Bridge Report:(4767)TOW the Fiscal Year ended June 2025

Kenichi Muratsu President | TOW Co., Ltd. (4767) |

|

Company Information

Market | TSE Standard Market |

Industry | Service |

President | Kenichi Muratsu |

HO Address | Tokyo, Minato-ku, Toranomon 4-3-13, Hulic Kamiyacho Building 3F |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥374 | 48,969,096 shares | ¥18,314 million | 11.8% | 100 shares | |

DPS Est | Dividend yield Est | EPS Est | PER Est | BPS Act | PBR Act |

¥18.30 | 4.9% | ¥36.59 | 10.2 x | ¥241.07 | 1.6 x |

*Share price as of closing on August 25, 2025. Taken from the brief report on the financial results in the fiscal year ended June 2025.

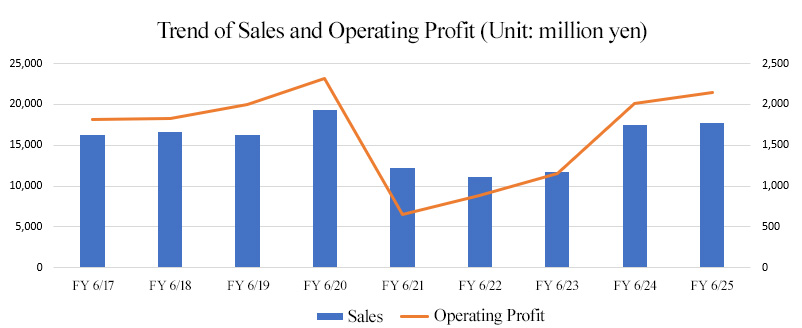

Consolidated Earnings

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

June 2022 (Act.). | 11,134 | 883 | 924 | 598 | 13.22 | 14.00 |

June 2023 (Act.). | 11,774 | 1,150 | 1,178 | 355 | 8.61 | 14.40 |

June 2024 (Act.). | 17,503 | 2,006 | 2,058 | 1,405 | 34.71 | 14.00 |

June 2025 (Act.). | 17,782 | 2,152 | 2,194 | 1,132 | 27.72 | 15.00 |

June 2026 (Est.). | 18,800 | 2,208 | 2,250 | 1,500 | 36.59 | 18.30 |

*Unit: million-yen, yen. Estimates are those of the Company. Net income is profit attributable to owners of parent (the same applies for net income hereinafter).

We present this Bridge Report reviewing the earnings results in the fiscal year ended June 2025 and the outlook for the fiscal year ending June 2026 for TOW.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended June 2025 Earnings Results

3. Fiscal Year ending June 2026 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended June 2025, sales grew 1.6% year on year to 17,782 million yen. The sales from real events and hybrid events regarding information, telecommunication, food products, and beverages increased. In addition to the large-scale events of government agencies and groups, the EXPO in Osaka, Kansai in 2025 contributed to the healthy sales. Operating income rose 7.3% to 2,152 million yen. As they expanded fee-based operations by offering high added value and started in-group production, gross profit rose 8.3% year on year and gross profit margin increased 1.1 points year on year. Profit increased, as the 10.5% year-on-year augmentation of SG&A expenses was offset. Net income declined 19.5% year on year to 1,132 million yen. An extraordinary loss of 580 million yen was posted, as they implemented corrective measures regarding the operation of a labor system.

- For the fiscal year ending June 2026, sales are expected to grow 5.7% year on year to 18.8 billion yen. Their core business in the event promotion field and the large-scale automobile exhibitions will contribute. Operating income is projected to rise 2.6% year on year to 2,208 million yen. The profitable fee-based operations are expected to grow. They will promote in-group production, and maintain an advanced earning capacity with business operations that offer high value by utilizing the strengths of the corporate group, so gross profit margin is forecast to rise 0.4 points year on year. On the other hand, operating income margin is projected to decline 0.4 points year on year, as they will redevelop a governance structure and continue the investment in the management base and human capital, increasing SG&A expenses by 19.6% year on year. They plan to pay an interim dividend of 9.15 yen/share and a year-end dividend of 9.15 yen/share, for a total of 18.30 yen/share per year. The expected payout ratio is 50.0%.

- In the fiscal year ended June 2025, gross profit margin rose 1.1 points from the previous fiscal year to 17.9%. One of the factors in this increase is the expansion of fee-based operations through the provision of high added value. The experience design department, which is a group of experts in planning, digital technology, videos, and PR, has given various proposals with high added value. Their comprehensive capability of utilizing real and digital technologies has been evaluated by clients further, which led to the expansion of their fee-based operations. Their sales composition ratio has increased steadily. According to its business, most of personnel expenses are posted as the cost of sales. The in-house production by subsidiaries and the expansion of fee-based operations contributed significantly to the improvement in gross profit margin amid the rising personnel expenses. We would like to keep paying attention to the speed of that expansion.

1. Company Overview

In the field of event promotion in the advertising industry, the company is the largest independent enterprise. The company strives to evolve “experience design” based on the comprehensive capability of proposing and implementing various measures from physical and digital aspects, including press conferences, PR events, exhibitions, video streaming, and social media, by accurately grasping the strategic intentions of clients, and grows business.

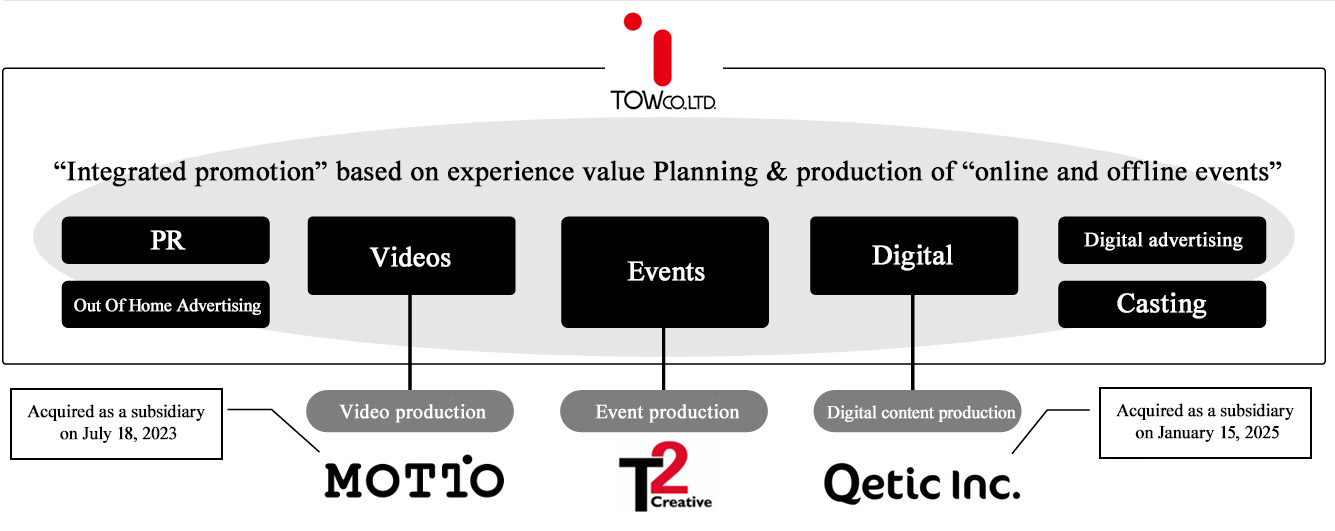

The corporate group is composed of TOW Co., Ltd., and the following three consolidated subsidiaries: T2 Creative Co., Ltd. (hereinafter called “T2C”), which produces, operates, and directs events and produces videos, Motto Inc., a commercial production company that became a subsidiary in July 2023, and Qetic Inc., which plans, produces, and manages a broad range of social media and digital content and was acquired as a subsidiary in January 2025; and SP Ring Tokyo Co., Ltd., which is an event company that became an equity-method affiliate in fiscal year ended June 2024 through the acquisition of additional shares.

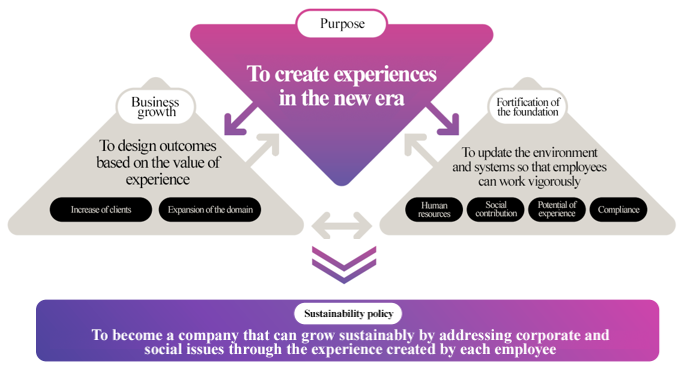

[1-1 Purpose]

Their purpose is to “create experiences in the new era,” which indicates the social meaning of existence of the company.

For assisting client companies in promoting their customers to purchase their products and services, become their fans, and keep using their products and services as an escort, they put importance on experiences, which “the most effective means for motivating people,” and aim to brush up “experience design” for the evolution from a “means for increasing popularity” to a “measure to close the gap between brands and consumers.”

(Taken from the reference material of the company)

[1-2 Business Description]

Planning to Implementation of Events and Promotion

A transaction concerning events and promotion arises as soon as an organizer or a promoter thinks of any objective (intention to get information across to their audience).

TOW receives an explanation on this objective from the organizer or promoter, and after analysis and research, they formulate a strategy or plan. Then, they proceed into each stage, developing the initial plan into a basic scheme, an implementation scheme, and a detailed scheme based on numerous meetings, which in the end become deliverables matching the respective method. TOW proceeds with the preparations according to reference material and conducts events and promotion.

Scope of TOW’s Business and Competitive Advantage

TOW receives orders for the whole abovementioned process from planning to implementation. They undertake analysis and research, devising a strategy and formulating the concept, project proposal, actual production, effectiveness verification, and other work incidental to the above processes, employing a number of methods tailored for each task.

TOW’s work lies in conveying the intention of an organizer or a promoter to consumers by taking on the comprehensive production and direction of the overall promotion, while outsourcing respective tasks to companies specialized in respective fields including real events, online events, video creation, SNS-based campaigns, digital advertising operation, digital media operation, SNS account operation, user experience design of digital services, promotion, and sales promotion and so on.

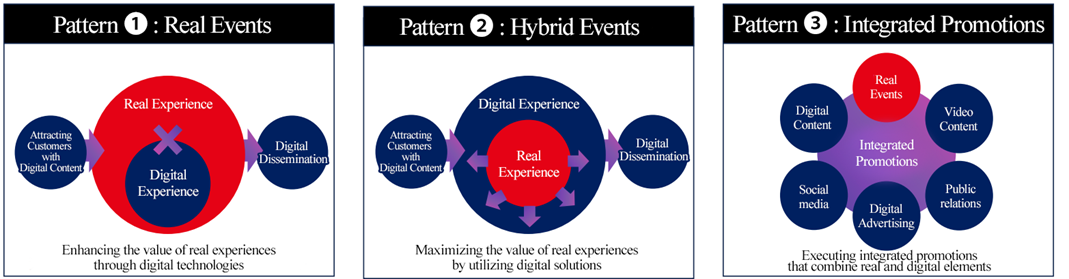

Residents and society have adopted digital technologies rapidly, and the fusion of real and digital systems has been accelerated further, so there are an increasing number of cases where clients demand sales promotion that integrates real and digital methods to maximize the outcomes of corporate marketing.

The company offers services in the three categories: “real events,” “hybrid events,” and “integrated promotions” to give optimal solutions for satisfying needs.

