Bridge Report:(7685)BuySell Technologies the fiscal year ended December 2021

President and CEO Kyohei Iwata | BuySell Technologies Co., Ltd (7685) |

|

Company Information

Market | TSE Mothers |

Industry | Wholesale (trade) |

President and CEO | Kyohei Iwata |

HQ address | 8th Floor, PALT Building, 28-8, Yotsuya 4-Chome, Shinjuku-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Act.) | Trading unit | |

¥2,667 | 14,162,284 shares | ¥ 37,770 million | 33.9% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥20.00 | 0.7% | ¥122.77 | 21.7x | ¥319.34 | 8.4 x |

* The share price is the closing price as of March 3. Each number are taken from the brief financial report for the FY Ended December 2021.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2018 | 10,118 | 496 | 472 | 329 | 27.50 | 5.50 |

December 2019 | 12,828 | 846 | 817 | 505 | 41.94 | 7.50 |

December 2020 | 14,764 | 968 | 922 | 565 | 41.12 | 7.50 |

December 2021 | 24,789 | 2,315 | 2,295 | 1,314 | 93.26 | 14.00 |

December 2022 Est. | 32,500 | 3,100 | 3,040 | 1,730 | 122.77 | 20.00 |

* The estimated values are based on the forecasts made by the Company. On January 1, 2021, a 2-for-1 stock split was conducted. EPS and DPS were adjusted retroactively.

This Bridge Report presents BuySell Technologies’ financial results for the fiscal year ended December 2021 and so on.

Table of Contents

Key Points

1. Corporate Overview

2. Fiscal Year Ended December 2021 Earnings Results

3. Fiscal Year Ending December 2022 Earnings Forecasts

4. Medium-term Management Plan for 2024

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

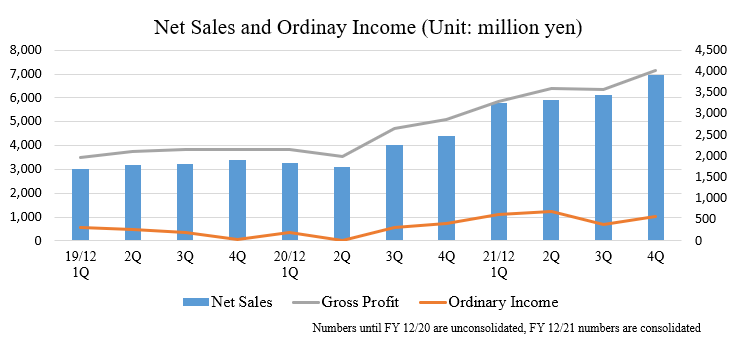

- The sales for the term ended Dec. 2021 were 24,789 million yen, up 67.9% year on year. Although the performance in the first quarter (January-March) was affected by the declaration of a state of emergency, the number of at-home visits recovered from the second quarter (April-June) onward. Further, TIMELESS Corporation into consolidation as subsidiaries contributed. Ordinary profit increased 148.8% year on year to 2,295 million yen. A significant increase in profit was achieved by absorbing the increase in SG&A expenses due to the increase in purchase volume per at-home visit, the store purchase business becoming profitable, and the inclusion of the business results of TIMELESS Corporation. Sales and profit increased for the seventh consecutive year. As a result of strategic carry-over of inventory in the second half to increase the toC sales ratio from the next fiscal year onward to the point of exceeding the forecast profit, net sales fell short of the forecast, but ordinary profit exceeded the forecast.

- For the term ending Dec. 2022, the company forecasts sales of 32,500 million yen, up 31.1% year on year, and an ordinary profit of 3,040 million yen, up 32.4% year on year. The company expects gross profit margin to improve by continuing to strengthen the at-home pick up service and by reinforcing toC sales, which increased inventory in the previous fiscal year. Store purchases will also be strengthened by opening more stores. The company plans to make an upfront investment mainly in human resources recruitment for medium-term growth, and SG&A expenses are expected to increase 31.4% year on year, but this will be absorbed by the increase in sales, resulting in a significant increase in profit. In Q1 of FY 12/21, sales and operating profit grew significantly due to the auction of main products in stock for TIMELESS' first online auction. In the first quarter of the current fiscal year, profit is expected to decrease year on year due to the above growth, but excluding this effect, the company plans to increase both sales and profit in each quarter year on year. The company plans to pay a dividend of ¥20.00/share, up ¥6.00/share from the previous year. The expected dividend payout ratio is 16.3%.

- The company announced a three-year medium-term management plan for 2024. The company has set the following four goals to achieve its ideal status: "To establish a position as a reuse tech company by promoting the fusion of real-life and technology (IT and DX)," "To maintain a solid leading position unrivaled by any other company in the reuse at-home pick up service," "To achieve organic growth over the three-year period (FY 12/2024) by targeting an average annual growth rate of approximately 40% in consolidated ordinary profit," and "To establish a corporate governance structure that balances sustainable growth and governance tightening to maximize shareholder value.”

- After the inclusion of TIMELESS in the scope of consolidation, the company expects a significant increase in both sales and profit in the current fiscal year. One of the factors behind this is the accelerated opening of BuySell and TIMELESS stores. To achieve the goal of more than 50 group stores in the final year of the medium-term management plan, the company needs to open 10 stores per year, and the speed at which it opens new stores is particularly noteworthy, as BuySell currently has only five stores. In the medium-term management plan, which is the first to be announced since the company went public, we expect to see progress on the store opening strategy, area expansion, and the scheme of turning the reuse platform into a SaaS.

1. Corporate Overview

BuySell Technologies operates reuse business that leverages the strengths of the "Internet" and "Real world".

The Company attracts sellers through a marketing strategy that makes full use of the Internet and mass media, and also provides the at-home pick up service throughout Japan. Its characteristics or strengths include the maximization of synergy with a variety of purchase and sales channels, the robust customer base centered around seniors, and the high-quality management. The Company is aiming for further growth by developing a huge potential reuse market and creating new businesses utilizing its customer base.

[1-1 History]

President Iwata, who was in charge of marketing at a major advertising company, questioned the situation where large and famous companies with abundant advertising expenses are favored to the disadvantage of small and medium-sized companies and start-ups with a small budget. He retired from the major advertising company and established a consulting company for his desire to help companies, including ones with weak capital, develop true marketing. He met BuySell Technologies (formerly Ace Co., Ltd.) while supporting many start-ups and small businesses.

The Company had long been providing the at-home pick up service, which is its current core business, but when President Iwata's consulting engagement started in May 2016, its marketing depended almost entirely on flyers. The homepage was not sophisticated, and the business performance was not good. The Company, which undertook a full-fledged reform under President Iwata, began to see the results when it registered a record number of applications in August of the same year, renewing the record in September.

In this process, President Iwata felt that while "the at-home pick up service" has a high added value and there are many customers who need it, the way in which the benefits of the service are communicated, the brand is constructed, marketing actions are taken, and others were extremely inadequate. He was convinced that with his marketing know-how, the Company could transform itself into a more attractive company.

In October of the same year, President Iwata assumed the role of Chief Sales and Marketing Officer (CSMO). In November, the Company name was changed to BuySell Technologies, and a new TV commercial was put on air and the reform sped up. He assumed the post of president in September 2017. The business expanded steadily thanks to the success of conducting the PDCA cycle of creative activities and the purchase of TV commercials utilizing his expertise. The Company also established a compliance system and was listed on the Tokyo Stock Exchange Mothers in December 2019.

[1-2 Corporate Philosophy and Management Philosophy]

The Company upholds the following missions and values.

Mission | Beyond people, beyond time, we aim to become a bridge connecting important things. |

Value | Immediately connect: start immediately, complete immediately, and move on Connect oneself: don't evaluate, move your hands Connect without fea change yourself, change your organization, and continue to challenge to change the world |

The Company believes that things have value that goes beyond their physical existence, and that properly connecting them is its mission and social existence value.

In addition, the company is strongly aware of the need to address environmental issues and co-create with all stakeholders, and considers its group mission to be "contributing to the creation of a recycling-oriented society through the revitalization of the secondary distribution market to realize a sustainable society" and "pursuing sustainable growth and maximizing corporate value as a company that co-creates value with various stakeholders including customers, shareholders, employees and society.

[1-3 Market Environment]

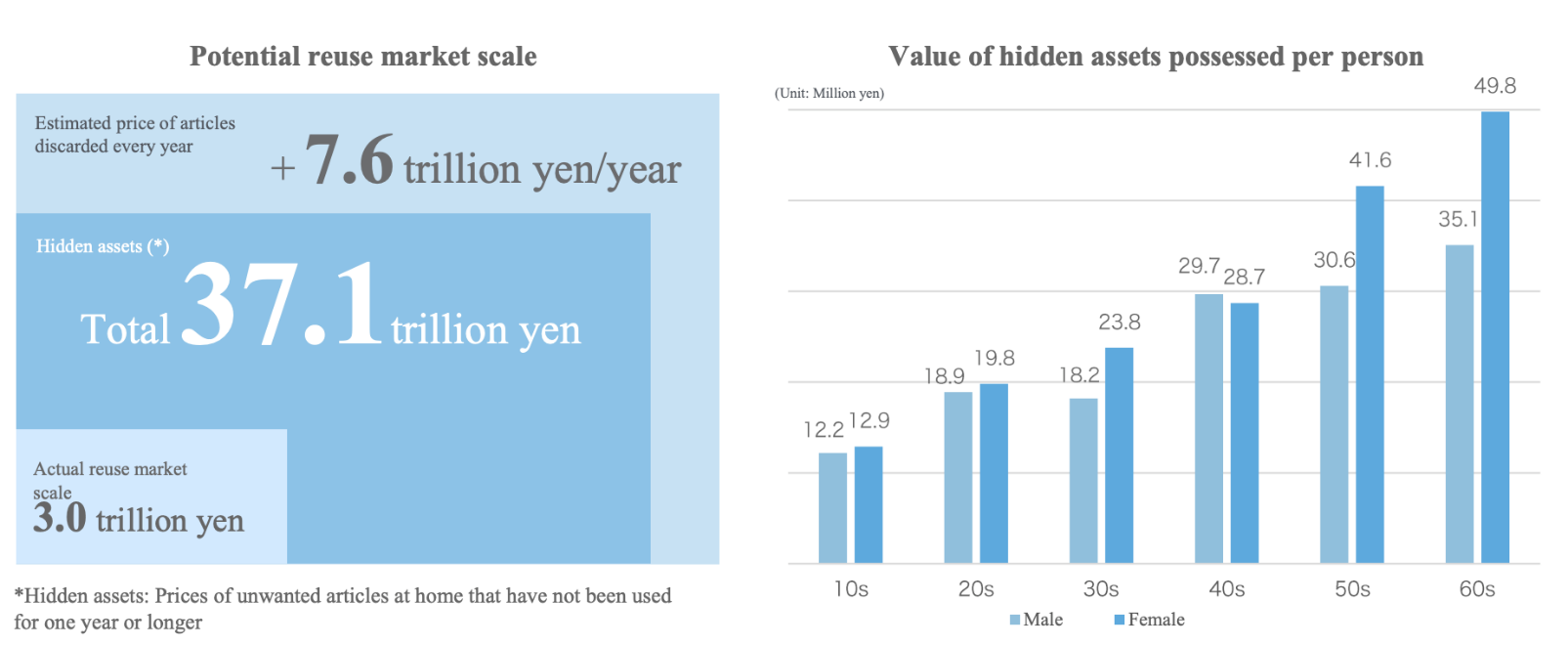

The scale of the reuse market is estimated to be about 2.4 trillion yen in 2020 and is expected to grow to 3.5 trillion yen by 2025.

However, this is only a figure for the actual reuse market, and the total potential size of the reuse market, including "hidden assets," which are unused items in houses that have not been used for more than one year, is estimated to be approximately 37 trillion yen.

In addition, in Japan, where the population continues to shrink, disused articles are estimated to increase by 7.6 trillion yen each year, and the potential reuse market is expected to continue expanding.

In terms of hidden asset holdings per capita in each age group, seniors in their 50s and older hold a significant portion.

(Source: the reference material of the Company)

BuySell Technologies intends to develop reuse markets with large growth potential by digging up potential products that constitute "hidden assets at home" sleeping at home with a focus on its strength in the at-home pick up service.

[1-4 Business Description]

(1) Business Model

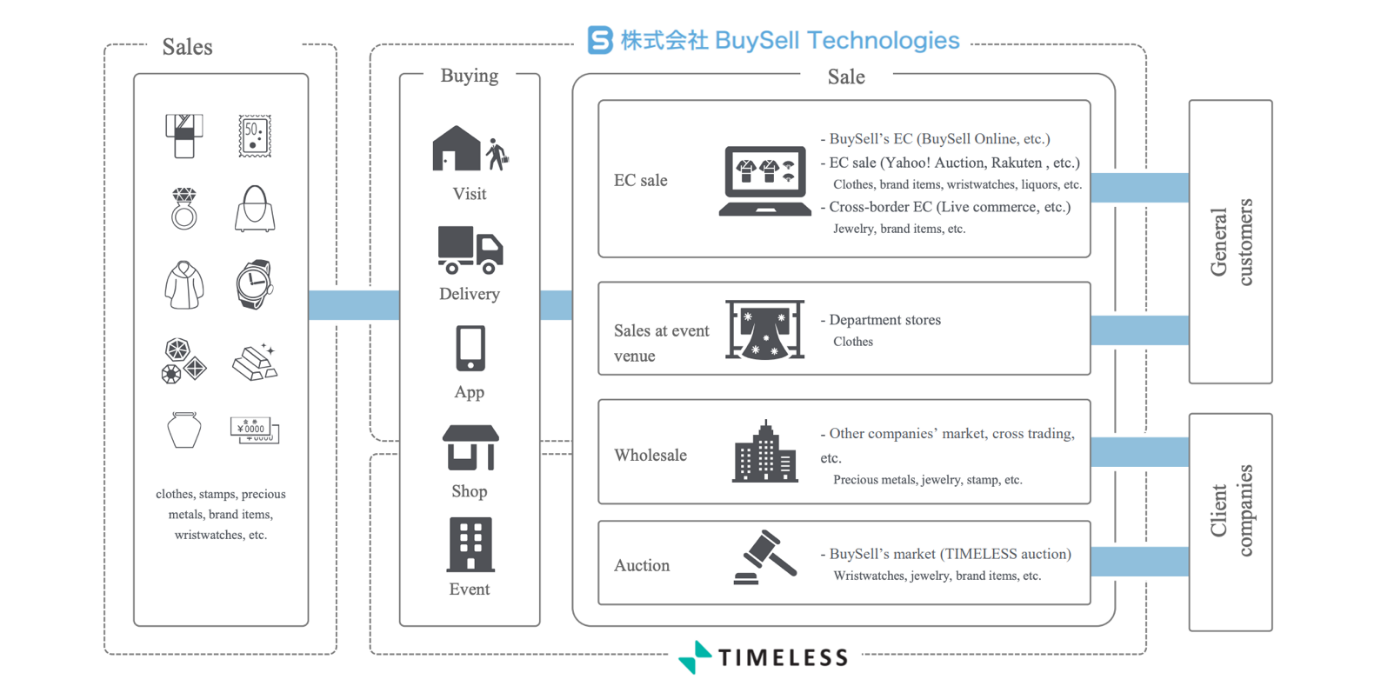

The company and its subsidiary, TIMELESS, BuySell Link Inc. operate the reuse business by utilizing respective strengths in the Internet and in real transactions. (BuySell Link Inc. is a special subsidiary for the purpose of promoting the employment of people with disabilities.)

It attracts sellers through a marketing strategy that makes full use of the internet and mass media, and also provides a shipping purchase service and a store purchase service as well as the at-home pick up service delivered by its assessors who can travel throughout Japan.

The Company sells purchased products to general customers though EC sales at EC malls such as the Company's own EC site "Reuse Select Shop BuySell" and Yahoo! Auctions, and at cross-border EC sites such as eBay, and special event sales at department stores. In addition, it sells to external vendors through the “Timeless Auction", which is held by TIMELESS Corporation, which was acquired as a subsidiary, and wholesale using other companies' markets.

(Source: the reference material of the Company)

The Company has built a system to consistently manage and execute the entire flow from marketing to attracting customers, purchase appraisal, inventory management, and sales on its own.

At the same time as expanding its mainstay reuse business, the Company is also focusing on launching and developing new business adjacent to the reuse business and other services utilizing customer data.

(2) Overview of Each Service

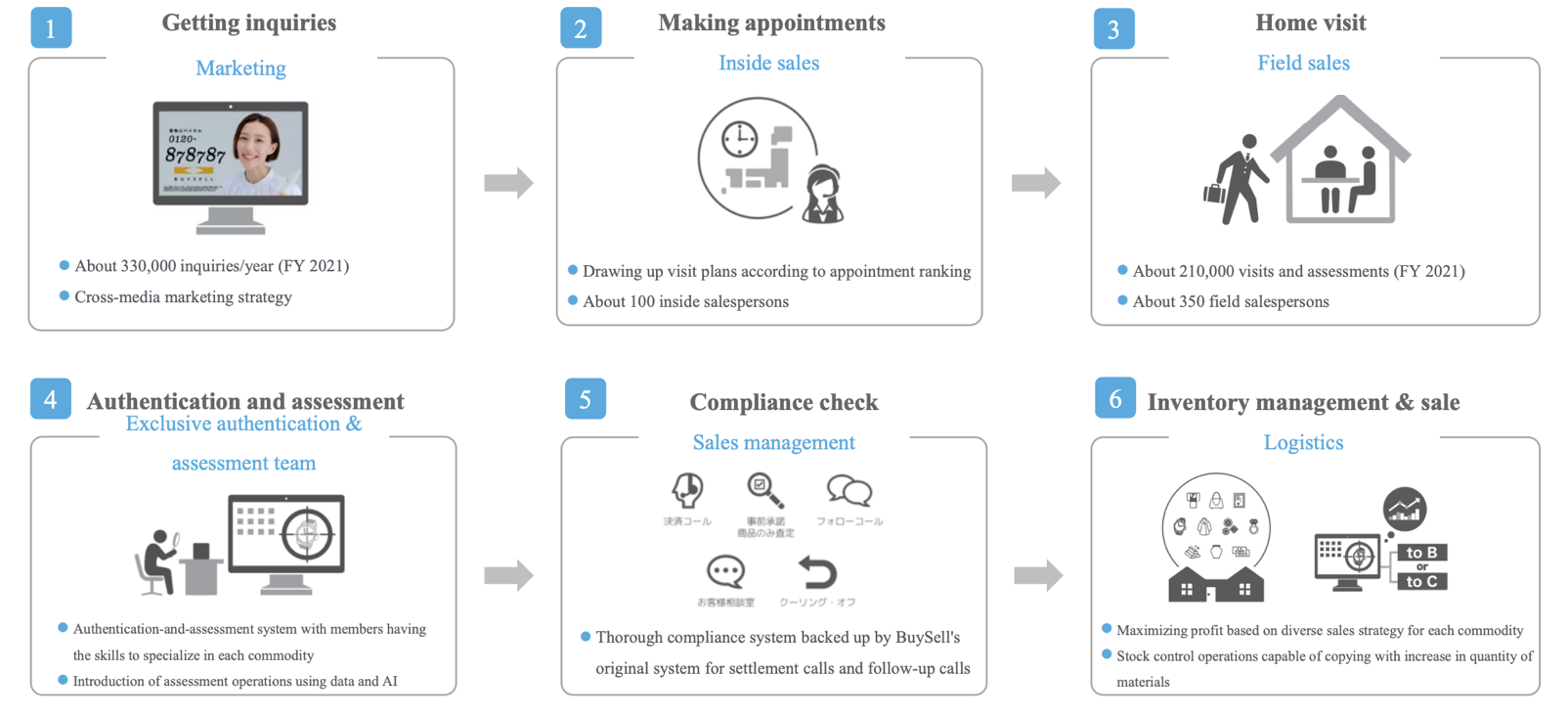

The Company's reuse business consists of the following business flo "Attracting sellers" → "Conducting purchase" → "Selling purchased products". The outline and features of each step of "customer attraction", "purchase" and "sales" are described in detail below.

(Source: the reference material of the Company)

1) Attracting Customers: Developing cross-media marketing aimed at high-net-worth seniors

◎Marketing

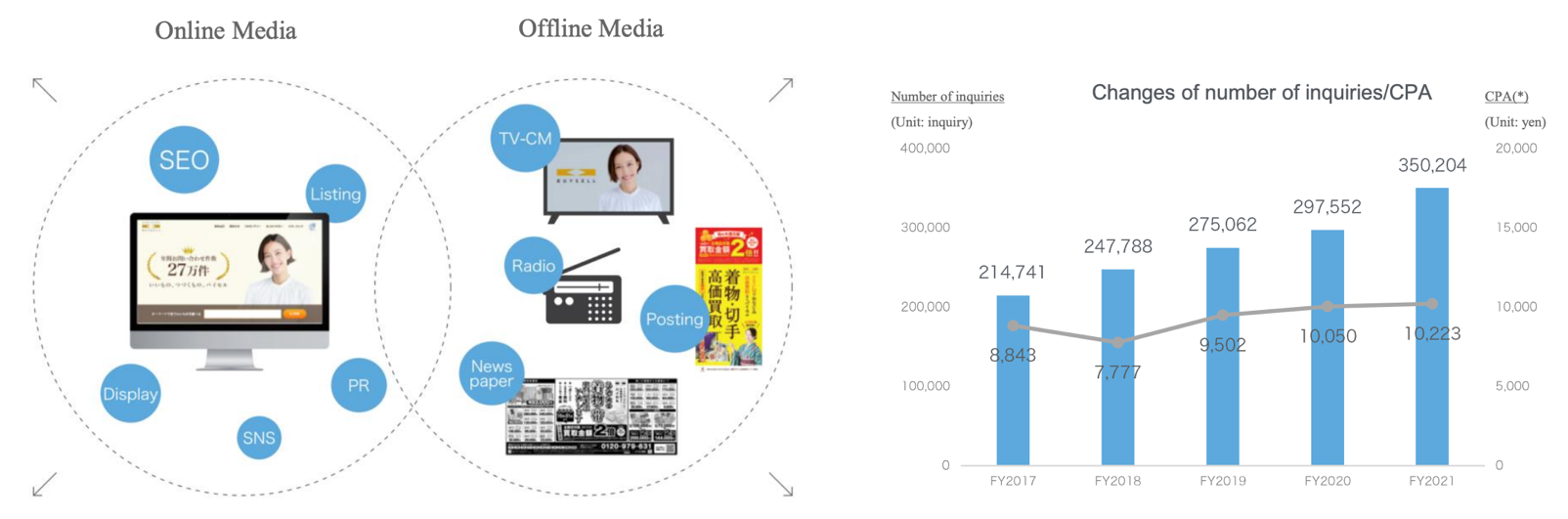

Marketing activities for receiving appraisal requests from customers are the starting point of the business strategy and execution, and maximizing the number of customers is the first key to the success of the Company's business. The marketing skills and expertise of the management team, including President Iwata, play a major role.

The Company develops cross-media marketing that leverages "the Internet", such as SEO (Search Engine Optimization), listing ads, and SNS, as well as "the mass media" centered on TV commercials.

In addition to advertising operation from a macro perspective based on market conditions and seasonality, the company conducts detailed analysis for each kind of daily media, area, etc., to realize efficient CPA (cost per action) and maximize cost-effectiveness in its marketing activities.

Due to such detailed marketing activities, the number of inquiries and customers are increasing year by year.

(Source: the reference material of the Company)

◎Inside Sales: Providing services that meet customer needs and maximizing the efficiency of assessor operations

In response to incoming calls from potential buyers, the company approached through marketing, approximately 120 operators listen directly to customers’ requests and cooperate with assessors to provide services in line with customer needs.

In July 2020, the organization was changed from the previous "Call Center Business Department" to the "Inside Sales Division" for the purpose of organizing sales from the time of answering the first inquiry call.

Moreover, the call center not only performs administrative tasks such as receiving inquiries about products to be sold and arranging the date and time of visits, but also provides the customer with an explanation that will be given when they are visited by an assessor, as well as an overview of the Company's services, information regarding the range of products that can be assessed, and a guidance for preventing uninvited solicitations so that customers can use the Company's services with greater confidence.

In addition, the Inside Sales Division, along with these customer-oriented services, generates highly profitable and effective appointments by classifying them into five ranks based on the expected gross profit per business visit (expected cost per visit) when the call is received.

This organizational change has resulted in a steady increase in the ratio of highly ranked appointments over the years, contributing to an increase in variable profit per at-home visit.

2) Purchase: Developing the "at-home pick up service" meeting a wide range of customer needs

◎The At-home Pick up Service

"The at-home pick up service" which involves going to the homes of customers who made inquiries and conducting an appraisal and a purchase, is the main purchasing method.

In addition, the Company also carries out a "shipping purchase service", in which customers send products to be sold to the Company, and a "store purchase service", in which customers bring products directly to the Company.

The Field Sales Division, which is in charge of "the at-home pick up service," has approximately 350 assessors as of the end of 2021, and 13 centers (as of December 2021) in the Kanto, Kansai, Nagoya, Fukuoka, and other areas, to cover all parts of Japan.

"The at-home pick up service" can flexibly respond to purchase requests from customers who have difficulty using store purchases service or shipping purchase service and meet a wider range of customer needs, such as when there is a wide variety of products to be assessed, the quantity of appraisals is large, it is difficult to carry the products due to their weight, as well as when there are inquiries from distant customers and elderly customers.

For example, if a customer wants to sell a large number of kimonos which weighs approximately 1 kg per piece, and it is difficult to carry them, "the at-home pick up service" in which the Company's assessor visits a customer's home to conduct an appraisal and a purchase, is highly compatible with such customer needs.

◎Assessor

The number of field sales assessors is also increasing steadily in parallel with the expansion of business scale, based on the company's recruiting capability. Since 2017, the company has been strengthening its recruitment of new graduates.

The company also focuses on the training of assessors to enhance customer satisfaction.

The Enablement Department, a division specializing in education and training, has introduced a systematic education and training system for assessors and implements education and training programs tailored to each assessor in each center, based on the company's unique internal management index.

The Company emphasizes the education of assessors and regularly conducts on-the-job training, including sales skills training and on-site training, to improve sales attitude, appraisal skills, and compliance awareness.

In addition, the Company is working to achieve thorough compliance because the Company must provide customers with safety and security when its employees visit customers’ houses.

The assessors alone cannot make a decision on the contract, and the compliance department calls the customer at the time of the contract and issues a decision call to confirm the contents of the sales contract (confirmation of the product, the price and the customer's satisfaction with the price), after which the contract is finalized.

Furthermore, the compliance department calls the customer again (follow-up call) after the assessor has left to receive the customer's candid opinions about the at-home pick up service, specifically about the assessor's attitude, compliance and customer satisfaction. The results of follow-up call, including customers’ voices, complaints and compliments are managed for each assessor, and the assessors are thoroughly informed of these to further improve their performance.

The company is also working to ensure that it complies with the cooling-off policy in accordance with laws and regulations.

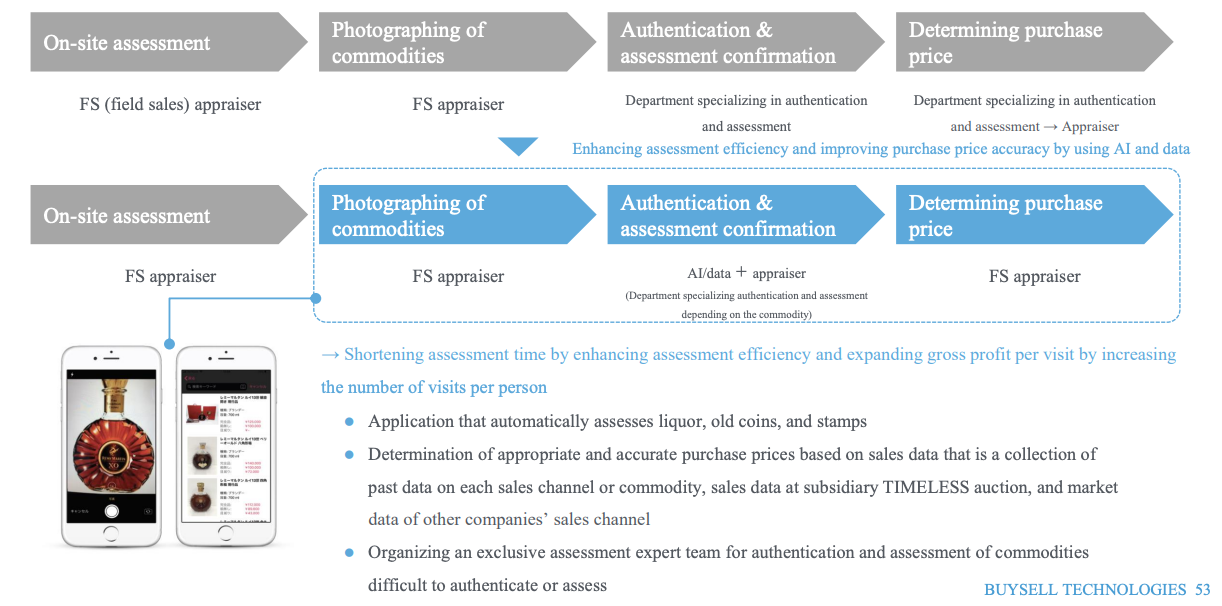

◎Authenticity Appraisal

To ensure accurate appraisal and prevention of counterfeit purchase and assessors' fraudulent appraisal, the Company's appraisal system requires not only an on-site appraisal by a visiting assessor but also a double check by another assessor who specialize in authenticity appraisal and appraisal, based on information from photos and videos sent from the visiting assessor using mobile terminals and such.

In addition, the company is using valuation data and technology to improve the efficiency and productivity of valuation and pricing decisions by automating operations using machine learning technology, etc., with the aim of maximizing the volume of purchases.

◎Products

It mainly deals with kimonos, stamps, old coins, precious metals, jewelry, brand-name items, watches, antiques, furs, alcoholic beverages and others, and focuses mainly on products with high selling prices.

(Source: the reference material of the Company)

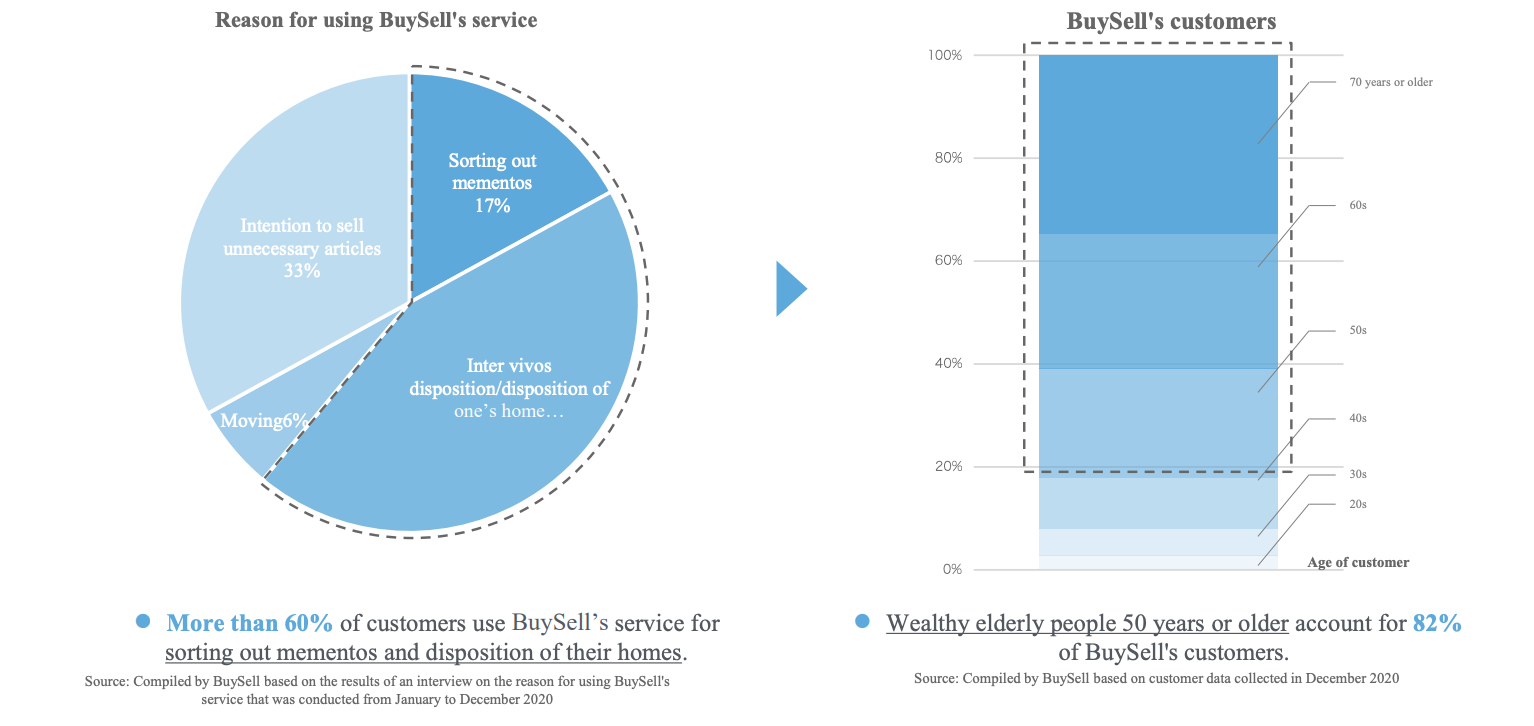

◎Main Customers

There are many inquiries from senior wealthy people whose needs are aligned with the at-home pick up service, which is the Company's main service. In the FY ended December 2021, customers in their 50s and over accounted for approximately 82% of all customers.

In addition, senior customers use the Company's purchase services for disposition of one’s home, sorting out mementos and pre departure decluttering cleaning which account for approximately 60% of the reasons for using the services.

(Source: the reference material of the Company)

3) Sales:

◎Inventory Management

After the cooling-off period, purchased products are managed centrally from inspection to exhibition by more than 300 staff including part-time job in the Company's own warehouse in Funabashi, Chiba Prefecture.

AXIS, an IT system developed by the Company, manages inventory for each product, and processes cooling-off requests.

The product is sent to the most suitable sales route, taking into account various aspects such as the characteristics and condition of the product as well as the market environment.

◎Sales System

After planning sales strategies based on inventory status, the Company sells purchased products through sales channels such as antique markets, auctions for dealers, e-commerce sales, special events and others.

For corporate sales through antique markets and auctions, the Company uses face-to-face auction formats for each product, and repeats negotiations with business partners until they find a sales partner that can produce a higher Profit Margin. Approximately 80% of Sales comes from corporate customers.

In addition, the company holds an auction of kimonos regularly at Narashino Warehouse, and actualizes appropriate sales at each quality level and the distribution of more goods through TIMELESS Auction, which is held by TIMELESS Corporation, which was acquired as a subsidiary.

On the other hand, in sales to end-user general consumers, in order to provide high-quality products, the Company conducts EC sales (Rakuten Market, Yahoo! Auctions and others) and sales at department store events. It operates two e-commerce sites, "Reuse Select Shop BuySell" which was launched in July 2018 and focuses on the sales of reused kimonos, and " BUYSELL brandchée ", which was opened on February 2020 and focuses on selling luxury reuse products such as brand-name items, watches, jewelry and alcoholic beverages. The company is also running a live commerce business for the Chinese market.

The Company aims to maximize Profits by expanding sales to general consumers while shortening the inventory turnover period (reducing inventory risk) through sales to corporations. The ratio of toC sales, which started in 2018, was initially about 9%, but grew to 20.3% in FY 12/21, driving profit growth.

By formulating optimal sales strategies for each product according to demand trend and building various sales channels, the Company is steadily accumulating results in sales, which is the third key to the success of the reuse business.

[1-5 Strengths and Features]

1) Maximization of synergy with a broad range of purchase and sales channels

The company is striving to maximize synergy by utilizing the strengths of the company and its subsidiary, TIMELESS, based on a wide array of purchase and sales channels of the two companies. Among many players in the reuse market, the Company has a unique business model of purchasing "luxury products" with a high unit price though a non-store-type "the at-home pick up service" which is unmatched by other competitors and constitutes a clear differentiator.

2) Strong Customer Base Centered on Senior Customers

As mentioned above, customers in their 50s and over make up approximately 82% of the Company's customer base. According to the Company's survey, 80% of the customers are satisfied with the responsiveness of the company's services, and the trust of senior high net worth individuals is strong.

This strong customer base will be a great advantage in future business development.

3) High Quality Management Team

One of the factors supporting the Company's growth is its excellent marketing strategy. According to President Iwata, no other start-up can run TV commercials as cost-effectively as the Company.

Running successful TV commercials requires familiarity with the industry structure including which players exist and what kind of setups are required, but at the Company, President Iwata who is from a major advertising company and have a great deal of knowledge, experience, and expertise, are strongly promoting a cross-marketing strategy.

In addition, in order to pursue sustainable growth by earning the trust of customers as well as to list the Company, it is essential to have a complete compliance system, and cash management in the purchase process is also an important point. Under the leadership of Mr. Koji Ono, who was appointed as Director and CFO in October 2016, the Company has been working to improve operations from an accounting perspective.

At the annual meeting of shareholders in Mar. 2021, a new director and CTO was appointed. The CTO Masayuki Imamura has the experience of engaging in a variety of digital transformation (DX) projects.

The Company runs its business with six high-quality executives, including two outside board directors, covering both offense and defense.

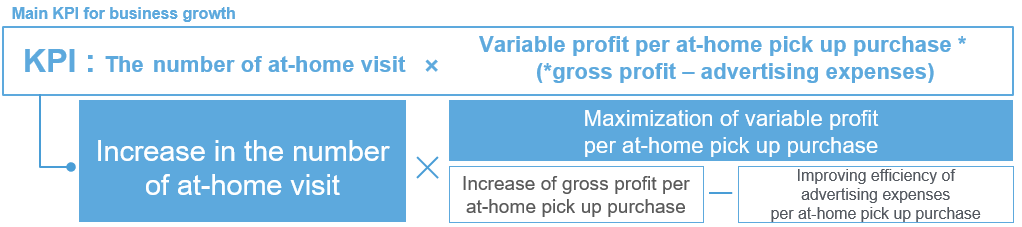

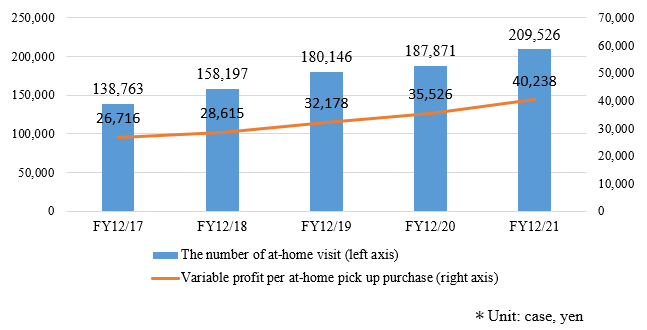

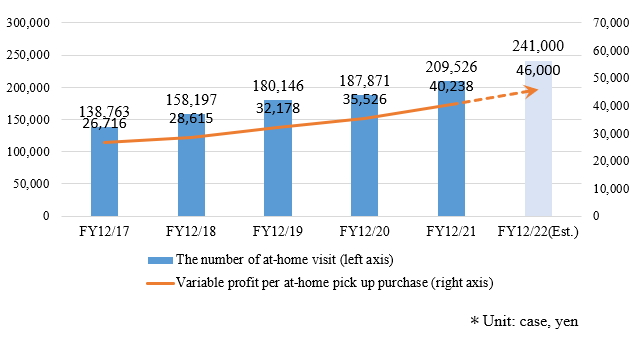

4) Main KPIs: "the number of at-home visit" x "Variable profit per at-home pick up purchase"

The Company has set "the number of at-home visit" x "Variable profit per at-home pick up purchase" as the main KPIs for the reuse business.

It pursues an increase in the number of inquiries by raising awareness in order to increase "the number of at-home visit", and seeks to maximize Variable profit per at-home pick up purchase by increasing the purchase of high-priced products and optimizing advertising expenses.

(Source: the reference material of the Company)

2. Fiscal Year Ended December 2021 Earnings Results

(1) Business Results

| FY 12/20 | Ratio to Sales | FY 12/21 | Ratio to Sales | YoY | Compared to the forecast |

Net Sales | 14,764 | 100.0% | 24,789 | 100.0% | +67.9% | -1.6% |

Gross Profit | 9,664 | 65.5% | 14,487 | 58.4% | +49.9% |

|

SG&A | 8,696 | 58.9% | 12,172 | 49.1% | +40.0% |

|

Operating Income | 968 | 6.6% | 2,315 | 9.3% | +139.1% | +3.8% |

Ordinary Income | 922 | 6.2% | 2,295 | 9.3% | +148.8% | +4.3% |

Current Net Income | 565 | 3.8% | 1,314 | 5.3% | +132.3% | +6.8% |

* Unit: million yen.

Substantial increase in sales and profit due to increase in on-site purchase volume and contribution from TIMELESS subsidiary

The sales in the cumulative term ended Dec. 2021 were 24,789 million yen, up 67.9% QoQ. The performance in the first quarter (January-March) was affected by the declaration of a state of emergency, but the number of at-home visits recovered after second quarter (April-June). Further, the acquisition of TIMELESS Corporation as a subsidiary, too, contributed.

Ordinary profit increased 148.8% QoQ to 2,295 million yen. The rise in the volume of purchases per at-home visit and the inclusion of TIMELESS's performance absorbed the increase in SG&A expenses, resulting in a significant increase in profit. Sales and profits increased for the seventh consecutive fiscal year.

Sales fell short of the plan but recurring profit exceeded the forecast as a result of strategic inventory carry-over in 2H to increase the toC sales ratio in the next fiscal year and beyond, within the scope of exceeding the planned profit.

(Main SG&A expenses)

| FY 12/20 | FY 12/21 | YoY | Compared to the forecast |

Advertising Expense | 2,990 | 3,905 | +30.6% | +0.2% |

Labor Costs | 2,349 | 3,087 | +31.4% | -3.5% |

Total SG&A | 8696 | 12,172 | +40.0% | -3.4% |

* Unit: million yen.

Even on a quarterly basis, the fourth quarter (October-December) recorded the highest sales ever.

(2) Trends of major KPIs

The number of at-home visits decreased in the first quarter but recovered after the second quarter.

Gross profit per business visit fell short of the full-year plan due to the strategic stockpiling of inventory and sales restraint to increase the toC sales ratio in the second half of the fiscal year, but variable profit per business visit grew 13.3% quarter on quarter as advertising expenses were kept at the planned level through continuous cost control.

| FY 12/20 | FY 12/21 | YoY |

The Number of At-home Visit | 187,871 | 209,526 | +11.5% |

Variable Profit per At-home pick up Purchase | 35,526 | 40,238 | +13.3% |

* Unit: case, yen

(3) Financial Condition and Cash Flows

◎ Main BS (Non-consolidated)

| End of 12/20 | End of 12/21 | Increase and Decrease |

| End of 12/20 | End of 12/21 | Increase and Decrease |

Current Assets | 5,822 | 7,346 | +1,524 | Current Liabilities | 3,084 | 3,649 | +564 |

Cash Equivalent | 3,640 | 4,772 | +1,131 | ST Interest Bearing Liabilities | 1,059 | 1,075 | +16 |

Inventories | 1,862 | 2,142 | +279 | Non-current Liabilities | 2,501 | 2,043 | -458 |

Noncurrent Assets | 3,014 | 2,938 | -76 | LT Interest Bearing Liabilities | 2,495 | 2,040 | -455 |

Tangible Assets | 305 | 362 | +57 | Liabilities | 5,586 | 5,692 | +106 |

Intangible Assets | 2,246 | 2,093 | -153 | Net Assets | 3,251 | 4,592 | +1,341 |

Investment, Others | 462 | 482 | +19 | Retained Earnings | 1,595 | 2,805 | +1,209 |

Assets | 8,837 | 10,285 | +1,448 | Total Liabilities and Net Assets | 8,837 | 10,285 | +1,448 |

* Unit: million yen

Total assets increased 1,448 million yen from the end of the previous term to 10,285 million yen due to an increase in cash and deposits and inventories. Total liabilities increased 106 million yen from the end of the previous term to 5,692 million yen. Net assets increased 1,341 million yen from the end of the previous term to 4,592 million yen due to an increase in retained earnings.

Capital-to-asset ratio increased 7.4% from the end of the previous term to 44.0%.

In terms of inventories, the company is working to increase the turnover period to improve the ratio of high-margin sales to general consumers.

3. Fiscal Year Ending December 2022 Earnings Forecasts

(1) Business Results

◎Consolidated Financial Forecast

| FY 12/21 | Ratio to Sales | FY 12/22 Est. | Ratio to Sales | YoY |

Net Sales | 24,789 | 100.0% | 32,500 | 100.0% | +31.1% |

Gross Profit | 14,487 | 58.4% | 19,100 | 58.8% | +31.8% |

SG&A | 12,172 | 49.1% | 16,000 | 49.2% | +31.4% |

Operating Income | 2,315 | 9.3% | 3,100 | 9.5% | +33.9% |

Ordinary Income | 2,295 | 9.3% | 3,040 | 9.4% | +32.4% |

Net Income | 1,314 | 5.3% | 1,730 | 5.3% | +31.6% |

*Unit: million yen.

Forecasting a significant increase in both sales and profit

Sales are projected to increase 31.1% year on year to 32,500 million yen, and recurring profit to rise 32.4% y-o-y to 3,040 million yen. The company expects to improve gross profit margin by continuing to strengthen on-site purchases and by reinforcing "toC" sales, which increased inventory in the previous period. The company will also strengthen storefront purchasing by opening more stores. The company plans to make upfront investments centered on hiring human resources for medium-term growth, and SG&A expenses are expected to increase 31.4% year on year. However, the increase in sales is expected to absorb this increase, resulting in a significant increase in profit.

In the first quarter of fiscal year ended December 2021, sales and operating profit grew significantly due to the prioritized auction of inventory held in preparation for TIMELESS' first online auction.

Although profits are expected to decline in the current Q1 due to a reaction to this, excluding this impact, the company plans to increase sales and profits YoY in each quarter.

The company plans to pay a dividend of 20.00 yen per share, up 6.00 yen per share from the previous term. The expected dividend payout ratio is 16.3%.

(Main SG&A expenses)

| FY 12/18 | FY 12/19 | FY 12/20 | FY 12/21 | FY 12/22 Est. | YoY |

Advertising Expense | 1,927 | 2,613 | 2,990 | 3,905 | 4,900 | +25.5% |

Labor Costs | 1,745 | 2,084 | 2,349 | 3,087 | 4,000 | +29.5% |

* Unit: million yen. FY 12/20 numbers are non-consolidated.

(Transition of KPIs)

| FY 12/21 | FY 12/22 Est. | YoY |

The Number of At-home Visit | 209,526 | 241,000 | +15.0% |

Variable Profit per At-home pick up Purchase | 40,238 | 46,000 | +14.3% |

* Unit: case, yen

(2) Impact of COVID-19

Although the number of at-home visits is slightly lower than expected due to a further increase of infected patients in Japan in January 2022, it is expected to recover from February onward, and at this point, the company believes the impact on the company's performance will be negligible.

4. Medium-term Management Plan 2024

The company announced a three-year medium-term management plan for 2024.

(1) Ideal state

The following four are the goals to be achieved by 2024.

☆ | To establish a position as a reuse tech company by promoting the integration of reality x technology (IT and DX) |

☆ | To maintain a solid leading position unrivaled by any other company in the reuse at-home pick up service |

☆ | An average annual growth rate of approximately 40% in consolidated ordinary profit during the three years of organic growth (FY 12/2024) |

☆ | To establish a corporate governance structure that balances sustainable growth and governance tightening to maximize shareholder value |

(2) Management Strategy

① Basic policy

As mentioned in the Company Overview section, the growth potential of the reuse market is extremely large.

The company believes that in this explicit market, which is estimated to be worth 3 trillion yen in 2022, all purchase channels (stores, home delivery, etc.) will be available, although the customer base ranges from young people to senior citizens, competition is intense.

On the other hand, in the dormant reuse market, which is estimated to have hidden assets of 37.1 trillion yen, the main need is to sell items for clearance and disposal, so at-home pick up services are advantageous because they allow direct access to unwanted items in customers’ houses; the customer base is mainly senior citizens who have many hidden assets, and competition is not expected to be as intense as in the explicit market.

Therefore, the company's basic policy is to "expand market share by strengthening purchase channels such as stores and M&A" in the explicit market and to "place the highest priority on investment for growth in the at-home pick up service and maintain a leading position" in the latent market.

② Competitive advantage in potential markets

The company's mainstay business is the at-home pick up service, which allows direct access to "hidden assets" lying in the home by visiting customers at their residences. The company's strength lies in its ability to purchase goods such as kimonos and stamps, which are in high demand for disposal, as well as the fact that approximately 60% of its customers use the service for estate liquidation and home clearance, and that 82% of its customers are seniors in their 50s or older.

These points are the source of the company's competitive advantage in the "hidden assets" market, a reuse market with large growth potential.

③ Five Management Strategies

The company has set forth five management strategies to realize its vision.

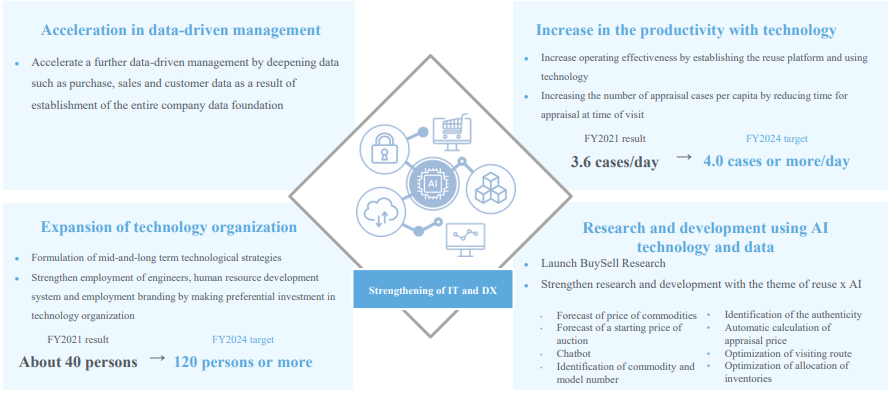

A | To accelerate technology investments, particularly in IT and DX enhancement |

B | To continue to strengthen the at-home pick up service and toC sales |

C | To expand the purchase store business |

D | M&A |

E | New Business |

Based on "A," the company aims for organic growth in "B" and "C," and inorganic growth in "D" and "E."

[A: To accelerate technology investments, focusing on IT and DX enhancement]

They will accelerate business growth by improving productivity through the use of technology and deepening data-driven management through the development of data infrastructure.

They aim to become a reuse tech company by promoting the fusion of reality (people and products) and technology (IT and DX).

(Taken from the reference material of the company)

B・C: Basic Policy for Organic Growth Strategy

As a basic strategic policy to achieve organic growth in existing businesses over the medium to long term, the company will focus on strategies to expand "C to B to C" transactions, where growth in both sales and profit margins is possible for both purchase and sale.

[B: To continue to strengthen the at-home pick up service and toC sales"]

◎Area expansion strategy for the at-home pick up service

The company aims to achieve further growth by increasing the number of at-home visits and maximizing variable profit per visit in each area through the development of optimal marketing strategies and the allocation of offices and personnel to each regional area, in addition to the metropolitan areas centered on Tokyo, Nagoya, and Osaka.

In the Tokyo, Nagoya, and Osaka areas, where the volume of inquiries and purchases is high, and gross profit per visit is high, but competition is fierce and advertising expenses tend to be high, the company will further strengthen its foundation through ongoing investment.

On the other hand, in the priority regional areas, where gross profit per visit is lower than those in the Tokyo, Nagoya, and Osaka areas, but the competitive environment is not as fierce as in the Tokyo, Nagoya, and Osaka areas, investments will be strengthened because they enable efficient advertising with low advertising costs.

The company will develop a cross-media marketing strategy, which is one of the company's strengths, by dividing the areas into smaller segments. In addition, by increasing the number of offices, the company will strengthen its sales force with an optimized organization and staffing in each area.

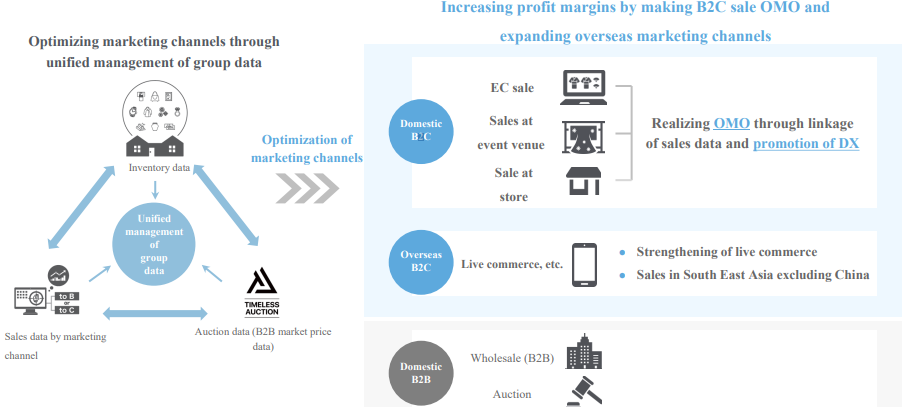

Strengthening of toC sales through the use of technology in sales

The company aims to improve profitability by optimizing sales channels through centralized management of group data such as "inventory," "sales by channel," "auctions," etc., promoting Online-Merge-Offline (OMO) in toC sales, and expanding overseas sales channels.

(Taken from the reference material of the company)

[C: Expansion of the purchase store business.]

They will accelerate store development while leveraging group synergies to strengthen the toC purchase channel, which is differentiated from at-home pick up service.

As of December 2021, BuySell had five stores in major cities nationwide, and its main products are kimonos, stamps, and old coins. Due to its large-scale marketing, the company is highly recognized for its at-home pick up service, which is a major advantage in attracting customers.

On the other hand, TIMELESS, whose main products are brand-name products, watches, and jewelry, has 14 permanent stores in department stores nationwide, whose good location and a sense of security are significant characteristics.

By leveraging the advantages and features of both companies, the company will accelerate store development through group synergies by promoting mutual customer traffic, marketing, data sharing, hiring and personnel exchanges, and other measures. The company aims to have over 50 group stores by 2024.

(Main KPI targets for the at-home pick up service)

| Results in 2021 | Goal in 2024 |

Number of at-home visits | 209526 | 320000 |

Variable profit per at-home visit (yen) | 40238 | 51000 |

Gross profit per at-home visit (yen) | 57324 | 72000 |

Advertising expense per at-home visit (yen) | 17086 | 21000 |

Number of inquiries | 350204 | 508000 |

CPA (yen/case) | 10223 | 13000 |

Number of employees (people) in FS business (at-home visits) | 344 | 560 |

Highly Ranked Appointment Ratio (%) | 44.4 | 50 |

Ratio of toC sales (%) | 20.3 | 30 |

*CPA: Advertising cost per action (advertising cost related to at-home pick up service divided by the number of inquiries)

*High-Rank Appointment Rati Appointments are classified into five ranks, A-E, according to the estimated gross profit earned per at-home visit for internal management accounting purposes. Percentage of the number of at-home visits for appointments of high-rank A-C among the ranks concerned (the number of ABC rank appointments divided by the number of at-home visits).

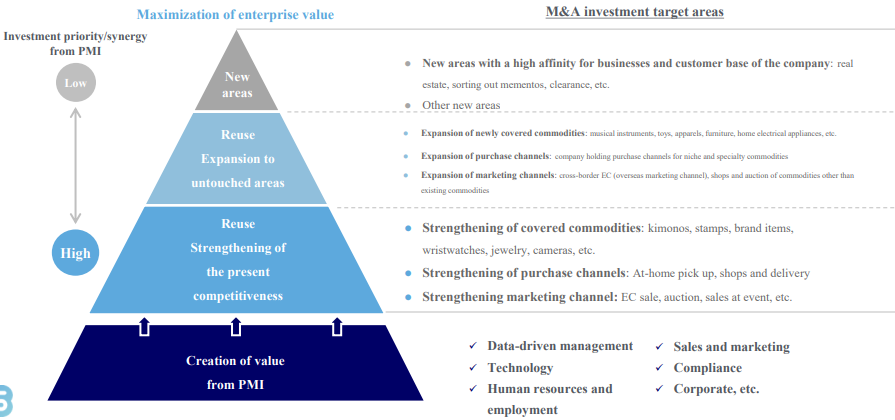

[D: M&A Strategy]

The company will focus on M&A in the reuse domain, giving priority to executing investments that contribute to strengthening existing competitiveness and developing areas that have yet to be reused.

In addition, the company aims to increase corporate value by enhancing return on investment through strategic M&A in areas where there is a high probability of creating synergies through PMI.

TIMELESS, which became a subsidiary in 2020, has contributed significantly to the enhancement of the Group's corporate value by generating group synergies through effective PMI after M&A, generating profits that significantly exceeded the burden of goodwill amortization, and improving EPS over the dilution impact of the stock swap.

Based on this track record, the company will continue to pursue effective M&A activities.

(Taken from the reference material of the company)

[E: New Business]

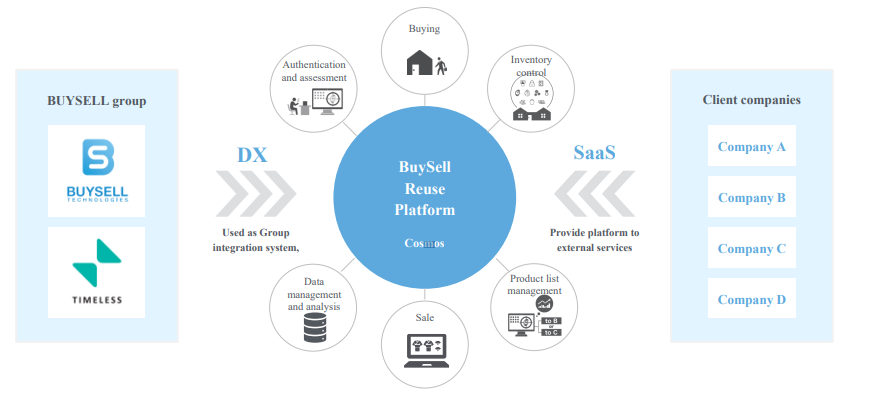

Scheme of changing the reuse platform into SaaS

The platform that has been used within the company group up to now was launched as the BuySell reuse platform (Cosmos) and was converted to SaaS. By providing this platform to outside vendors, the company will create a new pillar of revenues. The platform will provide a full range of functions from purchasing to selling and will realize a world in which a variety of reuse vendors use the BuySell Reuse Platform.

In addition, the company will use the platform as an integrated group system through the promotion of DX in pursuit of greater efficiency and maximization of earnings.

(Taken from the reference material of the company)

Promoting commercialization in the areas of liquidation and disposal needs and seniors

The company has been promoting a model of sending customers through alliances, focusing on areas that have a high affinity with the company's main customers, such as seniors and their clearance and disposal needs (collection of unwanted items, real estate sales, insurance, inheritance and counseling for end-of-life preparation, etc.), and aims to launch a business within its own group in addition to this model.

(3) Investment and Financial Strategy

① Capital Allocation Policy

Based on the ability to generate operating cash flow based on high-profit growth and flexible debt financing based on a stable financial base, the company aims to secure funds to invest in businesses and M&A for growth and allocate capital for sustainable growth.

Investment resources will be allocated in the following order of priority: "operating CF from business," "interest-bearing debt," and "equity."

Regarding capital allocation, in addition to business investments for organic growth, priority will be given to strategic investments for inorganic growth, mainly M&A.

② Investment Policy

The company is actively pursuing strategic investments in M&A for non-continuous growth and business investments for sustainable growth based on a disciplined investment policy.

Regarding business investment, the company will invest in technologies for enhancing IT and DX, marketing, human resources (recruitment and organizational strengthening), relocation and expansion of warehouses, store expansion, and strengthening of the compliance system. The company will control the allocation of funds while considering the forecast profit.

In M&A, from the perspective of maximizing corporate value and synergies, priority will be given to majority investments that can be consolidated into a consolidated group. The company will implement disciplined investment practices such as setting a maximum EV/EBITDA multiple and targeting profitable companies or companies with a high probability of becoming profitable in the short term.

For new businesses, the initial investment will be limited, and after carefully examining business profitability and growth potential, the investment limit will be gradually expanded in phases where the return on investment can be expected.

③ Financial Policy

To enable aggressive business investment and M&A activities while securing investment funds, the company maintains the stability of its financial base through disciplined financial management while emphasizing investment for growth.

The company's financial discipline includes a net D/E ratio of 0.5 or lower, a Net Debt/EBITDA ratio of 1.0 or lower, and a capital adequacy ratio of 40% or higher.

④ Shareholder Return Policy

The company's basic policy is to return profits to shareholders through stable and continuous dividends, while aiming to increase TSR (Total Shareholder Return) through medium- and long-term share price appreciation by increasing EPS through prioritizing investments for growth.

The target consolidated dividend payout ratio is 20%. They will maintain the current dividend policy.

(4) Governance Structure and ESG/SDGs

① Strengthen the corporate governance structure

With the aim of enhancing corporate value, further improving governance, and increasing management transparency and objectivity, the company will shift to a system in which independent outside directors constitute a majority of the Board of Directors, along with the transition to a company with an audit committee.

In addition, the company will continue to operate a voluntary Nomination and Compensation Advisory Committee, which is chaired and majority-owned by outside directors and will increase the ratio of female directors from the perspective of promoting diversity on the Board of Directors. The number of female directors increased by two to become three out of a total of eleven directors.

In addition, by nominating directors based on a skills matrix that defines key areas of expectation for directors, the composition of the Board of Directors will be changed to enable both medium- and long-term growth of the group and stronger governance.

*All of these changes are subject to approval at the general shareholders' meeting to be held in March 2022.

② ESG/SDGs

From the perspective of the sustainability of business activities required by society, the company established a sustainability strategy policy focusing on compliance, risk management, and organizational and human resource management.

The two pillars of the strategy are "compliance and risk management" and "organization and human resource management."

Under "Compliance and Risk Management," the key measures are to strengthen corporate/service governance, enhance information security, and maintain/improve reliability in at-home pick up service.

In the area of organizational and human resource management, the key measures are strengthening recruitment and training, improving employee engagement, and bridging the skills and gender gap.

(5) Business Performance Targets

The organic and inorganic targets for 2024 are as follows

① Organic Targets

| Actual results for FY 12/21 | Target for FY 12/24 | CAGR |

Net sales | 247 | 465 | approx. 23% |

Ordinary Income | 22.9 | 60 | approx. 38% |

Ordinary Income Ratio | approx. 9% | approx. 13% | +4pt |

*Unit: Hundred million yen. Organic growth of existing businesses of BuySell and TIMELESS. The impact of future M&A is excluded. CAGR: compound annual growth rate.

② Inorganic Targets

They aim for non-continuous growth through aggressive promotion of M&A.

The recurring profit target for FY12/2024 is 6 billion-plus yen.

To lay the foundation for long-term business sustainability and growth in FY12/2024 and beyond.

5. Conclusions

After the consolidation of TIMELESS, the company expects a significant increase in both sales and profit in the current fiscal year. One of the reasons for this is the acceleration of store openings by Buysell and TIMELESS. The company needs to open 10 new stores per year to reach the 50-store mark in the final year of its medium-term management plan, and the speed at which it opens new stores is particularly noteworthy, as Buysell currently has only five stores.

In addition to the store-opening strategy, the medium-term management plan, which is being released for the first time since the company went public, also calls for progress in area expansion and the concept of turning the reuse platform into a SaaS.

<Reference: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organizational Type | Company with audit and supervisory |

Directors | 6 directors, including 2 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

Corporate Governance Report

The latest revision date: March 25, 2021

<Fundamental Concept>

The Company recognize that establishing corporate governance is essential in order to increase corporate value, maximize shareholder returns, and build good relationships with stakeholders such as customers, business partners, employees, local communities, and government agencies.

To this end, the Company believe that it is important to establish a decision-making body that responds quickly and fairly to changes in the business environment, pursue Profits through its businesses, ensure that its financial soundness and improve its credibility, actively disclose information to fulfill accountability, build an effective internal control system, and ensure that audit and supervisory board members maintain their independence and fulfill their audit functions.

<Reasons for not implementing each principle of the Corporate Governance Code>

The Company has implemented all the basic principles of the Corporate Governance Code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |