Bridge Report:(7685)BuySell Technologies Fiscal Year Ended December 2023

President and CEO Kyohei Iwata | BuySell Technologies Co., Ltd (7685) |

|

Company Information

Market | TSE Growth Market |

Industry | Wholesale (trade) |

President and CEO | Kyohei Iwata |

HQ address | PALT Building, 28-8, Yotsuya 4-Chome, Shinjuku-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Act.) | Trading unit | |

¥2,903 | 14,285,511 shares | ¥41,470 million | 17.5% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥25.00 | 0.9% | ¥132.30 | 21.9x | ¥589.51 | 4.9x |

* The share price is the closing price as of March 15. Each figure is from the financial results for the fiscal year ended December 2023.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2020 | 14,764 | 968 | 922 | 565 | 41.12 | 7.50 |

December 2021 | 24,789 | 2,315 | 2,295 | 1,314 | 93.26 | 14.00 |

December 2022 | 33,724 | 3,694 | 3,672 | 2,268 | 158.28 | 20.00 |

December 2023 | 42,574 | 2,796 | 2,754 | 1,453 | 100.11 | 25.00 |

December 2024 Est. | 52,480 | 3,400 | 3,310 | 1,890 | 132.30 | 25.00 |

* The estimated values are based on the forecasts made by the Company. On January 1, 2021, a 2-for-1 stock split was conducted. EPS and DPS were adjusted retroactively.

This Bridge Report presents BuySell Technologies’ financial results for the fiscal year ended December 2023 and so on.

Table of Contents

Key Points

1. Corporate Overview

2. Fiscal Year Ended December 2023 Earnings Results

3. Fiscal Year Ending December 2024 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Sales grew 26.2% year on year, and ordinary income declined 25.0% year on year in the fiscal year ended December 2023. Both sales and all kinds of profits exceeded the company's forecasts. Regarding sales of each company, sales at BuySell (non-consolidated) and Timeless grew 11% and 32% year on year, respectively, and Four Nine's full-year contribution (recorded only in 4Q in the previous fiscal year) boosted the rate of increase in sales.

- Until September, KPIs such as the receipt of inquiries and the number of visits in the at-home pickup service business remained sluggish due to the impact of the wide-area robbery incidents, severe heat, and other factors. However, the KPIs showed a gradual shift toward improvement, with the number of at-home visits recovering to an 11.1% year on year increase in the fourth quarter, backed by a leveling off in the second half of September and repeat visits.

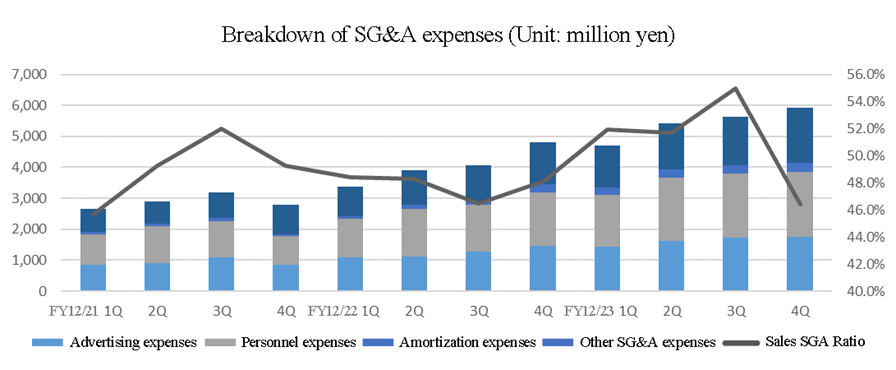

- In terms of revenues, aggressive promotional activities to increase appointments with customers in response to a decrease of inquiries in the at-home pickup service, an increase of personnel (up 323 year on year) due to strengthened hiring of new graduates and mid-career workers, an increase of the floor space of the head office and expansion of the warehouse, and increased depreciation due to the inclusion of Four Nine in the scope of consolidation all weighed on earnings. However, in the fourth quarter, the SG&A expense ratio declined to 46.4%, thanks to a recovery in the at-home pickup service and a strong increase of store purchase service, as well as efforts to improve the efficiency of SG&A expenses.

- The company forecasts sales of 52,480 million yen (up 23.3% year on year), an operating income of 3,400 million yen (up 23.6% year on year), and an adjusted EBITDA of 4,910 million yen (up 22.9% year on year) for the fiscal year ending December 2024. The company views this fiscal year as a run-up period that will lead to a high growth phase in the fiscal year ending December 2025 and beyond; thus, it plans to manage its operations with an emphasis on efficiency. The full-year contribution from the inclusion of Nisso in the scope of consolidation is expected to increase 2.3 billion yen in terms of sales. In the at-home pickup service business, the company plans to emphasize efficiency in marketing investments, and in the store purchase service business, it plans to hire store personnel and support personnel proactively. The business environment is expected to improve. In light of the recognition of challenges in terms of cost in the past expansion strategy, the company plans to strictly examine the investment return of SG&A expenses as a whole. As a result of the above efforts, the adjusted EBITDA ratio is expected to remain unchanged from 9.4%, despite the full-year contribution from Nisso pushing down gross margin. The company plans to pay a dividend of 25.00 yen per share, unchanged from the previous fiscal year. The expected dividend payout ratio is 18.9%.

- The fiscal year ended December 2023 was a challenging one for the company, marked by a series of robbery cases, severe heat, and other difficulties. However, the company took the initiative to identify and address these challenges during the second half of the year. It seems that the company has been diligently working on solutions. The results of these efforts have begun to materialize in the form of KPI improvement since September 2023. The fiscal year ending December 2024 is not seen as a year for aggressive growth. Instead, it is considered a year to solidify the foundation for a return to a high-growth trajectory by the fiscal year ending December 2025 and beyond. While costs may seem high in the short term, it is important to keep a close eye on how KPIs are changing.

- The company will be shifting to a two-person representative system starting in April 2024. Mr. Tokushige, the newly appointed Representative Director, President and CEO, is being recruited from outside the company. While his experience in leading large, labor-intensive organizations will likely be valuable to the company, his influence both within and outside the company remains to be seen. We hope that he will exert a positive influence.

1. Corporate Overview

BuySell Technologies operates reuse business that leverages the strengths of the "Internet" and "Real world". The Company attracts sellers through a marketing strategy that makes full use of the Internet and mass media, and also provides the at-home pick up service throughout Japan. Its characteristics or strengths include the maximization of synergy with a variety of purchase and sales channels, the robust customer base centered around seniors, and the high-quality management. The Company is aiming for further growth by developing a huge potential reuse market and creating new businesses utilizing its customer base.

[1-1 History]

President Iwata, who was in charge of marketing at a major advertising company, questioned the situation where large and famous companies with abundant advertising expenses are favored to the disadvantage of small and medium-sized companies and start-ups with a small budget. He retired from the major advertising company and established a consulting company for his desire to help companies, including ones with weak capital, develop true marketing. He met BuySell Technologies (formerly Ace Co., Ltd.) while supporting many start-ups and small businesses. The Company had long been providing the at-home pick up service, which is its current core business, but when President Iwata's consulting engagement started in May 2016, its marketing depended almost entirely on flyers. The homepage was not sophisticated, and the business performance was not good. The Company, which undertook a full-fledged reform under President Iwata, began to see the results when it registered a record number of applications in August of the same year, renewing the record in September. In this process, President Iwata felt that while "the at-home pick up service" has a high added value and there are many customers who need it, the way in which the benefits of the service are communicated, the brand is constructed, marketing actions are taken, and others were extremely inadequate. He was convinced that with his marketing know-how, the Company could transform itself into a more attractive company. In October of the same year, President Iwata assumed the role of Chief Sales and Marketing Officer (CSMO). In November, the Company name was changed to BuySell Technologies, and a new TV commercial was put on air and the reform sped up. He assumed the post of president in September 2017. The business expanded steadily thanks to the success of conducting the PDCA cycle of creative activities and the purchase of TV commercials utilizing his expertise. The Company also established a compliance system and was listed on the Tokyo Stock Exchange Mothers in December 2019. In April 2022, the company got listed on the Growth Market of TSE through the stock market restructuring.

[1-2 Corporate Philosophy and Management Philosophy]

The Company upholds the following missions and values.

Mission:Our Mission | Beyond people, beyond time, we aim to become a bridge connecting important things. |

Value :What We Aim to Be | 1. Hospitality We listen to others and provide them with joy and delight that exceeds their expectations. 2. Professional Maximize your performance by leveraging your professional knowledge and skills. 3. Creative Without being bound by existing concepts, we discover challenges ourselves and create new value. |

The Company believes that things have value that goes beyond their physical existence, and that properly connecting them is its mission and social existence value. In addition, the company is strongly aware of the need to address environmental issues and co-create with all stakeholders, and considers its group mission to be "contributing to the creation of a recycling-oriented society through the revitalization of the secondary distribution market to realize a sustainable society" and "pursuing sustainable growth and maximizing corporate value as a company that co-creates value with various stakeholders including customers, shareholders, employees and society.

Furthermore, the company intends to reflect the value in its human resources evaluation system and link them to the development of next-generation human resources.

[1-3 Market Environment]

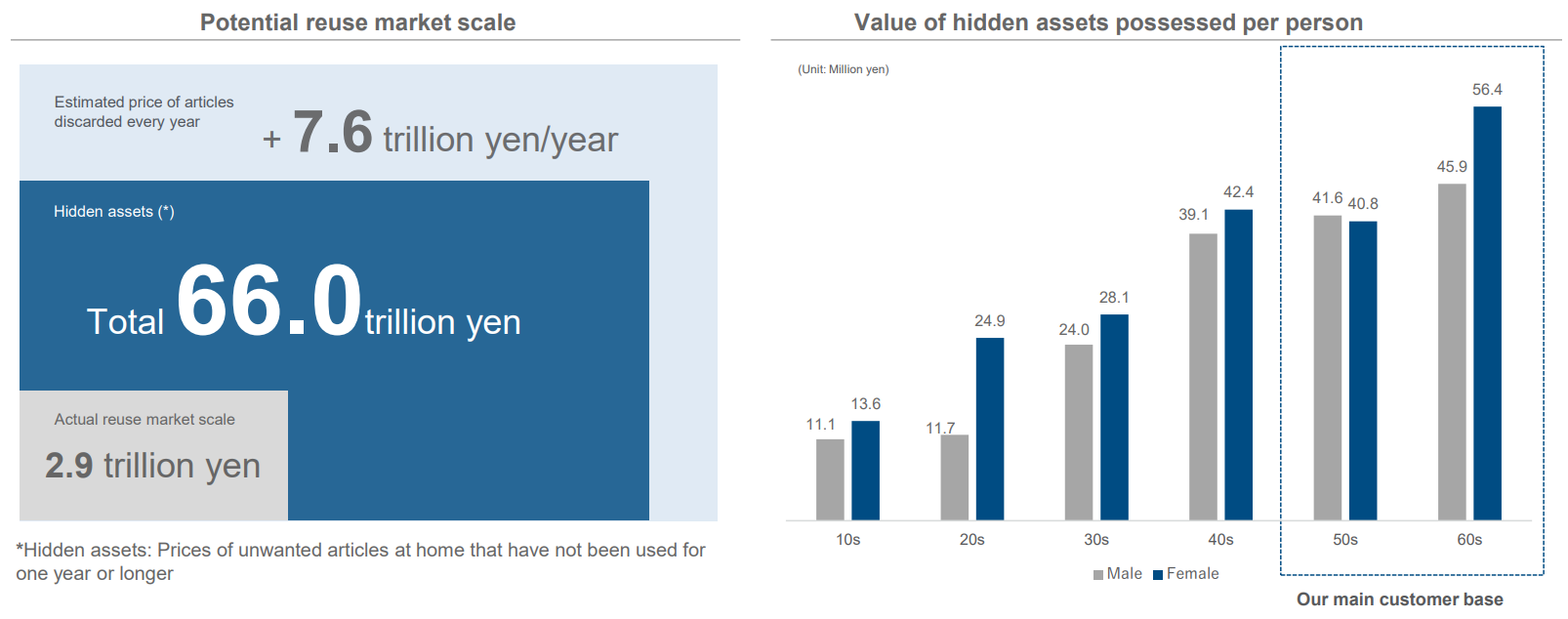

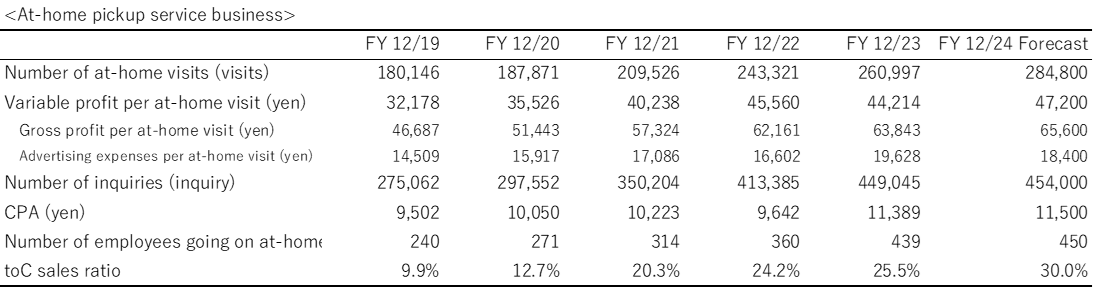

The scale of the reuse market is estimated to be about 2.9 trillion yen in 2022 and is expected to grow to 4 trillion yen by 2030.

However, this is only a figure for the actual reuse market, and the total potential size of the reuse market, including "hidden assets," which are unused items in houses that have not been used for more than one year, is estimated to be over 66 trillion yen. In addition, in Japan, where the population continues to shrink, disused articles are estimated to increase by 7.6 trillion yen each year, and the potential reuse market is expected to continue expanding. In terms of hidden asset holdings per capita in each age group, seniors in their 50s and older hold a significant portion.

The company intends to cultivate the reuse market, which has great potential for growth, by focusing on on-site purchase, which is one of the company's strengths, and by uncovering potential "hidden assets" in the home.

[1-4 Business Description]

(1)Business Model

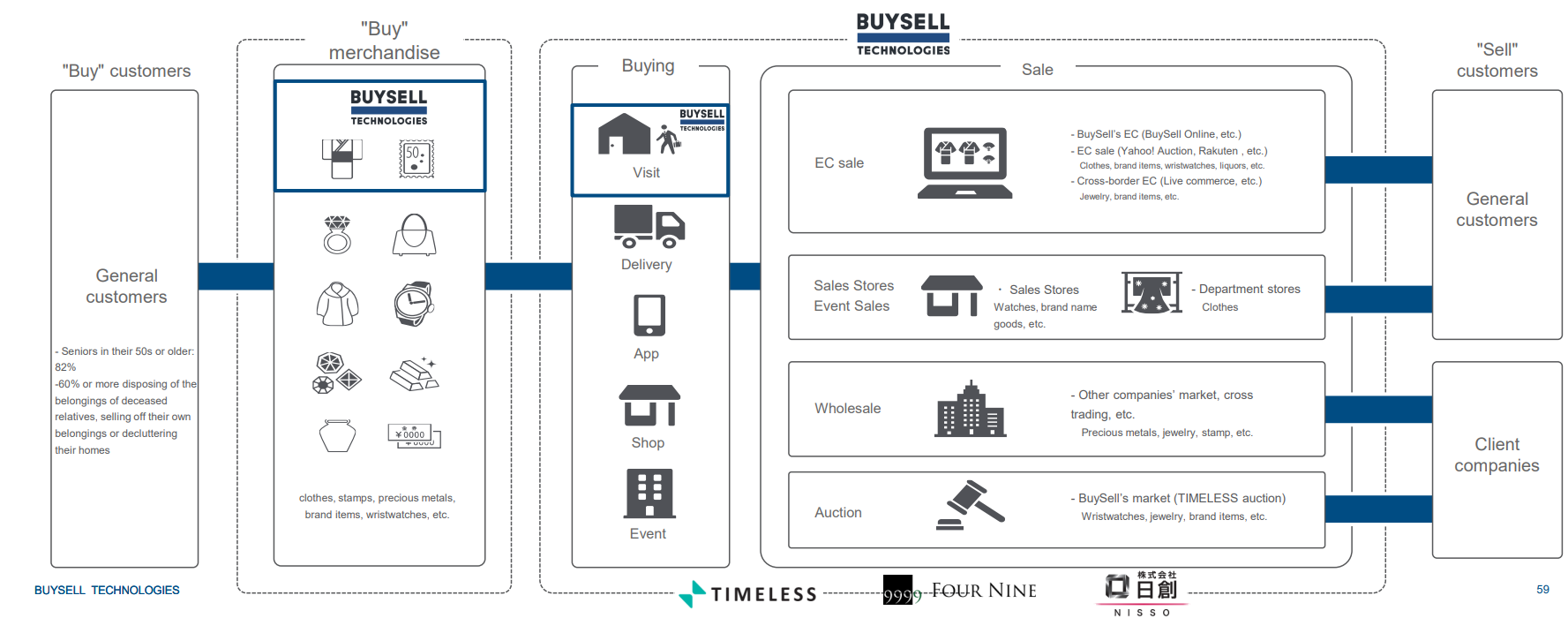

The company and its 6 subsidiary, TIMELESS, BuySell Link Inc., FOUR-NINE, Inc., Nisso Co., Ltd., and Musubi Co., Ltd. operate the reuse business by utilizing respective strengths in the Internet and in real transactions. (BuySell Link Inc. is a special subsidiary for the purpose of promoting the employment of people with disabilities.)

It attracts sellers through a marketing strategy that makes full use of the internet and mass media, and also provides a shipping purchase service and a store purchase service as well as the at-home pick up service delivered by its assessors who can travel throughout Japan.

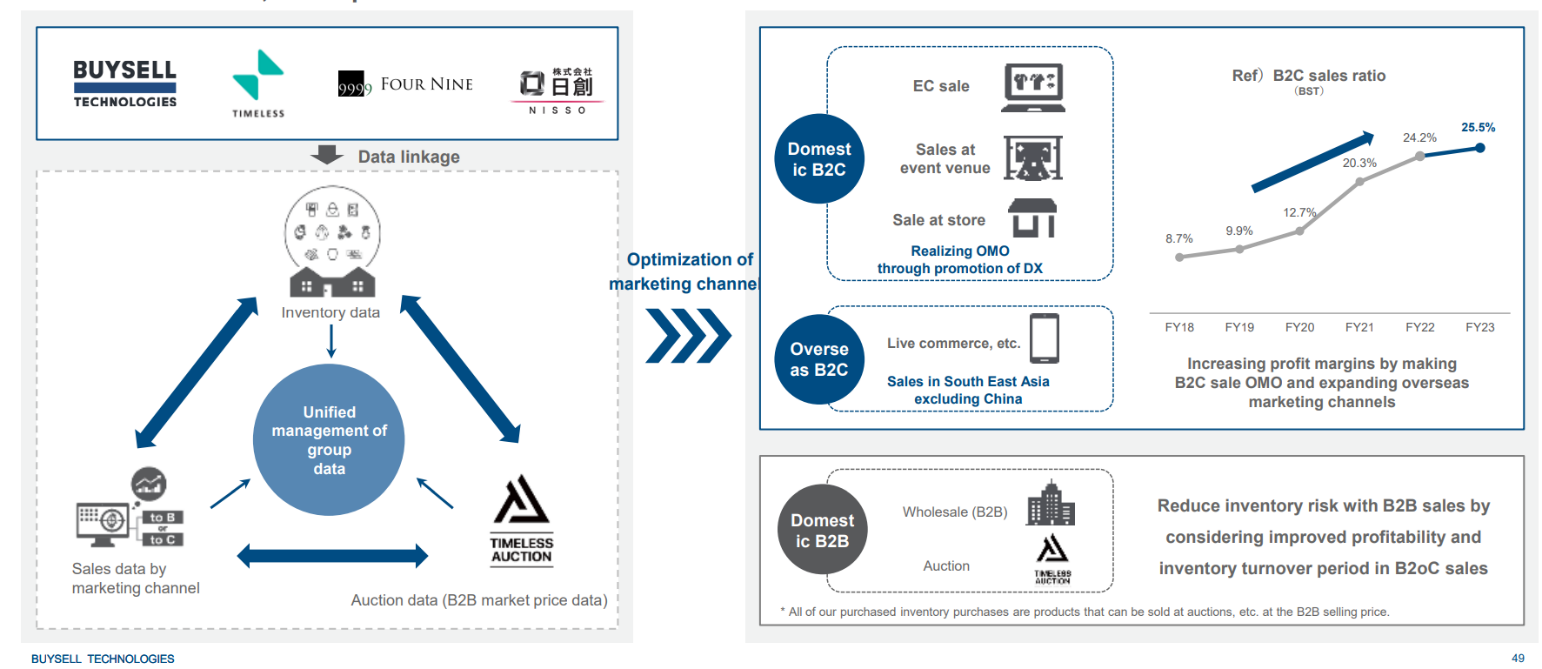

The Company sells purchased products to general customers (toC sales) though EC sales at EC malls such as the Company's own EC site “BuySell Online and BuySell brandchée” and Yahoo! Auctions, and at cross-border EC sites such as eBay, and special event sales at department stores. In addition, it sells to external vendors through the “Timeless Auction", which is held by TIMELESS Corporation, which was acquired as a subsidiary, and wholesale using other companies' markets.

(Source: the reference material of the Company)

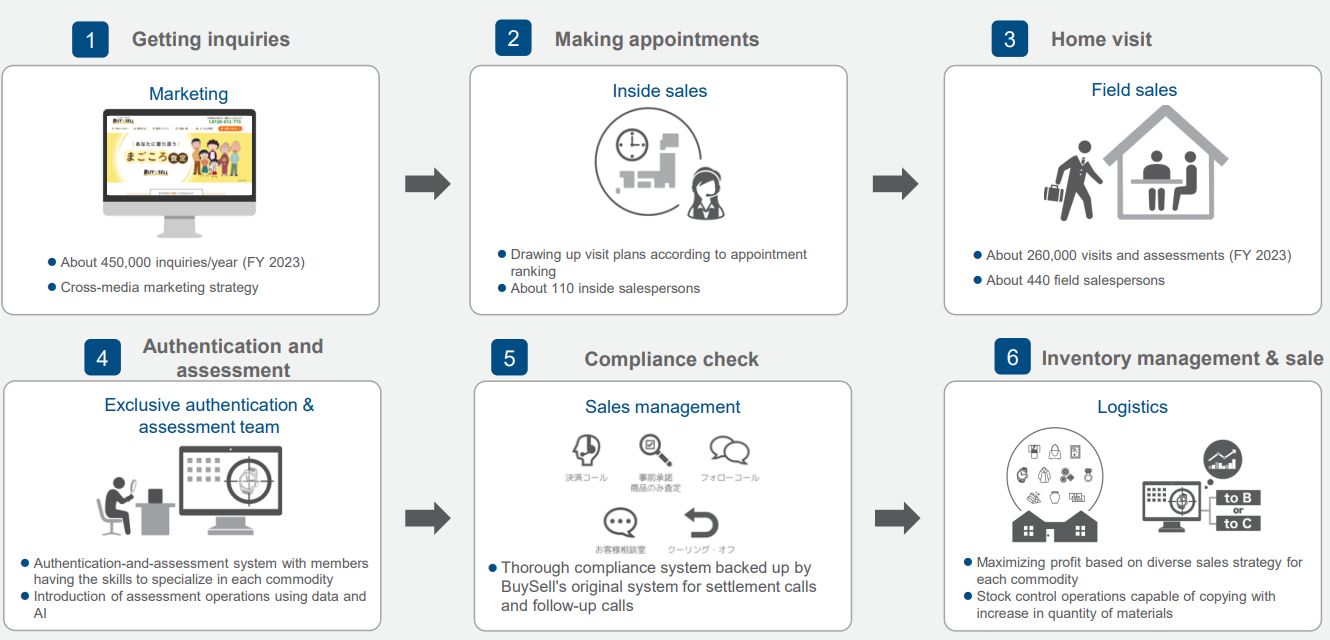

The Company has built a system to consistently manage and execute the entire flow from marketing to attracting customers, purchase appraisal, inventory management, and sales on its own. At the same time as expanding its mainstay reuse business, the Company is also focusing on launching and developing new business adjacent to the reuse business and other services utilizing customer data.

(2) Overview of Each Service

The Company's reuse business consists of the following business flo "Attracting sellers" → "Conducting purchase" → "Selling purchased products". The outline and features of each step of "customer attraction", "purchase" and "sales" are described in detail below.

(Source: the reference material of the Company)

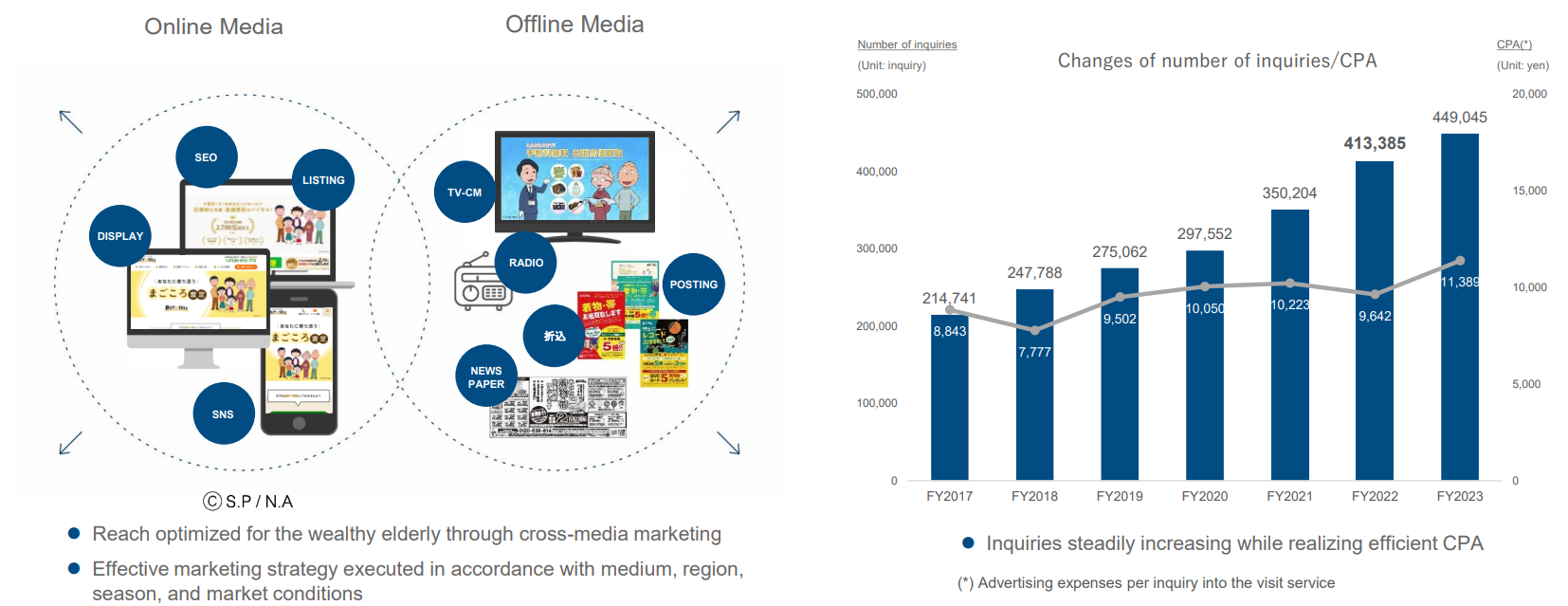

1) Attracting Customers: Developing cross-media marketing aimed at high-net-worth seniors

◎Marketing

Marketing activities for receiving appraisal requests from customers are the starting point of the business strategy and execution, and maximizing the number of customers is the first key to the success of the Company's business. The marketing skills and expertise of the management team, including President Iwata, play a major role.

(Source: the reference material of the Company)

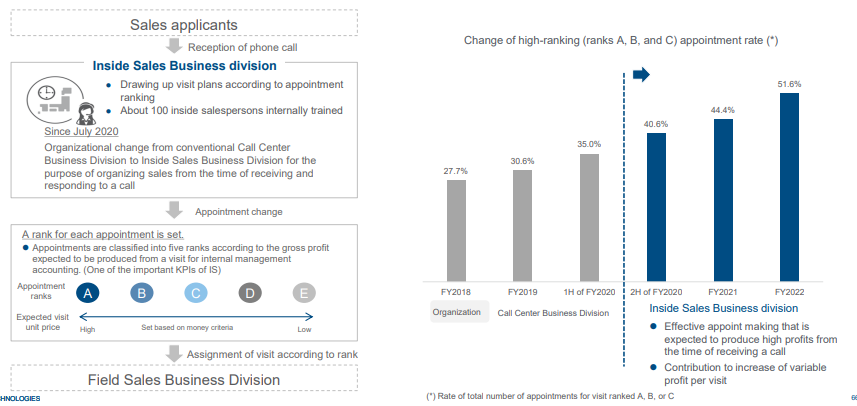

◎Inside Sales: Providing services that meet customer needs and maximizing the efficiency of assessor operations

In response to incoming calls from potential buyers, the company approached through marketing, approximately 100 operators listen directly to customers’ requests and cooperate with assessors to provide services in line with customer needs.

In July 2020, the organization was changed from the previous "Call Center Business Division" to the "Inside Sales Division" for the purpose of organizing sales from the time of answering the first inquiry call.

Moreover, the call center not only performs administrative tasks such as receiving inquiries about products to be sold and arranging the date and time of visits, but also provides the customer with an explanation that will be given when they are visited by an assessor, as well as an overview of the Company's services, information regarding the range of products that can be assessed, and a guidance for preventing uninvited solicitations so that customers can use the Company's services with greater confidence.

In addition, the Inside Sales Division, along with these customer-oriented services, generates highly profitable and effective appointments by classifying them into five ranks based on the expected gross profit per business visit (expected cost per visit) when the call is received.

This organizational change has resulted in a steady increase in the ratio of highly ranked appointments over the years, contributing to an increase in variable profit per at-home visit.

The company receives 449,000 calls (The Fiscal Year Ended December 2023 Results) for asking about purchase per year, and records all of them, to trace the subsequent appointments and home visits. With this, they extract common items and essential points from highly ranked appointments, and educate operators about them. By repeating this cycle, they increase gross profit from home visits.

(Source: the reference material of the Company)

2) Purchase: Developing the "at-home pick up service" meeting a wide range of customer needs

◎The At-home Pick up Service

"The at-home pick up service" which involves going to the homes of customers who made inquiries and conducting an appraisal and a purchase, is the main purchasing method.

In addition, the Company also carries out a "shipping purchase service", in which customers send products to be sold to the Company, and a "store purchase service", in which customers bring products directly to the Company.

The Field Sales Division, which is in charge of "the at-home pick up service," has approximately 439 assessors as of the end of 2023, with based in the Kanto, Kansai, Nagoya, Fukuoka, and other areas, to cover all parts of Japan. "The at-home pick up service" can flexibly respond to purchase requests from customers who have difficulty using store purchases service or shipping purchase service and meet a wider range of customer needs, such as when there is a wide variety of products to be assessed, the quantity of appraisals is large, it is difficult to carry the products due to their weight, as well as when there are inquiries from distant customers and elderly customers. For example, if a customer wants to sell a large number of kimonos which weighs approximately 1 kg per piece, and it is difficult to carry them, "the at-home pick up service" in which the Company's assessor visits a customer's home to conduct an appraisal and a purchase, is highly compatible with such customer needs.

◎Assessor

The number of field sales assessors is also increasing steadily in parallel with the expansion of business scale, based on the company's recruiting capability. Since 2017, the company has been strengthening its recruitment of new graduates.

The company also focuses on the training of assessors to enhance customer satisfaction.

The Sales Enablement Department, a division specializing in education and training, has introduced a systematic education and training system for assessors and implements education and training programs tailored to each assessor in each center, based on the company's unique internal management index.

Considering the shortening of the training period as a KPI, they constantly review their educational programs. Several years ago, the training period was about 6 months, but currently, it is about 5 months.

Furthermore, the compliance department calls the customer again (follow-up call) after the assessor has left to receive the customer's candid opinions about the at-home pick up service, specifically about the assessor's attitude, compliance and customer satisfaction and so on.

The results of follow-up call, including customers’ voices, complaints and compliments are managed for each assessor, and the assessors are thoroughly informed of these to further improve their performance.

The company is also working to ensure that it complies with the cooling-off policy in accordance with laws and regulations.

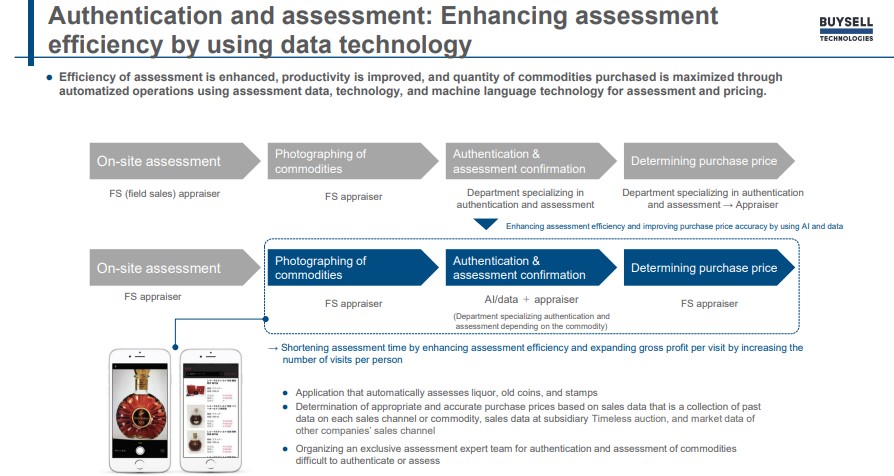

◎Authenticity Appraisal

To ensure accurate appraisal and prevention of counterfeit purchase and assessors' fraudulent appraisal, the Company's appraisal system requires not only an on-site appraisal by a visiting assessor but also a double check by another assessor who specialize in authenticity appraisal and appraisal, based on information from photos and videos sent from the visiting assessor using mobile terminals and such.

In addition, the company is using valuation data and technology to improve the efficiency and productivity of valuation and pricing decisions by automating operations using machine learning technology, etc., with the aim of maximizing the volume of purchases.

◎Products

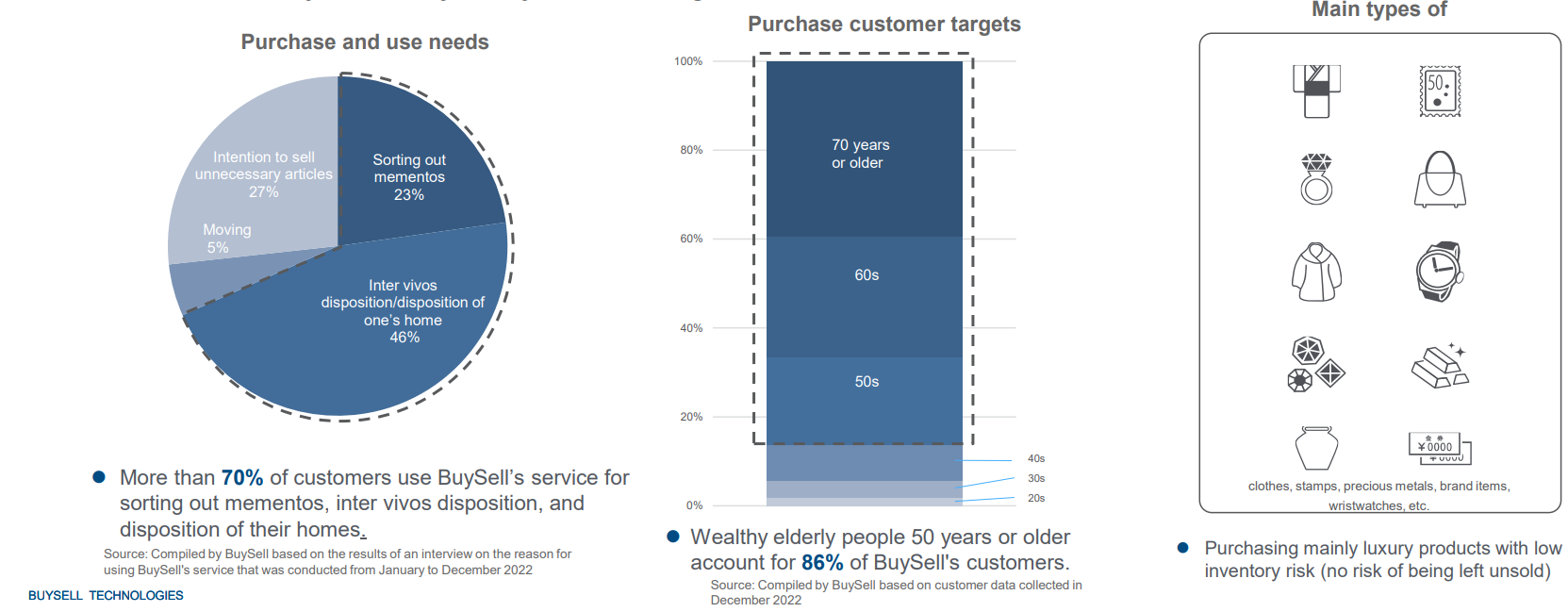

It mainly deals with kimonos, stamps, old coins, precious metals, jewelry, brand-name items, watches, antiques, furs, alcoholic beverages and others, and focuses mainly on products with high selling prices.

(Source: the reference material of the Company)

◎Main Customers

There are many inquiries from senior wealthy people whose needs are aligned with the at-home pick up service, which is the Company's main service. In the FY ended December 2022, customers in their 50s and over accounted for approximately 86% of all customers.

In addition, senior customers use the Company's purchase services for disposition of one’s home, sorting out mementos and pre departure decluttering cleaning which account for approximately 70% of the reasons for using the services.

(Source: the reference material of the Company)

3) Sales:

◎Inventory Management

After the cooling-off period, purchased products are managed centrally from inspection to exhibition by more than 300 staff including part-time job in the Company's own warehouse in Funabashi, Chiba Prefecture.

AXIS, an IT system developed by the Company, manages inventory for each product, and processes cooling-off requests.

The product is sent to the most suitable sales route, taking into account various aspects such as the characteristics and condition of the product as well as the market environment.

◎Sales System

After planning sales strategies based on inventory status, the Company sells purchased products through sales channels such as antique markets, auctions for dealers, e-commerce sales, special events and others.

For corporate sales through antique markets and auctions, the Company uses face-to-face auction formats for each product, and repeats negotiations with business partners until they find a sales partner that can produce a higher Profit Margin. In the FY ended December 2023, approximately 74% of Sales comes from corporate customers.

In addition, the company holds an auction of kimonos regularly at Narashino Warehouse, and actualizes appropriate sales at each quality level and the distribution of more goods through TIMELESS Auction, which is held by TIMELESS Corporation, which was acquired as a subsidiary.

On the other hand, in sales to end-user general consumers, in order to provide high-quality products, the Company conducts EC sales (Rakuten Market, Yahoo! Auctions and others) and sales at department store events. It operates two e-commerce sites, "BuySell Online" which was launched in July 2018 and focuses on the sales of reused kimonos, and " BUYSELL brandchée ", which was opened on February 2020 and focuses on selling luxury reuse products such as brand-name items, watches, jewelry and alcoholic beverages. The company is also running a live commerce business for the Chinese market.

The Company aims to maximize Profits by expanding sales to general consumers while shortening the inventory turnover period (reducing inventory risk) through sales to corporations. The ratio of toC sales(non-consolidated), which started in 2018, was initially about 9%, but grew to 25.5% in fiscal year ended December 2023, driving profit growth.

By formulating optimal sales strategies for each product according to demand trend and building various sales channels, the Company is steadily accumulating results in sales, which is the third key to the success of the reuse business.

[1-5 Strengths and Features]

1) Maximization of synergy with a broad range of purchase and sales channels

The company is striving to maximize synergy by utilizing the strengths of the company and its subsidiary, TIMELESS, based on a wide array of purchase and sales channels of the two companies. Among many players in the reuse market, the Company has a unique business model of purchasing "luxury products" with a high unit price though a non-store-type "the at-home pick up service" which is unmatched by other competitors and constitutes a clear differentiator.

2) Strong Customer Base Centered on Senior Customers

As mentioned above, customers in their 50s and over make up approximately 86% of the Company's customer base. According to the Company's survey, 80% of the customers are satisfied with the responsiveness of the company's services, and the trust of senior high net worth individuals is strong.

This strong customer base will be a great advantage in future business development.

3) High Quality Management Team

One of the factors supporting the Company's growth is its excellent marketing strategy. According to President Iwata, no other start-up can run TV commercials as cost-effectively as the Company.

Running successful TV commercials requires familiarity with the industry structure including which players exist and what kind of setups are required, but at the Company, President Iwata who is from a major advertising company and have a great deal of knowledge, experience, and expertise, are strongly promoting a cross-marketing strategy.

In addition, in order to pursue sustainable growth by earning the trust of customers, it is essential to have a complete compliance system, and cash management in the purchase process is also an important point. Under the leadership of Director and CFO Mr. Koji Ono, the Company has been working to improve operations from an accounting perspective.

Mr. Masayuki Imamura, a director and CTO, has a proven track record of driving digital transformation across multiple companies, including well-known ones. He has led the expansion and growth of technology organizations to support data-driven management. Notably, his achievements were recognized with the "Findy Team+ Award" two years in a row, in 2022 and 2023, awarded to "companies with high productivity indicators for engineering organizations."

The Company runs its business with six high-quality executives, including two outside board directors, covering both offense and defense.

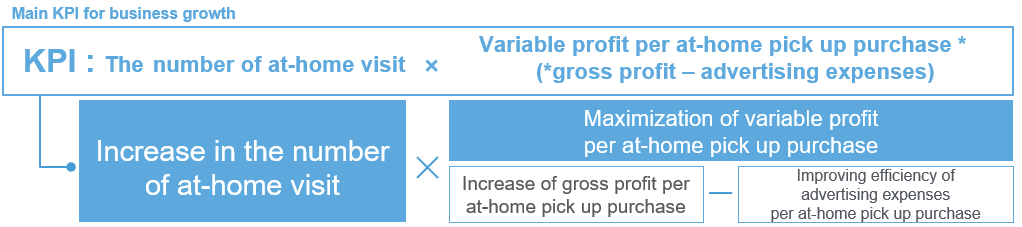

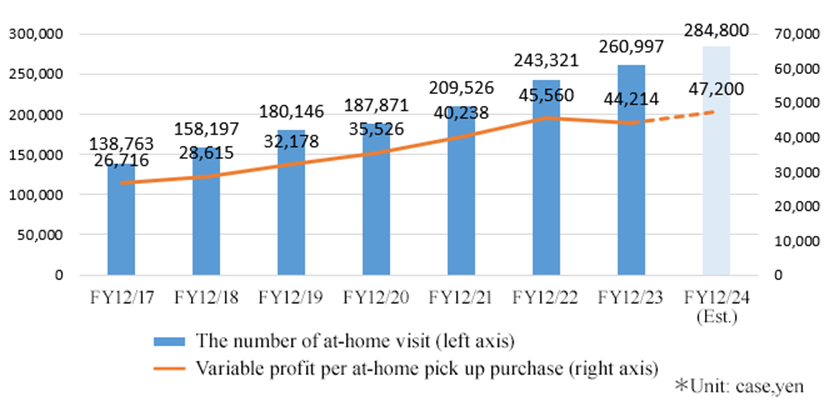

4) Main KPIs: "the number of at-home visit" x "Variable profit per at-home pick up purchase"

The Company has set "the number of at-home visit" x "Variable profit per at-home pick up purchase" as the main KPIs for the reuse business.

It pursues an increase in the number of inquiries by raising awareness in order to increase "the number of at-home visit", and seeks to maximize Variable profit per at-home pick up purchase by increasing the purchase of high-priced products and optimizing advertising expenses.

(Source: the reference material of the Company)

(Source: the reference material of the Company)

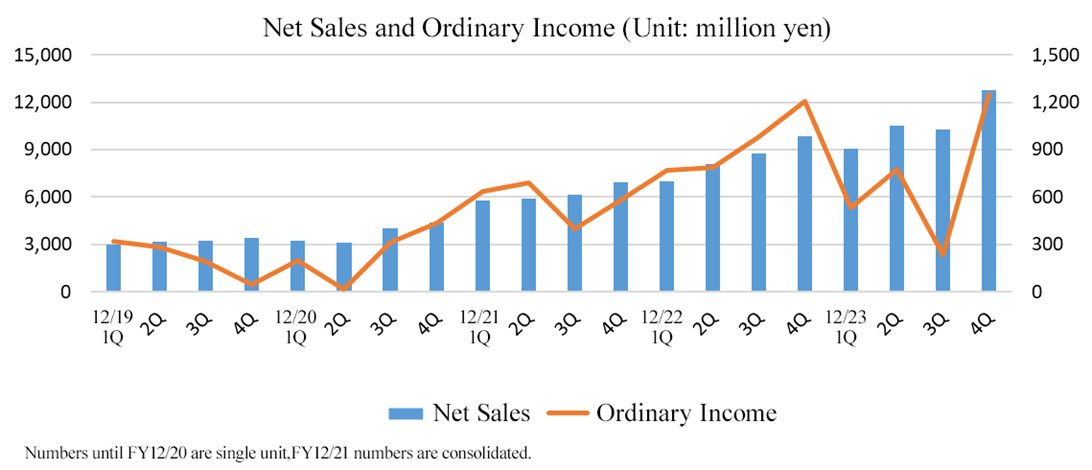

2. Fiscal Year Ended December 2023 Earnings Results

(1) Business Results

| FY 12/22 (cumulative total) | Ratio to Sales | FY 12/23 (cumulative total) | Ratio to Sales | YoY | Company’s Forecast | Compared with the forecast |

Net Sales | 33,724 | 100.0% | 42,574 | 100.0% | +26.2% | 42,310 | +0.6% |

Gross Profit | 19,864 | 58.9% | 24,493 | 57.5% | +23.3% | 24,434 | +0.2% |

SG&A | 16,169 | 47.9% | 21,696 | 51.0% | +34.2% | 21,894 | -0.9% |

Operating Income | 3,694 | 11.0% | 2,796 | 6.6% | -24.3% | 2,540 | +10.1% |

Adjusted EBITDA | 4,339 | 12.9% | 3,994 | 9.4% | -8.0% | 3,776 | +5.8% |

Ordinary Income | 3,672 | 10.9% | 2,754 | 6.5% | -25.0% | 2,500 | +10.2% |

| Current Net Income | 2,268 | 6.7% | 1,453 | 3.4% | -35.9% | 1,330 | +9.3% |

* Unit: million yen.

Created by Investment Bridge based on disclosed material of the company.

Created by Investment Bridge based on disclosed material of the company.

For the fiscal year ended December 2023, sales increased 26.2% year on year to 42,574 million yen. Regarding sales of each company, sales at BuySell (non-consolidated) and Timeless grew 11% and 32% year on year, respectively, and Four Nine's full-year contribution (recorded only in 4Q in the previous fiscal year) boosted the rate of increase in sales. The achievement ratio against the company's forecast revised in November 2023 was 0.6% higher than the forecast for sales and 5.8% higher for adjusted EBITDA. The strong performance of the store purchase service business, as well as the streamlining of advertising and promotional expenses and the promotion of cost improvement throughout the company, contributed to these results.

The company posted record profits in the fourth quarter (October - December), and although KPIs such as the number of inquiries received and the number of visits in the at-home pickup service business remained sluggish until the third quarter due to the impact of the wide-area robbery incidents, they leveled off in the second half of September, and the number of repeat visits was steady, leading to an 11.3% year on year increase in the number of at-home visits.

Gross profit increased 23.3% year on year to 24,493 million yen (gross profit margin: 57.5%). While there was a negative impact on the mix due to the inclusion of Four Nine in the scope of consolidation (gross profit margin in the order of 20%), which also buys used goods at directly managed stores, measures to improve gross profit margin for at-home visits were effective, and the company achieved its planned level.

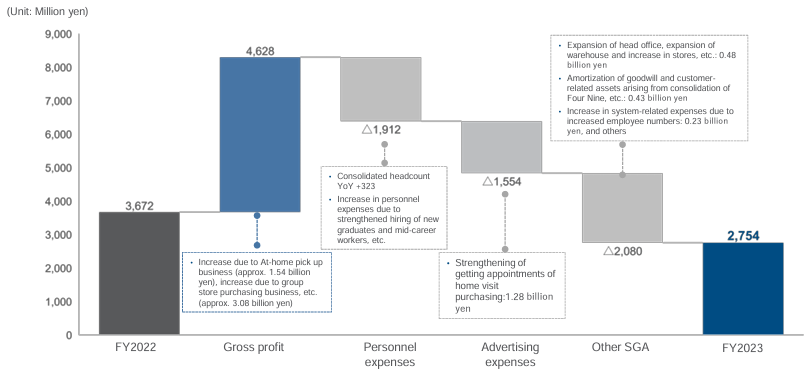

Ordinary income decreased 25.0% year on year to 2,754 million yen. Aggressive promotional activities to increase appointments with customers in response to a decrease of inquiries in the at-home pickup service, an increase of personnel (up 323 year on year) due to strengthened hiring of new graduates and mid-career workers, an increase of the floor space of the head office and expansion of the warehouse, and increased depreciation due to the inclusion of Four Nine in the scope of consolidation all weighed on earnings. However, in the fourth quarter, the SG&A expense ratio declined to 46.4%, thanks to a recovery in the at-home pickup service and a strong increase of store purchase service, as well as efforts to improve the efficiency of SG&A expenses.

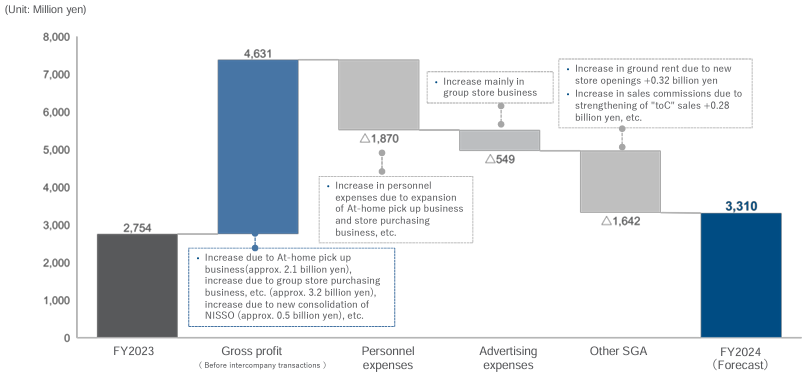

Analysis of Changes in Profit (Consolidated Ordinary Income)

(Source: the reference material of the Company)

Main SG&A expenses

Created by Investment Bridge based on disclosed material of the company.

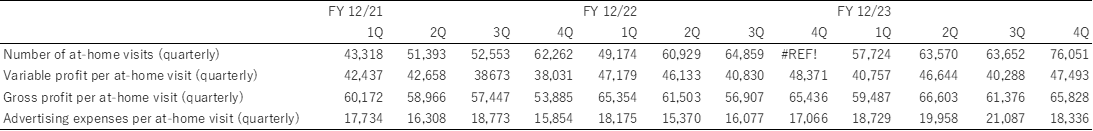

(2) Trends in major KPIs for the at-home pickup service business

(Created by Investment Bridge based on disclosed material of the company.)

(Created by Investment Bridge based on disclosed material of the company.)

The number of at-home visits was sluggish, increasing 4.3% year on year in the second quarter and decreasing 1.9% year on year in the third quarter due to the impact of the wide-area robbery incidents and the severe heat. However, the number of inquiries recovered in the latter half of September and revisit rate also increased, resulting in a clear recovery trend with an increase of 11.3% year on year in the fourth quarter.

Variable profit per at-home visit remained 3.0% lower than the previous fiscal year due to the increase in advertising and promotional expenses in response to the weak inquiries. Although gross profit per at-home visit turned to recovery from a 9.0% year on year decrease in the first quarter, the increase in advertising and promotional expenses per at-home visit in the second and third quarters heavily impacted earnings.

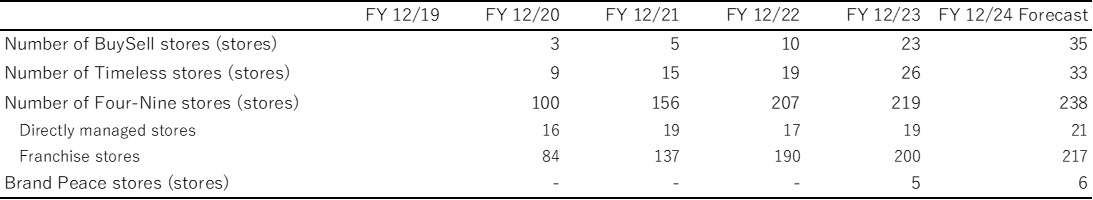

(3) Trends in major KPIs for the store business

(Created by Investment Bridge based on disclosed material of the company.)

Store development showed positive results across all business segments. While the Four Nine franchise fell short of its store opening target, BuySell and Timeless successfully kept pace with the rebound in customer traffic by achieving their store opening plans.

(4) Financial Condition and Cash Flows

◎ Main BS (Consolidated)

| End of 12/22 | End of 12/23 | Increase and Decrease |

| End of 12/22 | End of 12/23 | Increase and Decrease |

Current Assets | 10,448 | 13,416 | +2,968 | Current Liabilities | 5,690 | 7,160 | +1,470 |

Cash Equivalent | 6,999 | 7,756 | +757 | ST Interest Bearing Liabilities | 1,717 | 2,909 | +1,192 |

Inventories | 2,794 | 4,543 | +1,749 | Non-current Liabilities | 3,715 | 5,550 | +1,835 |

Noncurrent Assets | 7,196 | 7,904 | +708 | LT Interest Bearing Liabilities | 3,333 | 5,159 | +1,826 |

Tangible Assets | 717 | 1,148 | +431 | Liabilities | 9,406 | 12,710 | +3,304 |

Intangible Assets | 5,690 | 5,695 | +5 | Net Assets | 8,238 | 8,610 | +372 |

Investment, Others | 788 | 1,059 | +271 | Retained Earnings | 4,875 | 6,038 | +1,163 |

Assets | 17,644 | 21,320 | +3,676 | Total Liabilities and Net Assets | 17,644 | 21,320 | +3,676 |

* Unit: million yen

Merchandise inventories increased to 4,543 million yen, up 1,749 million yen from the end of the previous fiscal year. This was due to inventory expansion at both BuySell and Timeless, as well as the inclusion of Nisso in the scope of consolidation. The inventory turnover period increased from 66.2 days in the previous fiscal year to 75.5 days. Goodwill associated with the inclusion of Nisso in the scope of consolidation amounted to approximately 200 million yen (amortized over 12 years).

Interest-bearing debt increased both in the short and long terms as the company borrowed working capital in line with its inventory buildup strategy. Due in part to the increase in interest-bearing debt, equity ratio declined from 46.2% in the previous fiscal year to 39.5%.

◎Cash Flow(Consolidated)

| FY 12/22 | FY 12/23 | Increase and Decrease |

Operating cash flow(A) | 2,969 | 1,238 | -1,730 |

Investing cash flow(B) | -2,349 | -1,612 | +736 |

Free cash flow(A+B) | 620 | -374 | -994 |

Financing cash flow | 1,588 | 1,051 | -536 |

Cash and Equivalents at the end of term | 7,005 | 7,682 | +677 |

* Unit: million yen

Operating cash flow was 1,238 million yen, despite a pre-tax profit of 2,755 million yen and an increase of 1,045 million yen in depreciation, amortization of goodwill and customer-related assets. This was due to an increase of 1,244 million yen in inventories, a payment of 1,813 million yen in corporate taxes, etc.

Investing cash flow was an outflow of 1,612 million yen. This included an outflow of 246 million yen for the acquisition of subsidiary shares (Nisso Co., Ltd.) involving a change in the scope of consolidation, an outflow of 553 million yen for the acquisition of tangible fixed assets related to new store openings and expansion of the head office and warehouse, and an outflow of 631 million yen for the acquisition of intangible fixed assets related to the development of the company's in-house systems.

Financing cash flow was 1,051 million yen, despite an outflow of 1,004 million yen for the acquisition of treasury shares due to a net increase of 3,388 million yen in long-term borrowings.

As a result, the balance of cash and cash equivalents at the end of the fiscal year was 7,682 million yen.

(5) Topics

(1) Transition to a new management structure, with two representatives

It has been announced that a new management system will be introduced in April 2024. Mr. Kyohei Iwata, the current Representative Director, President and CEO, will assume the position of Representative Director Chairman, and Mr. Kosuke Tokushige will assume the position of Representative Director, President and CEO. Mr. Iwata will be in charge of accelerating the growth of the group's store business and expanding data-driven management throughout the group, while Mr. Tokushige will be in charge of the growth and productivity improvement of the at-home pickup service business and strengthening human resource development and organizational management. Mr. Tokushige joined Recruit in 2006 and worked in sales in the food and beverage information sector before serving as head of the marketing support business at Recruit Marketing Partners. He became an executive officer of the company in 2015 and has since promoted businesses such as customer acquisition media for restaurants and DX support at Recruit.

(2) Acquisition of Musubi Co., Ltd.

In March 2024, the company acquired Musubi Co., Ltd. (established in 2017), which operates "Kaitori Musubi" stores that purchase a variety of products, including brand bags, watches, jewelry, and precious metals, around Japan as a subsidiary. The stock acquisition cost was 4.5 billion yen.

Musubi operates 45 directly managed stores and has achieved rapid growth through a store opening strategy that achieves high profitability per store and human resource development.

This subsidiary will further accelerate the growth of the group store strategy by creating group synergies such as recruitment, inventory sales channel collaboration, and human resource training, in addition to expanding the store purchase channel.

The subsidiary is expected to contribute to profit after deducting goodwill. However, considering the upfront investment for accelerating store openings and personnel improvements after the group integration, the company expects that the consolidation will have a limited impact on profit this fiscal year.

3. Fiscal Year Ending December 2024 Earnings Forecasts

(1) Business Results

◎Consolidated Financial Forecast

| FY 12/23 | Ratio to Sales | FY 12/24 Est. | Ratio to Sales | YoY |

Net Sales | 42,574 | 100.0% | 52,480 | 100.0% | +23.3% |

Gross Profit | 24,493 | 57.5% | 29,125 | 55.5% | +18.9% |

SG&A | 21,696 | 51.0% | 25,725 | 49.0% | +18.6% |

Operating Income | 2,796 | 6.6% | 3,400 | 6.5% | +23.6% |

Adjusted EBITDA | 3,994 | 9.4% | 4,910 | 9.4% | +22.9% |

Ordinary Income | 2,754 | 6.5% | 3,310 | 6.3% | +20.2% |

Net Income | 1,453 | 3.4% | 1,890 | 3.6% | +30.0% |

*Unit: million yen.

Positioning this fiscal year as a phase for laying the foundation for the next Medium-term Management Plan

Sales are expected to increase 23.3% year on year to 52,480 million yen, operating profit 23.6% to 3,400 million yen, and adjusted EBITDA 22.9% to 4,910 million yen. The company views this fiscal year as a run-up period that will lead to a high growth phase in the fiscal year ending December 2025 and beyond; thus, it plans to manage its operations with an emphasis on efficiency. The full-year contribution from the inclusion of Nisso in the scope of consolidation is expected to increase 2.3 billion yen in terms of sales.

In the at-home pickup service business, the company plans to prioritize the efficiency of marketing investments. Although this will suppress sales growth rate, it will firmly secure profit growth by improving variable profit. In the store purchase service business, the company does not expect the same level of earning contribution as in the previous fiscal year due to the rebound from the COVID-19 pandemic and the high price of gold, which were tailwinds in the previous fiscal year. Additionally, the company will actively recruit store and support personnel. Thus, the company made a conservative plan, assuming that profits would remain flat.

Based on the assumption that negative factors in the external environment for the at-home pickup service business will disappear, the business environment is expected to improve. In light of the recognition of challenges in terms of cost in the past expansion strategy, the company plans to strictly examine the investment return of SG&A expenses as a whole. The SG&A expense ratio is expected to decrease from 51.0% in the previous fiscal year to 49.0%. Of that amount, the ratio of advertising expenses to sales is expected to decline from 15.3% in the previous fiscal year to 13.5%. However, adjusted EBITDA ratio is expected to remain flat at 9.4% due to a decline in gross profit margin as a result of Nisso's full-year contribution.

The company plans to pay a dividend of 25.00 yen per share, unchanged from the previous fiscal year. The expected dividend payout ratio is 18.9%.

Analysis of Changes in Profit (Consolidated Ordinary Income)

(Source: the reference material of the Company)

In the first quarter, due to the M&A-related expenses for Musubi of about 80 million yen, ordinary income is expected to decrease year on year. However, the ordinary income forecast is 1,350 million yen for the first half and 1,960 million yen for the second half (the ratio between the first and second halves is 4 : 6), which is the same as usual, so there is no need to be overly concerned about the M&A-related expenses. In the second half, the company assumes that profitability will improve due to the strengthening of the new graduate workforce and the realization of cost efficiency. Regarding Musubi, the company plans to include its sales and profits from the second quarter (not reflected in the initial plan).

Regarding the current medium-term management plan, the plan for the fiscal year ending December 2024 will be replaced with the company's forecast announced this time, and no qualitative changes will be made. The company will continue to work on the final year based on the medium-term management plan announced earlier and plans to announce a new medium-term management plan at the time of the announcement of the full-year financial results for the fiscal year ending December 2024, scheduled in February 2025.

4. Conclusions

The fiscal year ended December 2023 was a year of many challenges, but the issues have become clear, and the company is working on addressing them. The external environment is also starting to recover from its worst period, and there were signs of improvement in the KPIs in the fourth quarter of the fiscal year ended December 2023. The fiscal year ending December 2024 will be a year of consolidating its position. Therefore, in the short term, the company's performance may be stable compared to its past growth rate, but we would like to pay attention to changes in KPIs from the fiscal year ending December 2025 onward.

We would also like to pay attention to how the two-person representative system will affect the company's performance. Mr. Tokushige, who will be newly appointed as Representative Director, President and CEO, is being recruited from outside the company, so his influence both within and outside the company is unknown. However, we believe that his management experience in leading a large labor-intensive organization will be useful in the company, and we expect him to exert a positive influence.

<Reference: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organizational Type | Company with Audit & Supervisory Committee |

Directors | 11 directors, including 6 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

Corporate Governance Report

The latest revision date: March 22, 2024

<Fundamental Concept>

The Company recognize that establishing corporate governance is essential in order to increase corporate value, maximize shareholder returns, and build good relationships with stakeholders such as customers, business partners, employees, local communities, and government agencies.

To this end, the Company believe that it is important to establish a decision-making body that responds quickly and fairly to changes in the business environment, pursue Profits through its businesses, ensure that its financial soundness and improve its credibility, actively disclose information to fulfill accountability, build an effective internal control system, and ensure that audit and supervisory board members maintain their independence and fulfill their audit functions.

<Reasons for not implementing each principle of the Corporate Governance Code>

The Company has implemented all the basic principles of the Corporate Governance Code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |