Bridge Report:(7191)Entrust second quarter of the Fiscal Year ending March 2023

President Yutaka Kuwabara | Entrust Inc. (7191) |

|

Company Information

Market | TSE Prime |

Industry | Other financial business (finance and insurance) |

President | Yutaka Kuwabara |

HQ Address | 1-4 Kojimachi, Chiyoda-ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥694 | 22,359,964 shares | ¥15,517 million | 18.6% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥13.50 | 1.9% | ¥42.71 | 16.2x | ¥198.93 | 3.5x |

* Share price as of closing on November 4. Number of shares issued at the end of the most recent quarter excluding treasury shares.

*BPS and ROE are the results for the term ended March 2022. The figures are rounded off.

*DPS and EPS are the company's forecasts for the term ending March 2023.

Non-Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2019 (Actual) | 3,136 | 842 | 840 | 564 | 25.44 | 7.00 |

Mar. 2020 (Actual) | 3,626 | 1,021 | 1,026 | 687 | 30.93 | 9.00 |

Mar. 2021 (Actual) | 4,203 | 1,149 | 1,153 | 760 | 34.07 | 11.00 |

Mar. 2022 (Actual) | 4,943 | 1,184 | 1,179 | 779 | 34.88 | 12.00 |

Mar. 2023 (Forecast) | 6,230 | 1,530 | 1,530 | 955 | 42.71 | 13.50 |

*The forecasted values are from the company. Unit: million yen, yen.

This Bridge Report reviews the summary of the financial results of the 2Q ending March 2023 and full-year earnings forecasts for the fiscal year ending 2023 of Entrust Inc.

Table of Contents

Key Points

1. Company Overview

2. Mid-term Management Plan (2022-2024) —Road to the Higher

3. Second quarter of the Fiscal Year ending March 2023 Earnings Results

4. Fiscal Year ending March 2023 Earnings Forecasts

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending March 2023, sales grew 26.9% year on year to 2,990 million yen, and operating income rose 32.1% year on year to 773 million yen. In terms of sales, the number of new contracts for rent payment guarantee rose steadily and the number of contracts held increased, so the initial and renewed guarantee fees increased and the sales of the guarantee business grew considerably. In terms of profit, the fee for outsourcing to management companies and bad debt expenses augmented in parallel with the growth of sales of the guarantee business, but the company curtailed the augmentation of other costs, contributing to profit.

- The company revised the earnings forecast for the term ending March 2023 on October 19. According to the new management plan, sales are expected to rise 26.0% year on year to 6,230 million yen, and operating income is projected to increase 29.2% year on year to 1,530 million yen. In terms of sales, sales growth will be driven by the increase of sales from rent payment guarantee through the accumulation of stock, the increase of monthly renewed contracts, etc. In terms of profit, the growth of sales of rent payment guarantee, the subsiding of augmentation of bad debt costs through the development of a system for coping with increased guarantee contracts, and the decline in temporary expenses for opening centers will contribute. In parallel with the revision to the earnings forecast, the forecast dividend has been revised upwardly from 13.00 yen/share per year to 13.50 yen/share per year (up 1.50 yen/share from the previous term). The expected payout ratio is 31.6%.

- The company revised the full-year earnings forecast upwardly, reflecting the favorable results in the first half, but the forecast is still conservative, as the revision was only for taking into account the better-than-expected performance in the first half. Their business performance in the second half of the term is noteworthy, to see how much they can increase sales and profit to achieve the numerical goals in the mid-term plan: sales of 8 billion yen and an operating income of 2 billion yen in the term ending March 2024. The key is the accumulation of stock and the increase of renewed guarantee fees through the increase of monthly renewed contracts. It is noteworthy whether the company will be able to keep increasing new contracts and how much the number of contracts for rents will increase in the second half.

1. Company Overview

As a comprehensive guarantee service provider, it offers a wide range of guarantees that replace joint guarantors, such as medical expense payment guarantees at hospitals and nursing-care fee payment guarantees at nursing homes, with a focus on rent payment guarantees for rental housing. The company also focuses on providing the services derived from guarantees (solution business) and aims to contribute to society through its guarantee businesses. The company’s headquarters is in Tokyo, and it also has offices in Sendai, Akita, Toyama, Hamamatsu, Nagoya, Osaka, and Fukuoka. The corporate name is derived from the English word “Entrust.” As a comprehensive guarantee service company, it aims to be a company that can provide satisfactory services by gaining the full trust of customers in all fields and entrusting them with their operations.

Prestige International (S) Pte Ltd. (Singapore), a group company of Prestige International Inc. (4290) listed on the Tokyo Stock Exchange’s Prime Market, holds 56.84% of their outstanding shares.

(1) Management philosophy

The company’s management stance is to provide its clients with three values (joy, peace of mind, and trust), while it operates business in accordance with its five principles (excitement, challenge, awareness, dignity, and active participation). In addition, it aims to be a company where the growth of the company and the happiness of employees are linked, and in the belief that “if all employees can sense this, the company will definitely grow,” the company closely observes its three mottos (cheerful, fun, and serious) in its daily work.

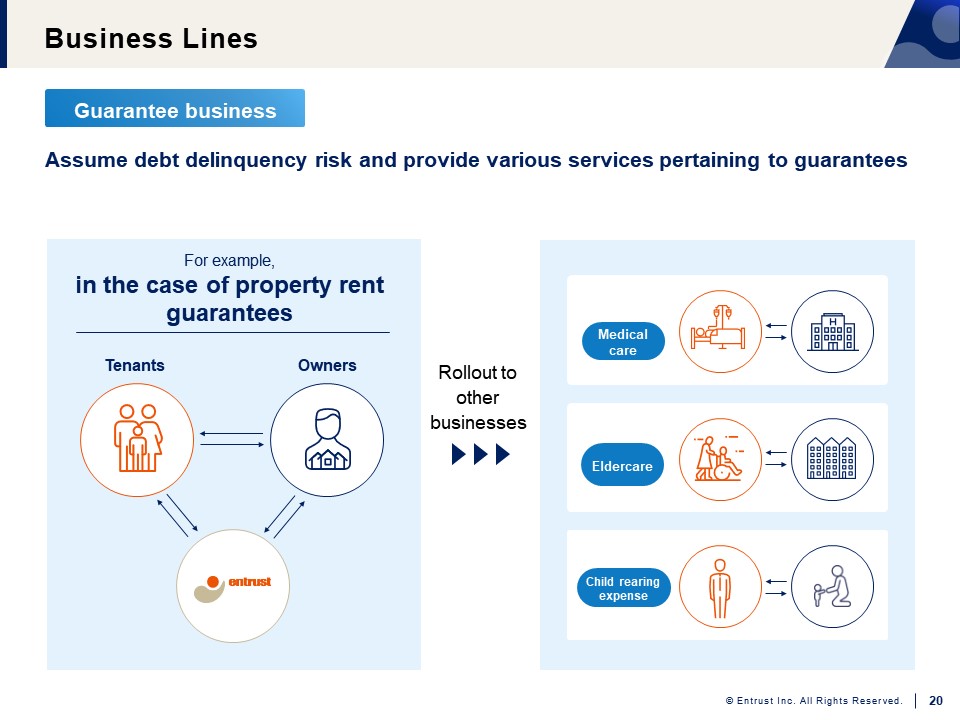

(2) Business outline

Under the single segment of comprehensive guarantee service, its businesses are divided into the guarantee business and the solution business. In the guarantee business, the company covers the risk of delinquency of various expenses related to contracts as a joint guarantor, and provides related services to real estate management companies, etc., such as application screening, debt collection, legal response support, and receivables management.

On the other hand, in the solution business, the company does not provide joint guarantees, but only provides related services. For this reason, the main revenue in the guarantee business is the guarantee fees from lessees and the commissions from real estate management companies, etc., while in the solution business, the main revenue arises from the commissions from real estate management companies, etc. Sales in both services are divided into new sales associated with new contracts, and renewal and running sales (recurring sales), pushing up the ratio of recurring sales year by year (profit growth and strengthening of the revenue base are also progressing).

◎Guarantee Business (72.7% of the sales in the second quarter of the term ending March 2023)

The company offers mainly rent payment guarantees, medical expense payment guarantees, nursing care cost payment guarantees, and child support expense payment guarantees. The subscription rate of rent payment guarantee in the rental real estate field is around 80%, and the market continues to grow. In the case of rent payment guarantee, the company acts as a joint guarantor of the lessee in each lease contract of rental property, and assumes the risk of delinquent payment of rent, etc. In the medical cost payment guarantee, however, the company acts as a joint guarantor in the hospitalization procedures of each medical institution, and assumes the risk of delinquency related to the payment of hospitalization expenses, etc. In the case of guarantee for payment of nursing-care charges, the company acts as a joint guarantor in the tenancy contract of a nursing care facility, and assumes the risk of delinquency, such as fees for nursing care facilities. In the case of guarantee for payment of expenses for bringing up children, it will act as a joint guarantor of the person who pays child support and assumes the risk of non-payment of child support.

In the rent payment guarantee and the guarantee for payment of nursing-care charges businesses, compensation is received at the time of a guarantee contract and its renewal, and the compensation is divided pro rata according to the number of months within the guarantee period and recorded as sales. In the medical expense payment guarantee, sales are mainly recorded for each target month. In addition, regarding the rent payment guarantee and the guarantee for payment of expenses for bringing up children, the company minimizes risks and stabilizes earnings by conducting pre-underwriting screening and delinquent payment collection (emphasis on compliance). In the case of medical expense payment guarantee and nursing-care cost payment guarantee, the company normally concludes insurance contracts with non-life insurance companies to hedge the risk of delinquency.

(Source: materials for explaining the company’s financial results)

In addition to expanding rent payment guarantees, medical expense payment guarantees are expected to grow in the future. The company’s research shows that unpaid medical expenses of about 4.5 million yen are occurring on average per hospital. Changes in the external environment, such as the amendment of the Civil Code, an increase in the number of foreign visitors to Japan, and an increase in the burden of medical expenses at the counter will boost the trend, and it is expected that the market for guaranteeing the payment of medical care costs will expand in the future. The company targets approximately 8,300 medical institutions with hospitalization facilities nationwide (excluding psychiatric departments) and through partnerships with major non-life insurance companies, it plans to accelerate the introduction of medical expense payment guarantee to hospitals.

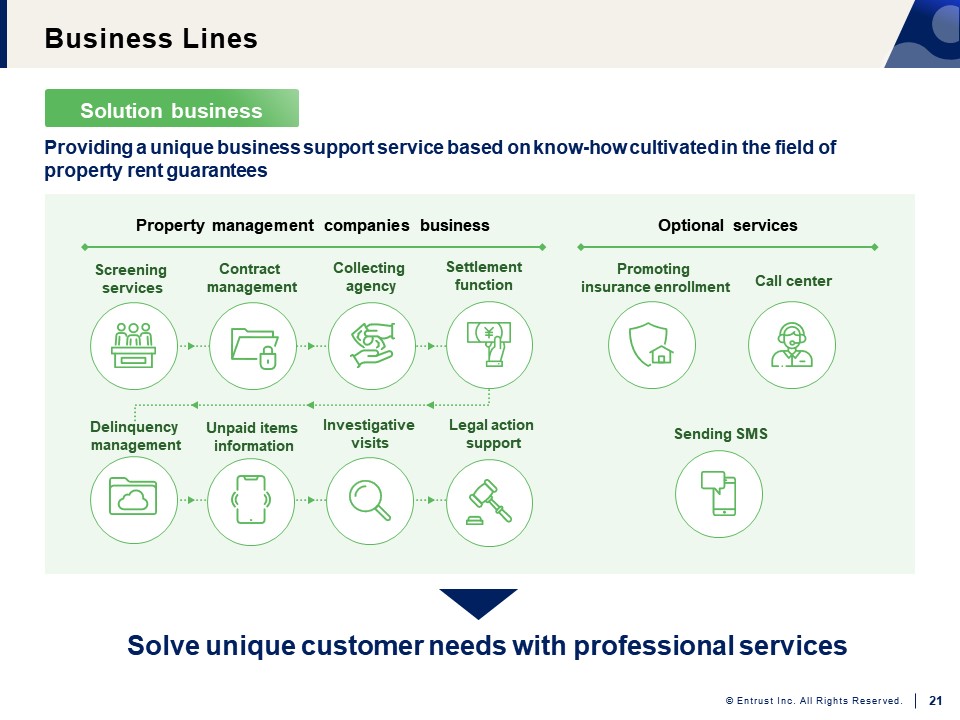

◎Solution Business (27.3% of the sales in the second quarter of the term ending March 2023)

Solution Business is divided into C&O (Consulting & Operation) service, insurance desk service, and Doc-on service. The C&O service provides the know-how cultivated through the company’s rent payment guarantee as an entrustment service, and offers services for tenants of rental real estate, such as screening, delinquency management, and notification on unpaid amounts, to real estate management companies full-line or individually. The company has established systems that can flexibly provide various related services, such as a unique screening system based on a scoring model and an in-house call center.

The insurance desk service cooperates with non-life insurance companies and small-premium short-term insurance companies to comprehensively support the operations of real estate management companies, such as solicitation of fire insurance for residents of rental housing and promotion of insurance coverage. Specifically, the company will provide guidance on fire insurance, respond to inquiries by the call center, conclude contracts, transfer after the conclusion of contracts, etc. and report to the real estate management company. After the revision to the Insurance Business Act that came into effect in May 2016, the service has gained a reputation as a service that solves various problems faced by real estate management companies ((1) increase in workload due to stricter regulations on solicitation of insurance, (2) improvement of insurance coverage rate, and (3) response to the duty of care of a prudent manager in terms of compliance). To provide services, it is essential that the company has specialized knowledge and know-how, a dedicated system, and an operation system.

The Doc-on service is a package of SMS (short message service), a credit card payment service, and a call center service (SMS list management, message creation, delivery volume management, call center support such as receivership correspondence, payment confirmation, report management, etc.). Their three strengths can be cited as (1) high security using the communication networks of major domestic SMS carriers, (2) cost reduction required for contacts compared to postal guidance in paper media, and (3) high open rate compared to conventional communication methods such as postcards and e-mails.

(Source: materials explaining the company’s financial results)

(3) Company’s strengths in Guarantee Business

To generate profits in the maintenance business, controlling delinquency rate and improving late collection rate are vital. The company controls delinquency rate through transactions with good customers and optimum screening while collections are appropriately enforced, collecting most of the delinquencies. The following three advantages of the company in these guarantee operations are its profit-generating drivers.

Evaluation | ◆ Precise operation based on accurate risk assessment ◆ Improving economic efficiency rather than unreasonable expansion by selecting excellent lenders and borrowers (high profit margin) ◆ Generating a virtuous cycle of expanding the customer base |

Recovery | ◆ Compliance-oriented collection (certified through strict auditing when listed) ◆ Steady implementation of legitimate legal processing ◆ Efficient collection schemes by specialized staff and the supporting IT infrastructure |

Expertise | ◆ Accumulation of screening and collection know-how (expertise) ◆ Freeing the client organizations’ staff (real estate management companies, hospitals, etc.) from unfamiliar tasks ◆ Meeting needs by proposing solutions |

(4) External environment in the guarantee market

Oligopolization by leading real estate management companies | Consolidation of real estate management companies Incorporation of the management of real estate into the business of leading management companies and the rise in the rate of use of the institutional guarantee system |

Amendment to the Civil Code | Favorable trend of legislation, and the shift to institutional guarantee It became mandatory to indicate the maximum amount covered by each co-signer, so it became difficult of find co-signers. Accordingly, the demand for institutional guarantee grew. *Enforced on April 1, 2020. |

Increase of households | Stable rental market trend The population is shrinking, but through the increase of households, the number of rental housing units is expected to increase. *National Institute of Population and Social Security Research (2019), “Forecast for the number of households in Japan (in each prefecture)” |

(Taken from the website of the company)

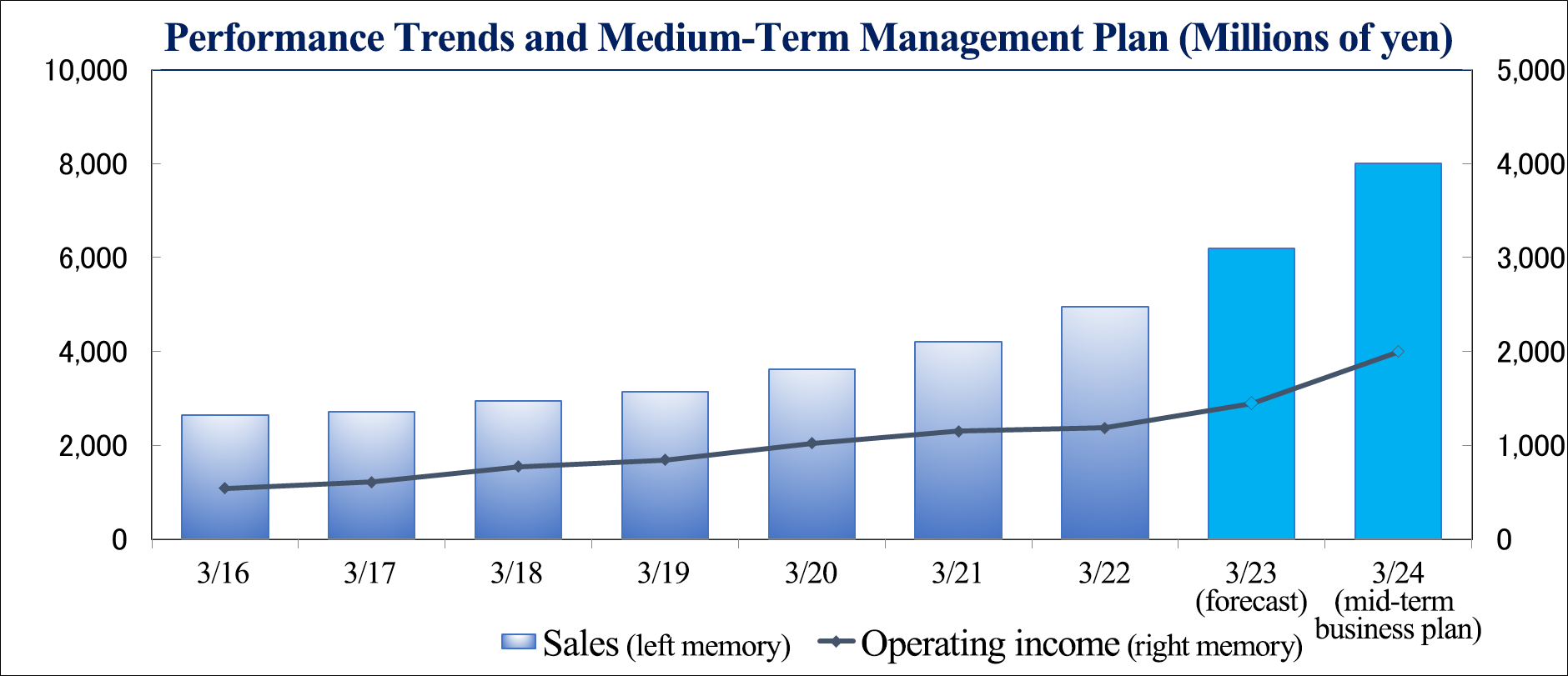

2. Mid-term Management Plan (2022-2024) —Road to the Higher

On May 14, 2021, the company announced a mid-term management plan for the three-year period from the term ended March 2022 to the term ending March 2024.

(1) Numerical goals

They aim to achieve sales of 8 billion yen and an operating income of 2 billion yen in the term ending March 2024.

| FY3/21 (Results) | FY3/24 (Goal) | Growth rate |

Sales | 4,203 | 8,000 | 1.90 times CAGR: 23.9% |

Operating Income | 1,149 | 2,000 | 1.74 times CAGR: 20.3% |

Operating Income Margin | 27.4% | 25.0% | - |

Payout Ratio | 32.3% | 30-40% | - |

ROE | 20.8% | 20.0% | - |

*Unit: million yen. CAGR is calculated by Investment Bridge Co., Ltd.

(2) What is expected to be achieved in the second mid-term management plan

While the first mid-term management plan (the term ended March 2019 to the term ended March 2021): To Realize Zero to One corresponds to “hop” of triple jump, the second mid-term management plan corresponds to “step” of triple jump.

As indicated by its subtitle: “Road to the highe making sales of 10 billion yen achievable” the target sales for the term ending March 2024 are set at 8 billion yen. For further growth, the three-year period of the second mid-term management plan is positioned as the period for preparing for achieving sales of 10 billion yen in the third mid-term management plan, which corresponds to “jump” of triple jump.

Concretely, they will implement the following measures.

Growth in the conventional and new markets | Conventional market (rental real estate field) | To release new guarantee products, to meet customer needs |

New market (healthcare/nursing-care field) | The business of guarantee for payment of medical charges advanced from the introduction phase to the growth phase. They will accelerate the growth of the business | |

Zero to One Spirit Endeavor and development of new businesses | Business development(the field of guarantee for expenses for bringing up children, etc.) | To grow it as the first B2C business |

Business creation (developing new products and businesses) | Endeavor to create new guarantee services |

In the conventional market, the company will release new services for rent payment guarantee to expand the rental real estate field.

In the new market, the company will concentrate on the healthcare field, in which a business model for growth has been established.

Regarding new businesses, the company will pursue the potential of not only BtoB business, but also BtoC business. In addition, the company aims to grow as a provider of comprehensive guarantee service by expanding the system and services for guarantee by sharing the know-how accumulated so far.

(3) Growth strategy

Growing domains | Business segment | Results for FY3/21 | Mid-term plan for FY3/24 | Growth rate | |||

Sales | Ratio to total sales | Sales | Ratio to total sales | ||||

Conventional market | Rental real estate field | Rent payment guarantee & solution | 3,815 | 90.8% | 6,400 | 80% | 1.7 times |

New market | Healthcare field | Medical charge field | 341 | 8.1% | 1,370 | 17% | 4.0 times |

Nursing-care field | Guarantee for payment of nursing-care charges | 36 | 0.9% | 130 | 2% | 3.6 times | |

Creation and development of new businesses | New business | BtoC business of guarantee for expenses for bringing up children and other new businesses | 10 | 0.2% | 100 | 1% | 9.5 times |

| 4,203 | 100% | 8,000 | 100% | 1.9 times | ||

*Unit: million yen

◎ Rent payment guarantee & solutions

The rent payment guarantee business is targeted at growing real estate management firms and provides custom-made services for solving problems with clients. The company will strive to increase average spending per customer through the shift from solution business to guarantee business with high average spending per customer. In addition, the company will release a variety of new services, including the guarantee for credit-card payment of tenants, to expand its market share.

◎ Guarantee for payment of medical charges

The business of guarantee for payment of medical charges is expected to grow in the post-pandemic period, as some hospitals still have accounts receivable from patients. There are few competitors, so they have accumulated know-how in the market created by themselves. By enhancing business cooperation, the company aims to accelerate the growth of this business. In Sma-Hos, a service of guarantee covered by hospitals, they will cement the alliances with non-life insurance companies. In the service package of guarantee with hospitalization covered by patients, they will actively form alliances with linen suppliers. This business is targeted at about 8,300 hospitals with hospitalization facilities, excluding psychiatric departments. The company plans to increase its market share from about 2.9% to 5.3% in the final term of the mid-term plan.

◎ Guarantee for payment of nursing-care charges

For the business of guarantee for payment of nursing-care charges, the company will conduct active investment, and cultivate and energize the market as the front-runner. With the custom-made guarantee service that is the most excellent as of today, the company will propose the guarantee service to leading nursing-care facility operators, to spread the service.

◎ Guarantee for expenses for bringing up children

In the field of guarantee for expenses for bringing up children, too, the company is the front-runner, and operates this service as a BtoC business in cooperation with Internet companies. To achieve commercialization in the three-year period of the ongoing mid-term plan, the company will upgrade and promote insurance services, invest in marketing, sales, and online systems, and strengthen its brand for enhancing popularity and promoting customer learning.

◎ Creation of new businesses

Furthermore, the company will endeavor to create new businesses following the guarantee for payment of medical, nursing-care, and childcare charges, with the aim of triggering destructive innovation. The company will also discuss the alliances with venture firms, invest in them, and implement M&A, while enhancing the development of new guarantee programs for mortgages, scholarships, etc. and other services.

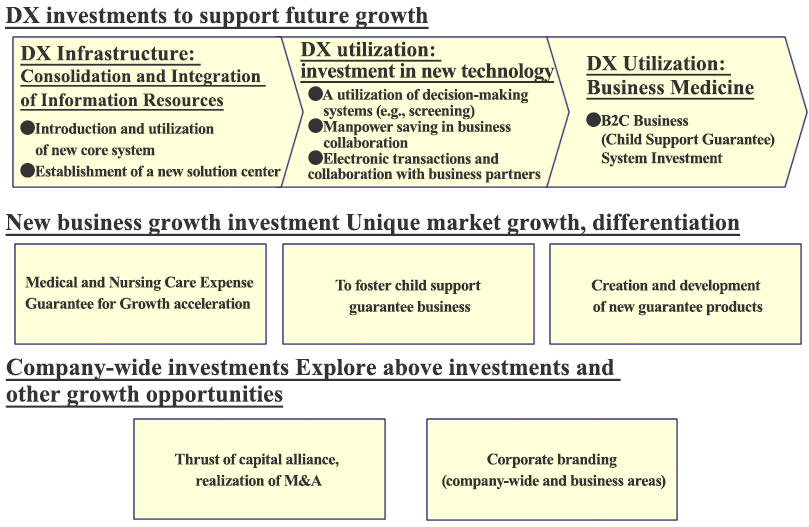

(3) Investment policy and financial strategy that underpin growth

The company plans to implement the following investment for growth, spending 1.5 to 2 billion yen in three years.

For DX, which will support future growth, the company plans to allocate funds to the establishment of a new solution center (call center), the adoption of AI for screening, labor saving, BtoC business systems, etc.

For developing new businesses, the company will develop new guarantee services, to popularize the company as a comprehensive guarantee service provider.

In addition, the company will actively form alliances and implement M&A, and while acknowledging that it is essential to improve its corporate brand to expand business and recruit more new graduates, the company will organize a project team and work on measures, including the update of its website.

(Taken from the mid-term management plan of the company)

The company will allocate 2.5 billion yen, which will be generated through operating cash flow in the three-year period of the ongoing mid-term plan, to the investment for growth spending 1.5 to 2 billion yen and shareholder return with a payout ratio of 30 to 40%. As of the end of the previous term, the company held about 3 billion yen in cash, but according to the situation, the company will consider borrowing money from banks.

Regarding ROE, the company will allocate the funds generated through cash flows, which will increase in parallel with growth, to reinvestment, to accelerate the growth speed and keep the rate 20% or higher.

(4) Promotion of initiatives for ESG and SDGs

Guarantee is a new partnership for providing peace of mind among people. The provision of peace of mind facilitates the reduction of inequality of opportunities, the expansion of fair transactions, the realization of new partnerships in response to social changes, etc. The company helps solve social issues through various guarantee businesses.

Some cases in which the company’s guarantee services helped solve social issues | |

Rent payment guarantee | For the guarantee service for elderly people, the company added a regular monitoring service, to dispel owners’ anxiety, which increased opportunities to rent for elderly people. |

Guarantee for payment of medical charges | This service solved the problems with hospitalized patients who cannot find co-signers and medical institutions that have accounts receivable from patients, securing patients’ opportunities to be hospitalized and stabilizing the management of medical institutions. |

Guarantee for payment of nursing-care charges | This service provided elderly people who cannot find co-signers with opportunities to enter nursing-care facilities. Through the popularization of guarantee for payment of nursing-care charges, the risk of lessors is expected to be reduced and the deposit to be paid at the time of moving-in is expected to decrease. |

Guarantee for payment of expenses for bringing up children | By spreading the reliable service of guarantee for payment of expenses for bringing up children, the company contributes to the better lives of single-parent families and the healthy growth of children. |

The company’s performance has been improving steadily, to achieve sales of 8 billion yen. The sales from rent payment guarantee in FY 3/2023 exceed the assumed one in the mid-term management plan. In addition, the company is strengthening its system for guarantee for payment of medical charges to increase contracts.

3. Second quarter of the Fiscal Year ending March 2023 Earnings Results

(1) Non-consolidated earnings

| FY3/22 2Q | Ratio to Sales | FY3/23 2Q | Ratio to Sales | YoY | Initial Forecast | Forecast Ration |

Sales | 2,356 | 100.0% | 2,990 | 100.0% | 26.9% | 2,960 | +1.0% |

Gross Profit | 1,198 | 50.9% | 1,451 | 48.5% | 21.1% | - | - |

SG&A | 613 | 26.0% | 677 | 22.6% | 10.5% | - | - |

Operating Income | 585 | 24.9% | 773 | 25.9% | 32.1% | 695 | +11.4% |

Ordinary Income | 587 | 24.9% | 771 | 25.8% | 31.2% | 690 | +11.8% |

Profit Attributable to Owners of Parent | 378 | 16.1% | 478 | 16.0% | 26.3% | 430 | +11.3% |

*Unit: million yen

*Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report).

Sales and operating income grew 26.9% and 32.1%, respectively, year on year.

Sales increased 26.9% year on year to 2,990 million yen. In terms of sales, the sales of the guarantee business rose 54.3% year on year to 2,173 million yen, and the sales of the solution business declined 13.7% year on year to 817 million yen. The sales from rent payment guarantee increased 59.7%, thanks to the switch from solutions and the increase of transactions with existing clients. On the other hand, the business of guarantee for payment of medical charges progressed as planned as a whole.

Operating income rose 32.1% year on year to 773 million yen. In terms of profit, the fee for outsourcing to management companies and bad debt expenses augmented in parallel with the growth of sales of the guarantee business, but the company curtailed the augmentation of other costs, contributing to profit. Gross profit margin decreased 2.4 points year on year to 48.5%. The ratio of SGA to sales dropped 3.4 points year on year to 22.6%. As a result, operating income margin rose 1 point year on year to 25.9%. Non-operating profit/loss was mainly from commissions paid amounting to 4 million yen as non-operating expenditure (not posted in the same period of the previous year). In addition, extraordinary profit/loss was composed of only a loss of 3 million yen on valuation of investment securities as extraordinary loss (not posted in the same period of the previous year).

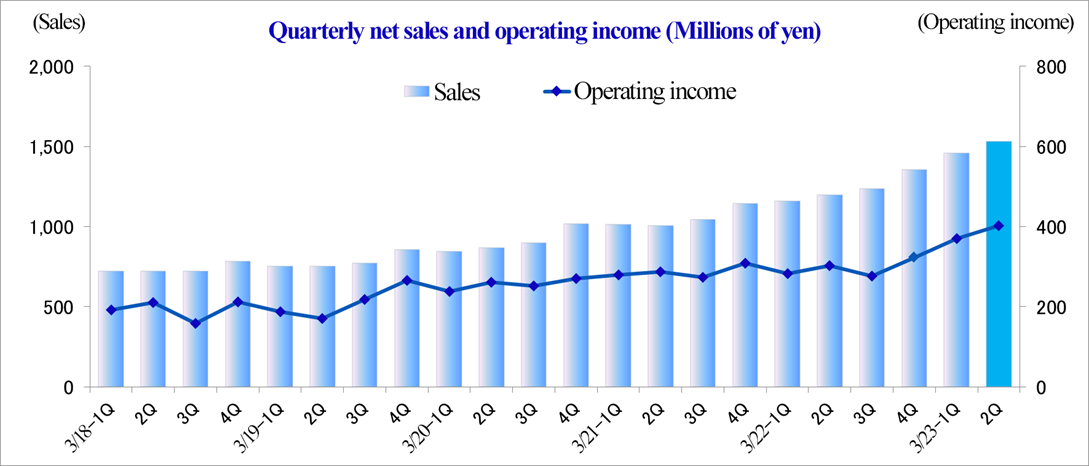

Variation in quarterly performance

Quarterly sales and profit increased quarter on quarter and year on year.

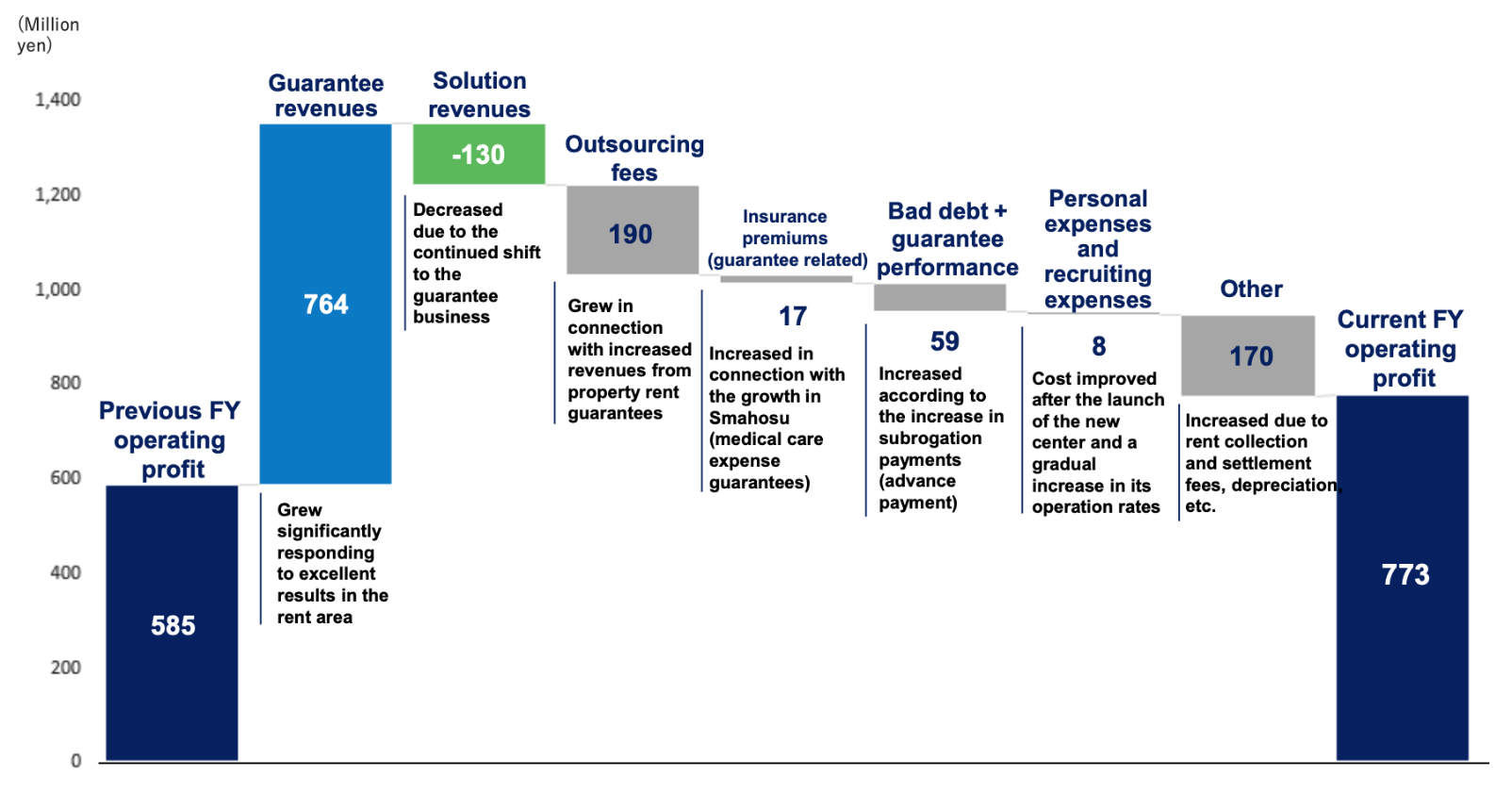

Factors in increase/decrease of operating income

Operating income in FY3/22 2Q | 585 |

Growth of sales from guarantee | 764 |

Decline in sales from solutions | -130 |

Increase in entrustment fees | -190 |

Increase in insurance premiums (related to guarantee) | -17 |

Augmentation of bad debt + execution of guarantee | -59 |

Augmentation of personnel expenses | -8 |

Increase in other expenses | -170 |

Operating income in FY3/23 2Q | 773 |

*Unit: million yen

(From the company material)

Operating income grew considerably, as the augmentation of strategic costs subsided and the sales from guarantee increased significantly. The rise in costs is mainly attributable to the increase in outsourcing fees in parallel with the growth of sales from rent payment guarantee, the increase in bad debt and execution of guarantee in parallel with the increase of subrogation payment, and other costs, such as fees for settling rent payment and depreciation.

(2) Trend of each business

| FY3/22 2Q | Ratio to Sales | FY3/23 2Q | Ratio to Sales | YoY |

Sales | 2,356 | 100.0% | 2,990 | 100.0% | +26.9% |

Guarantee Business | 1,408 | 59.8% | 2,173 | 72.7% | +54.3% |

Solution Business | 948 | 40.3% | 817 | 27.3% | -13.7% |

No. of Contracts in the Rent Field at the End of the Term [Contracts] | 397,559 | 100.0% | 411,614 | 100.0% | +3.5% |

Guarantee Business [Contracts] | 126,271 | 31.8% | 175,799 | 42.7% | +39.2% |

Solution Business [Contracts] | 271,288 | 68.2% | 235,815 | 57.3% | -13.1% |

◎ Guarantee Business

The sales of the guarantee business grew, thanks to the increase in initial and renewed guarantee fees, as the number of new contracts for rent payment guarantee has grown healthily and the number of contracts held has increased.

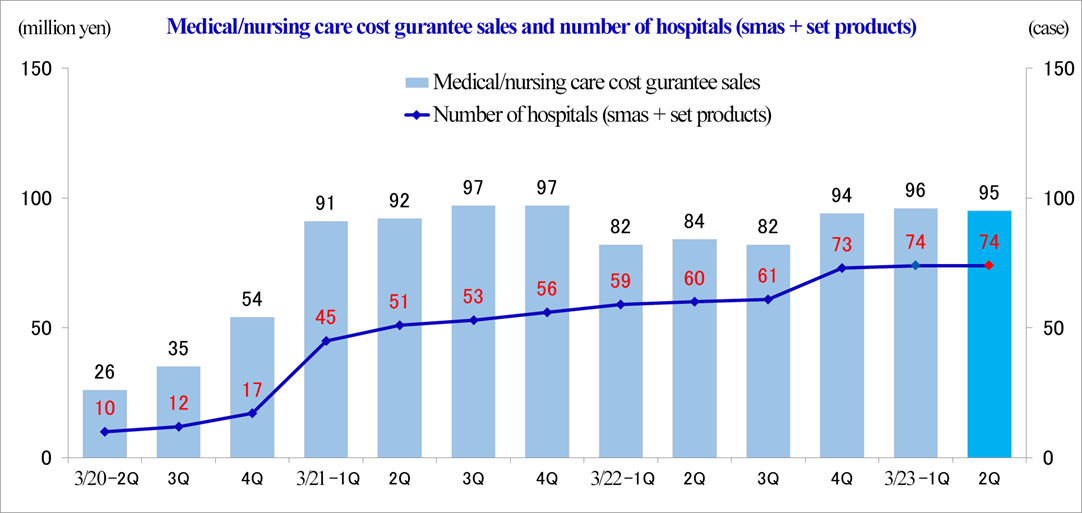

Regarding guarantee for payment of medical charges, the marketing activities in the medical field have been normalized, and requests for quotes increased steeply, so the company increased employees and actively promoted the business. For Sma-Hos, the company will promote the switch from the former product Niji, and the number of hospitals is expected to rise in the second half of the term.

[Data on affiliated parties]

Sma-Hos, a system for serving as a cosigner of each customer | 74 medical institutions (+1 from the end of the previous term); the number of hospital beds: 19,719 |

Hospitalization service with guarantee for payment of medical charges, etc. | 168 medical institutions (-4 from the end of the previous term); the number of hospital beds: 33,538 |

Guarantee for payment of nursing-care expenses | 208 nursing care business operators (+ 3 from the end of the previous term) |

*Produced by Investment Bridge Co., Ltd. with reference to the material for briefing financial results of Entrustment.

◎ Solution Business

The sales of the solution business declined, due to the continued shift from C&O services to the guarantee business.

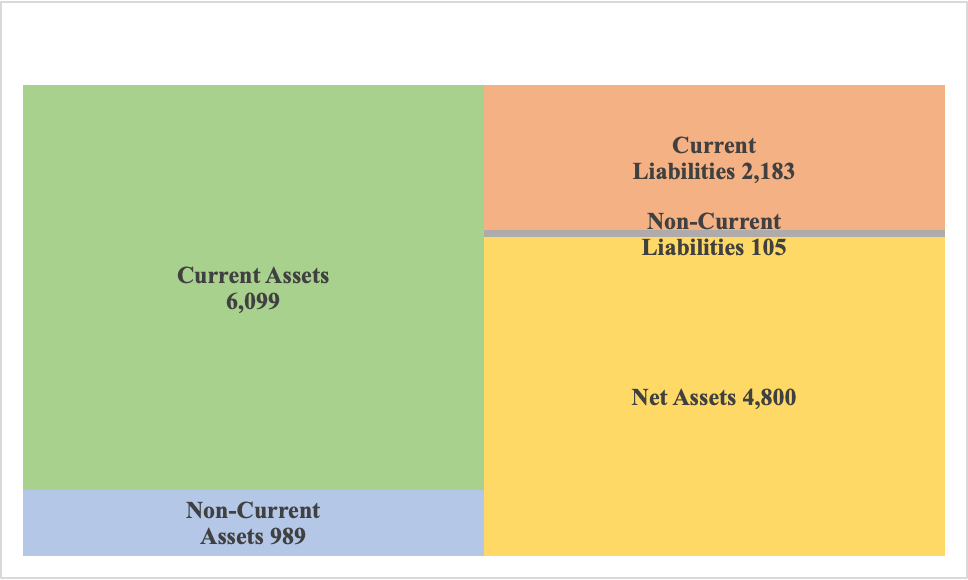

(3) Financial condition and cash flow

◎Financial condition

| March 2022 | Septemver 2022 |

| March 2022 | September 2022 |

Cash and Deposits | 3,268 | 3,873 | Contract Liabilities | 1,182 | 1,492 |

Advances Paid | 2,011 | 2,322 | Provision for Execution of Guarantee | 111 | 146 |

Current Assets | 5,310 | 6,099 | Current Liabilities | 1,774 | 2,183 |

Tangible Fixed Assets | 95 | 89 | Fixed Liabilities | 96 | 105 |

Intangible Fixed Assets | 250 | 222 | Liabilities | 1,871 | 2,288 |

Investments and Other Assets | 669 | 677 | Net Assets | 4,454 | 4,800 |

Fixed Assets | 1,015 | 989 | Total Liabilities and Net Assets | 6,325 | 7,089 |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. Based on disclosed materials.

The total assets as of the end of September 2022 stood at 7,089 million yen, up 763 million yen from the end of the previous term. The major factors in increasing total assets were cash & deposits and advances paid in the assets side and income taxes payable, contract liabilities, reserves for executing guarantee, and retained earnings after posting net income in the side of liabilities and net assets. The increase in advances paid is linked to sales promotion for services in which rents are paid in advance. The augmentation of contract liabilities is due to the increase of new contracts for rent payment guarantee, which will become a revenue source from the following month, but increase rate is expected to be stabilized through the increase of sale of monthly renewed guarantee. The liquidity of assets is high, as current assets account for about 86% of total assets. Capital-to-asset ratio is as high as 67.6%.

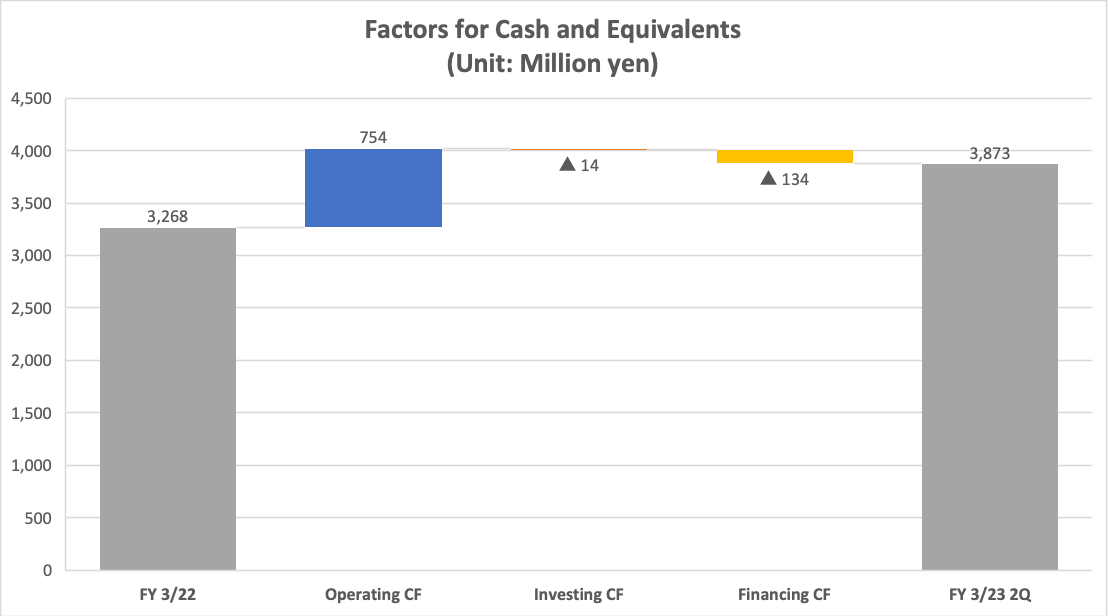

◎Cash flow

| FY3/22 2Q | FY3/23 2Q | YoY | |

Operating Cash Flow | 311 | 754 | +443 | +142.3% |

Investing Cash Flow | -73 | -14 | +58 | - |

Free Cash Flow | 238 | 739 | +501 | +210.7% |

Financing Cash Flow | -122 | -134 | -11 | - |

Cash and Equivalents at the End of Term | 3,191 | 3,873 | +682 | +21.4% |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. Based on disclosed materials.

In terms of CF, the cash inflow from operating activities expanded due to the increases in net income before taxes and other adjustments, allowance for doubtful accounts, contract liabilities, etc. The cash outflow from investing activities shrank due to the decline in expenditure for depositing guarantee money and the collection of guarantee money deposited, so the surplus of free cash flow expanded. The cash outflow from financing activities augmented due to the increase in payment of dividends, etc. Accordingly, the cash position as of the end of September 2022 was up 21.4% from the previous term.

4. Fiscal Year ending March 2023 Earnings Forecasts

(1) Earnings forecasts

| FY3/22 | Ratio to Sales | FY3/23 Est. | Ratio to Sales | YoY | Initial Forecast | Forecast Ratio |

Sales | 4,943 | 100.0% | 6,230 | 100.0% | 26.0% | 6,200 | +0.5% |

Operating Income | 1,184 | 24.0% | 1,530 | 24.6% | 29.2% | 1,450 | +5.5% |

Ordinary Income | 1,179 | 23.9% | 1,530 | 24.6% | 29.7% | 1,450 | +5.5% |

Net Income | 779 | 15.8% | 955 | 15.3% | 22.5% | 910 | +4.9% |

*Unit: million yen

Sales and operating income projected to grow 26.0% and 29.2%, respectively, year on year.

Seeing the healthy performance in the first half of the term, the company revised the earnings forecast for the term ending March 2023 on October 19. The new earnings forecast calls for a 26.0% YoY increase in sales to 6,230 million yen and a 29.2% YoY increase in operating income to 1,530 million yen. Sales are expected to grow at a rate exceeding that in FY 3/2022. The performance of rent payment guarantee is projected to exceed the assumed one in the mid-term management plan. Also for guarantee for payment of medical charges, the company will strengthen its system for increasing contracts. In terms of sales, the sales of the solution business, which will continue the shift to guarantee services in C&O services, will decline, but the sales of the guarantee business will grow due to the increase of contracts for rent payment guarantee and the significant rise in renewal guarantee fees due to the increase of monthly renewed contracts.

In terms of profit, the sales of the guarantee business will grow, the increase rate of bad-debt costs will decrease thanks to the establishment of a system for coping with the increase of guarantee contracts, and temporary expenses for opening centers will drop, contributing to profit.

Operating income margin is forecast to rise 0.6 points from the previous term to 24.6%.

In parallel with the revision to the earnings forecast, the forecast dividend has been revised upwardly from 13.00 yen/share per year to 13.50 yen/share per year (up 1.50 yen/share from the previous term). The expected payout ratio is 31.6%. The dividend amount is projected to increase for the 7th consecutive term.

Factors in the increase/decrease of operating income

Operating income in FY3/22 | 1,184 |

Increase in sales from guarantee | +1,558 |

Decrease in sales from solutions | -271 |

Increase in entrustment fees | -420 |

Increase in insurance premiums (related to guarantee) | -44 |

Augmentation of bad debt + execution of guarantee | -109 |

Augmentation of personnel expenses | -43 |

Increase in other expenses | -325 |

Operating income in FY3/23 | 1,530 |

*Unit: million yen

The growth of sales from guarantee will contribute to the rise in profit. In terms of costs, the rise in costs is mainly attributable to the increase in outsourcing fees in parallel with the growth of sales from rent payment guarantee, the increase in bad debt and execution of guarantee in parallel with the increase of subrogation payment, and other costs, such as fees for settling payment. Although the costs for bad debt and execution of guarantee will augment, the rate of increase in costs for bad debt is expected to decline thanks to the establishment of a system for coping with the increase of advance payment.

(2) Outlook for each business

| FY3/22 | FY3/23 (forecast) | YoY |

Guarantee Business | 3,053 | 4,611 | +51.0% |

Solution Business | 1,890 | 1,618 | -14.4% |

Total Sales | 4,943 | 6,230 | +26.0% |

*Unit: million yen

◎ Guarantee Business

The sales of the guarantee business are expected to grow 51.0% year on year.

The sales from rent payment guarantee are expected to grow 52.4% year on year. Renewal guarantee fees are expected to rise, due to the accumulation of contracts and monthly renewed contracts.

In the new domain of guarantee, etc., sales are expected to grow 19.9% year on year.

Regarding the guarantee for payment of medical charges, the decline in guarantee fees is subsiding, and the impact of the COVID-19 pandemic is reflected in the plan based on the term ended March 2022.

Regarding the guarantee for payment of nursing-care expenses, the pandemic is subsiding, so the company will enhance activities for expanding sales.

Regarding the guarantee for payment of expenses for bringing up children, the company will improve services and establish a business base.

Sales | FY3/22 | FY3/23 (forecast) | YoY |

Rent Payment Guarantee | 2,696 | 4,186 | +55.3% |

New Domains of Guarantee, etc. | 356 | 425 | +19.4% |

Total Sales of the Guarantee Business | 3,053 | 4,611 | +51.0% |

*Unit: million yen

◎ Solution Business

The sales from solution business are projected to decline 14.4% year on year.

In C&O service, the shift to guarantee services will continue, so sales are projected to drop 16.7% year on year.

In insurance desk service, sales are expected to grow 15.8% year on year, through the expansion of mainly small-premium short-term insurance.

The sales from Doc-on service are forecast to decrease slightly year on year.

Sales | FY3/22 | FY3/23 (forecast) | YoY |

C&O Service | 1,726 | 1,437 | -16.7% |

Insurance Desk Service | 114 | 132 | +15.8% |

Doc-on Service | 49 | 48 | -2.0% |

Total Sales of the Solution Business | 1,890 | 1,618 | -14.4% |

*Unit: million yen

(3) Progress rate

| Results in the first half of FY 3/2023 | The company’s forecast for FY 3/2023 | Progress rate |

Sales | 2,990 | 6,230 | 48.0% |

Operating Income | 773 | 1,530 | 50.6% |

Ordinary Income | 771 | 1,530 | 50.4% |

Net Income | 478 | 955 | 50.1% |

*Unit: million yen

The company revised the full-year earnings forecast upwardly, reflecting the favorable results in the first half, but the forecast is still conservative, as the revision was only for taking into account the better-than-expected performance in the first half.

5. Conclusions

The financial results of the company in the second quarter of the term ending March 2023 are healthy, as sales and operating income grew 26.9% and 32.1%, respectively, year on year. This is because the sales from rent payment guarantee rose 59.7% year on year, thanks to the switch from solutions and the increase of transactions with existing clients, and also because the efficiency of business operations improved and the temporary expenses for opening centers, etc. dropped. The company revised the full-year earnings forecast upwardly, reflecting the favorable results in the first half, but the forecast is still conservative, as the revision was only for taking into account the better-than-expected performance in the first half. Their business performance in the second half of the term is noteworthy, to see how much they can increase sales and profit to achieve the numerical goals in the mid-term plan: sales of 8 billion yen and an operating income of 2 billion yen in the term ending March 2024. The key is the accumulation of stock and the increase of renewed guarantee fees through the increase of monthly renewed contracts. It is noteworthy whether the company will be able to keep increasing new contracts and how much the number of contracts for rents will increase in the second half.

Regarding guarantee for payment of medical and nursing-care charges, which did not show strong recovery in the first half of this term due to the constraints on marketing due to the spread of COVID-19 in the previous term, marketing activities in the medical field got back to normal, and it seems that requests for quotes are increasing rapidly. The company plans to increase employees and actively expand the business of guarantee for payment of medical and nursing-care charges. Regarding Sma-Hos, the company will promote the switch from the former product Niji, and the number of client hospitals is expected to increase in the second half of the term. While many medical institutions face difficulty in collecting medical charges, the market of guarantee for payment of medical charges is expected to grow. It is noteworthy how much the company will be able to form alliances with medical institutions and nursing-care enterprises and increase sales from guarantee for payment of medical and nursing-care charges in the second half of the term.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 8 directors, including 3 external ones |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report: updated on June 23, 2022

Basic Policy

Our company adheres to the management philosophies of “how much we can please our customers,” “how much we can assure our customers,” and “how much trust we can win from our customers,” and strives to strengthen our corporate governance with a focus on “maintaining compliance and maximizing shareholder profits” while making efforts to expand our business.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Principle | Reasons for not implementing the principles |

【Supplementary Principle 2‐4‐1】 | Our company considers employees as the largest assets, and upholds the basic policy of developing a sound labor environment that can enhance the ambition and motivation of each employee and enable them to keep working while feeling that “their jobs are worthwhile.” We have adopted training for female managers, which dispels the common concerns of female leaders and hones necessary skills, the “Open Position System,” which provides employees with opportunities to exert their respective abilities proactively, and so on, to foster a challenging organizational culture. In addition, we recruit and promote competent personnel regardless of gender and nationality. Regarding recruitment, we aim to secure excellent personnel when recruiting new graduates and mid-career workers, but it has not been long since we started recruiting new graduates, so mid-career workers make up core personnel. We established human resources systems under these policies, so we have not set measurable goals for the promotion of female employees to managerial posts. We recognize that the setting of goals, etc. need to be discussed. |

【Supplementary Principle 3-1-3】 | Our company offers a variety of guarantee services to solve social issues in the fields of “housing,” “healthcare,” “nursing care,” “upbringing,” etc., which are indispensable to the living of people. Our company believes that we engage in activities for sustainability through our business itself, and these activities are disclosed via our website. Regarding the effects of risks and opportunities arising out of climate change on the business activities, revenues, etc. of our company, we are assessing them by collecting and analyzing data. We will disclose information when necessary. |

【Supplementary Principle 4-1-3】 | Our company has not formulated a plan for successors to the CEO and others, but the board of directors appoints a CEO after comprehensively discussing the experience, knowledge, ability, personality, track record, etc. of each candidate. From now on, we would like to train successors and formulate a plan at the right timing. |

<Disclosure Based on the Principles of the Corporate Governance Code>

Principles | Disclosure content |

【Principle 1-4. Strategic Shareholding】 | Our company shall consider holding shares strategically, when it is determined that such shareholding contributes to improving corporate value through the strengthening of business cooperation, etc. We shall evaluate shares to be held for profitability, taking into account the transaction status and capital costs, and take into consideration the evaluation results, to determine whether to continue holding. We shall reduce any shares that do not meet our shareholding objectives. In addition, we continue holding the shares currently held by us as a result of our calculation of the profitability based on the earnings amount expected from the shareholding and comparison with capital costs, etc. When exercising our voting rights, we will make a decision after scrutinizing proposals and considering the status of achievement of purposes of shareholding, the management status of the invested company, etc. |

【Principle 3-1. Enhancement of Information Disclosure】 | (1) Our management philosophy is disclosed on our website, in addition to the Corporate Governance Report and the Annual Securities Report. For specific management strategies and the management plan, please see our Medium-term Management Plan disclosed on May 14, 2021. (2) Our basic policy for corporate governance is based on the principles of the Corporate Governance Code, and is disclosed in our corporate governance report, securities report, and website. (3) Directors’ compensation shall be resolved at the Board of Directors meeting after the deliberations of the voluntary Nomination and Compensation Committee, of which a majority is comprised of Outside Directors, to the extent approved at General Meetings of shareholders. Moreover, Executive Officers may allocate up to three months of the determined compensation to the stock compensation-type stock options. Further, using operating income as a key indicator, we adopted Performance-linked Compensation which provides the amount equivalent to one month of the fixed compensation multiplied by a certain factor as a bonus, if operating income exceeds the forecast by 10% or more. (4) When giving proposals for the appointment or dismissal of executive officers, the nomination of candidates of directors or auditors or dismissal thereof, we comprehensively consider the experience, knowledge, ability, personality, track record, etc. of each of them, and then the board of directors discusses the appointment or dismissal of executive officers; the nomination and compensation committee deliberates on the nomination of candidates for directors or dismissal thereof, and the board of directors makes a resolution; and the board of auditors has discussions regarding auditors and concurs, and then the board of directors gives its approval. (5) Upon proposing election and removal of an Executive Officer, as well as nomination of candidates for and removal of a Director and an Auditor, the reason will be explained at the Board of Directors meeting. Furthermore, upon the nomination of a Director and an Auditor, each candidate’s career background, the reason for election of the candidates for Outside Directors and candidates for Outside Auditors, and the reason for removal of a Director and an Auditor, will be stated in the Notice of Convocation of General Meeting of Shareholders.

|

【Principle 4-9.Criteria for judging the independence of independent outside directors and their qualities】 | With reference to Tokyo Stock Exchange’s criteria for judging the independence of independent executives, we select those who possess a great deal of knowledge and experience and can oversee and guide directors from a fair standpoint as candidates for independent outside directors. |

【Principle 5-1. Policy on Constructive Dialogue with Shareholders】 | With regard to our IR activities, Office of the President assists in dialogue with shareholders under the instructions from our Representative Director and the Head of Business Management Department. We follow our basic policy that the Representative Director handles dialogue with our shareholders, in light of the significance of such dialogue, and also in accordance with shareholders’ requests. Furthermore, our policy provides that we principally hold financial results briefings twice a year, as well as briefing sessions for individual investors whenever necessary. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages, or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (Entrust Inc.: 7191) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.