| WASHHOUSE Co., Ltd. (6537) |

|

||||||||

Company |

WASHHOUSE Co., Ltd. |

||

Code No. |

6537 |

||

Exchange |

TSE Mothers FSE Q-Board |

||

Industry |

Service business |

||

President |

Yasutaka Kodama |

||

Address |

86-1, Shinei-cho, Miyazaki-shi, Miyazaki prefecture |

||

Year-end |

End of December |

||

URL |

|||

*The share price is the closing price on August 27. The number of shares issued is from the end of 1H FY12/18. ROE and BPS are those from the end of the previous term.

|

||||||||||||||||||||||||

|

|

*The forecasted values were provided by the company. *The Company conducted a 100-for-1 share split on April 2, 2016, a 2-for-1 share split on April 1, 2017. EPS and DPS have been revised retroactively.

We present this Bridge Report reviewing the first half of fiscal year December 2018 earnings results of WASHHOUSE Co., Ltd. |

| Key Points |

|

| Company Overview |

|

WASHHOUSE operates laundromats mainly based on the franchise system, with the aim of creating the global standard in the self-service laundry industry.

The company has developed an unprecedented franchise chain (FC) business system, which unifies the quality of stores by managing and operating all stores concurrently, so that both the FC headquarters and franchised shops can thrive. As a great advantage, the company has a stable earning structure with recurring revenue.

It made inroads into Osaka and Tokyo, embarking on nationwide business on a full-scale basis. It also plans to expand its business outside Japan.

As of the end of June 2018, 528 laundromats (500 franchised ones and 28 directly managed ones) are in operation in Tokyo, Osaka and 16 other prefectures.

【1-1 Corporate history】

When starting up this business, President Kodama pondered over how to keep increasing sales and profit eternally in the age that will certainly witness the decreased birthrate and aging and declining population, whether the business has social meanings, whether there are any forerunners, whether the company can survive competitions, whether the business can be imitated easily, whether it is possible to achieve recurring revenue, and so on from various aspects, and decided to do the laundromat business.

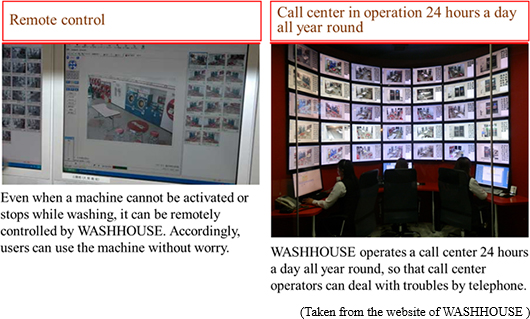

For expanding the scale of business, the FC system is effective, but the FC business is accompanied by the problem of the conflict between the FC headquarters and franchised stores. In order to solve this problem, the company immediately introduced a call center that is in operation 24 hours a day all year round and the "system for managing and operating all stores at the same time," which is composed of the swift support based on management webcams and remote control, etc. and reduced the burdens of franchised stores considerably. Its business grew steadily, partially thanks to the expansion of needs due to the increase in the number of working females.

From the Kyushu area, including Miyazaki Prefecture, where the business was launched, the company expanded its sales territory, entering Osaka in Dec. 2015 and Tokyo in Jul. 2016.

Then, in Nov. 2016, WASHHOUSE got listed on Mothers of Tokyo Stock Exchange and Q-Board of Fukuoka Stock Exchange.

【1-2 Corporate ethos, etc.】

The ethos of WASHHOUSE is "to think about all matters from the viewpoint of customers and keep being demanded by society."

Under this ethos, the company is working on "creation of global standards in the laundromat industry" with the aim of continuously offering satisfactory services to users on behalf of store owners by fully managing laundromats after the opening of the store rather than "just selling self-service laundry equipment and instructing owners to operate it."

【1-3 Market environment】

◎ Growing laundromat market

According to the "Survey on coin-operated cleaning facilities" by the Ministry of Health, Labour and Welfare, although it is somewhat out of date, the number of laundromats in Japan in fiscal year 2013 was 16,693, and that in fiscal 1996 was 10,228, indicating a compound annual growth rate (CAGR) of 2.9%. If it keeps growing at a rate of 3%, it will exceed 18,000 stores in fiscal year 2016, which also exceeds the number of the stores (17,656) of FamilyMart ranking second in the convenience store field (as of the end of Nov. 2017), and is approaching the number of stores (19,970) of Seven-Eleven, which ranks first (as of the end of Nov. 2017). 【1-2 Corporate ethos, etc.】

The ethos of WASHHOUSE is "to think about all matters from the viewpoint of customers and keep being demanded by society."

Under this ethos, the company is working on "creation of global standards in the laundromat industry" with the aim of continuously offering satisfactory services to users on behalf of store owners by fully managing laundromats after the opening of the store rather than "just selling self-service laundry equipment and instructing owners to operate it."

【1-3 Market environment】

◎ Growing laundromat market

According to the "Survey on coin-operated cleaning facilities" by the Ministry of Health, Labour and Welfare, although it is somewhat out of date, the number of laundromats in Japan in fiscal year 2013 was 16,693, and that in fiscal 1996 was 10,228, indicating a compound annual growth rate (CAGR) of 2.9%. If it keeps growing at a rate of 3%, it will exceed 18,000 stores in fiscal year 2016, which also exceeds the number of the stores (17,656) of FamilyMart ranking second in the convenience store field (as of the end of Nov. 2017), and is approaching the number of stores (19,970) of Seven-Eleven, which ranks first (as of the end of Nov. 2017).

◎ Growth factors

In the background of such growth, there are: ◎ Growth factors

In the background of such growth, there are:

Women's needs for "the reduction in cleaning time" due to the increase of dual-earner households, Women's needs for "the reduction in cleaning time" due to the increase of dual-earner households,

Measures against allergies, such as the allergy to pollen, Measures against allergies, such as the allergy to pollen,

Decrease in the use of cleaning services due to the increase of low-priced high-quality clothes, Decrease in the use of cleaning services due to the increase of low-priced high-quality clothes,

Enhancement of awareness of cleanliness,

and so on.

In addition to these external factors, enterprises, including WASHHOUSE, started offering a variety of services considering the convenience for users, and so "users have increased" and then "the number of laundromats has grown."

According to president Kodama, "rate of utilization," which indicates how many households use laundromats among all households living within 2 km from a store, was about 3% on national average 10 years ago, but it is now 5-8%, and expected to increase further.

◎ Market players

It is difficult to obtain detailed information, but the number of main players in the self-service laundry market is said to be 4 to 5. WASHHOUSE has the largest number of laundromats with the same brand, and is the only listed company in this field.

Although many enterprises carry out the FC business for growth (increasing in the number of stores), WASHHOUSE possesses an unparalleled "system for managing and operating all stores at the same time," which was developed in pursuing the streamlining of business operation and unification of quality. (For details, see "1-5 Characteristics and Strengths.")

【1-4 Business contents】

1. Business structure

WASHHOUSE conducts the three kinds of business: (1) FC business, (2) store management business, and (3) direct management business, etc. Enhancement of awareness of cleanliness,

and so on.

In addition to these external factors, enterprises, including WASHHOUSE, started offering a variety of services considering the convenience for users, and so "users have increased" and then "the number of laundromats has grown."

According to president Kodama, "rate of utilization," which indicates how many households use laundromats among all households living within 2 km from a store, was about 3% on national average 10 years ago, but it is now 5-8%, and expected to increase further.

◎ Market players

It is difficult to obtain detailed information, but the number of main players in the self-service laundry market is said to be 4 to 5. WASHHOUSE has the largest number of laundromats with the same brand, and is the only listed company in this field.

Although many enterprises carry out the FC business for growth (increasing in the number of stores), WASHHOUSE possesses an unparalleled "system for managing and operating all stores at the same time," which was developed in pursuing the streamlining of business operation and unification of quality. (For details, see "1-5 Characteristics and Strengths.")

【1-4 Business contents】

1. Business structure

WASHHOUSE conducts the three kinds of business: (1) FC business, (2) store management business, and (3) direct management business, etc.

(1) FC business

WASHHOUSE created a unique operation-supported FC business.

The company selects candidate places for opening laundromats, sells "a set of WASHHOUSE laundromat systems," which contains the design, interior finish work, equipment installation, etc. in a WASHHOUSE brand store, to franchisees, and receives the preparation fees for opening store, including advertisements, and fees for franchise rights.

For increasing franchisees, the company adopts the division system where sales staff visit possible franchisees, with which telephone staff set up an appointment, so that sales staff can concentrate on more active sales activities without the mental burden of sales calls. In addition, business simulation, contract production, etc. are conducted by other staff, so that sales staff can devote themselves to "footwork."

Furthermore, by concluding business matching contracts with financial institutions, etc., the company is accumulating information on sites for building laundromats and candidate owners, and developing a "system" for increasing laundromats.

WASHHOUSE designs a plan to open new laundromats for each term based on the accumulated data on correlative relations of "the number of years of career of sales staff and achievements of opening franchised stores."

Therefore, the company can achieve the target values set at the beginning of each term with overwhelming probability.

(2) Store management business

WASHHOUSE undertakes the management of all franchised stores, reports a monthly operation status, including revenue and expenditure, to franchisees, and subtracts the fee for laundromat management from monthly sales.

In order to keep each store "reliable, safe, and clean," WASHHOUSE provides franchisees with such services as (1) FC business

WASHHOUSE created a unique operation-supported FC business.

The company selects candidate places for opening laundromats, sells "a set of WASHHOUSE laundromat systems," which contains the design, interior finish work, equipment installation, etc. in a WASHHOUSE brand store, to franchisees, and receives the preparation fees for opening store, including advertisements, and fees for franchise rights.

For increasing franchisees, the company adopts the division system where sales staff visit possible franchisees, with which telephone staff set up an appointment, so that sales staff can concentrate on more active sales activities without the mental burden of sales calls. In addition, business simulation, contract production, etc. are conducted by other staff, so that sales staff can devote themselves to "footwork."

Furthermore, by concluding business matching contracts with financial institutions, etc., the company is accumulating information on sites for building laundromats and candidate owners, and developing a "system" for increasing laundromats.

WASHHOUSE designs a plan to open new laundromats for each term based on the accumulated data on correlative relations of "the number of years of career of sales staff and achievements of opening franchised stores."

Therefore, the company can achieve the target values set at the beginning of each term with overwhelming probability.

(2) Store management business

WASHHOUSE undertakes the management of all franchised stores, reports a monthly operation status, including revenue and expenditure, to franchisees, and subtracts the fee for laundromat management from monthly sales.

In order to keep each store "reliable, safe, and clean," WASHHOUSE provides franchisees with such services as

24/7 Call centers 24/7 Call centers

Swift support based on management webcams and remote control Swift support based on management webcams and remote control

Daily inspection and cleaning Daily inspection and cleaning

Replenishment of detergents Replenishment of detergents

Maintenance patrol Maintenance patrol

Bill collection Bill collection

Advertisement

Sales are composed of the fees for store management and system maintenance, sales of detergents, cleaning fees, advertising charges, etc.

Since franchisees need not manage their laundromats, if they can bear initial investment costs, they can own multiple stores, increase revenue, and reduce the risk of revenue fluctuation with stores being operated in different regions.

(3) Direct management business, etc.

The company directly manages some of "WASHHOUSE" laundromats, receiving the charges for washing and drying machines from users. A directly managed store is opened mainly when entering a new area. It takes the roles as an antenna shop, such as popularizing the "WASHHOUSE" brand as a "reliable, safe, and clean" laundromat, promoting possible users to use it, and offering a store model to franchisees and land owners (individuals and corporations that are thinking of utilizing their real estate).

In addition, the company receives commission fees related to the calculation of expenses for laundromat operation, etc. from enterprises.

2. Store operation

As of June 2018, WASHHOUSE operates 528 franchised stores and 28 directly managed stores, that is, a total of 500 stores in Tokyo, Osaka and 16 other prefectures. In 2017, in addition to opening the first stores in the Chubu area (Aichi Prefecture), and Shikoku area (Ehime, Kagawa, and Tokushima Prefectures), stores have been also opened in seven other prefectures for the first time, such as Nara, Hyogo, and Okayama. The company plans to continue nationwide development. Advertisement

Sales are composed of the fees for store management and system maintenance, sales of detergents, cleaning fees, advertising charges, etc.

Since franchisees need not manage their laundromats, if they can bear initial investment costs, they can own multiple stores, increase revenue, and reduce the risk of revenue fluctuation with stores being operated in different regions.

(3) Direct management business, etc.

The company directly manages some of "WASHHOUSE" laundromats, receiving the charges for washing and drying machines from users. A directly managed store is opened mainly when entering a new area. It takes the roles as an antenna shop, such as popularizing the "WASHHOUSE" brand as a "reliable, safe, and clean" laundromat, promoting possible users to use it, and offering a store model to franchisees and land owners (individuals and corporations that are thinking of utilizing their real estate).

In addition, the company receives commission fees related to the calculation of expenses for laundromat operation, etc. from enterprises.

2. Store operation

As of June 2018, WASHHOUSE operates 528 franchised stores and 28 directly managed stores, that is, a total of 500 stores in Tokyo, Osaka and 16 other prefectures. In 2017, in addition to opening the first stores in the Chubu area (Aichi Prefecture), and Shikoku area (Ehime, Kagawa, and Tokushima Prefectures), stores have been also opened in seven other prefectures for the first time, such as Nara, Hyogo, and Okayama. The company plans to continue nationwide development.

【1-5 Characteristics and strengths】

(1) Creation of a new FC business system

WASHHOUSE can be characterized most by its unique FC business model.

In ordinary FC business, a conflict between the FC headquarters and franchisees tends to emerge.

While franchisees pay franchise fees and royalties to the FC headquarters, the FC headquarters permit them to use a brand name, offers know-how to them, supply products to them, store operation, staffing, etc. must be carried out by franchisees on their own responsibility.

For franchisees, the operation and management of stores are significant burdens. If their business performance is favorable, there are no problems, but if sales are sluggish, the franchisee complains, "the system of the headquarters is poor," while the FC headquarters blames, "the education in the franchisee is poor," and these complaints lead to a lawsuit in many cases.

Meanwhile, WASHHOUSE introduced the "system for managing and operating all stores at the same time." The company conducts necessary tasks for operating and managing franchised stores: 【1-5 Characteristics and strengths】

(1) Creation of a new FC business system

WASHHOUSE can be characterized most by its unique FC business model.

In ordinary FC business, a conflict between the FC headquarters and franchisees tends to emerge.

While franchisees pay franchise fees and royalties to the FC headquarters, the FC headquarters permit them to use a brand name, offers know-how to them, supply products to them, store operation, staffing, etc. must be carried out by franchisees on their own responsibility.

For franchisees, the operation and management of stores are significant burdens. If their business performance is favorable, there are no problems, but if sales are sluggish, the franchisee complains, "the system of the headquarters is poor," while the FC headquarters blames, "the education in the franchisee is poor," and these complaints lead to a lawsuit in many cases.

Meanwhile, WASHHOUSE introduced the "system for managing and operating all stores at the same time." The company conducts necessary tasks for operating and managing franchised stores:

24/7 Call centers 24/7 Call centers

Swift support based on management webcams and remote control Swift support based on management webcams and remote control

Daily inspection and cleaning Daily inspection and cleaning

Replenishment of detergents Replenishment of detergents

Maintenance patrol Maintenance patrol

Bill collection Bill collection

Advertisement

As a consequence, franchisees are free from the burdens of store operation.

In addition, since the company targets real estate that would have sales of over 1 million yen, it has meticulously surveyed the market, including local population, age distribution, income state, etc. and accumulated know-how for cultivating profitable property.

Thanks to the combination of the system for managing stores fully and the capability of cultivating profitable real estate, the satisfaction level of franchisees is very high, and no laundromats have been closed due to sluggish performance in the past 15 years. This result is outstanding.

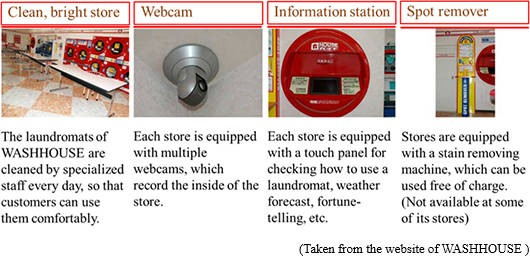

(2) Bright, clean, easy-to-use stores

A laundromat generally reminds us of a "dimly-lit, dirty, and eerie" place, but WASHHOUSE operates "reliable, safe, and clean" stores with the unified brand targeting women and families including children. Advertisement

As a consequence, franchisees are free from the burdens of store operation.

In addition, since the company targets real estate that would have sales of over 1 million yen, it has meticulously surveyed the market, including local population, age distribution, income state, etc. and accumulated know-how for cultivating profitable property.

Thanks to the combination of the system for managing stores fully and the capability of cultivating profitable real estate, the satisfaction level of franchisees is very high, and no laundromats have been closed due to sluggish performance in the past 15 years. This result is outstanding.

(2) Bright, clean, easy-to-use stores

A laundromat generally reminds us of a "dimly-lit, dirty, and eerie" place, but WASHHOUSE operates "reliable, safe, and clean" stores with the unified brand targeting women and families including children.

In the past, using a laundromat was considered as one of "sloppy acts in homemaking." However, there is a growing interest in laundromats, which can wash and dry a larger amount of clothes in a shorter period of time than household washing machines, as the employment rate for women rose, high-rise condominiums increased, and the life-work balance changed. Especially, the washing of large items, such as futons and carpets, for removing ticks and allergens is attracting attention, due to the rising health consciousness.

In addition, the needs for laundromats mounted with equipment for washing and drying kids' sneakers are getting stronger.

In these circumstances, the company installs the following equipment for meeting the needs of consumers:

In the past, using a laundromat was considered as one of "sloppy acts in homemaking." However, there is a growing interest in laundromats, which can wash and dry a larger amount of clothes in a shorter period of time than household washing machines, as the employment rate for women rose, high-rise condominiums increased, and the life-work balance changed. Especially, the washing of large items, such as futons and carpets, for removing ticks and allergens is attracting attention, due to the rising health consciousness.

In addition, the needs for laundromats mounted with equipment for washing and drying kids' sneakers are getting stronger.

In these circumstances, the company installs the following equipment for meeting the needs of consumers:

Washing machines with a capacity of 22 kg, which can wash a full-sized futon, and dryers with a capacity of 25 kg (in standard stores), Washing machines with a capacity of 22 kg, which can wash a full-sized futon, and dryers with a capacity of 25 kg (in standard stores),

Sneaker laundry equipment, which can wash sporting shoes, sneakers for commuting to school, etc. Sneaker laundry equipment, which can wash sporting shoes, sneakers for commuting to school, etc.

Devices for removing stains free of charge (Spot remover)

Furthermore, all stores are monitored by management webcams 24 hours a day, and mounted with IoT laundry equipment, which can be controlled remotely by the headquarters, so as to offer real-time support like manned stores, although the laundromats are unmanned. Like this, the company has established a system that can be used by users without worry. Devices for removing stains free of charge (Spot remover)

Furthermore, all stores are monitored by management webcams 24 hours a day, and mounted with IoT laundry equipment, which can be controlled remotely by the headquarters, so as to offer real-time support like manned stores, although the laundromats are unmanned. Like this, the company has established a system that can be used by users without worry.

The company also indicates the components of detergents and the temperature in each dryer, to dispel the worries of consumers. In order to keep stores clean, the company cleans stores every day, including the cleaning of the filters of dryers and the sterilization of washing machines.

(3) Stable earning structure with recurring revenue

The sales from the store management business are composed of the monthly store management fee (50,000 yen per store), the fee for system maintenance (10,000 yen), ad charge (30,000 yen), cleaning charge (about 40,000 yen), etc., that is, a total of about 130,000 yen/month.

As of the end of Dec. 2016, the number of franchised stores of WASHHOUSE was 361. Accordingly, the sales from store management in the term ended Dec. 2017 can be calculated by adding the sales from existing stores (361 stores × 130,000 yen/store/month × 12 months = 563 million yen) and the sales from 105 new stores opened in the term ended Dec. 2017 (sales vary according to the date of opening).

The sales from store management in the term ending Dec. 2018 can be obtained by adding the sales from existing stores (563 million yen), the sales from new stores opened in the term ended Dec. 2017 (105 stores × 130,000 yen/store/month × 12 months = 164 million yen), and the sales from 133 new stores(estimated) opened in the term ending Dec. 2018.

The company also indicates the components of detergents and the temperature in each dryer, to dispel the worries of consumers. In order to keep stores clean, the company cleans stores every day, including the cleaning of the filters of dryers and the sterilization of washing machines.

(3) Stable earning structure with recurring revenue

The sales from the store management business are composed of the monthly store management fee (50,000 yen per store), the fee for system maintenance (10,000 yen), ad charge (30,000 yen), cleaning charge (about 40,000 yen), etc., that is, a total of about 130,000 yen/month.

As of the end of Dec. 2016, the number of franchised stores of WASHHOUSE was 361. Accordingly, the sales from store management in the term ended Dec. 2017 can be calculated by adding the sales from existing stores (361 stores × 130,000 yen/store/month × 12 months = 563 million yen) and the sales from 105 new stores opened in the term ended Dec. 2017 (sales vary according to the date of opening).

The sales from store management in the term ending Dec. 2018 can be obtained by adding the sales from existing stores (563 million yen), the sales from new stores opened in the term ended Dec. 2017 (105 stores × 130,000 yen/store/month × 12 months = 164 million yen), and the sales from 133 new stores(estimated) opened in the term ending Dec. 2018.

Like this, sales from the store management business grow steadily, as the sales from new stores are added to those from existing stores, year by year.

On the other hand, the satisfaction level of franchisees is very high, which can be represented by the fact that no stores have been closed because of poor performance in the past 15 years, and so there is a low possibility that the number of stores will decrease. This fortifies the stable earning structure with recurring revenue.

(4) Efforts for improving the soundness of the self-service laundry market

Although the laundromat market is growing, president Kodama mentioned that there remain a lot of problems, including the issue of compliance with the law.

For example, the dryers in a laundromat consume a large volume of gas, and so the Fire Service Act, the Building Standards Act, etc. specify the materials for exhaust ducts, how to install them, etc. in detail, for safety reasons. However, there are many illegal installations.

Some laundromat operators try to reel in users by offering to wash clothes on behalf of customers as a measure for differentiating their services from competitors, but they are very likely to be violating the dry cleaning business law.

The dry cleaning business law enforced in 1950 set forth the following provisions from the viewpoint of maintaining public health.

Like this, sales from the store management business grow steadily, as the sales from new stores are added to those from existing stores, year by year.

On the other hand, the satisfaction level of franchisees is very high, which can be represented by the fact that no stores have been closed because of poor performance in the past 15 years, and so there is a low possibility that the number of stores will decrease. This fortifies the stable earning structure with recurring revenue.

(4) Efforts for improving the soundness of the self-service laundry market

Although the laundromat market is growing, president Kodama mentioned that there remain a lot of problems, including the issue of compliance with the law.

For example, the dryers in a laundromat consume a large volume of gas, and so the Fire Service Act, the Building Standards Act, etc. specify the materials for exhaust ducts, how to install them, etc. in detail, for safety reasons. However, there are many illegal installations.

Some laundromat operators try to reel in users by offering to wash clothes on behalf of customers as a measure for differentiating their services from competitors, but they are very likely to be violating the dry cleaning business law.

The dry cleaning business law enforced in 1950 set forth the following provisions from the viewpoint of maintaining public health.

In a nutshell,

In a nutshell,

Even if a laundromat operator obtains a dry cleaner's license, he/she cannot offer services of handling and folding up the laundry, etc. at a laundromat, which is not a dry cleaning shop. Even if a laundromat operator obtains a dry cleaner's license, he/she cannot offer services of handling and folding up the laundry, etc. at a laundromat, which is not a dry cleaning shop.

The washing machines and dryers inside a facility registered as a dry cleaning shop are exclusively for dry cleaning business operators, and so they cannot be used by others (users of laundromats) from the viewpoint of hygiene.

Despite the existence of these laws, in order to avoid the guidance from a public health center, some business operators set a counter inside their stores, install washing machines, explain "We use this washing machine," but actually they wash the laundry of users with unregistered laundromat equipment outside the counter (not installed ones), and fold up the laundry.

In this situation, president Kodama considered that in order to promote the use of laundromats, it is indispensable to develop "reliable, safe, and clean" laundromats inside his company and improve the soundness of the self-service laundry industry, therefore established the National Association of Laundromat Operators in Dec. 2003.

This association specified the operation standards for equipment and hygienic management complying with laws, regulations, etc. At present, the directly managed stores and franchised laundromats of WASHHOUSE belong to this association, which takes the roles of improving the soundness of this industry and educating general consumers (about the usefulness of laundromats, etc.). The washing machines and dryers inside a facility registered as a dry cleaning shop are exclusively for dry cleaning business operators, and so they cannot be used by others (users of laundromats) from the viewpoint of hygiene.

Despite the existence of these laws, in order to avoid the guidance from a public health center, some business operators set a counter inside their stores, install washing machines, explain "We use this washing machine," but actually they wash the laundry of users with unregistered laundromat equipment outside the counter (not installed ones), and fold up the laundry.

In this situation, president Kodama considered that in order to promote the use of laundromats, it is indispensable to develop "reliable, safe, and clean" laundromats inside his company and improve the soundness of the self-service laundry industry, therefore established the National Association of Laundromat Operators in Dec. 2003.

This association specified the operation standards for equipment and hygienic management complying with laws, regulations, etc. At present, the directly managed stores and franchised laundromats of WASHHOUSE belong to this association, which takes the roles of improving the soundness of this industry and educating general consumers (about the usefulness of laundromats, etc.).

|

| First Half of Fiscal Year December 2018 Earnings Results |

Sales and profits dropped.

Sales were 1,342 million yen, down 6.9% year on year. The number of newly opened franchised shops was 35, down 10 from the same period of the previous year.

Gross profit ratio dropped 9.7% year on year. SG&A expenses could not be offset while they remained flat at 460 million yen. As a result, the company incurred an operating loss of 14 million yen.

Since the company was unable to open the planned number of stores, both sales and profits fell short of their respective initial estimates. Sales and profits dropped.

Sales were 1,342 million yen, down 6.9% year on year. The number of newly opened franchised shops was 35, down 10 from the same period of the previous year.

Gross profit ratio dropped 9.7% year on year. SG&A expenses could not be offset while they remained flat at 460 million yen. As a result, the company incurred an operating loss of 14 million yen.

Since the company was unable to open the planned number of stores, both sales and profits fell short of their respective initial estimates.

① FC business

The number of newly opened franchised shops in each prefecture is as follows: [Kanto area (5)] Tokyo (5), [Chubu area (4)] Aichi (4), [Kansai area (3)] Osaka (1), Nara (1), Hyogo (1), [Chugoku area (4)] Okayama (1), Hiroshima (1), Yamaguchi (2), [Shikoku area (4)] Kagawa (3), Ehime (1), [Kyushu area (15)] Fukuoka (9), Nagasaki (1), Kumamoto (2), Miyazaki (1), and Kagoshima (2), for a total of 35 stores. (The number of new store openings in Kyushu area was 15, but as one of the existing stores closed due to redevelopment of a neighboring commercial facility, the number of franchised stores increased by 14 during the term).

However, the number of newly opened stores fell short of the estimate by 13 since due to insufficient promotion and expansion of the existing areas and cultivation of new areas. As a result, the number of FC stores as of the end of June 2018 was 500.

② Store management business

Sales grew thanks to the increase in recurring revenue.

③ Direct management business, etc.

The company did not open any new directly operated stores or purchase any franchised stores. The number of directly operated stores is 28 at the end of June 2018, unchanged from the previous year. ① FC business

The number of newly opened franchised shops in each prefecture is as follows: [Kanto area (5)] Tokyo (5), [Chubu area (4)] Aichi (4), [Kansai area (3)] Osaka (1), Nara (1), Hyogo (1), [Chugoku area (4)] Okayama (1), Hiroshima (1), Yamaguchi (2), [Shikoku area (4)] Kagawa (3), Ehime (1), [Kyushu area (15)] Fukuoka (9), Nagasaki (1), Kumamoto (2), Miyazaki (1), and Kagoshima (2), for a total of 35 stores. (The number of new store openings in Kyushu area was 15, but as one of the existing stores closed due to redevelopment of a neighboring commercial facility, the number of franchised stores increased by 14 during the term).

However, the number of newly opened stores fell short of the estimate by 13 since due to insufficient promotion and expansion of the existing areas and cultivation of new areas. As a result, the number of FC stores as of the end of June 2018 was 500.

② Store management business

Sales grew thanks to the increase in recurring revenue.

③ Direct management business, etc.

The company did not open any new directly operated stores or purchase any franchised stores. The number of directly operated stores is 28 at the end of June 2018, unchanged from the previous year.

Current assets declined by 464 million from the end of the previous term, due to a decrease in cash and deposits. Noncurrent assets grew by 93 million yen as investments and other assets increased. Total assets fell by 370 million yen from the end of the previous term to 3,668 million yen.

Total liabilities were 1,473 million yen, down 297 million yen from the end of the previous term due to a decrease in trade payables.

Net assets fell by 72 million yen from the end of the previous term to 2,194 million yen as retained earnings declined.

As a result, equity ratio increased by 3.7% from 56.1% at the end of the previous term to 59.8%.

Current assets declined by 464 million from the end of the previous term, due to a decrease in cash and deposits. Noncurrent assets grew by 93 million yen as investments and other assets increased. Total assets fell by 370 million yen from the end of the previous term to 3,668 million yen.

Total liabilities were 1,473 million yen, down 297 million yen from the end of the previous term due to a decrease in trade payables.

Net assets fell by 72 million yen from the end of the previous term to 2,194 million yen as retained earnings declined.

As a result, equity ratio increased by 3.7% from 56.1% at the end of the previous term to 59.8%.

Free CF was nearly unchanged from the same period of the previous year. The cash position improved.

Free CF was nearly unchanged from the same period of the previous year. The cash position improved.

|

| Fiscal Year December 2018 Earnings Estimates |

No revision to the earnings forecast. Double-digit increase in in sales and profit.

There is no change in estimates for the full year. Sales dropped and losses were incurred in the cumulative second quarter of the term as the number of newly opened franchised stores dropped from to the same period of the previous fiscal year, and also, the number of new store openings fell short of the estimate by 13 due to insufficient promotion and expansion of the existing areas and cultivation of new areas. However, as the company tend to earn a major part of its sales and profits in the fourth quarter (Oct. to Dec.), they consider that these results will not affect its earnings estimates at this stage.

Sales are estimated to be 4,011 million yen, up 18.9% year on year. Continuing from the previous term, the company will proceed steadily with nationwide development, including opening stores in new areas.

Operating income is projected to be 300 million yen, up 23.1% year on year. Although SG&A expenses will increase due to the reinforcing of sales staff, they will be offset by the previous term's recurring revenue and new store openings, and the company expects to see a double-digit increase in profits.

The dividend is to be 8 yen/share, as was the previous term. Payout ratio is estimated to be 29.3%.

(2) Plans for store openings

In total, a new record of 133 stores will be opened, including 41 in the Kanto area, 9 in the Chubu area, 31 in the Kansai area, 18 in the Chugoku-Shikoku area, and 34 in the Kyushu area. In detail, 130 stores will be franchised, and the remaining 3 will be directly operated.

There will be an estimated 596 franchised stores and 31 directly operated stores at the end of Dec. 2018. No revision to the earnings forecast. Double-digit increase in in sales and profit.

There is no change in estimates for the full year. Sales dropped and losses were incurred in the cumulative second quarter of the term as the number of newly opened franchised stores dropped from to the same period of the previous fiscal year, and also, the number of new store openings fell short of the estimate by 13 due to insufficient promotion and expansion of the existing areas and cultivation of new areas. However, as the company tend to earn a major part of its sales and profits in the fourth quarter (Oct. to Dec.), they consider that these results will not affect its earnings estimates at this stage.

Sales are estimated to be 4,011 million yen, up 18.9% year on year. Continuing from the previous term, the company will proceed steadily with nationwide development, including opening stores in new areas.

Operating income is projected to be 300 million yen, up 23.1% year on year. Although SG&A expenses will increase due to the reinforcing of sales staff, they will be offset by the previous term's recurring revenue and new store openings, and the company expects to see a double-digit increase in profits.

The dividend is to be 8 yen/share, as was the previous term. Payout ratio is estimated to be 29.3%.

(2) Plans for store openings

In total, a new record of 133 stores will be opened, including 41 in the Kanto area, 9 in the Chubu area, 31 in the Kansai area, 18 in the Chugoku-Shikoku area, and 34 in the Kyushu area. In detail, 130 stores will be franchised, and the remaining 3 will be directly operated.

There will be an estimated 596 franchised stores and 31 directly operated stores at the end of Dec. 2018.

(3) Future business development

① Sales management/personnel allocation

Regarding insufficient promotion and expansion of existing areas and cultivation of new areas, the company has clarified the reasons and modification points, for example, what they cannot do now but had been able to do a few years back because the company is growing so rapidly.

Currently the company is going back to where it started off and building a base by carrying out a market area analysis and grasping competitor trends accurately and in detail, in order to recover the performance in the second half of the term.

② Other related and peripheral businesses

(Self-manufacture of detergents)

The company expects to obtain approval regarding the acquisition of land for construction purpose from Miyazaki Prefecture by spring next year.

(Money lending business)

WASHHOUSE FINANCIAL, the company's subsidiary, was registered as a Moneylending Business on August 1, 2018. The company expects it to contribute to faster FC development.

(Development of urban-type stores, etc.)

The format of urban-type stores, which utilize vacant tenant spaces within a building, etc. and are not opened next to parking lots, has almost been finalized. Favorable management data are being collected at these stores as they require lesser initial investments than existing ones.

Also, the company is gaining confident as stores in Tokyo are performing better than expected. (3) Future business development

① Sales management/personnel allocation

Regarding insufficient promotion and expansion of existing areas and cultivation of new areas, the company has clarified the reasons and modification points, for example, what they cannot do now but had been able to do a few years back because the company is growing so rapidly.

Currently the company is going back to where it started off and building a base by carrying out a market area analysis and grasping competitor trends accurately and in detail, in order to recover the performance in the second half of the term.

② Other related and peripheral businesses

(Self-manufacture of detergents)

The company expects to obtain approval regarding the acquisition of land for construction purpose from Miyazaki Prefecture by spring next year.

(Money lending business)

WASHHOUSE FINANCIAL, the company's subsidiary, was registered as a Moneylending Business on August 1, 2018. The company expects it to contribute to faster FC development.

(Development of urban-type stores, etc.)

The format of urban-type stores, which utilize vacant tenant spaces within a building, etc. and are not opened next to parking lots, has almost been finalized. Favorable management data are being collected at these stores as they require lesser initial investments than existing ones.

Also, the company is gaining confident as stores in Tokyo are performing better than expected.

|

| Conclusions |

|

As mentioned in this report, there is a seasonal tendency that the company opens laundromats mainly in the fourth quarter (Oct. to Dec.) every year. This is because store owners and the company intend to have an early opening of new stores and a fast return on investment by opening stores to meet the demand arising during the time of seasonal change of clothes and year-end and New-year holidays. As a result, both sales and profits were significantly larger in the fourth quarter than in other quarters. This trend will remain in the current term, too, and the company expects a large number of new store openings in Nov. and Dec. We would like to continue paying attention to the situation of new store openings, especially the progress of planned new store openings in the Kanto area up to the end of the fourth quarter. Although the interest in laundromats has been on rise, President Kodama believes that the company is the only one that operates this business with a unique business model of "opening stores in areas where there are sufficient sales" and "achieving mutual prosperity of the headquarters and franchised shop owners," not as a side job or for the purpose of utilizing idle land. Also, convenience store-led establishment of laundromats is not working well apparently. We would like to pay attention to the business development of the company pursuing sustainable growth based on its strong competitive advantage.

|

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last update date: Apr. 5, 2018

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company mentioned, "We will implement all of the basic principles." ◎ Corporate Governance Report

Last update date: Apr. 5, 2018

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company mentioned, "We will implement all of the basic principles."

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |