| enish, inc. (3667) |

|

||||||||

Company |

enish, inc. |

||

Code No. |

3667 |

||

Exchange |

1st Section of Tokyo Stock Exchange |

||

Industry |

Information, Communications |

||

President |

Kohei Antoku |

||

HQ Address |

Roppongi Hills Mori Tower 39F, 6-10-1 Roppongi, Minato-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

*Stock price as of close on October 30, 2015. Shares outstanding as of end of most recent quarter and exclude treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. 20 for 1 and 2 for 1 stock splits were performed in September 2012 and October 2013 respectively.

* EPS has been retroactively adjusted to reflect these stock splits. |

|

| Key Points |

|

| Company Overview |

|

Native applications are applications that can be enjoyed by users by downloading them to their smartphones. Browser applications, on the other hand, are not downloaded but can be accessed and enjoyed over various platforms such as GREE, mixi, and Mobage. Both forms of applications are provided for free, but various items including tools used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social networking services (SNS) platform providers, and a portion of the fees received is paid by enish to the platform providers as usage fees. <Corporate Vision: Cultivating Fans of enish Around the World>

Based upon the concept of "Link with Fun", enish maintains a goal of "cultivating fans of enish around the world."

<Business Description>

enish maintains only a single business segment entitled social applications business (Games are considered as one type of application category). Based upon the Company's earnings foundation built up in the browser application business, enish is also cultivating its efforts in the newer native applications business. While games are provided free of charge, various items including tools used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased for browser applications is seconded to the social networking services (SNS) platform providers, and a fee is paid by enish to the platform providers as usage fees. Also, enish is cultivating its efforts in Online to Offline (O2O) business, which develops in-game advertising of alliance partners (alliance partner capitalizes on enish's games as a part of sales promotion).Social games have features that allow: 1) users to communicate with other users through games, 2) items and tools to be sold to users of games which are provided free of charge, 3) smartphone users to easily play games for free, 4) games without goals to be played, 5) release of new functions as games are updated, and 6) the function to allow for the addition of characters and items in the normal operations of games as a means of differentiating them from packaged games. How the games are "operated" after the launch is the key for the success of games after their "launch". "Operation" refers to event operations within games, and the three different types of events including acquisition event where items and characters are acquired and collected to develop games, cultivation event where characters are cultivated for growth of both characters and games (Implement distribution of specialized items needed for cultivation), and usage event where cultivation items and characters capability are tested. Furthermore, the usage event draws a great deal of attention from users and contributes to large growth in sales as it allows for users to battle and cooperate with each other in the games and displays user rankings in real time as the game progresses. <Social Games Market Environment>

According to a research firm, mobile game market size within Japan is estimated to increase from ¥261.0 billion in 2012 to ¥827.0 billion in 2015. The ratio of native games, market drivers, to the total is expected to have risen from 44% in 2012 to 71% in 2015.

<Fundamental Policies>

Introduction of new native titles, global deployment, and maintenance of a stable earnings foundation are the three fundamental policies in enish's business deployment strategy. With regards to native title introductions, games will be deployed in various genres regardless of whether they target male or female users, and strict adherence to development plans will also be implemented. Furthermore, the outcome of launch in the Japanese market will be carefully considered in collaboration with local partners to lower the risk of global business deployment. Maintenance of a stable earnings foundation will be achieved by leveraging marketing capabilities and maintaining profitability of existing browser titles, while at the same time implementing measures to continue to introduce contents and add new functions.

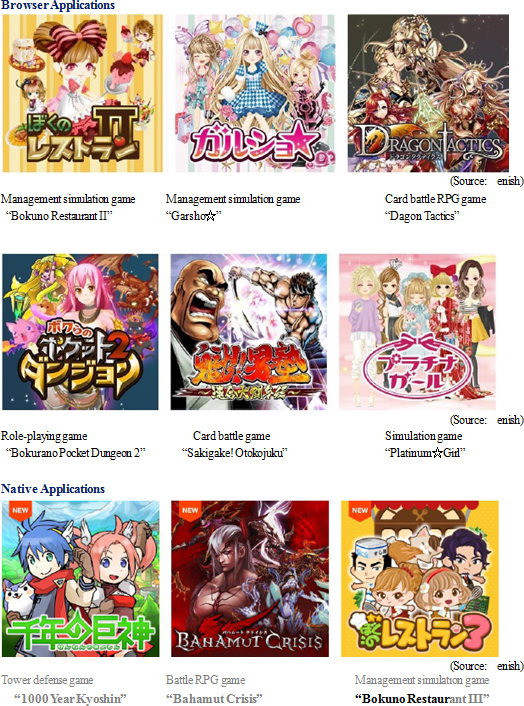

<Main Titles>

"Bokuno Restaurant II", "Garsho☆" and other management simulation games are long selling games that are popular with female users. The ratio of males and females in browser games base is 39.1% and 60.9% respectively. Many of the female users are long-term ongoing users.

|

| Third Quarter of Fiscal Year December 2015 Earnings Results |

Native Games Weak, but Browser Games Strong

Sales declined by 3.5% quarter-on-quarter to ¥1.312 billion during the third quarter (July to September). Native games suffered from weak demand but strength in browser games including "Garsho☆","Platinum☆Girl" and "Sakigake! Otokojuku" helped to limit the decline in total sales. With regards to profits, reviews of the cost structure contributed to large declines in cost of sales and sales, general and administrative expenses compared with the second quarter, and allowed the operating loss to decline from ¥476 million during the second quarter to ¥165 million in the third quarter.

"MIRA MIRA" (Publishing Title) Released on August 27

With regards to native games, the simulation game called "MIRA MIRA" (Publishing title) was released on August 27, and a game developed by Square Enix called "Yurukami!" was expanded to make it more attractive to female users was also released on October 9. Meanwhile, the market maintained strong expectations for the role-playing game "12 Odins" (Original title), scheduled to be released during the third quarter, as reflected by the large number of pre-launch member registrations of over 120,000. But the release of competing role-playing games by competitors and the shortfall in key performance indicators (KPI) of "MIRA MIRA" led enish to postpone the launch of "12 Odins" to pursue further improvements in its quality.

Proper Strategy, Consignment to External Partners of Operations for Existing Native Applications

With regards to the weak trend for existing native games, enish is considering the consignment of operations of existing native applications to external partners as part of its strategy to efficiently leveraging human resources, and has completed the transfer of operations of "1000 Year Kyoshin" during the third quarter. Also, enish has decided to switch operations of "Bokuno Restaurant III" to an external partner based upon key performance indicators.

With regards to sales, general and administrative expenses, a small increase in advertising expenses for new titles was recorded, but declines in director compensation due to a reduction in pay, general payroll resulting from rationalization of the workforce, hiring expenses arising from restraint in new hires and commissions paid due to rationalization and reductions in overseas facilities were recorded.  Sales Fell by 13.1%, Operating Loss of ¥793 Million Incurred (Compared with Operating Profit of ¥294 Million in Previous 3Q)

Sales declined by 13.1% year-on-year to ¥4.192 billion. This result was basically in line with expectations given the outlook for a continued downtrend in browser games, which still account for a majority of enish's sales. At the same time, weakness in native games was noted along with the release of the updated version of "1000 Year Kyoshin" in May and the release of "MIRA MIRA" in August.With regards to profits, the lower sales resulting from weakness in the updated version of "1000 Year Kyoshin" and the postponing of a new title release, and increases in new title development, outsourcing, and labor expenses contributed to a deterioration in cost of sales margin. And while sales, general and administrative expenses remained in line with the previous year's levels due to cost structure reviews, an operating loss of ¥793 million was incurred (Compared with an operating profit of ¥294 million in the previous third quarter). Losses resulting from closure of enish Thailand's operations, and reductions in enish China's operations contributed to the booking of an extraordinary loss of ¥158 million, which in turn led to the booking of a net loss of ¥1.221 billion (Compared with a net profit of ¥167 million in the same period of the previous year).  Note Regarding Revision of Exercise Price for 7th Third Party Placement Stock Option Issuance

In order to secure funding necessary for development of native applications and marketing activities, including the acquisition of popular intellectual properties, stock acquisition rights were issued by third party allotment to Daiwa Securities on September 24, 2015. enish plans to make aggressive acquisitions of popular native application intellectual properties and has already entered into negotiations with multiple companies for the acquisition of intellectual properties. Titles based on popular intellectual properties that are widely known to users can easily relate the story lines (therefore higher marketing efficiency) and can contribute to the acquisition of new users and raising of existing user satisfaction levels (High retention rates have been confirmed).Intellectual property rights include not only those of original authors but also those concerning secondary works that were developed by using the original copyrights. The intellectual properties that enish intends to use include movies, animations, comics and their characters, etc. Capital Funding Overview

|

||||||||||||||

| Fiscal Year December 2015 Earnings Estimates |

4Q: New Title Contribution Expected to Boost Sales, but Conservative Outlook for Profitability Adopted

In addition to the celebrity simulation game "MIRA MIRA" for female users released in August, "Yurukami!" jointly developed with Square Enix was launched in October. Furthermore, the farming simulation game called "Qlton" and the role-playing game called "12 Odins" are expected to be released during the fourth quarter. In addition to the contributions from the above-mentioned native games, a continuation of the favorable trend in browser games is expected to lead to the large quarter-on-quarter increase in sales during the fourth quarter. However, a conservative stance with regards to profitability has been adopted due to the outlook for aggressive advertising spending. Consequently, the operating loss is expected to expand from ¥165 million during the third quarter to ¥255 million during the fourth quarter.

(2) Endeavors to Achieve Full-Year Earnings Estimates

With the goal of achieving its earnings estimates, enish has been focusing efforts on four issues from the second quarter onwards: 1) expanding sales, 2) strengthening of the progress management structure, 3) rationalization of and reduction in overseas facilities, and 4) implementation of strict cost controls. With regards to the rationalization and reduction in overseas facilities, enish has switched to a strategy of collaborating with local partners distributing its contents in overseas markets and subsequently chosen to rationalize and reduce facilities in China, and moving the customer service (CS) function from Thailand to Japan as a means of switching fixed costs to variable costs (Move has been completed). Moreover, various cost saving measures have been implemented, including optimization of the work force, reduction of director compensation and all the other measures as part of the strategy of strict adherence to cost management (Although the Company plans to continue strengthening its administrative structure and further promoting cost reduction, in an overall view, the Company's efforts have been nearly completed).On the other hand, the efforts to expand the sales and strengthen the progress management structure are still underway. With regards to the expansion of the sales, measures to strengthen the earnings structure, including addition of functionality and improvement in operations, are being implemented. Endeavors to shorten the development period for new titles and strict adherence to development plans are also being implemented. Furthermore, a task force comprised of an internal committee is taking the lead in strengthening the progress management structure including milestone management, progress monitoring, and prototyping to validate quality levels at an early stage. Efforts to Expand Sales

Ongoing efforts are being made to improve operational quality and add functionality to browser games, which are a driver of earnings, and the relatively small margin of decline in sales of 3.3% quarter-on-quarter during the third quarter can be attributed to the success of these efforts. With regards to improve operational quality, outsourcing of some management tasks, shifting to in-house manufacturing, and placing of important functions under enish's control have been undertaken. Also quality checks and monthly reviews of companies to which work is outsourced are being made into part of the routinely conducted practices.As explained earlier in this report, four new native games are expected to be released. "MIRA MIRA" and "Yurukami!" had been already launched, and "Qlton" and "12 Odins" are expected to be released in the middle to the last part of the fourth quarter ("Qlton" and "12 Odins" are currently in the final phase of development.). Also, developing a popular IP is currently being developed as a new title to be released in the fiscal year December 2016.     |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

|