Bridge Report:(4767)TOW the fiscal year ended June 2023

Kenichi Muratsu President | TOW Co., Ltd.(4767) |

|

Company Information

Market | TSE Prime Market |

Industry | Service |

President | Kenichi Muratsu |

HO Address | Tokyo, Minato-ku, Toranomon 4-3-13, Hulic Kamiyacho Building 3F |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥313 | 40,272,344 shares | ¥12,605million | 3.8% | 100 shares | |

DPS Est | Dividend yield Est | EPS Est | PER Est | BPS Act | PBR Act |

¥14.00 | 4.5% | ¥22.74 | 13.8 x | ¥208.86 | 1.5 x |

*Share price as of closing on ,September 4 2023. Number of shares issued at the end of the most recent quarter excluding treasury shares.

ROE and BPS are results from FY 6/23, EPS and DPS are results from FY 6/24 forecast (average value of range forecast).

Numbers are rounded.

Consolidated Earnings

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

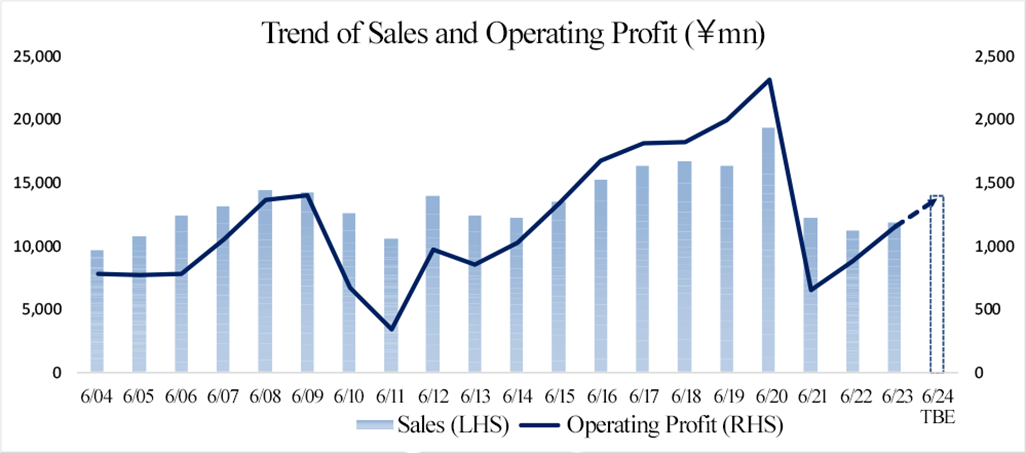

June 2019 (Act.). | 16,278 | 1,995 | 2,017 | 1,345 | 29.94 | 14.50 |

June 2020 (Act.). | 19,325 | 2,316 | 2,332 | 1,584 | 35.26 | 16.75 |

June 2021 (Act.). | 12,209 | 655 | 698 | 455 | 10.14 | 12.90 |

June 2022 (Act.). | 11,134 | 883 | 924 | 598 | 13.22 | 14.00 |

June 2023 (Act.). | 11,774 | 1,150 | 1,178 | 355 | 8.61 | 14.40 |

June 2024 (Est.). | 14,000 | 1,370 | 1,400 | 915 | 22.74 | 14.00 |

*Unit: million-yen, yen. Estimates are those of the Company. The definition of net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

* On April 1, 2020, the company implemented a 2-for-1 stock split, which is reflected in EPS and DPS.

We present this Bridge Report reviewing the fiscal year ended June 2023 earnings results and the outlook for the fiscal year ending June 2024 for TOW.

Table of Contents

Key Points

1. Company Overview

2. Medium-term initiatives

3. Fiscal Year ended June 2023 Earnings Results

4. Fiscal Year ending June 2024 Earnings Forecasts

5. Conclusions

<Reference1: Regarding Corporate Governance>

<Reference2: Issues to be addressed and initiatives>

Key Points

- In FY June 2023, sales and operating income grew 5.8% and 30.2%, respectively, year on year. Sales increased, despite the reactionary decline from the Tokyo 2020 Olympic and Paralympic Games. The return to real events intensified gradually through the revitalization of social and economic activities, and there was a sign of full-scale recovery. In the online promotion field, steady growth was seen thanks to the growth of the digital advertisement market, etc. In addition, by offering high added value, the company increased fee-based tasks, etc. In terms of profit, gross profit margin improved and SGA ratio dropped considerably, so operating income margin improved from 7.9% year on year to 9.8%. As the special merit rewards for retired executives were posted in the section of an extraordinary loss, profit attributable to owners of parent decreased 40.6% year on year. The company paid a term-end dividend of 7.20 yen/share as forecast, for 14.40 yen/share per year.

- For FY June 2024, it is forecast that sales and operating income will increase 18.9% and 19.1%, respectively, year on year. As there is a sign of full-scale recovery in the real field, where the company operates its core business, the event/promotion business, which is the mainstay, is expected to grow. In the steadily growing digital market, the online domain is projected to grow further and sales are expected to increase by double digits. In terms of profit, for gross profit, the company will promote fee-based tasks by providing high added value and secure revenues by optimizing order placement. Regarding SGA, the company plans to strategically invest in human capital and develop a foundation for engaging in priority themes for business growth, etc. in order to expand the business domain and improve the advantage and originality of the corporate group. Profit attributable to owners of parent is expected to increase significantly, because there will be no longer effect of an extraordinary loss, which was posted in the previous fiscal year. Following the policy in the previous fiscal year, the company plans to pay an annual dividend of 14.00 yen/share (including an interim dividend of 7.00 yen/share).

- In FY June 2023, sales and ordinary income dropped year on year in the first half, but in the cumulative third quarter, sales and profit grew year on year, and in the full year, sales growth rate and profit growth rate were higher than those in the cumulative third quarter. The recovery trend intensified quarter by quarter. As almost all regulations for coping with COVID-19 were lifted and advertisers resumed real promotional activities on a full-scale basis, real events were revitalized. Events, such as expositions, which produce significant effects on the company’s business, tend to be held in the first half of each fiscal year. Accordingly, it is forecast that sales will grow 24.6% to 7,962 million yen and ordinary income will rise 43.2% to 970 million yen in the first half of FY June 2024, and annual ordinary income will grow by double digits for 3 consecutive years. There seems to be room for further growth from the current fiscal year to the next fiscal year. EPS is expected to rise in the current fiscal year, but share price is stagnant. Considering that PER and dividend yield remain low, there seems to be significant room for readjustment. It is noteworthy that the return to shareholders has been enhanced further.

1. Company Overview

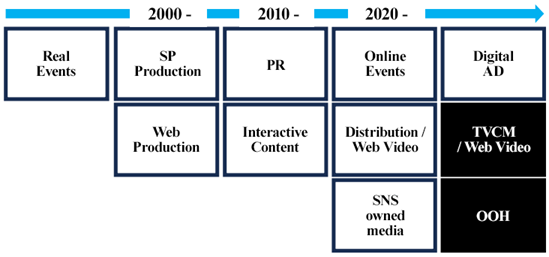

TOW is the largest independent company in the field of events and promotion of the advertising industry and is listed on the Prime market of the Tokyo Stock Exchange. They have expanded the scale of their business with the planning, production, and operation of press conferences, promotional events, exhibitions, and cultural and sport events as their forte. In addition to the production capabilities cultivated through real events, they have engaged in business in the digital field since the early 2000s and have been successful in acquiring new customers, fostering the relationship with and bringing new stimulation to their existing customers by making full use of their planning and production capabilities centered on experience value* and exerting the capability to create catching content and the capability to revitalize platforms in regard to their offline and online activities.

TOW have been engaging in the development of TOW Experience Design Model, which will contribute to the growth of their clients, realizing the improvement of the value they provide and business growth, and sets their new corporate image as to be a production for designing outcomes centered on experience value.

* Experience value means the value of appeal to customers’ mind, including emotional value, sensible value, and functional value.

The corporate group is composed of TOW Co., Ltd. and its consolidated subsidiary T2 Creative Co., Ltd. (hereinafter called “T2C”), which produces, operates, and directs events and produces videos (as of the end of June 2023).

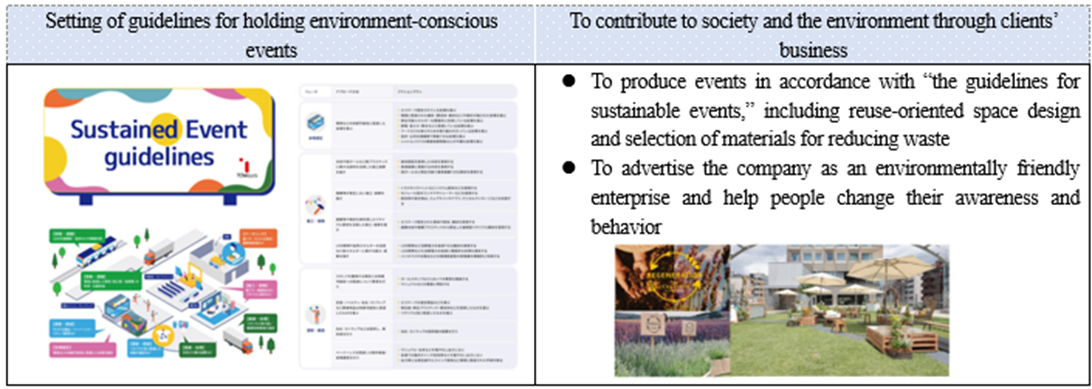

In July 2023, the company acquired Motto Inc., which produces commercials, as a consolidated subsidiary.

Business Description

Planning to Implementation of Events and Promotion

A transaction concerning events and promotion arises as soon as an organizer or a promoter thinks of any objective (intention to get information across to their audience).

TOW receives an explanation on this objective from the organizer or promoter, and after analysis and research, they formulate a strategy or plan. Then, they proceed into each stage, developing the initial plan into a basic scheme, an implementation scheme, and a detailed scheme based on numerous meetings, which in the end become deliverables matching the respective method. TOW proceeds with the preparations according to reference material and conducts events and promotion.

Scope of TOW’s BusinessTOW receives orders for the whole abovementioned process from planning to implementation. They undertake analysis and research, devising a strategy and formulating the concept, project proposal, actual production, effectiveness verification, and other work incidental to the above processes, employing a number of methods tailored for each task.

TOW’s work lies in conveying the intention of an organizer or a promoter to consumers by taking on the comprehensive production and direction of the overall promotion, while outsourcing respective tasks to companies specialized in respective fields including real events, online events, video creation, SNS-based campaigns, digital advertising operation, digital media operation, SNS account operation, user experience design of digital services, promotion, and sales promotion and so on.

T2 Creative Co., Ltd. conducts mainly the “production,” “operation,” and “direction” of events.

Purpose

The company set its purposes with the hope of contributing to customers, residents, and society based on “the value of experience,” which is the universal strength of the company.

(Taken from the reference material of the company)

The company set an enhancement theme for fulfilling its purpose. The company will work on the expansion of its domain for improving comprehensive promotion.

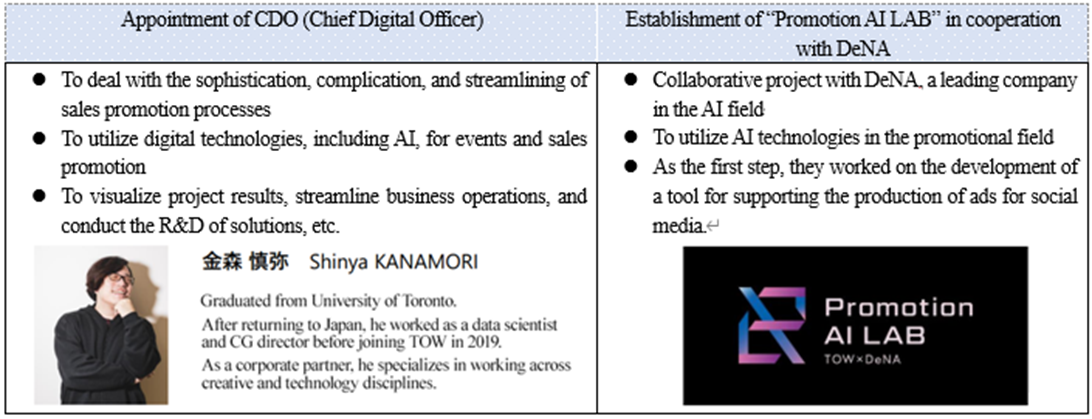

【Enhancement theme】 In order to grow sustainably in the age with a high degree of uncertainty, the company focuses on “AI,” which is a technology that would transform our society and industries radically, and “the environment,” for which initiatives are accelerated due to ESG activities and SDGs.

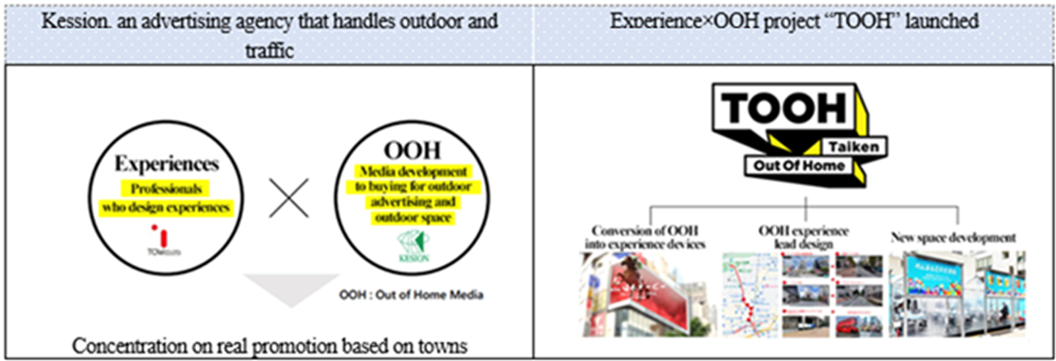

| 【Domain expansion】 Following the digital domain (including social media and digital advertisement), the “video” and “OOH” domains will expand.

|

(Taken from the reference material of the company)

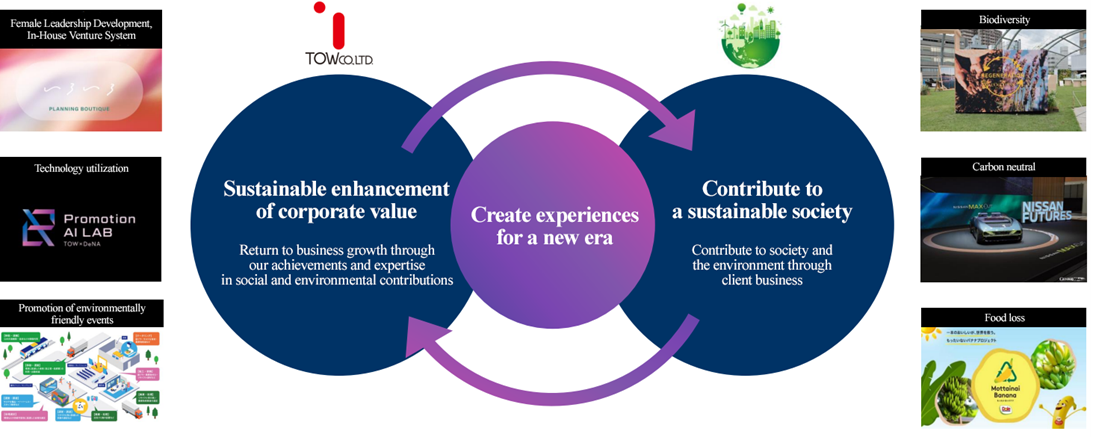

Basic stance for sustainability

In order to fulfill the purpose of “creating experiences in the new era,” the company pursues the virtuous cycle of sustainability through clients’ business.

(Taken from the reference material of the company)

Sustainability policy

To tackle issues with enterprises and society with the power of experience value created by individual employees, and become a company that will grow sustainably

|

Under the purpose, the company identifies four important themes as material issues, and tackles them, with the aim of “contributing to a sustainable society” and “improving sustainable corporate value.”

|

(Taken from the reference material of the company)

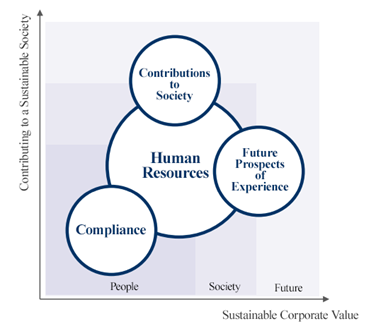

Material issues and systems for addressing them

The company shall establish a sustainability committee, set company-wide policies and goals regarding material issues, and develop systems for them.

●To update the personnel evaluation system for praising the growth and good performance of employees

●Education of employees (knowledge sharing, training for each class, and expertise development)

●Empowerment of women

・Development of female leaders and utilization of an in-company venture system

・Application for Eruboshi Certification

●Development of a working environment

“Compliance with corporate ethics and laws,” “appropriate information management,” “appropriate measures for addressing environmental issues,” and “maintenance and improvement of the working environment”

2. Medium-term initiatives

(Taken from the reference material of the company)

(Taken from the reference material of the company)

| With the aim of expanding the domain based on videos, the company acquired a company that produces commercials as a consolidated subsidiary. |

(Taken from the reference material of the company)

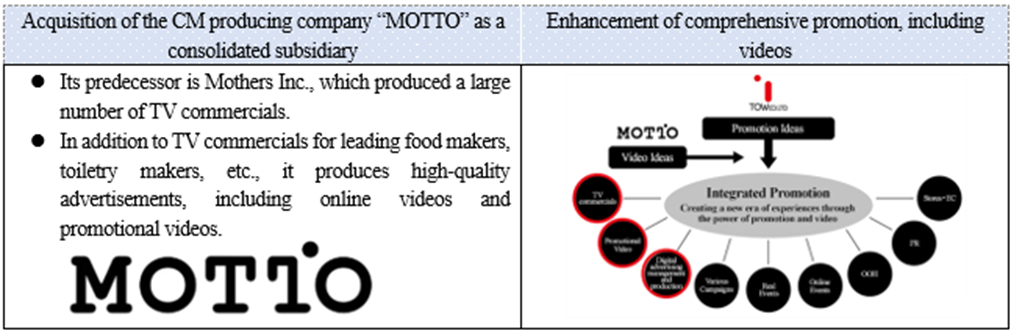

| To form business tie-ups with “outdoor and transportation ad agencies” and improve experience value by combining experiences and OOH, with the aim of expanding the domain based on real things |

(Taken from the reference material of the company)

3. Fiscal Year ended June 2023 Earnings Results

(1)Consolidated Earnings

| FY 6/22 | Ratio to sales | FY 6/23 | Ratio to sales | YoY | Company Forecast | Forecast Ratio |

Sales | 11,134 | 100.0% | 11,774 | 100.0% | +5.8% | 12,000 | -1.9% |

Gross profit | 1,733 | 15.6% | 1,900 | 16.1% | +9.6% | - | - |

SG&A | 850 | 7.6% | 750 | 6.4% | -11.8% | - | - |

Operating Income | 883 | 7.9% | 1,150 | 9.8% | +30.2% | 1,076 | +6.9% |

Ordinary Income | 924 | 8.3% | 1,178 | 10.0% | +27.5% | 1,200 | -1.8% |

Quarterly Net Income Attributable to Owners of Parent | 598 | 5.4% | 355 | 3.0% | -40.6% | 289 | +23.1% |

*Unit: million yen. Figures include reference figures calculated by Investment Bridge Co., Ltd. and actual results may differ (applies to all tables in this report)

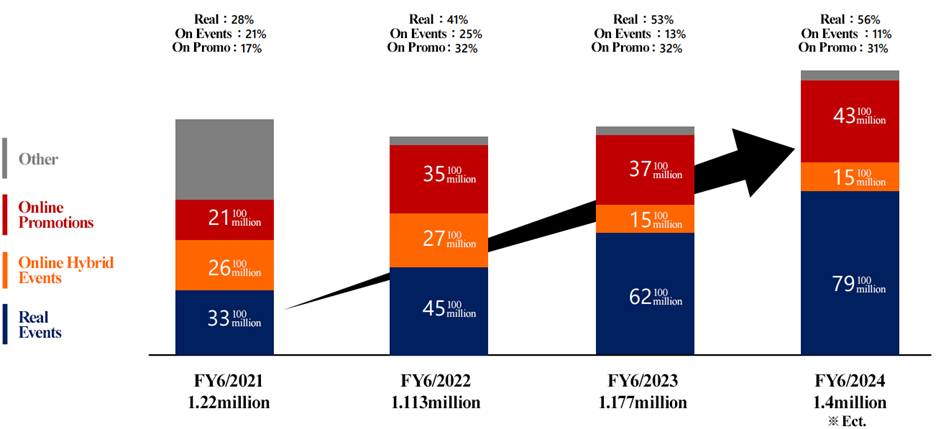

Sales and ordinary income grew 5.8% and 27.5%, respectively, year on year.

Sales were 11,774 million yen, up 5.8% year on year. Sales increased, despite the reactionary decline from the Tokyo 2020 Olympic and Paralympic Games. The return to real events intensified gradually through the revitalization of social and economic activities, and there was a sign of full-scale recovery. In the online promotion field, steady growth was seen thanks to the growth of the digital advertisement market, etc. In addition, by offering high added value, the company increased fee-based tasks, etc.

Operating income was 1,150 million yen, up 30.2% year on year. In terms of profit, gross profit margin improved and gross profit increased 9.6% year on year to 1.9 billion yen. SGA ratio dropped considerably from 7.6% to 6.4%, due to the decreases in remuneration for retired executives and provision for retirement benefits for executives, and SGA decreased 11.8% to 750 million yen, so operating income margin rose from 7.9% in the previous fiscal year to 9.8%. Regarding non-operating performance, ordinary income grew 27.5% year on year to 1,178 million yen, due to the decrease in dividends received, etc. As the special merit rewards for retired executives amounting to 647 million yen were posted in the section of an extraordinary loss, profit attributable to owners of parent decreased 40.6% year on year to 355 million yen.

Sales by Category

The sales from real events recovered significantly, and online promotion increased steadily.

| FY 6/22 | FY 6/23 | |||

| Sales | Ratio to Sales | Sales | Ratio to Sales | Sales |

Real Events | 4,563 | 41.0% | 6,269 | 53.2% | +37.4% |

Online Events | 2,786 | 25.0% | 1,504 | 12.8% | -46.0% |

Online Promotion | 3,586 | 32.2% | 3,723 | 31.6% | +3.8% |

Other | 197 | 1.8% | 277 | 2.4% | +40.3% |

Total | 11,134 | 100.0% | 11,774 | 100.0% | +5.8% |

*Unit: million yen.

①Real events・・・Sales grew 37.4% year on year to 6,269 million yen. Sales increased considerably thanks to the return to real events and real promotion through the revitalization of social and economic activities and living activities.

②Online events: Sales dropped 46.0% to 154 million yen. In addition to the switch from online events to real ones, and some large-scale events held in the same period of the previous year were not conducted, resulting in a drop in sales.

③Online promotion: Sales rose 3.8% to 3,723 million yen. Business inquiries about online promotion measures, including promotion based on social media and videos and digital ads, increased steadily.

④Othe Sales increased 40.3% to 277 million yen. The company received orders from governmental offices and groups.

Sales by Industry

Growth of new major business categories, including digital platform providers, and a sign of recovery of major business categories, excluding automobiles

| FY 6/22 | Ratio to sales | FY 6/23 | Ratio to sales | YoY |

Information, Communication | 2,340 | 21.1% | 2,648 | 22.6% | +13.2% |

Automobiles | 1,787 | 16.1% | 1,538 | 13.1% | -14.0% |

Foods, Beverages, and Luxury Goods | 1,320 | 11.9% | 1,562 | 13.3% | +18.3% |

Cosmetics, Toiletries, and Sundries | 1,037 | 9.3% | 1,266 | 10.8% | +22.0% |

Governments, Organizations | 1,127 | 10.2% | 986 | 8.4% | -12.5% |

Finance | 734 | 6.6% | 630 | 5.4% | -14.3% |

Transportation and Leisure | 1,006 | 9.1% | 1,116 | 9.5% | +10.9% |

Precision Instruments, Other Manufacturing | 936 | 8.4% | 745 | 6.3% | -20.5% |

Wholesale, Retailing | 374 | 3.4% | 532 | 4.5% | +42.2% |

Other | 428 | 3.9% | 719 | 6.1% | +68.0% |

Total | 11,093 | 100.0% | 11,745 | 100.0% | +5.9% |

Of the above, game transactions | 882 | 8.0% | 1,010 | 8.6% | +14.5% |

*Excluding the sales of planning

*Unit: million yen

●The sales in the field of information and telecommunication kept increasing, partly due to the growth of digital platform providers.

●The sales in the industry of food and beverages increased, due to the recovery of real events in addition to online promotion.

●The recovery of sales in the field of automobiles was delayed, partly due to the global shortage of supply of semiconductors.

●The sales in the cosmetics, toiletries and sundries were healthy.

●The sales in the industry of governments and organizations declined, partially due to the projects for the Tokyo Olympic and Paralympic Games in 2020.

●The sales from video game-related business remained healthy.

Number of transactions in each price range Average spending per project

The number of projects recovered steadily, mainly medium-scale ones, increased.

| FY 6/22 | FY 6/23 | Ratio to sales | |||

| Price | Number | Price | Number | Price | Number |

~¥10.00mn | 2,703 | 1,014 | 3,054 | 1,169 | +350 | +155 |

¥10.00~20.00mn | 2,113 | 148 | 2,448 | 172 | +335 | +24 |

¥20.00~50.00mn | 2,529 | 87 | 3,451 | 116 | +922 | +29 |

¥50.00~100mn | 1,074 | 16 | 1,791 | 26 | +717 | +10 |

¥100mn~ | 2,672 | 15 | 998 | 7 | -1,673 | -8 |

Total | 11,093 | 1,280 | 11,745 | 1,490 | +651 | +210 |

Transaction Unit | 8.6 |

| 7.8 |

| -0.7 |

|

*Excluding the sales of planning

*Unit: million yen

●The number of orders increased 16.4% from the previous year.

●The number of medium-scale orders increased, boosting sales.

The number of orders worth 20 to 50 million yen grew 33.3% from the previous year.

The number of orders worth 50 to 100 million yen grew 62.5% from the previous year.

●The number of large-scale orders and average spending per client decreased due to the recoil from the Tokyo Olympic and Paralympic Games in 2020.

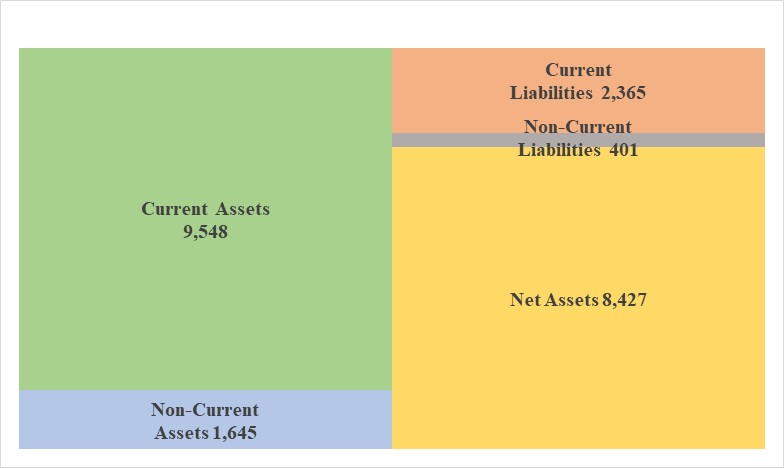

(2) Financial Condition & Cash Flow(CF)

Financial Condition

| Jun. 22 | Jun. 23 |

| Jun. 22 | Jun. 23 |

Cash, Equivalents | 8,590 | 5,781 | Accounts Payable | 1,087 | 990 |

Accounts Receivable | 2,132 | 2,459 | Short Term Debt | 840 | 840 |

Uncompleted Work Payments | 131 | 233 | Taxes Payable | 267 | 66 |

Uncollected Payments | 528 | 868 | Retirement Benefits for Directors | 454 | 312 |

Prepaid Expenses | 97 | 143 | Liabilities | 3,219 | 2,767 |

Current Assets | 11,537 | 9,548 | Net Assets | 10,544 | 8,427 |

Investments, Other | 2,005 | 1,454 | Total Liabilities, Net Assets | 13,764 | 11,194 |

Noncurrent Assets | 2,226 | 1,645 | Interest bearing liabilities | 840 | 840 |

*Unit: million yen. Accounts Receivable: Uncollected Sales/Loans transferred using the factoring methods.

*Produced by Investment Bridge Co., Ltd. with reference to the disclosed material.

The total assets as of the end of FY June 2023 stood at 11,194 million yen, down 2,569 million yen from the end of the previous term, because the company acquired treasury shares.

Current assets decreased 1,988 million yen to 9,548 million yen, mainly because cash equivalent decreased 288 million yen.

Fixed assets decreased 581 million yen to 1,645 million yen. Among fixed assets, tangible fixed assets dropped 28 million yen to 164 million yen, mainly sale of employee company housing and depreciation., while intangible fixed assets declined 2 million yen to 26 million yen. These decreases are all attributable to mainly depreciation/amortization. Investments and other assets decreased 334 million yen to

Current liabilities stood at 2,365 million yen, down 233 million yen. This is mainly because income taxes payable decreased 200 million yen.

Fixed liabilities stood at 410 million yen, down 218 million yen. This is mainly because reserve for retirement benefits for officers and deferred tax liabilities decreased 170 million yen and 70 million yen, respectively.

Net assets decreased 2,117 million yen to 8,427 million yen, mainly because the company spent 1,626 million yen to acquire treasury shares, etc. and retained earnings decreased 299 million yen.

Capital-to-asset ratio dropped 1.3 points from the end of the previous term to 75.1%.

Cash Flow

| FY 6/22 | FY 6/23 | YoY | |

Operating CF (A) | 1,555 | -717 | -2,272 | - |

Investment CF (B) | -24 | 211 | +236 | - |

Free CF (A+B) | 1,530 | -505 | -2,036 | - |

Financing CF | -520 | -2,303 | -1,782 | - |

Cash, Equivalents at the end of term | 8,590 | 5,781 | -2,808 | -32.7% |

*Unit: million yen

The balance of cash and cash equivalents as of the end of FY June 2023 stood at 5,781 million yen, down 288 million yen from the end of the previous term.

From operating activities, there was a cash outflow of 717 million yen (a cash inflow of 1555 million yen in the same period of the previous year), mainly because the company paid 553 million yen as income before income taxes and minority interests , 647 million yen as special merit rewards, 477 income taxes and 326 million yen as trade receivables.

From investing activities, there was a cash inflow of 211 million yen (a cash outflow of 24 million yen in the same period of the previous year). This is mainly because there was a revenue of 231 million yen due to the cancellation of insurance reserve.

From financing activities, there was a cash outflow of 233 million yen (a cash outflow of 520 million yen in the same period of the previous year). This is mainly because the company paid 1,694 million yen for acquiring treasury shares and 608 million yen as dividends.

4. Fiscal Year ending June 2024 Earnings Forecasts

(1)Consolidated Earnings

| FY 6/23 Act. | Ratio to sales | FY 6/24 Est. | Ratio to sales | YoY |

Sales | 11,774 | 100.0% | 14,000 | 100.0% | +18.9% |

Operating Income | 1,150 | 9.8% | 1,370 | 9.8% | +19.1% |

Ordinary Income | 1,178 | 10.0% | 1,400 | 10.0% | +18.7% |

Net Income Attributable to Owners of Parent | 355 | 3.0% | 915 | 6.5% | +157.4% |

*Unit: million yen

For FY June 2024, it is forecast that sales and ordinary income will increase 18.9% and 18.7%, respectively, year on year.

The full-year forecast calls for sales of 14 billion yen (up 18.9% from the previous term), an operating income of 1,370 million yen (up 19.1% from the previous term), an ordinary income of 1.4 billion yen (up 18.7% from the previous term), and a profit attributable to owners of parent of 915 million yen (up 157.4% from the previous term).

As there is a sign of full-scale recovery in the real field, where the company operates its core business, the event/promotion business, which is the mainstay, is expected to grow. In the steadily growing digital market, the online domain is projected to grow further and sales are expected to increase by double digits. In terms of profit, for gross profit, the company will promote fee-based tasks by providing high added value and secure revenues by optimizing order placement. Regarding SGA, the company plans to strategically invest in human capital and develop a foundation for engaging in priority themes for business growth, etc. in order to expand the business domain and improve the advantage and originality of the corporate group. Profit attributable to owners of parent is expected to increase significantly, because there will be no longer the effect of an extraordinary loss, which was posted in the previous fiscal year.

There is no revision to the dividend forecast. As the company has temporarily abolished the policy of keeping consolidated payout ratio from exceeding 50% like in the previous term, the minimum dividend is to be 14.0 yen, which was calculated by multiplying the closing value on the day before the date of announcement of financial results (Aug. 8, 2023) by the dividend yield of 4.5%. Therefore, the company plans to pay a term-end dividend of 7.00 yen/share for an annual dividend of 14.00 yen/share.

(2) Outlook for each category

●The company will expand online business while increasing the ratio of real events and raise its top line.

(Taken from the reference material of the company)

(3)Initiatives

Recognition of the environment in FY June 2024

Marketing activities will intensify due to the revitalization of social and economic activities and living activities. Accordingly, the real domain, where the company operates its core business, is expected to be revived, while the digital market is expected to grow steadily.

The company aims to revive and expand the real domain, by seizing business opportunities while consumers’ behavior and awareness are changing and crowds of people are returning. | × | To expand the online domain further, by taking advantage of the growth of the digital market |

| There will emerge a sign of positive effects on the company toward FY June 2024. |

Initiatives for marketing centered on real things

(Taken from the reference material of the company)

Initiatives for comprehensive promotion centered on digital content

(Taken from the reference material of the company)

5. Conclusions

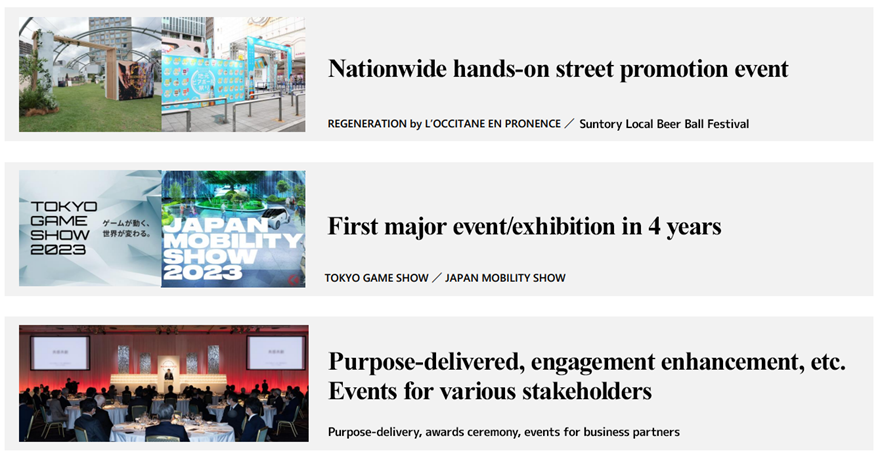

In FY June 2023, sales and ordinary income dropped year on year in the first half mainly due to the reactionary decline from the large-scale projects for Tokyo 2020 Olympic and Paralympic Games, but in the cumulative third quarter, sales and profit grew year on year, and in the full year, sales growth rate and profit growth rate were higher than those in the cumulative third quarter. The recovery trend intensified quarter by quarter. As almost all regulations for coping with COVID-19 were lifted and advertisers resumed real promotional activities on a full-scale basis, real events were revitalized. Large events, such as Tokyo Game Show in September and Japan Mobility Show in October, which produce significant effects on the company’s business, tend to be held in the first half of each fiscal year. The ratio of the business performance between the first and second halves of FY June 2023 was 55 : 45. It is forecast that sales will grow 24.6% to 7,962 million yen and ordinary income will rise 43.2% to 970 million yen in the first half of FY June 2024, and annual ordinary income will grow by double digits for 3 consecutive years. There seems to be room for further growth from the current fiscal year to the next fiscal year.

On the other hand, there will be no longer effect of the extraordinary loss posted in the previous fiscal year, so EPS is expected to significantly rise in the current fiscal year, but share price is stagnant. Considering that PER and dividend yield remain low, there seems to be significant room for readjustment. It is noteworthy that the return to shareholders has been enhanced further, as the company acquired 5.5 million treasury shares, which account for 12.1% of outstanding shares in September last year.

<Reference 1: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 4 outside ones(including 4 independent outside directors) |

◎ Corporate Governance Report Updated on September 30,2022

Basic Policy

Our company recognizes corporate governance as "building and operating a structure that achieves appropriate and efficient decision making and business execution by the management, prompt result reports to stakeholders, and soundness, fairness and high transparency of business administration in order to continuously improve the corporate value." In order to achieve sustainable growth and improve our medium and long-term corporate value while fulfilling our responsibility to shareholders, customers, employees and other stakeholders, our company will achieve effective corporate governance in accordance with the basic policy stated below.

1. Respect the rights of shareholders and ensure equality.

2. Consider the interests of stakeholders including shareholders and cooperate properly.

3. Disclose company information properly and ensure the transparency.

4. Improve the effectiveness of the supervisory function for business execution by the board of directors.

5. Have constructive dialogue with shareholders who have an investment policy that matches the interests of shareholders over the medium to long term.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 3-1-2 Disclosure and provision of information in English】

We prepare an English version of business reports and also disclose analyst reports in English semi-annually on our website. In the future, we will consider provision of the materials for results briefing and contents of the convocation notice, etc. in English in light of trends of ratios of institutional investors and foreign investors among the company’s shareholders.

【Supplementary Principle 3-1-3 Initiatives on Sustainability】

【Supplementary Principle 4-2-2 Establishment of Policies concerning Initiatives for Sustainability】

With regard to the company’s policies and initiatives on sustainability, the Board of Directors will take the lead in future discussions as necessary to ensure that the company can disclose the impact of climate change-related risks and revenue opportunities on the company’s business activities, revenue, etc. in accordance with the TCFD or an equivalent framework, taking into account the appropriate size of the company and industry trends.

【Supplementary Principle 4-1-2 Commitment to the mid-term management plan】

【Principle 5-2 Formulation and announcement of management strategies and plans】

The company’s top priority is to achieve its performance goals for a single fiscal year, and the formulation of the medium-term management plan is currently put on hold due to the discontinuity of the business environment, however, the company has formulated and announced its business growth vision at the Financial Results Briefing for Q2 of FY June 2021. In addition, the company believes that it is significant to establish a management vision and to develop strategies from a medium-term viewpoint, and will announce its medium-term management plan when the company has confidence in trends in the industry environment and in its verification of the effectiveness of measures.

【Supplementary Principle 4-10-1 Appropriate Involvement and Advice from Independent Outside Directors through the Establishment of a Voluntary Advisory Committee】

In order to strengthen the independence, objectivity, and accountability of the functions of the Board of Directors in relation to the nomination and compensation, etc. of directors etc., when examining the nomination and compensation etc., we will examine the development of a system aimed at implementing more fair and transparent examinations and procedures, including deeper collaboration with independent external directors.

<Main Disclosed Principles>

【Supplementary Principle 1-2-4 Electronic Exercise of Voting Rights, etc.】

Considering the exercise of voting rights by institutional investors and overseas investors, our company made the exercise of voting rights via the Internet possible from the 46th annual meeting of shareholders.

【Principle 1-4 Cross-holding shares】

The basic policy in making investments other than for pure investment purposes is to create synergy effects in the company’s integrated promotion business through business alliances and information sharing with companies that we invest in. In order to improve value in the medium- to long-term perspectives, we hold the minimum number of listed shares only when it is determined that holding the shares would be effective in consideration of strengthening relationships with business partners, etc.

With regard to the exercise of voting rights of cross-holding shares, in order to ensure appropriate responses, we examine each case from comprehensive viewpoints including the medium- to long-term improvement of the corporate value of the share issuing company as well as the medium- to long-term growth of economic benefits for us. For the major cross-holding shares, we will report the status of the exercise of voting rights to the Board of Directors.

【Principle 2-3 Issues regarding Sustainability including Social and Environmental Issues】

The company’s Board of Directors recognizes that addressing issues related to sustainability including social and environmental issues is an important management task, and the Environmental Management Committee and other committees are actively working on addressing these issues. Specifically, the company has been working on the environmental issues since 2000, and disclosing the information on its website.

https://tow.co.jp/iso/

【Principle 4-9 Independence Standards and Qualification for Independent External Directors】

We select external director candidates who meet the independence criteria set by the Tokyo Stock Exchange.

【Supplementary Principle 4-11-1 View on the balance, diversity and scale of knowledge, experience and capabilities as the entire Board of Directors】

The company stipulates the number of directors as 14 or less by the articles of incorporation, and as of September 24, 2021, the Board of Directors consists of 10 members (including 4 external directors). For the members of the Board of Directors, we take into consideration the diversity of experience, knowledge, capabilities, etc.

The skills matrix is also disclosed in the Notice of Convocation of General Meeting of Shareholders.

【Principle 5-1 Policy for having constructive dialogue with shareholders】

We are convinced that the most important mission to fulfill our company's responsibility is to promote two-way constructive dialogue with shareholders and investors, and to realize effective corporate governance in order to achieve sustainable growth and improve our medium and long-term corporate value.

Based on this idea, our company will implement the following measures.

1. Designation of directors in charge of dialogue with shareholders

In our company, executives have dialogue with shareholders, and the managing director controls IR activities.

2. Measures for organic coordination of in-company departments

In our company, the general affair team, which is also in charge of IR activities, discusses and exchanges opinions on a daily basis with the accounting team and they also collaborate in preparing the disclosed materials and discuss the content with executives.

3. Efforts for enhancing dialogue methods other than individual interviews

Our company will conduct the general shareholders' meeting that earns shareholders' trust by valuing the general shareholders' meeting as an opportunity for important dialogue with shareholders and ensuring sufficient information disclosure of our business. In addition, our company will work on achieving closer communication with shareholders and investors by regularly holding financial results briefing.

4. Measures for feedback of opinions and concerns of shareholders

Our company will compile the opinions and concerns about our company heard in the dialogue with shareholders and investors at the department in charge and develop a system that reports this regularly to executives and the board of directors according to its importance and nature.

5. Measures for managing insider information

The basic policy of our company is to provide fair information disclosure in order to ensure substantive equality for shareholders and investors. Based on this policy, we will disclose important information about our company in a timely and fair manner, and strive to manage the information rigorously so that it will not be provided only to some shareholders and investors.

<Reference 2: Issues to be addressed and initiatives>

Issues to be addressed

◎Initiatives in FY June 2024

Regarding the market environment of our corporate group, we expect that real marketing activities will be resumed due to the revitalization of social and economic activities and daily life activities, and the digital market will keep growing steadily. We have expanded the real and online domains, and there is a sign of their positive effects on our performance in FY June 2024. Under this environment, we concentrate on mainly the following initiatives.

①Initiatives for expanding the real domain

We will concentrate on nationwide experience-based promotion, large-scale events and expositions, which will be held for the first time in 4 years, events for stakeholders to disseminate our purposes and enhance engagement, and so on. In addition, we aim to improve experience value utilizing the experience domain, which is our forte, with the collaborative project “TOOH” with Kesion Co., Ltd., an outdoor advertisement company, as daily life activities in towns are expected to be revitalized.

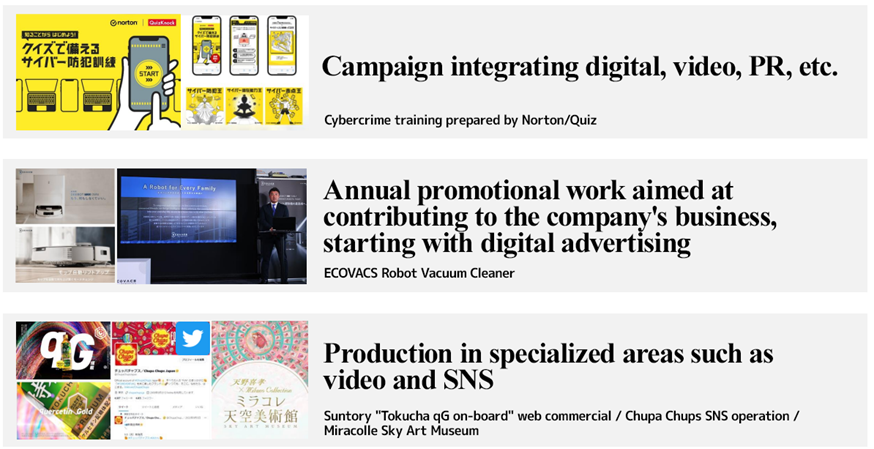

②Initiatives for expanding the online domain

We will keep concentrating on comprehensive campaigns utilizing websites, social media, videos, PR activities, etc., annual promotion aimed at contributing to enterprises through digital ads, and the digital domain, including the production of videos and social media contents in specialized fields. In addition, we acquired MOTTO, a company producing commercials, as a consolidated subsidiary, while expecting the growth of the business domain based on videos. Then, we aim to further expand comprehensive promotion we produce and improve the value we provide. As there is a sign of full-scale recovery in the real field, where we operate our core business, we will try to increase event/promotion projects as our core business and further expand the online domain in the steadily growing digital market through the above actions, to increase our top line. Our sales are projected to grow 18.9% year on year to 14 billion yen. Furthermore, we will continue our efforts to secure revenues through fee-based tasks based on high added value and optimization of order placement, and strategically invest in human capital for growing our business domain and improving our group’s advantages and originality, and spend funds for developing a foundation for working on priority themes for medium/long-term business growth.

◎ Medium/long-term initiatives

In order to fulfill our purpose of “creating experiences in the new era,” we will strive to achieve sustainable growth and improve corporate value. Major initiatives are as follows.

①Priority themes: “Technology and AI” and “the Environment”

In response to the sophistication, complication, and streamlining of promotion processes amid the rapid digitalization of day-to-day activities, we will accelerate the utilization of digital technologies, including AI, for events and promotion, and promote the visualization of project results, the streamlining of operations, the development of original solutions, etc. to update our experience domain further. In addition, we will improve our capability of addressing environmental issues by producing environment-conscious events in accordance with our “guidelines for sustainable events” and then not only solve issues with enterprises, but also contribute to society and the environment through clients’ business.

②Enhancement of initiatives for sustainability

Our corporate group will contribute to a sustainable society by contributing to society and the environment through clients’ business, and then utilize our experience and know-how for growing our business and improving corporate value in a sustainable manner. With this mindset, we will set our sustainability policy: “to tackle issues with enterprises and society through experiences created by individual employees and develop a company that can grow sustainably,” and work on the following 4 key issues.

Human resources: Aiming to become a company in which diverse personnel creating experiences in the new era can flourish

Potential of experience: To lead the evolution of the experience domain by utilizing technology

Social contribution: To improve our company’s services and contribute to society and the environment through clients’ business

Compliance: To recognize corporate social responsibility and comply with laws and regulations

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (TOW Co., Ltd.:4767) and contents of Bridge Salon (IR seminars) can be seen at https://www.bridge-salon.jp/