Bridge Report:(9278)BOOKOFF GROUP the first half of fiscal year March 2020

President Yasutaka Horiuchi | BOOKOFF GROUP HOLDINGS LIMITED(9278) |

|

Company Information

Market | TSE 1st Section |

Industry | Retail (commerce) |

President | Yasutaka Horiuchi |

HQ Address | 2-14-20 Kobuchi, Minami-ku, Sagamihara-shi |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥1,093 | 17,447,413 shares | 19,070million | 16.7% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥18.00 | 1.6% | ¥68.78 | 15.9 x | ¥736.20 | 1.5 x |

*The share price is the closing price on December 6. Number of shares issued is obtained by excluding the number of treasury shares from the number of shares issued at the end of the latest quarter.

*ROE and BPS are the actual value as of the end of the previous year.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 (Actual) | 76,564 | -530 | 5 | -528 | -25.69 | 25.00 |

March 2017 (Actual) | 81,344 | 116 | 588 | -1,159 | -56.41 | 10.00 |

March 2018 (Actual) | 80,049 | 613 | 1,092 | -889 | -43.31 | 10.00 |

March 2019 (Actual) | 80,796 | 1,550 | 2,120 | 2,172 | 112.19 | 15.00 |

March 2020 (Forecast) | 83,000 | 1,800 | 2,300 | 1,200 | 68.78 | 18.00 |

*The forecasted values were provided by the company.

*Unit: Million yen or yen

We present this Bridge Report reviewing the first half of fiscal year March 2020 financial results and fiscal year March 2020 financial forecast of BOOKOFF GROUP HOLDINGS LIMITED.

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year March 2020 Financial Results

3. Fiscal Year March 2020 Financial Forecast

4. Medium Term Management Policy and Progress Status

5. Conclusions

<Reference: Corporate Governance>

Key Points

- In the first half of the fiscal year ending March 2020, both sales and operating income grew 6.0% and 60.4% year on year, respectively, due to the strong sales of existing directly managed stores in Japan and monetization of the HUGALL business. During the current term, the company resumed aggressive opening of new stores. In Japan, it opened two large-sized complex “BOOKOFF SUPER BAZAAR” and two One-stop purchasing consultation desk, and, in Malaysia, it opened the fourth store. Furthermore, 36 directly operated stores in Japan were revitalized. Under the “One BOOKOFF” tactics, it increased smartphone application members (exceeding the target of 1 million) and promoted “Omni-channel O2O” using E-commerce and real stores.

- The full-year forecast remains unchanged. Sales are estimated to grow 2.7% year on year and operating income is estimated to increase 16.1% year on year. The percentage of progress against the full-year forecast was 49.7% for sales (48.2% for the same period last year based on full-year results) and 48.9% for operating income (35.4% for the same period last year based on full-year results). Although the growth of profit was remarkable, full-year earnings forecast remained unchanged, taking into account the burden of scheduled system investment and the impact of the consumption tax hike. The dividend will be 18 yen/share, an increase of 3 yen/share (a payout ratio of 26.2%).

- Under the medium-term management policy, two strategies to “upgrade individual stores” and “use all group strengths to compete and win” are making steady progress. In the first half of the fiscal year, the struggle of books and apparel was covered with trading cards and hobby-related goods as well as watches, high-end brand items and jewelry. The healthy sales of trading cards and hobby-related goods are the sign that the strategy to “upgrade individual stores” are achieving results. In addition to the results of this strategy, the strong performance of watches, high-end brand items and jewelry also reaffirmed that the company’s strength is “safety, security, and hassle-free” that is not available with flea market applications. Regarding the strategy, “using all group strength to compete and win,” inventory cooperation between stores and BOOKOFF Online is progressing, and strengthening the functions of smartphone applications and membership acquisition is also going well.

1. Company Overview

The company runs a group of the largest reuse chain stores that has expanded its reuse business into various fields, including books, CDs, DVDs, games, apparel, sporting goods, baby goods and miscellaneous goods. It has about 800 (directly managed + franchised) store network covering all over the country. Also, they pursue synergies between “reuse at physical stores” and “reuse at online stores.”

[Corporate philosophies of the BOOKOFF Group]

・Contributing to society through our business activities

・The pursuit of employee’s material and spiritual wellbeing With these corporate philosophies, the BOOKOFF Group has made efforts towards the reuse of various items, with a focus on the purchase and sale of books. By doing so, they have nurtured the brand, the store network, and human resources, which in turn have become the Group's strength. With their mission “Being a source of an enjoyable and prosperous life for many people “, they aim to be a leading company in the reuse business, and a company where people can grow and work with peace of mind, confidence, and passion.

[Efforts towards diversity]

The company believes that “employees are the greatest asset” and that “developing skills and intelligence of human resources will directly lead to growth of the company.” They strive to improve the work environment by utilizing the strengths of each employee, both male and female; and to provide opportunities for employee to develop their skills and fulfill themselves. As part of this, a region selection system was implemented in October 2014, allowing employees to work within a specific area. In addition, under the “married couple transfer system,” employees who are married couples may transfer to a store near their spouse’s workplace.

The BOOKOFF Group also makes an effort to provide employment for persons with disabilities, and they established B-Assist, Inc. in October 2010 (which was recognized as a special subsidiary under the Employment Promotion Act for Persons with Disabilities in December 2010). The company provides employment opportunities and an environment where disabled persons who are capable of working can do so not as “welfare” but as “part of everyday business activities.” There are currently more than 100 persons with disabilities working in and contributing to the BOOKOFF Group.

