Bridge Report:(4767)TOW the fiscal year ended June 2022

Kenichi Muratsu President | TOW Co., Ltd.(4767) |

|

Company Information

Market | TSE Prime Market |

Industry | Service |

President | Kenichi Muratsu |

HO Address | Tokyo, Minato-ku, Toranomon 4-3-13, Hulic Kamiyacho Building |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥306 | 45,472,344 shares | ¥13,914 million | 5.8% | 100 shares | |

DPS Est | Dividend yield Est | EPS Est | PER Est | BPS Act | PBR Act |

¥14.40 | 4.7% | ¥3.85 | 79.5 x | ¥231.21 | 1.3 x |

*Share price as of closing on September 27, 2022. Number of shares issued at the end of the most recent quarter excluding treasury shares. ROE and BPS are results from FY 6/22, EPS and DPS are results from FY 6/23 forecast (average value of range forecast).

Numbers are rounded.

Consolidated Earnings

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

June 2018 (Act.). | 16,688 | 1,825 | 1,873 | 1,207 | 26.87 | 13.50 |

June 2019 (Act.). | 16,278 | 1,995 | 2,017 | 1,345 | 29.94 | 14.50 |

June 2020 (Act.). | 19,325 | 2,316 | 2,332 | 1,584 | 35.26 | 16.75 |

June 2021 (Act.). | 12,209 | 655 | 698 | 455 | 10.14 | 12.90 |

June 2022 (Act.). | 11,134 | 883 | 924 | 598 | 13.22 | 14.00 |

June 2023 (Est.). | 11,200 ~12,200 | 907 ~1,076 | 930 ~1,100 | 95 ~254 | 2.11 ~5.60 | 14.40 |

*Unit: million-yen, yen. Estimates are those of the Company. From the FY ended March 2016, the definition of net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

* On April 1, 2020, the company implemented a 2-for-1 stock split, which is reflected in EPS and DPS.

We present this Bridge Report reviewing the fiscal year ended June 2022 earnings results and the outlook for the fiscal year ending June 2023 for TOW.

Table of Contents

Key Points

1. Company Overview

2. Action Plan for FY June 2023

3. Fiscal Year ended June 2022 Earnings Results

4. Fiscal Year ending June 2023 Earnings Forecasts

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

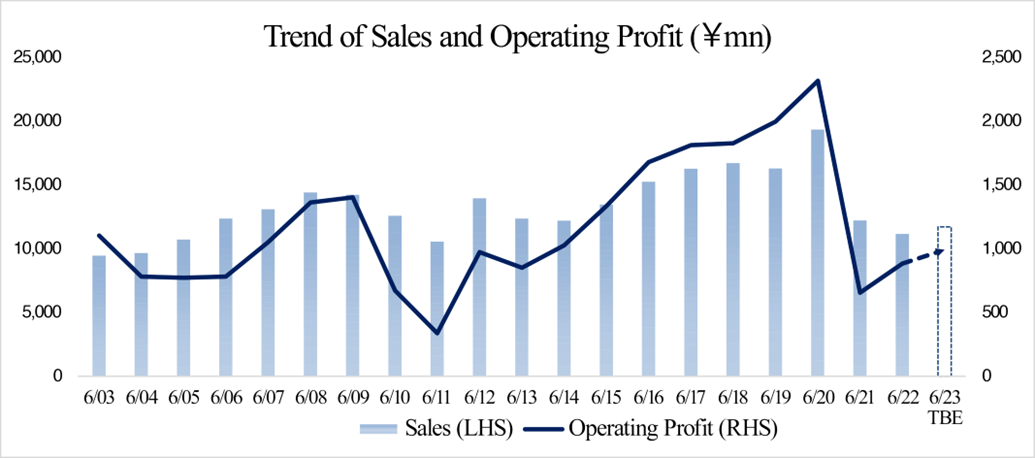

- In FY June 2022, sales dropped 8.8% year on year, but ordinary income rose 32.3% year on year. The business of real events, which has been the mainstay, recovered temporarily in the first half of FY June 2022, as COVID-19 subsided. In the second half, some projects were postponed or cancelled due to pre-emergency measures against COVID-19, affecting the recovery of large-scale events in the advertisement market. On the other hand, the business of producing online events and promotion has grown steadily. Profit grew considerably, as there was no impact of large-scale projects for public offices and groups, which were less profitable in the previous term, and the company kept promoting “the monetization of value of specialized personnel,” “the securing of appropriate revenues through the enhancement of the functions of the production management section,” and “the improvement in profitability through in-house production.” They paid a term-end dividend of 7.00 yen/share (for an annual dividend of 14.00 yen/share).

- For FY June 2023, it is expected that sales will increase 0.6-9.6% and ordinary income will rise 0.7-19.0% from the previous term. Since the period affected by the pandemic and the scale of cancellation or postponement are still unpredictable, the company decided to disclose the estimated ranges of the earnings forecasts. In this situation, the company will continue its growth strategies in a steady manner, in order to grow the real and online business domains. In the fields of online events and online promotion, the company will strive to grow further while expecting that online advertisements will increase. In the field of real events, the company aims to recover its performance based on the accumulated knowledge and new ideas. In terms of profit, the company will keep improving profitability by monetizing the value provided by personnel with expertise and realizing in-house production. The company plans to pay a dividend of 14.40 yen/share, including an interim dividend of 7.20 yen/share.

- The drop in sales in FY June 2022 is due to the decrease of orders for large-scale projects from public offices, which were less profitable. The businesses targeted at private enterprises were all healthy. Accordingly, the company secured a significant increase in profit. The forecasts for FY June 2023 are shown with ranges. The novel coronavirus has been spreading recently, but its impact on real events seems to be limited. The company swiftly prepared for online events and promotion before its competitors. Regarding online promotion, it seems that the company can secure profit from even projects with a low unit price. It seems that the company is about to complete a business model that can minimize the impact of the spread of COVID-19 on revenues even if its sales composition is different. It can be said that the company is getting back on a recovery trend after the coronavirus pandemic.

1. Company Overview

TOW is the largest independent company in the field of events and promotion of the advertising industry and is listed on the Prime market of the Tokyo Stock Exchange. They have expanded the scale of their business with the planning, production, and operation of press conferences, promotional events, exhibitions, and cultural and sport events as their forte. In addition to the production capabilities cultivated through real events, they have engaged in business in the digital field since the early 2000s and have been successful in acquiring new customers, fostering the relationship with and bringing new stimulation to their existing customers by making full use of their planning and production capabilities centered on experience value* and exerting the capability to create catching content and the capability to revitalize platforms in regard to their offline and online activities.

TOW have been engaging in the development of TOW Experience Design Model, which will contribute to the growth of their clients, realizing the improvement of the value they provide and business growth, and sets their new corporate image as to be a production for designing outcomes centered on experience value.

The corporate group is composed of TOW Co., Ltd. and its consolidated subsidiary T2 Creative Co., Ltd. (hereinafter called “T2C”), which produces, operates, and directs events and produces videos (as of the end of June 2022).

“Interactive Promotion (IP)” means the promotion through the creation of impressive experiences with digital technologies and ideas and the distribution of information on the experiences to win sympathy.

*Experience value: Implied to emotional, sensational, and rational values that appeal to customer’s experience

Business Description

Planning to Implementation of Events and Promotion

A transaction concerning events and promotion arises as soon as an organizer or a promoter thinks of any objective (intention to get information across to their audience).

TOW receives an explanation on this objective from the organizer or promoter, and after analysis and research, they formulate a strategy or plan. Then, they proceed into each stage, developing the initial plan into a basic scheme, an implementation scheme, and a detailed scheme based on numerous meetings, which in the end become deliverables matching the respective method. TOW proceeds with the preparations according to reference material and conducts events and promotion.

Scope of TOW’s Business

TOW receives orders for the whole abovementioned process from planning to implementation. They undertake analysis and research, devising a strategy and formulating the concept, project proposal, actual production, effectiveness verification, and other work incidental to the above processes, employing a number of methods tailored for each task.

TOW’s work lies in conveying the intention of an organizer or a promoter to consumers by taking on the comprehensive production and direction of the overall promotion, while outsourcing respective tasks to companies specialized in respective fields including real events, online events, video creation, SNS-based campaigns, digital advertising operation, digital media operation, SNS account operation, user experience design of digital services, promotion, and sales promotion and so on.

T2 Creative Co., Ltd. conducts mainly the “production,” “operation,” and “direction” of events.

Purpose

The company set its purposes with the hope of contributing to customers, residents, and society based on “the value of experience,” which is the universal strength of the company.

2. Action plan for FY June 2023

| Expansion of real events | To hold real events in various ways according to purposes |

The company will grasp the changes in the economy, lifestyles, etc., address new social issues, and promote real events that would enliven society, enterprises, and residents, to lead “the return to reality.”

(Taken from the reference material of the company)

| Expansion of real events | Enhancement of proposals for “real experiences in the new age” and the establishment of value to be offered |

To evolve real value by combining the nurtured knowledge of planning and producing events and new ideas

To create real experiences with “new roles” suited for the OMO* age

【Release in May 2022】

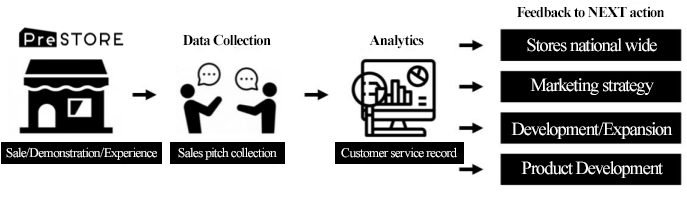

Experience-based test marketing service “PreSTORE”

✓To establish a real foothold in prime land in Tokyo, and carry out demonstrative experiments for sale, attending to customers, etc.

✓To analyze the real voices and behavior of visitors to their shop and collect findings for the next action

(Taken from the reference material of the company)

To propose new real PoC measures for supporting the business expansion of enterprises

*OMO: Abbreviation of Online Merges with Offline, which means the fusion of online and offline items

PoC: Abbreviation of Proof of Concept, which means the demonstration of feasibility of a concept

【Release in June 2022】

EVENT CONNECT, a real event package linked with LINE

✓It is possible to make a reservation for an event in LINE, and use LINE-linked contents at the venue of the event.

✓It is possible to receive messages for “users” via LINE even after an event.

(Taken from the reference material of the company)

To contribute to the development of sustainable relationships between enterprises and residents and the increase of fans

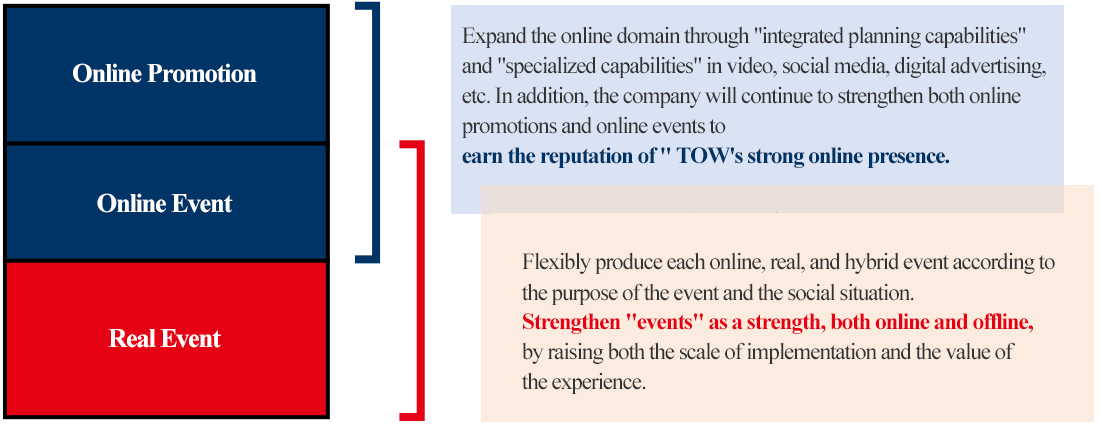

| Expansion of the online field | To expand the field while focusing on “social media,” “videos,” and “digital advertisement” |

Based on comprehensive planning, the company will expand the field of online experiences with social media, videos, and digital advertisement.

To do so, the company will organize a functional team/group, and accelerate the expansion of the field.

(Taken from the reference material of the company)

| Improvement in the superiority and originality of TOW | To develop solutions based on “value of experience,” which is the forte of the company |

【Development of new original solutions】

✓To establish “Experience Design Lab,” which leads development and utilization

★Themes under consideration

・Digital sales promotion field

・Metaverse

・Solutions linked with social media

・Environment-oriented events

Setting priority themes for real and digital events

【Continuation and advance of “Experience Design Engine”】

✓To enrich the functions of “Experience Design Engine,” an original database of outcomes, which was developed last year

✓To collect data of about 30% of projects in the previous fiscal year. This fiscal year, the company will design experiences and collect and use data, with the aim of collecting data of about 50%.

3. Fiscal Year ended June 2022 Earnings Results

(1) Consolidated Earnings

| FY 6/21 | Ratio to sales | FY 6/22 | Ratio to sales | YoY | Company Forecast | Forecast Ratio |

Sales | 12,209 | 100.0% | 11,134 | 100.0% | -8.8% | 11,051 | +0.8% |

Gross profit | 1,470 | 12.0% | 1,733 | 15.6% | +17.9% | - | - |

SG&A | 815 | 6.7% | 850 | 7.6% | +4.3% | - | - |

Operating Income | 655 | 5.4% | 883 | 7.9% | +34.7% | 801 | +10.3% |

Ordinary Income | 698 | 5.7% | 924 | 8.3% | +32.3% | 841 | +9.9% |

Quarterly Net Income Attributable to Owners of Parent | 455 | 3.7% | 598 | 5.4% | +31.3% | 543 | +10.2% |

*Unit: million yen. Figures include reference figures calculated by Investment Bridge Co., Ltd. and actual results may differ (applies to all tables in this report)

Sales declined 8.8% year on year, but ordinary income rose 32.3% year on year.

Sales were 11,134 million yen, down 8.8% from the previous term. As the business environment, the field of real events saw a temporary recovery trend in the first half of the term, as COVID-19 subsided. In the second half, the postponement and cancellation of projects due to the pre-emergency measures against COVID-19, which were taken intermittently from January 2022 to March 21, hindered the recovery of large-scale events in the advertisement market. On the other hand, the Internet ad market expanded, leading to the steady growth of the field of production of online events and promotion.

The sales in each category are as follows.

| FY 6/21 | FY 6/22 | |||

Sales | Ratio to Sales | Sales | Ratio to Sales | YoY | |

Real Events | 3,381 | 27.7% | 4,563 | 41.0% | +35.0% |

Online Events | 2,601 | 21.3% | 2,787 | 25.0% | +7.1% |

Online Promotion | 2,106 | 17.2% | 3,586 | 32.2% | +70.3% |

Other | 4,121 | 33.8% | 198 | 1.8% | -95.2% |

Total | 12,209 | 100.0% | 11,134 | 100.0% | -8.8% |

*Unit: million yen.

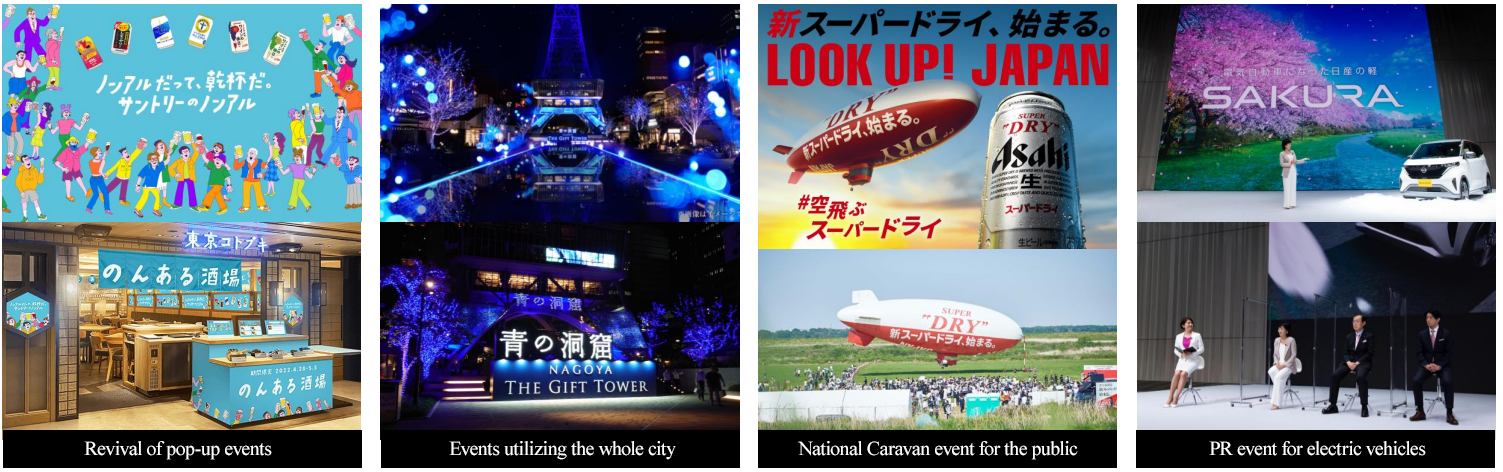

Real events: 4,563 million yen, up 35.0%. The projects related to the Tokyo Olympic and Paralympic Games in 2020 contributed, but the impact of the cancellation and postponement of events due to the intermittent declaration of a state of emergency and the implementation of a pre-emergency measure against COVID-19 in January 2022 was significant, hindering recovery. Accordingly, sales did not reach the pre-pandemic level.Online events: 2,787 million yen, up 7.1%. Hybrid video-streaming events combining real and online items grew.Online promotion: 3,586 million yen, up 70.3%. Business inquiries about online promotion utilizing social media, videos, etc. increased. Othe 198 million yen, down 95.2%. Sales dropped as there were no large-scale projects for public offices and groups, which were undertaken in the previous year.

Operating income was 883 million yen, up 34.7% from the previous term. Profit grew considerably, as there was no impact of large-scale projects for public offices and groups, which were less profitable in the previous term, and the company kept promoting “the monetization of value of specialized personnel,” “the securing of appropriate revenues through the enhancement of the functions of the production management section,” and “the improvement in profitability through in-house production.” Gross profit margin improved from 12.0% in the previous term to 15.6%, and operating income margin increased significantly from 5.4% in the previous term to 7.9%, as the company made efforts to curtail the augmentation of SGA, which increased only 4.3% to 850 million yen. Regarding non-operating revenues, the revenues from subsidies declined, but dividend received increased, ordinary income rose 32.3% year on year to 924 million yen, and profit attributable to owners of parent grew 31.3% year on year 598 million yen.

They paid a term-end dividend of 7.00 yen/share (for an annual dividend of 14.00 yen/share).

Sales by Industry

| FY 6/21 | Ratio to sales | FY 6/22 | Ratio to sales | YoY |

Information, Communication | 2,297 | 18.9% | 2,412 | 21.8% | +5.0% |

Automobiles | 1,297 | 10.6% | 1,787 | 16.1% | +37.8% |

Foods, Beverages, and Luxury Goods | 930 | 7.6% | 1,313 | 11.8% | +41.2% |

Cosmetics, Toiletries, and Sundries | 855 | 7.0% | 1,042 | 9.4% | +22.0% |

Governments, Organizations | 4,783 | 39.3% | 1,535 | 13.9% | -67.9% |

Finance | 585 | 4.8% | 325 | 2.9% | -44.5% |

Transportation and Leisure | 423 | 3.5% | 841 | 7.6% | +98.8% |

Precision Instruments, Other Manufacturing | 414 | 3.4% | 933 | 8.4% | +125.3% |

Wholesale, Retailing | 259 | 2.1% | 423 | 3.8% | +63.2% |

Other | 337 | 2.8% | 482 | 4.3% | +42.8% |

Total | 12,180 | 100.0% | 11,093 | 100.0% | -8.9% |

Of the above, game transactions | 825 | 6.8% | 882 | 8.0% | +6.9% |

*Excluding the sales of planning

*Unit: million yen

●Recovery in main business fields

・In the automobile field, real events are recovering.

・In the field of food products, beverages, etc., sales expanded thanks to the recovery of real events in addition to online promotion.

・The field of information and telecommunication was healthy, as digital platform providers performed well.

・In the field of precision equipment, BtoB events expanded.

●In the field of public offices and groups, there was no longer large-scale projects, but projects related to the Tokyo Olympic and Paralympic Games in 2020 contributed.

●The video game-related field remained healthy.

Number of transactions in each price range

| FY 6/21 | FY 6/22 | Ratio to sales | |||

| Price | Number | Price | Number | Price | Number |

~¥10.00mn | 2,031 | 828 | 2,703 | 1,014 | +672 | +186 |

¥10.00~20.00mn | 1,517 | 108 | 2,113 | 148 | +596 | +40 |

¥20.00~50.00mn | 1,830 | 58 | 2,529 | 87 | +698 | +29 |

¥50.00~100mn | 941 | 15 | 1,074 | 16 | +132 | +1 |

~¥100mn | 5,861 | 11 | 2,672 | 15 | -3,189 | +4 |

Total | 12,180 | 1,020 | 11,093 | 1,280 | -1,086 | +260 |

Transaction Unit | 11.9 |

| 8.6 |

| -3.2 |

|

Transaction Unit (Excluding large-scale government transactions) | 8.0 |

| 8.6 |

| +0.6 |

|

*Excluding the sales of planning

*Unit: million yen

●No. of transactions increased 122%.

●The recovery of large-scale transactions was small due to the impact of the novel coronavirus, although real events are recovering. (The number of transactions whose sales are 50 million yen or ove 26 31)

●For online promotion, the company secured profitability through in-house production and monetization of value to be provided, although the unit price of some transactions is low.

(2) Financial Condition & Cash Flow

Financial Condition

| Jun. 21 | Jun. 22 |

| Jun. 21 | Jun. 22 |

Cash, Equivalents | 7,580 | 8,590 | Accounts Payable | 1,346 | 1,087 |

Accounts Receivable | 2,631 | 2,132 | Short Term Debt | 840 | 840 |

Uncompleted Work Payments | 67 | 131 | Taxes Payable | 21 | 267 |

Uncollected Payments | 925 | 528 | Retirement Benefits for Directors | 429 | 454 |

Prepaid Expenses | 64 | 97 | Liabilities | 3,099 | 3,219 |

Current Assets | 11,325 | 11,537 | Net Assets | 10,324 | 10,544 |

Investments, Other | 1,840 | 2,005 | Total Liabilities, Net Assets | 13,423 | 13,764 |

Noncurrent Assets | 2,098 | 2,226 | Interest bearing liabilities | 840 | 840 |

*Unit: million yen. Accounts Receivable: Uncollected Sales/Loans transferred using the factoring methods

As of the end of FY June 2022, total assets stood at 13,764 million yen, up 340 million yen from the end of the previous term.

Current assets increased 212 million yen from the end of the previous term to 11,537 million yen. This is mainly because uncollected payments decreased by 396 million yen and accounts receivable also decreased by 498 million yen, although cash and equivalents increased 109 million yen from the end of the previous term.

Noncurrent assets stood at 2,226 million yen, up 128 million yen from the end of the previous term. Tangible noncurrent assets were 192 million-yen, down 36 million yen from the end of the previous term. This is mainly due to depreciation etc. Intangible noncurrent assets were 28 million yen almost the same amount as the end of the previous term. Investments and other assets grew 164 million yen from the end of the previous term to 205 million yen. This is mainly because investment securities increased 145 million yen from the end of the previous term.

Current liabilities increased 70 million yen from the end of the previous term to 2,598 million yen. This is mainly because trade accounts payable (part of accounts payable) decreased 259 million yen, but taxes payable and other liabilities increased 246 million yen and 82 million yen.

Fixed liabilities augmented 50 million yen from the end of the previous term to 620 million yen. This is mainly because deferred tax liabilities, retirement benefits for directors and provisions retirement benefits for directors increased by 26 million yen, 12 million yen and 11 million yen.

Net assets grew 220 million yen from the end of the previous term to 10,544 million yen. This is mainly because retained earnings increased 121 million yen and valuation difference on available-for-sale securities also increased 100 million yen from the end of the previous term.

Capital-to-asset ratio dropped 0.1 point from the end of the previous term to 76.4%.

Cash Flow

| FY 6/21 | FY 6/22 | YoY | |

Operating CF (A) | 3,388 | 1,555 | -1,832 | -54.1% |

Investment CF (B) | -206 | -24 | +181 | - |

Free CF (A+B) | 3,182 | 1,530 | -1,651 | -51.9% |

Financing CF | -657 | -520 | +136 | - |

Cash, Equivalents at the end of term | 7,580 | 8,590 | +1,009 | +13.3% |

*Unit: million yen

The balance of cash and cash equivalents as of the end of FY June 2022 stood at 8,590 million yen, up 109 million yen from the end of the previous term.

The company posted a cash inflow of 1,555 million yen from operating activities (a cash inflow of 3,388 million yen in the previous term). This is mainly due to a decrease in accounts payable of 258 million yen, net income before income tax of 926 million yen, a decrease in accounts receivable of 498 million yen, decrease in uncollected payments of 143 million yen and drop in corporate tax fund by 119 million yen.

The company posted a cash outflow of 24 million yen from investment activities (a cash outflow of 206 million yen in the previous term). This is mainly because 23 million yen was spent for acquiring tangible noncurrent assets.

The company posted a cash outflow of 520 million yen from financial activities (a cash outflow of 657 million yen in the previous term). This is mainly because the expenditure for dividends was 623 million yen.

4. Fiscal Year ending June 2023 Earnings Forecasts

Consolidated Earnings

| FY 6/22 Act. | Ratio to sales | FY 6/23 Est. | Ratio to sales | YoY |

Sales | 11,134 | 100.0% | 11,200~12,200 | 100.0% | +0.6~9.6% |

Operating Income | 883 | 7.9% | 907~1,076 | 8.1~8.8% | +2.7~21.8% |

Ordinary Income | 924 | 8.3% | 930~1,100 | 8.3~9.0% | +0.7~19.0% |

Net Income Attributable to Owners of Parent | 598 | 5.4% | 95~254 | 0.9~2.1% | -84.0~-57.4% |

*Unit: million yen

The forecasts for FY June 2023 are indicated with ranges. Sales and ordinary income are expected to rise.

The forecasts for FY June 2023 are indicated with ranges. It is forecast that sales will be 11.2-12.2 billion yen (up 0.6-9.6% year on year), operating income will be 907-1,076 million yen (up 2.7-21.8% year on year), ordinary income will be 930-1,100 million yen (up 0.7-19.0% year on year), and profit attributable to owners of parent will be 95-254 million yen (down 84.0-57.4% year on year). The pre-emergency measures against COVID-19, which were implemented intermittently from January to March 2022, significantly affected real large-scale events in the advertisement market, in which the company excels, and the market environment in 4Q of FY June 2022 was highly uncertain. Through the easing of restrictions on activities, the flow of people is recovering, but the number of infected people in Japan became the largest in the world due to the rapid spread of new variants, so some projects, such as events in which beverages and dishes are served and events held in a closed space which tends to become crowded, were cancelled or postponed. Accordingly, the market environment surrounding the company remains uncertain. Regarding the outlook for performance in FY June 2023, the period affected by the pandemic and the scale of cancellation or postponement are still unpredictable, so the company decided to disclose forecasted ranges. In this situation, the corporate group will continue its growth strategies steadily, in order to grow the real and online domains. In the fields of online events and promotion, the company aims to grow further while expecting that more advertisements will become online. In the field of real events, there is no longer special demand related to the Olympic and Paralympic Games like in the previous term, but the company aims to recover its performance based on the knowledge it has accumulated and new ideas, as economic activities are recovering, and the behavior of residents is changing.

In terms of profit, the company will keep improving profitability by monetizing the value provided by personnel with expertise and achieving in-house production. Regarding SGA, the remunerations for directors who will retire will decrease and the company plans to invest in strategic solution development for raising the base salaries of all employees (which was conducted in February 2022), investing in personnel affairs, including the recruitment of new graduates, expanding its business domains, and enhancing the superiority and originality of the company. An extraordinary loss of 647 million yen will be posted, because the company plans to pay ordinary and special merit rewards to the director and chairman Osamu Kawamura, who is scheduled to retire, and ordinary merit rewards to the director and vice-chairman Michihiro Akimoto.

There is no revision to the dividend forecast. As the company has temporarily abolished the policy of keeping consolidated payout ratio from exceeding 50% like in the previous term, the minimum dividend is to be 14.4 yen, which was calculated by multiplying the closing value on the day before the date of announcement of financial results (Aug. 8, 2022) by the dividend yield of 4.5%. Therefore, the company plans to pay an interim dividend of 7.20 yen/share and a term-end dividend of 7.20 yen/share for an annual dividend of 14.40 yen/share.

Progress of business in FY 6/23

|

| FY 6/22 (as of Jul. 30, 2021) | FY 6/23 (as of Jul. 31, 2022) | Change from the previous term |

Transactions with general corporations | Backlog of orders (sum of A, B, and I) | 3,865 | 4,131 | 266 |

Sum of II and III | 1,397 | 1,292 | -105 | |

Transactions with governmental offices and groups | Backlog of orders (sum of A, B, and I) | 685 | 515 | -170 |

Sum of II and III | 32 | 226 | 194 | |

Total | Backlog of orders (sum of A, B, and I) | 4,550 | 4,647 | 97 |

Sum of II and III | 1,429 | 1,518 | 89 |

* Unit: million yen

A: Transactions for which event scale (price), schedules, etc. have been determined B: Transactions for which orders are to be placed, but there are uncertainties over price, schedules, etc. I: Transactions for which the company is likely to receive orders (probability of 80% or higher) II: Planned and proposed transactions for which the company is likely to receive orders (probability of 50% or higher) III: Transactions that are being planned or proposed |

●Corporation promotion is up 106% from the previous term, showing a recovery trend.

●In particular, there is a sign of recovery in medium and large-scale real events.

・Measures for real experiences, such as pop-up shops and street promotion, are recovering.

●The number of business inquiries in the online field remains healthy.

●Due to the rapid spread of the novel coronavirus in recent years, some projects were cancelled or postponed. Accordingly, the future outlook is unclear.

●The transactions with public offices decreased, due to the end of the Olympic and Paralympic Games.

Recent status of order receipt, and the outlook for FY June 2023

Real events | ●Real corporate events are recovering, but the company flexibly responds to the resurgence of COVID-19. ●The company will concentrate on proposing and holding real events based on the knowledge they have accumulated according to new lifestyles. |

|

|

Online events (including hybrid events) | ●Hybrid events, which utilize real and video-streaming items, became common. ●Online events aimed at producing direct contact points with fans became active. |

|

|

Online promotion | ●Business inquiries about projects utilizing “social media” and “videos” increased. ●The company enhanced the proposal for “digital sales promotion” and “digital advertisement,” which contribute to actual sales significantly. |

Policy for FY June 2023

While the mindsets and lifestyles of residents are expected to change and become more active,

the company will deliver impressive, empathetic, and exciting experiences to residents and contribute to business results, through “the design of customers’ experiences based on value of experience.”

The company will pursue mainly the following two visions.

The company aims to revive and expand the real experience domain, by grasping the timing of change in people’s motivation to act and the recovery of flow of people. While paying attention to the impact of the “seventh wave” of the pandemic, the company will contribute to the business results of enterprises with the value of real experiences. The company will revive and expand real events. |

× | The company will grasp the trend of the digital market, which will keep growing, and further expand the online domain. The company will expand the new domain of digital experience, which is now indispensable in marketing and lifestyles, and contribute to the comprehensive design of customers’ experiences in the OMO age. |

(Taken from the reference material of the company)

Keywords for executing the policy = “extension” and “contribution to business”

Extension | ●To extend the order receiving area (videos, social media, PR, digital ad, etc.) by designing customers’ experiences in an integrated manner ●To extend target brands and services based on the understanding of clients and full-funnel marketing |

|

|

Contribution to business | ●To contribute to business with the growth vision “To design outcomes based on the value of experience” ●To help clients increase and develop their customers, through the design of experiences with dots and lines |

5. Conclusions

The drop in sales in FY June 2022 is due to the decrease of orders for projects from public offices, which were less profitable. The businesses targeted at private enterprises were all healthy, partially thanks to the rebound from the impact of COVID-19 in the previous term. Accordingly, the company secured a significant increase in profit. The forecasts for FY June 2023 are shown with ranges, while considering the impact of COVID-19, but it seems to be slightly conservative. The novel coronavirus has been spreading rapidly in recent years, but its impact on real events seems to be limited. As soon as COVID-19 broke out in the spring of 2020, the company took measures for online events and promotion swiftly ahead of other companies. Accordingly, its know-how is advanced compared with competitors. Regarding online promotion, it seems that the company can secure profit from even projects with a low unit price. It seems that the company is about to complete a business model that can minimize the impact of the spread of COVID-19 on revenues even if its sales composition is different. It can be said that the company is getting back on a recovery trend after the coronavirus pandemic, which was protracted compared with the initial forecast. It is expected that it will not take so much time to reach the level in FY June 2019 (sales: 16,278-million-yen, ordinary income: 2,017 million yen, and EPS: 29.94 yen). If the number of foreign visitors to Japan recovers, the outlook will become brighter.

*On April 1, 2020, the company conducted a 2-for-1 stock split, so EPS has been revised accordingly.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 10 directors, including 4 outside ones(including 3 independent outside directors) |

◎ Corporate Governance Report Updated on December 22, 2021

Basic Policy

Our company recognizes corporate governance as "building and operating a structure that achieves appropriate and efficient decision making and business execution by the management, prompt result reports to stakeholders, and soundness, fairness and high transparency of business administration in order to continuously improve the corporate value." In order to achieve sustainable growth and improve our medium and long-term corporate value while fulfilling our responsibility to shareholders, customers, employees and other stakeholders, our company will achieve effective corporate governance in accordance with the basic policy stated below.

1. Respect the rights of shareholders and ensure equality.

2. Consider the interests of stakeholders including shareholders and cooperate properly.

3. Disclose company information properly and ensure the transparency.

4. Improve the effectiveness of the supervisory function for business execution by the board of directors.

5. Have constructive dialogue with shareholders who have an investment policy that matches the interests of shareholders over the medium to long term.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 2-4-1 Ensuring Diversity in Appointment of Core Personnel, etc.】

To ensure diversity, the company actively appoints mid-career hires and others as core personnel. Furthermore, as for the promotion of female employees to management positions, there are 12 female managers as of June 2021, accounting for 13.6% of all management positions. The company continues to discuss policies, goals, and environmental improvements, for ensuring diversity.

【Supplementary Principle 3-1-2 Disclosure and provision of information in English】

We prepare an English version of business reports and also disclose analyst reports in English semi-annually on our website. In the future, we will consider provision of the materials for results briefing and contents of the convocation notice, etc. in English in light of trends of ratios of institutional investors and foreign investors among the company’s shareholders.

【Supplementary Principle 3-1-3 Initiatives on Sustainability】

【Supplementary Principle 4-2-2 Establishment of Policies concerning Initiatives for Sustainability】

With regard to the company’s policies and initiatives on sustainability, the Board of Directors will take the lead in future discussions as necessary to ensure that the company can disclose the impact of climate change-related risks and revenue opportunities on the company’s business activities, revenue, etc. in accordance with the TCFD or an equivalent framework, taking into account the appropriate size of the company and industry trends.

【Supplementary Principle 4-1-2 Commitment to the mid-term management plan】

【Principle 5-2 Formulation and announcement of management strategies and plans】

The company’s top priority is to achieve its performance goals for a single fiscal year, and the formulation of the medium-term management plan is currently put on hold due to the discontinuity of the business environment, however, the company has formulated and announced its business growth vision at the Financial Results Briefing for Q2 of FY June 2021. In addition, the company believes that it is significant to establish a management vision and to develop strategies from a medium-term viewpoint, and will announce its medium-term management plan when the company has confidence in trends in the industry environment and in its verification of the effectiveness of measures.

【Principle 4-8 Effective Use of Independent Outside Directors】

As of the end of the Annual General Meeting of Shareholders in 2021, the Company’s Board of Directors consists of 10 directors (including 3 directors who also serve as Audit Committee members), of which 4 are outside directors (including 3 independent outside directors), providing supervision. In appointing directors, including independent outside directors, the Company continues to examine the composition of the Board of Directors, considering the balance of knowledge in corporate management, financial accounting, legal and risk management, industry knowledge, etc. that the Board of Directors holds as a whole.

【Supplementary Principle 4-10-1 Appropriate Involvement and Advice from Independent Outside Directors through the Establishment of a Voluntary Advisory Committee】

In order to strengthen the independence, objectivity, and accountability of the functions of the Board of Directors in relation to the nomination and compensation, etc. of directors etc., when examining the nomination and compensation etc., we will examine the development of a system aimed at implementing more fair and transparent examinations and procedures, including deeper collaboration with independent external directors.

【Principle 4-11 Preconditions for Ensuring the Effectiveness of the Board of Directors and the Board of Corporate Auditors】

The company’s Board of Directors consists of individuals with professional knowledge and affluent experience in management, risk management, sales, digital and other fields, and the Company recognizes that the size of the Board is appropriate for effectively fulfilling its roles and responsibilities as the Board of Directors. Moreover, the Company’s Audit Committee members have affluent experience and a high level of knowledge in finance, accounting, and legal affairs. With regard to diversity including the aspects of gender and internationality, the company continues its efforts to ensure that the appropriate size is considered in the composition of the Board.

<Main Disclosed Principles>

【Supplementary Principle 1-2-4 Electronic Exercise of Voting Rights, etc.】

Based on the trend of the ratio of institutional and overseas investors among shareholders and other factors, the company will adopt an electronic voting system and an electronic voting platform for the 46th General Meeting of Shareholders.

【Principle 1-4 Cross-holding shares】

The basic policy in making investments other than for pure investment purposes is to create synergy effects in the company’s integrated promotion business through business alliances and information sharing with companies that we invest in. In order to improve value in the medium- to long-term perspectives, we hold the minimum number of listed shares only when it is determined that holding the shares would be effective in consideration of strengthening relationships with business partners, etc.

With regard to the exercise of voting rights of cross-holding shares, in order to ensure appropriate responses, we examine each case from comprehensive viewpoints including the medium- to long-term improvement of the corporate value of the share issuing company as well as the medium- to long-term growth of economic benefits for us. For the major cross-holding shares, we will report the status of the exercise of voting rights to the Board of Directors.

【Principle 2-3 Issues regarding Sustainability including Social and Environmental Issues】

The company’s Board of Directors recognizes that addressing issues related to sustainability including social and environmental issues is an important management task, and the Environmental Management Committee and other committees are actively working on addressing these issues. Specifically, the company has been working on the environmental issues since 2000, and disclosing the information on its website.

https://tow.co.jp/iso/

【Principle 4-9 Independence Standards and Qualification for Independent External Directors】

We select external director candidates who meet the independence criteria set by the Tokyo Stock Exchange.

【Supplementary Principle 4-11-1 View on the balance, diversity and scale of knowledge, experience and capabilities as the entire Board of Directors】

The company stipulates the number of directors as 14 or less by the articles of incorporation, and as of September 24, 2021, the Board of Directors consists of 10 members (including 4 external directors). For the members of the Board of Directors, we take into consideration the diversity of experience, knowledge, capabilities, etc.

The skills matrix is also disclosed in the Notice of Convocation of General Meeting of Shareholders.

【Principle 5-1 Policy for having constructive dialogue with shareholders】

We are convinced that the most important mission to fulfill our company's responsibility is to promote two-way constructive dialogue with shareholders and investors, and to realize effective corporate governance in order to achieve sustainable growth and improve our medium and long-term corporate value.

Based on this idea, our company will implement the following measures.

1. Designation of directors in charge of dialogue with shareholders

In our company, executives have dialogue with shareholders, and the managing director controls IR activities.

2. Measures for organic coordination of in-company departments

In our company, the general affair team, which is also in charge of IR activities, discusses and exchanges opinions on a daily basis with the accounting team and they also collaborate in preparing the disclosed materials and discuss the content with executives.

3. Efforts for enhancing dialogue methods other than individual interviews

Our company will conduct the general shareholders' meeting that earns shareholders' trust by valuing the general shareholders' meeting as an opportunity for important dialogue with shareholders and ensuring sufficient information disclosure of our business. In addition, our company will work on achieving closer communication with shareholders and investors by regularly holding financial results briefing.

4. Measures for feedback of opinions and concerns of shareholders

Our company will compile the opinions and concerns about our company heard in the dialogue with shareholders and investors at the department in charge and develop a system that reports this regularly to executives and the board of directors according to its importance and nature.

5. Measures for managing insider information

The basic policy of our company is to provide fair information disclosure in order to ensure substantive equality for shareholders and investors. Based on this policy, we will disclose important information about our company in a timely and fair manner, and strive to manage the information rigorously so that it will not be provided only to some shareholders and investors.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (TOW Co., Ltd.:4767) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/