| enish, inc. (3667) |

|

||||||||

Company |

enish, inc. |

||

Code No. |

3667 |

||

Exchange |

1st Section of Tokyo Stock Exchange |

||

Industry |

Information, Communications |

||

President |

Kohei Antoku |

||

HQ Address |

39th Floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

*Stock price as of close on July 31, 2015. Shares outstanding as of end of most recent quarter and exclude treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. 20 for 1 and 2 for 1 stock splits were performed in September 2012 and October 2013 respectively.

* EPS has been adjusted to reflect these stock splits. |

|

| Key Points |

|

| Company Overview |

|

Native apps are those that can be enjoyed by users by downloading them to their smartphones. Browser applications, on the other hand, are not downloaded but can be accessed and enjoyed over various platforms like GREE, mixi, and Mobage. Both forms of applications are provided free of charge, but various items including tools (In the case of "Bokuno Restaurant II," recipes and items to decorate the interior of restaurants can be purchased to make the games more fun to use and more attractive to virtual customers within the game) used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a portion of the fees received is paid by enish to the platform providers as usage fees. <Management Policies: Creation of High Value Added Services, Provision of New Enjoyable Experiences>

First, in order to achieve the mission of "Creating enish Fans throughout the World" based upon the corporate slogan of "Link with Fun," enish's game designers, engineers, and art designers will create high value added services. Second, the Company maintains a fundamental management policy of "striving to be a company that always produces creators and specialists with skills that are recognized by the global market" and it will provide new enjoyable experiences through its social applications to users throughout the world. These two are the core management policies of enish.

<Company History>

<Business Description>

enish maintains only a single business segment entitled the social applications business (Games are considered as one type of application category). Based upon the Company's earnings foundation built up in the browser application business, enish is also fortifying its efforts in the newer native apps business. While games are provided free of charge, various items including tools used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a fee is paid by enish to the platform providers as usage fees. In addition, enish is cultivating the "Online to Offline (O2O) business where advertisements are posted within the games (Providing companies which seek to use games as opportunities to promote sales).

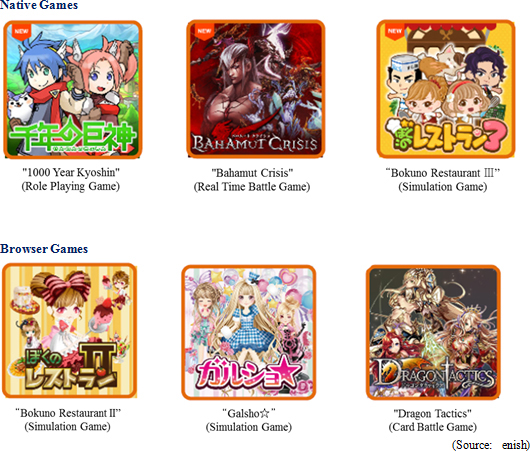

<Main Titles>

"Bokuno Restaurant II", "Galsho☆" and other management simulation games are long selling games that are popular with female users. In particular, sales of "Galsho☆"continue to grow despite the passage of four years since its release. The ratio of male to female users of browser based games is 39.1% to 60.9% respectively. enish is promoting a shift from browser games to native games and it has released three native games, namely "1000 Year Kyoshin", "Bahamut Crisis", and "Bokuno Restaurant III" during fiscal year December 2014.

|

| First Half of Fiscal Year December 2015 Earnings Results |

Sales Fall 11.5% Year-On-Year, Current Loss of ¥630 Million Incurred

Sales fell by 11.5% year-on-year to ¥2.880 billion. The declining trend was inevitable as browser applications still make up the bulk of overall sales, but it remained basically in line with expectations. Meanwhile, the contributions of native applications were limited, due in part to the fact that sales of the updated "1000 Year Kyoshin" in May 2015 fell shy of initial estimates by about 80%, and also to the delays in release of new titles aimed at quality improvement.An operating loss of ¥627 million was incurred. The poor performance of native applications caused weaker-than-expected sales, which could not absorb the higher costs for new titles, such as higher outsourcing fees and higher labor expenses due to increased personnel costs. Consequently, a gross loss of ¥2 million was incurred (According to enish's accounting practice, game development expenses, including those for the coming term onwards, shall be booked in the term that they occur). At the same time, reviews of the selling, general and administrative expense structure led to the booking of one-off expenses and to a 5.8% year-on-year increase in SG&A expenses to ¥625 million. Efforts to improve profitability from the second half onwards including restructuring and reductions of overseas facilities contributed to the booking of an extraordinary loss of ¥159 million. Combined with the influence of tax effect accounting (Deferred tax assets reversals totaling ¥303 million were booked due to the earnings estimates which called for losses during the full year), a net loss amounting to ¥1.050 billion was incurred during the first half.    Cost of sales rose by 26.5% year-on-year and 7.8% quarter-on-quarter to ¥1.495 billion. While fee collection commissions declined due to the lower sales, labor expenses arising from increases in the work force and outsourcing fees for new title development grew. Selling, general and administrative expenses rose by 14.6% year-on-year and 20.5% quarter-on-quarter to ¥341 million. Advertising expenses for "1000 Year Kyoshin" and commissions arising from the reduction of overseas operations increased. At the same time, refined hiring activities allowed hiring expenses to decline from the previous term and overall personnel expenses to stabilize.   |

| Fiscal Year December 2015 Earnings Estimates |

Full-Year Earnings Estimates Revised to Reflect Native Application Development Trends of the First Half

Sales are expected to decline by 10.1% year-on-year to ¥5.8 billion during the full year. Amidst the declining trend in browser applications, the weak response to "1000 Year Kyoshin", halt of development of some titles, and delay in development of new titles are expected to limit the potential contributions from native applications to overall earnings. At the same time, operating expenses are expected to rise by 8.7% year-on-year to ¥6.850 billion due to development expenses for new titles and one-off expenses arising from reductions and withdrawals in the overseas business. Extraordinary losses resulting from restructuring and reductions in overseas facilities and reversal of deferred tax assets are expected to contribute to a net quarterly loss of ¥1.6 billion.Meanwhile, ¥30 million in advertising expenses for each of the four native application titles scheduled to be released during the second half have been factored into enish's earnings estimates. Factors behind the Earnings Estimate Revision

With regards to existing titles, the decline in browser applications is expected to be in line with expectations. However, the outlook for sales of the native application "1000 Year Kyoshin" has been revised significantly downwards. At the same time, key performance indicator analysis is currently being conducted and the estimates for the updated version and the Android version of "Bokuno Restaurant 3 DX" released during the first half remain unchanged. And while browser application sales are expected to decline overall, some titles are reportedly showing signs of recovery.In the meantime, out of the six titles that had been originally scheduled to be released during the current term, two have been frozen and the other four have been postponed. The two titles the development of which has been frozen are "Valiant Soul," which was found difficult to improve its quality, and "Kunio-kun," the development of which has been behind schedule and its outlook unclear. Work on "Kunio-kun", which is a familiar character in Japan, had been promoted along with a Korean manufacturer to localize it for the Korean market. Moreover, the remaining four titles are all in their final stages of completion and efforts are being made to further improve their quality. Reduction in Managing Director Compensation

To take responsibility for the weaker earnings performance during the current term, the managing directors plan to implement a reduction in their compensation beginning from July for an unspecified period of time as specified below:

Details of Managing Director Compensation Reductions

Endeavors to Realize Revised Earnings Estimates

In order to grow the top line, measures to improve operational quality and functions, and to strengthen the earnings foundation of the existing browser applications will be implemented. At the same time, efforts will be promoted to increase the development speed of native applications and to strictly adhere to the development plans.With regards to the supervisory function, an internal committee will lead efforts to promote attainment monitoring and milestone management, and quality levels will be confirmed at an early stage by using prototypes. With regards to costs, various cost reduction efforts will continue to be promoted including optimization of human resources, reduction in director compensation, reductions in overall costs, and strengthening of the supervisory function. In addition to the above, enish has also begun to restructure its overseas business. enish has begun to reduce its overseas facilities in China, Korea, etc. due to its decision to collaborate with local partners for distribution of contents in overseas markets and halt their own provision of contents. Moreover, the Thai subsidiary has been closed and the CS function has been transferred back to Japan to change some fixed costs to variable costs. (2) Endeavors to Achieve Growth

Introduction of new native titles, global deployment, and maintenance of a stable earnings foundation are the three main issues in enish's business deployment strategy.With regards to native title introductions, games will be deployed in various genre regardless of user gender, and strict adherence to development plans will also be implemented. As explained earlier, a decision has been made to collaborate with local partners to lower the risk of global business development. Furthermore, Japanese contents to be introduced into overseas markets will be determined after trends in the Japanese market have been assessed. Maintenance of a stable earnings foundation will be achieved by leveraging marketing capabilities and maintaining profitability of existing browser titles, while at the same time implementing measures to continue to introduce contents and add new functions. (3) Titles Currently Being Developed

Currently, four titles (Two titles each for male and female users) are being developed and all of them are scheduled to be released within the current term.

|

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015, Investment Bridge Co., Ltd. All Rights Reserved. |