Bridge Report:(6232)Autonomous Control Systems Laboratory Fiscal Year March 2019

President Hiroaki Ohta | Autonomous Control Systems Laboratory Ltd. (6232) |

|

Corporate Information

Exchange | TSE Mothers |

Industry | Machinery (Manufacturing) |

President | Hiroaki Ohta |

Address | WBG Marive West 32F, 2-6-1 Nakase, Mihama-ku, Chiba-city, Chiba |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Act.) | Trading Unit | |

¥4,070 | 10,246,605 shares | ¥41,704 million | - | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

- | - | ¥11.67 | 348.8 times | ¥457.93 | 8.9 times |

*Share price as of closing on May 15

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2016 (Act.)* | 121 | -6 | 0 | -1 | - | - |

Mar. 2017 (Act.) | 156 | -533 | -486 | -488 | - | - |

Mar. 2018 (Act.) | 370 | -542 | -454 | -460 | - | - |

Mar. 2019 (Act.) | 807 | -330 | -176 | -183 | -19.42 | - |

Mar. 2020 (Est.) | 1,418 | 9 | 187 | 119 | 11.67 | - |

*For the term ended Mar. 2016, two-month results are indicated, because accounting periods were changed. The estimated values were provided by the company.

*(Unit: ¥mn)

Autonomous Control Systems Laboratory develops and manufactures fully autonomous drones utilizing the cutting-edge autonomous control technology, which can “think and fly by themselves,” and offers solutions for streamlining business operation, automating business processes, and adopting IoT while utilizing drones. We will outline this company and its performance as well as the interview with the President Ohta.

Table of Contents

Key Points

1. Company Overview

2. Overview of the Financial Results for Fiscal Year Ended March 2019

3. Fiscal Year Ending March 2020 Earnings Forecast

4. Interview with the President Ohta

5. Conclusions

<Reference: Corporate Governance>

Key Points

- The drones provided by Autonomous Control Systems Laboratory are “made in Japan, and think and fly by themselves to work for people.” The company possesses all necessary technologies for autonomous control, including “Visual SLAM,” which estimates the drone’s location even without the global positioning system (GPS), and recognizes itself as an integrator of drone technologies. Since the drones are customized by installing the data of each customer’s business know-how and reflecting feedback from customers, the switching cost is high, and contracts last long.

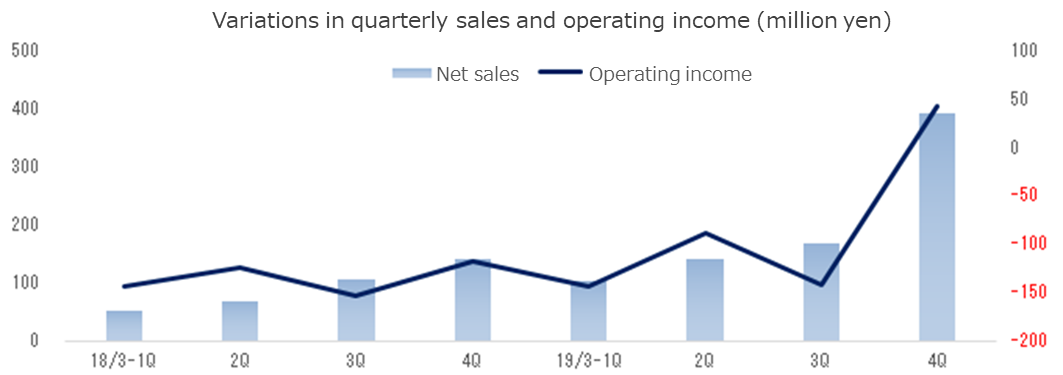

- In the term ended March 2019, the number of customers and the sales volume of drones increased steadily, and these were as estimated as a whole. The company posted an operating loss of 330 million yen, but 4Q (January to March) saw an operating income of 44 million yen. In the term ending March 2020, sales are estimated to be over 1.4 billion yen, up 75.7% year on year, and it is forecasted that the company will no longer post an operating loss, but an operating income of 9 million yen. Net income is projected to be 119 million yen, due to the posting of revenue from the subsidy of a national project, etc.

- Each project has progressed steadily, and the sales volume of drones increased from 40 in the term ended March 2018 to 106 in the term ended March 2019. In the term ending March 2020, it is estimated to be 220, with sales exceeding the break-even point. If the sales volume in the term ending March 2021 reaches around 500, which is a goal, marginal profit will grow considerably. According to the progress of projects, sales volume will vary somewhat, but a significant proportion of a sales increment will contribute to profit.

1. Company Overview

Autonomous Control Systems Laboratory develops and sells fully autonomous drones (which can fly based on a preset program or the like without being operated by a person), which do not require the operation with a controller and automatically take off and return. The company targets the fields of “infrastructure inspection,” “logistics and mail transportation,” and “disaster prevention and control,” in which high-level autonomous flying is frequently demanded. The drones of the company work on behalf of human workers in these fields. Accordingly, the business of the company is to not merely manufacture and sell machines, but also offer solutions for streamlining business operation, automating business processes, and adopting IoT. The company deals with tasks from planning, system development and installation, to after-sales services on a one-stop basis.

【Basic policy for business administration】

The first policy is to create purposes of use of drones that would generate actual economic effects, through projects with business partners (core clients) with which the company can foster continuous transaction relations in various fields, based on “ACSL-PF1,” an industrial drone platform. The second policy is to establish a business model for facilitating technological innovation by maintaining large revenue and continuing investment for development, by dealing with the fee-charging proof of concept (PoC) using original drones and systems, system integration for using drones for customers’ businesses, and mass production (of customized industrial products for which the pressure of replacement is low).

【Corporate History】

Autonomous Control Systems Laboratory has roots in Nonami Laboratory, Chiba University, which started developing the technology for fully autonomous drones in 1998. Nonami Laboratory accumulated research outcomes from fundamental research, and succeeded in actualizing autonomous control for the first time in the world in August 2001. Then, it was incorporated as Autonomous Control Systems Laboratory Ltd. (ACSL) in November 2013, so that its autonomous control technology could be used in a broad range of industries. In July 2016, Mr. Hiroaki Ohta (who is the present president) was appointed as COO, to establish management and development systems, and the company was listed in Mothers of Tokyo Stock Exchange in December 2018.

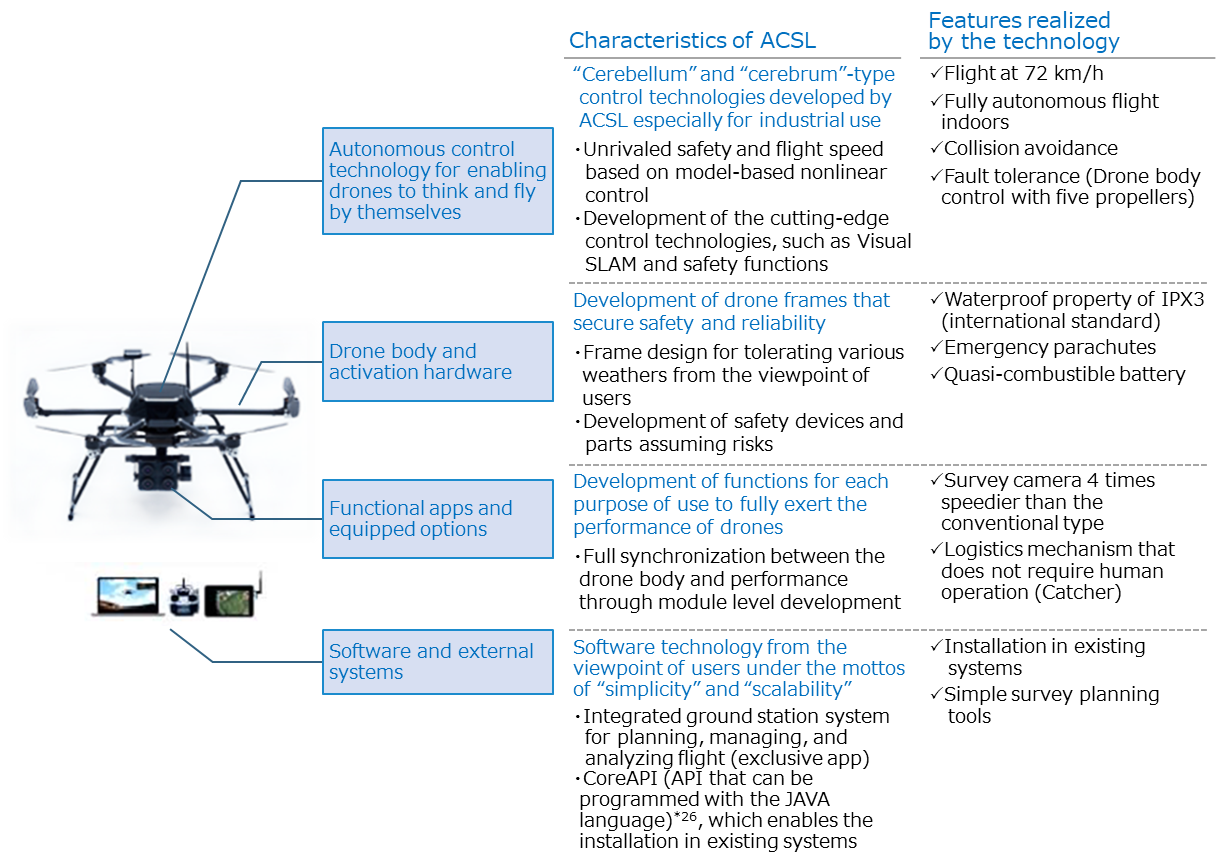

【Platform technology-Autonomous control technology for “enabling drones to think and fly by themselves,” its peripheral technologies, and system development capability】

The company has developed and commercialized necessary technologies for autonomous flying as platform technologies, including Visual SLAM for estimating the drone’s location, which realizes autonomous flying without GPS with image processing, original communications and cloud systems for accumulating and analyzing flight logs and image data of drones, AI for flight control, which can recognize people, passages, etc., and parachutes for enhancing safety. By integrating these technologies, the company developed the platform “ACSL-PF1,” and based on it, the company develops and supplies customized drones for each industrial purpose of use.

Platform “ACSL-PF1”

(Taken from the reference material of the company)

Autonomous control technology for enabling drones to think and fly by themselves

The autonomous control technology corresponds to the human brain. For the technologies such as control of drone positions and flight movements, etc., which correspond to “cerebellum” for controlling human movement functions, the company uses the cutting-edge control theory of the model base and algorithms for nonlinear control for some parts. Nonlinear control is more accurate than the common control method (PID control) adopted by competitors and groups that promote open source codes. Therefore, the drones of ACSL are excellent in resistance to wind, stability during high-speed flight and against abrupt movements, and so on.

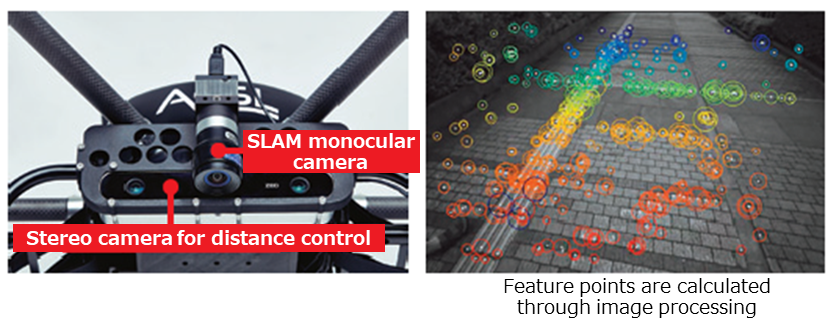

For the parts corresponding to the “cerebrum,” which controls the human functions to see object with the eyes and think, the company uses “Visual SLAM,” an original environment recognition technology for estimating the drone’s location with a built-in GPU, which performs a real-time analysis and processing of the images taken by a “SLAM monocular camera” for estimating the location and direction of the drone and the images taken by a “stereo camera for distance control” mounted with two camera modules. By connecting it with the “cerebellum”-like unit of the drone, it became possible to enable fully autonomous flight without GPS, which could not be realized by conventional GPS-based drone control.

While the conventional satellite-based control uses GPS data, an air pressure sensor (measuring barometric altitude), and a digital compass (measuring azimuth), “Visual SLAM” does not require them.

Cutting-edge cerebrum-like technologies

While the drone’s position and direction are estimated with the downward-pointing SLAM monocular camera, two images with different optical axes are taken with the front stereo camera for distance control, which is mounted with two camera modules, and these images are analyzed on a real-time basis to calculate the distance (horizontal and vertical directions) from an object. Since GPS data are not used, the drone can fly autonomously and safely even indoors and in the vicinity of a structure where GPS cannot be used.

(Taken from the reference material of the company)

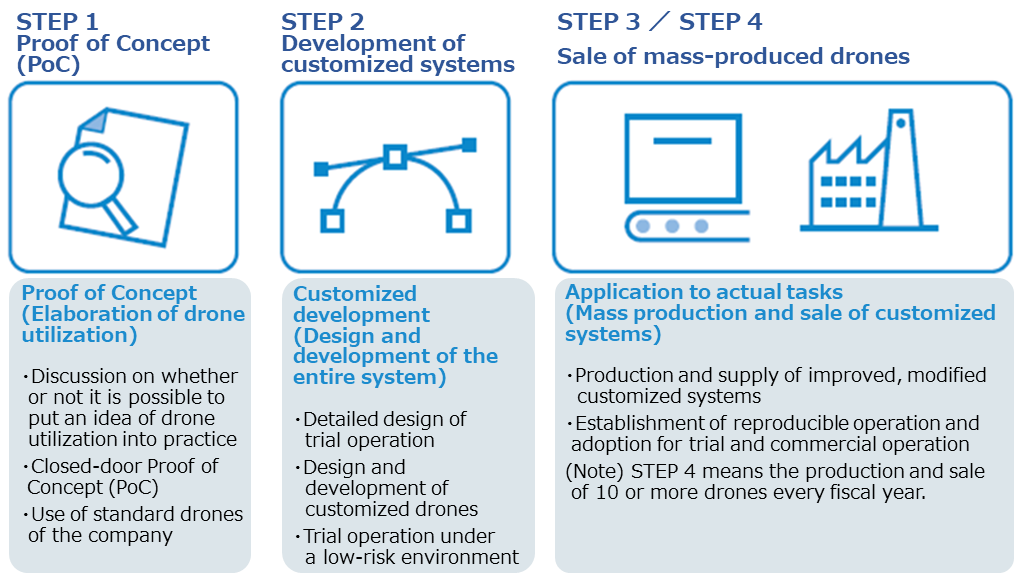

【Business model】

The services of the company can be classified into Step 1, which conducts Proof of Concept (PoC) according to customer needs, Step 2, which designs and develops customized drones based on PoC, and Steps 3 and 4, which produce a small number of drones and apply them to actual tasks.

STEP 1

To meet customers’ needs for adoption of drones, the company conducts PoC using its test drones for solving problems while charging fees. PoC means an experiment using available technologies in order to study the feasibilities of new use cases. The company checks whether it is possible to streamline business operation, automate processes, and adopt IoT, etc. with the minimum system configuration of drones, which are the purposes of drone adoption of customers. The company demonstrates that concepts and theories can be put to practical use.

STEP 2

The company conducts the design and development of the entire customized systems, including the integration of drones into customers’ existing systems, and offers operation simulators required for installing drones safely and services of maintaining and inspecting drones (system installation and operation support).

STEP 3

The company carries out trial operation of customized systems developed at STEP 2 in customers’ facilities, sells them for commercial use, and offers maintenance support after selling drones. Through maintenance support, the company receives drone maintenance fees, which arise regularly after sale, prices of supplies, and charges for on-site consulting services. In addition, the company is continuously improving the practical design for each customer.

Drones are adopted for inspecting factory equipments, buildings, bridges, etc., assessing closed environments, such as sewerage pipes, transporting items for distribution and postal services, surveying disaster-affected areas at an early stage, and so on. The incorporation of drones for them helps streamline business operation, automate processes, and apply IoT.

STEP 4 means the production and supply of 10 or more drones every fiscal year. It is different from STEP 3, in that full-blown incorporation of drones into concrete operations is assumed.

(Taken from the reference material of the company)

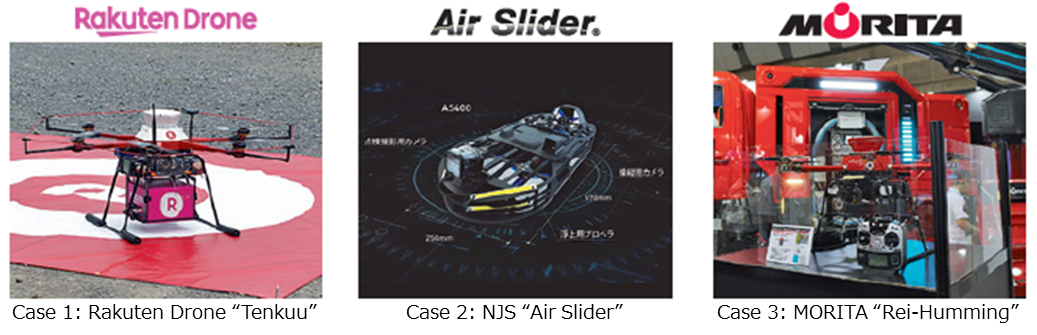

Cases of some users

(Taken from the reference material of the company)

Case 1 “Tenkuu,” a multicopter-type drone of Rakuten, Inc. for delivery

Drone-based distribution system promoted with the aim of solving the last mile problem around Japan

Case 2 “Air Slider,” a drone of NJS Co., Ltd. for inspecting and assessing conduits and closed spaces

Inspection drone system for facilitating the rationalization of inspection of infrastructure in a closed environment, including sewers

Case 3 “Rei-Humming,” a disaster response drone of MORITA CORPORATION

A disaster response drone system that is mounted on fire engines and can conduct surveys for a long period of time

2. Overview of the Financial Results for Fiscal Year Ended March 2019

| FY3/18 | Ratio to sales | FY3/19 | Ratio to sales | YOY | Estimate as of listing | Initial estimate comparison |

Net Sales | 370 | 100.0% | 807 | 100.0% | +118.1% | 803 | +0.5% |

Gross profit | 177 | 47.8% | 403 | 50.0% | +127.9% | - | - |

SG&A expenses | 719 | 194.3% | 733 | 90.9% | +2.0% | - | - |

Operating income | -542 | - | -330 | - | - | -302 | - |

Ordinary income | -454 | - | -176 | - | - | -150 | - |

Net income | -460 | - | -183 | - | - | -150 | - |

*Unit: Million yen

In the 4th quarter, an operating income was posted.

Sales were 807 million yen, up 118.1% year on year. The sales from Steps 1-2, in which the company conducts PoC for demonstrating economic merits and customized development based on PoC, grew 35.2% year on year to 293 million yen. The sales from Steps 3-4, which correspond to the stages of mass-producing and selling drones, increased 4.2 times year on year to 384 million yen.

As for STEPs 1 and 2, the number of transactions increased from 60 in the previous term to 81, thanks to the increase of new customers and the growth of existing customers’ needs for use of drones for other purposes. As for STEPs 3 and 4, which correspond to the phases of applying drones to actual tasks for users, sales volume grew from 40 drones in the previous term to 106 drones, as more customers adopted drone systems. The price of a drone is about 3.84 million yen. Other sales doubled, as the sales from maintenance, including the sale of parts, increased in proportion to the cumulative sales volume of drones, and the sales form a national project (one project in the term ended March 2019) were posted.

Operating income/loss improved from an operating loss of 542 million yen to an operating loss of 330 million yen. Gross profit ratio increased 2.2 points and gross profit grew 127.9% year on year to 403 million yen, thanks to the economies of scale due to sales growth. SG&A expenses, which are composed of mainly personnel and R&D costs, slightly increased by 2.0% year on year. R&D cost augmented over 10% year on year to 366 million yen, but the ratio of R&D cost to sales dropped 43 points to 45%. The cost for development exclusively for specific projects was posted as the cost for STEPs 1 and 2, and the R&D cost posted in SG&A expenses is related to the platform technology (internal development cost), which is the base for drones.

Net loss was curbed and stood at 183 million yen, due to the improvement in non-operating income/loss as the company posted a subsidy of 150 million yen (96 million yen in the previous term) for the development related to a national project implemented in the previous term ended March 2018.

Sales of each Step

| FY 3/18 | composition ratio | FY 3/19 | Composition ratio | YOY | Estimate as of listing | Initial estimate comparison |

STEPs 1 and 2: Development of solutions | 217 | 58.7% | 293 | 36.4% | +35.2% | 350 | -16.0% |

STEPs 3 and 4: Sales of mass-produced drones | 90 | 24.5% | 384 | 47.6% | +326.6% | 351 | +9.5% |

Other | 62 | 16.8% | 129 | 16.0% | +108.2% | 100 | +29.2% |

Total | 370 | 100.0% | 807 | 100.0% | +118.1% | 801 | +0.8% |

*Unit: Million yen

|

| FY 3/17 | FY 3/18 | FY 3/19 |

Development of solutions (STEPs 1 and 2) | Net sales (million yen) | - | 217 | 293 |

No. of projects (projects) | 12 | 60 | 81 | |

Sale of drones (STEPs 3 and 4) | Net sales (million yen) | - | 90 | 384 |

No. of drones (units) | 40 | 40 | 106 | |

Other sales | Maintenance service (million yen) | - | 34 | 63 |

National project (million yen) | - | 28 | 66 |

The subsidy received for a national project is usually booked as non-operating income, but for the project of “NEDO performance evaluation criteria” aimed at conducting an entrusted experiment, new R&D is not conducted and the entrusted experiment is carried out by using the existing technology of the company. Accordingly, the subsidy for it is booked as sales. In addition, the development cost for a national project is posted as R&D cost in the SG&A expenses section for the period in which the company incurred it, but the subsidy for this development will be received in the following period and posted as other sales or non-operating income as mentioned above.

The company posts sales when each project is completed. In the initial year, the company has mainly short-term contracts, such as quarterly and semiannual ones, but from the second year, the company has mainly long-term contracts, such as annual ones. Therefore, sales tend to be posted at the end of each term. In addition, contracts are getting larger year by year.

For the current term, sales of 392 million yen, which account for 49% of annual sales, were posted in the 4th quarter (January to March), securing an operating income of 44 million yen.

【Financial Conditions and Cash Flow】

Financial conditions

| Mar. 2018 | Mar. 2019 |

| Mar. 2018 | Mar. 2019 |

Cash and deposits | 2,068 | 4,465 | Advances received/Deposits received | 46 | 110 |

Notes and accounts receivable - trade | 70 | 256 | Total current liabilities | 330 | 225 |

Total current assets | 2,290 | 4,858 | Total net assets | 2,022 | 4,701 |

Total fixed assets | 62 | 68 | Total liabilities and net assets | 2,353 | 4,926 |

*Unit: Million yen

Term-end total assets stood at 4,926 million yen. In the debit side, cash and deposits are dominant, while the credit side is composed of advances received, deposits received, and net assets. Capital-to-asset ratio is 95.4% (85.9% as of the end of the previous term).

Cash flows (CF)

| FY 3/18 | FY 3/19 | YOY | |

Operating cash flow (A) | -517 | -176 | +340 | - |

Investing cash flow (B) | 107 | -58 | -166 | - |

Free cash flow (A+B) | -409 | -235 | +174 | - |

Financing cash flow | 2,320 | 2,631 | +311 | +13.4% |

Cash, equivalents at term end | 2,068 | 4,465 | +2,396 | +115.8% |

*Unit: Million yen

Operating CF improved, as the sale of drones increased and the collection of accounts receivable progressed. On the other hand, investing CF became negative due to the purchase of fixed assets, the payment of security deposits and guarantee money, and no more withdrawal of time deposits. Financing CF was attributed from the issuance of shares in the term ended Mar. 2018 and the term ended Mar. 2019.

【Business highlight】

Expansion of the range of drone use through the amendment to the Civil Aeronautics Act

In Sep. 2018, the Civil Aeronautics Act was amended, and requirements for BVLOS (Beyond Visual Line of Sight) flight of drones (without guides) in uninhabited areas were specified (the amendment to “Examination guidelines for permitting and approving the flight of unmanned aircraft”). This amendment means that it became possible to fly a drone out of sight in uninhabited areas by satisfying the requirements set forth in the amended Civil Aeronautics Act.

Furthermore, the guidelines for examining the flight over a third party are scheduled to be amended, making it possible to fly a drone out of sight in urban areas, etc.

Practical application of ACSL drones to long-distance transportation

In response to the above amendment, Japan Post was permitted to carry out an BVLOS flight without guides for the first time in Japan in Nov. 2018. They started transporting mails 9 km between Odaka and Namie Post Offices with ACSL drones. In Nov. 2018, Japan Post started saving manpower for mail transportation in Minamisouma-shi and Namie-machi, Fukushima Prefecture, and ACSL provided a fully autonomous drone that can realize “BVLOS flight without guides” for the first time after the revision to the examination guidelines set forth by the Civil Aeronautics Act. Previously, transportation took about 25 minutes by truck, but now it is possible to automatically transport mails in about 15 minutes by drone.

Expansion of domestic business

With the new PoC, the company succeeded in increasing customers, and encouraged existing customers to apply drones to actual tasks for business expansion. For PoC with a new customer, the company demonstrated autonomous flight inside a pitch-dark tunnel without GPS, and discussed the possibility of use of drones instead of workers for infrastructure inspection. As an example of practical application for an existing customer, NJS Co., Ltd. carried out screening surveys of sewer and drainage pipes from the ground using drones without workers entering a manhole.

Autonomous flight inside a tunnel | Screening survey of sewer and drainage pipes |

| |

(Taken from the reference material of the company)

Business expansion through the foray into overseas markets

In Southeast Asia, including Singapore, the company started full-scale sales promotion, including the participation in exhibitions and demonstrative experiments at customers’ facilities. At Unmanned Systems Asia 2019, the company demonstrated Visual SLAM, which is the cutting-edge technology for autonomous flight without GPS, and AirSlider, which can fly in a closed space, gaining acclaim (see the next section). The overseas business expansion of ACSL was covered by several foreign media.

Scene of flight demonstration without GPS

(taken from the website of the company)

Continuous investment in R&D, and technological advance

The company improved the cutting-edge technologies for autonomous flight utilizing image processing (Visual SLAM), drone control with LTE communications, etc. and proceeded with the development of next platform drones. In detail, the company developed a cellular drone that can transmit information and videos in a wide range of airspace by utilizing LTE communications and enable autonomous flight at level 3 (BVLOS flight in uninhabited areas) (a cellular drone is a trademark of NTT Docomo Inc.). It has been confirmed that it is possible to stably transmit videos and signals required for the level 3 operation of drones via the LTE network.

Furthermore, the company sophisticated the “Visual SLAM” technology, which enables autonomous flight without GPS, and succeeded in developing customized camera modules and Stereo SLAM (stereo camera).

Fortification of organizational and business bases

In order to develop a robust development system for technologies, the company kept rigorously selecting and recruiting engineers from inside and outside Japan. In the term ended Mar. 2019, the company recruited 2 foreign engineers and 1 Japanese engineer, and in the term ending Mar. 2020, the company has recruited 1 foreign engineer and 1 Japanese engineer (no engineers resigned from the company in the term ended Mar. 2018 and the term ended Mar. 2019). As of May 14, 2019, the number of employees is 47 (R&D staff account for over 45%, and production and quality control, marketing, and management staff each make up 18%.). In the product development section, doctoral degree holders account for about 30% and foreign members make up around 50% (from 9 countries, including China, India, other Asian countries, Europe, and the U.S.). In parallel with business expansion, the company plans to increase employees, and is looking for personnel who possess expertise in each technological field, with the aim of realizing an efficient product development system.

For improving quality, the company obtained the ISO9001 certification by a third party, strengthening the quality management process. The risks for the company are customers’ restraint of using drones and reputation damage due to criticism against the drone industry in the wake of an accident of not only ACSL’s drones, but also other makers’ drones. Accordingly, the company will make continuous efforts to improve quality management, and actively obtain certifications from third-party institutions, etc.

Quality policy

・ Prioritizing safety quality, the company offers products and services that satisfy customers’ needs, and regulatory requirements. At the same time, the company also keeps improving its quality management system.

・ Under the mission: “Liberate Humanity through Technology,” the company pursue world-class autonomous technology and accomplish social implementation, to automate and unman human tasks and promote evolution of humanity

3. Fiscal Year Ending March 2020 Earnings Forecast

| Results for FY 3/19 | Ratio to sales | Estimate for FY 3/20 | Ratio to sales | YOY |

Net sales | 807 | 100.0% | 1,418 | 100.0% | +75.6% |

Gross profit | 403 | 50.0% | 850 | 60.0% | +110.8% |

SG&A expenses | 733 | 90.9% | 841 | 59.3% | +17.1% |

Operating income | -330 | - | 9 | 0.6% | - |

Ordinary income | -176 | - | 187 | 13.2% | - |

Net income | -183 | - | 119 | 8.4% | - |

*Unit: Million yen

Sales estimated to keep growing, securing annual operating income.

Sales are estimated to be 1,418 million yen, up 75.6% year on year. Due to the expansion of the customer base through the development of solutions, the sales from STEPs 1 and 2 are projected to grow 95.2% year on year to 572 million yen, and due to the increase of sales of drones through the adoption of drones by customers, the sales from STEPs 3 and 4 are forecasted to rise 89.1% year on year to 726 million yen. As for STEPs 1 and 2, the number of requests of solutions is estimated to increase from 81 in the previous term to 110, especially for leading companies. As for STEPs 3 and 4, the number of drone sales is estimated to grow from 106 to 220.

Operating income/loss is expected to improve from a loss of 330 million yen in the previous term to a profit of 9 million yen. It is forecasted that gross profit ratio will rise 10 points to 60% and gross profit will increase 110.8% year on year to 850 million yen, due to the decline in ratio of fixed assets through sales growth. Through staff increase, etc., SG&A expenses are estimated to augment 17.1% year on year to 841 million yen, but they will be offset by the growth of gross profit. R&D cost is estimated to be 361 million yen, almost unchanged from the previous term (366 million yen), and its sales ratio is forecasted to drop 20 points to 25%.

Taking into account the subsidy of 180 million yen for R&D related to the national project implemented in the term ended Mar. 2019, ordinary income is projected to be 180 million yen.

Sales of each STEP

| Results for FY 3/19 | Composition ratio | Estimate for FY 3/19 | Composition ratio | YOY |

STEPs 1 and 2: Development of solutions | 293 | 36.4% | 572 | 40.3% | +95.2% |

STEPs 3 and 4: Sale of mass-produced drones | 384 | 47.6% | 726 | 51.2% | +89.1% |

Other | 129 | 16.0% | 120 | 8.5% | -7.0% |

Total | 807 | 100.0% | 1,418 | 100.0% | +75.7% |

*Unit: Million yen

KPI of each STEP

| FY 3/17 | FY 3/18 | FY 3/19 | Estimate for FY 3/20 | |

STEPs 1 and 2 | No. of requests of solutions | 12 | 60 | 81 | 110 |

STEPs 3 and 4 | Sales volume of drones | 40 | 40 | 106 | 220 |

4. Interview with the President Ohta

As a manufacturer of commercial drones, Autonomous Control Systems Laboratory Ltd. (ACSL), which develops and manufactures fully autonomous drones that “think and fly by themselves” by making the most of the state-of-the-art autonomous control technology and offers solutions to operational streamlining, full automation, and adoption of IoT by utilizing drones, aims to contribute to society and expand business by creating the use of drones that bring about actual economic effects. It, however, just got listed on the market of the high-growth and emerging stocks (Mothers) of the Tokyo Stock Exchange in December last year. A large number of investors hope to know more about ACSL. We interviewed Mr. Hiroaki Ohta, who moved from one of the leading consulting companies, McKinsey & Company Inc., and started out on a new career at ACSL as the Chief Operating Officer (COO) and currently serves as the president there, about ACSL’s strengths and growth strategies.

After specializing in aeronautics and astronautics at Graduate School of Engineering of Kyoto University and serving as an assistant professor there, President Ohta devoted himself to research at University of California, Santa Barbara. He simultaneously occupied the position of a technical advisor at a start-up in Silicon Valley. He joined McKinsey & Company in 2010. He was designated as the COO of ACSL in July 2016 and has taken up the current position since March 2018. He earned a doctor’s degree at Kyoto University.

【Profile】

President Ohta originally was a doctor of semiconductors but chose a career at McKinsey & Company.

We have heard that President Ohta specialized in aeronautics and astronautics at Graduate School of Engineering of Kyoto University and carved out careers as a technical advisor at a start-up in Silicon Valley and a consultant at McKinsey & Company. What brought you to Autonomous Control Systems Laboratory Ltd. as the COO in July 2016?

President Ohta : I originally was a scholar. After earning a doctor’s degree at Kyoto University, I joined a semiconductor company, ROHM Co., Ltd. (securities code 6963), to research the blue light-emitting diode (LED). Afterward, the post of an assistant professor at Kyoto University became open, and I decided to go back to Kyoto University as a teacher in the fields of materials and plasma for a year. Then, by a strange chance, I taught at University of California, Santa Barbara, the United States, for two years as a research assistant to Professor Shuji Nakamura (who is a laureate of the Nobel Prize in Physics in 2014) in the field of the blue LED. At the same time, I helped Professor Nakamura with the operation of his company based in Silicon Valley. I devoted myself to research up until I was around 34 years old. During this period, I wrote approximately 100 research papers because I thought I would become a professor at university.

Did you hope to become a professor at university? However, you worked for McKinsey & Company as a consultant, didn’t you?

President Ohta : I came back to Japan when my wife gave birth to our first baby. I provided consultation services mainly for high-tech and technology-related companies. After six years of experience as a consultant, one of my business friends, whom I have known since I worked for McKinsey & Co. and who was the largest shareholder of our company (Autonomous Control Systems Laboratory) and in charge of investment in our company (a capital increase was underwritten in March 2016) at the time when The University of Tokyo Edge Capital Co., Ltd. (a venture capital that engages in developing start-up companies; generally known as UTEC) got listed, introduced me to ACSL, and I joined ACSL as the COO.

That means that ACSL had been at full fling toward initial public offering (IPO) since your company welcomed you as the COO.

President Ohta : ACSL got listed two and a half years after I entered the company. As our company is a start-up originating in a university, I had an impression that it was like a research group regardless of its drone technology. Then Rakuten, Inc. (securities code 4755) and UTEC made investment of 720 million yen in total in our company as class A preferred stock. The investment required upgrading our company from the aspect of business management, and the then founder of ACSL was the Chief Executive Officer (CEO) and I served as the COO to comprehensively supervise the business. Although it was not always easy to deal with, we shifted the corporate structure to the one that can successfully provide IPO through a host of approaches, including inviting the current Chief Financial Officer (CFO) and a person from the Unite States who served as an assistant teacher at Tokyo University as the Chief Technical Officer (CTO), for a year since then. Increasing the capital for class B preferred stock and raising 2.1 billion yen a year and a half later, our company successfully got listed another year later since then as planned.

From an extension of a laboratory to a group of experts in industrial-use autonomous flying drones

That means your company “restarted” after professionals of corporate management were gathered. We can sense trace of your hardships in your words, “it was not always easy to deal with.”

President Ohta : Mr. Satoshi Washiya, who currently serves as the COO (who engaged in corporate transformation projects for Japanese and European companies at the Japanese and Swedish branches of McKinsey & Company after earning a master’s degree at School of Creative Science and Engineering of Waseda University), entered our company at around the same time as I joined them, and at that time, I served as the COO while he worked as the CFO and coped with various tasks, such as audits and organization of rights-related matters involving Chiba University. A year later, Mr. Kensuke Hayakawa, who is the current CFO, started working with us and propelled forward all the preparations for listing. He is also in charge of risk management as well as the IPO process. I asked Mr. Washiya to contribute to our company from the perspective of business because he is an excellent sales person. Mr. Kenzo Nonami, the chairman, is a mechanical and theoretical teacher and theorist of the control theory; however, the technology of image processing, which is called “Simultaneous Localization and Mapping (SLAM),” is the technology that Doctor Chris Raabe, the CTO, specialized in. He was an engineer at The Boeing Company in the United States after graduating from Georgia Institute of Technology and earning a master’s degree at University of Michigan, but he took the doctoral course at University of Tokyo and worked as an assistant professor there. He is the best expert of images in this field who is proficient in Japanese. He has extensive knowledge of images and drones. I believe that there are only a few people like him in the world. As I have just mentioned, our company underwent considerable structural changes in 2016 and 2017.

Your company was set up in November 2013, but started under a new structure around 2017.

President Ohta : Our company got listed five years after the establishment; however, for the first two years, only 10 or 20 workers were engaged in the business at a university laboratory. Although Rakuten, Inc. and UTEC invested the sum of 720 million yen in our company as capital increase of class A preferred stock in March 2016, we used all of the fund within two years after I joined ACSL in July 2016. The amount of sales at the time I entered our company was around 150 million yen.

Your company was far from “getting listed” in terms of sales. By the way, on what did you spend the fund of 720 million yen?

President Ohta : We used the fund for redeveloping our drone. We remodeled the whole of our product with the sum of 720 million yen. The drone that our company had at that time was called “MS06” which was the fruit of the research at university. It took us 6 months to upgrade it to the current “PF1” model, including the parts contained inside it and its brand management. Possessing data that we had cultivated for 20 years since the research period at Chiba University, we were capable of developing all the software required for “PF1” by ourselves. Therefore, we will be able to manufacture autonomous flying drones even if the use of the technology of the United States or China gets prohibited due to national defense or other reasons. We regard ourselves as a rare company in Japan. Some of our competitors are not capable of developing the software controlling their drones and adopt software manufactured in China or other nations. Our company has developed our own software because Chairman Nonami has been in this field for 20 years. With experience as a senior research scientist at the National Aeronautics and Space Administration (NASA), and the vice president and the director of the Academic-Industry Collaborative Research Intellectual Property Organization at Chiba University, he engaged in the operation of a drone laboratory for a long period of time and started his own business.

Although he did not have any experience in business operation, he developed a trailblazing drone through trial and error and collected data using subsidies. He raised external funds for the first time in 2016 and began preparing for listing. It was a new start of our company from the viewpoint of business. Some new workers joined ACSL, including the COO, CFO, and CTO as mentioned above.

The CTO, who leads development, worked at the largest aerospace equipment manufacturer in the world.

Your company shifted from an extension of a laboratory to a group of experts on industrial-use autonomous drones.

Your company’s roots go back to a university laboratory but ACSL has aimed not at business or listing as an extension of a university laboratory but at for-profit business from the beginning.

President Ohta : That is right. Currently, 30 engineers are working at our company and half of them are from other countries. Many of the employees who we have hired recently are not Japanese. We, of course, recruit Japanese staff but focus on newly employing those from other nations than Japan. A number of potential workers have checked our website and gathered at our company. A lot of people hope to develop drones and there are a myriad of enthusiastic fans of robots. We have received inquiries from people all around the world, including ones from Brazil, India, and Germany, to name a few, who have contacted us lately. Four of the five people who have joined our company recently are from other countries. This means that we do not consider nationality to be an important factor.

Doctor Chris Raabe, the CTO, whom I referred to earlier, worked as an aircraft development engineer at The Boeing Company. He possesses specialized knowledge of drones and has boosted the appeal of our company in both Japanese and English. It is one of our company’s strengths and business weapons that we have attracted people with superior talents throughout the world.

【ACSL prepares all the technologies necessary for autonomous control by itself and satisfies customer needs through “technological adjustment.”】

“Technological adjustment” is an analog world.

Not only has the position of the management been occupied newly by the ones with business-oriented mindset, but new workers in the development section have also joined your company. Under the supervision of Doctor Chris Raabe, the CTO, engineers are gathering from all across the world. Do you think that the technological advantages under the development structure are the “cerebrum” and the “cerebellum” of your drone as described in your company’s prospectuses and securities reports?

President Ohta : Yes, we do think that they are the “cerebrum” and the “cerebellum” of our product. Drones fly by picking up external signals and information with their sensors, including the atmospheric pressure sensor and gyro sensor, and they also receive image information, ultrasonic waves, and global positioning system (GPS) signals. The atmospheric pressure sensor works like the ear of humans that senses atmospheric pressure, namely, a part that senses the height. The gyro sensor is similar to our semicircular canals. Furthermore, our drone has an eye (which consists of a camera and a processor of images taken by the camera). We are working on how we will fuse these elements to make the drone act.

For example, regarding the eye function, some technology companies may give explanations, such as “we build a platform using the eye function,” and semiconductor manufacturers would encourage consumers to use their chips a lot. NVIDIA sells its GPU after all, which serves as the brain of artificial intelligence (AI). What differentiates our company from other corporations is that we fuse technologies into a final product, which is one of our strong points.

Your company not sells software, systems, or chips alone, but manufactures and sells final products, and you need to fuse a variety of technologies to realize such a business model.

President Ohta : Moreover, drones are analog devices. As smartphones are digital tools, new models can be launched in six months, for instance, by using debug tools. We, however, have to be devoted to tasks in an analog world, such as fine-tuning a drone while paying attention to signals when the drone wobbles. It may be easy for you to understand what I mean if you imagine manufacturers of multifunction machines. Although multifunction machines have middleware, software, and user interfaces, the mechanism that moves the motors and feeds out papers is analog. I think that what our company does is similar to what these manufacturers do. When analog technology is involved, many companies tend to avoid such business because it requires a great deal of time.

Our company’s final products are analog. We integrate all the software required for autonomous flying into final products. Integration of all the software necessary for autonomous flying is an analogue technology. Our company is able to build final products, which is our strength. Generally speaking, our company is like a car manufacturer. The reason behind our sales growth (from 150 million yen in FY2017 to 370 million yen in FY2018 and even to over 800 million yen in FY2019) is our capability to manufacture and sell drones worth 3.5 million to 4 million yen as final products. If we sold technology only, the price per license would not be as high as the drone itself. What I would like you to remember are that our company manufactures final products and that we do so by combining our own technologies in an analog manner. That has made our company an “only one” company.

An analog technology is the vital element. Your company stabilizes flying drones by adjusting information from various sensors and signals from the GPS. Do you mean that such subtle adjustment depends considerably on the analog technology?

President Ohta : An exhibition of unmanned robots, which is held once every two years, was hosted in April in Singapore, and our company was the only one that gave a demonstration inside the exhibition room. Many drone companies exhibited their drones but did not perform demonstrations because such demonstrations were challenging from the technological aspect. We demonstrated our small-sized drone, “Mini.” It was a demonstration that showed how the 60-centimeter drone autonomously flied above something resembling to a bridge girder for inspection. In order to conduct this demonstration, we fine-tuned the drone so that it could fly stably by making analyses many times while flying the drone every day and running not just the image processing software but also the motor controlling software. Images are processed and computed by the GPU, which is manufactured by NVIDIA and built in the drone, at a rate of around 10 milliseconds. All the computation and processing are performed externally on the ground through the Wi-Fi network but done through edge computing. Therefore, our drones fly fully automatically with analog processing and edge computing combined and eliminate intervention of humans. Drones available at mass retailers fly under control of humans but that kind of drone can be sold for around 300,000 yen. Meanwhile, our company’s drones fly in a fully automated manner without a need for humans to intervene, making them worth over 3 million yen. Our company is able to produce such drones and possesses all the necessary technologies, and we are capable of manufacturing analog products by combining the technologies.

The “cerebrum” means edge computing and local processing by the drone itself, which are not digital processing. Our drones on their own process the activity of “moving” while flying. It is easier to communicate, and control it from the outside; however, our products fly while thinking by themselves. This means that they can replace humans, putting them an added value. External control and 4G- or 5G-network control require humans who do remote control. That makes drones mere tools. Humans are irreplaceable in these cases, and the price of these drones will be less than 1 million yen. Our products, on the other hand, automatically perform inspection operation for humans even in rooms and in a no GPS environment.

Our company’s products are introduced as drones that can fly without the GPS, have the image processing technology, and have the cerebrum; however, what we would like to appeal is that our company has all the necessary technologies and develops our drones in an analog manner, which has built higher entry barriers to market. Thus, other major manufacturers cannot do the same thing right away. DJI, a drone manufacturer targeting Chinese consumers, is superior in the camera function but has taken its stance toward “drones controlled by humans.” It has not attached much attention to the cerebrum-based drones.

Only-one products realized with the techniques all of which have been developed by ACSL

I see. It is certain that the “image processing technology” and “cerebrum” are more appealing and seem to be easier for people to understand. In contrast, when someone talk about an “analog technology,” I think that we would like to say, “now is the digital era, isn’t it?” Including DJI’s superior digital cameras, debug tools can deal with almost everything in the digital world where there are “0” and “1”; however, you think that autonomous control in the three-dimensional world is difficult because it is not as simple as that in the digital world with “0” and “1,” don’t you?

President Ohta : In other words, I think that is right because we need to make adjustment through analog processing. In addition, the fact that our company has all the necessary technologies is one of our strengths although a belief in development by a company itself is not always valued these days. Companies in early days cannot do what they want to do if they do not have their own technologies. You know that such companies as International Business Machines Corporation (IBM) and Intel Corporation in the semiconductor field all had their own technologies although they eventually were divided because of their deteriorating cost competitiveness. Therefore, the keyword for our company is the only firm that has all the drone technologies, including the production technology. We develop all software by ourselves. These are ACSL’s strengths.

I understand that your company is capable of developing unique products because you possess all the necessary technologies, as demonstrated by the story that only your company did a demonstration flight of your drone in the exhibition in Singapore. Do you think that the fact that your company has all the technologies is mainly due to the experience and data that your company has cultivated for 20 years since 1998?

President Ohta : As a starting point, I believe so. We have incorporated the image processing technology (“Visual SLAM”) on the basis of that. We succeeded in adding image processing thanks to the base formed for the last 20 years. The base cultivated for 20 years means the control software, which is the essential element for incorporating image processing. Our competitors generally employ the software developed by DJI or 3D Robotics in the United States. The software of 3D Robotics uses open source codes, making it impossible for the competitors to cultivate their own data and, therefore, connect such pieces of software. Our company, on the other hand, possesses our own software and understands it well. In our company, engineers exchange opinions and hold discussion, such as “Let’s fix the software in this way,” “That will put a burden on this part,” and “So what is next?”

We are currently devoted to developing a drone for indoor use that can fly narrow space, such as a 90-centimeter-wide passages. Our engineers are considering how the new drone can automatically fly in such narrow places by discussing a variety of matters, including that air may bounce back if a drone flies in narrow space and that a drone may have narrower eyesight because the distance from a drone to the walls and the ceiling is short in a narrow place. Then, another issue may arise when the engineers have manufactured a pilot drone, such as that NVIDIA’s chips are too heavy. Smaller-sized drones have entered the mainstream in the inspection field to which we are giving weight; however, the balance of a drone will change when the size of the drone’s body is reduced only a little. We can increase the number of chips for larger drones, but weight has a huge impact on small drones. We are propelling forward our development through discussion over needs for lighter control software, lighter semiconductors, and lighter application software.

In the car industry, only a limited number of players, such as Toyota, can manufacture gasoline engine cars. Things look easy but, no one can do what such manufacturers do because adjustment at an analog level is required for producing final products. In the same manner, a myriad of knowhow on analog processing is crucial for releasing and selling autonomous flying drones with confidence.

ACSL engages in the B to B business whose entry barriers are high for Chinese companies. “Stepping into operations of client companies” and “feedback” are required.

I have heard that the entry barriers were higher in the field of fossil fuel cars, which require technological adjustment, than in the market of electric cars that can be manufactured through combination of components, and the same applies to autonomous flying drones.

President Ohta : The number of Chinese companies is large in the B to C business field but limited in the industrial-use B to B segment. Drones targeted at general consumers are controlled by humans, and if such consumer-oriented drones break down, manufacturers will receive few complaints because controllers’ skills matter to some extent. On the other hand, as our company’s drones are designed for the B to B field and fully automated, if our drone has fallen down, our company will be responsible for the failure in accordance with the product liability. Therefore, we have to elaborate our drones because our business is similar to the business of self-driving vehicles at level 5.

Our company earns sales through four steps from STEP 1 (Proof of Concept; PoC) to STEP 2, STEP 3, and STEP 4. “Feedback” in each phase is vital in order to make our products truly useful in business operation. Although we have all the necessary technologies, no one will buy our products if we sell drones based on the product-out concept. For example, in the logistics field, the concept of Rakuten, Inc. and that of Japan Post Co., Ltd. are not the same, because their tasks are different from each other. In the inspection field, inspection of petrochemical factories and that of tunnels are different. The reason for this is that the inspection process differs from one another and the ultimate way of placing an order for inspection operation is different. Therefore, it is important that a drone can fly no matter who pushes the button on a tablet device. This is not necessarily all about technology. What matters are to step into operations of client companies and thus to take into account operational feedback that we receive.

With about 60 companies adopting our drones currently, we are developing custom-made drones while engaging in PoC in Step 1 and Step 2. Since our company’s drones are reaching the stage of being used in business operation, these companies have announced their intention to continue investment in us until “ACSL’s drones are fully developed for industrial use.” We have cooperated with NJS CO., LTD. in developing a drone for inspection of drainage for four years, and the drone is getting better and better.

The point of “stepping into business operation” may be similar to the business model of system integrators. They need to develop unique cloud networks and servers according to the business of each client company. As our company engages in business in the B to B field, our drones must be suited to the operation of each of our client firms. For that, our client companies must disclose their operational knowhow to us, such as how letters are transferred between post offices in the case of Japan Post Co., Ltd. Then, do we disclose such confidential information to overseas companies? The answer is no. Therefore, few overseas firms can win contracts away from us. Furthermore, as we have only a few competitors in Japan, our company receives a host of orders. I assume that a very small number of companies are moving ahead with introduction of their drones to actual business operation for a charge although drones developed by some companies are featured on television news programs. I believe that our company takes the lead in industrial-use drones in Japan; however, the amount of sales that we have generated is not large as I mentioned earlier. Our drones are basically in the PoC phase and has not reached the stage of being put into practice yet.

Our company will sell drones that are designed to satisfy the business needs of each client company ultimately from the medium- and long-term perspective of 20 to 30 years. We will make our drones suited not to each client firm but to each operational application.

Your company will evolve your drones into versatile ones that can be used in each operational application in the long run. In other words, you will be able to sell your products with little or no development cost. Still, STEP 1 and STEP 2 are time-consuming phases, aren’t they?

President Ohta : Yes, they are. We consider our business to be a prescription-based business because our client companies continue renewing contracts. Some projects take one or two years from STEP 1 to STEP 2 while others require only a year to move on to STEP 3. In some cases, after reaching STEP 3, we go back to STEPs 1 and 2 in another scope. Some clients who say that they have little time ask us to go on to STEP 3 in the shortest possible time because they want to use a drone as soon as possible. Other customers who seek high quality ask our company to be as meticulous as possible in STEP 1. The more elaborative we are in STEP 1, the higher the value added will be, and the drone will be capable of taking over the tasks that humans have traditionally done.

Client companies who have strived with us to fully develop their own drones for two or three years will become reluctant to adopt other firms’ drones, because their knowhow has been incorporated into our robot and it has already taken root in their business processes. Therefore, the contract renewal rate is almost 100%. In addition, our company possesses the intellectual property. For instance, our drones designed for use in tunnels are equipped with multiple cameras and LED lights for flying in darkness. We have carefully selected the LED light that are friendly to the SLAM technology for image processing, and adjusted the eye function of the computer so that the light can work better in darkness as in the human eyes that shift to the black and white lens in a dark place. Analog adjustment is necessary when a drone enters a tunnel because, unexpectedly, the drone cannot recognize what it is seeing as images.

Once we have developed a custom-made model for a client, the client buys 3 to 5 drones of the model at first. This is STEP 3. We consider STEP 4 to be when 10 custom-made drones are sold. The number, 10, is a rough indication that the usability of the drone is improving and the client is expanding the area to fly the drone. Client companies that are currently in STEP 4 include NJS, and I think that Rakuten Inc. is also reaching the stage. We invest development cost while holding discussion with customers face to face so that we never fail to meet their respective needs. Don’t you think that it is exactly the way that Japanese companies choose to do business? (Laughter)

【Prescription-Based Business Model】

Sales are recorded intensively in the fourth quarter because it takes client companies a while to inspect and accept the product that the company has delivered. The corporate philosophy is to “steadily thrive in the black.”

Does your company renew the contract with each client every year?

President Ohta : Yes, we do. Since many Japanese companies renew contracts each year and complete inspection and acceptance of their products at that time, sales are posted mainly in March. This is the reason for the tendency toward the intense recording of sales in the fourth quarter. Investors may feel uncomfortable because of the small amounts of sales in the first and second quarters; however, our company has secured client companies by entering into contracts in the long term. If a client hopes to buy additional drones during its contract period, we can generate sales in the first, second, or third quarter. We will earn income when we additionally sell or upgrade parts, if not drones themselves.

Although your company offers services on a year-round basis from the first quarter to the fourth quarter, sales are recorded intensively in the fourth quarter because of the time required for product inspection and acceptance by customers. Thus, you do not want investors to worry too much even when you do not make progress as forecasted during the year.

President Ohta : Yes, because our business is not ad hoc. Our business model is not the one that relies only on sale of drones themselves but the one that accumulates. While we have made only linear estimates, we believe that we have a potential of rapidly growing our business depending on the number of clients and the number of drones sold. We were in the red and did not disclose our corporate philosophy when our company got listed, but we tell people, when they have asked about our philosophy, that we have follow a philosophy of “steadily thriving in the black.” Currently the research and development cost is a burden on us, but we are using funds in developing drones that can sell satisfactorily while receiving “feedback.” There are a limitless number of development items, ranging from motors to batteries. Thus, although the number of items for research and development is countless, we select the “weak” points of our products that we are able to improve and modify after we actually fly our drones at client’s sites. We eliminate the “weak” points. Once we have made satisfactory improvement in one point, we move on to the next weakness, because we know the business knowhow of each client, how much we can spend in developing a drone, and what functions of a drone will replace humans. Our drones will eventually be adopted.

ACSL develops drones based on the items pointed out by clients and their demand (which are hints as to development) and converts them to sales eventually. The cost of the software accounts for most of the cost of a drone itself.

Not a few companies fail to lead research and development cost to revenue; however, your company’s R&D expenses are an exact step toward adoption and mass production of your products.

President Ohta : Many robot manufacturers are in the red worldwide and some of the companies go bankruptcy. You will generate only a small amount of sales just by saying that your company’s robots are superior or automatic. Then, how do we overcome such obstacles? The answer is that we thoroughly manufacture machines that can be used in business operation by customers. Some people think that China spearheads the drone industry; however, their drones require manual control by humans to fly. We have come to understand that the added-value of drones themselves is lower than we expected, and our company aims at that respect, which is that a drone can sell for 3 million to 4 million yen if it is truly usable in operational application. Moreover, the cost of sales ratio of the components is not large and most of the price of a drone includes software, enabling us to achieve a very high profitability with a drone that sold at 3 million or 4 million yen.

Your drone is expensive, costing 4 million yen per product, but yields an extremely high marginal profit rate because the majority of the cost is only for software. Manufacturers in China and other nations, however, have cost competitiveness, don’t they?

President Ohta : Their business models are different from ours. I think that the strengths of the manufacturers in Shenzhen, China, are cameras and semiconductors, and they have an ecosystem for manufacturing robots worth around 200,000 yen, allowing them to produce products at low prices in general. This means that they have hardware competitiveness. Their drones that sell at 250,000 yen, however, are hardware and the cost is around 200,000 yen. if you do not consider the progression of the production efficiency by the effect of mass production, they cost 200,000 yen for each drone no matter how many drones they manufacture.

In this sense, the cost of sales ratio of components is high. Chinese manufacturers seem to be endeavoring to sell many drones, not to add value to their products with software.

In addition, Chinese manufacturers do not enter the B to B field because the quality of their drones is not satisfactory enough to meet the needs of the customers in the field. They will not develop drones according to each client’s requirements, but they manufacture and sell a lot of cost-competitive gadgets worth 200,000 to 300,000 yen for B to C business. Regarding computers, for example, the body of a computer itself is made in China but the operation system with the computer as an edge is developed in Japan by system integrators. The difference between our company and Chinese manufacturers is similar to such a difference in the case of computers. Our company takes extra time and effort. We are different from such Chinese companies in the target market, the way of doing business, and the software layers. Their drones are convenient because they can be controlled while controllers watch their smartphones but are less likely to be fully automated in the future.

I have an impression that research and development expenses and labor cost largely make up your selling, general and administrative (SG&A) expenses. While the number of employees is increasing at your company, the majority of them are engineers and other technicians. How do you work on sales activities and prospect for new customers?

President Ohta : In Japan, customers with budgets allocated for their in-house projects themselves contact us. Therefore, we will not proactively attend exhibitions in Japan from this year onward. Meanwhile, our company’s presence abroad has not been strong enough yet, and we place advertisements and participate in exhibitions. This is why labor cost accounts greatly for expenses for sales activities. We strive to use SG&A and indirect expenses in a lean manner as much as possible. As for research and development, as I described earlier, we have always satisfied our clients’ requirements by improving the items pointed out by clients no matter how challenging it is to make adjustment because they basically give us hints about improvement. We are able to convert all of these into sales.

Although our company now sell our drones at 3 million to 4 million yen, we sold them for about 1.5 million yen when I joined our company. They were something like an extension of radio-controlled planes that needed to be controlled by humans. The business model at that time was to generate revenue from a school operation business by encouraging customers to go to our school at which they learned how to control our machines. It is not a bad idea to raise income through the school business, but we could not sell our products when we relied on the business model.

There is constraint that allows only post office workers to transfer letters. Thus, our company do not have the right to fly drones on behalf of Japan Post Co. Ltd. The reason why Japan Post has adopted our company’s drone is that it is fully automated. We have programmed our drone to do everything from leaving the ground, flying, and landing on the destination just by pressing a button even under a lot of constraints, such as laws. The fact that Japan Post has put our drone into practice was referred to in the press release in November 2018, but only a little about our company was written as a small addition.

We are propelling forward projects with not only Japan Post but also other companies, and the profit rate is high; therefore, I think that our company can reach a breakeven point early. We earned 800 million yen by selling 100 drones in the previous term (ended March 2019). I expect that we will be able to establish a profitable structure at once if we keep patience this year.

Sales of 1.2 billion to 1.3 billion yen seems to be a breakeven point, aside from which upfront investment of national projects is taken into consideration. I assume that your company has been entrusted with a number of projects that are now in STEPs 1 and 2, which has still imposed burdens of upfront investment; however, sales will grow in a trajectory like that for the term ending March 2021 if the number of drones sold increases as estimated (500 drones).

President Ohta : Growth will become stagnant at some point for STEPs 1 and 2 because human resources need to be raised according to the number of clients. We will reinforce human resources only gradually. Once we have experienced and developed the use of our drones in general, we will be able to provide quality products without undergoing STEP 1 (PoC) for each customer. We estimate that the number of drones sold will multiply exponentially thanks in part to expansion of the areas in which customers use our products. We explained that we would sell 100 drones when our company got listed and 500 drones three years later. Our vision has been that the number of customers grow on a liner basis while the quantity of drones sold will exponentially increase. We sometimes receive a question if the profit rate will decrease as sales grow following an increase in the number of drones sold. The answer is that the unit price will be several hundreds of yen that is equal to labor cost because the tasks of humans are done by our drones. As our drones have the value added by the software as I described earlier, manual tasks done by humans will be reduced significantly even when the absolute cost is low.

We have made business estimates that accumulate based on the progress of each pipeline. In reality, progress of projects is complex because they may be behind or ahead of schedule; however, we have maintained a certain degree of punctuality in general. We would like to generate satisfactory results this and next term in order to earn trust of clients because our company provided IPO before we yielded profit. Although some people think that it is better to take action after our company has become “more matured,” we will show good results. we believe that the Tokyo Stock Exchange approved the listing of our company because they understood that our company engages in a prescription-based business with steady pipelines.

I see. What you said is that requests for a reduction in the unit price will less likely happen and profitability will be sustained even though your company sell mainly hardware products because your drones do the tasks traditionally done by humans. Moreover, your business estimates are accumulated with the clients’ project plans taken into account. Thank you for your explanation.

I am afraid that the time is up although I would like to ask more about your company. I really appreciate your detailed explanations for a long period of time. This interview has changed my view of your company. I sincerely wish further success and prosperity of President Ohta and Autonomous Control Systems Laboratory Ltd.

【After the Interview】

Not a few research and development-based companies, such as start-ups in the biotech field, got listed before they generated enough profit, and failed to meet public expectations. Although ACSL is not a start-up in the biotech field, I regarded the company as something like such companies because I viewed it as “a research and development-based company that got listed before yielding satisfactory profit.” I, however, realized that the truth is completely different while interviewing President Ohta.

What President Ohta explained in this interview can be summarized as the following four points:

Firstly, the company is a “group of experts in industrial-use autonomous drones that solve the issue of labor shortages.” The company is not an extension of a laboratory but has been aimed to become a for-profit business since the establishment. It is more like a start-up set up by President Ohta.

The second point is the company’s technological advantages, which means that the company has all the technologies necessary for autonomous flying control and is capable of adjusting them through analog processing. The business model in which the company takes extra time and effort by making the most of its technologies is different from the path taken by Chinese manufacturers.

Thirdly, the company’s business is a prescription-based model, and fixed expenses (software) accounts largely for the cost of its drones. Furthermore, it engages in research and development according to the hints as to development given by clients, which will be converted to sales eventually.

Finally, the company will realize a profitable structure at once next term.

5. Conclusions

From the results for the term ended Mar. 2019, it has been confirmed that the company is performing in accordance with the plan set when it was listed. In addition, from the interview with the president, we think you have understood their technological advantage, business model, earning structure with high marginal profit ratio, the difference in policies from Chinese enterprises, etc.

Although sales volume may vary somewhat according to the progress of the project, if it reaches the goal of 500 next term, “the business will become profitable” because marginal profit ratio is high. This explanation is persuasive. For the term ending Mar. 2020, operating income is estimated to be 9 million yen, so the break-even point of sales is considered to be around 1.4 billion yen. Through the recruitment of R&D staff, the break-even point of sales will increase in the term ending Mar. 2021, but most of sales growth will certainly contribute to profit. We would like to expect that their future business operation will be successful.

Reference: Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 outside ones |

Auditors | 3 auditors, including 3 outside ones. |

◎ Corporate Governance Report

The Latest Update: Dec. 21, 2018

Basic Policy

Our company believes that our mission is to foster and maintain trusting relationships with all stakeholders, including shareholders, employees, business partners, clients, creditors, and local communities, and conduct business administration putting importance on the interest of every stakeholder, under the slogan of “creating drones that will develop a future and support society.” To do so, it is indispensable for our business to grow stably and lastingly, and we recognize that it is important to strengthen corporate governance for improving the soundness and transparency of business administration, which would be the foundation for the growth, and we actively work on it.

Concretely, we are striving to enrich general meetings of shareholders, upgrade the functions of the boards of directors and auditors, carry out timely, appropriate information disclosure and IR activities, and tighten internal control systems, to enhance corporate governance further.

<Principles that have not been followed, and reasons>

Autonomous Control Systems Laboratory Ltd. has implemented all the Basic Principles of the corporate governance code.

TSE Corporate Governance Information Service:http://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Autonomous Control Systems Laboratory Ltd. (6232) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/