Bridge Report:(6455)MORITA Second Quarter of Fiscal Year ending March 2023

Masahiro Nakajima, Chairman & CEO | MORITA HOLDINGS CORPORATION (6455) |

|

Company Information

Market | TSE Prime Market |

Industry | Transportation equipment (Manufacturing) |

Chairman & CEO | Masahiro Nakajima |

HQ Address | Keihanshin-Midosuji Building, 3-6-1 Dosho-machi, Chuo-ku, Osaka-shi |

Year-end | End of March |

Homepage | https://www.morita119.com/en/ |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

1,219 yen | 46,918,542 shares | 57,193 million yen | 6.7% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

TBD | - | TBD | - | 1,835.49 yen | 0.7x |

* Share price as of closing on November 10. Number of shares outstanding is taken from the financial statements for the second quarter of the fiscal year ending March 2023. ROE and BPS are results of the previous term.

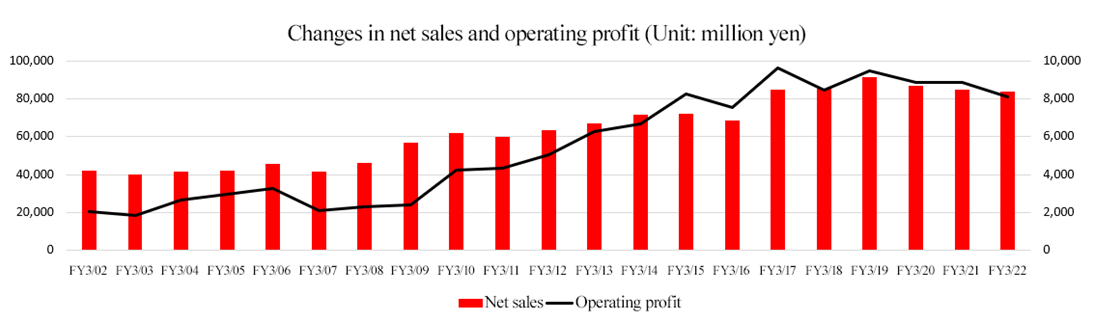

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 Act. | 91,524 | 9,483 | 10,104 | 6,3.91 | 141.30 | 34.00 |

March 2020 Act. | 86,922 | 8,855 | 9,326 | 6,971 | 153.93 | 38.00 |

March 2021 Act. | 84,667 | 8,855 | 9,479 | 6,224 | 137.09 | 38.00 |

March 2022 Act. | 83,602 | 8,115 | 8,761 | 5,350 | 118.10 | 40.00 |

March 2023 Est. | - | - | - | - | - | - |

*Unit: million yen, yen. Estimates are those of the Company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply. In Fire Fighting Vehicles Business and Environmental Conservation Vehicles Business, the timing of supply of chassis is unclear, and it is difficult to forecast business performance reasonably, so a forecast for this term is still to be made.

This report includes the outline, business performance trend, etc. of MORITA HOLDINGS CORPORATION.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of Fiscal Year ending March 2023 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

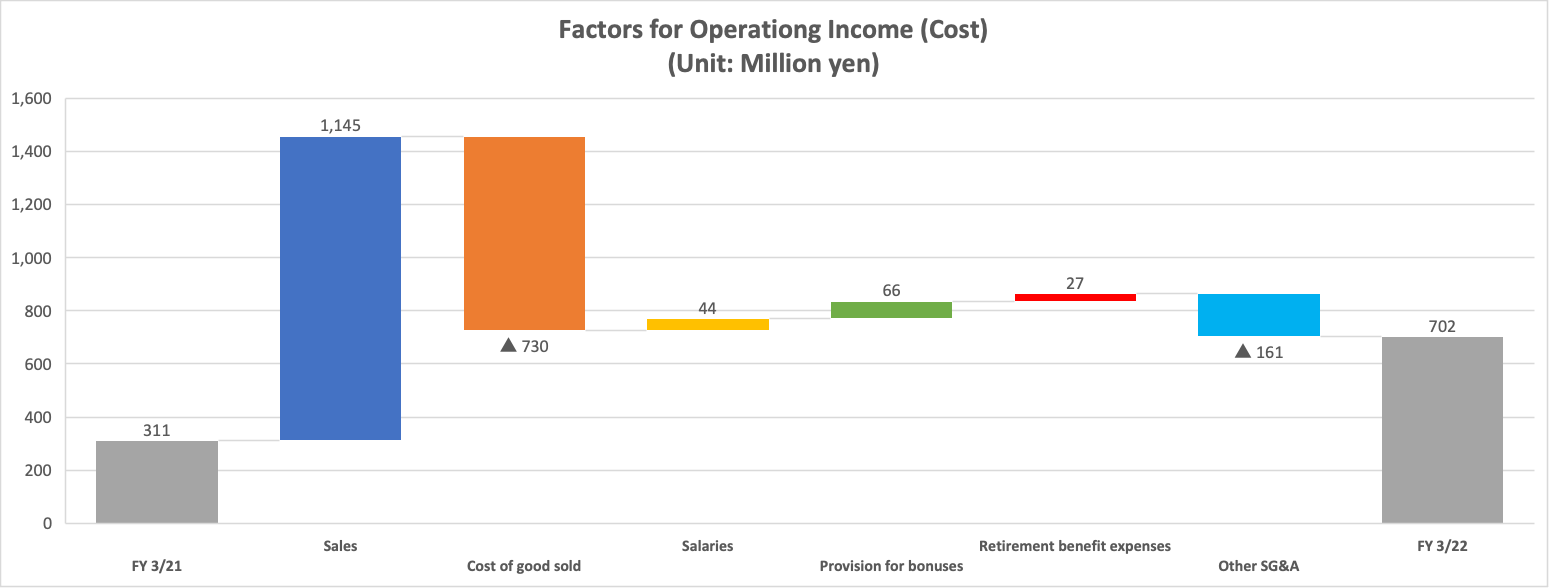

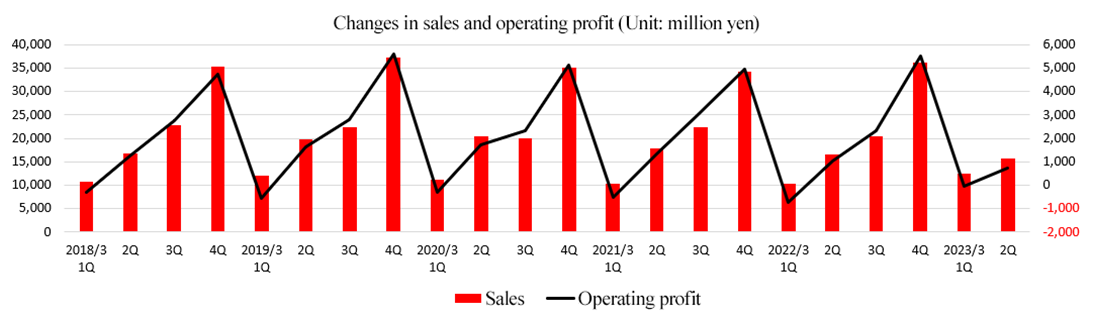

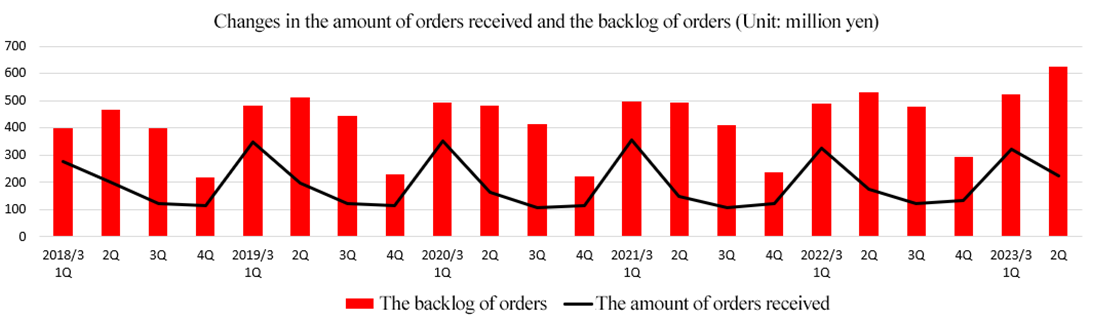

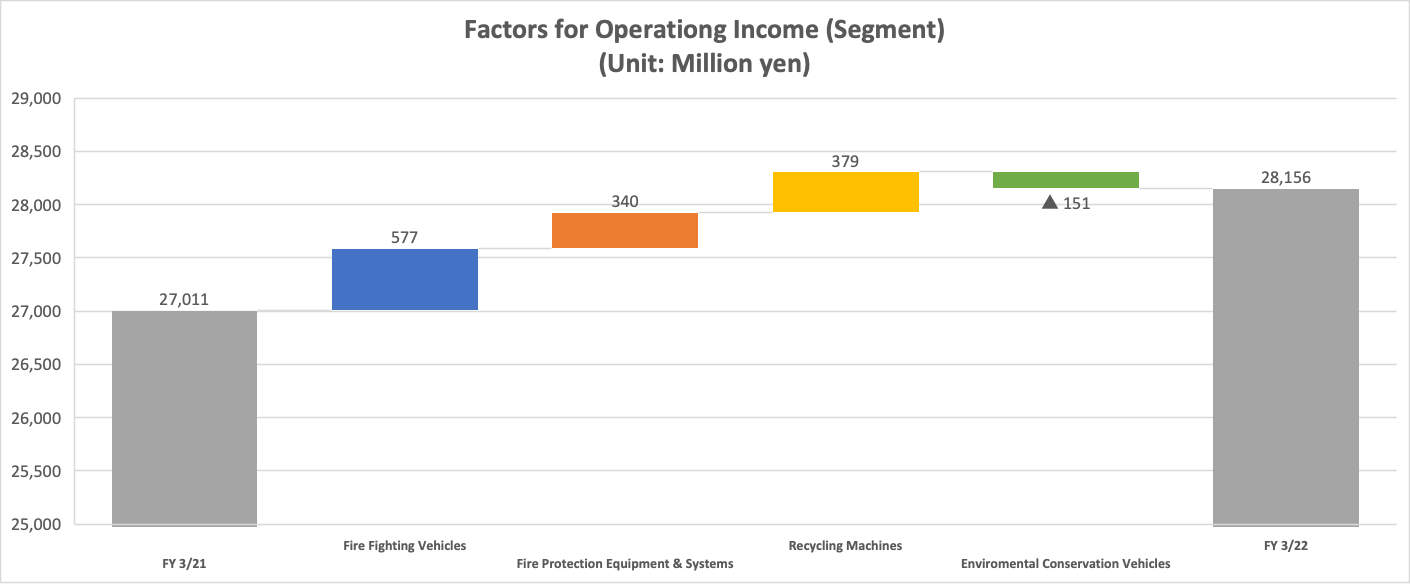

- In the second quarter of the term ending March 2023, sales grew 4.2% year on year to 28,156 million yen. Sales increased in the three segments: Fire Fighting Vehicles, Fire Protection Equipment & Systems, and Recycling Machines. Operating income rose 125.3% year on year to 702 million yen. Thanks to the sales growth, gross profit increased 5.7% year on year, while SGA was unchanged year on year, so profit rose considerably. The amount of orders received increased 9.9% year on year to 54.8 billion yen. The backlog of orders rose 17.9% year on year to 62.5 billion yen, hitting a record high for the second quarter.

- Regarding the business performance in the term ending March 2023, the timing of supply of chassis in Fire Fighting Vehicles Business and Environmental Conservation Vehicles Business is unclear, and it is difficult to forecast it reasonably, so an earnings forecast is still to be made. As soon as it becomes possible to disclose the forecast, the company will announce it. The problem with the supply of chassis will be solved in the short term, when Hino Motors resumes manufacturing, but from the medium/long-term viewpoint, the company has started measures for diversifying procurement methods.

- In the first half of the term ending March 2023, sales and profit grew and the number of orders received was healthy. For fire trucks in Japan, the company tends to post sales from orders in the first half of a term in the second half. Normally, it can be expected that annual sales and profit will be healthy, but the supply of chassis remains uncertain, and a full-year earnings forecast is still to be made. This is unavoidable, but bad news for investors. We hope that they will disclose their forecast as soon as possible. On the other hand, from the medium-term viewpoint, we would like to pay attention to the basic policy in the mid-term management plan “Morita Reborn 2025” and the progress toward their goals.

1. Company Overview

The company, which is the top manufacturer of fire trucks, was founded in 1907. Under the corporate slogan "Protecting Human Life and Mother Earth," the company is operating the four businesses: Fire Fighting Vehicles, Fire Protection Equipment & Systems, Recycling Machines, and Environmental Conservation Vehicles, with a focus on Fire Fighting Vehicles. The company’s strengths include having products with the largest market share in each business, high technological and development capabilities, and outstanding design capabilities.

【1-1 History】

1907: The founder Shosaku Morita established the Fire Protection Association as his privately-run business in Minami-ku, Osaka City (the current Nishi-Shinsaibashi, Chuo-ku, Osaka City) and started production and sale of fire extinguishers and fire pumps.

1910: Created Japan's first fire pump with a gasoline engine.

1917: Developed Japan's first domestically produced fire trucks.

1980: Got listed on the First Sections of the Osaka Securities Exchange and the Tokyo Stock Exchange.

2008: Shifted to a holding company system and changed the corporate name from Morita Co., Ltd. to Morita Holdings Corporation

2008: Transformed Miyata Industry Co., Ltd. into a subsidiary through a tender offer.

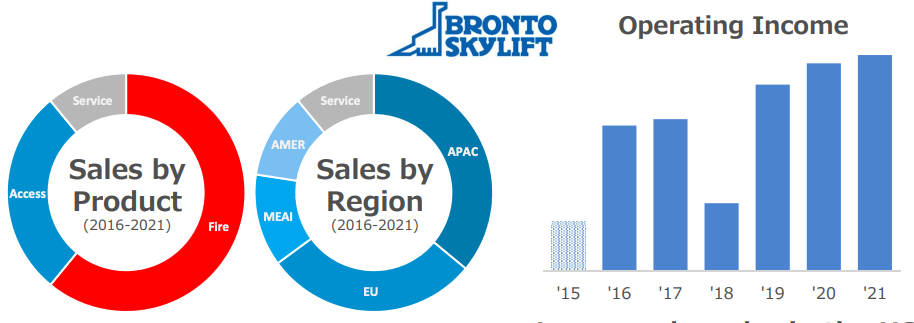

2016: Acquired the Finnish company BRONTO SKYLIFT OY AB as a subsidiary.

2022: Got listed on the Prime Market of the Tokyo Stock Exchange due to market reorganization.

【1-2 Corporate Philosophy】

Corporate philosophy | With our dedication to quality production and unceasing technological innovations, we strive to work in harmony with society by contributing to the creation of a "safe, comfortable and prosperous society" and embracing sincere business activities. |

【1-3 Market environment】

Regarding the domestic market trends of the Fire Fighting Vehicles Business, which is Morita Holdings' core business, the number of domestically owned fire trucks is about 25,000, which has not changed much over the long term. In the 1990s, demand for fire trucks was around 1,600 vehicles per year. However, due to the transfer of tax sources from the national government to local governments, fire trucks have been purchased with the local governments' budget, and the replacement cycle has been extended. Recently, the demand of fire trucks has been 1000 to 1200 per year.

In terms of competition, the company holds the leading position with a 58% share. There are 14 fire truck manufacturers nationwide, and the company with the second largest market share is Nihon Kikai Kogyo Co., Ltd., a subsidiary of Katakura Industries Co., Ltd. (Standard Market of TSE: 3001). There are also mainly local manufacturers for local production for local consumption.

Purchasing fire trucks is conducted through a competitive bidding process. In Japan, orders are received in the first half of a term and shipped in the second half. Since products are primarily made-to-order, manufacturers need to produce each unit according to its specifications. No competitor can respond to requests in detail and has a system that can produce as many units as the company, so there is little room for large fluctuations in market share.

In addition, it is difficult to imagine that the market will grow significantly. Still, if the firefighting industry is required to respond to technological innovation such as CASE in the future, it will become a severe issue for small and medium-sized manufacturers.

*CASE

An acronym for Connected, Autonomous, Shared & Services (sometimes refers to car sharing and services or only sharing), and Electric. They are creating new demand and markets in each area by significantly changing the conventional concept of cars.

【1-4 Business description】

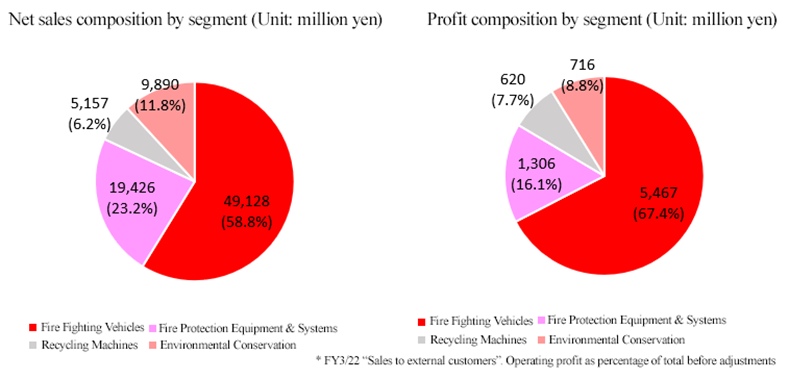

The four segments to be reported are Fire Fighting Vehicles Business, Fire Protection Equipment & Systems Business, Recycling Machines Business and Environmental Conservation Vehicles Business.

(1)Overview of Each Segment

① Fire Fighting Vehicles Business

The company develops, manufactures, sells, and overhauls various fire trucks, including pump trucks, ladder trucks, fire trucks for industrial complexes, and rescue trucks, and provides after-sales services.

Regarding overseas business, the company exports these vehicles from Japan, and the Finnish company, Bronto, sells fire trucks with folding ladders and aerial work platforms globally.

(Source: the company’s website)

①-1 Domestic Business

Clients include private companies such as electric power companies and petroleum complexes, but most of clients are local governments. Many of the company's competitors are local manufacturers, but the company covers the entire country.

The company's market share was once around 40% due to declining demand, but since the early 2000s, the company has been pursuing both market share and profitability improvement as a leading manufacturer of fire trucks. Since fire trucks are purchased through competitive bidding, it is primarily a price competition. However, by developing and introducing high-value-added products, the company has increased its market share in a way that does not fall into price competition. Thus, its market share rose from about 40% in 2000 to nearly 60%.

◎ High added value

An example of a high-value-added product is the CAFS System.

CAFS (Compressed Air Foam System) is a system that enhances fire extinguishing efficiency by adding a small amount of a fire extinguishing agent to water, sending compressed air into it, and releasing it as foam.

Since it can extinguish a fire with a small amount of water, it effectively prevents secondary damage, such as water damage at the fire site. In addition, since the recoil when water is discharged is small, it can reduce the burden on firefighters holding hoses during firefighting activities. Thus, the product can facilitate the participation of elderly firefighters and women.

The company manufactures the CAFS in-house, but competitors use imported products. It has a touch panel monitor and can switch between water, foam, and mixed liquids, realizing excellent operability unique to the company's products.

①-2 Overseas business

The company exports mainly high-performance vehicles, such as ladder trucks, to Asia.

The company's world-class technology transcends national borders and contributes to the safety and security of the world.

(Source: the company’s website)

Bronto is a company that became a consolidated subsidiary in 2016.

It is a global brand that has a lineup of fire trucks with folding ladders that can reach up to 112 m above the ground and aerial work platforms. Headquartered in Finland, it has built a sales network in over 100 countries worldwide.

|

|

(Source: the company’s website)

Since the acquisition, the business has been steadily growing, especially in the North American market for aerial work platforms. As the investment in renewable energy infrastructure in the United States expanded, in the fiscal year 2022, Bronto received an order for the largest-ever aerial work platform project in North America.

(Based on the company’s reference material)

② Fire Protection Equipment & Systems Business

The company develops, manufactures, and sells fire extinguishers and disaster prevention-related products, such as fire extinguishing equipment for group homes, hospitals, and clinics.

(Source: the company’s website)

Most fire extinguishers are sold through distributors. End users include office buildings, condominiums, and commercial facilities.

The company used to have the third largest market share for fire extinguishers, but in 2008 it acquired Miyata Kogyo, which had the fourth largest market share at the time. Through the acquisition, the company increased its competitiveness and expanded its market share. Since becoming the company with the largest market share in 2014, it has maintained this position for eight consecutive years.

The company's main fire extinguisher is made of aluminum, which is characterized by its light weight and excellent design. It also has the advantage of being domestically produced. Therefore, it is high-quality and not affected by exchange rates.

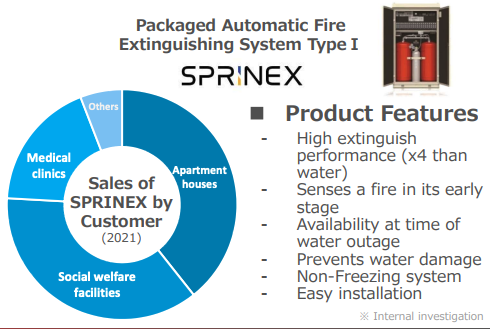

◎ Sprinex - Packaged automatic fire extinguishing equipment

Sprinex, which is packaged automatic fire extinguishing equipment, demonstrates the company's uniqueness in the Fire Protection Equipment & Systems Business. Sprinklers, which are widely used as fire extinguishing equipment for buildings, are installed in a water tank in the basement or on the roof of a building and feed water to prevent the spread of fire. Since Sprinex is about the size of a locker; it has the advantage of being easy to retrofit to buildings that previously had no fire extinguishing equipment.

(Based on the company’s reference material)

Many of the casualties in building fires are due to the delay in evacuating. In the wake of fires that killed the elderly at social welfare and medical facilities, the Fire Services Act was amended, and the standards for installing sprinkler systems were revised. In April 2015, it became mandatory to install fire extinguishing equipment in facilities, such as clinics with floors where elderly people who find it difficult to evacuate by themselves in the event of a fire are present, regardless of their size. However, retrofitting a sprinkler to an existing facility requires large-scale construction, including installing a water tank.

Under these circumstances, Sprinex, which can be easily retrofitted and has fire extinguishing performance equal to or greater than sprinklers connected to specific facilities' water supply systems, has been highly evaluated, and its track record is steadily expanding.

In addition, adoption of Sprinex is not limited to bedside clinics, but is also increasing in pencil apartments where it is difficult to secure space for a water storage tank.

③ Recycling Machines Business

The company develops, manufactures, sells, and maintains various types of large-scale environmental machinery for scrap metal processing, as well as equipment that promotes smoother and more efficient recycling, such as waste volume reduction and waste sorting. The company also designs and constructs recycling plazas and waste treatment facilities.

(Source: the company’s website)

Main customers are iron scrap processors.

④ Environmental Conservation Vehicles Business

The company develops, manufactures, and sells vehicles for cleaning, waste collection, transportation, and disposal that are indispensable for environmental conservation, such as sanitary vehicles (vacuum trucks) and garbage collectors.

(Source: the company’s website)

The company's main customers are private companies commissioned by local governments.

【1-5 Features, Strengths, and Competitive Advantages】

(1)The largest market shares

The company has acquired a high market share in each business by promoting high value-added products.

Segment | Share |

Fire Fighting Vehicles Business | Fire fighting vehicles 58% |

Fire Protection Equipment & Systems Business | Fire extinguishers 38% |

Recycling Machines Business | Scrap shears 59% |

Environmental Conservation Vehicles Business | Sanitary vehicles 85% |

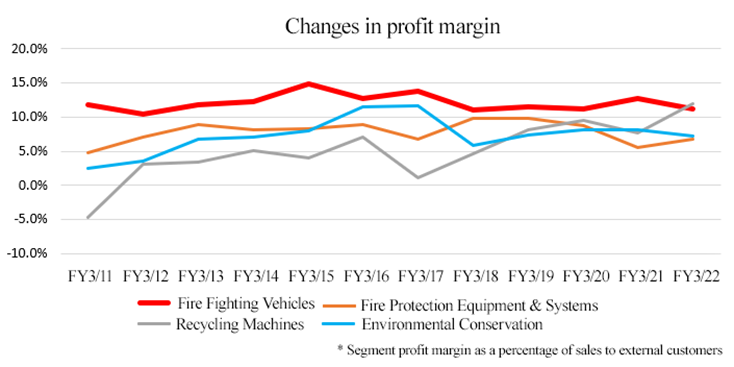

(2)High profitability

The profit margin in the Fire Fighting Vehicles Business is expected to stay above 10% over the long term, outperforming its competitors.

(3)High technical and development capabilities

The research and development division (Morita ATI Center) under Morita Holdings is the center of research and development. The Morita ATI Center is working on research and development in various fields, such as chemistry (research and development of fire extinguishing agents), electricity, and machinery while cooperating with the development departments of the operating companies.

The company always tries to think from the user's viewpoint and focuses on solving customer problems. Not only the operating companies, but also the ATI Center staff members adopt a market-oriented approach, such as exchanging information with related parties close to customers. In addition, the company is actively working on open innovation, such as promoting joint research with many universities and research institutes in a wide range of fields.

The new R&D base is scheduled to be completed in July 2023. By consolidating the group's research and development departments, including the development departments of the operating companies, the company intends to strengthen further and speed up its research and development system.

(4)Outstanding design capabilities

As an element of differentiation, the company focuses on designs and aims for designs that consider safety, innovation, and functionality. With its in-house designers, the company endeavors to win prestigious design awards in Japan and overseas at every opportunity and has won many awards.

(Award example)

+ Residential fire extinguisher It is the first product of the disaster prevention brand "+maffs" targeting general consumers. Based on the brand concept of "disaster prevention as a lifestyle," it features a matte texture and adopts a design that harmonizes with your home, which is the opposite of conventional design. The company has updated the fire extinguishers, which are conventionally hidden, and made them into a product that can be put in a place where people can see it and extinguish the fire quickly. |

Press-type garbage collector "PB7 type Pressmaster®" Pressmaster® is a press-type garbage collection vehicle that combines the cool car look with a powerful and functional form that gives a sense of reliability and aspires to integrate with the landscape. The company designed this product, while hoping that workers would feel joy and pride using it, and that people and society would see it as a car that would clean their city and look forward to it. |

(Source: the company’s website)

【1-6 Growth strategy】

The mid-term management plan “Morita Reborn 2025” is ongoing.

They plan to enhance the development of cutting-edge technologies in the fire-fighting and disaster prevention fields, in which the company operates their core business, and offer new solutions to the changing society, to protect as many people as possible from diversifying and enlarging disasters and help make the global society safer and more secure.

In Fire Fighting Vehicles Business, which is the mainstay, it takes 3-5 years to complete the processes from development to sale of new products, and it is important to implement business development strategies for overseas business operation from the long-term viewpoint. Accordingly, to avoid conducting business administration from the short-term viewpoint, the period of the mid-term management plan is 7 years ending in FY 2025.

(1)Outline of the mid-term management plan “Morita Reborn 2025”

<Basic policy>

1 | Increasing the profitability of our existing business |

2 | Cultivating and expanding overseas businesses and new businesses |

3 | Enhancing basic research capabilities and new product development |

4 | Developing innovative human resources |

5 | Promoting CSR activities |

(2)Points of the basic policy

①Increasing the profitability of our existing business

As a primary theme, the company will add high value to products and increase cost competitiveness by reducing costs through the automation of manufacturing processes, etc.

②Cultivating and expanding overseas businesses and new businesses

*Overseas businesses

Firstly, they will promote the continuous growth of Bronto. After the acquisition, the performance of Bronto improved steadily, and operating income margin rose to nearly 9%. In particular, there remains room for growth in the North American market, so further growth can be expected.

Secondly, they will sell Morita products outside Japan via Bronto.

The specs of fire trucks vary among countries, so they are dealing with this matter by utilizing the know-how of Bronto.

Thirdly, they assume M&A.

*New businesses

For Fire Fighting Vehicles Business, the company enriched the lineup of products for tolerating damage from storms and floods, which frequently occur nowadays, and enhanced business operations in peripheral markets.

For Fire Protection Equipment & Systems Business, the company aims to expand its business in fields where it is not mandatory to install fire extinguishing equipment, etc. in accordance with the Fire Service Act.

③Enhancing basic research capabilities and new product development

The company will proceed with R&D for technological innovation, including CASE (Connected, Autonomous, Shared, and Electric). They will fortify their R&D system by establishing a new R&D base and integrating the development functions of the corporate group. They will also promote open innovation further.

④Developing innovative human resources

With the aim of improving corporate value in a sustainable manner by utilizing the diversity of employees, they are making efforts to develop an environment that would motivate employees and enable diverse personnel to flourish.

As part of such efforts, the company adopted “a system for having employees retire at the age of 65,” raising the retirement age from 60 to 65, in October 2022.

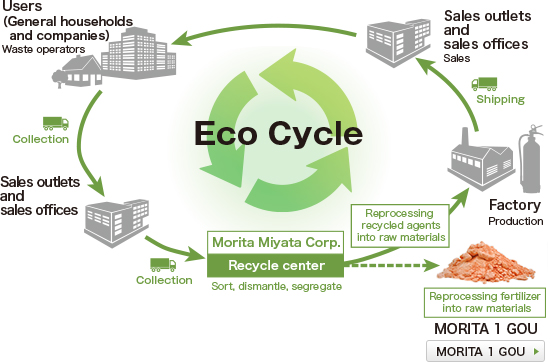

⑤Promoting CSR activities

As part of efforts for conserving the natural environment, they are developing a system for recycling fire extinguishers. They collect fire extinguishers after their useful lives, reuse fire extinguishing agents, and convert some fire extinguishing agents that cannot be reused into fertilizers, to reduce waste.

(Source: the company’s website)

The company also conducts activities for facilitating communication with local communities, in order to develop a safe, comfortable, affluent society.

Support for the activities of Osaka Science & Technology Center

Since 2007, the company has been sponsoring the visiting science class held by Osaka Science & Technology Center. |

Voluntary cleaning for local communities

The company is fostering bonds with local communities through cleaning around factories, which are production bases of the Morita Group. |

Support for disaster relief and restoration of devastated areas

The company inspects fire trucks used in devastated areas free of charge, donates fire-extinguishing foams, etc. to support the restoration of devastated areas. |

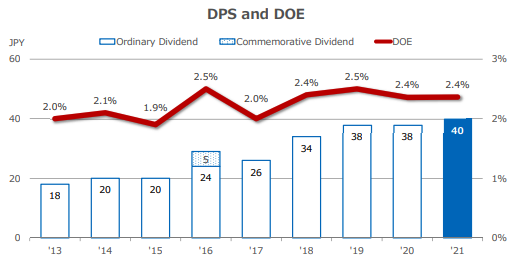

(3) Numerical goals for FY 2025

Item | Goal |

Operating income | To break the record operating income of 9.6 billion in FY 2016 |

Operating income margin | 12% |

ROE | 10% |

DOE | 2.5% or higher |

Investment budget for growth strategy, including M&A | 20 billion yen |

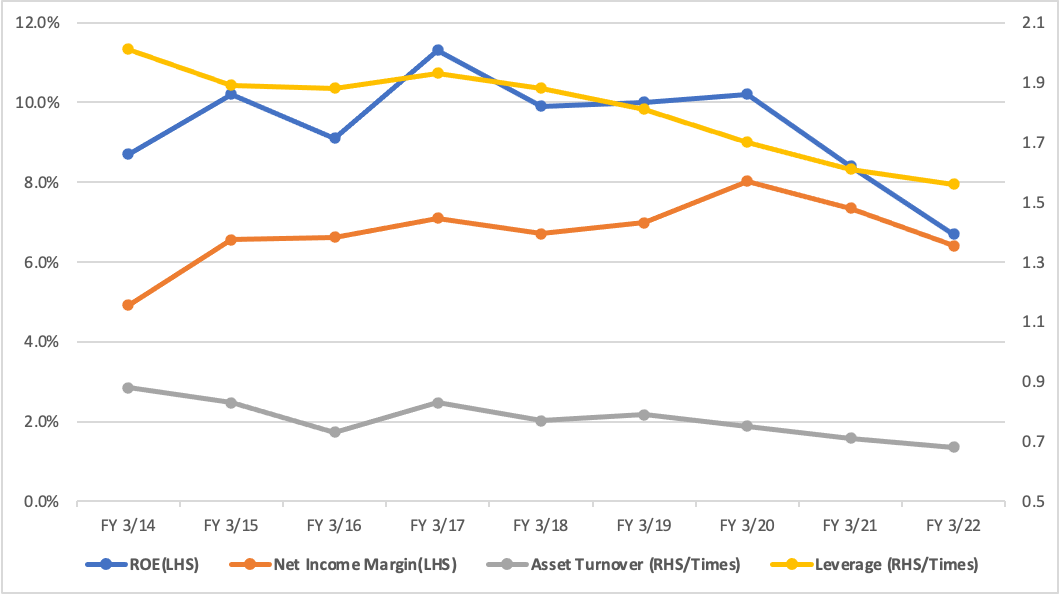

【1-7 ROE Analysis】

| FY3/14 | FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 | FY3/20 | FY3/21 | FY3/22 |

ROE (%) | 8.7 | 10.2 | 9.1 | 11.3 | 9.9 | 10.0 | 10.2 | 8.4 | 6.7 |

Net income margin (%) | 4.92 | 6.55 | 6.62 | 7.10 | 6.71 | 6.98 | 8.02 | 7.35 | 6.40 |

Total asset turnover [times] | 0.88 | 0.83 | 0.73 | 0.83 | 0.77 | 0.79 | 0.75 | 0.71 | 0.68 |

Leverage [times](x) | 2.02 | 1.89 | 1.88 | 1.93 | 1.88 | 1.81 | 1.70 | 1.61 | 1.56 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

In the past two terms, net income margin, total asset turnover, and leverage declined, and ROE fell below 8%, which is considered as a value that should be pursued by Japanese enterprises. In the mid-term management plan “Morita Reborn 2025,” they aim to achieve an ROE of 10%.

【1-8 Return to shareholders】

While fortifying their financial standing and corporate base, the company aims to achieve a DOE (dividend on equity ratio) of 2.5% or higher under the basic policy of “maintaining or improving stable dividends.”

(Taken from the reference material of the company)

【1-9 Sustainability】

(1) Sustainability

In April 2022, the company established Sustainability Committee.

Under this committee, the company established a working group composed of members selected from related sections and group companies, and started discussing purposes (social meanings of existence) and the identification of material issues. The company also worked on dealing with the recommendations from TCFD, including the measurement of GHG emissions and the setting of goals.

2. Second Quarter of Fiscal Year ending March 2023 Earnings Results

【2-1 Consolidated Business Results】

| 2Q of FY3/22 | Ratio to sales | 2Q of FY3/23 | Ratio to sales | YoY |

Sales | 27,011 | 100.0% | 28,156 | 100.0% | +4.2% |

Gross Profit | 7,201 | 26.7% | 7,615 | 27.0% | +5.7% |

SG&A | 6,889 | 25.5% | 6,913 | 24.6% | +0.3% |

Operating Income | 311 | 1.2% | 702 | 2.5% | +125.3% |

Ordinary Income | 631 | 2.3% | 864 | 3.1% | +37.0% |

Net Income | 262 | 1.0% | 363 | 1.3% | +38.5% |

*Unit: million yen.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

▲of expense account indicates that the expense has increased.

Sales grew, and profit increased considerably.

Sales rose 4.2% year on year to 28,156 million yen. Sales increased in the three segments: Fire Fighting Vehicles, Fire Protection Equipment & Systems Business, and Recycling Machines.

Operating income grew 125.3% year on year to 702 million yen. In particular, Fire Protection Equipment & Systems Business contributed, and gross profit rose 5.7% year on year, so gross profit margin increased 0.3% year on year. SGA was unchanged year on year, so profit rose considerably. The amount of orders received increased 9.9% year on year to 54.8 billion yen. The backlog of orders rose 17.9% year on year to 62.5 billion yen, hitting a record high for the second quarter.

*Since the sales to governmental organizations account for a significant proportion of sales of Fire Fighting Vehicles Business, sales and profit of this segment tend to be higher in the fourth quarter of each term.

【2-2 Trends by Segment】

| 2Q of FY3/22 | Composition ratio | 2Q of FY3/23 | Composition ratio | YoY |

Fire Fighting Vehicles | 11,910 | 44.1% | 12,487 | 44.3% | +4.8% |

Fire Protection Equipment & Systems | 8,058 | 29.8% | 8,398 | 29.8% | +4.2% |

Recycling Machines | 2,411 | 8.9% | 2,790 | 9.9% | +15.7% |

Environmental Conservation Vehicles | 4,630 | 17.1% | 4,479 | 15.9% | -3.3% |

Total sales | 27,011 | 100.0% | 28,156 | 100.0% | +4.2% |

Fire Fighting Vehicles | -506 | - | -344 | - | - |

Fire Protection Equipment & Systems | 183 | 2.3% | 561 | 6.7% | +206.6% |

Recycling Machines | 317 | 13.1% | 314 | 11.3% | -0.9% |

Environmental Conservation Vehicles | 317 | 6.8% | 164 | 3.7% | -48.3% |

Adjustment | 0 | - | 6 | - | - |

Total segment profit | 311 | 1.2% | 702 | 2.5% | +125.3% |

*Unit: million yen. The composition ratio for segment income means the ratio of segment income to sales.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

| 2Q of FY3/20 | 2Q of FY3/21 | 2Q of FY3/22 | 2Q of FY3/23 | YoY |

Sales |

|

|

|

|

|

Overall | 51,509 | 50,486 | 49,863 | 54,806 | +9.9% |

Fire Fighting Vehicles | 40,170 | 39,482 | 37,017 | 40,712 | +10.0% |

Fire Protection Equipment & Systems | 3,417 | 3,545 | 4,096 | 4,818 | +17.6% |

Recycling Machines | 2,574 | 2,239 | 2,988 | 3,079 | +3.0% |

Environmental Conservation Vehicles | 5,347 | 5,218 | 5,760 | 6,195 | +7.5% |

Backlog of orders |

|

|

|

|

|

Overall | 48,246 | 49,525 | 53,033 | 62,541 | +17.9% |

Fire Fighting Vehicles | 36,448 | 37,659 | 38,847 | 43,207 | +11.2% |

Fire Protection Equipment & Systems | 3,983 | 4,504 | 5,303 | 6,741 | +27.1% |

Recycling Machines | 2,857 | 2,255 | 3,351 | 4,838 | +44.4% |

Environmental Conservation Vehicles | 4,957 | 5,105 | 5,529 | 7,754 | +40.2% |

*Unit: million yen.

(1) Fire Fighting Vehicles

Sales grew, and loss shrank.

While the supply of chassis remained uncertain, domestic sales were stagnant, but outside Japan, the significant backlog of orders at the beginning of the term contributed to sales.

(2) Fire Protection Equipment & Systems

Sales and profit increased.

As price revisions contributed, the sales of fire extinguishers were healthy. In addition, the company received large-scale orders for fire extinguishing equipment.

(3) Recycling Machines

Sales rose, and profit declined.

While the sales of products were firm, the sales of parts and maintenance services declined.

(4) Environmental Conservation Vehicles

Sales and profit dropped.

This business was affected by mainly the delay of supply of chassis due to the shortage of semiconductors.

【2-3 Financial condition and cash flow】

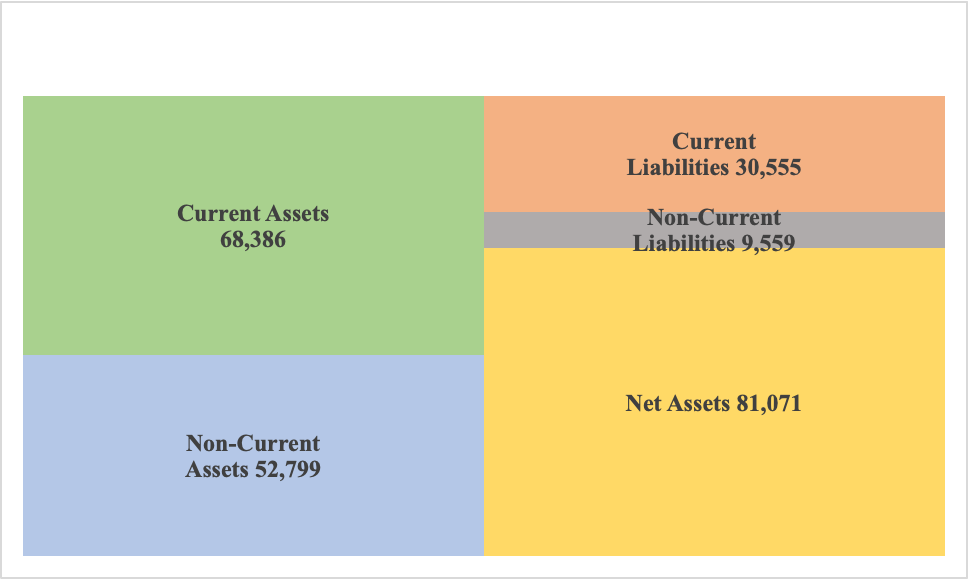

◎Main BS

| End of March 2022 | End of September 2022 | Increase/ Decrease |

| End of March 2022 | End of September 2022 | Increase/ Decrease |

Current Assets | 71,629 | 68,386 | -3,243 | Current Liabilities | 33,118 | 30,555 | -2,563 |

Cash and deposits | 29,276 | 24,976 | -4,300 | Payables | 16,428 | 13,894 | -2,534 |

Receivables | 24,218 | 15,458 | -8,760 | Short-term Borrowings | 6,270 | 5,766 | -504 |

Inventories | 16,890 | 25,537 | +8,647 | Noncurrent Liabilities | 10,143 | 9,559 | -584 |

Noncurrent Assets | 53,538 | 52,799 | -739 | Long-term Borrowings | 54 | 62 | 8 |

Property, plant and equipment | 32,179 | 32,683 | +504 | Total Liabilities | 43,261 | 40,114 | -3,147 |

Intangible Assets | 2,672 | 2,673 | +1 | Net Assets | 81,906 | 81,071 | -835 |

Investment and Other Assets | 18,686 | 17,443 | -1,243 | Retained earnings | 71,099 | 70,536 | -563 |

Total Assets | 125,167 | 121,186 | -3,981 | Total Liabilities and Net Assets | 125,167 | 121,186 | -3,981 |

*Unit: million yen. Receivables include electronically recorded monetary claims, and payables include electronically recorded ones.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Total assets decreased 3.9 billion yen from the end of the previous term to 121.1 billion yen, due to the decreases in cash and receivables.

Total liabilities decreased 3.1 billion yen to 40.1 billion yen, due to the drop in payables.

Net assets declined 800 million yen to 81 billion yen, due to the drop in retained earnings, the increase in treasury shares, etc.

Capital-to-asset ratio rose 1.4% from the end of the previous term to 66.1%.

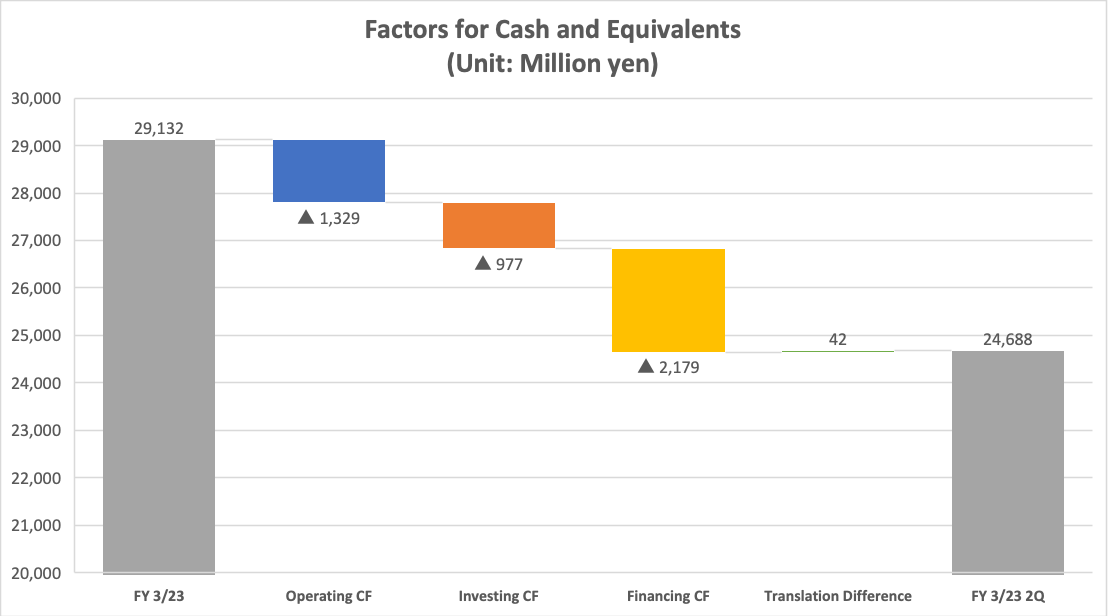

◎ Cash Flow

| 2Q of FY3/22 | 2Q of FY3/23 | Increase/Decrease |

Operating cash flow | 2,291 | -1,329 | -3,620 |

Investing cash flow | -636 | -977 | -341 |

Free cash flow | 1,655 | -2,306 | -3,961 |

Financing cash flow | -803 | -2,179 | -1,376 |

Cash and equivalent | 23,723 | 24,688 | +965 |

*Unit: million yen.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Operating CF and free CF turned negative. Due to the purchase of treasury shares, the cash outflow from financing activities augmented. The cash position improved.

3. Fiscal Year ending March 2023 Earnings Forecasts

【3-1 Earnings forecast】

The timing of supply of chassis in Fire Fighting Vehicles Business and Environmental Conservation Vehicles Business is unclear, and it is difficult to forecast it reasonably, so an earnings forecast is still to be made. As soon as it becomes possible to disclose the forecast, the company will announce it.

The problem with the supply of chassis will be solved in the short term, when Hino Motors resumes manufacturing and shipment, but from the medium/long-term viewpoint, the company has started measures for diversifying procurement methods.

【3-2 Outlook for each segment】

*Taken from the material for briefing the financial statements for FY 2021 released in May 2022.

Segment | Overview |

Fire Fighting Vehicles | While the backlog of orders at the beginning of the term is large, the company is expected to keep receiving a healthy number of orders, but the supply of chassis is uncertain. |

Fire Protection Equipment & Systems | The demand for fire extinguishers and Sprinex is expected to be high. |

Recycling Machines | As the demand and supply of iron scraps have been tightened, and prices are high, so demand is projected to be firm. |

Environmental Conservation Vehicles | The backlog of orders at the beginning of the term is large, but the supply of chassis is uncertain. |

4. Conclusions

In the first half of the term ending March 2023, sales and profit grew and the number of orders received was healthy. For fire trucks in Japan, the company tends to post sales from orders in the first half of a term in the second half. Normally, it can be expected that annual sales and profit will be healthy, but the supply of chassis remains uncertain, and a full-year earnings forecast is still to be made. This is unavoidable, but bad news for investors. We hope that they will disclose their forecast as soon as possible.

On the other hand, from the medium-term viewpoint, we would like to pay attention to the basic policy in the mid-term management plan “Morita Reborn 2025” and the progress toward their goals.

<Reference: Regarding Corporate Governance>

Composition of the organizational structure, directors and auditors

Organizational structure | Company with auditors |

Directors | 9 including 3 outside directors (including 3 independent officers) |

Auditors | 4 including 3 outside auditors (including 3 independent officers) |

Corporate Governance Report

Last update date: July 13, 2022

<Basic policy>

In addition to the corporate philosophy: “With our dedication to quality production and unceasing technological innovations, we strive to work in harmony with society by contributing to the creation of a "safe, comfortable and prosperous society" and embracing sincere business activities,” our corporate group states “placing importance on revenues, constantly seeking the greatest value and aiming for transparent and robust management” in a section of the management policy and views abiding by laws and regulations, elevating efficiency and transparency and maximizing corporate value from the viewpoint of shareholders as the basic policy and objective of corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Basic principle 2】

We recognize that cooperation with various stakeholders is indispensable for sustainable growth and the elevation of corporate value in the medium/long term. Furthermore, while we aim to solve social challenges through our actual business activities of firefighting, disaster prevention, recycling and environment protection and we believe that our existence is supported by this aspect, we set up a “Sustainability Committee” on April 28th, 2022 in order to further reinforce initiatives pertaining to sustainability and implement more effective initiatives.

Moreover, our corporate group has formulated corporate philosophy, management policy and guidelines for action as our management philosophy. Among them, we have stated “With our dedication to quality production and unceasing technological innovations, we strive to work in harmony with society by contributing to the creation of a "safe, comfortable and prosperous society" and embracing sincere business activities” as our corporate philosophy, and our Board of Directors and management executives demonstrate their leadership in fostering corporate culture and climate of respecting the rights and positions of various stakeholders and sound business activity ethics.

【Principle 2-3. Challenges pertaining to sustainability, such as social and environmental issues】

We shall realize a “safe, comfortable and prosperous society,” which is part of our corporate philosophy, and appropriately address challenges pertaining to sustainability, such as social and environmental issues, as a company with the slogan of “Protecting Human Life and Mother Earth.” We set up a Sustainability Committee on the April 28th, 2022 and shall debate on formulating the basic sustainability policy, identifying material items (important challenges) and establishing indices, etc. which should be our goals.

【Supplementary Principle 2-3① Response to challenges pertaining to sustainability】

The Board of Directors recognizes the response to challenges pertaining to sustainability such as the consideration toward the global environment such as climate change, respect for human rights, consideration for the health and labor environment as well as fair and appropriate treatment of staff, fair and reasonable transactions with business partners and risk management in case of natural disasters, etc. as important management challenges leading not only to risk reduction, but also to revenue earning opportunities. Therefore, we set up a Sustainability Committee on April 28th, 2022 in order to aim for the promotion of initiatives toward sustainability and elevation of corporate value in the medium/long term, and we shall assertively and actively address these challenges.

【Supplementary Principle 3-1③ Initiatives concerning sustainability】

While we aim to solve social challenges through our actual business activities of firefighting, disaster prevention, recycling and environment protection and we believe that our existence is supported by this aspect, we set up a “Sustainability Committee” on April 28th, 2022 in order to further promote the initiatives pertaining to sustainability and make them more effective. This committee shall debate on formulating a basic sustainability policy, identifying material issues and establishing indices, etc. which should be our goals, and report and propose them to the Board of Directors. Furthermore, as for investment in human capital, we state “to produce personnel who possess the ability to trigger innovation” as the basic policy of our mid-term management plan and we disclose our policy for the training of human resources on our corporate website. With regard to investment in intellectual property, we have arranged systems for working toward the promotion of employees’ inventions, etc. and the elevation of enthusiasm for research while stating “to strengthen the basic research capacity and the capability of developing new products” as the basic policy of our mid-term management plan. We shall go on to consider appropriate disclosure regarding the impact of climate change on our business activities, revenues, etc.

【Supplementary Principle 4-2② The role of the Board of Directors in dealing with challenges pertaining to sustainability】

While we aim to solve social challenges through our actual business activities of firefighting, disaster prevention, recycling and environment protection and we believe that our existence is supported by this aspect, our Board of Directors set up a “Sustainability Committee” on April 28th, 2022 in order to aim for the promotion of initiatives pertaining to sustainability and further elevation of the corporate value in the medium/long term. This committee shall debate on formulating the basic sustainability policy, identifying material issues and establishing indices, etc. which should be our goals, and report and make suggestions to the Board of Directors.

Moreover, we are making efforts to develop a system in which the Board of Directors will engage in effective supervision by making the progress of the mid-term management plan including the strategy concerning the allotment of management resources and a business portfolio items to be reported at the Board of Directors’ meetings if necessary.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically-held shares】

(1) Policy regarding strategic shareholding

Our company holds listed shares strategically as a result of comprehensively considering the necessity in terms of business activities such as business alliances and maintenance and reinforcement of transactions from the medium/long-term viewpoint for achieving sustainable growth and elevating corporate value.

(2) Details of examination on the appropriateness of strategic shareholding

With regard to strategically-held shares, the appropriateness of holding each stock shall be examined after a comprehensive consideration of the objective of holding the shares, benefits and risks stemming from holding the shares, etc. at a meeting of the Board of Directors, etc. every year. In case the meaning of holding the shares is judged to be insufficient, we shall gradually diminish the shares while taking into account the market environment, etc.

(3) Criteria for the exercise of voting rights for strategically-held shares

We shall appropriately exercise voting rights for strategically-held shares while considering whether the strategically-held shares will be useful for the efficient and sound management of the issuing company and whether the elevation of corporate value can be expected in addition to whether proposals are in line with our policy for strategically-held shares.

【Principle 3-1 Enrichment of information disclosure】

(i) We disclose our corporate philosophy, management policy and guidelines for action on our corporate website. Moreover, as for the management strategy and plan, we formulated the mid-term management plan “Morita Reborn 2025,” covering a period from April 1st, 2019, to March 31st, 2026, and disclosed it on April 26th, 2019.

(ii) Our fundamental thoughts regarding corporate governance are noted in the Corporate Governance Report as well as the Annual Securities Report.

(iii) We ensure the objectivity and transparency of the compensation, etc. for our directors based on the consultation with the Compensation Consultation Committee, whose majority and head are independent outside directors, and determine compensation amounts at a Board of Directors’ meeting within the total compensation determined at a General Meeting of Shareholders.

(iv) Regarding the policy and procedures for the appointment and dismissal of our directors and the representative directors of major subsidiaries, we ensure objectivity and transparency based on the consultation with the Nominating Consultation Committee, whose majority and head are independent outside directors, following which we perform the procedures for the appointment or dismissal. As for auditors, we perform the appointment procedures after comprehensively considering whether the candidate could contribute to the sound management, maintenance of internal credibility, etc. of our corporate group, having the Board of Directors make a suggestion to the Board of Auditors, and gaining approval from the Board of Auditors.

(v) We disclose the reasons for the selection and dismissal of director and auditor candidates in the Notice of Convocation of a General Meeting of Shareholders.

【Supplementary Principle 4-10① Authority, role, etc. of the Nominating Committee and the Compensation Committee】

While independent outside directors currently do not account for the majority of our company directors, we have set up a Nominating Consultation Committee and a Compensation Consultation Committee, where the majority and head are independent outside directors, and we strive for the enhancement of a corporate governance system that ensures objectivity and transparency.

Furthermore, the committees discuss the appointment and dismissal of directors and executive officers and compensation respectively and report the results to the Board of Directors, following which the Board of Directors passes resolutions based on this report.

【Principle 5-1 Policy regarding constructive dialogue with shareholders】

At our company, we appoint an executive in charge of IR, while the Management Planning Division is responsible for IR.

Our basic policy lies in holding individual meetings at our company offices and offices of our investors in Tokyo and Osaka as well as through telephone and online meeting systems in addition to organizing a session for explaining financial results to shareholders and investors once a year as a general rule. In addition, we are making efforts to enrich dialogue with shareholders and investors through small irregular meetings and responding to telephone interviews and requests for factory tours.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back issues of the Bridge Report (MORITA HOLDINGS CORPORATION: 6455) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.