Bridge Report:(9616)Kyoritsu Maintenance the first half of the fiscal year March 2020

Haruhisa Ishizuka Chairman |

Takumi Ueda President | Kyoritsu Maintenance Co., Ltd. (9616) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service |

Chairman | Haruhisa Ishizuka |

President | Takumi Ueda |

HQ Address | 2-18-8 Soto Kanda, Chiyoda-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Market Cap. | ROE (Act.) | Trading Unit | |

¥5,270 | 38,990,336 shares | ¥205,479 million | 12.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥47.00 | 0.9% | ¥261.60 | 20.1x | ¥2,163.88 | 2.4x |

*Share price as of closing on December 3, 2019. Number of shares outstanding as of the end of the most recent quarter excluding treasury shares.

*ROE is the result of FY3/19. BPS and PBR as of the end of the first half of FY3/20.

*DPS and EPS are based on the forecast of FY3/20. They are rounded off.

Consolidated Financial Results

Fiscal Year | Revenue | Operating Profit | Ordinary Profit | Net Profit | EPS(¥) | DPS(¥) |

March 2016 | 135,053 | 10,244 | 9,775 | 5,970 | 157.28 | 52.00 |

March 2017 | 135,828 | 11,815 | 11,514 | 7,135 | 184.35 | 62.00 |

March 2018 | 152,021 | 13,087 | 12,928 | 8,778 | 225.86 | 40.00 |

March 2019 | 162,811 | 14,567 | 14,321 | 9,567 | 245.41 | 45.00 |

March 2020 Forecast | 183,000 | 15,700 | 15,400 | 10,200 | 261.60 | 47.00 |

* A 2 for 1 stock split was implemented on April 1, 2017. EPS of FY3/16 and FY3/17 in above table have been calculated on the assumption that this stock split was implemented at the beginning of FY3/16. Forecast was announced by the Company.

This Bridge Report provides information about Kyoritsu Maintenance Co., Ltd. including the review of the financial results in the first half of the fiscal year ending March 2020 and the financial forecast of fiscal year ending March 2020.

Index

Key Points

1. Company Overview

2. Medium-Term Management Plan “Kyoritsu Jump Up Plan”: 5 Years Plan from Fiscal Year 3/2018 to 3/2022 and the progress

3. First Half of Fiscal Year ending March 2020 Financial Results

4. Fiscal Year ending March 2020 Financial Forecast

5.Conclusions

<Reference: Corporate Governance>

Key Points

- For the first half of the term ending March 2020, revenue and ordinary profit grew 18.4% and 14.5%, respectively, year on year. The business environment surrounding the company is favorable, as international students from outside Japan increased, the ratio of students who go on to universities/colleges rose, more enterprises adopted a dormitory system, foreign visitors to Japan increased, and the demand for domestic travel grew because Golden Week in 2019 was 10 consecutive holidays. On the other hand, the company steadily proceeded with “customer satisfaction improvement” and “advanced development,” which are the primary objectives of the mid-term management plan, while the shortage of manpower became evident and there are some concerns over external affairs. The ordinary profit for the first half increased for the 9th consecutive term, hitting a record high for the 7th consecutive term.

- There is no revision to the full-year forecast, and it is forecasted that revenue and ordinary profit will grow 12.4% and 7.5%, respectively, year on year in the term ending March 2020. The performance in the first half was healthy, but the full-year financial forecast has not been revised, considering some concerns over the effects of Typhoon Hagibis in October and the worsening of the relation between Japan and South Korea. As for the funds generated by the acceleration in the sales and lease back of real estate exceeding the amount set in the mid-term management plan, the company plans to allocate most of the surplus to additional development investment, to earn more profits. For the estimation of operating profit, the company took into account negative factors of a total of 1.45 billion yen compared to the previous term, mainly due to the expenses for the preparations to open new facilities and large-scale renovation. The projected annual dividend is 47.0 yen/share (including the interim dividend of 22.0 yen/share).

- Thanks to the effects of the successive holidays in Golden Week, etc., the business performance in the first half of the term ending March 2020 was healthy. Typhoon Hagibis inflicted enormous damage on the Kanto region, but its effect seems to be minor as a whole. There is another concern over the trend of the number of foreign visitors to Japan, but in the first half of the term ending March 2020, the decline in the number of Korean visitors to Japan was fully offset by the increase of visitors from other countries, and the demand from domestic customers was strong. Accordingly, its effect, too, is minor. The company has been struggled with improving the quality of the internet service for customers for years, but various measures are taken these days. The Company will be stronger if it is able to attain good results. In the next term, Tokyo Olympic Games will be held in 2020, and they are expected to bring some benefits to the company. PER is over 20x, but it can be said that there are still scope for share price improvement considering the underlying double-digit growth in in FY3/20 operating profit forecast and medium-to-long-term growth potential.

1.Company Overview

Kyoritsu Maintenance has been conducted business activities under the management policy upon the concept of “contributing to development of society through the provision of healthy food, comfortable living services in various stages of people’s lives and great comfort.” In its dormitory business, Kyoritsu seeks to provide modern versions of the “traditional Japanese boarding house” (Geshukuya – Traditional Japanese dormitories that also provide food services). Its hotel business segment can be divided into the business hotel operations, where “large hot spring type bathing facilities” and “good tasting breakfast menus” maximized the accumulated know-how in its dormitory business are provided, and resort hotel operations, where “high quality resort lifestyles in spite of reasonable price” are provided. Kyoritsu also provides various services such as building maintenance for both residential and office buildings, building rental and leasing services and parking lot operations management. In its food services business, eating-out business and restaurant operations are conducted. Furthermore, for the primary revenue stream, Kyoritsu is using its massive power of brand recognition to maintain its position as the leader within the dormitory business, and to accelerate growth in its hotel business.

The composition of consolidated fiscal year March 2019 revenue by business segment is provided below.

Business Segment | Business Description | Revenue Share* |

Dormitory | Dormitories for students and employees, Domeal and outsourced dormitory management | 27.5% |

Hotel | Dormy Inn (Business hotels), Resort hotels | 44.0% |

Contracted Services | Management of office building and residential property | 8.7% |

Food Services | Restaurant business, outsourced cafeteria business, hotel restaurant outsourcing business | 3.9% |

Construction | Construction, planning, design, brokerage, condominium sales, Sales and lease back of real estate, other related business of real estate | 8.9% |

Other (Not an official consolidated business segment) | Senior Life Business (senior citizen residence management and operations), Public Kyoritsu Partnership business (PKP: commissioned business for local governments), Support services for live-alone insurance agency business, comprehensive human resources services, financing services and administrative outsourcing services | 7.0% |

*Before elimination of intersegment transactions

<Corporate History>

Kyoritsu Maintenance was established in September 1979. The founder, Haruhisa Ishizuka, has long been associated with the food service industry and started the Company by taking on the operations of corporate cafeteria facilities on a commissioned basis. In the following year of 1980, the Company established a two-story wooden structure with 28 small-four-Japanese-straw-mat-rooms as its first dormitory facility in Sakura City, Chiba Prefecture. Based on the principle of providing “nutritious food” that “fosters the health and well-being of students to put their parents’ minds at ease,” Kyoritsu was able to steadily expand its business of dormitories for students through partnerships with various schools. Also, the Company steadily expanded its operating territory to cover the Tokyo, Kanagawa, Nagoya and Osaka regions. In April 1985, Kyoritsu started offering dormitories for employees which have highly unique features of “individual rooms with commissary functions providing breakfast and dinner,” and “large bathing facilities”. In June 1993, the Company moved its headquarter to its current location and in July of the same year, it came to the resort hotel business with the opening of a facility in Nagano Prefecture, followed by their entry to the business hotel realm in August with the opening of a facility in Saitama Prefecture. In September 1994, Kyoritsu got listed its shares on the JASDAQ Market, and in March 1999 it moved its listing to the Second Section of the Tokyo Stock Exchange, and then to the First Section in September 2001.

2.Medium-Term Management Plan “Kyoritsu Jump Up Plan”: 5 Years Plan from Fiscal Year 3/2018 to 3/2022 and the progress

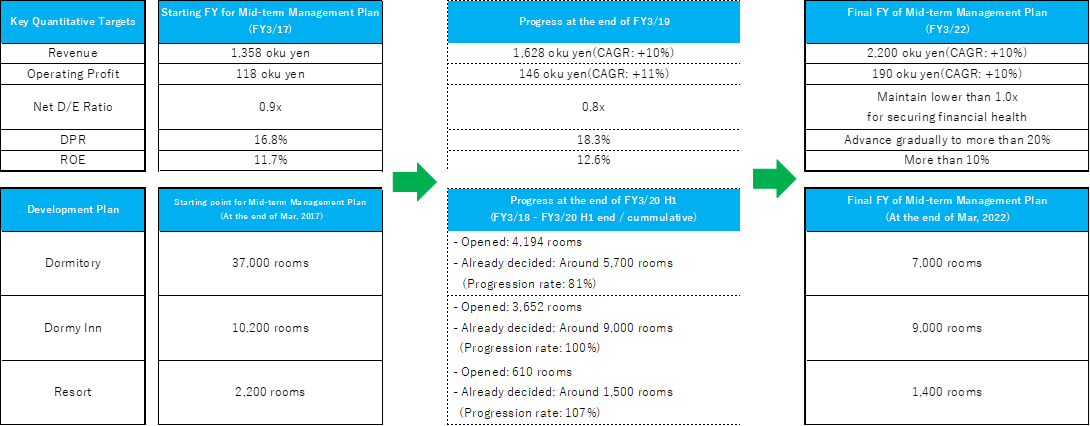

The new mid-term management plan “Kyoritsu Jump Up Plan” was started in the term ended March 2018 and has been healthy since then. The progress rates toward numerical goals for the development of facilities of dormitories and hotels are much higher than the initial estimates.

(1) “Kyoritsu Jump Up Plan” Overview

Name: “Kyoritsu Jump Up Plan”

Fundamental Strategy

Ⅰ.Customer Satisfaction Improvement

Produce products and services that lead to better customer satisfaction, raise customers’ assessment of the Company and get greater trust

Ⅱ.Advanced Development

Expand business bases and build a solid business foundation

Period: April 2017 to March 2022

Key Quantitative Targets / Development Plan and Progress

(Source: the company)

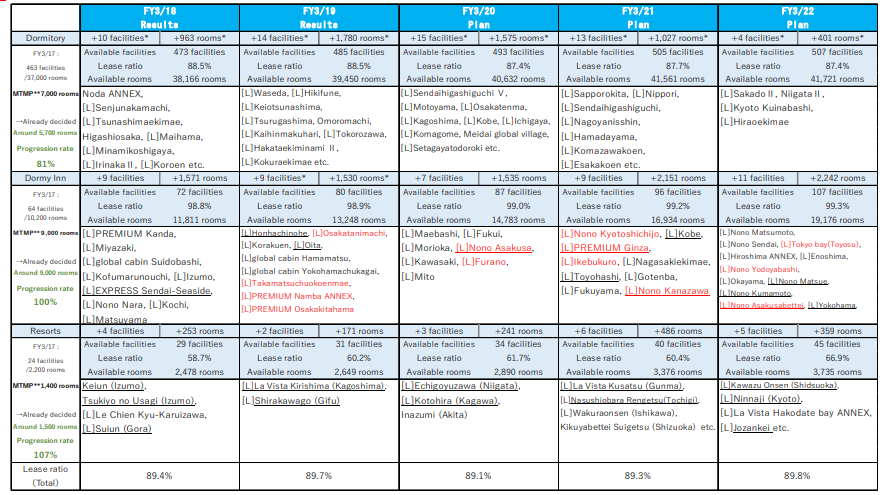

(2) Development Plan of Dormitories and Hotels for Sustainable Growth

*The number of increase in development facilities/rooms (not available facilities/rooms at the end of FY)

(Note) Red-highlighted parts mean the development facility with higher inbound ratio than our average. [L]parts mean the facilities for lease.

Underline parts mean the developing facilities for sales and lease back of real estate not only complied with but also planned.

(Source: Kyoritsu Maintenance)

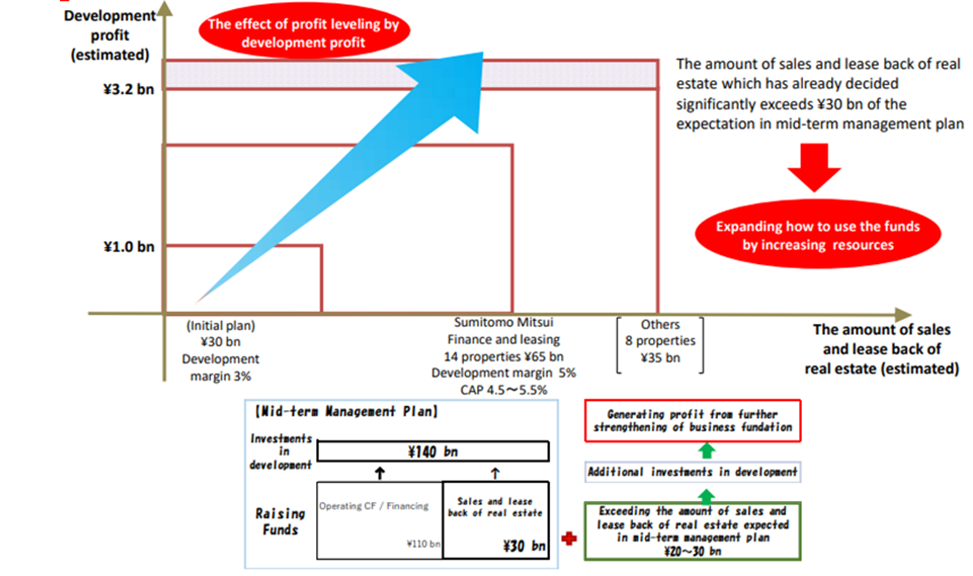

(3) Acceleration of sales and lease back of real estate

The amount of sales and lease back of real estate has already exceeded the one expected in the mid-term management plan.

(Source: the company)

(4) Stable securing of human resources

The Company has been implementing measures to secure human resources needed to ensure that the speed of its business expansion can be maintained. Along with proactive hiring of new graduates, efforts will be made to stably secure highly skilled human resources that can respond well to the needs of our customers.

* Stable Securing of Human Resources: Further Strengthen Hiring Capabilities, Promote High Rates of Retention

Number of New Graduate HiresApril 2019 | April 2020 | April 2021 |

296 (Act) | 300 (Plan) | 300~320 (Plan) |

General work: 31 | General work: 22 | General work: 20 |

Hotel: 260 | Hotel: 270 | Hotel: 270~290 |

Senio 5 | Senio 8 | Senio 10 |

Kyoritsu Maintenance employed 57 foreign students from Nepal, Vietnam, China, Republic of Korea, etc. in April 2019. There are no restrictions in the number of recruits for foreign students, and the company will actively recruit talented personnel.

Utilizing the good relationships with universities and colleges cultivated through the Dormitory Business, the Company has a strong recruiting route for graduates with a recommendation from them. The number of recruits who graduated and were introduced from the universities and colleges that used the Company's dormitories was 147, which was 49.7% of the total recruits, in April 2019.

* Multilingual staff

▶ To establish a system in which the staff at the call center of the company can attend to guests at hotels by telephone

▶ Especially, in the Tokyo Metropolitan Area and the Kansai Area, where the ratio of foreign guests is high, the company positions multilingual staff (speaking English, Chinese, and South Korean) at the front desk.

* Cleaning and housekeeping staff

▶ At 18 hotels, the company can directly employ and educate staff regardless of nationality, by utilizing its recruitment capacity. In the other hotels, the company outsources tasks to several firms.

▶ The company is simplifying cleaning tasks through business operation reform, with the same quality.

3.First Half of Fiscal Year ending March 2020 Financial Results

(1) Consolidated Earnings

| FY 3/19 H1 | Ratio to revenue | FY 3/20 H1 | Ratio to revenue | YoY |

Revenue | 79,204 | 100.0% | 93,815 | 100.0% | +18.4% |

Gross profit | 19,427 | 24.5% | 21,034 | 22.4% | +8.3% |

SG&A | 11,383 | 14.4% | 11,967 | 12.8% | +5.1% |

Operating Profit | 8,044 | 10.2% | 9,066 | 9.7% | +12.7% |

Ordinary Profit | 7,839 | 9.9% | 8,972 | 9.6% | +14.5% |

Net Profit | 5,319 | 6.7% | 6,114 | 6.5% | +14.9% |

*Unit: million yen

* Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report)

Revenue and ordinary profit grew 18.4% and 14.5%, respectively, year on year.

In the first half of this term, international students from outside Japan increased, the ratio of students who go on to universities/colleges rose, more enterprises adopted a dormitory system, foreign visitors to Japan increased, and the demand for domestic travel grew because Golden Week in 2019 was 10 consecutive holidays. At the same time, there were still areas of concern, including labor shortages, the US-China trade dispute and deteriorating relations between Japan and South Korea. In addition, the Company was also affected by unexpected natural disasters such as torrential rainfall in the northern area of Kyushu and large typhoons. Under the circumstances, the Company proactively pursued further improvement of customer satisfaction and advanced development which are the two core components of the medium-term management plan.

As a result, revenue increased 18.4% year on year to ¥93,815 million. The company recorded the expenses related to preparations to open new facilities, as well as the large-scale renovation expenses for further improvement of customer satisfaction in the first half, but these were fully offset by revenue growth and sales and lease back of real estate same as the first half of the previous fiscal year. Consequently, operating profit increased 12.7% year on year to ¥9,066 million. Ordinary profit increased 14.5% to ¥8,972 million, increasing for the 9th consecutive term and hitting a record high for the 7th consecutive term. Profit attributable to owners of parent was 6,114 million yen, up 14.9% year on year.

(2) Financial performance by Business Segment

| FY 3/19 H1 | Ratio to revenue | FY 3/20 H1 | Ratio to revenue | YoY |

Dormitory | 24,283 | 26.9% | 25,177 | 25.7% | +3.7% |

Hotel | 39,043 | 43.3% | 42,632 | 43.4% | +9.2% |

Others | 26,826 | 29.8% | 30,316 | 30.9% | +13.0% |

Adjustments | -10,948 | - | -4,310 | - | - |

Total Revenue | 79,204 | 100.0% | 93,815 | 100.0% | +18.4% |

Dormitory | 3,727 | 38.9% | 3,841 | 35.3% | +3.1% |

Operating Profit Margin | 15.4% | - | 15.3% | - | -0.1pp |

Hotel | 4,782 | 50.0% | 5,277 | 48.4% | +10.4% |

Operating Profit Margin | 12.2% | - | 12.4% | - | +0.1pp |

Others | 1,060 | 11.1% | 1,777 | 16.3% | +67.6% |

Operating Profit Margin | 4.0% | - | 5.9% | - | +1.9pp |

Adjustments | -1,525 | - | -1,829 | - | - |

Total Operating Profit | 8,044 | 100.0% | 9,066 | 100.0% | +12.7% |

Operating Profit Margin | 10.2% | - | 9.7% | - | - |

*Units: million yen

*Others = Comprehensive Building Management Business, Food Services Business, Development Business and the businesses not included in reported segments

Dormitory Business

Revenue was 25,177 million yen, up 3.7% year on year, and operating profit was 3,841 million yen, up 3.1% year on year.

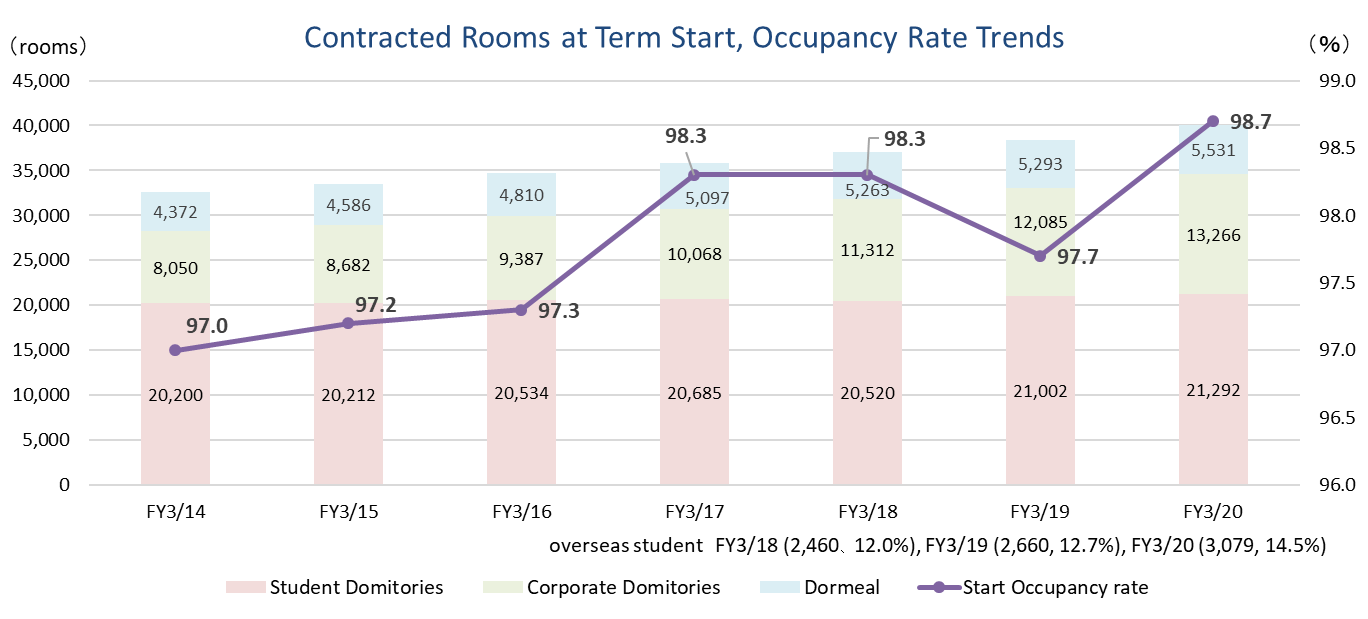

In April, the company established a total of 13 facilities and 1,451 rooms, including Meiji Global Village, which is a dormitory for international student exchange. The number of occupied rooms at the beginning of the term was 40,089, up 1,709 from the previous term. The business of dormitories for students performed well, thanks to the increase of international students, etc. As for the business of dormitories for corporate employees, the enterprises that adopted a dormitory system increased and the number of contracts with existing client enterprises rose. The occupancy rate in the entire dormitory business at the beginning of the term was 98.7%, up 1.0 point from the previous term, indicating a good start, and the dormitories opened in the term ending March 2020 produced revenue of 980 million yen. As for profit, offsetting the expenses for preparation for opening new facilities amounting to about 190 million yen and the cost for large-scale renovation of existing facilities amounting to about 70 million yen, the dormitories opened in the term ended March 2019 contributed to the growth of profit.

Created by Investment Bridge using Kyoritsu Maintenance Data

Hotel Business

Revenue was 42,632 million yen, up 9.2% year on year, and operating profit was 5,277 million yen, up 10.4% year on year. Revenue and profit grew, fully offsetting the effects of the natural disasters like huge typhoons and the expenses for the preparation for opening new facilities amounting to about 890 million yen, including those that are still to be opened, and the large-scale renovation of existing facilities amounting to about 64 million yen.

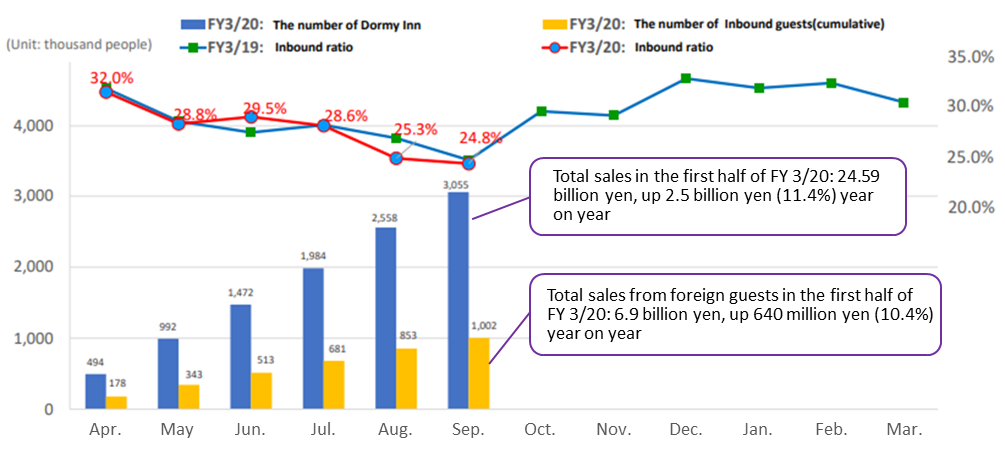

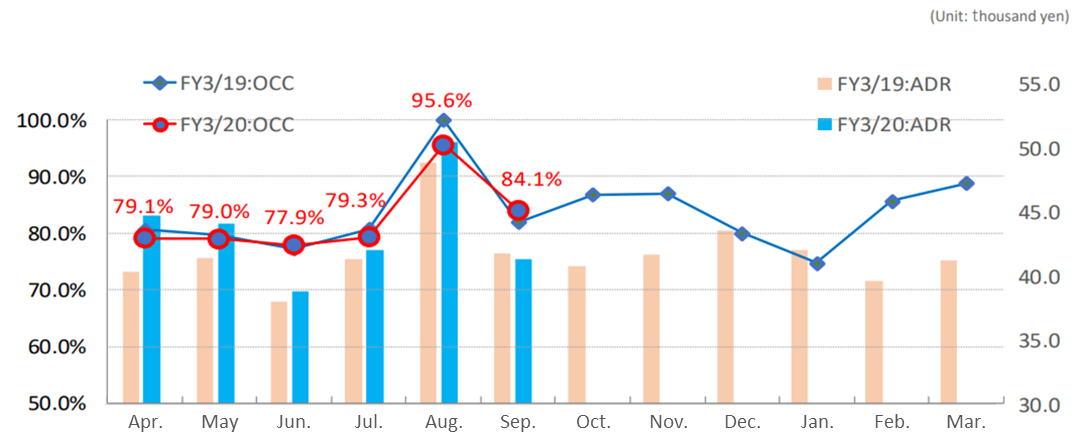

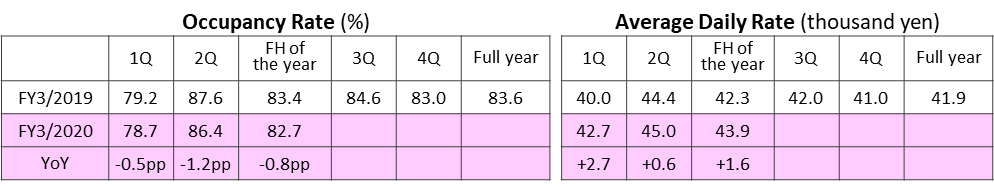

Dormy Inn (Business Hotel) Business

Revenue was 25,670 million yen, up 10.3% year on year. In the current term, the company has opened 3 facilities of “Natural Hot Spring Myogi no Yu Dormy Inn Maebashi,” “Natural Hot Spring Habutae no Yu Dormy Inn Fukui,” and “Natural Hot Spring Sansa no Yu Dormy Inn Morioka,” in the first half. The number of travelers from South Korea decreased due to deterioration relations between Japan and South Korea. However, this negative impact was fully offset by growth in the number of guests from other countries, particularly China and Hong Kong. As a result, the number of inbound guests continued to increase. RevPar (the average room price multiplied by the occupancy rate for each room), one of the key performance indicators, undercut levels in the same period of the previous fiscal year in the Osaka region (*) where the impact from the change of the number of inbound guests is high and other competitors have been focusing on supplying their new hotels. However, our nationwide expansion enabled us to cover this, and our characteristic service and unique features gave our hotels a strong popularity among domestic guests. As a result, RevPar exceeded levels in the same period of the previous year by 2.3% for existing Dormy Inn nationwide. Coupled with an increase in the number of available rooms, these factors boosted revenue and operating profit.

(*) Although RevPar in the Osaka region undercut levels in the same period of the previous year, our RevPar by area remained the highest in the country.

Out of the year-on-year revenue increase of 2.39 billion yen, 1.59 billion yen is from the hotels opened in FY 3/2019, 0.68 billion yen is from the hotels opened in FY 3/2020, and 0.44 billion yen is from existing hotels. Operating profit rose 19.1% (730 million yen) to 4.57 billion yen. Through the rise in RevPAR and the improvement in cost efficiency, the profit from existing hotels grew 620 million yen, and the profit from the hotels opened in the term ending March 2019 increased 240 million yen.

The number of foreign hotel guests grew 152,000 year on year to 1 million. The share of Korean people decreased from 42.0% to 28.1%, that of those from Hong Kong increased from 22.6% to 33.2% and that of Chinese people rose from 14.5% to 17.2%.

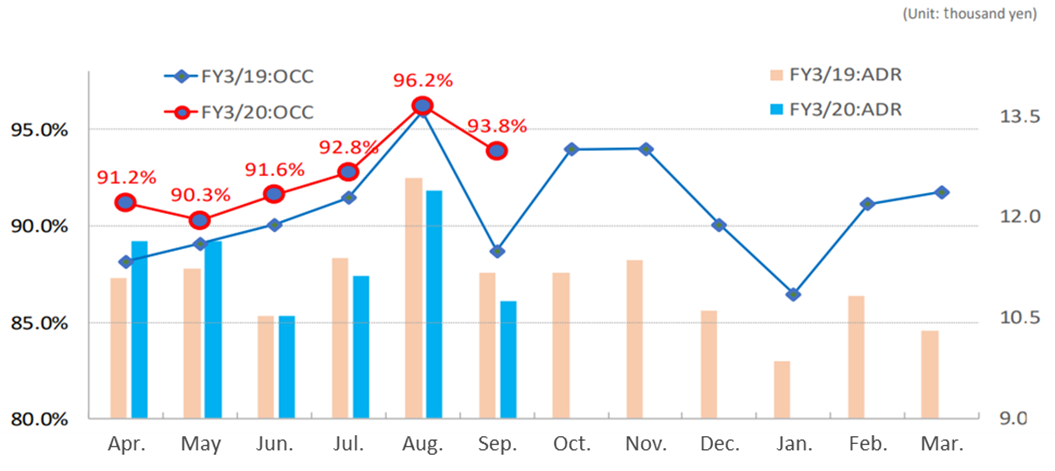

Trend of Current Dormy Inn (Business Hotel) Occupancy Rate and Average Daily Rate

(Note) Above figures are excl. the impact of facilities that have been opened on and after April 1, 2018 to compare 2 periods of occupancy rate and ADR on a common basis

(Source: Kyoristu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data

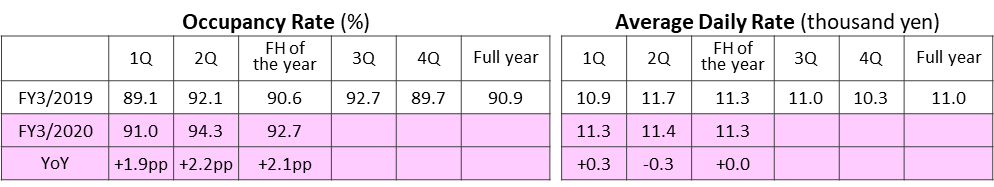

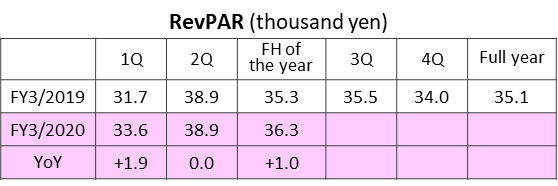

Trend of Dormy Inn Revenue Per Available Room

(Note) Above figures are excl. the impact of facilities that have been opened on and after April 1, 2018 to compare 2 periods of RevPAR on a common basis

(Source: Kyoritsu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data

Variations in the number and ratio of foreign hotel guests of Dormy Inn

(Source: the company)

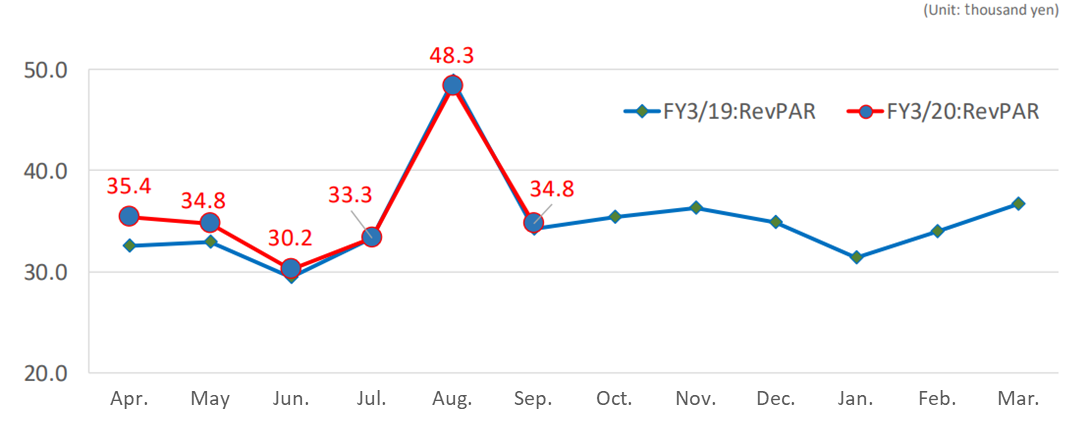

Resort (Resort Hotel) Business

Revenue was 16,960 million yen, up 7.6% year on year. In the current term, the company has opened two facilities: “Echigo-Yuzawa Hot Spring, Yukemuri-no-yado, Yuki-no-hana” and “Kotohira Hot Spring, Oyado, Shikishima-kan.” Though some facilities were temporarily closed for renewal and there were some effects by natural disasters, the company moved its focus to a price strategy and as a result, and RevPAR in existing resort hotels exceeded levels in the same period of the previous fiscal year by 2.8%. Out of the year-on-year revenue increase of 1.19 billion yen, 0.81 billion yen is from the hotels opened in FY 3/2019, 0.4 billion yen is from existing hotels, and 0.33 billion yen is from the hotels opened in FY 3/2020. Operating profit was 707 million yen, down 25.2% year on year. RevPAR was healthy, expenses were rationalized and as a result, existing hotels increased profit by 770 million yen, but could not offset the effects of temporary closing for large-scale renovation and expenses for preparation for opening hotels in the current term.

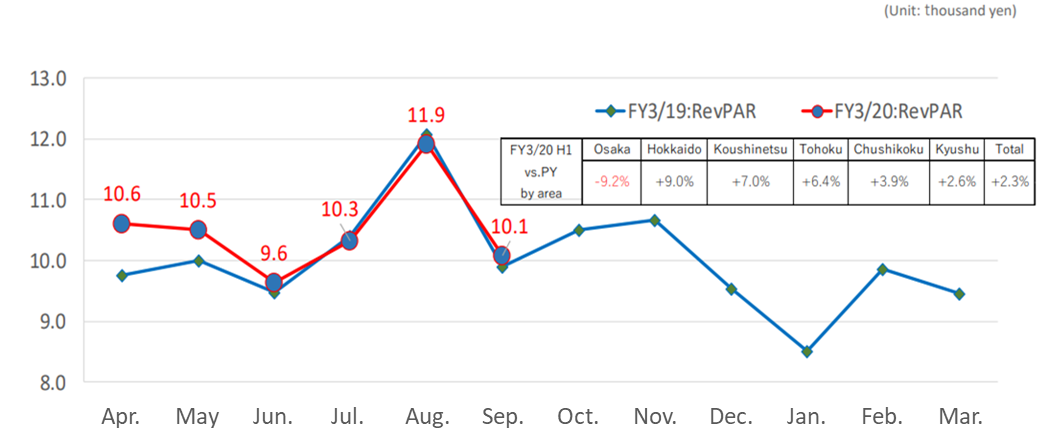

Trend of Resort Hotel Existing Facility Occupancy Rate

(Note) The above graph excludes the hotels opened on or after April 1, 2018. (to compare the above two terms under the same conditions)

(Source: Kyoritsu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data.

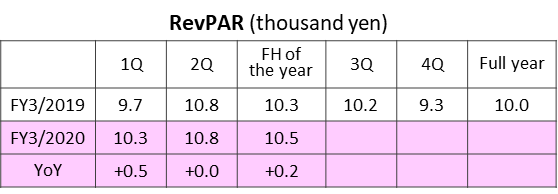

Trend of Resort Hotel Revenue Per Available Room

(Note) Above figures are excl. the impact of facilities that have been opened on and after April 1, 2018 to compare 2 periods of RevPAR on a common basis

(Source: Kyoritsu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data.

Other Business

Revenue was 30,316 million yen, up 13.0% year on year, and operating profit was 1,777 million yen, up 67.6% year on year. Revenue and profit grew in every business. For Comprehensive Building Management Business, revenue was 8,074 million yen, up 8.5% year on year, and operating profit was 231 million yen, up 635.4% year on year. Revenue and profit grew, due to the increase of construction projects and contracts for building custodial service. For Food Service Business, revenue was 3,673 million yen, up 7.4% year on year, and operating profit was 86 million yen, up 240.9% year on year. Revenue and profit grew mainly driven by increase in the contracted hotel restaurants managed, etc. For Development Business, revenue was 11,723 million yen, up 20.5% year on year, and operating profit was 1,061 million yen, up 1.4% year on year.

The revenue of the other businesses (not included in the segments to be reported), including the Senior Life business (management of senior citizen housing), the Public Kyoritsu Partnership business (PKP: commissioned services business for regional government bodies), single life support business and insurance agency business, comprehensive human resource services business, and financing and administrative outsourcing services, increased 9.8% year on year to 6,844 million yen, while their operating profit was 397 million yen (in the same period of the previous year, an operating loss of 43 million yen posted). The steady improvement in profits from Senior Life and PKP Businesses contributed.

(3) Financial Conditions and Cash Flow

◎Summarized Balance Sheet

| Mar. 19 | Sep. 19 |

| Mar. 19 | Sep. 19 |

Cash and Cash Equivalents | 16,643 | 20,413 | Trade Payables | 6,788 | 8,330 |

Accounts Receivables | 9,273 | 13,028 | ST Interest-Bearing Liabilities | 16,150 | 26,467 |

Current Assets | 41,056 | 47,782 | LT Interest-Bearing Liabilities | 66,802 | 63,234 |

Tangible Assets | 108,991 | 107,382 | Liabilities | 122,961 | 124,584 |

Intangible Assets | 3,236 | 3,402 | Net Assets | 79,570 | 84,370 |

Investments and Others | 48,569 | 49,753 | Total Liabilities and Net Assets | 202,531 | 208,955 |

Non-current Assets | 160,796 | 160,537 | Total Interest-Bearing Liabilities | 82,952 | 89,701 |

*Inventories = real estate for sale + real estate for sale in progress + expense of uncompleted contracts

*LT Interest Bearing Liability includes convertible bonds

*Units: million yen

The total assets as of the end of the first half (the end of Sep. 2019) were 208,955 million yen, up 6,423 million yen from the end of the previous term, mainly due to the increase in cash & cash equivalents and accounts receivable. Liabilities augmented 1,623 million yen from the end of the previous term to 124,584 million yen, due to the increase in interest-bearing liabilities. Net assets were 84,370 million yen, up 4.8 billion yen from the end of the previous term, thanks to the rise in retained earnings.

Capital-to-asset ratio was 40.4%, up 1.1 points from the end of the previous term.

Net D/E ratio, one of the KPIs for the Company, was 0.8x. This indicates that financial soundness has been maintained.

◎Cash Flow

| FY 3/19 H1 | FY 3/20 H1 | YoY | |

Operating cash flow | 6,112 | 11,924 | 5,811 | +95.1% |

Investing cash flow | -10,906 | -13,842 | -2,936 | - |

Financing cash flow | 7,584 | 5,747 | -1,837 | -24.2% |

Cash and cash equivalents at the end of the period | 19,790 | 19,857 | 67 | +0.3% |

*Units: million yen

As for operating CF, the company had an inflow of 11,924 million yen, up 5,811 million yen year on year, mainly due to the decline in inventory assets. As for investing CF, the company had an outflow of 13,842 million yen, up 2,936 million yen year on year, due to the augmentation of expenditure for acquiring tangible assets. As for financing CF, the company had an inflow of 5,747 million yen, down 1,837 million yen year on year.

As a result, the balance of cash and cash equivalents as of the end of the first half of the current term grew 0.3% to 67 million yen from the end of the same period of the previous year.

4.Fiscal Year ending March 2020 Financial Forecast

Consolidated Financial Forecast

| FY 3/ 19 Act. | Ratio to revenue | FY 3/ 20 Est. | Ratio to revenue | YoY |

Revenue | 162,811 | 100.0% | 183,000 | 100.0% | +12.4% |

Operating Profit | 14,567 | 8.9% | 15,700 | 8.6% | +7.8% |

Ordinary Profit | 14,321 | 8.8% | 15,400 | 8.4% | +7.5% |

Net Profit | 9,567 | 5.9% | 10,200 | 5.6% | +6.6% |

*Unit: million yen

It is forecasted that revenue and ordinary profit will grow 12.4% and 7.5%, respectively, year on year.

There is no revision to the full-year forecast, and it is projected that revenue will grow 12.4% year on year to 183 billion yen and ordinary profit will rise 7.5% year on year to 15.4 billion yen.

The performance in the first half was healthy, but the full-year consolidated financial forecast has not been revised, considering concerns over the effects of Typhoon Hagibis, which hit Japan in October, and the unstable relation between Japan and South Korea.

As of now, the company plans to allocate most of the funds generated by the acceleration in the sales and lease back of real estate exceeding the amount set in the mid-term plan to additional development investment to earn more profits.

For the estimation of operating profit, the company took into account negative factors amounting to 1.45 billion yen, which is composed of the 450 million yen year on year augmentation of hotel-opening cost, the 800 million yen increase in expenses for large-scale renovation for improving customer satisfaction level and the 200 million yen rise in system upgrading cost.

Preconditions of key indicators for the full-year financial forecast

Dormitory Business

-Initial occupancy rate: 98.7%, up 1.0 points year on year

-Initial number of occupied rooms: 40,089, up 4.5% year on year

Dormy Inn Business

-Number of hotels opened and rooms

・7 hotels/1,535 rooms (+11.6%)

-RevPAR: 10.3 thousand yen, up 3.0% year on year

Resort Business

-Number of hotels opened and rooms

・3 hotels/241 rooms (+9.1%)

-RevPAR: 36.7 thousand yen, up 4.8% year on year

There is no revision to the projected DPS. The projected annual dividend is 47.0 yen per share (including the interim dividend of 22.0 yen/share).

ESG-related activities

・Enhancing corporate governance system

▶ Appointment of outside directors

One outside director who does not belong to the audit committee was appointed in June 2019. The director is a former Commissioner of Japan Tourism Agency, and versed in the administration of land, transportation, and sightseeing.

Two outside directors who belong to the audit committee were appointed. They are versed in finance, accounting, business administration, and economics.

-Developed a system so that the three directors above could monitor the business administration of the company as independent executives (which has been already listed in Tokyo Stock Exchange).

They participate in all the meetings with the board of directors and express their constructive opinions proactively.

▶ To disclose convocation notices electronically/early, to enable shareholders to think over the bills to be discussed at a general meeting of shareholders to a sufficient degree

・Gender equality

▶ The company appointed the first female director at the general meeting of shareholders in June 2019.

▶ The ratio of full-time female employees is increasing (as of the end of fiscal 2018, the ratio was 47.5%, plus 4.9 points from the end of fiscal 2015)

▶The ratios of female executives to executives and to full-time female employees are growing gently.

・Affordable and clean energy

▶ Renewable energy

Participation in activities of Nakanojo Town, Gunma Prefecture, which promotes regional vitalization through the local production for local consumption of electric power

▶ Environmental conservation activities

-To implement the WECO campaign for hotel guests who stay for successive days*

-To adopt business cards made from limestone (LIMEX business cards)

Measures to improve the company’s recognition

■ A corporate TV commercial in the program for broadcasting “Hakone Ekiden” – undoubtedly one of the well-known Ekiden races held in Japan

■ Provision of programs for terrestrial TV, Internet TV, and radio, and corporate TV commercials

■ TV commercials for La Vista of Kyoritsu Resort in Hokkaido and Kyushu areas

■ PR videos of Kyoritsu Resort

■ Official sponsor of the Japan women’s football league (“Nadeshiko League”) in 2019

Signed a contract for official sponsorship with the Nadeshiko League, where “strong, energetic women” flourish.

To support activities for conveying dreams and touching moments from earnest players of the Nadeshiko League to as many people as possible

■ Enhancement of IR activities - Participation in various IR events, etc.

- IR events for individual investors in Japan: Holding of briefing sessions for individual and institutional investors, participation in IR fairs, meetings with investors, etc.

- IR events for institutional investors outside Japan: Participation in overseas IR road shows and conferences

(5 times in the term ended March 2019)

Measures for improving customer satisfaction level

■ Establishment and strengthening of a comprehensive customer network

* Utilization of customer data for optimal hospitality for customers

▶ Effective utilization of data on usage by customers for marketing, and thoroughgoing preservation and management of customer data

▶ By holding customer data in advance, it is possible to attend to customers appropriately when they use the company’s services.

* To design membership programs so that customers will deepen their understanding of the company and keep using its services

▶ To design privileges and services so that loyal and repeat customers will deepen their understanding of the business and services of the company and use them with their family members

* To design point programs for enjoying benefits by using the company’s booking channel

▶ Tie-up with a shared point program with which customers can accumulate and use points easily*

*Formed a tie-up with “d points” of NTT DOCOMO in November 2018. The service of using the d points was launched in April 2019.■ Development of “Domico,” an app for dormitory occupants

(In the current term, the company started installing the app in dormitories.)

* To enable customers to apply for meals and make a cancellation on the day concerned easily with a smartphone

* To enable customers to submit a notification on a sleepover with a smartphone

5.Conclusions

Thanks to the effects of the successive holidays in Golden Week, etc., the business performance in the first half of the term ending March 2020 was healthy. Typhoon Hagibis inflicted enormous damage on the Kanto region at the beginning of the second half, but its effect seems to be minor as a whole. Another concern is the trend of the number of foreign visitors to Japan. In October, the number of South Korean visitors to Japan dropped 65.5% year on year, and the number of foreign visitors decreased 5.5% despite the effects of Rugby World Cup (these figures were estimated by JNTO), but in the first half of the term ending March 2020, the decline in the number of Korean visitors to Japan was fully offset by the increase of visitors from other countries, and the demand from domestic customers was strong. Accordingly, its effect, too, is minor. The company has been struggled with improving the quality of the internet service for customers for years, but various measures are taken these days. The Company will be stronger if it is able to attain good results. In the next term, Tokyo Olympic Games will be held in 2020, and they are expected to bring some benefits to the company. PER is over 20x, but it can be said that there are still scope for share price improvement considering the underlying double-digit growth in FY3/20 operating profit forecast and medium-to-long-term growth potential.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors(as of December 1, 2019)

Organization type | Company with audit and supervisory committee |

Directors (excluding the members of the audit and supervisory board) | 16 directors, including 3 external ones |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report

Modified date: July 17, 2019

<Basic Policy>

Our company has, since inauguration, been following our management philosophy of “customers first” and striving for attaining our management policy of great contribution to society through provision of services of supplying food and shelter. In addition, we consider that it is essential to enrich our corporate governance system in order to achieve sustainable company development and long-term maximization of shareholder’s interest and therefore take multitudinous measures, including acceleration of management decision-making, strengthening of the function of management supervision, enhanced and thorough accountability, expeditious and appropriate information disclosure, and the like. Our company has recognized that one of the most important business challenges is to secure transparency, soundness, etc.

Furthermore, our company as an organization in compliance with the Companies Act has set up general meetings of shareholders, the board of directors, the audit and supervisory board, and accounting auditors. We have also established the compliance committee and meetings to exchange management information on our corporate group.

<Implementation of each principle of the Corporate Governance Code>

Principles | Reasons for non-compliance |

【Supplementary principle 4-10-1 Involvement of and advice from independent external directors regarding important matters, such as nomination and remuneration】

| Our company has not established any advisory committee that consists mainly of independent external directors under our board of directors.In our company, when the board of directors examines nomination and remuneration, it takes into account opinions of multiple independent external directors. |

<Disclosure Based on the Principles of the Corporate Governance Code>

Principle | Background |

【Principle 1-4 So-called strategically held shares】 | < Policy on strategic shareholding>Our company has held shares of our partner companies as strategically held shares for the purpose of cementing our transaction relationships.Taking into consideration various factors of a relevant partner company, such as the profitability at this moment and in the future, the corporate planning department and the department in charge of transactions at our company will assess whether or not it is appropriate to strategically hold shares of the company from the perspective of whether or not strengthening of the business relationship with the company contributes to maintenance and improvement of our company’s corporate value.

<Screening of strategically held shares>Regarding the shares of all of our partner companies that our company has held, once a year, our corporate planning department asks the department in charge of transactions about the status of shareholding, taking into account the initial purpose of acquiring the shares, the trading conditions, such as the current transaction amount and transaction content, and economic rationale based on cost of capital and other related factors.When it turns out, through the screening, that some of the shares do not suit our initial purpose of share acquisition any longer, we will reduce them through sale or any other means. The details of the screening are reported to the board of directors every year. We discussed the purposes of holding shares of business partners and the rationality of shareholding as of the end of the term ended March 2019, and decided to keep holding the shares of 12 companies.

<Criteria for exercising voting rights>Regarding the exercise of the voting rights related to the strategically held shares, our company will exercise the rights in a proper manner, after assessing whether or not the content of a relevant bill contributes to maintenance and improvement of our company’s corporate value and enhancement of shareholders’ value through dialogue with a related company by the department (company) in charge of transactions and examination by dedicated departments, such as our corporate planning department.With respect to any bill that could damage our company’s corporate value or shareholder value, we will not exercise the voting rights in a positive manner, regardless of whether or not the bill has been proposed by our company or any of the shareholders. |

【Principle 2-6 Fulfillment of functions as an asset owner of corporate pension funds】 | Our company has adopted a contract-type corporate pension plan, and endeavors to prevent any conflict of interest from arising between beneficiaries of the corporate pension funds and our company by entrusting multiple Japanese and overseas pension fund management institutions with management of the reserve fund, and leaving entirely to each of those institutions selection of organizations to invest in and exercise of the voting rights.Our company has assigned human resources with expertise in finance and personnel affairs to the department in charge of fund management so that the department will be able to develop greater expertise and fulfill their expected functions, such as monitoring of pension fund management institutions. |

【Principle 4-11 Preconditions for ensuring the effectiveness of the board of directors and the audit and supervisory committee】 ≪Supplementary principle 4-11-1≫ Views on the appropriate balance, diversity, and size of the board of directors as a whole | Our company has appointed people with extensive knowledge and experience in various fields, such as corporate management and finance, as directors in accordance with our policy of designating directors regardless of nationality, race, or gender.With each of the directors possessing considerable expertise, our board of directors as a whole is well balanced and diverse in terms of knowledge, experience, and skills.In addition, we endeavor to achieve greater diversity by appointing those who have profound knowledge and insight as independent external directors. |

≪Supplementary principle 4-11-2≫ Status of members holding concurrent posts among the board of directors and the audit and supervisory committee | Our company discloses, every year, the status of directors who concurrently hold multiple posts through the reference material attached to the Notice of Convocation of General Meeting of Shareholders.Furthermore, as the attendance rate of the directors, including independent external directors, at meetings of the board of directors is high, where the directors proactively speak up, ask questions, and hold discussion with each other, we have considered that the number of directors holding concurrent posts is reasonable and acceptable, and the directors have properly fulfilled their respective roles and responsibilities. |

≪Supplementary principle 4-11-3≫ Evaluation of the effectiveness of the board of directors | Once a year, our company analyzes and evaluates the effectiveness of the board of directors during a period from the end of March to May, which corresponds to the end of a fiscal year. The methods for analysis and evaluation are to conduct a questionnaire survey targeting directors, summarize the results at the secretariat of the board of directors, and check the contents of the analysis and evaluation at a meeting of the board of directors. As a result of the evaluation of the effectiveness of the board of directors in the previous fiscal year, it was concluded that there are no special problems with the structure and operation of the board of directors, the provision of information to directors, or the like, and the board of directors functioned effectively. By implementing various measures, our company will strive to improve the effectiveness of the board of directors further. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.

The back number of Bridge Reports (Kyoritsu Maintenance Co., Ltd.:9616) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/