Bridge Report:(7685)BuySell Technologies Fiscal Year Ended December 2024

Chairman Kyohei Iwata |

President & CEO Kosuke Tokushige | BuySell Technologies Co., Ltd (7685) |

|

Company Information

Market | TSE Growth Market |

Industry | Wholesale (trade) |

Chairman and Representative Director | Kyohei Iwata |

President, Representative Director & CEO | Kosuke Tokushige |

HQ address | PALT Building, 28-8, Yotsuya 4-Chome, Shinjuku-ku, Tokyo |

Year-end | End of December |

Homepage | https://buysell-technologies.com/en/ |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE (Act.) | Trading unit | |

¥2,760 | 29,236,924 shares | ¥80,693 million | 23.4% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥20.00 | 0.72% | ¥113.89 | 24.2x | ¥416.02 | 6.6x |

* The share price is the closing price as of March 28. Figures are from the financial results for the fiscal year ended December 2024. The number of outstanding shares excludes the number of treasury shares.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2021 | 24,789 | 2,315 | 2,295 | 1,314 | 46.63 | 7.00 |

December 2022 | 33,724 | 3,694 | 3,672 | 2,268 | 79.14 | 10.00 |

December 2023 | 42,574 | 2,796 | 2,754 | 1,453 | 50.05 | 12.50 |

December 2024 | 59,973 | 4,733 | 4,198 | 2,411 | 83.97 | 15.00 |

December 2025 Est. | 99,790 | 6,500 | 6,100 | 3,330 | 113.89 | 20.00 |

* The estimated values are based on the forecasts made by the Company. On January 1, 2021 and January 1, 2025, a 2-for-1 stock split was conducted. EPS and DPS were adjusted retroactively.

This Bridge Report presents BuySell Technologies’ financial results for the fiscal year ended December 2024 and so on.

Table of Contents

Key Points

1. Corporate Overview

2. Fiscal Year Ended December 2024 Earnings Results

3. Fiscal Year Ending December 2025 Earnings Forecasts

4. Medium-Term Management Plan

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended December 2024, sales grew 40.9% year on year and operating income rose 69.3% year on year, exceeding the annual forecast. In 4Q, they proactively carried forward the sale of inventory to the fiscal year ending December 2025 for preparation, so it can be said that they were able to achieve favorable financial results. Real sales growth rate, excluding the impact of new consolidated subsidiaries, was 22.3%. Both the home visit purchase business and the existing purchase business of the group were healthy, as the measures for increasing the average price paid off. In terms of earnings, operating income margin improved 1.3 points year on year, as gross profit margin dropped due to the change in the product mix caused by the inclusion of subsidiaries for store operation into the scope of consolidation (non-consolidated gross profit margin remained high) and the ratio of SG&A expenses to sales improved due to the sales growth.

- For the, fiscal year ending December 2025 which is the initial fiscal year of the new medium-term management plan, sales are expected to grow 66.4% year on year and operating income is projected to rise 37.3% year on year. REXT HOLDINGS, which joined the corporate group in 4Q of the previous fiscal year, is expected to increase annual sales by 21.6 billion yen. Excluding this effect, sales are forecast to grow 30.4% year on year. The number of stores of the corporate group for in-store purchase is expected to be 498 at the end of the fiscal year (418 at the end of the previous fiscal year). It is assumed that the opening of new stores will be accelerated for each brand. In this business, the number of stores is a key performance indicator (KPI), so we would like to monitor it, to check whether their performance will be in line with the forecast. It should be noted that the growth rates of sales and profit in 1Q of the current fiscal year will be relatively high, because they implemented the inventory carry-over strategy in 4Q of the previous fiscal year. While steadily conducting investment for achieving medium/long-term growth, they aim to achieve an over 20% organic growth of profit. They plan to pay a dividend of 20 yen/share, up 5 yen/share from the previous fiscal year (after considering the 2-for-1 stock split dated January 1, 2025).

- “Operating income before goodwill amortization, etc.” has been set as a practical profit evaluation indicator this fiscal year. Concretely, it is calculated with the formul “Operating income + Goodwill amortization + Depreciation/amortization of client-related assets.” In addition to the organic growth, the company implements a non-continuous growth strategy based on a roll-up strategy, so they have decided to set this as a KPI this fiscal year.

- They disclosed a new medium-term management plan with the final fiscal year being fiscal year ending December 2027. The concrete numerical goals for fiscal year ending December 2027 are sales of 140 billion yen (CAGR in 3 years: 32.7%), an operating income of 11 billion yen (up 32.5% year on year), and an operating income before goodwill amortization of 12.3 billion yen (up 30.3% year on year). This plan set organic growth goals without taking into account new M&A projects. Since the company has a non-continuous growth strategy based on a roll-up strategy, it should be kept in mind that actual sales revenue may further increase. During the period of the new medium-term management plan, they plan to continuously invest in brands for establishing their business base and competitive advantage from a long-term perspective and strategically invest in mainly overseas business operations, etc. while pursuing steady organic growth. For fiscal year ending December 2027, operating income is projected to be 11 billion yen, while taking into account the strategic investment of about 3 billion yen. Without considering the investment, operating income margin is expected to show a 10.0% organic growth.

- The external environment has been severe in recent years, due to the COVID-19 pandemic and social accidents, but they succeeded in making the home visit purchase business profitable and also systematizing the in-store purchase business with the roll-up strategy. The external environment is becoming milder and there remains room for growing the reuse market in Japan, so it is highly likely that their medium-term management plan will be completed. They have just started the foray into overseas markets, but their overseas business has a potential to become a pillar in the next medium-term management plan. If sales growth and profitability improvement become evident, the evaluation on the company will change. In addition, a roll-up strategy increases growth potential as post-merger integration (PMI) progresses in many cases. We would like to pay attention to the progress of PMI.

1. Corporate Overview

BuySell Technologies operates reuse business that leverages the strengths of the "Internet" and "Real world."

The Company attracts sellers through a marketing strategy that makes full use of the Internet and mass media, and also provides the home visit purchase service throughout Japan. Its characteristics or strengths include the maximization of synergy with a variety of purchase and sales channels, the robust customer base centered around seniors, and the high-quality management. The Company is aiming for further growth by developing a huge potential reuse market and creating new businesses utilizing its customer base.

[1-1 History]

Mr. Iwata (currently Chairman and Representative Director of BuySell Technologies Co., Ltd.), who was in charge of marketing at a major advertising company, questioned the situation where large and famous companies with abundant advertising expenses are favored to the disadvantage of small and medium-sized companies and start-ups with a small budget. He retired from the major advertising company and established a consulting company for his desire to help companies, including ones with weak capital, develop true marketing. He met BuySell Technologies (formerly Ace Co., Ltd.) while supporting many start-ups and small and medium-sized businesses.

The Company had long been providing the home visit purchase service, which is its current core business, but when Mr. Iwata's consulting engagement started in May 2016, its marketing depended almost entirely on flyers. The homepage was not sophisticated, and the business performance was not good.

The Company, which undertook a full-fledged reform under Mr. Iwata, began to see the results when it registered a record number of applications in August of the same year, renewing the record in September. In this process, Mr. Iwata felt that while "the home visit purchase service" has a high added value and there are many customers who need it, the way in which the benefits of the service are communicated, the brand is constructed, marketing actions are taken, and others were extremely inadequate. He was convinced that with his marketing know-how, the Company could transform itself into a more attractive company.

In October of the same year, Mr. Iwata assumed the role of Chief Sales and Marketing Officer (CSMO). In November, the Company name was changed to BuySell Technologies, and a new TV commercial was put on air and the reform sped up. He assumed the post of president in September 2017. The business expanded steadily thanks to the success of conducting the PDCA cycle of creative activities and the purchase of TV commercials utilizing his expertise. The Company also established a compliance system and was listed on the Tokyo Stock Exchange Mothers in December 2019. In April 2022, the company got listed on the Growth Market of TSE through the stock market restructuring.

In April 2024, in order to continue to strategically expand the scale of the group's operations and organization, Mr. Kosuke Tokushige was invited to become President, Representative Director & CEO, and Mr. Iwata was appointed Chairman and Representative Director.

[1-2 Corporate Philosophy and Management Philosophy]

The Company upholds the following missions, visions, and values.

Mission :Our Mission | Transcend people, transcend time, become a bridge connecting precious things. |

Vision : Our ideal state | Leaders in the recycling-oriented society with excellent people and new technologies. |

Value : Values we cherish | 1. Hospitality We listen to others and provide them with joy and delight that exceeds their expectations. 2. Professional Maximize your performance by leveraging your professional knowledge and skills. 3. Creative Without being bound by existing concepts, we discover challenges ourselves and create new value. |

The Company believes that things have value that goes beyond their physical existence, and that properly connecting them is its mission and social existence value.

In addition, the company is strongly aware of the need to address environmental issues and co-create with all stakeholders, and considers its group mission to be "contributing to the creation of a recycling-oriented society through the revitalization of the secondary distribution market to realize a sustainable society" and "pursuing sustainable growth and maximizing corporate value as a company that co-creates value with various stakeholders including customers, shareholders, employees and society. The company intends to reflect the value in its human resources evaluation system and link them to the development of next-generation human resources.

[1-3 Business Description]

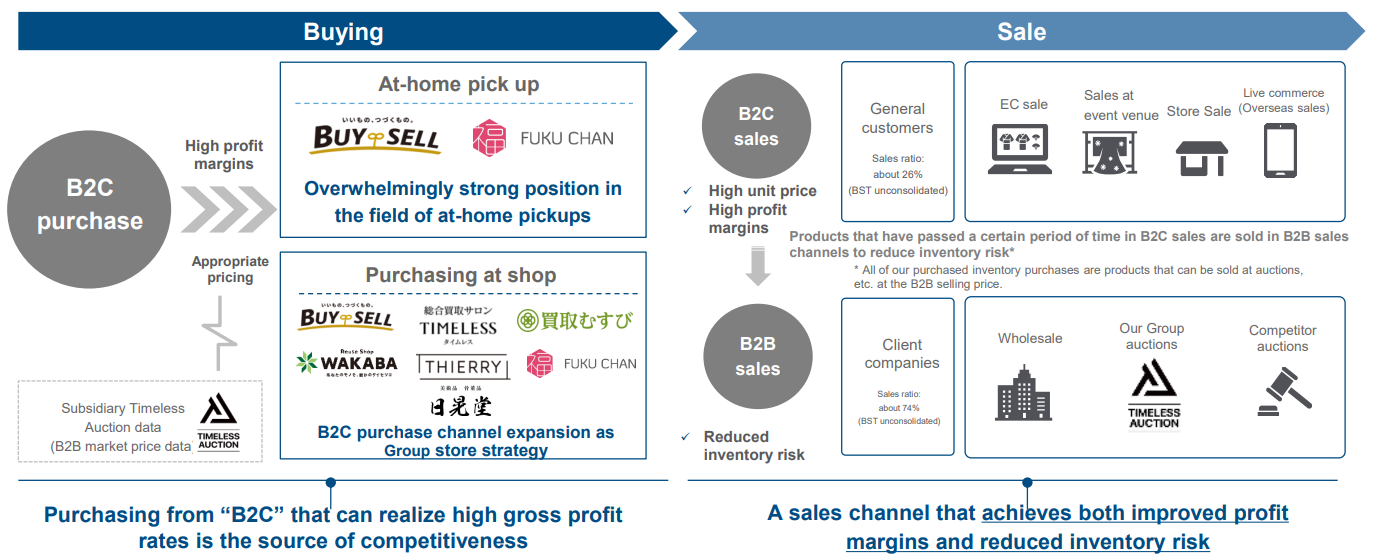

(1) Business Model

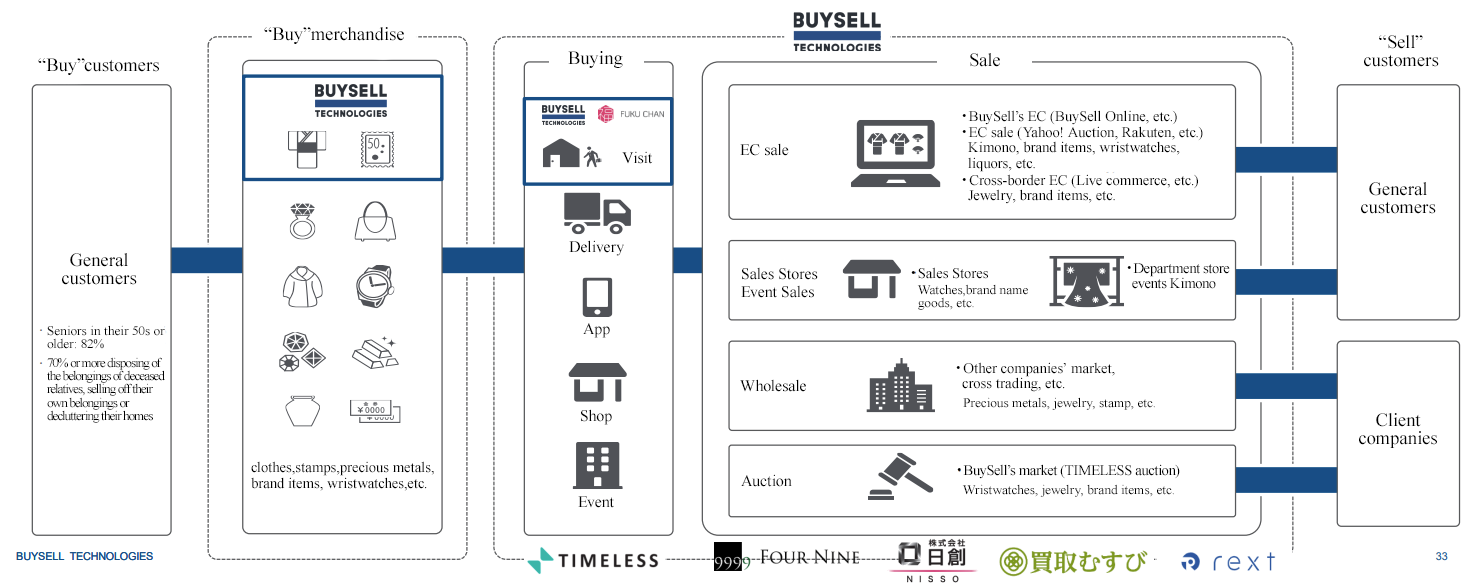

The BuySell Group offers general reuse services to realize the cyclical use of items through purchase and sale. Their core business can be classified into mainly the home visit purchase business and the in-store purchase business. The products purchased from general customers through these channels are sold via auctions held by their group company, BtoB transactions, and BtoC sales channels operated by the company.

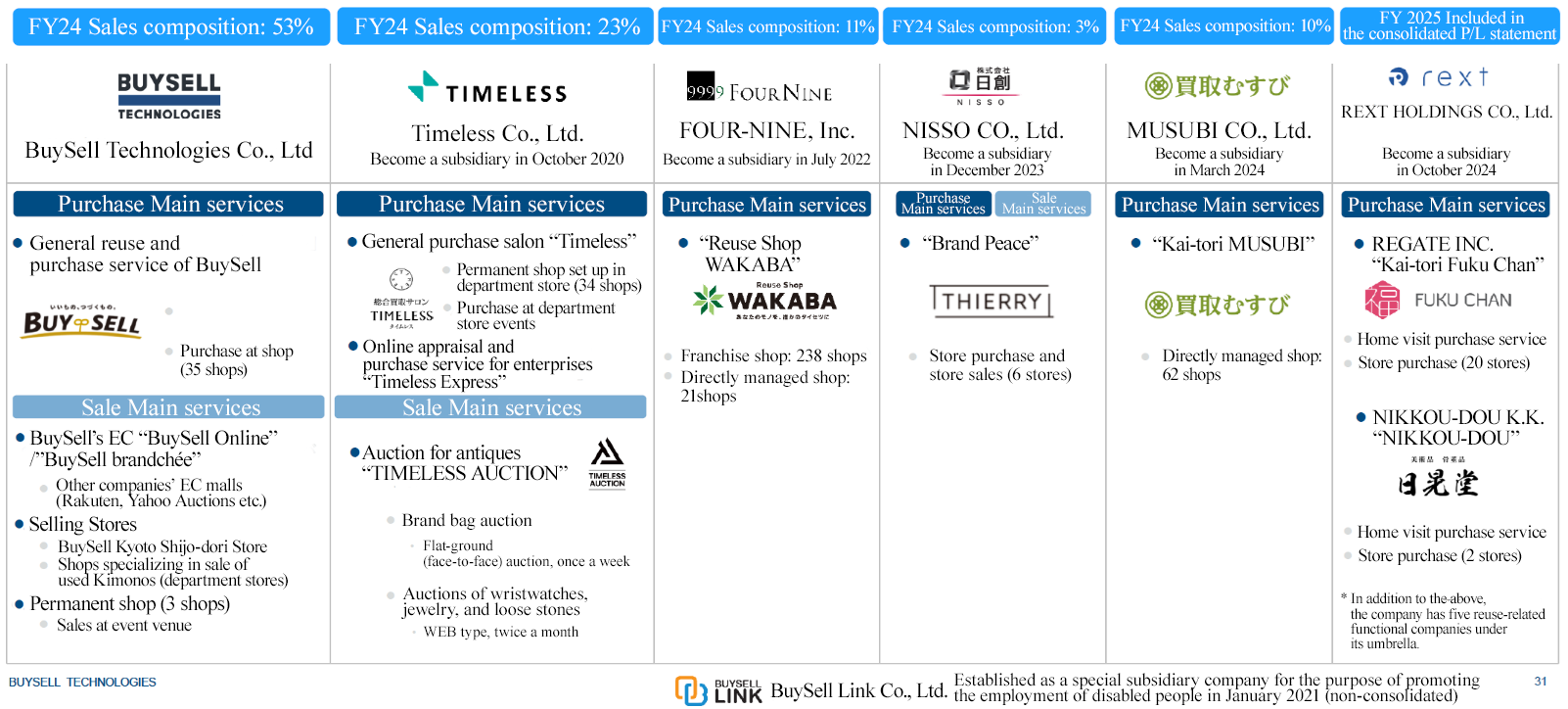

The BuySell Group also concentrates on a roll-up strategy. This strategy began with the acquisition of Timeless as a subsidiary in 2020, and they have acquired 5 companies through M&A so far. Currently, the corporate group is composed of a total of 13 companies.

Regarding purchase service, it attracts sellers through a marketing strategy that makes full use of the internet and mass media, and also provides a shipping purchase service and a store purchase service as well as the home visit purchase service delivered by its assessors who can travel throughout Japan.

The Company sells purchased products to general customers (toC sales) though EC sales at EC malls such as the Company's own EC site “BuySell Online and BuySell brandchée” and Yahoo! Auctions, and at cross-border EC sites such as eBay, and special event sales at department stores. In addition, it sells to external vendors through the “Timeless Auction", which is held by TIMELESS Corporation, which was acquired as a subsidiary, and wholesale using other companies' markets.

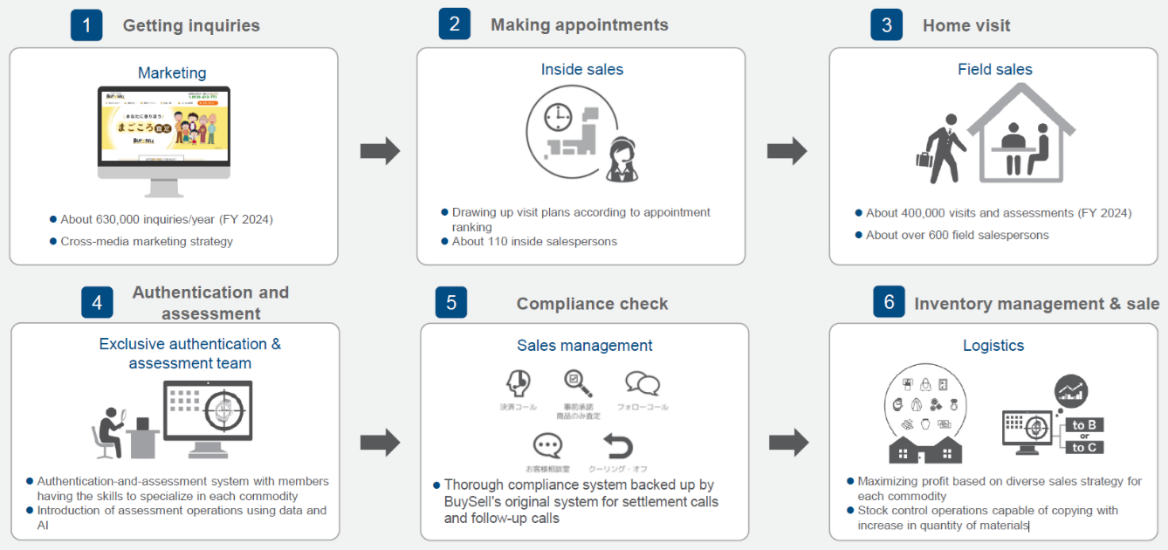

What is unique about the company is that it has built a system to consistently manage and execute the entire flow from marketing to attracting customers, purchase appraisal, inventory management, and sales on its own. At the same time as expanding its mainstay reuse business, the company is also focusing on launching and developing new business adjacent to the reuse business and other services utilizing customer data.

The company's home visit purchase business consists of the following business flo "Attracting sellers" → "Conducting purchase" → "Selling purchased products."

Overview of the business model in the home visit purchase business

"The home visit purchase service" which involves going to the homes of customers who made inquiries and conducting an appraisal and a purchase, is the main purchasing method. In addition, the Company also carries out a "shipping purchase service," in which customers send products to be sold to the Company, and a "store purchase service," in which customers bring products directly to the Company.

The number of employees engaged in the home visit purchase service (field sales) was 463 as of the end of 2024. They have increased workforce in step with the business scale expansion, by utilizing their high capability of recruitment. They also concentrate on the training of employees by adopting a systematic system for education and training.

"The home visit purchase service" can flexibly respond to purchase requests from customers who have difficulty using store purchases service or shipping purchase service and meet a wider range of customer needs, such as when there is a wide variety of products to be assessed, the quantity of appraisals is large, it is difficult to carry the products due to their weight, as well as when there are inquiries from distant customers and elderly customers.

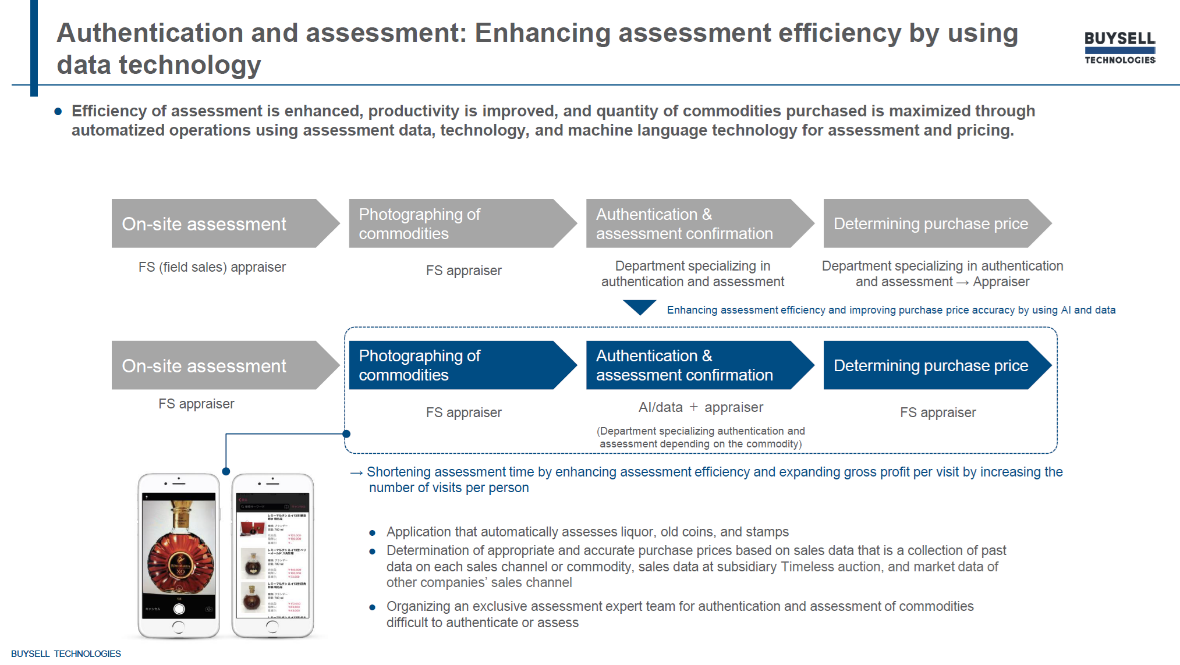

In order to conduct accurate appraisal and prevent the purchase of bogus products and the falsification by appraisers, they adopted a double-check system in which visiting appraisers appraise items at each customer’s house and then the items are checked by employees specializing in checking authenticity and appraisal based on data, such as images, videos, etc. sent by visiting appraisers by mobile terminal. They aim to maximize the amount of purchased items, by automating operations with the machine learning technology based on appraisal data, streamlining the price determination process, and improving productivity.

It deals with Kimonos, stamps, old coins, precious metals, jewelry, brand-name items, watches, records, antiques, furs, alcoholic beverages and others for main purchase products, and focuses mainly on products with high selling prices.

There are many inquiries from senior wealthy people whose needs are aligned with the home visit purchase service, which is the Company's main service, and customers in their 50s and over accounted for approximately 86% of all customers. As most of our customers are seniors, there are relatively many cases where the customers use the company's purchase services for disposition of one’s home, sorting out mementos and pre departure decluttering cleaning.

2. Fiscal Year Ended December 2024 Earnings Results

(1) Business Results

| FY 12/23 (cumulative total) | Ratio to Sales | FY 12/24 (cumulative total) | Ratio to Sales | YoY | Company’s Forecast | Compared with the forecast |

Net Sales | 42,574 | 100.0% | 59,973 | 100.0% | +40.9% | 61,850 | -3.0% |

Gross Profit | 24,493 | 57.5% | 31,655 | 52.8% | +29.2% | 32,651 | -3.0% |

SG&A | 21,696 | 51.0% | 26,921 | 44.9% | +24.1% | 27,971 | -3.8% |

Operating Income | 2,796 | 6.6% | 4,733 | 7.9% | +69.3% | 4,680 | +1.1% |

Adjusted EBITDA | 3,994 | 9.4% | 6,398 | 10.7% | +60.2% | 6,332 | +1.0% |

Ordinary Income | 2,754 | 6.5% | 4,198 | 7.0% | +52.4% | 4,140 | +1.4% |

Net Income | 1,453 | 3.4% | 2,411 | 4.0% | +65.9% | 2,240 | +7.6% |

* Unit: million yen.

Created by Investment Bridge based on disclosed material of the company.

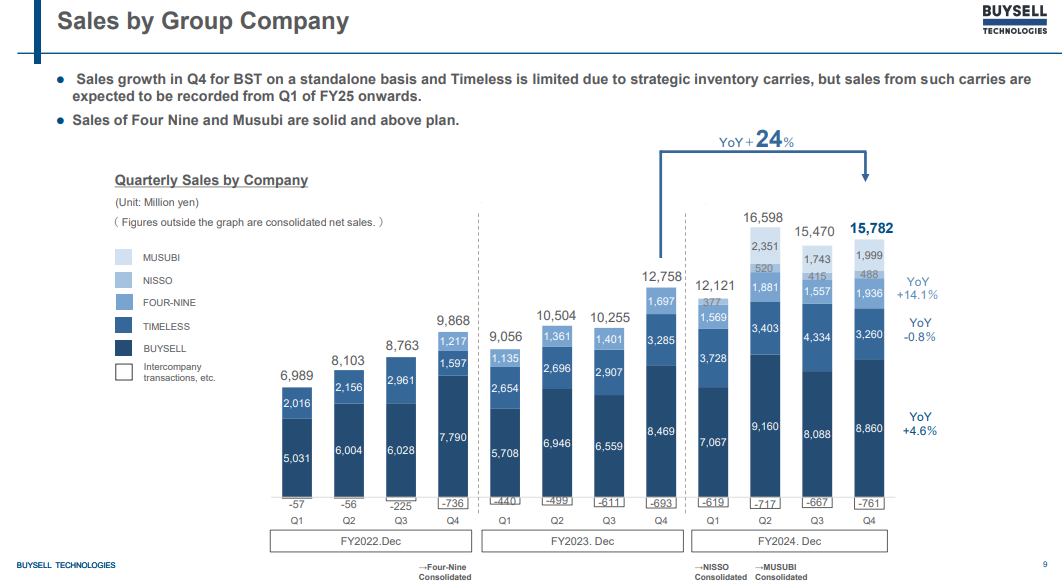

In the fiscal year ended December 2024, sales grew 40.9% year on year to 59,973 million yen, operating income rose 69.3% year on year to 4,733 million yen, and adjusted EBITDA increased 10.7% year on year to 6,398 million yen. Sales slightly fell below the company’s forecast, and operating income and other profits exceeded the forecast, which called for sales of 61,850 million yen, an operating income of 4,680 million yen, and an adjusted EBITDA of 6,332 million yen. The drop in sales is attributable to the proactive carry-over of inventory sale in 4Q to fiscal year ending December 2025, so it can be said that the performance was almost in line with the forecast. In 1Q, NISSO CO., Ltd. joined the corporate group, and in 2Q, MUSUBI joined the corporate group. These new consolidated subsidiaries increased sales by 7,893 million yen. Excluding the contribution of these new consolidated subsidiaries, real sales growth rate is 22.3%. Both the home visit purchase business and the existing purchase business of the group were healthy, as the measures for increasing the average price paid off.

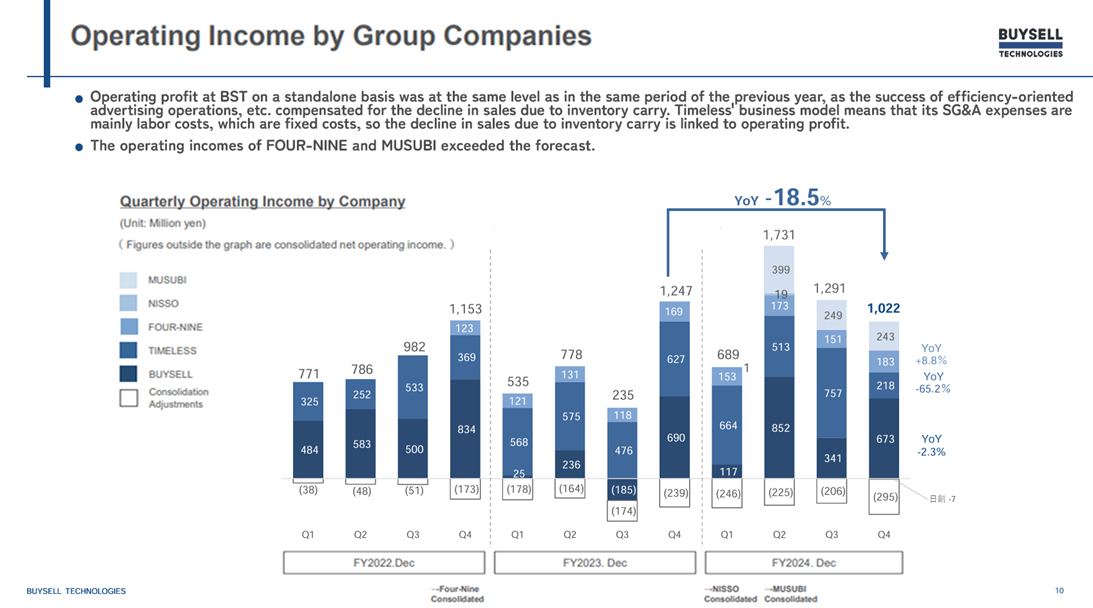

In terms of earnings, gross profit margin dropped 4.7 points from the previous fiscal year, due to the change in the product mix caused by the inclusion of subsidiaries for store operation into the scope of consolidation, and nonconsolidated gross profit margin remained as high as 64.1%. The ratio of SG&A expenses to sales dropped 6.1 points year on year thanks to the sales growth despite the increase of employees and the inclusion of new subsidiaries. As a result, operating income margin improved 1.3 points year on year.

(Created by Investment Bridge based on disclosed material of the company.)

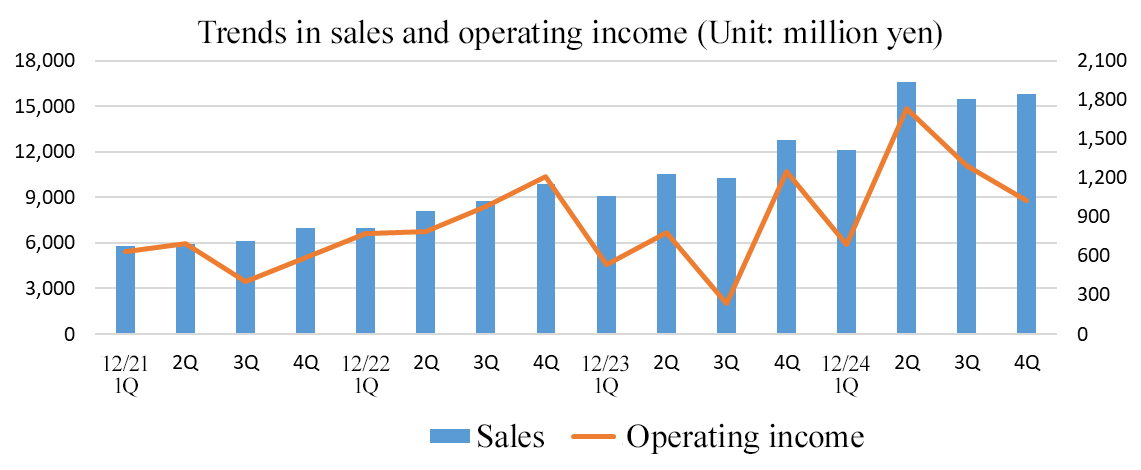

Regarding the quarterly performance trend, the y/y sales growth rate in 3Q (3 months) was 48.2%, and that in 4Q (3 months) was 40.9%. The quarter on quarter growth rate was 35.7%, and that in the same period of the previous year was 42.7%. This indicates that growth rate has declined. However, this is because the strategic inventory management for the following fiscal year was conducted by BuySell Technologies and Timeless, so it should be noted that the above result is not so unfavorable. This measure was conducted, just because the probability of completing the annual profit plan increased. It can be said that they always operate business from a medium-term perspective.

(Source: the reference material of the Company)

Regarding the performance in each group company, it is obvious that the growth of BuySell Technologies and Timeless was limited due to the above-mentioned inventory management. The performance of FOUR-NINE and MUSUBI, which did not conduct inventory management, exceeded the forecast. Inventory management is expected to become a factor in growth in 1Q of fiscal year ending December 2025.

(Source: the reference material of the Company)

The operating income in each group company was affected by inventory management in 4Q. BuySell Technologies secured a certain level of profitability, as advertisement management focused on efficiency paid off. The earnings of FOUR-NINE and MUSUBI exceeded the forecast.

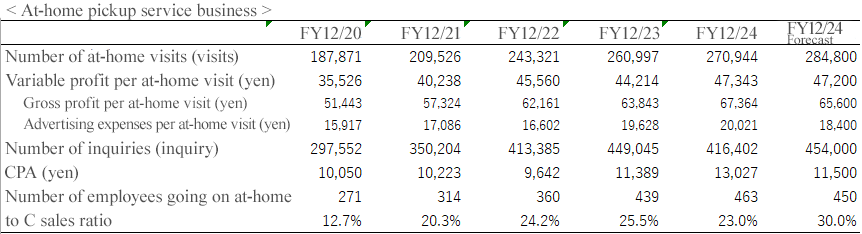

(2) Trends in major KPIs for the home visit purchase service business

Created by Investment Bridge based on disclosed material of the company.

Created by Investment Bridge based on disclosed material of the company.

In 4Q, they invested in advertisement while putting importance on profitability based on profitability-focused management strategies, so the number of home visits was decreased intentionally. Gross profit per home visit was healthy, as gross profit grew due to the strategic increase of revisits (revisiting rate doubled from the previous year) and efficient marketing activities. The advertising cost per home visit exceeded the forecast, but profit per home visit exceeded the full-year forecast, as they secured gross profit.

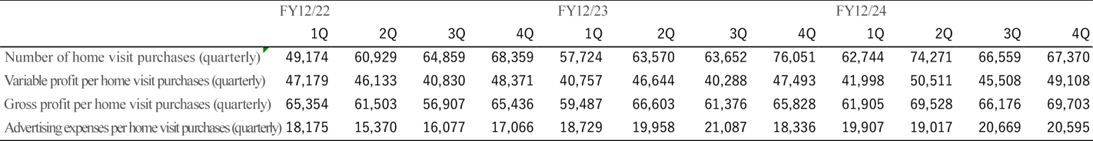

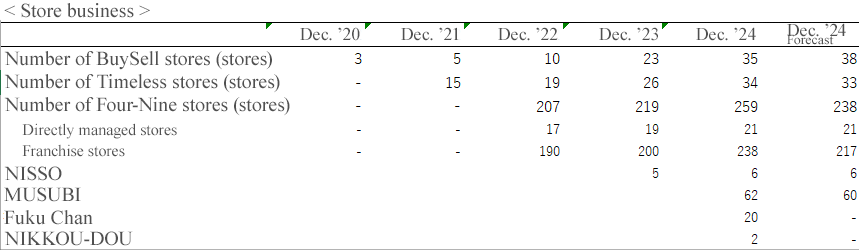

(3) Trends in major KPIs for the store business

Created by Investment Bridge based on disclosed material of the company.

The number of stores of the BuySell Group was 418 as of the end of December 2024. The number of franchised FOUR-NINE stores exceeded the forecast considerably, and the new network of stores of the corporate group expanded. Since the impact of the number of stores on sales was significant, the result exceeding the forecast gives a positive impression.

(4) Financial Condition

◎ Main BS (Consolidated)

| End of 12/23 | End of 12/24 | Increase and Decrease |

| End of 12/23 | End of 12/24 | Increase and Decrease |

Current Assets | 13,416 | 23,820 | +10,403 | Current Liabilities | 7,160 | 13,127 | +5,967 |

Cash Equivalent | 7,756 | 13,217 | +5,461 | ST Interest Bearing Liabilities | 2,909 | 6,576 | +3,667 |

Inventories | 4,543 | 9,023 | +4,479 | Non-current Liabilities | 5,550 | 20,754 | +15,204 |

Noncurrent Assets | 7,904 | 22,556 | +14,652 | LT Interest Bearing Liabilities | 5,159 | 20,343 | +15,184 |

Tangible Assets | 1,148 | 2,022 | +873 | Liabilities | 12,710 | 33,882 | +21,171 |

Intangible Assets | 5,695 | 18,479 | +12,784 | Net Assets | 8,610 | 12,494 | +3,883 |

Investment, Others | 1,059 | 2,053 | +994 | Retained Earnings | 6,038 | 8,092 | +2,054 |

Assets | 21,320 | 46,376 | +25,055 | Total Liabilities and Net Assets | 21,320 | 46,376 | +25,055 |

* Unit: million yen

Created by Investment Bridge based on disclosed material of the company.

The balance sheet expanded, as they strategically increased the inventory of BuySell Technologies and Timeless (effect: up 2.14 billion yen) and REXT HOLDINGS joined the corporate group in 4Q. As a result, inventory turnover period increased from 75.5 days in the previous fiscal year to 89.1 days, but this is a result of strategic activities, so you do not need to perceive this fluctuation in a negative light. We would like to check whether it contributes to the sales growth in 1Q. Intangible fixed assets augmented significantly, due to the posting of goodwill of MUSUBI (about 4.1 billion yen in 1Q, to be amortized over a period of 17 years) and REXT HOLDINGS (about 9 billion yen in 4Q, to be amortized over a period of 18 years).

◎ Cash Flows (Consolidated)

| FY 12/23 | FY 12/24 | Increase and Decrease |

Operating cash flow (A) | 1,238 | 2,126 | +888 |

Investing cash flow (B) | -1,612 | -14,437 | -12,825 |

Free cash flow (A+B) | -374 | -12,311 | -11,937 |

Financing cash flow | 1,051 | 17,824 | +16,772 |

Cash and Equivalents at the end of term | 7,682 | 13,196 | +5,513 |

* Unit: million yen

Created by Investment Bridge based on disclosed material of the company.

Operating cash flow in the end of the fiscal year saw an inflow of 2,126 million yen. In addition to net income before taxes and other adjustments of 4,221 million yen, depreciation, amortization of goodwill, and depreciation of customer-related assets of 1,412 million yen, and payment fee of 405 million yen were recorded. On the other hand, 2,912 million yen in inventories and 1,380 million yen in income taxes paid was factors in the decline.

Investment cash flow saw an outflow of 14,437 million yen. In addition to 13,250 million yen spent for the acquisition of shares in subsidiaries (MUSUBI and REXT HOLDINGS) resulting in a change in the scope of consolidation, 363 million yen was spent for the acquisition of tangible fixed assets related to the opening of new stores, and 721 million yen was spent for the acquisition of intangible fixed assets related to the development of in-house systems.

While there was income from short-term borrowings of 1,500 million yen and income from long-term borrowings of 21,271 million yen, 650 million yen was spent for repayment of short-term borrowings, and 3,876 million yen was spent for repayment of long-term borrowings.

As a result, the cash and cash equivalents at the end of the consolidated accounting period was 13,196 million yen.

3. Fiscal Year Ending December 2025 Earnings Forecasts

(1) Business Results

◎ Consolidated Financial Forecast

| FY 12/24 | Ratio to Sales | FY 12/25 (Company’s Forecast) | Ratio to Sales | YoY |

Net Sales | 59,973 | 100.0% | 99,790 | 100.0% | +66.4% |

Gross Profit | 31,655 | 52.8% | 52,680 | 52.8% | +66.4% |

SG&A | 26,921 | 44.9% | 46,180 | 46.3% | +71.5% |

Operating Income | 4,733 | 7.9% | 6,500 | 6.5% | +37.3% |

Operating Income Before Goodwill Amortization, etc. | 5,567 | 9.3% | 7,897 | 7.9% | +41.9% |

Ordinary Income | 4,198 | 7.0% | 6,100 | 6.1% | +45.3% |

Net Income | 2,411 | 4.0% | 3,330 | 3.3% | +38.1% |

* Unit: million yen

The company aims to achieve non-continuous growth through a 20% organic profit growth and a roll-up strategy.

For the fiscal year ending December 2025, which is the initial fiscal year of the new medium-term management plan, sales are expected to grow 66% year on year and operating income is projected to rise 37% year on year. REXT HOLDINGS, which joined the corporate group in 4Q of the previous fiscal year, is expected to increase annual sales by 21.6 billion yen. Excluding this effect, sales are forecast to grow 30.4% year on year. The gross profit margin of REXT HOLDINGS is relatively high and the ratio of SG&A expenses to sales is high, so operating income margin produces a negative effect. While steadily conducting investment for achieving medium/long-term growth, they aim to achieve an over 20% organic growth of profit. They plan to pay a dividend of 20 yen/share, up 5 yen/share from the previous fiscal year (after considering the 2-for-1 stock split dated January 1, 2025).

“Operating income before goodwill amortization, etc.” has been set as a practical profit evaluation indicator this fiscal year. Concretely, it is calculated with the formul “Operating income + Goodwill amortization + Depreciation/amortization of client-related assets.” In addition to the organic growth, the company implements a non-continuous growth strategy based on a roll-up strategy, so they have decided to set this as a KPI this fiscal year. For fiscal year ending December 2025, goodwill amortization (including the depreciation/amortization of assets related to clients) is projected to be about 1.4 billion yen. Out of it, the goodwill amortization of REXT HOLDINGS, which was acquired as a consolidated subsidiary, is expected to be 500 million yen.

Since the company implemented an inventory carry-over strategy in 4Q of the previous fiscal year, it should be noted that the y/y growth rates of sales and profit are expected to be relatively high in 1Q of the current fiscal year.

The number of stores of the corporate group for in-store purchase business is expected to be 498 at the end of the fiscal year (418 at the end of the previous fiscal year). It is assumed that the opening of stores will be accelerated in each brand. In this business, the number of stores is a key performance indicator (KPI), so we would like to monitor it, to check whether the performance will be in line with the forecast.

Created by Investment Bridge based on disclosed material of the company.

The assumptions for other major KPIs (the home visit purchase business: BuySell Technologies + Fuku Chan) are as follows.

They plan to increase the number of home visits from 270,944 in the previous fiscal year to 436,000, by increasing the number of FS staff members from 720 to 760 (including 114 employees fresh out of college). Variable profit per home visit is projected to rise from 47,343 yen in the previous fiscal year to 49,900 yen. They plan to increase variable profit, by keeping the advertising cost per home visit 20,000 yen, unchanged from the previous fiscal year, while increasing gross profit per home visit from 67,364 yen to 69,900 yen.

4. Medium-Term Management Plan

(1) Overview

At the time of the announcement of the company’s earnings forecast for the fiscal year ending December 2025, BuySell Technologies has also disclosed a medium-term management plan that will end in the fiscal year ending December 2027. Specific numerical targets for the fiscal year ending December 2027 are 140 billion yen for sales (three-year Compound Annual Growth Rate (CAGR): 32.7%), 11 billion yen for operating income (three-year CAGR: 32.5%), and 12.3 billion yen for operating income before goodwill amortization (three-year CAGR: 30.3%). The earnings targets in the plan are organic ones with new mergers and acquisitions (M&A) not taken into account. As the company has drawn up strategies for non-continuous growth through roll-up strategy, we would like to keep in mind that actual sales and profit may grow further.

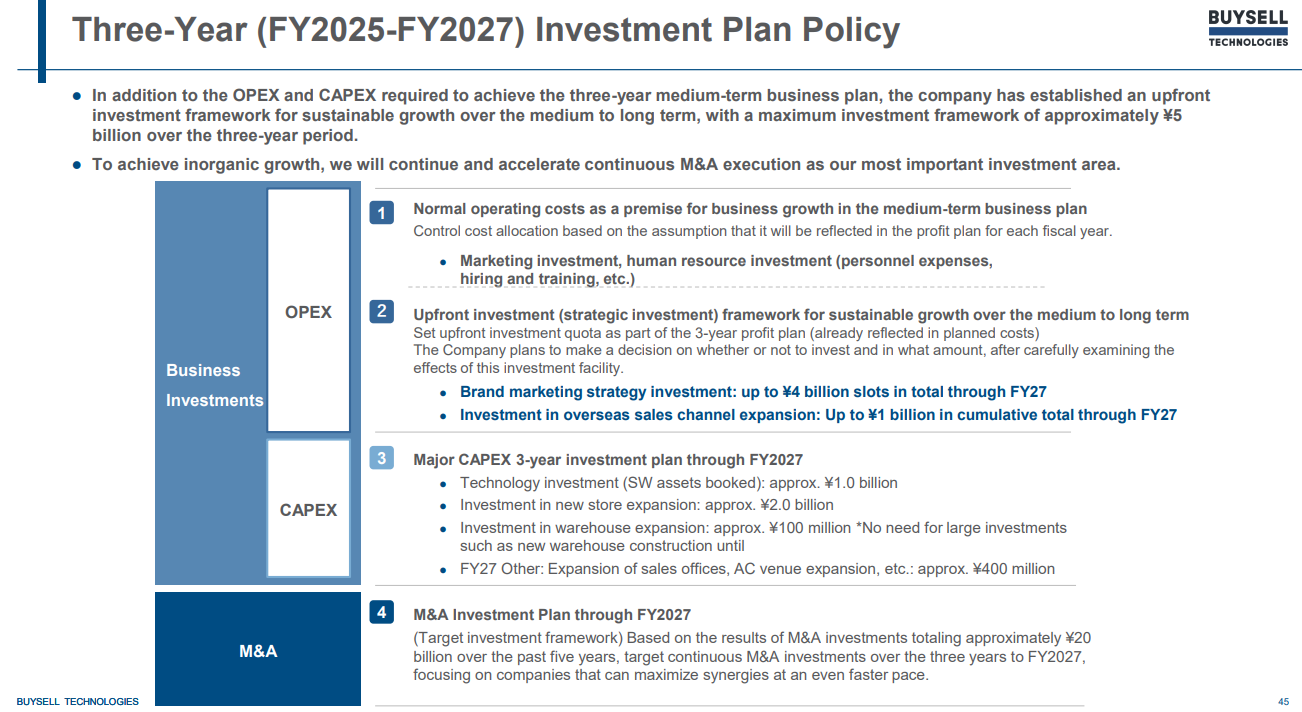

While pursuing organic and strong growth, the company intends to consistently and continuously make investments in brand development aimed at building a business foundation and a competitive edge in the longer term and strategic investments in such strategies as expansion to overseas markets, during the period of the medium-term management plan. Operating income for the fiscal year ending December 2027 is expected to be 11 billion yen, of which about 3 billion yen is for strategic investments. We would like to note that the company forecasts that operating income margin will remain unchanged from 7.9% for the fiscal year ended December 2024, but organic operating income margin with strategic investments being taken into consideration will go up to 10.0%.

(2) Market Environment

While the population is expected to diminish gradually in Japan, it is projected that the number of people aged 65 years and above, who are the main customers of BuySell’s home visit purchase services, will show a gradual increase. Regarding the macroeconomy, the inflation rate in Japan has been on an upward trend since 2022 and is expected to keep rising at about 2% per year. The company, therefore, forecasts that the desire to sell personal belongings and buy reused items will be driven further by the rapid aging of the population.

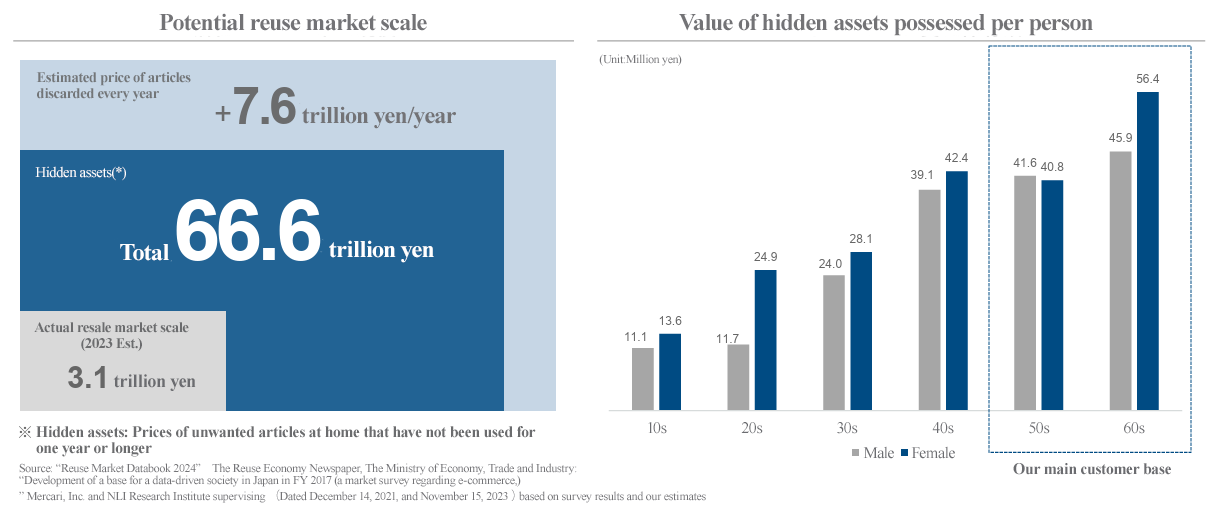

The scale of the emerging resale market is 3.1 trillion yen (estimated in 2023). There are seemingly hidden assets worth 66.6 trillion yen, based on which the company believes that there is still room for business expansion. People who have more hidden assets are those who are in their 50s and 60s, and people of this age group match the company’s main customers. The company will continue its long-term growth by focusing on expanding purchase services targeted at people in this age group.

(Source: the reference material of the Company)

The company estimates that the Service Available Market (SAM) of its home visit purchase business will be 4.8 trillion yen (as calculated regarding hidden assets limited to the products that the company handles) and the Service Obtainable Market (SOM) will be 1.5 trillion yen (the amount multiplied by the estimated number of customers who desire to sell their personal belongings = the emerging market of home visit purchase services, of the products that the company handles), when hidden assets worth 66.6 trillion yen are considered to be the Total Available Market (TAM) of the home visit purchase business. From now on, the company’s basic strategy is to cultivate potential markets by increasing the number of home visits for purchase services, while making the most of not only the position of BuySell Technologies alone, but the market’s top position of Fuku Chan as well.

Meanwhile, the TAM of the in-store purchase business is defined as 3.1 trillion yen of the emerging resale market (Customer to Customer and Business to Customer markets). In this case, the SAM is 1.3 trillion yen (an estimated amount of sales from in-store purchase services, of the Business to Customer market) and the SOM is 0.9 trillion yen (the amount of sales of products handled by the BuySell Group, of the SAM). While there are a number of competitors in the market and the barrier to entering the market is low, the company will boost sales by expanding the store network of its corporate group and increasing the market share through M&As.

(3) Business Strategies

The company has not only endeavored to attain the targets of the medium-term management plan, but also mapped out priority strategies for each business area with an eye to the growth in the future beyond the medium-term plan.

< Home Visit Purchase Business >

As BuySell Technologies, which is the leading company in the home visit purchase industry, and Fuku Chan, which is the second in the industry, has merged into the same corporate group, the most important point will be to establish an overwhelming competitive edge while making the most of the synergy between the two companies. BuySell plans to specifically take the following measures: (1) to improve profitability through enhanced efforts to acquire repeat customers, (2) to optimize marketing costs and make investments in brand development, (3) to introduce sales enablement to its group companies, and (4) to increase the average purchase amount per home visit through expansion of the range of products to purchase.

(1) Improvement of profitability through enhanced efforts to acquire repeat customers: BuySell Technologies alone successfully increased the rate of home visit purchase for repeat customers to 9% from 2% in the previous fiscal year as a result of its efforts to acquire repeat customers in the fiscal year ended December 2024. It will aim for the rate of 20% for home visit purchase for repeat customers in the fiscal year ending December 2027 by further brushing up this know-how. This know-how can be applied horizontally to Fuku Chan, and BuySell will strive to raise the home visit purchase rate regarding repeat customers across its corporate group. It is expected that variable profit per home visit will rise because an increase in the home visit purchase rate regarding repeat customers will directly result in growing gross profit through acquisition of products with high unit prices and declining advertising expenses (with the marketing cost for home visit purchase regarding repeat customers being zero).

(2) Optimization of marketing costs/brand development investments: Three group companies that operate the home visit purchase business (BuySell, Fuku Chan, and NIKKOU-DOU) mutually manage the media, timing, areas, and other relevant elements relating to marketing in order to optimize costs. The companies will establish a competitive edge and reduce the costs of acquiring customers by proactively making investments aimed at improvement of the brand value.

(3) Introduction of sales enablement to group companies: BuySell will raise gross profit per home visit across the corporate group by standardizing the initiatives for sales organization enhancement that it has implemented and introducing them to the group companies.

(4) Increase of the average purchase amount per home visit through expansion of the range of products to purchase: While taking into account that each group company is specialized in different business areas, BuySell will share the know-how of purchase, advance pricing, expand the range of products to handle, and take any other necessary measures.

<Group Store Business>

While BuySell is endeavoring to realize non-continuous growth through a roll-up strategy, the number of its group companies is increasing. The segments are divided into multi-channel stores, mass retail stores, stores operated permanently in department stores, and stores specializing in particular products. As the company will carry out more roll-up strategy, it plans to aim to establish competitiveness in the group store business while propelling forward mass-market strategies and differentiation strategies based on the strength of each group company and realizing total optimization of the corporate group as a whole. At the same time, it will balance profitability improvement with an increase in the number of stores by creating synergy among the group companies in such fields as marketing, store operation, assessment, authenticity appraisal, enablement (personnel development), and store development. The company aims to operate 650 stores or more as of the end of the fiscal year ending December 2027.

<Sales Business>

Regarding sales, the company hopes to successfully improve the warehouse operations and optimize the sales promotion and logistics costs by integrating the inventories of purchased products across the corporate group and incorporate purchase and sales data into big data. It will optimize the amount of sales by selectively using the most suitable sales channel for each product category in order to increase the amount of gross profit. Likewise, it will endeavor to expand sales channels overseas. The company has already set up a subsidiary in the Hainan Island, China. Reused products that have been authenticated in Japan earn great consumer trust overseas, so potential markets are considered to be huge.

<Technology/Personnel Affairs Areas>

The company will continue to boost profitability and productivity based on data by launching “Cosmos,” a general mission-critical system it has developed in house, and adopting it at the group companies. In the medium term, it plans to build AI-based business operation systems for call center operations, assessment operations, and any other relevant operations. Meanwhile, regarding personnel and organizations, it will formulate personnel strategies and priority measures so that the performance of each individual will be maximized and productivity will be raised. In a nutshell, the company will strive to ensure that there is no employment mismatch, and enhance engagement and develop human resources so that each employee will display initiative in the business.

<M&A Strategy>

With regard to the roll-up strategy, while giving priority to M&A in the resale business, the company intends to continuously make investments that contribute to enhancement of competitiveness and expansion to the areas in which reused products are not widely distributed. It will also endeavor to establish a framework for Post-Merger Integration (PMI) in order to realize systematic M&A. The investment rules the company has defined are to set the upper limit for EV/EBITDA ratio, contribute to profit even in the first consolidated fiscal year based on the Japanese GAAP (avoiding goodwill impairment), and unlock the potential for generating excess profit through the synergy created by PMI. Specific numerical targets have not been disclosed, but given the company’s past business performance, we can expect high investment efficiency.

<Capital Policy>

The basic principles of the capital policy remain unchanged. With regard to capital allocation, the company intends to stably and continuously pay dividends while prioritizing allocation of capital to business investments for organic growth and strategic investments including M&A (with a consolidated dividend payout ratio roughly estimated at 20%). It will consider stock repurchase depending on the level of its share price.

Concerning investment capital, the company plans to start with allocation of the cash generated from operating activities that it raises through sustainable profit growth. It will then combine debt finance while considering possibilities of procurement. According to the company, equity finance may be another option depending on the share price level, the market environment, and other relevant factors, but it will give lower priority to equity finance than to debt finance. The investment principles during the medium-term management plan are as follows:

(Source: the reference material of the Company)

<Financial Principle>

As the company had carried out multiple M&A projects based on debt finance, interest-bearing liabilities increased to 26,977 million yen (as of the end of the fiscal year ended December 2024). As a result, net D/E ratio stood at 1.1, and net DEBT/EBITDA ratio was 2.1. While the company will give focus to investment in growth, it believes that execution of well-ordered financial management will allow it to stabilize the financial base and secure funds for investment. Therefore, it revised the financial disciplines and has established new ones with the necessity to reflect the required time for recouping investments and the like, the ability to generate cash flows, and investment efficiency being taken into account. Specifically, the company has defined the financial disciplines as follows: (1) a net D/E ratio of 1.0 or less (which is 0.7 with the term ending December 2025 included), (2) a net DEBT/EBITDA ratio of 2.0 or less (which is 1.1 with the term ending December 2025 included), (3) a ratio of goodwill to equity of about 1.0 or less (which is 1.0 with the term ending December 2025 included), and (4) an equity ratio of 30% or more (which is 30% with the term ending December 2025 included).

<Principle of Shareholder Return>

The company intends to prioritize investments in growth and, regarding shareholder return, it considers improvement in total shareholder return as the first priority with medium- and long-term increases in the share price taken into account. Certainly, it has established a principle of dividend payment with a consolidated payout ratio roughly estimated at 20% (which remains unchanged) based on its plan to stably and continuously pay dividends. While it purchased treasury shares worth about 1 billion yen in the fiscal year ended December 2023, they said that there is a possibility that it will acquire treasury shares again depending on such factors as the share price and the financial capacity.

5. Conclusions

The external environment has been severe in recent years, due to the COVID-19 pandemic and social accidents, but they succeeded in making the home visit purchase business profitable and also systematizing the in-store purchase business with the roll-up strategy. The external environment is becoming milder and there remains room for growing the reuse market in Japan, so it is highly likely that their medium-term management plan will be completed. They have just started the foray into overseas markets, but their overseas business has a potential to become a pillar in the next medium-term management plan. If sales growth and profitability improvement become evident, the evaluation on the company will change. In addition, a roll-up strategy increases growth potential as post-merger integration (PMI) progresses in many cases. We would like to pay attention to the progress of PMI.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organizational Type | Company with Audit & Supervisory Committee |

Directors | 11 directors, including 6 outside directors |

Audit & Supervisory Committee | 3 members, including 3 outside members |

◎ Corporate Governance Report

The latest revision date: March 26, 2025

<Fundamental Concept>

The Company recognize that establishing corporate governance is essential in order to increase corporate value, maximize shareholder returns, and build good relationships with stakeholders such as customers, business partners, employees, local communities, and government agencies.

To this end, the Company believe that it is important to establish a decision-making body that responds quickly and fairly to changes in the business environment, pursue Profits through its businesses, ensure that its financial soundness and improve its credibility, actively disclose information to fulfill accountability, build an effective internal control system, and ensure that audit and supervisory committee members maintain their independence and fulfill their audit functions.

<Reasons for not implementing each principle of the Corporate Governance Code>

The Company has implemented all the basic principles of the Corporate Governance Code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |