| Takasho Co., Ltd. (7590) |

|

||||||||

Company |

Takasho Co., Ltd. |

||

Code No. |

7590 |

||

Exchange |

JASDAQ |

||

Industry |

Retail (Commerce) |

||

President |

Nobuo Takaoka |

||

HQ Address |

Minami Akasaka 20-1, Kainan-shi, Wakayama-ken |

||

Year-end |

January 20 |

||

URL |

|||

* Stock price as of closing on 2012/9/11. Number of shares at the end of the most recent quarter excluding treasury shares.

ROE and BPS are calculated by using actual amounts during or at the end of the previous term. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

|

|

| Key Points |

|

| Company Overview |

|

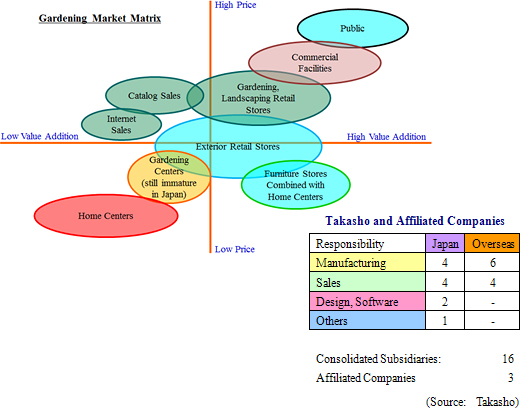

The Takasho Group manufactures products in Japan and China that are sold in Japan, Europe, Asia, and Oceania. The Group boasts of an integrated structure with the ability to plan, manufacture and sell products, and has become the leading company within the "gardening market," which has become a firmly established market in Japan. <Sales Routes>

Takasho' s marketing division can be divided by sales route between the "professional use" products that are used by midsized construction companies, "home use" products sold to home centers on a wholesale basis and used by general consumers, "E-commerce and catalog sales," and "exports." Each of these respective divisions accounted for 47.3%, 46.1%, 2.8%, and 3.8% respectively in fiscal year January 2012."Professional use" products are products sold primarily through the "PROEX" catalog, which is the industry' s largest catalog with 250,000 units published and distributed by direct mail to gardening and landscaping companies, architects and designers, construction companies specializing in exterior construction, commercial facilities and other users. Pictures of actual gardens using Takasho' s products are included in the catalogs, and customers can fill in diagrams provided in the catalogs to order products they want to use in actual landscapes and facilities they are creating. Customers send these diagrams by fax or email to Takasho. In turn, Takasho will then create image diagrams using CAD and CG technologies to be sent back to customers within the same day to show what the gardens and landscapes they are creating look like using Takasho products. The Company also boasts of the ability to supply products ordered in a very short period of time.  |

| Business Strategy |

|

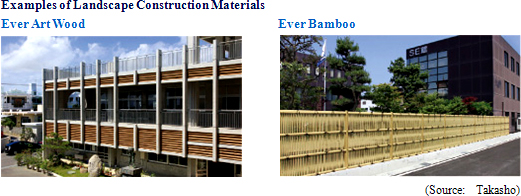

Vertically integrated business is used to describe not only the vertical integration of product planning, manufacturing and sales functions, but also Takasho' s efforts in the area of downstream services. The Company provides total support for gardens by fortifying its product and service contents and Internet and other media mix. As a means of promoting sales, Takasho uses gardening centers, various exhibition sites, and gardening related magazines including "BISES" (Consolidated subsidiary Nihon Integrate Inc.), and it opened the first authentic and large scale gardening center in Japan adjacent to its headquarters in April 2012. Over half of the space at this facility is used to display various plants and flowers, and invites customers to spend their time enjoying the atmosphere of open gardens created at the center. In terms of its global business, Takasho is expanding its manufacturing plants in China to manufacture products of the same quality as those manufactured in Japan for sale in the United States, the United Kingdom, Germany, Australia, China and Korea. In addition, a collaborative alliance has been formed with Gardener' s Supply Company of the United States to develop and promote products and various services for sale in stores and over the Internet. Home use products are manufactured at Jiujiang Takasho (Jiangxi, China) and other locations in China, and professional use products including Ever Art Wood are manufactured by Zhengte Takasho, the joint venture with Zhengte Group (Zhejiang, China) which boasts of a franchise store network of 100 stores, for export to Japan and sale within China. The concept of total business represents Takasho' s operations where professional and home use products are sold in stores and over the Internet as solutions to meet all of the "gardening" needs of customers. Specifically, Takasho will make aggressive investments to leverage its domestic and overseas network so that it can conduct the "gardening" business internationally, including China and other parts of Asia, and within Japan. At the same time the Company seeks to provide environmentally friendly solutions through retail stores and over the Internet while ensuring that profits are secured. The concept of modern business reflects Takasho' s efforts to provide solutions in the realm of "Smart Living Garden" and "landscape construction materials" (Non residential). In the former area, collaboration with house makers is being focused upon the "smart house" concept with "energy conserving yards" and "Smart Living Garden" applications being proposed. The "Smart Living Garden" is based on the traditional practices of green gardening and planting vegetation in yards combined with new solar panel, solar powered lighting and other technologies that promote energy conservation. At the same time, Takasho has appointed one agent in each prefecture to be responsible for cultivating demand for "landscape construction materials" (Non residential) from hospitals and other non-residential facilities. One of the key points of this strategy is the need to raise the images both inside and outside of these facilities by providing products, technology and knowhow in the areas outside of facilities. These solutions must also consider the themes of the aging population and rapid advance of information technology to improve the comfort, effective use of space, and promote overall safety and energy conservation at these facilities.   |

| First Half Fiscal Year January 2013 Earnings Results |

Sales, Current Profit Rise by 10.6%, 11.6% Year-Over-Year

Sales during the first half rose by 10.6% year-over-year to ¥9.25 billion. This strong increase in sales was attributed to growth in sales of professional use segment products, and favorable business trends within Japan and China that allowed overall sales of subsidiaries to grow and helped to offset difficulties arising from the restructuring of business operations of subsidiaries in Europe.With regards to profits, deterioration in gross profit margin due to anticipatory investments was recorded but higher selling, general and administrative costs caused by the establishment of subsidiaries were offset by higher sales. Consequently operating profit rose by 19.2% year-over-year to ¥750 million. An expansion in translation losses resulting from foreign exchange contracts (¥35 million in loss, compared with ¥7 million in income during the previous term) as part of the Company' s risk hedging activities caused current profits to grow by a lesser margin of 11.6% year-over-year. However a decline in extraordinary loss from ¥41 million to ¥23 million and a drop in tax rates allowed net profit to rise by 18.4% year-over-year to ¥0.38 billion.  Sales of Garden Create Co., Ltd., Takasho' s subsidiary with the largest sales, rose on the back of increases in capacity at its wrapping plant. And sales of Toko Shizai Corporation' s official launch of its Niigata store (A large store with 800 square meters of floor space with space for garden and exterior related products.) and those of Nihon Integrate Inc., which publishes the gardening related magazine "BISES," also rose. With regards to overseas operations, the direct shipping of products from Jiangxi Takasho (Jiangxi, China) to Japanese home centers reached full speed, and exports from Zhangte Takasho (Zhejiang, China) began on the official launch of production there. At the same time in Europe, the start of direct imports of products from China by transaction partners led to worsening of earnings of the European subsidiary. Therefore the European subsidiary was turned into a 100% owned subsidiary in August and is endeavoring to cultivate retail clients in the local market (This led to a shift in the subsidiary' s previous role as an importer of products.). In February of the current term, Digilight Sales Co., Ltd. (Kainan-shi, Wakayama) was established for the sale of interior LED lighting fixtures and commercial signage lighting. Furthermore Garden Create Co., Ltd. was formed from the merger of Wakayama Garden Create Co., Ltd. with Nara Garden Create Co., Ltd. in January 2012.  Main Product Sales

Artificial bamboo fence related:

Ever Art Wood: Sun shade products: Solar powered lighting: Low voltage lighting:

¥1,152 million, up 9% year-over-year

¥1,035 million, up 26% year-over-year ¥1,876 million, up 16% year-over-year ¥268 million, down 41% year-over-year ¥102 million, up 83% year-over-year   |

| Fiscal Year January 2013 Earnings Estimates |

|

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2012, All Rights Reserved by Investment Bridge Co., Ltd. To view back numbers of Bridge Reports on Takasho Co., Ltd. (7590) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/ |