The comprehensive capability of grasping the strategic intention of each client and proposing and implementing various measures from real and digital aspects as a hands-on supporter is their overwhelming strength, competitive advantage, and differentiation factor.

(Taken from the reference material of the company)

Establishment of a new structure for integrating real and digital technologies for the evolution of experience design

Amid the accelerated fusion of real and digital technologies, they acquired the digital production company Qetic, which excels in the fields of entertainment and culture, as a subsidiary in January 2025.

They established a new structure for integrating real and digital technologies for the evolution of experience design by combining T2 Creative Co., Ltd., which produces, operates, and organizes events and creates videos, and Motto Inc., which produces commercials.

They plan to cement the cooperation with a subsidiary that possesses expertise in each field at an accelerated pace, improve quality and revenue, induce synergetic effects of planning and production of integrated promotional events based on experience value, and concentrate on the expansion of the three categories.

(Taken from the reference material of the company)

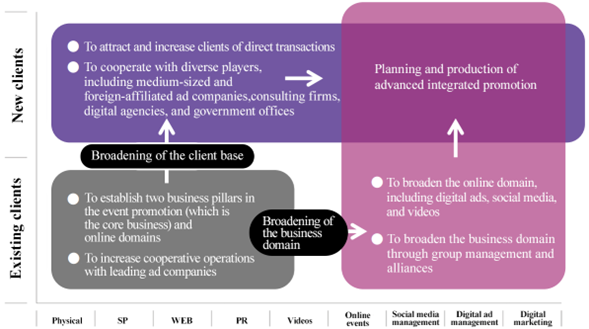

[1-3 Business Strategy]

They are expanding business by broadening their client base and business domain.

For broadening the client base, they will maintain or deepen the relationships with leading ad agencies, and concentrate on increasing clients for direct transactions while the shift from the mass media to digital content is progressing rapidly. In order to brush up experience design, they will promote the collaboration with a broad range of players.

For broadening the business domain, they strive to expand the online domain and form alliances.

Through the broadening of them, they will plan and produce more advanced integrated promotion programs.

(Taken from the reference material of the company)

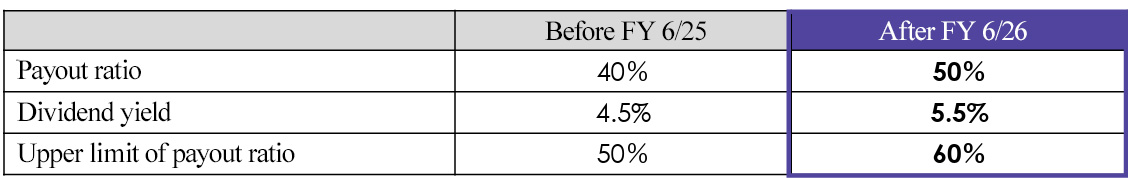

[1-4 Dividend Policy]

In the task-undertaking business, the burden of reinvestment is relatively light, so equity capital accumulates. Considering this characteristic, the company recognized again that stable profit return is one of important challenges, and revised their dividend policy from the fiscal year ending June 2026, to return profit to shareholders proactively.

Previously, the company determined the minimum dividend amount with the upper limit of the consolidated payout ratio being 50% under the basic policies: (1) consolidated payout ratio and (2) the dividend per share obtained by multiplying the closing price on the day preceding the announcement of the financial results by the dividend yield 4.5%, whichever is higher, and (3) securing internal reserve. They decided to raise the minimum dividend by revising indicators and the targets: “a payout ratio of 50%,” “a dividend yield of 5.5%,” and “the upper limit of payout ratio being 60%” without the changing the above three indicators in the fiscal year ending June 2026.

(Taken from the reference material of the company)

The dividend per share estimated with this policy is 18.3 yen/share, up 3.30 yen/share from the previous fiscal year, so they plan to pay an interim dividend of 9.15 yen/share and a year-end dividend of 9.15 yen/share. They will flexibly adjust the dividend, if profit changes due to the change in the business environment, the trend of business performance, or special circumstances, such as M&A.

2. Fiscal Year ended June 2025 Earnings Results

[2-1 Consolidated Earnings]

| FY 6/24

| Ratio to sales | FY 6/25

| Ratio to sales | YoY | Forecast Ratio |

Sales | 17,503 | 100.0% | 17,782 | 100.0% | +1.6% | -1.2% |

Gross profit | 2,939 | 16.8% | 3,183 | 17.9% | +8.3% |

|

SG&A | 932 | 5.3% | 1,030 | 5.8% | +10.5% |

|

Operating Income | 2,006 | 11.5% | 2,152 | 12.1% | +7.3% | +1.6% |

Ordinary Income | 2,058 | 11.8% | 2,194 | 12.3% | +6.6% | +2.1% |

Net Income | 1,405 | 8.0% | 1,132 | 6.4% | -19.5% | -20.7% |

*Unit: million yen. Figures include reference figures calculated by Investment Bridge Co., Ltd. and actual results may differ (applies to all tables in this report)

Sales and profit increased.

Sales grew 1.6% year on year to 17,782 million yen. The sales from real events and hybrid events regarding information, telecommunication, food products, and beverages increased. In addition to the large-scale events of government agencies and groups, the EXPO in Osaka, Kansai in 2025 contributed to the healthy sales.

Operating income rose 7.3% to 2,152 million yen. As they expanded fee-based operations by offering high added value and started in-group production, gross profit rose 8.3% year on year and gross profit margin increased 1.1 points year on year. Profit increased, as the 10.5% year-on-year augmentation of SG&A expenses was offset.

Net income declined 19.5% year on year to 1,132 million yen. An extraordinary loss of 580 million yen was posted, as they implemented corrective measures regarding the operation of a labor system.

[2-2 Sales trends by category]

| FY 6/24

| Ratio to sales | FY 6/25

| Ratio to sales | YoY |

Real Events | 10,860 | 62.0% | 11,247 | 63.3% | +3.6% |

Hybrid Events | 2,182 | 12.5% | 2,232 | 12.6% | +2.3% |

Integrated Promotions | 4,237 | 24.2% | 4,179 | 23.5% | -1.3% |

Other | 224 | 1.3% | 123 | 0.7% | -45.3% |

Total | 17,503 | 100.0% | 17,782 | 100.0% | +1.6% |

*Unit: million yen

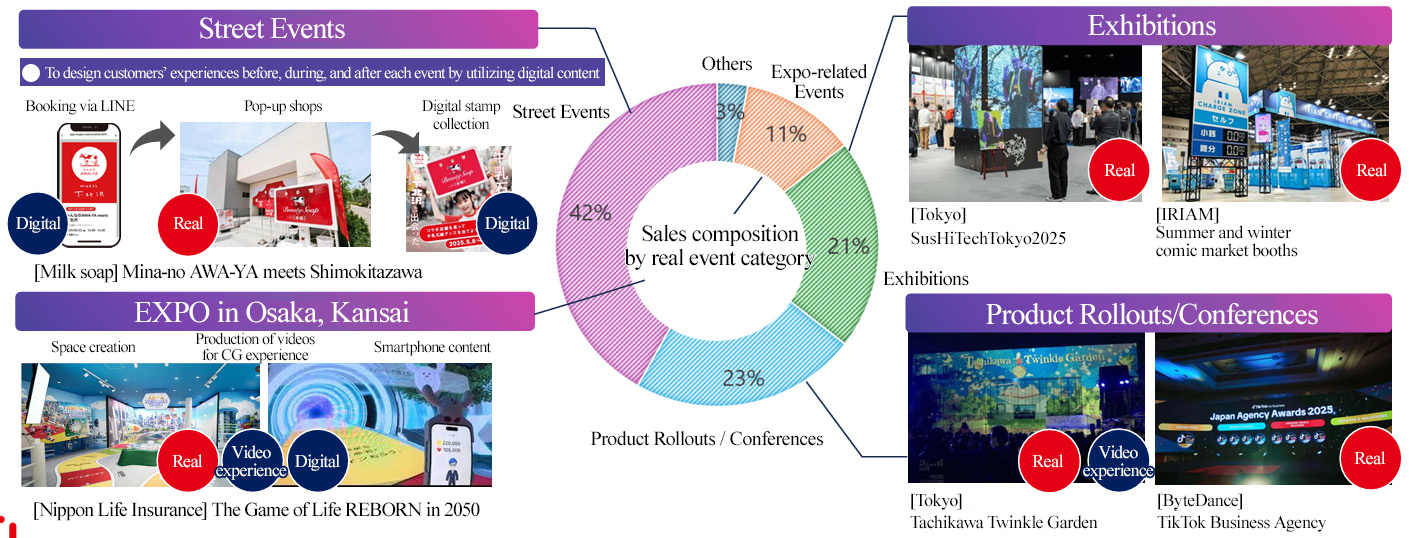

(1) Real events

Sales grew 3.6% year on year to 11,247 million yen. The utilization of digital technologies and videos for large-scale events is now common. The sales from street events mainly for beverages and articles of taste, which need to attract customers and disseminate information with digital technologies, remained stable, accounting for 42%. The demand for real experiences remained strong, so the sales from business conferences and operations for government agencies and groups mainly in Tokyo increased significantly.

(Taken from the reference material of the company)

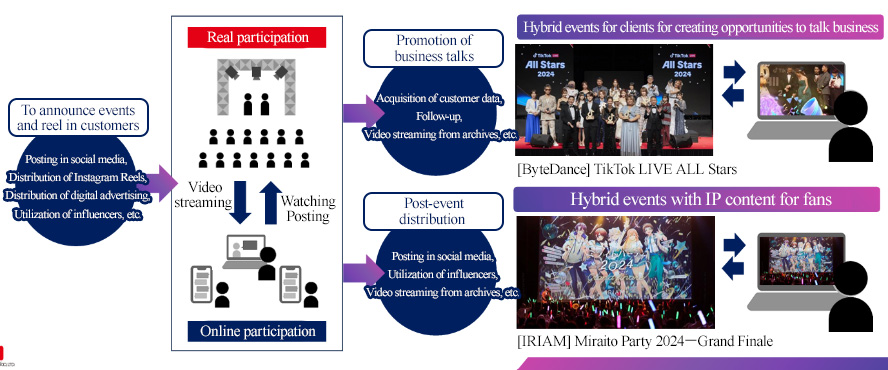

(2) Hybrid events

Sales increased 2.3% year on year to 2,232 million yen. Projects related to information and telecommunication, games, IP content, etc. increased. In addition to the BtoB events where the close communication with clients is emphasized, hybrid events play an important role in marketing activities, also among intellectual property (IP) companies that aim to strengthen the engagement in content with fans, so this business is expanding. They are compatible with digital technologies and videos, so further expansion is expected.

(Taken from the reference material of the company)

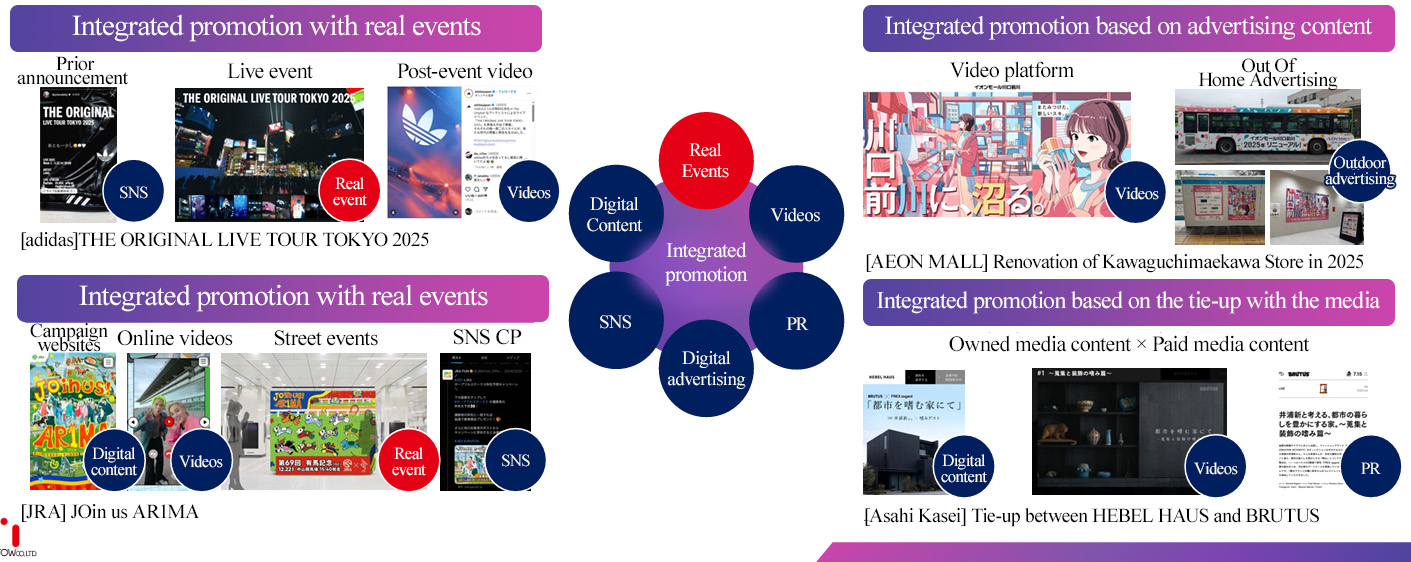

(3) Integrated Promotions

Sales declined 1.3% year on year to 4,179 million yen. Through the cooperation among group companies, video-related tasks increased, but sales declined as they allocated resources to the EXPO in Osaka, Kansai. Sales dropped, but they received more orders for integrated promotion, which combines events, in which the company excels, and digital technologies and videos, in which the group companies (Qetic and Motto) excel. Based on ad content, integrated promotion means are diversifying, including tie-ups with the media and OOH*.

*OOH

OOH stands for Out-Of-Home Advertising, which is a collective term for “advertisements seen outside homes,” meaning all kinds of advertising at transportation facilities and outdoors, including posters in stations, large-sized displays in streets, signboards, and advertisements in buses.

(Taken from the reference material of the company)

(4) Other

Sales dropped 45.3% year on year to 123 million yen. Secretariat tasks entrusted by government agencies and groups decreased.

[2-3 Trend in each business category]

(Sales growth)

Information & telecommunication, food products & beverages & articles of taste, government agencies & groups, finance, manufacturing of precision equipment, etc., and other (energy, materials, machinery, education, medical services, religion, publication, real estate, and housing equipment)

Regarding “information & telecommunication,” they significantly increased sales from foreign-affiliated platform providers and telecommunication carriers, which put importance on real contact points no matter whether the business is BtoB or BtoC.

Regarding “food products, beverages, and articles of taste,” the scale of experience-based events and promotion expanded, and caravan-type measures increased, so their sales composition ratio remained high.

Regarding “government agencies and groups,” they received more orders for large-scale events under the theme of sustainability and sports promotion in addition to the EXPO in Osaka, Kansai.

Over the past few years, the sales from video-related projects, on which they concentrate, have increased by double digits.

(Drop in sales)

Automobiles, cosmetics & toiletries & daily goods, transportation & leisure, and distribution & retail

Regarding “transportation and leisure,” they kept receiving orders for large-scale events of IP content enterprises, but the number of orders for large-scale game exhibitions decreased, so sales dropped.

Regarding “automobiles,” tasks for integrated promotion increased, but sales declined due to the reactionary decrease of large-scale exhibitions and the shrinkage of street promotion.

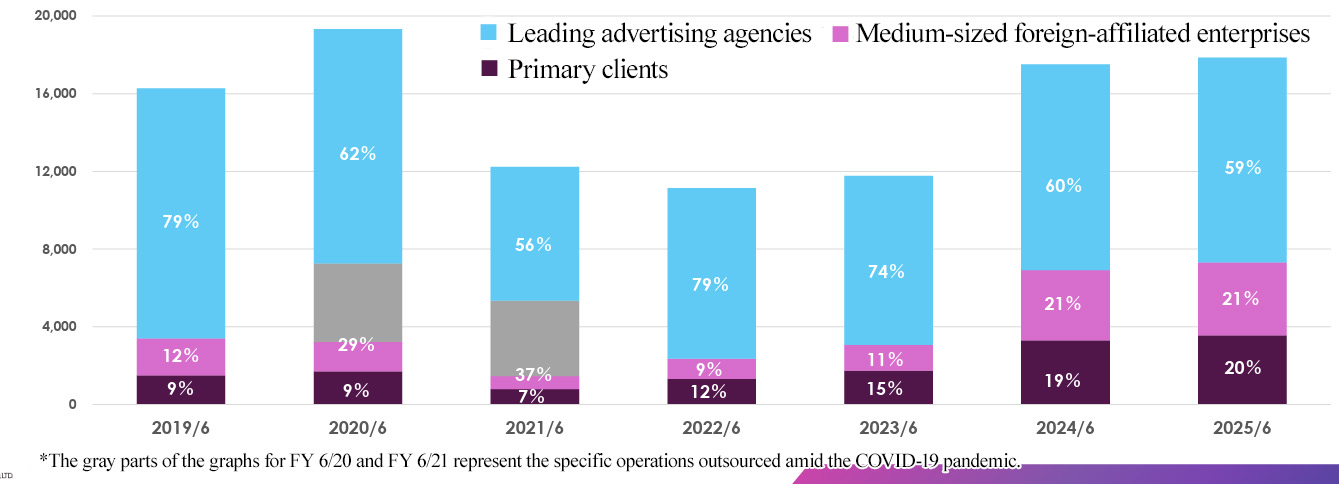

[2-4 Trend of sales from each client category]

The sales from leading ad agencies, including the operations related to the EXPO in Osaka, Kansai, were healthy. From leading ad agencies, they receive an increasing number of orders for events and promotion based on experience value and integrated promotion based on the cooperation among group companies in addition to the EXPO-related operations.

Regarding primary clients, important targets for “broadening the client base,” the number of clients who put importance on experience value increased, and they received more orders related to information & telecommunication, IP content, government agencies and groups.

From medium-sized foreign-affiliated enterprises, etc., they received more orders for events and promotion, which are the core business, mainly beverages, food products & articles of taste and IP content.

In fiscal year ended June 2025, primary clients accounted for 20% of sales and medium-sized foreign-affiliated enterprises, etc. made up 21%, showing the steady expansion of clients.

(Taken from the reference material of the company)

[2-5 Financial Condition & Cash Flow (CF)]

(1) BS

| End of FY 6/24

| End of FY 6/25 | Increase/ decrease |

| End of FY 6/24 | End of FY 6/25 | Increase/ decrease |

Current Assets | 12,326 | 12,255 | -70 | Current liabilities | 4,422 | 3,880 | -542 |

Cash and Deposits | 8,452 | 8,128 | -324 | Accounts Payable | 2,046 | 1,595 | -450 |

Accounts Receivable | 3,541 | 3,712 | +170 | Short Term Debt | 840 | 541 | -298 |

Non-current Assets | 1,759 | 1,964 | +205 | Non-current liabilities | 360 | 447 | +86 |

Property, plant and equipment | 216 | 214 | -2 | Liabilities | 4,782 | 4,327 | -455 |

Investments, Other Assets | 1,497 | 1,604 | +107 | Net Assets | 9,302 | 9,892 | +589 |

Investment securities | 1,161 | 1,072 | -89 | Retained Earnings | 8,432 | 8,973 | +540 |

Total Assets | 14,085 | 14,219 | +134 | Treasury shares | -1,876 | -1,790 | +85 |

|

|

|

| Total Liabilities, Net Assets | 14,085 | 14,219 | +134 |

*Unit: million yen. “Accounts receivable” is the sum of notes receivable, accounts receivable-trade, contract assets, and electronically recorded monetary claims. “Accounts payable” is the sum of electronically recorded payables and accounts payable-trade.

Total assets increased 100 million yen from the end of the previous fiscal year to 14.2 billion yen, due to the increase in accounts receivable, etc. Total liabilities decreased 400 million yen to 4.3 billion yen, due to the decline in accounts payable and short-term debt. Net assets increased 500 million yen to 9.8 billion yen, due to the growth of retained earnings, etc.

Capital-to-asset ratio rose 3.5 points from the end of the previous fiscal year to 69.5%.

(2) CF

| FY 6/24

| FY 6/25 | Increase/decrease |

Operating CF | 3,395 | 733 | -2,662 |

Investing CF | -44 | -91 | -46 |

Free CF | 3,350 | 641 | -2,708 |

Financing CF | -678 | -966 | -287 |

Cash, Equivalents at the end of term | 8,452 | 8,128 | -324 |

*Unit: million yen

The cash inflow from operating activities and the surplus of free cash flow shrank, due to the decrease in net income before taxes and other adjustments, etc.

The cash position declined slightly.

[2-6 Topics]

◎ Defects in the labor system and corrective measures

(1) Outline of the defects in the labor system

In the fiscal year ended June 2025, it was found that they operated a system for entrusting employees with technical tasks while specifying deemed working hours while they did not choose the representative of a majority of workers, make the agreement to known to all employees, or satisfy requirements, and the scope of application of supervisors differed between the judgment based on the system and the actual situation, so they received a recommendation and guidance for correction from a labor standards office.

(2) Corrective measures

① Payment of unpaid wages

Expenses of 580 million yen for mainly paying wages that were not paid due to the past system were posted as extraordinary loss (labor costs) in the fiscal year ended June 2025.

② Initiatives for preventing recurrence and fortifying the business foundation

On the other hand, they plan to continue initiatives for preventing recurrence and fortifying the business foundation, such as the correction of the system, the revision to personnel expenses, and the strengthening of the business operation system, from fiscal year ending June 2026 as well. The company will proceed with these initiatives, while positioning them as “structural investment for fortifying the business base in the medium/long term.”

In particular, they will concentrate on the redevelopment of their corporate governance structure and the enhancement of its functions, while considering it as an opportunity to reconsider the base of reliability of business administration.

3. Fiscal Year ending June 2026 Earnings Forecasts

[Consolidated Earnings]

| FY 6/25 Act. | Ratio to sales | FY 6/26 Est. | Ratio to sales | YoY |

Sales | 17,782 | 100.0% | 18,800 | 100.0% | +5.7% |

Gross profit | 3,183 | 17.9% | 3,440 | 18.3% | +8.1% |

SG&A | 1,030 | 5.8% | 1,232 | 6.6% | +19.6% |

Operating Income | 2,152 | 12.1% | 2,208 | 11.7% | +2.6% |

Ordinary Income | 2,194 | 12.3% | 2,250 | 12.0% | +2.5% |

Net Income | 1,132 | 6.4% | 1,500 | 8.0% | +32.5% |

*Unit: million yen

Expecting both increases in sales and profit.

For the fiscal year ending June 2026, sales are expected to grow 5.7% year on year to 18.8 billion yen. Their core business in the event promotion field and the large-scale automobile exhibitions will contribute.

Operating income is projected to rise 2.6% year on year to 2,208 million yen. The profitable fee-based operations are expected to grow. They will promote in-group production, and maintain an advanced earning capacity with business operations that offer high value by utilizing the strengths of the corporate group, so gross profit margin is forecast to rise 0.4 points year on year. On the other hand, operating income margin is projected to decline 0.4 points year on year, as they will redevelop a governance structure and continue the investment in the management base and human capital, increasing SG&A expenses by 19.6% year on year.

As noted in "1. Company Overview 1-4 Dividend Policy," they plan to pay an interim dividend of 9.15 yen/share and a year-end dividend of 9.15 yen/share, for a total of 18.30 yen/share per year. The expected payout ratio is 50.0%.

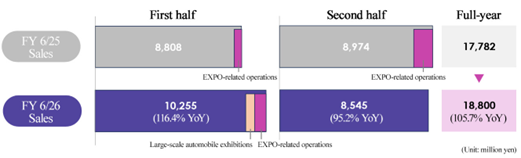

◎ Sales in the first and second halves

In the first half of the fiscal year ending June 2026, part of the business operations related to the EXPO in Osaka, Kansai and large-scale automobile exhibitions will contribute, but in the second half, these two factors will longer exist, so it is projected that the sales in the first half will increase year on year, but the sales in the second half will decrease year on year. They aim to expand the major categories: real events, hybrid events, and integrated promotion throughout the year, and are expected to increase annual sales by 5.7%.

(Taken from the reference material of the company)

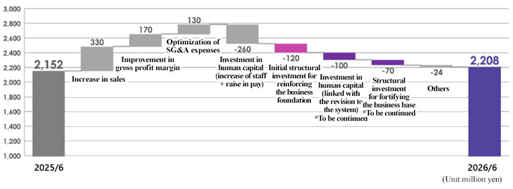

◎ Factors in increasing/decreasing operating income

Operating income is expected to rise 630 million yen year on year, due to the sales growth thanks to the good business environment and the satisfaction of demand, the improvement in gross profit margin through the expansion of profitable business operations, and the optimization of SG&A expenses, but due to the initially planned investment in human capital and structural investment for reinforcing the business foundation, net operating income is forecast to rise 2.6% year on year to 2,208 million yen.

Some defects were discovered in their labor system as mentioned above, so they plan to correct and revise the system. The investment in human capital amounting to 100 million yen and the structural investment for fortifying the business foundation amounting to 70 million yen in the wake of revision to the system in fiscal year ending June 2026 will be continuously posted from fiscal year ending June 2027 as well.

(Taken from the reference material of the company)

◎ Status of order receipt

They classify their ongoing projects, including proposed ones, as follows.

(Taken from the reference material of the company)

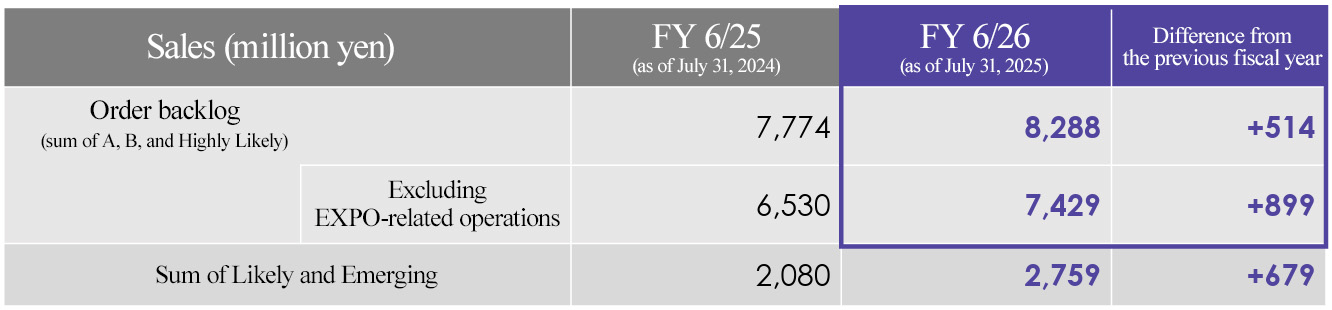

They disclose the sum of the amounts of A, B, and highly likely projects as order backlog.

The order backlog as of the end of July 2025 stood at 8,288 million yen, up 6.6% year on year. When EXPO-related operations are excluded, the order backlog stood at 7,429 million yen, up 13.8% year on year, showing healthy performance.

(Taken from the reference material of the company)

4. Conclusions

In the fiscal year ended June 2025, gross profit margin rose 1.1 points from the previous fiscal year to 17.9%. One of the factors in this increase is the expansion of fee-based operations through the provision of high added value. The experience design department, which is a group of experts, has worked cooperatively with sales team to provide various proposals with high added value. Their comprehensive capability of utilizing real and digital technologies has been evaluated by clients further, which led to the expansion of their fee-based operations. Their sales composition ratio has increased steadily. According to its business, most of personnel expenses are posted as the cost of sales. The in-house production by subsidiaries and the expansion of fee-based operations contributed significantly to the improvement in gross profit margin amid the rising personnel expenses. We would like to keep paying attention to the speed of that expansion.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 4 outside ones(including 4 independent outside directors) |

◎ Corporate Governance Report Updated on February 25, 2025

<Basic Policy>

Our company recognizes corporate governance as "building and operating a structure that achieves appropriate and efficient decision making and business execution by the management, prompt result reports to stakeholders, and soundness, fairness and high transparency of business administration in order to continuously improve the corporate value."

In order to achieve sustainable growth and improve our medium and long-term corporate value while fulfilling our responsibility to shareholders, customers, employees and other stakeholders, our company will achieve effective corporate governance in accordance with the basic policy stated below.

1. Respect the rights of shareholders and ensure equality.

2. Consider the interests of stakeholders including shareholders and cooperate properly.

3. Disclose company information properly and ensure the transparency.

4. Improve the effectiveness of the supervisory function for business execution by the board of directors.

5. Have constructive dialogue with shareholders who have an investment policy that matches the interests of shareholders over the medium to long term.

<Reasons for non-compliance with each principle of the Corporate Governance Code>

[Supplementary Principle 4-1-2 Commitment to the Medium-term Management Plan] [Principle 5-2 Formulation and announcement of management strategies and plans]

The company’s top priority is to achieve its performance goals for a single fiscal year, and the formulation of the Medium-term Management Plan is currently put on hold due to the discontinuity of the business environment, however, in order to achieve sustainable growth and the purposes, the company implements business growth strategies by “broadening the client base and the business domain,” which was planned and announced at the session for briefing the financial results in the second quarter of the fiscal year ended June 2021. In addition, the company believes that in order to achieve sustainable growth, it is important to formulate management visions and strategies from the medium-term viewpoint, and also swiftly respond to changes in the business environment. The specific details are also mentioned in the “Priority Issues to be Addressed” section of the Annual Securities Report.

<Disclosure based on each principle of the Corporate Governance Code>

[Principle 1-4 Cross-holding shares]

The basic policy in making investments other than for pure investment purposes is to create synergy effects in the company’s integrated promotion business through business alliances and information sharing with companies that we invest in. In order to improve value in the medium- to long-term perspectives, we hold the minimum number of listed shares only when it is determined that holding the shares would be effective in consideration of strengthening relationships with business partners, etc.

With regard to the exercise of voting rights of cross-holding shares, in order to ensure appropriate responses, we examine each case from comprehensive viewpoints including the medium- to long-term improvement of the corporate value of the share issuing company as well as the medium- to long-term growth of economic benefits for us. For the major cross-holding shares, we will report the status of the exercise of voting rights to the Board of Directors.

[Principle 2-3 Issues regarding Sustainability including Social and Environmental Issues]

[Supplementary Principle 2-3-1: Responding to challenges relating to sustainability]

[Supplementary Principle 3-1-3: Initiatives concerning sustainability]

[Supplementary Principle 4-2-2: Developing a policy on initiatives relating to sustainability]

The Board of Directors of the company has recognized that addressing sustainability-related challenges in order to realize purposes is an important management issue. The Board of Directors has established a governance system in which the Sustainability Committee, established as an advisory body to the Board of Directors, deliberates and reports on sustainability issues, along with a supervisory system. The sustainability policy of the group is “to be a company that grows sustainably by addressing corporate and social issues through the experiences created by each and every employee.” Under this policy, the Group has identified four material issues and formulated them as strategies based on the two sustainability efforts of “contributing to a sustainable society” and “enhancing corporate value sustainably.” The specific details are also mentioned in the “Sustainability Approach and Initiatives” section of the Annual Securities Report.

https://tow.co.jp/ir/library/report/

[Supplementary Principle 2-4-1: Ensuring diversity in the appointment of core personnel]

In order to secure diversity, the company recruits people regardless of gender, age, nationality, work history, etc. The company also promotes mid-career hires to core personnel, so the ratio of mid-career hires to managers, excluding directors and executive officers, is over 40% and mid-career hires account for 75% of directors and executive officers of the company. Regarding the promotion of female employees to managerial posts, there were 7 female managers, including female directors, as of the end of September 2024, accounting for 17.1% of all managers. Regarding the promotion of non-Japanese workers, the company has not set a measurable goal, because the business is operated mainly inside Japan. Regarding mid-career hires at managerial posts, the company has not set a measurable goal, because the skills the company requires do not depend on recruitment routes. The policy and environment development are described in “Sustainability-related policy and measures” of the Annual Securities Report.

https://tow.co.jp/ir/library/report/

[Supplementary Principle 4-11-1 View on the balance, diversity and scale of knowledge, experience and capabilities as the entire Board of Directors]

The company stipulates the number of directors as 14 or less by the articles of incorporation, and as the end of September 2024, the Board of Directors consists of 8 members (including 4 external directors). For the members of the Board of Directors, we take into consideration the diversity of experience, knowledge, capabilities, etc. The skills matrix is also disclosed in the Notice of Convocation of General Meeting of Shareholders.

[Principle 5-1 Policy for having constructive dialogue with shareholders]

We are convinced that the most important mission to fulfill our company's responsibility is to promote two-way constructive dialogue with shareholders and investors, and to realize effective corporate governance in order to achieve sustainable growth and improve our medium and long-term corporate value. Based on this idea, our company will implement the following measures.

1. Designation of directors in charge of dialogue with shareholders

In our company, executives have dialogue with shareholders, and the managing director controls IR activities.

2. Measures for organic coordination of in-company departments

In our company, the general affair team, which is also in charge of IR activities, discusses and exchanges opinions on a daily basis with the accounting team and they also collaborate in preparing the disclosed materials and discuss the content with executives.

3. Efforts for enhancing dialogue methods other than individual interviews

Our company will conduct the general shareholders' meeting that earns shareholders' trust by valuing the general shareholders' meeting as an opportunity for important dialogue with shareholders and ensuring sufficient information disclosure of our business.

In addition, our company will work on achieving closer communication with shareholders and investors by regularly holding financial results briefing.

4. Measures for feedback of opinions and concerns of shareholders

Our company will compile the opinions and concerns about our company heard in the dialogue with shareholders and investors at the department in charge and develop a system that reports this regularly to executives and the board of directors according to its importance and nature.

5. Measures for managing insider information

The basic policy of our company is to provide fair information disclosure in order to ensure substantive equality for shareholders and investors. Based on this policy, we will disclose important information about our company in a timely and fair manner, and strive to manage the information rigorously so that it will not be provided only to some shareholders and investors.

[Measures to achieve management conscious of capital costs and share price (under review)]

The company's PBR exceeds 1, and although it continues to implement initiatives to increase its corporate value, it is still discussing its policies and measures for the future.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (TOW Co., Ltd.: 4767) and contents of Bridge Salon (IR seminars) can be seen at https://www.bridge-salon.jp/