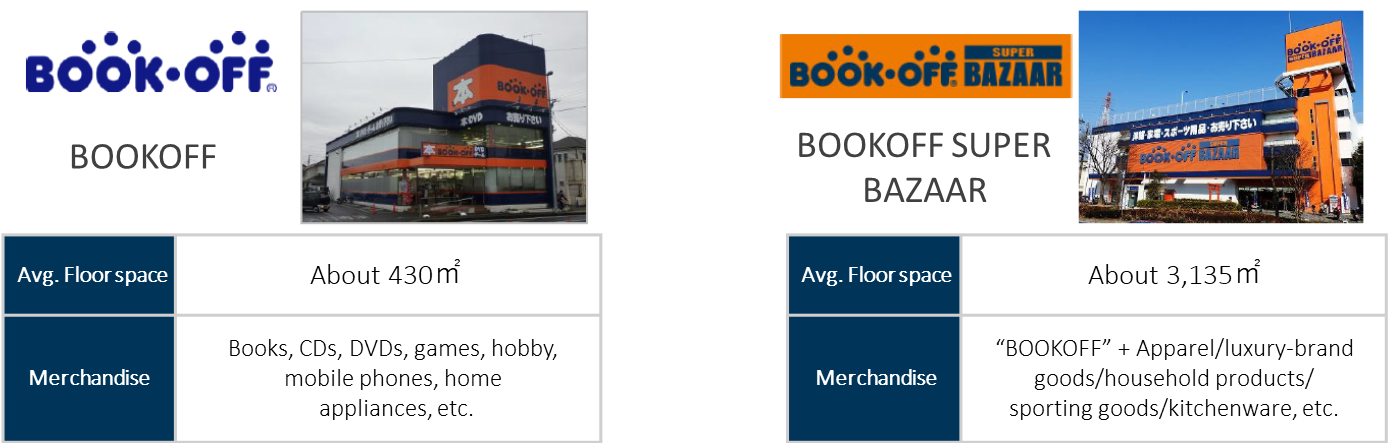

1-1 Business Description

As the chain headquarter of the reuse stores “BOOK・OFF” for books, software and more, the company operates the franchise (FC) system and directly managed stores. There are three types of directly managed stores;1)“BOOK・OFF” (books, CDs, DVDs, games, electronics and mobile phones, etc.), 2)“BOOK・OFF PLUS” (a medium-sized complex BOOKOFF with apparel & brand-name goods), and 3) “BOOK・OFF SUPER BAZAAR” (a large-sized complex BOOKOFF with a wide variety of commodities; books, software, electronics (audio and visual devices, computers, etc.), apparel, sporting goods, baby goods, watches, brand bags, jewelry, tableware and miscellaneous goods).

It also operates the E-commerce (EC) site “BOOKOFF Online,” HUGALL that provides purchasing and trading services for the wealthy class at major department stores, new bookstores, and book review community websites.

Its main subsidiaries, Booklet Co. Ltd., BOOKOFF-With Co., Ltd, BOOK・OFF Okinawa Inc, Manas Co., Ltd and BOOKOFF Minami Kyushu Inc. operate “BOOKOFF” stores in Japan. BOOKOFF-With Co., Ltd operates reuse stores for apparel, baby goods and others, besides BOOKOFF stores. BOOKOFF-With is also a franchisee of a reuse chain store, “Kingram,” which handles watches, brand bags and jewelry. Also, Booklet, BOOKOFF-With and BOOKOFF Okinawa operate reuse stores for apparel and more.

As for overseas business operation, BOOK・OFF U.S.A. INC. runs “BOOK・OFF” stores in the United States, BOK MARKETING SDN.BHD runs “Jalan Jalan Japan” in Malaysia, and SCI BOC FRANCE leases real estate owned in France.

(Source: the Company’s material)

2. First Half of Fiscal Year March 2020 Financial Results

2-1 Consolidated Results

| 1H of FY 3/19 | Ratio to sales | 1H of FY 3/20 | Ratio to sales | YOY |

Sales | 38,953 | 100.0% | 41,289 | 100.0% | +6.0% |

Gross profit | 23,182 | 59.5% | 25,322 | 61.3% | +9.2% |

SG&A expenses | 22,633 | 58.1% | 24,441 | 59.2% | +8.0% |

Operating income | 549 | 1.4% | 881 | 2.1% | +60.4% |

Ordinary income | 897 | 2.3% | 1,144 | 2.8% | +27.6% |

Profit attributable to owners of parent | 441 | 1.1% | 557 | 1.4% | +26.5% |

Unit: million yen

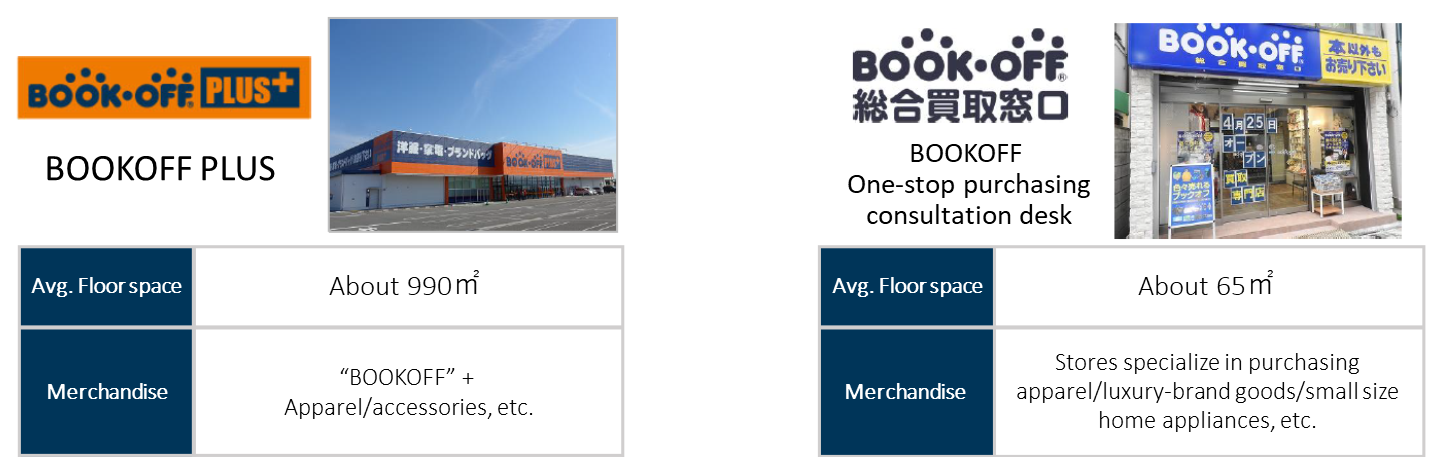

In the first half, sales grew 6.0% year on year and operating income increased 60.4% year on year.

Sales increased 6.0% (2,335 million yen) year on year to 41,289 million yen. In addition to the strong performance of directly operated existing stores in Japan (sales increased 1,330 million yen, up 104.2% year on year) and “HUGALL,” a business to purchase goods at department stores (an increase of 560 million yen), conversion of 9 franchised stores to directly owned stores in the Kyushu area also brought a positive effect (an increase of 290 million yen in sales). In addition, the impact of directly operated new stores and store closures was a factor of an increase of 120 million yen in sales. Furthermore, the sales of directly operated existing stores in Japan include online sales of 420 million yen. This reflects the effect of Omni-channel O2O under the “One BOOKOFF” tactics.

Ordinary income increased 27.6% (247 million yen) year on year to 1,144 million yen. The HUGALL business, which turned profitable as scheduled, had a significant effect on profit and loss improvement (380 million yen). There was also contribution from directly operated existing stores in Japan (70 million yen) and the effect of reducing company-wide costs associated with restructuring of the Group (180 million yen). These increases offset the strategic investments (a decrease of 320 million yen due to PR activities such as TV commercials to promote the “One BOOKOFF” tactics and M&A expenses) and the initial deficit associated with active store openings (a decrease of 70 million yen), resulting in a significant increase in operating income.

Operating loss of 64 million yen due to special factors in the second quarter (July to September)

In the second quarter (July-September), sales of books and apparel were sluggish, and sales were down 1.8% from the first quarter to 20,461 million yen. Struggle of comics caused the sluggish sales of books, while printed books were strong. The company does not anticipate a business environment in which sales of books as a whole will grow significantly, and it intends to maintain overall book sales by increasing the number of printed books while reducing dependence on comics.

In terms of profits and losses, gross profit declined 5.7% year on year due to a decrease in sales of highly profitable books as well as apparel for which profit margins tend to be affected by seasonal factors (summer clothing has lower profit margins). As a result, operating loss was 64 million yen (ordinary income was 52 million yen due to the income from recycling of used paper), as it could not absorb the strategic investment of 320 million yen and SG&A expenses, which increased 2.2% year on year due to TV commercials (approximately 100 million yen) and due diligence expenses related to M&A (approximately 100 million yen).

2-2 Financial Condition and Cash Flow

Financial Conditions

| March. 2019 | September. 2019 |

| March. 2019 | September 2019 |

Cash and Deposits | 6,142 | 5,083 | Income Taxes Payables | 135 | 170 |

Receivables | 1,590 | 1,759 | Provision for Sales Rebates | 546 | 529 |

Inventories | 12,915 | 13,763 | Asset Retirement Obligations | 1,747 | 1,806 |

Current Assets | 23,765 | 23,139 | Interest-Bearing Liabilities | 17,417 | 18,374 |

Property, Plant, and Equipment | 5,932 | 6,199 | Lease Obligations | 1,507 | 1,521 |

Intangible Assets | 1,204 | 2,044 | Liabilities | 27,640 | 27,936 |

Investments and Others | 9,744 | 9,654 | Net Assets | 13,006 | 13,102 |

Non-Current Assets | 16,882 | 17,899 | Total Liabilities and Net Assets | 40,647 | 41,039 |

Unit: million yen

Tangible and intangible noncurrent assets increased as a result of opening new stores, investing in systems, and making Jewelry Asset Managers Inc. a wholly owned subsidiary (see below). Interest-bearing liabilities increased due to the procurement of M&A funds. Equity ratio was 31.8% (31.6% at the end of last fiscal year).

Cash Flows (CF)

| 1H of FY3/19 | 1H of FY3/20 | YOY | |

Operating cash flow(A) | 1,024 | 955 | -69 | -6.8% |

Investing cash flow (B) | -161 | -1,928 | -1,766 | - |

Free cash flow(A+B) | 862 | -973 | -1,835 | - |

Financing cash flow | -6,752 | -67 | +6,685 | - |

Cash and Equivalents at the end of term | 7,960 | 5,083 | -2,877 | -36.1% |

Unit: million yen

Operating CF was 955 million yen due to the income before tax of 1,002 million yen, depreciation and amortization of 772 million yen, increase in trade receivables of negative 127 million yen, increase in inventories of negative 584 million yen, and corporate tax refunds (the difference between payments and refunds) of 169 million yen. Meanwhile, investing CF was negative 1,928 million yen due to the investments in opening of new stores and system development, store transfer, M&A, and the other factors. The deficit of financing CF shrank due to borrowing and repaying of long- and short-term loans and the payment of dividends (in the same period last year, bonds with stock acquisition rights were redeemed.).

2-3 Major Efforts

Under the policies to “end the group’s recovery phase and advance to consistent earnings growth” and “make substantial investments to build a base for growth in the future,” the company is making the following efforts.

For the organization and people | For business operations |

・Use the regional headquarters structure for unified operations of directly operated and franchised stores ・Increase training budgets and programs to enable employees to realize their full potential | ・Continue to operate stores focused on their local markets (upgrade individual stores) ・Continue progress with “One BOOKOFF” to advance and grow ・Make HUGALL profitable in FY3/2020 and take on new challenges |

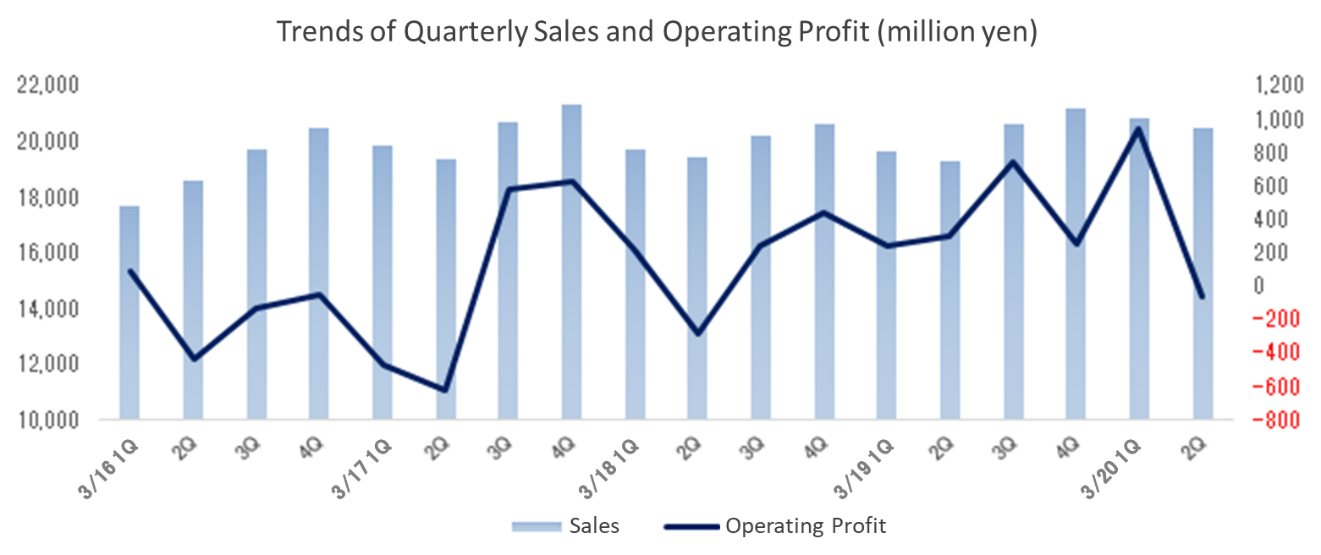

Efforts for the organization and human resources

In the first half of the term, the company gave more authority to each area branch, giving a sense of speed to the policy, and also integrated management for directly-managed stores and franchised ones in each region to promote exchange of knowledge and human resources between them. Furthermore, they carried out more than 50 trainings including teaching strategies and training the management team, in addition to teaching basic business manners, ways to deal with customers and knowledge about merchandise, in order to develop its strength of human resources.

(Source: The Company’s material)

Efforts towards business

Full-year plan | Progress in the first half | |

Existing stores and business ・Sales in directly operated existing stores are expected to be 100.5% of those in the previous term. ・Same level of existing store renovations as in FY 3/2019.

・Realize year-round profitability of HUGALL and contribute to profits. |

104.2%

Refurbished 36 stores (23 stores in the same period last term). HUGALL contributed to the revenue in the cumulative second quarter (it is expected to contribute to the full- year results, too). | |

New stores, etc. ・Open BOOKOFF SUPER BAZAAR ・Open BOOKOFF one-stop purchasing consultation desks ・Acquire franchised stores and directly manage them. (decrease in franchised stores) |

4 stores 7-8 stores

9 stores |

2 stores 2 stores

9 stores |

Other investment activities ・Carry out strategic IT investments to realize “one BOOKOFF.” ・Handle many works related to the maintenance of IT infrastructure, which include dealing with the end of Windows 7 support and increased consumer tax, reduced tax rates, etc. |

Progressing and handling as planned.

| |

Existing stores/HUGALL Business

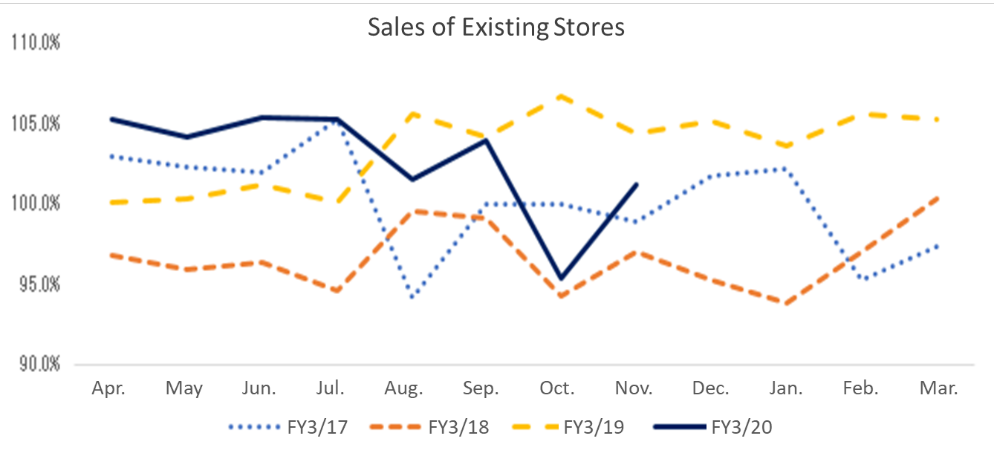

The sales in directly operated existing stores were 104.2% of those in the same period last year (104.9% in the first quarter, and 103.5% in the second quarter), exceeding the results in the same month of the previous year for 19 consecutive months, and HUGALL business turned profitable.

Sales of existing stores

(Source: The Company’s material)

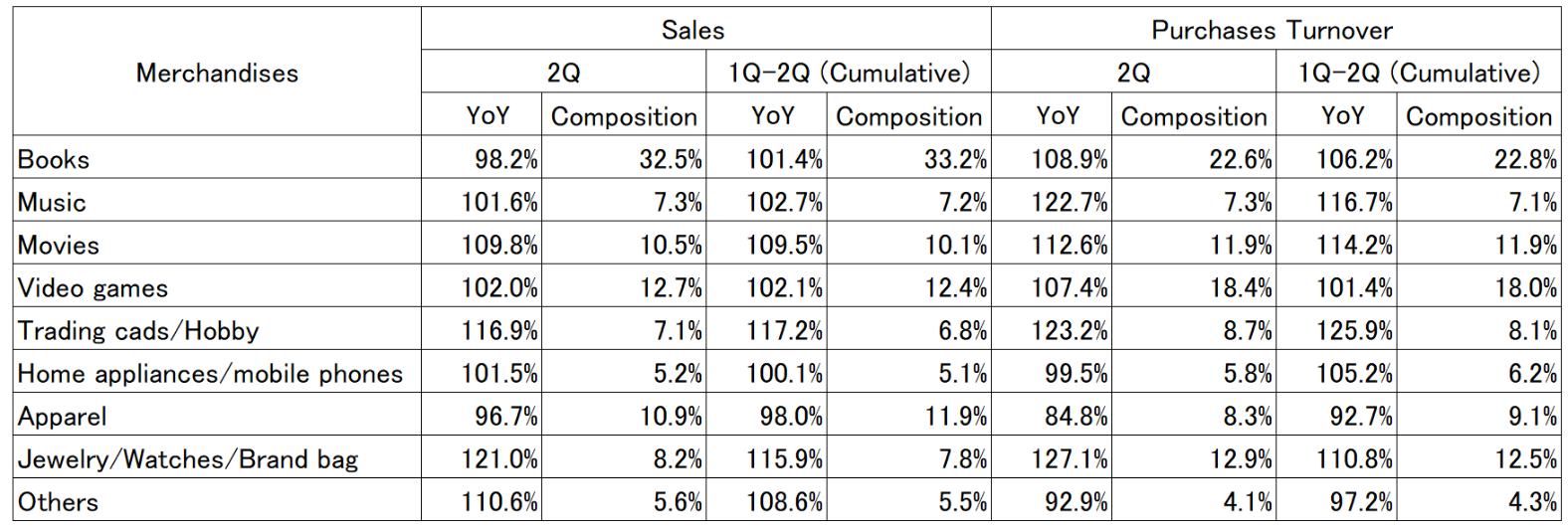

The sales of each product category in existing stores were 101.4% (104.5%, 98.2%) for books, which occupy a large part in product composition and are highly profitable, 104.6% (104.8%, 104.4%) for software, 115.9% (110.9%, 121.0%) for jewelry, watches and high-end brand items, and 117.2% (117.7%, 116.9%) for trading cards, and other hobby-related goods. On the other hand, the sales of apparel fell short of the results in the same period of the previous year at 98.0% (99.1%, 96.7%) due to the influence of weather and temperature.

In the first half of the term, the company focused on refurbishment of directly operated existing stores, and so it refurbished 36 stores, in order to enhance selling capacity and attract more customers. They continued to add and enhance merchandise based on characteristics of each region and refurbish the interiors/exteriors from the previous term, and as a result of strengthening the jewelry, watches, high-end brand items, trading cards, and hobby-related goods handled by carefully considering the characteristics of the regions where stores were located, their sales grew significantly, as mentioned above.

Higashi Tokorozawa Store: Added sporting and outdoor goods |

Route 50 Mito Motoyoshida Store: Exterior renovations |

Yokohama Vivre Store: Added hobby-merchandise (including anime merchandise) |

Jiyugaoka Stn. Store: Increased sales of apparel, high-end brand items |

(Source: The Company’s material)

The operating income for HUGALL business turned positive. The company has been making efforts to bring efficiency by integrating distribution functions with the E-Commerce Department, etc. from the previous term, as a result of which the ratio of purchase costs (= expenses/purchase amount) declined from 126% in the second preceding term to 71% in the previous term, which further decreased to 56% in the first half of the current term. In addition, the efforts to increase purchase in department stores produced good results. However, Nihombashi Mitsukoshi Store, the company’s flagship store, closed down at the end of September 2019, due to the expiration of the contract with Mitsukoshi.

Opening of new directly-managed stores

Four new stores were opened in Japan, i.e., BOOKOFF SUPER BAZAAR 5 Sapporo Miyanosawa Store (Sapporo-shi, Hokkaido, 2,785.2 m2, April 18), BOOKOFF SUPER BAZAAR Ito Yokado Nagareyama Store (Nagareyama-shi, Chiba, 2,646.6 m2, April 25), BOOKOFF General Purchase Desk Kyodo Nodai Odori Store (Setagaya-ku, Tokyo, 59.4 m2, April 12), and BOOKOFF One-stop Purchasing Consultation Desk Hiroo Store (Shibuya-ku, Tokyo, 49.5 m2, July 13). At the end of September, there were 789 stores in Japan with 389 directly-managed stores and 400 franchised stores. On the other hand, the company opened the fourth “Jalan Jalan Japan” (1,848 m2) in Malaysia on May 18. The number of stores overseas at the end of September was 15 (9 stores in the Unites States, 2 franchised stores in France, and 4 stores in Malaysia).

“One BOOKOFF” Activities

The company promoted “Omni-channel O2O” strategy by using E-Commerce website “BOOKOFF online” and enhancing service policies for the application members, and also expanded the installation of the electronic purchase system.

The number of members of the smartphone application, which was launched in June 2018, exceeded the target of one million, and reached 1.05 million at the end of September 2019. An increasing number of people are becoming the smartphone application members from the card members as a result of enhanced functions such as point management, distribution of coupons and information related to sale, and bookmarking of stores. The frequency of purchase and purchase amount increase with more people switching to the smartphone application members.

In order to promote Omni-channel O2O utilizing the E-commerce website “BOOKOFF Online,” the company is expanding the target directly-operated stores and franchised ones. The final goal is to enable purchase of products of all the stores on BOOKOFF Online (by linking store stocks with BOOKOFF Online) and to allow customers to receive the products they purchased on BOOKOFF Online at the store they wish, and so the company started off with linking store stocks with BOOKOFF Online. As of the end of the first half of the term, products of 450 stores are available on BOOKOFF Online. The company plans to complete linking the stocks of all the stores with BOOKOFF Online by FY3/2021, the year when it will be celebrating its 30th year of establishment, and enable customers to receive products at 350 stores by the end of FY 3/2021.

The scope of “Omni-channel O2O” strategy can be expanded by increasing recognition of BOOKOFF Online. According to Rakuten Research, the recognition rate of BOOKOFF Online is less than 20%, while stores have 96% recognition rate (according to Macromill Inc.), creating a huge gap between them. Therefore, while the effects of linking the stocks of stores with BOOKOFF Online are already becoming apparent with sales of the Group’s E-Commerce business in the first half increasing by 15% year on year, etc., this is just the beginning considering its potential.

Furthermore, the electronic purchase system, of which the company is promoting installation, is now installed in over 570 stores. By installing the electronic purchase system, purchase acceptance and procedure for settlement of accounts can be made significantly simpler. As for barcode settlement, 4 payment types, i.e., R Pay, LINE Pay, Pay Pay, and Origami Pay, were installed simultaneously to improve customer convenience.

Measures for visitor promotion

As a measure to promote visitors, the company carried out various promotional activities including broadcasting of a television commercial featuring Mr. Kokoro Terada, in order to increase awareness of “BOOKOFF offering more than just books.” It gained popularity mainly on social media, and contributed largely to the increase of awareness of products other than books.

(Source: The Company’s material)

New challenges

The company acquired all the shares of Jewelry Asset Managers Inc., which provides a comprehensive service related to jewelry, in September 2019. Jewelry Asset Managers Inc. operates directly-managed stores of the brand “aidect,” which offers services such as the repair and remake of jewels, at 18 different locations such as the inside of major department stores and shopping centers.

Through cooperation between Jewelry Asset Managers Inc. running directly-operated stores in Daimaru Tokyo, Tamagawa Takashimaya, etc., and the HUGALL business providing purchasing services for the wealthy class, the company aims to enhance services for the wealthy class at department stores. There is also a strong demand from department stores for extra services in addition to purchasing and trading services, especially something related to the end-of-life planning. If HUGALL, which has strength in purchasing, and Jewelry Asset Managers Inc., which provides repair, remake, and other services, cooperate, “we will be able to offer a value with a broader concept of reuse. For instance, when a mother cleans out her jewelry during her lifetime, we can redesign and give it her daughter instead of just purchasing and selling it. This way, we may be able to increase bases for the wealthy class.” (President Horiuchi).

Also, “once the business at department stores gets on track, we plan to expand it in BOOKOFF SUPER BAZAAR (BSB) as well” (President Horiuchi). As BSB consists of a selling space handling high-end brand jewelry, it will create business opportunities such as recommending remake at the time of purchase and holding a consultation meeting about jewelry remake for a limited period. In addition to BSB, One-stop purchasing consultation desk, which are present at 15 places in the Tokyo Metropolitan Area, can be utilized. Jewelry Asset Managers Inc. will also benefit as it will increase the chances to contact with customers.

Firstly, the company will maintain and increase bases to expand HUGALL so that it can secure procurement, and if it gets on track, BOOKOFF all over Japan will act as a liaison, creating opportunities for Jewelry Asset Managers Inc. to expand their jewelry remake services.

3. Fiscal Year March 2020 Financial Forecast

3-1 Full-year Financial Forecast

| FY3/19 Results | Ratio to sales | FY 3/20 Forecast | Ratio to sales | YOY |

Sales | 80,796 | 100.0% | 83,000 | 100.0% | +2.7% |

Operating income | 1,550 | 1.9% | 1,800 | 2.2% | +16.1% |

Ordinary income | 2,120 | 2.6% | 2,300 | 2.8% | +8.5% |

Profit attributable to owners of parent | 2,172 | 2.7% | 1,200 | 1.4% | -44.8% |

Unit: million yen

Full-year earnings forecast remains unchanged, with sales up 2.7% year on year and operating income up 16.1% year on year

Although sales, operating income and ordinary income were better than the ones in the previous year, the company maintained its full-year forecast in light of trends such as implementation of strategic investments from the third quarter onward and some factors that were unforeseen at the beginning of the year. The effects of revitalizing existing stores, opening new stores and transferring franchise stores to directly managed stores are expected to contribute to an increase in sales by 2.7% year on year to 83 billion yen. In terms of profit, HUGALL is expected to be profitable for the full year. IT investments to realize “One BOOKOFF” and investments such as coping with the end of Windows 7 support, the consumption tax hike, and the reduction of tax rates will be absorbed. As a result, operating income is expected to increase 16.1% year on year to 1.8 billion yen. The net income is expected to decrease 44.8% year on year to 1.2 billion yen due to many transient factors included in the previous year’s results.

3-2 Events in the second half

| Events | Detail |

In the initial plan | Opening of new BSB stores | Himego store in Mito (October 3), and Route 25 Nagahata store in Yao |

Smartphone applications for members | Linkage with e-commerce, expansion of functions such as inventory search | |

Omni-channel | Launch of cooperation with book inventory at stores, expansion of target stores | |

Electronic purchasing and barcode payments | Expansion of stores with electronic purchase and barcode settlement, addition of available payment methods, launch of cashless purchase | |

Not in the initial plan | Closure of Nihombashi Mitsukoshi store, which is the HUGALL flagship store | Flagship store was closed due to the contract expiration (September 30). Renewal was not possible. |

Relocation of BSB | BSB will be relocated due to the expiration of rental contract. (Route 2 Nagata store in Kobe Agro Garden Kobe Komagabayashi store, November) | |

More office space in Tokyo | To strengthen IT development and marketing systems (November 11) | |

Additional PR measures | Internet advertisement to improve inflow to BOOKOFF Online | |

Improvement of work style and employee benefits | Shorter business hours on New Year’s Eve and New Year’s Day, review of salary system | |

Other risk factors | Impact of consumption tax increase | Concern over a decrease in consumption after October |

Weather factors | Temperature trends (affecting apparel), typhoons and other disasters |

Sales at existing directly managed store in Japan in October 2019 were 95.3%. Due to the impact of Typhoon No. 19, more than half of all directly managed stores, mainly in the Kanto area, were temporarily closed, and many other stores had shortened business hours. Although the consumption tax hike seemed to have given an impact, it showed a recovery trend in November at 101.2%.

4. Medium Term Management Policy and Progress Status

The company’s two core growth strategies are “upgrading individual stores” (store management and merchandise) and “using all the BOOKOFF Group strength” (attracting customers and improvement of IT systems). To “upgrade individual stores”, the company will continue to work on creating unique stores and altering the organization to promote the delegation of authority. The company has refrained from opening new stores, but will start opening new stores actively. As for “using all the BOOKOFF Group strength”, under the “one BOOKOFF” tactics, the company will promote “Omni-channel O2O” using E-commerce, while also strengthening HUGALL, a purchasing and trading service for wealthy class. As an exit strategy, they will also work on overseas business development, particularly in Malaysia, which supports the BOOKOFF way of thinking positively regarding buying and trade-ins in Japan.

4-1 Upgrading individual stores

The company will continue creating unique stores by renewing them and adding merchandise based on the characteristics of each area while opening both large suburban stores and small comprehensive stores in city centers. The large suburban stores are large-scale, comprehensive reuse stores with an area of 1,650-3,300 square meters, able to attract customers with an abundant inventory and merchandise lineup. The company plans to open 4 to 5 of these stores per year, focusing on major urban areas in Japan. The small comprehensive stores in city centers will employ professionals to take care of customers and assess the buying price at a purchase counter. These stores will buy and sell not only books and software, but a variety of other merchandise as well. The company plans to open 7 to 8 small stores in FY 3/2020, with the goal of growing the current 13 locations into 50 locations as soon as possible.

4-2 "Using all the BOOKOFF Group strength”

With the aim of maximizing the customer lifetime value (LTV), the company is working to create good experiences through E-commerce and electronic purchasing, and to create opportunities for members to revisit stores by utilizing smartphone applications. Specifically, the company is implementing the “omni-channel O2O strategy using E-commerce” to eliminate the inconvenience of online shopping and enhance customer convenience by maximizing its nationwide store network, which is its strength.

At the end of September, the number of smartphone application members reached 1,050,000, and a smartphone application that will enable online ordering will be available at the end of the third quarter. The company’s smartphone application started with a membership card function such as point management, coupon distribution, sales information distribution, and favorite store registration, and the members could order goods on a linked web-site. However, in the second phase, the members can purchase goods through the smartphone application and receive them at home or a nearby BOOKOFF. Furthermore, in the third phase, they can look for goods at BOOKOFF nationwide using the application. By the end of the term, the company is intending to improve UI and UX to increase the number of members. From next fiscal year onwards, it will strengthen loyalty programs for the smartphone application to build an environment where the company and users can interact via smartphones while it will automatically send messages. For example, the application will make it possible to propose a children’s book to a user who purchased a stroller or propose a user who purchased a comic to sell it after reading it. The company is expecting to have 3 million members.

Strengthening the HUGALL business is another initiative. The business already became profitable in the first half, and it is reaching the growth phase. The flagship Nihombashi Mitsukoshi store will be closed, but the company will cover the closure by purchasing goods at events at department stores, as many department stores support the HUGALL business. It will also strengthen cooperation with Jewelry Asset Managers Inc. which became a subsidiary. Profitability of the HUGALL business is created through purchasing goods.

4-3 Overseas strategy

The company operates in the United States, France, and Malaysia. There are 9 directly-operated BOOKOFF stores in the United States, 2 franchise in France and 4 Jalan Jalan Japan stores in Malaysia. Product lineups that meet the needs of the local area, and knowledge cultivated in Japan for managing stores and developing human resources are both highly evaluated overseas. In both the United States and France, books and soft media bought from local customers are the main products, but some stores are also focusing on hobby items and some of their efforts bear fruits.

The company entered the Malaysian market in 2016 and opened its fourth store this May. They have released a Malaysian original package called “Jalan Jalan Japan.” The package focuses on selling products that were not sold locally in Japan, and supports the BOOKOFF way of thinking regarding buying and trade-ins in Japan as being a viable group exit strategy. The store concepts of “Preloved in Japan,” “large amounts of goods,” and “low prices” match local needs, and business performance is strong. It will focus on human resource development and work to further expand the store network. First of all, the company is intending to establish ten stores within three to four years. In the medium term, it is also considering the acceptance of discarded products from the business entities in the same industry.

(Source: The Company’s material)

The Malaysian business not only contributes to the reduction of disposal costs of the domestic business. The local business itself also contributes to profits. Unsold products are disposed of as industrial waste. The Malaysian business leads reduction of disposal costs, and all stores are performing well. Store operations require securing a large number of products and operations to deal with a large number of products, making it difficult for other companies to develop similar businesses. As a result, this business is unique to the company, which boasts the best sales in the industry. In addition to the fact that Malaysian store managers are receiving training in management and other activities in Japan, Japanese employees of the manager class are dispatched to Malaysia to penetrate the management skills.

4-4 Performance target

The targets for the fiscal year ending March 2023 are “3 billion yen in ordinary income, a ROA (ordinary income to total assets ratio) of 6.5% or more and an interest-bearing debt-to-operating CF ratio of 5.0x or less”. Based on the core business strategies of “upgrading individual stores” and “using all the BOOKOFF Group strength”, the company will establish their goals during the first two years (FY 3/20~FY 3/21), and reap the rewards during the second two years (FY 3/22~FY3/23). They also plan to raise ROE by improving capital efficiency while maintaining a reasonable amount of capital leverage.

In addition, a total investment of 10 billion yen is planned during the four years from FY 3/2020 to FY 3/2023. In each term, 1 billion yen will be used for opening new stores such as BOOKOFF SUPER BAZAAR and comprehensive reuse stores, and 600-800 million yen for improving distribution and for the refurbishment and repair of existing stores. A further 1 billion yen will be used to build the “One BOOKOFF” system, reinforce the price database, update equipment, and introduce a next-generation operating system (the yearly total is planned to be between 2.6-2.8 billion yen).

5. Conclusions

Under the medium-term management policy, two strategies to “upgrade individual stores” and “use all group strength to compete and win” are making steady progress. In the first half of the fiscal year, the struggle of books and apparel was covered with trading cards and hobby-related goods as well as watches, high-end brand items and jewelry. The healthy sales of trading cards and hobby-related goods are the sign that the strategy to “upgrade individual stores” are achieving results. In addition to the results of this strategy, the strong performance of watches, high-end brand items and jewelry also reconfirmed that the company’s strength is “safety, security, and hassle-free” that is not available with flea market applications. Many people who want to sell jewelry, watches, and high-end brand items are relatively old, and they tend to avoid flea market applications because they cannot see the buyers and also it takes time to post and ship the goods.

Regarding the strategy of “using all the BOOKOFF Group strength,” inventory cooperation between stores and BOOKOFF Online is progressing as part of “Omni-channel O2O” using E-commerce and strengthening the functions of smartphone applications and membership acquisition are also going well. As for the HUGALL business, we would like to see business development in cooperation with Jewelry Asset Managers Inc.

The challenge, on the other hand, is the rebuilding of books and apparel that fell below the sales level in the previous year. In the long term, as for books, shrinking of the market will be inevitable due to the digitization of books, and the apparel business is difficult to control as it is affected by the weather. We hope to see how to improve the results in the second half of the year.

BOOKOFF CORPORATION LTD., a subsidiary that operates reuse stores “BOOKOFF,” is working to support the reconstruction of “Shuri Castle,” an icon of Okinawa. People who apply for selling unnecessary books, CDs, DVDs, video games, etc. at “BOOKOFF Online” and use the on-line home pick-up service can donate the entire money they earn to Naha City as Shuri Castle reconstruction support funds, if they wish. This initiative is being implemented using the service “Kimochi-to” (= “With heart”) through which BOOKOFF Online supports people’s willingness to support others using things that they no longer need.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report:Updated on June 27, 2019

Basic policy

Under the BOOKOFF GROUP HOLDINGS Limited, which is a pure holding company, the Group’s common corporate philosophy is “Contributing to the economic and social development through our corporate activities” and “Providing opportunities for fulfillment both professionally and personally to all our dedicated employees” And the basic principles of our corporate governance are “ensuring transparency and efficiency of management,” “rapid decision-making,” and “enhancing accountability.” Based on these principles, we will establish good relationships with our stakeholders, including shareholders, customers, employees, business partners, and local communities, and establish a system to make transparent, fair, prompt, and decisive decision-making. We aim to achieve sustainable growth and increase corporate value over the medium to long term.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4]

In accordance with the “Regulations on Investment and Securities Management,” the company stipulates policy not to acquire cross-holding shares in principle. However, as an exception, it may hold shares of its franchise chain member companies. Regarding the exercise of voting rights of cross-holding shares, the company will examine the contents of the proposal carefully, conduct dialogue with the companies as necessary, and judge whether it will contribute to the improvement of shareholders’ value, and will exercise appropriately.

[Principle 4-11]

Currently, there are 2 internal directors, 3 outside directors (of which 2 are independent outside directors), 1 full-time corporate auditor, and 2 outside corporate auditors (of which 1 is an independent outside corporate auditor). The directors consist of experienced business executives, certified public accountants, persons with extensive business experience, and persons highly qualified in their field. The auditors consist of certified public accountants, lawyers, and persons coming from business companies. In particular, the outside directors and outside corporate auditors are persons with abundant knowledge and experience, and we consider the balance of members in a way that ensures stable and sustainable growth can be achieved. Due to the Group's overseas business ratio, we do not consider nationalities on the Board of Directors, but we do consider the gender ratio as a subject for further discussion.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary principle 4-11①】

The Company considers that it is appropriate to have about 8 to 10 directors and about 3 to 4 corporate auditors in order to have substantial and effective discussions at the Board of Directors meetings. Currently, there are 2 internal directors, 3 outside directors (of which 2 are independent outside directors), 1 full-time corporate auditor, and 2 outside corporate auditors (of which 1 is an independent outside corporate auditor). The directors consist of experienced business executives, certified public accountants, persons with extensive business experience, and persons highly qualified in their field. The corporate auditors consist of certified public accountants, lawyers, and persons coming from business companies. In particular, the outside directors and outside corporate auditors are persons with abundant knowledge and experience, and we consider the balance of members in a way that ensures stable and sustainable growth can be achieved. Regarding the appointment of directors, we select them based on whether the candidates contribute to the enhancement of our corporate value, have dialogue with them, and discuss at the Nominating Advisory Committee, which consists of the President and independent outside directors, based the Committee’s rules. Finally, the decision is made at the Board of Directors. Guidelines regarding the appointment of outside directors are in place, and their independence criteria are in the report on corporate governance.

[Principle 5-1]

The company appoints an executive in charge of IR and designates the Corporate Planning Department as in charge of IR. For shareholders and investors, the company holds financial results briefings once in six months, and is conducting small meetings and individual interviews as needed. In addition, the company has established the IR policy and disclosed it on its website.

■IR Policy <Policy to promote constructive dialogue with shareholders>

https://www.bookoffgroup.co.jp/ir/policy.html

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on BOOKOFF GROUP HOLDINGS LIMITED(9278) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/