BRIDGE REPORT :(8931)WADAKOHSAN CORPORATION

Chairperson Norimasa Wada |

President Takero Takashima | WADAKOHSAN CORPORATION(8931) |

|

Company Information

Market | JASDAQ |

Industry | Real Estate |

Chairperson | Norimasa Wada |

President | Takero Takashima |

HQ Address | 4-2-13, Sakaemachidori, Chuo-ku, Kobe-shi, Hyogo |

Year-end | February |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

765 | 11,099,798 shares | 8,491 million | 8.5% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

34.00 | 4.4% | 166.67 | 4.6 x | 2,032.35 | 0.4 x |

*The share price is the closing price on April 23, 2019. The number of issued shares is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter. ROE, BPS are actual results at the end of the previous term.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2016 Act. | 28,950 | 2,938 | 2,055 | 1,238 | 123.86 | 26.00 |

Feb. 2017 Act. | 31,374 | 3,063 | 2,193 | 1,370 | 137.10 | 27.00 |

Feb. 2018 Act. | 35,149 | 3,304 | 2,424 | 1,589 | 158.23 | 30.00 |

Feb. 2019 Act. | 39,287 | 3,445 | 2,687 | 1,843 | 166.07 | 32.00 |

Feb. 2020 Est. | 40,000 | 3,500 | 2,700 | 1,850 | 166.67 | 34.00 |

*The forecasted values were provided by the company

This Bridge Report presents WADAKOHSAN’s earnings results for fiscal year February 2019 and earnings estimates for fiscal year February 2019

Table of Contents

Key Points

1. Company Overview

2. Strengths of WADAKOHSAN

3. Fiscal Year ended February 2019 Earnings Results

4. Fiscal Year ending February 2020 Earnings Forecasts

5. Conclusions

<Reference: Strategies for ESG>

Key Points

- In the fiscal year ended February 2019, sales and operating income grew 11.8% and 4.3%, respectively, YoY. While there was a sales drop in reaction to the increase in sales from selling the base ground for condominium sites in the previous term (approximately 1.8 billion yen), it was absorbed by the sales of condominiums including delivery of 2 large-scale properties with a total of over 100 units. With good sales, profitability of all income projects from operating income onwards exceeded the initial forecast. The dividend is scheduled to be 32 yen, which is the regular dividend of 30 yen plus 2 yen to commemorate the 120th anniversary.

- The sales and operating income for the fiscal year ending Feb. 2020 are estimated to increase 1.8% and 1.6%, respectively, YoY. Although revenues from the other real estate sales and Property leasing revenue will decline, sales of detached housing units, which is foreseen to reach at a record-high level, will grow 36.0% YoY. Sales of the mainstay condominiums are also expected to rise 1.5% YoY. On the profit side, a decrease in the gross profit margin is factored in on the basis of rising construction costs due to rising land prices and labor shortages in the construction industry. The commemorative dividend of 2 yen will not be issued for the fiscal year ending Feb. 2020, while a common dividend plan to by 4 yen, resulting in a total dividend of 34 yen per share. This is an increase in 10 consecutive terms (payout rati 20.4%).

- As for condominium sales in the fiscal year ending Feb. 2020, although the number of units to be delivered will decrease by 180, amount sales will increase due to an increase in the average price per unit (from 41 million yen to 55 million yen). The company solved the rise in sales price (average price per condominium unit) associated with the rise in land prices and construction costs by developing high-grade condominiums in the upscale neighborhood. Conclusion of contracts proceeded smoothly as a result of these efforts, and 75.5% of the 575 units scheduled to be delivered this term have already completed conclusion of sales contracts. With regard to purchasing land, taking into consideration market conditions, the company will focus on profitability and carefully carry out purchasing land.

1. Company Overview

This time-honored real estate firm was founded in 1899. With its main bases among Kobe-shi, Akashi-shi and Hanshin area in Hyogo Prefecture, the company has developed its community based real estate business by selling lots for condominiums and detached houses, and dealing in real estate leases and effective land use. The company specializes in buying up sites and planning, and outsources design, architecture and sales to other firms. The main focus is selling lots for medium scale condominiums, under the “WAKOHRE” brand name, with around 30-50 units each. Within Kobe-shi, the company has been the number one “a provider of buildings” for 21 years running and is placed the second as “a provider of condominiums.” The company was also ranked as the third “a provider of buildings” and the seventh “a provider of condominiums” in the Kinki region (ranking in 2018). As of the end of February 2019, the cumulative supply results were 478 buildings with 18,135 residences (based on those which had started construction).

The company began a real estate leasing business in Kobe-shi in January 1899. It was incorporated as Wadakohsan Ltd. in December 1966, and reorganized into Wadakohsan Co., Ltd. in September 1979.

1-1. Business philosophy - symbiosis (living together) your way of living contributes to others’ happiness

The corporate philosophy is “symbiosis,” where your way of living contributes to the happiness of others, values the connections between people and supports one another. Based on this idea, the company holds up “PREMIUM UNIQUE” as its product concept, and aims to create unique places to live in that fit each customer’s own way of life, while responding to the feelings of each person who resides there.

1-2. Business segments

The business segments are divided into sales of condominiums developed for the “WAKOHRE” brand, sales of detached houses developed for the “WAKOHRE-Noie” brand (the sales for both businesses are entrusted to external enterprises), other real estate revenue from dealing in the sale and development of real estate for investment and residential land, property leasing revenue from the lease of condominiums (the brand name “WAKOHRE-Vita” and others), stores, parking lots etc., and “others,” including things like insurance agency fees not included in the report segment. The sales composition for the term ended Feb. 2019 puts the condominium sales at 79.5% (FY2/18: 77.3%), sales of detached houses at 5.6% (FY2/18: 5.0%), other real estate sales revenue at 7.9% (FY2/18: 10.1%), property leasing revenue at 6.7% (FY2/18: 6.8%), and others at 0.2% (FY2/18: 0.7%). The segment profit composition puts condominium sales at 71.3% (FY2/18: 60.8%), sales of detached houses at 1.7% (FY2/17: 1.4%), other real estate sales at 1.9%(FY2/18: 14.1%), property leasing revenue at 23.4%(FY2/18:21.3%), and others at 1.7% (FY2/18: 2.4%).

Condominium sales business

The main areas are the Kobe and Akashi areas (around Kobe-shi and Akashi-shi in Hyogo Prefecture), the Hanshin area (Ashiya-shi, Nishinomiya-shi, Amagasaki-shi, Itami-shi and Takarazuka-shi in Hyogo Prefecture), and the focus is on developing medium scale condominiums with 30-50 units whose market has low competition, under the “WAKOHRE” brand with leading condominium businesses. In addition to a sales strategy that focuses on highly popular areas and supplies different types of condominiums in the same area, thereby realizing diversified needs of consumers and achieving high sales efficiency. Strengths include establishing an efficient business model with unique local community strategy, such as condominium gallery strategy that suppresses selling costs by the sale multiple condominiums at the same time in one permanent condominium gallery. Furthermore, the company is pursuing new possibilities by carrying out large-scale projects and expanding the business area to Hokusetsu area in Osaka Prefecture and Himeji-shi in Hyogo Prefecture, which are adjacent to Kobe-shi and the Hanshin area.

FY Feb. 19 Project Example(Source: WADAKOHSAN)

| WAKOHRE Kobe-Sannomiya Trad Tower Large-scale property with a total of over 100 units in downtown in the vicinity of stations.

Chuo-ku, Kobe-shi 194 units in total (delivered in March 2018) 9-minute walk from “Sannomiya” Station on JR Tokaido Main Line

|

| WAKOHRE Okamoto The Residence Redevelopment property/ Luxury residential area High-grade condominium with an average price of over 80 million yen. Higashinada-ku, Kobe-shi 38 units in total (delivered in February 2019) 6-minute walk from “Okamoto” Station on Hankyu-Kobe Line

|

| WAKOHRE Senri-Tsukumodai Property with the strategy expanding business area into neighboring regions (Hokusetsu area in Osaka Prefecture) Suita-shi, Osaka Prefecture 24 units in total(delivered in September 2018) 4-minute walk from “Yamada” Station on Hankyu-Senri Line

|

| 2/09 | 2/10 | 2/11 | 2/12 | 2/13 | 2/14 | 2/15 | 2/16 | 2/17 | 2/18 | 2/19 | 2/20 Est. |

No. of unitsdelivered | 620 | 623 | 614 | 585 | 653 | 786 | 765 | 686 | 762 | 676 | 755 | 575 |

No. of units contracted | 429 | 566 | 926 | 673 | 746 | 759 | 1,058 | 697 | 716 | 632 | 622 | 650 |

No. of units launched | 560 | 374 | 910 | 773 | 737 | 885 | 967 | 829 | 559 | 591 | 809 | 600 |

No. of purchased land | 505 | 503 | 546 | 835 | 1,394 | 621 | 1,091 | 778 | 663 | 792 | 548 | 650 |

No. of units contracted (undelivered) | 186 | 129 | 442 | 530 | 622 | 595 | 888 | 899 | 853 | 809 | 677 | - |

No. of inventory of unitscompleted | 34 | 123 | 2 | 25 | 24 | 0 | 18.5* | 11 | 9 | 19 | 9.5* | - |

*Properties after the decimal point are for the JV property.

Detached house sales business

Since 2007, the company has been developing around 10 houses with the “WAKOHRE-Noie” brand, in Kobe-shi and the Hanshin area, including the Hokusetsu area in Osaka Prefecture.

From the large amount of various site information the company is able to gather, there are many properties suitable for sale for detached house lots in terms of location, area, and site shape. In addition, where the business period for condominiums is just under two years, these projects can be as short as one year, meaning that with high capital turnover and they can be used to fill the gaps of the period completed the condominium construction.

Utilizing the development concept with a focus on landscaping and design and planning abilities cultivated by the work in condominiums, the company aims to differentiate itself from traditional “power builders.”

| 2/09 | 2/10 | 2/11 | 2/12 | 2/13 | 2/14 | 2/15 | 2/16 | 2/17 | 2/18 | 2/19 | 2/20 Est. |

No. of units delivered | 18 | 32 | 51 | 37 | 73 | 67 | 60 | 45 | 38 | 54 | 62 | 70 |

No. of units launched | 27.5 | 16 | 66 | 35 | 105 | 44 | 55 | 56 | 30 | 57 | 93 | - |

Other real estate sales business

The company conducts planning, development and sales (of single buildings) of real estate for investment, and the sale of residential land and land for industrial use. As well as shouldering the function of effective utilization of property information, revenue from selling off lease properties (inventory assets) that accompanies property handover is also included in this segment. A few years, the company has enhanced sales of single rental housing buildings aimed at investors.

| 2/09 | 2/10 | 2/11 | 2/12 | 2/13 | 2/14 | 2/15 | 2/16 | 2/17 | 2/18 | 2/19 | 2/20 Est. |

Sales(million) | 4,482 | 5,095 | 3,668 | 337 | 217 | 1,697 | 593 | 1,463 | 1,185 | 3,539 | 3,106 | 2,700 |

Property leasing business

The company mainly manages residential properties, in addition, stores and offices, parking lots, self-storage and others. As a business that can maintain a stable cash flow, in an industry that tends to be strongly influenced by condominium market conditions, since its founding the company has continued to contribute to the stability of revenue. Its basic strategies are to assure stable revenue by improving the occupancy rate (the rate of tenants moving in), and to maintain and improve the quality of its portfolio through movement of property. With the residences, keeping in mind the movement of property after a fixed period of time has expired, the asset composition is focused on 200-300 million yen properties, with many hopeful buyers amongst high net worth individuals. The company maintains an occupancy rate of around 95% . In addition, by managing assets and liabilities appropriately, it also aims to reduce the risk of lengthening investment return periods, and the risks associated with assets becoming excessive. The yield of each person is high, at 9-10%, and it aims to cover the burden of indirect expenses with the stable revenue from the leasing operations.

| End of 2/09 | End of 2/10 | End of 2/11 | End of 2/12 | End of 2/13 | End of 2/14 | End of 2/15 | End of 2/16 | End of 2/17 | End of 2/18 | End of 2/19 |

No. of housings | 2,036 | 1,905 | 1,859 | 1,725 | 1,565 | 1,782 | 1,805 | 1,844 | 1,813 | 1,837 | 1,881 |

No. of stores, offices | 103 | 93 | 89 | 82 | 77 | 82 | 95 | 97 | 99 | 99 | 117 |

No. of parkings | 857 | 883 | 704 | 709 | 555 | 563 | 554 | 553 | 505 | 513 | 510 |

No. of self-storage etc | 118 | 118 | 114 | 114 | 114 | 114 | 114 | 114 | 114 | 114 | 114 |

Change of occupancy rate(%) | 93.50 | 96.00 | 94.20 | 95.10 | 95.00 | 95.60 | 95.42 | 95.98 | 96.34 | 96.31 | 95.50 |

2. Strengths of WADAKOHSAN

(1) Having the area among Kobe, Akashi, and Hanshin, the foremost residential areas in Japan, as their area of business; (2) the WAKOHRE brand prevailing in their business area; (3) amid the business environment exposed to management risk due to fluctuations in real estate market conditions, maintaining sound finance and having high stability in operations via thorough risk management; and (4) succeeding in differentiating the company itself from major real estate companies and railway property firms through expanding business in primarily mid-scale condominiums under the product concept of “PREMIUM UNIQUE,” while possessing the capabilities of handling large-scale properties. Although they have been prudent in their property selection, in recent years, they are expanding their business area to Himeji-shi in Hyogo Prefecture and Osaka Prefecture (Hokusetsu area), which are next to their existing business region, while strengthening their capabilities to handle large-scale properties. Their efforts to boost their growth are garnering much interest.

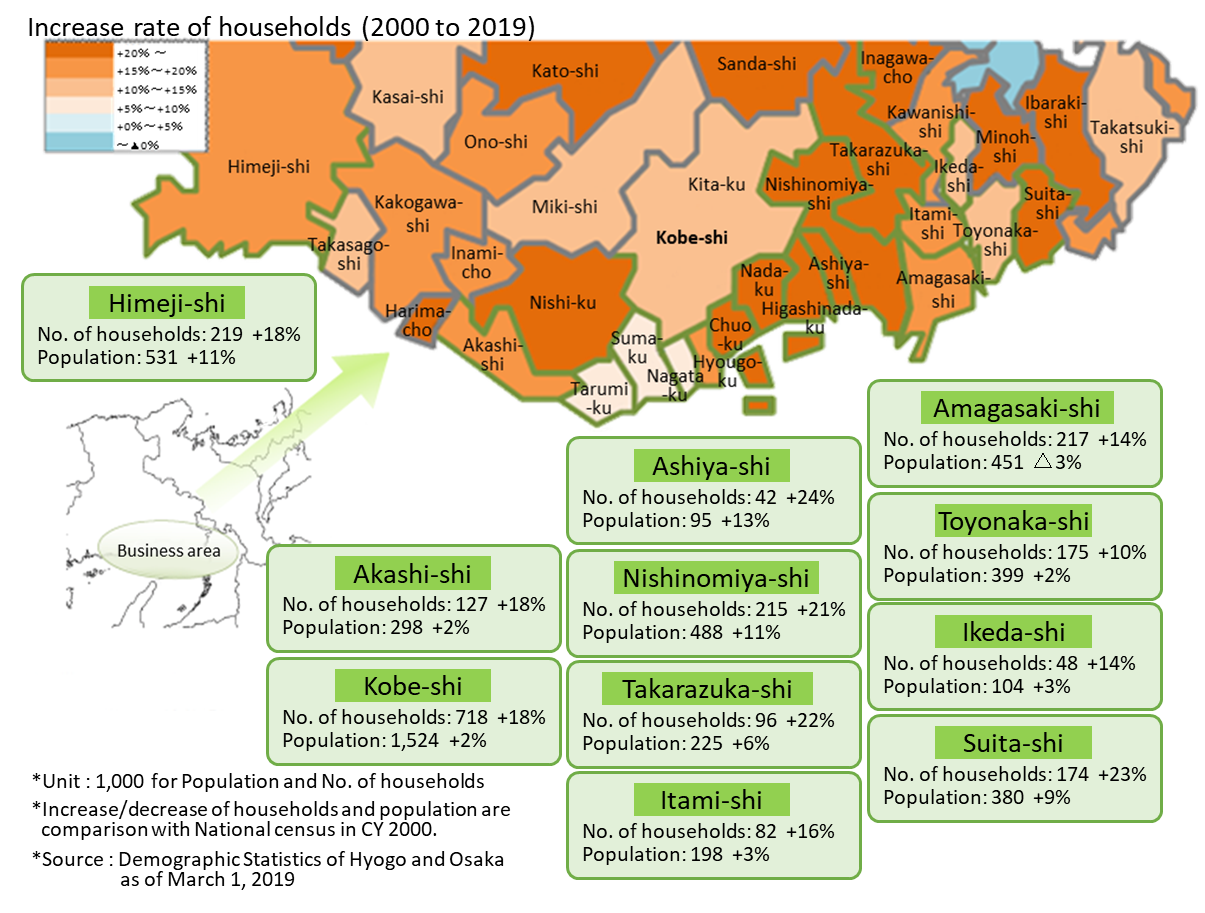

2-1. Japan’s foremost residential area as their region of business

They meet the high demand for housing by making Japan’s foremost residential area, area among Kobe, Akashi and Hanshin, their main area of business while establishing a comparative advantage with their information capabilities; they even have a reputation for building a community entrenched in the region.

(Source: WADAKOHSAN)

2-2. Prevailing WAKOHRE brand in Kansai

Their WAKOHRE brand is prevailing in Kansai, and the power of the brand lets them hold their own against other major condominium developers. In the 21th (2018) Condominium Brand Questionnaire Survey, conducted by the Osaka headquarters of Nihon Keizai Shimbun Inc., WAKOHRE was ranked both in the 4th place in the Individuality brand section and the Familiarity brand section.

Top 10 companies of brands with “Indeviduality” Top 10 companies of brands with “Familiarity”

1st | Geo (Hankyu Realty) | 19.8% | Lions Mansion (Daikyo) | 46.1% |

2nd | Proud (Nomura Real Estate Development) | 16.7% | Geo (Hankyu Realty) | 22.5% |

3rd | Lions Mansion (Daikyo) | 14.7% | Laurel (Kintetsu Real Estate) | 22.0% |

4th | WAKOHRE (WADAKOHSAN) | 11.9% | WAKOHRE (WADAKOHSAN) | 14.0% |

5th | The Parkhouse (Mitsubishi Estate) | 10.6% | Proud (Nomura Real Estate Development) | 13.3% |

6th | Park Homes (Mitsui Fudosan) | 8.5% | Park Homes (Mitsui Fudosan) | 12.5% |

7th | Pressance Loger (Pressance Corporation) | 7.5% | The Parkhouse (Mitsubishi Estate) | 12.1% |

8th | Laurel (Kintetsu Real Estate) | 7.3% | ESLEAD (Japan Eslead) | 10.8% |

9th | BRANZ (Tokyu Land Corporation) | 5.8% | BRANZ (Tokyu Land Corporation) | 6.7% |

10th | ESLEAD (Japan Eslead) | 5.6% | Pressance Loger (Pressance Corporation) | 6.5% |

* Produced based on the reference material of the company (Source: “The 21st (2018) survey about condominium brands” by Osaka head office of Nikkei Inc.)

2-3. Maintaining sound finances via thorough risk management

They are maintaining sound finances via thorough risk management, have well-balanced transactions with financial institutions and remain stable. As a result, in their corporate history spanning over 120 years in the real estate industry, where many companies have gone out of business, they have only reported a deficit during fiscal year ended Feb. 2010 after being affected by the global financial crisis. They continue to have stable dividends.

2-4. Successful in differentiating themselves from major firms, and having room for growth due to expand their business areas

Small and medium condominium businesses were eliminated in the Kinki region due to the real-estate recession after the global financial crisis, and only major real estate companies and railway real estate companies survived. However, since these real estate companies specialize in large-scale properties and properties along the railroads, there are not many cases where they compete in site acquisitions with WADAKOHSAN, who develops medium-scale condominiums with around 30-50 units. Meanwhile, WADAKOHSAN has its sights on further expanding its operations, making efforts to develop large-scale properties in the existing business area and expanding into Himeji-shi in Hyogo Prefecture and Osaka Prefecture (Hokusetsu area), which are next to their existing business area.

[ Actual results in 2018]

Rankings for the number of condominium buildings supplied in the Kinki region

| 2016 |

| 2017 |

| 2018 | |||

1st | Pressance | 37 | 1st | Pressance | 42 | 1st | Pressance | 53 |

2nd | WADAKOHSAN | 21 | 2nd | Nihon Eslead | 22 | 2nd | Nihon Eslead | 29 |

3rd | Nihon Eslead | 15 | 3rd | WADAKOHSAN | 12 | 3rd | WADAKOHSAN | 21 |

4th | Tokyu Land Corporation | 9 | 4th | Hankyu Realty | 11 | 4th | Hankyu Hanshin Realty | 12 |

5th | NTT Urban Development Corporation | 8 | 5th | Nissho Estem | 10 | 5th | Nissho Estem | 10 |

Rankings for the number of condominium buildings supplied in the Kobe-Shi

| 2016 |

| 2017 |

| 2018 | |||

1st | WADAKOHSAN | 9 | 1st | WADAKOHSAN | 9 | 1st | WADAKOHSAN | 9 |

2nd | Pressance | 6 | 2nd | Pressance | 5 | 2nd | Pressance | 8 |

3rd | Nissho Estem | 2 | 3rd | KandenRealty & Development | 2 | 3rd | Nissho Estem | 2 |

4th | Shinko Real Estate | 1 | 4th | Nihon Eslead | 1 | 3th | Mitsubishi Estate Residence | 2 |

4th | Hankyu Realty | 1 | 4th | Sekisui House | 1 | 3th | JR West Real Estate & Development | 2 |

(Based on the data provided by Real Estate Economic Institute, Source :WADAKOHSAN)

3. Fiscal Year ended February 2019 Earnings Results

Unit: million yen | FY Feb. 18 | Ratio to sales | FY Feb. 19 | Ratio to sales | YoY | Initial Forecast | Compared to Forecast | |

Sales | 35,149 | 100.0% | 39,287 | 100.0% | +11.8% | 39,000 | +0.7% | |

Gross profit | 6,823 | 19.4% | 7,153 | 18.2% | +4.8% | - | - | |

SG&A expenses | 3,519 | 10.0% | 3,707 | 9.4% | +5.4% | - | - | |

Operating Income | 3,304 | 9.4% | 3,445 | 8.8% | +4.3% | 3,350 | +2.9% | |

Ordinary Income | 2,424 | 6.9% | 2,687 | 6.8% | +10.9% | 2,500 | +7.5% | |

Net Income | 1,589 | 4.5% | 1,843 | 4.7% | +16.0% | 1,700 | +8.4% | |

Sales and operating income increased 11.8% and 4.3%, respectively, YoY.

Sales grew 11.8% YoY to 39,287 million yen. While other real estate sales drop 12.2% YoY in reaction to an increase in sales from selling the base ground for condominium sites (approximately 1.8 billion yen) in the previous term, sales of condominiums increased 14.9% YoY as delivery of properties including 2 large-scale properties with a total of over 100 units progressed favorably. Similarly, real estate leasing income also increased due to steady delivery of detached housing units and start of leasing operation of revenue real property for sales.

Operating income grew 4.3% YoY to 3,445 million yen. Although the gross profit margin of the mainstay condominium sales was almost the same as that of the previous year, the gross profit margin of the entire company decreased by 1.2 points in response to the large contribution from the sales of the above-mentioned base ground for condominium sites. SG&A expenses increased mainly due to advertising expenses associated with sales of large-scale properties, but it was absorbed by the increase in sales. Net income increased 16.0% YoY to 1,843 million yen due to decreases in interest expenses, funding costs and extraordinary losses.

Sales were as expected, but the profitability of all income items from operating income onwards exceeded the initial forecast.

Trend of each business segment

Unit: million yen | FY Feb. 18 | Ratio to sales | FY Feb. 19 | Ratio to sales | YoY | Initial Forecast | Compared to Forecast |

Condominium sales | 27,178 | 77.3% | 31,229 | 79.5% | +14.9% | 31,300 | -0.2% |

Detached housing unit sales | 1,774 | 5.0% | 2,205 | 5.6% | +24.3% | 2,200 | +0.3% |

Other real estate sales | 3,539 | 10.1% | 3,106 | 7.9% | -12.2% | 3,000 | +3.6% |

Property leasing revenue | 2,403 | 6.8% | 2,647 | 6.7% | +10.2% | 2,500 | +5.9% |

Other | 252 | 0.7% | 97 | 0.2% | -61.6% | - | - |

Sales | 35,149 | 100.0% | 39,287 | 100.0% | +11.8% | 39,000 | +0.7% |

Condominium sales | 2,472 | 60.8% | 3,016 | 71.3% | +22.0% |

|

|

Detached housing unit sales | 57 | 1.4% | 72 | 1.7% | +26.2% |

|

|

Other real estate sales | 573 | 14.1% | 80 | 1.9% | -85.9% |

|

|

Property leasing revenue | 865 | 21.3% | 989 | 23.4% | +14.3% |

|

|

Other | 97 | 2.4% | 71 | 1.7% | -26.8% |

|

|

Adjustment sum | -760 | - | -784 | - | - |

|

|

Operating Income | 3,304 | - | 3,445 | - | +4.3% |

|

|

*Composition ratio of operating income is the ratio to the total before adjustment.

Condominium sales

Sales were 31,229 million yen (up 14.9% YoY) and segment income was 3,016 million yen (up 22.0% YoY). Construction of 17 buildings including large scale properties “WAKOHRE Kobe-Sannomiya Trad Tower (a total of 194 units)” and “WAKOHRE Shin-Kobe Masters Residence (a total of 122 units)” as well as “WAKOHRE Konanyamate Everge (a total of 32 units)” was completed. As delivery progressed according to the plan, the number of delivered units increased 11.7% YoY to 755 units (the company records sales at the time of completion of delivery, instead of the time of concluding contracts).

The number of units sold was 19 buildings, 809 units (up 36.9% YoY), mainly in Kobe, Akashi and the Hanshin area. Although the number of units for which the company concluded contracts, which indicates sales trends, decreased 1.6% YoY to 622 units, the contract amount increased 7.9% YoY to 30,795 million yen as the average price per unit increased (from 40 million yen to 41 million yen).

KPI for Condominium Sales Business

| FY Feb. 18 | YoY | FY Feb. 19 | YoY | Initial Forecast | Compared to Forecast |

No. of units delivered | 676 | -11.3% | 755 | +11.7% | 760 | -0.7% |

No. of units launched | 591 | +5.7% | 809 | +36.9% | 740 | +9.3% |

No. of units contracted | 632 | -11.7% | 622 | -1.6% | 670 | -7.2% |

No. of units contracted(undelivered) | 809 | -5.2% | 677 | -16.3% | - | - |

No. of inventory of units completed | 19 | +111.1% | 9.5 | -50.0% | - | - |

No. of units purchased land | 792 | +19.5% | 548 | -30.8% | 700 | -21.7% |

Detached housing unit sales

Sales were 2,205 million yen (up 24.3% YoY) and segment income was 72 million yen (up 26.2% YoY). The company launched 93 units, far exceeding 57 units of the previous fiscal year, including the secondary sales of “WAKOHRE-Noie Kobe-Kanokodai” (Kita-ku, Kobe-shi), a large-scale property with a total of 90 units. Contracts and deliveries progressed smoothly, and the number of delivered units increased by 8 to 62.

Other real estate sales

Sales were 3,106 million yen (down 12.2% YoY) and segment income was 80 million yen (down 85.9% YoY). Sales and profit in the segment decreased in response to high income generated from the sales of base ground (approximately 1.8 billion yen) of highly profitable condominiums site in the previous term. However, development and sales of real estate for investment were smoothly.

The company sold a total of 9 buildings, 111 units, including 4 wooden framed buildings (34 units), and 5 steel-framed buildings (77 units).

Unit: million yen | FY Feb. 18 | FY Feb. 19 | |||

| No. of projects | Sales | No. of projects | Sales | YoY |

Land for development etc. | 14 | 2,932 | 5 | 1,472 | -49.8% |

Apartments for investment | 7 | 608 | 9 | 1,277 | +110.3% |

Others | 0 | 0 | 4 | 357 | - |

Total | 21 | 3,539 | 18 | 3,106 | -12.2% |

| FY Feb. 18 | FY Feb. 19 | ||

Wooden framed building | 7 | 60 | 4 | 34 |

Steel-framed building (RC and S structures) | - | - | 5 | 77 |

Total | 7 | - | 9 | 111 |

Property leasing revenue

Property leasing revenue was 2,647 million yen (up 10.2% YoY), and segment income was 989 million yen (up 14.3% YoY). The mainstay real estate for residential use maintained a high occupancy rate of over 95%, while the leases of stores and offices also remained smoothly at a level of around 90%. The leasing income from apartments for investment also contributed the revenue increase. After completion of construction, the company looks for residents for its real estate for sale, and sells such property to local high-net-worth individuals and corporate bodies after property leasing revenue becomes stable.

Unit: million yen | Income | Composition ratio | YoY |

Residences | 1,761 | 66.5% | +10.0% |

Stores and offices | 733 | 27.7% | +14.7% |

Parking lots | 94 | 3.6% | -2.1% |

Self-storage and other | 58 | 2.2% | -11.2% |

Total | 2,647 | 100.0% | +10.2% |

Change of occupancy rate

| End of 1H of 2/17 | End of 2/17 | End of 1H of 2/18 | End of 2/18 | End of 1H of 2/19 | End of 2/19 |

Residences | 93.5% | 96.5% | 94.2% | 96.9% | 92.1% | 95.7% |

Stores and offices | 93.0% | 93.9% | 94.0% | 96.0% | 89.7% | 92.3% |

Parking lots | 68.2% | 69.9% | 66.6% | 66.1% | 66.6% | 67.3% |

Gross profit of each business segment

Unit: million yen | FY Feb. 18 | Gross profit rate | FY Feb. 19 | Gross profit rate | YoY |

Condominium sales | 4,678 | 17.2% | 5,354 | 17.1% | +14.5% |

Detached housing unit sales | 223 | 12.6% | 260 | 11.8% | +16.9% |

Other real estate sales | 790 | 22.3% | 295 | 9.5% | -62.6% |

Property leasing revenue | 1,035 | 43.1% | 1,171 | 44.2% | +13.2% |

Others | 97 | - | 73 | - | - |

Total | 6,823 | 19.4% | 7,153 | 18.2% | +4.8% |

Balance Sheets And Cash Flow(CF)

Balance Sheets

Unit: million yen | End of Feb. 18 | End of Feb. 19 |

| End of Feb. 18 | End of Feb. 19 |

Cash and deposits | 13,354 | 12,285 | Accounts payable-trade | 5,558 | 6,652 |

Real estate for sale | 3,654 | 5,575 | ST Interest-Bearing Debts | 19,093 | 23,748 |

Real estate for sale in process | 41,453 | 40,376 | Advances received | 7,534 | 3,816 |

Current Assets | 60,530 | 59,508 | LT Interest-Bearing Debts | 31,793 | 25,188 |

Property, plant and equipment | 25,279 | 24,644 | Liabilities | 66,539 | 63,734 |

Intangible Assets | 541 | 618 | Net Assets | 21,063 | 22,558 |

Investments and Other Assets | 1,252 | 1,521 | Total Liabilities and Net Assets | 87,603 | 86,292 |

Noncurrent Assets | 27,073 | 26,784 | Interest-bearing debts | 50,886 | 48,937 |

Total assets as of the end of the fiscal year stood at 86,292 million yen, down 1,310 million yen from the end of the previous term. While the real estate for sale showed growth due to an addition of the properties that got in full operation, the company saw a decrease in real estate in process, mainly condominiums, as a result of delivery of large-scale properties. The decrease in property, plant and equipment is due to the transfer of rental property to inventory. The funds collected from the delivery of large-scale properties were used to return debt. Equity ratio was 26.1% (24.0% at the end of the previous term).

There is no major change in the financial environment, and it seems that smooth funding is continuing. Interest expense is also declining gradually as interest rates level fall.

The number of new projects and the amount of the asset

Unit: million yen | FY Feb. 18 No. of projects | Amount of assets | FY Feb. 19 No. of projects | Amount of assets |

Condominiums | 27 | 7,880 | 14 | 3,878 |

Detached housing unit | 6 | 1,013 | 11 | 883 |

Apartments for investment | 19 | 791 | 32 | 1,913 |

Others | 8 | 924 | 4 | 246 |

Total | 60 | 10,608 | 61 | 6,920 |

In March, which is in the fiscal year ending Feb. 2020, the purchase of land for a large-scale project with a total of 123 units located in a central and favorable location in Kobe-shi was completed.

Cash Flow(CF)

Unit: million yen | FY Feb. 18 | FY Feb. 19 | YoY | |

Operating CF(A) | -2,726 | 2,573 | +5,300 | - |

Investing CF (B) | -2,389 | -1,345 | +1,044 | - |

Free CF(A+B) | -5,116 | 1,228 | +6,345 | - |

Financing CF | 7,408 | -2,282 | -9,690 | - |

Cash and Equivalents at the end of term | 10,920 | 9,867 | -1,053 | -9.7% |

〈Reference〉ROE Analysis

| FY Feb. 15 | FY Feb. 16 | FY Feb. 17 | FY Feb. 18 | FY Feb. 19 |

ROE | 7.31% | 7.24% | 7.55% | 7.99% | 8.45% |

Net income margin | 3.92% | 4.28% | 4.37% | 4.52% | 4.69% |

Total asset turnover [times] | 0.49 | 0.42 | 0.43 | 0.43 | 0.45 |

Financial Leverage [times] | 3.84 | 3.99 | 4.05 | 4.12 | 3.99 |

*ROE (return on equity) is obtained by multiplying 3 elements, namely, “Net profit margin (net income ÷ sales),” “Assets turnover (sales ÷ total assets),” and “Financial Leverage (total assets ÷ net assets, reciprocal of equity ratio) ROE = Net profit margin × Assets turnover × Financial Leverage.

*For the total assets and net assets required for calculation, the balance during the term (average of the balance at the end of the previous fiscal year and the balance at the end of the current fiscal year) was used (Since the equity ratio stated in the consolidated financial statements and the securities report is calculated on the balance at the end of the fiscal year, the reciprocal of it and the above-mentioned leverage do not always match.)

4. Fiscal Year ending February 2020 Earnings Forecasts

Unit: million yen | FY Feb. 19 Actual | Ratio to sales | FY Feb. 20 Forecast | Ratio to sales | YoY |

Sales | 39,287 | 100.0% | 40,000 | 100.0% | +1.8% |

Operating Income | 3,445 | 8.8% | 3,500 | 8.8% | +1.6% |

Ordinary Income | 2,687 | 6.8% | 2,700 | 6.8% | +0.4% |

Net Income | 1,843 | 4.7% | 1,850 | 4.6% | +0.4% |

Sales and ordinary income are estimated to grow 1.8% and 1.6%, respectively, YoY.

Sales are estimated to grow 1.8% YoY to 40 billion yen. Other real estate sales and property leasing revenue are expected to decline, while detached housing units sales are expected to grow 36.0% YoY, with delivery number approaching near record-high levels, and condominium sales are also expected to rise 1.5% YoY. Sales will increase for four consecutive years and are expected to reach a record high. Operating income will increase 1.6% YoY to 3.5 billion yen. SG&A expenses are expected to remain at the same level as the previous fiscal year, but the decline in gross profit margin is factored in, taking into account rising real estate prices and soaring construction costs caused by labor shortages in the construction industry.

Forecasts for each segment

Unit: million yen | FY Feb. 19 Actual | Ratio to sales | FY Feb. 20 Forecast | Ratio to sales | YoY |

Condominium sales | 31,229 | 79.5% | 31,700 | 79.3% | +1.5% |

Detached housing unit sales | 2,205 | 5.6% | 3,000 | 7.5% | +36.0% |

Other real estate sales | 3,106 | 7.9% | 2,700 | 6.8% | -13.1% |

Property leasing revenue | 2,647 | 6.7% | 2,600 | 6.5% | -1.8% |

Other | 97 | 0.2% | - | - | - |

Total | 39,287 | 100.0% | 40,000 | 100.0% | +1.8% |

Condominium sales

Construction of 16 buildings will be completed including “WAKOHRE The Kobe Tor-Road” (a total of 192 units. To be delivered in August 2019) and “WAKOHRE Shin-Kobe Station Livlia” (a total of 33 units. To be delivered in November 2019). Although the number of sales will decrease 23.8% YoY, net sales will grow 1.5% YoY to 31.7 billion yen due to the increase in the average price per unit (from 41 million yen to 55 million yen). As of the end of the previous fiscal year, the contracts for 435 units were closed against the planned 575 units, and the contract rate already reached 75.5%.

“WAKOHRE The Kobe Tor-Road” is in a distance of 8 minutes of walk from “Sannomiya” Station on JR Tokaido Main Line. It is in a rare and valuable location that combines the uptown living environment of mountain side with the convenience of the commercial area of Tor-Road. A total of 38 types of floor plans are developed from 40 m2 to over 150 m2 with shared facilities and excellent management services for residents.

|

|

WAKOHRE The Kobe Tor-Road Chuo-ku, Kobe-shi; a total of 192 units 8-minute walk from “Sannomiya” Station on JR Tokaido Main Line To be delivered in August 2019 | WAKOHRE Shinkobe Station Livlia Chuo-ku, Kobe-shi; a total of 33 units 6-minute walk from “Shin-Kobe” Station on Kobe City Subway To be delivered in November 2019 |

(Source: WADAKOHSAN)

The company expects that purchasing will increase 18.6% YoY to 650 units. But it will focus on profitability and carefully carry out purchasing, taking into consideration market conditions. Meanwhile, it will aggressively work on the redevelopment (area renovation) of the “retail market” where it has a solid track record. The area renovation to redevelop the “retail market” that thrived as local commercial facilities in the post-war period is on the increasing trend in the Kansai region, and the company has been spearheading the field.

Redevelopment property in the “retail market” (All images are from WADAKOHSAN)

WAKOHRE Tsukaguchi Ekimae First Emblem

| Redevelopment project of the Municipal Matsumoto Housing/Minatogawa Cooperative Association Building

|

“WAKOHRE Tsukaguchi Ekimae First Emblem” (Amagasaki-shi, Hyogo Prefecture), which was launched in December 2018, is a large-scale project with a total number of 117 units. It is built in a good location, a 1-minute walk from “Tsukaguchi” station on the Hankyu Kobe Line. This large-scale project with over 100 units facing south is the company’s first comdominium on the Hankyu Kobe Line. All units are equipped with disaster prevention storage warehouses in preparation for emergency disasters. Delivery is scheduled in June 2021.

In addition, in recognition of its performance, the company was chosen to redevelop the “Minatogawa market (Minaichi)” by Kobe-shi. As a redevelopment project of the Municipal Matsumoto Housing/Minatogawa Cooperative Association Building, the company will build a 14-story condominium on the site. The first floor will be designated for stores. It is scheduled for completion in April 2022. The Municipal Matsumoto Housing/Minatogawa Cooperative Association Building was a building from the first basement level to the 10th floor with about 40 stores on the lower floors, but they were closed in March 2019 due to the aging of buildings and the abolition of municipal buildings.

Area expansion (All images are from WADAKOHSAN)

While focusing mainly on the Hokusetsu region in Osaka Prefecture, WADAKOHSAN is expanding the business in wide areas. In the Hokusetsu region in Osaka Prefecture, as of the end of the previous fiscal year, it is selling 3 buildings including “WAKOHRE Senri Takemidai Masters Residence” (a total of 66 units, launched in July 2018 and to be delivered in September 2019), “WAKOHRE Toyonaka Dear Place” (a total of 22 units, launched in May 2018 and to be delivered in January 2020), and “WAKOHRE Ikeda Station Flats” (a total of 39 units, launched in September 2018 and to be delivered in August 2020).

WAKOHRE Senri Takemidai Masters Residence | WAKOHRE Toyonaka Dear Place | WAKOHRE Ikeda Station Flats |

|

|

|

The conclusion of contracts for “WAKOHRE Osaka Shinmachi Tower Residence” (a total of 118 units, launched in August 2018 and to be delivered in January 2021), the first high-rise condominium project in Osaka-shi supplied by WADAKOHSAN, is also making steady progress. It has wonderful lighting and ventilation achieved by making the most of the condominium’s open corner plot which faces 3 connecting roads. Furthermore, in addition to the “liveability” provided through a wide range of facilities within a walking distance, including parks, educational institutions, and commercial facilities, residents can walk to the Shinsaibashi area where department stores and other shops gather. The “library,” a common area of the condominium, features books selected by JUNKUDO Bookstore. It is also easy to get around, as the residents can use “Hommachi” Station on Subway Midosuji Line, Yotsubashi Line, and Chuo Line, which are in a distance of an 8-minute walk, and other 6 stations of 5 railway lines.

WAKOHRE Osaka Shinmachi Tower Residence

KPI for Condominium Sales Business

| FY Feb. 19 Actual | YoY | FY Feb. 20 Forecast | YoY |

No. of units delivered | 755 | +11.7% | 575 | -23.8% |

Average price per unit | ¥41 million | +2.5% | ¥55 million | +34.1% |

No. of units launched | 809 | +36.9% | 600 | -25.8% |

No. of units contracted | 622 | -1.6% | 650 | +4.5% |

No. of purchased land | 548 | -30.8% | 650 | +18.6% |

No. of condominiums that have been procured and are to be released in each region (as of the end of the fiscal year ended Feb. 2018)

Region | No. of condominium buildings | No. of condominium units |

Kobe-shi | 13 | 558 |

Hanshin area* | 8 | 181 |

Akashi-shi and Himeji-shi | 1 | 43 |

Osaka | 2 | 111 |

Detached housing unit sales

The company plans to deliver 70 detached housing units, expecting that sales will grow 36.0% YoY to 3.0 billion yen. “WAKOHRE-Noie Ikeda-Satsukigaoka” (Ikeda-shi, Osaka Prefecture), which will be delivered this term, has 6 blocks in total. It is in a distance of a 10-minute walk from “Ikeda Station” on Hankyu-Takarazuka Line and is built in a good location with convenience in a large “Ikeda Mountain Scenic Area.” All units adapt the criteria of the “Certified Low-Carbon Housing,” which is the next-generation housing performance with excellent insulation and energy-saving capabilities.

Other real estate sales

The company plans to sell 4 wooden framed buildings (22 units) and 7 steel-framed buildings (94 units). These figures are higher than the results of the previous fiscal year, but sales are expected to decrease 13.1% YoY to 2.7 billion yen as most of them are small-sized apartments.

Unit: million yen | No. of projects | No. of units | FY Feb. 20 Forecast No. of buildingss | No. of units | FY Feb. 19 Actual No. of buildings | No. of units |

Wooden framed building | 16 | 156 | 4 | 22 | 4 | 34 |

Steel-framed building | 43 | 689 | 7 | 94 | 5 | 77 |

(RC and S structures) | 2 | 36 | ||||

Total | 59 | 845 | 11 | 116 | 9 | 111 |

5. Conclusions

As for condominium sales in the fiscal year ending Feb. 2020, although the number of units to be delivered will decrease by 180 units, amount sales will increase due to the increase in the average price per unit. The company absorbed the rise in sales price (average price per condominium unit) associated with the rise in land prices and construction costs by developing high-grade condominiums in the upscale neighborhood. Conclusion of contracts proceeded smoothly as a result of these efforts, and the company has already concluded sales contracts of 75.5% of the 575 units scheduled to be delivered this term.

With regard to purchasing, taking into consideration market conditions, the company will focus on profitability and carefully carry out purchasing. Land prices seem to be rising moderately in Osaka Prefecture, Kyoto Prefecture, and Hyogo Prefecture, but the company says that the price difference is expanding based on the convenience of the location such as station proximity. In the central area of Osaka-shi, where most of the purchasing is done by bid, the severe situation seems to continue because of competition among hotel companies, etc.; however, in Kobe and the Hanshin area, which are the company’s mainstay areas, it seems that the company is making advantageous purchasing using its strong network with local real estate agencies. Furthermore, as a measure against rising construction costs, the company not only works with the local construction companies but also makes efforts to have continuous transactions with major general contractors which have strong material procurement capabilities and personnel mobilization ability to control the cost as a whole. As a result, the gross profit margin on sales of condominiums for the fiscal year ended Feb. 2019 declined only 0.1 points to 17.1%, and it expects that the decline will remain 0.1 to 0.2 points in the fiscal year ending Feb. 2020. Combined with pricing strategies, cost reductions, condominium development according to location characteristics, and steady purchasing, solid performance is anticipated until the fiscal year ending Feb. 2022, and the results of good performance will be returned to shareholders through dividends.

As a medium-term development, it seems that the company is also exploring projects in pursuit of synergy with its group company Seikou ukou Co., Ltd., which deals with condominium management, etc.

< Reference: Strategies for ESG >

As an ESG initiative, WADAKOHSAN is working to create safe, secure, and healthy housing for residents and is also focusing on social contribution by providing housing compensation at the time of natural disasters and youth development support. Furthermore, in terms of governance, as explained in the Corporate Governance Report, the company considers that the establishment of a sound, transparent, and efficient management system is its top priority and works on the development and enhancement of the governance system.

Current corporate governance system

◎ Organization type, and the composition of directors and auditors

Organization type | Company with company auditor(s) |

Directors | 7 directors, including 1 external one |

Auditors | 4 directors, including 3 external ones |

◎ Corporate Governance Report Updated on May 22, 2018

Fundamental way of thinking

The fundamental policy regarding the company’s corporate governance is that establishing a highly transparent, sound and efficient business framework is believed to be an issue of utmost importance, and we are working to implement it. Although we are a small organization, we are building a simple and efficient organizational framework that also takes mutual checking and balancing, and independence into account. To further strengthen the speeding up of decision making and realizing a highly transparent management, we are striving to strongly maintain the following 5 principles of the governance system.

1. The manifestation of supervisory functions based on substantial discussion at the board of directors’ meeting.

2. Timely and adequate deliberation on important matters for managerial decision-making via the board of managing directors.

3. Implementation of highly effective auditing by the auditor.

4. Establishment of an internal control system via installing an internal auditing room, holding an internal integration committee, etc.

5. Collaboration with external agencies such as law firms to create a compliance structure.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

WADAKOHSAN has implemented all the Basic Principles of the corporate governance code.

<Transition to a Company with Audit and Supervisory Committee>

In order to enhance corporate value by strengthening the audit function of the Board of Directors, improving corporate governance, and ensuring prompt decision-making and transparency of management, the company plans to become a Company with Audit and Supervisory Committee. With approval at the 53rd Annual General Meeting of Shareholders (scheduled to be held on May 29, 2019), the company will have 12 directors, of which 4 will be elected as outside directors.

<Environment>

In addition to adopting the City of Kobe’s environmental performance standard for condominiums, the company is also working on the development of smart condominiums. It is also implementing a project to install seismic control device as standard in wooden houses. Furthermore, it is taking measures against Sick-House Syndrome for all of their housing.

Adoption of the City of Kobe’s environmental performance standard for condominiums. | In Kobe, when constructing a building of a certain scale, the operating company self-evaluates the environmental efforts such as consideration to global warming and safety and security of the residents, and notifies them to the city. The city announces the scoring results on the website, etc. The company publishes this result on the leaflets of condominiums and advertising materials such as websites to show the safety of the building. |

Realization of highly insulated and highly airtight housing | “WAKOHRE-Noie Kobe-Kanokodai” adopts the two-by-four method, which has higher air tightness than the conventional framework method, in all residences. Double-roof construction, floor insulation, and high-insulation facilities in the entrance door and bathroom are used to achieve insulation performance about 1.5-fold better than that of the “Thermal Insulation Performance Class 4” houses based on the law to ensure product quality. |

Enhance support function with a smartphone app | “WAKOHRE Mikage 1-chome” adopts a service that uses smartphones. It enables the users to confirm energy usage, operate Eco-Jozu (water heater) and gas equipment from outside, and fill the bathtub with hot water with one smartphone. The company supports safe and secure living. |

Measures against Sick-House Syndrome | For the floor and fittings of the company’s buildings, materials of F ☆☆☆☆ grade that emit very little formaldehyde are used. Also, non-formalin type is selected as the vinyl adhesive in consideration for Sick-House Syndrome, etc. |

<Society>

Joined the "Phoenix Mutual Aid," a housing reconstruction mutual aid system implemented by Hyogo Prefecture

The company joined the “Phoenix Mutual Aid,” the first housing reconstruction mutual aid system of its kind adopted by Hyogo Prefecture in September 2005 (a benefit will be paid for reconstruction or repair in case of damages due to a natural disaster). The company bears the cost of mutual aid premium for one year from the time of delivery of a unit sold by the company in Hyogo Prefecture.

Implementation of management system “Mimamorume” to monitor children to and from school

“Mimamorume” is a service provided by Hanshin Railway. When a child with a specified IC tag passes through the school gate when going to or leaving school, an e-mail is automatically delivered to the e-mail address of the pre-registered parents. It brings relief to parents as they know their children’s status from going to school and returning home. The company adopted it in “WAKOHRE Mukonoso The Grand Comfort."

Activities to support youth development

As an aging society with fewer children progresses, the company provides various support for children to have a healthy social life.

Children Painting Competition “My Dream House” It is a competition in which children from preschool to elementary school freely paint their dream houses to develop expressiveness and creativity. |

Vissel Kobe Soccer School Partner In order to support activities to promote soccer among young people, the company sponsors a “soccer school” run by Vissel Kobe. |

Childcare Support Project “Skip” by Kobe Shimbun Co., Ltd. The company cosponsors a parent-child participatory regional event “Skip Salon” hosted by Kobe Shimbun on the “Childcare Day,” which is on the 12th of each month. |

<Others>

Disclosure

The company developed a disclosure policy and posted it on its website for investors to clarify the policy concerning timely and fair information disclosure to the stakeholders. Furthermore, as IR activities, it posts information materials on financial results and various indicators on the website for investors and holds financial results briefings for analysts and institutional investors twice a year in Tokyo and Kobe. It also holds briefing sessions for individual investors.

Creating a pleasant working environment

In order to create a working environment in which employees can work comfortably, the company is making efforts to improve various welfare programs, including paid vacation and hourly vacation. To improve the working environment for women, it also established the systems of maternity leave, childcare leave and short working hours. For maintaining the health of employees, a health committee meeting with an industrial physician is also held every month, and medical checkups and mental health checks are provided to keep track of their health.

Retention rate within 3 years from joining the company | 87.8% | Gender difference in average years of employment | 9 months |

Rate to take maternity and childcare leaves | 100% | Rate of female employees within 5 years of joining a company | 41.1% |

Rate to return to work from maternity and childcare leaves | 100% |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on WADAKOHSAN CORPORATION (8931) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/