Bridge Report:(6537)WASHHOUSE second quarter of Fiscal Year ending December 2021

Yasutaka Kodama President | WASHHOUSE Co., Ltd.(6537) |

|

Company Information

Market | TSE Mothers, FSE Q-Board |

Industry | Service business |

President | Yasutaka Kodama |

HQ Address | 86-1, Shinei-cho, Miyazaki-shi, Miyazaki prefecture |

Year-end | End of December |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥561 | 6,898,800 Shares | ¥3,870million | - | 100 Shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥0.00 | 0.0% | ¥12.49 | 44.91x | ¥261.78 | 2.1x |

*The share price is the closing price on August 31. Each DPS is taken from financial results of the second quarter for the fiscal year ending December 2021.

BPS is taken from financial results of the fiscal year ended December 2020.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | Fiscal Year |

Dec. 2017 Act. | 3,375 | 243 | 247 | 156 | 22.94 | 8.00 |

Dec. 2018 Act. | 2,749 | 12 | 16 | 2 | 0.33 | 8.00 |

Dec. 2019 Act. | 2,188 | -174 | -159 | -179 | -26.20 | 8.00 |

Dec. 2020 Act. | 2,182 | -124 | -90 | -128 | -18.65 | 0.00 |

Dec. 2021 Est. | 3,432 | 125 | 120 | 86 | 12.49 | 0.00 |

*Unit: million yen, yen. Consolidated values have been used from the term ended December 2018.

*The Company conducted a 100-for-1 share split on April 2, 2016, a 2-for-1 share split on April 1, 2017. EPS and DPS have been revised retroactively.

This Bridge Report presents earnings results for the second quarter of Fiscal Year ending December 2021 of WASHHOUSE Co., Ltd

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of Fiscal Year ending December 2021 Earnings Results

3. Fiscal Year ending December 2021 Earnings Forecasts

4. Future Initiatives

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending Dec. 2021, sales increased 8.9% year-on-year to 1,027 million yen. Under the FC division, the company opened nine new franchised stores. Gross profit increased 4.1% year-on-year due to an increase in the profit margin of the WASH House Coin Laundry System Set through the adoption of integrated laundry equipment, despite an increase in depreciation due to an increase in the number of directly managed stores. SG&A expenses decreased 6.9% year-on-year due to the effect of cost control. However, due to the spread of COVID-19, the company was unable to conduct on-site surveys on new properties and visit landowners and franchise owners to discuss business, resulting in sales and profits falling short of the company's plan.

- Although the business results for the second quarter of the term ending Dec. 2021 fell short of the plan, the company did not revise the earnings forecasts announced on February 8, 2021 (expecting that sales will increase 57.3% year-on-year to 3,432 million yen, operating income will rise 249 million yen year-on-year to 125 million yen in the black), as it will be able to make up for the progress delay by partially resuming visits to individual landowners in the second half of the fiscal year due to an increase in vaccination rate. However, dividends will not be paid as in the previous fiscal year.

- The company launched the WASH House App as a cashless payment system in April of the previous year. It is now possible to make cashless payments without the use of coins. In addition, in-app advertising started at the end of the previous year. While doing laundry, customers can use coupons to save money at nearby stores and use the receipts from their purchases to save money on laundry. To realize President Kodama's goal of "free laundry," the trend of advertising revenue will be closely watched. We look forward to the contribution of the detergent plant (the company's Miyazaki Plant), which was completed in February 2021, to revenues.

1. Company Overview

WASHHOUSE operates laundromats mainly based on the franchise system, with the aim of creating the global standard in the self-service laundry industry.

The company has developed an unprecedented franchise chain (FC) business system, which unifies the quality of stores by managing and operating all stores concurrently, so that both the FC headquarters and franchised shops can thrive. As a great advantage, the company has a stable earning structure with recurring revenue.

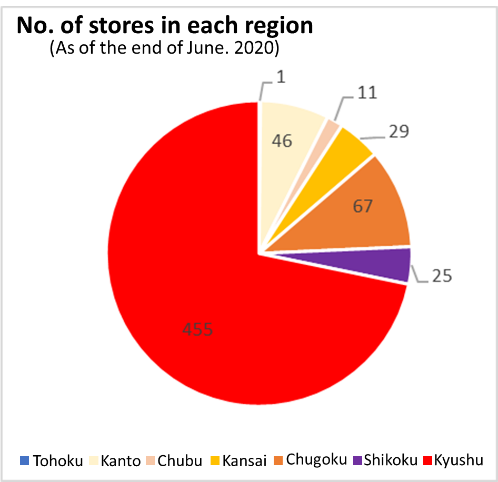

It made inroads into Osaka and Tokyo, embarking on nationwide business on a full-scale basis. It also plans to expand its business outside Japan. As of the end of June 2020, 627 laundromats (575 franchised ones and 52 directly managed ones) are in operation in Tokyo, Osaka and 22 other prefectures.

【1-1 Corporate History Until listing】

When starting up this business, President Kodama pondered over how to keep increasing sales and profit eternally in the age that will certainly witness the decreased birthrate and aging and declining population, whether the business has social meanings, whether there are any forerunners, whether the company can survive competitions, whether the business can be imitated easily, whether it is possible to achieve recurring revenue, and so on from various aspects, and decided to do the laundromat business.

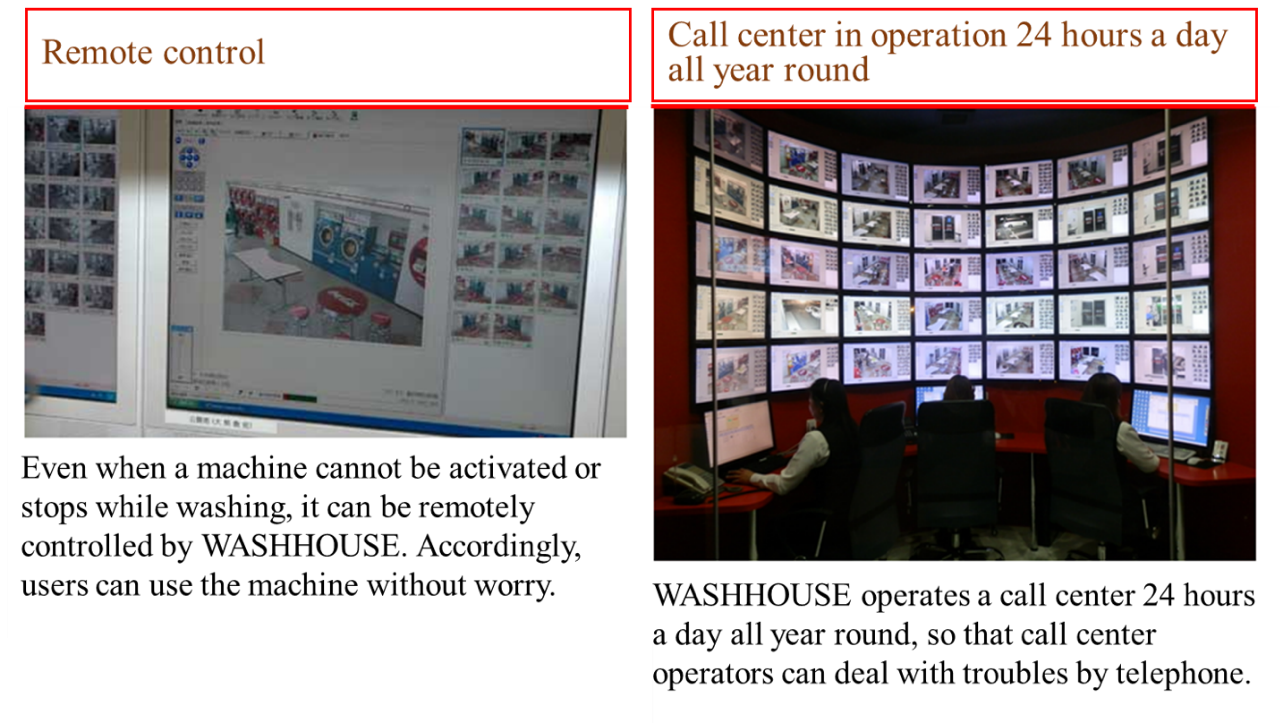

For expanding the scale of business, the FC system is effective, but the FC business is accompanied by the problem of the conflict between the FC headquarters and franchised stores. In order to solve this problem, the company immediately introduced a call center that is in operation 24 hours a day all year round and the “system for managing and operating all stores at the same time,” which is composed of the swift support based on management webcams and remote control, etc. and reduced the burdens of franchised stores considerably. Its business grew steadily, partially thanks to the expansion of needs due to the increase in the number of working females.

From the Kyushu area, including Miyazaki Prefecture, where the business was launched, the company expanded its sales territory, entering Osaka in Dec. 2015 and Tokyo in Jul. 2016.

Then, in Nov. 2016, WASHHOUSE got listed on Mothers of Tokyo Stock Exchange and Q-Board of Fukuoka Stock Exchange.

【1-2 Management Philosophy】

The ethos of WASHHOUSE is “to think about all matters from the viewpoint of customers and keep being demanded by society.”

Under this ethos, the company is working on “creation of global standards in the laundromat industry” with the aim of continuously offering satisfactory services to users on behalf of store owners by fully managing laundromats after the opening of the store rather than “just selling self-service laundry equipment and instructing owners to operate it.”

【1-3 Market Environment】

◎ Growing laundromat market

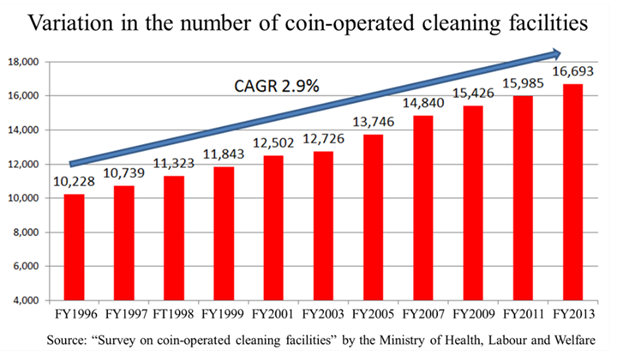

According to the “Survey on coin-operated cleaning facilities” by the Ministry of Health, Labor and Welfare, although it is somewhat out of date, the number of laundromats in Japan in fiscal year 2013 was 16,693, and that in fiscal 1996 was 10,228, indicating a compound annual growth rate (CAGR) of 2.9%. If it keeps growing at a rate of 3%, it will exceed 18,000 stores in fiscal year 2016, which also exceeds the number of the stores (17,656) of FamilyMart ranking second in the convenience store field (as of the end of Nov. 2017), and is approaching the number of stores (19,970) of Seven-Eleven, which ranks first (as of the end of Nov. 2017).

◎ Growth factors

In the background of such growth, there are:

*Women’s needs for “the reduction in cleaning time” due to the increase of dual-earner households,

*Measures against allergies, such as the allergy to pollen,

*Decrease in the use of cleaning services due to the increase of low-priced high-quality clothes,

*Enhancement of awareness of cleanliness, and so on.

In addition to these external factors, enterprises, including WASHHOUSE, started offering a variety of services considering the convenience for users, and so “users have increased” and then “the number of laundromats has grown.”

According to president Kodama, “rate of utilization,” which indicates how many households use laundromats among all households living within 2 km from a store, was about 3% on national average 10 years ago, but it is now 5-8%, and expected to increase further.

◎ Market players

It is difficult to obtain detailed information, but the number of main players in the self-service laundry market is said to be 4 to 5. WASHHOUSE has the largest number of laundromats with the same brand, and is the only listed company in this field.

Although many enterprises carry out the FC business for growth (increasing in the number of stores), WASHHOUSE possesses an unparalleled “system for managing and operating all stores at the same time,” which was developed in pursuing the streamlining of business operation and unification of quality. (For details, see “1-5 Characteristics and Strengths.”)

【1-4 Business Description】

1. Composition

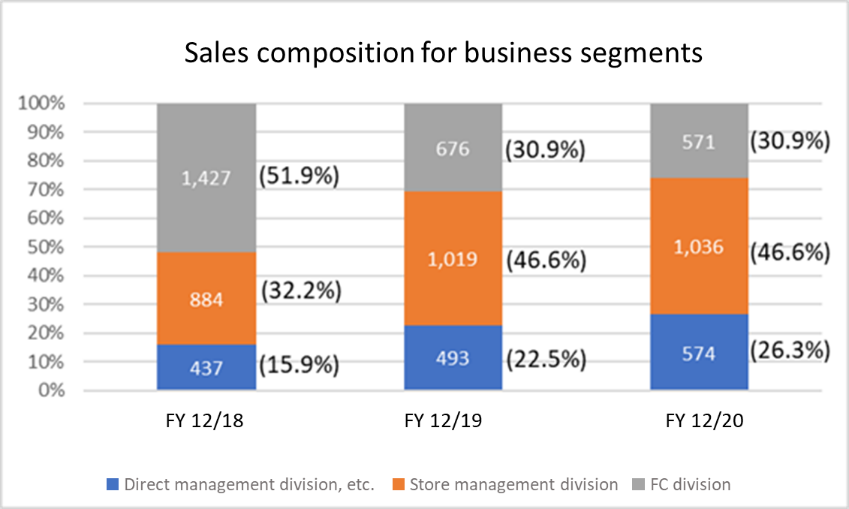

WASHHOUSE conducts the three kinds of business division: (1) FC division, (2) store management division, and (3) direct management division, etc.

(1) FC division

WASHHOUSE created a unique operation-supported FC division.

The company selects candidate places for opening laundromats, sells “a set of WASHHOUSE laundromat systems,” which contains the design, interior finish work, equipment installation, etc. in a WASHHOUSE brand store, to franchisees, and receives the preparation fees for opening store, including advertisements, and fees for franchise rights.

For increasing franchisees, the company adopts the division system where sales staff visit possible franchisees, with which telephone staff set up an appointment, so that sales staff can concentrate on more active sales activities without the mental burden of sales calls. In addition, business simulation, contract production, etc. are conducted by other staff, so that sales staff can devote themselves to “footwork.” Furthermore, by concluding business matching contracts with financial institutions, etc., the company is accumulating information on sites for building laundromats and candidate owners, and developing a “system” for increasing laundromats.

WASHHOUSE designs a plan to open new laundromats for each term based on the accumulated data on correlative relations of “the number of years of career of sales staff and achievements of opening franchised stores.”

(2) Store management division

WASHHOUSE undertakes the management of all franchised stores, reports a monthly operation status, including revenue and expenditure, to franchisees, and subtracts the fee for laundromat management from monthly sales.

In order to keep each store “reliable, safe, and clean,” WASHHOUSE provides franchisees with such services as

*24/7 Call centers

*Swift support based on management webcams and remote control

*Daily inspection and cleaning

*Replenishment of detergents

*Maintenance patrol

*Advertisement

Sales are composed of the fees for store management and system maintenance, sales of detergents, cleaning fees, advertising charges, etc.

Since franchisees need not manage their laundromats, if they can bear initial investment costs, they can own multiple stores, increase revenue, and reduce the risk of revenue fluctuation with stores being operated in different regions.

(3) Direct management division, etc.

The company directly manages some of “WASHHOUSE” laundromats, receiving the charges for washing and drying machines from users. A directly managed store is opened mainly when entering a new area. It takes the roles as an antenna shop, such as popularizing the “WASHHOUSE” brand as a “reliable, safe, and clean” laundromat, promoting possible users to use it, and offering a store model to franchisees and land owners (individuals and corporations that are thinking of utilizing their real estate).

In addition, the company receives commission fees related to the calculation of expenses for laundromat operation, etc. from enterprises.

2. Store operation

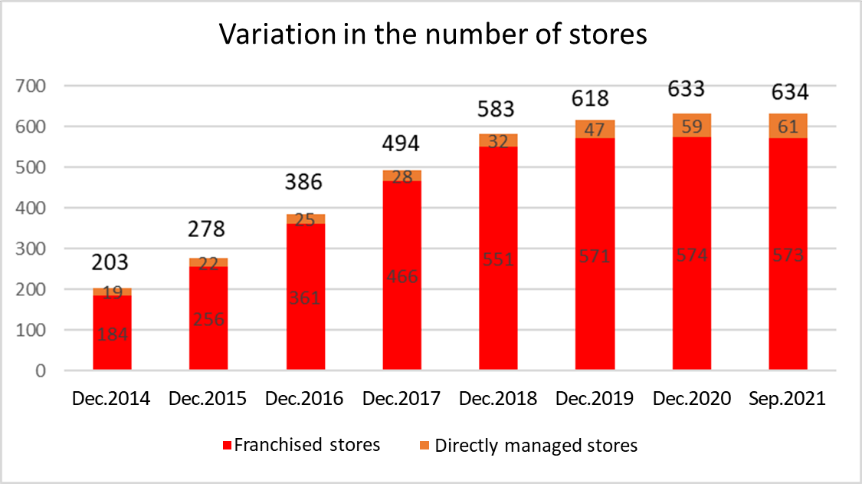

As of June 2021, WASHHOUSE operates 573 franchised stores and 61 directly managed stores, that is, a total of 634 stores in Tokyo, Osaka and 24 other prefectures.

The company will continue nationwide business operations.

|

|

【1-5 Characteristics and strengths】

(1) Creation of a new FC business system

WASHHOUSE can be characterized most by its unique FC business model.

In ordinary FC business, a conflict between the FC headquarters and franchisees tends to emerge.

While franchisees pay franchise fees and royalties to the FC headquarters, the FC headquarters permit them to use a brand name, offer know-how to them and supply products to them, but store operation, staffing, etc. must be carried out by franchisees on their own responsibility.

For franchisees, the operation and management of stores are significant burdens. If their business performance is favorable, there are no problems, but if sales are sluggish, the franchisee complains, “the system of the headquarters is poor,” while the FC headquarters blames, “the education in the franchisee is poor,” and these complaints lead to a lawsuit in many cases.

Meanwhile, WASHHOUSE introduced the “system for managing and operating all stores at the same time. ”As mentioned above, the company conducts all the necessary tasks for operating and managing franchised stores: As mentioned above, 24/7 Call centers, Swift support based on management webcams and remote control, Daily inspection and cleaning, Replenishment of detergents, Maintenance patrol, Advertisement. As a consequence, franchisees are free from the burdens of store operation.

In addition, since the company targets real estate that would have sales of over 1 million yen, it has meticulously surveyed the market, including local population, age distribution, income state, etc. and accumulated know-how for cultivating profitable property.

Thanks to the combination of the system for fully managing stores and the capability of cultivating profitable real estate, the satisfaction level of franchisees is very high, contributing to outstanding results of no closing stores caused by poor performance up until the current 18th term.

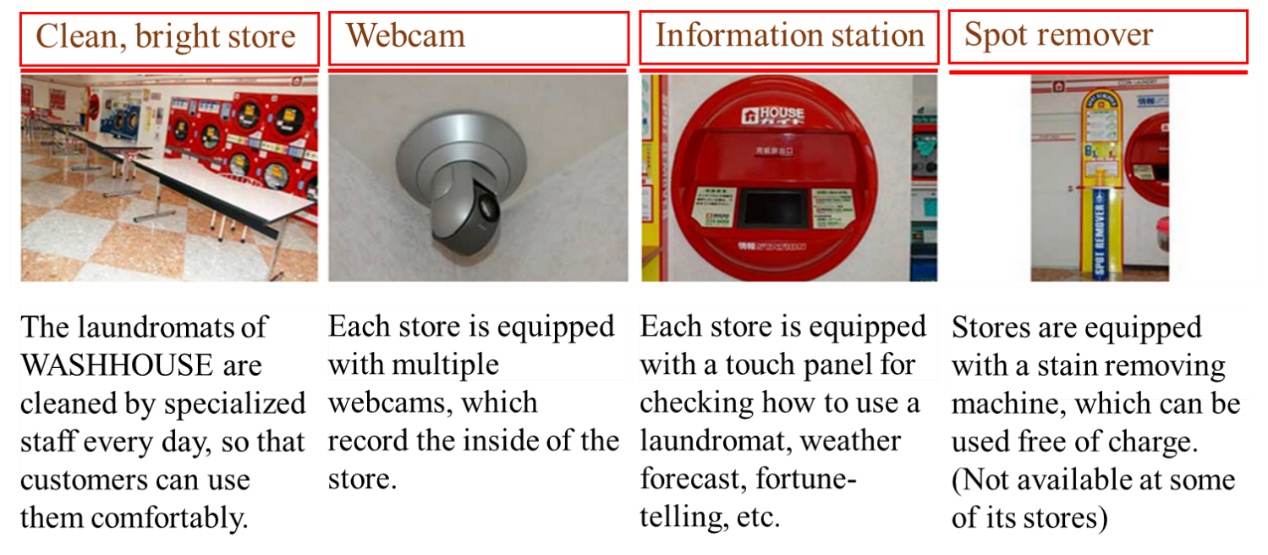

(2) Bright, clean, easy-to-use stores

A laundromat generally reminds us of a “dimly-lit, eerie and dirty” place, but WASHHOUSE operates “reliable, safe, and clean” stores with the unified brand targeting women and families including children.

(Taken from the website of WASHHOUSE)

(Taken from the website of WASHHOUSE)

In the past, using a laundromat was considered as one of “sloppy acts in homemaking.” However, there is a growing interest in laundromats, which can wash and dry a larger amount of clothes in a shorter period of time than household washing machines, as the employment rate for women rose, high-rise condominiums increased, and the life-work balance changed. Especially, the washing of large items, such as futons and carpets, for removing ticks and allergens is attracting attention, due to the rising health consciousness.

In addition, the needs for laundromats mounted with equipment for washing and drying kids’ sneakers are getting stronger.

In these circumstances, the company installs the following equipment for meeting the needs of consumers:

*Washing machines with a capacity of 22 kg, which can wash a full-sized futon, and dryers with a capacity of 25 kg (in standard stores),

*Sneaker laundry equipment, which can wash sporting shoes, sneakers for commuting to school, etc.

*Devices for removing stains free of charge (Spot remover)

Furthermore, all stores are monitored by management webcams 24 hours a day, and mounted with IoT laundry equipment, which can be controlled remotely by the headquarters, so as to offer real-time support like manned stores, although the laundromats are unmanned. Like this, the company has established a system that can be used by users without worry.

(Taken from the website of WASHHOUSE)

The company also indicates the components of detergents and the temperature in each dryer, to dispel the worries of consumers. In order to keep stores clean, the company cleans stores every day, including the cleaning of the filters of dryers and the sterilization of washing machines.

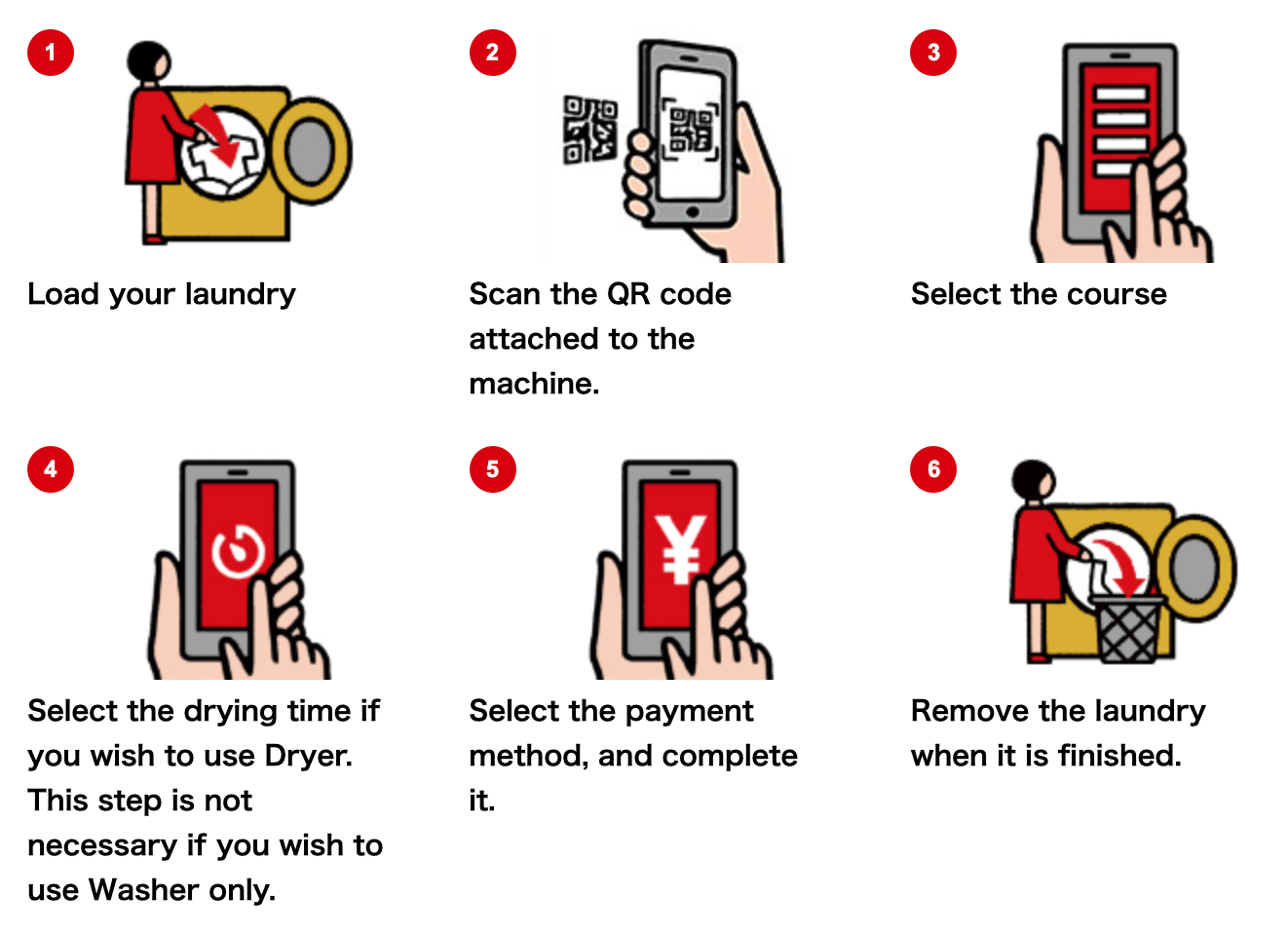

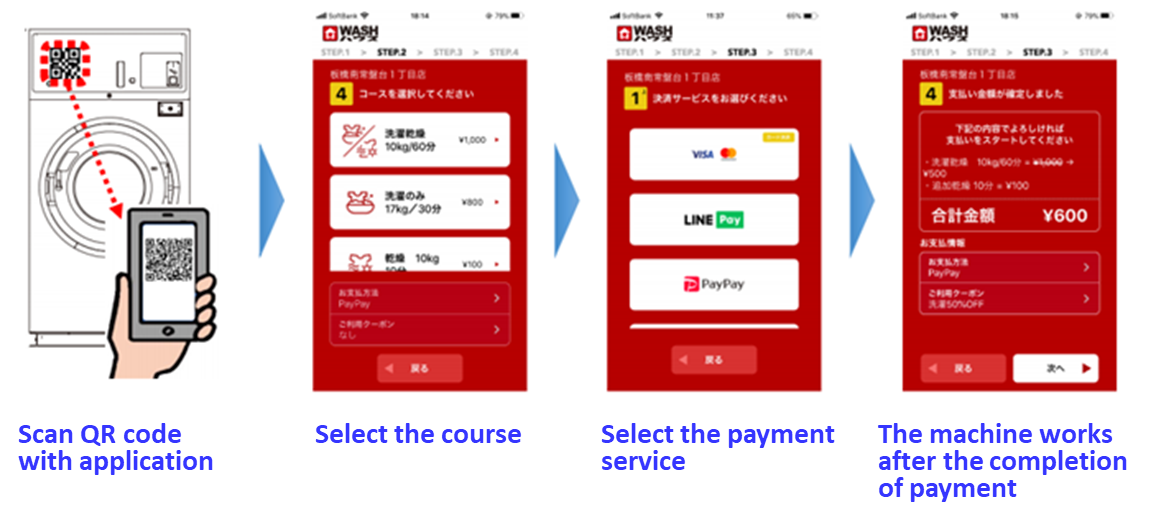

In addition, in April 2020, the company released the WASH House App, a smartphone payment application for coin laundries.

The app is aimed at strengthening the coin laundry business as a platform and is equipped with cashless payment functions and information distribution functions such as special coupons, and it was installed in all WASH House stores at the end of May 2020.

The company has also incorporated functions to create collaborations with a wide variety of other industries, and will continue to work to create stores that are needed by users by providing them with meaningful information and highly convenient services that are closely related to their daily lives.

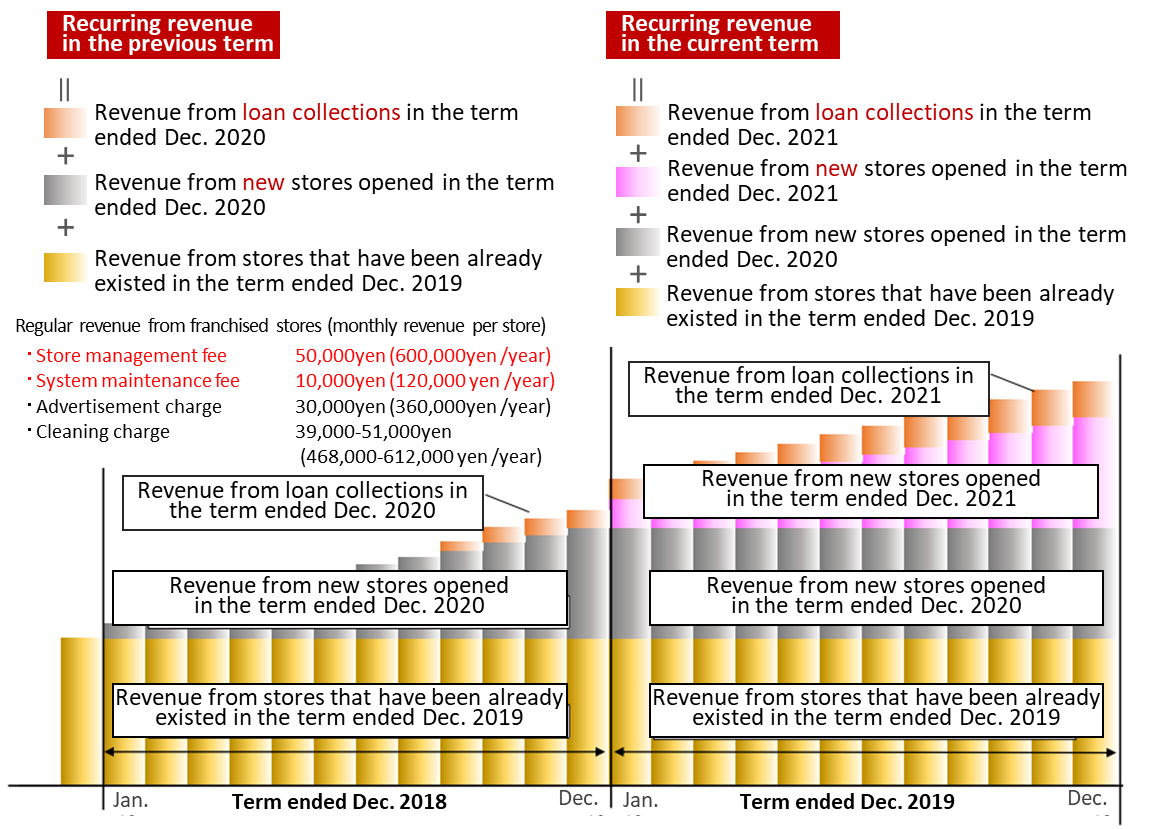

(3) Stable earning structure with recurring revenue

The sales from the store management business are composed of the monthly store management fee (50,000 yen per store), the fee for system maintenance (10,000 yen), ad charge (30,000 yen), cleaning charge (about 40,000 yen), etc., that is, a total of about 130,000 yen/month.

As of the end of Dec. 2018, the number of franchised stores of WASHHOUSE was 551. Accordingly, the sales from store management in the term ended Dec. 2019 can be calculated by adding the sales from existing stores (551 stores × 130,000 yen × 12 months = 859 million yen) and the sales from 21 new stores opened in the term ended Dec. 2019 (sales vary according to the date of opening).

The sales for the term ended Dec. 2020 are composed of the sales from existing stores (859 million yen), the sales from new stores opened in the term ended Dec. 2019 (21 stores × 130,000 yen/store/month × 12 months = 32 million yen), and the sales from 81 new stores(estimated) opened in the term ended Dec. 2020, and also the revenue from collection of loans by Washhouse Financial Co., Ltd., which is a 100% subsidiary and started its business in the term ended Dec. 2018.

(Taken from the website of WASHHOUSE)

Like this, sales from the store management business grow steadily, as the sales from new stores are added to those from existing stores, year by year.

Meanwhile, the satisfaction level of franchisees is very high, as seen by the fact that no stores have been closed because of poor performance up until now. Therefore, there is a low possibility that the number of stores will decrease.

The revenue from Washhouse Financial is stable and recurring. This fortifies the stable revenue structure of the company.

(4) Efforts for improving the soundness of the self-service laundry market

Although the laundromat market is growing, president Kodama mentioned that there remain a lot of problems, including the issue of compliance with the law.

For example, the dryers in a laundromat consume a large volume of gas, and so the Fire Service Act, the Building Standards Act, etc. specify the materials for exhaust ducts, how to install them, etc. in detail, for safety reasons. However, there are many illegal installations.

Some laundromat operators try to reel in users by offering to wash clothes on behalf of customers as a measure for differentiating their services from competitors, but they are very likely to be violating the dry cleaning business law.

The dry cleaning business law enforced in 1950 set forth the following provisions from the viewpoint of maintaining public health.

(Excerpt from the dry cleaning business law)

Section | Provision | In other words | |

Article 2 | 2 | In this law, a “dry cleaning business operator” means a person who operates dry cleaning business (including a person who does not wash clothes, but receives and delivers the laundry). | A person who folds up clothes, too, is recognized as a dry cleaning business operator. |

3 | In this law, a “dry cleaner” means a person who has obtained a license described in Article 6. | In order to conduct dry cleaning business, it is necessary to obtain a dry cleaner’s license. | |

4 | In this law, a “dry cleaning shop” means a facility of a dry cleaning business operator for handling, receiving, and delivering the laundry. | In order to open a dry cleaning shop, it is necessary to notify the governor of the prefecture. In addition, the dry cleaning shop needs to undergo the governor’s inspection before use. A dry cleaner needs to be employed at each dry cleaning shop. | |

In a nutshell,

*Even if a laundromat operator obtains a dry cleaner’s license, he/she cannot offer services of handling and folding up the laundry, etc. at a laundromat, which is not a dry cleaning shop.

*The washing machines and dryers inside a facility registered as a dry cleaning shop is exclusively for dry cleaning business operators, and so they cannot be used by others (users of laundromats) from the viewpoint of hygiene.

Despite the existence of these laws, in order to avoid the guidance from a public health center, some business operators set a counter inside their stores, install washing machines, explain “We use this washing machine,” but actually they wash the laundry of users with unregistered laundromat equipment outside the counter (not installed ones), and fold up the laundry.

In this situation, president Kodama considered that in order to promote the use of laundromats, it is indispensable to develop “reliable, safe, and clean” laundromats inside his company and improve the soundness of the self-service laundry industry, therefore established the National Association of Laundromat Operators in Dec. 2003.

This association specified the operation standards for equipment and hygienic management complying with laws, regulations, etc. At present, the directly managed stores and franchised laundromats of WASHHOUSE belong to this association, which takes the roles of improving the soundness of this industry and educating general consumers (about the usefulness of laundromats, etc.).

2. Second Quarter of Fiscal Year ended December 2021 Earnings Results

(1) Business Results (Cumulative)

| 2Q FY 12/20 | 2Q FY 12/21 | YoY | Company Plan | Compared with the company plan |

Sales | 943 | 1,027 | +83 | 1,519 | -491 |

Gross profit | 303 | 315 | +12 | 499 | -183 |

SG&A | 422 | 393 | -29 | 492 | -98 |

Operating Income | -188 | -77 | +41 | 6 | -83 |

Ordinary Income | -110 | -78 | +31 | 4 | -82 |

Quarterly Net Income | -114 | -81 | +32 | 3 | -84 |

*Unit: million yen.

Growth in revenue and reduction in deficit

Sales increased 8.9% year-on-year to 1,027 million yen.

New store openings in the FC division remained unchanged at nine stores. It was 22 stores below the plan. The spread of COVID-19 made it difficult to conduct business activities, and in some cases, it took time for owners to complete the screening process for financing, and in other cases, owners decided not to open new stores.

Gross profit increased 4.1% year-on-year due to higher profit margins on the WASH House Coin Laundry System Set through the introduction of integrated laundry equipment, despite an increase in depreciation as a result of an increase in the number of directly managed stores. SG&A expenses dropped 6.9% year-on-year due to cost cutting effects, and operating loss improved by 41 million yen year-on-year to an operating loss of 77 million yen.

Due to the impact of the spread of COVID-19, the company was unable to conduct on-site surveys on new properties and visit landowners and franchise owners for business negotiations, resulting in sales and profits falling short of the company plan.

(2) Sales trend in each business segment

| 2Q FY12/20 | Ratio to Sales | 2Q FY12/21 | Ratio to Sales | YoY |

Sales |

|

|

|

|

|

FC division | 166 | 17.6% | 212 | 20.6% | +27.1% |

Store management division | 517 | 54.8% | 515 | 50.1% | -0.4% |

Direct management division, etc. | 259 | 27.4% | 299 | 29.1% | +15.6% |

Total | 943 | 100.0% | 1,027 | 100.0% | +8.9% |

Gross profit |

|

|

|

|

|

FC division | 49 | 29.4% | 67 | 31.9% | +2.5% |

Store management division | 186 | 36.1% | 181 | 35.2% | -0.9% |

Direct management division, etc. | 67 | 26.0% | 66 | 22.1% | -3.9% |

Total | 303 | 32.1% | 315 | 30.7% | +4.1% |

*Unit: million yen.

*Ratio to sales for gross profit is gross profit to sales.

① FC division

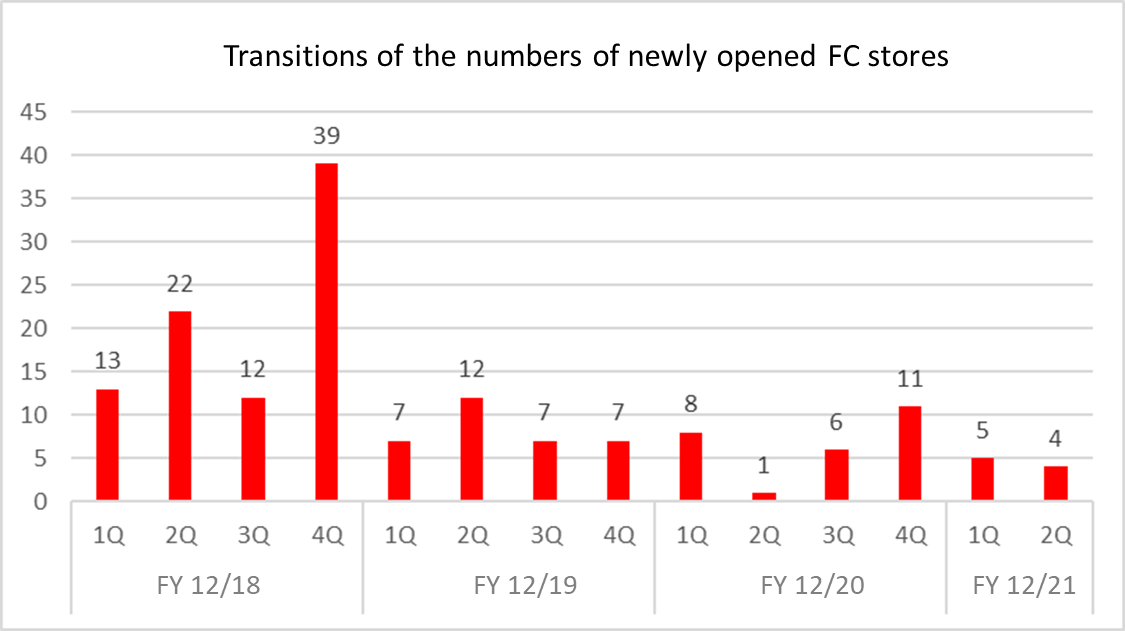

The total number of new FC stores opened was nine, including one in the Chugoku area (Yamaguchi), one in the Shikoku area (Ehime), and seven in the Kyushu area (five in Fukuoka, one in Miyazaki, and one in Kagoshima). Three of the existing stores were converted to directly managed stores, and seven stores were closed for owners’ reasons, resulting in a decrease of one store during the period and a total of 573 franchise stores at the end of June 2021. The number of stores was 22 less than the plan.

Although the number of new stores opened was unchanged from the same period of the previous year, there was one remodeling case, resulting in increases in sales and profits.

Gross profit margin increased 2.5 points thanks to an increase in the profit margin of the WASH House Coin Laundry System Set through the adoption of integrated laundry equipment.

② Store management department

Sales and profits decreased due to many rainy days in the same period of the previous year and a decrease in the number of stores due to the conversion of franchised stores to direct management. Gross profit margin decreased 0.9 points due to the partial revision to the classification of cost of sales and SG&A expenses.

③ Direct management division, etc.

The number of franchised stores increased to 61 at the end of June 2021 due to the conversion of three stores from franchised stores and the closure of one store due to the owner's circumstances, resulting in an increase in sales, but an increase in depreciation expenses, resulted in a decrease in profits. Gross profit margin declined 3.9 points.

◎ Topics

① Proprietary detergent factory (Miyazaki Factory completed in February 2021). Shipments to directly managed stores began in April 2021. The company will start using the detergent in Kyushu in the second half.

(Taken from the website of WASHHOUSE)

② WASH House App

Adding a new function to check the availability of store equipment.

(Taken from the website of WASHHOUSE)

(3) Financial standing and cash flows

◎Main BS

| End of Dec. 20 | End of June. 21 |

| End of Dec. 20 | End of June. 21 |

Current Assets | 2,337 | 1,970 | Current liabilities | 1,233 | 752 |

Cash | 1,211 | 809 | Payables | 59 | 46 |

Receivables | 112 | 111 | Deposits received | 349 | 316 |

Operating loans | 625 | 626 | Noncurrent liabilities | 997 | 1,380 |

Noncurrent Assets | 1,766 | 1,962 | Guarantee deposited | 821 | 823 |

Tangible Assets | 1,342 | 1,436 | Total Liabilities | 2,231 | 2,132 |

Intangible Assets | 29 | 116 | Net Assets | 1,871 | 1,801 |

Investment, Others | 393 | 410 | Shareholder’s Equity | 1,801 | 1,719 |

Total Assets | 4,103 | 3,933 | Total Liabilities and Net Assets | 4,103 | 3,933 |

|

|

| Borrowing Ballance | 707 | 663 |

*Unit: million yen

Current assets decreased 366 million yen from the end of the previous fiscal year due to a decrease in cash etc. Total assets decreased 169 million yen from the end of the previous fiscal year to 3,933 million yen, despite an increase of 196 million yen from the end of the previous fiscal year in noncurrent assets due to an increase in tangible assets caused by an increase in the number of directly managed stores.

Total liabilities decreased 99 million yen from the end of the previous fiscal year to 3,933 million yen, due to an overall decrease in loans payable, despite the transfer of short-term and long-term liabilities due to the construction of a detergent factory.

Net assets decreased 70 million yen from the end of the previous fiscal year to 1,801 million yen due to a decrease in retained earnings.

As a result, capital-to-asset ratio was 44.0%, unchanged from the end of the previous fiscal year.

◎Cash Flow

| 2Q FY 12/20 | 2Q FY 12/21 | Increase/decrease |

Operating Cash Flow | -223 | -179 | +44 |

Investing Cash Flow | -312 | -175 | +136 |

Free Cash Flow | -535 | -354 | +181 |

Financing Cash Flow | 356 | -48 | -405 |

Term End Cash and Equivalents | 1,076 | 809 | -267 |

*Unit: million yen.

The negative free cash flow shrank as the detergent factory began operating. Although there were some transfers between short-term and long-term loans, the repayment of short-term loans was significant, resulting in negative financing cash flow. The cash position declined.

3. Fiscal Year ending December 2021 Earnings Forecasts

3-1 Forecasts of Consolidated Business Results

| FY Dec. 20 | Ratio to Sales | FY Dec. 21 Est. | Ratio to Sales | YoY |

Sales | 2,182 | 100.0% | 3432 | 100.0% | +57.3% |

Gross profit | 697 | 32.0% | - | - | - |

SG&A | 822 | 37.7% | - | - | - |

Operating Income | -124 | - | 125 | 3.6% | - |

Ordinary Income | -90 | - | 120 | 3.5% | - |

Quarterly Net Income | -128 | - | 86 | 2.5% | - |

*Unit: million yen

Although the business results for the second quarter of the term ending Dec. 2021 fell short of the plan, the company did not revise the earnings forecasts announced on February 8, 2021 (expecting that sales will increase 57.3% year-on-year to 3,432 million yen and operating income will rise 249 million yen year-on-year to 125 million yen in the black), as it will be able to make up for the delay in progress by partially resuming visits to individual landowners in the second half of the fiscal year due to an increase in vaccination rate. However, dividends will not be paid as in the previous fiscal year.

4. Future Initiatives

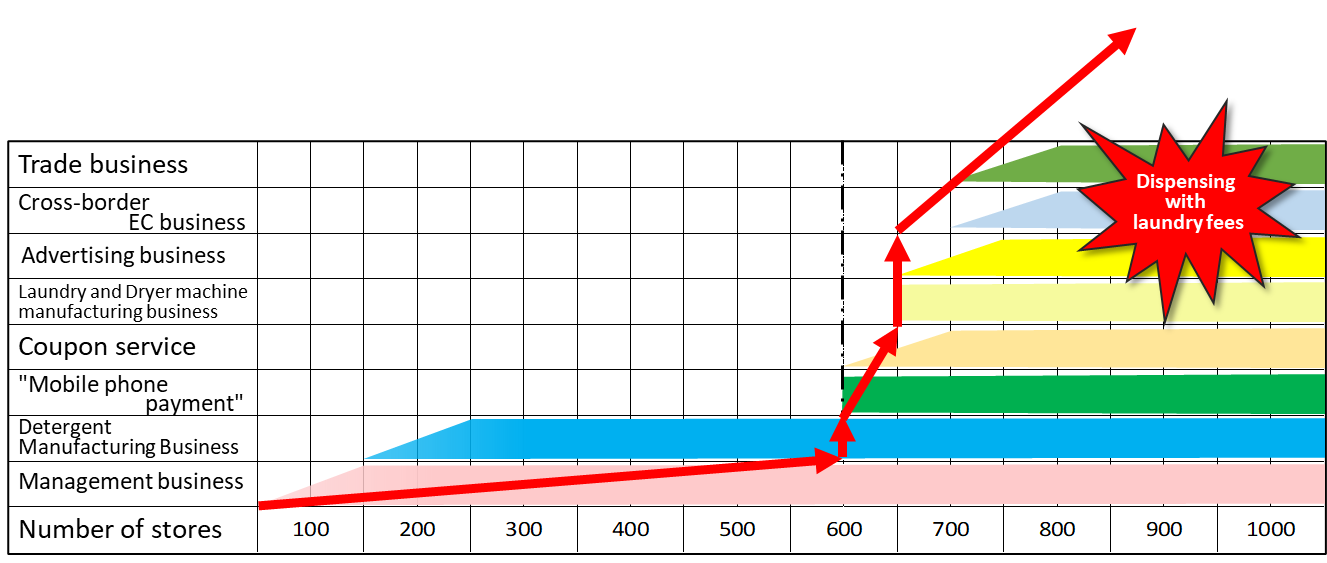

◎ Goals at the time of establishment

1. Aiming for more than 20,000 stores nationwide

2. In-house detergent manufacturing

3. Building unitization

4. In-house supply of LP gas

5. To manufacture washing machines and drying machines

6. To establish a finance company

7. Overseas expansion

Underlined parts already achieved

◎ Approach to business development

Stage 1: Expansion of the store network to serve as a media for disseminating information and expansion of the revenue base

Stage 2: Development of software and hardware devices to realize their ideal state (providing free laundry)

Stage 3: The revenue structure of the advertising business, cross-border EC business, and trading business will change (the advertising business has already started seeing a change)

(Taken from the website of WASHHOUSE)

The key to the realization of the third stage is the WASH House App. In particular, it will depend on what will become of the advertising revenue.

WASH House App

1. Cashless payment system

Since the launch of all WASH House stores in May 2020, the number of downloads and users of the app have been increasing, as it has enabled the use of cashless services.

(Taken from the website of WASHHOUSE)

2. Mutual customer referral system

This is a function that enables users to issue coupons that can be used at nearby stores while waiting for their laundry to be done, which is a feature of coin laundries. This scheme is designed to mutually send customers to other stores within chain store facilities and complexes, and is beneficial to users, tenants, and the company.

The company is currently in discussions with several chain store headquarters to use this Mutual Customer Referral System to link up with the WASH House App and open new stores in their facilities, and as a result, the company was able to open ten new stores simultaneously in October 2020. The company will continue to open more stores in the future.

(Taken from the website of WASHHOUS

3. Advertising system

Users of the WASH House app see advertisements in the app when they use the coin laundry, check the end time, and finish the laundry, making it possible for advertisers to create advertisements with a high hit rate.

Specifically, the company will start accepting posting in advertising space in the WASH House App in November 2020. The company considers the revenue generated from this advertising system to be a major turning point in its future revenue structure change. Additionally, the company believes that these efforts are the first step toward the realization of free coin laundry usage fees.

To promote these objectives, the company plans to launch the WASH House App Download Campaign at all its stores in the same month, and it expects the number of downloads and users to increase further at the group's coin laundry stores.

(Taken from the website of WASHHOUSE)

5. Conclusions

The number of new franchise stores opened in the previous fiscal year was eight in the first quarter, one in the second quarter, six in the third quarter, and eleven in the fourth quarter, which was a boost towards the end of the fiscal year, but overall, the number of new stores was small. The company has had a slow start in the current fiscal year with only five stores in the first quarter, so we hope that it will turn things around in the future.

Although vaccination against COVID-19 has started, there is still no prospect of its subsiding due to the spread of mutated strains, so the impact of the spread of COVID-19 continues to be a concern.

On the other hand, the WASH House App was released in April of the previous year as a cashless payment system. It is now possible to make cashless payments without the use of coins. In addition, in-app advertising started at the end of the previous year. While doing laundry, customers can use coupons to save money at nearby stores, and use the receipts from their purchases to save money on laundry. To realize President Kodama's goal of "free laundry," the trend of advertising revenue will be closely watched. We look forward to the contribution of the detergent plant (the company's Miyazaki Plant), which was completed in February 2021, to revenues.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 1 outside one |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report

Last update date: Apr. 23, 2021

<Basic policies>

Our company will comply with laws, carry out fair and transparent corporate activities, and contribute to the regional community by achieving growth. Additionally, we will strive to gain trust from all concerned stakeholders including shareholders, customers, clients, employees, and the regional community and plan to expand global corporate activities in the future.

Furthermore, we aim to maximize our corporate value by improving the management’s fairness and transparency, making agile adaptation to environmental changes, strengthening our competitiveness, and striving to build a corporate governance structure according to our company’s growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company mentioned, “We will implement all of the basic principles.”

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |