Bridge Report:(8275)Forval Second quarter of fiscal year ending March 2022

President Masanori Nakajima | Forval Corporation (8275) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Wholesale (Commerce) |

President | Masanori Nakajima |

Address | 14F AOYAMA Oval Bldg. 5-52-2 Jingu-mae, Shibuya-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,064 | 25,635,096 shares | ¥27,275 million | 11.7% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥26.00 | 2.4% | ¥74.29 | 14.3x | ¥484.87 | 2.2x |

* The share price is the closing price on December 6. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE and BPS are the actual values for FY3/2021.

* DPS and EPS are estimates for FY3/2022.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 (Actual) | 51,351 | 2,854 | 2,960 | 1,743 | 68.67 | 21.00 |

March 2019 (Actual) | 57,520 | 3,221 | 3,308 | 2,064 | 82.30 | 25.00 |

March 2020 (Actual) | 49,731 | 3,229 | 3,324 | 1,067 | 42.48 | 26.00 |

March 2021 (Actual) | 49,788 | 2,616 | 2,483 | 1,357 | 53.34 | 26.00 |

March 2022 (Estimate) | 50,000 | 3,000 | 3,000 | 1,900 | 74.29 | 26.00 |

* The estimated values were provided by the company.

* Unit: million yen.

We will report on the results of Forval for the second quarter of fiscal year ending March 2022 through this Bridge Report.

Table of Contents

Key Points

1. Company Overview

2. Growth Strategy

3. Second Quarter of Fiscal Year Ending March 2022 Earnings Results

4. Fiscal Year Ending March 2022 Earnings Forecasts

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending March 2022, sales declined 0.1% year on year, while ordinary income grew 11.8% year on year. Regarding sales, while the sale of devices, such as business phones, dropped, the sales of icon services grew steadily and the Forval Business Group, etc. witnessed sales growth, thanks to the contribution of Esumi Co., Ltd., which was included in the scope of consolidation in the second quarter of the previous term, but the General Environment Consulting Business Group, etc. witnessed a decline in sales, due to the decrease in sales of solar power generation systems, etc. Regarding profit, gross profit rose 2.2% year on year, but SG&A augmented 3.3% year on year, due to the increase of employees and the posting of expenses for acquiring Elcom Co., Ltd. as a subsidiary in July.

- For the term ending March 2022, sales and ordinary income are forecasted to increase 0.4% and 20.8% year on year, respectively. While profitability is expected to be boosted through an accelerated shift toward recurring revenue-based business, such as the icon services, the rate of sales growth will be low because the company is focusing on shifting from selling hardware to providing services more suitable to the new era.

- The company launched new services for the purpose of strengthening its icon services further. One new service is Kizuna PARK, a platform for information analysis for business administration of small and medium-sized enterprises, and another new service is GX Icon Start, a new icon service. We can also expect a lot from IEYASU Powered by FORVAL, a cloud-based attendance management system, which has been released recently, PPLS, which reviews and standardizes workflows, and streamlines business operations through paperless systems and standardization, SIM Work, an electronic contract service, etc. It is noteworthy what kinds of synergetic effects these new services will produce for expanding the sales of icon services.

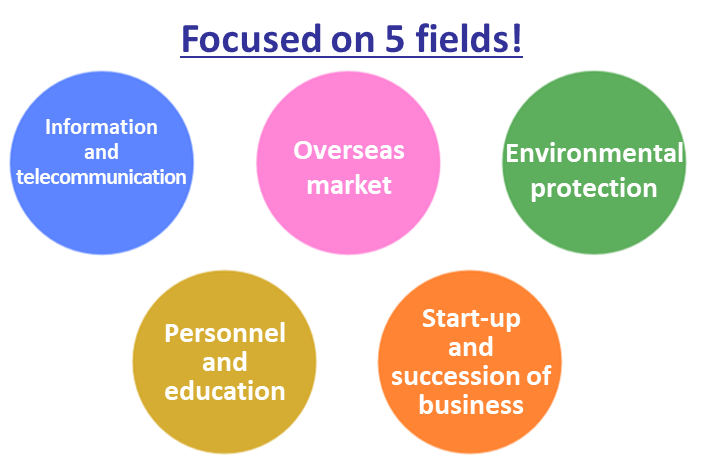

1. Company Overview

Forval Corporation aims to become a next-generation management consulting company specializing in 5 fields: “information and telecommunication,” “overseas market,” “environmental protection,” “personnel and education,” and “start-up and succession of business.” For advancing and streamlining business administration based on IT, the company offers telecommunication/Internet-related services, including IP phone services, which are compatible with optical fibers for offices, FMC services (that fused fixed-line telecommunication and mobile one), and IP integration solutions, which combined them with network security; and other services, including the sale and installation of office automation/network devices, the production of websites, the sale and installation of solar power systems and all-electric products. The corporate name “FORVAL” is derived from “For Social Value,” and infused with the management ethos: “We aim to become an enterprise that can create social value.”

The business of Forval is classified into 3 segments: (1) the Forval Business Group, which sells office automation and network devices for small and medium-sized enterprises, undertakes services, offers consulting services, and so on mainly via Forval Corporation, (2) the Forval Telecom Business Group, which operates telecommunication services for VoIP, mobile devices, etc., Internet-related services, ordinary printing, insurance services, etc. mainly via FORVAL TELECOM, Inc., and (3) the General Environment Consulting Business Group, in which APPLE TREE Co Ltd., which was acquired as a subsidiary in the term ended March 2014, wholesales and installs all-electric and eco-friendly housing equipment. In addition, the other business segment, which is not to be reported, includes IT education services, the development of IT engineers and administrators, and ITEC Inc., which introduces would-be executives and international students in Southeast Asia.

As the added value of hardware sale has recently declined, the company is shifting to consulting services, which can be differentiated from competitors and have high added value. The mainstay is icon, an IT consulting service launched in April 2008. In addition, as part of consulting services, the company assists small and medium-sized enterprises in installing information systems and business operations in ASEAN countries. For information systems, the company offers IP integration solutions. For business operations in ASEAN countries, the company established FORVAL (CAMBODIA) CO., LTD. in May 2010, PT FORVAL INDONESIA (Jakarta, Indonesia) in July 2011, FORVAL VIETNAM CO., LTD. (Ho Chi Minh, Vietnam) in August 2011, and opened a representative office in Yangon, Myanmar in March 2012 and then incorporated the office naming it FORVAL MYANMAR CO., LTD. in February 2013, to expand the network in ASEAN countries.

The stock exchange for the company was changed from JASDAQ (standard) of Tokyo Stock Exchange (TSE) to the second section of TSE on Jan. 24, 2014, and then to the first section of TSE on October 2, 2014.

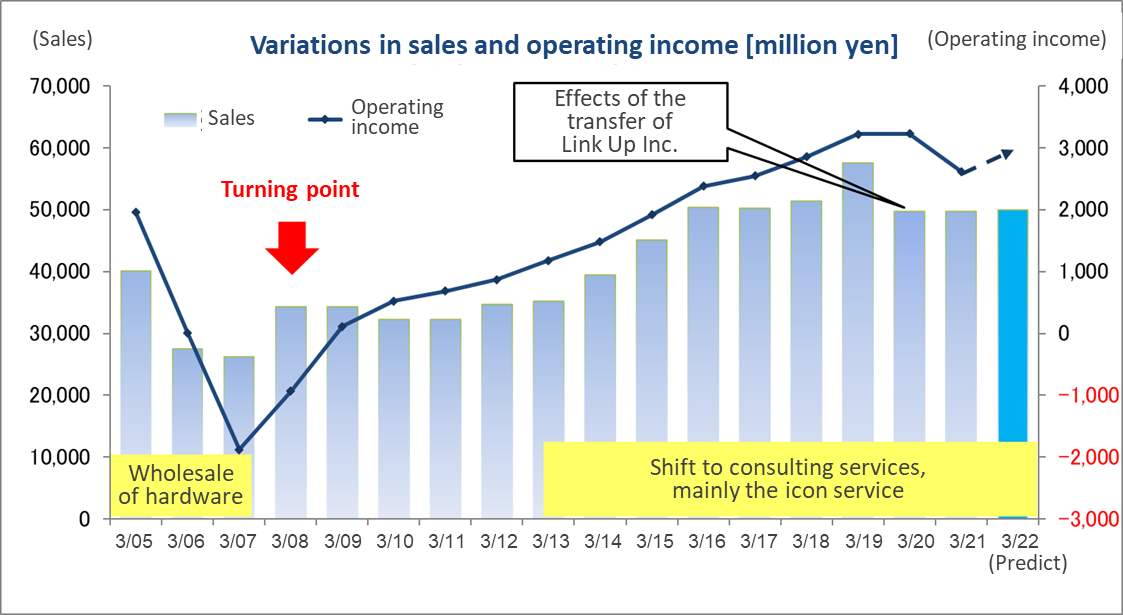

Variation in business performance of the Forval Group

We can see the outcomes of their efforts to improve the skills of employees by educating them about the IT field and encouraging them to obtain qualifications and the shift from wholesale of hardware to consultancy offering icon services.

2. Growth Strategy

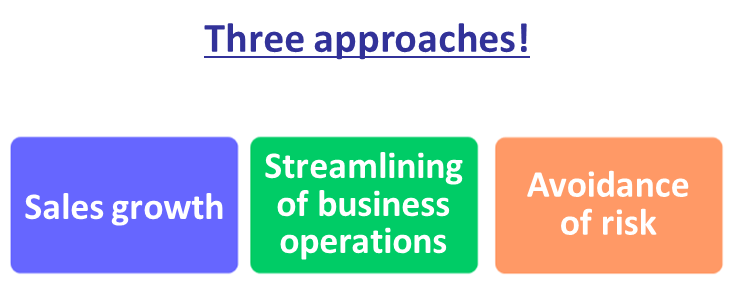

The mid-term vision of the Forval Group is to realize “next-generation management consultancy” for supporting the permanent growth and business succession of small and medium-sized enterprises, which underpin the Japanese economy. By utilizing APPLE TREE Co Ltd., which was acquired in 2013, in addition to the knowledge and technology about information and telecommunication, which are the existing business domains, and the knowhow to make inroads into overseas markets, it becomes possible to offer management consulting services considering how to address environmental issues, whose importance is growing, operate business, and contribute to the environment. Furthermore, the company developed a system for educating employees of client enterprises about the fields of information and telecommunication, overseas markets, and the environmental protection in a one-stop manner. ITEC Inc., which was acquired in 2013, joined the Forval Group, enriching the lineup of services regarding human resources and education for client enterprises. In addition, the company will strive to strengthen the domains of start-up and succession of business. In these five domains, the company will offer consulting services for expanding sales, streamlining business operations, and avoiding risks, and contribute to the profits of small and medium-sized enterprises.

Characteristics of the next-generation management consultancy of the Forval Group

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

(1) Expansion of the domain of information & telecommunication-Expansion of icon services

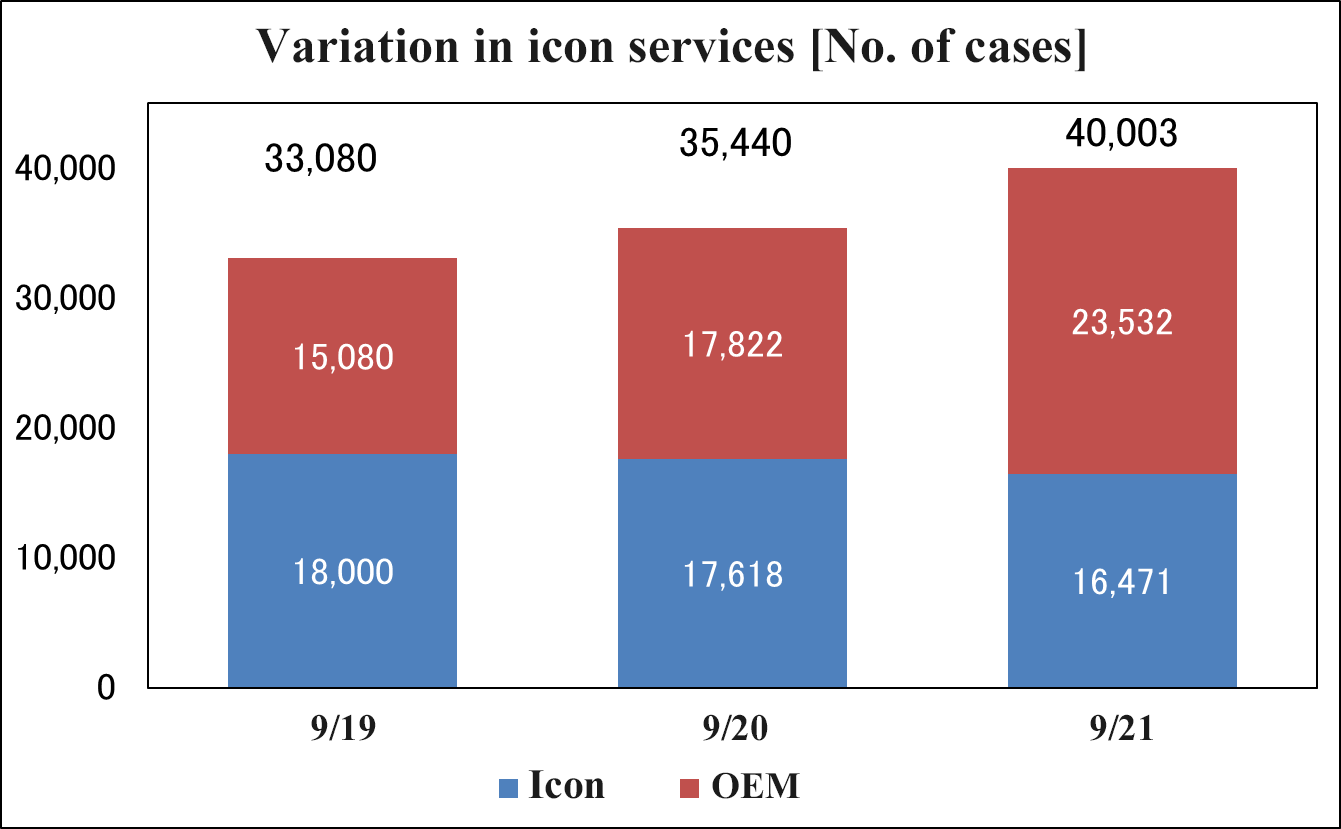

Variation in the number of cases in which icon services were adopted based on OEM

The company focuses on the development of networks based on the OEM of icon services for further expanding and strengthening the icon business. By offering the know-how of new business models that have been differentiated, the company aims to increase the number of business partners and the number of icon users. In the first half of FY 3/22, the number of icon services installed increased 12.9% year on year to 40,003. In particular, the number of icon installations by OEM in the first half of FY3/22 was 23,532, which was a significant increase of 32.0% year on year, and the driving force behind the growth in the overall number of icon service installations. The reason why the number of icons of the company has been sluggish is that the company has received orders mainly for services that require consulting with higher added value.

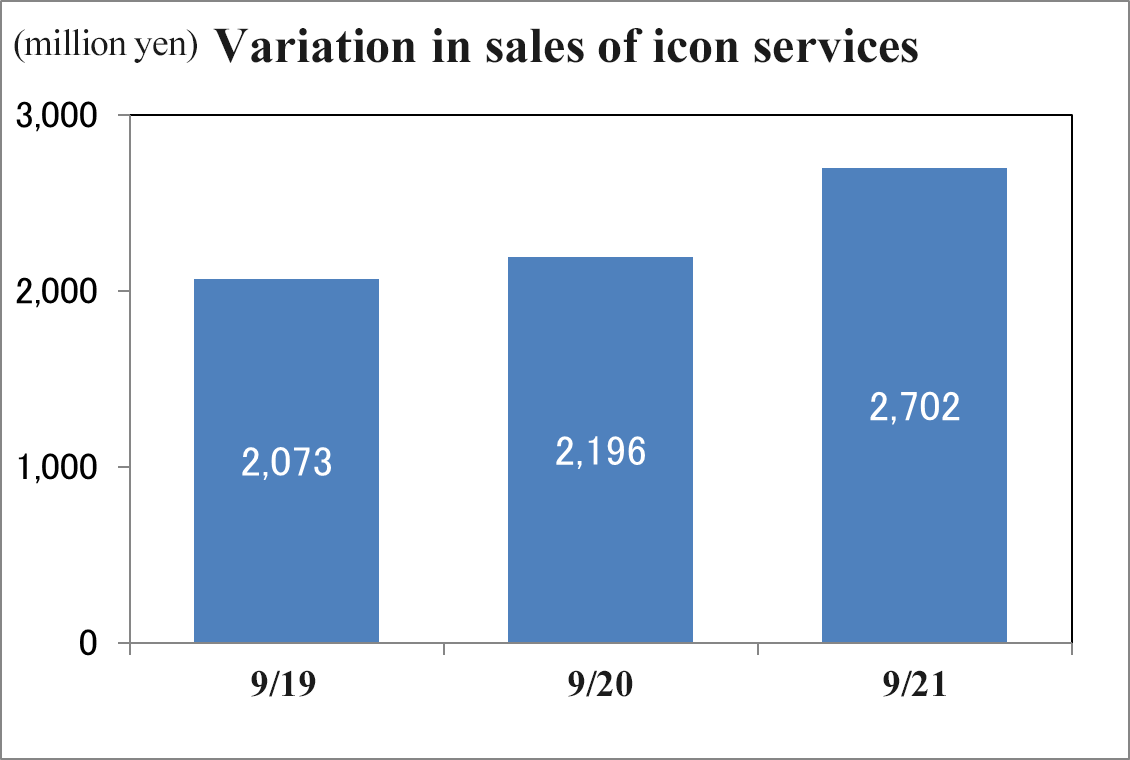

Variation in sales of icon services

For the first half of fiscal year ending March 2022, the sales of icon services grew 23.1% year on year, indicating steady performance. Since the launch of icon services, the sales related to icon services have grown steadily, thanks to the rise in average spending per customer through the increase of users, the focus on quality, and additional consulting services. The company aims to expand the sales of icon services, which are profitable, by releasing new services and promoting OEM actively.

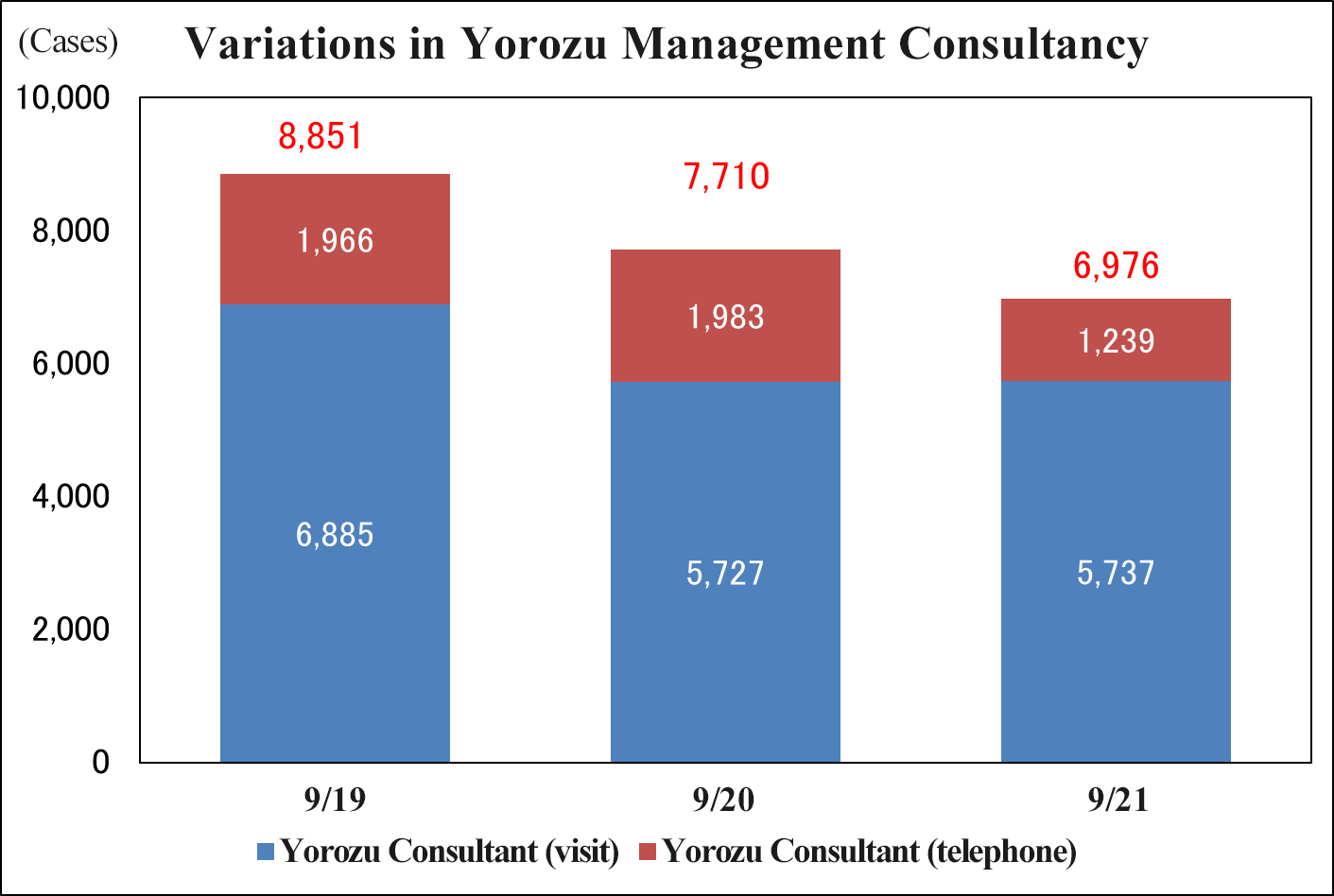

Variations in the number of Yorozu Management consultations

In Yorozu Management Consultancy, consultants visit clients regularly and give support for solving troubles in business administration. This business supports a broad range of fields, including sales growth, the increase of sales channels, the increase of new clients, business matchmaking, recruitment, cash management, and business succession. The consultants give advice about solutions, while enlisting cooperation from not only the company, but also the entire corporate group and business partners.

In the first half of the term ending March 2022, the number of cases of Yorozu Management Consultancy decreased 9.5% year on year from 7,710 to 6,976. The number of cases of visiting consultation increased slightly, but the number of cases of telephone consultation dropped considerably. In the term ended March 2017, the company shifted its strategy from the increase of consultation cases to the pursuit of the quality of consultation, and it can be expected that consultation cases that would directly increase profit will increase in the future.

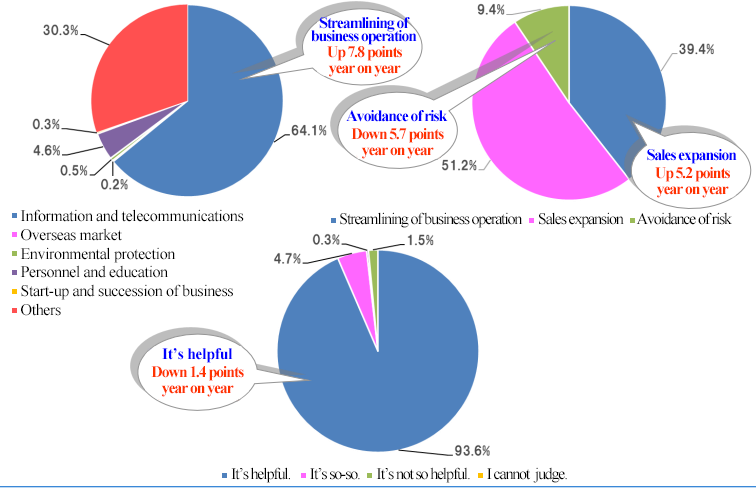

Details of the clients’ consultation and customer satisfaction in Yorozu Management Consultancy (1H of FY March 2022)

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

According to the interview survey targeted at clients (1H of FY 3/22), 93.6% of clients answered that Yorozu Management Consultancy was helpful. The number of transactions of high-quality Yorozu Management Consultancy is expected to keep growing. In addition, consultation cases related to sales growth and information/telecommunication increased. From now on, the excellence of consultancy of the company is expected to generate various business chances.

(2) Expansion of the overseas domain-Growth of the business of supporting overseas business expansion

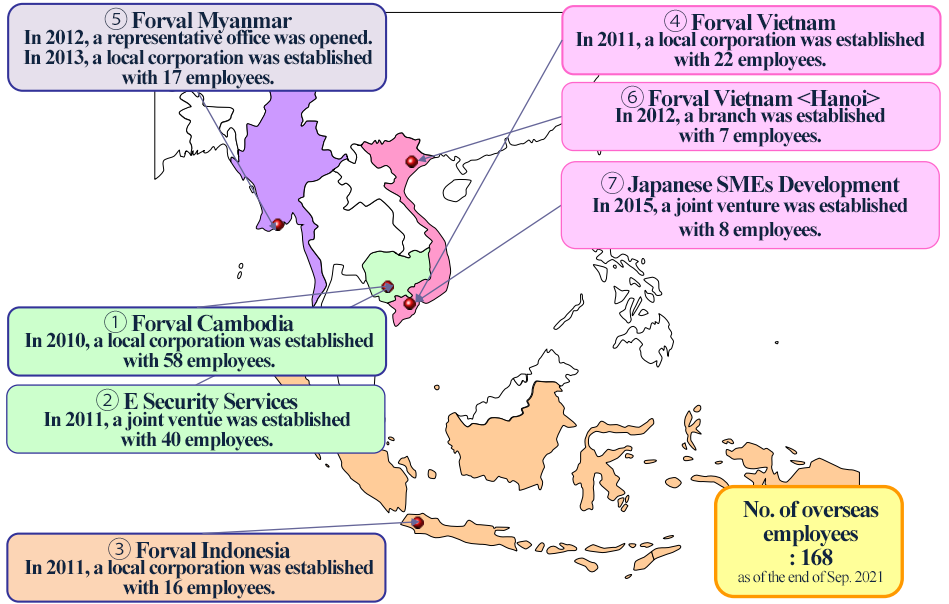

The chairperson Okubo of the company has engaged in a broad range of supportive activities, ranging from the development of educational infrastructure to the education of personnel, in Cambodia, where there are no sufficient opportunities of education, through CIESF, a public interest incorporated foundation established and directed by himself.

In the business of supporting the entry to the ASEAN market, the experience and personnel connections nurtured in such CIESF activities are useful. Under the recognition that “it is important to take advantage of the growth of Asian regions, in order to realize the growth of the Forval Group and its clients, that is, small and medium-sized enterprises,” the company has already established overseas corporations in Cambodia (May 2010), Indonesia (July 2011), and Vietnam (August 2011), and the representative office in Myanmar in March 2012.

Furthermore, in order to enrich and strengthen local supportive systems, the company started full-scale business activities in April 2014, in Myanmar, where the company obtained the approval for establishment of a corporation in February 2013 and went ahead with preparation. As of the end of September 2021, the number of employees at 7 overseas footholds (overseas subsidiaries and affiliates) was 168.

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

The “global icon service,” which is the business of supporting business expansion in ASEAN countries, is a business model for assisting enterprises in solving various problems and removing obstacles before and after entering an overseas market in a one-stop manner. At present, the company offers this service in 4 countries: Cambodia, Vietnam, Indonesia, and Myanmar. By offering information, supporting FS, establishing a local corporation on behalf of each client, supporting the recruitment and education of personnel, the development of back-office systems, the establishment of a network environment, the search for local business partners, etc. comprehensively, the company provides clients with comfortable office spaces comparable to those in Japan, based on the information and telecommunication technologies at which the company excels the most. The company offers comprehensive support in Japan and foreign countries.

In addition, the company finds and increases prospective clients of “global icon services” by actively forming alliances with Japanese administrative organs, local financial institutions, overseas central governments, administrative organs, industrial parks, etc.

Details of global icon services

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

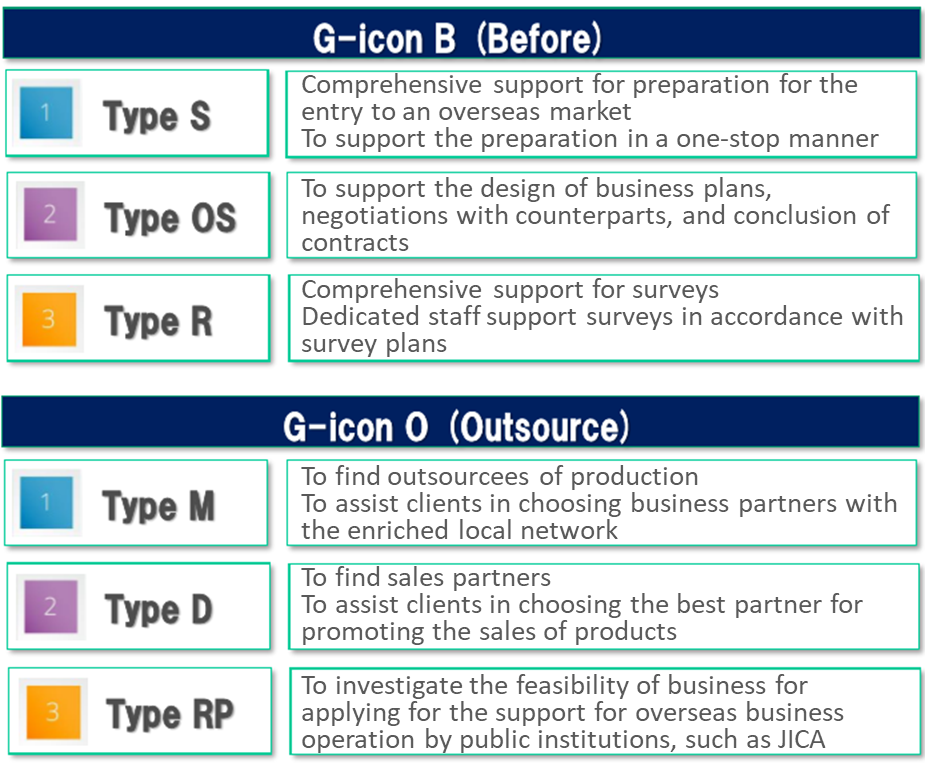

In global icon, the company can support clients in 6 ways: (1) comprehensive support for preparation for the entry to an overseas market, (2) support for the design of business plans and negotiations with counterparts, (3) comprehensive support for surveys, (4) finding outsources of production, (5) finding sales partners, and (6) investigating the feasibility of business for applying for the support for overseas business operation by public institutions, such as JICA.

Release of new global icon services

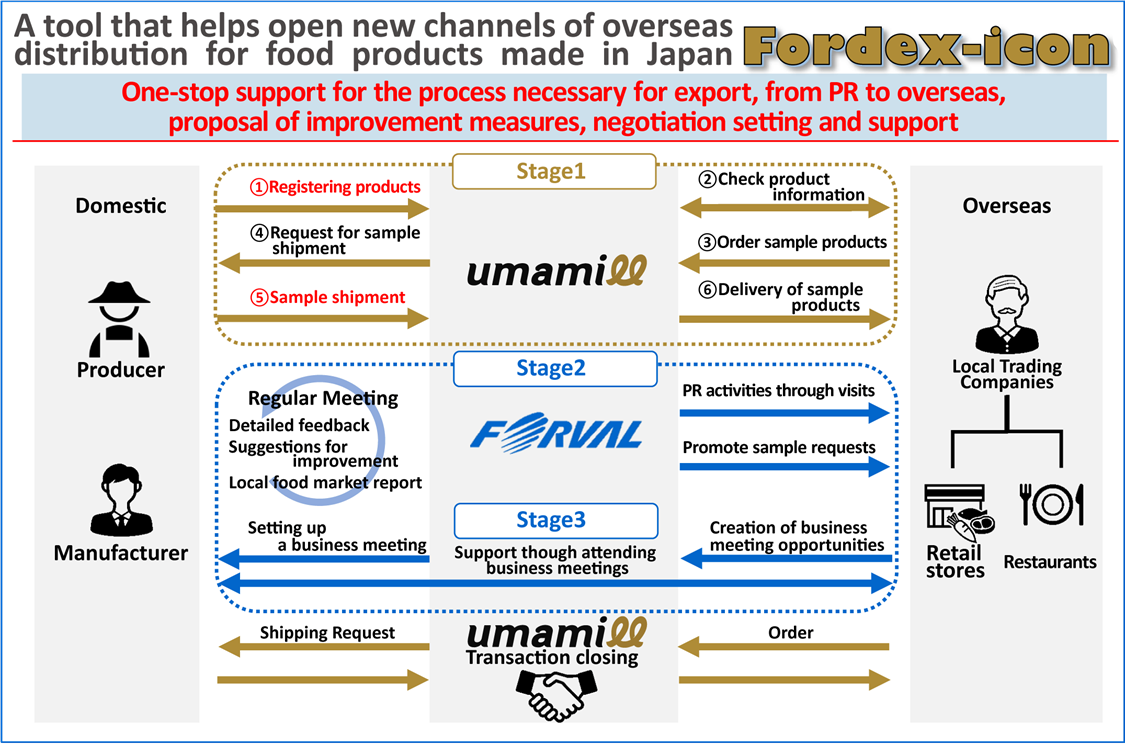

The company released Fordex-icon; a tool that helps open new channels for overseas distribution of food products made in Japan. The service is designed for food-related business operators that aim to export food items produced in Japan to overseas countries, helping them in a variety of aspects, including promoting their products and collecting feedback on their sample items in target countries, proposing improvement measures on the basis of product evaluations, and offering opportunities for business talks that could lead to actual transactions, after the food-related business operators deliver their sample items to overseas food buyers via Umamill, a platform for exporting Japanese food products. The company is currently offering the tool in Singapore, Hong Kong, and Cambodia, and intends to also begin providing the service in other nations one by one.

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

Results of orders received from municipalities

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

The collaboration with municipalities and governmental agencies is giving the company business opportunities of helping multiple municipalities break into markets in Southeast Asia this term as well as it did in the previous term.

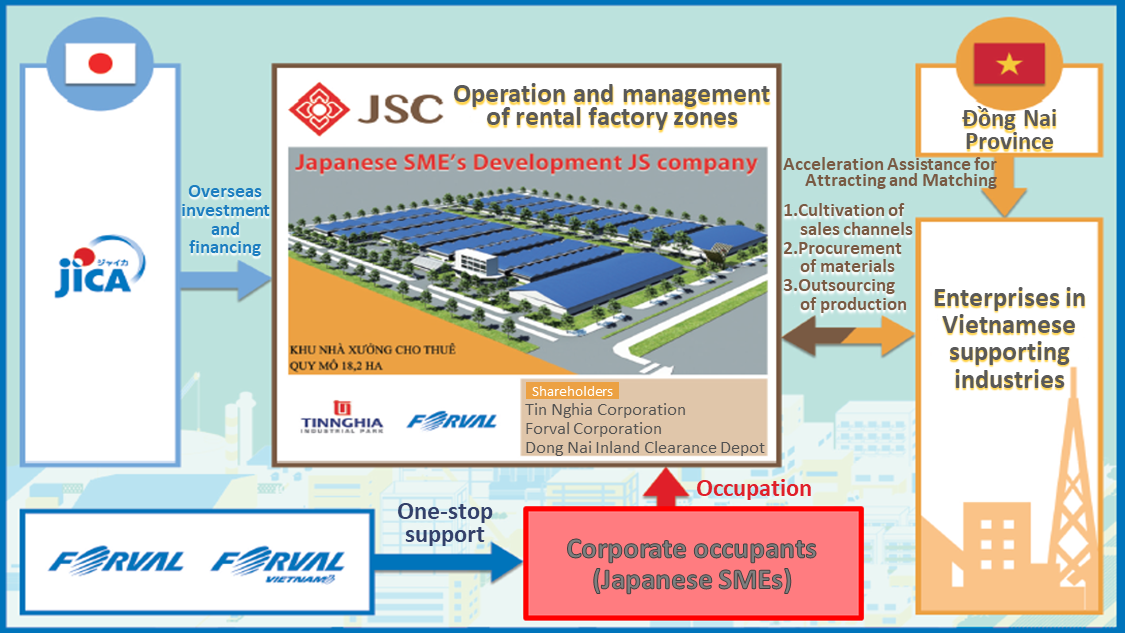

Example of characteristic projects for supporting overseas business expansion: Rental factory in Vietnam

Forval Corporation engages in the operation of rental factories in Vietnam as part of supportive business that is more advanced than the conventional consultancy for supporting overseas business expansion. In this business, the company constructs rental factories exclusively for Japanese small and medium-sized enterprises (SMEs) in the Nhơn Trạch III Industrial Park in southern Vietnam. In the premises with an area of 18 ha, the company developed a space for housing about 100 enterprises, and this is expected to become a leading hub of Japanese SMEs. Since development requires a lot of money, the company utilizes the overseas investment/financing system of Japan International Cooperation Agency (JICA), and conducts continuous monitoring surveys for checking what kinds of support and services are needed for Japanese enterprises entering overseas markets. The company is expected to obtain the competitive know-how to make inroads into markets in other countries and regions.

In addition, more clients introduced by alliance partners, including 45 Japanese financial institutions and 4 leading tax accountant corporations, plan to enter overseas markets. They have strong interests in the rental factories in Vietnam, and 100 districts are already to be reserved for alliance partners.

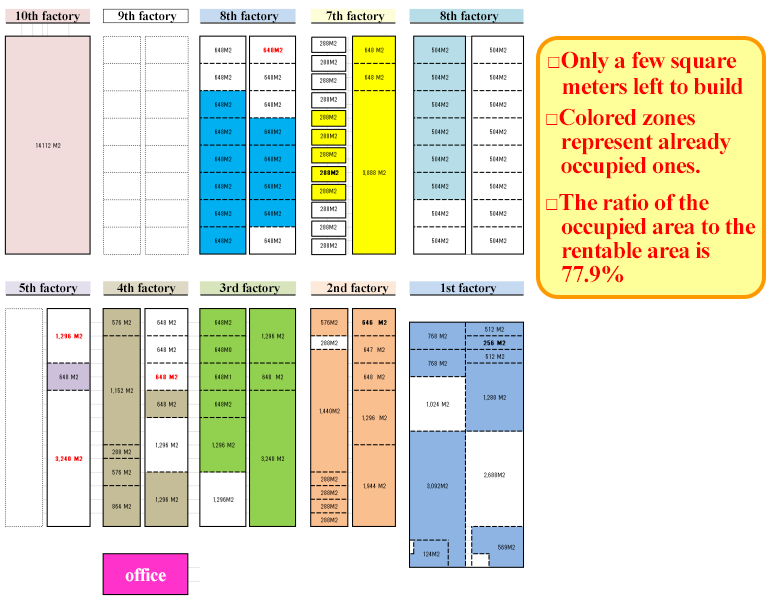

The number of users of the rental factory zones is rising on a steady basis and 77.9% of the area available for rent has been occupied.

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

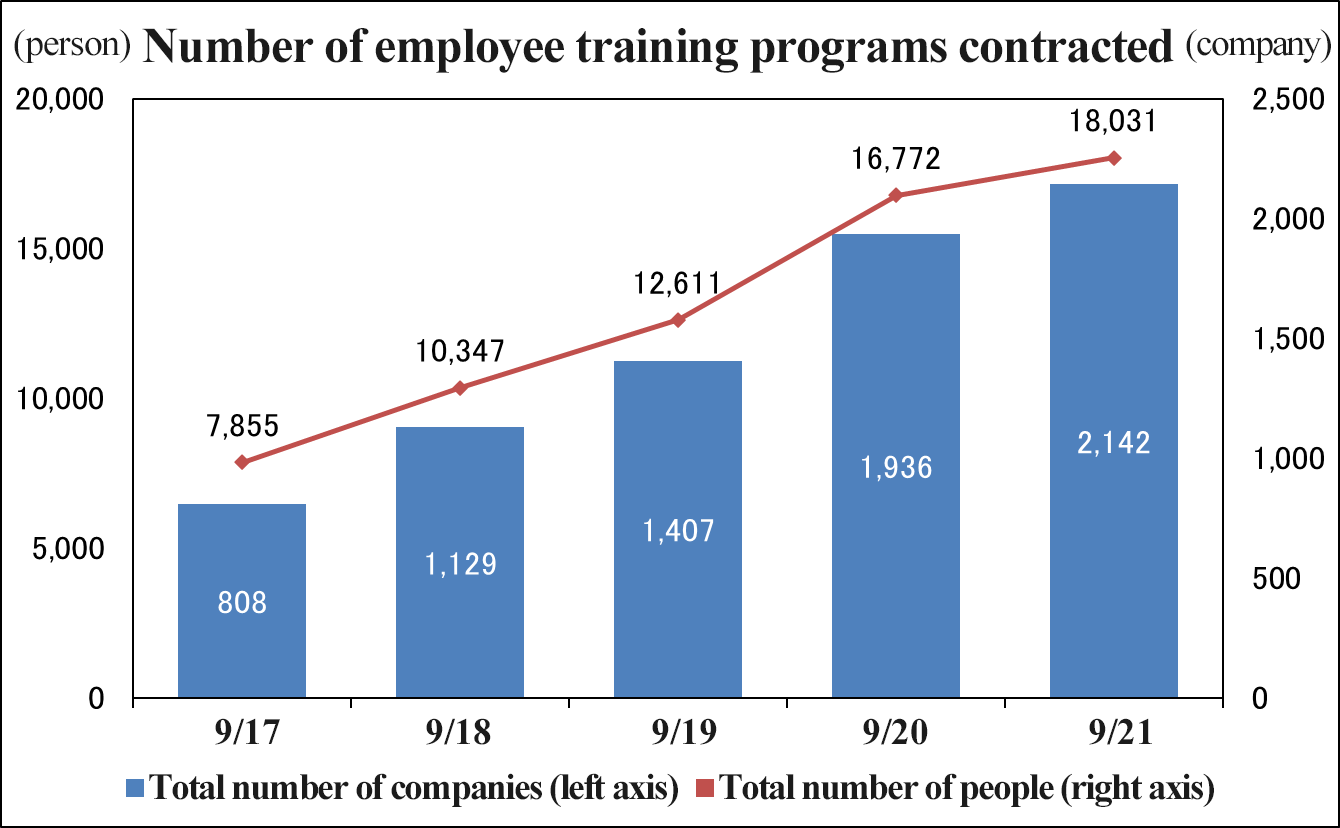

Undertaking of the training of employees of Japanese companies

By the end of September 2021, Forval Corporation has been entrusted by a total of 2,142 enterprises , up 10.6% YoY, with the training of a total of 18.031 employees, up 7.5% YoY, in 4 countries: Cambodia, Vietnam, Indonesia, and Myanmar. In addition, the company introduces foreign skilled workers to Japanese enterprises, but in the second quarter of FY 3/22, the number of workers who received a job offer dropped from 10 to 6 year on year. This is because the number of jobs available significantly dropped due to the spread of COVID-19.

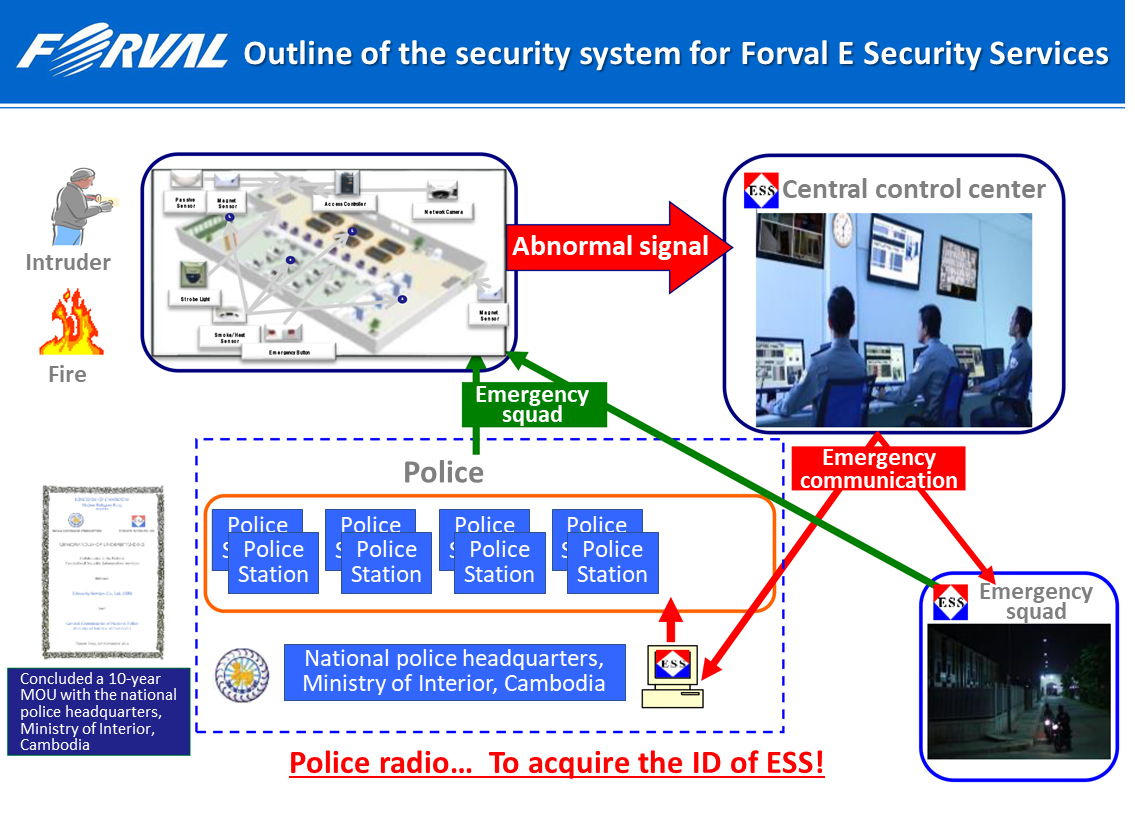

Situation of security services

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

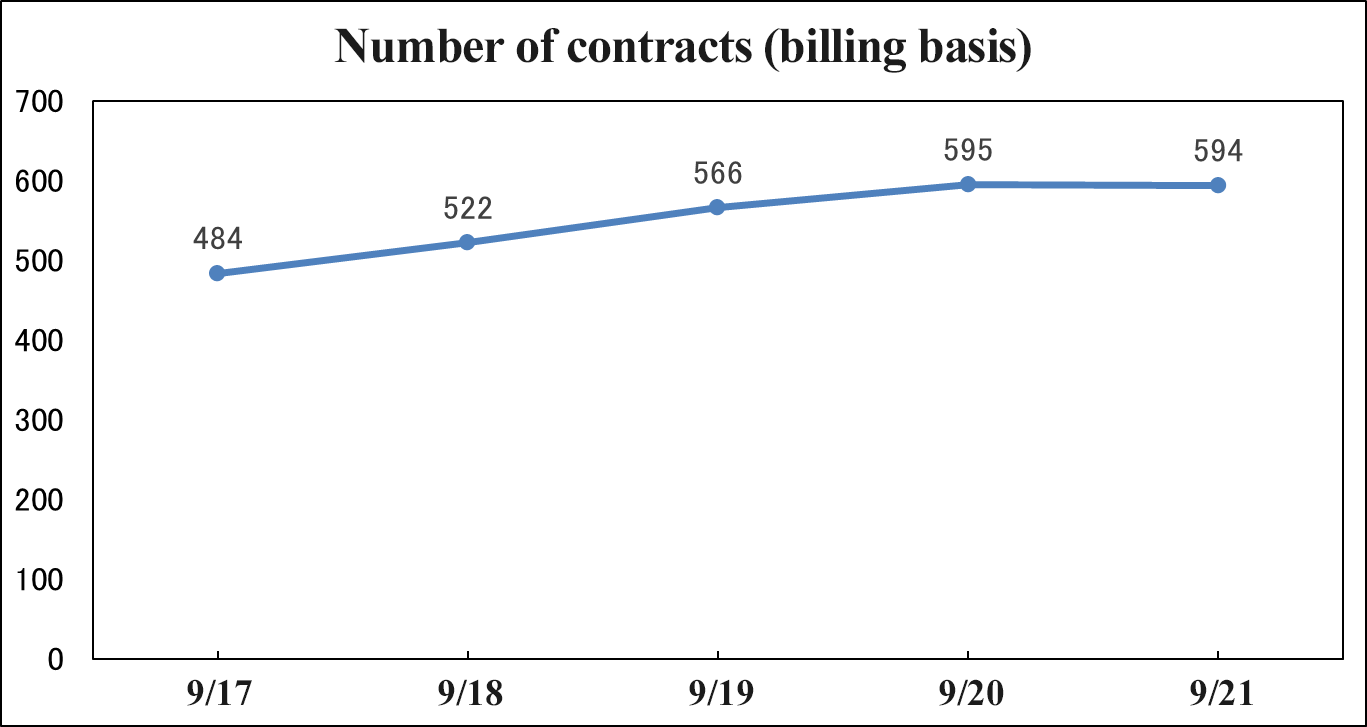

The company signed a 10-year MOU (memorandum of understanding) with the national police headquarters, Ministry of Interior, Cambodia, and offers security services in Cambodia. The number of subscribers to the fee-charging security service has been on a plateau, due to two lockdowns for coping with COVID-19.

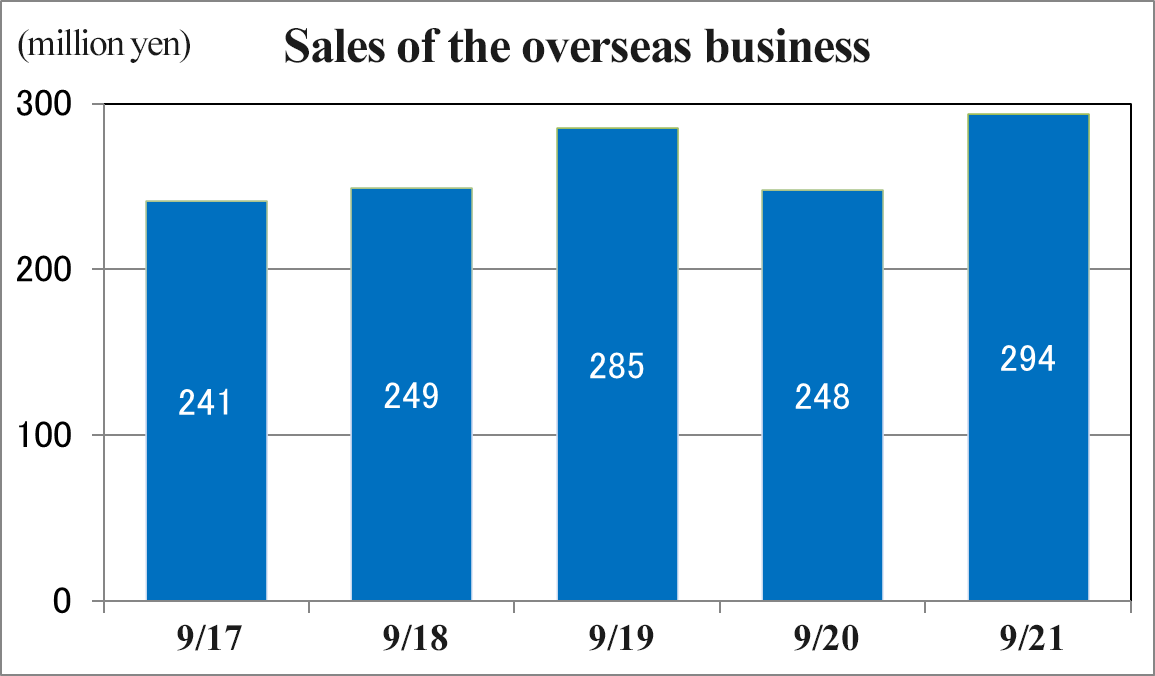

Variation in the sales of the overseas business

The sales of the overseas business are subject to the equity method, and not included in consolidated sales, but they are expanding as a result of the expansion of overseas bases. However, sales in the overseas market in the 1H of term ended March 2021 decreased due to the restrictions imposed on the cross-border movement of people amid the COVID-19 pandemic. In the first half of the current term, the sales of the overseas business increased 18.5% year on year, showing an enhanced recovery trend.

*Including the overseas business-related sales not included in consolidated sales

3. Second Quarter of Fiscal Year Ending March 2022 Earnings Results

(1) Consolidated Business Result for second quarter of FY3/22

| 2Q of FY3/21 | Ratio to sales | 2Q of FY3/22 | Ratio to sales | YoY |

Net sales | 23,455 | 100.0% | 23,424 | 100.0% | -0.1% |

Gross profit | 8,583 | 36.6% | 8,776 | 37.5% | +2.2% |

SG&A expenses | 7,559 | 32.2% | 7,811 | 33.3% | +3.3% |

Operating income | 1,024 | 4.4% | 965 | 4.1% | -5.7% |

Ordinary income | 913 | 3.9% | 1,021 | 4.4% | +11.8% |

Profit attributable to owners of parent | 460 | 2.0% | 733 | 3.1% | +59.2% |

*Unit: million yen.

Sales declined 0.1% year on year, while ordinary income rose 11.8% year on year.

Sales decreased 0.1% year on year to 23,424 million yen. Ordinary income grew 11.8% year on year to 1,021 million yen. Regarding sales, the Forval Business Group, etc. witnessed sales growth, thanks to the expansion of icon services and the inclusion of Esumi Co., Ltd. in the scope of consolidation, but the General Environment Consulting Business Group, etc. witnessed the decline in sales due to the drop in sales of solar power generation systems, etc. As a result, sales decreased 31-million-yen year on year.

Operating income decreased 5.7% year on year to 965 million yen. Regarding profit, gross profit grew 193 million yen or 2.2% year on year, but SG&A augmented 251 million yen or 3.3% year on year due to the posting of expenses for acquiring Elcom Co., Ltd. as a subsidiary in July, so operating income declined 58-million-yen year on year. While gross profit margin rose 0.9 points year on year to 37.5%, the ratio of SG&A to sales increased 1.1 points year on year to 33.3% and operating income margin dropped 0.3 points year on year to 4.1%. Ordinary income increased 11.8% year on year, as provision of allowance for doubtful accounts was only 49 million yen in the first half of the current term, while it was 152 million yen and posted as non-operating expenses in the same period of the previous term. Profit attributable to owners of parent increased considerably by 59.2% year on year, as Forval Telecom transferred the Hiroshima business division of TRY-EX Co., Ltd. and a gain from business transfer of 354 million yen was posted as extraordinary profit.

Sales declined 633 million yen and operating and ordinary incomes each decreased 25 million yen, as the compensation paid to customers are now deducted from sales due to the application of the Accounting Standard for Revenue Recognition, etc. and net sales from transactions in which the company was involved as an agency were recorded.

*The amounts were rounded down, and the ratios were rounded off.

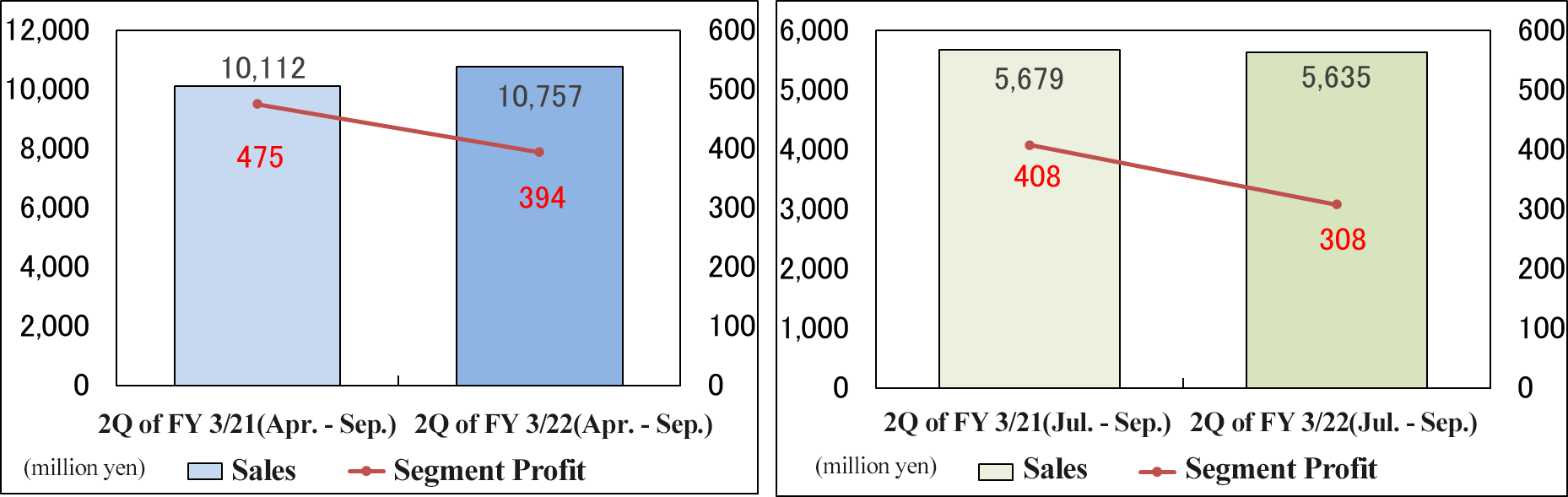

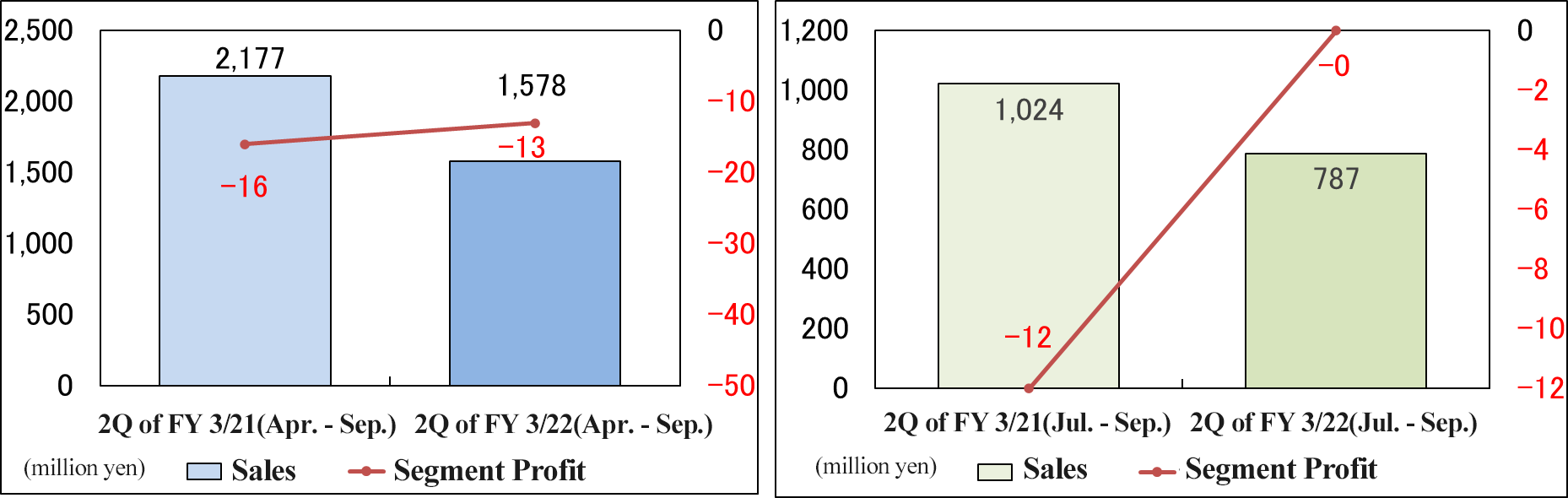

Sales and profit of each segment

| 2Q of FY 3/21 | Composition ratio | 2Q of FY 3/22 | Composition ratio | YoY |

Forval Business Group | 10,112 | 43.1% | 10,747 | 45.9% | +6.3% |

Forval Telecom Business Group | 10,428 | 44.5% | 10,175 | 43.4% | -2.4% |

General Environment Consulting Business Group | 2,177 | 9.3% | 1,578 | 6.7% | -27.5% |

Other Business Group | 736 | 3.1% | 922 | 3.9% | +25.2% |

Consolidated sales | 23,455 | 100.0% | 23,424 | 100.0% | -0.1% |

Forval Business Group | 475 | 47.1% | 394 | 38.6% | -17.1% |

Forval Telecom Business Group | 514 | 50.9% | 506 | 49.6% | -1.4% |

General Environment Consulting Business Group | -16 | - | -13 | - | - |

Other Business Group | 36 | 3.6% | 134 | 13.2% | +272.2% |

Consolidated adjustment, etc. | 14 | - | -56 | - | - |

Consolidated operating income | 1,024 | - | 965 | - | -5.7% |

*Unit: million yen.

*Sales refer to sales to external customers.

Forval Business Group (unit: million yen)

Regarding the performance of the Forval Business Group in the first half (Apr.-Sep.), sales grew 6.3% year on year, as the sales of icon services increased steadily while the sale of devices, such as business phones, declined, and Esumi Co., Ltd., which was included in the scope of consolidation in the second quarter of the previous term, contributed. On the other hand, profit decreased 17.1% year on year, due to the increase of employees, the posting of expenses for acquiring Elcom Co., Ltd., etc. Through the application of the Accounting Standard for Revenue Recognition, etc., sales decreased 216 million yen.

In the second quarter (Jul.-Sep.), sales and profit dropped 0.8% and 24.4%, respectively, year on year.

Forval Telecom Business Group (unit: million yen)

Regarding the performance of the Forval Telecom Business Group in the first half (Apr.-Sep.), sales and segment profit declined 2.4% and 1.4%, respectively, year on year, as the sales of ISP services, etc. decreased while the sales of new electric power services increased. Through the application of the Accounting Standard for Revenue Recognition, etc., sales dropped 418 million yen.

In the second quarter (Jul.-Sep.), sales and segment profit declined 2.1% and 4.8%, respectively, year on year.

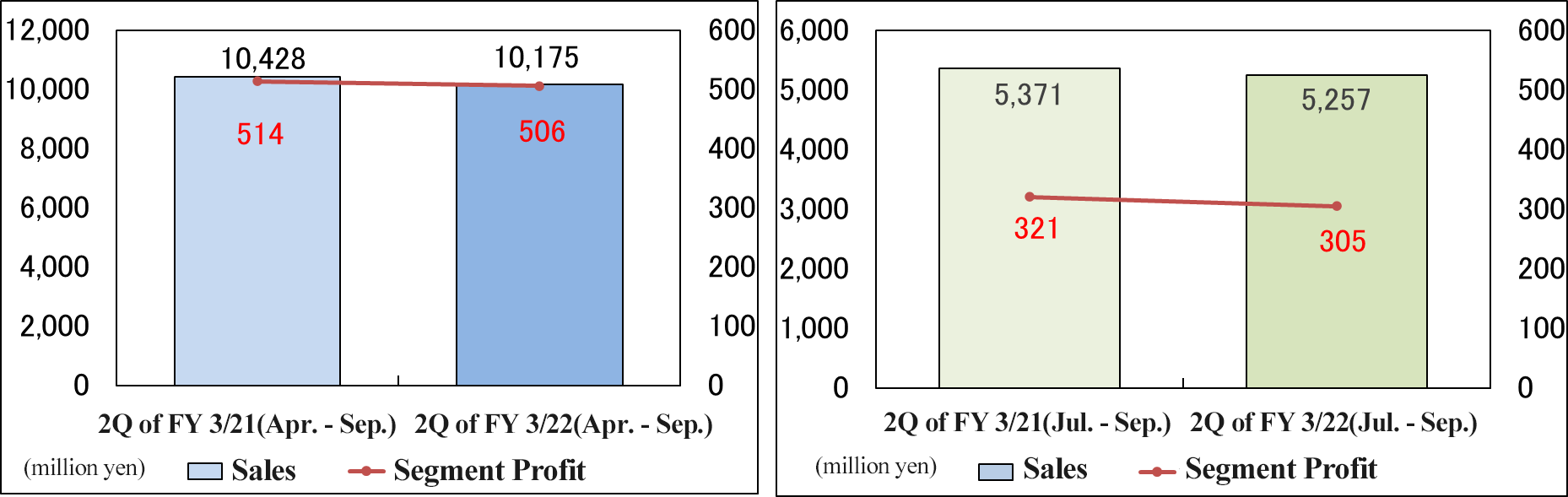

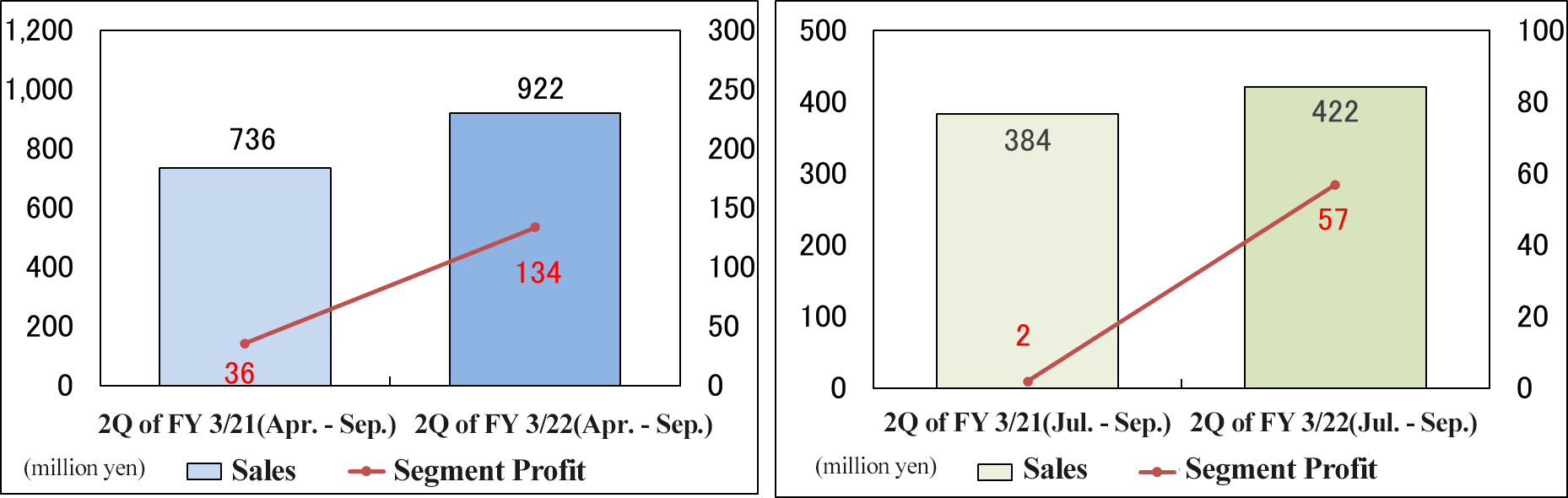

Comprehensive Environment Consulting Business Group (unit: million yen)

In the General Environment Consulting Business Group in the first half (Apr.-Sep.), a decrease in sales mainly from photovoltaic power generation systems resulted in sales of down 27.5% year on year and segment loss of 13 million yen (which was loss of 16 million yen in the previous term) in the term ended March 2021. . The application of the Accounting Standard for Revenue Recognition, etc. did not produce any effects on its results.In the second quarter (Jul.-Sep.), sales declined 23.1%, but segment loss was shrank year on year.

Other Business Group (unit: million yen)

Regarding the performance of the Other Business Group in the first half (Apr.-Sep.), sales and profit grew 25.2% and 272.2%, respectively, year on year, thanks to the contribution of KAELUNETWORKS Inc., which became a subsidiary, and the healthy performance of the IT engineer dispatch business of ITEC Inc. The application of the Accounting Standard for Revenue Recognition, etc. produced little effect on its results.

In the second quarter (Jul.-Sep.), sales and profit grew 10.0% and 2,505.3%, respectively, year on year.

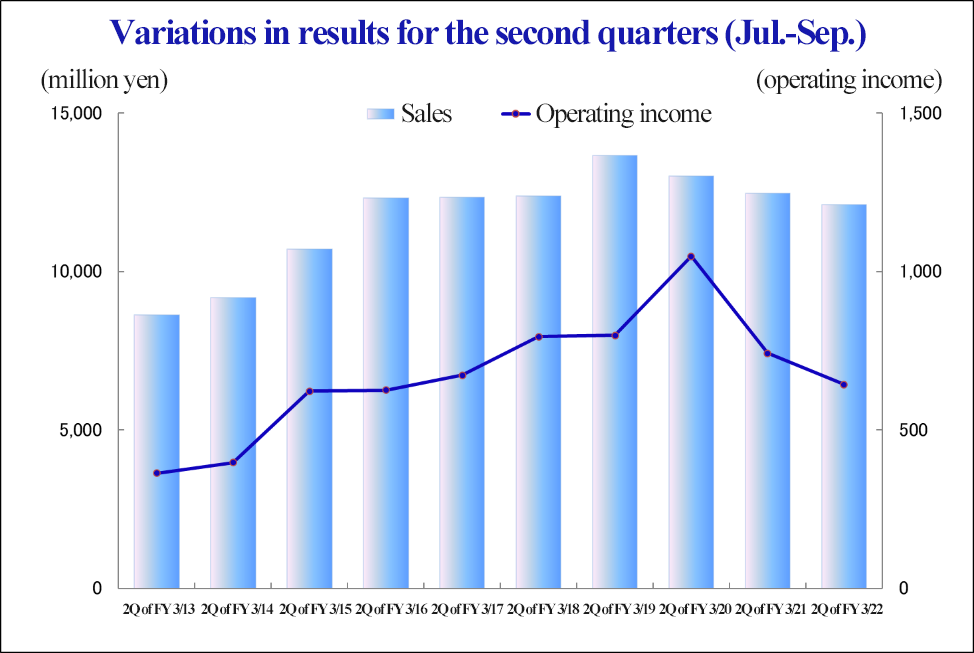

Variations in results for the second quarters (Jul.-Sep.)

Total of sales | FY3/20 | FY3/21 | YoY | FY 3/22 | YoY |

1Q | 11,789 | 10,995 | -6.7% | 11,321 | +3.0% |

2Q | 13,013 | 12,460 | -4.3% | 12,102 | -2.9% |

3Q | 12,104 | 12,569 | +3.8% |

|

|

4Q | 12,824 | 13,764 | +7.3% |

|

|

Total of sales | 49,731 | 49,788 | +0.1% |

|

|

Operating income | FY3/20 | FY3/21 | YoY | FY 3/22 | YoY |

1Q | 492 | 282 | -42.6% | 322 | +14.2% |

2Q | 1,047 | 741 | -29.2% | 642 | -13.3% |

3Q | 693 | 708 | +2.2% |

|

|

4Q | 995 | 883 | -11.2% |

|

|

Total of operating income | 3,229 | 2,616 | -19.0% |

|

|

*Unit: million yen.

In the second quarter (Jul.-Sep.) of the term ending March 2022, sales and profit increased from the previous quarter (Apr.-Jun.), but declined from the same period of the previous term.

(2) Financial Conditions and Cash Flows (CF)

Financial Conditions

| March 2021 | September 2021 |

| March 2021 | September 2021 |

Cash and deposits | 10,963 | 8,653 | Trade payables | 5,478 | 4,793 |

Trade receivables | 6,852 | 6,409 | Short-term loans payable | 3,912 | 3,474 |

Inventories | 925 | 1,274 | Other payables | 2,788 | 2,553 |

Current assets | 22,335 | 20,089 | Long-term loans payable | 140 | 317 |

Property, plant, and equipment | 920 | 1,212 | Liabilities | 18,369 | 17,392 |

Intangible assets | 1,846 | 2,493 | Net assets | 13,040 | 13,248 |

Investments and others | 6,307 | 6,845 | Total liabilities and net assets | 31,410 | 30,640 |

Noncurrent assets | 9,074 | 10,551 | Total interest-bearing liabilities | 4,053 | 3,791 |

*Unit: million yen.

*Trade receivables = Notes receivable, accounts receivable, and contract assets

The total assets as of the end of September 2021 stood at 30,640 million yen, down 769 million yen from the end of the previous term. The main factors in increasing assets were property, plant, and equipment, goodwill, investment securities, etc., while the main factors in decreasing assets were cash and deposits. The main factors in increasing liabilities and net assets were long-term debts and retained earnings, while the main factors in decreasing liabilities and net assets were trade payables and short-term debts. Capital-to-asset ratio was 40.9%, up 1.4 points from the end of the previous term. In addition, interest-bearing liabilities stood at 3,791 million yen, down 261 million yen from the end of the previous term.

Cash Flow |

|

|

| |

| 2Q of FY 3/21 | 2Q of FY 3/22 | YoY | |

Operating Cash Flow (A) | -62 | 17 | 80 | - |

Investing Cash Flow (B) | -556 | -998 | -442 | - |

Free Cash Flow (A + B) | -619 | -980 | -361 | - |

Financing Cash Flow | -179 | -1,391 | -1,212 | - |

Cash and Equivalents at Term End | 8,939 | 8,577 | -362 | -4.1% |

*Unit: million yen.

Operating CF turned positive, as net income before taxes and other adjustments increased and trade receivables decreased year on year. On the other hand, the deficit of investing CF augmented due to the expenses for acquiring investment securities and for acquiring a subsidiary through the change in the scope of consolidation, and the deficit of free CF increased, too. In addition, the deficit of financing CF increased due to the decline in short-term debts, etc., and the cash position at the end of September 2021 declined.

(3) Acquisition of third-party certificates, etc.

The company has actively obtained the following third-party certificates, etc.

◆ “A certified enterprise in the DX certification system,” in which the Ministry of Economy, Trade and Industry certifies enterprises that are ready for DX

◆ “Excellent health-oriented corporations 2021 (Section of large-sized corporations: White 500)” selected by Nippon Kenko Kaigi as enterprises that strategically conduct excellent health-oriented business administration

◆ “Excellent health-oriented enterprise (Gold)” certified by Tokyo Council for Declaration of Health-oriented Enterprises

◆ “Institutions supporting management innovation, etc.” certified by the national government as enterprises that provide SMEs with specialized support

◆ The company obtained a certificate in “DX Mark Certification System,” in which the Association for Promotion of Personal Information Security in SMEs certifies enterprises that actively promote DX.

(4) Recent capital and business alliances

Elcom Co., Ltd.

On July 1, the company acquired all shares of Elcom Co., Ltd., which undertakes the development and maintenance of public facility management systems, and conducts the development, production, sale, maintenance, etc. of automatic ticket-issuing machines, IC-card equipment, gate systems for controlling entry and exit, etc., to make it a wholly owned subsidiary. Elcom undertakes the development and maintenance of public facility management systems in each prefecture, conducts the development, production, sale, and maintenance of automatic ticket-issuing machines, IC-card equipment, gate systems for controlling entry and exit, etc., and undertakes the development and production of system equipment. The company has been handling IC cards since their early days, acquiring the license to issue wide-area IC cards and occupying the largest share in the market of IC card-compatible ticket-issuing machines. The acquisition of this company as a wholly owned subsidiary is expected to lead to synergy among group companies, expanding sales through the sale to respective customer networks and maximizing earning opportunities through the mutual staffing of engineers among group companies.

LillyHoldings, Inc.

The company formed a business alliance for sale in the Lilly Cloud Restaurant Business, which is a virtual restaurant business, with LillyHoldings, Inc., which offers nationwide services for Map Engine Optimization (MEO), production of videos and websites, and digital marketing, including the franchise operation of virtual restaurants. The Lilly Cloud Restaurant Business is a virtual restaurant business, in which LillyHoldings analyzes trends thoroughly from the viewpoint of digital marketing, establishes a hit brand (business) in the field of delivery services, and operates franchise for restaurants throughout Japan. With its service, it is possible to generate new sales without changing the existing cost structure, by operating a new brand in the field of food delivery, while sharing the cooking equipment and staff of actual restaurants. Through this business tie-up, it is possible to support restaurants suffering the decrease of customers due to the COVID-19 pandemic in operating delivery business effectively for increasing sales. This is expected to enhance their consulting capability for SMEs.

4. Fiscal Year Ending March 2022 Earnings Forecasts

(1) Full-year Consolidated Earnings Forecast

| FY 3/21 Results | Ratio to sales | FY 3/22 Estimates | Ratio to sales | YoY |

Net sales | 49,788 | 100.0% | 50,000 | 100.0% | +0.4% |

Operating income | 2,616 | 5.3% | 3,000 | 6.0% | +14.6% |

Ordinary income | 2,483 | 5.0% | 3,000 | 6.0% | +20.8% |

Profit attributable to owners of parent | 1,357 | 2.7% | 1,900 | 3.8% | +39.9% |

*Unit: million yen.

Sales and ordinary income are expected to increase 0.4% and 20.8% YoY respectively

With the aim of becoming a group for supporting business administration as a next-generation management consultant and helping SMEs earn profit, the company strives to differentiate itself from competitors in the five fields: (i) management consulting services utilizing the knowledge and technologies of information and telecommunication (information and telecommunication), (ii) management consulting services for cultivating overseas markets with unique knowledge (overseas market), (iii) environmentally-friendly cutting-edge management consulting services (environmental protection), (iv) management consulting services for producing personnel required for next-generation management (personnel and education), and (v) management consulting services for corporate lifecycles (start-up and succession of business), and makes efforts to expand its business while implementing M&A for offering high-quality services. In particular, the company will promote digital transformation (DX), and switch to green energy that will not generate greenhouse gases as it will be necessary to care for the earth environment more strongly. To actualize green transformation (GX), which is aimed at growth by reforming industrial structures, society, and economy, the company will strive to enhance SMEs’ awareness of GX, visualize the degree of contribution to environmental conservation with paperless and energy-saving systems, and launch new services for actualizing GX efficiently while promoting DX. Like this, the company engages in the promotion of DX and GX of SMEs.

Now that the first half of the term ended, there is no change in the plan that the company estimates sales and ordinary income will be at 50 billion yen and 3 billion yen, up 0.4% and 20.8% year on year, respectively, for the term ending March 2022. Regarding sales, the spread of COVID-19 is changing ways of working at an accelerated rate, and the company will proactively make proposals according to the new workstyle environment, such as working from home and promoting a paperless office. While profitability is expected to be boosted through a further accelerated shift to recurring revenue-based business, such as the icon services, the rate of sales growth will be low because the company is currently focusing on providing services suited to the new era rather than on selling hardware.

Operating income is projected to rise 14.6% year on year to 3 billion yen. Sales increases in recurring revenue-based business, such as the highly profitable icon services, will contribute to profit. In addition, the company will revise the conditions for purchasing electricity at Forval Telecom in hopes of contributing to improving profitability by avoiding risks posed by price fluctuations. Operating income on sales is forecasted to grow 0.7 points year on year to 6.0%.

As for dividends, the initially estimated annual dividend of 26 yen/share will be unchanged. The payout ratio will be 35.0%.

(2) Future growth strategy

Enhancement of the icon services - Release of services that cater to SMEs with new work styles

The work-style reform laws enforced in April 2019 have required companies to take a number of measures, such as to make sure that their employees use paid leave, ensure the effectiveness of their approaches to understanding the situation surrounding working hours at their companies, enrich their flextime systems, fulfill obligations to make efforts at the work-shift interval system, adopt the highly professional system, set an upper limit on overtime work hours, and abolish the measures that give SMEs grace to apply a premium overtime rate for overtime work, which requires improving the time efficiency in accordance with the stricter working hour standards. Companies need to precisely grasp how many hours their employees are working and analyze and improve the way that the employees use their time working; however, many SMEs are falling behind in doing so. Under these circumstances, Forval Corporation plans to contribute to promoting work-style reform at SMEs, which are its clients, by proactively releasing services that can cater to its client companies adopting new work styles.

【IEYASU Powered by FORVAL, cloud-based attendance management system】

The company released “IEYASU Powered by FORVAL,” a cloud-based attendance management system, which is a new icon service for responding to the workstyle reform of SMEs, in June 2019. By adopting “IEYASU Powered by FORVAL” and reforming workstyles appropriately, it is possible to reduce excessive work of employees, increase their private time, and improve their physical and mental health. In addition, productivity will be improved as employees will work efficiently within limited working hours, and the turnover rate of employees will decrease, and new personnel will be attracted, as a comfortable working environment will be developed.

Basic function of IEYASU Powered by FORVAL

Daily attendance | Check employee work status in real time Daily imprint data and work data can be managed separately |

Approval and application | Equipped with application and approval functions for overtime and holiday work Applications and approvals can be made on a daily or monthly basis |

CSV data output | Daily attendance data and monthly summary data can be freely output in CSV format for each employee Linkage to payroll software is possible by using the Excel tool provided separately |

Various settings | Fractional time processing rules and settings such as working hours, predetermined hours, and deemed hours can be set Can be operated in accordance with the company's work rules |

IC card imprinting | By simply holding up an IC card, such as a transportation system IC card or employee ID card, the user can be identified and imprinted smoothly |

Daily report function | Improve work efficiency and labor productivity by managing work hours and incorporating them into actual work content |

Report function | Visualize employee attendance in an easy-to-understand manner with graphs and tables |

Overtime alert | Real-time monitoring of employees' overtime hours You can set "Target Attendance", "Target Period", "Alert Criteria", and "Notification Method" to suit your company. |

Attendance Entry Anywhere | Even employees who work directly from home can register their arrival and departure anytime, anywhere with a smartphone or tablet |

Location information acquisition | Administrators can view employee location information acquired by GPS on the administrator screen Know where employees registered to clock in and out |

PPLS

In October 2020, the company released PPLS, a consulting service for streamlining business operations by reviewing workflow and producing manuals. PPLS allows Forval Corporation’s client companies, when they adopt it, to reduce waste through reconstruction of their business flows and promotion of paperless offices, and achieve standardization through preparation of manuals, which will help raise productivity and deliver uniform quality. The service also enables client companies to make a shift to a working environment in which documents are stored and shared in electronic format through the sorting and categorization of paper documents, which have traditionally been stored in large quantity and taken up vast space in offices. Workers will be able to get the documents that they want instantly, and large space will no longer be required to store documents.

【SIM Work, an electronic contract conclusion service】

In December 2020, Management Information Inc., one of the subsidiaries of Forval Corporation, began offering SIM Work, an electronic contract conclusion service that performs all contract-related operations on the computer, which have traditionally been done using paper and stamps, in order to reduce the time, effort, and cost of managing paper contracts and enhance business efficiency. SIM Work prepares contracts in electronic format with proof that identity of the parties concerned has been confirmed and the contract is not falsified by giving them electronic certificates issued by third parties and concludes the contracts online. Moreover, use of electronic contracts will reduce the time, effort, and cost of managing paper contracts and cutting the number of days and processes required before the conclusion of contracts, which will boost business efficiency. The service will draw the interest of myriad companies because users can sign contracts even if the other party involved has not employed SIM Work and is offered at price friendly to the budgets that can be spent by SMEs.

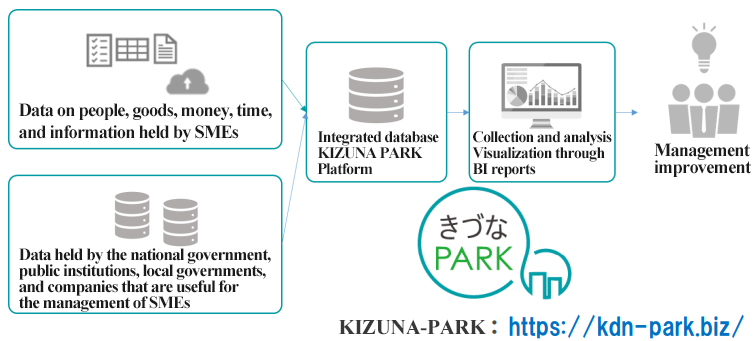

【Establishment of an information analysis platform for the management of SMEs】

The company opened Kizuna PARK, an information analysis platform for the management of SMEs on Japan Digital Day, that is, October 10. Kizuna PARK is a platform for collecting, accumulating, analyzing, and utilizing the management information on SMEs, which was developed under the concept of a place where a variety of content is put together that would combine important management information of SMEs, connect enterprises, and be handed over to the next generation. By storing their own corporate data, it is possible to obtain a lot of useful output for business administration. By utilizing this platform, client enterprises can receive useful information for digitization and DX, and visualize their own management information. For example, by collecting the management information of many SMEs, it is possible to compare the statistical information of companies of the same scale, and combine them with a variety of data, including the open data disclosed by the national government, public institutions, and local governments, and the data related to the management of SMEs produced by other institutions, to make managerial decisions for improving productivity and growing business.

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

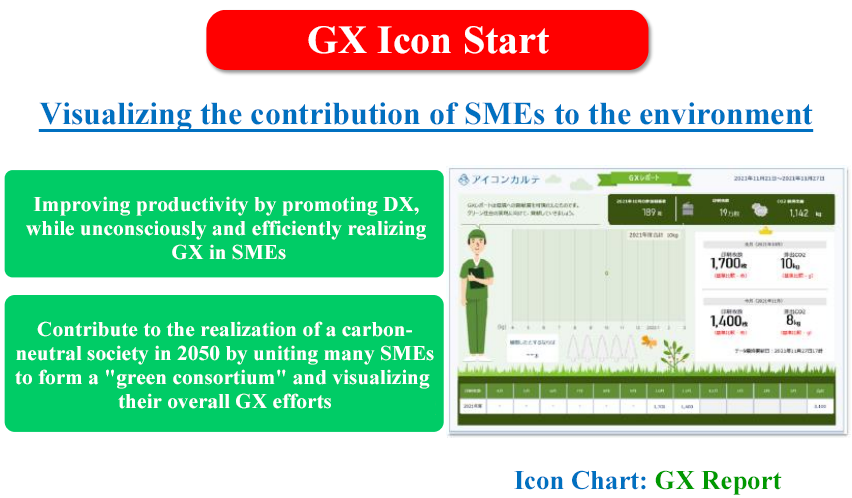

【Release of GX Icon Start, a new icon service】

On October 1, the company released GX Icon Start, a new service that has visualized the degree of contribution of SMEs to the environment for the first time in Japan. Green transformation (GX) is the switch to green energy that would not generate greenhouse gases to reform industrial structures, society, and economy and achieve growth. GX Icon Start is a service for improving SMEs’ awareness of GX initiatives, visualizing the degree of contribution to environmental conservation with paperless and energy-saving systems, and helping achieve a green society, and is aimed at realizing GX efficiently while improving productivity through DX. It is also aimed at contributing to the realization of carbon neutrality by 2050, by creating “a green consortium,” in which many SMEs get together and aim to realize a green society, and visualizing GX initiatives. In detail, it offers Icon Record GX Reports, which includes information on GX initiatives and measures and visualizes the progress of GX (degree of contribution to the environment).

(Taken from the reference material for the financial results of Forval Corporation for the second quarter of term ending March 2022)

Growth cycle through the strengthening of icon services

The sales of icon services are highly correlated with the operating income of the company. The growth rate of consolidated operating income is about 1.5 times that of sales of icon services. It can be said that it is indispensable to expand the sales of icon services, in order to achieve profit growth.

The company plans to actively allocate the profits earned through the expansion of icon services to the increase of employees, the development of new services, and M&A. New investments are expected to increase the icon services and average spending per customer, inducing the growth cycle of the sales of icon services and the overall operating income of the company.

5. Conclusions

The financial results of the company in the second quarter looks unfavorable, as sales and operating income declined 0.1% and 5.7%, respectively, year on year. However, the decline in sales is attributable to the decrease of solar power generation systems, etc. in the General Environment Consulting Business Group, and the drop in operating income is attributable to the posting of expenses for acquiring Elcom Co., Ltd. as a subsidiary in July. Regarding the General Environment Consulting Business Group, the sales in the first half declined, but loss shrank year on year. In addition, the expenses for acquisition are temporary, and do not affect its mid/long-term growth potential. Meanwhile, the healthy performance of icon services, which are the mainstay of the company, has been confirmed. The number of icon transactions in the first half of the current term was up 12.9% year on year. In addition, the sales of icon services increased 23.1% year on year, as their efforts focused on quality paid off and average spending per customer rose. The expansion of sales from highly profitable icon services will lead to the improvement in profitability. Gross profit margin rose 0.9 points year on year.

While the sales of icon services have grown steadily, the company launched new services for the purpose of further strengthening icon services. One of them is Kizuna PARK, an information analysis platform for the management of SMEs. By utilizing this platform, client SMEs can receive useful information for digitization and DX, and visualize their own management information. The other is GX Icon Start, a new icon service. Clients now can get Icon Record GX Reports, which includes information on GX initiatives and measures and visualizes the progress of GX (degree of contribution to the environment). We can also expect a lot from IEYASU Powered by FORVAL, a cloud-based attendance management system, which has been released recently, PPLS, which reviews and standardizes workflows, and streamlines business operations through paperless systems and standardization, SIM Work, an electronic contract service, etc. It is noteworthy what kinds of synergetic effects these new services will produce for expanding the sales of icon services and how they will improve profitability.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors (excluding audit and supervisory committee) | 8 directors, including 2 outside ones |

Audit and supervisory committee | 3 members, including 2 outside ones |

◎ Corporate Governance Report

The submission date of the corporate governance report after the application of the corporate governance code: June 3, 2021

<Basic Policy>

Our company recognizes that it is important to tighten corporate governance, in order to achieve growth with profit amid the rapidly changing business environment, set the following as the basic policies, and is making efforts to actualize them:

We will discuss systems suited for our company in response to changes in the social environment, legal systems, etc. and conduct necessary reform for tightening corporate governance.

<Regarding the observance of the principles of the corporate governance code>

Codes we do not follo Major principles we do not follow, and reasons for not following them

Principles | Reason for not following the principle |

【Principle 1-2 Exercise of rights at general meetings of shareholders】 【Supplementary Principle 1-2-4】 | Our company recognizes the importance of the development of an environment where overseas investors can exercise their voting rights easily, for example, by providing them with information in English, and will have comprehensive discussions about English translation, etc. while considering appropriate costs, timing, etc. |

【Principle 3-1 Improvement in information disclosure】 | (1) Our company’s ideal state (management philosophy, etc.), management strategy and planOur company’s ideal state (management philosophy, etc.) is as described in “Corporate ethos” in Corporate Information of our website. Under the basic philosophy of “aiming to distribute happiness to everyone by creating social value while going with employees, family members, customers, shareholders, and business partners,” we designed our management strategy and plan. However, the management situation in our business environment is changing rapidly, so we do not announce concrete figures or the like in the current management strategy and plan, which would make us stick to concrete numerical goals and hinder our flexible response. |

【Supplementary Principle 3-1-2】 | Our company recognizes the usefulness of information in English for overseas investors, and will discuss it while considering the shareholder composition, etc. |

【Principle 4-1 Roles and duties of the board of directors (1)】 【Supplementary Principle 4-1-2】 | Our company’s ideal state (management philosophy, etc.) is as described in “Corporate ethos” in Corporate Information of our website. Under the basic philosophy of “aiming to distribute happiness to everyone by creating social value while going with employees, family members, customers, shareholders, and business partners,” we designed our management strategy and plan. However, the management situation in our business environment is changing rapidly, so we do not announce concrete figures or the like in the current management strategy and plan, which would make us stick to concrete numerical goals and hinder our flexible response. However, we analyze the results compared with the goals in each mid-term management plan and reflect the analysis results in the plan for the following term. |

【Principle 4-2 Roles and duties of the board of directors (2)】【Supplementary Principle 4-2-1】 | At the 36th annual meeting of shareholders, a new budget for remunerations for adopting the system for giving remunerations to executives in the form of shares with restrictions on share transfer was approved, and we give remunerations to 4 directors in the form of shares with restrictions on share transfer in order to share value with shareholders. |

【Principle 4-10 Utilization of an arbitrary system】 【Supplementary Principle 4-10-1】 | The board of directors of our company is composed of as few as 8 members, including 2 independent outside directors. We believe that with the current system, we can receive appropriate involvement and advice from independent outside directors in the deliberation of important matters regarding nomination, remuneration, etc. |

【Principle 5-2 Formulation and announcement of management strategy and plan】 | We have formulated a mid-term management plan. However, the management situation in our business environment is changing rapidly, so we do not announce concrete figures or the like in the current management strategy and plan, which would make us stick to concrete numerical goals and hinder our flexible response. |

<Major principles we disclose>

Principles | Major principles we disclose |

【Principle 1-4 Strategically held shares】 | Our company does not hold any listed shares as strategically held shares. We have no plan to hold such shares, but if it is judged that it is meaningful to hold such shares after considering the business relationships with business partners, etc., the board of directors will discuss it. If we hold such shares and exercise voting rights, we will examine each bill and judge whether or not it will contribute to the improvement in corporate value of our company and the invested enterprise. |

【Principle 2-6 Exertion of functions as an asset owner of corporate pensions】 | Our company does not have a corporate pension fund system. |

【Principle 4-11 Prerequisites for securing the effectiveness of the board of directors and the audit committee】【Supplementary Principle 4-11-1】 | Our company considers that the board of directors is needed to be composed of members who possess diverse knowledge, experience, and skills. Namely, we believe that it is indispensable to secure the diversity of the board of directors with such members in order to oversee business execution and make decisions about important items. In addition, from the viewpoints of holding sufficient discussions and making decisions swiftly in the board of directors, we think that the board of directors should be composed of up to 15 members, including up to 10 directors (excluding directors belonging to the audit committee) and up to 5 directors who belong to the audit committee. The procedures were discussed under the above policy and approved by the board of directors. |

【Supplementary Principle 4-11-2】 | Our company discloses the important concurrent posts of directors and outside directors in other listed companies through our business reports and reference material for general meetings of shareholders. |

【Supplementary Principle 4-11-3】 | In order to evaluate the effectiveness of the board of directors, our company conducted “a self-assessment questionnaire survey for evaluating the board of directors” targeting all directors, and then analyzed and evaluated their answers. As a result, we confirmed that the board of directors holds meetings properly, secures the balance between knowledge, experience, and abilities, and deliberates each bill to a sufficient degree. We will keep striving to enhance the effectiveness of the board of directors while reflecting the evaluation results in the activities in the following fiscal year. |

【Principle 5-1 Policy for constructive dialogues with shareholders】 | Our company holds voluntary, effective dialogues with shareholders and investors, mainly via the representative director. In addition to holding a briefing session for shareholders after each general meeting of shareholder, we upload the reference material and videos of the financial results briefing session, which is held every six months for mainly analysts and institutional investors from the viewpoint of fairness, to our website.When necessary, the director in charge of IR and the section in charge of IR give assistance, and the section in charge of IR takes the initiative in coordinating related divisions in order to realize smooth dialogues with shareholders and investors, and their opinions obtained through the dialogues are shared by the board of directors when necessary, to improve our corporate value.During the dialogues with shareholders and investors, we make efforts to prevent the leakage of insider information in accordance with the regulations for managing inside information.Our policies for systems and activities for promoting constructive dialogues with shareholders are as follows: The director in charge of IR manages the dialogues with shareholders and investors, and we strive to realize voluntary, constructive dialogues.The section in charge of IR takes the initiative in coordinating related divisions, for example, by sharing necessary information for producing reference material in order to hold smooth dialogues with shareholders and investors.The section in charge of IR listens to the requests from shareholders and investors, holds individual interviews between them and the representative director, the director in charge of IR, or the section in charge of IR, and organizes a session in which the representative director reports financial results and a briefing session for shareholders after each general meeting of shareholders.Our company feeds back opinions that we have gotten through dialogue with our shareholders and investors to the top executives as necessary to share and utilize information.Pursuant to the regulations for internal information management, our company takes measures to prevent insider information from being leaked out during dialogue with the shareholders and investors.(Currently, we temporarily refrain from holding financial results briefings to prevent the further spread of COVID-19.) |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |