if four or mor times in a row.

*2: Shareholder benefit yield and dividend yield were estimated from the closing price on May 9, 2025 (986 yen).

4. Progress of key strategies and major initiatives of Medium-Term Management Plan “WILL-being 2026”

The company has revised the management targets of its medium-term management plan (WILL-being 2026) on May 13, 2024, which was announced on May 11, 2023 and will end in fiscal year ending March 2026 (hereinafter referred to as “the medium-term management plan”).

[Background of the revision of management targets]

One year has passed since the announcement of this medium-term management plan, during which conditions have diverged from the original assumptions. To avoid management decisions that might prioritize short-term profit generation or restrict investments needed for future growth in pursuit of the management targets set for the fiscal year ending March 2026, the company decided to revise this plan. Moving forward, the company will focus on driving strategies that strengthen its ability to generate sustainable profits. Accordingly, the company will shift to management that maximizes the promotion of these strategies to ensure the realization of a growth phase from the fiscal year ending March 2026 onward.

(Reference material of the company)

[Progress of key strategies (no revisions) and major initiatives]

◆Strategy Ⅰ: To realize further growth and monetization in the construction engineer field

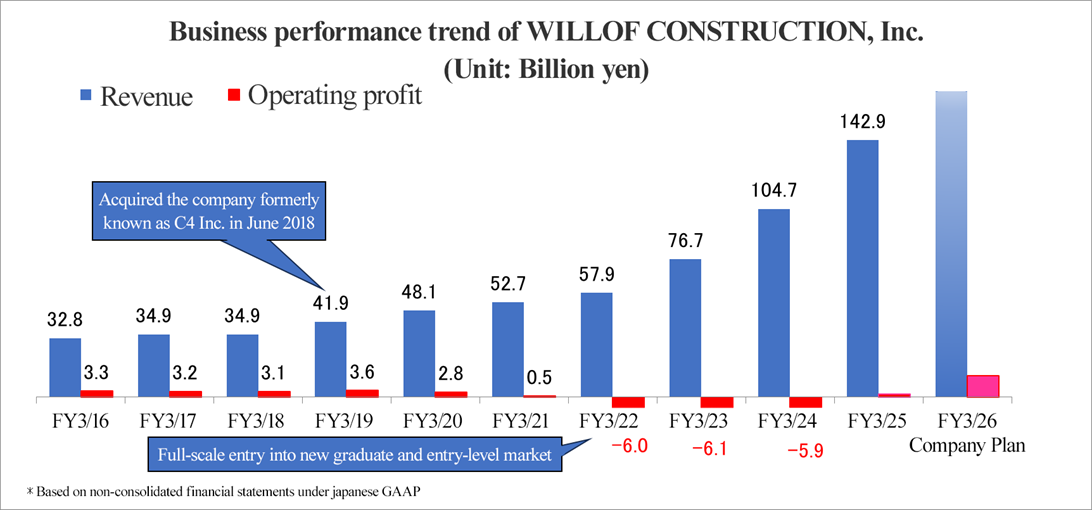

◎ Business performance trends in the construction engineer field (WILLOF CONSTRUCTION, Inc.)

The construction engineer field, which achieved profitability as planned in the fiscal year ended March 2025, will be positioned as one of the core businesses in the fiscal year ending March 2026. Sales revenue in the construction engineer field (WILLOF CONSTRUCTION, Inc.) for the fiscal year ended March 2025 grew four-fold (CAGR: +22%) from the fiscal year immediately prior to the acquisition (fiscal year ended March 2018). Operating income moved into the black in fiscal year ended March 2025, and the business is expected to become one of the pillars of the company's business in the future.

◎ Major initiatives in the construction engineer field

The company actively hired inexperienced personnel, including new graduates. They also enhanced post-employment training programs and held internal networking events to support employee development and retention.

(Reference material of the company)

◆Strategy Ⅱ: Regrowth of the domestic Working business (excluding the construction engineer field)

The company is working to expand its support for employment of non-Japanese workers. This service leverages a wide range of recruitment channels to hire people both domestically and overseas, while providing support for attracting clients, interviews, and training. Post-employment support, such as assistance in obtaining necessary qualifications, is also continuously offered.

◎ Major initiatives in supporting employment of non-Japanese workers

They actively supported non-Japanese people seeking better working conditions and skill acquisition. By collaborating with supervising organizations, they provided support to both the hiring companies and non-Japanese workers. Additionally, their local Vietnamese subsidiary, WILLOF Vietnam Company Limited, received the FDI (Foreign Direct Investment) Award, which is given to outstanding foreign companies. The company group continues to provide support through education and recruitment assistance, overcoming all barriers such as borders and nationalities, to help everyone build a happy future.

(Reference material of the company)

◆Strategy Ⅲ: Stable growth of the overseas Working business

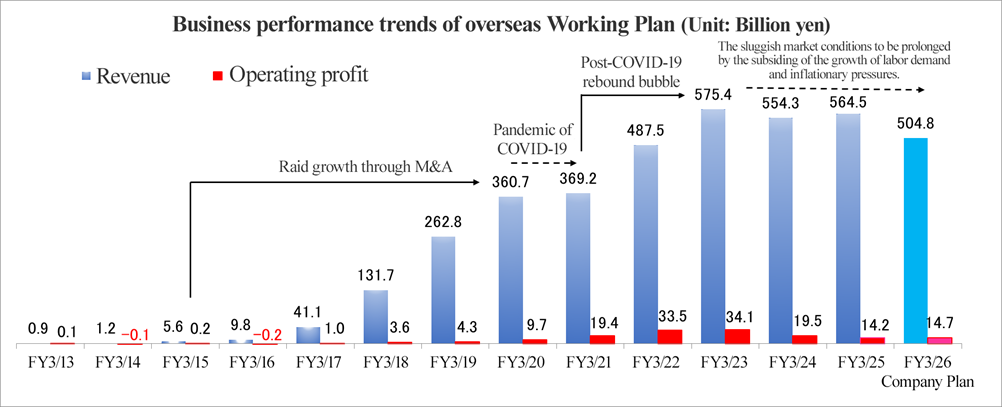

◎ Business performance trend in the overseas Working business

By smoothly advancing PMI through earn-out schemes for business succession and pursuing cost synergies by integrating back-office functions, the company has expanded its performance while maintaining high profitability even after the fiscal year ended March 2020, during which no M&A was conducted. Recently, although the business has been affected by the subsiding of the steep growth of labor demand in the post-COVID period and market deterioration due to inflationary pressures, the CAGR of revenue based on the fiscal year ended March 2015, when full-scale M&A began, remains at a high level of 58.7%.

◎ Major Initiatives in the overseas Working business

The main clients in the overseas Working business are government bodies and related agencies, the financial industry, and the telecommunications industry. The business provides staffing and recruitment services primarily for white-collar workers, focusing on medium to high-priced, high-performing talent.

(Reference material of the company)

[Measures for Realizing Business Administration Conscious of Capital Cost and Stock Price]

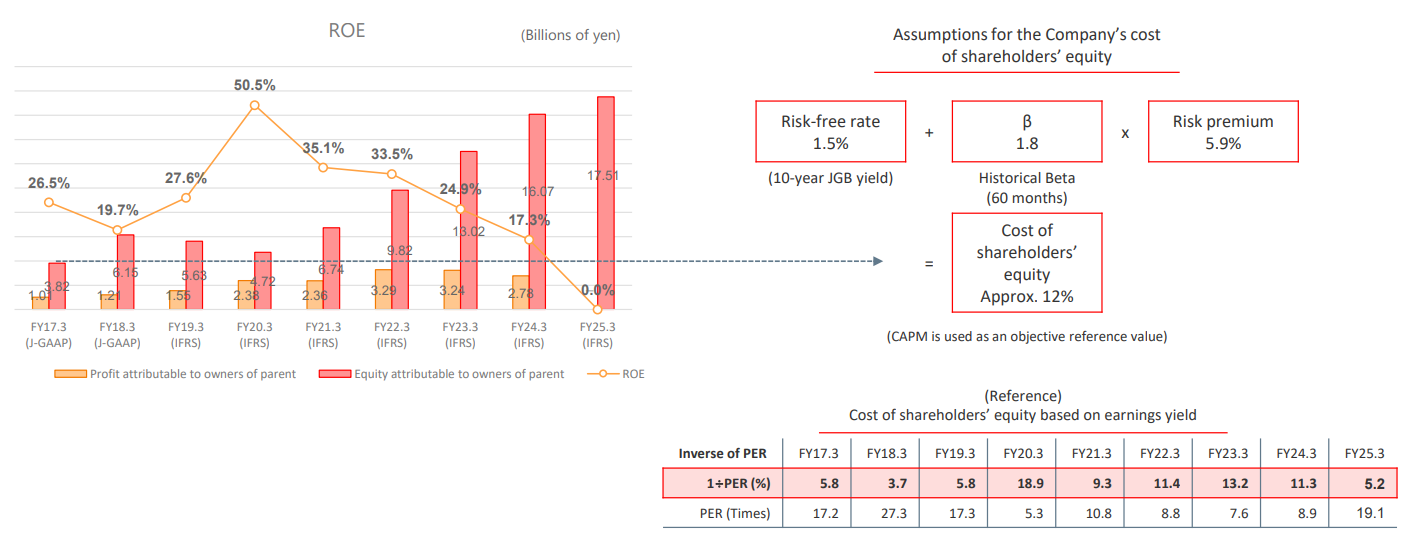

◆Cost of Shareholders’ Equity and ROE

Due to slower profit growth and an increase in equity attributable to owners of the parent company from improved financial health, ROE has been declining year by year after peaking in the fiscal year ended March 2020. In the fiscal year ended March 2025, ROE fell below the company’s recognized cost of shareholders’ equity (approximately 12%).

(Reference material of the company)

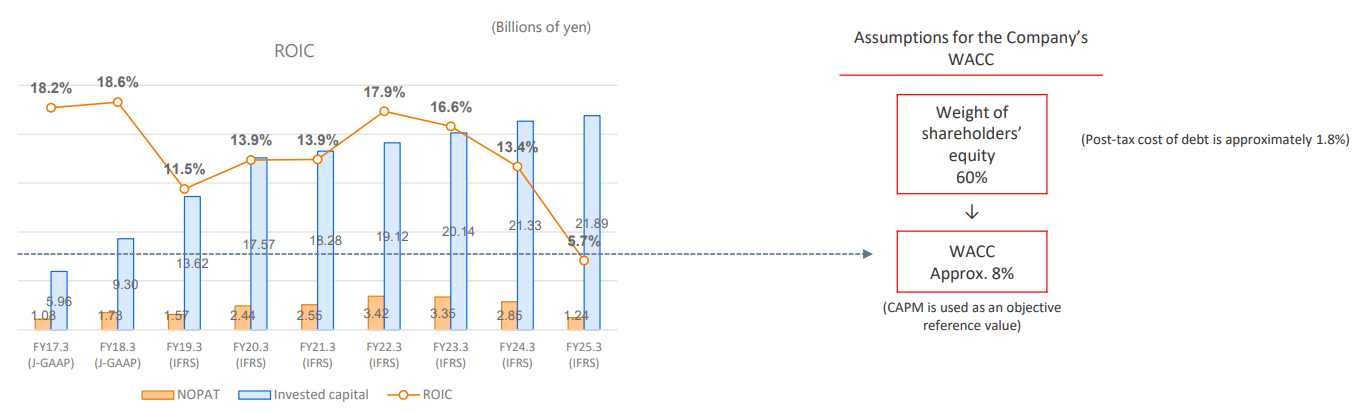

◆Weighted Average Cost of Capital (WACC) and ROIC

Due to slower profit growth and an increase in capital resulting from improved financial health, ROIC has been declining year by year after peaking in the fiscal year ended March 2022. In the fiscal year ended March 2025, ROIC fell below the company’s recognized WACC (approximately 8%).

(Reference material of the company)

◆Cash Allocation Policy

Investment in the growth of existing businesses, including M&A, is given the highest priority. At the same time, share buybacks will be considered as needed depending on stock price and business performance.

Cash Generation | ||

Operating cash flow is generated through the regrowth of the domestic Working business. | ||

| Cash allocation policy | |

Growth investments | Investment in existing businesses | An increase of 3.5 billion yen in SG&A expenses (including revenue-generating advertising and recruitment costs) is planned over the three-year medium-term plan. |

M&A | A maximum investment framework of 10 billion yen is set for the three-year medium-term plan. | |

Shareholder Return | Dividend | Dividends will be progressive, with a total payout ratio of 30% or higher |

Acquisition of treasury shares | Shareholder returns will be carried out flexibly based on stock price and business performance. | |

* WACC is approximately 8%. The priority order for cash allocation is as follows:

investment in existing businesses → M&A → dividends → shareholder return → reduction of interest-bearing debt → holding as cash and deposits

◆M&A Policy

Targets and financial discipline have been established, and M&A activities, which had been paused under the previous medium-term management plan, will be resumed.

Targets | While emphasizing the consistency with the goal of “maximizing and optimizing career paths to develop workers into experts,” the company seeks businesses that can accelerate growth for Will Group and contribute to future operating profit margin targets. ◆Technical staffing business in IT, construction, and manufacturing fields ◆Recruitment business with expected expansion into expert roles ◆Education and training business |

Process | ◆Involvement from the initial stage by the responsible domain managers and PMI (post-merger integration) personnel ◆Ensuring transparency through the company’s past M&A process execution |

Financial rules | ◆M&A funding will be prioritized by using free cash flow first, followed by borrowing if needed ◆Achieve ROIC exceeding the company’s cost of capital (WACC approx. 8%) through appropriate pricing at acquisition |

Governance | ◆To strengthen management for synergy generation, monitor acquisition plans during investment, and make timely decisions on withdrawal or sale to implement proper governance |

5. Conclusions

In the company's earnings results for the fiscal year ended March 2025, operating income dropped 48.3% year on year, although sales grew 1.1% year on year. Though it may seem tough at first glance, the operating income in the fiscal year ended March 2024 included the temporary gain on sale of shares of subsidiaries amounting to 2,063 million yen, and this is due to decline in sales revenue (3,420 million yen in the fiscal year ended March 2024) and operating income (543 million yen in the fiscal year ended March 2024) of said subsidiaries in the fiscal year ended March 2025. Excluding such temporary profit, etc., operating income grew 22.0% year on year, the results were favorable. In the construction engineer field, which is expected to grow in the medium-term management plan, sales grew over 3.8 billion yen year on year, and operating income moved into the black. In fiscal year ended March 2025, they planned to recruit 1,200 people in the construction engineer field, but actually they recruited 1,704 people. This is because they smoothly recruited inexperienced people, including new graduates, based on the accumulated know-how for recruitment and the alliances with external agents. In the construction engineer field, the negotiation with clients for prices turned out to be effective, so the average contract price of inexperienced workers, including employees fresh out of college, is increasing. This is a positive trend. The company is expected to considerably increase sales and profit in the construction engineer field in fiscal year ending March 2026, too. In the construction engineer field, where the significant shortage of manpower lingered, they recruited many people in fiscal year ended March 2025, so it is highly likely that the sales revenue and operating income in the construction engineer field will increase significantly in fiscal year ending March 2026. It is noteworthy how much they will improve the performance in the construction engineer field, by training increased employees. It is a shame that the retention rate in the construction engineer field fell below the initial plan. This is due to the increase of inexperienced employees who have resigned. They will strive improve retention rate, by assessing workplaces, interviewing workers as follow-up activities, providing initiatives for qualifications, revising the salary evaluation system, and so on. It is noteworthy whether these measures will lead to the improvement in retention rate in the construction engineer field.

While the construction engineer field is healthy, the overseas Working business is struggling. In Singapore and Australia, companies still curb recruitment due to the stagnant demand for personnel, so sales and profit, excluding the effects of exchange rates, decreased in the businesses of introduction and dispatch of workers in fiscal year ended March 2025. For fiscal year ending March 2026, the sales of the overseas Working business are forecast to drop 10.6% year on year, under the assumption that the market condition will remain harsh. Exchange rates are conservatively forecast, so it is unlikely that sales will drop that much, but it seems difficult to improve the recruitment environment significantly. It is noteworthy when the overseas Working business will start full-scale recovery.

The company has achieved significant growth through active and strategic M&A mainly outside Japan. However, from the period of the previous medium-term management plan, the company has refrained from conducting M&A. According to the current medium-term management plan, they will set targets, formulate financial rules, and resume M&A. We would like to pay attention to what kind of M&A will be conducted with expectation.

<Reference: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with auditor(s) |

Directors | 5 directors, including 3 external ones |

Auditors | 4 auditors, including 4 external ones |

Corporate Governance Report Updated on June 24, 2024

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company follows all principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code>

[Supplementary Principle 2-4-1① Ensuring Diversity Within the Company, Including Promotion of Women’s Activities]

In an era where market conditions are rapidly changing and a future is difficult to predict, the company recognizes the importance of utilizing diverse perspectives and values in corporate management, in order to create new business opportunities without being bound by the current business domain. Therefore, the corporate group actively and continuously hires and promotes diverse human resources, including women, non-Japanese nationals, and mid-career workers with a variety of work experiences, and promotes initiatives such as development of a working environment that makes the most of individual characteristics and abilities, as well as management-level education. They will continue to work to have a ratio of core personnel equal to respective employee ratios by 2030.

(1) Promotion of Female Core Personnel.

In recent years, the company has been actively promoting the advancement of women, and has conducted career development training for young employees, as well as management training for managers. While the percentage of female employees among full-time employees is 46.3%, the percentage of female managers is 30.0%, falling below the percentage of female employees. Aiming to increase the ratio of female managers to 40% by 2030, the company will continue to improve the workplace environment, foster career awareness, etc., and increase the number of female employees who will be involved in management decision-making in the future.

(2) Promotion of non-Japanese employees as core personnel

Our corporate group not only owns 35 overseas consolidated subsidiaries, but also offers staffing services with non-Japanese personnel in Japan, so many non-Japanese employees belong to our company. The ratio of non-Japanese employees to regular employees is 30.7% and the ratio of non-Japanese managers is as high as 40.2%. We will keep promoting non-Japanese employees actively inside and outside Japan.

(3) Promotion of mid-career workers as core personnel (in Japanese enterprises only)

Our corporate group actively recruits mid-career workers with various work records, and promotes them to managerial positions. The ratio of mid-career workers to regular employees is 70.5%, and the ratio of managers promoted from mid-career hires is 69.0%, securing the same level. We will continue the recruitment, training, and promotion of new graduates and mid-career workers.

[Principle 3-1 Enhancement of Disclosure of Information]

(i) Management philosophy, management strategy, and the mid-term management plan are disclosed on the company’s website.

(Management Philosophy: https://willgroup.co.jp/profile/policy/)

(The Mid-term Management Plan: https://willgroup.co.jp/ir/strategy/)

(ii) It is as stated in I-1 “Basic Approach” of this report. For specific policies and initiatives based on this, please refer to each section of this report.

(iii) The company’s policy for determining the remuneration for directors is described in II-1 “Matters Relating to Institutional Structure and Organizational Operation, etc. [Relating to Remuneration of Directors]” of this report.

(ⅳ) The election and appointment of executives and nomination of candidates for directors are comprehensively reviewed from the viewpoint of the right personnel for the right position, in accordance with internal rules, taking into consideration accurate and prompt decision making, appropriate risk management, monitoring of execution of duties, and the balance that can cover each function of the company and each business division of the group companies. Furthermore, in nominating candidates for corporate auditors, they are comprehensively reviewed from the viewpoint of the right personnel for the right position, while ensuring the balance between their knowledge in finance and accounting, knowledge in the company’s business areas, and their diverse perspectives on corporate management. Based on these policies, the Nominating Committee, which includes independent outside directors, deliberates in advance, and the Board of Directors makes a resolution. Similarly, the dismissal of executives is discussed in advance by the Nominating Committee, which includes independent outside directors, in accordance with internal rules, and is resolved at the Board of Directors meeting.

(v) Candidates for directors and corporate auditors as well as the reason for their election and their career are stated in the reference material for the General Meeting of Shareholders on a case-by-case basis. For reference material for each General Meeting of Shareholders, please refer to the Notice of Convocation of the General Meeting of Shareholders posted on the company’s website. In the event of dismissal, appropriate disclosure will be made in a timely manner in accordance with policies and procedures. (Notice of Convocation of the General Meeting of Shareholders: https://willgroup.co.jp/ir/stock_info/general_meeting/)

[Principle 5-1 Policies related to Constructive Interaction with Shareholders]

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website.

(Disclosure policy: https://willgroup.co.jp/ir/disclosure/)

Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director, and executive officers in charge of the management headquarters aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy, and continuity with regard to management and business strategies, financial information etc.

(2) The management headquarters takes a central role, and the management planning, general affairs, financial affairs, accounting, legal affairs department and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair, and suitable fashion.

(3) As a means of dialogue, the company holds company briefings for individuals, as well as financial results briefings for institutional investors. In addition, the company will continue to enhance IR activities by posting video clips of briefings, contents of question-and-answer sessions, and other information on the company’s website.

(4) Individual meetings with shareholders will be conducted, with the IR Group of Corporate Secretariat as the point of contact. Based on the shareholder’s request and the purpose of the meeting, executives, directors including outside directors, or corporate auditors will meet with the shareholders and provide appropriate responses within a reasonable scope.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

(6) In addition to establishing a quiet period in accordance with the Disclosure Policy, the Company will operate and thoroughly implement rules and regulations regarding the management of insider information.

*The disclosed documents relating to the above items can be found on the company’s website (https://willgroup.co.jp/ir/news/).

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |