Bridge Report:(6537)WASHHOUSE the First Half of the Fiscal Year ending December 2025

Yasutaka Kodama President | WASHHOUSE Co., Ltd.(6537) |

|

Company Information

Market | TSE Growth, FSE Q-Board |

Industry | Service business |

President | Yasutaka Kodama |

HQ Address | 86-1, Shinei-cho, Miyazaki-shi, Miyazaki prefecture |

Year-end | End of December |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥374 | 6,925,400 Shares | ¥2,590 million | 1.8% | 100 Shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥0.00 | - | ¥13.13 | 28.5x | ¥249.23 | 1.5x |

*The share price is the closing price on November 5. The total market cap was obtained by multiplying the closing price on November 5 by the number of shares outstanding and rounding the product. ROE, BPS, and PBR were the actual results in FY 12/24. DPS, EPS, and PER are as per the forecast for FY 12/25.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Dec. 2021 Act. | 2,132 | -140 | -142 | -176 | -25.62 | 0.00 |

Dec. 2022 Act. | 1,921 | -54 | 61 | 11 | 1.70 | 0.00 |

Dec. 2023 Act. | 1,914 | 13 | 26 | -33 | -4.83 | 0.00 |

Dec. 2024 Act. | 2,083 | 22 | 24 | 31 | 4.53 | 0.00 |

Dec. 2025 Est. | 3,292 | 189 | 178 | 90 | 13.13 | 0.00 |

*Unit: million yen.

This Bridge Report presents earnings results for the first half of the fiscal year ending December 2025 of WASHHOUSE Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. 1H of Fiscal Year ending December 2025 Earnings Results

3. Fiscal Year ending December 2025 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

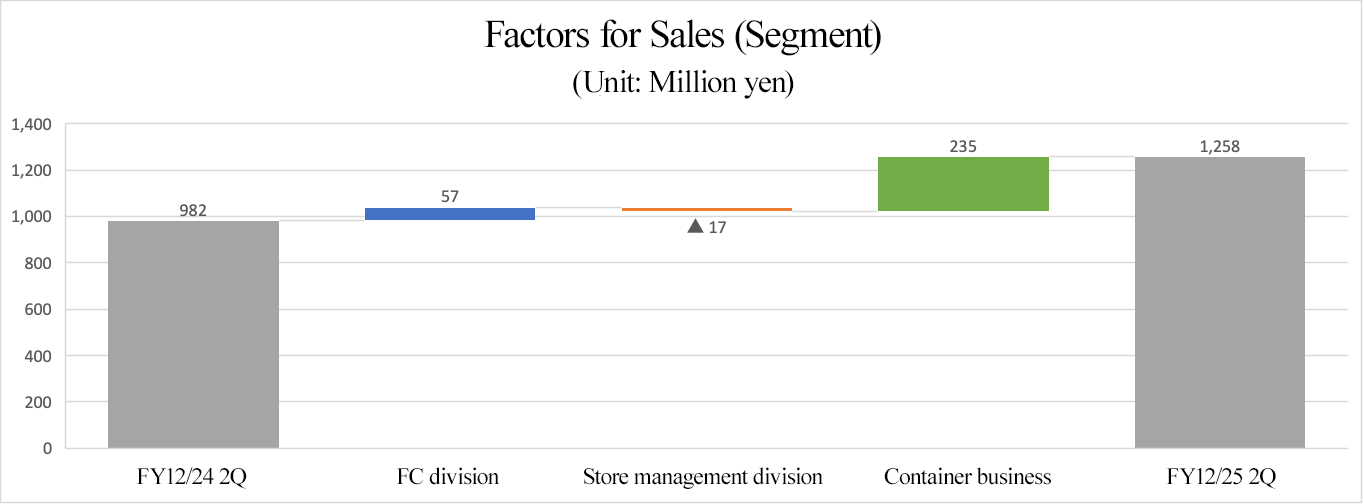

- In the first half of the fiscal year ending December 2025, sales grew 28.0% year on year to 1,258 million yen. They promoted the expansion of the sponsors’ advertisement business in which they provide effective ad spots by using the advertisement system of the app of Washhouse. They are also steadily strengthening the “self-service laundry business as a platform.” In the first half of FY 12/2025, they opened 3 new franchised laundromats and renovated 9 laundromats. In addition, they are developing and selling accommodation facilities utilizing shipping containers. Operating income was 21 million yen (a loss of 17 million yen in the same period of the previous year). Regarding profits, gross profit margin declined year on year from 37.7% to 32.2%, but SGA decreased, so they were able to secure an operating income.

- The full-year earnings forecast has been left unchanged, and it is projected that sales will grow 58.0% year on year to 3,292 million yen and operating income will rise 748.8% year on year to 189 million yen in FY 12/2025. In the second half of FY 12/2025, they are expected to complete the project for opening new laundromats that has been postponed from the first half and increase renovation projects, including the installation of additional equipment. The company will further accelerate the growth of its “self-service laundry business as a platform.” In the FC division, it will gradually install its original washing and drying machines in laundromats and expand its laundromat network. In the laundromat operation division, the company will conduct a PR campaign that will exceed the level of the fiscal year ended December 2024. In addition, the company will sell shipping container-type self-service laundromats and develop, sell, and operate laundromats using shipping containers, including hotels.

- In the first half of FY 12/2025, sales and profit fell below the forecast, because the number of unsunny days was larger than usual and the opening of new laundromats was postponed until the second half, but they steadily increased sales by 28.0% year on year. In addition, the number of downloads of Washhouse App has steadily grown, fortifying the customer base. The shipping container business moved into the black in the first half of FY 12/2025, so we look forward to seeing it contribute to profit. Regarding overseas business operation, they exhibited their products and services at a home appliance expo in China in March, causing significant repercussions. Share price is stagnant, but they increased sales and profit from the previous fiscal year in FY 12/2024, and are expected to increase sales and profit significantly by installing their unique laundry equipment in laundromats in FY 12/2025. The outlook for FY 12/2026, in which the shipping container business and overseas business operation are expected to be conducted on a full-scale basis, is also bright. It is expected that the company will keep improving its performance and the evaluation of the company in the stock market will change significantly.

1. Company Overview

WASHHOUSE operates laundromats mainly based on the franchise system, with the aim of creating the global standard in the self-service laundry industry.

The company has developed an unprecedented franchise chain (FC) business system, which unifies the quality of laundromats by managing and operating all laundromats concurrently, so that both the FC headquarters and franchised shops can thrive. As a great advantage, the company has a stable earning structure with recurring revenue.

It made inroads into Osaka and Tokyo, embarking on nationwide business on a full-scale basis. It also plans to expand its business outside Japan.

As of June 2025, 576 laundromats (508 franchised ones and 68 directly managed ones) are in operation in Tokyo, Osaka and 25 other prefectures.

[1-1 Corporate History Until listing]

When starting up this business, President Kodama pondered over how to keep increasing sales and profit eternally in the age that will certainly witness the decreased birthrate and aging and declining population, whether the business has social meanings, whether there are any forerunners, whether the company can survive competitions, whether the business can be imitated easily, whether it is possible to achieve recurring revenue, and so on from various aspects, and decided to do the self-service laundry business.

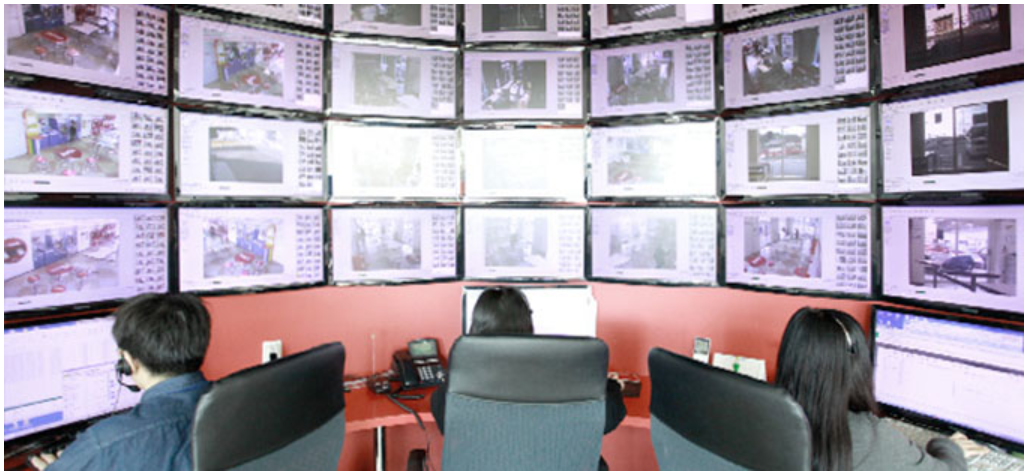

For expanding the scale of business, the FC system is effective, but the FC business is accompanied by the problem of the conflict between the FC headquarters and franchised laundromats. In order to solve this problem, the company immediately introduced a call center that is in operation 24 hours a day all year round and the “system for managing and operating all laundromats at the same time,” which is composed of the swift support based on management webcams and remote control, etc. and reduced the burdens of franchised laundromats considerably. Its business grew steadily, partially thanks to the expansion of needs due to the increase in the number of working females.

From the Kyushu area, including Miyazaki Prefecture, where the business was launched, the company expanded its sales territory, entering Osaka in Dec. 2015 and Tokyo in Jul. 2016.

Then, in Nov. 2016, WASHHOUSE got listed on Mothers of Tokyo Stock Exchange and Q-Board of Fukuoka Stock Exchange. The company moved to the TSE Growth Market in April 2022.

[1-2 Management Philosophy]

The ethos of WASHHOUSE is “to think about all matters from the viewpoint of customers and keep being demanded by society.”

Under this ethos, the company is working on “creation of global standards in the self-service laundry industry” with the aim of continuously offering satisfactory services to users on behalf of laundromat owners by fully managing laundromats after the opening of the laundromat rather than “just selling self-service laundry equipment and instructing owners to operate it.”

[1-3 Market Environment]

◎ Social background of needs for a self-service laundry

As the patients of allergic diseases are increasing and customers increasingly want to reduce housework hours due to the increase of double-income households, self-service laundromats, which can contribute to health and hygiene and enable customers to use time efficiently, are expected to be demanded and used by more people.

Many families also face laundry-related challenges at home. Some cannot set up washers and dryers in their apartments. Others have machines that are too small to accommodate large items like futons or cannot hang their laundry out on balconies. Double-income households may lack the time to manage laundry at home. Families with children tend to generate too much of laundry to handle. A self-service laundry has come to play an increasingly important part in our lives for these reasons.

◎ Potential of a self-service laundry

According to a survey of the Ministry of Health, Labour and Welfare, the number of self-service laundromats in Japan is increasing at an annual rate of around 5%, and the company estimates that there are currently around 28,000 such laundromats. In the background of such growth, there are women’s needs for “the reduction in cleaning time” due to the increase of double-income households, measures against allergies, such as the allergy to pollen, decrease in the use of cleaning services due to the increase of low-priced high-quality clothes, and enhancement of awareness of cleanliness, and so on.

(Taken from the reference material of the company)

About 9% of Japanese citizens use a self-service laundromat (once or more times in 2 or 3 months), so this market still has significant room for increasing users.

Equipment for self-service laundromats has some advantages, including (1) the functions to wash and dry futons and blankets, (2) short washing or drying time compared with household washing and drying machines, (3) sterilization with hot air, and (4) the function to suck dust with vacuum. The company will fulfill central roles in this industry, increasing the ratio of users to citizens and opening more laundromats.

◎ Characteristics of the Business and Market Players

The self-service laundromat is a unique business unlike any other. The equipment start operating once the usage fee is paid, and since the system uses detergent and gas, no inventory or losses are generated. This makes the business unique in that it can be profitable with a small number of users. In addition, because they are unmanned laundromats, business operations are not dependent on the abilities of individuals, and labor costs can be kept to a minimum. Furthermore, most of the businesses are privately owned and operated, which means that it is an industry with outdated practices, with a low level of management awareness and delayed compliance with laws and regulations.

The number of main players in the self-service laundry market is said to be 4 to 5. WASHHOUSE has the largest number of laundromats with the same brand, and is the only listed company in this field.

Although many enterprises carry out the FC business for growth (increasing in the number of laundromats), WASHHOUSE possesses an unparalleled “system for managing and operating all laundromats at the same time,” which was developed in pursuing the streamlining of business operation and unification of quality. (For details, see “1-5 Characteristics and Strengths.”)

[1-4 Business Description]

1. Composition

There are two divisions: FC division, store operation division.

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

(1) FC division

WASHHOUSE has a unique operation-supported FC division.

They design a plan of opening a laundromat, and sell “Washhouse Package,” including all of necessary items for opening a laundromat, including equipment for a self-service laundromat and decorations. In addition, the company receives the preparation fees for opening laundromats, including advertisements, and fees for franchise rights.

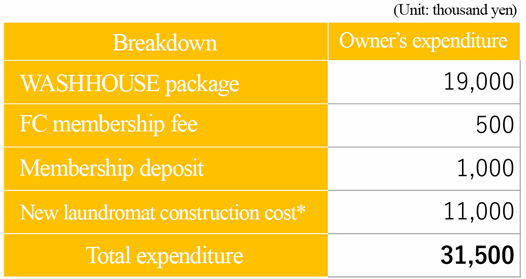

Revenue structure of the FC division at the time of laundromat opening

*Standard example, actual situation may vary among properties. | An example of owner’s expenditure at the time of laundromat opening

*Standard example, the actual situation may vary depending on construction conditions and tenant property status. |

Monthly operating revenue model for FC laundromats

*Monthly revenue structure model. | Owner’s monthly income and expense model

*Monthly revenue structure model. |

(Taken from the reference material of the company)

For increasing franchisees, the company adopts the division system where business simulation, contract production, etc. are conducted by other staff than sales staff, so that sales staff can devote themselves to “footwork.” Furthermore, by concluding business matching contracts with financial institutions, etc., the company is accumulating information on sites for building laundromats and candidate owners and developing a “system” for increasing laundromats.

WASHHOUSE designs a plan to open new laundromats for each term based on the accumulated data on correlative relations of “the number of years of career of sales staff and achievements of opening franchised laundromats.”

(2) Store operation division

By adopting an integrated management and operation system in all laundromats, including franchised and directly managed ones, they offer unified quality. They provide franchised laundromats with a 24/7 call center, swift support based on management cameras and remote control, daily inspection & cleaning, the replenishment of detergents, maintenance, and advertisement services, and receive compensation for these services from the owners of franchised laundromats. Regarding directly managed laundromats, they collect the charges for use of washing and drying machines from users of the laundromats. They also receive the revenue from “Washhouse App.”

A directly managed laundromat is opened mainly when entering a new area. It takes the roles as an antenna shop, such as popularizing the “WASHHOUSE” brand as a “reliable, safe, and clean” self-service laundromat, promoting possible users to use it, and offering a laundromat model to franchisees and landowners (individuals and corporations that are thinking of utilizing their real estate).

Since franchisees need not manage their laundromats, if they can bear initial investment costs, they can own multiple laundromats, increase revenue, and reduce the risk of revenue fluctuation with laundromats being operated in different regions.

2. Laundromat operation

As of June 2025, WASHHOUSE operates 508 franchised laundromats and 68 directly managed laundromats, that is, a total of 576 laundromats in 27 prefectures. The company will continue nationwide business operations.

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

[1-5 Characteristics and strengths]

(1) Creation of a new FC business system

WASHHOUSE can be characterized most by its unique FC business model.

In ordinary FC business, a conflict between the FC headquarters and franchisees tends to emerge.

While franchisees pay franchise fees and royalties to the FC headquarters, the FC headquarters permit them to use a brand name, offer know-how to them and supply products to them, but laundromat operation, staffing, etc. must be carried out by franchisees on their own responsibility.

For franchisees, the operation and management of laundromats are significant burdens. If their business performance is favorable, there are no problems, but if sales are sluggish, the franchisee complains, “the system of the headquarters is poor,” while the FC headquarters blames, “the education in the franchisee is poor,” and these complaints lead to a lawsuit in many cases.

Meanwhile, WASHHOUSE introduced the “system for managing and operating all laundromats at the same time.” As mentioned above, the company conducts all the necessary tasks for operating and managing franchised laundromats: As mentioned above, 24/7 Call centers, Swift support based on management webcams and remote control, Daily inspection and cleaning, Replenishment of detergents, Maintenance patrol, Advertisement. As a consequence, franchisees are free from the burdens of laundromat operation.

In addition, since the company targets real estate that would have sales of over 1 million yen, it has meticulously surveyed the market, including local population, age distribution, income state, etc. and accumulated know-how for cultivating profitable property.

Thanks to the combination of the system for fully managing laundromats and the capability of cultivating profitable real estate, the satisfaction level of franchisees is very high, contributing to outstanding results of no closing laundromats caused by poor performance up until now.

(2) Bright, clean, easy-to-use laundromats

A self-service laundry generally reminds us of a “dimly-lit, eerie and dirty” place, but self-service laundry WASHHOUSE operates “reliable, safe, and clean” laundromats with the unified brand targeting women and families including children.

(Taken from the website of WASHHOUSE)

In the past, using a self-service laundry was considered as one of “sloppy acts in homemaking.” However, there is a growing interest in self-service laundries, which can wash and dry a larger amount of clothes in a shorter period of time than household washing machines, as the employment rate for women rose, high-rise condominiums increased, and the life-work balance changed. Especially, the washing of large items, such as futons and carpets, for removing ticks and allergens is attracting attention, due to the rising health consciousness.

In addition, the needs for self-service laundromats mounted with equipment for washing and drying kids’ sneakers are getting stronger.

In these circumstances, the company installs the following equipment for meeting the needs of consumers:

*Washing machines with a capacity of 22 kg, which can wash a full-sized futon, and dryers with a capacity of 25 kg (in standard laundromats),

*Sneaker laundry equipment, which can wash sporting shoes, sneakers for commuting to school, etc.

*Devices for removing stains free of charge (Spot remover)

Furthermore, all laundromats are monitored by management webcams 24 hours a day, and mounted with IoT laundry equipment, which can be controlled remotely by the headquarters, so as to offer real-time support like manned laundromats, although the laundromats are unmanned. Like this, the company has established a system that can be used by users without worry.

(Taken from the website of WASHHOUSE)

The company also indicates the components of detergents and the temperature in each dryer, to dispel the worries of consumers. In order to keep laundromats clean, the company cleans laundromats every day, including the cleaning of the filters of dryers and the sterilization of washing machines.

In addition, in April 2020, the company released the WASHHOUSE app, a smartphone payment application for self-service laundries.

The app is aimed at strengthening the self-service laundry business as a platform and is equipped with cashless payment functions and information distribution functions such as special coupons, and it was installed in all WASH House laundromats at the end of May 2020.

The company has also incorporated functions to create collaborations with a wide variety of other industries and will continue to work to create laundromats that are needed by users by providing them with meaningful information and highly convenient services that are closely related to their daily lives.

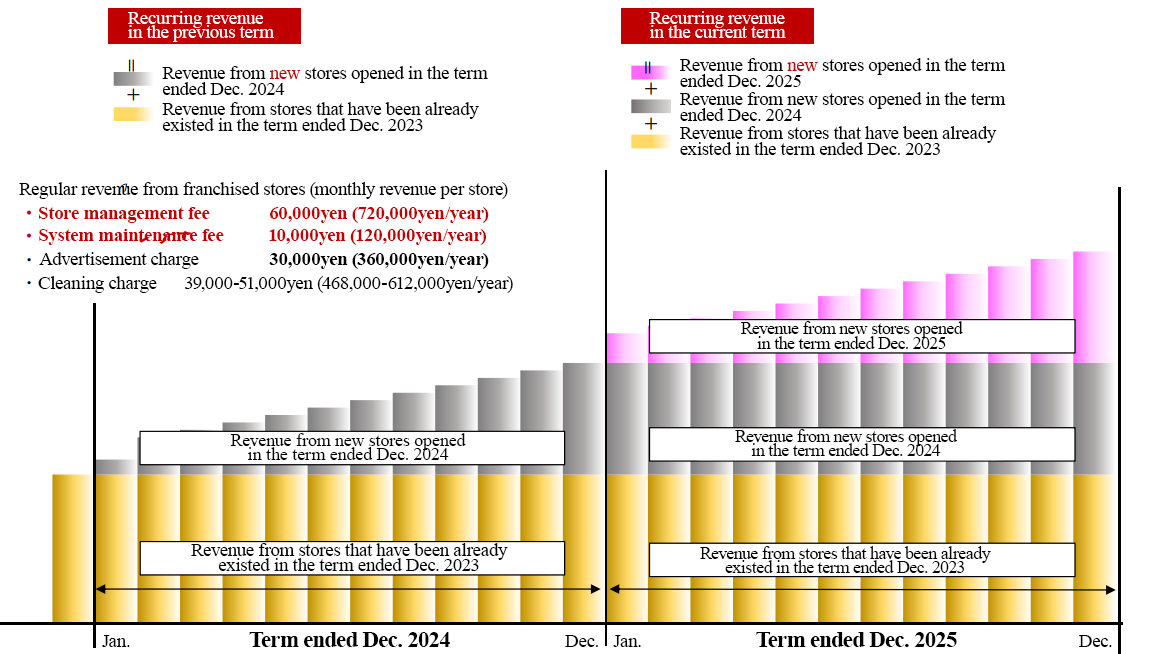

(3) Stable earning structure with recurring revenue

The sales from the laundromat management business are composed of the monthly laundromat management fee (60,000 yen per laundromat), the fee for system maintenance (10,000 yen), ad charge (30,000 yen), cleaning charge (39,000 – 51,000 yen), etc., that is, a total of about 140,000 – 150,000 yen/month.

(Taken from the reference material of the company)

Like this, sales from the laundromat management business grow steadily, as the sales from new laundromats are added to those from existing laundromats, year by year.

Meanwhile, the satisfaction level of franchisees is very high, as seen by the fact that no laundromats have been closed because of poor performance up until now. Therefore, there is a low possibility that the number of laundromats will decrease.

The revenue from Washhouse Financial is stable and recurring. This fortifies the stable revenue structure of the company.

(4) Efforts for improving the soundness of the self-service laundry market

Although the self-service laundry market is growing, president Kodama mentioned that there remain a lot of problems, including the issue of compliance with the law.

For example, the dryers in a self-service laundry consume a large volume of gas, and so the Fire Service Act, the Building Standards Act, etc. specify the materials for exhaust ducts, how to install them, etc. in detail, for safety reasons. However, there are many illegal installations.

Some self-service laundry operators try to reel in users by offering to wash clothes on behalf of customers as a measure for differentiating their services from competitors, but they are very likely to be violating the dry cleaning business law.

The dry cleaning business law enforced in 1950 set forth the following provisions from the viewpoint of maintaining public health.

(Excerpt from the dry cleaning business law)

Section | Provision | In other words | |

Article 2 | 2 | In this law, a “dry cleaning business operator” means a person who operates dry cleaning business (including a person who does not wash clothes but receives and delivers the laundry). | A person who folds up clothes, too, is recognized as a dry cleaning business operator. |

3 | In this law, a “dry cleaner” means a person who has obtained a license described in Article 6. | In order to conduct dry cleaning business, it is necessary to obtain a dry cleaner’s license. | |

4 | In this law, a “dry cleaning shop” means a facility of a dry cleaning business operator for handling, receiving, and delivering the laundry. | In order to open a dry cleaning shop, it is necessary to notify the governor of the prefecture. In addition, the dry cleaning shop needs to undergo the governor’s inspection before use. A dry cleaner need to be employed at each dry cleaning shop. | |

In a nutshell,

*Even if a self-service laundry operator obtains a dry cleaner’s license, he/she cannot offer services of handling and folding up the laundry, etc. at a self-service laundry, which is not a dry cleaning shop.

*The washing machines and dryers inside a facility registered as a dry cleaning shop is exclusively for dry cleaning business operators, and so they cannot be used by others (users of self-service laundries) from the viewpoint of hygiene.

Despite the existence of these laws, in order to avoid the guidance from a public health center, some business operators set a counter inside their laundromats, install washing machines, explain “We use this washing machine,” but actually they wash the laundry of users with unregistered self-service laundry equipment outside the counter (not installed ones), and fold up the laundry.

In this situation, president Kodama considered that in order to promote the use of self-service laundries, it is indispensable to develop “reliable, safe, and clean” self-service laundries inside his company and improve the soundness of the self-service laundry industry, therefore established the National Association of Laundromat Operators in Dec. 2003.

This association specified the operation standards for equipment and hygienic management complying with laws, regulations, etc. At present, the directly managed laundromats and franchised laundromats of WASHHOUSE belong to this association, which takes the roles of improving the soundness of this industry and educating general consumers (about the usefulness of self-service laundries, etc.).

[1-6 Business developments]

After the listing of WASHHOUSE in 2016, there emerged a trend of opening self-service laundromats.

The number of laundromats has increased from 20,000 to 28,000, indicating clearly that the habit of using a self-service laundry is spreading.

Under these circumstances, the company has been insisting “We have no intention of being a mere laundry business operator,” since the inauguration of business, because they had a vision of offering “charge-free” laundry and drying services.

Then, they conducted experiments of charge-free services and finally succeeded in monetization with ads.

Customers can wash and dry clothes “free of charge,” drink coffee “free of charge,” and get Miyazaki Beef or eels by lottery!! Customers can wash clothes at a lower cost than washing at home!

Furthermore, customers can get useful information and purchase products at affordable prices!

The concept of laundry will be changed.

For 22 years, WASHHOUSE has been preparing for charge-free services and pursued thoroughgoing cost reduction, while assuming that price-cutting wars will break out in the fields of detergent factories, in-house washing and drying machines, and mission-critical systems. While looking ahead to global business operation, they researched and developed washing and drying machines and systems unique to WASHHOUSE, and strove to install digital signages in them.

[1-7 New Products]

The development of the company’s original washing and drying machines, which it had been working on in order to realize its goal of offering free laundry services since establishment, has now been completed. Through this development, they will brush up their capabilities as a manufacturer. In addition, bringing this new laundry equipment to the market will not only expand the group’s business in the future, but will also significantly change the conventional standards of the industry.

In addition, on December 26 last year, they opened their first shipping container-type self-service laundromat, WASHHOUSE Miyazakikomatsu, equipped with their original washing and drying machines. Going forward, they plan to adopt this type when opening new laundromats and renovating existing laundromats.

(Taken from the reference material of the company)

[1-8 WASHHOUSE App]

Advertisement system

Accepting applications for advertisements in ad spots, they distribute video ads and banner ads via Washhouse App. They plan to offer laundry services free of charge by collecting revenue from the advertisement system. The users of self-service laundromats would see ads in the app at the time of checking the time of completion of washing, at the time of completion, etc. Accordingly, advertisers can post ads with a high response rate.

Brewery companies, movers, food makers, local governments, and others have posted ads via Washhouse App so far.

Cashless payment system

By reading the code with the app, users can choose services, such as washing and drying, and payment methods. Accordingly, users can settle payment without using any coins. Currently, 13 payment methods are available.

Booking system

Users can book a service by choosing a laundromat and a machine in the “window for booking laundry” in Washhouse App, selecting a washing course, drying time, and date and time. Users scan the displayed QR code with the equipment in the laundromat at the scheduled time, settle payment with Washhouse App, and then start washing.

By using the booking system, users can avoid the situation in which “they bring the laundry, but no washing machines are available.” It can significantly contribute to the alleviation of congestion inside each laundromat.

Mutual promotion system

Just after starting washing at Washhouse, the user gets a coupon that can be used at a nearby supermarket or the like. The user can go shopping at a nearby store at discount prices while waiting for the completion of washing/drying. Nearby supermarkets, etc. print a coupon for Washhouse on a receipt, so that customers can wash the laundry at a discount price.

With this system, Washhouse and nearby stores mutually promote the visit of customers, increasing the number of users and the popularity for each other.

The number of downloads of the app has grown steadily, and reached 1 million in May. It is increasing at a pace of about 33,000 downloads per month, and they aim to achieve 1.2 million downloads by the end of this year.

Provision of value beyond laundry services

They plan to implement campaigns, etc. for all laundromats using Washhouse App, to offer value beyond self-laundry services. For example, they will conduct a campaign in which consumers may get Miyazaki beef by lot after downloading the app.

[1-9 Overseas Expansion]

The company plans to localize the original washing and drying machines completed last year for the Chinese market.

It will be exhibiting at the “China Household Electrical Appliances World Expo” in Shanghai on March 20.

(Taken from the reference material of the company)

For opening laundromats in China, they are developing a pre-launch system. Ther discussion with a Chinese cooperative company has entered the final stage. After reconsidering their business model based on the results of a market survey, they aim to open a laundromat in China within this year.

In October, two employees from Thailand completed the training in Japan and returned to Thailand. They are expected to start activities for operating business in Thailand, although it has been delayed due to the coronavirus pandemic.

[1-10 Launch of New Businesses]

They launched the “shipping container business.” This business is to plan, develop, sell, and operate facilities utilizing shipping containers. In addition, they aim to induce synergy with the self-laundry business by installing self-laundry equipment in container-based facilities.

・ Since December 1, 2024, they have been operating a facility for long-term stay with 10 rooms for construction workers in Wajima City, Ishikawa Prefecture.

・ On February 1, 2025, they started operating “Hotel Washhouse Tanegashima” with 8 rooms in Tanegashima, Kagoshima Prefecture.

・ On June 30, 2025, they started running the relocatable, sustainable trailer-based hotel “1NLDK” at two locations in Aoshima, Miyazaki City and Kanegahama, Hyuga City, Miyazaki Prefecture with 6 rooms and 2 rooms, respectively, at the same time.

The term “1NLDK” was coined by combining 1LDK and NATURE. This hotel was designed while focusing on the harmony between nature and lodging space. By lodging there, hotel guests can spend time with nature while seeing each local culture.

For 1NLDK, they chose areas where people can enjoy outdoor activities, such as surfing and trekking.

|

|

Hotel Washhouse Tanegashima | 1NLDK AOSHIMA |

(Taken from the reference material of the company)

[1-11 To expand their business by modifying their revenue structure]

・1st stage: To expand the network of laundromats for disseminating information as the media and grow the revenue base

・2nd stage: To develop software, hardware, etc. for realizing them

・3rd stage: The advertisement business, the cross-border EC business, the logistics/trading business, and the shipping container business

In the EC business, they are at the final stage of designing a strategy for developing the brand of their products.

They also plan to hold some events. On August 2, they held “Million Festival in Bayside” for commemorating 1 million downloads of Washhouse App at Bayside Place Hakata.

2. 1H of Fiscal Year ending December 2025 Earnings Results

(1) Business Results

| FY 12/24 1H | Ratio to Sales | FY 12/25 1H | Ratio to Sales | YoY | The company’s forecasts | Compared with the forecasts |

Sales | 982 | 100.0% | 1,258 | 100.0% | +28.0% | 1,596 | -21.2% |

Gross profit | 370 | 37.7% | 405 | 32.2% | +9.3% | 509 | -20.4% |

SG&A | 388 | 39.5% | 383 | 30.5% | -1.2% | 430 | -10.9% |

Operating Income | -17 | - | 21 | 1.7% | - | 78 | -72.4% |

Ordinary Income | -14 | - | 21 | 1.7% | - | 72 | -70.1% |

Net Income | 7 | 0.7% | 19 | 1.6% | +172.5% | 29 | -34.3% |

*Unit: million yen.

Sales grew 28.0% year on year, and an operating income was posted.

Sales grew 28.0% year on year to 1,258 million yen.

Taking advantage of the characteristic of self-laundry, that is, unavoidable waiting time, they promoted the expansion of the sponsors’ advertisement business in which they offer ad spots with a high reaction rate based on the advertising system of Washhouse App. In addition, they are steadily strengthening the “self-service laundry business as a platform,” including the development of unique washing and drying machines. Furthermore, they are looking for prospective owners of franchised laundromats and developing the land for opening new laundromats for domestic laundromat operation, and also engage in the development, sale, etc. of accommodation facilities based on shipping containers.

Operating income was 21 million yen (a loss of 17 million yen in the same period of the previous year). Regarding profits, gross profit margin declined year on year from 37.7% to 32.2%, but SGA decreased, so they were able to secure an operating income.

(2) Sales trend in each business segment

| FY 12/24 1H | Composition Ratio | FY 12/25 1H | Composition Ratio | YoY | |

Sales |

|

|

|

|

| |

Self-service laundry business | FC division | 92 | 9.4% | 149 | 11.8% | +61.1% |

Store operation division | 889 | 90.5% | 872 | 69.3% | -1.9% | |

Shipping container business | - | - | 235 | 18.7% | - | |

Total | 982 | 100.0% | 1,258 | 100.0% | +28.0% | |

Gross profit |

|

|

|

|

| |

Self-service laundry business | FC division | 17 | 18.8% | 41 | 27.9% | +141.2% |

Store operation division | 353 | 39.7% | 349 | 40.1% | -1.1% | |

Shipping container business | - | - | 13 | 5.9% | - | |

Total | 370 | 37.7% | 405 | 32.2% | +9.3% | |

*Unit: million yen. Composition of gross profit is gross profit ratio.

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

①Self-service laundry business

a. FC division

Sales were 149 million yen (up 61.1% year on year), and gross profit was 41 million yen (up 141.2% year on year).

The company opened 3 new franchised laundromats and renovated 9 laundromats. Gross profit margin increased 9.0 points year on year to 27.9%.

b. Store operation division

Sales were 872 million yen (down 1.9% year on year), and gross profit was 349 million yen (down 1.1% year on year).

As the sales of existing laundromats were sluggish due to the unfavorable weather, the revenue from delivery of items for laundromat operation declined. Gross profit margin rose 0.4 points year on year to 40.1% thanks to cost reduction, etc.

② Shipping container business

Sales were 235 million yen, and gross profit was 13 million yen.

It is a new business launched in FY 12/2025. Gross profit margin was 5.9%.

(3) Financial standing and cash flows

◎ Main BS

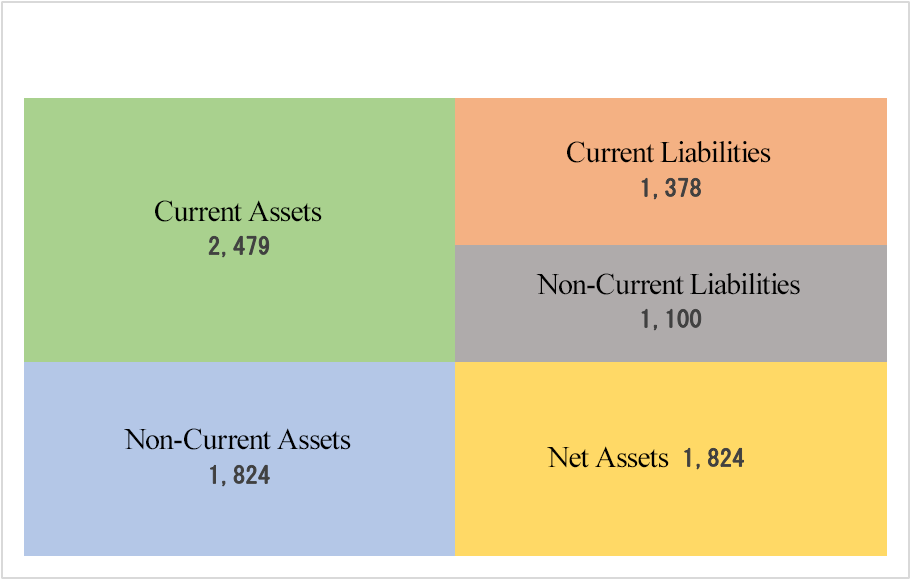

| End of Dec. 2024 | End of Jun. 2025 |

| End of Dec. 2024 | End of Jun. 2025 |

Current Assets | 2,367 | 2,479 | Current liabilities | 1,214 | 1,378 |

Cash | 999 | 916 | Deposits received | 366 | 370 |

Receivables | 162 | 136 | Noncurrent liabilities | 1,048 | 1,100 |

Operating loans | 853 | 810 | Guarantee deposited | 750 | 754 |

Noncurrent Assets | 1,715 | 1,824 | Borrowing Ballance | 754 | 924 |

Tangible Assets | 1,150 | 1,262 | Total Liabilities | 2,263 | 2,478 |

Intangible Assets | 133 | 119 | Net Assets | 1,820 | 1,824 |

Investment, Others | 431 | 440 | Shareholder’s Equity | 1,686 | 1,705 |

Total Assets | 4,083 | 4,303 | Total Liabilities and Net Assets | 4,083 | 4,303 |

*Unit: million yen. Borrowing Balance = Long-term debt + Short-term debt + Current portion of long-term debt due within one year

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

The total assets as of the end of the second quarter of the fiscal year ending December 2025 stood at 4,303 million yen, up 220 million yen from the end of the previous fiscal year. This is mainly because of an increase in inventories. Total liabilities increased 215 million yen to 2,478 million yen, mainly due to an increase in short-term borrowings. Total net assets increased 4 million yen to 1,824 million yen, mainly due to posting net income.

Equity ratio declined by 1.9 points from the end of the previous fiscal year to 40.4%.

3. Fiscal Year ending December 2025 Earnings Forecasts

Forecasts of Consolidated Business Results

| FY 12/24 | Ratio to Sales | FY 12/25 Est. | Ratio to Sales | YoY |

Sales | 2,083 | 100.0% | 3,292 | 100.0% | +58.0% |

Operating Income | 22 | 1.1% | 189 | 5.8% | +748.8% |

Ordinary Income | 24 | 1.2% | 178 | 5.4% | +615.3% |

Net Income | 31 | 1.5% | 90 | 2.8% | +190.1% |

*Unit: million yen.

The full-year forecast has been left unchanged. In the fiscal year ending December 2025, sales are expected to increase 58.0% year on year to 3,292 million yen, and operating income is projected to rise 748.8% year on year to 189 million yen. In the second half of FY 12/2025, they are expected to complete the project for opening new laundromats that has been postponed from the first half and increase renovation projects, including the installation of additional equipment.

The company will further accelerate the growth of its “self-service laundry business as a platform.” In the FC division, it will gradually install its original washing and drying machines in laundromats and expand its laundromat network. In the laundromat operation division, the company will conduct a PR campaign that will exceed the level of the fiscal year ended December 2024. In addition to giveaway campaigns featuring prizes provided by advertisers, the company plans to continue offering added value beyond laundry services, such as information on how to purchase Miyazaki Wagyu at special prices and advertisements for new products. In addition, the company will sell shipping container-type self-service laundromats and develop, sell, and operate laundromats using shipping containers, including hotels.

The company plans to open 30 franchised laundromats, and the number of franchised laundromats is expected to reach 548, including 65 directly managed laundromats, by the end of the fiscal year.

4. Conclusions

In the first half of FY 12/2025, sales and profit fell below the forecast, because the number of unsunny days was larger than usual and the opening of new laundromats was postponed until the second half, but they steadily increased sales by 28.0% year on year. The operation of laundromats equipped with unique washing and drying machines developed by the company has just started, and such laundromats are expected to increase at an accelerated rate. In terms of profit, the company has already moved into the black. In addition, the number of downloads of Washhouse App has steadily grown, fortifying the customer base. The shipping container business has started on a full-scale basis and was profitable in the first half of the year, so we look forward to seeing it contribute to profit. Regarding overseas business operation, they exhibited their products and services at a home appliance expo in China in March, causing significant repercussions. We would like to expect that they will open a laundromat in China within this year.

The company got listed in 2016, and share price has been stagnant since 2017. The current share price is much lower than the IPO price (1,150 yen after retroactive adjustment). However, thanks to the outcomes of activities for reforming the revenue structure, they increased sales and profit from the previous fiscal year in FY 12/2024, and are expected to increase sales and profit significantly by installing their unique laundry equipment in laundromats in FY 12/2025. The outlook for FY 12/2026, in which the shipping container business and overseas business operation are expected to be conducted on a full-scale basis, is also bright. It is expected that the company will keep improving its performance and the evaluation of the company in the stock market will change significantly.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 1 outside one |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report

Last update date: March. 28, 2025

<Basic policies>

Our company will comply with laws, carry out fair and transparent corporate activities, and contribute to the regional community by achieving growth. Additionally, we will strive to gain trust from all concerned stakeholders including shareholders, customers, clients, employees, and the regional community and plan to expand global corporate activities in the future.

Furthermore, we aim to maximize our corporate value by improving the management’s fairness and transparency, making agile adaptation to environmental changes, strengthening our competitiveness, and striving to build a corporate governance structure according to our company’s growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company mentioned, “We will implement all of the basic principles.”

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |