Bridge Report:(7840)FRANCE BED Second Quarter of the Fiscal Year Ending February 2022

Shigeru Ikeda, Chairman/President | FRANCE BED HOLDINGS CO., LTD. (7840) |

|

Company Information

Market | TSE 1st Section |

Industry | Other products (manufacturing business) |

Chairman/President | Shigeru Ikeda |

HQ Address | Shinjuku Square Tower 6F, 6-22-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

Fiscal Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥914 | 41,397,500 shares | ¥37,837 million | 6.1% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥30.00 | 3.3% | ¥62.70 | 14.6x | ¥1,011.22 | 0.9x |

*The share price is the closing price on December 20. Numbers of shares issued, DPS, EPS, and BPS are from the financial results for the second quarter of Fiscal Year ending March 2022. ROE is from the financial results for the previous term.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 Act. | 52,410 | 2,606 | 2,606 | 1,806 | 44.88 | 25.00 |

March 2019 Act. | 51,764 | 2,363 | 2,361 | 2,599 | 66.02 | 28.00 |

March 2020 Act. | 52,430 | 2,492 | 2,436 | 1,520 | 39.07 | 28.00 |

March 2021 Act. | 52,430 | 3,246 | 3,451 | 2,295 | 59.87 | 30.00 |

March 2022 Est. | 54,000 | 3,700 | 3,650 | 2,350 | 62.70 | 30.00 |

*Unit: million yen, yen. Estimates are those of the Company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This Bridge Report presents France Bed Holdings’ summary of Financial Results for the Second Quarter of the Fiscal Year Ending February 2022, etc.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of Fiscal Year Ending March 2022 Earnings Results

3. Fiscal Year Ending March 2022 Earnings Forecasts

4. Future Initiatives

5. Future Focuses

<Reference1: Medium-Term Management Plan (FY 3/2022-FY 3/2024)>

<Reference2: Regarding Corporate Governance>

Key Points

- As a pioneer in the welfare equipment rental business, France Bed Holdings operates the medical services business, which manufactures, procures, rents, retails, and wholesales medical/nursing-care beds and welfare equipment, and the home furnishing and health business, which manufactures, procures, and wholesales household beds, furniture, and bedding, and so on.

- The sales in the second quarter of the term ending March 2022 were 25,978 million yen, up 6.4% year on year. Sales increased in both segments. The welfare equipment rental business, which is the mainstay, was healthy and in the home furnishing and health business, the sale of beds for homes, etc., whose sales considerably declined due to the novel coronavirus pandemic in the previous year, has recovered. Operating income was 1,865 million yen, up 46.6% year on year. Gross profit margin improved 1.8 points and gross profit rose 10.1% year on year as nursing care-related rental, which has a low cost of sales ratio, now accounts for a larger part of sales in the medical service business and thanks to the favorable sales of mattresses with high unit price and high added value with high gross profit margin in the home furnishing and health business. The increase in SG&A such as personnel costs was offset, and profit considerably increased. Net income was 1,305 million yen, up 53.4% year on year. Loss caused by temporary closing, etc., recorded as extraordinary loss in the same period of the previous fiscal year, no longer exists, while gain on sale of fixed assets was recorded as extraordinary income.

- No change in earnings forecast. For the term ending March 2022, sales are projected to rise 2.9% year on year to 54 billion yen and operating income is estimated to increase 13.9% year on year to 3.7 billion yen. Sales and profit are forecasted to grow for both businesses. The dividend is to be 30.00 yen/share, unchanged from the previous term. The expected payout ratio is 47.8%.

- In the Medium-Term Management Plan (FY 3/22-FY 3/24), of which the current fiscal year is the first year, the Group plans to focus its management resources on the silver business to solve the problems in the nursing care sector through new products and services, as the shortage of medical and nursing care workers is expected to become more serious due to the declining birthrate and aging population. The company aims to become a company that “is of use to society and contributes to society.” By providing products and services that are useful for daily life, the company will earn revenues and post appropriate profits, strive to conduct business administration while putting importance on ESG without just sticking to economic value, and create social value at the same time. In addition, by continuously endeavoring to create new value according to the changes in the social environment, the company hopes to remain an enterprise that is expected by society to exist for over 100 years. It aims to achieve sales of 59 billion yen, an ordinary income of 4.8 billion yen, and a ROE of 8% or higher in the term ending March 2024.

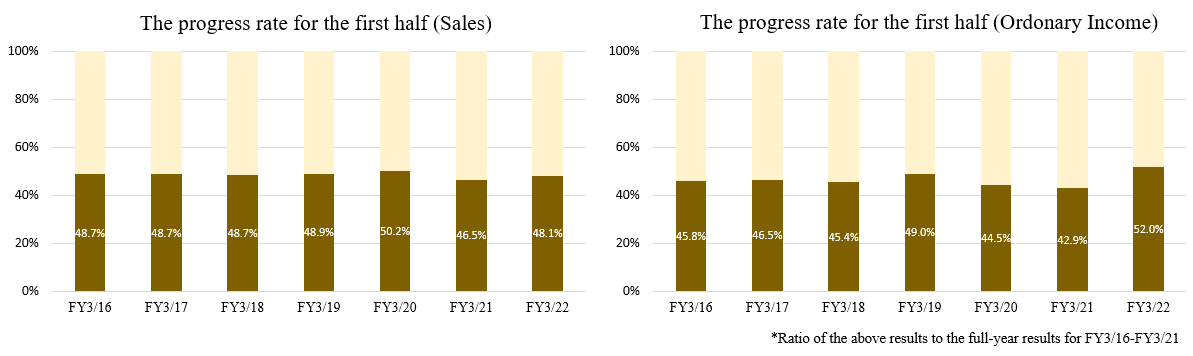

- The progress rate in the first half is 48.1% for sales and 52.0% for ordinary income. While sales are at about the same level as in previous years, ordinary income is at a high level. Attention will be paid to how much sales and profit are going to build up from the third quarter, mainly through the recovery of the home furnishing and health business, which is on the way of being freed from the impact of the novel coronavirus pandemic.

- Environmentally friendly products of not only the company, but also other companies have high added value, and a certain expansion of demand is also expected as awareness concerning the environment is rising among both individuals and corporations. We would like to expect the disclosure of the detailed variation in sales of these products, which will be the driver of the home furnishing and health business, whose ordinary income is projected to grow significantly in the mid-term management plan.

1. Company Overview

The company’s management philosophy is “France Bed aims to be an affectionate company that helps people live affluent, relaxing lives through creation and innovation.” The company is engaged in the medical services business, which includes the manufacture, purchase, rental, retail, and wholesale of medical and nursing care beds and welfare equipment, and the home furnishing and health business, which includes the manufacture, purchase, and wholesale of household beds, furniture, bedding, etc. It is a pioneer in the welfare equipment rental business. The company’s characteristics and strengths include human-friendly manufacturing and a system for offering a broad range of services swiftly.

【1-1 Corporate History】

Mr. Minoru Ikeda, who is the father of Mr. Shigeru Ikeda (currently Chairman and President of France Bed Holdings Co., Ltd.), established Futaba Corporation, the predecessor of France Bed Co., Ltd., in 1949. The company manufactured seats for automobile products, and in 1956, it began manufacturing Japan’s first splitable bed, France Bed, which became a huge hit. The company name was changed to France Bed Co., Ltd. in 1961. In 1963, the company was listed on the Second Section of the Tokyo Stock Exchange, and in 1966, it was listed on the First Section of the Tokyo Stock Exchange.

At France Bed Sales Co., Ltd., which was established in 1958 mainly for the purpose of selling France Bed, Mr. Shigeru Ikeda was selling medical treatment beds for home care, which he started as a new business in 1983. When they received requests for trade-ins in cases where users died soon after the sale of the beds, the company started a rental service. In order to fully operate the rental business considering the extremely high level of customer satisfaction, in 1987, the group company Nippon Sanitary Bedding Co., Ltd. merged with France Bed Sales Co., Ltd. and changed the company name to France Bed Medical Service Co., Ltd. becoming a pioneer in the welfare equipment rental business.

Initially, the rental service itself was not well known and struggled, but it has steadily expanded by capturing the needs of local governments that want to reduce costs through switching from free provision of welfare equipment to rental.

With the start of the nursing care insurance system in 2000, the rental of welfare equipment was incorporated into the system, thanks in part to Chairman and President Ikeda’s efforts to lobby the Ministry of Health, Labour and Welfare, and business expanded rapidly.

In March 2004, France Bed Holdings Co., Ltd. was established through the share transfer of France Bed Co., Ltd. and France Bed Medical Service Co., Ltd. In the same month, the company’s stock was listed on the First Section of the Tokyo Stock Exchange and the First Section of the Osaka Securities Exchange.

In April 2009, France Bed Medical Service Co., Ltd. was merged into France Bed Co., Ltd.

【1-2 Corporate Philosophy】

The company has the following management philosophy.

As stated in the interview with the President, the guiding principle of the company’s activities is to solve the product users’ problems.

☆ | France Bed aims to be an affectionate company that helps people live affluent, relaxing lives through creation and innovation. |

☆ | We will achieve the greatest possible value for our shareholders. We will create new and highly valuable products and services. |

☆ | We will strengthen the group’s overall power by making effective use of its business resources. |

【1-3 Environment Surrounding the Company】

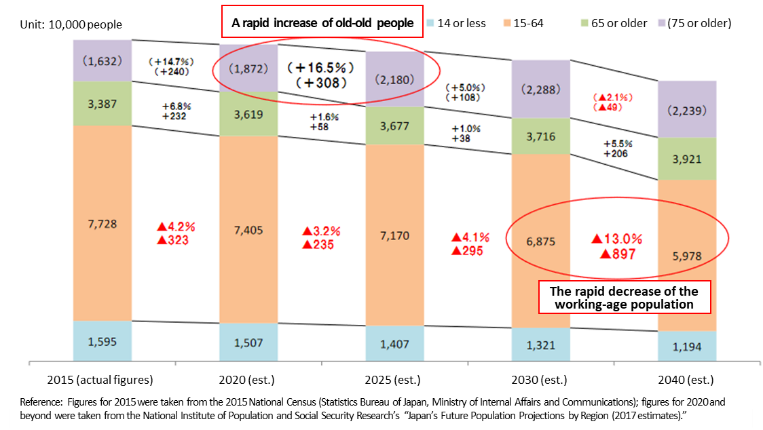

(1) Declining birthrate and aging population: Lack of nursing care providers and increase in elderly care at home

As the birthrate declines and the population ages, the number of people who require nursing care increases, while the working-age population (15-64 years old) declines. It is certain that there will be a shortage of nursing care personnel in nursing care facilities and the number of elderly caregivers at home will further increase, making coping with the super-aging society a major challenge for the Japanese society.

|

|

(Taken from the reference material of the company)

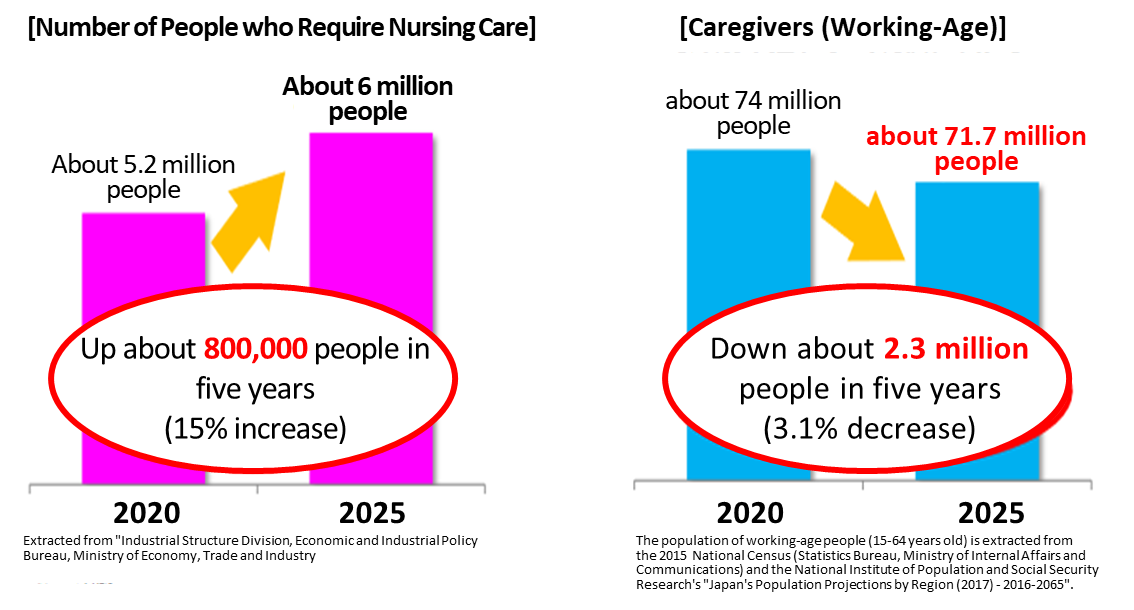

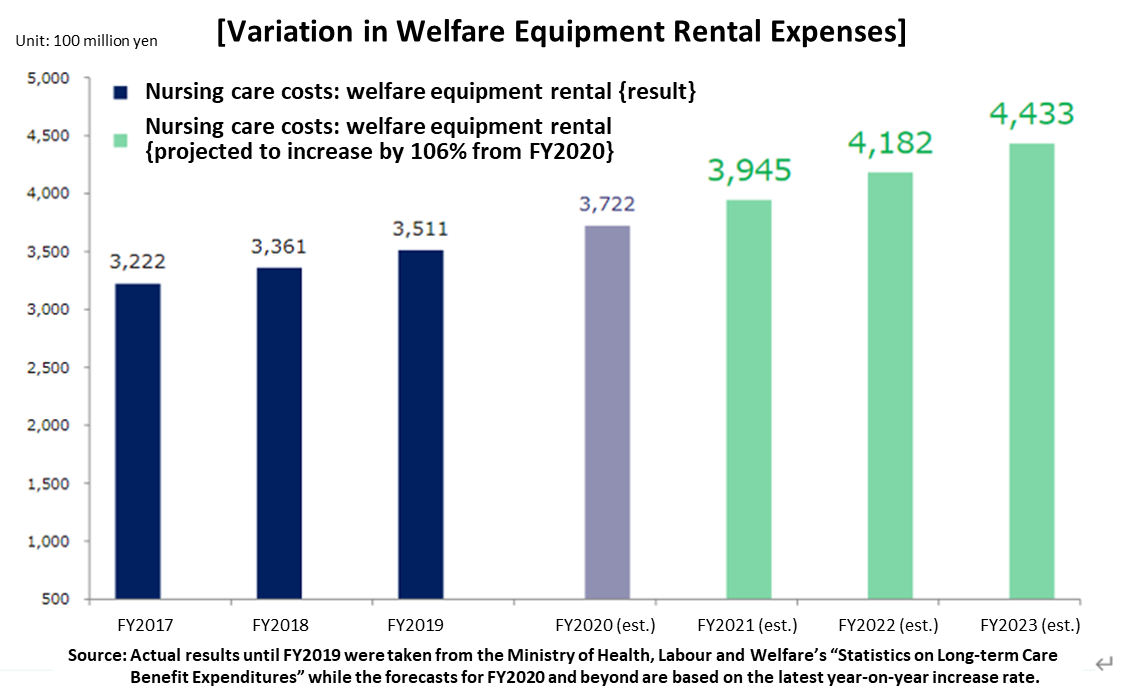

(2) Healthy welfare equipment rental market

Considering the aging of Japan’s population and the increase of people who require nursing care, the company expects the cost of renting welfare equipment, mainly nursing care beds, to continue to grow steadily, and the company forecasts that it will continue to increase at an annual rate of 6% from FY2020 onward.

(Taken from the reference material of the company)

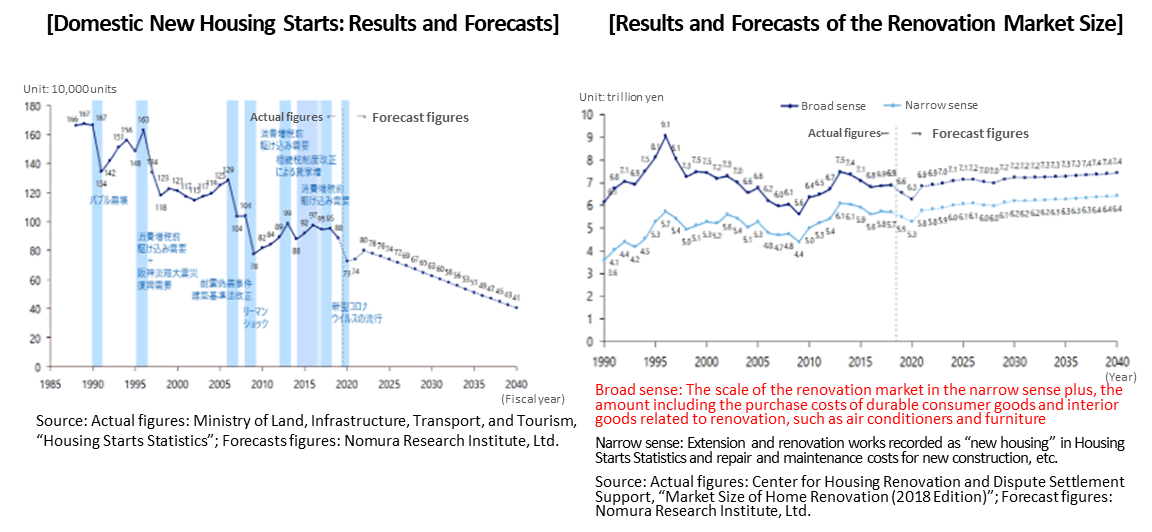

(3) Housing starts will decline, but the renovation market will remain strong

Although the number of new housing starts is expected to decline, the renovation market is expected to expand, albeit moderately, and as a result, replacement demand for durable consumer goods is expected to be strong.

(Taken from the reference material of the company)

【1-4 Business Description】

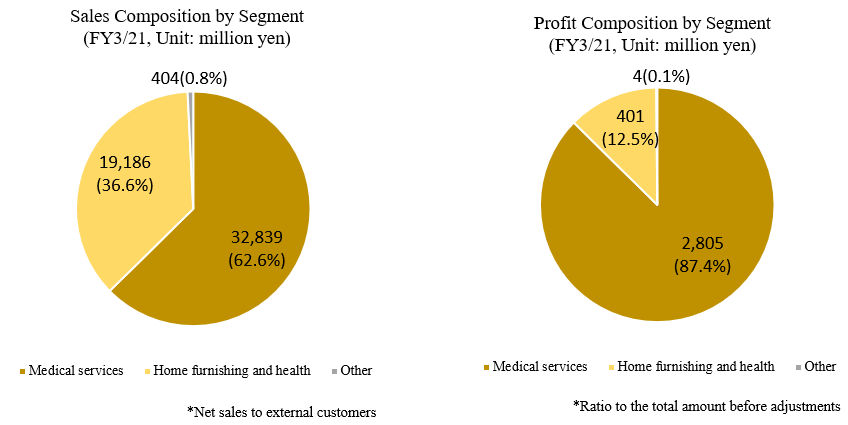

The two reported segments are Medical Services and Home Furnishing and Health. Other includes real estate leasing etc.

(1) Medical services business

In addition to developing, manufacturing, purchasing, renting, retailing, and wholesaling medical and nursing care beds and welfare equipment, the company provides linen supply services to medical and welfare facilities and hotels, although its geographic reach is limited. The company is also involved in the production of medical and welfare facilities.

The company’s production and development departments, which produce beds, furniture, and nursing care products for home and institutional use, and its sales and marketing departments, which have a nationwide sales network of their own stores and affiliated distributors, work in unison to propose unique products and services.

Since 1983, when the company started Japan’s first rental service for medical beds, it has been pursuing an environmentally friendly and gentle lifestyle through its services and products.

(Major subsidiaries and affiliates)

France Bed Co., Ltd., Homecare service Yamaguch, Tsubasa Co., Ltd., Kashidasu Co., Ltd., Jiangsu France Bed Co., Ltd., France Bed Medical Service Co., Ltd., Mistral Service Corporation.

(Business description)

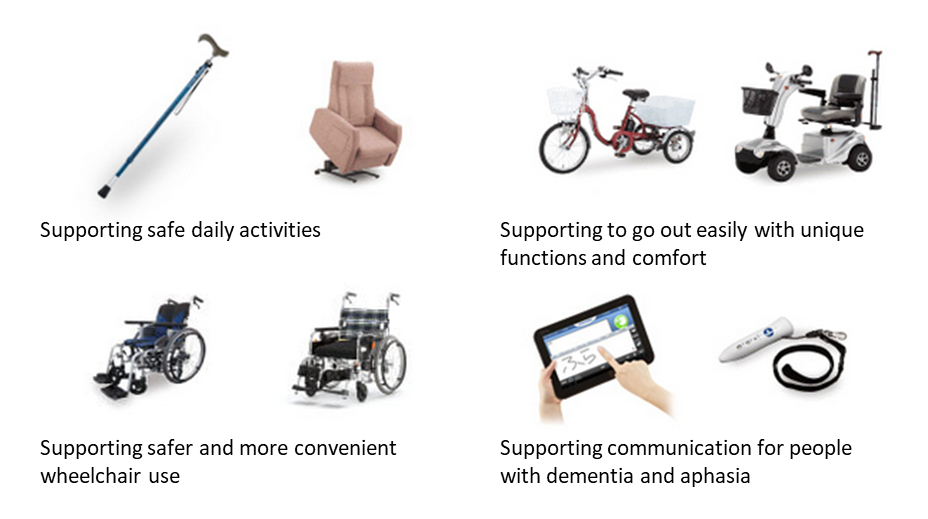

① Manufacture, purchase, rental, retail, and wholesale of medical and nursing care beds as well as welfare equipment

The company rents and sells nursing care products, welfare equipment, health support products, and products of the Reha tech brand for active seniors through its experienced professional staff in stores and on the Internet.

At the stores, the company provides various consultation services such as nursing care consultation and care plan preparation, and holds various health-related seminars and events.

② Linen supply for medical and welfare facilities, hotels, etc.

The company provides clean and safe linens to medical and welfare facilities and hotels. Linen for medical and welfare facilities is finished quickly and carefully in a cleaning factory equipped with disinfection facilities. The factory meets strict hygiene standards and has been designated as a Medical Service Mark Certified Factory.

③ Production of medical and welfare facilities

Based on the demand for safety from clients, that is, medical and welfare facilities, the company is doing its utmost efforts in design and development to further improve the safety of its products. The company was also one of the first to introduce home-like designs and materials to medical and nursing care beds, adding warmth to the inorganic spaces of medical and welfare facilities. The psychological effects of interior design on medical treatment life are also taken into consideration to support the realization of a higher quality medical and welfare environment.

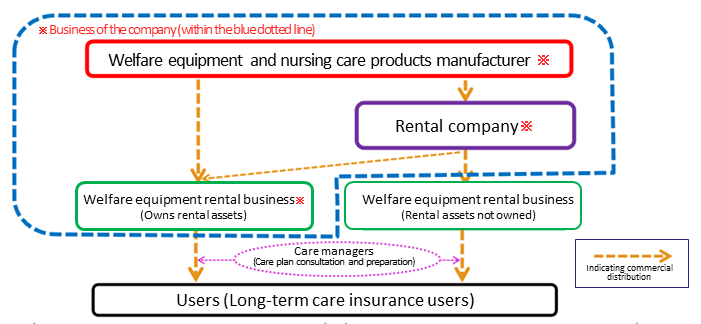

(Commercial distribution)

There are two main channels: direct rental and wholesale rental and sales.

*Direct rental

The company, which is both a manufacturer of welfare and nursing care equipment and a welfare equipment rental service provider, maintains its own rental assets and rents them to users of long-term care insurance through care managers.

*Wholesale rental and sales

The company, a manufacturer of welfare equipment and nursing care products, provides rental wholesaling and wholesales to welfare equipment rental companies, as well as wholesales of products to rental wholesalers who rent or sell products to welfare equipment rental companies.

(Taken from the reference material of the company)

(2) Home furnishing and health business

The company develops, manufactures, purchases, and sells beds, furniture, bedding, health equipment, etc.

In the production and development department, the company has been working on the development of beds and bedding products based on its research for comfortable sleep that it has been pursuing since its establishment, as well as the creation of diverse and valuable products ranging from furniture and interior design to health equipment.

In addition, the sales department has established a wide range of sales channels, including furniture stores, department stores, interior specialty stores, and lodging facilities throughout Japan.

Utilizing the unique knowledge that both divisions have built up, the company is contributing to the creation of a new, richer lifestyle culture through products and services that have never been seen before.

(Major subsidiaries and affiliates)

France Bed Co., Ltd., France Bed Sales Co., Ltd., FB TOMONOKAI Co., Ltd., Tokyo Bed Co., Ltd., France Bed Furniture Co., Ltd., Jiangsu France Bed Co., Ltd.

(Business description)

① Supporting people’s lives as a leading manufacturer in the furniture and interior design industry

As a leading manufacturer in the furniture and interior design industry, the company supports the realization of affluent lifestyles by proposing high value-added products to the consumer market from various perspectives such as health, sleep, lifestyle, and environmental friendliness, with an eye on both domestic and overseas markets.

② Developing high value-added products

In addition to beds that provide comfortable sleep, which the company has pursued since its establishment, it develops a wide variety of high value-added products that create a rich and healthy lifestyle, from general interior furniture such as living room sofas and dining sets to health devices such as massage machines.

③ Production of comfortable and high-quality hotel interiors from the planning stage

Using the knowledge of creating comfortable spaces that the company has cultivated over the years, the company carries out comprehensive production services for hotels. Starting with the delivery of beds and interior furnishings, the company produces effective spaces, including the design and construction of guest rooms and lobbies, as well as interior coordination, in accordance with the concept of the hotel.

【1-5 Characteristics and strengths】

(1) Product development capabilities: Pursuing user-friendly manufacturing

The company’s management philosophy is “to be an affectionate company that helps people live affluent, relaxing lives through creation and innovation,” and its guiding principle is to solve customers’ problems.

Based on this guideline, the company is pursuing people-friendly manufacturing, such as an automatic bed for assisting turn over and a multi-position bed for getting up from the bed, which will help improve ADL (Activities of Daily Living) and make it easier for people to return to their homes and society.

In addition, the company is focusing on the development of environmentally friendly products.

(Taken from the reference material of the company)

(2) Broad and prompt service provision system

As a leading company in the industry, the company provides a wide range of unique and friendly services for people to live with a peace of mind, from home to hospitals and facilities, including sales and rental of welfare equipment, production of hospitals and welfare facilities, and sales and rental of medical equipment.

In addition, welfare equipment including nursing beds, for example, must be installed in a house before the patient is discharged from a hospital and returns home. Therefore, it is important to be able to make arrangements quickly.

In addition to building and expanding its core maintenance center, the company is working to further strengthen its service provision system by adding small service depots, which are logistics bases without maintenance functions, in urban areas.

(3) Providing a life of affluence and gentleness

As a leading manufacturer in the furniture and interior design industry, the company has been creating a rich lifestyle culture for 70 years by pursuing the realization of a rich and gentle lifestyle.

【1-6 ROE Analysis】

| FY3/17 | FY3/18 | FY3/19 | FY3/20 | FY3/21 |

ROE (%) | 5.1 | 4.5 | 6.5 | 4.0 | 6.1 |

Net income margin (%) | 3.70 | 3.45 | 5.02 | 2.90 | 4.38 |

Total asset turnover | 0.85 | 0.82 | 0.81 | 0.85 | 0.86 |

Leverage | 1.64 | 1.62 | 1.62 | 1.63 | 1.63 |

In the Medium-Term Management Plan (FY 3/22-FY 3/24), the company aims to achieve a ROE of 8% or higher in FY 3/24.

Since the company plans to achieve a net income margin of 5.4% in FY 3/24, it will need to increase its total asset turnover and leverage to achieve a ROE of 8%.

2. Second Quarter of Fiscal Year Ending March 2022 Earnings Results

【2-1 Overview of Results】

| 2Q FY3/21 | Ratio to sales | 2Q FY3/22 | Ratio to sales | YoY |

Sales | 24,398 | 100.0% | 25,978 | 100.0% | +6.4% |

Gross profit | 12,825 | 52.6% | 14,126 | 54.4% | +10.1% |

SG&A | 11,553 | 47.4% | 12,260 | 47.2% | +6.1% |

Operating Income | 1,272 | 5.2% | 1,865 | 7.1% | +46.6% |

Ordinary Income | 1,480 | 6.0% | 1,901 | 7.3% | +28.4% |

Quarterly Net Income | 851 | 3.5% | 1,305 | 5.0% | +53.4% |

*Unit: million yen.

Sales grew and substantial increase in profit

Sales increased 6.4% year on year to 25,978 million yen. Sales increased in both segments. The core welfare equipment rental business performed well, and the interior health and wellness business saw a recovery in sales of home beds and other products, which had fallen sharply in the previous year due to the coronavirus pandemic. Operating income increased 46.6% year on year to 1,865 million yen. The gross profit margin improved by 1.8 percentage points due to an increase in the ratio of sales of nursing-care related rental equipment, which has a low cost of sales ratio, in the Medical Service Business, and strong sales of high unit price, high value-added mattresses, which have a high gross profit margin, in the Interior Health Care Business. Gross profit increased by 10.1% year on year, and the increase in SG&A expenses such as labor costs was offset by a significant increase in profit. Net income increased 53.4% year on year to 1,305 million yen. In the same period of the previous fiscal year, the company posted an extraordinary loss due to temporary closures, etc., and posted a gain on the sale of fixed assets as an extraordinary gain.

In addition, the “Accounting Standard for Revenue Recognition” (Corporate Accounting Standard No. 29, March 31, 2020) has been applied since the first quarter of the term ending March 2022. In case of not using the standard, sales would stand at 25,855 million yen (up 6.0% year on year) and operating income at 1,804 million yen (up 41.8% year on year).

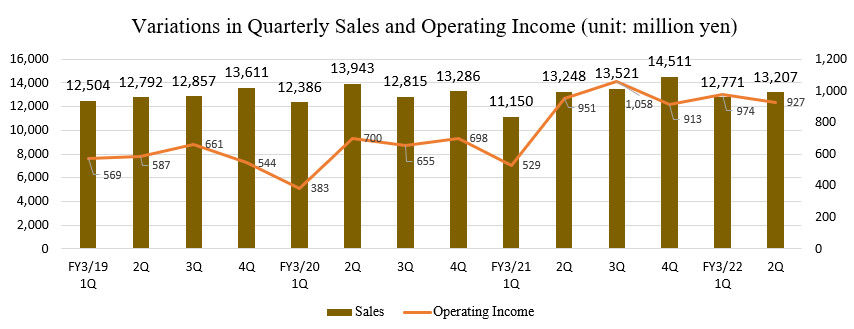

In terms of quarterly performance, a trend of recovery can be seen with the performance bottoming out in the first quarter of the term ended March 2021, but the sales and profit in the second quarter of the term ending March 2022 remain almost unchanged from the same period of the previous fiscal year.

【2-2 Trend in each Segment】

| 2Q FY3/21 | Ratio to total sales | 2Q FY3/22 | Ratio to total sales | YoY |

Medical services | 15,015 | 61.5% | 16,446 | 63.3% | +9.5% |

Home furnishing and health | 9,185 | 37.6% | 9,290 | 35.7% | +1.1% |

Other | 198 | 0.8% | 242 | 0.9% | +22.2% |

Total sales | 24,398 | 100.0% | 25,978 | 100.0% | +6.4% |

Medical services | 1,361 | 9.0% | 1,567 | 9.5% | +15.1% |

Home furnishing and health | 140 | 1.5% | 373 | 4.0% | +165.3% |

Other | 2 | 1.0% | 1 | 0.8% | -7.0% |

Adjustment | -24 | - | -42 | - | - |

Total profit | 1,480 | 6.0% | 1,901 | 7.3% | +28.4% |

*Unit: million yen. The ratio of profit in each segment to total sales means profit margin in each segment. From the fiscal year ending March, 2022, the segmental target has been changed from operating income to ordinary income in order to strengthen business portfolio management.

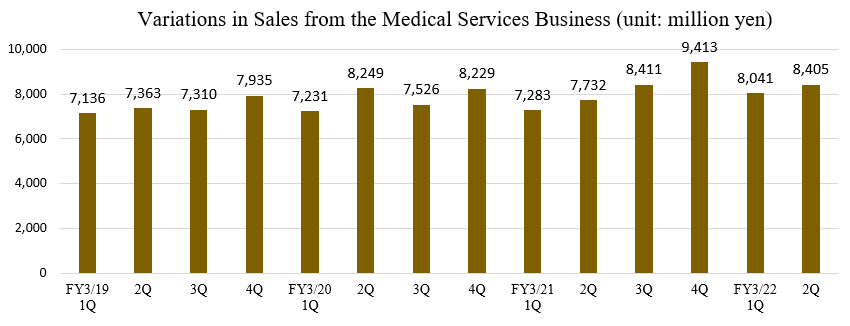

(1) Medical services business

Sales and profit grew.

Sales rose 9.5% year on year to 16,446 million yen.

The sales of nursing care-related rental were healthy, with demand exceeding the national average. Kashidasu Co., Ltd., acquired in October 2020, also made a contribution.

Profit rose 15.1% year on year to 1,567 million yen.

In addition to growth in sales, rental of beds for nursing care manufactured by the company performed well, and the ratio of costs of sales decreased, offsetting the increase in SG&A such as the expansion of infrastructure in the welfare equipment rental business and personnel costs.

Profit was secured in regard to transactions with hospital facilities while sales remained unchanged, due to the sale of beds contributing to non-contact and reduction of work duties, etc. amid the novel coronavirus pandemic.

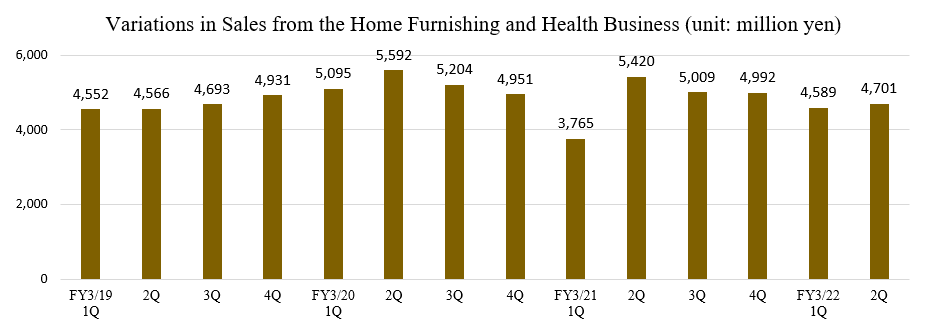

(2) Home furnishing and health business

Sales and profit grew.

Sales rose 1.1% year on year to 92,090 million yen.

From the same period in the previous fiscal year, when sales to furniture shops considerably dropped due to self-restraint on going out, etc. under the first state of emergency, the sales of mainly mattresses, down, health devices, etc. have recovered.

Profit rose 165.3% year on year to 373 million yen.

The mattress equipped with a disinfection function as a standard, whose unit price is high, captured the rise in the awareness concerning hygiene caused by the prolonged novel coronavirus pandemic and achieved a favorable performance, contributing to the improvement in gross profit margin. Event and shipping expenses are also decreased.

【2-3 Financial Standing and Cash Flows】

Main BS

| End of Mar. 2021 | End of Sep. 2021 | Increase/ decrease |

| End of Mar. 2021 | End of Sep. 2021 | Increase/ decrease |

Current Assets | 32,055 | 29,838 | -2,216 | Current Liabilities | 17,698 | 17,838 | +139 |

Cash and Deposits | 9,702 | 8,033 | -1,668 | Trade Payables | 5,332 | 4,373 | -958 |

Trade Receivables | 10,039 | 8,809 | -1,229 | Short-Term Debt | 6,876 | 8,980 | +2,104 |

Inventories | 7,787 | 8,361 | +574 | Noncurrent Liabilities | 7,106 | 5,501 | -1,604 |

Noncurrent Assets | 30,135 | 30,891 | +756 | Long-Term Debt | 5,592 | 4,015 | -1,577 |

Tangible Assets | 19,633 | 20,548 | +915 | Total Liabilities | 24,804 | 23,339 | -1,464 |

Intangible Assets | 1,826 | 1,760 | -66 | Net Assets | 37,412 | 37,408 | -4 |

Investments, Others | 8,674 | 8,582 | -92 | Retained Earnings | 35,881 | 36,540 | +659 |

Total Assets | 62,217 | 60,747 | -1,469 | Total Liabilities, Net Assets | 62,217 | 60,747 | -1,469 |

*Unit: million yen. Trade receivables include electronically recorded ones, and trade payables also include electronically recorded ones. Interest-bearing liabilities include lease obligations.

Total assets decreased 1.4 billion yen from the end of the previous term to 60.7 billion yen, due to the decline in cash and deposits and trade receivables, etc.

Liabilities decreased 1.4 billion yen from the end of the previous term to 23.3 billion yen, due to the decline in long-term debt, etc. Net assets stood at 37.4 billion yen, nearly unchanged from the previous term.

Capital-to-asset ratio increased 1.4 points from the end of the previous term to 61.5%.

Cash Flow

| 2Q FY3/21 | 2Q FY3/22 | Increase/decrease |

Operating Cash Flow | 5,878 | 2,675 | -3,202 |

Investing Cash Flow | -2,676 | -3,284 | -607 |

Free Cash Flow | 3,202 | -609 | -3,811 |

Financing Cash Flow | -557 | -624 | -66 |

Cash and Equivalents | 13,353 | 11,033 | -2,320 |

*Unit: million yen.

The cash inflow from operating activities shrank and free CF turned negative, due to the increase of inventories, etc.

The cash position dropped.

【2-4 Topics】

①Selection of the new market category “Prime Market”

In July 2021, the company received the initial assessment results regarding the compliance with listing criteria for the new market category from the Tokyo Stock Exchange, Inc., confirming the eligibility to be listed on the new market category “Prime Market.”

Then, the company decided to select “Prime Market” as the new market category.

From now on, they will proceed with the designated procedures pertaining to the application for selection of the new market category based on the schedule determined by the TSE.

②Implementation of M&A for fortifying the business foundation of the medical service business

In November 2021, the company announced that it would turn Homecare service Yamaguchi of its subsidiary FRANCE BED CO., LTD. into a wholly-owned subsidiary.

Its shares were transferred on December 20, 2021.

(Outline of Homecare service Yamaguchi)

Established in 1986. It provides welfare services, such as the sale and rental of welfare equipment and business for living and nursing care of special facility residents, mainly in Yamaguchi Prefecture. In the term ended October 2020, sales were 2,028 million yen and operating income was 252 million yen. Total assets stand at 1,454 million yen, while net assets stand at 728 million yen.

(Background of the reorganization into a wholly-owned subsidiary)

The corporate group engages in the expansion of the business foundation and scale through the increase of marketing bases, M&A, etc., with the objective to expand the market share of the welfare equipment rental business, which is the core business of the mainline medical service business.

They believe that through acquiring the client base owned by Homecare service Yamaguchi through this M&A, it will be possible to make the business foundation of the medical service of FRANCE BED HOLDINGS GROUP even more solid, leading to the expansion of the business scale.

③Announcement of purchase of treasury shares

Purchase of treasury shares was announced in November 2021.

The total number of shares to be purchased is up to 550,000, accounting for 1.49% of the number of shares outstanding excluding treasury shares.

The total acquisition price is up to 500 million yen.

The period is from December 1, 2021, to February 28, 2022.

3. Fiscal Year Ending March 2022 Earnings Forecasts

【3-1 Earnings Forecasts】

| FY3/21 | Ratio to sales | FY3/22 Est. | Ratio to sales | YoY | Progress Rate |

ProSales | 52,430 | 100.0% | 54,000 | 100.0% | +2.9% | 48.1% |

Operating Income | 3,246 | 6.1% | 3,700 | 6.8% | +13.9% | 50.4% |

Ordinary Income | 3,451 | 6.5% | 3,650 | 6.7% | +5.7% | 52.0% |

Net Income | 2,295 | 4.3% | 2,350 | 4.3% | +2.3% | 55.5% |

*Unit: million yen. Estimates are those of the Company.

No change in earnings forecast. Sales and profit are expected to increase.The full-year earnings forecasts remain unchanged. The estimate of sales is projected to grow 2.9% year on year to 54 billion yen and operating income by 13.9% year on year to 3.7 billion yen. Sales and profit are expected to increase in both businesses.

The dividend is to be 30.00 yen/share, unchanged from the previous term. The estimated payout ratio is 47.8%.

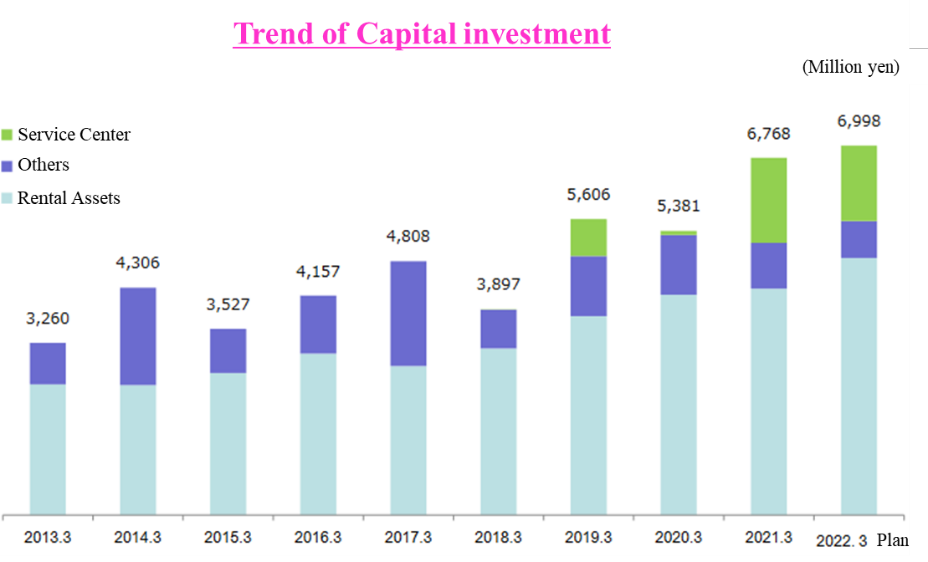

Plan for equipment investment

| FY3/20 | FY3/21 | 1H of FY3/22 | FY3/22 (Initial Plan) | FY3/22 (Revised Plan) |

Rental assets | 4,172 | 4,288 | 2,432 | 5,094 | 4,869 |

Equipment for manufacturing and distribution | 275 | 343 | 240 | 488 | 457 |

Service centers | 76 | 1,611 | 527 | 1,371 | 1,430 |

Acquisition of software | 314 | 161 | 125 | 195 | 156 |

Other | 544 | 365 | 74 | 95 | 86 |

Total | 5,383 | 6,770 | 3,399 | 7,244 | 6,999 |

Depreciation | 4,518 | 4,931 | 2,619 | 5,371 | 5,365 |

【3-2 Trend in each Segment】

| FY3/21 | Ratio to total sales | FY3/22 (forecast) | Ratio to total sales | YoY | Progress Rate |

Medical services | 32,839 | 62.6% | 34,200 | 63.3% | +4.1% | 48.0% |

Home furnishing and health | 19,186 | 36.6% | 19,800 | 36.7% | +3.2% | 46.9% |

Total sales | 52,430 | 100.0% | 54,000 | 100.0% | +2.9% | 48.1% |

Medical services | 2,954 | 8.9% | 3,000 | 8.7% | +1.5% | 52.2% |

Home furnishing and health | 522 | 2.7% | 650 | 3.2% | +24.5% | 57.3% |

Total profit | 3,451 | 6.5% | 3,650 | 6.7% | +5.7% | 52.0% |

*Unit: million yen. From FY3/22, a target ordinary income in each segment is set instead of a target operating income, for the purpose of strengthening the business portfolio management.

(1) Medical services business

Sales and profit are expected to grow.

The company will concentrate managerial resources to the welfare equipment rental business.

With regard to rental sales, three marketing offices were newly established in the first half. Two offices are to be established in the second half. In addition to reinforcing sales staff by recruiting 30 new graduates in April 2021, the company additionally built one small service depo in the first half.

As mentioned above, Homecare service Yamaguchi, which provides welfare services such as the sale and rental of welfare equipment and business for living and nursing care of special facility residents, mainly in Yamaguchi Prefecture, was turned into a wholly-owned subsidiary.

The company will proactively boost the rental of the multi-position bed, an important rental product, and promote the shift to a new product, the multi-fit handrail.

Medical DX Promotion Division was newly established

(2) Home furnishing and health business

Sales and profit are projected to grow.

The company aims to increase profit margin by providing products that could meet the needs of the times.

The development and sale of products with new added value, such as environmental friendliness, will be enhanced in order to improve profit margin.

One exhibition hall of the group was newly established in the first half to increase places for promoting products.

The company engages in the development of products for e-commerce business operators and reinforcement of online sale to strengthen the e-commerce business.

4. Future initiatives

4-1 Promotion of ESG management

The company will reinforce especially initiatives for conserving the “environment.”

(1) Home furnishing and health business

The whole lineup of mattresses, the mainstay of the business, was certified with the “Eco Mark.” An Eco Mark certification of a mattress with a disinfection function was the first in the industry. Furthermore, as many springs (iron), which are natural resources, are used in mattresses, it is necessary to separate them from other materials to allow for reuse. However, the springs in regular mattresses are often covered with non-woven bags one by one or tightly fixed, making the disassembly extremely laborious.

Moreover, the disposal methods of mattresses vary among municipalities. While some municipalities collect and dispose of (disassemble) mattresses, municipalities that accept only disassembled mattresses and municipalities that do not collect and dispose of mattresses account for about 18%.

In order to address this situation, the company developed “MORELIY,” an environmentally friendly system for disassembling mattresses.

With a structure of successive springs unique to FRANCE BED, it is possible to easily disassemble the mattress into springs and other materials, reducing the burden of disposal. It won the 2021 Good Design Award.

In order to advertise such environmentally friendly products toward consumers with high awareness of environmental issues, the group increased the number of exhibition halls from 31 as of the end of March 2021 to 33 as of the end of November 2021.

(2) Medical service business

While the performance of the welfare equipment rental business is achieving solid growth, more than 100,000 rental items are disposed of every year, which is worth 250 million yen just for products whose book value is remaining.

Then, the company will engage in the reduction of total disposal amount and development of products suitable for rental to work toward reducing the environmental burden and expanding profit.

4-2 Expansion of proactive investment in medical service business

The investment in equipment in the medical service business is growing every year. The company conducts proactive investment in infrastructure, which supports the expansion of the business.

In addition to relocating and newly building Tokyo Service Center with an investment amount of 3 billion yen in May 2022, the company is planning to newly build Osaka Service Center (provisional name), with the plan to start operation in April 2023. The investment amount is currently being estimated.

In addition, the company is in the process of selecting one from proposed sites for Nagoya Service Center (provisional name) and will go on to newly build and relocate key maintenance centers in urban areas.

Moreover, as the company turned Homecare service Yamaguchi into a wholly-owned subsidiary as mentioned above, they will also proactively promote M&A to speed up the acquisition of market shares, targeting mainly welfare equipment rental companies which face difficulties in finding a successor or wish for a business transfer.

5. Future Focuses

The progress rate for the first half was 48.1% for net sales and 52.0% for ordinary income. Sales are almost at the same level as usual, but ordinary income is at a high level. It will be interesting to see how much sales and profits will increase from the third quarter onward as the interior health business recovers from the effects of the coronavirus pandemic.

Not only does the company provide high value-added eco-friendly products, but demand for such products is expected to grow steadily as both individuals and corporations become more environmentally conscious.

We expect the company to disclose specific sales trends of these products, which will be the driver of the interior health and wellness business, for which high ordinary income growth is planned in the mid-term management plan.

<Reference1:Medium-Term Management Plan (FY 3/2022-FY 3/2024) >

The company announced a three-year Medium-Term Management Plan whose initial year is this term ending March 2022.

【1 Review of the Previous Medium-Term Plan】

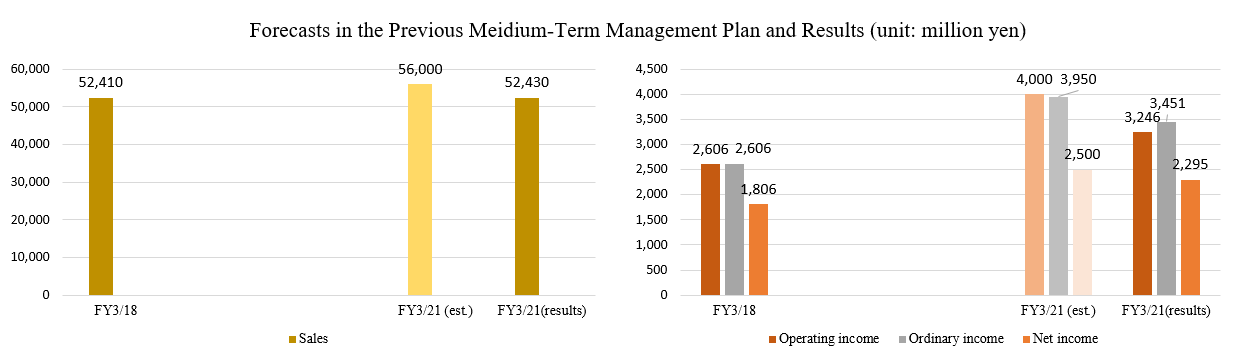

(1) Overall performance

Amid the novel coronavirus pandemic, sales and profit fell below the estimates.

The ROE for the term ended March 2021 was 6.1%, up 0.1 points from the estimate 6.0%.

(2) Performance of each segment

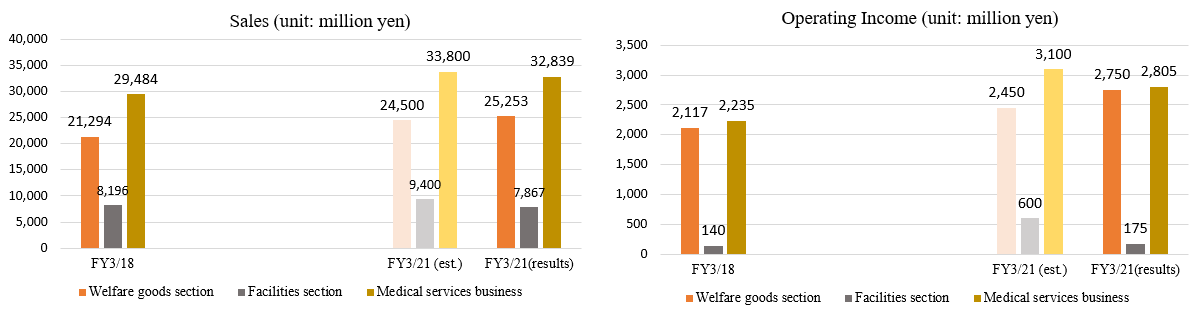

① Medical services business

The welfare goods section performed well, and its sales and profit exceeded the estimates, but the performance of the facilities section, which sells products to hospital facilities and supplies linen goods, fell below the forecasts. As a result, the performance of the medical services business did not reach the forecast.

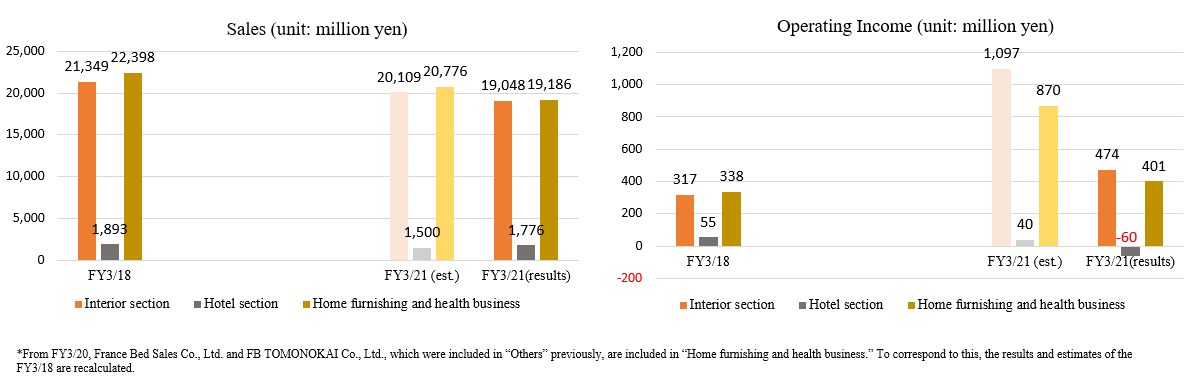

② Home furnishing and health business

The performance of the home furnishing section, which mainly sells household beds, did not reach the forecast, but the company promoted the shift from quantity to quality, improving profitability.

【2 Outline of the New Medium-Term Management Plan】

(1) External environment

As mentioned in 【1-3 Environment Surrounding the Company】, it is anticipated that the shortage of medical and nursing-care staff will worsen through the decline in birthrate and the aging of the population.

(2) Vision

To resolve problems with the external environment and problems of Japan, the company plans to focus the management resources of its corporate group to businesses for elderly people, and offer new products and services to solve the issues in the nursing-care field.

The company aims to become a company that “is of use to society and contributes to society.”

By providing products and services that are useful for daily life, the company will earn revenues and post appropriate profits, strive to conduct business administration while putting importance on ESG without just sticking to economic value, and create social value at the same time.

In addition, by continuously endeavoring to create new value according to the changes in the social environment, the company hopes to remain an enterprise that is expected by society to exist for over 100 years.

(3) Group strategy

The following strategies were stated regarding each field in the business portfolio.

Field | FY3/21 Net sales | Strategy |

Welfare equipment | 25.2 billion yen | Core business with a high market growth rate and a high profit margin. Seeking to expand the business scale and increase its market share by proactive investments. |

Home furnishing | 19 billion yen | Promoting the shift from quantity to quality and elevating business efficiency to improve profit margin despite the low market growth rate. |

Facilities | 7.8 billion yen | Improving profit margin by reforming the business structure. |

Hotels | 1.7 billion yen | Improving profit margin by reforming the business structure. |

Overseas | 100 million yen | Taking another challenge to foster this segment to be a driver of future growth. |

New business | - | Developing new business which will become a pillar for securing revenues in the future. |

(4) Reinforcement of the management foundation to support continuous enterprise growth

The following five themes were specified as essential issues from the perspective of ESG.

Offering even more safe and secure high value-added products |

Pursuing the reuse and recycling of raw materials |

Reducing CO2 emissions and converting energy |

Fostering human resources |

Promoting diversity and work-life balance |

In addition to continuing to offer high value-added commodities and services, the company will pursue the promotion of its rental service, development of environmentally friendly products, and the reuse and recycling of raw materials to efficiently use raw materials, to contribute to the realization of living with richness and kindness on solid business foundations comprised of compliance, governance, and sound financial position.

During this term, the company is planning to set medium-term objectives and KPIs in accordance with the five important themes, announce them both internally and externally, and launch initiatives.

(5) Priority measures regarding each business

① Medical services business

The priority measure is expanding business by focusing management resources on welfare equipment rental business.

As mentioned above, the welfare equipment rental market is projected to grow 6% year on year after FY2020 as well.

Furthermore, considering that the baby-boom generation will become old-old age from 2022, and the increase rate of old-old age people especially in major urban areas will be striking, the company will implement the following concrete measures.

Expansion strategy

The company will focus its management resources on the medical services business and increase direct transactions in urban areas where the increase rate of old-old age people is striking. In rural areas, they will enhance wholesale rental transactions.

To achieve this, they will increase the number of sales offices mainly in Tokyo, Nagoya, and Osaka by 11, from 92 as of the end of March 2021 to 103 by the end of March 2024.

They will also increase the number of employees by 80, mainly in Tokyo, Nagoya, and Osaka.

Furthermore, they will seek the maximization of the productivity of business activities by proceeding with the digitalization of work duties related to receiving orders, in addition to promoting M&A targeted predominantly at welfare equipment rental businesses facing the difficulty in finding a successor, etc., and enterprises hoping for business transfer.

Building infrastructure to support business expansion

As for key maintenance centers for the maintenance and repair of rental equipment, the Tokyo service center will be newly built and relocated in May 2022. It plans to expand the total floor area 1.4 times and adopt solar power generation.

Plans for preparations in Osaka and Nagoya are also in progress.

Furthermore, regarding the welfare equipment rental business, as expanding the logistics and delivery system will be one of the requirements for gaining a competitive advantage, they will also forge ahead with establishing more small service depos, which are logistical bases without a maintenance function.

They plan to establish four more depos mainly in urban areas (Hachioji City, Tokyo; Ota Ward, Tokyo; Nerima Ward, Tokyo; and Kawasaki City, Kanagawa Prefecture), increasing the total number of bases to 16 by the end of March 2024.

Development of products for labor-saving or workload reduction

The company will develop welfare equipment that will lead to labor-saving or workload reduction, addressing the challenges in the nursing care industry, such as the lack of nursing care personnel and nursing care of the elderly by the elderly.

The product into which they are currently pouring their efforts is the multi-position bed for getting up from the bed.

By transforming into four positions from the sleeping posture to a standing position, it reduces the burden on the caregiver while assisting the users’ independent life.

The model for homes has been introduced since 2020. A model for hospitals and welfare institutions will be sold in November 2021, and in one to two years, a model for overseas markets will be developed.

(Taken from the reference material of the company)

② Home furnishing and health business

The priority measure is to improve profit margin by providing products that could meet the needs of the times.

New housing starts is forecasted to decline, but the renovation market is expected to grow gently, so the demand for replacing durable goods is projected to be favorable.

The concrete measures are as follows.

Development of products that could meet the needs of the times

As people became more conscious about health and hygiene amid the novel coronavirus pandemic and as there are environmental issues, the company will develop and promote functional products with new added value.

*New “Life Treatment Mattress”

Since the mattresses of the bedding brand Culiess AG which specializes in hygiene, are highly evaluated, the antiseptic feature has been made into a standard feature of the cloth of the mattresses. They enable users to sleep in a clean, highly hygienic environment with (i) a sterile and breathable mattress that remains clean, (ii) an antibacterial bed frame that remains clean, and (iii) antiseptic bedding that remains clean.

The company obtained the eco-labeling certification for all products, to advertise the fact that they are environmentally friendly.

*Environmentally friendly mattress “Reco-Plus”

Since mattresses include many iron springs, which are made of natural resources, it is necessary to separate them from other materials for recycling. However, the springs of general mattresses are covered with non-woven bags or tightly fixated, so it is troublesome to disassemble them. The methods for discarding mattresses vary among municipalities. Some municipalities collect and discard (disassemble) mattresses, while other municipalities accept only disassembled mattresses, and some other municipalities do not collect or discard them.

s

Meanwhile, the environmentally friendly mattress “Reco-Plus” has a continuous spring structure unique to France Bed, which can reduce workload at the time of discarding the mattress, because it is possible to separate the springs from other materials easily. This mattress is recyclable and reusable, because the ratio of recyclable materials, such as stuffing and surface cloth, is high. This mattress is certified for eco-labeling, and complies with the Green Purchasing.

* “MORELIY,” an environmentally friendly system for disassembling mattresses

In order to create a scheme allowing consumers to easily participate in activities concerning the preservation of the environment, the company developed “MORELIY,” an environmentally friendly system for disassembling mattresses, which makes the disassembly of mattresses simple.

Mattresses where “MORELIY” is used can be easily disassembled into cushion materials, springs and fabric, allowing for the completion of disassembly in approximately 15 minutes without any tools.

Disassembling conventional mattresses itself was not possible, but as “MORELIY” allows for separation of materials, it will lead to the promotion of waste reuse (thermal recycling and material recycling).

By making the workflow encompassing the disassembly, separation and recycling of mattresses simple, the company will create a scheme allowing consumers to easily participate in activities concerning the preservation of the environment and will install “MORELIY” in 50% of mattresses in the following 10 years.

Expansion of the pet business

The overall market related to pet animals is growing steadily at an annual rate of around 2%.

The company has launched the brand called France Pet. By utilizing its technologies nurtured through the manufacturing of interior products for many years, the company will enrich the lineup of products for pets.

Expansion of opportunities to showcase their original products with unique features

The company will increase showrooms for its corporate group, and use them as the second selling spaces in cooperation with business partners. The company will promote middle and high-grade products with unique features, which have a high profit margin. By the end of March 2024, the company will increase the number of showrooms by 4 to 35.

Response to the growing EC market

It is expected that more consumers will use mail-order and EC services amid the novel coronavirus pandemic and the EC market will grow further.

The sales via mail order and EC have grown by double digits in the past two terms.

The company will enrich the lineup of products that are easy to deliver and suited for online sale, to meet the demand for products available via mail order and EC.

(Taken from the reference material of the company)

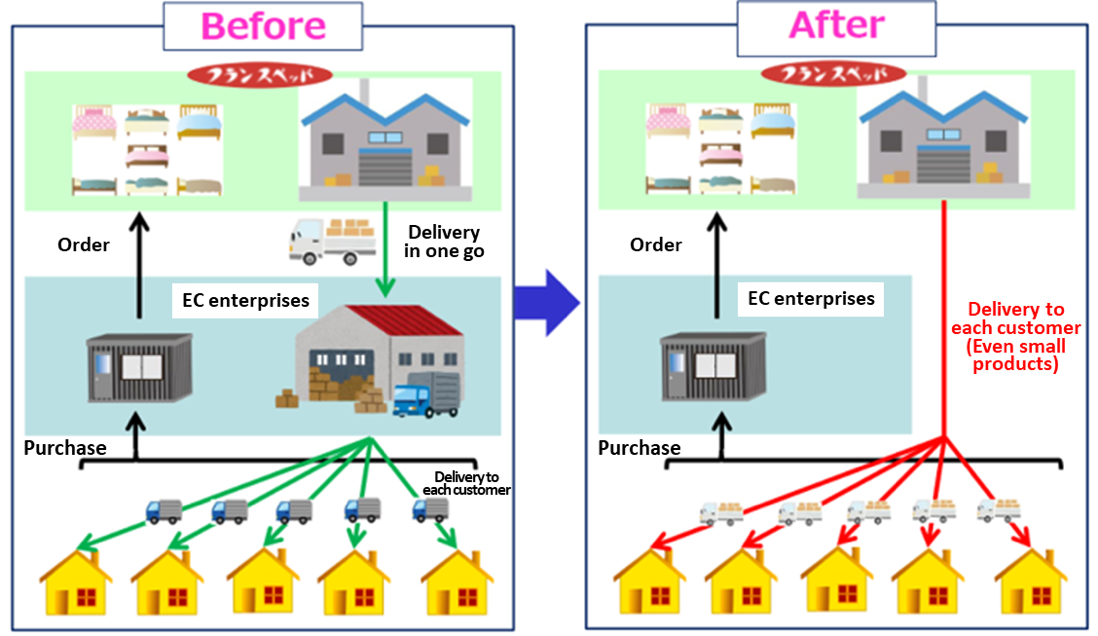

Measures for increasing online transactions

Due to the growth of demand from housebound consumers, online transactions are increasing rapidly. Accordingly, small and medium-sized EC enterprises are facing difficulty in handling and managing products, arranging shipment, etc.

To solve this problem, the company will develop a cooperative system for dealing with processes from product management and shipment arrangement on behalf of EC enterprises.

With this service, EC enterprises can concentrate on the tasks for receiving orders and meet consumer needs accurately.

(Taken from the reference material of the company)

(6) Return to shareholders

Under the basic policy of stable dividends, the company will accumulate profit stably while keep on paying a dividend of 15 yen/share in each half period for a total of 30 yen/share per year regardless of the profit level, and aim to increase the dividend level through comprehensive judgment while considering necessary investments for medium/long-term corporate growth for achieving a consolidated payout ratio of around 50%.

The company plans to acquire treasury shares continuously.

(7) Numerical goals

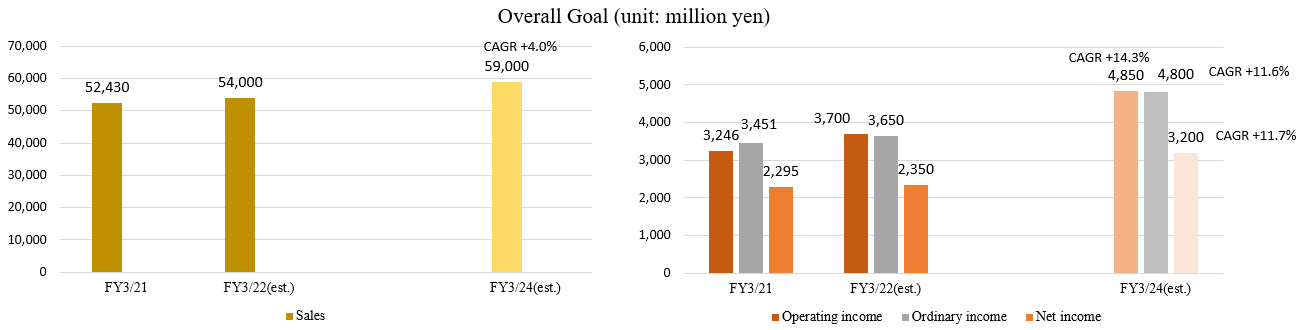

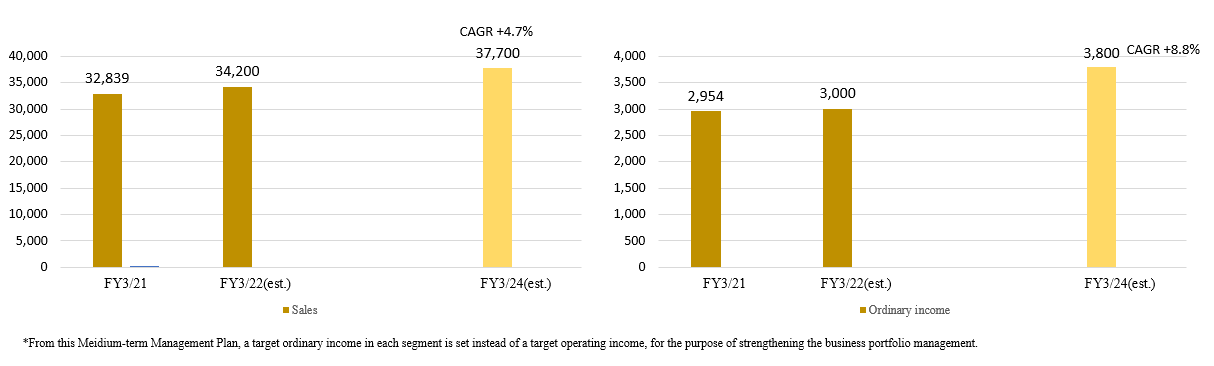

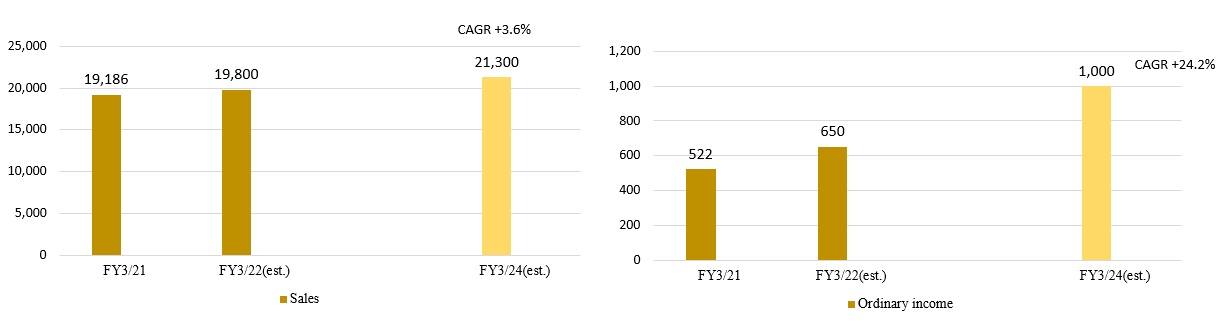

The numerical goals for the entire company and each segment are as follows.

The company plans to increase ROE from the current 6% level to over 8% in three years.

*CAGR stands for the compound annual growth rate for the period from FY3/21 (results) to FY3/24 (estimate). This was calculated by Investment Bridge Co., Ltd.

Medical services business

Home furnishing and health business

<Reference2: Regarding Corporate Governance>

Organization Type and the Composition of Directors and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 9 directors, including 3 outside ones |

Corporate Governance Report

Last updated in December 3, 2021.

<Basic Policy>

Our company recognizes that corporate governance is the basic framework for corporate management in relation to various stakeholders such as shareholders, customers, employees, business partners, and local communities, and consists of the (i) supervisory function of management, (ii) establishment of corporate ethics, (iii) risk management, (iv) compliance, (v) accountability, and (vi) improvement of management efficiency. In light of this basic framework, we believe that it is our greatest responsibility to strive to increase shareholder profits.

In recognition of this, we shifted to a company with an audit committee to further enhance its corporate governance system in June 2016. In addition, based on the resolution of the 16th Annual Meeting of Shareholders held on June 25, 2019, one independent outside director, who will be a member of the audit committee, will be added to reinforce the audit and supervisory functions of the company. This will contribute to the sustainable growth of our company and its subsidiaries (hereinafter referred to as the “Group”) and the creation of a business culture and corporate climate that respects better business ethics.

To enhance and strengthen corporate governance, our company has identified four issues to be addressed: (i) enhancement of audit functions, (ii) ensuring compliance with laws and regulations, (iii) improvement of IR, and (iv) promoting the organic revitalization of its subsidiary businesses.

In order to address these issues, we will clarify and enhance the functions of the company’s board of directors, audit committee, and other groups (audit group, corporate planning group, accounting and general affairs group, secretarial group, and human resources department), and clearly define and strengthen their functions to improve the transparency of management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Published based on the code after the revision in June 2021.

Principles | Reasons for not implementing the principles |

【Supplementary principle 2-4-1 Securing of Diversity within the Company through the Promotion of Female Employees’ Advancement】 | In order to work toward the promotion of female employees’ advancement within the company, we are having discussions on the improvement of the recruitment ratio of new graduates and career employees, adopting a return-to-work system and establishing a diversity promotion division, etc., mainly in FRANCE BED CO., LTD., a business company. Our company will engage in securing diversity while setting measurable goals as a future challenge. Furthermore, our company will work toward fostering human resources by educating employees in accordance with the recruitment policy recognizing diversity and forge ahead with developing a comfortable working environment through further enrichment of in-house regulations and systems concerning the working-style reform with a telecommuting system as one example, as well as the parental/nursing care leave system, etc. |

[Supplementary Principle 3-1-2: Enhancement of Information Disclosure] | Our company’s foreign shareholding ratio is below 10% and the information disclosed and provided in English is currently limited to the corporate brochure and consolidated financial statements published on the company website. From now on, our company will proceed with the expansion of disclosed information to a reasonable extent. |

【Supplementary principle 4-2-2 Formulation of Basic Policy Concerning Challenges Pertaining to Sustainability, etc.】 | Our company recognizes in its Mid-Term Management Plan that implementing business portfolio management and promoting ESG management while taking into account the environment, society and governance through the reinforcement of management foundations which will support continuous corporate growth are necessary in order to improve the corporate value in the medium/long term. We are currently formulating our basic policy regarding the initiatives pertaining to sustainability and will regularly follow up on the progress thereof at the Board of Directors meetings. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

[Principle 1-4 Strategically Held Shares] | The Group strategically holds shares with the aim to achieve sustainable growth and enhance corporate value. Annually, we routinely and continuously compare transactions, returns, such as dividends, risks, and capital cost for strategically held shares to assess their reasonableness from a mid-to-long term perspective. In the event that the reasonableness of shareholding cannot be confirmed through assessment, we will proceed in reducing those shares. With regard to exercising voting rights of strategically held shares, each proposal at the General Meeting of Shareholders is discussed based on the viewpoint of improving the mid-to-long term corporate value of both the Group and the issuing company. Proposals that are deemed to undermine corporate value will be opposed. For the issuing companies that have posted a deficit successively for a certain period or caused a scandal or the like, proposals will be carefully examined and be dealt appropriately. |

【Principle 3-1-3 Initiatives Concerning Sustainability, etc.】 | In its Mid-Term Management Plan, our company specified five themes in regard to the reinforcement of management foundations which will support continuous corporate growth, which are “(1) Offering even more reliable and safe commodities with high added value,” “(2) Pursuing the reuse and recycling of raw materials,” “(3) Reducing CO2 emissions and switching energy,” “(4) Fostering human resources,” “(5) Promoting diversity and work-life balance,” as well as foundations supporting business, which are “(1) Governance,” “(2) Compliance,” and “(3) Sound financial position.” Furthermore, our company has published a message from the President alongside introducing the relation to SDGs in initiatives addressing ESG challenges on the company website’s CSR information page. From now on, we will continue discussing “environmental philosophy and action policy,” “quantitative disclosure of risks and opportunities,” “situation concerning the development of a governance system,” “indices and goals regarding greenhouse gas emissions,” etc., and will proceed with procedures for disclosure. |

[Principle 5-1 Policy for Constructive Dialogue with Shareholders] | Our company appoints a director to supervise IR and defines a corporate planning division as its IR department. Financial report briefings are conducted every six months for shareholders and investors. The Representative Director, Chairman, and President and others will explain management policies, financial standing, etc., directly to attendees, and these contents are published on the company’s website. In addition, small meetings for institutional investors and company briefings for individual investors are held several times a year, and as much as possible, the Representative Director participates and gives explanations. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |