Bridge Report:(7191)Entrust the term ended March 2022

President Yutaka Kuwabara | Entrust Inc. (7191) |

|

Company Information

Market | TSE Prime |

Industry | Other financial business (finance and insurance) |

President | Yutaka Kuwabara |

HQ Address | 1-4 Kojimachi, Chiyoda-ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥547 | 22,357,364 shares | ¥12,229 million | 18.6% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥13.00 | 2.4% | ¥40.70 | 13.4x | ¥198.93 | 2.7x |

* Share price as of closing on June 2. Number of shares issued at the end of the most recent quarter excluding treasury shares.

*BPS and ROE are the results for the term ended March 2022. The figures are rounded off.

*DPS and EPS are the company's forecasts for the tern ending March 2023.

Non-Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2019 (Actual) | 3,136 | 842 | 840 | 564 | 25.44 | 7.00 |

Mar. 2020 (Actual) | 3,626 | 1,021 | 1,026 | 687 | 30.93 | 9.00 |

Mar. 2021 (Actual) | 4,203 | 1,149 | 1,153 | 760 | 34.07 | 11.00 |

Mar. 2022 (Actual) | 4,943 | 1,184 | 1,179 | 779 | 34.88 | 12.00 |

Mar. 2023 (Forecast) | 6,200 | 1,450 | 1,450 | 910 | 40.70 | 13.00 |

*The forecasted values are from the company. Unit: million yen, yen.

This report includes the overview of the financial results of Entrust Inc. for the term ended March 2022.

Table of Contents

Key Points

1. Company Overview

2. Mid-term Management Plan (2022-2024) —Road to the Higher

3. Fiscal Year ended March 2022 Earnings Results

4. Fiscal Year ending March 2023 Earnings Forecasts

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended March 2022, sales grew 17.6% year on year to 4,943 million yen and operating income rose 3.0% year on year to 1,184 million yen. In terms of sales, new contracts for rent payment guarantee increased significantly, contributing to the sales growth, but the sales from the guarantee of medical charges dropped due to mainly the constraint of marketing, etc. caused by the spread of COVID-19 in the first half. In terms of profit, bad debt costs augmented due to the increase of subrogation payment through the growth of the rent payment guarantee service, and there were temporary expenses for opening centers and closing Yokohama Solution Center.

- For the term ending March 2023, sales are expected to grow 25.4% year on year to 6.2 billion yen and operating income is projected to rise 22.4% year on year to 1,450 million yen. In terms of sales, the increase of new contracts, monthly renewed contracts, etc. will increase the sales from rent payment guarantee, and then sales are expected to grow. In terms of profit, the increase rate of bad-debt costs is projected to decline thanks to the sales growth of rent payment guarantee and the development of a system for responding to the increase of guarantee contracts, and the decline in temporary expenses for establishing centers is forecast to contribute to profit. Regarding dividends, the company plans to pay an interim dividend and a term-end dividend of 6.50 yen/share each, a total of 13.00 yen/share, up 1.00 yen/share from the previous term. The expected payout ratio is 31.9%.

- As many medical institutions around Japan see some medical charges uncollected, the market of guarantee of medical charges is expected to grow. Although the impact of the spread of COVID-19 is lingering, the company is predicted to enhance its marketing activities more than ever in the term ending March 2023, while looking ahead to the post-pandemic period. It is noteworthy how much they can increase affiliated medical institutions through the enhancement of marketing activities.

1. Company Overview

As a comprehensive guarantee service provider, it offers a wide range of guarantees that replace joint guarantors, such as medical expense payment guarantees at hospitals and nursing-care fee payment guarantees at nursing homes, with a focus on rent payment guarantees for rental housing. The company also focuses on providing the services derived from guarantees (solution business) and aims to contribute to society through its guarantee businesses. The company’s headquarters is in Tokyo, and it also has offices in Sendai, Akita, Toyama, Hamamatsu, Nagoya, Osaka, and Fukuoka. The corporate name is derived from the English word “Entrust.” As a comprehensive guarantee service company, it aims to be a company that can provide satisfactory services by gaining the full trust of customers in all fields and entrusting them with their operations.

Prestige International (S) Pte Ltd. (Singapore), a group company of Prestige International Inc. (4290) listed on the Tokyo Stock Exchange’s Prime Market, holds 56.84% of their outstanding shares.

(1) Management philosophy

The company’s management stance is to provide its clients with three values (joy, peace of mind, and trust), while it operates business in accordance with its five principles (excitement, challenge, awareness, dignity, and active participation). In addition, it aims to be a company where the growth of the company and the happiness of employees are linked, and in the belief that “if all employees can sense this, the company will definitely grow,” the company closely observes its three mottos (cheerful, fun, and serious) in its daily work.

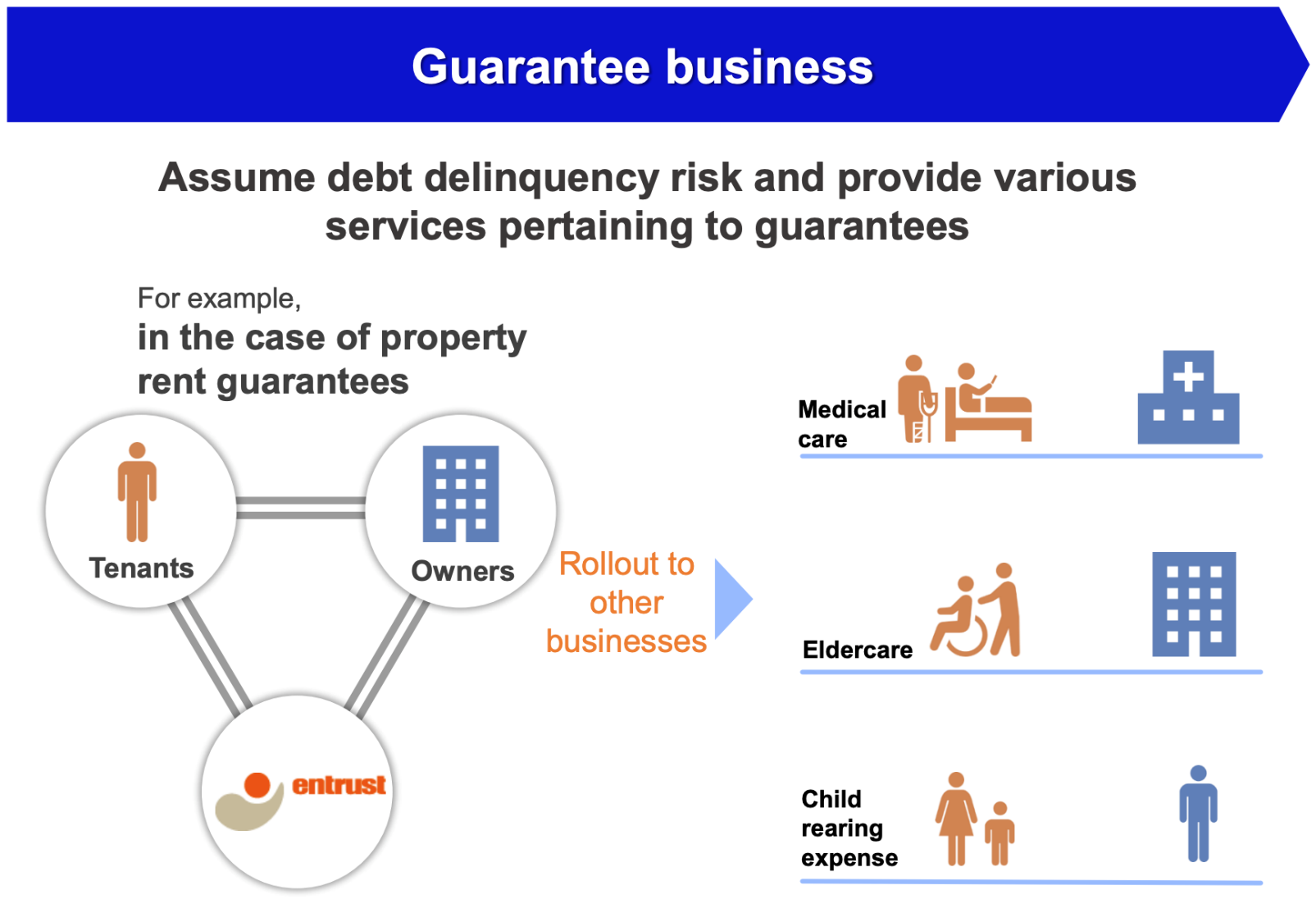

(2) Business outline

Under the single segment of comprehensive guarantee service, its businesses are divided into the guarantee business and the solution business. In the guarantee business, the company covers the risk of delinquency of various expenses related to contracts as a joint guarantor, and provides related services to real estate management companies, etc., such as application screening, debt collection, legal response support, and receivables management.

On the other hand, in the solution business, the company does not provide joint guarantees, but only provides related services. For this reason, the main revenue in the guarantee business is the guarantee fees from lessees and the commissions from real estate management companies, etc., while in the solution business, the main revenue arises from the commissions from real estate management companies, etc. Sales in both services are divided into new sales associated with new contracts, and renewal and running sales (recurring sales), pushing up the ratio of recurring sales year by year (profit growth and strengthening of the revenue base are also progressing).

◎ Guarantee Business (61.8% of sales in the term ended March 2022)

The company offers mainly rent payment guarantees, medical expense payment guarantees, nursing care cost payment guarantees, and child support expense payment guarantees. The subscription rate of rent payment guarantee in the rental real estate field is around 80%, and the market continues to grow. In the case of rent payment guarantee, the company acts as a joint guarantor of the lessee in each lease contract of rental property, and assumes the risk of delinquent payment of rent, etc. In the medical cost payment guarantee, however, the company acts as a joint guarantor in the hospitalization procedures of each medical institution, and assumes the risk of delinquency related to the payment of hospitalization expenses, etc. In the case of guarantee for payment of nursing-care charges, the company acts as a joint guarantor in the tenancy contract of a nursing care facility, and assumes the risk of delinquency, such as fees for nursing care facilities. In the case of guarantee for payment of expenses for bringing up children, it will act as a joint guarantor of the person who pays child support and assumes the risk of non-payment of child support.

In the rent payment guarantee and the guarantee for payment of nursing-care charges businesses, compensation is received at the time of a guarantee contract and its renewal, and the compensation is divided pro rata according to the number of months within the guarantee period and recorded as sales. In the medical expense payment guarantee, sales are mainly recorded for each target month. In addition, regarding the rent payment guarantee and the guarantee for payment of expenses for bringing up children, the company minimizes risks and stabilizes earnings by conducting pre-underwriting screening and delinquent payment collection (emphasis on compliance). In the case of medical expense payment guarantee and nursing-care cost payment guarantee, the company normally concludes insurance contracts with non-life insurance companies to hedge the risk of delinquency.

(Source: materials for explaining the company’s financial results)

In addition to expanding rent payment guarantees, medical expense payment guarantees are expected to grow in the future. The company’s research shows that unpaid medical expenses of about 4.5 million yen are occurring on average per hospital. Changes in the external environment, such as the amendment of the Civil Code, an increase in the number of foreign visitors to Japan, and an increase in the burden of medical expenses at the counter will boost the trend, and it is expected that the market for guaranteeing the payment of medical care costs will expand in the future. The company targets approximately 8,300 medical institutions with hospitalization facilities nationwide (excluding psychiatric departments) and through partnerships with major non-life insurance companies, it plans to accelerate the introduction of medical expense payment guarantee to hospitals.

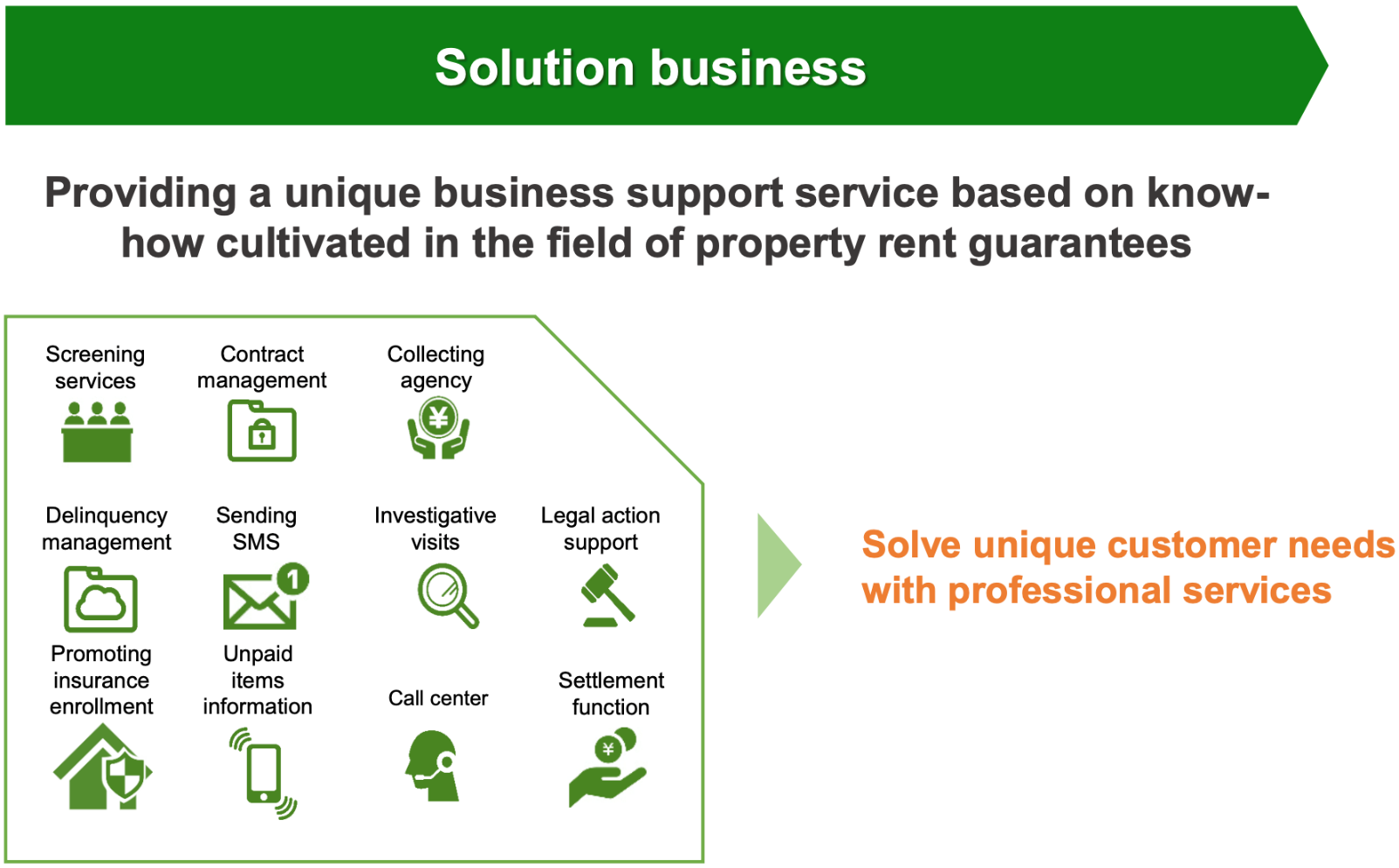

◎ Solution Business (38.2% of sales in the term ended March 2022)

Solution Business is divided into C&O (Consulting & Operation) service, insurance desk service, and Doc-on service. The C&O service provides the know-how cultivated through the company’s rent payment guarantee as an entrustment service, and offers services for tenants of rental real estate, such as screening, delinquency management, and notification on unpaid amounts, to real estate management companies full-line or individually. The company has established systems that can flexibly provide various related services, such as a unique screening system based on a scoring model and an in-house call center.

The insurance desk service cooperates with non-life insurance companies and small-premium short-term insurance companies to comprehensively support the operations of real estate management companies, such as solicitation of fire insurance for residents of rental housing and promotion of insurance coverage. Specifically, the company will provide guidance on fire insurance, respond to inquiries by the call center, conclude contracts, transfer after the conclusion of contracts, etc. and report to the real estate management company. After the revision to the Insurance Business Act that came into effect in May 2016, the service has gained a reputation as a service that solves various problems faced by real estate management companies ((1) increase in workload due to stricter regulations on solicitation of insurance, (2) improvement of insurance coverage rate, and (3) response to the duty of care of a prudent manager in terms of compliance). To provide services, it is essential that the company has specialized knowledge and know-how, a dedicated system, and an operation system.

The Doc-on service is a package of SMS (short message service), a credit card payment service, and a call center service (SMS list management, message creation, delivery volume management, call center support such as receivership correspondence, payment confirmation, report management, etc.). Their three strengths can be cited as (1) high security using the communication networks of major domestic SMS carriers, (2) cost reduction required for contacts compared to postal guidance in paper media, and (3) high open rate compared to conventional communication methods such as postcards and e-mails.

(Source: materials explaining the company’s financial results)

(3) Company’s strengths in Guarantee Business

To generate profits in the maintenance business, controlling delinquency rate and improving late collection rate are vital. The company controls delinquency rate through transactions with good customers and optimum screening while collections are appropriately enforced, collecting most of the delinquencies. The following three advantages of the company in these guarantee operations are its profit-generating drivers.

Evaluation | ◆ Precise operation based on accurate risk assessment ◆ Improving economic efficiency rather than unreasonable expansion by selecting excellent lenders and borrowers (high profit margin) ◆ Generating a virtuous cycle of expanding the customer base |

Recovery | ◆ Compliance-oriented collection (certified through strict auditing when listed) ◆ Steady implementation of legitimate legal processing ◆ Efficient collection schemes by specialized staff and the supporting IT infrastructure |

Expertise | ◆ Accumulation of screening and collection know-how (expertise) ◆ Freeing the client organizations’ staff (real estate management companies, hospitals, etc.) from unfamiliar tasks ◆ Meeting needs by proposing solutions |

2. Mid-term Management Plan (2022-2024) —Road to the Higher

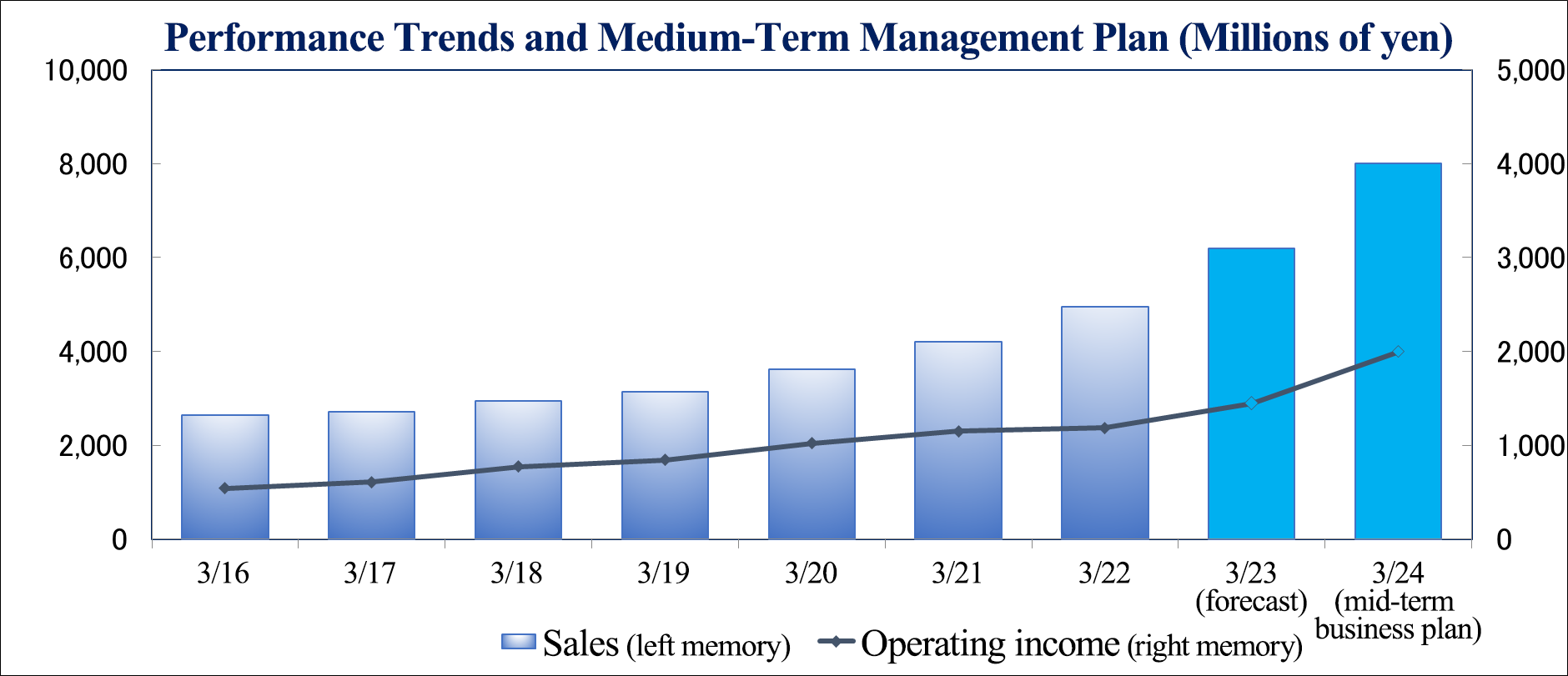

On May 14, 2021, the company announced a mid-term management plan for the three-year period from the term ended March 2022 to the term ending March 2024.

(1) Numerical goals

They aim to achieve sales of 8 billion yen and an operating income of 2 billion yen in the term ending March 2024.

| FY3/21 (Results) | FY3/24 (Goal) | Growth rate |

Sales | 4,203 | 8,000 | 1.90 times CAGR: 23.9% |

Operating Income | 1,149 | 2,000 | 1.74 times CAGR: 20.3% |

Operating Income Margin | 27.4% | 25.0% | - |

Payout Ratio | 32.3% | 30-40% | - |

ROE | 20.8% | 20.0% | - |

*Unit: million yen. CAGR is calculated by Investment Bridge Co., Ltd.

(2) What is expected to be achieved in the second mid-term management plan

While the first mid-term management plan (the term ended March 2019 to the term ended March 2021): To Realize Zero to One corresponds to “hop” of triple jump, the second mid-term management plan corresponds to “step” of triple jump.

As indicated by its subtitle: “Road to the higher, Let’s Go! 10 billion yen,” the target sales for the term ending March 2024 are set at 8 billion yen. For further growth, the three-year period of the second mid-term management plan is positioned as the period for preparing for achieving sales of 10 billion yen in the third mid-term management plan, which corresponds to “jump” of triple jump.

Concretely, they will implement the following measures.

Growth in the conventional and new markets | Conventional market (rental real estate field) | Shift to growth, further expansion |

New market (healthcare/nursing-care field) | Full-throttle acceleration of growth | |

Zero to One Spirit Endeavor and development of new businesses | Business development (in the field of expenses for bringing up children, etc.) | To develop businesses that directly connect to BtoC clients |

New business creation | Endeavor to create new guarantee services |

In the conventional market, the company will release new services for rent payment guarantee to expand the rental real estate field.

In the new market, the company will concentrate on the healthcare field, in which a business model for growth has been established.

Regarding new businesses, the company will pursue the potential of not only BtoB business, but also BtoC business. In addition, the company aims to grow as a provider of comprehensive guarantee service by expanding the system and services for guarantee by sharing the know-how accumulated so far.

(3) Growth strategy

Growing domains | Business segment | Results for FY3/21 | Mid-term plan for FY3/24 | Growth rate | |||

Sales | Ratio to total sales | Sales | Ratio to total sales | ||||

Conventional market | Rental real estate field | Rent payment guarantee & solution | 3,815 | 90.8% | 6,400 | 80% | 1.7 times |

New market | Healthcare field | Medical charge field | 341 | 8.1% | 1,370 | 17% | 4.0 times |

Nursing-care field | Guarantee for payment of nursing-care charges | 36 | 0.9% | 130 | 2% | 3.6 times | |

Creation and development of new businesses | New business | BtoC business of guarantee for expenses for bringing up children and other new businesses | 10 | 0.2% | 100 | 1% | 9.5 times |

| 4,203 | 100% | 8,000 | 100% | 1.9 times | ||

*Unit: million yen

◎ Rent payment guarantee & solutions

The rent payment guarantee business is targeted at growing real estate management firms and provides custom-made services for solving problems with clients. The company will strive to increase average spending per customer through the shift from solution business to guarantee business with high average spending per customer. In addition, the company will release a variety of new services, including the guarantee for credit-card payment of tenants, to expand its market share.

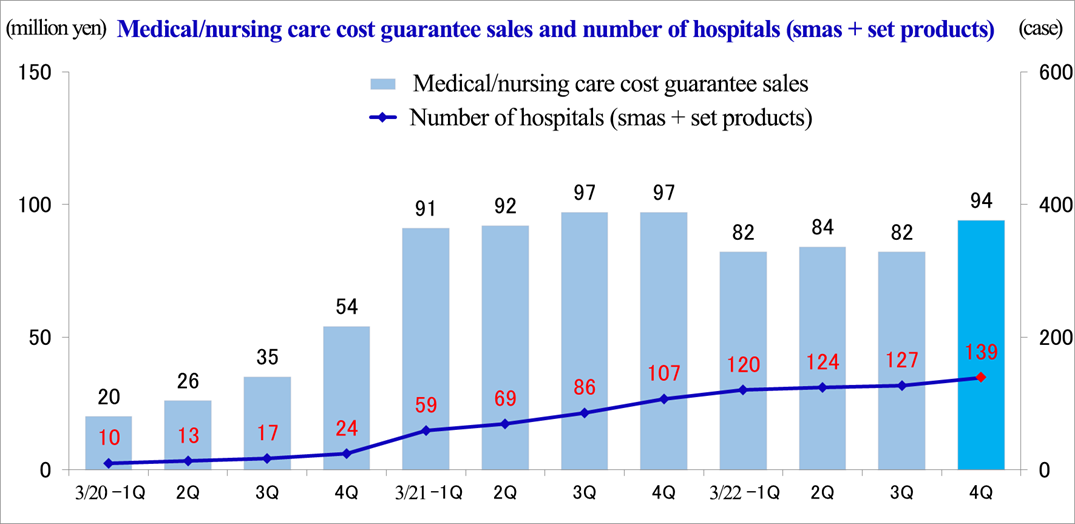

◎ Guarantee for payment of medical charges

The business of guarantee for payment of medical charges is expected to grow in the post-pandemic period, as some hospitals still have accounts receivable from patients. There are few competitors, so they have accumulated know-how in the market created by themselves. By enhancing business cooperation, the company aims to accelerate the growth of this business. In Sma-Hos, a service of guarantee covered by hospitals, they will cement the alliances with non-life insurance companies. In the service package of guarantee with hospitalization covered by patients, they will actively form alliances with linen suppliers. This business is targeted at about 8,300 hospitals with hospitalization facilities, excluding psychiatric departments. The company plans to increase its market share from about 2.9% to 5.3% in the final term of the mid-term plan.

◎ Guarantee for payment of nursing-care charges

For the business of guarantee for payment of nursing-care charges, the company will conduct active investment, and cultivate and energize the market as the front-runner. With the custom-made guarantee service that is the most excellent as of today, the company will propose the guarantee service to leading nursing-care facility operators, to spread the service.

◎ Guarantee for expenses for bringing up children

In the field of guarantee for expenses for bringing up children, too, the company is the front-runner, and operates this service as a BtoC business in cooperation with Internet companies. To achieve commercialization in the three-year period of the ongoing mid-term plan, the company will upgrade and promote insurance services, invest in marketing, sales, and online systems, and strengthen its brand for enhancing popularity and promoting customer learning.

◎ Creation of new businesses

Furthermore, the company will endeavor to create new businesses following the guarantee for payment of medical, nursing-care, and childcare charges, with the aim of triggering destructive innovation. The company will also discuss the alliances with venture firms, invest in them, and implement M&A, while enhancing the development of new guarantee programs for mortgages, scholarships, etc. and other services.

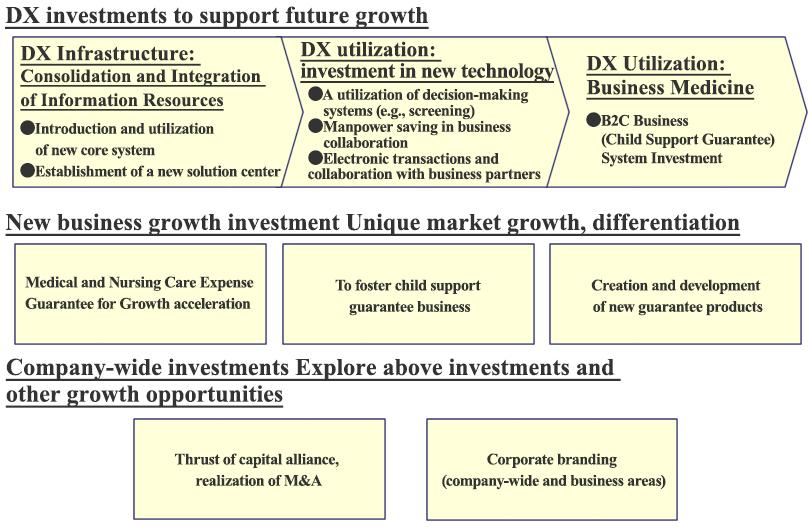

(3) Investment policy and financial strategy that underpin growth

The company plans to implement the following investment for growth, spending 1.5 to 2 billion yen in three years.

For DX, which will support future growth, the company plans to allocate funds to the establishment of a new solution center (call center), the adoption of AI for screening, labor saving, BtoC business systems, etc.

For developing new businesses, the company will develop new guarantee services, to popularize the company as a comprehensive guarantee service provider.

In addition, the company will actively form alliances and implement M&A, and while acknowledging that it is essential to improve its corporate brand to expand business and recruit more new graduates, the company will organize a project team and work on measures, including the update of its website.

(Taken from the mid-term management plan of the company)

The company will allocate 2.5 billion yen, which will be generated through operating cash flow in the three-year period of the ongoing mid-term plan, to the investment for growth spending 1.5 to 2 billion yen and shareholder return with a payout ratio of 30 to 40%. As of the end of the previous term, the company held about 3 billion yen in cash, but according to the situation, the company will consider borrowing money from banks.

Regarding ROE, the company will allocate the funds generated through cash flows, which will increase in parallel with growth, to reinvestment, to accelerate the growth speed and keep the rate 20% or higher.

(4) Promotion of initiatives for ESG and SDGs

Guarantee is a new partnership for providing peace of mind among people. The provision of peace of mind facilitates the reduction of inequality of opportunities, the expansion of fair transactions, the realization of new partnerships in response to social changes, etc. The company helps solve social issues through various guarantee businesses.

Some cases in which the company’s guarantee services helped solve social issues | |

Rent payment guarantee | For the guarantee service for elderly people, the company added a regular monitoring service, to dispel owners’ anxiety, which increased opportunities to rent for elderly people. |

Guarantee for payment of medical charges | This service solved the problems with hospitalized patients who cannot find co-signers and medical institutions that have accounts receivable from patients, securing patients’ opportunities to be hospitalized and stabilizing the management of medical institutions. |

Guarantee for payment of nursing-care charges | This service provided elderly people who cannot find co-signers with opportunities to enter nursing-care facilities. Through the popularization of guarantee for payment of nursing-care charges, the risk of lessors is expected to be reduced and the deposit to be paid at the time of moving-in is expected to decrease. |

Guarantee for payment of expenses for bringing up children | By spreading the reliable service of guarantee for payment of expenses for bringing up children, the company contributes to the better lives of single-parent families and the healthy growth of children. |

3. Fiscal Year ended March 2022 Earnings Results

(1) Non-consolidated earnings

| FY3/21 | Ratio to Sales | FY3/22 | Ratio to Sales | YoY |

Sales | 4,203 | 100.0% | 4,943 | 100.0% | +17.6% |

Gross Profit | 2,126 | 50.6% | 2,398 | 48.5% | +12.8% |

SG&A | 976 | 23.2% | 1,214 | 24.6% | +24.4% |

Operating Income | 1,149 | 27.4% | 1,184 | 24.0% | +3.0% |

Ordinary Income | 1,153 | 27.4% | 1,179 | 23.9% | +2.3% |

Profit Attributable to Owners of Parent | 760 | 18.1% | 779 | 15.8% | +2.5% |

*Unit: million yen

*Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report).

Sales and operating income grew 17.6% and 3.0%, respectively, year on year.

Sales stood at 4,943 million yen, up 17.6% year on year. In terms of sales, new contracts for rent payment guarantee increased significantly, and sales from rent payment guarantee increased 43.3% year on year. On the other hand, the sales from the guarantee of payment of medical fees dropped due to mainly the constraint of marketing, etc. caused by the spread of COVID-19 in the first half.

Operating income was 1,184 million yen, up 3.0% year on year. In terms of profit, bad debt costs augmented due to the increase of subrogation payment through the growth of the rent payment guarantee service, and there were temporary expenses for opening centers and closing Yokohama Solution Center. Gross profit margin dropped 2.1 points year on year to 48.5%. In addition, the ratio of SG&A to sales rose 1.3 points year on year to 24.6%. As a result, operating income margin declined 3.4 points year on year to 24.0%. Regarding non-operating profit/loss, loss on retirement of fixed assets posted as non-operating expenses amounted to 9 million yen (there was no such loss in the previous term). In addition, no extraordinary profit/loss was posted.

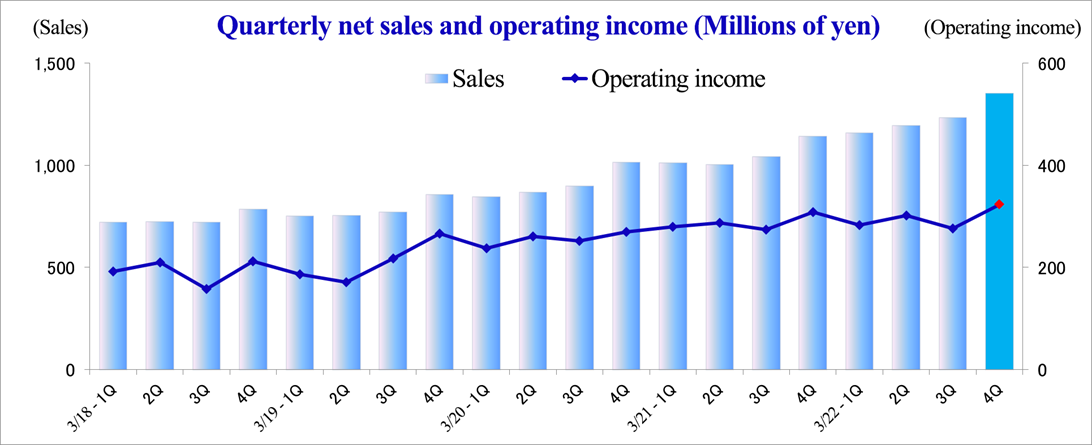

Variation in quarterly performance

Quarterly sales and profit increased quarter on quarter and year on year.

Factors in increase/decrease of operating income

Operating income in FY3/21 | 1,149 |

Growth of sales from guarantee | +758 |

Decline in sales from solutions | -18 |

Increase in entrustment fees | -281 |

Drop in insurance premiums (related to guarantee) | +79 |

Augmentation of bad debt + execution of guarantee | -137 |

Augmentation of personnel expenses | -100 |

Increase in other expenses | -266 |

Operating income in FY3/22 | 1,184 |

*Unit: million yen

The company allocated funds to the establishment of mission-critical systems and centers in preparation for the growth of the rent payment guarantee services and its business. They are expected to improve business operations from the next term. Entrustment fees increased 281 million yen year on year in parallel with the growth of sales from rent payment guarantee. In addition, insurance premiums (guarantee-related costs) decreased 79 million yen year on year, through the adjustment of guarantee fees for payment of medical charges. In addition, personnel expenses augmented 100 million yen year on year, and other expenses, including rent payment fees, debt collection costs, and costs for establishing centers, increased 266 million yen year on year.

(2) Trend of each business

| FY3/21 | Ratio to Sales | FY3/22 | Ratio to Sales | YoY |

Sales | 4,203 | 100.0% | 4,943 | 100.0% | +17.6% |

Guarantee Business | 2,294 | 54.6% | 3,053 | 61.8% | +33.1% |

Solution Business | 1,909 | 45.4% | 1,890 | 38.2% | -1.0% |

No. of Contracts in the Rent Field at the End of the Term [Contracts] | 385,833 | 100.0% | 407,512 | 100.0% | +5.6% |

Guarantee Business [Contracts] | 113,283 | 29.4% | 146,885 | 36.0% | +29.7% |

Solution Business [Contracts] | 272,550 | 70.6% | 260,627 | 64.0% | -4.4% |

*Unit: million yen. The number of contracts in the rent field in the term ended March 2022 is a roughly estimated one.

◎ Guarantee Business

The sales of the guarantee business grew, thanks to the increase of new contracts for rent payment guarantee and the rise in updated guarantee fees through the increase of contracts in effect.

On the other hand, the sales from guarantee for repayment of medical charges declined, due to the constraint of marketing amid the spread of COVID-19 in the first half. Despite the impact of the COVID-19 pandemic, the company enhanced marketing in the second half, increasing affiliated medical institutions and new customers, and the performance in the fourth quarter offset the decline in guarantee fees collected from existing customers.

[Data on affiliated parties]

Sma-Hos, a system for serving as a cosigner of each customer | 73 medical institutions (+17 from the end of the previous term); the number of hospital beds: 19,608 |

Hospitalization service with guarantee for payment of medical charges, etc. | 172 medical institutions (+14 from the end of the previous term); the number of hospital beds: 34,404 |

Guarantee for payment of nursing-care expenses | 205 nursing care business operators (+ 6 from the end of the previous term) |

*Produced by Investment Bridge Co., Ltd. with reference to the material for briefing financial results of Entrustment.

◎ Solution Business

Through the shift from solution business to guarantee business, sales declined, but for insurance desk service, the service of promoting small-premium short-term insurance performed well.

(3) Financial condition and cash flow

◎Financial condition

| May 2021 | May 2022 |

| May 2021 | May 2022 |

Cash and Deposits | 3,075 | 3,268 | Deferred Revenue/Contract Liabilities | 946 | 1,182 |

Advances Paid | 1,537 | 2,011 | Provision for Execution of Guarantee | 102 | 111 |

Current Assets | 4,677 | 5,310 | Current Liabilities | 1,551 | 1,774 |

Tangible Fixed Assets | 51 | 95 | Fixed Liabilities | 59 | 96 |

Intangible Fixed Assets | 239 | 250 | Liabilities | 1,611 | 1,871 |

Investments and Other Assets | 575 | 669 | Net Assets | 3,933 | 4,454 |

Fixed Assets | 866 | 1,015 | Total Liabilities and Net Assets | 5,544 | 6,325 |

*Unit: million yen

The total assets as of the end of March 2022 stood at 6,325 million yen, up 780 million yen from the end of the previous term. Major factors in the increase in total assets include, in the side of assets, cash and deposits, advances paid, prepaid expenses, and investments and other assets, and in the side of liabilities and net assets, contract liabilities (deferred revenues in the previous term), provision for execution of guarantee, other fixed liabilities, and retained earnings due to the posting of net income. As current assets account for about 84% of total assets, the liquidity of assets is high. Capital-to-asset ratio is as high as 70.3%.

◎ Cash flow

| FY3/21 | FY3/22 | Y/y | |

Operating Cash Flow | 551 | 618 | 67 | +12.2% |

Investing Cash Flow | -267 | -169 | 97 | - |

Free Cash Flow | 284 | 449 | 165 | +58.2% |

Financing Cash Flow | -225 | -257 | -31 | - |

Cash and Equivalents at the End of Term | 3,075 | 3,268 | 192 | +6.2% |

*Unit: million yen

In terms of cash flows, the cash inflow from operating activities expanded thanks to the increases in net income before taxes and other adjustments, depreciation, and provision for doubtful receivables. The cash outflow from investment activities shrank due to the decline in the expenditure for acquiring tangible and intangible fixed assets and the expenditure for acquiring investment securities, and the surplus of free cash flow grew. The cash outflow from financial activities augmented due to the increase in payment of dividends, etc. Accordingly, the term-end cash position increased 6.2% year on year.

4. Fiscal Year ending March 2023 Earnings Forecasts

(1) Earnings forecasts

| FY3/22 | Ratio to Sales | FY3/23 Est. | Ratio to Sales | YoY |

Sales | 4,943 | 100.0% | 6,200 | 100.0% | +25.4% |

Operating Income | 1,184 | 24.0% | 1,450 | 23.4% | +22.4% |

Ordinary Income | 1,179 | 23.9% | 1,450 | 23.4% | +22.9% |

Net Income | 779 | 15.8% | 910 | 14.7% | +16.7% |

*Unit: million yen

Sales and operating income projected to grow 25.4% and 22.4%, respectively, year on year.

It is forecast that sales will grow 25.4% year on year to 6.2 billion yen and operating income will rise 22.4% year on year to 1,450 million yen.

In terms of sales, the sales of the solution business, which will continue the shift to guarantee services in C&O services, will decline, but the sales of the guarantee business will grow due to the increase of contracts for rent payment guarantee and the significant rise in renewal guarantee fees due to the increase of monthly renewed contracts.

In terms of profit, the sales of the guarantee business will grow, the increase rate of bad-debt costs will decrease thanks to the establishment of a system for coping with the increase of guarantee contracts, and temporary expenses for opening centers will drop, contributing to profit.

Regarding dividends, the company plans to pay an interim dividend and a term-end dividend of 6.50 yen/share each, a total of 13.00 yen/share, up 1.00 yen/share from the previous term. The expected payout ratio is 31.9%.

Factors in the increase/decrease of operating income

Operating income in FY3/22 | 1,184 |

Increase in sales from guarantee | +1,486 |

Decrease in sales from solutions | -228 |

Increase in entrustment fees | -445 |

Increase in insurance premiums (related to guarantee) | -47 |

Augmentation of bad debt + execution of guarantee | -90 |

Augmentation of personnel expenses | -85 |

Increase in other expenses | -322 |

Operating income in FY3/23 | 1,450 |

*Unit: million yen

The total amount of entrustment fees is expected to increase 445 million yen year on year, in parallel with the growth of sales from rent payment guarantee. In addition, insurance premiums (guarantee-related costs) are projected to increase 47 million yen year on year, as guarantee fee adjustment for medical charges will subside. Expenses for bad debt and execution of guarantee are forecast to augment 90 million yen, but the growth rate of bad-debt costs will subside thanks to the development of a system for coping with the increase in payment for guarantee. Also, due to the increase in settlement fees, etc., other expenses are projected to augment 322 million yen, year on year.

(2) Outlook for each business

| FY3/22 | FY3/23 (forecast) | YoY |

Guarantee Business | 3,053 | 4,538 | +48.6% |

Solution Business | 1,890 | 1,660 | -12.2% |

Total Sales | 4,944 | 6,200 | +25.4% |

*Unit: million yen

◎ Guarantee Business

The sales from rent payment guarantee are expected to grow 52.4% year on year. Renewal guarantee fees are expected to rise, due to the accumulation of contracts and monthly renewed contracts.

In the new domain of guarantee, etc., sales are expected to grow 19.9% year on year.

Regarding the guarantee for payment of medical charges, the decline in guarantee fees is subsiding, and the impact of the COVID-19 pandemic is reflected in the plan based on the term ended March 2022.

Regarding the guarantee for payment of nursing-care expenses, the pandemic is subsiding, so the company will enhance activities for expanding sales.

Regarding the guarantee for payment of expenses for bringing up children, the company will improve services and establish a business base.

Sales | FY3/22 | FY3/23 (forecast) | YoY |

Rent Payment Guarantee | 2,696 | 4,110 | +52.4% |

New Domains of Guarantee, etc. | 356 | 427 | +19.9% |

Total Sales of the Guarantee Business | 3,053 | 4,538 | +48.6% |

*Unit: million yen

◎ Solution Business

The sales from solution business are projected to decline 12.2% year on year.

In C&O service, the shift to guarantee services will continue, so sales are projected to drop 15.0% year on year.

In insurance desk service, sales are expected to grow 27.2% year on year, through the expansion of mainly small-premium short-term insurance.

The sales from Doc-on service are forecast to decrease slightly year on year.

Sales | FY3/22 | FY3/23 (forecast) | YoY |

C&O Service | 1,726 | 1,467 | -15.0% |

Insurance Desk Service | 114 | 145 | +27.2% |

Doc-on Service | 49 | 48 | -2.0% |

Total Sales of the Solution Business | 1,890 | 1,660 | -12.2% |

*Unit: million yen

5. Conclusions

According to the company’s plan, sales are expected to grow 25.4% year on year in the term ending March 2023. In particular, the sales from the rent payment guarantee business, which is the mainstay, are expected to grow 52.4% year on year, thanks to the significant increase in renewal guarantee fees due to the increases of contracts and monthly renewed contracts. The steady increase of contracts in the rent field will lead to the rise in renewal guarantee fees and contribute to the stabilization of the revenue base and the improvement in mid/long-term growth potential. It is noteworthy how much they can increase contracts in the rent field in the first half of the term ending March 2023.

The sales from guarantee for payment of medical charges did not reach the forecast in the previous term, due to the constraint on marketing amid the spread of COVID-19 in the first half, but in the second half, marketing activities were conducted actively, increasing new affiliated medical institutions. Although the impact of the spread of COVID-19 is lingering, the company is predicted to enhance its marketing activities more than ever in the term ending March 2023, while looking ahead to the post-pandemic period. As there are many medical institutions around Japan that have accounts receivable from patients, the market of guarantee for payment of medical charges is strongly expected to grow. It is noteworthy how much they can increase affiliated medical institutions through the enhancement of marketing activities.

In addition, we would like to pay attention to the progress of creation of new businesses. The company is endeavoring to create new businesses, following the guarantee for payment of medical charges, nursing-care costs, and expenses for bringing up children, in accordance with their mid-term management plan. They uphold the policy of enhancing the development of new guarantees, such as those for mortgages and scholarships, and new services, and are considering alliances with venture firms, investments in them, and M&A. In the medium/long term, we would like to pay attention to the progress of development of such new guarantees and services with expectation.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 9 directors, including 3 external ones |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report: updated on Dec. 17, 2021

Basic Policy

Our company adheres to the management philosophies of “how much we can please our customers,” “how much we can assure our customers,” and “how much trust we can win from our customers,” and strives to strengthen our corporate governance with a focus on “maintaining compliance and maximizing shareholder profits” while making efforts to expand our business.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Principle | Reasons for not implementing the principles |

[Principle 4-11. Precondition for Ensuring the Effectiveness of the Board of Directors and Audit and Supervisory Board] | Our company’s Board of Directors is comprised of Internal Directors who are familiar with all areas of our business operations, Directors who are involved with general management of Prestige International Group as a Representative Director of its parent company, and Outside Directors who have affluent experience and knowledge as a director of other companies. As it is deemed to contribute to active discussions and quick decision making, the company’s Articles of Incorporation specifies that the number of directors shall be no more than 10. In addition, we have no foreign directors, however, it is determined that the headcount and the balance are currently ensured, since our company’s businesses are conducted within Japan. We ensure that our Corporate Auditors have knowledge necessary for audits conducted by Corporate Auditors obtained from outside seminars and information sharing with relevant accounting auditors, even though they do not have professional knowledge in finance or accounting. |

<Disclosure Based on the Principles of the Corporate Governance Code>

Principles | Disclosure content |

[Principle 1-4. Strategic Shareholding] | Our company shall consider holding shares strategically, when it is determined that such shareholding contributes to improving corporate value through the strengthening of business cooperation, etc. We shall evaluate shares to be held for profitability, taking into account the transaction status and capital costs, and take into consideration the evaluation results, to determine whether to continue holding. We shall reduce any shares that do not meet our shareholding objectives. In addition, we continue holding the shares currently held by us as a result of our calculation of the profitability based on the earnings amount expected from the shareholding and comparison with capital costs, etc. Furthermore, we shall make decisions whether to exercise voting rights by considering the progress toward the shareholding objectives and the business status of the invested companies, after carefully reviewing the details of proposals. Our company shall adequately study related party transactions so that such transactions will not decrease the soundness of the management of our company, that they are effective in light of rational judgments, and that terms and conditions of such transactions do not remarkably differ from other external transactions, before we carry out such transactions. Moreover, we obtain the approval of the Board of Directors for related party transactions when necessary, in accordance with laws and regulations and the internal regulations such as the Regulations of the Board of Directors. In the approving process at the Board of Directors meeting, they conduct adequate deliberation to protect corporate value and the common interests of our company and our shareholders by examining the fairness and validity of such transactions from the more objective position, by having Outside Directors join relevant discussions as well as having Corporate Auditors provide their opinions when necessary. At the same time, our Executives and Executive Officers are required to submit Related Party Transaction Survey Sheets on a regular basis to identify existing transactions with related parties. |

[Principle 3-1. Enhancement of Information Disclosure] | (1) Our management philosophy is disclosed on our website, in addition to the Corporate Governance Report and the Annual Securities Report. For specific management strategies and the management plan, please see our Medium-term Management Plan disclosed on May 14, 2021. (2) Our basic policy on Corporate Governance is disclosed on our website, in addition to the Corporate Governance Report and the Annual Securities Report, based on the principles of each code. (3) Directors’ compensation shall be resolved at the Board of Directors meeting after the deliberations of the voluntary Nomination and Compensation Committee, of which a majority is comprised of Outside Directors, to the extent approved at General Meetings of shareholders. Moreover, Executive Officers may allocate up to three months of the determined compensation to the stock compensation-type stock options. Further, using operating income as a key indicator, we adopted Performance-linked Compensation which provides the amount equivalent to one month of the fixed compensation multiplied by a certain factor as a bonus, if operating income exceeds the forecast by 10% or more. (4) Upon proposing election or removal of an Executive Officer, as well as nomination of candidates for and removal of a Director and an Auditor, the Board of Directors make a resolution comprehensively taking into consideration the candidates’ experience, knowledge, capabilities, personality, and achievements, after examining at the Board of Directors for election or removal of Executive Officers, or after deliberations at the Nomination and Compensation Committee for a resolution proposal for nomination of candidates for and removal of Directors, or after discussing and obtaining an approval from the Audit and Supervisory Committee for Auditors. (5) Upon proposing election and removal of an Executive Officer, as well as nomination of candidates for and removal of a Director and an Auditor, the reason will be explained at the Board of Directors meeting. Furthermore, upon the nomination of a Director and an Auditor, each candidate’s career background, the reason for election of the candidates for Outside Directors and candidates for Outside Auditors, and the reason for removal of a Director and an Auditor, will be stated in the Notice of Convocation of General Meeting of Shareholders. |

[Principle 5-1. Policy on Constructive Dialogue with Shareholders] | With regard to our IR activities, Office of the President assists in dialogue with shareholders under the instructions from our Representative Director and the Head of Business Management Department. We follow our basic policy that the Representative Director handles dialogue with our shareholders, in light of the significance of such dialogue, and also in accordance with shareholders’ requests. Furthermore, our policy provides that we principally hold financial results briefings twice a year, as well as briefing sessions for individual investors whenever necessary. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages, or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (Entrust Inc.: 7191) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.